#also marketing profiting off of expected controversy is awful

Explore tagged Tumblr posts

Text

You remember that one time in 2021 where Dominos brought back the Noid for like one commercial out of literally nowhere, attempted to make TikTok trends and article headlines about it, even giving him a horrendous 'Ugly Sonic' makeover, likely as bait for 'long-time' fans to riot over it-

And literally nothing came out of it. Nobody had any clue what to do with it. We just said 'huh... Okay-cool' and moved on with our lives. Yeah, since then, it looks like Dominos has removed most evidence that they ever did that on their own platforms, just like it never happened.

The most we got out of that phase was the fact that the Noid is somehow canonically considered a Crash Bandicoot villain now...

That's really great. I'm really glad that happened.

#actually /srs#I really hate this 'remove good and creative designs and replace it with realism' movement#is the 'uncanny valley' not taught in character design classes#idk-actually I only took one pre-college class so far#who cares if it will appeal to kids-why are you trying to bring out a looney-tunes-based-60's-Batman villain and expect children won't like#it#also marketing profiting off of expected controversy is awful#the noid#dominos

76 notes

·

View notes

Text

Alastor and Astrology

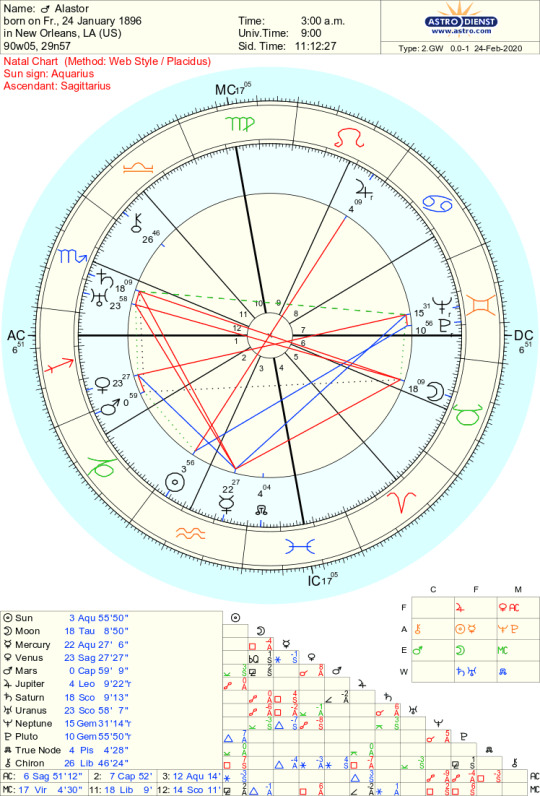

Alastor potential birth chart

January 24th 1896, New Orleans(Jan 24 1986 is the birth date of voice actor Edward Bosco.) Alastor died in 1933 getting shot in the head and on the wiki, it said he was in his 30’s when he died. 1933 minus 1896 equals 37. I figured that the dark hour of 3:00 am would be fitting for him.

Sun in Aquarius

Friendly and sociable, you may have a wide circle of acquaintances. Friends are very important to you. Intellectually oriented, you are happiest with friends that share common ideas and interests. Strangely, you find it more difficult to cultivate a truly satisfying intimate relationship. This aloofness exists because feelings are rarely expressed outwardly, and you usually seem distant. You resist anything or anyone threatening your independence.

Alastor is shown being sociable to Charlie, Angel, Husk, etc. He’d be happy with Charlie, Mimzy, Rosie, who share his love of singing and dancing. With a constant smile on his face, Alastor tries to never express what true feelings he may have at the moment. Anyone threatening his independence like the overlords or perhaps his father would likely not live very long.

Moon in Taurus

A Taurus Moon emphasizes the material side of life, and emotions are centered on the comforts and possessions in life. You tend to be a collector and an accumulator of the things that, in your view, make up the "good life." With the Moon in Taurus, you want the best that life has to offer, and you find it difficult to settle for less. The emotions are earthy and practical, highly attracted to material possessions and the satisfactions that come from material comforts. Sense impressions are very strong, the sense of touch and taste is highly developed, and you probably have a pleasant speaking and singing voice. At least you are fond of music, art, dancing and all things that make life more pleasurable. You innate good taste probably extends to decorating the home and having a great sense for interior design.

Mercury in Aquarius

In Aquarius, Mercury produces a mind that is original, detached, and abstract. Ideas come to you as bursts of insights. Your mind is hyper-active and going constantly. Thoughts are rarely organized, rather arriving in flashes and fragments which are often the seeds of invention and progress. The thought pattern is scientific and dispassionate.Your ideas may sometimes be considered very progressive and some may be well ahead of their time. Your unique approach will prompt some to label you as being a little crazy or at least eccentric. You like to do things that are unusual or avant garde just to shake up the establishment and create controversy. You have no respect for tradition and little concern for the lessons of the past. You are a pure progressive. You love to rebel against the system in supporting causes and ideas that are controversial and revolutionary.You are very intuitive, and accordingly, an excellent judge of character. Being very fair-minded, you judge people by what they seem to know or what they do, rather than who they are or what position they occupy. You believe strongly in equality and fair play. A humanitarian, you support ideas and programs that assist those less fortunate than yourself, and you support the concepts of total social reform.You're witty and open to a wide range of ideas, but at times, you become mentally fixed in your opinions and very stubborn. You are talkative and social, but you often come off as rather aloof and cerebral. It may be hard for you to find common ground in many social circles. Nonetheless, you are very verbal and enjoy expressing you views to anyone who will listen. Writing and speaking both come easily for you.

Theory: in his human life, Alastor resisted the racist standards/discriminations, being part Creole and having a mother who wasn’t white. He most likely killed off anyone who had bullied him. It is possible that Alastor will redeem himself by working with Charlie and the other protagonists to stand up against the Archangels, overlords, and/or Lucifer. They who claim that “demons deserve to die” or the overlords who wish to brainwash the populace in Hell would face Alastor’s wrath. The name Alastor means “spirit of vengeance/tormentor,” after a figure who wanted justice for familial issues. It could be good or bad (tormenting innocent people or tormenting evil people, both of which Alastor would relish in.)The speaking/writing aspect could translate into him speaking in his radio broadcasts. The Aquarius symbol can represent water, electricity, or in his case, radio waves. Venus in Sagittarius

You are humorous, sociable and even a flirt. Outgoing and personable, you are very friendly and sometimes not too serious. There is a strong love of personal freedom in your nature that makes it a little hard for you to settle down to a restrictive sort of relationship. You feel more comfortable in a relationship when things go slowly, and your partner doesn't get too serious too fast. In fact, you would probably like it better if the relationship stayed casual, and pressures of serious love never emerged. Threats to your freedom make you very nervous. Deer need their freedom and Alastor is no exception. Throughout the show, we see him socializing and casually flirting with Charlie, Husk, and Vaggie with dramatic gestures, invasive physical touch and in Charlie’s case, dancing. He likely did the same thing with his companions as a human. His humorous side comes into play with his dad jokes and clown-like demeanor. Mars in Capricorn

You are hard-working, very determined. Since much of your energy is focused on your career, you have a tendency to become something of a workaholic. There is a drive to satisfy professional ambitions. This is likely to manifest with innate managerial skills and good old-fashioned common sense. You have strong material urges, but even stronger is the need to get status and recognition. To attain these ends, you use your energy in very practical and profitable ways. You have little use for laziness or a lack of ambition. Alastor is ambitious when it comes to getting what he wants, whether through charm or brutal force. He was likely a workaholic at his job as a radio host. In Hell, he conquered many parts of Hell, killing those who stood in his way “seemingly overnight.” His goal is to take over all of Hell and broadcast his victory, via overthrowing the king of Hell most likely. Not only does he enjoy the finer things in life and the afterlife, he also enjoys the recognition that comes with it, both admiration and fear from others.

Jupiter in Leo

Jupiter is in Leo in your chart. This placement of Jupiter suggests optimism, self confidence and generosity. You have much physical energy and a strong constitution. You have a dramatic flair in showing off your status and prosperity; you're big on grandeur in all forms. Your dignified demeanor inspires confidence and produces excellent leadership qualities. You expect appreciation and admiration in return for your benevolence, and you may seem a little offended if you don't always get it.

Being one of the most flamboyant characters in the show, Alastor lives for drama and showing off. Broadcasting his killings and conquests, both as a human and demon gives him great joy and affirms his powerful position. He appears dignified in nearly any situation, not fazed by Sir. Pentious’ attack nor when Charlie refuses to make a deal with him. With Jupiter in Leo, one could say that “theater is his religion/worldview.”“The world is a stage, and the stage is world of entertainment.” Saturn in Scorpio

Saturn in Scorpio adds much purpose and impatience to your nature. You demand much of yourself and of others. You approach responsibilities with an intensity of purpose that overwhelms people who won't carry their share of the load. You have terrific willpower and much energy. With your determination, it's hard to remain calm and reflective. Secretive and unforgiving, you resent it deeply when you are treated unfairly. Despite your strong drive for success, your approach is usually subtle and calculating.

Scorpio represents the supernatural, Saturn represents misery and death. With so much dark energy running through Alastor, it’s no surprise that he became known as the infamous Radio Demon. Alastor doesn’t like to be treated unfairly, both as a human and demon, and those who do would quickly meet their end. He does have a subtle approach to his plans, observing Charlie’s family portrait with great interest, summoning voodoo symbols when Charlie isn’t looking, watching Charlie sing on TV with fascination.He is demanding on Niffty, Husk, and Vaggie. He bribes Husk into greeting the guests and working at the stand with booze, summons Niffty to clean the hotel, and telling Vaggie to smile. “One never plans a murder out loud.” Uranus in Scorpio

Many of your peers born during the years when Uranus was in Scorpio are apt to bring about massive and often disruptive changes. The seeds of revolution and instability may take root from within this group. Uranus in Scorpio tend to be rebels. Their determination and strong will keep them heads above anyone else. But it may not be obvious at first. Uranus in Scorpio is more of a dark horse that you don’t see coming until the last second. That’s when they pounce.Disruptive changes included the 1929 stock market crash, the Great Depression, war, Alastor’s murders and his death by a bullet through his head.

Neptune in Gemini

Neptune in Gemini are in awe of the world and want to learn as much about it as possible. They are sociable and great communicators. But they and also be drawn into fantasy and illusion. They can also be taken advantage of if they’re not careful. Theory: this might explain Alastor creating illusions using his magic, as well as music, song, and dance, as Neptune rules the arts. Wanting to learn about the world could have been his desire as a child. He may have been taken advantage of in his human life, thus deciding to take advantage of others to make himself feel more secure.

Pluto in Gemini

People during the Gilded Age between 1882 and 1914 were often optimistic, fashionable, sociable and arrogant (describing Alastor and how he was brought up by society).Things in the world seemed to be improving, getting people positive to the extreme. However, things were getting bad and there were cracks in the worldview. The rich and the poor, duality is associated with Gemini. Constantly immersing themselves in deeper and more intense experiences than ever before, they reshape their thinking patterns continuously, ever evolving, ever becoming better. Love and affection are also very beneficial to their state, as it points to them they are appreciated and that it’s worth it to have a bright outlook for the future.

What could Alastor’s ascendant be?

Leo, Gemini, Capricorn, or Sagittarius Sun in Aquarius, Moon in Taurus The combination of your Sun and Moon signs produces a personality that people find easy to like and admire. This is not so much for what you do as it is for what you don't do. You’re never petty or small, and your appeal is to those in the higher as well as the lower rungs of society. You don't pester people with your worries and anxieties, but when others come to you, you drop everything to listen to their problems. You're interested in people, and like to be around them as an observer, but somehow maintaining a distance and not getting too involved individually. You rate people not on their position or rank, but simply on whether they interest you or not. You have a certain self-sufficiency about you, and you never feel that you have to put on airs to impress anyone. You have all it takes to be executive, except the desire that would be required. You seem to be devoid of any domineering or missionary spirit, willing to "live and let live." This combination blends the originality and independence of Aquarius, with the determination and powerful will of Taurus. These two fixed signs together give a will that is so strong that it may become obstinate and intransigent. Happiness can depend on assuring peacefulness and harmony in environment or home life, and in respect to human relationships.

Sun opposed Jupiter

The opposition of the Sun and Jupiter suggests an over-expanded ego. Jupiter deals with judgment, and with this aspect, the drive for significance is subject to being overemphasized. There is often a tendency toward extravagance and pretension. You can have too much optimism, and promise more than you can deliver. There is a continuous need to control urges to enter grandiose schemes and avoid ostentatious manners. The strength of this aspect lies in your ability to apply much charm to gain the approval of those you deal with in your daily affairs. There is often much talent and creativity associated with this aspect.

Sun trine Pluto

The Sun in your chart is trine Pluto giving you a highly evolved power of concentration and will. You have a way of mobilizing your talents to reach your goals. You have many leadership abilities, but you may not be so interested in leadership. You focus instead on your personal agenda. You often display an attitude of righteous indignation toward those who bend the truth and take advantage of others. You are an extremely perceptive person. There is much investigative skill associated with this aspect, and your insight in human motivations can serve you well in fields of behavior sciences. You may not always agree with people, but you understand them very well. Moon opposed Uranus

The Moon and Uranus form an opposition in your chart. This opposition suggests a conflict in your life regarding emotional matters. The Moon denotes emotions and Uranus produces unstable situations. Thus, you may be called on to deal with unpredictable emotions that may appear as nervous tension. It may require conscious effort on your part to maintain a responsible role in your domestic affairs.

Moon opposed Saturn

The opposition between the Moon and Saturn suggests a negative mental attitude and often a restriction of the spontaneous flow of ideas. Intellectual responses are somewhat slowed. Even if you are very bright, the inability to express self in other than a prosaic manner often hides real mental abilities. Thus, you are more contemplative than conversational, but nonetheless a good listener. Venus conjunct Mars

The conjunction between Venus and Mars shows a strong desire nature needing expression. You are the aggressor in relationships with the opposite sex, and you are ever eager and aggressive in making social contacts, as well. Artistic endeavors may be an active outlet for your hyperactive nature.

Moon square Mercury

The square formed between the Moon and Mercury suggests conflict between your mind and your emotions. You have difficulties making reasonable judgments because your feelings get in the way. Irrational decisions place you at odds with people sometimes, and you have the feeling that you're being treated unfairly when this may not be the case. You dwell on trivial personal matters and may have a real sense of insecurity.

Mercury square Uranus

Mercury in a square aspect with Uranus speeds the perceptions, and quickens the intuitions. At times you can be erratic in your drive to be independent. Your speech can become sarcastic and brusque, and mental energies can be wasted in temperament. You love a battle of wits and will take the other side of just about any argument just for the fun of it.

Mercury trine Neptune

The aspect between Mercury and Neptune suggests you're a practical idealist with an intuitive mind. Because your intuition is so highly developed, you understand what motivates others in their relationships with you. You have an artistic imagination and the skill to express it well. You can visualize objects or processes in your mind, much as though you were looking at a finished product. In this regard, your mind is very inspirational. You communicate effectively, and with a flair for dramatic delivery.

Mercury square Saturn The square between Mercury and Saturn suggests mental restraint and strong ties to traditional ways of thinking. Mental processes are on the pessimistic side. You worry too much, often about unimportant details. You have much concern about succeeding or failing to succeed. Your education may have been rigidly disciplined and conforming to traditional doctrine. There is a tendency because of this, to uphold the established order and resist change. Numerology

A = 1

L = 3

A = 1

S = 1

T = 2

O = 6

R = 9

1 + 3 + 1 + 1 + 2 + 6 + 9 =23

2 + 3 = 55 Destiny number

http://astrology-numerology.com/num-birthname.html

The number 5 Destiny suggests that the direction of growth in your lifetime will be toward becoming a harbinger of change, freedom, and progressive thought and action. The number 5 Destiny potentially endows you with the wonderful characteristic of multi-talents and versatility. You must develop in ways allowing you to do so many things well. The tone of the number 5 is the constructive use of freedom, and in your drive to attain this freedom, you must be the master of adaptability and change.As you mature, you must become good at presenting ideas and knowing how to approach people to get what you want. Naturally, this will give you an edge in any sort of selling game and spells easy success when it comes to working with people in most jobs. Whatever you do, you have the capacity to be clever, analytical, and a very quick thinker.You must learn to accept changes as they come along and avoid clinging to the outdated. Avoid rebellion, and focus on enlightenment and progression thinking that will benefit mankind. You life is broadened by gaining an understanding and an appreciation of all kinds of people.The Destiny 5 will be welcome in many varied professional environments. The public sector is a natural for you because you must administer to all peoples. The media, advertising, promotion, publicity, all types of selling, and entertainment are all potential fields that may interest you. Settling on a single career may not be in the cards for you, as you are in a continuous state of flux brought by constantly changing interests. Alastor: Jan 24 1896 Charlie: July 3 before 1830s Husk: age 60-75Died in 1970s1970-75 = 1895VA birthdate Dec 10 Dec 10 1895 Niffty: age 22Died in 1950s1950-22 = 1928 March 22 1928 Vaggie/Vagatha: died in 20142014 – 22 = 1992Voice actor birthdate May 10May 10 1992 Angel Dust/Anthony: died in his 30s 1947Voice actor birth date June 17 19951947 – 30 = 1917 June 17 1917

3 notes

·

View notes

Text

5 Reasons This Fast Growing Blue Chip Is One Of The Best Tech Stocks In The World

New Post has been published on http://cyberspace2k.net/5-reasons-this-fast-growing-blue-chip-is-one-of-the-best-tech-stocks-in-the-world/

5 Reasons This Fast Growing Blue Chip Is One Of The Best Tech Stocks In The World

(Source: imgflip)

While my income growth retirement portfolio is focused on higher-yielding stocks, history shows that lower-yielding but fast-growing dividend growth stocks are also a great way to exponentially compound your wealth over time.

For example, between 1969 and 2011, dividend growth stocks yielding less than 3% managed to be the second best performing group of stocks. They beat the S&P 500 by about 3% per year over this 42 year period. They also did so with the second best risk-adjusted returns (returns/volatility), as shown by this group’s information ratio.

This is why I want to highlight Microsoft (MSFT), one of my favorite blue chip tech dividend growth stocks. Thanks to its strong rally this year, the stock’s yield is rather paltry.

MSFT Total Return Price data by YCharts

However, there are five reasons why I still think the company remains an attractive long-term income growth investment. In fact, even from today’s elevated prices, I think Microsoft might realistically achieve about 16% annualized total returns over the next decade. That’s not just likely to significantly beat the market over that time period, but potentially quadruple your money over the next 10 years.

Most importantly, the company’s strong fundamentals and likely decades long growth runway mean that Microsoft is as close to a “buy and hold forever” stock as you can find on Wall Street.

1. Short-Term Growth Engine Firing On All Cylinders

Replacing Steve Ballmer with Satya Nadella in 2014 turned out to be a master stroke. That’s because Nadella was the head of Microsoft’s cloud division and shifted the company’s focus from its legacy Windows business to cloud/software as a service subscription model. The results speak for themselves.

(Source: Microsoft Earnings Presentation)

Microsoft, despite its massive size, is seeing strong top line growth with revenue rising 17% in the past quarter (YOY). More importantly, its bottom line is growing as well. Thanks to sales outpacing cost growth, both the gross margin and operating margin expanded, resulting in a 30% boost to operating income. Note that operating income excludes the beneficial effects of tax cuts. Thus, this year this is the more important metric for investors to focus on.

The biggest reason for Microsoft’s massive operating profit growth was its success in converting its over 1 billion global Windows users to its cloud subscription service. The company’s commercial unit, which has 89% of revenue from recurring subscriptions, saw its sales soar 53%. More importantly, its gross margins on those sales also rose by 6% over the past year to an impressive 58%. This shows that Microsoft enjoys a wide moat that gives it strong pricing power (more on this in a moment).

(Source: Microsoft Earnings Presentation)

The heart of Microsoft’s commercial success is its fast growing intelligent cloud business. Not just is this growing at double digits, but that growth rate accelerated to 26% YOY in the latest quarter.

(Source: Microsoft Earnings Presentation)

Meanwhile, operating margins on cloud, despite aggressive capex investment, are also rising. This is why Microsoft’s cloud business (which accounted for 21% of revenue in the past 12 months) saw operating profits rise 34%.

(Source: Microsoft Earnings Presentation)

The company’s success in cloud is due to torrid growth in Azure, its cloud computing/artificial intelligence data analytics platform. Azure is the world’s second fastest growing cloud platform and continues to increase at nearly triple digit rates. In comparison, Amazon’s (AMZN) AWS cloud platform, currently the largest in the world, is growing at 49%. This indicates that Microsoft is gaining market share in what’s arguably one of the most important industries of the coming century.

Part of the company’s strategy involves continually adding new services to increase the strength of its cloud offering. Or to put another way, Microsoft wants its suite of cloud offerings to become a one stop shop “walled garden” ecosystem that locks in customers for the long term. This is why it bought LinkedIn back in 2016.

(Source: Microsoft Earnings Presentation)

Microsoft’s controversial $26.2 billion acquisition of LinkedIn also appears to be paying off. Thanks to a 41% increase in engagements from its 575 million member base, this business saw 37% revenue growth which outpaced its 17% increase in operating costs. As a result, operating losses at LinkedIn fell 49%, and this acquisition is on track to become accretive to Microsoft’s EPS within a year or so.

(Source: Microsoft Earnings Presentation)

Meanwhile, the company continues to make great inroads with switching its corporate Windows clients to its Office 365 commercial subscription service. Microsoft has consistently been growing its commercial 365 subscriber base by about 30% for the last two years. Today, the company has 135 million commercial Office 365 users, which represents roughly 12% of its installed global user base. This indicates that Microsoft’s fast growth in commercial productivity services should continue for the foreseeable future.

(Source: Microsoft Earnings Presentation)

Even Microsoft’s legacy and hardware businesses are doing well. While Windows OEM consumer sales are down slightly, that’s to be expected as global PC sales are in secular decline. More importantly, its professional Windows sales are growing at double digits. Meanwhile, its non core businesses, like Surface, Xbox live, gaming, and search (Bing) revenue are all showing double-digit sales growth.

Search revenue: 17% growth

Surface revenue: 25% growth

Xbox Live subscription revenue: 36% growth

Gaming hardware: 39%

And like with its other operating units, Personal Computing is also seeking margin expansion as operating profit rose 38%, more than double the division’s 17% revenue growth.

But wait, it gets better! Not just is Microsoft managing to grow its top line at double digits off an enormous base ($110 billion TTM revenue), but that growth is expected to accelerate.

Q1 2019 Guidance

Metric

Midrange Guidance

YOY Growth

Revenue

$27.7 billion

25%

Operating Income

$8.85 billion

58%

(Source: management guidance)

For the next quarter, management is guiding for even more impressive growth of 25% in revenue and a stunning 58% growth in operating income. The bottom line is that Microsoft is once more a revenue and profit growth machine. And thanks to its strong long-term growth runway, that is likely to continue for the foreseeable future.

2. Long-Term Growth Potential Is Excellent

Analyst firm Research & Markets expects cloud computing to grow at about 27.5% CAGR between 2017 and 2025, when it will become a $1.25 trillion global market. Now granted this is for every part of the cloud industry, which includes markets that Microsoft isn’t targeting. But given that Microsoft’s cloud business generated just $23 billion in the past year, this shows that Microsoft’s growth runway in cloud is long and vast.

The key to its cloud strategy is incorporating ever more useful applications, including those driven by AI data analytics. These allow companies to not just store their data in Microsoft’s cloud, but make sense of it, including how to optimize operations to boost profitability. For instance, Dynamics 365, Microsoft AI driven data analysis suite, saw 61% revenue growth indicating that the company’s corporate clients are loving its new offerings. Meanwhile, the company’s computer engineers added 500 new capabilities to its Azure cloud platform over the past year, which explains why its red hot growth rate continues.

According to analyst firm Synergy Research, in Q2 2018, the cloud computing market grew 50%. That’s compared to 44% for the full year 2017 and 50% in 2016. The industry’s top five players (Amazon, Microsoft, IBM (NYSE:IBM), Google (NASDAQ:GOOG) (NASDAQ:GOOGL) and Alibaba (NYSE:BABA)) control 75% of the market and continue to tighten their grip.

More importantly, according to Synergy, only four of the world’s 25 largest cloud providers saw any growth in market share (Amazon, Google, Alibaba, and Microsoft). IBM’s market share remained flat at 8% and everyone else lost ground.

According to John Dinsdale, Chief Strategist at Synergy:

In a large and strategically vital market that is growing at exceptional rates, they (industry leaders) are throwing the gauntlet down to their smaller competitors by continuing to invest enormous amounts in their data center infrastructure and operations. Their increased market share is clear evidence that their strategies are working.”

In other words, in cloud computing, moats are getting wider, thanks to the importance of AI driven data analytics. The more users a company can attract to train its AI algorithms to analyze data better, the more of an edge its service suite will gain. This shows that cloud computing has a very large network effect, in which winners tend to keep on winning.

Analyst firm Gartner thinks that the industry’s top two players (Microsoft and Amazon) might end up controlling 90% of the cloud market by 2020. Personally, I think that Alphabet and Alibaba’s strong cloud growth rates make this unlikely. But Microsoft’s market share is still likely to grow modestly over time. Combined with the torrid growth rate of the global cloud market that should easily allow its intelligent cloud business to keep up its rapid growth rate for at least the next decade, and likely far beyond.

Part of Microsoft’s strategy to dominate the cloud/AI analytics is by an increasing focus on developers. This is why it recently bought GitHub for $7.5 billion in an all stock deal. Now, long-time Microsoft investors might be leery of the company making large scale purchases, given the terrible track record it had with those in the Ballmer years. But the thing to remember about Nadella’s Microsoft is that its big M&A deals are far more focused and represent good strategic fits for Microsoft’s cloud/software as a service business model.

For example, here’s what Nadella said when announcing the GitHub acquisition.

“According to LinkedIn data, software engineering roles in industries outside of tech such as retail, healthcare, and energy are seeing double-digit growth year over year, 25 percent faster than the growth of developer roles in the tech industry itself…As every company becomes a digital company, value creation and growth across every industry will increasingly be determined by the choices developers make.”

This highlights the strategic reason Microsoft wants to own GitHub, which is basically the Facebook (FB) for software developers. That’s because it’s the world’s leading software application design platform with 28 million developers and 85 million applications in its repository. Now, it’s important to realize that GitHub is open source, so Microsoft isn’t likely to get much proprietary software from this deal. But the brilliance of the acquisition is that Microsoft wants GitHub developers to use Azure as their primary development platform. In other words, Microsoft wants GitHub app developers to become the Android of software application development, and for Azure to be the backbone infrastructure on which they operate.

This is a brilliant move that other companies like Apple (AAPL) and Alphabet have adopted with their own ecosystems. They crowdsource innovation from millions of developers all over the world rather than try to design everything in house. And just like Facebook bought Instagram and Snapchat to build its own social media empire, Microsoft is strengthening its own moat by adding LinkedIn (world’s biggest professional social network) and GitHub (world’s biggest developer network) to app driven cloud empire.

Now, it should be noted that GitHub isn’t going to move the needle for Microsoft financially. That’s because the rapidly growing company’s revenues will be a drop in the bucket compared to Microsoft’s $110 billion in sales.

GitHub 2015 revenue: $95 million

GitHub 2016 revenue: $200 million

But the point of this acquisition was to further strengthen Microsoft’s cloud platform, which is ultimately the heart of the stock’s long-term investment thesis. But part of that thesis resides in management itself, including Nadella’s brilliant execution so far.

3. World Class Management Team With Proven Execution Ability

Satya Nadella has been with Microsoft for over 20 years and was the head of its cloud computing division before taking over the top spot four years ago. Nadella’s willingness to refocus the company’s business model on cloud has proven a major success. A major reason he’s been able to restore the company to strong growth is his adaptability.

As CEO Satya Nadella told analysts at this quarter’s conference call:

We reorganized our engineering teams to break free of the categories of the past and better align with the emerging tech stack from silicon to AI to experiences, to better serve the needs of our customers today and long into the future. We reoriented our sales and marketing teams, adding industry and technical expertise to partner more deeply with our customers on their digital transformation journeys.” – Satya Nadella

Basically, under Nadella, Microsoft has once become a highly customer-oriented company, the opposite of the Ballmer years. As a result, Microsoft’s business units have not just seen strong growth, but more importantly, the company’s profitability has greatly improved.

Company

Gross Margins

Operating Margin

Net Margin

FCF Margin

Return On Invested Capital

Microsoft

67.6%

34.5%

29.5%

29.2%

139.9%

Industry Average

49.9%

5.1%

3.8%

NA

10.3%

(Source: Morningstar, Gurufocus, CSImarketing)

In tech, many companies battle to win market share by undercutting rivals on price. Microsoft’s focus on creating one of the world’s most advanced and useful cloud/data analytics platforms allows it to grow strongly while retaining exceptional profitability. For example, its net margins are about 650% above the industry norm, and its most recent return on invested capital was a staggering 140%. This indicates management is allocating shareholder capital with incredible discipline and more skillfully than almost any company in the world. Then, of course, there’s the company’s impressive free cash flow margin.

Free cash flow is the most important metric for dividend investors to focus on. That’s because FCF is what’s left over after running the company and investing in future growth. In the past year, Microsoft converted almost 30% of revenue into FCF ($32.3 billion). This means that even after paying its $12.7 billion dividend, the company had $19.6 billion left over to spend on buybacks, acquisitions, or add to its $134 billion cash pile.

And keep in mind that all this impressive profitably isn’t coming at the expense of investing for the future. Microsoft’s R&D spending, mostly into cloud and AI driven data analytics, has been exploding in the last two years.

MSFT Research and Development Expense (TTM) data by YCharts

MSFT R&D to Revenue (TTM) data by YCharts

Today, Microsoft’s R&D/revenue margin is the second highest of the world’s top five cloud computing companies. This bodes well for the company’s ability to retain its edge and continue generating strong top and bottom line growth in the coming years.

In fact, analysts currently expect Microsoft to enjoy low double digit sales growth over the next decade, mostly driven by its strong commercial and cloud businesses. Combined with slightly increased margins and steady buybacks, that’s expected to generate about 14% EPS growth. For a tech giant of Microsoft’s scale, that is a very impressive growth rate indeed. It also sets the company up to become a strong market beater in the coming years.

4. Dividend Profile: Super Safe Dividend, Fast Growth And Market Crushing Return Potential

The most important aspect to any income investment, and what ultimately drives total returns over time, is the dividend profile. This consists of three parts: yield, dividend safety and long-term payout growth potential.

Company

Forward Yield

TTM FCF Payout Ratio

Projected 10 Year Dividend Growth

10 Year Potential Annual Total Return

Valuation Adjusted Total Return Potential

Microsoft

1.6%

39%

14.0%

15.6%

16.2%

S&P 500

1.8%

38%

6.2%

8.0%

2% to 5%

(Source: Morningstar, Gurufocus, Gordon Dividend Growth Model, FastGraphs, BlackRock, Vanguard, Simply Safe Dividends, Yardeni Research, Multpl.com)

Now, it is true that Microsoft’s yield is paltry, lower than even the pitiful payout of the S&P 500. However, what it lacks in current income, Microsoft more than makes up for in bank vault like dividend safety and strong long-term growth potential. That’s because its trailing FCF payout ratio is just 39%, indicating that its massive and growing stream of subscription based cash flow is more than enough to cover the dividend. And then, there’s the fortress like balance sheet to consider.

In the M&A and capex-heavy tech sector, a strong balance sheet is essential.

Company

Debt/EBITDA

EBITDA/Interest

Current Ratio

S&P Credit Rating

Average Interest Rate

Microsoft

1.5

18.1

2.9

AAA

3.6%

Industry Average

1.3

26.5

1.9

NA

NA

(Sources: Morningstar, Gurufocus, FastGraphs)

Microsoft is one of just two companies with a AAA credit rating (the other is Johnson & Johnson (NYSE:JNJ)), which is a higher rating than the US Treasury. That’s thanks to very manageable debt levels, supported by a massive stream of recurring and stable cash flow.

In fact, Microsoft, like many large tech blue chips, actually has a net cash position. In Microsoft’s case, cash exceeds total debt by $57.5 billion. And given that its retained FCF (free cash flow minus dividends) is nearly $20 billion per year, to say the company’s balance sheet is safe would be an understatement.

What about its dividend growth potential? Well, currently, analysts expect Microsoft to grow its EPS by 14% over the next 10 years. While all such forecasts need to be taken with a healthy grain of salt, in this case, I think that is a reasonable projection. That’s because Microsoft’s twin growth catalysts of its fast growing cloud and ongoing rapid transition of commercial Office users to Office 365 should easily allow for double digit top and bottom line growth. And as we’ve seen over the past few years, Microsoft is not sacrificing margin to win market share.

Assuming that FCF/share grows in line with EPS and Microsoft maintains a relatively stable payout ratio, this means that it should be able to grow its dividend by about 14% CAGR for the next 10 years as well. For context, that would mean approximately quadrupling the payout by 2028, meaning a yield on today’s cost of about 6.4%.

Now, historically (since 1956), dividend stocks have generally followed the rule that total returns equal yield + dividend growth. That’s called the Gordon Dividend Growth Model or GDGM. As long as a company’s business model is stable over time, and it starts out at fair value, then this formula is usually a good approximation of long-term total return potential. So assuming Microsoft experiences no major changes in its valuation metric, it should easily be capable of 15% total returns over the next decade. That’s in contrast to the 8% return the GDGM estimates for the S&P 500.

But when we consider starting valuations for both Microsoft and the S&P 500, then we see that Microsoft could actually generate about three times the returns of the broader market. That’s because Morningstar, BlackRock and Vanguard estimate from today’s valuations the S&P 500 is likely to return just 5% (or less) annually over the next five to 10 years.

In contrast, Microsoft’s valuation adjusted total return potential is about 16%. How do I get to that estimate? Well, that’s where Microsoft’s valuation comes in.

5. Valuation: Still Potentially 6% Undervalued Making It A Buy Today

MSFT Total Return Price data by YCharts

Over the past 12 months, Microsoft shares have been on fire, crushing not just the S&P 500 but also the tech heavy Nasdaq. So, naturally, many investors might worry that Microsoft is currently grossly overvalued. Fortunately, I think it’s actually about 6% undervalued.

Now, it should be noted that there are numerous ways to value a stock, and none are 100% objectively correct. This is why I typically use several time tested methods in concert to ensure that no single approach provides a false valuation picture.

One approach is to compare the PE ratio to its historical PE ratio. Over time, PE ratios (like most valuation metrics) tend to mean revert, unless the company’s business model goes into permanent decline. Due to the permanent earnings boost from tax cuts this year, I’m using the forward PE ratio to get a clearer picture of relative valuations.

Currently, Microsoft’s forward PE is 25.2, which is much higher than the S&P 500’s 16.6. So, that means it’s overvalued right? Well, actually over the past 20 years (including the stagnant Ballmer years), MSFT’s average PE was 29.6. This implies it might be 15% undervalued today.

But 25.2 is still a pretty high multiple, so the question is how reasonable is that given the company’s strong long-term growth prospects? To answer that, I use a Fair Value PE formula devised by Benjamin Graham, Buffett’s mentor and the father of modern value investing. That formula is: (8.5 + (2X long-term EPS growth rate))/discount rate. The discount rate (decimal form) is your desired long-term rate of return. For these calculations, I use 10% because that’s better than the market’s historical (since 1871) 9.2% CAGR.

Forward PE

Historical PE

Implied 10 Year EPS Growth Rate

Graham Fair Value PE

Graham Fair Value

Discount To Fair Value

25.2

29.6

8.4%

33.2

$142

32%

(Sources: Gurufocus, Benjamin Graham, FastGraphs)

The Graham Fair Value formula can tell us two things. First, that Microsoft’s current shares are baking in about 8.4% long-term EPS growth. That’s far below what its currently growing at and what analysts expect it to achieve over the long term. In fact, assuming Microsoft can indeed growth EPS at 14% over the next 10 years (I think it can) then according to Graham a fair value PE and price would be 33.2 and $142, respectively. That implies shares might be as much as 32% undervalued.

However, there is indeed a time tested valuation method that does show Microsoft as highly overvalued. This is an approach that has worked well since 1966, developed by Investment Quality Trends or IQT. IQT has been beating the market for over 32 years (that’s as far back as the publicly tracked model portfolio goes) by comparing yields to their historical yields. The reason this works is that, assuming the business model doesn’t collapse, a dividend stock’s yield tends to be mean reverting over time. This means it cycles around a relatively fixed point that approximates fair value. IQT has been running its asset management business for 52 years purely based on buying blue chip dividend stocks when yields are much higher than historical norms (undervalued), and selling when they are far beneath them (overvalued).

Yield

5 Year Average Yield

13 Year Median Yield

Discount To Fair Value

1.6%

2.6%

2.3%

-35%

(Sources: Gurufocus, Simply Safe Dividends)

In the case of Microsoft, we can see that the five year average yield and 13-year median yield are indeed similar. And so, under this time tested valuation model, Microsoft’s 1.6% yield appears to indicate it might be 35% overvalued. However, note that Microsoft is set to hike its dividend in the next quarter, so that overvaluation could drop substantially, depending on the magnitude of the hike. Given its strong results, the company could easily increase the dividend 15% to 20%, which would drastically lower this frightening overvaluation figure.

One final approach I use is a three stage discounted cash flow or DCF model, such as provided by Morningstar. A DCF model estimates a stock’s intrinsic value purely based on the net present value of all future cash flow (extending out to infinity). Theoretically, this is the purest form of valuation. Unfortunately, because it uses so many assumptions (including long-term smoothed out growth rates over decades) and requires a discount rate that’s different for everyone, it shouldn’t be used in isolation.

However, as one method among several, it can provide some insight. That’s especially true for Morningstar’s 100% long-term focused analysts who are usually some of the most conservative in their growth assumptions.

Morningstar Fair Value

Discount To Fair Value

$122

11%

(Source: Morningstar)

Morningstar’s DCF model (which I can confirm is conservative) shows Microsoft as 11% undervalued today. Combining this with the other valuation models, I estimate the stock is worth at least $114 today, implying a margin of safety of 6%.

Estimated Fair Value

Discount To Fair Value

Long-Term Valuation Return Boost

$114

6%

0.6%

(Sources: Gurufocus, FastGraphs, Simply Safe Dividends, Benjamin Graham, IQ Trends, Gordon Dividend Growth Model, Morningstar)

Over time, all stocks trade purely off fundamentals. This means that assuming Microsoft reverts to fair value over the next decade investors could expect a 0.6% CAGR return boost from the stock’s current valuation. Thus, the valuation adjusted GDGM estimate of its long-term potential total return is: 1.6% yield + 14% dividend growth (proxy for EPS and FCF growth) + 0.6% valuation boost = 16.2%. Historically, this formula has been about 80% to 90% accurate, which means that Microsoft very likely has strong market beating return potential.

Under the Buffett principle that “it’s better to buy a wonderful company at a fair price than a fair company at a wonderful price”, I generally feel comfortable recommending Grade A blue chips at fair value or better. This means that Microsoft is still a buy today, at least for long-term investors comfortable with its risk profile.

Risks To Consider

Microsoft is certainly a low risk blue chip, but there are nonetheless some challenges it will face in the coming years.

(Source: Microsoft Earnings Presentation)

A short to medium-term risk is currency fluctuation. As a giant multinational, Microsoft does business all over the world. Thus, fluctuations in the value of the US dollar relative to other currencies can have a substantial impact on its sales, earnings, and cash flow. As you can see above this quarter currency fluctuations helped boost its growth rates. But the US dollar is now strengthening, which means that foreign sales could soon translate into less US dollars and create a negative growth headwind. That’s because US interest rates are either rising (short-term rates) or flat (long-term) but much higher than in the UK, EU, and Japan. Thus, dollar-denominated assets are becoming more attractive and foreign capital is flowing into them, increasing relative demand for dollars. Fortunately, over time, currency fluctuations tend to cancel out, meaning that this is not a long-term threat to the company’s investment thesis.

But Microsoft does have some long-term fundamental risks to be aware of. The first is the effects of more aggressive capex spending on its all important FCF. Free cash flow fell by 15% in the latest quarter and on a TTM basis only grew 3% due to heavier investment into the company’s cloud business. The good news is that operating cash flow grew 13% and a major part of this quarter’s weakness was one time tax charges related to the new accounting rules (ASC 606) that recently went into effect in the US.

But the point is that investors will want to watch Microsoft’s FCF conversion ratio going forward. Specifically, that its FCF/share will be growing roughly in line with its earnings. Remember that earnings is for accounting, but FCF is for paying dividends. FCF is operating cash flow minus capex (including R&D) and so if Microsoft continues ramping up its capex cloud spending too quickly, it may result in FCF/share growth being far more tepid than its impressive EPS figures. That might result in slower than expected dividend growth, which is ultimately what I and income investors care about.

However, at the same time, we can’t forget that Microsoft is going to have to stay on its toes, because the world of cloud computing is full of hungry rivals who are gunning to dominate this incredibly profitable and fast growing industry. This is why investors need to trust Nadella to allocate capital well. That means investing R&D effectively and in a disciplined fashion. It also means making smart strategic acquisitions.

Acquisitions like LinkedIn and GitHub represent major execution risk in the M&A happy tech sector. The prices Microsoft paid for both companies is rich and only time will tell whether or not these prove accretive to EPS and FCF/share. Now, it should be pointed out that both LinkedIn and GitHub seem like sensible additions to Microsoft’ core offerings and fit well with its cloud/data analytics platforms.

In other words, Nadella is not Ballmer, happily making flashy mega deals in an effort to empire build and in the process lighting shareholder cash on fire. Still investors need to remember that even the best management teams can occasionally misstep. So, as the battle between Amazon, Alphabet and Microsoft heats up, Nadella might be tempted to overpay for a deal that ends up not working out.

Bottom Line: Microsoft Is One Of The Best Technology Dividend Growth Stocks You Can Buy

Don’t get me wrong, after a 50% rally over the last year, I fully understand why many value focused income investors might be leery of buying Microsoft right now. However, the fact remains that the company’s fundamentals are as strong as ever thanks to wide moats in both its legacy Windows and fast growing cloud computing business.

And under the excellent leadership of Satya Nadella, a proven master at cloud computing, I think Microsoft is poised to become one of the most dominant names in cloud and AI. Those are two of the most important tech industries of the coming century and thus represent both massive and very long growth runways.

Which is why I consider Microsoft to be one of the best tech dividend growth stocks you can buy today. Because despite that 50% rally, I think shares are still likely 6% undervalued. And for a world class blue chip like this, I have no qualms about recommending long-term investors buy at even such a modest discount to fair value.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

0 notes

Text

5 Reasons This Fast Growing Blue Chip Is One Of The Best Tech Stocks In The World

New Post has been published on http://cyberspace2k.net/5-reasons-this-fast-growing-blue-chip-is-one-of-the-best-tech-stocks-in-the-world/

5 Reasons This Fast Growing Blue Chip Is One Of The Best Tech Stocks In The World

(Source: imgflip)

While my income growth retirement portfolio is focused on higher-yielding stocks, history shows that lower-yielding but fast-growing dividend growth stocks are also a great way to exponentially compound your wealth over time.

For example, between 1969 and 2011, dividend growth stocks yielding less than 3% managed to be the second best performing group of stocks. They beat the S&P 500 by about 3% per year over this 42 year period. They also did so with the second best risk-adjusted returns (returns/volatility), as shown by this group’s information ratio.

This is why I want to highlight Microsoft (MSFT), one of my favorite blue chip tech dividend growth stocks. Thanks to its strong rally this year, the stock’s yield is rather paltry.

MSFT Total Return Price data by YCharts

However, there are five reasons why I still think the company remains an attractive long-term income growth investment. In fact, even from today’s elevated prices, I think Microsoft might realistically achieve about 16% annualized total returns over the next decade. That’s not just likely to significantly beat the market over that time period, but potentially quadruple your money over the next 10 years.

Most importantly, the company’s strong fundamentals and likely decades long growth runway mean that Microsoft is as close to a “buy and hold forever” stock as you can find on Wall Street.

1. Short-Term Growth Engine Firing On All Cylinders

Replacing Steve Ballmer with Satya Nadella in 2014 turned out to be a master stroke. That’s because Nadella was the head of Microsoft’s cloud division and shifted the company’s focus from its legacy Windows business to cloud/software as a service subscription model. The results speak for themselves.

(Source: Microsoft Earnings Presentation)

Microsoft, despite its massive size, is seeing strong top line growth with revenue rising 17% in the past quarter (YOY). More importantly, its bottom line is growing as well. Thanks to sales outpacing cost growth, both the gross margin and operating margin expanded, resulting in a 30% boost to operating income. Note that operating income excludes the beneficial effects of tax cuts. Thus, this year this is the more important metric for investors to focus on.

The biggest reason for Microsoft’s massive operating profit growth was its success in converting its over 1 billion global Windows users to its cloud subscription service. The company’s commercial unit, which has 89% of revenue from recurring subscriptions, saw its sales soar 53%. More importantly, its gross margins on those sales also rose by 6% over the past year to an impressive 58%. This shows that Microsoft enjoys a wide moat that gives it strong pricing power (more on this in a moment).

(Source: Microsoft Earnings Presentation)

The heart of Microsoft’s commercial success is its fast growing intelligent cloud business. Not just is this growing at double digits, but that growth rate accelerated to 26% YOY in the latest quarter.

(Source: Microsoft Earnings Presentation)

Meanwhile, operating margins on cloud, despite aggressive capex investment, are also rising. This is why Microsoft’s cloud business (which accounted for 21% of revenue in the past 12 months) saw operating profits rise 34%.

(Source: Microsoft Earnings Presentation)

The company’s success in cloud is due to torrid growth in Azure, its cloud computing/artificial intelligence data analytics platform. Azure is the world’s second fastest growing cloud platform and continues to increase at nearly triple digit rates. In comparison, Amazon’s (AMZN) AWS cloud platform, currently the largest in the world, is growing at 49%. This indicates that Microsoft is gaining market share in what’s arguably one of the most important industries of the coming century.

Part of the company’s strategy involves continually adding new services to increase the strength of its cloud offering. Or to put another way, Microsoft wants its suite of cloud offerings to become a one stop shop “walled garden” ecosystem that locks in customers for the long term. This is why it bought LinkedIn back in 2016.

(Source: Microsoft Earnings Presentation)

Microsoft’s controversial $26.2 billion acquisition of LinkedIn also appears to be paying off. Thanks to a 41% increase in engagements from its 575 million member base, this business saw 37% revenue growth which outpaced its 17% increase in operating costs. As a result, operating losses at LinkedIn fell 49%, and this acquisition is on track to become accretive to Microsoft’s EPS within a year or so.

(Source: Microsoft Earnings Presentation)

Meanwhile, the company continues to make great inroads with switching its corporate Windows clients to its Office 365 commercial subscription service. Microsoft has consistently been growing its commercial 365 subscriber base by about 30% for the last two years. Today, the company has 135 million commercial Office 365 users, which represents roughly 12% of its installed global user base. This indicates that Microsoft’s fast growth in commercial productivity services should continue for the foreseeable future.

(Source: Microsoft Earnings Presentation)

Even Microsoft’s legacy and hardware businesses are doing well. While Windows OEM consumer sales are down slightly, that’s to be expected as global PC sales are in secular decline. More importantly, its professional Windows sales are growing at double digits. Meanwhile, its non core businesses, like Surface, Xbox live, gaming, and search (Bing) revenue are all showing double-digit sales growth.

Search revenue: 17% growth

Surface revenue: 25% growth

Xbox Live subscription revenue: 36% growth

Gaming hardware: 39%

And like with its other operating units, Personal Computing is also seeking margin expansion as operating profit rose 38%, more than double the division’s 17% revenue growth.

But wait, it gets better! Not just is Microsoft managing to grow its top line at double digits off an enormous base ($110 billion TTM revenue), but that growth is expected to accelerate.

Q1 2019 Guidance

Metric

Midrange Guidance

YOY Growth

Revenue

$27.7 billion

25%

Operating Income

$8.85 billion

58%

(Source: management guidance)

For the next quarter, management is guiding for even more impressive growth of 25% in revenue and a stunning 58% growth in operating income. The bottom line is that Microsoft is once more a revenue and profit growth machine. And thanks to its strong long-term growth runway, that is likely to continue for the foreseeable future.

2. Long-Term Growth Potential Is Excellent

Analyst firm Research & Markets expects cloud computing to grow at about 27.5% CAGR between 2017 and 2025, when it will become a $1.25 trillion global market. Now granted this is for every part of the cloud industry, which includes markets that Microsoft isn’t targeting. But given that Microsoft’s cloud business generated just $23 billion in the past year, this shows that Microsoft’s growth runway in cloud is long and vast.

The key to its cloud strategy is incorporating ever more useful applications, including those driven by AI data analytics. These allow companies to not just store their data in Microsoft’s cloud, but make sense of it, including how to optimize operations to boost profitability. For instance, Dynamics 365, Microsoft AI driven data analysis suite, saw 61% revenue growth indicating that the company’s corporate clients are loving its new offerings. Meanwhile, the company’s computer engineers added 500 new capabilities to its Azure cloud platform over the past year, which explains why its red hot growth rate continues.

According to analyst firm Synergy Research, in Q2 2018, the cloud computing market grew 50%. That’s compared to 44% for the full year 2017 and 50% in 2016. The industry’s top five players (Amazon, Microsoft, IBM (NYSE:IBM), Google (NASDAQ:GOOG) (NASDAQ:GOOGL) and Alibaba (NYSE:BABA)) control 75% of the market and continue to tighten their grip.

More importantly, according to Synergy, only four of the world’s 25 largest cloud providers saw any growth in market share (Amazon, Google, Alibaba, and Microsoft). IBM’s market share remained flat at 8% and everyone else lost ground.

According to John Dinsdale, Chief Strategist at Synergy:

In a large and strategically vital market that is growing at exceptional rates, they (industry leaders) are throwing the gauntlet down to their smaller competitors by continuing to invest enormous amounts in their data center infrastructure and operations. Their increased market share is clear evidence that their strategies are working.”

In other words, in cloud computing, moats are getting wider, thanks to the importance of AI driven data analytics. The more users a company can attract to train its AI algorithms to analyze data better, the more of an edge its service suite will gain. This shows that cloud computing has a very large network effect, in which winners tend to keep on winning.

Analyst firm Gartner thinks that the industry’s top two players (Microsoft and Amazon) might end up controlling 90% of the cloud market by 2020. Personally, I think that Alphabet and Alibaba’s strong cloud growth rates make this unlikely. But Microsoft’s market share is still likely to grow modestly over time. Combined with the torrid growth rate of the global cloud market that should easily allow its intelligent cloud business to keep up its rapid growth rate for at least the next decade, and likely far beyond.

Part of Microsoft’s strategy to dominate the cloud/AI analytics is by an increasing focus on developers. This is why it recently bought GitHub for $7.5 billion in an all stock deal. Now, long-time Microsoft investors might be leery of the company making large scale purchases, given the terrible track record it had with those in the Ballmer years. But the thing to remember about Nadella’s Microsoft is that its big M&A deals are far more focused and represent good strategic fits for Microsoft’s cloud/software as a service business model.

For example, here’s what Nadella said when announcing the GitHub acquisition.

“According to LinkedIn data, software engineering roles in industries outside of tech such as retail, healthcare, and energy are seeing double-digit growth year over year, 25 percent faster than the growth of developer roles in the tech industry itself…As every company becomes a digital company, value creation and growth across every industry will increasingly be determined by the choices developers make.”

This highlights the strategic reason Microsoft wants to own GitHub, which is basically the Facebook (FB) for software developers. That’s because it’s the world’s leading software application design platform with 28 million developers and 85 million applications in its repository. Now, it’s important to realize that GitHub is open source, so Microsoft isn’t likely to get much proprietary software from this deal. But the brilliance of the acquisition is that Microsoft wants GitHub developers to use Azure as their primary development platform. In other words, Microsoft wants GitHub app developers to become the Android of software application development, and for Azure to be the backbone infrastructure on which they operate.

This is a brilliant move that other companies like Apple (AAPL) and Alphabet have adopted with their own ecosystems. They crowdsource innovation from millions of developers all over the world rather than try to design everything in house. And just like Facebook bought Instagram and Snapchat to build its own social media empire, Microsoft is strengthening its own moat by adding LinkedIn (world’s biggest professional social network) and GitHub (world’s biggest developer network) to app driven cloud empire.

Now, it should be noted that GitHub isn’t going to move the needle for Microsoft financially. That’s because the rapidly growing company’s revenues will be a drop in the bucket compared to Microsoft’s $110 billion in sales.

GitHub 2015 revenue: $95 million

GitHub 2016 revenue: $200 million

But the point of this acquisition was to further strengthen Microsoft’s cloud platform, which is ultimately the heart of the stock’s long-term investment thesis. But part of that thesis resides in management itself, including Nadella’s brilliant execution so far.

3. World Class Management Team With Proven Execution Ability

Satya Nadella has been with Microsoft for over 20 years and was the head of its cloud computing division before taking over the top spot four years ago. Nadella’s willingness to refocus the company’s business model on cloud has proven a major success. A major reason he’s been able to restore the company to strong growth is his adaptability.

As CEO Satya Nadella told analysts at this quarter’s conference call:

We reorganized our engineering teams to break free of the categories of the past and better align with the emerging tech stack from silicon to AI to experiences, to better serve the needs of our customers today and long into the future. We reoriented our sales and marketing teams, adding industry and technical expertise to partner more deeply with our customers on their digital transformation journeys.” – Satya Nadella

Basically, under Nadella, Microsoft has once become a highly customer-oriented company, the opposite of the Ballmer years. As a result, Microsoft’s business units have not just seen strong growth, but more importantly, the company’s profitability has greatly improved.

Company

Gross Margins

Operating Margin

Net Margin

FCF Margin

Return On Invested Capital

Microsoft

67.6%

34.5%

29.5%

29.2%

139.9%

Industry Average

49.9%

5.1%

3.8%

NA

10.3%

(Source: Morningstar, Gurufocus, CSImarketing)

In tech, many companies battle to win market share by undercutting rivals on price. Microsoft’s focus on creating one of the world’s most advanced and useful cloud/data analytics platforms allows it to grow strongly while retaining exceptional profitability. For example, its net margins are about 650% above the industry norm, and its most recent return on invested capital was a staggering 140%. This indicates management is allocating shareholder capital with incredible discipline and more skillfully than almost any company in the world. Then, of course, there’s the company’s impressive free cash flow margin.

Free cash flow is the most important metric for dividend investors to focus on. That’s because FCF is what’s left over after running the company and investing in future growth. In the past year, Microsoft converted almost 30% of revenue into FCF ($32.3 billion). This means that even after paying its $12.7 billion dividend, the company had $19.6 billion left over to spend on buybacks, acquisitions, or add to its $134 billion cash pile.

And keep in mind that all this impressive profitably isn’t coming at the expense of investing for the future. Microsoft’s R&D spending, mostly into cloud and AI driven data analytics, has been exploding in the last two years.

MSFT Research and Development Expense (TTM) data by YCharts

MSFT R&D to Revenue (TTM) data by YCharts

Today, Microsoft’s R&D/revenue margin is the second highest of the world’s top five cloud computing companies. This bodes well for the company’s ability to retain its edge and continue generating strong top and bottom line growth in the coming years.

In fact, analysts currently expect Microsoft to enjoy low double digit sales growth over the next decade, mostly driven by its strong commercial and cloud businesses. Combined with slightly increased margins and steady buybacks, that’s expected to generate about 14% EPS growth. For a tech giant of Microsoft’s scale, that is a very impressive growth rate indeed. It also sets the company up to become a strong market beater in the coming years.

4. Dividend Profile: Super Safe Dividend, Fast Growth And Market Crushing Return Potential

The most important aspect to any income investment, and what ultimately drives total returns over time, is the dividend profile. This consists of three parts: yield, dividend safety and long-term payout growth potential.

Company

Forward Yield

TTM FCF Payout Ratio

Projected 10 Year Dividend Growth

10 Year Potential Annual Total Return

Valuation Adjusted Total Return Potential

Microsoft

1.6%

39%

14.0%

15.6%

16.2%

S&P 500

1.8%

38%

6.2%

8.0%

2% to 5%

(Source: Morningstar, Gurufocus, Gordon Dividend Growth Model, FastGraphs, BlackRock, Vanguard, Simply Safe Dividends, Yardeni Research, Multpl.com)

Now, it is true that Microsoft’s yield is paltry, lower than even the pitiful payout of the S&P 500. However, what it lacks in current income, Microsoft more than makes up for in bank vault like dividend safety and strong long-term growth potential. That’s because its trailing FCF payout ratio is just 39%, indicating that its massive and growing stream of subscription based cash flow is more than enough to cover the dividend. And then, there’s the fortress like balance sheet to consider.

In the M&A and capex-heavy tech sector, a strong balance sheet is essential.

Company

Debt/EBITDA

EBITDA/Interest

Current Ratio

S&P Credit Rating

Average Interest Rate

Microsoft

1.5

18.1

2.9

AAA

3.6%

Industry Average

1.3

26.5

1.9

NA

NA

(Sources: Morningstar, Gurufocus, FastGraphs)

Microsoft is one of just two companies with a AAA credit rating (the other is Johnson & Johnson (NYSE:JNJ)), which is a higher rating than the US Treasury. That’s thanks to very manageable debt levels, supported by a massive stream of recurring and stable cash flow.

In fact, Microsoft, like many large tech blue chips, actually has a net cash position. In Microsoft’s case, cash exceeds total debt by $57.5 billion. And given that its retained FCF (free cash flow minus dividends) is nearly $20 billion per year, to say the company’s balance sheet is safe would be an understatement.

What about its dividend growth potential? Well, currently, analysts expect Microsoft to grow its EPS by 14% over the next 10 years. While all such forecasts need to be taken with a healthy grain of salt, in this case, I think that is a reasonable projection. That’s because Microsoft’s twin growth catalysts of its fast growing cloud and ongoing rapid transition of commercial Office users to Office 365 should easily allow for double digit top and bottom line growth. And as we’ve seen over the past few years, Microsoft is not sacrificing margin to win market share.

Assuming that FCF/share grows in line with EPS and Microsoft maintains a relatively stable payout ratio, this means that it should be able to grow its dividend by about 14% CAGR for the next 10 years as well. For context, that would mean approximately quadrupling the payout by 2028, meaning a yield on today’s cost of about 6.4%.

Now, historically (since 1956), dividend stocks have generally followed the rule that total returns equal yield + dividend growth. That’s called the Gordon Dividend Growth Model or GDGM. As long as a company’s business model is stable over time, and it starts out at fair value, then this formula is usually a good approximation of long-term total return potential. So assuming Microsoft experiences no major changes in its valuation metric, it should easily be capable of 15% total returns over the next decade. That’s in contrast to the 8% return the GDGM estimates for the S&P 500.

But when we consider starting valuations for both Microsoft and the S&P 500, then we see that Microsoft could actually generate about three times the returns of the broader market. That’s because Morningstar, BlackRock and Vanguard estimate from today’s valuations the S&P 500 is likely to return just 5% (or less) annually over the next five to 10 years.

In contrast, Microsoft’s valuation adjusted total return potential is about 16%. How do I get to that estimate? Well, that’s where Microsoft’s valuation comes in.

5. Valuation: Still Potentially 6% Undervalued Making It A Buy Today

MSFT Total Return Price data by YCharts

Over the past 12 months, Microsoft shares have been on fire, crushing not just the S&P 500 but also the tech heavy Nasdaq. So, naturally, many investors might worry that Microsoft is currently grossly overvalued. Fortunately, I think it’s actually about 6% undervalued.

Now, it should be noted that there are numerous ways to value a stock, and none are 100% objectively correct. This is why I typically use several time tested methods in concert to ensure that no single approach provides a false valuation picture.

One approach is to compare the PE ratio to its historical PE ratio. Over time, PE ratios (like most valuation metrics) tend to mean revert, unless the company’s business model goes into permanent decline. Due to the permanent earnings boost from tax cuts this year, I’m using the forward PE ratio to get a clearer picture of relative valuations.

Currently, Microsoft’s forward PE is 25.2, which is much higher than the S&P 500’s 16.6. So, that means it’s overvalued right? Well, actually over the past 20 years (including the stagnant Ballmer years), MSFT’s average PE was 29.6. This implies it might be 15% undervalued today.

But 25.2 is still a pretty high multiple, so the question is how reasonable is that given the company’s strong long-term growth prospects? To answer that, I use a Fair Value PE formula devised by Benjamin Graham, Buffett’s mentor and the father of modern value investing. That formula is: (8.5 + (2X long-term EPS growth rate))/discount rate. The discount rate (decimal form) is your desired long-term rate of return. For these calculations, I use 10% because that’s better than the market’s historical (since 1871) 9.2% CAGR.

Forward PE

Historical PE

Implied 10 Year EPS Growth Rate

Graham Fair Value PE

Graham Fair Value

Discount To Fair Value

25.2

29.6

8.4%

33.2

$142

32%

(Sources: Gurufocus, Benjamin Graham, FastGraphs)

The Graham Fair Value formula can tell us two things. First, that Microsoft’s current shares are baking in about 8.4% long-term EPS growth. That’s far below what its currently growing at and what analysts expect it to achieve over the long term. In fact, assuming Microsoft can indeed growth EPS at 14% over the next 10 years (I think it can) then according to Graham a fair value PE and price would be 33.2 and $142, respectively. That implies shares might be as much as 32% undervalued.

However, there is indeed a time tested valuation method that does show Microsoft as highly overvalued. This is an approach that has worked well since 1966, developed by Investment Quality Trends or IQT. IQT has been beating the market for over 32 years (that’s as far back as the publicly tracked model portfolio goes) by comparing yields to their historical yields. The reason this works is that, assuming the business model doesn’t collapse, a dividend stock’s yield tends to be mean reverting over time. This means it cycles around a relatively fixed point that approximates fair value. IQT has been running its asset management business for 52 years purely based on buying blue chip dividend stocks when yields are much higher than historical norms (undervalued), and selling when they are far beneath them (overvalued).

Yield

5 Year Average Yield

13 Year Median Yield

Discount To Fair Value

1.6%

2.6%

2.3%

-35%

(Sources: Gurufocus, Simply Safe Dividends)

In the case of Microsoft, we can see that the five year average yield and 13-year median yield are indeed similar. And so, under this time tested valuation model, Microsoft’s 1.6% yield appears to indicate it might be 35% overvalued. However, note that Microsoft is set to hike its dividend in the next quarter, so that overvaluation could drop substantially, depending on the magnitude of the hike. Given its strong results, the company could easily increase the dividend 15% to 20%, which would drastically lower this frightening overvaluation figure.

One final approach I use is a three stage discounted cash flow or DCF model, such as provided by Morningstar. A DCF model estimates a stock’s intrinsic value purely based on the net present value of all future cash flow (extending out to infinity). Theoretically, this is the purest form of valuation. Unfortunately, because it uses so many assumptions (including long-term smoothed out growth rates over decades) and requires a discount rate that’s different for everyone, it shouldn’t be used in isolation.

However, as one method among several, it can provide some insight. That’s especially true for Morningstar’s 100% long-term focused analysts who are usually some of the most conservative in their growth assumptions.

Morningstar Fair Value

Discount To Fair Value

$122

11%

(Source: Morningstar)

Morningstar’s DCF model (which I can confirm is conservative) shows Microsoft as 11% undervalued today. Combining this with the other valuation models, I estimate the stock is worth at least $114 today, implying a margin of safety of 6%.

Estimated Fair Value

Discount To Fair Value

Long-Term Valuation Return Boost

$114

6%

0.6%

(Sources: Gurufocus, FastGraphs, Simply Safe Dividends, Benjamin Graham, IQ Trends, Gordon Dividend Growth Model, Morningstar)

Over time, all stocks trade purely off fundamentals. This means that assuming Microsoft reverts to fair value over the next decade investors could expect a 0.6% CAGR return boost from the stock’s current valuation. Thus, the valuation adjusted GDGM estimate of its long-term potential total return is: 1.6% yield + 14% dividend growth (proxy for EPS and FCF growth) + 0.6% valuation boost = 16.2%. Historically, this formula has been about 80% to 90% accurate, which means that Microsoft very likely has strong market beating return potential.