#amazon seller loans

Explore tagged Tumblr posts

Text

Intelligent Financing Strategies for Marketplace Sellers

As capital is essential to any business, it can mean the difference between growth and stagnation for marketplace vendors. Acquiring the appropriate finance solutions is critical for success in the ever-changing world of e-commerce, where prospects are abundant, but obstacles are formidable. Designed explicitly for marketplace sellers, this essay will explore some astute financing tactics with an emphasis on Amazon merchants and the distinct market conditions they face.

Understanding Amazon Invoice Financing:

Amazon sellers frequently choose invoice finance to increase cash flow and efficiently manage working capital. The basic idea behind invoice finance is to sell your past-due bills at a discount to a third-party lender for quick cash. It eliminates the need for Amazon merchants to wait for clients to pay their bills; instead, they can be reimbursed for purchases immediately.

Your outstanding invoices' value determines the advances you receive from authorized financing providers through a partnership with Amazon invoice financing. As a result, sellers can easily access funds that they can use to fund business expansion by reinvesting them in marketing, inventory, and other departments.

Financing Options for Amazon Sellers

Amazon provides various financing options suited to the specific needs of its merchants. Offerings to accommodate sellers of all sizes and stages of development range from conventional loans to credit lines and even customized financing schemes.

Advantages and disadvantages of various financing options

Traditional loans are appropriate for longer-term projects or more significant investments since they have fixed periods and interest rates.

Cash flow management is made more accessible by lines of credit, which offer continuous access to funds and flexibility.

Specialized finance schemes For example, Amazon Lending only loans to Amazon merchants based on their performance indicators and sales history.

For their business, sellers must make the best selection possible when selecting a financing option, which includes considering variables like interest rates, payback terms, and eligibility restrictions.

Amazon Seller Finance's Importance

Also referred to as Amazon seller loans, Amazon seller finance is created primarily to cater to the particular requirements of platform sellers. A seller's performance measures, including volume of sales, stock levels, and client feedback, are usually the basis for offering these loans.

Benefits of Financing Amazon Sellers:

Application procedure simplification

favorable interest rates

Versatile possibilities for repayment

Connectivity to the Amazon platform for a smooth transactional experience

Sellers can obtain the funds they require to start marketing campaigns, increase their product options, or invest in inventory by utilizing Amazon seller financing.

Overview of Amazon Vendor Central in the UAE

Vendor Central on Amazon connects with global customers for merchants who want to grow into foreign markets. With the help of Amazon Vendor Central, vendors in the United Arab Emirates (UAE) may reach the well-off customer base in the area and participate in the quickly expanding e-commerce market.

Amazon Vendor Central UAE's advantages include:

Easy order fulfillment with access to Amazon's vast logistical network

exposure to the Middle East's varied consumer base

Assistance with product listings and marketing tactics optimization from Amazon's team of specialists

Working with Amazon Vendor Central UAE might provide new opportunities for marketplace merchants wishing to expand and diversify their sales channels.

Finding Your Way Around Amazon Seller UAE

Despite the potential risks associated with market expansion, Amazon offers many chances for sellers interested in the UAE market. With its advantageous location, expanding economy, and technologically literate populace, the United Arab Emirates presents a favorable environment for the growth of e-commerce enterprises.

Success Strategies for UAE-Based Amazon Sellers

Conduct in-depth market research to comprehend local consumers' tastes and purchasing behaviors.

Sellers can position themselves for success on Amazon by being aware of the distinctive features of the UAE market and adjusting their strategy accordingly.

Strategies for Smart Financing

Knowledge truly is power when it comes to funding. Marketplace vendors may make well-informed judgments that promote expansion and profitability by implementing clever financing techniques.

Tips for Making Better Financing Decisions:

Assess Your Needs: Before pursuing funding, decide how much capital you need and for what purpose.

Evaluate Your Options: Find the financing option that best suits your company's needs and financial constraints by investigating several options.

Schedule for Repayment: As you plan to repay the monies appropriately, consider how the financing may affect your cash flow.

Marketplace sellers can effectively position themselves for sustained success in the highly competitive e-commerce industry by adopting a strategic approach to financing and remaining knowledgeable about their available options.

Source URL: https://medium.com/@kolsonhenry24/intelligent-financing-strategies-for-marketplace-sellers-900735cd8c7a

Conclusion

Marketplace vendors must employ astute finance techniques to succeed. Sellers can succeed in highly competitive e-commerce platforms like Amazon by being informed, investigating various financing options, and making decisions consistent with their business goals.

#amazon small business loans#amazon daily advance#amazon vendor central uae#Amazon seller central UAE#amazon seller uae#amazon seller loans#amazon seller financing#Financing solutions for Amazon Sellers#amazon invoice financing#financing for marketplace sellers

0 notes

Text

Amazon Seller Funding: Unlocking Growth Opportunities for Your Business

In the ever-evolving landscape of e-commerce, securing funding is crucial for Amazon sellers aiming to scale their businesses. This comprehensive guide on Amazon Seller Funding unravels the intricacies of financial support, offering actionable insights and expert advice to propel your venture to new heights.

Amazon Seller Funding: Navigating the Financial Landscape

As an Amazon seller, understanding the nuances of funding is paramount to sustained success. Let’s delve into the various aspects of Amazon Seller Funding.

More: https://buzz.filmunik.com/amazon-seller-funding

0 notes

Text

RECENT ECOMMERCE NEWS (INCLUDING ETSY), LATE JUNE 2024

Welcome to my latest summary of Etsy and other ecommerce news, relevant for small and microbusinesses online!

Get these updates plus my website blog posts via email: http://bit.ly/CindyLouWho2Blog Get all of the most timely updates plus exclusive content by supporting my Patreon: patreon.com/CindyLouWho2

TOP NEWS & ARTICLES

Etsy has yet again changed how processing times work for some countries, and this time, they’ve opted everyone into working on every national holiday. [post by me on LinkedIn, with screenshots] Many people are happy they can officially opt out of working on some days, but not so happy Etsy opted them in. The next day, Etsy clarified that this is currently only available for Canada and the US, and is only for national holidays, not regional or provincial ones.

The old Etsy listing form disappeared as promised on June 25, and the new one is still a mess [post by me on LinkedIn]. Etsy claims to have fixed numerous issues with the new listing form, including manual translations, bulk editing, and sharing to Pattern. No word on the numerous pricing issues that have affected non-US sellers in particular through the domestic pricing tool, and that have apparently changed both variations and shipping prices for US sellers. The latest new listing form fix is the inability to save drafts, although it doesn’t seem to be working for everyone.

USPS seems to have reused its tracking numbers early recently, with widespread reports of labels created June 18 and later showing as already being delivered in April or May. I’ve updated that linked Patreon post with info on how to get Etsy to correct their own records, so that seller protection and Star Seller status are not affected.

ETSY NEWS

Wondering if your images meet Etsy’s minimum size requirements? I did a video for you [on Patreon] so you can easily check for yourself.

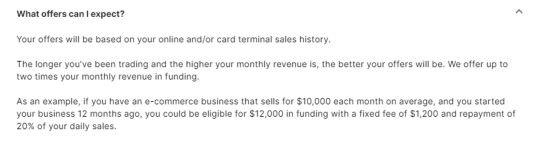

Etsy is still pushing shop loans through YouLend, “up to two times your monthly revenue.” Thanks to Michele from Artologica for the screenshot of the dashboard notification, and some of what you see once you click it:

and a link to the Etsy program at YouLend. Please read the terms carefully, as they get repaid through your future sales. It appears to be US-sellers only.

There’s a new “Made for You” page with a lot of links to various features for buyers, but I don’t see it linked anywhere on the desktop version of the site. I also don’t really see the point, but maybe we’ll have to wait and see how they use it.

Apologies for missing this one, but sellers in Turkey must now use “ShipEntegra” to mail orders, unless they already use another service. In effect, this means all new shops in Turkey are required to sign up and only ship orders through ShipEntegra, as of June 3.

Apparently the “Buy More and Save” badge Etsy applied to some listings that already had multiple quantity discounts is just a test [item 2] per Etsy.

ECOMMERCE NEWS (minus social media)

General

Facebook appears to be removing links to EcommerceBytes on its platforms.

Amazon

Amazon's "Subscribe & Save" feature will be available for products that are not Fulfilled By Amazon items, as of June 27.

Amazon's Prime Day 2024 is July 16-17th.

“Ad Relevance” is Amazon’s proposed solution to the end of ad cookies; it has AI at its core.

North American Amazon orders will stop using plastic air pillows by the end of the year.

Amazon is facing another lawsuit on copying successful sellers’ products and manipulating the Buy Box, this time in the UK.

eBay

As of July 1, eBay will be charging most of its sellers more for Express Payouts: $2 each time instead of 1.5% of the total.

eBay is now charging buyers of luxury wallets and handbags an optional $40 for authentication, for items between $200-$499.99. Items $500 and up are still authenticated for free.

The eBay Summer 2024 Seller Update included new tools and renamed programs, but some of them had already been announced.

If you are using the eBay seller app, watch for draft listings disappearing.

Shopify

Businesses selling through Shopify can now apply to sell on Target Plus, a third-party marketplace that currently has around 1200 sellers.

Shopify now has a chatbot for site owners, called Sidekick, but it is currently only available to English stores in North America.

Walmart

Walmart+ Week started June 17th, almost a month before Amazon’s Prime Day.

All Other Marketplaces

Just a few months after ending selling fees, Mercari is laying off a substantial portion of its US-based workers. It’s also still looking for new sellers, offering credits that can be spent on the site for opening a new shop and inviting friends.

Payment Processing

Apple Pay Later is being phased out in favour of “Affirm”, a third-party Buy Now Pay Later app that will be available in more countries than Apple’s own product.

Shipping

USPS hopes to change its non-standard package surcharges by region, charging more when the package travels further.

9 notes

·

View notes

Text

read these books yourself and better yet, if you can afford it, distribute the books. Make a free little library. Buy copies to loan out to friends / family. Give them as gifts

or if you can’t afford to distribute them (because books arent free), request them at your local library (they’re typically hitting the schools first, then the libraries so they might not be banned in libraries yet), put up posters advertising the books, and above all keep an eye on local politics. Email your representatives expressing your disapproval. Get a group of friends to show up at a council meeting with you if they’re discussing the topic. Your library/school officials will most likely appreciate your support, and a few people can make a big impact on the local level

if the books are public domain (published before 1923) you can probably find them on the internet. If they are not public domain though, I would recommend trying to buy or borrow a legally purchased copy if possible so that the authors get that support. We haven’t seen bans target book sellers (yet), so used bookstores can be a good place to look for cheaper options.

If you buy a digital copy, you may want to save that off somewhere secure just in case (though I should add that legally, you may not be allowed to). If we get to the point where books are banned from stores (which importantly is NOT happening yet, and lets hope we do not get to that point), physical copies and local digital storage are safer than copies saved only on your Amazon or other cloud account (or on a website). A lot of times “buying” digital content only gives you an unlimited license to view it, which doesn’t stop it from being pulled by the distributer. (Which is why you can get in legal trouble for distributing / reselling digital content - you don’t really own it). Your license may also prohibit making copies, just like legally you aren’t supposed to rip CDs or scan whole books when you borrow them from the library (in real life, no one cares unless you’re making a lot of money off of it, but that may change if we get full book bans)

To everyone in red states where book bans are likely to take place soon, here’s some lists for you <3

As a history student going into library science, people way under hype how crazy book banning is

Multiple lists of books already banned in schools/libraries or ones that likely will be:

Banned Books Week 2024: 100 of the Most Challenged Books

Banned Books: Top 100

Banned Book List

Colorado Banned Book List

The Complete List of Banned & Challenged Books by State

Banned Books from the University of Pennsylvia Online Books Page

Top 10 Most Challenged Books in 2023

PEN America Index Of School Book Bans – 2023-2024

Challenged and Banned Books

Places to order books other than Amazon:

Internet Archive (free)

Libby (free with library card)

Thrift Books

Book Outlet

BookBub

Abe Books

Half Price Books

Barnes & Noble

Better World Books

PangoBooks

Book Finder

Goodwillbooks

Alibris

Places to support that fight against book banning:

American Library Association

Unite Against Banned Books

National Coalition Against Censorship

PEN America

There’s a reason politicians fight so hard to limit knowledge and it should scare you.

Some recs below based on reviews I’ve seen

I Know Why the Caged Bird Sing by Maya Angelou

The House on Mango Street by Sandra Cisneros

This Book is Gay by Juno Dawson

Melissa by Alex Gino

Looking for Alaska by John Green

The Kite Runner by Khaled Hosseini

All Boys Aren't Blue by George Matthew Johnson

Gender Queer by Maia Kobabe

All American Boys by Jason Reynolds

And Tango Makes Three by Justin Richardson

Aristotle and Dante Discover the Secrets of the Universe by Benjamin Alire Sáenz

The Hate U Give by Angie Thomas

The Color Purple by Alice Walker

Flamer by Mike Curato

Let's Talk About It: The Teen's Guide to Sex, Relationships, and Being a Human by Erika Moen and Matthew Nolan

Lawn Boy by Jonathan Evison

This Day in June by Gayle E. Pitman

Me and Earl and the Dying Girl by Jesse Andrews

Stamped: Racism, Antiracism, and You by Ibram X. Kendi and Jason Reynolds

Sex is a Funny Word by Cory Silverberg

Prince & Knight by Daniel Haack

The Handmaid’s Tale by Margaret Atwood

Drama by Raina Telgemeier

This One Summer by Mariko Tamaki

The Curious Incident of the Dog in the Night-Time by Mark Haddon

I Am Not Your Perfect Mexican Daughter by Erika L. Sanchez

Roll of Thunder, Hear My Cry by Mildred D. Taylor

The Absolutely True Diary of a Part-Time Indian by Sherman Alexie

Persepolis by Marjane Satrapi

Beloved by Toni Morrison

6K notes

·

View notes

Text

GST Registration Online – A Complete Guide for Businesses & Startup India Registration

Goods and Services Tax (GST) is crucial to running a business in India. Whether you are a startup or an established business, obtaining GST registration online is mandatory if your turnover exceeds the prescribed limit. If you are registering your company under Startup India Registration, getting a GST number is a key step toward compliance and tax benefits.

What is GST Registration?

GST registration is the process by which a business gets registered under the Goods and Services Tax (GST) Act. It allows businesses to collect tax legally and pass on input tax credit benefits.

Under the Startup India Registration scheme, having a GST number is beneficial as it helps in securing government incentives, funding, and credibility in the market.

Who Needs GST Registration?

Businesses must apply for GST registration online if they meet any of the following criteria:

✅ Annual Turnover: If the turnover exceeds ₹40 lakh (₹20 lakh for service providers). ✅ Interstate Business: If you supply goods/services outside your home state. ✅ E-commerce Sellers: If you sell on platforms like Amazon, Flipkart, or Shopify. ✅ Exporters & Importers: Businesses involved in international trade. ✅ Registered Under Startup India Registration: If your startup is recognized under Startup India Registration, getting GST ensures compliance and tax benefits.

Benefits of GST Registration for Startups

For businesses registered under the Startup India Registration scheme, GST registration offers several advantages:

🔥 Legal Recognition: A GST-registered business gains more credibility. 💰Tax Credit Benefits: Claim input tax credit on purchases and reduce costs. ⚡Eligibility for Government Tenders & Loans: GST registration is required for various government schemes.

📜 Simplified Compliance: GST eliminates multiple indirect taxes, making tax filing easier. 📢 Global Business Expansion: If you plan to export, GST is a must for claiming export benefits.

Step-by-Step Process for GST Registration Online

Here’s how you can apply for GST registration online:

Step 1: Visit the GST Portal

Go to the official GST portal (www.gst.gov.in) and click on ‘Register Now.’

Step 2: Fill out the GST Application Form

Enter details such as:

Business name

PAN number

Mobile number & email ID

Business Type & address

Step 3: Upload Required Documents

You’ll need: 📜 PAN Card of the business owner 🏠 Address proof of the business 📝 Bank account details 📄 Incorporation certificate (if registered under Startup India Registration)

Step 4: Verification via OTP & ARN Generation

After submitting the form, you’ll receive an Application Reference Number (ARN) for tracking the status.

Step 5: GST Certificate Issuance

Once approved, you’ll get your GSTIN (GST Identification Number), which is required for invoicing and tax filing.

Why Choose Professional Assistance for GST Registration?

🔹 Quick & Error-Free Filing – Avoid mistakes that can lead to application rejection. 🔹 Expert Advice – Get clarity on tax slabs, exemptions, and compliance requirements. 🔹 Integrated Startup Solutions – If you’re applying for Startup India Registration, we help with both GST and DPIIT recognition.

Conclusion

Getting GST Registration Online is a crucial step for businesses, especially those under Startup India Registration. It ensures compliance, tax benefits, and credibility, helping startups grow efficiently.

0 notes

Text

How do I find the best vending machines on sale?

Before diving into the market for vending machines, it's crucial to understand your specific needs. Are you looking for a machine that dispenses snacks, beverages, or a combination of both? Consider the location where the machine will be placed, as well as the preferences of your target audience.

Additionally, think about the size and capacity of the vending machine. If you anticipate high traffic, a larger machine with a greater product capacity might be necessary. Conversely, for smaller locations, a compact machine may be more suitable.

To ensure you get the best vending machine, it's essential to research the leading brands in the industry, United Vending being a leader in the segment. Such brands have established reputations for quality, reliability, and innovation in the vending machine market.

Look for reviews and testimonials from other users to get a sense of each brand's strengths and weaknesses. You can also reach out to industry forums and communities to get recommendations and insights from experienced vending machine operators.

When evaluating vending machines, pay close attention to the quality and features offered. Look for machines with durable construction and reliable mechanisms to ensure longevity and minimal maintenance like United Vending. United Vending has been doing business for more than 15 years. They have been in business in London for over a decade with free on-loan vending machines given to industries in hospitality and finance.

Finding the right platform or seller is crucial to securing a good deal on a vending machine. Online marketplaces like eBay, Amazon, and specialized vending machine websites offer a wide range of options. Additionally, consider reaching out to local distributors and manufacturers directly for potential discounts and personalized service.

Attending industry trade shows and expos can also provide opportunities to see machines in action and negotiate deals with sellers. Networking with other vending machine operators can lead to trusted recommendations and insider tips on where to buy the best machines.

0 notes

Text

This is so true!! I really dislike when any kind of dichotomy is formed…I love how this post promotes library use, but buying books isn’t inherently bad! I love having my own shiny new library I can hoard like a little dragon. I love my beautiful hardcovers I bought off Amazon from pristine sellers. I love my beat up mass market paperbacks I found at the top of a dusty shelf in a used bookstore. I love my plastic-bound, scratched up library copies I’ve waited two weeks for because the interlibrary loan system teaches patience. I even love my cheap Kindle books that I can feverishly scroll through when I have a spare moment! Books, man. No matter the format, or the way you find em, they rock. I love how we all just go feral over em, no matter the way we get em. :D

HAVE PEOPLE NOT HEARD OF LIBRARIES??????? They are 100% cheaper than AMAZON

26K notes

·

View notes

Text

Expert Tips and Trends for Jewelry Enthusiasts

When it comes to finding unique, high-quality jewelry at fantastic prices, pawn shops are often overlooked. Yet, they offer a treasure trove of opportunities for savvy shoppers. Today, we’re taking you behind the scenes at Diamond Jewelry & Loan, known as the best pawn shop in Los Angeles, to share expert tips, trends, and insider advice that can elevate your jewelry game.

Insights from the Best Pawn Shop in Los Angeles Welcome to Diamond Jewelry & Loan, a staple in Los Angeles for over 75 years. Established in 1945, we have built a reputation for delivering top-notch customer service, offering fair prices, and maintaining the highest standards in the pawn industry. We’re dedicated to helping you make informed decisions, whether you’re buying, selling, or seeking a loan against your valuable items.

Expert Advice on Jewelry Care for Autumn Seasonal Care Tips for Diamond and Gold Jewelry Autumn brings beautiful colors and cooler weather, but it also presents unique challenges for jewelry care. Proper maintenance is essential to keep your diamond and gold pieces looking their best. Regularly clean your jewelry to remove dirt and oils that can dull its shine. You can use a gentle cleaning solution specifically designed for diamonds and gold, or make your own with mild dish soap and warm water.

Cleaning and Storing Your Jewelry When cleaning your jewelry, use a soft brush to gently scrub away any grime. Be sure to rinse thoroughly and dry with a lint-free cloth. For storage, keep your pieces in a cool, dry place. Individual pouches or compartments in a jewelry box can prevent scratches and tangling. Avoid exposing your jewelry to harsh chemicals or extreme temperatures, as these can cause damage.

Preventing Damage from Seasonal Weather Changes Autumn weather can be unpredictable, with sudden changes in temperature and humidity. To prevent damage, avoid wearing your jewelry during outdoor activities where it could be exposed to the elements. If you’re caught in the rain, make sure to dry your jewelry thoroughly before storing it. Using silica gel packets in your jewelry box can help absorb moisture and protect your pieces.

Recommended Products for Jewelry Care Maintaining your jewelry’s brilliance requires the right tools. We recommend the following top-rated products available on Amazon:

Hagerty Diamond and Gold Clean: A reliable solution for keeping your diamonds and gold sparkling. Connoisseurs Jewelry Wipes: Convenient wipes for quick touch-ups on the go. Jewelry Cleaning Kit by Simple Shine: Includes a gentle cleaning solution, brush, and cloth for comprehensive care. Autumn Sales and Deals at Diamond Jewelry & Loan Highlighting Current Promotions and Discounts Autumn is a fantastic time to score deals on exquisite jewelry at Diamond Jewelry & Loan. We’re offering special promotions and discounts on a wide range of items, from dazzling diamonds to elegant gold pieces. Whether you’re a collector or a first-time buyer, there’s something for everyone.

Perfect Opportunity for Deal Hunters and Collectors Our autumn sales provide a unique opportunity to find high-quality jewelry at unbeatable prices. With our expert curation, you can trust that every piece meets our stringent standards for quality and authenticity. Don’t miss out on these limited-time offers!

Tips for Making the Most Out of Autumn Sales Navigating sales can be overwhelming, but we’re here to help. Start by setting a budget and knowing what you’re looking for. Arrive early to get the best selection, and don’t hesitate to ask our knowledgeable staff for assistance. When negotiating prices, be respectful and reasonable—building a rapport with the seller can often lead to better deals.

Books and Movies About Pawn Shops Recommended Reads for Those Interested in Pawn Shops & Jewelry For those who love to immerse themselves in the world of pawning and jewelry trading, there are several must-read books. Titles like “Pawnonomics” by Yigal Adato and “The Art of the Pawn” by David Goodman offer fascinating insights into the industry. These books provide a deeper understanding of the history, economics, and cultural significance of pawn shops.

Brief Reviews and Why They Are Worth Reading “Pawnonomics” explores the role of pawn shops in modern economies, highlighting their importance as financial services providers. “The Art of the Pawn” takes readers on a historical journey, showcasing the evolution of pawning from ancient civilizations to today’s high-tech operations. Both books are engaging reads that offer valuable perspectives on the industry.

Movies and TV Shows Featuring Pawn Shops Pawn shops have made their mark in popular media, with numerous movies and TV shows exploring their unique dynamics. Films like “Pawn Shop Chronicles” and “The Pawnshop” provide thrilling, often humorous takes on the pawn world. TV shows such as “Pawn Stars” offer a reality-based look at the day-to-day operations of a family-run pawn shop, highlighting the fascinating stories behind the items brought in.

Trending TV Shows About Pawn Shops and Collectibles Overview of Popular TV Shows TV shows like “Pawn Stars” and “Hardcore Pawn” have brought pawn shops into the spotlight, showcasing the intriguing stories and characters that walk through their doors. These shows have changed public perception, turning pawn shops into places of curiosity and excitement rather than just financial necessity.

What These Shows Reveal About the Buying and Selling Process Through these series, viewers gain insight into the meticulous process of appraising and negotiating items. They reveal the expertise required to identify valuable pieces, as well as the art of making fair deals. The shows also highlight the diversity of items that come through pawn shops, from rare collectibles to everyday valuables.

How These Shows Influence Trends in Pawn Shopping The popularity of these TV shows has increased interest in pawn shopping, encouraging more people to explore pawn shops for unique finds and great deals. They’ve also sparked a trend towards collecting, with viewers inspired to seek out rare and valuable items.

Client Testimonials and Success Stories Highlighting Positive Customer Experiences At Diamond Jewelry & Loan, customer satisfaction is our top priority. Our clients have shared countless positive experiences, praising our friendly service, fair appraisals, and high-quality items. Whether they’re purchasing jewelry or securing a loan, our customers appreciate the ease and professionalism of our services.

Stories of Finding Unique and Valuable Items At our diamond pawn shop, our clients uncover exclusive treasures. Vintage watches, rare gemstones – each piece tells a story. Excitement fills the air as they discover these hidden gems, adding a personal touch to their collections.

Testimonials About Quick and Hassle-Free Loans Our loan process is designed to be fast, easy, and confidential. Clients have expressed their gratitude for the quick access to cash and the straightforward terms of our loans. These testimonials highlight our commitment to providing financial solutions that meet our customers’ needs.

Your Premier Pawn Shop in Los Angeles Diamond Jewelry & Loan stands out as the best pawn shop in Los Angeles, offering exceptional service, valuable expertise, and a wide selection of high-quality items. Whether you’re looking to buy, sell, or secure a loan, our team is dedicated to ensuring your experience is positive and rewarding. Visit us today and discover why we’re the preferred choice for jewelry enthusiasts and deal hunters alike.

Interested in learning more? Visit Diamond Jewelry & Loan Pawn Shop and take advantage of our seasonal promotions and exclusive deals for first-time customers. We look forward to serving you!

0 notes

Text

Mastering Embedded Finance: The Comprehensive Perfios Manual

In today's rapidly evolving financial landscape, the concept of embedded finance is revolutionizing the way businesses interact with financial services. No longer confined to traditional banking channels, embedded finance promises seamless integration into everyday business activities. This blog is your roadmap to understanding the implications of embedded finance for your business. We'll explore its transformative potential and how it's reshaping the fintech industry, providing insights into the opportunities and challenges it presents. Get ready to navigate the future of finance and unlock new possibilities for your business with embedded finance.

What is embedded finance & how does it change FinTech? Customers love products but they value the experience of using them or buying them even more. Research reinforces this shift, revealing that a staggering 80% of customers prioritize the experience as much as, if not more than, the offerings themselves. Embedded finance addresses this head-on, delivering a seamless and frictionless financial experience within the ecosystems consumers already frequent.

The traditional model of financing involved approaching your seller/vendor and your credit provider separately in order to enable a purchase. Think about applying for a personal loan to buy a washing machine. This involves a lot of hassle and documentation for the customer, precipitating abandonment of the purchase itself.

Embedded finance shatters these boundaries, integrating financial services from payments and lending to insurance and wealth management directly into the platforms and experiences you already use. By leveraging Application Programming Interfaces (APIs), embedded finance allows for the effortless integration of financial tools within non-financial experiences.

As we delve deeper into this transformative trend, we'll explore its far-reaching impact on the financial landscape, creating a win-win situation for both businesses and consumers.

Embedded Finance: Its Impact & Future Projections Recent research highlights a glaring gap between consumer expectations and the services provided by traditional financial institutions. While 73% of consumers expect their financial needs to be anticipated, only 37% feel their providers meet this expectation. Moreover, the staggering 70% average cart abandonment rate in e-commerce, largely due to high prices, underscores the pressing need for diversified and simplified financing options.

The consensus from this research paints a clear picture: consumers want to pay less & pay it easily. From zero-interest point-of-sale loans to enticing rewards, embedded finance enhances convenience and savings for consumers. Notably, consumer willingness to embrace embedded financial services is evident with significant interest shown in opening checking accounts with non-traditional players

Over 46% of millennials, a digitally savvy generation, express interest in managing finances through familiar platforms like Amazon or Starbucks. Embedded Finance has the potential to revolutionize financial accessibility and convenience for both businesses and consumers. Businesses can cater to customer needs in real-time, fostering loyalty and boosting sales through targeted financial options. Consumers, on the other hand, experience and appreciate the intuitive integration of their finances with their online behaviors.

The impact is undeniable! Statistics speak volumes: a staggering 88% of companies implementing embedded finance report a surge in customer engagement while a remarkable 85% confirm its effectiveness in acquiring new customers. This isn't just a fad; it's a full-fledged market primed for exponential growth. Analysts predict the Global Embedded Finance Market to reach a colossal $384.8 billion by 2029, fueled by a staggering 30% Compound Annual Growth Rate (CAGR).

Examples of Embedded Finance Embedded Finance integrates financial services like payments, loans, insurance, and investments directly into non-financial platforms. This goes beyond loyalty points – it's about pivoting how you interact with money in your everyday life. From effortless in-app payments to on-the-spot financing, embedded finance ensures that you complete your online journeys without interruption. Let's look at a few examples of embedded finance and its implementation in real life scenarios:

Embedded Credit: Embedded Credit empowers consumers to access and manage loans within digital platforms. Imagine converting a purchase into manageable installments during an online shopping spree.

Embedded Payments: Embedded Payments streamline transactions within apps or platforms, becoming indispensable for e-commerce and SaaS solutions. They facilitate diverse transactions like in-game purchases, payroll automation, and subscription-based payments.

Embedded Investments: Embedded Investments open avenues for stock market participation within various platforms. Through API-based brokerage firms, investors can seamlessly trade stocks without leaving their preferred platform, whether it's a messaging app or an employee portal.

Embedded Insurance: Embedded Insurance bundles insurance seamlessly with product purchases, enhancing customer convenience. Companies like Tesla offer auto insurance at the point of sale, setting a new standard for integrated services.

Use Cases of Embedded Finance Imagine a world where financial services seamlessly integrate into the fabric of your daily activities. No longer confined to separate apps or bank branches, money management becomes effortless and frictionless. Embedded finance unlocks this very possibility.

Consider the ease of purchasing a new phone online and securing financing for it right at checkout, spreading the cost without breaking the bank. Picture seamlessly paying for your ride-hailing service with a single click within the app itself. Envision booking a dream vacation and effortlessly acquiring travel insurance at the same time, ensuring peace of mind alongside adventure. These are just a few examples of how embedded finance revolutionizes how we interact with money.

The applications extend far beyond basic transactions. Coffee shop apps could allow for instant account top-ups, while e-commerce platforms curate insurance options tailored to specific purchases. Retail loyalty programs can evolve into sophisticated investment opportunities, allowing you to effortlessly convert reward points into stocks or mutual funds.

Embedded finance isn't limited to B2C interactions either. Imagine businesses leveraging embedded finance to streamline B2B transactions. Invoice financing within online marketplaces or instant access to working capital for freelancers can revolutionize cash flow management.

Key Players in the Embedded Finance ecosystem Consequently, traditional paradigms of financial distribution are undergoing a metamorphosis. Gone are the days when banks and financial institutions (FIs) held a monopolistic grip on product dissemination. In their place emerges a dynamic ecosystem where digital entities seamlessly integrate FIs, distributors, technology providers and other stakeholders, fostering agility and universality in product delivery.

Key Players in the Embedded Finance ecosystem

This agility empowers the creation of innovative financial products and their delivery through familiar, trusted platforms. This phenomenon, hailed globally as the embedded finance revolution, has begun its conquest, with payments emerging as one of its initial battlegrounds. The crux of embedded finance lies in its simplicity.

How Does Embedded Finance Work & How is Perfios Supporting The Revolution?

Embedded Finance Facilitates Seamless Integration: Embedded finance streamlines financial services integration into digital platforms. Perfios Credit Gateway (PCG) exemplifies this by offering APIs that seamlessly embed credit facilities into e-commerce and other non-financial platforms.

Technological Advancements Drive Integration: Rapid fintech advancements and API proliferation enable scalable integration. PCG leverages these technological strides, facilitating quick and hassle-free credit processes within diverse platforms.

Consumer Preferences Shape Innovation: Evolving consumer preferences prioritize convenience and streamlined experiences. PCG responds to these expectations by providing intuitive credit solutions embedded directly into everyday transactions.

Financial Inclusion through Integration: Embedded finance bridges gaps for underserved populations, democratizing access to financial products. PCG contributes to financial inclusion by embedding credit options into various platforms, catering to diverse consumer needs.

E-commerce Amplifies Embedded Finance Adoption: E-commerce platforms leverage embedded finance to enhance customer experiences and boost sales. PCG's integration within e-commerce ecosystems enables diverse financing options, driving conversion and customer satisfaction.

APIs Revolutionize Financial Integration: APIs revolutionize the integration of financial services into non-financial platforms, ensuring swift and seamless transactions. PCG's robust APIs empower businesses to embed credit facilities effortlessly, enhancing their offerings and competitiveness.

Fintech Collaboration Fuels Embedded Finance: Collaboration between fintech companies and traditional institutions propels the embedded finance revolution. PCG exemplifies this collaboration, partnering with banks to provide seamless credit solutions within non-financial platforms.

Future Prospects of Embedded Finance: Embedded finance holds immense potential for reshaping consumer finance and driving innovation. With PCG at the forefront, the future promises even more seamless integration and accessibility of financial services across diverse digital platforms.

Pros & Cons of Embedded Finance: Pros: Cons:

Behavioral economic advantages encourage beneficial financial behaviors.

One-step financial shopping offers convenience for users.

Enhanced security protocols protect users' financial information.

Streamlined user experience simplifies financial transactions.

Embedded finance cultivates trust and brand loyalty.

Increased financial access extends services to underserved populations.

Expanding the service portfolio attracts new customers and revenue. 1. Behavioral economic pitfalls may lead to impulsive decisions.

Complexity can confuse users navigating multiple options.

Customer overload from too many choices may lead to decision fatigue.

Increased need for customer support due to complexity.

Loss of focus on core offerings for businesses.

Security and privacy concerns with handling sensitive financial data.

Regulatory compliance complexity and cost.

Reliance on third parties may pose operational risks.

Trust erosion if users perceive services as intrusive. Understanding Open Banking and Embedded Finance With An Everyday Scenario: Imagine you have a favorite pizza place (the bank) where you love to order your favorite pizza (your banking services). Now, open banking is like inviting your friends (third-party financial service providers) to the pizza place and letting them taste your pizza (accessing your banking data) through a special window (APIs). Your friends can then suggest new toppings (financial services) or even make a pizza delivery app (fintech apps) based on your preferences.

Now, embedded finance is taking things a step further. It's like having your favorite pizza delivered directly to your doorstep (integrating financial services) when you order it from your favorite ride-sharing app (non-financial platform). So, while open banking is about sharing access to your pizza place, embedded finance is about making your pizza available wherever you are whether it's at the pizza place or while you're on the go.

In simpler terms, open banking is like sharing your pizza with friends, while embedded finance is about having your pizza wherever you want it thanks to innovative partnerships and integrations!

Conclusion As explored in this blog, embedded finance shows a seismic shift and its impact is multifaceted. By leveraging open banking principles, embedded finance empowers businesses to extend financial tools into diverse platforms revolutionizing how consumers interact with money. From simplified payments to personalized insurance options, the possibilities are boundless.

In essence, embedded finance isn't just about transactions; it's about transformation! It empowers consumers by democratizing access to financial products, cultivates brand loyalty through tailored experiences and drives innovation across industries.

1 note

·

View note

Text

Cloud Capital

FINANCE AND COMMERCE

According to some commentators, wealth, having moved from the feudal period, when the emphasis was on land ownership and wealth from this ownership was provided by rents in various forms and servitude to the lords of the manors, to the capitalist period when the emphasis was on industrial production and the means of production, profit, the buying and selling of shares and capital in companies, buying and selling of goods in markets, the provision of wages, economies of scale and addition of benefit, to the period where we are quickly moving into, that of cloud capitalism, which, in fact is less of a capitalist system and more of a return to feudalism.

Some defining attributes of this new economic model is that the oligarchs who control it tend to produce nothing of huge physical significance (for example goods) themselves but charge fees in the form of rents and or subscriptions for the use of their virtual services. The real estate is virtual and takes the form of platforms or virtual marketplaces.

The seller fees that, for example, Amazon charge are referral fees (introduction of a buyer to a seller), seller account fees and shipping/fulfilment fees. There can be other optional charges for product storage, advertising & promotion, financing. Amazon have buyer/subscriber fees also, such as Amazon Prime which ensures quicker and usually free delivery, and ancillary subscription based services such as music and film streaming services.

The different operating models of vehicle producing companies such as Tesla and Volkswagen highlight the main differences between traditional capitalist and cloud capital enterprises.

Volkswagen is built on a heavily capitalised business producing profitable products and services. Investment is private and public and designed to give investors a return on the capital they provide. Public companies' shares are bought and sold in international trading houses providing opportunities for capital to invest and provide income. Buyers are largely asked to purchase goods and services at point of sale through cash or finance (loans and or leasing plans).

Tesla customers 'invest' in the business by placing a deposit or committing to a finance scheme. Buying into the Tesla brand gives some benefits to the user such as dedicated charging stations when on a journey. The Tesla car is almost like a computer on wheels with enhanced features such as automatic navigation and hands free driving. The emphasis is on the software rather than the hardware: electric vehicles are much more simple that traditional internal combustion engined ones. In Tesla cars, their connectivity is constant.

Running in parallel with this is cryptocurrency, the possibility of purely digital banks and complete extinction of bricks and mortar banks and building societies, and possibly stock markets, the potential of AI to replace many occupations, the removal of the wage earning job and certainly the 9-5.

There are also anxieties around how the above developments will affect the individual and society, and insecurities surrounding global health, food security, energy security, the effects of climate change and political, economic and military upheavals with associated massive scale migration.

WARFARE

Access to technology and the monopolisation and control of information technology can lend huge leverage in conflict situations. During WWII, Britain realised that the Luftwaffe were utilising radio navigation for night bombing missions. Until their blitzkrieg on Britain ended when they launched Operation Barbarossa, British military intelligence and the Air Ministry devised means of jamming and 'bending' these signals causing the bombing missions to miss their intended targets.

The modern equivalent is SatNav, an American development. During the military operations in Kuwait, Saudi Arabia and Iraq in the early 1990s, the Pentagon managed to tweak SatNav technology to provide accuracy to within 3 metres. This provided the US and allied forces with enormous advantages in military planning of the initial and subsequent conflicts in the middle east. Saddam's regime did try to jam some GPS signals but the US destroyed the jamming apparatus. GPS provided a huge advantage over previous surveillance systems such as radar and visual observation and being a largely American technology, gives them huge advantage over any potential adversaries. Enemy movements could now be accurately assessed, precision given to weapons' targeting and avoidance of friendly fire was enhanced. Saddam's fibre cable network which operated outside of GPS and was used to control his missile arsenal was sabotaged by the coalition forces. As a result of this, other countries have been developing their own GPS systems: India developed a regional system called NavIC. Russia has GLONASS, which, with China's BEIDOU, comes closest to the US SatNav system as does the European Union's GALILEO system. Japan has QZSS which requires development but has the promise of reaching SatNav functionality as it develops.

0 notes

Text

Stock Exchanges: A Comprehensive Guide for the General Public

Have you ever wondered how companies like Apple or Tesla raise money or why the prices of their stocks fluctuate? The answer lies in stock exchanges, the bustling marketplaces where shares of companies are bought and sold. Think of a stock exchange as a giant auction house where investors trade shares to grow their wealth or support businesses. In this article, we'll break down what stock exchanges are, how they work, and why they matter—all in simple terms.

1. What Is a Stock Exchange?

A stock exchange is a marketplace where investors buy and sell shares of publicly traded companies. Think of it like a farmers' market, but instead of fruits and vegetables, you trade company stocks. This organized system ensures that buyers and sellers can trade shares securely and transparently.

2. How Do Stock Exchanges Work?

Stock exchanges operate like matchmaking platforms connecting buyers and sellers. When a company wants to raise money, it issues shares through an Initial Public Offering (IPO). These shares are then traded on the stock exchange, where prices change based on supply and demand.

3. Major Stock Exchanges Worldwide

Some of the world's largest stock exchanges include:

New York Stock Exchange (NYSE) – The largest by market capitalization.

Nasdaq – Known for technology stocks like Apple and Amazon.

London Stock Exchange (LSE) – One of the oldest exchanges globally.

Tokyo Stock Exchange (TSE) – Asia's leading stock exchange.

4. Role of Stock Exchanges in the Economy

Stock exchanges play a crucial role in the economy by facilitating capital raising and wealth generation. They help companies expand while offering investment opportunities to the public, thus promoting economic growth.

5. Types of Securities Traded

Besides stocks, many other financial instruments are traded on stock exchanges:

Shares/Stocks: Ownership in a company.

Bonds: Loans made to companies or governments.

Mutual Funds: Pooled investments managed by professionals.

Exchange-Traded Funds (ETFs): Similar to mutual funds but traded like stocks.

6. How Companies List on Stock Exchanges

Companies undergo a rigorous process called listing, which involves meeting strict requirements set by the stock exchange. They must disclose financial details, ensuring transparency and investor protection.

7. Trading Process Explained

Trading on stock exchanges follows a clear process:

Order Placement: Investors place buy/sell orders through brokers.

Matching Orders: The exchange matches buyers and sellers based on price and availability.

Transaction Completion: The trade is finalized, and ownership is transferred.

8. Stock Market Indices

Stock market indices measure the performance of selected stocks, helping investors track market trends. Popular indices include:

S&P 500 – Tracks 500 major U.S. companies.

Dow Jones Industrial Average (DJIA) – Focuses on 30 top U.S. companies.

FTSE 100 – Represents the top 100 companies listed on the London Stock Exchange.

9. Why Stock Prices Fluctuate

Stock prices change due to various factors such as:

Company Performance: Strong earnings can boost prices.

Economic Indicators: Inflation, interest rates, and unemployment affect stocks.

Global Events: Wars, pandemics, and political changes can create uncertainty.

10. Risks and Rewards of Investing

Investing in stock exchanges offers potential rewards but comes with risks:

Rewards: Dividend income, capital gains, and portfolio growth.

Risks: Market volatility, economic downturns, and company failures.

11. Regulation and Security Measures

Stock exchanges are heavily regulated by government agencies to ensure fair trading and prevent fraud. In the U.S., the Securities and Exchange Commission (SEC) oversees these activities.

12. Stock Market Terms You Should Know

Here are some common terms to know:

Bull Market: A rising market with increasing prices.

Bear Market: A declining market with falling prices.

Portfolio: A collection of investments held by an individual.

Dividend: Profit shared with shareholders.

13. Impact of Global Events on Stock Exchanges

Global events such as economic crises, wars, and technological advancements can cause market volatility. For instance, the COVID-19 pandemic led to significant market fluctuations worldwide.

14. How to Start Investing in Stocks

Starting is simpler than you think:

Learn the Basics: Understand how markets work.

Choose a Brokerage: Find a reliable online broker.

Set Investment Goals: Define your financial objectives.

Build a Portfolio: Diversify your investments to reduce risks.

Monitor Regularly: Stay updated on market news.

15. Conclusion and Final Thoughts

Stock exchanges are the beating heart of the global economy, enabling businesses to grow and investors to build wealth. By understanding how they function, you can make informed investment decisions and potentially secure your financial future.

FAQs About Stock Exchanges

1. What is the difference between stocks and bonds? Stocks represent ownership in a company, while bonds are loans investors give to companies or governments in exchange for interest payments.

2. How can I start trading on a stock exchange? You can start by opening an account with a brokerage firm, funding your account, and placing trade orders.

3. Are stock exchanges only for big investors? No, anyone can invest in stocks with a small amount of money through online trading platforms.

4. Why do stock prices change so frequently? Stock prices fluctuate due to changing market conditions, company performance, and global events.

5. Is investing in stocks risky? Yes, stock investing carries risks, but with proper research and strategy, you can manage these risks effectively.

0 notes

Text

A Comprehensive Guide on Amazon Bookkeeping for Your E-commerce Business

In the dynamic realm of e-commerce, especially on Amazon, mastering financial management is key to business success. "A Comprehensive Guide for Amazon Bookkeeping for Your E-commerce Business" is tailor-made for entrepreneurs navigating the financial intricacies of Amazon's platform. This guide demystifies Amazon bookkeeping services, offering clear, step-by-step guidance for maintaining accurate financial records, ensuring compliance, and making informed decisions. It's an invaluable resource for both novices and seasoned e-commerce professionals, simplifying complex bookkeeping concepts. By equipping readers with the knowledge to streamline financial processes, this guide is an essential tool for anyone looking to enhance their e-commerce business's financial health and drive growth on Amazon.

Importance of Amazon Bookkeeping Services for Sellers

Amazon bookkeeping services are crucial for sellers on the platform, playing a vital role in maintaining financial health and ensuring business success. Here's why it's so important:

Bookkeeping helps you understand your business's financial status. By tracking expenses like inventory costs, shipping, and Amazon fees, you can gauge how well your business is performing. Regularly updated books give you a clear picture of your financial situation, allowing you to make informed decisions.

Knowing your net profit is essential for any business. Amazon bookkeeping services help you determine this by subtracting expenses from your total sales. This calculation is crucial for understanding your business's profitability and for future planning.

Accurate bookkeeping is indispensable during tax season. It helps in reporting your earnings accurately and ensures compliance with tax regulations. Without proper bookkeeping, you risk inaccurate tax filings, which can lead to penalties.

Proper bookkeeping helps in identifying potential tax deductions, which can significantly lower your tax bill. E-commerce businesses have specific deductions, but you can only take advantage of them if you're organized, and your expenses are well-documented.

When seeking loans or investments, financial statements generated through bookkeeping are crucial. They demonstrate to lenders and investors that your business is a viable risk and that their money will be well managed.

Regular bookkeeping helps in identifying and rectifying financial errors, preventing costly mistakes. Without up-to-date books, you may overlook discrepancies that could lead to significant financial losses.

By maintaining consistent financial records, you can compare your business's performance over different periods. This comparison helps in identifying trends, planning for seasonal variations, and strategizing for growth.

Just like amazon, for those who also sell on platforms like Shopify, incorporating Shopify bookkeeping into your financial strategy can streamline your overall e-commerce bookkeeping. This integration ensures a cohesive approach to managing your multi-platform e-commerce business.

Efficient bookkeeping gives you peace of mind. Knowing that your financial records are in order, you can focus more on growing your business rather than worrying about financial discrepancies or compliance issues.

Amazon bookkeeping services are not just a regulatory requirement but a fundamental aspect of running a successful e-commerce business. They provide clarity on your financial health, assist in strategic decision-making, ensure tax compliance, and support growth and investment opportunities. For Amazon sellers, investing time and resources in proper bookkeeping is a step towards sustained success and financial stability.

How to Get Started with Amazon Bookkeeping?

Starting with Amazon bookkeeping can seem daunting, but it's essential for managing your e-commerce business effectively and take care whether the amazon bookkeeping services you have opted for are following the correct steps. Here’s a simplified, step-by-step guide to help you get started and maintain accurate financial records.

Step 1: Choose the Right Accounting Software

Select user-friendly accounting software that caters to e-commerce needs, such as inventory management and sales tracking. Double-entry accounting systems are particularly beneficial for Amazon sellers as they provide a comprehensive view of finances, including assets, liabilities, income statements, and cash flow. This type of system ensures accuracy and helps in generating detailed financial reports.

Step 2: Incorporate Useful Add-Ons

Customize your accounting software with add-ons specifically designed for Amazon sellers. These tools can automatically import data from your Amazon Seller Central account, streamlining the bookkeeping process. Prioritize add-ons that assist with inventory management, sales tax tracking, and integrating data from different sales channels. This is especially crucial if you're operating across state lines or on a global scale.

Step 3: Set Up Your Chart of Accounts

Develop a chart of accounts to systematically categorize your financial transactions. This framework should include primary categories like assets, liabilities, equity, revenue, and expenses, and further divided into sub-categories unique to your e-commerce operations. This organization is key to maintaining clarity in your financial records and aids in efficient analysis.

Step 4: Track Cost of Goods Sold (COGS)

Accurately account for the Cost of Goods Sold, which encompasses all expenses related to obtaining or manufacturing the products you sell. This includes purchase costs, shipping fees, tariffs, and any additional relevant expenditures. Utilizing inventory management software helps in tracking these costs more efficiently and provides insights into product profitability.

Step 5: Begin Recording Transactions

Regularly record each financial transaction using your established system. Consistent updates are crucial for organized and up-to-date books. Establish a routine schedule for your bookkeeping tasks to ensure you stay on track and avoid backlogs.

Step 6: Organize Financial Record Storage

Effectively manage your financial records, particularly in preparation for tax season. Digital records are acceptable and often preferred, so leveraging cloud-based storage solutions like Google Drive or Dropbox can offer both security and accessibility. This step is vital for maintaining organized and easily retrievable financial documentation.

Step 7: Consider Outsourcing as You Grow

As your business grows, consider opting for outsourced Amazon bookkeeping services. This transition can free up your time to focus on core business activities. Depending on your business's complexity and budget, you can opt for a professional bookkeeper, an accountant, or a certified public accountant (CPA). Each offers different levels of expertise and can provide varying degrees of financial insight and strategy.

Conclusion

In conclusion, proper bookkeeping is an invaluable asset for any Amazon seller looking to enhance their business's financial health and success. It simplifies the process of managing your finances, from choosing the right accounting software to understanding the nuances of Amazon bookkeeping services. This guide empowers you to accurately track your financial health, identify tax deductions, make informed business decisions, and strategize for growth. Whether you're a beginner or an experienced e-commerce professional, incorporating these practices will not only streamline your financial operations but also provide peace of mind as you navigate the competitive landscape of Amazon selling. Embracing these bookkeeping strategies is a vital step towards achieving long-term success and stability in the ever-evolving world of e-commerce.

Visit:

Steemit: https://steemit.com/@ap-outsourcing

WriteupCafe: https://writeupcafe.com/profile/

Reddit: https://www.reddit.com/user/Online-CPA-Services

#accounting#accounting and bookkeeping services#bookkeeping services#Bookkeeping Company#accounting outsourcing

1 note

·

View note

Text

0 notes

Text

Ebay and Amazon Product Scraping

In the fast-paced world of e-commerce, where products are constantly changing, prices are fluctuating, and competitors are vying for the spotlight, having the right data at your fingertips can make all the difference. That's where DataScrapingServices.com steps in, providing you with the power of eBay and Amazon product scraping to keep your business ahead of the curve.

eBay and Amazon are two of the largest online marketplaces in the world, offering an immense array of products across various categories. To succeed in this competitive landscape, businesses need real-time, comprehensive, and accurate data. That's precisely what our eBay and Amazon product scraping services deliver. Our cutting-edge scraping technology can gather data on products, prices, reviews, seller information, and much more from eBay and Amazon. Whether you're a seller looking to optimize your pricing strategy, a reseller searching for profitable products, or a business tracking market trends, our services can provide you with the data you need.

E-commerce giants like eBay and Amazon host an incredible array of products, making them a goldmine of data. However, manually extracting this data can be a time-consuming and daunting task. That's where our expertise in web scraping comes into play. Our dedicated team at DataScrapingServices.com utilizes advanced techniques to extract product information from eBay and Amazon with precision and efficiency. Our eBay and Amazon Product Scraping services offer a range of benefits for businesses of all sizes. By automating the process of data extraction, we enable businesses to quickly gather valuable insights on product details, prices, reviews, and seller information. This information can be instrumental in making informed decisions, optimizing pricing strategies, monitoring competitor activities, and identifying market trends.

For businesses looking to expand their product offerings or launch new marketing campaigns, our eBay and Amazon Product Scraping services are invaluable. By having access to a wealth of product data, businesses can gain insights into consumer preferences, identify gaps in the market, and make strategic decisions that lead to growth. At DataScrapingServices.com, we take pride in our ability to transform raw data into actionable insights that drive results. Our commitment to quality, accuracy, and timely delivery sets us apart as a trusted partner in the field of web scraping. We're dedicated to helping businesses harness the power of data to achieve their goals and make informed decisions.

Best Data Scraping Service Provider - Datascrapingservices.com

Real Estate Agents Data Scraping

Texas Realtors Data Scraping

Scraping Mining Industry Email List

Scraping Mortgage Mailing Lists

Bathroom Tiles Contractor Email List

Real Estate Data Scraping

Real Estate Industry Database

Loan Officer Email List

Real Estate Investor Email List

Best Ebay and Amazon Product Scraping Services in USA:

Jacksonville, Chicago, Omaha, Louisville, Miami, Portland, Tulsa, Atlanta, San Antonio, Las Vegas, Austin, Milwaukee, San Jose, Oklahoma City, Fresno, Seattle, Long Beach, Mesa, Charlotte, Honolulu, Virginia Beach, Arlington, Springs, Boston, Dallas, Orlando, Wichita, Los Angeles, Bakersfield, Philadelphia, Columbus, Washington, Sacramento, Denver, Colorado, San Diego, El Paso, Albuquerque, San Francisco, Nashville, Indianapolis, Houston, Fort Worth, Kansas City, Raleigh, Memphis, New Orleans, Tucson and New York.

Conclusion:

If you're ready to harness the potential of eBay and Amazon Product Scraping for your business, contact us at [email protected]. Our team is here to provide you with customized solutions that can elevate your e-commerce strategies and help you stay ahead in the competitive online marketplace. Let DataScrapingServices.com be your partner in turning e-commerce data into success.

Website: Datascrapingservices.com

Email: [email protected]

#ebayandamazonproductscraping#ebayandamazonproductscraper#datascrapingservices#webscrapingexpert#websitedatascraping

0 notes

Text

Get vcc

The world has digitalized beyond our imagination. The progress of the tech industry has surprised us to bits. The internet is like the eighth wonder of the world. Pretty much everything can be found on the internet now. You can get whatever you want to be delivered to your doorstep with just a few clicks. Human life has become easier with this blessing of digitalization.

However, every coin has two sides. The Internet has benefitted us a lot but also compromised our privacy. If you buy something online, you need to pay through your debit or credit card mostly. It means the information on that card is shared with the merchant. Your identity, your address, your social and financial details and all. This information can be backfired if it gets into the wrong hand. So, you need to be careful about that but how?

As we know in this digital era, every problem has its own solution. In this matter, the solution is using a prepaid visa card. It is more like one of those superhero’s stealth modes. You get your job done but no one gets to know who did the job. You can buy anything online, and make any payments without sharing your personal and financial details. Also, it works without any bank account being linked and is accepted pretty much everywhere around the world. If you still don’t have it, you better check it out now. We have it served at the table right in front of you. Give the whole article a read to find out more details.

A Little Overview On Prepaid Visa Card

Before we share our selling proposition, let’s help you understand what we are actually selling. You see, a prepaid Visa card is preloaded with a certain amount of money. Now, you might be thinking it’s like a traditional debit card. Well, you are pretty much right as a debit card deducts money from the bank account linked to it. You can spend as long as you have money in your bank account, right? The same thing goes for a prepaid Visa card, except it doesn’t require any bank account.

You can’t call it a credit card either because you’re not taking any loan. With a credit card, you pay after spending the money. Some people lose track of spending and end up in debt. Unlike a credit card, a prepaid Visa card allows you to spend only the amount you loaded. Overall, it’s more like a debit card but without any bank account linked, though it is also issued by financial institutions.

You don’t need to go through the complexities of getting a traditional Visa card. Anyone can buy a prepaid Visa card, and that is the beauty of it. It doesn’t require that many application processes, and you don’t even need to share any of your information. Go anonymous! Just load the card and start using it. You can use it anywhere traditional Visa cards are accepted.

In short, a prepaid Visa card helps you secure your personal and financial information and keep track of your spending as it won’t exceed the amount you loaded on it. If you still haven’t availed of this amazing Visa card for yourself, it’s time you did so. We offer the best-prepaid Visa card at a great deal for you. Check it out below.

You will find several prepaid Visa card sellers online. If you’re wondering why you should buy VCC and buy Amazon AWS Account from us, we won’t blame you. We are availing all the prepaid Visa card features for you. Our card features alone are enough to convince you to buy it. However, we not only want to convince our clients but also impress them. That’s why we’ve worked on providing the best customer service. Here are the details of our service.

Why Do You Need To Buy Prepaid Visa Card?

This question might have come up in your mind at some point. That’s why we thought: why don’t we clean this up? Let’s get started.

How do you actually apply for a traditional Visa card? Usually, you go to a bank, open an account, and submit an application for a Visa card. Then, the bank goes through a process of verification and provides you with the card. Simple, right? Well, not as simple as it seems. The process involves many steps that might be difficult for you. The bank runs a credit check on the applicant and collects financial details and all.

However, obtaining a prepaid Visa card from a financial institution is a little bit simpler. All you need is an account with funds in it. Then, ask for a prepaid Visa card of a specific amount that should not be more than the amount you have in the account. Since you’re not borrowing any money from the bank, the process is faster.

0 notes

Text

New Post has been published on All about business online

New Post has been published on https://yaroreviews.info/2023/08/amazon-releases-some-seller-funds-after-complaints

Amazon releases some seller funds after complaints

Daniel Moore

By Faarea Masud

Business reporter

Amazon has started releasing some sellers’ funds back to them after many UK and EU sellers complained of money being held unexpectedly.

The change in policy comes after the BBC reported it led to some sellers’ business being close to collapse.

Amazon told some sellers it will now delay the temporary holds on money until January 2024.

But one ink seller, Daniel Moore, who had £230,000 frozen, said Amazon were only “delaying our anguish”.

Amazon wrote in an email to one seller in the early hours of Saturday: “We understand that the transition to this policy on 3 August has caused a one-time cash-flow issue for your business. To support you in preparing for the policy change, we have extended your policy transition until 31 January 2024”.

Amazon’s initial policy update sent in May stated it would temporarily hold seller funds to cover customer refund demands. It said sellers’ would be able to withdraw their money only from the delivery date plus a further seven days.

The policy was implemented on 3 August across the UK and EU for sellers registered before August 2016.

But its email about the change was not seen by many EU and UK sellers, and in many cases was automatically sent to their junk folder.

The change comes at a time businesses are struggling with the soaring costs of living and increases in energy bills, materials and operating costs.

‘Gobbledegook’

Andy Pycock, 53, from Buckinghamshire, has been selling home, garden and leisure products on Amazon and had £25,000 frozen on 3 August.

He had taken out a loan with Amazon Lending to cover the period of withdrawals being frozen – and paid fees to have it restructured.

Andy Pycock

But hours later on early Saturday morning, he was told of Amazon’s policy change, meaning his takings were available again.

He said his business had suffered a slowdown as he was unable to afford to restock and fulfil orders during the period his money was frozen.

Andy, who has been selling on Amazon since 2016, said the lack of notification, and last-minute changes from Amazon, has made him question his future involvement with the firm.

He said Amazon’s explanations as to why it will be holding money from established sellers like him sounded like “corporate gobbledegook”.

“This doesn’t make any sense,” Andy told the BBC. “Amazon is toxic as equally as it is brilliant – but we also feel they’re our greatest enemy right now”.

He says he “dreads” looking at his Amazon Seller account due to its various changes and “confusing” implementation of policy.

Amazon said the policy was introduced to align all sellers worldwide on to the same policy.

However, some UK and EU sellers have been told it will be implemented in September, whilst others are now being told it will be implemented in January next year.

One seller on Amazon’s Seller Forums called the situation “shambolic”.

Amazon sellers fear collapse as site withholds cash

Minister demands Amazon answer on freezing seller cash

Daniel Moore said that amount of his takings which Amazon had frozen was “disproportionately high versus the potential refunds processed by customer returns or non-delivery”.

Having hundreds of thousands of pounds of his takings frozen meant he was unable to pay his VAT bill on time, or order new stock.

He says he received notification on Saturday saying all of his takings had now been released, but that the pause in income led to issues along his whole supply chain that could take up to two further weeks to resolve.

He said the delay in the implementation of Amazon’s temporary hold policy was “initially good news”, but that “it simply kicks the can down the road to a month where corporation tax and personal tax is due. January is a very difficult month”.

Daniel said the policy “is still unfair” and that established sellers like his firm Ink Jungle posed “no risk” to Amazon.

“If items are being delivered tracked or by FBA what is the risk? It makes no sense to hold onto the funds for so long after delivery”, Daniel added.

FBA, Fulfilled by Amazon, is where sellers keep their stock in Amazon’s warehouse, and Amazon delivers the goods to buyers once sold.

Amazon’s change in policy implementation for affected sellers comes after small business minister Kevin Hollinrake had demanded the tech giant explain how it will “mitigate” the effects of the policy on many sellers, in a letter seen by the BBC.

Seller Mario Katz says he has now had £5,000 released from his frozen funds. He was “happy” that he could now resume withdrawing amounts daily for the day-to-day running of his business.

“But I cannot celebrate, as I cannot trust Amazon.

“I’m still scared about the policy taking effect in January”, he said.

Amazon said the vast majority of its sellers were not affected by the temporary hold implemented on 3 August.

It is not yet clear if those companies will receive compensation for any losses incurred during the period that their withdrawals were frozen.

Amazon has been contacted for comment.

The issues are similar to those faced by Etsy sellers after that marketplace began withholding 75% of sellers’ funds for around 45 days. Hundreds of sellers complained it was undermining their businesses. Etsy reduced the amount it was holding after a BBC report in to the problem.

Related Topics

Amazon

Online shopping

Retailing

UK economy

More on this story

Minister demands Amazon answers on withheld funds

17 hours ago

Amazon sellers fear going under as cash is withheld

3 days ago

Etsy U-turn in row over withholding sellers’ money

2 August

0 notes