#asics review

Text

0 notes

Text

Artificial intelligence is worse than humans in every way at summarising documents and might actually create additional work for people, a government trial of the technology has found.

Amazon conducted the test earlier this year for Australia’s corporate regulator the Securities and Investments Commission (ASIC) using submissions made to an inquiry. The outcome of the trial was revealed in an answer to a questions on notice at the Senate select committee on adopting artificial intelligence.

The test involved testing generative AI models before selecting one to ingest five submissions from a parliamentary inquiry into audit and consultancy firms. The most promising model, Meta’s open source model Llama2-70B, was prompted to summarise the submissions with a focus on ASIC mentions, recommendations, references to more regulation, and to include the page references and context.

Ten ASIC staff, of varying levels of seniority, were also given the same task with similar prompts. Then, a group of reviewers blindly assessed the summaries produced by both humans and AI for coherency, length, ASIC references, regulation references and for identifying recommendations. They were unaware that this exercise involved AI at all.

These reviewers overwhelmingly found that the human summaries beat out their AI competitors on every criteria and on every submission, scoring an 81% on an internal rubric compared with the machine’s 47%.

Human summaries ran up the score by significantly outperforming on identifying references to ASIC documents in the long document, a type of task that the report notes is a “notoriously hard task” for this type of AI. But humans still beat the technology across the board.

Reviewers told the report’s authors that AI summaries often missed emphasis, nuance and context; included incorrect information or missed relevant information; and sometimes focused on auxiliary points or introduced irrelevant information. Three of the five reviewers said they guessed that they were reviewing AI content.

The reviewers’ overall feedback was that they felt AI summaries may be counterproductive and create further work because of the need to fact-check and refer to original submissions which communicated the message better and more concisely.

3 September 2024

2K notes

·

View notes

Video

youtube

UNBOXING THE RAREST KITH XMEN ASICS WOLVERINE 1975

1 note

·

View note

Text

'*•.¸my personal shopping list¸.•*'

Im a huge money spender(/// ̄  ̄///)... and always when i go shopping i buy bunch of unnecessary sweets, clothes and other things i dont even need!! i have used so much money that even my mom isnt giving me any money anymore....(¬_¬;) so my only plan is to save money and make a list so i dont use it on useless stuff. (ill also do reviews on them on my tiktok @futurebillionarexo (my phone is broken so im not updating on there in a while)

My wellness shopping list+*:ꔫ:*﹤

garnier fructis hair food banana 3-in-1 hairmask

creatine (gym era coming soon...)

asics gel-rocket 10 volleyball shoes white/classic red

cerave foaming facial cleanser (it should be good for my combo skin)

neutrogena hydro boost water gel

cerave eye repair cream

coconut oil (so many benefits omg)

manyo pure cleansing oil

dove intensive repair shampoo

garnier fructis banana conditioner

silk bonnet

azec indian clay mask

evening primrose oil capsules

vitamin E

gua sha (steel)

castor oil

glasses

big boy black baggy jeans

a digital camera (to get that 2000s aesthetic)

revlon hot air brush

a lip pencil

nyx butter gloss

makeup remover

individual lashes (i need to find fluffy but natural looking ones...)

individual lash glue (RECOMMENDATIONS!?!?)

#shopping list#glowup#wonyoungism#lashes#makeup#skincare#sakura haruno#k on anime#fashion#style#y2kcore#2000s aesthetic

36 notes

·

View notes

Text

What Equipment to Use for Mining Bitcoin Profitably After the Halving?

In April 2024, the next Bitcoin halving took place. The reward for mining one block was reduced by 50% and is now 3.125 BTC. Due to this, some may begin to doubt mining — will this activity continue to bring in a decent income? Based on our extensive experience, we can confidently say that mining can and should remain profitable even after the halving. In this article, we will discuss how to organize Bitcoin mining most rationally and what equipment to choose for this.

Bitcoin Price Will Definitely Rise After the Halving

Since the launch of the first cryptocurrency, its halving has occurred approximately every four years. In 2024, this happened for the fifth time. Throughout all these years, the price of BTC, its market capitalization, and audience have steadily increased. The popularity of mining is also growing, and new technologies are being developed to increase its efficiency.

The person or team behind Bitcoin came up with halving to control inflation and maintain demand for the coin. Halving benefits Bitcoin and in no way deprives miners of their well-deserved reward. The rarer the asset, the higher its value — this rule works after each halving. That’s why starting mining right now is an excellent idea.

Three Secrets to Keep Mining Profitable

To make money mining BTC after its halving in 2024, you need to:

Buy or rent the latest generation equipment

Reduce expenses

Find a reliable hosting provider

Let’s take a closer look at all these points.

Today, one of the best ASICs for mining Bitcoin is the Antminer 21 series. It stands out for its high hashing power combined with relatively modest energy consumption. The Antminer 21 significantly outperforms miners of previous generations. The manufacturer of this series, Bitmain, is one of the most well-known in the industry. This is a reliable brand with a very strong team, extremely popular among crypto professionals.

To increase revenue, you can purchase multiple devices and combine them into a mining farm. However, this may require too high initial costs. Additionally, you will need to find a place to host the equipment. It not only consumes a lot of energy but also makes a lot of noise. To reduce the noise level, you can buy ASICs with a water cooling system — but they are more expensive than regular ones.

To cut costs, you can rent a miner instead of buying it. Remote providers can afford the most modern ASICs. You will be able to choose one or several machines with suitable characteristics. The provider will take care of the installation, maintenance, and repair of the equipment. Their staff has all the necessary knowledge and skills. Your involvement in mining will be minimal, and you will be able to receive truly passive income.

Another option is to try cloud mining, a more modern and accessible alternative. You will be renting not an ASIC but hashing power. First, you will purchase a contract on the most comfortable terms for you. After that, your task will be reduced to regularly transferring the commission to the provider — and they will take care of everything else. You will start receiving income on the rise in the price of Bitcoin. If you want to increase your profits, you can buy multiple contracts.

Each halving forces mining providers to rethink their strategies and optimize their activities. Some of those who cannot cope with these tasks close down. That’s why it’s important to check the provider’s history — the longer they have been in business, the better.

The second important parameter is customer reviews. It’s not a problem if some of them are negative — the main thing is that the majority are positive. The contract terms of a good provider are detailed and transparent. The support service is polite, informed, and responds promptly to customer inquiries.

ECOS meets all the criteria of a first-class provider for remote mining. This company is located in the free economic zone of Armenia, where cryptocurrencies are legal, and miners are exempt from taxes for 25 years. The Razdan power plant provides stable access to cheap energy. The security of the territory where the equipment is located is guaranteed by armed guards. The equipment downtime is close to zero. If an ASIC breaks down, it will be promptly repaired on-site, without wasting time sending it to the manufacturer’s service center.

ECOS clients can choose a cloud mining contract from existing options or create their own, individual one. The selection of equipment rental or purchase options is also very large. Clients appreciate ECOS for its transparent terms, reasonable prices, and quality service. This is an ideal provider for beginner miners who are just taking their first steps in the industry. Experienced miners note the exceptional reliability of ECOS, honesty, and timely payment of rewards.

ECOS Client Case

To confirm the above theory, let’s consider a real case of one of the ECOS clients. Let’s denote him by the nickname anto******duate.org.

Immediately after the previous halving in 2020, he bought an Antminer T17 for $699. The hashing speed of this miner was 38 terahashes per second. Four years ago, this model was considered advanced, one of the best on the market.

From November 25, 2020, to November 1, 2021, anto******duate.org earned 0.08026213 BTC with his Antminer T17, which in fiat currency amounted to $5,327. Hosting and miner maintenance costs were only $1,080. The client received a net profit of $3,548. Mining turned out to be a more profitable activity for him than buying bitcoins. If he had bought bitcoins, his profit would have been only $2,900.

To estimate your upcoming expenses and profits, you can use the calculator on the ECOS website. We hope that with the help of this tool, you will see that mining BTC can still be profitable even after the halving!

3 notes

·

View notes

Text

How to Determine If a Forex or Cryptocurrency Platform Is Legitimate

The rise of Forex and cryptocurrency trading has led to a significant increase in the number of platforms available to traders. However, not all of these platforms are reputable or trustworthy. Knowing how to differentiate a legitimate trading platform from a fraudulent one is crucial for protecting one's investments. This article provides a comprehensive guide on how to evaluate the legitimacy of a Forex or cryptocurrency platform, covering key areas such as regulatory information, legal disclosures, company registration details, online reputation, and social media presence.

1. Check Regulatory Information

The first and most important step in determining the legitimacy of a Forex or cryptocurrency platform is to check its regulatory status. Reputable platforms are usually regulated by recognized financial authorities, such as the U.S. Commodity Futures Trading Commission (CFTC), the U.K. Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or similar bodies in other jurisdictions.

1.1 How to Verify Regulation Status

Visit the Regulator's Official Website: To verify if a platform is genuinely regulated, visit the official website of the regulatory body mentioned by the platform. Use the regulator’s search tool to look up the platform's name or registration number. Ensure that every detail matches exactly, as fraudulent platforms often provide misleading or incorrect information.

Confirm with the Platform: Cross-check the information on the regulatory body’s website with the details provided on the platform’s own website. Any discrepancies between the two could be a red flag.

1.2 Why Regulation Matters

Regulation ensures that a platform adheres to strict financial rules, operates transparently, and is subject to regular audits. It also provides a certain level of protection for investors, as regulatory bodies can intervene in cases of misconduct.

2. Review Legal Information on the Company’s Website

A legitimate Forex or cryptocurrency platform will have a well-documented legal section on its website. This section should include terms and conditions, privacy policies, and risk disclosures.

2.1 Key Legal Disclosures to Look For

Terms and Conditions: These outline the contractual obligations between the user and the platform. They should be clear, comprehensive, and not contain any ambiguous language that could be exploited.

Privacy Policy: A legitimate platform will have a detailed privacy policy explaining how user data is collected, used, and protected. Look for specifics about data encryption and user confidentiality.

Risk Disclosure Statements: Trading in Forex and cryptocurrencies involves significant risk. Platforms should provide risk disclosure statements outlining the potential for loss and advising users on the risks associated with trading.

2.2 Assessing the Legality of Documents

Carefully read through these documents to ensure they are professionally written and free from grammatical errors or inconsistencies. Poorly written or vague legal documents can be an indication of a scam platform.

3. Verify Company Registration Information

A legitimate platform should provide clear details about its corporate identity, including its registered company name, registration number, and office address.

3.1 How to Verify Registration Details

Check the Company’s Name and Registration Number: These details should be available on the platform's website. Verify them with the official company registry in the platform's home country.

Confirm Office Address: Ensure the company’s physical address is real and not just a P.O. box. A quick Google Maps search can provide insights into whether the address is a legitimate office space or a residential area.

3.2 Importance of Registration Verification

Verifying registration information helps confirm that the company is a legitimate entity and not a fly-by-night operation. Registered companies are more likely to adhere to financial regulations and are accountable to the law.

4. Check Website Registration Details

Beyond corporate registration, it is also essential to check the domain registration details of the platform’s website. This can provide further clues about the legitimacy of the platform.

4.1 Steps to Check Domain Registration

Use WHOIS Lookup Tools: Websites like WHOIS.net or ICANN WHOIS can provide information about the domain’s registration date, owner, and contact details. A domain registered recently, especially within the last six months, could be a warning sign.

Look for Transparency: Legitimate platforms often have their domain registered under their company name, with contact details that match their corporate information. Be wary of domains registered under privacy protection services or those that hide their registrant details.

4.2 Domain Registration Red Flags

Domains with private registration or those that have been recently created may indicate a lack of transparency and could be associated with fraudulent activities.

5. Check Online Reputation

The online reputation of a Forex or cryptocurrency platform can provide significant insights into its legitimacy.

5.1 Use Review Websites and Forums

Read User Reviews: Websites like Trustpilot, Forex Peace Army, and similar forums can provide user reviews and feedback about the platform. Pay attention to common complaints, especially those related to withdrawals, platform stability, or customer service issues.

Look for Patterns: Isolated negative reviews are common for any business, but consistent patterns of complaints could indicate systemic issues or fraudulent behavior.

5.2 Assessing Credibility of Reviews

Be cautious of overly positive reviews that seem generic or promotional. These could be fake reviews posted by the platform itself or by paid reviewers.

6. Verify Social Media and Other Online Information

A legitimate Forex or cryptocurrency platform should have a robust social media presence. Their social media channels can offer insights into their customer service quality and overall reputation.

6.1 Evaluate Social Media Profiles

Check Activity Levels: Active social media profiles with regular updates, transparent communication, and engagement with users are positive indicators of legitimacy.

Look for Red Flags: Be wary of platforms with inactive social media accounts or those filled with complaints and no responses. Also, avoid platforms that disable comments on their social media posts, as this could be an attempt to hide negative feedback.

6.2 Cross-Check Information

Ensure that the information on social media matches what is on the platform’s website and in official communications. Discrepancies could be a warning sign.

7. Compare Regulatory Bodies with Provided Information

Ensure the regulatory bodies listed by the platform match exactly with what is stated on their official website. Even a single incorrect letter could indicate deception. Some fraudulent platforms may list legitimate regulatory bodies but slightly alter the names or registration numbers.

7.1 Common Deceptive Practices

Fraudulent platforms may use names that closely resemble well-known regulatory bodies, such as “Financial Services Authority” instead of the actual “Financial Conduct Authority.” Always verify directly with the official regulator.

8. Conclusion

Determining the legitimacy of a Forex or cryptocurrency platform requires diligence and attention to detail. By thoroughly checking regulatory information, legal disclosures, company and website registration details, online reputation, and social media presence, one can reduce the risk of falling victim to scams. Remember, if anything seems suspicious or too good to be true, it probably is.

FAQs

1. What should I do if a platform claims to be regulated but I cannot find it on the regulator's website?

If a platform claims to be regulated but does not appear on the regulator’s website, it is best to avoid it. Contact the regulatory body directly to verify any information provided by the platform.

2. Why is checking the company's registration details important?

Verifying a company's registration details ensures that it is a legally recognized entity. This reduces the risk of dealing with a fraudulent or non-existent company.

3. Can I trust user reviews on Forex or cryptocurrency platforms?

User reviews can be helpful, but they should be approached with caution. Look for patterns in reviews and be wary of overly positive or promotional reviews that may be fake.

4. What does it mean if a platform has a new domain registration?

A new domain registration could indicate that the platform is a recent entrant, which may lack a proven track record. It could also be a red flag for a potentially fraudulent operation.

5. How can social media help in assessing a platform's legitimacy?

Social media can provide insights into a platform’s customer service, engagement, and reputation. Platforms that are active and responsive on social media are generally more reliable.

6. Is regulation the only factor that determines a platform's legitimacy?

While regulation is a key factor, it is not the only one. Other factors like legal disclosures, company registration, online reputation, and transparency also play crucial roles in determining a platform's legitimacy.

Reference:

TraderKnows

Wikipedia

2 notes

·

View notes

Text

Ahhhhhh I finally got the shoes I ordered from Asics’s online store. I say it’s a good thing I wasn’t able to buy the pair of Asics Novablast 2 or the Metaspeed Sky or the Gel Nimbus Lite 2 which I saw in Asics Acienda last week since it gave me the chance to read more reviews about these models and search for other options. Well, my search led me to Asics Novablast 3, which wasn’t available in their Acienda store when I went there, but spending all that time poring over countless reviews convinced me it’s the best pair for me.

Following my minor injury I wanted to find a pair of shoes that’s a bit more cushioned compared to my previous pairs which are the Nike Zoom Pegasus 35 and the Asics Dynaflyte 2. At the same time, I should still be able to do tempo runs and speed workouts without feeling like I’m being held back by too much cushioning.

All three above mentioned models (the Novablast 2, the Metaspeed Sky, and the Gel Nimbus Lite 2) meet most of the characteristics I’m looking for in a new pair, but only the Novablast 3 managed to tick all the boxes:

☑️Aesthetically pleasing ☑️Cushioned ☑️Comfortable ☑️Good fit ☑️Lightweight ☑️Responsive ☑️Explosive

So I ordered this pair last Friday and I just got it today and damn I’m just so happy with my choice. Opening the box I was blown away by how sleek it looked. Just by fitting it I already felt like I can take my running to the next level — it’s cushioned but at the same time light and springy. Super excited to run on these!

14 notes

·

View notes

Text

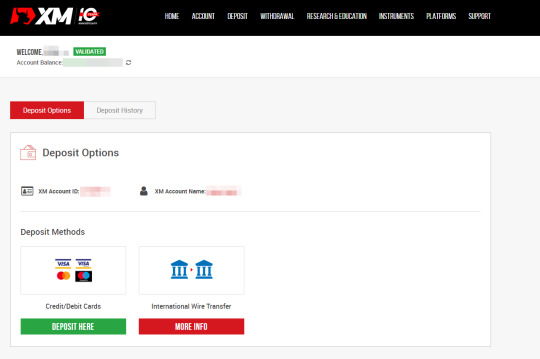

xm broker review

XM Group is a group of regulated online brokers. XM Group offers clients multi-asset trading on various trading platforms, including the popular MetaTrader 4 and MetaTrader 5 platforms. The company is regulated by several financial authorities, including the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the UK.

Overall, XM Group has received positive reviews from clients for its wide range of asset classes, multiple trading platforms, and low fees. However, as with any broker, it is important to carefully consider your own trading needs and do your own due diligence before choosing a broker. It is also important to note that trading carries a high level of risk and may not be suitable for all investors.

XM pros & cons

pros:

Offers 1,230 CFDs, including 57 forex pairs.

Autochartist and Trading Central complement in-house research offering.

The XM Shares account requires a $10,000 deposit if you want exchange-traded securities (non-CFD).

Excellent research content that includes daily videos, podcasts, and organized articles.

In-house broadcasting features TV-quality video content, and live recordings.

A comprehensive selection of educational webinars, articles, and Tradepedia courses.

Offers full MetaTrader suite — which features signals market for copy trading, along with Analyzzer algorithm.

cons:

Standard account spreads are expensive compared to industry leaders.

Average spreads are not published for the commission-based XM Zero account.

Is XM Group safe?

XM Group is considered average-risk, with an overall Trust Score of 90 out of 99. XM Group is not publicly traded, does not operate a bank, and is authorised by two tier-1 regulators (high trust), two tier-2 regulators (average trust), and one tier-3 regulator (low trust). XM Group is authorised by the following tier-1 regulators: Australian Securities & Investment Commission (ASIC) and the Financial Conduct Authority (FCA). Learn more about Trust Score.

Open a Demo Account here.

Promotions and Bonuses here.

MT4 / MT5 Trading Platforms here.

Android MT4 here.

3 notes

·

View notes

Text

XM Broker Review 2023: A Comprehensive Analysis of Trading Fees and Services

XM Broker Review 2023

XM is a global forex and CFD broker regulated by Australia's ASIC, CySEC of Cyprus, and Belizean authority IFSC. XM has low stock CFD and withdrawal fees. Account opening is user-friendly and fast. You can use many educational tools, such as webinars and a demo account. On the other hand, XM has a limited product portfolio as it offers mainly CFDs and forex trading. Its forex and stock index CFD fees are average, and there is no investor protection for clients onboarded outside the EU.

XM is a regulated broker, it is overseen by top-tier financial regulators in multiple countries . XM is also covered by investor protection in selected jurisdictions.

XM Highlights

🗺️ Country of regulationCyprus, Australia, Belize, United Arab Emirates💰 Trading fees classAverage💰 Inactivity fee chargedYes💰 Withdrawal fee amount$0💰 Minimum deposit$5🕖 Time to open an account1 day💳 Deposit with bank cardAvailable👛 Depositing with electronic walletAvailable💱 Number of base currencies supported10🎮 Demo account providedYes🛍️ Products offeredForex, CFD, Real stocks for clients under Belize (IFSC)

Visit Broker74.89% of retail CFD accounts lose money

Fees

XM has low trading fees for CFDs and charges no withdrawal fee. On the other hand, forex and stock index fees are only average, and there is a fee for inactivity.

AssetsFee levelFee termsS&P 500 CFDLowThe fees are built into the spread, 0.4 points is the average spread cost during peak trading hours.Europe 50 CFDAverageThe fees are built into the spread, 2.5 points is the average spread cost during peak trading hours.EURUSDAverageWith Standard, Micro, and Ultra-Low accounts the fees are built into the spread. 1.7 pips is the Standard account's average spread cost during peak trading hours. With XM Zero accounts, there is a $3.5 commission per lot per trade and a small spread cost.Inactivity feeLow$15 one-off maintenance fee after one year of inactivity, followed by $5 per month fee if the account remains inactive

XM trading fees

XM trading fees are average. XM has many account types, which all differ in pricing. The Standard, Micro, and Ultra Low accounts charge higher spreads but there is no commission. The XM Zero account charges lower spreads, but there is a commission. The following calculations were made using the Standard account.

We know it's hard to compare trading fees for CFD brokers. So how did we approach the problem of making their fees clear and comparable? We compared brokers by calculating all the fees of a typical trade for selected products.

We chose popular instruments within each asset class:

- Stock index CFDs: SPX and EUSTX50

- Stock CFDs: Apple and Vodafone

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

A typical trade means buying a leveraged position, holding it for one week and then selling. For volume, we chose a $2,000 position for stock index and stock CFDs, and $20,000 for forex transactions. The leverage we used was:

- 20:1 for stock index CFDs

- 5:1 for stock CFDs

- 30:1 for forex

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for XM fees.

CFD fees

XM has low stock CFD, while average stock index CFD fees.

XMFxProAdmirals (Admiral Markets)S&P 500 index CFD fee$2.5$1.1$1.4Europe 50 index CFD fee$3.1$1.2$1.4Apple CFD fee$6.7$9.4$5.3Vodafone CFD fee$2.3$14.7$14.2

Visit Broker74.89% of retail CFD accounts lose money

Account opening

XM accepts customers from all over the world. There are a few exceptions though; among others, you can't open an account from the USA, Canada, China, Japan, New Zealand or Israel.

What is the minimum deposit at XM?

The required XM minimum deposit is $5 for two XM Account types (Micro, Standard), which is very low, and $100 for the XM Zero account.

Account types

XM offers many account types, which differ in pricing, base currencies, minimum deposit and contract size.

MicroStandardXM ZeroShares AccountClient countryEEA

Australia

Other countriesEEA

Australia

Other countriesEAANon-EEA and non-Australian clientsPricingNo commission, but higher spreadNo commission, but higher spreadThere is a commission, but the spread is very lowMarket spread and commissionBase currenciesUSD, EUR, GBP, JPY, CHF,

AUD, HUF, PLN, SGD, ZARUSD, EUR, GBP, JPY, CHF,

AUD, HUF, PLN, SGD, ZARUSD, EUR, JPYUSDMinimum deposit$5$5$100$10,000Contract size1 Lot = 1,0001 Lot = 100,0001 Lot = 100,0001 share

Islamic or swap-free accounts are also available. With Islamic accounts, a flat commission is charged if you hold your leveraged position overnight instead of the percentage-based financing rates.

XM doesn't offer corporate accounts. If you sign up for a non-European entity, you will not be eligible for European client protection measures.

How to open your account

XM account opening is fully digital, fast and straightforward. You can fill out the online application form in 20 minutes. Our account was verified on the same day.

You can select many languages other than English:

ArabicBengaliChineseCzechDutchFilipinoFrenchGermanGreekHungarianIndonesianItalianKoreanMalayPolishPortugueseRussianSpanishSwedishThaiVietnamese

To open an account at XM, you have to go through these steps:

- Fill in your name, country of residence, email address and telephone number.

- Select the trading platform (MT4 or MT5) and account type.

- Add your personal information, such as your date of birth and address.

- Select the base currency and the size of the leverage.

- Provide your financial information and answer questions about your financial knowledge.

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

Visit Broker74.89% of retail CFD accounts lose money

Deposit and withdrawal

Account base currencies

At XM, you can choose from 9 base currencies. The available base currencies are:

EURUSDGBPCHFJPYAUDSGDPLNHUFZAR

XMFxProAdmirals (Admiral Markets)Number of base currencies10811

Why does this matter? For two reasons. If you fund your trading account in the same currency as your bank account or you trade assets in the same currency as your trading account base currency, you don't have to pay a conversion fee.

Deposit fees and options

XM charges no deposit fees. You can use bank transfers and credit/debit cards for depositing funds. Clients onboarded under IFSC can also deposit using the SticPay electronic wallet.

XMFxProAdmirals (Admiral Markets)Bank transferYesYesYesCredit/debit cardYesYesYesElectronic walletsYesYesYes

A bank transfer can take several business days, while payment with a credit/debit card is instant.

You can only deposit money from accounts that are in your name.

XM review - Deposit and withdrawal - Deposit

XM withdrawal fees and options

XM charges no withdrawal fees. The only exception is bank (wire) transfers below $200, which incur a $15 fee.

XMFxProAdmirals (Admiral Markets)Bank transferYesYesYesCredit/debit cardYesYesYesElectronic walletsYesYesYesWithdrawal fee$0$0$0

For credit/debit cards and electronic wallets (Skrill, Neteller), the withdrawal amount cannot exceed the amount you deposited using the same instrument. This means that you can only withdraw your trading profits via bank transfer.

How long does it take to withdraw money from XM? We tested debit card withdrawal and it took 2 business days.

You can only withdraw money to accounts that are in your name.

How do you withdraw money from XM?

- Log in to your account

- Go to 'Withdraw Funds'

- Select the withdrawal method

- Enter the withdrawal amount

Visit Broker74.89% of retail CFD accounts lose money

Web trading platform

Trading platformScoreAvailableWeb2.8starsYesMobile3.8starsYesDesktop3.4starsYes

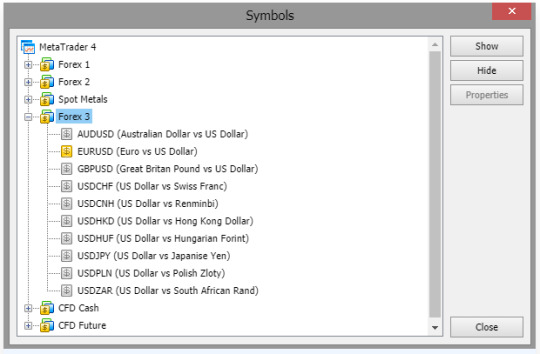

XM does not have its own trading platform; instead, it uses third-party platforms: MetaTrader 4 and MetaTrader 5. These platforms are very similar to each other in functionality and design. One major difference is that you can't trade stock CFDs on MetaTrader 4, only on MetaTrader 5.

We tested the MetaTrader 4 platform as it is more widely used.

MetaTrader 4 is available in an exceptionally large number of languages.

XM web trading platform languagesArabicBulgarianChineseCroatianCzechDanishDutchEnglishEstonianFinnishFrenchGermanGreekHebrewHindiHungarianIndonesianItalianJapaneseKoreanLatvianLithuanianMalayMongolianPersianPolishPortugueseRomanianRussianSerbianSlovakSlovenianSpanishSwedishTajikThaiTraditional ChineseTurkishUkrainianUzbekVietnamese

Look and feel

The XM web trading platform has great customizability. It is easy to change the size and the position of the tabs.

However, the platform feels outdated and some features are hard to find. For example, it took us a while to figure out how to add an asset to the watchlist.

Visit Broker74.89% of retail CFD accounts lose money

XM review - Web trading platform

Login and security

XM requires two-step authentication for the account login on the website where you can deposit and withdraw. The trading platform itself, however, doesn't have two-step authentication.

Search functions

The search functions are OK. You can find assets grouped into various categories. However, we missed the usual search function where you can type in the name of an asset manually.

XM review - Web trading platform - Search

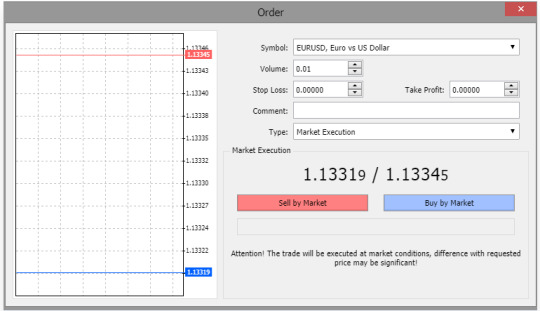

Placing orders

You can use all the basic order types. However, you won't find more sophisticated order types such as 'one-cancels-the-other'. The following order types are available:

- Market

- Limit

- Stop

- Trailing Stop

Trailing Stop is available only in the MT4 desktop platform

To get a better understanding of these terms, read this overview of order types.

There are also order time limits you can use:

- Good 'til canceled (GTC)

- Good 'til time (GTT)

XM review - Web trading platform - Order panel

Alerts and notifications

You cannot set alerts and notifications on the XM web trading platform. This feature is available only on the desktop trading platform.

Portfolio and fee reports

XM has clear portfolio and fee reports. You can easily see your profit-loss balance and the commissions you paid. These reports can be found under the 'History' tab. We couldn't find a way to download them.

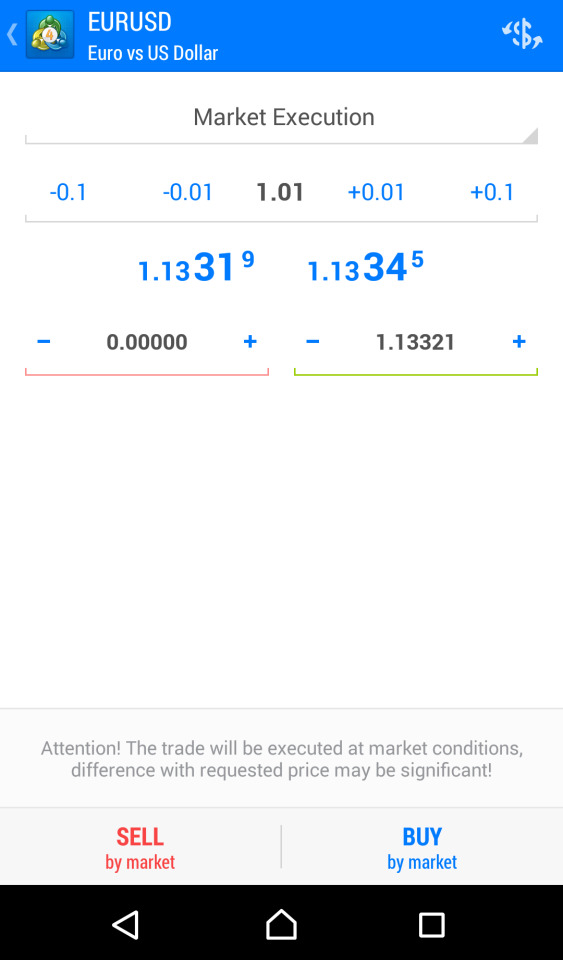

Mobile trading platform

XM offers MetaTrader 4 and MetaTrader 5 mobile trading platforms. Similarly to the web trading platform, we tested the MetaTrader 4 platform on Android.

Once you have downloaded the MT4 mobile trading platform, you should access the relevant XM server.

Just like on the web trading platform, you can choose from many languages on the mobile trading platform as well. Changing the language is a bit tricky on Android devices, as you can do it only if you switch the default language of your mobile.

XM mobile trading platform languagesArabicChinese (Simplified)Chinese (Traditional)CzechEnglishFrenchGermanGreekHindiIndonesianItalianJapaneseKoreanPolishPortuguesePortuguese (Brazil)RussianSpanishThaiTurkishUkrainianVietnamese

Look and feel

XM has a great mobile trading platform, we really liked its design and user-friendliness. It is easy to find all the features it provides.

XM review - Mobile trading platform

Login and security

XM requires only one-step login for the platform, but provides two-step account login to access deposit and withdrawal functions. A two-step login procedure for the trading platform would be safer.

You can't use fingerprint or Face ID authentication. Offering this feature would be more convenient.

Search functions

The search functions are good. You can search by typing the name of the product or by navigating the category folders.

XM review - Mobile trading platform - Search

Placing orders

You can use the same order types and order time limits as on the web trading platform.

XM review - Mobile trading platform - Order panel

Alerts and notifications

You can set alerts and notifications for your mobile, although only through the desktop trading platform. It would be much easier if you could set these notifications on the mobile trading platform as well.

Visit Broker74.89% of retail CFD accounts lose money

Desktop trading platform

For desktop trading too, you can use the MetaTrader 4 and 5 platforms; we tested MetaTrader 4.

It has the same design, is available in the same languages, offers the same order types, has the same search functions, and offers the same portfolio and fee reports as the web trading platform.

The desktop trading platform doesn't have two-step authentication; however, XM provides a two-step account login procedure on the website where you can deposit and withdraw funds.

The major difference is that you can set alerts and notifications on the desktop trading platform in the form of mobile push and email notifications. To set these, you have to add your email address and mobile MetaQuotes ID (you can find it in the MT4 app's settings). You can add them if you go to 'Tools' and then 'Options'.

Markets and products

XM is a CFD and forex broker with a great number of currency pairs available for trading. However, the CFD selection is lower compared to some XM alternatives.

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74.89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

XMFxProAdmirals (Admiral Markets)Currency pairs (#)557047Stock index CFDs (#)242943Stock CFDs (#)1,2611,7003,252ETF CFDs (#)--372Commodity CFDs (#)152528Bond CFDs (#)--2Cryptos (#)*-3042

Cryptos are available for customers onboarded under XM Global Limited entity.

You can't change the leverage levels of the products, which is a drawback. Changing the leverage manually is a very useful feature when you want to lower the risk of your trade. Be careful with forex and CFD trading, as the preset leverage levels may be high.

Real stocks and ETFs

XM provides real stocks for clients onboarded under XM's IFSC-regulated entity. You can trade stocks only using the Shares Account. It is a big addition compared to its competitors.

XMFxProAdmirals (Admiral Markets)Stock markets (#)3-11ETFs (#)--192

Visit Broker74.89% of retail CFD accounts lose money

Research

Trading ideas

XM provides trading ideas under the 'Trade Ideas' tab, where you can find various assets and their recent performances.

Read the full article

3 notes

·

View notes

Text

So last year I started writing that if I was to implement asymmetric passwords right now, I would use Argon2id for key derivation, Ed25519 for signatures, and Ristretto255 for the OPRF. I haven't really reviewed those choices since, but they are probably still good.

Argon2id output size must match the private key size of Ed25519: 256 bits.

The other Argon2id parameters can just be left configurable in the implementation, but there are some universally applicable ideas:

You are competing with the insecurity of just sending the plain password to the server. Any parameters are profoundly more secure than that. The private key derived with this Argon2id run never leaves your client and is only around in memory momentarily. The server only sees that private key's signatures and public key.

The key UX consideration is how much time it takes and how much it bogs down the user's device from doing anything else useful while logging in. Unfortunately many users in the world still have fairly low-spec hardware, and you are competing with the speed of sending their password with plain text.

The recommended Argon2 tuning order is to raise memory as much as you can - the whole point of Argon2 is to be memory hard to take away any cost advantage from GPU, FPGA, and ASIC crackers - then raise the parallelism, then raise the iterations.

So that lets us figure out the best parameters that can be used across all devices with some minimum specs that we want to support while still having an acceptably fast login experience on all of them.

And obviously for users who know to seek out those settings, we could also let users raise their account's minimum Argon2id parameters higher than the default minimum.

But can we do even better?

In principle we could always have higher parameters than our secure minimum while keeping acceptably fast logins if the user's device has the specs for it. This just adds a small risk of a slow login if they later try to log in from an atypically low-spec or constrained system.

So why not just automate that process? First try to get larger allocations until the system refuses, while also doing a microbenchmark to test if using that much memory at once hits a slowdown. Then do a microbenchmark to see when speedup from parallelism drops off. You might be able to combine these two. Now start running an Argon2id implementation that gives you some way to choose at each iteration whether to stop or continue, and stop once you're less than one iteration's duration away from your maximum acceptable login time.

This is getting better, but what do you do for users who log in from devices with significantly different specs? Maybe they dropped and broke their phone so they're using an old temp phone for a while. Or they normally log in from a high-end gaming rig but today they're at grandma's and hopping on her budget computer to get something done.

When a user logs in, we have to use the saved parameters to check their login, otherwise Argon2id would give us a different private key and the Ed25519 public key wouldn't match the saved one.

But if the measured best parameters are different enough, then after logging in successfully we could start the creation of a new entry as a background lower-priority task.

Unless the user leaves in about a login's worth of time right after logging in, that will finish and we can save that so the login uses the best settings next time.

Okay but what about churn if you use multiple devices regularly? What about needlessly sending a less secured key after throwing away more secure parameter entry? What about needlessly spending more time logging in after throwing away a lower parameter entry?

We could actually have more than one entry of Argon2id parameters, salt, and public key for a user. So long as the minimum parameters meet our security bar, the only downside is a tiny risk of a weakness in the composition of Ed25519 deriving public keys from separate private keys that result from independently randomly salted and differently parameterized Argon2id runs somehow leaking statistical information about the password.

Each entry can be expired once it hasn't been needed for a login for too long - or we could even make the code pluggable, since this is a cache eviction problem and there are many different schemes for that, maybe someone knows a better one.

It feels vulnerable to a downgrade attack, but it isn't meaningfully so, because if you didn't have this scheme then you would just have to pick parameters that are secure enough - so just use those parameters as your minimums.

That seems pretty great, but there's a really sucky part to this scheme: both the login experience and the implementation suffer a lot when you are logging in from a much weaker system than any remembered entry. And I don't just mean it would be slow, I mean it might require your Argon2id implementation to handle cases like "every device until now let us use 2GiB of memory and this one's refusing to give us more than 256MiB, so now we have to compute the same result in an eighth of the space".

(Aside: this is a good example of why "limit this program to [amount] memory" is not really the right resource control knob a lot of the time if the implementation is "refuse to let the program address more memory" rather than "use swap space if it tries to have more memory" - code that is willing to give up speed to fit within your memory constraints shouldn't have to reimplement memory page swapping, and if you are not willing to give it that opportunity then that would be a different knob.)

One way to mitigate that sucky edge case:

Since you have an acceptable minimum parameterization of Argon2id anyway, just keep an entry for that permanently.

This is worse in the event of a server compromise than only having stronger parameter entries, but if you didn't have the dynamicism and multiple entries you would still always have this lowest secure parameters entry on the server,

It's still better than just having the lowest parameters in the absence of server secret storage compromise or downgrade attack, because you send a public key and signature corresponding to a private key derived from the password with better parameters.

So I've gone back and forth in my mind about this scheme being worth it or not. There is something really nice about users' password security organically automatically upgrading as their technology upgrades. On the other hand it is very complex, would require a lot of reimplemention of some of the most security-sensitive and "don't write this yourself unless you're a cryptographer and computer security expert!" parts of the system, with more cleverness and complexity than existing implementations.

I think the tie breaker for me is that this is all probably very temporary and maybe already obsolete. The future is not users logging in by typing in passwords that they remember. Asymmetric passwords is a great way to make that better, but that's going away. The future is your device knowing cryptographic keys for each login for you, and maybe one password securing the encrypted secret storage where those keys live.

The recent passkey announcements and standardization was a good reminder of that.

Over a year ago I did some testing and found that 128MiB, 1 lane, and 3 iterations was tolerably slow on some realistically old or weak phones and pretty great on new high-end ones. That's lower than you'd use for server-side password hashing, but I'd rather have the security increase of never sending the password to the server. So you could probably dial that up by approximately a year's worth of typical user technology spec improvement and still get a great login experience range.

That's probably good enough until the passkey stuff takes over entirely.

2 notes

·

View notes

Text

Insync litigation support

The documentary evidence must utterly refute the factual allegations in the complaint, resolve all factual issues as a matter of law and conclusively dispose of the claims at issue (Yue Fung USA Enters., Inc. A complaint may be dismissed based upon documentary evidence, pursuant to CPLR 3211(a)(1), only if the factual allegations contained in the complaint are definitively contradicted by the evidence submitted or if the evidence conclusively establishes a defense (Yew Prospect v Szulman, 305 AD2d 588 Sta-Brite Servs., Inc. The complaint asserts a cause of action for negligence and a cause of action for breach of contract.ĭefendant contends that documentary evidence directly contradicts the allegations of plaintiffs' complaint. The complaint concludes that plaintiffs have been damaged because the underlying action could not be pursued due to the expiration of the statute of limitations after inSync failed to make service. The complaint further alleges that inSync accepted the job, but failed to serve the papers as requested and never had any further communication with Agulnick. al., Supreme Court, Queens County, Index Number 703219/2014 (the underlying action). The complaint alleges that Agulnick engaged InSync to serve a summons and complaint on behalf of Butler upon two of the defendants in Butler v the City of New York, Koledin, et. Plaintiffs commenced this action with the electronic filing of a summons and complaint on December 18, 2015. Plaintiffs, Deshon Butler (Butler) and Peter M. Notice of Motion, Affidavits (Affirmations), Exhibits Annexed 1ĭefendant, inSync Litigation Support, LLC (inSync), moves for an order, pursuant to CPLR 3211(a)(1) and (7), dismissing the complaint. The following papers were read on this motion: Papers Numbered InSync Litigation Support, LLC, Defendant(s). This opinion is uncorrected and will not be published in the printed Official Reports.ĭeshon Butler and Peter M. Learn more about our capabilities in Risk Transformation.Published by New York State Law Reporting Bureau pursuant to Judiciary Law § 431. Overall risk rating, based on our self-assessment of your regulatory risk.Where relevant, benchmarking data to call out leading or lagging behaviours.Actionable insights based on our engagement and industry expertise.Whichever service or support we deliver, we will provide you with a report that presents a meaningful view of your organisation’s regulatory posture and the measures required to safeguard your business. Leverage our broad experience to optimise the brand and reputation impacts of the process.Provide a level of independence and confidence in the eventual outcome.Provide effective challenge, where necessary, to your internal teams and datasets to ensure a validated, verifiable and defensible outcome you can stand behind.Provide board/executive level insights to progress/risks/issues as they evolve during a review.Cost-effectively manage the documentary/evidence based demands of such reviews (using dedicated document management system and tools we can provide, if needed).Use existing regulatory protocols, standards and advisories to ensure responses are fully aligned and reflect regulator expectations.Prepare for and lead/coordinate the response to ensure your business remains focused.Whether it be ASIC, APRA, ACCC, AUSTRAC, or any other regulator or Statutory Authority, our proven experience combined with effective methodologies, tools and techniques, means we can work quickly with your existing resources to provide an optimal response that doesn’t grind the business to a halt. Whether the review is industry-wide or targeting you alone, we have the breadth and depth to quickly resource your needs and provide meaningful, intelligent thinking around the response/engagement strategy and approach. These same skills and experiences are invaluable when responding to unplanned regulatory or government intervention or inquiry where time is of the essence and there is no time for learning curves or familiarisation. Our team have deep practical experience setting up, managing and transforming regulatory compliance regimes and the role they play in supporting an organisation’s ‘ticket to play’. Whether you are responding to regulators, litigation lawyers, or disgruntled shareholders, or dealing with Enforceable Undertakings, Class Actions, a Regulatory ‘Requirements’ Letter, or a government-initiated inquiry, additional skilled resources can be critical to the quality of your outcome. Unplanned regulatory intervention or inquiry can really stretch a business and sometimes a helping hand or fresh set of eyes can help you effectively manage through the process.

2 notes

·

View notes

Video

youtube

SEAN WOTHERSPOON AIR MAX 1 vs ASICS ATMOS

0 notes

Text

Fp markets

#Fp markets pro

#Fp markets plus

#Fp markets plus

It will be automatically deleted after 30 days of inactivityįor stockbroking accounts it gets a lot higher, minimum $1000, plus the IRESS monthly fee If you want to expand your research, and evaluate some options similar to this broker, you can consult the alternatives to FP Markets. The table below helps chart some of the main pros and cons in key broker areas. This starts at a low point of $1,000 up to $50,000 depending on your account type so may not be feasible for more casual traders. The minimum deposit on a stockbroking account here is also very high. That would certainly discourage less-experienced traders. The monthly fee you will encounter here is also high at $55 per month to use the IRESS/Viewpoint platform. Starting with downsides of the broker, if you are looking to use the IRESS platform you will find this is only available to Australian traders. Though it is costly to manage, the IRESS service also provides great depth for more experienced traders at FP Markets. This extensive selection is supported by a great low-fee environment that is ideal for the casual trader with no inactivity fee charged at all. Pros and Cons ProsĪt FP Markets, one of the major positives is the fact you will have a wealth of assets to choose from in trading. They are further secured by offering negative balance protection, segregated accounts, and ICF insurance coverage to EU traders. When it comes to physical presence, they do only have two offices internationally but continue to offer great service worldwide including in Australia where, as a high volume stock trader you can benefit from specific accounts and features for stockbroking. You will also find a wide variety of account types here to fit every need. To back up their trusted reputation the broker has won more than 30 awards over the years. With more than 10,000 assets and different execution methods available, FP Markets is perfect for a range of traders. ( 74-89% of retail CFD accounts lose money)įP Markets is both an ECN/STP and DMA broker with spreads from 0 pips, regulated by both CySEC, and ASIC and very well known for its IRESS stockbroking service (not available outside Australia) and its wide range of assets. This can help you see exactly what they have to offer. With that in mind, you can take advantage of an excellent demo account offered by FP Markets. There are many things to consider when starting out with a broker. Very well-regulated by CySEC, ASIC, and SVG.In this FP Markets review, the expert InvestinGoal team has taken a closer look at all the key features of the broker including trading platforms, costs, minimum deposits, and more. Among traders, FP Markets is renowned for the lightning-fast execution speeds they offer. Regulatory oversight comes from some of the most respected bodies in the industry with CySEC, ASIC, and SVG all available. Founded in 2005 the broker is also very well-regulated. The company's outstanding 24/7 multilingual service has been recognized by Investment Trends as home to some of the most content clients in the industry, having been awarded 'The Highest Overall Client Satisfaction Award,' five years running from Investment Trends.įP Markets has been awarded as the ' Global Forex Value Broker' in three consecutive years (2019, 2020, 2021) at the Global Forex Awards.įP Markets has been awarded the " Best Forex Trading Experience in the EU" at the Global Forex Awards 2021.FP Markets is an experienced Australian ECN broker.

#Fp markets pro

FP Markets is an Australian Regulated global Forex Broker with more than 17 years of industry experience.įP Markets offers highly competitive interbank Forex spreads available from 0.0 pips and leverage up to 500:1 on its pro account.ĭownload FP Markets' Mobile App and trade on the go across several powerful online platforms like MetaTrader4, MetaTrader5, WebTrader, and Iress.

2 notes

·

View notes

Text

Rentalzi Review – Fake Reputation Can’t Hide The Truth Forever

Prime conditions present at rentalzi.com should be reliable and advanced enough to elevate your trading experience and help you build most lucrative strategies. At least that’s what the website owners would like you to believe.

In truth, this brokerage company is yet another shady conduct claiming to operate under full regulatory supervision. Despite not owning any legit Forex licenses, the site in question doesn’t shy away from claiming to be one of the most well regulated international brokerage conglomerates.

Regulated Nowhere

The first clue we based the beginning of our investigation was the website’s claim about the company being based in Hong Kong. SFC, being the financial authority in charge of regulating trading platforms in that jurisdiction, doesn’t have any information about this firm.

What’s more, prominent regulators like FCA, CySEC, BaFin, ASIC and other Tier 1 supervisors also possess no data about this business. The only registry where this firm shows up is the SVGFSA register. However, the website itself doesn’t say anything about HQ being in SVG, so it remains a mystery about their true location.

It is known, though, that offshore service providers like Rich FX care not for your fund safety, negative balance protection or compensation plans.

Falsified High Ratings

The involvement of review seller networks is evident in this case. If you take a look at Sitejabber, Trustedreviews, and TrustProfile, for example, all of the ratings – 100% of them, are the highest grades.

If these reviews were truthful, flawless ratings would not be present in that percentage. Also, how come their TrustPilot page is empty if they’re so famous and reliable?!

Urges You To Deposit

The determined boiler room agents who get their foul hands on your contact number can flood you with phone calls to either drive you crazy or force you to invest.

In the beginning the deal may sound like a profit chance you wouldn’t want to miss. Pushy fraudsters urge you to deposit cash into their scheme so you wouldn’t miss the last shot at getting rich until their fake offer expires.

It goes without saying that such offers are completely fake as well as the artificial hype surrounding them. You’ll be left empty handed and without proper legal support, chances to get your investment back are slim.

Markets In Focus

As published on Whois, this shady scheme has been in business for over three years now – plenty of time to earn more than just pocket money from defrauding traders from:

France

United Kingdom

Australia

Germany

At the end of the day, it matters less where you reside. Besides the swindler’s universal focus on more developed markets, no one is truly safe.

If you’ve already fallen victim for the Rentalzi scam, please refer to our chargeback experts for help in fund recovery.

Unknown Software

The nameless Rentalzi platform is advertised throughout the entire website. All customers are promised a version for every single operating system or device. It isn’t easy to even preview this allegedly convenient, high-performance terminal, though. At least not without registering for an account first.

However, that is currently impossible without the Promo code. Since we didn’t own one, we couldn’t open an account. At this point, the sole existence of this unknown trading portal is questionable.

0 notes

Text

Okay so pumunta akong Acienda kanina to buy a new pair of running shoes. Since sarado yung Oregon (which sells Nike products) and di ko naman bet yung running shoes ng Adidas, I made up my mind to buy from Asics. After checking Asics Acienda's available models and reading several reviews, I concluded that I'd get either the Novablast 2 or the Metaspeed Sky. However upon testing these shoes I realized that the Novablast 2 is too bulky for my taste. The Metaspeed Sky, while it looks amazing, has a bad fit on me. I checked their other models and found the Gel Nimbus Lite 2. It was love at first sight and first fit so I decided to get this pair instead. I have a pretty high credit limit in Ggives so right from the beginning I was already set on using it to buy new shoes. I asked the cashier if they accept Ggives and she said yes, but when she punched the item she couldn't select this payment method. Turns out when they updated their POS last weekend it removed the option to pay via Ggives. I didn't bring enough cash with me and even if I did I still wouldn't want to spend cash so I had to part ways with the Gel Nimbus Lite 2. I guess I'll have to look for nearby stores that accept Ggives first. I have a feeling I would be getting Nike Zoom Pegasus again lol.

7 notes

·

View notes

Text

VenturyFX Review: Is it a Legit or Scam Forex Broker?

In this detailed review, we will explore all aspects of this platform, including its offerings, regulations, fees, and user experiences, to help traders make an informed decision.

What is VenturyFX?

VenturyFX is a relatively new player in the online Forex trading industry, offering access to a variety of financial instruments including Forex, commodities, indices, and more. The platform claims to provide advanced trading tools and competitive spreads to both retail and institutional traders. With its sleek design and user-friendly interface, it aims to cater to traders at all experience levels.

However, with numerous Forex brokers available, it’s crucial to verify whether VenturyFX stands up to its promises or falls into the category of unregulated brokers that may pose risks to investors.

VenturyFX Regulation and Licensing

One of the first things we consider when evaluating a Forex broker is its regulatory status. A broker’s regulatory framework is critical for ensuring that it adheres to industry standards, provides transparency, and offers client protection. VenturyFX claims to be regulated, but upon closer examination, there is no strong evidence to suggest that it holds any licenses from Tier-1 regulatory authorities like the FCA (Financial Conduct Authority), CySEC (Cyprus Securities and Exchange Commission), or ASIC (Australian Securities and Investments Commission).

The absence of high-level regulation is a red flag that potential traders should be aware of. While the broker may claim compliance with local regulations, traders need to ask themselves if they feel comfortable dealing with a platform that lacks robust oversight. Unregulated brokers can disappear with client funds without legal consequences, making it a risky choice.

Trading Platforms and Tools

VenturyFX provides a range of trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are widely known for their reliability and functionality in the trading community. Both platforms offer customizable charts, a variety of technical indicators, and automated trading capabilities through Expert Advisors (EAs).

However, while the availability of MT4 and MT5 is a positive aspect, we noticed a lack of additional advanced trading tools that more reputable brokers tend to offer. Brokers that strive for excellence typically provide a variety of market research tools, including economic calendars, trading signals, and in-depth market analysis, all of which seem to be missing or underdeveloped on VenturyFX.

Account Types and Spreads

VenturyFX offers several account types catering to different types of traders. The accounts generally range from Standard to VIP, with each providing different spreads, leverage, and features. While the broker advertises competitive spreads, some traders have reported that the actual spreads they encounter are significantly wider than advertised, particularly during high market volatility.

Spreads and fees are crucial in evaluating a broker because hidden costs can drastically reduce a trader’s profits. Unfortunately, VenturyFX is not transparent about its fee structure, which raises concerns. Traders should be cautious about this broker’s vague approach to spreads, commissions, and other fees.

Deposit and Withdrawal Methods

The deposit and withdrawal process is another critical factor when choosing a broker. VenturyFX supports various payment methods, including credit/debit cards, bank transfers, and e-wallets such as Skrill and Neteller. However, several user reviews have highlighted issues with the withdrawal process. Complaints often revolve around delays in processing withdrawals and, in some cases, users reported being unable to withdraw their funds entirely.

While the broker states that withdrawals can take up to 5 business days, some traders claim they have waited weeks without resolution. This uncertainty around withdrawals is a major red flag, as any legitimate broker should provide quick and hassle-free access to client funds.

Customer Support

Customer service is a vital element that distinguishes a reliable broker from a potential scam. VenturyFX offers support through live chat, email, and phone. However, feedback from users indicates that the support is inconsistent at best. Some users have reported prompt responses, while others claim that their inquiries were left unanswered or addressed inadequately.

A dependable broker should provide round-the-clock, responsive customer service to resolve any issues, especially when it comes to traders’ funds and platform performance. VenturyFX’s customer support does not seem to meet these standards, leaving traders in doubt about the platform’s overall reliability.

VenturyFX User Reviews and Complaints

When evaluating any broker, user reviews and testimonials provide essential insight into the actual experiences of traders. VenturyFX has received mixed feedback across various review platforms. While some traders have praised its intuitive interface and trading platforms, a concerning number of users have expressed dissatisfaction with its withdrawal process, lack of transparency, and unresponsive customer support.

Many reviews suggest that VenturyFX is untrustworthy, with complaints about the broker engaging in questionable practices, such as manipulating spreads or preventing users from withdrawing profits. These are clear indicators of a potential Forex scam, and traders should approach VenturyFX with caution.

Is VenturyFX a Scam?

While VenturyFX offers legitimate trading platforms like MT4 and MT5, the absence of transparency in its fee structure, coupled with unresolved withdrawal complaints, raises red flags. In the highly competitive world of Forex trading, where scams are all too common, it’s vital to choose a broker with a solid reputation and strong regulatory oversight.

Final Verdict: Should You Trade with VenturyFX?

In conclusion, while VenturyFX might appeal to traders with its advanced platforms and various account types, the risks far outweigh the benefits. The lack of robust regulation, poor customer support, and troubling withdrawal issues make it difficult to recommend this broker. If you’re looking for a secure and transparent trading environment, we advise exploring alternatives that are well-regulated and have a proven track record of safeguarding traders’ interests.

#VenturyFX#VenturyFX Review#VenturyFX Reviews 2024#VenturyFX Scam#VenturyFX Forex#VenturyFX Trading#VenturyFX Broker#forex trading#forex broker#forex market#forextrading#cfd trading forex#forex expert advisor#cfd trading platform

0 notes