#atal pension yojana (apy)

Explore tagged Tumblr posts

Text

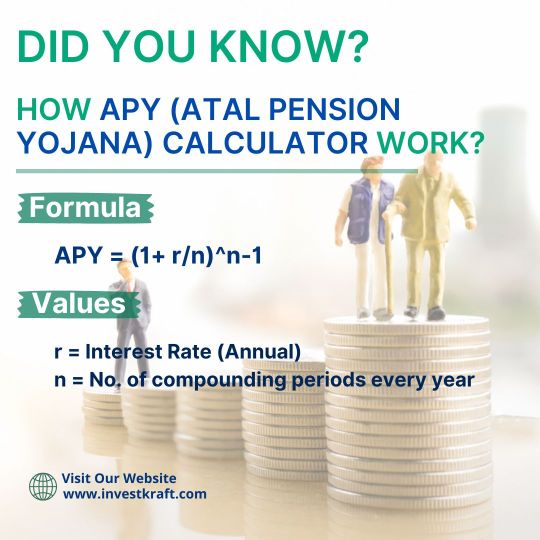

How Accurate Is the Atal Pension Yojana Calculator?

The accuracy of the Atal Pension Yojana (APY) Calculator, particularly on the Investkraft website, is generally reliable. This online tool estimates the pension amount one can receive under the APY scheme based on inputs like age, contribution amount, and the chosen pension plan. While it provides a useful estimate, it's essential to understand that the final pension amount may vary slightly due to factors such as changes in government regulations or economic conditions. However, Investkraft strives to keep its calculator updated to reflect any such changes, ensuring users get as accurate a prediction as possible. Overall, while the APY Calculator offers valuable insights into potential pension benefits, it's advisable to consult with financial experts for a comprehensive retirement planning strategy.

2 notes

·

View notes

Text

Atal Pension Yojana के अंतर्गत मिलेंगे 5000 रुपए प्रति माह की पेंशन, जाने कैसे मिलेगा लाभ

Atal Pension Yojana: https://combonews.in/under-atal-pension-yojana-you-will-get-a-pension-of-rs-5000-per-month-know-how-to-get-the-benefit/

0 notes

Link

APY योजना के तहत, व्यक्ति 60 वर्ष की आयु तक पहुंचने तक हर महीने एक निश्चित राशि का योगदान कर सकते हैं और फिर किए गए योगदान और जिस उम्र में वे योजना में शामिल हुए, उसके आधार पर हर महीने एक निश्चित पेंशन राशि प्राप्त करते हैं। पेंशन की राशि 1000 रुपये से लेकर 5000 रुपये हो सकती है। केंद्र सरकार भी आपके कुल वार्षिक योगदान का 50% या 1000 रुपये प्रति वर्ष का सह-योगदान करेगी।

0 notes

Text

Atal Pension Yojana Benefits। অটল পেনশন যোজনা স্কিমের মাধ্যমে বছরে পাবেন ₹60000 হাজার টাকা, কিভাবে আপনিও পাবেন বিশদে জেনে নিন।

0 notes

Text

Atal Pension Yojana: Financial Freedom for All Indians

Looking for a reliable way to secure your future? The Atal Pension Yojana Scheme offers financial freedom to all Indians! With guaranteed pension benefits, the APY Scheme is designed to support the unorganized sector. Whether you're self-employed or working, start contributing today for a better tomorrow! The APY Yojana provides options for varying pension amounts, ensuring you receive benefits based on your contribution. See how the progress of Atal Pension Yojana has impacted millions of lives across the country! Ready to plan your retirement? Learn more and take the first step toward financial security.

0 notes

Text

Atal Pension Yojana - Atal Pension Scheme : Tax Exemptions, Eligibility, And Contribution

Senior citizens require some sort of support from the government to spend their old age comfortably. While the government has started many pension schemes and saving schemes, Atal Pension Yojana (APY) is a leading saving scheme that helps the elderly get a fixed pension amount after the age of 60. Let us learn more details about this pension scheme of the government.

https://www.jaagrukbharat.com/atal-pension-yojana-apy-for-senior-citizens-in-india-details-eligibility-and-more-1404157

0 notes

Text

Important Government Schemes for UPSC 2024

When preparing for the UPSC exams, a thorough understanding of various government schemes is crucial. Here’s a detailed look at some significant schemes you should focus on for the 2024 examination:

1. Pradhan Mantri Jan Dhan Yojana (PMJDY)

Objective:

To ensure access to financial services, namely Banking/Savings & Deposit Accounts, Remittance, Credit, Insurance, and Pension in an affordable manner.

Key Features:

Account Opening: Zero balance savings accounts.

RuPay Debit Card: Free issuance to all account holders.

Overdraft Facility: Up to ₹10,000 is available after six months of satisfactory operation.

Insurance Cover: Accidental insurance cover of ₹2 lakh and life cover of ₹30,000 for accounts opened up to 28th August 2018.

Achievements:

Increased financial inclusion.

Enabled direct benefit transfers.

2. Atal Pension Yojana (APY)

Objective:

To create a universal social security system for all Indians, especially the poor, the under-privileged, and workers in the unorganized sector.

Key Features:

Age Eligibility: 18 to 40 years.

Pension Benefits: Minimum guaranteed pension ranging from ₹1,000 to ₹5,000 per month.

Contribution Period: Minimum of 20 years.

Government Co-contribution: 50% of the total contribution or ₹1,000 per annum, whichever is lower.

Achievements:

Promoted retirement savings among unorganized sector workers.

Enhanced social security.

3. Pradhan Mantri Awas Yojana (PMAY)

Objective:

To ensure housing for all by 2022 by providing affordable housing to the urban poor.

Key Features:

Beneficiary Categories: Economically Weaker Section (EWS), Low Income Group (LIG), Middle Income Group (MIG).

Subsidy: Credit-linked subsidy for home loans taken by eligible urban poor to buy, construct, or renovate a house.

Technology Sub-Mission: Promotes use of modern, innovative, and green technologies and building materials.

Achievements:

Significant increase in housing development projects.

Improved living conditions for the urban poor.

4. Ayushman Bharat Yojana (PM-JAY)

Objective:

To provide health cover of ₹5 lakh per family per year for secondary and tertiary care hospitalization to over 10 crore poor and vulnerable families.

Key Features:

Coverage: Covers both pre-hospitalization and post-hospitalization expenses.

Cashless and Paperless: Services across all public and empaneled private hospitals.

E-Cards: Issued to the beneficiaries for access to healthcare services.

Achievements:

Improved access to quality healthcare.

Reduced out-of-pocket expenditure for medical treatments.

5. Swachh Bharat Mission (SBM)

Objective:

To achieve universal sanitation coverage and to put focus on sanitation.

Key Features:

Gramin (Rural): Focus on eliminating open defecation through construction of household-owned and community-owned toilets.

Urban: Focus on 100% scientific management of municipal solid waste.

Behavioral Change: Extensive Information, Education and Communication (IEC) activities to promote hygiene practices.

Achievements:

Increased toilet coverage in rural areas.

Enhanced cleanliness and hygiene across urban areas.

6. Beti Bachao Beti Padhao (BBBP)

Objective:

To address the declining Child Sex Ratio (CSR) and related issues of women empowerment over a life-cycle continuum.

Key Features:

Multi-Sectoral Action: Involvement of Ministries of Women and Child Development, Health & Family Welfare, and Human Resource Development.

Focus Areas: Enforcement of Pre-Conception and Pre-Natal Diagnostic Techniques (PCPNDT) Act, promoting girl child education, and generating awareness about gender equality.

Achievements:

Improved awareness and advocacy on gender equality.

Positive changes in the Child Sex Ratio (CSR).

7. Make in India

Objective:

To transform India into a global design and manufacturing hub.

Key Features:

Sectors: Focus on 25 sectors including automobiles, textiles, biotechnology, and electronics.

Ease of Doing Business: Simplification of policies and regulations to attract foreign investment.

Skill Development: Initiatives to develop skills required for manufacturing and other sectors.

Achievements:

Increased Foreign Direct Investment (FDI).

Boosted manufacturing sector growth.

8. Skill India Mission

Objective:

To provide market-relevant skills training to over 40 crore youth by 2022.

Key Features:

Pradhan Mantri Kaushal Vikas Yojana (PMKVY): Short-term training and recognition of prior learning.

National Skill Development Corporation (NSDC): Facilitates private sector participation in skill training.

Skill Loan Scheme: Financial assistance for skill training programs.

Achievements:

Enhanced employability of the workforce.

Bridged the skills gap in various sectors.

9. Digital India

Objective:

To transform India into a digitally empowered society and knowledge economy.

Key Features:

Digital Infrastructure: High-speed internet, digital identity (Aadhaar), and mobile connectivity.

E-Governance: Online access to government services.

Digital Literacy: Initiatives like the National Digital Literacy Mission (NDLM).

Achievements:

Improved access to government services.

Increased digital literacy and internet penetration.

10. Jal Jeevan Mission

Objective:

To provide safe and adequate drinking water through individual household tap connections by 2024 to all households in rural India.

Key Features:

Community Participation: Involvement of local communities in water management.

Sustainable Water Supply: Focus on sustainable water sources and efficient use of water.

Technological Intervention: Use of technology in monitoring and ensuring water quality.

Achievements:

Increased household tap connections.

Enhanced water supply management in rural areas.

Familiarize yourself with these schemes, understand their objectives, features, and achievements, and keep abreast of any updates or new schemes introduced by the government. This will not only help you in the UPSC exams but also in understanding the broader context of India’s developmental policies.

0 notes

Text

Atal Pension Yojana adds record 12.2 million new members in 2023-24

A record 12.2 million new accounts were opened in the Atal Pension Yojana (APY) during 2023-24 taking the total enrolments to 66.2 million under the government’s social security scheme, according to figures compiled by the Pension Fund Regulatory and Authority (PFRDA).

According to APY data, around 70.44 per cent of the total enrolments in the scheme has been done by public-sector banks, 19.80 per cent by regional rural banks, 6.18 per cent by private sector banks, 0.37 per cent by payment banks, 0.62 per cent by small finance banks and 2.39 per cent by cooperative banks.

Source: bhaskarlive.in

0 notes

Text

Financial Inclusion

Financial Inclusion is described as the method of offering banking and financial solutions and services to every individual in the society without any form of discrimination. It primarily aims to include everybody in the society by giving them basic financial services without looking at a person's income or savings. Financial inclusion chiefly focuses on providing reliable financial solutions to the economically underprivileged sections of the society without having any unfair treatment. It intends to provide financial solutions without any signs of inequality. It is also committed to being transparent while offering financial assistance without any hidden transactions or costs.

Pradhan Mantri Jan Dhan Yojana (PMJDY)

Atal Pension Yojana (APY)

Pradhan Mantri Vaya Vandana Yojana (PMVVY)

Stand Up India Scheme

Pradhan Mantri Mudra Yojana (PMMY)

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

Sukanya Samriddhi Yojana

0 notes

Text

Social Security Schemes in India

Social security schemes in India play a crucial role in providing financial protection and support to individuals and families in times of need. These schemes aim to promote social welfare, reduce poverty, and ensure a basic standard of living for all citizens. Some of the key social security schemes in India and their benefits include:

Employees' Provident Fund (EPF): EPF is a retirement benefits scheme that provides financial security to employees in the organized sector. It helps employees build a corpus for retirement through regular contributions from both the employer and employee. Read more about social security schemes here.

Employees' State Insurance (ESI): ESI provides medical, maternity, disability, and other benefits to employees and their dependents. It ensures access to healthcare services and financial support during emergencies.

National Social Assistance Programme (NSAP): NSAP includes schemes like the Indira Gandhi National Old Age Pension Scheme, the Indira Gandhi National Widow Pension Scheme, and the Indira Gandhi National Disability Pension Scheme. These schemes provide financial assistance to elderly, widows, and disabled individuals who are below the poverty line.

Pradhan Mantri Suraksha Bima Yojana (PMSBY): PMSBY is an accident insurance scheme that provides a cover of Rs. 2 lakh for accidental death and full disability and Rs. 1 lakh for partial disability.

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY): PMJJBY is a life insurance scheme that provides a cover of Rs. 2 lakh in case of death due to any reason.

Atal Pension Yojana (APY): APY is a pension scheme for workers in the unorganized sector, providing them with a guaranteed minimum pension amount based on their contributions.

National Pension System (NPS): NPS is a voluntary, long-term retirement savings scheme that allows individuals to create a retirement corpus through regular contributions during their working years.

These schemes provide a safety net for individuals and families, ensuring financial stability during various life stages such as old age, disability, and death. They also promote financial inclusion and help reduce income inequality by providing access to financial services for all sections of society.

1 note

·

View note

Text

FM Sitharaman rebuts Congress charges on Atal Pension Yojana

New Delhi, March 26: Finance Minister Nirmala Sitharaman, in a strong rebuttal to Congress charges on the Atal Pension Yojana (APY) on Tuesday, described it as a scheme based on ‘best practice choice architecture’ and also underlined the fact that the APY subscribers are getting guaranteed 8 per cent return every year.

0 notes

Text

Atal Pension Yojana – Scheme Details, Features & Benefits

The central government of India launched its Atal Pension Yojana (APY) in FY2015-16 to consolidate the social security of the working poor. This scheme replaced the previously announced Swavalamban Scheme, as earlier, the beneficiaries used to face complexities while redeeming their benefits

0 notes

Text

0 notes

Text

অটল পেনশন যোজনায় পান প্রতি মাসে ১০০০ টাকা থেকে ৫০০০ টাকা পর্যন্ত পেনশন! জানুন কিভাবে আবেদন করবেন!

0 notes

Text

TTotal enrolments under various schemes of NPS, APY crossed 1.35 crore margin during FY 2022-23

TTotal enrolments under various schemes of NPS, APY crossed 1.35 crore margin during FY 2022-23 File Pic Total enrolments under various schemes of National Pension System (NPS) and Atal Pension Yojana (APY) have crossed one crore 35 lakh margin during the Financial Year 2022-23. With cumulative enrolment of over 10 lakh subscribers, NPS Private sector- comprising NPS All Citizen and NPS…

View On WordPress

0 notes

Text

Atal Pension Scheme: Know Eligibility, Benefits And Other Details

Atal Pension Yojana (APY) is a government-backed pension scheme launched by the Government of India in 2015. The scheme is aimed at providing a steady stream of income to Indian citizens in their old age, particularly those working in the unorganised sector. Under the Atal Pension Yojana, subscribers can contribute a certain amount of money on a monthly, quarterly, or yearly basis, depending on…

View On WordPress

0 notes