#artificial intelligence stocks in India

Explore tagged Tumblr posts

Text

Read this latest and interesting blog to learn the differences between large-cap, mid-cap, and small-cap stocks to build a diversified portfolio that suits your goals. Start investing smarter with Jarvis AI – ai financial advisor for personalized stock recommendations, AI-driven insights, and portfolio management.

#jarvis ai#small cap stocks#mid cap stocks#large cap stocks#ai financial advisor#best stock market advisor in India#portfolio advisory services#artificial intelligence stocks in india#best long term stocks

0 notes

Text

Blackstone Surges to Record High: A Closer Look at Their Impressive Q3 Results

Blackstone, the world's largest commercial property owner, achieved a remarkable milestone on Thursday as its shares surged to a record high. This impressive performance comes on the heels of better-than-expected third-quarter results and an improved real estate investment performance. Let’s dive into the factors driving this success and what it means for the market.

Key Highlights from Q3

In the third quarter, Blackstone invested or committed a staggering $54 billion, marking the highest amount in over two years. This surge in investment activity is attributed to the Federal Reserve’s recent rate cut in September, which significantly reduced the cost of capital. The U.S. central bank’s previous rate hikes had stymied real estate deals and financing, leading to increased defaults in the office market affected by corporate cost-cutting and the rise of hybrid and remote work.

Stephen Schwarzman, Blackstone’s Chief Executive, emphasized the positive impact of the rate cut, stating, “Easing the cost of the capital will be very positive for Blackstone’s asset values. It will be a catalyst for transaction activity.” This sentiment was echoed by Jonathan Gray, President and Chief Operating Officer, who noted that while commercial real estate sentiment is improving, it remains cautious.

Strategic Investments and Areas of Focus

Blackstone has been proactive in planting the “seeds of future value” by substantially increasing its pace of investment. A key area of focus is the revolutionary advancements in artificial intelligence (AI) and the associated digital and energy infrastructure. In September, Blackstone announced the $16 billion purchase of AirTrunk, the largest data center operator in the Asia-Pacific region. This acquisition is part of Blackstone’s $70 billion investment in data centers, with over $100 billion in prospective pipeline development.

Other notable investment themes include renewable energy transition, private credit, and India’s emergence as a major economy. These strategic areas highlight Blackstone’s commitment to innovation and growth.

Recovery in Commercial Real Estate

The Blackstone Real Estate Income Trust (BREIT), a benchmark for the industry, reported a 93% slump in investor stock redemption requests from a peak. This indicates a recovery in investor confidence and a shift towards positive net inflows of capital. BREIT’s core-plus real estate investments, which include stable, income-generating, high-quality real estate, showed a 0.5% decline in Q3 performance, an improvement from a 3.8% drop over the past 12 months. The riskier opportunistic real estate investments posted a 1.1% increase, reversing previous declines.

Student Housing and Data Centers

Among rental housing, student housing has emerged as a significant focus. Wesley LePatner, set to become BREIT CEO on Jan. 1, highlighted the structural undersupply in the U.S. student housing market, emphasizing its potential as an all-weather asset class. BREIT has consistently met investor redemption requests for several months, showcasing strong performance.

Furthermore, the demand for data centers remains robust. QTS, which Blackstone took private in 2021, recorded more leasing activity last year than the preceding three years combined. Such sectors, once considered niche, are now integral to the commercial real estate landscape.

Financial Performance and Outlook

Blackstone’s third-quarter net income soared to approximately $1.56 billion, up from $920.7 million a year earlier. Distributable earnings, profit available to shareholders, rose to $1.28 billion from $1.21 billion. Total assets under management jumped 10% to about $1.11 trillion, driven by inflows to its credit and insurance segment.

The Path Forward

As Blackstone continues to navigate the evolving market landscape, it remains focused on identifying “interesting places to deploy capital.” With a robust investment strategy and a keen eye on emerging trends, Blackstone is well-positioned for future growth.

Join the Conversation: What are your thoughts on Blackstone’s impressive Q3 performance and strategic investments? How do you see these trends impacting the broader real estate market? Share your insights and engage with our community!

#real estate investing#investing#money#investment#danielkaufmanrealestate#real estate#economy#housing#daniel kaufman#homes#ai#artificial intelligence#student housing#commercial and industrial sectors#commercial real estate#self storage#investing stocks

4 notes

·

View notes

Text

AI in the stock market: Transforming the way we Invest

Artificial Intelligence (AI) is quickly becoming a main player in many industries, including the stock market. Since the stock market is full of unpredictable trends and large amounts of data, it can be hard for human traders to keep up and make quick decisions. AI in the stock market helps by analyzing this data faster and more accurately. It can predict market trends, making it easier for investors to navigate the complexities of the stock market. In short, AI in the stock market is changing the way we trade and invest in market prediction using machine learning to provide smarter, faster solutions.

The Role of Artificial intelligence in stock market (AI in the Stock Market)

Artificial intelligence uses smart machine learning (ML) to study large amounts of past and current stock market data. These technology look for patterns, trends, and connections that human traders might miss. This is important because in the stock market, even small changes in how people feel about the market or big global events can cause stock prices to change a lot. AI helps spot these changes quickly, allowing for better decision-making through AI stocks in India.

Machine learning is a key part of AI in the stock market. It helps AI to learn from past data, adapt to new information, and improve its predictions and decisions over time. Whether it’s studying company earnings reports, understanding investor feelings from social media, or tracking stock movements in real-time, stock market prediction using machine learning can respond quickly and accurately. This gives traders a big advantage in the market.

Al-powered Trading Algorithm

Automated trading, also called algorithm trading, is a popular way AI is used in the stock market. AI-powered programs follow set rules based on things like market conditions or stock data. When certain conditions are met, the AI can automatically make trades without needing human help. This has several benefits:

Speed: AI in the stock market processes data far faster than humans, enabling quicker analysis and decision-making. In a fast-moving market, even a few milliseconds can make a big difference in profit or loss.

Accuracy: AI removes human emotions and errors, making decisions more precise and reducing costly mistakes.

Scalability: AI can monitor and trade multiple stocks and markets at the same time, which humans can’t do as efficiently.

Predictive Analytics and Market Forecasting

Another important way to use AI in the stock market is through predictive analytics. This means AI looks at past data to predict future stock movements. AI can study years of stock prices, company finances, economic trends, and news to make predictions. For example, if AI notices that a stock usually drops after certain market conditions, it can warn traders about possible risks or chances to make money.

News Impact and Sentiment Analysis

News and public opinion play a big role in stock prices. While traditional traders manually go through financial news, market reports, and social media, AI in the stock market can do this instantly and more accurately. Using natural language processing (NLP), AI can read the language in news articles, press releases, and social media to figure out if the overall feeling is positive, negative, or neutral.

For example, Stock market prediction using machine learning can quickly analyze a company’s report, spot patterns in the language, and predict if the news will affect the stock price in a good or bad way. This allows traders to respond quickly, even before the market fully reacts to the news.

Risk Management and Portfolio Optimization

AI is also very important in managing risk in the stock market. In such an unpredictable environment, controlling risk is just as important as finding opportunities. AI systems can constantly watch a portfolio and alert traders to potential risks in real-time. By looking at things like stock price changes, economic signals, and global events, AI in the stock market helps to reduce risks for traders.

Conclusion

The use of AI is increasing day by day we should read AI informative blogs & news , to be ready & stay updated about AI and its trends. Artificial intelligence is clearly changing the stock market. Stock market prediction using machine learning can quickly handle large amounts of data, make predictions, and trade automatically, giving traders and investors big advantages. However, this growth also presents challenges, particularly concerning fairness and ethics in the market. As AI in the stock market continues to improve, it’s important for regulators, investors, and developers to work together to make sure we get the most benefits from AI while minimizing any risks.

#aionlinemoney.com

2 notes

·

View notes

Text

US NSA Jake Sullivan set to visit India early next week

New Delhi: US National Security Advisor Jake Sullivan is set to visit India early next week to take stock of the India-US Initiative on Critical and Emerging Technologies (iCET). The iCET represents a landmark initiative between the two countries in areas of emerging technologies such as artificial intelligence, semiconductors, biotech, and defence innovation. Sullivan’s trip will be the last…

0 notes

Text

Machine Learning: The Future of Technology with TGC India

what is Machine Learning

In today's fast-evolving tech landscape, Machine Learning (ML) has become the cornerstone of innovation and transformation. At TGC India, we are dedicated to empowering individuals with the knowledge and skills required to thrive in this exciting domain. Let’s explore what Machine Learning is, why it matters, and how TGC India can guide you in mastering it.

What is Machine Learning?

Machine Learning is a branch of Artificial Intelligence (AI) that enables computers to learn from data and make decisions or predictions without being explicitly programmed. It uses algorithms to analyze patterns, identify trends, and improve performance over time.

For instance:

Netflix recommends movies based on your watch history.

Self-driving cars use ML to make real-time decisions.

TGC India offers comprehensive training on how to implement these powerful ML techniques in real-world scenarios.

Why Learn Machine Learning?

High Demand for ML Professionals: Companies worldwide are looking for skilled ML engineers and data scientists to optimize their operations.

Competitive Salaries: ML professionals enjoy lucrative salaries due to the scarcity of talent in this field.

Diverse Applications: ML is used in industries like healthcare, finance, retail, and entertainment.

Future-Proof Career: The increasing adoption of AI ensures that ML skills will remain relevant for years to come.

At TGC India, we equip our students with cutting-edge knowledge to meet the growing demand for ML experts.

How Machine Learning is Shaping Industries

Healthcare:

Disease diagnosis through pattern recognition

Personalized treatment plans using patient data

Finance:

Fraud detection and prevention

Stock market predictions

E-commerce:

Recommender systems to enhance user experience

Dynamic pricing models

Transportation:

Autonomous vehicles and route optimization

Predictive maintenance of vehicles

With a curriculum tailored to industry needs, TGC India helps you explore these applications hands-on.

Learn Machine Learning at TGC India

At TGC India, we offer a world-class learning experience in Machine Learning through:

Expert Faculty: Learn from industry professionals with years of experience.

Hands-On Training: Work on real-life projects and case studies to gain practical exposure.

State-of-the-Art Infrastructure: Access advanced tools and software used in the ML industry.

Flexible Learning Options: Choose between online and offline classes to suit your schedule.

Placement Assistance: Benefit from our strong industry connections for job placements.

Machine Learning Courses Offered by TGC India

Introduction to Machine Learning: Ideal for beginners to understand the basics of ML and data science.

Advanced Machine Learning with Python: Covers algorithms, deep learning, and neural networks.

Industry-Specific ML Training: Focused courses for fields like healthcare, finance, and e-commerce.

Why Choose TGC India for Machine Learning?

Proven track record in delivering high-quality tech education.

Customizable course content to match your learning goals.

Continuous support from mentors and peers.

Conclusion

Machine Learning is transforming the world as we know it, and there’s no better time to dive into this dynamic field. With TGC India, you get the knowledge, skills, and confidence to build a successful career in Machine Learning.

Start your journey today! Visit TGC India’s website to learn more about our Machine Learning courses and enroll now!

Ready to make your mark in Machine Learning? TGC India is here to help you every step of the way!

1 note

·

View note

Text

How Technology is Revolutionizing Warehouse Operations

In today’s fast-paced world, warehouses are no longer just large storage spaces—they are the backbone of supply chains, ensuring goods move seamlessly from manufacturers to consumers. As industries evolve, the future of warehousing in India is undergoing a transformative shift driven by technology. From smart warehousing to data-driven solutions, innovation is paving the way for unprecedented efficiency, accuracy, and scalability. Let’s explore how technology is revolutionizing warehouse operations and shaping the future.

1. The Rise of Smart Warehousing: Where Intelligence Meets Efficiency

Smart warehousing is more than a buzzword; it’s a paradigm shift. By leveraging technologies like the Internet of Things (IoT), artificial intelligence (AI), and cloud computing, warehouses can now "think" and "communicate."

For example, IoT-enabled sensors monitor inventory levels in real-time, automatically reordering stock when supplies run low. AI algorithms analyze data to optimize space utilization, reduce waste, and predict demand trends. These innovations ensure warehouses operate at peak efficiency, saving time and costs while enhancing service quality.

In India, where e-commerce is booming, smart warehousing is emerging as a game-changer. Companies like Flipkart and Amazon are investing heavily in these technologies to meet customer expectations for faster deliveries.

2. Human-Robot Collaboration: The Future of Smart Warehousing

The idea of robots replacing humans in warehouses is giving way to a more collaborative vision. Human-robot collaboration combines the precision of machines with the problem-solving skills of humans.

Autonomous mobile robots (AMRs) are increasingly used for tasks like picking, packing, and transporting goods. They navigate warehouse floors efficiently, reducing the time and effort required for manual labor. Meanwhile, human workers focus on tasks that require judgment, creativity, and decision-making.

This partnership is not just about efficiency; it’s about creating a safer workplace. Robots handle repetitive or hazardous tasks, reducing workplace injuries and fatigue among human workers.

3. Advanced Data Warehousing: Turning Information into Insight

Data is the new oil, and warehouses are becoming data goldmines. The future of data warehousing involves integrating vast amounts of information collected from warehouse management systems (WMS), IoT devices, and customer interactions.

By analyzing this data, businesses can make informed decisions about inventory management, demand forecasting, and supply chain optimization. For instance, predictive analytics can identify peak seasons and suggest proactive stocking strategies, ensuring products are always available when customers need them.

In India, where supply chains are complex and diverse, data warehousing is helping businesses bridge gaps and streamline operations.

4. Warehouse Management Systems: The Digital Command Center

A warehouse management system (WMS) is like the brain of a modern warehouse. These systems integrate every aspect of operations—from receiving and storing goods to picking, packing, and shipping.

Future WMS solutions are becoming smarter, incorporating AI and machine learning to adapt to dynamic market conditions. These systems can now:

Automatically assign tasks to workers based on their skills and availability.

Optimize storage layouts to maximize space.

Track goods in real time, ensuring complete visibility across the supply chain.

By embracing these systems, Indian warehouses are becoming more agile, responsive, and customer-centric.

5. The Role of Automation in the Future of Warehousing

Automation is at the heart of the future of warehousing solutions. From conveyor belts and automated storage systems to drones that track inventory, automation is reducing manual errors and increasing speed.

One of the most exciting developments is the use of automated guided vehicles (AGVs) in large warehouses. These vehicles transport goods within the facility, minimizing human intervention and speeding up processes.

In India, automation is gaining momentum in sectors like retail, pharmaceuticals, and manufacturing, where precision and efficiency are critical.

6. Sustainability: The Green Future of Warehousing

Technology is also helping warehouses become more sustainable. Energy-efficient lighting systems, solar-powered facilities, and AI-driven energy management are reducing the carbon footprint of warehousing operations.

Government warehousing facilities in India are adopting green practices to align with global sustainability goals. For private players, eco-friendly warehouses are not just good for the planet—they’re also a smart investment, as consumers increasingly prioritize brands that value sustainability.

1 note

·

View note

Text

"Best Artificial Intelligence Stocks in India: Top Picks for 2024"

Investing in artificial intelligence (AI) stocks in India offers an exciting opportunity as the country’s tech sector embraces this transformative technology. AI is revolutionizing industries like healthcare, manufacturing, and IT services, making AI-related stocks highly attractive to investors. Some of the best AI stocks in India include companies like Infosys, Tata Consultancy Services (TCS), and Wipro, which are integrating AI into their services and products. These companies are poised to benefit from the growing demand for AI-driven solutions. Additionally, startups focused on AI innovation and data analytics are also gaining traction in the market. To explore the top AI stocks in India and learn more about their potential, visit Best Artificial Intelligence Stocks in India.

0 notes

Text

Revolutionize Retail with Self-Checkout Kiosks: Made in India

Self-checkout kiosks, crafted by India’s leading manufacturers, are revolutionizing the way businesses interact with customers, offering a seamless and efficient shopping experience. These cutting-edge solutions not only enhance convenience but also empower customers by allowing them to complete transactions independently, making long queues a thing of the past.

Manufactured with state-of-the-art technology, India's self-checkout kiosks are designed to cater to diverse retail needs, from large supermarkets to convenience stores and high-end retail outlets. Featuring intuitive touchscreens, advanced barcode scanners, and secure payment gateways, these kiosks provide an effortless and swift checkout process. Customers can easily scan their items, make payments, and collect receipts in just a few clicks—reducing wait times and improving overall store efficiency.

What makes India’s self-checkout kiosks even more impactful is their integration of artificial intelligence (AI) and machine learning. These smart kiosks can track customer behavior, monitor inventory, and provide valuable insights into purchasing patterns. This data enables retailers to refine their operations, optimize stock levels, and create personalized shopping experiences. Additionally, the kiosks are designed with a focus on security, using advanced fraud prevention mechanisms to ensure safe transactions.

Manufacturers in India are also pioneering in the integration of Internet of Things (IoT) technology, enabling real-time monitoring and remote diagnostics. This ensures that kiosks remain operational with minimal downtime, providing both retailers and customers with a reliable, hassle-free experience.

0 notes

Text

SEBI's New Framework for AI Tools: A Step Towards Regulated Innovation

In a significant move towards regulating artificial intelligence in India's financial markets, the Securities and Exchange Board of India (SEBI) has proposed comprehensive amendments to assign responsibility for AI tools used by market infrastructure institutions and intermediaries. This development comes at a crucial time when, as noted by leading SEBI expert lawyer and Thinking Legal's founder, Vaneesa Agrawal, "AI is taking the world by storm and is widely expected to change every aspect of life over the medium (or maybe even short) term."

Understanding the New Framework

The proposed amendments span across three major regulations: the Securities Contracts Regulation (Stock Exchanges and Clearing Corporations) Regulations, 2018; the SEBI (Depositories and Participants) Regulations, 2018; and the SEBI (Intermediaries) Regulations, 2008. These changes aim to establish clear accountability for AI implementation in financial markets.SEBI expert lawyersemphasize that these changes aim to establish clear accountability for AI implementation in financial markets.

The fundamental principle underlying these amendments is accountability. As Vaneesa Agrawal points out in her analysis of AI regulation, "While AI offers immense potential benefits, its unregulated growth poses significant risks that could have far-reaching consequences." This aligns perfectly with SEBI lawyers' observation of this proactive approach to regulation.

Key Responsibilities Under the New Framework

The cornerstone of these amendments lies in their clear delineation of responsibilities. SEBI lawyershighlight that this clarity is crucial for ensuring accountability in the rapidly evolving AI landscape. As multiple SEBI expert lawyers point out, the framework establishes specific obligations that cannot be delegated or circumvented.

Privacy, security, and integrity of investors' and stakeholders' data

Outputs arising from the usage of such tools and techniques

Compliance with applicable laws in force

The Need for AI Regulation in Financial Markets

The timing of these amendments is particularly relevant. As Vaneesa Agrawal emphasizes in her recent article, "To mitigate these risks, it is essential to develop robust regulatory frameworks that govern the development and deployment of AI. These frameworks should address issues such as data privacy, algorithmic bias, and the ethical implications of AI technologies."

Note that this proposed framework appears to address these concerns directly. The SEBI expert lawyers also point out that these regulations cover both internally developed AI tools and those procured from third-party providers, ensuring comprehensive oversight regardless of the source.

Scope and Application

The regulatory landscape for AI in financial markets is evolving rapidly, and SEBI's proposed framework reflects this dynamic environment. Vaneesa Agrawal, an expert SEBI lawyer explains that the amendments' scope is intentionally broad to accommodate future technological developments while maintaining regulatory effectiveness.

The amendments define AI tools broadly to include:

Applications or software programs for market analysis and trading

Executable systems for risk management and compliance

Tools used for facilitating trading and settlement

Systems for automated compliance requirements

Public product offerings utilizing AI capabilities

Management or other business purposes

SEBI expert lawyers point out that this comprehensive definition ensures no critical AI applications in financial markets escape regulatory oversight. The scope also extends to AI tools used in customer interface, data analytics, and decision-making processes, as noted by experienced SEBI lawyers following these developments.

This comprehensive scope reflects what SEBI expert lawyer, Vaneesa Agrawal describes as the need for "striking the right balance between innovation and control," which she identifies as "crucial to harnessing the benefits of AI while mitigating its potential harms."

Impact on Market Participants

The implementation of these amendments will significantly affect various market participants, as SEBI lawyershighlight. Vaneesa Agrawal also states that understanding these impacts is crucial for ensuring compliance and maintaining market efficiency.

Stock Exchanges and Clearing Corporations

Expert SEBI lawyers advise regular audits of AI systems. Ensure that the tools meet regulatory standards.

Depositories

For this market, SEBI lawyers note the importance of maintaining transaction integrity. This means the industry must adapt to their AI-powered security measures.

Intermediaries registered with SEBI

SEBI expert lawyers emphasize the need for proper documentation.

Asset Management Companies

SEBI lawyers suggest evaluating AI tools used in portfolio management and implementing regular monitoring systems

Investment Managers of Alternative Investment Funds

SEBI lawyers recommend comprehensive documentation and to maintain clear audit trails of AI-driven decisions.

Infrastructure and Real Estate Investment Trust Managers

SEBI lawyers, for this market, advise implementing appropriate safeguards for sensitive data.

A Forward-Looking Approach

SEBI's approach aligns with global trends in AI regulation. Vaneesa Agrawal, an expert SEBI lawyer, notes in her article that "International cooperation would be key for ensuring that AI is developed and used in a responsible and beneficial manner." This perspective is particularly relevant as India's financial markets become increasingly integrated with global systems.SEBI expert lawyersobserve that this alignment with international standards will facilitate cross-border transactions and cooperation.

"By establishing clear guidelines and ethical frameworks, policymakers can ensure that AI is developed and deployed responsibly, benefiting society as a whole."

- Vaneesa Agrawal, SEBI lawyer and founder of Thinking Legal

Conclusion

SEBI's proposed amendments represent a significant step toward creating a structured framework for AI deployment in India's financial markets. AsVaneesa Agrawal concludes in her analysis, "The future of AI is uncertain, but the need for thoughtful regulation is undeniable." The regulations strike a balance between enabling innovation and ensuring responsibility, particularly in protecting investor interests and maintaining market integrity.

The proposed changes provide a foundation for responsible AI adoption while maintaining the flexibility needed for technological advancement. Expert SEBI lawyers continue to monitor these developments closely, providing valuable insights into their implementation and impact.

0 notes

Text

Are you looking to secure your future wealth? Searching for the top stocks to invest in for the long term? Look no further! Get ready to secure your future wealth with the top five stocks for long-term investment.

#jarvis ai#best stock market advisor in india#share market advisor#ai tool for stock market india#stocks for ai#stocks for long term#stocks for long term investment#stock advisory company#jarvis artificial intelligence#top ai shares in India#artificial intelligence stocks in india

0 notes

Text

High Paying Jobs in Mumbai – Top Career Opportunities for Professionals

High Paying Jobs in Mumbai – Top Career Opportunities for Professionals

Mumbai, the financial capital of India, is home to some of the world’s largest companies, thriving industries, and a bustling job market. As the city of dreams, Mumbai attracts professionals from various fields, offering lucrative career opportunities across sectors. From finance and technology to entertainment and healthcare, the high-paying job market in Mumbai is vast and diverse.

If you're looking to advance your career and secure a high-paying job, Mumbai is the place to be. In this article, we'll explore the top career opportunities for professional jobs in Mumbai and how you can position yourself for success in this competitive landscape.

Why Mumbai is the Hub for High Paying Jobs

Before we dive into the top career opportunities, let’s take a moment to understand why Mumbai offers such high-paying roles.

Financial Capital of India Mumbai is home to India’s major financial institutions, including the Bombay Stock Exchange (BSE) and the Reserve Bank of India (RBI). The city hosts a significant number of multinational corporations (MNCs) and top Indian companies, making it a hotspot for finance professionals and business experts.

Growing Tech Industry With the rapid growth of the tech industry, Mumbai has become a central hub for IT and software development companies. Many top global tech firms, including Google, Amazon, and Microsoft, have established offices here, offering excellent salaries to skilled professionals.

Entertainment and Media Capital Mumbai is also the epicenter of India’s entertainment industry. Known as "Bollywood," the city offers career opportunities for those in the media, advertising, and entertainment fields, with many lucrative roles for content creators, producers, directors, and actors.

Diverse Job Market Mumbai offers job opportunities across a wide range of sectors including healthcare, law, real estate, consulting, and marketing. The diversity of industries makes it an attractive location for professionals from various backgrounds.

Top High Paying Jobs in Mumbai

Now that we’ve established why Mumbai is an ideal place for high-paying jobs, let’s look at some of the top career opportunities for professionals in the city.

1. Investment Banker

Investment banking is one of the most lucrative fields in Mumbai. Investment bankers help companies raise capital, manage mergers and acquisitions, and provide financial advisory services. With Mumbai being the hub for India’s financial institutions, investment bankers in the city are well-compensated for their expertise.

Skills Required:

Strong knowledge of financial markets and analysis

Excellent quantitative and analytical skills

MBA or finance-related qualifications

Communication and negotiation skills

Salary Range: ₹10,00,000 to ₹50,00,000 per annum (based on experience and seniority)

2. Software Engineer/Developer

Mumbai’s growing tech industry offers high-paying roles for software engineers and developers. With companies like TCS, Infosys, Cognizant, and international firms like Google and Microsoft, there is no shortage of opportunities for professionals with expertise in software development, cloud computing, artificial intelligence (AI), machine learning (ML), and data science.

Skills Required:

Proficiency in programming languages like Java, Python, C++, and JavaScript

Strong problem-solving abilities

Experience with software development and databases

Knowledge of cloud computing and AI

Salary Range: ₹8,00,000 to ₹25,00,000 per annum

3. Chartered Accountant (CA)

Mumbai is a major hub for financial services and offers top-paying positions for Chartered Accountants (CAs). CAs are in high demand across various sectors, including banking, consulting, taxation, and corporate finance. The city’s top accounting firms, such as Deloitte, PwC, and EY, offer attractive packages to experienced professionals in this field.

Skills Required:

Chartered Accountant qualification

In-depth knowledge of accounting, auditing, and taxation

Analytical thinking and attention to detail

Good communication and interpersonal skills

Salary Range: ₹12,00,000 to ₹30,00,000 per annum

4. Marketing Director/Manager

The marketing industry in Mumbai is vibrant and offers excellent opportunities for professionals with leadership skills. Marketing directors and managers are responsible for planning and executing marketing strategies to build brand awareness and drive sales. Companies in Mumbai, especially those in the consumer goods, retail, and e-commerce industries, offer competitive salaries to top marketing professionals.

Skills Required:

Expertise in digital marketing, SEO, SEM, and content marketing

Strong leadership and project management skills

Ability to analyze market trends and customer data

Excellent communication and presentation skills

Salary Range: ₹12,00,000 to ₹35,00,000 per annum

5. Lawyers/Corporate Lawyers

Mumbai, as the financial capital, also hosts India’s top law firms and corporate houses. Corporate lawyers specializing in mergers and acquisitions, intellectual property (IP) law, and commercial law are highly sought after. High-end legal professionals working for MNCs and law firms in Mumbai enjoy lucrative compensation packages, along with perks and bonuses.

Skills Required:

Law degree (LLB or LLM)

Strong understanding of corporate law, litigation, and contracts

Exceptional negotiation and communication skills

Analytical and problem-solving skills

Salary Range: ₹10,00,000 to ₹40,00,000 per annum

6. Product Manager

In the fast-paced tech and e-commerce industry, product managers are crucial to the success of new products and services. They are responsible for overseeing product development, strategy, and implementation. With major tech firms and startups in Mumbai, product managers enjoy high-paying opportunities that often include performance-based bonuses and stock options.

Skills Required:

Experience in product lifecycle management

Strong analytical and strategic thinking skills

Understanding of market research and customer behavior

Leadership and team management skills

Salary Range: ₹12,00,000 to ₹35,00,000 per annum

7. Consultant (Management, Strategy, or IT)

Consultants, particularly in the fields of management, strategy, and IT, are highly paid professionals in Mumbai. Consulting firms like McKinsey & Company, Boston Consulting Group (BCG), and Accenture offer significant salaries and attractive benefits to professionals who provide advisory services to companies looking to optimize operations, improve business strategies, and implement technology solutions.

Skills Required:

Strong analytical and problem-solving abilities

Leadership and communication skills

MBA or equivalent qualifications

Industry-specific knowledge and expertise

Salary Range: ₹12,00,000 to ₹45,00,000 per annum

8. Data Scientist/Analyst

With the rise of big data, data scientists and analysts are in high demand in Mumbai’s tech and finance sectors. These professionals are responsible for analyzing complex data sets, identifying trends, and providing insights that help businesses make data-driven decisions. Companies in sectors like finance, healthcare, and e-commerce are offering high-paying opportunities for skilled data scientists.

Skills Required:

Proficiency in data analysis tools like Python, R, SQL, and Hadoop

Strong knowledge of machine learning and AI

Excellent problem-solving skills

Ability to communicate complex data insights to non-technical stakeholders

Salary Range: ₹10,00,000 to ₹30,00,000 per annum

How to Secure a High Paying Job in Mumbai

Network and Build Connections Networking plays a key role in landing high-paying jobs. Attend industry events, seminars, and connect with professionals on platforms like LinkedIn to increase your visibility and opportunities.

Upgrade Your Skills High-paying jobs require advanced skills and qualifications. Continuously upgrade your skills through online courses, certifications, and professional development programs to stay ahead of the competition.

Tailor Your Resume Ensure that your resume is customized to highlight the skills and experiences relevant to the job you're applying for. A well-crafted resume increases your chances of getting noticed by recruiters.

Prepare for Interviews Be prepared for tough interview rounds. Research the company thoroughly, understand its culture, and be ready to showcase how your skills align with the job requirements.

Conclusion

Mumbai is undoubtedly one of the best places to pursue high-paying jobs in India. With its diverse industries, multinational presence, and thriving job market, the city offers abundant opportunities for skilled professionals to grow and succeed. Whether you’re an investment banker, software engineer, marketing professional, or data scientist, Mumbai has something for everyone.

By upgrading your skills, networking effectively, and staying focused on your career goals, you can land one of the top high-paying jobs in Mumbai and take your career to new heights.

0 notes

Text

BNP Paribas AM: Investment Outlook for 2025

The Investment Outlook for 2025 highlights a year of significant economic and market transitions. With inflation under control, central banks are poised for easing cycles, offering new opportunities for investors. At the same time, geopolitical and environmental challenges underscore the importance of resilience, diversification, and thematic investing. Key Themes and Strategic Insights 1. Navigating Macroeconomic Shifts - Soft Landing or Recession Risks: - Markets anticipate a soft landing, but scenarios such as renewed inflationary pressures or a hard landing remain possible. - Global central banks, including the Federal Reserve and European Central Bank, are expected to cut rates to support growth. - Regional disparities persist, with the U.S. outperforming Europe, while China focuses on stabilizing its property market and stimulating emerging industries.

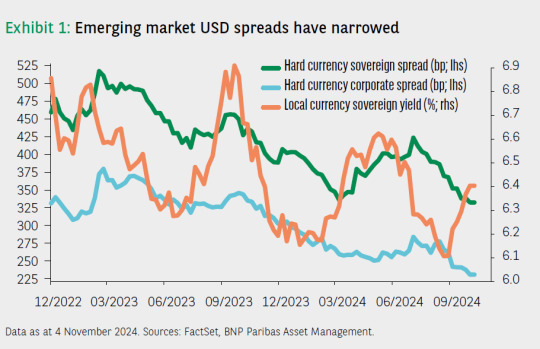

- Geopolitical Dynamics: - The re-election of Donald Trump introduces uncertainty, with potential shifts in U.S. tax policies, trade agreements, and global economic ties. - Geopolitical hotspots (e.g., Ukraine, Taiwan, Israel) create additional risks for markets. 2. Sustainability and Thematic Investments - Transition Finance: - Investments targeting decarbonization and sustainable operations in high-emission sectors (e.g., energy, heavy industry) are gaining momentum. - EU regulations like ESMA’s fund naming guidelines in 2025 will enhance transparency and accountability in transition investments. - Climate Adaptation: - Climate resilience strategies, including infrastructure upgrades and disaster response, are becoming central to investment portfolios. - Water scarcity solutions (e.g., smart irrigation, water treatment) present a diverse and resilient investment opportunity. - Natural Capital: - Regenerative agriculture, forestry, and water resource preservation are key areas for achieving both economic stability and sustainability goals. - Governments and institutions increasingly prioritize biodiversity and ecosystem restoration. 3. Equity Markets: Favoring Resilience - U.S. Market Leadership: - U.S. equities remain attractive due to fiscal stimulus and advancements in technology, particularly artificial intelligence (AI). - Small caps and value stocks are positioned for recovery as interest rates decline. - European Equities: - Europe lags due to structural challenges in Germany and geopolitical headwinds, but exporters benefit from robust U.S. growth. - Consumer-driven sectors depend on stronger demand recovery. - Emerging Markets: - Markets like India and Southeast Asia offer growth potential, driven by demographics and policy reforms. - China’s success in revitalizing its economy remains a critical swing factor. 4. Fixed Income: Life Beyond Cash - Opportunities in Bonds: - Investment-grade credit offers stable returns amid easing monetary policies. - U.S. mortgages and emerging market local currency bonds provide attractive yields. - Active Management: - A steep yield curve and higher real yields favor active strategies to capitalize on dispersion and timing. - Quantitative Tightening: - Central banks unwinding quantitative easing introduce volatility, creating arbitrage opportunities in fixed income markets.

5. Private Credit and Alternatives - Private Credit Expansion: - Private credit markets are democratizing, with innovations like ELTIF 2.0 making them accessible to retail investors in Europe. - Partnerships between asset managers, banks, and insurers streamline the credit chain. - Sustainability in Private Credit: - Investors increasingly demand ESG-compliant frameworks, pushing managers to develop robust methodologies for evaluating borrowers’ sustainability practices. - Infrastructure and Real Assets: - Renewable energy projects, energy-efficient buildings, and digital infrastructure investments align with long-term structural trends. Strategic Asset Allocation - Equities: - Overweight U.S. equities, particularly AI and technology sectors. - Focus on value opportunities in Europe and growth-oriented emerging markets. - Fixed Income: - Emphasize high-yield credit, local currency emerging market bonds, and inflation-linked securities. - Active duration management to navigate rate volatility. - Private Markets: - Leverage private credit for stable yields and diversification. - Real assets, including infrastructure and water solutions, provide inflation hedging and long-term growth. - Sustainability: - Prioritize transition finance, climate adaptation strategies, and natural capital investments. 2025 presents a landscape of opportunities driven by sustainability, technological innovation, and economic recovery. Investors should adopt a balanced and flexible approach, leveraging thematic investments, private markets, and active management to navigate risks and capture growth. Resilience, diversification, and long-term sustainability remain key to optimizing portfolios in an evolving global environment. Read the full article

0 notes

Text

Unlocking Success with Stock Market Advisory, SEBI Registered Investment Advisors, and Trade Ideas

Investing in the stock market can be both rewarding and challenging. To navigate this complex landscape successfully, leveraging stock market advisory services, working with a SEBI registered investment advisor, and using platforms like Trade Ideas can make a significant difference. Let’s explore how these elements can enhance your investment journey.

The Importance of Stock Market Advisory

Stock market advisory services are tailored to assist investors with strategic decisions, helping them maximise returns while minimising risks. These services analyse market trends, economic indicators, and technical data to provide actionable recommendations for various investment goals.

Whether you’re new to investing or an experienced trader, an advisory service can guide you through market fluctuations, identify high-potential stocks, and offer a roadmap for achieving your financial objectives.

The Role of SEBI Registered Investment Advisors

A SEBI registered investment advisor (RIA) is a financial professional recognised by the Securities and Exchange Board of India. These advisors adhere to strict ethical and regulatory standards, ensuring that investors receive transparent, unbiased, and reliable guidance.

Why choose an RIA?

Personalised Financial Planning: RIAs create investment strategies tailored to your financial goals, risk tolerance, and time horizon.

Fee-Only Model: Unlike commission-based agents, RIAs operate on a fee-only basis, ensuring their advice serves your best interests.

Regulatory Compliance: RIAs are bound by SEBI’s stringent rules, offering an added layer of trust and security.

Working with a SEBI registered investment advisor helps you make informed decisions while avoiding common pitfalls in the market.

Elevating Trading with Trade Ideas

Trade Ideas is a cutting-edge trading platform powered by artificial intelligence. It equips traders with tools to identify profitable opportunities, backtest strategies, and execute trades efficiently.

Key Features of Trade Ideas:

Real-Time Stock Scanning: Quickly identify stocks that meet specific criteria.

AI-Powered Insights: Leverage machine learning to uncover high-potential trade setups.

Backtesting: Evaluate the effectiveness of trading strategies before executing them.

For swing traders, Trade Ideas simplifies the process of finding the best stocks to swing trade by analyzing market patterns and generating actionable insights.

A Winning Combination

The synergy between stock market advisory services, SEBI registered investment advisors, and tools like Trade Ideas is transformative for investors. While advisory services and RIAs provide the human expertise required to build robust investment strategies, Trade Ideas adds a layer of technological precision, ensuring timely and accurate decision-making.

For instance, an advisor might recommend focusing on a particular sector, while Trade Ideas pinpoints specific stocks within that sector with optimal entry and exit points. This combination of expertise and technology ensures you stay ahead in a competitive market.

Conclusion

Success in the stock market is no longer about going it alone. With stock market advisory services, guidance from SEBI registered investment advisors, and the AI-powered capabilities of Trade Ideas, you have a comprehensive toolkit for making informed and profitable investment decisions.

Whether you’re a long-term investor or an active trader, integrating these resources into your strategy can unlock unparalleled opportunities. Start your journey to financial success today by embracing the best that human expertise and advanced technology have to offer.

0 notes

Text

0 notes

Text

BizzBuzz is an Indian business news platform that offers comprehensive coverage of various sectors, including stock markets, technology, Sports, Economy and finance. It provides a blend of news, in-depth analysis, and feature articles, catering to readers interested in India's dynamic business landscape.

Markets: Updates on stock market trends, IPOs, and equity news.

Economy: Insights into economic developments, including GDP growth, inflation, and policy changes.

Industry: News across sectors like agriculture, aviation, banking, and real estate.

Technology: Coverage of advancements in artificial intelligence, information technology, and gadgets. and get details about the latest launch of Smartphones, laptops, smartwatches, and Smart TVs.

Additionally, BizzBuzz offers multimedia content such as videos, podcasts, and visual stories to provide diverse perspectives on current business events.

For readers interested in the latest business news and analyses, BizzBuzz serves as a valuable resource.

1 note

·

View note

Text

Unlocking Success in Trading: SEBI-Registered Investment Advisors, Trade Ideas, and the Best Stocks to Swing Trade

Swing trading has become a popular strategy for traders looking to capitalise on short-to-medium-term price movements in the stock market. Achieving consistent success in swing trading, however, requires a combination of professional guidance, advanced tools, and an understanding of high-potential stocks. This article highlights the importance of working with a SEBI registered investment advisor, leveraging platforms like Trade Ideas, and identifying the best stocks to swing trade for optimal results.

Why Consult a SEBI-Registered Investment Advisor?

A SEBI-registered investment advisor is certified by the Securities and Exchange Board of India to provide expert financial guidance. Their registration ensures that they adhere to strict ethical and regulatory standards, making them a trustworthy choice for traders and investors.

Benefits of Working with SEBI-Registered Investment Advisors:

Tailored Financial Advice: Advisors offer personalized strategies based on your financial goals and risk tolerance.

Regulatory Assurance: Their adherence to SEBI guidelines guarantees unbiased and transparent advice.

Comprehensive Market Analysis: SEBI-registered advisors use advanced tools to analyze trends and recommend high-potential stocks.

Risk Management: They help you mitigate risks by providing effective entry and exit strategies.

If you’re a swing trader, these professionals can provide valuable insights into the most promising stocks and strategies to maximize your returns.

Using Trade Ideas to Enhance Swing Trading

Trade Ideas is a cutting-edge stock analysis platform that uses artificial intelligence to identify profitable opportunities in the market. For swing traders, this platform is a game-changer, offering a range of tools to streamline decision-making.

Features That Make Trade Ideas Ideal for Swing Trading:

AI-Powered Insights: The platform’s AI assistant, Holly, scans thousands of stocks to highlight the best trading opportunities.

Customizable Stock Scanning: Create filters based on criteria like price action, volume, and technical indicators to find swing trade candidates.

Real-Time Alerts: Stay updated on price movements and trade setups that match your strategy.

Backtesting Tools: Test and refine your swing trading strategies using historical market data.

Educational Resources: Access tutorials and webinars to enhance your trading knowledge.

With Trade Ideas, swing traders can quickly identify stocks with the potential for significant price movements and make informed trading decisions.

How to Identify the Best Stocks to Swing Trade

Finding the best stocks to swing trade requires a combination of research, technical analysis, and market insights. Here are some key characteristics to look for in swing trade candidates:

High Liquidity: Focus on stocks with high trading volumes to ensure smooth entry and exit.

Volatility: Choose stocks with enough price movement to capitalize on swings.

Strong Trends: Look for stocks in well-defined upward or downward trends.

Earnings Reports: Monitor upcoming earnings announcements, as they can create significant price movements.

Sector Momentum: Identify sectors experiencing bullish or bearish momentum to find potential opportunities.

Platforms like Trade Ideas can simplify this process by scanning the market for stocks that meet these criteria.

Combining Expertise and Technology for Swing Trading Success

The key to successful swing trading lies in combining expert guidance with advanced tools. Here’s how you can use these resources effectively:

Consult a SEBI-Registered Advisor: Get personalized advice on which stocks to trade and how to manage risk.

Leverage Trade Ideas: Use the platform’s AI-driven insights and customizable scanning tools to identify profitable trades.

Conduct Research: Stay informed about market trends, sector performance, and company fundamentals.

Test Your Strategies: Use backtesting tools to refine your approach and improve your trading success rate.

This holistic approach ensures that you’re equipped with the knowledge and tools needed to maximize returns while minimizing risks.

Conclusion

Swing trading offers significant profit potential for traders who approach it with the right strategies and tools. By working with a SEBI-registered investment advisor, utilizing Trade Ideas, and focusing on the best stocks to swing trade, you can improve your trading efficiency and achieve consistent success.

Start integrating professional guidance and AI-powered analytics into your trading journey today, and unlock the full potential of swing trading.

0 notes