#apy eligibility

Explore tagged Tumblr posts

Text

Collect Patient Payments - pVerify

At pVerify, we provide complete Collect Patient Payments, giving healthcare providers efficient methods to handle payments without any hassles. With the help of our platform, providers may securely and effectively collect money from patients for the services they have delivered. We provide numerous payment choices, such as online payments, automated payment plans, and payment reminders, that aim to meet the various demands of patients. We achieve this by utilizing modern technology and secure payment processors. Put your trust in pVerify for reliable, efficient, and secure solutions that can optimize revenue cycles and expedite patient collection of payments.

#medical#medical api#medical eligibility verification#pverify#patient estimation solution#insurance eligibility verification

0 notes

Photo

If you’re eligible to vote, you have the right to vote. If you run into any problems or have questions before or on Election Day, call or text the Election Protection Hotline:

📞 English: 1-866-OUR-VOTE 📞 Spanish: 1-888-VE-Y-VOTA 📞 Arabic: 1-844-YALLA-US 📞 Bengali, Cantonese, Hindi, Urdu, Korean, Mandarin, Tagalog, or Vietnamese: 1-888-API-VOTE

83 notes

·

View notes

Text

Blur Token Airdrop: How to Claim $Blur Airdrop

Blur Airdrop Eligibility : How to Get $Blur Token Airdrop?

Introduction Blur Airdrop:

Blur Airdrop ($BLUR) is a decentralized NFT marketplace known for its fast access to NFT reveals and improved user experience. They have completed the first season of airdrops called “Care Packages” and are now preparing for Season 3. In this guide, we will explore the steps to participate in the Blur Airdrop and maximize your rewards.

Step-by-step Guide for Blur Airdrop:

Connect your wallet to the Blur Airdrop Page.2. Navigate to the “Airdrop” tab to see the number of Care Packages you have earned. 3. Click on “Claim Airdrop” to claim your earned blur tokens. 4. To claim your $BLUR tokens, click on “Continue to BLUR,” “connect wallet and check eligibility,” and then “Next.” 5. complete all steps to approve and claim your tokens (if eligible). 6. Use MetaMask or a compatible wallet to claim $BLUR. 7. Confirm the transaction on your wallet.

Understanding $BLUR Tokenomics:

$BLUR has a maximum supply of 3 billion tokens, with 51% allocated to the community treasury, 29% to core contributors, 19% to investors, and 1% to advisors. Currently, only 360 million $BLUR tokens are unlocked and in circulation, with the remaining tokens still locked. Tokens are unlocked gradually, with the next unlock scheduled for June 15, 2023. 1. Strategies for Blur Season 3 Airdrop: Maximizing Blur Points: Bidding, listing, and lending on the Blur platform will earn you Blur Points. Actively participate in these activities to maximize your Blur Points.

2. Maximizing Bid Points: Place bids closest to the floor price across multiple active collections and keep your bids active for a longer duration to earn more Bid Points.

3. Maximizing Listing Points: List all your NFTs, especially blue chip and active collections, to earn more Listing Points. Utilize all of Blur’s listing tools and avoid gaming the system.

4. Maximizing Lending Points on Blend: Make Loan Offers using ETH in your Blur Pool with higher Max Borrow and lower APY to earn more Lending Points. Make multiple Loan Offers on different collections.

5. Maximizing Loyalty Points: List your NFTs exclusively through Blur to maintain 100% loyalty. Actively list blue chip and active collections while maintaining loyalty throughout Season 3.

6. Maximizing Holder Points: Deposit $BLUR tokens to earn Holder Points, which count for 50% of the Season 3 airdrop rewards. Maintain your deposit and avoid withdrawing to maximize your Holder Points.

28 notes

·

View notes

Text

The San Francisco tech scene is completely beyond satire. I'm in a discord server for game developers based in SF because even though I don't live in the bay area anymore it's still the closest hub for indie developers near me. I went to one of their meetups once, the talk itself was completely useless and I left about 30 mins in, but I did get two people to playtest my demo beforehand so it was still worthwhile. One of those things where you're in a sea of 50 people who annoy you and are able to find maybe one or two people who are cool to talk to.

Anyway, I just received a ping about their next meetup, which is-- I literally could not make up something more on the nose than this if I tried--

brought to you

by

✨ J.P. Morgan ✨

.

Actual quote from the event page:

Are you a developer looking to accept payments and monetize your users effectively? We are excited to announce this unique opportunity to get in on the ground floor and learn about how to monetize your payment flow for your gaming applications at scale. As you may be aware, the Apple App Store and other stores are now allowing outside payment methods within iPhone apps due to "anti-competitive" laws in the EU. As a result, if you are part of Apples small business program, you may be eligible for a discounted percentage fee on IAP instead of the normal 30% fee. We hope you can attend to explore these concepts and learn how you can save money on payment processing fees with J.P. Morgan Payments.

Food is sponsored by J.P. Morgan and drinks are available for purchase at the DNA Lounge bar. All proceeds from drink sales go directly to the venue which helps them keep the lights on, and also helps us continue to host events in their space. DNA Lounge is over 3,000 sqft and is the largest venue we've ever hosted our events at. Speakers will go on stage at 7:00pm. This is an all ages event, is open to the public and is a professional networking event for game developers, artists, students, indies, or really anyone interested in game development. ASL Interpretation services available upon request via email.

Speaker Lineup:

Alan Lee | Developer Relations at J.P. Morgan Payments

Enhance your Payment Experience with J.P Morgan’s Payment Developer Platform

In this session, The J.P Morgan Payments developer relations team will showcase how the Online Payments API allows you to seamlessly accept, process and settle payments from the large suite of supported payment methods. We’ll explore the extended capabilities like tools for fraud prevention, recurring payments and demonstrate how these features can help you improve authorization rates, secure transactions, and gain valuable insights into your payment flow.

so anyway if anybody needs me I will be basically anywhere except at this particular event

#it's such a shame because I actually love so many things about San Francisco#the techbros.... they are the worst and i cannot stand them

7 notes

·

View notes

Text

I'm having trouble connecting my store to TikTok Shop with CedCommerce. What should I do?

Having trouble connecting your store to TikTok Shop with CedCommerce - https://bit.ly/3SxSvkZ

Here’s how you can troubleshoot:

Ensure proper installation and permission settings.

Verify your TikTok Shop account status.

Double-check your API keys and credentials.

Confirm product eligibility and compliance.

Clear your browser cache and cookies for a fresh start.

For more detailed guidance, check out our support documentation or drop your questions here. We're here to help!

3 notes

·

View notes

Text

"DCA"(DIPLOMA IN COMPUTER APPLICATION)

The best career beginning course....

Golden institute is ISO 9001-2015 certified institute. Here you can get all types of computer courses such as DCA, CFA , Python, Digital marketing, and Tally prime . Diploma in Computer Applications (DCA) is a 1 year "Diploma Course" in the field of Computer Applications which provides specialization in various fields such as Fundamentals & Office Productivity tools, Graphic Design & Multimedia, Programming and Functional application Software.

A few of the popular DCA study subjects are listed below

Basic internet concepts Computer Fundamentals Introduction to programming Programming in C RDBMS & Data Management Multimedia Corel draw Tally ERP 9.0 Photoshop

Benefits of Diploma in Computer Application (DCA)

After completion of the DCA course student will able to join any computer jobs with private and government sectors. The certification of this course is fully valid for any government and private deportment worldwide. DCA is the only best option for the student to learn computer skills with affordable fees.

DCA Computer course : Eligibilities are here... Students aspiring to pursue Diploma in Computer Applications (DCA) course must have completed their higher school/ 10 + 2 from a recognized board. Choosing Computers as their main or optional subject after class 10 will give students an additional edge over others. Apart from this no other eligibility criteria is set for aspirants. No minimum cutoff is required.

"TALLY"

A Tally is accounting software. To pursue Tally Course (Certificate and Diploma) you must have certain educational qualifications to thrive and prosper. The eligibility criteria for the tally course is given below along with all significant details on how to approach learning Tally, and how you can successfully complete the course. Generally, the duration of a Tally course is 6 month to 1 year ,but it varies depending on the tally institution you want to join. Likewise, tally course fees are Rs. 10000-20000 on average but it also varies depending on what type of tally course or college you opt for. accounting – Accounting plays a pivotal role in Tally

Key Benefits of the Course:

Effective lessons (topics are explained through a step-by-step process in a very simple language) The course offers videos and e-books (we have two options Video tutorials in Hindi2. e-book course material in English) It offers a planned curriculum (the entire tally online course is designed to meet the requirements of the industry.) After the completion of the course, they offer certificates to the learners.

Tally Course Syllabus – Subjects To Learn Accounting Payroll Taxation Billing Banking Inventory

Tally Course

Eligibility criteria: 10+2 in commerce stream Educational level: Certificate or Diploma Course fee: INR 2200-5000 Skills required: Accounting, Finance, Taxation, Interpersonal Skills Scope after the course: Accountant, Finance Manager, Chartered Accountant, Executive Assistant, Operations Manager Average salary: INR 5,00,000 – 10,00,000

"In this Python course"

Rapidly develop feature-rich applications using Python's built-in statements, functions, and collection types. Structure code with classes, modules, and packages that leverage object-oriented features. Create multiple data accessors to manage various data storage formats. Access additional features with library modules and packages.

Python for Web Development – Flask Flask is a popular Python API that allows experts to build web applications. Python 2.6 and higher variants must install Flask, and you can import Flask on any Python IDE from the Flask package. This section of the course will help you install Flask and learn how to use the Python Flask Framework.

Subjects covered in Python for Web development using Flask:

Introduction to Python Web Framework Flask Installing Flask Working on GET, POST, PUT, METHODS using the Python Flask Framework Working on Templates, render template function

Python course fees and duration

A Python course costs around ₹2200-5000.This course fees can vary depending on multiple factors. For example, a self-paced online course will cost you less than a live interactive online classroom session, and offline training sessions are usually expensive ones. This is mainly because of the trainers’ costs, lab assistance, and other facilities.

Some other factors that affect the cost of a Python course are its duration, course syllabus, number of practical sessions, institute reputation and location, trainers’ expertise, etc. What is the duration of a Python course? The duration of a basic Python course is generally between 3 month to 6 months, and advanced courses can be 1 year . However, some courses extend up to 1 year and more when they combine multiple other courses or include internship programs.

Advantages of Python Python is easy to learn and put into practice. … Functions are defined. … Python allows for quick coding. … Python is versatile. … Python understands compound data types. … Libraries in data science have Python interfaces. … Python is widely supported.

"GRAPHIC DESIGN"

Graphic design, in simple words, is a means that professional individuals use to communicate their ideas and messages. They make this communication possible through the means of visual media.

A graphic designing course helps aspiring individuals to become professional designers and create visual content for top institutions around the world. These courses are specialized to accommodate the needs and requirements of different people. The course is so popular that one does not even need to do a lot of research to choose their preferred colleges, institutes, or academies for their degrees, as they are almost mainstream now.

A graphic design course have objectives:

To train aspirants to become more creative with their visual approach. To train aspirants to be more efficient with the technical aspects of graphics-related tasks and also to acquaint them with relevant aspects of a computer. To train individuals about the various aspects of 2-D and 3-D graphics. To prepare aspirants to become fit for a professional graphic designing profession.

Which course is best for graphic design? Best graphic design courses after 12th - Graphic … Certificate Courses in Graphic Design: Adobe Photoshop. CorelDraw. InDesign. Illustrator. Sketchbook. Figma, etc.

It is possible to become an amateur Graphic Designer who is well on the road to becoming a professional Graphic Designer in about three months. In short, three months is what it will take to receive the professional training required to start building a set of competitive professional job materials.

THE BEST COMPUTER INSTITUTE GOLDEN EDUCATION,ROPNAGAR "PUNJAB"

The best mega DISCOUNT here for your best course in golden education institute in this year.

HURRY UP! GUYS TO JOIN US...

Don't miss the chance

You should go to our institute website

WWW.GOLDEN EDUCATION

CONTACT US: 98151-63600

VISIT IT:

#GOLDEN EDUCATION#INSTITUTE#COURSE#career#best courses#tallyprime#DCA#GRAPHICAL#python#ALL COURSE#ROOPAR

2 notes

·

View notes

Text

UniLend Finance Tech Update Q3 2023⚙️

👷This new initiative will keep community updated on behind-the-scenes development by the engineering team.

Read blog for more details ➡️

https://medium.com/@unilend/mainnet-uprising-unilend-tech-update-q3-2023-f55fd51019ff

🌟Major Highlights

💠Launching our Governance to the community. This is an essential step leading to true decentralization of UniLend Finance.

💠Development of a new age liquidation mechanism.

💠Revamping the UniLend UI to enhance user experience.

✅Throughout the previous quarter, engineering team has focused on below major accomplishments:

🏛️UniLend Governance:

1. Launched our governance framework.

2. Introducing UFTG: UFTG is the governance token that wraps native UFT tokens and will be required by users to participate in the governance.

3. Created detailed governance documentation, empowering users to discuss and vote on platform-related matters.

🏦Liquidation Mechanism:

1. Introduced a new concept of Concentrated Liquidations, where a liquidator can potentially liquidate multiple eligible loans within the same transaction.

2. Developed APIs for our Liquidation mechanism to onboard leading ecosystem liquidators to build on UniLend V2!

3. Developed a state-of-the-art liquidation bot that will help us maintain the stability of UniLend v2.

4. Decentralized exchange integrations with the Liquidation bot is in progress

5. Dedicated Liquidation UI to make Liquidation process more transparent and user-friendly is in progress

📲New UI:

1. The engineering team is developing a new-age UI to improve user experience based on user feedback on our testnet.

2. UniLend V2 will now support WalletConnect and Coinbase wallet.

📺Stay tuned for more exciting products from UniLend!

🫶Thank you for being a part of our journey towards a decentralized future!

🗣 #Crypto #DeFi #Web3 #Blockchain #altcoin #UniLendV2 #Gem #Buy #HODL #UFT $UFT

#blockchain#crypto#defi#marketing#investing#cryptocommunity#cryptocurency news#cryptocurrency#cryptocurreny trading#unilendv2

4 notes

·

View notes

Photo

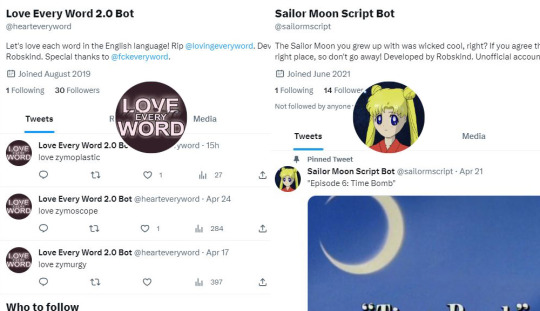

A lot has changed across Twitter over the past few months, much of it having impacted me directly. While I’ve had an ordinary account there for years, more recently I’ve created developer accounts, and on them applications (’bots’ if you will), coded programs that can interact with Twitter automatically. The first one of these was the Love Every Word Bot (@lovingeveryword).

With great misfortune, it is confirmed to have been completely lost. The circumstances behind this are unclear, but this year, the account was deactivated by Twitter themselves and unrecoverable soon after. The Love Every Word Bot, at its peak, had a follower count that was over 9,000 (not intended to be a Dragon Ball Z reference, the account literally had slightly over 9,000 followers before its demise) and was regularly interacted with. Every half hour, Love Every Word posted a word from the English dictionary with the word ‘love’ in front of it, and sometimes interacted with its spiritual twin account Fuck Every Word 2.0 (@fckeveryword). Ever since June 2019 it was active. Now it is time to move on.

Since then I spent some time formulating a backup plan to replace the original Love Every Word. Meanwhile, the Sailor Moon Script Bot (@sailormscript, tweeting dialogue from the English dub of Sailor Moon), one of the other developer accounts I created, continued its run. Eventually, I was ready to resurrect Love Every Word and its mission. On April 17th it made its return, as Love Every Word 2.0 Bot (@hearteveryword) with upgrades such as being able to provide word definitions. Both accounts may be in need of further updating, however, after what is supposed to occur on Twitter in the next few days.

To those who may not know, the Twitter corporation has been gradually closing off access to its API, which simply, is an interface that allows programs to communicate with each other. There is a version 2 that must be migrated to, but I cannot with the current applications that support both Love Every Word 2.0 and Sailor Moon Script bots. There is something I can do about this, but it’s possible either account may be put offline for a while. The good news is that in the end, both accounts are eligible to continue operating under the Free plan, which is designed for developer accounts that make little use of the API. Bad news is, Twitter’s new plans will rule out many other developers from continuing to operate there at all. Many fan-favorite bot accounts are in danger of dying, as they cannot afford to subscribe to Twitter’s new plans to continue their use of the API. While there’s great uncertainty with what direction the website is taking, preparation’s a good idea, and that’s what I‘m trying to do with what may happen.

2 notes

·

View notes

Text

MSN Laboratories Walk-in Interview for API Regulatory Affairs (Executive/Sr. Executive) | M.Sc. | 18th October 2024 Are you an experienced professional in API Regulatory Affairs? MSN Laboratories Pvt Ltd is conducting a walk-in interview for the position of Executive/Senior Executive in the API Regulatory Affairs department. The event is scheduled for Friday, 18th October 2024 at their R&D Center in Pashamylaram. This is a fantastic opportunity for candidates with a M.Sc. degree and 2-7 years of experience to join a highly regarded pharmaceutical company. Position Details Department: API Regulatory Affairs Designation: Executive/Senior Executive Qualification: M.Sc. (Chemistry/Pharmaceutical Sciences or related field) Experience: 2-7 years in Regulatory Affairs, preferably in API Job Location: MSN Laboratories Pvt Ltd, R&D Center, Pashamylaram Interview Date: Friday, 18th October 2024 Interview Time: 09:00 AM Interview Location: MSN Laboratories Pvt Ltd, R&D Center, Pashamylaram Job Responsibilities The selected candidate will be responsible for: Regulatory Submissions: Preparing, reviewing, and submitting dossiers for global markets to ensure regulatory compliance of Active Pharmaceutical Ingredients (APIs). Document Control: Managing and maintaining regulatory documentation, including updates and amendments as per regulatory guidelines. Compliance: Ensuring compliance with regulatory standards and guidelines for APIs across different markets. Coordination: Collaborating with internal teams, including R&D, QA, and production, to gather necessary documentation for regulatory filings. Audits and Inspections: Supporting regulatory audits and addressing queries raised by regulatory agencies. Global Market Registrations: Handling product registrations and renewals for APIs in various countries. Candidate Profile To be eligible for this position, you should possess the following: Educational Qualification: M.Sc. in Chemistry, Pharmaceutical Sciences, or a related field. Experience: Minimum of 2 years and up to 7 years of experience in API Regulatory Affairs. Skills: Strong knowledge of regulatory guidelines (e.g., ICH, FDA, EMA, etc.), excellent documentation skills, and the ability to handle global regulatory submissions. [caption id="attachment_56319" align="aligncenter" width="930"] MSN Walk-in Interview for Quality Control - Executive, Senior Executive[/caption] Documents to Bring Candidates attending the interview are requested to bring the following documents: Updated Resume Photocopy of Educational Certificates Latest Increment Letter Last Three Months’ Pay Slips Last Six Months’ Bank Statements Passport-sized Photographs Aadhar Card Copy How to Reach Us Contact Person: Dinesh Baratam Email: [email protected] location: MSN Laboratories R&D Center in Pashamylaram.

0 notes

Text

AMD ROCm 6.2.3 Brings Llama 3 And SD 2.1 To Radeon GPUs

AMD ROCm 6.2.3

AMD recently published AMD ROCm 6.2.3, the most recent version of their open compute software that supports Radeon GPUs on native Ubuntu Linux systems. Most significantly, this latest edition enables developers to use Stable Diffusion (SD) 2.1 text-to-image capabilities in their AI programming and offers amazing inference performance with Llama 3 70BQ4.

AMD focused on particular features to speed up the development of generative AI after its last release with AMD ROCm 6.1. Using vLLM and Flash Attention 2, AMD ROCm 6.2 provides pro-level performance for Large Language Model inference. This release also includes beta support for the Triton framework, enabling more users to develop AI functionality on AMD hardware.

The following are AMD ROCm 6.2.3 for Radeon GPUs’ four main feature highlights:

The most recent version of Llama is officially supported by vLLM. AMD ROCm on Radeon with Llama 3 70BQ4 offers amazing inference performance.

Flash Attention 2 “Forward Enablement” is officially supported. Its purpose is to speed up inference performance and lower memory requirements.

Formally endorsing stable diffusion (SD) The SD text-to-image model can be integrated into your own AI development.

Triton Beta Support: Use the Triton framework to quickly and simply develop high-performance AI programs with little experience

Since its first 5.7 release barely a year ago, AMD ROCm support for Radeon GPUs has advanced significantly.

With version 6.0, it formally qualified the usage of additional Radeon GPUs, such as the Radeon PRO W7800 with 32GB, and greatly increased AMD ROCm’s capabilities by adding support for the widely used ONNX runtime.

Another significant milestone was reached with the release of AMD ROCm 6.1, where it declared official support for the TensorFlow framework and multi-GPU systems. It also granted beta access to Windows Subsystem for Linux (WSL 2), which is now officially eligible for use with 6.1.

The AMD ROCm 6.2.3 solution stack for Radeon GPUs is as follows:

Although Linux was the primary focus of AMD ROCm 6.2.3, WSL 2 support will be released shortly.

ROCm on Radeon for AI and Machine Learning development has had a fantastic year, and it is eager to keep collaborating closely with the community to improve its product stack and support its system builders in developing attractive on-premises, client-based solutions.

Evolution of AMD ROCm from version 5.7 to 6.2.3

From version 5.7 to 6.2.3, AMD ROCm (Radeon Open Compute) has made substantial improvements to performance, hardware support, developer tools, and deep learning frameworks. Each release’s main improvements are listed below:

AMD ROCm 5.7

Support for New Architectures: ROCm 5.7 included support for AMD’s RDNA 3 family. This release expanded the GPUs that can utilize ROCm for deep learning and HPC.

HIP Improvements: AMD’s HIP framework for running CUDA code on AMD GPUs was optimized to facilitate interoperability between ROCm-supported systems and CUDA-based workflows.

Deep Learning Framework Updates: TensorFlow and PyTorch were made more compatible and performant. These upgrades optimized AI workloads in multi-GPU setups.

Performance Optimizations: This version improved HPC task performance, including memory management and multi-GPU scaling.

AMD ROCm 6.0

Unified Memory Support: ROCm 6.0 fully supported unified memory, making CPU-GPU data transfers smoother. This feature improved memory management, especially for applications that often access these processors’ memory.

New Compiler Infrastructure: AMD enhanced the ROCm Compiler (LLVM-based) for greater performance and larger workload support. We wanted to boost deep learning, HPC, and AI efficiency.

ROCm 6.0 might target more GPUs, especially in HPC, due to improved scalability and RDNA and CDNA architecture compatibility.

New CUDA compatibility features were added to the HIP API in this edition. These changes let developers convert CUDA apps to ROCm.

AMD ROCm 6.1

Optimized AI/ML Framework Compatibility: ROCm 6.1 improved PyTorch and TensorFlow performance. This improved mixed precision training, which maximizes GPU utilization in deep learning.

Experimental HIP Tensor Cores support allowed AI models to use hardware-accelerated matrix operations. This improvement greatly accelerated matrix multiplication, which is essential for deep learning.

Expanded Container Support: AMD included pre-built Docker containers that were easier to connect with Kubernetes in ROCm 6.1, simplifying cloud and cluster deployment.

More efficient data transfer in multi-GPU systems was achieved by improving memory and I/O operations.

AMD ROCm 6.1.3

Support for several GPUs makes it possible to create scalable AI desktops for multi-user, multi-serving applications.

These solutions can be used with ROCm on a Windows OS-based system thanks to beta-level support for Windows Subsystem for Linux.

More options for AI development are provided via the TensorFlow Framework.

AMD ROCm 6.2

New Kernel and Driver Features: ROCm 6.2 improved low-level driver and kernel support for advanced computing workload stability and performance. This significantly strengthened ROCm in enterprise environments.

AMD Infinity Architecture Integration: ROCm 6.2 enhances AMD’s Infinity Architecture, which connects GPUs at fast speeds. Multi-GPU configurations performed better, especially for large-scale HPC and AI applications.

HIP API expansion: ROCm 6.2 improved the HIP API, making CUDA-based application conversion easier. Asynchronous data transmission and other advanced features were implemented in this release to boost computational performance.

AMD ROCm 6.2.3

The most recent version of Llama is officially supported by vLLM. AMD ROCm on Radeon with Llama 3 70BQ4 offers amazing inference performance.

Flash Attention 2 “Forward Enablement” is officially supported. Its purpose is to speed up inference performance and lower memory requirements.

Formally endorsing stable diffusion (SD) The SD text-to-image model can be integrated into your own AI development.

Triton Beta Support: Use the Triton framework to quickly and simply develop high-performance AI programs with little experience

Key Milestone Summary

These versions supported new AMD architectures (RDNA, CDNA) as ROCm expanded its hardware support.

CUDA application porting became easier with HIP updates, while data scientists and academics found AI/ML framework support more useful.

Multi-GPU Optimizations: Unified memory support, RDMA, and AMD Infinity Architecture improved multi-GPU deployments, which are essential for HPC and large-scale AI training.

Each release improved ROCm’s stability and scalability by fixing bugs, optimizing memory management, and improving speed.

AMD now prioritizes an open, high-performance computing platform for AI, machine learning, and HPC applications.

Read more on Govindhtech.com

#AMDROCm#AMDROCm6#AMD#radeongpus#AI#hpc#govindhtech#news#TechNews#Technology#technologies#technologynews#technologytrends

0 notes

Text

Full stack course in pune with 100% placement

Are you a developer who is struggling and wants to upskill yourself? Or are you a professional who wants to switch careers from some domain to full stack development, a housewife, or a student with gap years looking to restart your career? But tired of seeking full stack developer Course in Pune, that provides you placement assistance till you get placed and also help you and train you for your interviews by providing the most important metrics for preparation.

So here we are Fullstack Seekho’s Full Stack Training in Pune is ranked as one of the best Full Stack classes in Pune which provides you with all the features like LinkedIn Optimization sessions, interview preparation sessions, Mock interviews before real industry interviews, 100% Placement Assistance and support till you get placed.

Fullstack Seekho has already conducted 263+ successful Placement drives for the students enrolled in the full stack developer classes in Pune. We have 5+ Years of experience in full stack Course in Pune and that helps us to leverage the careers of all the candidates who are enrolled in our Full Stack classes in Pune. Fullstack Seekho’s Expertise in MERN and MEAN stack development, JAVA full stack development, and Python full stack development have been a blessing for all the candidates facing problems or wanting a kickstart in their careers.

Featured Full Stack Developer classes in Pune

Full Stack Web Development Course in Pune: The MERN Stack course in Pune is one of the most selected courses among our featured training courses list. This is the web development course where you can learn the latest technologies like AngularJS, ReactJS, NodeJS, Restful APIs, and much more. This course will help you master skills for front end development, back-end development understanding databases, and much more.

Full Stack Python developer Course in Pune : The Python full stack development course in Pune is among other featured courses of Fullstack Seekho, candidates wanting to specifically go into the field of software and application development choose this full stack classes in Pune at Fullstack Seekho, this course gives you a complete understanding of the python modules, its libraries like Numpy, Keras, Pandas or neural networks like KNN, CNN, ANN, RNN and much more.

Full stack Java Course in Pune : Java is one of the best programming languages and is widely accepted in the Industry for Software development and Application development. Full stack Course in Pune in Java Programming can give you a kickstart if you are seeking to pursue your career in the field of Java Development. You will learn various things in Java like operators, Multithreading, collection framework, Inheritance, Polymorphism, Exception handling, and much more.

Features of Full Stack Developer classes in Pune

Placement Assistance

Fullstack Seekho Provides placement assistance where we support you and provide you with opportunities and hiring calls at the end of the course until you get placed.

Mock Interviews

A mock Interview will be conducted for each candidate where two HR and technical rounds have to be cleared by each candidate to be eligible for the placement process in our full stack classes in Pune.

Linkedin Optimization

LinkedIn is your digital profile for in today’s digital era, every MNC asks for submission of your LinkedIn profile So we make sure that your profile outshines every other profile in our hands on LinkedIn sessions.

Live Project

A Live Industry Project that teaches you industry application and real hands on experience will add value to your profile and will validate your skills in the eyes of the recruiter.

Internship Letter

We also provide you with an internship letter that gives you the kickstart in your career and also gives you an edge over Other Students and freshers in the field through our full stack course in Pune.

Online & Offline Training

Each course at Fullstack Seekho is available in different modes of learning, every candidate can learn courses in online and offline mode of learning.

What you’ll be able to do after this Full Stack Course in Pune

Creating Websites both dynamic and static with attractive animations.

Creating Front End Websites, Landing, Pages, and much more.

Creating complex Backend structures for web applications like E-Commerce Admin panel for the client side, Inventory management system, Learning management system, ed-tech learning platform, etc.

After Full Stack classes in Pune, you will also be able to create web software and software applications for industry usage.

Independent Project development and career as a freelancer.

Empower your organization with your advanced skill set.

Creating great e-commerce websites and also adaptability to new technologies.

1 note

·

View note

Text

Atal Pension Yojana - Atal Pension Scheme : Tax Exemptions, Eligibility, And Contribution

Senior citizens require some sort of support from the government to spend their old age comfortably. While the government has started many pension schemes and saving schemes, Atal Pension Yojana (APY) is a leading saving scheme that helps the elderly get a fixed pension amount after the age of 60. Let us learn more details about this pension scheme of the government.

https://www.jaagrukbharat.com/atal-pension-yojana-apy-for-senior-citizens-in-india-details-eligibility-and-more-1404157

0 notes

Text

Fibre NBN Time!

Since I saw the NBN Delivery Partners installing Fibre down my street in December 2023, I have been counting the days to when my place would be available to get upgraded to Fibre from FTTN/VDSL.

I did ask the contractors roughly when they reckon it'd be good to go, and they advised between February and April this year - that was a lie... But in any case, I waited. I checked Luke Prior's wonderful map, as well as the Rinseout Map. I had an integration going with Home Assistant which was pinging both the NBN and Launtel APIs every 8 hours for details, which would show on a handy-dandy card, and also, when the time was right, send a notification to me.

Which seemingly was all good for nothing, as I was seemingly checking more than what Home Assistant was...

Anywho, for months and months, all I saw was "Committed" with no real date other than May 2024, September 2024, December 2024, and back to September 2024. The exciting change came roughly during the last week of July, when the status changed to "Build Finalised" - Oooh. How exciting! Almost there! However, no date showed. About a week and a half later, the Launtel page updated, and we had a date that orders should be available from the 19th of August. I was on a day off that day, so I made sure I was up early to check I could put an order in and..... Couldn't order. And the page kept showing the 19th date until the 22nd of August, where, while I was eating my brekky, I saw that I was now eligible to order a service...! Hot Damn!

I called Aussie as soon as they opened and put my order in. The staff were great at accomodating my request for an appointment on the 26th as I had the day booked off already, so it would work well.

Then a few more days of waiting. I was allocated the 1pm-5pm slot and advised the install would take between 2-4 hours.

Get to today, and the tech shows up just after 2pm. We have a quick chat about what's getting done, why, and how. I largely left him to his work. We discussed and did a few things, after all, any help is good help, especially when paid per job, rather than per hour. The few things include:

Using the existing lead-in as a draw string (this is always easier with two people)

Finding the right pit to use (When I moved in, I got my DBYD maps, so had them for future reference, just like today!)

Finding an agreeable spot to install the exterior PCD (Unfortunately, no space worked, so my install is done without, and I'm probably happier without it)

Getting the NTD installed in the right spot on the inside (as I didn't want my access plate used for the fibre, as it's used for, well, the access!)

Unfortunately:

My lead-in conduit was cracked in the process, but it's probably something I can fix. I'll burn that bridge when I get to it.

The NTD was not able to go into the Hills Home Hub - it needs to have that ugly wall mount and the ugly cover and just for cleanliness, I would've preferred it in there, but it's been done now, so whatever.

Overall, I am pleased with how this installation has been, and I'm glad I now have the Fibre installed, as I can now get the speeds that I'm paying for - paying for a 100mbps service and getting only ~83mbps, despite syncing at 100mbps, is a bit rich.

I've fired up a Launtel service for the next few days too, just to kinda stress-test my old USG 3. I've got a 250/100 service which is going great thus far. I've run some backups to the other off-site location over IPSec and it's definitely a goer, so I'll toss up what to do with that after my trial ends - I have a feeling that once I have had a taste, it'll be tough to go without.

Next things on the list are to get by USG (soon to be a UCG - watch this space) and the NTD powered by UPS - ideally over POE as the runs are already there... Will see how we go!

Edit 26/8/24 10:00pm: I recall the tech saying that as far as being connected, it looked like I was the first in my street - way to be a trailblazer! That said, I’m sure others weren’t watching as intently as I was though…

0 notes

Text

Prime DeFi | Member area and video courses

Hurry! Open Enrollment Is Still Available!

Secure Your CCC Membership Now With Our Open Enrollment Special!*

Here’s everything you get INSTANT access to when you join right now!*

Access to the PROSPER™ Success Path course ($3,500 value)

Attend Weekly Group Coaching Calls ($3,000 value)

Access to the Private CCC Members Community ($2,000 value)

Our Quality Stamp of Approval support ($2,000 value)

APY Atlas™ Curated Templates Access ($2,000 value)

1 on 1 Coaching Calendar access for 90 days ($3,000 value)

Prosperity Quick Start Program Access ($500 value)

$500 Prize Contest Eligible ($500 value)

2 For 1 Membership Special ($1,000 value)

Try this premium course Click here : Prime DeFi | Member area and video courses

90-Day Action-Based Refund Guarantee

We 100% guarantee that you will love our program and community, or we will refund your cost if you give it a fair try within 90 days from purchase.Simply go through our training and create just 1 cash flow generating DeFi position in your own portfolio. If after doing so, you determine that this opportunity is just not for you, all you have to do is contact our team at [email protected]. As long as your request is made inside the 90-day refund period we’ll reimburse your cost. It's literally that simple!

#crypto#ace attorney investigations#investing stocks#investors#investing#investment#studio investigrave#stockmarket#forex#finance#stocks#financial#invest smart#invest in yourself#defi#ethereum#digitalcurrency#bitcoin#decentralized finance#Cryptocurrency#Blockchain#CryptoInvesting#CryptoTrading#DeFiProjects#DeFiTokens#Ethereum#SmartContracts#YieldFarming#DecentralizedExchanges#DeFiNews

0 notes

Text

How Does Navy Federal’s Savings Account Compare to Others?

Competitive Interest Rates and Low Fees

Navy Federal’s savings account is notable for offering competitive interest rates. Compared to major banks like Chase or Wells Fargo, which typically offer 0.01% APY, Navy Federal provides significantly higher rates—around 0.25% APY for their basic savings account. This difference can accumulate over time, helping savers earn more. Additionally, Navy Federal keeps fees low. Many traditional banks charge monthly fees, but Navy Federal has no minimum balance requirements or monthly service fees, making it an excellent choice for those starting to build their savings.

Strong Customer Service and Support

Navy Federal is renowned for its excellent customer service. As a credit union serving military members, veterans, and their families, its member-focused approach provides a personalized experience. Many members report positive interactions when handling banking needs. For instance, if a member has a question about their savings account, they can easily connect with a representative via phone or online chat. Unlike larger banks where customer service can be slow, Navy Federal is praised for its responsive and helpful support, providing a personal touch that is highly valued by customers.

Limited Eligibility but Better Benefits

One potential drawback of Navy Federal is its limited membership eligibility—only military members, veterans, and their families can join. However, for those who qualify, the benefits are substantial. Navy Federal offers a variety of savings account options, including special rates for children and retirement accounts. While larger banks like Bank of America or Citi may have broader access, they often lack the tailored options Navy Federal provides. Beyond savings, Navy Federal offers competitive loans and credit cards, making the overall value for eligible members very high.

Discover GlobalNexus: Your Comprehensive Source for USA Contact

Information For in-depth access to extensive USA contact details, explore the GlobalNexus directory. Offering a wide array of listings, this resource ensures you can find specific contacts across various industries and regions within the United States. Whether you’re searching for business contacts, customer service numbers, or professional connections, GlobalNexus is a dependable platform to streamline your search. Utilize its userfriendly interface and vast database to access the most relevant and current contact information tailored to your needs. Efficiently uncover detailed American business contact information with the GlobalNexus directory today.

0 notes

Text

CD and Savings Rates Today: Explore Today's Best Rates

New Post has been published on https://sa7ab.info/2024/08/11/cd-and-savings-rates-today-explore-todays-best-rates-2/

CD and Savings Rates Today: Explore Today's Best Rates

The offers and details on this page may have updated or changed since the time of publication. See our article on Business Insider for current information.Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate banking products to write unbiased product reviews.Banks are fighting for customer dollars right now, and people with cash to spare are well-positioned to benefit from a high rate environment. With rates rapidly changing, how can you feel confident that you're getting the best savings account or best CD?We monitor rates from banks and credit unions daily to help you feel confident before you open a new account. Experts don't expect CD rates to go up in 2024, so now could be a great time to lock in a rate if you're ready. Here are the top rates for popular savings accounts and CDs on Saturday, August 10.Featured Nationally Available Deposit RatesAccount NameAPY (Annual Percentage Yield) Accurate as of 8/9/2024Minimum Account Opening BalanceWestern Alliance Bank High-Yield Savings Premier5.31%$500BrioDirect High-Yield Savings Account5.30%$5,000Customers Banks Yield Shield Savings Account5.14%$25,000UFB Portfolio Savings5.15%$0Betterment Cash Reserve Account5.00% (5.50% APY for new customers' first three months)$10SoFi Checking and Savings (Member FDIC)up to 4.60%$0Featured Nationally Available CD RatesAccount NameAPY (Annual Percentage Yield) Accurate as of 8/9/2024Minimum Account Opening BalanceUSALLIANCE FINANCIAL 1 Year Online CD5.20%$500Sterling Federal Bank 3 Month CD5.10%$1Freedom Bank 6 Month CD, powered by Raisin5.00%$1Freedom Bank 1 Year No Penalty CD4.60%$1Discover 18 Month CD4.40%$2,500Bread Savings 2 Year High-Yield CD4.60%$1,500Quontic 5 Year CD4.30%$500Savings Account BonusAlliant High-Rate Savings AccountEarn a $100 bonus when you deposit at least $100 a month for 12 consecutive months and have a balance of $1,200 or more at the end of the 12-calendar-month period (offer expires December 31, 2024).See more savings account bonuses »Leading Checking & Savings Combo Account BonusSoFi Checking and Savings (Member FDIC)Earn up to $300 with qualifying direct deposit for eligible customers (offer expires 12/31/24, terms apply). Earn up to 4.60% APY on savings balances (including Vaults) with direct deposit.See more bank account bonuses »About High-Yield AccountsHigh-yield savings accounts aren't the only accounts paying favorable rates right now. You'll typically see the highest rates at online or lower-profile institutions rather than national brands with a significant brick-and-mortar presence. This is normal; online banks have lower overhead costs and are willing to pay high rates to attract new customers.High-Yield Savings AccountsThe best high-yield savings accounts provide the security of a savings account with the added bonus of a high APY. Savings accounts are held at a bank or credit union — not invested through a brokerage account — and are best for saving cash in pursuit of shorter-term goals, like a vacation or big purchase. High-Yield Checking AccountsThe best high-yield checking accounts tend to pay slightly lower rates than high-yield savings, but even they are strong in today's rate environment. A checking account is like a hub for your money: If your paycheck is direct deposited, it's typically to a checking account. If you transfer money to pay a bill, you typically do it from a checking account. Checking accounts are used for everyday spending and usually come with checks and/or debit cards to make that easy.Money Market AccountsThe best money market accounts could be considered a middle ground between checking and savings: They are used for saving money but typically provide easy access to your account through checks or a debit card. They usually offer a tiered interest rate depending on your balance.Cash Management AccountsA cash management account is also like a savings/checking hybrid. You'll generally see them offered by online banks, and, unlike a checking account, they usually offer unlimited transfers. A savings account often limits the number of monthly transfers, while a checking account doesn't. Cash management accounts typically come with a debit card for easy access, but you may have to pay a fee if you want to deposit cash.Certificates of DepositThe best CD rates may outpace any of the other accounts we've described above. That's because a certificate of deposit requires you to "lock in" your money for a predetermined amount of time ranging from three months to five years. To retrieve it before then, you'll pay a penalty (unless you opt for one of the best no-penalty CDs). The longer you'll let the bank hold your money, the higher rate you'll get. CD rates aren't variable; the rate you get upon depositing your money is the rate you'll get for the length of your term.About CD TermsLocking your money into an account in exchange for a higher interest rate can be a big decision. Here's what you need to know about common CD terms.No-Penalty CDsMost CDs charge you a fee if you need to withdraw money from your account before the term ends. But with a no-penalty CD, you won't have to pay an early withdrawal penalty. The best no-penalty CDs will offer rates slightly higher than the best high-yield savings accounts, and can offer a substantially improved interest rate over traditional brick-and-mortar savings accounts.6-Month CDsThe best 6-month CDs are offering interest rates in the mid-5% range. Six-month CDs are best for those who are looking for elevated rates on their savings for short-term gains, but are uncomfortable having limited access to their cash in the long term. These can be a good option for those who may just be getting started with saving, or who don't have a large emergency fund for unexpected expenses.1-Year CDsThe best 1-year CDs tend to offer some of the top CD rates, and are a popular option for many investors. A 1-year term can be an attractive option for someone building a CD ladder, or for someone who has a reasonable cash safety net but is still concerned about long-term expenses. 2-Year CDsThe best 2-year CD rates will be slightly lower than 1-year and no-penalty CD rates. In exchange for a longer lock-in period, investors receive a long-term commitment for a specific rate. These are best used as part of a CD ladder strategy, or for those worried about a declining rate market in the foreseeable future.3-Year CDsThe best 3-year CDs tend to have rates that are comparable to 2-year CDs. These are usually less popular for your average investor, but can be an important lever when diversifying investments and hedging against the risk of unfavorable rate markets in the long term.5-Year CDsThe best 5-year CDs will offer lower rates than the other terms on our list, but are still popular options for investors. These CDs are best for those looking to lock in high rates for the long term. CDs are generally viewed as safe investment vehicles, and securing a favorable rate can yield considerable earnings in year three and beyond — even if rates fall elsewhere.

0 notes