#atlanta estate investment planner

Explore tagged Tumblr posts

Text

Securing Your Future - A Guide to Georgia Estate Planning

Planning for the future is a crucial step that everyone should take, regardless of their age or financial status. Estate planning ensures that your assets are protected and distributed according to your wishes, providing peace of mind for you and your loved ones. In the state of Georgia, estate planning plays a significant role in preserving your wealth and ensuring a smooth transition of assets. In this blog, we will explore the key aspects of Georgia estate planning and why it is essential to take proactive steps in securing your future.

Understanding Estate Planning-

Estate planning involves making legal arrangements to protect and distribute your assets during your lifetime and after your passing. It goes beyond creating a will and encompasses various legal tools that can address specific concerns. These tools may include trusts, powers of attorney, advance healthcare directives, and more.

Importance of Estate Planning in Georgia-

Georgia, like every other state, has its own laws and regulations regarding estate planning. By understanding the local regulations, you can ensure that your assets are protected and distributed according to your wishes. Estate planning in Georgia can help you:

a) Protect your assets from unnecessary taxes and legal complications. b) Choose guardians for minor children. c) Plan for incapacity and designate trusted individuals to make financial and medical decisions on your behalf. d) Control how your assets are distributed to beneficiaries. e) Provide for charitable causes or organizations close to your heart. f) Minimize family disputes and conflicts.

Key Components of Georgia Estate Planning-

a) Will- A will is a legal document that outlines your wishes regarding the distribution of your assets after your passing. It allows you to name beneficiaries, appoint an executor, and provide for minor children.

b) Trusts- Trusts are versatile estate planning tools that can provide additional benefits, such as avoiding probate, protecting assets from creditors, and ensuring privacy. Popular types of trusts include revocable living trusts, irrevocable trusts, and special needs trusts.

c) Powers of Attorney- By creating powers of attorney, you can designate individuals to make financial and healthcare decisions on your behalf if you become incapacitated. This ensures that your affairs are managed according to your wishes.

d) Advance Healthcare Directives- Advance healthcare directives, including living wills and healthcare powers of attorney, allow you to specify your medical treatment preferences and appoint a healthcare proxy to make medical decisions when you are unable to do so.

e) Beneficiary Designations- Ensuring that your beneficiary designations are up to date is essential. These designations override any instructions in your will, so it's crucial to review and update them regularly to reflect your current wishes.

Seek Professional Guidance -

Estate planning can be complex, and it's advisable to seek professional guidance to ensure your plan aligns with Georgia's laws and achieves your objectives. An experienced estate planning attorney can provide personalized advice based on your unique circumstances, helping you navigate through legal complexities and maximize the benefits of your estate plan.

1 note

·

View note

Text

15 Tips for a Successful Videography Business in Atlanta, Georgia

Avoid revenue loss and poor executive decisions in your Atlanta-based videography business. Knowing how to grow and conduct your videography business will help you improve product quality, gain more prominent customers, and sign better contracts.

surroundedmedia.com gathered 15 essential tips for creating a successful videography business in Atlanta by focusing on defining a niche, attracting clients through your website and social media, and managing day-to-day operations.

1. Define a Niche

One key to success in videography is specializing in a niche. Whether it's wedding videography, corporate events, real estate videos, or music videos, focusing on a specific area helps you build expertise and stand out. Atlanta is a bustling hub with diverse industries, so defining a niche can also help you target a more specific client base. When starting, avoid spreading yourself too thin by trying to be a jack-of-all-trades. Instead, find a niche you’re passionate about and build your brand around it.

Watch this video to see how this videographer has developed a niche around equestrian events.

youtube

2. Develop a Business Plan

A clear business plan is essential for long-term success. Outline your business goals, target audience, pricing strategy, and projected financials. Understand what sets you apart from competitors and how you plan to scale. A well-thought-out business plan helps when seeking loans or investors to grow your business.

3. Invest in Quality Equipment

The quality of your equipment reflects directly on your final product. Invest in high-quality cameras, lenses, microphones, and lighting equipment to ensure professional-grade results. In a city as competitive as Atlanta, offering superior video quality can set you apart from other videographers. Don’t forget to regularly maintain and upgrade your equipment to stay ahead of the curve.

4. Build a Strong Portfolio

A portfolio is a videographer’s calling card. Showcase your best work online in various formats, such as demo reels or short clips. Ensure your portfolio highlights your niche and illustrates the quality clients can expect. Include testimonials or case studies from past clients to add credibility. Use platforms like Vimeo or YouTube to share your work widely.

5. Create a Professional Website

Your website is the first impression potential clients have of your business. It should be professional, user-friendly, and optimized for mobile devices. Include an “About” section, portfolio, client testimonials, and clear contact information. Ensure that your site loads quickly and offers a seamless experience. You can also use your website to share behind-the-scenes content, blog posts, or educational resources.

Visit surroundedmedia.com to see a professionally designed and marketed videography website.

6. Optimize Your Website for SEO

Starting and running a successful videography business in Atlanta, Georgia, requires more than just a camera and creative skills. With a thriving market and a competitive landscape, building a successful business that stands out involves strategic planning, marketing savvy, and staying ahead in technical expertise and customer service.

7. Leverage Social Media Marketing

Social media is a powerful tool for videographers. Platforms like Instagram, Facebook, and TikTok are perfect for sharing short clips, behind-the-scenes footage, and client testimonials. Create a consistent posting schedule and engage with your followers to build a loyal audience. Use relevant hashtags like #AtlantaVideographer or #GeorgiaWeddings to reach more potential clients.

8. Network with Local Businesses

Networking is crucial in a city like Atlanta, where personal connections can open doors to new clients. Attend industry events, join local business organizations, and collaborate with other professionals like wedding planners, event coordinators, or marketing agencies. Building a network of local partners can lead to referrals and long-term relationships.

9. Offer Competitive Pricing

Correctly pricing your services is vital to attract new clients and sustain your business. Research what competitors in Atlanta are charging and offer competitive pricing based on your experience and the quality of your work. It's essential to balance charging enough to sustain your business and remaining affordable to potential clients.

10. Focus on Client Experience

From the initial inquiry to the final delivery, prioritize exceptional client service. Respond to inquiries promptly, be transparent about pricing and timelines, and deliver work that meets or exceeds client expectations. Positive client reviews and word-of-mouth referrals are invaluable for growing your business in a competitive market like Atlanta.

11. Stay Updated with Technology and Trends

Videography is an industry where trends and technology evolve rapidly. Stay updated on the latest cameras, editing software, and production techniques to keep your work fresh and relevant. Clients expect you to deliver cutting-edge work, and staying informed helps you meet those expectations.

12. Diversify Your Revenue Streams

While your primary niche will generate most of your business, consider offering additional services to increase your income. For example, offer video editing services, drone footage, or social media video packages. Expanding your service offerings helps attract a broader range of clients and increases your business's profitability.

13. Invest in Professional Development

Developing your skills and expertise will make your services more valuable. Attend workshops, take online courses, and seek mentorship from experienced professionals to refine your craft. As a videographer in Atlanta, consider learning about storytelling techniques, cinematography, or video editing software to improve the quality of your work and elevate your business.

14. Ensure Legal and Financial Compliance

Ensure you are legally and ethically operating by registering your business, securing appropriate licenses, and obtaining insurance. Speak with a lawyer to draft contracts that protect you and your clients. Consider hiring an accountant to manage your finances, including tax filings, to ensure compliance with Georgia’s business laws.

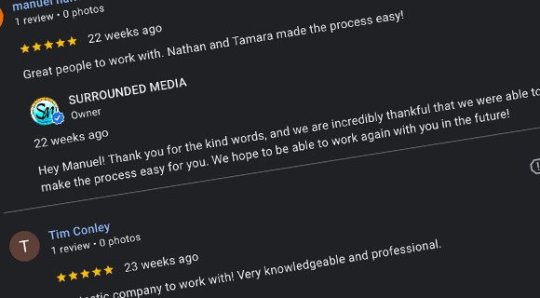

15. Focus on Online Reviews and Reputation Management

Client reviews can make or break your business, especially in a highly connected city like Atlanta. After completing a project, kindly ask satisfied clients to leave positive reviews on platforms like Google, Yelp, or Facebook. Negative reviews happen, but managing them professionally and promptly can maintain your business’s reputation.

Videography Services in Atlanta, Georgia

In this article, you discovered 15 professional tips to increase your videography business’s exposure, revenue, and success.

Starting and running a successful videography business in Atlanta, Georgia, requires more than just a camera and creative skills. With a thriving market and a competitive landscape, building a successful business that stands out involves strategic planning, marketing savvy, and staying ahead in technical expertise and customer service.

Ignoring essential planning, strategic marketing, and service guidelines will leave your business struggling to maintain its current revenue stream or acquire new clients and contracts.

Sources: sos.ga.gov/sites/default/files/forms/First_Stop_Business_Guide_2022.pdf corporatetraining.usf.edu/blog/how-to-use-social-media-marketing-to-grow-your-business nyfa.edu/student-resources/building-your-film-portfolio first.edu/blog/film-video-industry/how-to-make-money-as-a-freelance-videographer-a-comprehensive-guide/

Surrounded Media LLC

177 Fairway Drive Newnan, GA30265 (770) 727-1577

To see the original version of this article, visit www.surroundedmedia.com/blog/15-tips-for-a-successful-videography-business-in-atlanta-georgia

#videographer atlanta ga#Videography In Atlanta Georgia#Sports Videography Atlanta#Videography Atlanta#Cinematography Services Atlanta#Video Production Atlanta GA#Professional Videography Atlanta#Atlanta Wedding Videographer#Drone Videography Atlanta#Youtube

1 note

·

View note

Text

Legacy Planning for Entrepreneurs: Ensuring Long-Term Financial Security and Impact with Entrepreneurs Such as Evan Fletcher (Atlanta)

Entrepreneurship is not just about building successful businesses; it's also about creating a lasting legacy that extends beyond one's lifetime. Legacy planning for entrepreneurs involves strategic financial management and decision-making aimed at securing long-term financial security and leaving a meaningful impact on future generations. This blog explores the importance of legacy planning, key strategies for entrepreneurs, considerations for financial literacy, and tips for navigating the complexities of legacy planning.

Legacy planning is a proactive approach that allows entrepreneurs to shape how their achievements and wealth will be managed and distributed after their lifetime. It involves setting clear objectives for wealth preservation, succession, and philanthropy. By defining these goals early on, entrepreneurs can ensure that their business and personal assets are managed according to their wishes, minimizing potential conflicts among beneficiaries and maximizing the impact of their legacy.

Understanding Legacy Planning

Legacy planning encompasses more than just estate planning; it involves deliberate actions to preserve wealth, transfer assets efficiently, and fulfill philanthropic goals. For entrepreneurs, legacy planning begins with a clear vision of how they want their business and personal assets to contribute to their legacy. It involves identifying financial goals, assessing current assets and liabilities, and considering the impact of decisions on future generations.

Effective legacy planning also addresses tax implications and legal considerations to minimize financial burdens on heirs and maximize the value of the estate. By establishing a comprehensive plan early on, entrepreneurs like Evan Fletcher Atlanta ensure that their wishes are carried out and their legacy is preserved according to their values and objectives.

Key Strategies for Entrepreneurs

Entrepreneurs can implement several key strategies to enhance their legacy planning efforts. Diversifying investments and income streams helps mitigate risks and build a resilient financial foundation. Setting up trusts or family partnerships can facilitate the orderly transfer of assets and provide ongoing support for beneficiaries. Moreover, incorporating philanthropy into business practices allows entrepreneurs to make a positive impact on their communities while leaving a legacy of social responsibility.

Additionally, succession planning is crucial for ensuring continuity and sustainability after an entrepreneur's tenure as emphasized by leaders such as Evan Fletcher (Atlanta). Identifying and grooming future leaders within the organization and documenting operational procedures and business strategies are essential steps in succession planning. This ensures a smooth transition of leadership and preserves the entrepreneurial vision and values that define the company's legacy.

Considerations for Financial Literacy

Financial literacy is fundamental to effective legacy planning for entrepreneurs. Understanding investment strategies, tax implications, and estate planning options empowers entrepreneurs to make informed decisions that align with their long-term goals. Continuous education and staying updated on financial trends and regulations are essential for navigating the complexities of wealth management and legacy planning.

Entrepreneurs including Evan Fletcher (Atlanta) seek advice from financial advisors, estate planners, and legal experts to develop a personalized legacy plan that addresses their unique circumstances and objectives. Collaborating with professionals ensures that all aspects of legacy planning, from asset protection to charitable giving, are managed efficiently and in accordance with applicable laws and regulations.

Integrating Personal and Business Assets

Integrating personal and business assets in legacy planning requires careful consideration of tax implications and asset protection strategies. Entrepreneurs may choose to separate business and personal finances to safeguard personal wealth and facilitate the transfer of ownership or control. Creating a succession plan that addresses both business operations and personal wealth distribution ensures continuity and preserves family harmony.

Furthermore, leveraging insurance products such as life insurance or disability insurance can provide financial security and liquidity to cover estate taxes or business obligations as highlighted by leaders like Evan Fletcher (Atlanta). These insurance solutions play a crucial role in mitigating risks and ensuring that assets are protected and transferred according to the entrepreneur's wishes.

Impactful Philanthropy and Community Engagement

Philanthropy is a cornerstone of legacy planning for many entrepreneurs who seek to make a meaningful impact on society. Establishing a charitable foundation or donor-advised fund allows entrepreneurs to support causes they are passionate about while benefiting from tax advantages. Engaging family members in philanthropic activities instills values of giving back and creates a legacy of generosity and social responsibility.

Moreover, integrating corporate social responsibility (CSR) initiatives into business operations enables entrepreneurs to align business success with positive social and environmental outcomes. By investing in sustainable practices and supporting local communities, entrepreneurs can leave a legacy that extends beyond financial prosperity to include lasting contributions to society.

Ensuring Long-Term Financial Security

Ultimately, legacy planning for entrepreneurs is about ensuring long-term financial security and sustainability for future generations. By taking proactive steps to preserve wealth, transfer assets responsibly, and engage in philanthropy and community impact initiatives, entrepreneurs such as Evan Fletcher (Atlanta) create a legacy that reflects their values and contributes to a better world. Regularly reviewing and updating legacy plans ensures that they remain aligned with evolving goals and market conditions, providing peace of mind and confidence in the enduring impact of their entrepreneurial journey.

Legacy planning is an essential component of entrepreneurship that goes beyond financial success to encompass long-term impact and sustainability. By embracing strategic planning, integrating financial literacy, implementing key strategies, and prioritizing impactful philanthropy, entrepreneurs can shape a legacy that transcends generations and leaves a positive imprint on society. Investing in legacy planning today ensures that entrepreneurial achievements endure and continue to inspire future generations to innovate, lead, and contribute to a better tomorrow.

0 notes

Text

Kitchen Remodeling - Adding Value to your dwelling Real estate property Value

Basement remodeling atlanta

Kitchen remodeling is among the most newsworthy among remodeling projects every year, as kitchens have become the middle of activity in your house. Kitchen remodeling is the do it yourself job that includes one of the most value to your house. Because kitchens are getting to be the middle of activity in the home, kitchen redesigning is just about the popular of remodeling projects each year.

Kitchen remodeling atlanta

A kitchen remake is one of the recommended do it yourself projects for many Houston area homeowners. A Kitchen remodeling is probably the best investments you can create in terms of do it yourself and sometimes adds over the cost of the job towards the price of the property. Specifically, a kitchen remodel provides highest return on valuation on any type of remodeling. Kitchen remodeling is a lot of work, but the results might be spectacular.

Remodeling Projects

Remodeling your house may be an extremely large job, and there are many critical sides to consider when remodeling. By remodeling your kitchen you can contribute value to your home, and at once lower your expenses with energy efficient appliances for the kitchen, or by replacing your drafty kitchen windows. Redesigning your kitchen may be expensive, particularly if you work with a contractor towards the work, however a new kitchen can greatly increase home value. Remodeling costs will change with regards to the quantity of new appliances (along with their price level), and cost quality of cabinets, type of counter tops, and labor for the task. Remodeling any room of your house requires a great deal of creativity and commitment.

Remodeling your kitchen can not only add to your home's value, it can present you with additional storage and work space. Remodeling your kitchen area isn't small task and you will find many important considerations, however the result may be worth the commitment especially if you make wise choices as you go along. Remodeling your house is a superb way to provide your home a face lift.

Property Value Enhancements

An agent could be a good resource when considering how extensive a kitchen remodeling project to attempt. If you live not considering moving, but rather wish to remodel for your own satisfaction, Real Estate Agents are generally quite conscious of the amount previous clients have spent on remodeling and just how much the price of the house increased as a result, and the way much will be an excessive amount of. During the past, "home remodeling" simply meant repair jobs, but modern trends and increased diy options have fueled a need for homes which can be customized to individual needs.

Contractors

Contractors usually charge per hour for their labor together with price of materials. Contractors that see the business know that fulfilling the requirements of the customer 's what contains the deal. Contractors can take a large area of your financial allowance. Contractors focusing on kitchen remodeling are a great deal more familiar with working together with the kinds of plumbing, gas, and the electrical conditions can arise during a kitchen remodel.

Appliances

Appliances are hoped for combine along with all of those other room also to work diligently but quietly. By remodeling your house you can contribute value to your residence, at once spend less with power efficient kitchen appliances, or by replacing your drafty kitchen windows. Appliances usually come in fairly standard sizes, so that they defintely won't be hard to replace as soon as your kitchen remodeling is conducted and you have had time in order to save up more money. Appliances may be one of the most costly items to replace in a kitchen therefore it is best if you look carefully at what features have greatest importance for you. Appliances today are sleek, flexible, and gives more convenience than in the past.

Budget

You will want to make sure you are choosing the right kitchen remodel for your house as well as your budget. According to your requirements, your wants, as well as your budget, the expense may vary widely. Budget kitchen remodeling is really a challenging task that requires you to possess a creative bent of mind are available with your personal innovative ideas which suit your pocket. A kitchen planner/designer's focus should be to design for that the person lives, and asking the best questions will ensure your finished kitchen fits you along with your budget. Whatever your allowance, there is a large various cabinets and countertops accessible that will fit your taste and budget.

Conclusion

Kitchen remodeling is worth your expense, provided your house is in hands of experienced kitchen contractors. Kitchen remodeling is a superb method to help help house into your dream home. Kitchen remodeling is restricted only by imagination along with your budget. Kitchen remodeling is amongst the best investments you may make at your residence.

1 note

·

View note

Text

Kitchen Remodeling - Adding Value to your house Real estate property Value

Kitchen remodeling atlanta

Kitchen remodeling is amongst the newsworthy among remodeling projects each and every year, as kitchens have grown to be the midst of activity in the house. Kitchen remodeling will be the do-it-yourself job that contributes essentially the most value to your house. Because kitchens are becoming the center of activity in your home, kitchen redesigning is just about the discussed among remodeling projects annually.

home remodeling marietta

A kitchen remake is one of the most desirable home improvement projects for many Houston area homeowners. A Kitchen remodeling is amongst the best investments you possibly can make in relation to do-it-yourself and often adds a lot more than the price tag on the job to the value of the house. Specifically, a kitchen remodel provides the highest return on price of any type of remodeling. Kitchen remodeling is much work, nevertheless the results could be spectacular.

Remodeling Projects

Remodeling your home may be an extremely large job, and there are many main reasons take into consideration when remodeling. By remodeling your kitchen you can add value to your home, and also at the same time frame lower your expenses with energy efficient kitchen appliances, or by replacing your drafty kitchen windows. Redesigning your home can be expensive, particularly if you work with a contractor on the work, but a new kitchen can greatly increase home value. Remodeling costs will vary based on the amount of new appliances (along with their price range), and cost quality of cabinets, form of counter surfaces, and labor to complete the job. Remodeling any room of your house has a lot of creativity and commitment.

Remodeling your house can't only supplment your home's value, it could give you additional storage and office. Remodeling your kitchen is not any small task and you will find many important considerations, nevertheless the outcome may be worth the commitment particularly if make wise choices in the process. Remodeling your kitchen is a superb way to offer home a renovation.

Real-estate Value Enhancements

An agent could be a good resource when thinking about how extensive a kitchen remodeling project to execute. If you are not considering moving, but instead desire to remodel for your own satisfaction, Real estate professionals are usually quite alert to the amount previous clients have used on remodeling and the way much the value of your home increased consequently, and just how much would be excessive. Before, "home remodeling" simply meant repair jobs, but modern trends and increased do it yourself options have fueled a demand for homes that are customized to individual needs.

Contractors

Contractors usually charge on an hourly basis for labor together with price of materials. Contractors that understand the business are aware that fulfilling the requirements of the consumer is what has got the deal. Contractors can consume a sizable percentage of your allowance. Contractors focusing on kitchen remodeling are far more experienced with working with the types of plumbing, gas, as well as the electrical conditions can arise after a kitchen remodel.

Appliances

Appliances are expected to combine along with the rest of the room also to work diligently but quietly. By remodeling your house you can contribute value to your home, and also at the same time lower your expenses with power efficient appliances, or by replacing your drafty kitchen windows. Appliances usually appear in fairly standard sizes, in order that they will not hard to replace when your kitchen remodeling is completed and you've got had time to save up even more money. Appliances may be one of the most expensive things to replace inside a kitchen so it will be best if you carefully examine what features have greatest importance for you. Appliances today are sleek, flexible, and provide more convenience than previously.

Budget

You will need to make sure you are selecting the most appropriate kitchen remodel for your household and your budget. According to your preferences, your wants, and your budget, the costs can vary widely. Budget kitchen remodeling can be a challenging task that will need one to have a very creative bent of mind and come up with your own personal innovative ideas that also fit your pocket. A kitchen planner/designer's focus ought to be to the perception of the way a person lives, and asking the correct questions will ensure your finished kitchen fits you and your budget. Whatever your financial allowance, there is a large number of cabinets and counter surfaces accessible that will match your taste and budget.

Conclusion

Kitchen remodeling is worth your expense, provided your home is within hands of experienced kitchen contractors. Kitchen remodeling is a good strategy to help strengthen your house to your ideal home. Kitchen remodeling is bound only by imagination as well as your budget. Kitchen remodeling is one of the best investments you may make at home.

1 note

·

View note

Text

Advancements in Smart City Technologies hold a key to Smart Cities Market Growth

According to GlobalData’s latest published report, the Smart Cities market was valued at USD 511.1 billion in 2021 and is expected to reach USD 744.5 billion by 2026 over the forecast period (2021-2026). A smart city is an urban area that uses different types of electronic data collection sensors to supply information which is used to manage assets and resources efficiently. This includes data collected from citizens, devices, and assets.

The world is becoming increasingly urban. Cities cover only 2% of the Earth’s surface but account for 50% of its population, 75% of its energy consumption, and 80% of its carbon emissions. Commercial real estate consumes 53% of the world’s electricity consumption, a figure that will grow to over 80% by 2040. Cities are the powerhouses of the global economy. In 2015, cities generated 85% of global GDP. Yet the growth of the world’s largest cities must be managed in an era where the need to conserve energy and water is near the top of the public agenda.

Today, 1.5 million people are added to the global urban population every week, with most seeking the employment opportunities that cities can offer. By 2050, up to 70% of the world’s population will live in cities, making smart city projects necessary to cope with migration pressures. Cities are also at the sharp end of coping with climate change.

Furthermore, cities are facing severe economic difficulties as a result of the pandemic. Cities that were unable to effectively limit infection rates had to resort to lockdowns and stringent social distancing measures, resulting in their GDPs contracting. Taipei and Wellington are examples of cities that had success during 2020 and 2021 in limiting infection rates without resorting to lockdowns, and both recorded GDP growth in 2020.

Although the world appears, for now, to be exiting the pandemic, nations and cities must now face the prospect of rising inflation rates as a result of furlough schemes funded by quantitative easing. In summary, the pandemic’s economic fallout will cause municipal governments’ budgets to shrink and smart city solutions to become more expensive. Now more than ever, cities will need to choose carefully what smart city initiatives they invest in.

The smart city concept integrates information and communication technology (ICT) and various physical devices connected to the network (the Internet of Things, or IoT) to optimize the efficiency of city operations and services and connect to citizens. Smart cities represent the potential for ICT (particularly the internet, advanced computational power, cloud storage, sophisticated monitoring systems, and the IoT) to improve management of a city’s assets and quality of life for its residents. As cities grow and demands on space increase, developers and planners will face pressure to integrate new technology and new ways of thinking to ensure cities continue to be desirable places to live and work.

IoT, 5G, and AI are the most widely implemented smart city technologies. They provide the hardware (such as sensors and cameras), connectivity, and data analysis capabilities that collectively underpin most smart city infrastructures.

Atlanta is one of several cities making savvy use of IoT. In February 2021, Atlanta renewed its partnership with Olea Edge Analytics to integrate more commercial and industrial water meters with IoT sensors to quickly identify malfunctioning water meters and enable timely repairs. This will ensure water-intensive commercial and industrial facilities' consumption is accurately measured and estimated to save Atlanta tens of millions of dollars in recovered revenue.

Designed by Toyota, Woven City is a smart city project 60 miles from Tokyo that will use, among other technologies, AI in various capacities. For instance, AI will take care of monotonous domestic tasks like restocking the fridge and disposing of waste. It will also monitor inhabitants’ health, and fleets of autonomous vehicles will provide delivery services.

Need more information? GlobalData's new report covers more detail, providing an analysis of the following:

Competitive index dashboard

Key strategic initiatives

Market Dynamics including Venture Financing, Mergers & Acquisitions deals, Social Media Analytics, Job Analytics, and Patent Analytics

The comprehensive report provides global market size estimates, revenue numbers, and coverage of key issues and trends.

0 notes

Text

Starting Pay for Financial Planners - Junior or Entry-Level

According to Barry Bulakites, the average yearly income for a financial advisor is $51,000. That works up to around $24 an hour. The national average is 26% lower than this. CIGNA employs the highest-paid planners, while Northwestern College employs the lowest-paid planners. Besides education and experience, salaries are also influenced by these aspects. However, many of these programs demand at least three to four years of work experience in order to qualify for the certificates they provide. Financial advisors may also make extra commissions by selling specific financial products, such as mutual funds and insurance.

A financial planner's hours are flexible. If you don't need a lot of work, a part-time job may be a better option than a full-time one, which requires more time for research and analysis. They can also have to work on the weekends and at night. A financial planner's income relies on their ability to keep up with the latest advancements in the business. Indeed, LinkedIn, and CareerBuilder are just a few of the web resources where you may find job openings. Classified advertisements and private recruitment agencies are other sources of job leads for job searchers.

Your earnings are also influenced by where you reside. Financial planners in San Jose, California earn 36% more than their national counterparts, who get an average compensation of $14,900. 8 percent less than the national average is paid in Houston, TX, and Atlanta, GA. Before deciding on a job, research the cost of living in the location where you want to work. If you're coming from a place with a high cost of living, these cities' financial planner salaries can help you succeed financially.

A financial advisor must have a thorough understanding of numerous investment options. Moreover, they must be aware of tax and insurance restrictions. As a consequence, financial planners must be able to decipher complicated financial paperwork and communicate effectively with the people they serve. As experts in the fields of insurance, estate planning, and taxes, clients rely on the guidance of financial planners. As a result, financial planners' salaries are determined by their level of expertise, experience, and education. It's probable that when they expand, they'll make more money.

Even though financial counselors make a good living, the field's future success is uncertain. Financial advisors are becoming more popular. As a result, they demand a wage that is on par with their stature. In spite of this, financial advisors are still a feasible career choice for many people. They may make up to $100,000 a year, which is a good salary for someone in their position. A career as a financial planner may take numerous forms, and as a result, many opportunities for growth exist.

Barry Bulakites pointed out that, the cost of living varies greatly from one region to the next. Job opportunities abound in New York City. New York's annual median household income is $68,486. Nearly $5K more than the national average, which is the case here. In addition, rents in New York City tend to be significantly higher than in other major cities, making it even more attractive to work as a financial advisor in the Big Apple. As a result, there are a lot of jobs in finance available in New York City.

Financial planners often work for investment firms, banks, insurance companies, and other financial organizations after obtaining a certification in financial planning. Most financial planners are hired by financial services companies, although others are self-employed. The vast majority of CFPs operate during regular business hours. Some people may put in greater hours. The average annual income of a financial planner is $90,000, yet this is only the tip of the iceberg. Anyone contemplating a career in financial planning should give this compensation a serious look.

A bachelor's degree in a relevant discipline is required before beginning a career as a financial planner. In most cases, a bachelor's degree in one of business, economics, finance, or economics is required, while additional training might help you stand out from the competition. The ability to plan and invest in stocks and real estate, for example, may be useful. However, you'll need a solid grasp of arithmetic. Another advantage is the ability to work with an accounting system.

When it comes to a financial planner's remuneration, the range is normally between six and seven figures each year. Based on the amount of money the customer invests with them, an independent financial planner may charge a flat fee. Supplemental pay are not uncommon for employees of insurance companies, brokerage firms, and other financial organizations. However, in 2004, the median annual wage for financial planners was $62,700, which was still less than the average annual salary for accountants or lawyers. Inexperienced financial planners, however, may be able to increase this amount by more than 10%.

Barry Bulakites's opinion, an additional service that financial planners provide to their customers is information regarding the advantages and disadvantages of various financial options. As a result, they may assist clients in developing spending plans or establishing savings objectives in preparation for important life events. An effective financial plan considers factors such as inflation, investment returns, and usual spending habits. With this in mind, they will collaborate with a number of investment businesses and mutual fund providers to assist their customers reach their financial objectives.

0 notes

Text

Five Housing Market Predictions For 2020

Five Housing Market Predictions For 2020

Five Housing Market Predictions For 2020

By Fred McGill In 2019 we saw interest rates drop, housing inventory remain low and hot markets continue to heat up. Will those trends persist in 2020? Will home sales remain stagnant in the new year? Will an influx of new housing inventory come onto the market? Will younger consumers stop renting and start owning? Here are five predictions that are likely to shape the 2020 housing market and help us answer these questions and more: 1. Rising rents will lead to more millennial buyers. Contrary to widely held beliefs, most millennials actually do want to own homes as opposed to renting apartments. In a Chase Home Lending study, 70% of millennials surveyed said they would be willing to cut back on activities like spa trips, shopping and going to the movies to save money for a home purchase. That says a lot for this generation. One major factor that's been holding millennials back from homeownership is an inventory constraint issue in the hottest markets. It has become increasingly difficult to buy a home in cities like Nashville; Austin, Texas; and Raleigh, North Carolina. In those cities, job growth has outstripped housing, leading to a sparse housing supply below the $300,000 price point. While young buyers in these markets possess the job security and earning potential to purchase homes, not enough good housing options exist at their price point. This has led to crowds of buyers waiting on the sidelines in 2019. But there's a counteracting force that is beginning to shift the dynamic. New, luxury apartment inventory is flooding markets like Atlanta; Phoenix; Portland, Oregon; and Dallas, pushing up the median rent price and making the rent-versus-own argument a bit more balanced. A Realtor.com survey found that rising rents were the influencing factor that triggered 23% of millennial home buyers to make the decision to buy instead of rent. Expect this phenomenon to become more pronounced in 2020 and to influence more and more millennials to take the plunge into homeownership. 2. Baby boomers will sell their homes at a higher clip. Zillow recently published a study that found baby boomers are preparing to sell approximately 27% of America’s homes between now and 2040. Many of these homeowners will ultimately be seeking newer, low-maintenance homes with fewer stairs to climb and smaller yards to maintain. So, think of that four-bedroom, two-and-a-half-bath home in the suburbs that was built in 1985, has had one owner and has never been sold. There will be several thousand of those coming onto the market in 2020. This should help unclog the inventory pipeline problem that we currently have in the U.S. 3. There will be a new construction boom. Due to the shortage of existing homes for sale, potential buyers are increasingly considering new construction properties. At the same time, in December 2019 the National Association of Home Builders reported that home builder confidence reached the highest level in 20 years. Mortgage data suggests the same, as mortgage applications to purchase newly built homes were up 27% annually in November 2019, according to the Mortgage Bankers Association. According to economists at Fannie Mae, new housing starts are expected to reach their highest level since 2007 — the beginning of the housing crisis. In fact, Fannie Mae’s Economic and Strategic Research Group predicts builders will expand production by 10% in 2020. And this trend is unlikely to slow after 2020. The forecast for 2021 shows more than 1 million newly built single-family homes, which would mark a post-recession high. This would be well below the annual peak of about 1.7 million single-family housing units in 2005, but still a big improvement over the last few years. 4. Home prices will keep climbing, but growth rates will slow. The S&P CoreLogic Case-Shiller Home Price Indices, which track U.S. residential real estate prices, noted a year-over-year increase of 3.3% as of October 2019 and suggested a similar trajectory for 2020. According to Craig Lazerra, managing director and global head of index investment strategy at S&P Dow Jones, “If people were waiting to see if house prices would actually decline, as they did in ... that’s probably not going to happen, at least given the current economic backdrop.” In 2019, the biggest home price gains occurred in cities like Phoenix; Tampa; and Charlotte, North Carolina, which all registered price increases of more than 4.8% year over year. States in the Sunbelt and cities in Texas appear to show big gains again in 2020. Luckily for home buyers, the days of double-digit, year-over-year price increases are likely gone, even in the hottest markets. 5. Gentrification will continue in the fastest-growing cities. Evolving socioeconomic and racial dynamics will persist in urban cores of America's fastest-growing cities. According to a recent report by the New York Times, urban neighborhoods are attracting wealthier home buyers in a pattern that frequently makes it more challenging for middle-class home buyers to purchase properties in the neighborhoods where their families may have lived for the last 40 years. That said, many city planners agree that some forms of gentrification have yielded positive results for citizens of larger cities where impoverished communities were previously stuck in neutral for decades. Washington, D.C.; Philadelphia; and Atlanta are examples of cities that I have observed manage gentrification in thoughtful ways, leading to positive change for longtime residents and new residents alike. Overall, home buyers can expect the housing market to remain stable in 2020. This sentiment appears to be validated by economists, lenders and builders alike. A possible wild card could be the 2020 presidential election. But even in a big election year, and no matter the outcome, with unemployment at record lows and consumer sentiment near all-time highs, it is unlikely the housing market will suffer a downturn in 2020. Read More https://global.goreds.today/here-are-the-50-us-housing-markets-already-turning-ugly/ Read the full article

0 notes

Text

Retirement Planning for Entrepreneurs: The Role of Financial Literacy in Long-Term Wealth by Evan Fletcher (Atlanta)

Entrepreneurship offers many rewards, including the freedom to pursue your passions and the potential for significant financial success. However, it also comes with unique challenges, particularly when it comes to retirement planning. Unlike employees who have access to employer-sponsored retirement plans, entrepreneurs must take proactive steps to secure their financial future. In this blog, we will explore the importance of financial literacy for entrepreneurs in retirement planning and discuss strategies to build long-term wealth and security.

Understanding Retirement Needs

Entrepreneurs often have fluctuating income streams and irregular cash flow, making it essential to accurately assess their retirement needs. Begin by estimating your desired retirement lifestyle, considering factors such as housing, healthcare, travel, and leisure activities. Then, calculate how much income you will need to sustain that lifestyle throughout retirement. It's crucial to account for inflation and potential healthcare costs, as well as any outstanding debt or financial obligations. By gaining a clear understanding of your retirement needs as emphasized by entrepreneurs like Evan Fletcher (Atlanta), you can develop a targeted savings strategy to achieve your goals.

Building a Diverse Retirement Portfolio

Diversification is key to building a resilient retirement portfolio that can withstand market fluctuations and economic downturns. As an entrepreneur, you may have a significant portion of your wealth tied up in your business. While your business may be a valuable asset, it's essential to diversify your investments to mitigate risk. Consider investing in a mix of stocks, bonds, mutual funds, real estate, and other asset classes to spread risk and maximize returns. Additionally, explore tax-advantaged retirement accounts such as IRAs and 401(k)s, which offer potential tax benefits and compounding growth over time. By diversifying your retirement portfolio as encouraged by leaders such as Evan Fletcher (Atlanta), you can enhance stability and increase the likelihood of achieving your long-term financial goals.

Educating Yourself on Investment Options

Financial literacy plays a crucial role in understanding the various investment options available for retirement planning. Entrepreneurs must familiarize themselves with different investment vehicles, such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Each investment option comes with its own risk and return profile, and understanding these factors is essential for making informed decisions. Consider seeking guidance from financial advisors or attending investment workshops as underscored by entrepreneurs including Evan Fletcher (Atlanta) to enhance your knowledge and confidence in managing your retirement investments.

Creating a Contingency Plan

Entrepreneurs face unique risks and uncertainties that can impact their retirement savings. Market downturns, economic recessions, and unexpected business expenses are just a few examples of challenges that entrepreneurs may encounter. To safeguard your retirement nest egg, it's crucial to create a contingency plan that accounts for these potential risks. Establish an emergency fund to cover unforeseen expenses and maintain liquidity in your retirement portfolio. Leaders like Evan Fletcher (Atlanta) highlight the importance of purchasing insurance policies, such as disability insurance or key person insurance, to protect your income and business assets in the event of illness or disability.

Seeking Professional Guidance

Navigating the complexities of retirement planning can be overwhelming, especially for entrepreneurs juggling multiple responsibilities. Seeking professional guidance from financial advisors, accountants, and retirement planners can provide invaluable support in developing a comprehensive retirement strategy. These professionals can offer personalized advice tailored to your unique financial situation and goals, helping you optimize your retirement savings and minimize tax liabilities. By leveraging their expertise and experience, you can gain peace of mind knowing that your retirement plan is in capable hands.

However, it's essential to choose professionals who understand the specific needs and challenges faced by entrepreneurs. Look for advisors with experience working with small business owners and individuals with irregular income streams. Additionally, consider seeking out fee-only advisors who are transparent about their compensation structure and have a fiduciary duty to act in your best interest. Ultimately, the goal is to build a collaborative relationship with professionals who can provide guidance, support, and peace of mind as you navigate the journey towards financial independence and retirement readiness.

Monitoring and Adjusting Your Retirement Plan

Retirement planning is an ongoing process that requires regular monitoring and adjustment. As your business evolves and market conditions change, it's essential to review your retirement plan periodically and make necessary adjustments to stay on track towards your goals. Monitor your investment performance, reassess your risk tolerance, and update your retirement projections as needed. Additionally, stay informed about changes in tax laws and retirement regulations that may impact your savings strategy. By staying proactive and adaptable, you can ensure that your retirement plan remains relevant and effective in achieving your long-term financial objectives.

Empowering Entrepreneurs for Financial Independence

Financial literacy plays a pivotal role in retirement planning for entrepreneurs, empowering them to build long-term wealth and security. By understanding their retirement needs, diversifying their investment portfolio, and creating contingency plans, entrepreneurs such as Evan Fletcher Atlanta navigate the complexities of retirement planning with confidence and clarity. Seeking professional guidance and staying proactive in monitoring and adjusting their retirement strategy are essential steps in ensuring financial independence and a comfortable retirement lifestyle. With the right knowledge, resources, and strategies in place, entrepreneurs can enjoy the rewards of their hard work and entrepreneurship well into their golden years.

0 notes

Text

8 Signs You’re Ready to Stop Renting and Buy a Home

(TNS)—Renting a place to live may give you the freedom to move when you want and relieve you of the responsibilities of homeownership, but at some point, most people yearn for their own home.

Buying a house is a good way to start building financial security. As you pay down the mortgage, you build up home equity, which is a valuable financial resource.

Mortgage rates are low right now, so if you think you’re ready to buy a home, it’s a good time to make the move.

“For prospective and actual homebuyers, the decline in mortgage rates has provided a much-needed boost to housing affordability,” says Mark Hamrick, senior economic analyst for Bankrate. “This comes after home prices have risen steadily on a national basis since 2012.

“For those who were inclined to buy a home anyway, the drop in the cost of financing translates to a potential reduction in monthly mortgage payments. For those who weren’t initially intending to buy a home, the improvement in affordability might be what helps them to get off the proverbial fence.”

Deciding whether to rent or buy a home is a major decision. How do you know you’re ready? Here are eight signs that you’re ready to make the switch from renter to homeowner.

1. You’re tired of rising rent prices. Rental prices are on the rise nationwide, according to Apartment Guide, which tracks trends in the rental market. The average rent on a one-bedroom unit climbed 4.2 percent in 2018, to $1,140; two-bedroom units rose to $1,354 and studio apartments rose 5 percent to $1,065.

Rising rent makes it harder to budget for monthly housing costs and to save for other financial goals. When paying rent begins to feel like a bad investment and you want to build equity for the future, it’s time to figure out what loan you qualify for, says Bill Golden, a sales associate with RE/MAX Around Atlanta, who has more than 30 years in the real estate business.

Golden says many renters are ready to buy a home once they are financially stable. Many are motivated by the pride of ownership and wanting more control over their dwelling place.

“If one or more of those is tugging at your heart, at least look into the possibility of owning rather than renting,” Golden says. “If you’ve seen your rent escalate significantly but you feel trapped renting, it means the balance may be tipping toward buying. With today’s escalating rental rates and low (mortgage) interest rates, chances are your monthly outlay could be less on a purchase than on a rental.”

2. Your credit score has improved. Some renters are locked out of homeownership because they can’t qualify for a mortgage. A low credit score is a common reason why renters can’t make the leap to purchasing a home. A history of late payments and too much debt will hurt your score. One sign that you’re ready to buy a home is having a healthier credit score, says Bruce McClary, vice president of Communications for the National Foundation for Credit Counseling in Washington, D.C.

Although borrowers with a credit score as low as 500 can qualify for some home loans, they will be required to make bigger down payments and pay higher mortgage rates. A good credit score gets you better interest rates and loan terms.

“Establishing a credit history or recovering from a credit setback can take time, but the goal of homeownership is still realistic under those circumstances,” McClary says. “Receiving help from a nonprofit housing counseling agency that also offers credit counseling programs can make a big difference for anyone struggling with those barriers to homeownership.”

Before you apply for a mortgage, get a free copy of your credit report.

3. You’re good at managing debt. Another thing lenders look at when screening mortgage applicants is their debt-to-income ratio, or DTI. This is a key metric that’s calculated by adding up all monthly debts, then dividing the sum by your gross monthly income. The higher your DTI ratio, the more risk you pose to a lender.

Some conventional loans allow a DTI ratio of up to 50 percent, but many lenders prefer a ratio of no more than 43 percent. If you previously had a high DTI ratio and have since paid off some high balances, you’ll be in a stronger position to get a mortgage.

You’ll also have more wiggle room in your budget to put money into an emergency fund for home repairs and other unexpected expenses.

“Keeping credit card balances low and debt under control is beneficial in many ways,” McClary says. “It’s important to consider that keeping credit card balances at or below 30 percent of the available credit limit has a positive influence on the credit score.”

4. You have enough set aside for the extra costs of owning a home. When a pipe bursts or the air conditioner goes out in a rental unit, you don’t have to worry about paying for it; that’s the landlord’s responsibility. The same goes for property taxes, routine maintenance and homeowners insurance.

That’s not the case when you own a home. All those costs are your responsibility. If your income has risen or you’ve been able to set aside savings, you might realize you have enough extra money to handle the added expenses of homeownership.

“Clearly, if you put everything you have into the down payment and such to buy a house, then you have no money to do repairs should they come up,” Golden says. “You’re better off spending less on the house so you have some money to make improvements and repairs.”

5. You can afford the down payment and closing costs. “First-time homebuyers don’t have proceeds from another home to help fund the down payment. It’s one of the main reasons why the down payment is the biggest hurdle to homeownership,” says Rob Chrane, CEO of Atlanta-based Down Payment Resource, which finds programs that help people buy homes.

The down payment requirement depends on the type of home loan you get. For conventional loans, 20 percent down is usually required if you want to avoid paying private mortgage insurance, or PMI. Some mortgages insured by the Federal Housing Administration, known as FHA loans, require just 3.5 percent down. Fannie Mae and Freddie Mac back some mortgage products that require just 3 percent down; and loans guaranteed by the U.S. Department of Veterans Affairs and the U.S. Department of Agriculture (USDA) require no down payment.

Renters interested in buying a home should compare different loan programs to see which one is best for them. In addition, there are grants and programs to help homebuyers with down payments.

Another expense you have to be ready for is the closing costs, which typically equal 2 percent to 7 percent of the property’s sale price. The good news is that some closing costs are negotiable.

“Because the buyers are putting so much of what they have into the down payment, we usually try to get a seller to pay some, if not all, of the closing costs,” Golden says. “Even if (the buyers) have to pay a little more for the house, it doesn’t hurt their pocket as much.”

6. You’re ready to settle down in one place. Buying a home involves a lot of upfront costs that can take a few years to recoup, so if you anticipate moving before you can recover those costs, homeownership might not be right for you.

No one works at the same company for decades anymore, but a renter who is ready to buy a house should have job security, says Hamrick. A stable job means stable income, which lowers the risk that you will stop making your mortgage payments and default on the loan.

“For two-income households, obviously the risk and opportunity are twice that of situations where there’s just one wage earner,” Hamrick says. “In a perfect world, (buyers) would buy a home well beneath their means so they aren’t devoting so much of their income to the mortgage and other related costs.”

7. You’re going through a major life change. Many renters decide to purchase a home after a major life event, such as getting married, says Henry Yoshida, a certified financial planner and CEO of Rocket Dollar, a Texas-based provider of self-directed retirement accounts.

Marriage, a growing family, a new job and children leaving the nest are catalysts for people to buy a home.

“The four major cities in my home state, Texas, are simultaneously on top 10 lists for raising a family and retiring, so I see this firsthand,” Yoshida says. “My own neighbors on either side are retirees from California and a young family who relocated from the Northeast for a job.”

8. You know what you want. It’s smart to have a good idea of the area or neighborhood you want to live in and the type of home you want before you begin your quest. Houses, townhouses, condos, co-ops, duplexes—there are lots of options out there and each one has its own considerations for costs, upkeep and personal enjoyment.

If you buy a condo, for example, you don’t have to do the yardwork, but in addition to your mortgage, you must be able to afford the homeowners association fees.

Determine what you need and what is most important to you. Is it being near a good school or within walking distance of your job? Do you mind navigating stairs or having neighbors live above you? Do you want lots of amenities?

If you’ve moved to a new city or state to take a job, it might be a good idea to rent until you’ve familiarized yourself with the area. That way, you are more likely to choose a home and neighborhood you feel good about.

Ready to Leave Renting Behind? Here’s What to Do Next Before you start looking at homes for sale, shop around, compare lenders and get pre-approved for a mortgage. Getting pre-approved helps you know how much house you can afford, what loan program is best for your situation, and what price range to focus on so you don’t overextend your budget, says Ben Creamer, principal and managing broker of Downtown Apartment Co. in Chicago.

“This sets a realistic expectation for what the buyer is qualified to purchase, as well as what financial resources will be needed for closing,” Creamer says. “Knowing this upfront allows sufficient time to save and test the budget constraints.”

Choose a fixed-rate loan for 15 or 30 years if you want predictable, stable mortgage payments. However, don’t forget that owning a home involves a lot more than the monthly principal and interest payments for a mortgage. Property taxes and homeowners insurance are additional expenses that can increase your monthly payments over time, as is PMI if your down payment was too low. Then there are repairs, maintenance and utility costs to budget for, too.

As you weigh the decision to buy a home, make sure you can reach your other financial goals, Hamrick says. A new mortgage shouldn’t prevent you from paying down student loans and credit cards or from saving for retirement.

“In order for (buyers) to have a good chance of achieving a range of financial objectives, they should also have emergency savings,” Hamrick says. “That’s because of the inevitable expenses associated with homeownership.”

©2019 Bankrate.com Distributed by Tribune Content Agency, LLC

The post 8 Signs You’re Ready to Stop Renting and Buy a Home appeared first on RISMedia.

8 Signs You’re Ready to Stop Renting and Buy a Home published first on https://thegardenresidences.tumblr.com/

0 notes

Text

Ready To Invest in Real Estate in Atlanta? Here are 4 Tips for Success

Want to succeed in real estate? Make sure you read this blog post to learn how to do it! If you’re ready to invest in real estate in Atlanta, here are 4 tips for success…

Ready to invest in real estate in Atlanta? Here are 4 tips for success…

Tip #1. Read, Read, Read

Whether online or at your local bookstore or library, there is a wealth of information about real estate investing. Look for both how-to books as well as stories of others who have invested in real estate.

Read between the lines by stopping every 2-3 pages, pretending that you are that person in the story, and identifying what challenges you would have and how you would be successful in that situation. Our brains are muscles, so the more we exercise them and think about ‘what if’ scenarios, the more creative we become.

Our brains are muscles, so the more we exercise them and think about ‘what if’ scenarios, the more creative we become.

Tip #2. Analyze, Analyze, Analyze

Spend time every week figuring out the gross and net profit on 5 – 10 (or more) properties. The more practice that you have making calculations, the faster you will become. Research has shown that people need between 5,000 – 10,000 hours (3-5 years) to become an expert at something.

To become successful when investing in real estate, you need to become good at many different areas but if you are not getting a great deal when you buy based on the numbers, then you will not be successful.

Tip #3. Have an INNER and an OUTER Circle of Support

Inner circle – There will always be people around you who say, ‘you don’t have the ability to do that’, or ‘that is too risky’, or ‘you can’t do that here’. What you are looking for are 2-3 close friends or family who will encourage you as you move forward. Your inner circle should also include one or more real estate mentors.

You need a real estate mentor but you may also need a life coach to help you strengthen your mindset and self-confidence.

Outer circle – Those you met in person in your city or town or through books, seminars, and/or online who also invest in real estate, who will support, encourage, and offer guidance. These people will not be involved on a daily or weekly basis in your investing but they will be available as you need them.

In addition, you need to know some professionals who are familiar with real estate. You don’t go to a dentist to fix a broken arm, nor should you go to a lawyer who rarely or never is involved with real estate investments. Gather a database of real estate lawyers, real estate agents, accountants, tax planners.

You will be using their services regularly in the years to come so you want to know their level of expertise and if you can work with them on a regular basis.

Tip #4. Take Deliberate Action

Look at your time and money, make sure that you are not trying to mix in real estate investing with 20 other major activities in your life, and then plan out what you will do daily, in the next month, three months, 6 months, and in the next year as you start your journey towards being a real estate investor .

Or consider this when you’re going to invest in real estate…

You’ve just read 4 tips to help you invest in real estate. They’re good tips that will serve anyone. However, maybe you don’t want to do all that work. Well, one suggestion is to work with a wholesaler who has already done a lot of this work for you. And that’s what we do here at GEORGIA CashBuyers! We can help you skip a lot of these steps and start investing right away!

Ready to move forward right now? We’d love to help you find a great property that works for your situation. Simply

click here now and fill out the form

or call our office 678-884-8254.

0 notes

Text

Cities and Builders Face ‘Hornet’s Nest’ to Meet Affordable Housing Needs

WASHINGTON — The Wharf is a gleaming, $2.5 billion development that has transformed a long-stagnant waterfront into a major destination in the nation’s capital.

Along a mile of the Potomac River is an array of high-end hotels, entertainment venues, shops, restaurants and apartments. They include the 6,000-capacity Anthem concert venue, an InterContinental hotel and Vio, a luxury condominium where prices soared up to $2.9 million.

But the city has also required the developer to include affordable housing on the project’s 24 acres. Of the 761 units in the first phase of the development, 26 percent are listed as affordable, and more are promised in the second phase.

From Washington to San Francisco, municipal leaders are facing increased pressure to provide affordable housing. Using a combination of government subsidies, tax credits and zoning changes, they are encouraging developers to incorporate affordable units into mixed-use projects.

The Wharf development is a partnership between PN Hoffman and Madison Marquette, developers based in Washington. Monty Hoffman, chief executive of PN Hoffman, takes great pride in the affordable housing.

To make the Wharf project profitable, the partners sought to adjust the mix and build more units over all. The District of Columbia lowered its price for the land and reduced the percentage of lowest-cost housing while permitting more below-market, moderate-income “work force” units.

“It allowed us to avoid residential offerings only at the extreme ends — deep affordable and waterfront market rate,” Mr. Hoffman said. Absent such concessions, he said, he would have needed more office, hospitality, retail and market-rate housing to make the numbers work.

“We did not want to create a tourist or office-centric park,” he said. “We wanted a balanced community.”

Developers across the nation are finding that economics are crucial in determining how many and at what price such units may be included for a mixed-use project to be both socially responsive and financially profitable. And they are working with community leaders to find the right equation.

To further construction of multifamily units, Minneapolis recently moved to rezone most of the city to ban new single-family homes. Several Sun Belt cities, including Atlanta, Austin, Tex., and Houston, now require a percentage of affordable units in any mixed-use project.

California’s landscape is more challenging. Its residential property tax cap, an amendment to the State Constitution passed in 1978 and known as Proposition 13, forced localities to push for commercial development to generate revenue needed for schools, parks, the police and other public services.

Still, developers there are including moderate-income units in the mix, said Michael A. Covarrubias, chief executive of TMG Partners, a developer based in San Francisco. But, he added, the high cost of land has made that difficult. And the developer has to contend with residents opposed to gentrification in their neighborhoods.

“Affordable housing has been unavailable,” Mr. Covarrubias said. “It’s a hornet’s nest and a complicated road you go down to get the volume you need.”

To help address the problem, the tech giant Google has pledged to invest $1 billion in land and money to build homes, including those deemed affordable in the Bay Area. In Northern Virginia, JBG Smith has raised $78 million from investors for housing aimed at those who earn too much for government help but not enough to afford market rates. The firm is the dominant landlord in Crystal City, the section of Arlington where Amazon is locating its second headquarters, with 25,000 new jobs.

In Washington, market forces threaten to overtake government efforts to slow the gentrification of previously low-income neighborhoods, making them less affordable for longtime African-American residents and leading to cultural clashes.

The Metropolitan Washington Council of Governments has said the region needs to build more than 100,000 housing units by 2045, of which 40 percent should serve the lowest-income residents. Separately, the District of Columbia has set a goal of 36,000 units by 2025, of which 12,000 would be affordable. To reach that goal, the district’s mayor, Muriel E. Bowser, has offered solutions that include a $100 million annual housing production trust fund, regulatory relief and a higher building height limit.

“We just have to do many different things,” said Brian T. Kenner, a former deputy mayor for planning and economic development, who left district government on July 2 to work for Amazon. “Things we did before we have to alter, whether it’s making inclusive zoning even more robust or limited setbacks.”

The challenge for local governments is to find incentives like tax breaks that encourage developers, Mr. Kenner said. “Government can’t buy its way out,” he said.

But government, he said, remains concerned about the negative impact of development, which can displace residents as it alters neighborhoods.

The issue has come into focus with plans to turn Brookland Manor, an 80-year-old, 535-unit garden apartment complex in northeast Washington, into a 1,700-unit, $600 million mixed-use development.

The old complex included a small strip shopping center. Once predominantly occupied by low- and middle-income white families, the complex became home to a mostly African-American community after whites left the district for the suburbs. In deteriorating condition, it underwent a federally subsidized renovation in the early 1970s that led to litigation from residents who feared displacement.

That same battle is being replayed as MidCity Financial Corporation, its owner, seeks to triple the number of units, including townhomes and 22 percent lower-cost apartments alongside 181,000 square feet of retail. Residents are divided, despite MidCity’s promises to avoid displacing them. Some tenants object to the elimination of 134 four- and five-bedroom apartments for large families, and two lawsuits are working their way through the courts.

Two original buildings have been razed, as has the old shopping center, now a fenced-in lot with a sign urging an end to all gun violence. Despite the complaints of some residents, the proposed number of affordable units exceeds city requirements.

The District of Columbia is in a stronger position with properties it owns or controls, and requires 30 percent affordable housing units. The city encompasses several large parcels of former federal land ripe for development. These include the former Walter Reed Army Medical Center and St. Elizabeths Hospital, east of the Anacostia River. The 190-acre Robert F. Kennedy Stadium site is also up for grabs.

Developers and community groups are monitoring these parcels closely. To show activists the projects under development or soon to be, the Washington Interfaith Network ran several bus tours this year. Tour guides noted potential conflicts as the city seeks to reap new tax revenue while requiring developers to include socially desirable, if less profitable, features.

“At some point, you realize there’s just a machine that’s running,” said the Rev. Frankey Grayton, pastor of Edgewood Baptist Church in Washington and a prominent activist with WIN. “The development is happening at an alarming rate.”

Pastor Grayton was standing in front of a fenced building site in what is known as Hill East, a 67-acre parcel on the Anacostia River. City planners have long envisioned this tract, home to the now-closed D.C. General Hospital and other social-welfare buildings, as perfect for waterfront development.

As this prospect comes closer into view, community activists are organizing to ensure that low-income housing is included. In the first two buildings, it already is.

On what was the parking lot of D.C. General, a 202-unit, five-story apartment building is rising, one of two that will be the vanguard of Hill East. There will be 25,000 square feet of ground-floor retail and 106 low- and moderate-priced rentals, 30 percent of the total.

But it has been nine years in the making. After many meetings, hearings, permits and approvals, the mixed-use project is finally happening.

“It takes a village, as we say, to figure out the finances, the uses, the zoning,” Mr. Covarrubias, the San Francisco developer, said. “It’s a long, slow process.”

Sahred From Source link Real Estate

from WordPress http://bit.ly/30r8rIh via IFTTT

0 notes

Text

6 Ways To Reinvest The Proceeds From The Sale Of Your Atlanta House

There are many great ways you can reinvest the proceeds from the sale of your Atlanta house. In our latest post, we explore some options to make your new found cash work for you!

People sell their home for all sorts of reasons. Sometimes the cash is needed right away to pay a debt, and sometimes they find themselves with an unexpected surplus available to use elsewhere. Instead of spending this money on material objects and things that come and go, why not reinvest your earnings into something that will benefit you down the road? Below we will discuss some of our favorite ways to reinvest the proceeds from the sale of a Atlanta house!

Real Estate Crowd Funding

A great way to reinvest the profits made from your Atlanta area house, is to put the money into a real estate crowdfunding opportunity. You’ll want to research any investment before sinking your money into it, but investing in a real estate crowdfunding opportunity can be a passive and hands-off investment that can really pay off.

529 Plan

There is no greater investment than that in the future of your children. By contributing to a 529 plan or a designated college fund, you’re not only contributing to your child’s future, but you are also teaching them a financial lesson. The money placed in a 529 plan will grow tax-free, and will not be taxed when the money is withdrawn. Many families utilize these savings plans for their children ahead of time, so they are not blindsided by huge bills when their children begin college careers.

A Rental Property

When selling one home, it can be a great idea to reinvest in another. Not only will you avoid capital gains taxes this way, but you will also be able to find a rental property that really performs and generates a substantial profit for you. If one home or investment property isn’t working, maybe it’s time to try something different! When you find the right rental property in Atlanta , you’ll be able to generate an almost passive income, building on the proceeds you have received.

Home Improvements

If you sell an underperforming rental, you can use the funds to improve your primary residence. Building equity in your home as well as adding a feature you will personally enjoy is never a bad thing. Whether you want to improve a dated kitchen or repair an old roof, now is the time to get those things done. While you might be faced with capital gains taxes when you choose to spend the money on improvements, you will be able to take a deduction for your home improvement costs. Plus, in order to face capital gains taxes, you would need to generate hundreds of thousands of dollars in profits.

Pay Off Other Debts

Do you have high-interest debts weighing you down? Now is the time to clear them up once and for all. Paying money to borrow money doesn’t usually make sense. While carrying a mortgage can actually help in some financial situation, but having a high-interest loan or credit card doesn’t.