#and they only allow one apple id holder to have the account

Explore tagged Tumblr posts

Text

if anyone has a link to the last 15 mins that would make my life way easier for writing this fic

#the short of it is that amazon keeps quitting like ten times whenever you try to watch anything (until it gets 30 mins into an episode)#and they only allow one apple id holder to have the account#so i have to borrow my mums phone#which is...#not ideal#good omens

3 notes

·

View notes

Text

Can I Recover My Apple ID If I Forgot the Answers to My Account Recovery Questions?

Apple ID is a crucial part of the Apple ecosystem, as it allows users to access various services such as iCloud, the App Store, iTunes, Apple Music, and more. Ensuring the security of your Apple ID is essential, but there are instances when users find themselves locked out of their accounts. This often happens when they've forgotten the answers to their security questions. In such cases, many users ask, "Can I recovery apple id if I forgot the answers to my account recovery questions?"

In this detailed guide, we'll explore different methods and strategies that can help you regain access to your Apple ID, even if you've forgotten your account recovery answers. One particularly valuable resource is Apple's "iforgot" tool for resetting your password and account recovery. This guide will also shed light on other potential solutions for restoring your Apple ID and ensuring its continued security.

What Are Apple ID Security Questions?

Before diving into the recovery process, it is important to understand the role of security questions in your Apple ID. Apple requires users to set up security questions when they create their Apple ID to provide an extra layer of security. These questions are used when Apple needs to verify your identity, particularly during password recovery and other critical processes, like changing security settings.

Typically, these questions cover topics such as:

"What was the name of your first pet?"

"What was your dream job as a child?"

"What was the model of your first car?"

The answers to these questions are meant to be unique and personal, something only the account holder would know. However, if you’ve forgotten the answers to these security questions, gaining access to your Apple ID can become a bit more challenging. Fortunately, there are several recovery options you can try.

Steps to Recover Your Apple ID Without Security Question Answers

Apple provides multiple ways to recover your Apple ID. Here are the steps and options you can explore:

1. Use Apple's "iforgot" Tool

One of the primary methods to recover your Apple ID if you forget the answers to your account recovery questions is to use Apple's official password recovery tool: iforgot.apple.com.

How to Use the "iforgot" Tool

Visit the "iforgot" Website: Go to iforgot.apple.com on any device.

Enter Your Apple ID: You will be prompted to enter your Apple ID email address. Make sure to provide the correct email.

Verify Your Identity: If you've forgotten your security questions, the system will guide you to verify your identity through other means, such as using two-factor authentication, receiving a verification code on your trusted device, or answering questions about your Apple account that are not part of your security questions.

Reset Your Password: After successfully verifying your identity, you will be able to reset your Apple ID password. Once you’ve done this, you can regain access to your account.

This method is effective for many users, especially if they have two-factor authentication enabled or access to their trusted devices. If, for some reason, this method doesn’t work, there are other approaches to consider.

2. Use Two-Factor Authentication (2FA)

If you've set up two-factor authentication (2FA) for your Apple ID, you can bypass the need for security questions altogether. Two-factor authentication is an added layer of security that requires a code in addition to your password when you sign in. This code can be sent to one of your trusted devices, such as an iPhone, iPad, or Mac.

How to Use Two-Factor Authentication for Recovery:

Sign In with Your Apple ID: On a new or untrusted device, attempt to sign in with your Apple ID and password.

Receive the Verification Code: Apple will send a six-digit verification code to your trusted device(s). Enter the code when prompted.

Reset Your Password: Once verified, you will be prompted to reset your Apple ID password. You can then regain access to your account without the need for security questions.

It's important to note that if you haven't set up two-factor authentication, you should consider doing so in the future to enhance the security of your account and make account recovery easier.

3. Use Account Recovery

Account recovery is another method Apple provides if you're locked out of your account. It is designed to help you regain access to your Apple ID when you cannot reset your password or receive verification codes.

Steps to Initiate Account Recovery:

Visit the "iforgot" Website: Start by visiting iforgot.apple.com and entering your Apple ID.

Select "Don’t have access to your security questions?": If prompted for your security questions, you will often see an option to bypass them if you cannot remember the answers.

Start Account Recovery: Follow the prompts to start the account recovery process. Apple will guide you through providing as much information as possible to verify your identity.

Wait for Recovery: Account recovery can take several days, depending on the information you provide and the complexity of your case. Apple may contact you via email or phone to confirm your identity.

Regain Access: Once your identity has been verified, Apple will allow you to reset your password and regain access to your Apple ID.

This process may be slower than other methods, but it is essential when other recovery options have failed.

4. Contact Apple Support

If you've tried all the methods above and still cannot regain access to your Apple ID, contacting Apple Support directly might be the best option. Apple Support has access to additional tools that can help in difficult cases.

How to Contact Apple Support:

Go to Apple's Support Website: Visit support.apple.com and navigate to the Apple ID section.

Explain Your Situation: Describe your problem, mentioning that you’ve forgotten the answers to your security questions and have tried the "iforgot" tool and account recovery without success.

Receive Guidance: Apple Support may guide you through additional recovery steps or escalate your case for further investigation.

While waiting for support, be prepared to provide as much information as possible about your account to confirm your identity. This could include your previous passwords, details about your Apple devices, or payment methods linked to your account.

Preventing Future Lockouts

After recovering your Apple ID, it's essential to take preventive steps to ensure that you don't face the same issue again. Here are some best practices:

1. Set Up Two-Factor Authentication

If you haven’t already done so, enable two-factor authentication (2FA) for your Apple ID. 2FA is one of the most secure ways to protect your account, as it requires not only your password but also a verification code sent to one of your trusted devices.

How to Enable Two-Factor Authentication:

Go to Settings: On your iPhone or iPad, open the Settings app and tap on your Apple ID at the top of the screen.

Select "Password & Security": In the Apple ID menu, tap on "Password & Security."

Enable Two-Factor Authentication: Tap on "Turn on Two-Factor Authentication" and follow the prompts to set it up.

By doing this, you'll add an extra layer of security to your Apple ID and avoid issues related to forgotten security questions in the future.

2. Update Security Information

Ensure that your recovery email address and phone number are up to date. This way, Apple can reach you if you ever need to recover your account again. You can also review and update your security questions periodically to ensure they remain relevant.

How to Update Security Information:

Sign In to Your Apple ID Account: Visit appleid.apple.com and sign in with your Apple ID.

Select "Security": Navigate to the "Security" section, where you can review your trusted devices, phone numbers, and security questions.

Update Your Information: Make any necessary updates and save your changes.

3. Use a Password Manager

To avoid losing access to your Apple ID due to forgotten passwords or security answers, consider using a password manager. These tools store your passwords and recovery information securely, so you don't have to rely on memory alone.

Some of the most popular password managers include:

1Password

LastPass

Dashlane

By using a password manager, you'll have a secure way to store all your account details and recovery information.

Conclusion

Recovering your Apple ID if you've forgotten the answers to your security questions may seem daunting, but Apple provides several tools to help you regain access. The iforgot.apple.com tool is an excellent first step, especially if you have two-factor authentication enabled or a trusted device. Account recovery and contacting Apple Support offer additional methods if the basic options don't work.

Ensuring your Apple ID is secure by setting up two-factor authentication, keeping your recovery information updated, and using a password manager will protect your account from future lockouts. These proactive measures can give you peace of mind and make managing your Apple ID easier and more secure.

Ultimately, while forgetting security questions can be a hassle, with the right tools and practices, you can successfully recovery apple id and continue using Apple's vast array of services.

0 notes

Text

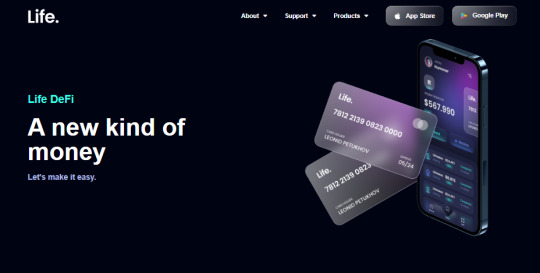

LifeCrypto: The future of DeFi

About LIFE Crypto

LIFE Crypto is a multi-chain crypto wallet built on Ethereum and BNB chains to connect cryptocurrencies with real-world daily transactions. Life DeFi Wallet, a non-custodial digital wallet service, now available on the Apple App Store, becomes the world's first multi-blockchain wallet from Apple that allows users to transfer digital assets to users under their name. This represents a major improvement over the use of complex public cryptocurrency addresses that have long been the standard for blockchain-based transfers. It also creates new use cases and value creation opportunities for businesses, users, brands, and more. Across multiple industries and verticals.

Life Crypto: Non-custodial Yet Easy

Life Crypto uses a single method to provide all crypto-related services in a non-custodial environment, but a traditional bank-like system that helps everyone - even novices In the world. Crypto World - Decentralized service that is instantly understandable and very easy to use. .

A few features of Life Crypto include:

Nickname, not address: Life Wallet users can send crypto to other Life Crypto users by simply identifying the correct username. No need to remember which complicated address belongs to whom.

Face ID: Use the biometric tools built into your smartphone to access your wallet instead of entering a private key or password.

Instant Transfer: One of the fastest throughput, Life Crypto can transfer assets instantly.

Staking: DeFi services are integrated directly into the wallet. Get life tokens without connecting to a third service. With an APR of up to 39%, Life Crypto offers significant savings compared to a traditional savings bank account.

Multi-chain: Running on both BSC and Ethereum smart chains, users can instantly switch between ERC20 or BEP20 LIFE tokens if they want to send tokens.

Debit Card: The upcoming VISA/MasterCard debit card will allow users to spend their crypto assets without converting them to fiat, providing crypto-enabled services worldwide world. Real world of life.

With services that rival the ease of centralized systems, Life Crypto never holds user funds and only token holders have access, thus providing the best service. . . of both worlds.

Life Wallet :

LIFE Wallet will have a distinct advantage as it will be cross-chain compatible and support a large number of tokens, allowing users to receive and transfer multiple cryptocurrencies with username flexibility. LIFE will always have the best options in terms of speed, price and reliability, thanks to the friendly protocol that allows LIFE to connect to the most modern blockchain technology. Life Wallet allows online shopping, takeout orders and money transfers between contacts.

Goals Of LifeCrypto:

The team's goal is to connect cryptocurrency to real-world transactions while facilitating login authentication and a variety of multi-chain wallets. The Life team is developing a full portfolio of easy-to-use products, no matter how familiar you are with cryptocurrency or blockchain technology. Life tokens are the life blood of the ecosystem. Stacking, app functionality, retail purchases, bank transfers and LIFE debit card transactions all depend on it. LIFE is a new currency.

LIFE Crypto & Hedera collaboration and the benefit of this collaboration

The LIFE team has announced their collaboration with Hedera, the most innovative L1 on the market. Life will evolve to enable the transfer of HBAR native coins to the Life wallet and support the entire Hedera ecosystem. This is a great partnership for Life as Hedera not only has incredible blockchain performance with low fees, high TPS, and fast transaction confirmations, but also has an impressive list of system partners. eco includes Google, IBM and Boeing. The partnership also covers the entire HBAR Foundation. The 2023 roadmap further emphasizes that the LIFE community has much more to offer. Plans are being worked on for marketplaces, DEXs, web browsers, ramp on/off, project integration and many general improvements.

Exchanges Listings

Tokenomics

Roadmap

Team

The Life Crypto team consists of experts with Oracle, Microsoft experience and extensive blockchain knowledge. Summarizing his knowledge, he understands the current issues facing the decentralized industry and Life Crypto is the culmination of his efforts. Developing a crypto ecosystem that provides non-custodial services in a traditional environment, including DeFi and banking services, Life Crypto creates a real possibility for crypto assets to go mainstream mainstream. A place where everyone can use the service and enjoy the benefits of cryptocurrency.

LIFE Crypto Social media link:

Website: http://www.lifecrypto.life/ Whitepaper: https://lifecrypto.life/wp-content/uploads/2022/01/LIFE-Whitepaper-3.0.pdf Twitter: https://twitter.com/LIFElabsHQ Telegram: https://t.me/LIFECrypto_TG Linkedin: https://www.linkedin.com/company/lifecrypto/

Content Writer

Bitcointalk Username: Derbyis Bitcointalk profile url: https://bitcointalk.org/index.php?action=profile;u=2837879 Address: 0x0Ad47A72ae72e4D13192BF32C228983CE6f37975

0 notes

Text

Credit Card Market News And Changes In The Next Few Years

Almost every second American has several bank cards, that is why credit card market news are relevant for most residents of the USA. Such a variety of cards is due to the fact that they are allocated for various needs. Some, for example, are used to pay for daily purchases, others are saved for large expenses, others for travel and so on. This is due to different conditions for each of the cards. In this country, a credit rating is asked everywhere. Without certain level of credit score, you cannot profitably rent a house or buy a car. Of course, it is permitted to make transactions without a credit rating, only their conditions due to the fact that the company has no idea about your solvency and discipline will be less profitable. So, in America everything is tied to a credit rating, and it, in turn, starts with the use of credit cards.

The-future-of-credit-cards

Credit card features

The conditions of some credit cards are designed in such a way that they are convenient and beneficial for small purchases. For example, they have a very low interest rate, but with it a small grace period. Other credit cards are selected according to the type of accrued bonuses and it is advantageous to use them to compensate for part of the costs. Therefore, you need to pay attention to all these parameters when choosing the offers that are right for you, and therefore you should be aware of credit card market news. There have always been many banks in America. Some of them entered the national and international market, others operate on the territory of a particular state. There are thousands of them and in the conditions of fierce competition, banks offer their customers various credit programs with all kinds of bonuses. Citizens of America have learned to profitably play on the privileges offered by banks. You just need to choose some of the most favorable options for your life conditions, needs and income level. From credit card market news, you can find out that American banks also offer their customers special credit programs, choosing the conditions of cards in such a way that they are beneficial for certain actions. For example, many banking institutions offer special cards to raise credit ratings. They, as a rule, are deprived of additional bonuses, such as cashback, and have rather bad conditions for the client. But they are issued even to those with a poor credit rating, and frequent use and timely repayment of debts provide a chance to increase it. Some large stores issue their own credit cards, which can only be utilized in that stores for payments. For example, the Amazon Store and Amazon Prime cards issued by Synchrony Bank are an excellent instance of such an offer. All customers can get the Amazon Store, unlike the Amazon Prime card which may be available only to owners of a premium account. These credit cards have a fixed interest rate of 25%, but the Amazon Prime Store Card offers 5% cashback. Almost all credit cards can be ordered online and picked up by mail. It takes a different amount of time, but overall it is a hassle-free and quick procedure. However, consumer lending is gradually going online. Credit cards were no exception, and therefore new solutions in this segment are increasingly appears on the market, which over time can change the industry beyond recognition. Typically, most banks seek to offer their customers classic credit cards above all. This product is often offered somewhat intrusively in one way or another, while there are not so many really good and convenient offers from traditional banks. In addition, the process of obtaining a card over the past few decades has not changed significantly. For many years this could only be done at banks offices. Card delivery by courier or mail was considered a real breakthrough several years ago. Of course, plastic cards improved and changed over time, for instance, the built-in microchip replaced the magnetic strip, but basically the product remained the same as it was.

Virtual-credit-cards

Virtual credit cards

Meanwhile, credit card market news reports that contactless payment technologies, in particular Google Pay and Apple Pay, are gaining more and more popularity. The development of such services essentially means that the days of plastic cards are numbered. In some European countries, more and more ATMs are appearing, allowing customers to withdraw cash from their accounts without using cards. Identification of account holders takes place via SMS, in which they receive a unique code to complete a transaction at an ATM. Also, in some countries of the world, new generation of payment cards with wider functionality are being developed. For instance, smart cards are gaining popularity in Japan, which, in addition to payment functions, can be used for identification, travel on public transport, as well as for various benefits or discounts in retail networks. The introduction of such products creates opportunities for expanding intersectoral integration. However, in order to succeed in the market, a truly revolutionary product is simply obliged to meet all the existing demands of the modern consumer. It should be characterized by the availability of convenient service, security, attractive service conditions and advanced functionality. In the age of the Internet, credit cards must comply with the “spirit of the high-tech times”.

Apple card

In August 2019, Apple - the most successful mobile technology seller announced the launch of the Apple Card virtual bank card. Goldman Sachs, an investment bank, acts as a credit card issuer in partnership with the Mastercard payment system. For the present it is available only in the United States. Users can apply an Apple credit card on their own in a few minutes in the Wallet application. To get a card, you need a smartphone with iOS version no lower than 12.4 and an American Apple ID account. At the registration stage, you will need to enter the mailing address, date of birth, income level and the last four digits of the social security number. Then this data will be sent to Goldman Sachs, after which the bank representative will approve or reject the application. As soon as the application is approved, the credit card will immediately appear in the Wallet application. There you can view information about expenses, payments, accrued cashback. Spending is categorized automatically. Each card is assigned a virtual number for the possible cases when seller does not support the Apple Pay payment function. The Apple Card itself has no expiration date or security code. You can block it with one touch in Wallet, but to completely deactivate the card you need to write or call Goldman Sachs. For purchases with the Apple Card 2% cashback is credited once a day, including digital goods in the App Store, for payment with a physical card or virtual number 1% cashback will be credited. The annual interest rate will be from 12.99 to a little over 24%. Apple will not charge fee for annual maintenance, deferred payments, or international transactions. If it is desired, the user can order a physical card made of titanium. An NFC chip is built into such a credit card for making contactless payments without a smartphone.

The future of credit card market

Similar products will increasingly appear on the market in the future, which can be found out almost daily from credit card market news. Thanks to the development of financial technologies, the largest online trading platforms and retail chains have received a whole line of possible payment options for every taste, depending on the preferences of their customers. Buyers began to use various electronic wallets, cryptocurrencies, rechargeable prepaid cards, PayPal, Google Wallet, Bitcoin, Amazon Payments and many others. It is worth noting that due to the factor of transaction speed and ease of processing, the rate of active users for virtual cards is an order of magnitude higher than for holders of classic credit cards. After attaching to Google Pay and Apple Pay services, a virtual card can be used not only on the Internet, but also in ordinary offline stores. This trend has flaws, but overall is the driving force behind increasing sales and improving online sales services. Thus, traditional plastic cards will probably irrevocably become a thing of the past within closer 10 years.

Start-using-a-credit-card-today

Start using a credit card today

Every ordinary American has two to three credit cards. People try to keep track of credit card market news, and parents teach children how to use a credit card correctly starting from high school. There is even the opportunity to open an account in the name of the child. All this is due to both favorable credit conditions and the fact that living without a credit card in the USA is extremely inconvenient. The formation of a positive credit rating most often begins with a credit card. The easiest way is to order a credit card with a security deposit and gradually increase your credit rating to receive other more advantageous offers. For example, having placed 2-3 thousands of dollars on such a deposit and actively using the card during the year, it is quite possible to earn more than 700 points in the credit rating, which is already considered a fairly high position and opens up access to more advantageous credit terms. Then select a bank card that matches your expense and avoid delays. You can apply a credit card almost anywhere by providing the lender with identification documents and some personal information. If you choose a credit card in accordance with your lifestyle and use it wisely, then this can be done completely free of charge. You will be able to pay for its service much less than the bank will accrue to you in the form of bonuses, and you will also earn a good credit history, which will allow you to take larger loans on favorable terms in the future. Read the full article

1 note

·

View note

Text

LifeCrypto : An innovative payment network and a new type of currency

About LIFE Crypto

LIFE Crypto is a multi-chain crypto wallet built on Ethereum and BNB chains to connect cryptocurrencies with real-world daily transactions. Life DeFi Wallet, a non-custodial digital wallet service, now available on the Apple App Store, becomes the world's first multi-blockchain wallet from Apple that allows users to transfer digital assets to users under their name. This represents a major improvement over the use of complex public cryptocurrency addresses that have long been the standard for blockchain-based transfers. It also creates new use cases and value creation opportunities for businesses, users, brands, and more. Across multiple industries and verticals.

Life Crypto: Non-custodial Yet Easy

Life Crypto uses a single method to provide all crypto-related services in a non-custodial environment, but a traditional bank-like system that helps everyone - even novices In the world. Crypto World - Decentralized service that is instantly understandable and very easy to use. .

A few features of Life Crypto include:

Nickname, not address: Life Wallet users can send crypto to other Life Crypto users by simply identifying the correct username. No need to remember which complicated address belongs to whom.

Face ID: Use the biometric tools built into your smartphone to access your wallet instead of entering a private key or password.

Instant Transfer: One of the fastest throughput, Life Crypto can transfer assets instantly.

Staking: DeFi services are integrated directly into the wallet. Get life tokens without connecting to a third service. With an APR of up to 39%, Life Crypto offers significant savings compared to a traditional savings bank account.

Multi-chain: Running on both BSC and Ethereum smart chains, users can instantly switch between ERC20 or BEP20 LIFE tokens if they want to send tokens.

Debit Card: The upcoming VISA/MasterCard debit card will allow users to spend their crypto assets without converting them to fiat, providing crypto-enabled services worldwide world. Real world of life.

With services that rival the ease of centralized systems, Life Crypto never holds user funds and only token holders have access, thus providing the best service. . . of both worlds.

Life Wallet :

LIFE Wallet will have a distinct advantage as it will be cross-chain compatible and support a large number of tokens, allowing users to receive and transfer multiple cryptocurrencies with username flexibility. LIFE will always have the best options in terms of speed, price and reliability, thanks to the friendly protocol that allows LIFE to connect to the most modern blockchain technology. Life Wallet allows online shopping, takeout orders and money transfers between contacts.

Goals Of LifeCrypto:

The team's goal is to connect cryptocurrency to real-world transactions while facilitating login authentication and a variety of multi-chain wallets. The Life team is developing a full portfolio of easy-to-use products, no matter how familiar you are with cryptocurrency or blockchain technology. Life tokens are the life blood of the ecosystem. Stacking, app functionality, retail purchases, bank transfers and LIFE debit card transactions all depend on it. LIFE is a new currency.

LIFE Crypto & Hedera collaboration and the benefit of this collaboration

The LIFE team has announced their collaboration with Hedera, the most innovative L1 on the market. Life will evolve to enable the transfer of HBAR native coins to the Life wallet and support the entire Hedera ecosystem. This is a great partnership for Life as Hedera not only has incredible blockchain performance with low fees, high TPS, and fast transaction confirmations, but also has an impressive list of system partners. eco includes Google, IBM and Boeing. The partnership also covers the entire HBAR Foundation. The 2023 roadmap further emphasizes that the LIFE community has much more to offer. Plans are being worked on for marketplaces, DEXs, web browsers, ramp on/off, project integration and many general improvements.

Exchanges Listings

Tokenomics

Roadmap

Team

The Life Crypto team consists of experts with Oracle, Microsoft experience and extensive blockchain knowledge. Summarizing his knowledge, he understands the current issues facing the decentralized industry and Life Crypto is the culmination of his efforts. Developing a crypto ecosystem that provides non-custodial services in a traditional environment, including DeFi and banking services, Life Crypto creates a real possibility for crypto assets to go mainstream mainstream. A place where everyone can use the service and enjoy the benefits of cryptocurrency.

LIFE Crypto Social media link:

Website: http://www.lifecrypto.life/ Whitepaper: https://lifecrypto.life/wp-content/uploads/2022/01/LIFE-Whitepaper-3.0.pdf Twitter: https://twitter.com/LIFElabsHQ Telegram: https://t.me/LIFECrypto_TG Linkedin: https://www.linkedin.com/company/lifecrypto/

Content Writer

Btt name : $50cents Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2708447 Address: 0x0F67269dC66698DC7166B40Dc1004D83bd2055cE

1 note

·

View note

Text

SUPPORTING BANGTAN: A MASTERPOST

Bangtan’s 5th mini album ‘LOVE YOURSELF 承 ‘Her’’ is coming out on the 18th September at 6pm KST. Within this post is everything you need to know in order to support our boys from buying their albums to how to vote on music shows. The title track and song they’re promoting is “DNA”.

○ Buying a ‘LOVE YOURSELF 承 ‘Her’ physical copy online

As always we have links here to stores online that will help the Hanteo/Gaon charts. Each store online will have different ways in which you can purchase the albums, either separately or both at once. Please make sure that when you order the album, you see the Hanteo Chart symbol. ⁃⁃ The Hanteo Chart is updated in real time daily and used mostly for Music Show wins. The Gaon Chart, which counts physical/digital sales, streaming etc closes every Sunday at 12am KST and is updated every Thursday. Here is a description and why both of these charts matter.

— — — Buying ‘LOVE YOURSELF 承 ‘Her’ digitally: MelOn and iTunes —

MelOn:

○ Purchasing a MelOn Pass and how to stream and download ‘LOVE YOURSELF 承 ‘Her’

Click here on how to create a MelOn account. Also a tutorial on how to change your app store country (Apple users) and how to purchase and stream ‘LOVE YOURSELF 承 ‘Her’ . THIS IS THE MOST IMPORTANT PART! Details include step by step on how to find and stream the album for it to chart correctly.

As long as you purchase a streaming pass, and your songs stream correctly IT DOES COUNT toward any digital points for music shows.

Please visit Melon For BTS for more information!

iTunes:

‣ iTunes purchases will not affect Korean charts but help them rank on the Billboard charts (USA), and give them more exposure internationally!

The best way to get Bangtan into the Billboard charts, and also ranking highly in your countries iTunes is to buy the title track first. AFTER that, purchase the full digital album. Buying the title track and other tracks individually help towards both song and album charts in the US.

Purchasing from iTunes is not similar to Melon. Although it is possible to change your iTunes Store to US, you cannot purchase the song if you do not have valid US-issued credit card or payment method. You can however be gifted a song from someone from the US to help Bangtan get on the Billboard 200 (Albums) and Billboard Hot 100 (Songs) charts.

Purchasing on iTunes is simple: Simply search ‘BTS’ and click to go to their artist page. Then, find “DNA” on the main page and press the price, following the prompts to buying the song.

Another way to help Bangtan get on the Billboard Hot 100 charts is through streaming application Spotify.

Please visit @BTS_Billboard on twitter and their tumblr page to check out details on how to sign up and receive the title track from iTunes for free!

Application Form to Receive the Title Track:

-> U.S. iTunes Account Holders: https://goo.gl/fTTx1i

-> Outside U.S. without a Valid U.S. iTunes ID: https://goo.gl/vKpFwF

RETWEET THEIR INFORMATION ON TWITTER: HERE

— — — — — — — — — — — — YOUTUBE — — — — — — — — — — — —

○ YOUTUBE STREAMING:

YouTube views are included in Billboard’s charts. Here’s how the figures are determined:

1,500 Youtube streams = 10 track sales = 1 album sale

Here’s how you can help increase the views and social rating for the MV:

Watch the MV

Leave comments on the MV

Remember to Like the MV

Share it on Social Media

‘Real views’:

Youtube’s support site states: “YouTube defines a view as a viewer’s intended and successful attempt to watch a YouTube video. Views are seen via watch pages (across all apps), embeds and leanback (playlists, mixes, autoplays etc.)”

Watching the MV on Youtube contributes to the score on 3 of the following Music Shows. (The Show, MCountdown and Inkigayo). Simple steps on how to increase the YouTube plays to help them count for music shows include:

The video needs to play from start to finish.

Playing the MV in 720p or above

Having the sound above 50% (on YouTube player)

DO NOT just click ‘replay’ or refresh the page or the views will be considered spam. Search it again on a new browser/tab!

Edit: it has come to our attention that is it not recommended for users to use incognito mode to watch the video as this does not allow Youtube to count the views correctly!

If you put the MV in a playlist and continuously rewatch it, make sure you clear your history/cookies every once in a while so that each view will still count

Only watch it on iBigHit channel

⁃⁃ To note: These are the main steps in how to increase the views and making them count towards scores/views etc but no one actually knows how the view system really works, but this is the main key that people succeed with.

Visit BTS Views on twitter for more information!

— — — — — — — — — — — — Spotify — — — — — — — — — — —

Spotify is a music streaming platform that help artists rank in the Billboard Hot 100 charts.

Spotify have a direct link to Billboard. Billboard endorses Spotify on their charts and even have Spotify players that play the song on every chart. Just take look at billboard.com and you will see for yourself. Spotify is also one of the most accessible streaming platforms that is both reliable and free.

If you have never made a Spotify account before, you will receive a free month of premium upon making one. This will be very helpful in helping the boys achieve Hot 100 status! Click HERE to create a Spotify account!

‣‣‣‣You must have an account from the US to make your streaming count towards the Billboard’s US Hot 100, BB 200, and other US-related charts.

At the same time, we recommend international fans outside of the US to stream BTS on Spotify from your own country on a separate device, so your streams will count for both global and US charts.

Spotify is available for Macs and PCs and mobile devices with iOS and Android operating systems.

If you use a free Spotify account to stream on the mobile app version, you’re unable to choose what song you want to listen to on an album, as it plays randomly. However, on the PC software version, you'll be able to play as you please, without it playing randomly or shuffle playing.

It’s also possible to use another email to get another free premium trial, so if you’re unable to buy it for the month, then do this.

The charting for Spotify and Billboard opens on Fridays 12am EST and closes Thursdays 11:59pm EST.

To Find Bangtan on Spotify:

Click on the search option

Search for BTS

Click on their artist page

Scroll down until you find the album section

Click ‘LOVE YOURSELF 承 ‘Her’’

Stream DNA!

You can also make a playlist on premium just of DNA and loop that. All streaming of DNA counts since the first 30 seconds of playing the song, will be registered as a play.

Sharing the DNA on social media via Spotify will also give them points towards other charts, such as the Twitter top tracks and Viral 50. Doing this through sharing via Spotify, or even #NowPlaying #BTS #DNA etc will help them out. Youtube views also count towards the Hot 100 chart!

Be sure to check out this event created by Spotify!

— — — — — — — — — — — MUSIC SHOWS — — — — — — — — — — —

Music Show wins are also an important part of the process, and something we can do as fans to help show our support to the boys. The boys will be promoting on a number of music shows, below is music shows which have awards for 1st place song (As Music Core doesn’t do this anymore) and how to help vote.

○ SBS The Show and Tudou Streaming:

Airs: Tuesdays at 8pm KST Scoring: 15% Korean Live Voting, 15% Chinese Live voting, 70% Pre-vote

‣ Prevoting: From Thursday 8am KST til Monday 12pm KST.

Voting includes: Streaming the MV on YouTube and Tudou(!!), Paid voting via Tudou for pre voting or app Laifeng during live voting. Hashtags on Twitter do count!

For example: Vote for BTS! #더쇼 Bangtan Fighting! # 방탄소년단 @SBS_MTV

⁃⁃ As long as you include BOTH hashtags, and mention the SBS The Show Twitter account, you can do this as many times as you want! Retweets do not count for this, always type out new tweets, as long as it is between prevoting times.

○ MBC Show Champion:

Airs: Wednesdays at 6pm KST Scoring: 50% Music digital sales, 20% physical sales, 15% Online voting, 15% ‘Professional’ music judges criteria

‣ Online voting: Click here on how to create an account for online voting. You know can only vote through the MBC app. You can also choose to download the ‘IDOL CHAMP’ app and vote through that. For android users, click HERE for APK download of the IDOL CHAMP app. WEBSITE link for where you can vote online that will take you to the iTunes app store, please remember, you can only vote 3 times per day!

○ MNet MCountdown:

Airs: Thursdays at 6pm KST Scoring: 50% Music Digital Sales, 15% Physical Sales, 15% SNS/YouTube views, 10% Pre Voting, 10% MNet Broadcasting, 10% Live Voting.

‣ Prevoting via MNET: To prevote in order for Bangtan to be selected, please click here! You must have an MNET account and be logged in. This is between Fridays 2pm KST until Mondays 9am KST. You can only vote once per account, so you can make multiple if needed. You can also sign in through your Twitter or Facebook account to vote!

‣ Live voting: Please note this is paid voting and international charges may apply to you. During airing, the hosts will prompt us from when we can send SMS votes if we are nominated. Mostly likely all you will need to text is ‘ 방탄소년단’ to #2336 IF that number doesn’t work, you can try either: 011822336, 822336 or 00822336. There is no guarantee that it will work, as MNet don’t reply with confirmation, but you’ll receive a failed message if it did not send. Only send ONE message as multiple will be counted as spam.

○ KBS Music Bank:

Airs: Fridays at 5pm KST Scoring: 65% Digital Sales, 20% KBS Broadcasting, Viewers Choice Chart* 10% voting (note: international fans cannot vote) 5% Physical Sales.

○ SBS Inkigayo: Airs: Sundays at 12:10pm KST Scoring: 55% Digital, 5% Physical, 35% YouTube/SNS, 5% MelOn Pre-Voting (Korea Only).

‣ Inkigayo DOESN’T do live voting anymore. This means majority of the scoring will come from digital streaming so please stream on MelOn. The removal of live voting will most likely affect Bangtan, as that was usually what helped them gain their wins on Inkigayo! Please focus on YouTube views if you’re unable to buy a MelOn pass.

Digital Score: The Song score comes from ‘Gaon Digital Charts’, which combines the download and streaming amounts from all Korean official music sites.

For more information please visit: Bangtan iChart as well as BTSxMVP!

— — OTHER WAYS TO POSITIVELY SHOW SUPPORT TO BANGTAN— —

○Supporting them on the Fancafe!

Click on the 응원하기 button (the one in light pink). You can only click on it once a day.

If you are not currently registered on the fancafe, here is a tutorial to do so! There is no tutorial on leveling up, sharing the answers is forbidden.

○Sharing/Liking/Etc. Content from BigHit/BTS!

Make sure that you share posts from Bangtan’s official Facebook page, as well as like and comment on them. You should also make sure that you are retweeting and favoriting Bangtan’s (BTS_twt) tweets as well as BigHit’s (bts_bighit / BigHitEnt) tweets. Clicking on the links that BigHit posts regarding Bangtan (usually news articles) is super helpful as well! Sending encouraging messages to Bangtan via Twitter is also encouraged!

○ Searching on Korean News Sites

In addition to this, you can help by searching 방탄소년단 or 방탄소년단 + song title (ex: 방탄소년단 DNA) on Korean search engines such as Nate or Naver! The best time to search would be after news about Bangtan is released, MV/teasers are released, after music shows, etc. This helps generate buzz and gives the boys more recognition in the public.

○ Other helpful links/threads: [Master Thread: CB info+projects] by BTS Comeback Archive

Please note we are releasing this masterlist prior to the album release later today, many links will not be accessible until that time! As always, thank you for working hard at supporting Bangtan and we hope this album promotion is a success!

3K notes

·

View notes

Text

best mobile banking apps

The world is advancing technologically with each passing year. This is an undeniable fact. Mobile banking has made things quite easier. It is becoming even more popular in this pandemic.

So, the question that arises now is it mandatory to have those traditional banking methods? What all things you need to consider while selecting a mobile banking app? Most importantly, you may be looking for top-notch security! Right? These are some of the top banking apps based on their popularity, features, and demand.

Bank of America Mobile Banking

Bank of America’s mobile banking application lets you manage U.S.-based bank accounts. You can keep a check on account activity and receive alerts. Just like any other banking app, this app also offers you to make transactions. This application is available for free to all users, Android or Mac. Following are the feature of the Bank of America Mobile Banking App:

This is applicable only for U.S. based bank accounts;

You can easily send or receive money

This mobile banking application has a unique feature that lets you activate or deactivate debit cards.

You can also apply for a new checkbook

Like any other mobile banking application, this lets you review your deposits and withdrawals in statements.

Wells Fargo Mobile Banking

Wells Fargo Mobile Banking is yet another one of the best applications for online banking. It gives you the freedom to control your finances and accounts. It does not matter where you are, as you can manage your account from anywhere around the globe. Wells Fargo online banking app makes every complex thing possible for you, be it an emergency transfer, card deactivation, or bill payments. Following are the features of the Wells Fargo Mobile Banking App:

● The biometric lock feature helps you protect your financial information

● You can now view transactions history on the go

● You can also choose your preferred language

● Attach cards to the digital wallet and review information anywhere, anytime;

● This mobile banking application lets you use the phone’s camera to deposit checks.

Discover Mobile Banking

Discover Mobile has a user-friendly user interface which makes it very popular among users. You can secure the application with its lock feature using a 4-digit passcode. This mobile banking application allows you to make transactions from your smartphones with ease. Following are the features of Discover Mobile App:

You can make transactions using just the mobile application

This application helps you keep a check on your Credit score

In case of any mishap, you can just freeze the account directly from the app

It offers a free wherein you can review profile details and modify them

Also, you can switch on alerts for your activities related to the account.

Capital One Mobile

Currently, Capital One Mobile is trending on the Apple Store. This is a great online banking application that allows you to lock this app with Face ID. This way, your financial information is extra secured. This application also allows you to perform banking activities from your smartphones. Following are the features of the Capital One mobile application:

More secured banking application to avoid unauthorized transactions

This enables hassle-free payments of recurring or one-time bills

With this application, you can instantly review and export statements

Another feature is you can report all the fraudulent transactions from the app itself.

Simple Mobile App

Simple has been a tough competition since 2012. This application is a one-stop for all your needs related to banking. Also, this banking application lets you upload checks in photo format to deposit them. Following are the features of Simple Mobile App:

You can easily manage all your shared bank accounts

With this application, you can calculate the amount left for you to spend after deducting your expenses

The goal app feature of this application lets you save for your future

Also, you can easily transfer money with other Simple users

You can also block your card instantly to get rid of any unauthorized transactions.

Schwab Mobile

Schab mobile banking application lets you do more than just transactions. You can use this application to track Stocks, Mutual funds, and much more. This application lets you trade on the app itself. Moreover, you can also use this application to follow daily market news. Following are the feature of the Schwab Mobile App:

It helps you protect sensitive data with Login ID and password

You can easily keep track of market news and trade

This online banking application lets you deposit checks by clicking pictures

Moreover, you can also receive real-time trading updates

Ally Bank

Ally bank is the best mobile banking application that lets you manage multiple accounts in a single app. Also, the app’s security feature is top-notch as you can use Touch ID, FaceID, or password to secure your account. It can also be used for investment activities. Another interesting feature this application offers is that it includes supporting trade tools. Following are the features of the Ally Bank Mobile App:

It has a unique eCheck feature to deposit checks

You can also schedule auto payments for your one-time or recurring bills

This application lets you locate nearby ATMs

You can easily pay anyone with an account holder in the U.S.

Also, you can use Ally Messenger to chat privately with anyone.

META DESCRIPTION:

Mobile banking makes transactions easier and applicable on the go. Here is a curated list of top mobile banking applications for secure transactions.

Hello, I am Blanche Harris. Being an online security expert, I love to make people aware of cyber threats and share helpful information to them regarding them. Download, install and activate your office setup at office.com/setup.

Source: https://blanchektechnologyhub.wordpress.com/2021/07/30/best-mobile-banking-apps/

0 notes

Text

Apple launches an online portal for Apple Card account holders

Apple today has launched an online portal for its Apple Card credit card, allowing account holders to manage their balance, view statements, schedule payments and more. The portal, card.apple.com, will be particularly useful in the case that you lose or misplace your iPhone and need to manage your card or pay your bill. In the past, you would have had to contact Goldman Sachs directly to do so.

The new site also offers an easy way to pay your balance when you’re at your desktop or laptop working on your monthly budgeting and bills, instead of having to go get your iPhone.

To use the site, cardholders will log in via their Apple ID. You can then view your card balance, available credit, next payment due date and amount on the homescreen. The main page also offers quick access to set up scheduled payments — a feature some cardholders may have not realized existed, as it was buried under the three-dot “more” menu when viewing their Apple Card in the Wallet app.

From the left-side navigation, you can browse your past statements or download them as PDFs.

And from the other settings, you can link or remove connected bank accounts, contact support, read the card terms, and more. What’s missing, however, is a way to remotely lock the card or request a replacement, in the event the card has been lost or stolen. Those features are still only available with the Wallet app, which is also where you can mange your Express Transit settings and your push notifications.

The lack of a website for card management had been one of the few quirks about Apple’s modern credit card. Though it’s convenient to have a built-in way to manage the card and pay the bill right from your iPhone, credit card holders still expect to be able to access their card through the web, as well.

The launch of the online portal shortly follows Apple’s debut of Path to Apple Card, a four-month credit worthiness improvement program focused on getting more consumers qualified.

0 notes

Text

How SLP Dividends Can Tokenize Anything, Including the Stock Market

New Post has been published on https://coinmakers.tech/news/how-slp-dividends-can-tokenize-anything-including-the-stock-market

How SLP Dividends Can Tokenize Anything, Including the Stock Market

How SLP Dividends Can Tokenize Anything, Including the Stock Market

Not everyone is lucky enough to have access to the stock market and the ability to buy shares in successful corporations like Apple or Coca-Cola. Many impoverished and politically restricted areas make such participation impossible for those who live there. However, thanks to the ability to tokenize virtually anything via SLPs (Simple Ledger Protocol tokens) and also to pay dividends on these same assets, myriad new possibilities have emerged. One of which being tokenization of traditional stocks, so people with nothing more than a $20-dollar smartphone and an internet connection can participate.

How SLP Tokens Work

SLP tokens are built on the Bitcoin Cash blockchain and function similar to Ethereum’s ERC-20 protocol. Anyone can have fun making their own SLP for just a few cents in BCH, and through the new dividends tool, issue payments to holders of these tokens at any time, in whatever amount they would like. This creates an opportunity for a business to become its own mint on the BCH chain, without going through all kinds of hassle or paying high fees. Once a new SLP token is minted, it can be held, used for special offers and unique functions, or as stated, issued to shareholders for the payment of dividends. For those interested in creating their own SLP token, it can be done easily via memo.cash or the Electron Cash SLP wallet.

Sending SLP Dividends to Anonymous Bearer Share Holders

Once an SLP is created it can be sent to effective shareholders who will receive payouts via the token when the issuer decides to send them. Each SLP has a unique token ID. Using Bitcoin.com’s SLP Dividend Calculator, a token creator can enter this ID and then enter the customizable payment settings such as amount and block height at which the payment should be broadcast. The tool will automatically calculate how much BCH each SLP token holder should receive proportionate to their token holdings. The calculator tool also allows tokens to be airdropped to users.

youtube

Back in August, news.Bitcoin.com’s Jamie Redman posted a detailed tutorial for issuing SLP dividends using the calculator tool. A video tutorial posted by Bitcoin.com Executive Chairman Roger Ver is also available, and goes into some potentially revolutionary uses for SLP dividends like making the traditional stock market accessible even to residents of third world countries. Describing a scenario where a traditional company stock like Coca-Cola is held by a financial custodian and then tokenized and sold, Ver states:

Right now the only people that can buy Coca-Cola stock are whatever institutions or somebody in a first world country … But if you tokenize the Coca-Cola stock now anybody, anywhere in the world with a $20-dollar cell phone can now own tokenized Coca-Cola shares.

Of course, it’s not just impoverished or geopolitically embattled parties that could make use of this opportunity. Anyone could. Further, if such SLP tokenized stock is sold at a premium due to the convenient service being provided, issuers might be incentivized to buy even more tokens — whatever crypto or token they are using — and then issue even more tokenized stock. This could theoretically lead to a largely tokenized, parallel stock system.

Darknet Markets, Bonds, and IPOs

Other possible applications for dividend tokens could be found in darknet marketplaces, bonds, and IPOs. With correct privacy protocols in place, darknet marketplaces might offer shares and rewards to their clients. Businesses can issue the tokens as bonds and pay interest on chain via the dividend. IPOs could be facilitated for anyone and everyone with the will to start a business, not just big corporations. Thanks to technology, striving for financial freedom and the ability to work for one’s own sustenance and happiness isn’t just limited to those with a Charles Schwab account anymore. Crypto and SLP dividends pave the way for true financial inclusion — not just more Wall Street special interests.

Source: news.bitcoin

0 notes

Text

How Would NYC's Anti-AirDrop Dick Pic Law Even Work?

New Post has been published on https://www.articletec.com/how-would-nycs-anti-airdrop-dick-pic-law-even-work/

How Would NYC's Anti-AirDrop Dick Pic Law Even Work?

It sounds good in theory.

A bill introduced last week by two members of the New York City Council would punish people who send harassing, sexually explicit photos and videos with up to a year of jail time or a $1,000 fine. One unfortunately growing trend the bill hopes to thwart? “Cyber flashing,” a type of digital harassment where creeps use Apple’s AirDrop feature to send dick pics and other lewd images straight to the home screens of unsuspecting strangers via Bluetooth and Wi-Fi.

The bill’s co-sponsors, council members Joseph Borelli and Donovan Richards, say it’s about time cyber flashers faced the same consequences as their offline counterparts. “Just like if you get on the train and flash someone, you’ll be arrested,” Richards says. “You should be held to the same standard, and the law should be applied to you equally.”

That’s logical enough. But how would it work in practice? From both a technical and a legal perspective, it turns out, the answer is far more complicated, reflecting just how hard it is to regulate against all kinds of online harassment.

Let’s start with the technical. Say you’re sitting on the subway and a stranger sends you a naked photo (ugh) via AirDrop. You might glance around for the culprit, but suppose you can’t pick him out on the crowded car? Your options for identifying the perp using digital fingerprints are now severely limited. Even if the victim shares the contents of their phone, the AirDrop logs wouldn’t be stored on the device, says Sarah Edwards, a digital forensics analyst who wrote a blog post on this very topic. Law enforcement could use third-party software to view those logs, but even so, the digital trail is weak.

For starters, iPhone users can name and rename their devices anything they want, meaning the name in the log wouldn’t necessarily match the name in the perpetrator’s device. Edwards says the sender’s AirDrop ID would be exposed, but she was unable to determine how to tie that to a specific device. “The lack of attribution artifacts at this time (additional research pending) is going to make it very difficult to attribute AirDrop misuse,” Edwards writes.

Will Strafach, an iOS security researcher and CEO of Guardian Mobile Firewall, agreed that attribution would be difficult without an eyewitness catching the perp in the act. “This is a really great first step, yet it will likely have to take some trial and error before it becomes easily enforceable, due to the digital nature of the crime,” he says.

“This is a really great first step, yet it will likely have to take some trial and error before it becomes easily enforceable, due to the digital nature of the crime.”

Will Strafach, Guardian Mobile Firewall

Councilman Borelli acknowledges these are technological hurdles he hasn’t yet figured out (“I just learned how to use AirDrop”), but not every case is as tough to crack as a random AirDrop attack. He points to an ongoing case in New York City, where a doorman sent lewd texts to several tenants. Though police knew the perpetrator’s identity, they said they couldn’t pursue the case, because under New York state law he hadn’t committed a crime. This law would change that, Borelli says.

“Right now the police don’t even have the legal ability to investigate the crime, because there is no crime,” he says. “I recognize this may not result in arrests every time this happens, but in cases where we know who the harasser is, we should be able to charge them with some sort of crime that meets the level of their depravity.”

That could have a ripple effect on tech platforms like Facebook and Twitter, as well as dating apps like Tinder where these types of unsolicited images are rampant. Right now, the only repercussion for sending or posting nudity on those platforms is getting the content or the account banned. With the law on its side, NYPD could issue subpoenas and other court orders that force these platforms to hand over information about the account holders, just as they do for other crimes and national security issues.

Borelli and Richards say they hope to bring both tech companies and law enforcement officials into the process as the bill heads to hearings in 2019. In particular, they hope to work with technology companies to help mitigate these risks in the first place. Richards, for instance, says it would be an “easy fix” for Apple to adapt AirDrop so people don’t receive a preview of the image before they accept it. Apple declined to comment on this possibility. (It is worth noting, however, that the default setting on iPhones allows people to receive AirDrops from their contacts only. In order to receive an unsolicited AirDrop, the receiver would have had previously to change those settings to allow AirDrops from anyone.)

In a statement, NYPD Lieutenant John Grimpel told WIRED, “The Department takes harassment of individuals through the unwanted dissemination of explicit materials seriously and looks forward to working with the Council on additional tools we can use to address this issue.”

Beyond the technical challenges of enforcing the proposed law, there are legal ones, too. The way the statute is written, the sender would have to intend to harass, alarm, or annoy the target. That’s because the law has to differentiate between what might be innocuous behavior (i.e., sending nude photos to a person who consented to receive them) and criminal behavior. But it also gives actual harassers a way out; one can imagine a guy sending a woman an unsolicited nude photo on a dating app, without her consent, only to claim later that he was flirting.

“This is the trouble always of harassment laws and the reason why they have difficulty in other contexts getting other traction,” says Mary Anne Franks, a law professor at the University of Miami and president of the Cyber Civil Rights Initiative. “There’s a lot of ways when we’re talking about internet communication that people can say, ‘I was just being funny or expressing myself.'”

The same he-said/she-said version of events that plays out in offline sexual harassment cases can become even muddier online. No law can change that, councilman Richards acknowledges. “There’s always ways individuals can figure out a loophole,” he says. “Our intent is to try to close this gap as much as we can.”

Despite these issues of enforcement, Franks believes the bill could deter would-be cyber harassers now operating in a virtually lawless landscape. “This sends a really strong message that behavior you might think is ambiguous isn’t ambiguous,” she says. “It’s criminal.”

More Great WIRED Stories

Source link

0 notes

Text

A Complete Guide On How to Use Apple Pay and Apple Pay Cash

IT has been infiltrating the financial sphere for a while now, making financial transactions faster and more comfortable. One of the most recent innovations is the emergence of contactless payment services Apple Pay and Apple Pay Cash. We will talk about the features of the two services and the advantages and disadvantages of contactless payment for the user. The safest, fastest and most convenient service to pay for goods and services offline in the global global network - Apple Pay - is available to customers of large banks. Apple Pay service was presented in the United States a couple of years ago, so the iPhone and Apple Watch, produced in 2014, are supported along with more recent models. Holders of iPhone 5 and iPhone 5s can use Apple Pay only through Apple Watch smart watches. How to set up Apple Pay? How to set up and download Apple Pay? Starting with iOS 8.1 or later, Apple Pay can be configured in the Wallet app (the so-called Passbook in earlier versions of iOS). Pressing the “+” icon in the “Wallet” allows users to add a credit or debit card to Apple Pay, or scan it to the camera. Credit and debit cards are checked in – in just a few seconds, but some cards require confirmation in the form of a phone call, application download, or email. As soon as the card is verified, it will be available for purchase both in stores and in applications. Up to eight cards can be registered with Apple Pay. Each card added to the "Wallet" contains information about the billing address, email and phone number. Clicking on the card displays detailed information, such as the last digits of the card number, of the card account that replaces the real card number in transactions, and also provides contact information of the bank that issued the card. Some cards can display information about recent transactions.

How-to-set-up-and-download-Apple-Pay What is it for? To pay for purchases or services in stores and the Internet using your own iPhone or Apple Watch smart watches. Connecting the device or somewhere to insert – is not required, as well as to give your device to the cashier in hand. You can allow the purchase with a fingerprint, that is, with the same action that unlocks the smartphone, or two clicks of the clock button. We bring the device to the terminal, in which we are accustomed to insert a bank card, bang-bang - and the goods are fully paid. Instant and perfectly safe. Forget about cash, and the card can even be removed from the wallet from now on. The device of the latest models of the iPhone and Apple Watch is designed in such a way that a special microchip is mounted inside the gadgets that allows you to transfer data at a distance of several tens of millimeters. Having brought the device to the terminal and having allowed purchase, you start in work intrabank mechanisms. Going into a further process does not make sense - these are complex technologies. Safe, ultra-secure, but extremely fast. Fractions of a second, and the purchase is paid and completed. So how to use Apple Pay and Apple Pay Cash? In the store, when you approach an Apple Pay-compatible terminal, the iPhone screen lights up and automatically opens the “Wallet”, where the user can select a card to pay for the goods. Payment is made by keeping the iPhone or Apple Watch at a distance of a few centimeters from the contactless reader with the NFC module. The finger registered in the TouchID must be held for a short period of time (or Apple Watch should be attached to the wrist), after which the payment will be certified and the transaction confirmed. The completed payment is indicated by a small vibration, a check mark on the screen and a sound signal. From time to time Apple Pay may not be much more convenient than holding a card, but it is important to recognize that Apple Pay is still more secure than a traditional transaction. With Apple Pay, the cashier does not see the credit card number, name, address, or any other personal information. There is no need to get a credit card or validate a driver's license or ID card, since all information is stored on the iPhone and is protected by several built-in security systems, including Touch ID. In some countries and regions, for payments using Apple Pay purchases in excess of a certain threshold, you may need to enter a PIN. Sometimes it is necessary to sign a check or use another payment method. If payment is made using Apple Pay Cash, the combination 0000 is always used as the PIN. Making an online payment through Apple Pay is as easy as making payments at the store, because you use the same credit card with Touch ID in applications that support Apple Pay API. Using Apple Pay in applications allows you to skip all the steps that are usually required, when making a purchase online, including entering information about delivery and payment. Is Apple Pay and Apple Pay Cash safe? Apple pays great attention to security in Apple Pay advertising to ensure iPhone owners that their billing information is secure and even more secured than a wallet. When a credit or debit card is added to the Apple Pay Wallet, it is assigned a unique number or “token” that is stored on the phone, not the actual card number. The iPhone itself has a dedicated chip called “Secure Element,” which contains all of the user's payment information, and credit card numbers and data are never uploaded to iCloud or Apple servers. When a transaction is completed, the device account number is sent via NFC along with a dynamic security code unique to each transaction used to verify the payment. The dynamic security code is a one-time cryptogram that replaces the CVV of the credit card and is used to confirm the payment. Dynamic security codes and device account numbers are embedded in the NFC specification that the company uses. In fact, much of Apple Pay is based on existing technology. Together with device account numbers and dynamic security codes, Apple also confirms each transaction using TouchID or FaceID on iPhone X. Whenever a transaction is executed from iPhone, the user must place a finger on the touch ID or look at the device to confirm payment. With the help of Apple Watch authentication is carried out through contact with the skin. When the watch is attached to the wrist, the user will be prompted to enter a password. After entering the access code, while skin contact is maintained (which is monitored using heart rate sensors), the watch can be used to make payments. If the watch is removed or skin contact is lost, the transaction is aborted. All methods, TouchID, FaceID and watch contact with the skin, will not allow someone who stole your device to make an unauthorized payment. Using an encrypted “tokenization” payment protects the credit card number from leaking confidential information to sellers or sending it with payments. Store employees do not see the name or address on a credit card or ID card because in this case, identification of the person is not required for verification purposes. In addition, if the iPhone is lost, the owner can use Find My iPhone to suspend all payments from the device, without the need to block the card. Banks are confident in the security of Apple Pay and decided to take responsibility for any fraudulent purchases made both in retail stores and online using this system. Apple emphasizes that the company does not store or control the transactions that people make with Apple Pay. Apple also says they don’t know what people are buying and they don’t save information about transactions. "We are not engaged in data collection", said Eddie Kew during the main speech on Apple Pay. “Apple doesn't know what, where you bought, or how much you paid. The transaction takes place only between you, the seller and the bank”. Drawbacks Unfortunately, mobile gadgets have the unpleasant property of unexpectedly discharged or lost. So, if you lose your iPhone, you will not only not be able to pay for the purchase, but you will also have to go through the whole procedure of binding a bank card. Terminals with contactless payments are not yet as common as one would like. So, you still have to carry a plastic payment card. APPLE PAY CASH In iOS 11.2, Apple introduced Apple Pay Cash, designed to send Apple Pay decentralized payments using messages on the iPhone, iPad and Apple Watch. Apple Pay Cash allows you to send money to friends and relatives with a connected debit or credit card. Recently, all users who use Apple Pay, could notice in their Wallet application or when paying by phone, a card with a nice design and the name PayCash. How does it work? The operating principle of Apple PayCash is very similar to a virtual bank card. You make yourself a card, which you can pay and accept payments from other users. The difference with the Apple version is that you can send money on demand through iMessage to your friends. Money can be sent in messages using standard fingerprint / face authentication (or touching the skin in Apple Watch), and the funds received are available on the Apple Pay Cash payment card, which is located in Wallet. The card can be used for purchases where Apple Pay works (like any other credit or debit card stored in the system), or the amount received can be transferred to a bank account. This type of transfer is currently limited to the United States. Like many decentralized money transfers, sending will be free when using a debit card, but using a credit card will be charged a 3% fee. How to use a card? The card is activated in the Wallet app. You need to click on her image, go through all the necessary instructions in the design and everything is ready. You can transfer money through iMessage. In the messenger, click on the Apple Pay icon, enter the required amount and send a message with a request to a friend. If he agrees, he will click on the black image with the image of the amount, and in a few seconds you will receive money. The same card can be paid in regular stores using Apple Pay. What about service fee and withdrawal? In the USA, no commission is charged for transferring or replenishing a friend’s debit card, but if the card is credit, the commission is 3%. With Apple PayCash, you can only withdraw money to a pegged Apple Pay card. For such an operation, there is also no commission. Another important point: for the transfer of more than $ 500, the device asks to confirm the operation of the social security number and date of birth. Therefore, if the phone of the American was stolen and somehow, they managed to crack the password, then transferring a large amount from the card will not work. How is Apple Pay Cash different from its competitors? Same price: Apple Pay Cash costs as much as Venmo and Square Cash. Sending money with a debit card or credit in an application is free and costs 3% of the transfer amount if you use a credit card. For PayPal, sending money with a debit or credit card costs 2.9% of the total plus 30 cents. There is no money directly from a bank account: unlike the competitors, the Apple service does not allow checks or other bank accounts to be linked to money transfers. Apple Pay Cash's payment options are limited to debit and credit cards issued by banks and their non-profit credit unions. Up to three days to transfer money to your bank: As with Venmo, PayPal and Square Cash, the money received at Apple Pay Cash goes to the application's account, which can then be transferred to a bank account. This can take up to three days. If fast money reception on a bank account has priority, cell, which is available in about 30 banks for mobile applications, can do it immediately and for free. Can be used as a virtual debit card: Apple allows you to save money in Apple Pay on a full-fledged Apple Pay Cash virtual debit card issued by the bank. This means that the federal government insures the money for up to $ 250,000, as would a traditional bank account. You can use Apple Pay Cash money in many applications and websites, as well as in millions of stores where Apple Pay is accepted. Square Cash gives you a debit card, while Venmo offers the same service to a certain number of customers. Similar transfer limits: With Apple Pay Cash, you can send up to $ 3,000 per wire transfer and up to $ 10,000 per week. With Venmo you can send up to $ 2999.99 per week per week. With Square Cash, you can ship up to $ 2,500 per translation per week in most states. PayPal limits individual transactions to $ 60,000 and sometimes $ 10,000 per transfer. Read the full article

0 notes

Text

CIT Bank Review

CIT Bank is an online banking platform, that offers some of the highest paying savings accounts and certificates of deposit (CD) available anywhere. They offer both online and mobile banking, and charge no fees. If you’re looking for high interest savings, CIT Bank should be on your short list of potential sources.

About Cit Bank

CIT was founded in 1908, to make financing available in and around St. Louis, Missouri. It is the parent company of CIT Bank, which is based out of Pasadena California. CIT Bank has since grown to where it has more than $30 billion in deposits, and over $40 billion in assets. It operates in Southern California as OneWest Bank.

Nationally, CIT Bank is one of the most prominent online banks in the country. It offers some of the most attractive interest rates available on certificates of deposit, high-yield savings and Custodial accounts.

On the commercial side, it provides financing, leasing and advisory services, mostly to middle-market companies and small businesses. CIT Business Capital also delivers an array of lending, leasing and factoring financing solutions, also to middle-market companies and small businesses. It also provides senior secured commercial real estate loans to owners, developers and investors through its CIT Real Estate Finance Group.

CIT Bank Savings Products and Rates

CIT Bank offers a full range of savings products, including high-yield savings and both regular and Jumbo certificates of deposit (CDs). Here’s a rundown of each product that they offer:

Premier High Yield Savings

The Premier High Yield Savings Account requires a minimum of $100 to open. There are no maintenance fees or account opening fees required. Interest is compounded daily, and the account comes with free online banking. It is available for neither custodial accounts nor for IRA accounts. Interest rates are as follows:

Balances of $1 to $100,000, 1.35% Annual Percentage Yield (APY)

Balances of over $100,000, 1.30% APY

The rates are certainly attractive, particularly on a savings account, but there is a downside. If your balance exceeds $100,000, the interest rate on the entire account drops to 1.30%. Of course, that’s because once you reach $100,000, you can get even higher rates by investing in a CIT Bank Jumbo CD.

Open a Cit Bank Savings Account>>

Jumbo CD

Jumbo CDs are available with a minimum opening deposit of $100,000. They are offered with tiered pricing, based on the term of the CD. These CDs are available for custodial accounts, but NOT for IRA accounts.

The rates for Jumbo CDs are as follows:

2-year CD: 1.45% APY

3-year CD: 1.40% APY

4-year CD: 1.60% APY

5-year CD: 1.75% APY

Open a Cit Bank Jumbo CD>>

Term CDs

Term CDs are available with a minimum opening deposit of $1,000. They are available for custodial accounts, but NOT for IRA accounts.

The rates for Term CDs are as follows:

6-month CD: 0.72% APY

1-year CD: 1.32% APY

2-year CD: 1.40% APY

3-year CD: 1.30% APY

4-year CD: 1.50% APY

5-year CD: 1.70% APY

Open a Cit Bank Term CD>>

No-Penalty CD

This CD offers high interest rates with both flexibility and access to your funds. It requires a minimum initial deposit of $1,000, there are no account opening or maintenance fees, and interest is compounded daily. The CD is available for custodial accounts, but NOT for IRA accounts.

No-Penalty CD rate: 1.45% APY for an 11-month term.

Early withdrawal advantage. No withdrawals are permitted during the first six days after receipt of funds by the bank. However, you can withdraw the total balance, including interest earned, without penalty, beginning seven days after the funds have been received.

Open a Cit Bank No Penalty CD>>

RampUP CDs