#also boeing is a big employer there

Explore tagged Tumblr posts

Text

The Perfect Balance of Study and Social Life

Having a quiet place to study can make all the difference when it comes to staying focused. That’s why Alight Norman offers private study rooms, giving you the space you need to concentrate without distractions. If you're searching for 1 bedroom apartments Norman area, this community offers more than just a place to live—it’s designed for both productivity and relaxation. When you need a break from studying, you can join one of the many social events for residents and friends, making it easy to meet new people. And if you have a furry companion, select buildings are pet-friendly, so you don’t have to leave them behind. With a mix of privacy, community, and convenience, this is the kind of space that helps you feel right at home.

Job Market and Industries in Norman, Oklahoma

Norman’s job market is shaped by education, healthcare, and technology. The University of Oklahoma is the city’s largest employer, drawing in academics, researchers, and staff. If you’re in healthcare, Norman Regional Health System offers plenty of opportunities. Aerospace and aviation are also big, thanks to companies like Boeing and the nearby Tinker Air Force Base. You’ll also find jobs in energy, especially with Oklahoma’s strong ties to oil and gas. Small businesses and startups keep the local economy diverse, and remote work is growing, too. While it’s not as fast-paced as Oklahoma City, Norman’s job scene is stable, with opportunities in different fields. Whether you’re looking for a university job, something in tech, or a role in the service industry, there’s a good mix of options.

Fred Jones Jr. Museum of Art in Norman, Oklahoma

Art lovers, history buffs, or just the casually curious—there’s something for everyone at the Fred Jones Jr. Museum of Art. Located on the University of Oklahoma campus, this museum has an impressive collection, from classic European paintings to Native American and Western art. You’ll find works by famous artists like Van Gogh and Monet, alongside pieces that highlight Oklahoma’s own artistic heritage. The museum is free to visit, which makes it easy to stop by whenever you’re in the area. Whether you want to take your time exploring or just drop in for a quick visit, the exhibits always offer something interesting. The space itself is modern and peaceful, perfect for an afternoon of wandering and discovering new art.

Norman PD Identify Child Found Alone, Parent Located

This situation is unsettling, but at least it had a safe outcome. A 1-year-old walking alone before dawn is a scary thought, and it’s a good thing someone noticed and called the police. It raises a lot of questions—how did the child get out? Was it a case of neglect or just an unfortunate accident? Kids that young can be incredibly curious, and sometimes things happen even in the most careful homes. But the fact that he was found with limited clothing in cold weather makes it even more concerning. Hopefully, authorities looked into the situation to make sure the child is in a safe environment. Credit to the bystander for acting quickly and to the Norman Police Department for working to identify him and reunite him with his family.

Link to map

Fred Jones Jr. Museum of Art 555 Elm Ave, Norman, OK 73019, United States Head north on Elm Ave toward W Boyd St 138 ft Turn right onto W Boyd St 0.6 mi Turn right onto Classen Blvd 1.4 mi Turn right onto 12th Ave SE/Classen Blvd Continue to follow Classen Blvd 0.3 mi Turn left Partial restricted usage road 266 ft Turn right Restricted usage road Destination will be on the left 16 ft Alight Norman 2657 Classen Blvd, Norman, OK 73071, United States

0 notes

Text

Your Path to Success: Interview Preparation Coaching in Chicago IL with AAA Targeted

AAA Targeted in Chicago, IL, offers exceptional interview preparation coaching designed to help individuals succeed in their professional journeys.

In today’s competitive job market, standing out in an interview is crucial. Chicago offers many opportunities, but candidates must be ready. Interview preparation coaching can help you build confidence and improve your skills. With personalized guidance, you can learn to answer tough questions and present your best self.

This coaching experience focuses on your unique needs and goals. The right coach can help you navigate the interview process, making it less stressful. Whether you are a recent graduate or changing careers, effective coaching can guide you on your path to success. Get ready to shine in your next interview!

The Importance Of Interview Coaching

Interview coaching is vital for job seekers. It helps prepare you for interviews. Good preparation boosts confidence. This can lead to better job offers. Chicago has many coaching options. Aaa Targeted stands out. They focus on real interview scenarios. This makes a big difference.

Sharpening Your Interview Skills

Interview skills can make or break your chances. Here are some key skills to develop:

Communication: Speak clearly and confidently.

Body Language: Maintain eye contact and a firm handshake.

Listening: Understand questions before answering.

Research: Know the company and its culture.

Coaching can help you practice these skills. Mock interviews allow you to rehearse. Feedback from coaches is essential. It helps identify your strengths and weaknesses. You will learn to tailor your answers to the job. This increases your chance of success.

Overcoming Interview Anxiety

Many feel nervous before interviews. Anxiety can impact performance. Here are some tips to manage it:

Practice: Regular mock interviews reduce anxiety.

Relaxation Techniques: Deep breathing calms nerves.

Positive Visualization: Imagine a successful interview.

Preparation: Being ready boosts confidence.

Aaa Targeted offers support for overcoming anxiety. Coaches teach techniques to stay calm. You will learn to focus on your strengths. This can turn anxiety into confidence.

What Makes Chicago's Job Market Unique

Chicago offers a job market like no other. It is diverse and full of opportunities. Many industries thrive here. This includes finance, technology, healthcare, and manufacturing. Each sector has its own unique needs and challenges.

The city attracts talent from all over the world. This creates a competitive atmosphere. Job seekers must stand out. Understanding what makes Chicago special is key.

Understanding The Local Economy

Chicago has a strong economy. It is the third-largest city in the U.S. The city is known for its corporate headquarters. Major companies are based here. They include Boeing, Caterpillar, and McDonald's.

Many startups also flourish in the city. The tech scene is growing fast. This adds to the variety of job options. Knowing this helps candidates prepare better.

Tailoring Your Approach To Chicago Employers

Chicago employers look for local knowledge. They value candidates who understand the city. This includes its culture and work environment. Tailoring your resume and cover letter is important.

Highlight experiences that relate to Chicago. Show how you fit into the local scene. Networking is crucial. Attend local events and connect with professionals.

Use social media to engage with Chicago companies. Follow them for updates. This shows your interest and initiative. Employers appreciate candidates who take these steps.

Introducing AAA Targeted

Aaa Targeted offers a unique approach to interview preparation. Based in Chicago, they focus on helping job seekers succeed. With a dedicated team, they guide clients through every step of the interview process.

Clients can expect personalized support tailored to their needs. The goal is to build confidence and improve skills. Aaa Targeted understands the challenges of job hunting in today’s market.

Expertise In Chicago's Employment Landscape

Aaa Targeted knows Chicago's job market well. They stay updated on local trends and industry demands. This knowledge helps clients target the right opportunities.

The team provides insights into the types of employers in the area. They understand what companies look for in candidates. This expertise ensures clients are well-prepared for local interviews.

Customized Coaching Strategies

Every client receives a tailored coaching plan. Aaa Targeted assesses individual strengths and weaknesses. This assessment allows them to design a strategy that fits each person.

Clients practice common interview questions and scenarios. Coaches provide feedback that helps improve responses. The focus is on real-life practice to build comfort and skill.

With Aaa Targeted, clients gain the tools they need. They learn to present themselves effectively. This tailored approach makes a real difference in interview success.

Components Of Interview Preparation Coaching in Chicago IL

Effective interview preparation is key to success. It builds confidence and sharpens skills. This process involves several components. Each part plays a role in helping candidates perform better. In Chicago, AAA Targeted offers tailored coaching. Their approach focuses on practical training and guidance.

Mock Interviews And Feedback

Mock interviews provide a safe space to practice. They simulate real interview scenarios. Candidates can experience the pressure without real stakes. Here are some benefits:

Realistic experience

Identifying strengths and weaknesses

Improving body language

Practicing answers in a timed setting

After each mock interview, feedback is crucial. Coaches provide insights on performance. This feedback helps candidates understand what to improve. It focuses on:

Answer clarity

Body language

Confidence level

With continuous practice and feedback, candidates grow more comfortable. They learn to navigate tricky questions and scenarios.

Mastering Common Interview Questions

Understanding common interview questions is essential. Many employers ask similar questions. Knowing how to answer them can boost confidence.

Practicing these questions helps candidates formulate clear answers. This preparation reduces anxiety. It ensures they convey their qualifications effectively.

With focused coaching, candidates can shine in interviews. They become ready to face any challenge with confidence.

Personal Branding And Storytelling Techniques

Personal branding is important for standing out in a crowd. It shapes how others see you. Storytelling techniques help share your journey. They create a strong connection with your audience. Together, they make you memorable in interviews.

Crafting Your Unique Narrative

Creating your unique narrative is essential. It tells your story in a compelling way. Here are some steps to help you:

Identify Key Moments: Think about your experiences. What shaped you?

Highlight Challenges: Share struggles you faced. Show how you overcame them.

Show Growth: Explain how you improved. What did you learn?

Connect to the Role: Link your story to the job. Why are you a good fit?

Your narrative should reflect your values. It should be honest and relatable. A strong story makes you stand out.

Presenting Your Skills With Confidence

Confidence is key in interviews. Here are some tips to present your skills:

Practice: Rehearse your answers. Use a mirror or record yourself.

Body Language: Maintain eye contact. Stand tall and smile.

Clear Communication: Speak slowly. Use simple words.

Show Enthusiasm: Be excited about the role. Let your passion shine.

Practice these skills to feel more at ease. You will convey your abilities better. Remember, your story is powerful. Use it to your advantage.

0 notes

Text

Ford Donating $1M, A Fleet Of Vehicles To Trump's January Inauguration

Ford CEO Jim Farley announces at a press conference that Ford Motor Company will be partnering with the worlds largest battery company, a China-based company called Contemporary Amperex Technology.

According to a corporate representative on Monday, Ford Motor Company is contributing $1 million and a fleet of cars to the inauguration of U.S. President-elect Donald Trump in January.

The incoming administration’s proposed policies on tariffs and electric vehicles (EV) are expected to affect Detroit automakers like Ford, who are having difficulty increasing sales of their battery-powered EV models.

Trump has previously suggested eliminating the EV tax credit, which is said to benefit companies like Ford. Currently, drivers who purchase or lease an electric vehicle are eligible for a $7,500 federal tax credit.

However, the tax credit perk’s future could be questionable since Trump and other officials in the incoming GOP administration have deemed it unnecessary spending in the past. Though, naturally, there is also a chance that the tax credit could remain in place or be phased away gradually. Time will tell.

Meanwhile, Democrat officials like Governor Gavin Newsom (D-Calif.) have argued that he will do everything in his power to fight any efforts to rid the tax credit.

“We’re not turning back on a clean transportation future — we’re going to make it more affordable for people to drive vehicles that don’t pollute,” said Newsom in a statement in November.

Many people assume that Elon Musk, a founder of the popular EV company Tesla, and a notable official in the incoming Trump administration as one of the heads of the Department of Government Efficiency (DOGE), could possibly affect any decisions regarding EVs. However, Trump has already maintained that Musk will be putting “America First” over all of his companies.

Although the first federal EV tax credit was established under President George W. Bush’s U.S. Energy Policy Act of 2005, the tax credits, which are $7,500 for new cars and $4,000 for used cars, were introduced as part of President Joe Biden’s Inflation Reduction Act to “combat climate change by encouraging the sale of EVs.”

Americans who agree with doing away the EV tax credit perk argue that if a customer is already wealthy enough to purchase an EV vehicle, then they will survive financially and should not mind if that tax credit is taken away. On the other hand, critics have argued that the tax credit is an important, beneficial perk as it “rewards those who are conscious about the environment.”

Earlier this month, Jim Farley, the CEO of Ford, expressed optimism to reporters that Trump would be receptive to hearing the American automaker’s thoughts on these steps.

“[Given] Ford’s employment profile and importance in the U.S. economy and manufacturing, you can imagine the administration will be very interested in Ford’s point of view,” Farley said.

In terms of support, Amazon and Meta Platforms are among the other big businesses that have financially contributed to the incoming GOP inauguration. Meta and Amazon both paid $1 million in donations to the president-elect’s inaugural fund last week, followed by OpenAI CEO Sam Altman, who promised that he would give the same amount as well.

General Motors (GM) has also pledged to donate $1 million to Trump.

Trump’s 2017 presidential inauguration brought in a record $106.7 million, while companies like Pfizer, AT&T, and Boeing contributed $61.8 million to Democrat President Joe Biden’s 2021 inauguration fund.

Stay informed! Receive breaking news blasts directly to your inbox for free. Subscribe here. https://www.oann.com/alerts

0 notes

Text

The Stock Market is not the Economy w/ Dan Price

Airlines spent 96% of free cash flow on stock buybacks for a decade, then cut 90,000 jobs when trouble hit. Then they got a $50 billion bailout

GE promised its CEO a huge bonus if stock hit $19. It didn’t, so GE re-did contract so the bonus kicks in at $10/share The CEO cut 20% of aviation staff to increase profits and raise the stock to $10 His bonus: $47M. If it goes up again, he gets $270M

JCPenney - April: furloughed 85,000 employees, May 10: Gave CEO $4.5M bonus on top of $17M/yr in pay, May 15: went bankrupt, Oct: laid off 15,000 people, Dec: closed 150 stores, Now: CEO left with $4.5M bonus after stock fell 88% in her 2 yrs

Boeing spent almost all of its cash on stock buybacks over the prior decade. In the past year, it cut 27,000 employees. It also fired its CEO over 2 deadly plane crashes and ensuing coverup, and gave him a $81 million exit package

On Jan. 6, when the mob stormed the Capitol, the stock market went up 250 points to a new record, handing the richest 1% an extra $300 billion. Also that day, a new report showed employment dropped for the first time since April and a then-record 3,900 people died of covid

Albertsons, US’ 2nd-largest grocery chain: *Profit is up 256% in pandemic *Stock at record high *Owned by private equity *CEO made $29M last year *Fired all California non-union drivers to replace them with gig workers with no benefits/min wage

The stock market for the 500 biggest companies ended the year up 15%, among the biggest gains ever. Also in that span, those companies lad off a record number of people, and wait times for food banks hit a record high

As part of the first stimulus, the Fed pumped about $3 trillion into the stock market, which helped it soar to record highs. At the same time, a record 30% of small businesses failed and unemployment tripled

Since 2009, stock market is up 233%. Since 2009, the federal min. wage is up 0%

Coca-Cola - This decade, it spent $48B on dividends and over $20B on stock buybacks 2018: CEO got 58% pay increase 2019: CEO got 12% pay increase, to $18.7M 2020: Company makes $8.3B profit…and it just laid off 12% of workers

Among the biggest 50 companies, they spent 79% of profits on stock buybacks and dividends in recent years to enrich executives and mostly-wealthy shareholders. Last year, those companies combined to lay off over 100,000 workers

Disney stock is up 21% in the past year to a new record high. In recent months they laid off 32,000 people. One of our employees lives near Disney World. Recently there was a line of cars outside his house for a drive-thru food bank 7.5 miles away

In the pandemic, total stock value has grown by $16.6 trillion. $8.3 trillion of that went to the richest 1%, and they pay a lower tax rate than those who are unemployed and need help

Salesforce - In the last 5 years, it has bought 27 companies for tens of billions of dollars. It just bought Slack for $27.7B. Its stock is at record high, up 23% in the past year after revenue surged 29%. And it just laid off 1,000 people

In November alone, the average member of the top 10% gained an average of $200,000 from the stock market while 7M people plunged into poverty

On one day in November: *The stock market hit 30,000 for the first time *Elon Musk became first person to gain $100B in a year *A Census report revealed 6M people face imminent eviction

Uber + Lyft spent $200M on November election ads to convince Californians they shouldn’t pay drivers minimum wage or benefits. In the 2 weeks after passage, Uber stock went up 39% and Lyft stock soared 52%. In return, all drivers were denied basic benefits

Average stock gains over 10 years CEOs with above-average pay: stock up 160% CEOs with below-average pay: stock up 280% And yet CEOs are rewarded whether the stock goes up or down

AT&T - 2018-2019: bought Time Warner for $100B, cut 29,000 jobs May: gave departing CEO $64M pension ($274K/mo for life), laid off 4,700 more workers August: laid off 600 more workers, Now: laid off thousands more - news sent stock up 2%

Marriott - 2018-2019: made $3.1B in profits, spent $5B on stock buybacks April: furloughed most employees, paid $160M in dividends to shareholders, gave CEO a 8% raise and 200% bonus Sept: laid off 17% of HQ staff Now: made $100M profit

$3B: what Jeff Bezos cashed out in stock in one day, as Amazon profits tripled in the pandemic. $2.1B: cost to give all Amazon warehouse workers 2 weeks paid sick leave and a year of hero pay (they got none of either now)

84% of stock market value is owned by richest 10% “but what about 401(k)s” Half of Americans don’t have one The average 401(k) balance has *declined* $5,000 in 6 years after inflation, because employers put in less & people can’t afford contributions

MGM - Laid off 18,000 people while giving its CEO $700K in stock. The value of the stock doubled to $1.4M after the stock went up, partly because of increased profitability due to the layoffs

Wells Fargo made $10B in staff cuts, meaning tens of thousands of employees lost their jobs. Wells Fargo also made a $2B profit, did $24B in stock buybacks last year, and paid its CEO $36M

Black and Latino Americans make up about 32% of the population but own only 1.7% of all stock value

1948-1979: Worker productivity: up 108%, Stock market: up 603%, Worker pay: up 93%. Since then, worker productivity: up 70%, Stock market: up 2,200%, Worker pay: up 12%. Corporations and workers used to get richer together. Now companies just keep the money

Deere - Construction sales are down 25%. Yet, it is posting a $2.25B profit as it cuts thousands of jobs. The result: Its stock grew 23% in a year to a record high. In the week after it announced job cuts, its stock grew 9%

Walmart - Stock is at record high, up 23% in a year. The Waltons have gotten over $20B richer in the pandemic. Online sales are up 74% and market share has grown…and it cut hundreds of corporate jobs

Macy’s - Its stock was down 60% in a year and they cut 3,900 jobs. So what did it do? Gave its CEO a $3.7M bonus, and gave about $1M each to 5 other execs

CEOs justify huge pay by saying they’re worth it. But there’s no correlation between profit and CEO pay at 61% of corporations. Since 1990, stock market: up 300%, CEO pay: up 550%

Stock for the parent company of Ann Taylor, Loft and Lane Bryant is down 75% in a year. It closed all 2,800 stores. So what did it do? Gave executives $5.5M in bonuses, including over $2M to the CEO

Where proceeds from stock buybacks + dividends went over the last 15 years: White people: $13 trillion, Black people: $0.18 trillion Hispanic people: $0.21 trillion When we talk about the systemic racial wealth gap, this is a pretty good place to start

Amid the early days of the pandemic, stocks grew 38%, the most ever in a 50-day span. At the same time, thousands of small businesses closed each day while thousands of people died from covid

Google - Stock at all-time high. $6.8B profit last year. Founders Page + Brin added $10B+ to fortunes in a year. Offered jobs to over 2,000 people and axed them w/ no severance before they ever worked a day - after they already left their prior jobs

Companies did $62B/year in stock buybacks in the ‘80s and ‘90s. Now they do $730B/year in stock buybacks. Worker pay increases are far smaller now than they were in the ‘80s and ‘90s

Chevron - Its CEO made $33.1M/year. 5 other execs made a total of $59M. It spent $13B on stock buybacks and dividends in a year then laid off 10-15% of its staff

Big companies don’t just spend profits on manipulating stock. They are a record $10 trillion in debt - mostly for stock buybacks + dividends to enrich themselves. When the bill comes due, layoffs typically ensue

In April, a record 30M people lost their jobs and small businesses lost 55% of their revenue. At the same time, the stock market rose the most since 1987 and billionaires gained $308B

#Eat the rich#capitalism#stock market#economic inequality#the left#working class#long post#us politics

450 notes

·

View notes

Text

America’s Pre-Stonewall Queer Rights Movement

We talk like the 1969 Stonewall Riots came out of nowhere, and in some important ways it did as it upended the gay rights movement that had existed. It rejected the respectability politics of prior efforts. We were no longer trying to say we’re just like you, please treat us nicely. Post-Stonewall we were radical and demanding rights, legal reforms and power. However, the steps prior to Stonewall were important as it showed LGBTQ people exist and helped people start getting organized, building networks and methods of communication that could be used after Stonewall

———————————————————————

A lot of queer people lived in small towns and farming communities and felt like they were the only one. Then they were drafted into the military and fought in World War II and found each other.

Upon returning home from war, they were under a great deal of pressure to marry and conform to a conservative lifestyle. Most did but they still looked for opportunities to meet others and many upstanding men in their communities would go to certain bathrooms or parks to cruise (finding other men for sex) and then return home to their respectable life afterwards. They were out to satisfy a need and if the cops ran a sting, they slinked out shamefully, and feared their name being reported in the newspaper for that could destroy their life.

The United States government was scared of the Communists and called that threat the Red Scare. Related to this is the Lavender Scare, which is the belief that queer people would be susceptible to being blackmailed and so it was important to remove them from positions in government, business, & society. Many cities passed laws that further marginalized queer people. But not everyone took this meekly, they started organizing to try to fight back.

———————————————————————

1945 - World War II ends

1947 - Vice Versa, the first American lesbian publication, is written and self-published by Lisa Ben (real name Edith Eyde) in Los Angeles. Lisa Ben is an anagram of “lesbian.” It survived 8 months and published 9 issues. Vice Versa's mix of editorials, short stories, poetry, book and film reviews and a letters column, a pattern subsequently followed by many queer publications.

1950 - The Mattachine Society is the first national gay rights organization formed after WWII. They coined the term homophile (to be used instead of homosexual which feels so clinical and often used as a diagnosis of a disorder), and when asked to speak about what is a homophile, they talked about love instead of sex. At the time, LGBT people were regularly described as deviants and having mental issues, frequently portrayed as villains in the movies, often were homeless & sex workers as a result of being kicked out of their homes. The Mattachine Society fought to change that perception by portraying LGBT people as respectable citizens. The society went into decline in the mid-1960′s and disappeared after Stonewall for seeming too stuffy and unwilling to be confrontational.

1952 - "Spring Fire," the first lesbian paperback novel, was published and sold 1.5 million copies. It was written by lesbian Marijane Meaker under the false name Vin Packer.

1952 - Christine Jorgensen becomes the first widely-publicized person to have sex reassignment surgery, in this case, male to female, creating a world-wide sensation. This was performed in Denmark, and upon arriving in the USA, her transition was the subject of a New York Daily News front-page story, making her a celebrity. She published an autobiography in 1967

1952 - Several members of the Mattachine Society formed a separate society called One, Inc. They published ONE magazine, a monthly magazine and the first U.S. pro-gay publication. The US Post Office declared it obscene and refused to deliver, but it was sold at newstands in LA. ONE existed until 1965.

1953 - The Diana Foundation was created in Houston and is still in existence, making it the oldest continuously active gay organization in the United States. The Diana Foundation is focused on assisting and supporting the needs of the gay community, by distributing funds to organizations that are dedicated to providing services that enhance the lives of individuals in the community.

1953 - President Eisenhower signs an Executive Order banning anyone identified as threats to national security--including those with criminal records, alcoholics, and “sex perverts”--to be excluded or terminated from federal employment. It's estimated 5000 employees were let go, and this number does not include the many who were not hired as questions about their sexual orientation were found during background checks. This ban extended to all subcontractors who want to do business with the federal government, like Boeing, IBM, and many other businesses. 1955 - Dissatisfied at the lack of women voices in the Mattachine Society, the first lesbian rights organization in the US, The Daughters of Bilitis, was founded. It was originally meant to be a social alternative to lesbian bars, which were subject to raids and police harassment. As the Daughters of Bilitis gained members, they shifted their focus to supporting women who were afraid to come out by educating them about their rights and about gay history. They held national conventions in Los Angeles every 2 years from 1960 to 1968. Their 1962 convention was covered by local TV channel WTTV, making it the first American broadcast that specifically covered lesbians.

1956 – The Ladder, the first nationally distributed lesbian publication in the United States, began publication. It was published monthly from 1956 to 1970, and every other month in 1971 and 1972. It was the primary publication and method of communication for the Daughters of Bilitis. A big part of it’s end was debate over whether to remain aligned with other homophile groups or to join the National Organization for Women and their fight for women’s rights.

1956 - Dr. Evelyn Hooker presented her work that disproved the diagnosis that being gay is a mental illness. She conducted psychological tests of gay individuals who were not incarcerated and also were not psychological patients. Her work was met with incredulity, but she continued her work and published several additional studies over the coming years.

1957 - The word “transsexual” is coined by U.S. physician Harry Benjamin to refer to people who have a gender identity inconsistent with their assigned sex and desire to permanently transition to the sex or gender with which they identify, usually through medical means (hormones & surgery)

1958 - The US Supreme Court ruled against the US Post Office for refusing to allow ONE magazine to be delivered by mail simply for having stories and poems about lesbian and gay characters. This is the first US Supreme Court ruling to deal with homosexuality

1958 - The first gay leather bar in the United States, the Gold Coast, opened in Chicago

1961 - in San Francisco, José Sarria became the first openly gay candidate in the United States to run for public office, running for a seat on the San Francisco Board of Supervisors. Sarria almost won by default as there were fewer than 5 candidates for the 5 open seats, but city officials recognized this and on the final day had gotten more than 30 candidates registered. Sarria lost but won enough votes to create the idea that a gay voting bloc could wield real power in city politics

1961 - the Tay-Bush raid, the largest raid on a gay bar in San Francisco, resulted in the arrests of 103 people. It is considered a pivotal event in the history of LGBT rights in San Francisco.

1962 – Illinois becomes the first U.S. state to remove sodomy law from its criminal code, but it criminalized acts of "Open Lewdness,” such as open displays of affection between people of the same sex

1962 - The Janus Society was founded in Philadelphia. It is notable as the publisher of Drum magazine, one of the earliest gay publications in the United States and the one most widely circulated in the 1960s. The Janus Society focused on a strategy of seeking respect by showing the public gay individuals conforming to hetero-normative standards of dress at protests.

1962 - In San Francisco the Tavern Guild, the first gay business association in the United States, was created by gay bar owners as a response to the Tay-Bush raid and continued police harassment and closing of gay bars

1962 - A panel of 8 gay men had 90 minutes on a New York radio station to talk about what it was like to be gay. They talked about their difficulties in maintaining careers, the problems of police harassment, and the social responsibility of gays and straights alike.

1964 - the first organized protest against gay discrimination took place in New York City. 10 people picketed in New York City to protest the armed forces’ anti-gay discrimination and the army’s failure to keep gay men’s draft records confidential. These brave people stood up and spoke out at a time when very few were willing to do so because they did not want to be identified for fear of their family's reaction and the likely loss of their job and housing.

1964 - Life magazine published the article "Homosexuality In America" which was the first time a national publication reported on gay issues. The article described San Francisco as "The Gay Capital of America." This resulted in a big migration of gays to the city.

1964 - the Council on Religion and the Homosexual was the first group in the U.S. to use the word "homosexual" in its name. It was a San Francisco-based organization founded for the purpose of joining homosexual activists and religious leaders. It held an event where local politicians could be questioned about issues concerning gay and lesbian people, including police intimidation. The event marks the first known instance of "the gay vote" being sought.

1965 - Frank Kameny & Jack Nichols led the first “homosexual rights” protest at the White House. They wanted equal treatment of gay employees in the federal government, the repeal of sodomy laws, and the removal of homosexuality as a mental disorder in the American Psychiatric Association’s manual of mental disorders. 10 men & 3 women bravely picketed, and were covered by ABC, UPI, AP, Reuters, and other news organizations.

1965 - Inspired by the picket at the White House, on July 4th 39 conservatively-dressed people were part of a protest called “Reminder Day” held in Philadelphia at the Liberty Bell to point out that gay people are denied the rights of “life, liberty, and the pursuit of happiness”. This picket was done on July 4th for 5 years in a row. The last time just a week after the Stonewall Riots.

1965 - Vanguard was created, an organization of LGBT youth in a low-income San Francisco district. It is considered the first Gay Liberation organization in the U.S. which encouraged gays & lesbians to engage in radical direct action, and to counter societal shame with gay pride, such as by coming out to family & friends

1966 - The New York Mattachine Society stages a "Sip-In" at Julius Bar in New York City. New York liquor laws prohibited serving alcohol to gays. While unsuccessful that day in getting served, the publicity helped get the law changed. 1966 - Riot at Compton's Cafeteria in San Francisco - Compton’s became a regular hangout for drag queens, trans individuals, and young gay street hustlers, including many who belonged to Vanguard, much to the chagrin of it’s owners. The gay bars didn’t allow them in due to transphobic policies. One night management was fed-up by the noisy crowd at one table and called the police. When a cop attempted to arrest a transgender woman (cross-dressing was illegal), she resisted by throwing coffee at the police officer. It was followed by drag queens pouring into the streets, fighting back with their high heels and heavy bags. In the aftermath of this, the city of San Francisco began treating trans people as a community of citizens with legitimate needs instead of simply as a problem to get rid of.

1966 - In Los Angeles a coalition of Homosexual organizations organized demonstrations for Armed Forces Day to protest the exclusion of LGBT from the U.S. armed services. The 15-car motorcade is sometimes called the nation's first gay pride parade

1966 - National Transsexual Counseling Unit was formed in San Francisco, the first transgender organization ever, this is one action taken due to the Compton’s Cafeteria riot.

1966 - The Society for Individual Rights opened America’s first gay and lesbian community center in San Francisco

1967 - On New Years Day at the Black Cat Tavern in Los Angeles, the balloons dropped at midnight, auld lang syne was sung and some bar patrons kissed, then at five minutes after midnight, 12 plainclothes policemen began swinging clubs and pool cues, dragging patrons out the door and into the street. Sixteen people were arrested that night—six of them charged with lewd conduct (otherwise known as kissing). The raid prompted a series of protests that began on 5 January 1967, organized by P.R.I.D.E. (Personal Rights in Defense and Education). It's the first use of the term "Pride" that came to be associated with LGBT rights.

1967 - The Advocate, an American LGBT-interest magazine, was first published as a local newsletter by the activist group Personal Rights in Defense and Education (PRIDE) in Los Angeles. It began as a way to alert gay men to police raids in Los Angeles gay bars.

1967 - Craig Rodwell opened the Oscar Wilde Memorial Bookshop in New York City, the first bookstore in the country focused on literature by gay and lesbian authors. Rodwell was also vice president of the Mattachine Society and the bookstore doubled as a community center.

1967 - The Student Homophile League at Columbia University is the first institutionally recognized gay student group in the United States.

1969 - Stonewall Riots

38 notes

·

View notes

Text

Long Term Benefits of Studying Mechanical and Mechatronics Engineering

A profession like engineering has been recognised and respected for generations. It’s well established that becoming an engineer has great benefits. However, there are certain fields in engineering that provide you benefits that last throughout your life.

Those fields are Mechanical or Mechatronics. If you choose to do B. Tech. in Mechanical or Mechatronics, you unlock a lot of potential and possibilities for your career.

The skills you learn in these fields have immense demand and you will never run out of employment options. Also, studying and working in Mechanical or Mechatronics can be extremely interesting for some individuals because it involves innovation and creativity too.

Here are some more reasons why studying Mechanical or Mechatronics Engineering is beneficial for you:

Ample Career Options

A degree in B Tech Mechanical or Mechatronics gives you a chance to work in various fields. The scope of employment widens further if you graduate from a top institute like MIT Manipal.

If we talk about BTech Mechatronics, you get skilled in various disciplines. It comprises electronics, mechanical, computer and designing systems. This is one big reason why you will have ample opportunities almost everywhere throughout your life.

Mechanical Engineering too gives you employment options in top MNCs like Google, Boeing, Microsoft, Apple and many others.

You Can Work Anywhere in The World

These two degrees will blur the borders for you. Mechanical and Mechatronic Engineers are in demand all over the world and the best opportunities can come from anywhere.

In the long run, there’s always a chance that some company from abroad can hire you and ask you to relocate. When you get to go abroad and work, you get an immense amount of exposure. Such factors give wings to your career and your life takes a big leap.

Makes You Financially Strong

Every student looks forward to becoming financially independent. When you study hard to become a Mechanical or Mechatronics Engineer, you get great employment opportunities and get to earn a lot throughout your life.

If you graduate from a good college or if you go abroad to work, the earning potential increases many folds. A great income throughout your career makes you financially strong and gives you a lot of confidence.

Conclusion

Choosing BTech Mechanical or Mechatronics shapes your life in a beautiful manner. It gives you knowledge, success and wealth. If you give enough effort during your college life and study well, there’s a good chance you will be sorted for the rest of your life as a mechanical or a mechatronics engineer.

1 note

·

View note

Text

### Civil servants felt obliged to listen to Greensill

It is unclear exactly what alternatives were explored: the Treasury says releasing information would compromise future policy-making. But it has released enough to show that officials felt torn: they were sceptical but felt obliged to listen to Greensill’s proposals.

On April 16, for instance, Greensill requested another call to discuss his “important and urgent” proposals. Roxburgh said yes. Minutes of the conversation state: “You were clear that we were in listening mode.” He also committed to “take \[Greensill’s\] points away and consider them”.

Sunak appears to have felt similarly, making clear that Cameron’s friends would get a special hearing and the Treasury would exhaust all possibilities but not wanting to overreach. He texted the former PM on April 23: “I have pushed the team to explore an alternative with the Bank \[of England\] that might work. No guarantees, but the Bank are currently looking at it and Charles should be in touch. Best, Rishi.”

Good news followed 24 hours after Sunak’s texts: Roxburgh, in the third of nine meetings with Greensill, said the government would do some “confidential” research with trusted banks and businesses to see if its revised proposals might work. Greensill said the company was “very pleased to hear this news”.

Over this period, Greensill enjoyed access to officials, in some instances receiving responses within ten minutes.

Nevertheless, it became apparent that the company’s proposals were as inappropriate as they first appeared. The Treasury had already published information about the scheme: a sudden change letting Greensill take part would seem suspicious and potentially present legal issues. Sunak’s officials also feared that the proposals were too complicated and not guaranteed to put money in the pocket of business owners. Minutes from a call on May 14 state that Roxburgh spoke to Greensill “at the chancellor’s request”. The official asked “simple questions” but the idea “sounded complicated”, with minutes adding: “The government’s schemes were subject to intense media, parliamentary and public scrutiny.”

On May 18, Sunak signed off what seemed like another definitive no: officials wrote to Greensill saying they were not redesigning their scheme because their proposal “would not bring sufficient benefits” to small businesses.

Yet even then, Greensill, with Cameron in the background, kept on coming back. On June 11, Roxburgh told Greensill he was “still considering matters”.

Only on June 26, two and a half months after Cameron’s text to Sunak, did the Treasury finally give up, with Roxburgh saying he had “genuinely put in a lot of time” to explore Greensill’s ideas but, on CCFF, had run out of road. Greensill wrote saying he was “embarrassed” by his initial oversights and had come up with a “simple and elegant solution” but the government’s view did not appear to have evolved since June. It was not possible to use Greensill as an intermediary for small businesses in a loan scheme designed to help big companies. The idea, in short, did not make sense.

As administrators wind up what is left of Greensill’s empire, questions remain about how the company was able to get so close to the public sector, securing, between 2018 and last month, contracts to pay NHS pharmacies and staff and also become an accredited lender under another Sunak scheme, the Coronavirus Large Business Interruption Loan Scheme. The government has been asked to explain how Greensill was able to lend £400 million in taxpayer-backed money to one steel empire under that scheme, when the maximum to any one group was meant to be £50 million.

The Treasury says it was not responsible for that decision, although correspondence reveals that Greensill was, again, able to make personal requests to Sunak’s department on that scheme.

All of which affirms the issue at the heart of the scandal: why was Cameron able to get one man and one company such access to the people who shaped Britain’s response to the pandemic — and why did Sunak agree to help him?

Cameron’s spokesman refused to respond.

## The ‘nuts’ email sent by Cameron

Sheridan. Great to talk. Here are the bullet points I promised. What we most need is for Rishi to have a good look at this and ask officials to find a way of making it work. It seems nuts to exclude supply chain finance. We all know that the banks will struggle to get these loans out of the door — and so other methods of extending credit to firms become even more important. All good wishes DC.

● Greensill is a significant UK employer and its most valuable fintech \[financial technology business\], and we are keen to use our technology to help in this time of national crisis.

● We delivered £120 billion in credit to 2.6 million SMEs \[small or medium-sized enterprises\] in 175 countries last year — and are growing at more than 100 per cent per year.

● The Covid crisis has caused a very sharp increase in the demand from SMEs for liquidity — at the same time as many banks and investors are standing on the sidelines.

● Greensill applied to the Covid Corporate Financing Facility (CCFF) to help it meet demand. HMT said “no” — apparently because the CCFF is to provide direct liquidity to non-financial corporates making a material contribution.

● All Greensill does is provide direct liquidity to non-financial corporates who make a material contribution to the UK economy — indeed we go one better and deliver liquidity directly to more than 100,000 SMEs in the UK today ... to pay invoices quickly that are generated by UK businesses in the real economy. Funding raised against invoices issued to large companies goes directly into the supply chain at every level, rather than to the big corporates.

● Our application conforms with all the conditions of the facility other than it has a securitisation company issuing the commercial paper rather than the finance subsidiary of Vodafone/NHS etc.

● In fact, the BoE \[Bank of England\] purchased identical supply chain finance paper in the financial crisis, so the precedent is there. Recall Andrew Bailey \[governor of the Bank\] has spoken of the unique importance of supply chain finance in this time of great economic \[unclear\].

● Surely HMG should be seen to be supporting UK fintechs — who are creating employment, driving innovation and already delivering billions in ultra low-cost liquidity to British SMEs — particularly when it has been proven.

● Allowing a securitisation company that issues qualifying commercial paper to access the facility does not create a bad precedent — it is one that a number of fintechs, like Greensill, could instantly use to help deliver cash to SMEs.

● Greensill (and fintechs like it) have the scale, technology, UK-based staff and capability to get credit — in scale — into the hands of UK SMEs in days.

Our ask is that you direct officials to work with Greensill to ensure the eligibility criteria are met — we are prepared to be flexible, but we need to work at speed. A failure to do so will, almost certainly, mean tens of thousands ... Greensill (and other fintechs) have to materially reduce their activities.

2 notes

·

View notes

Text

Aviation Industry

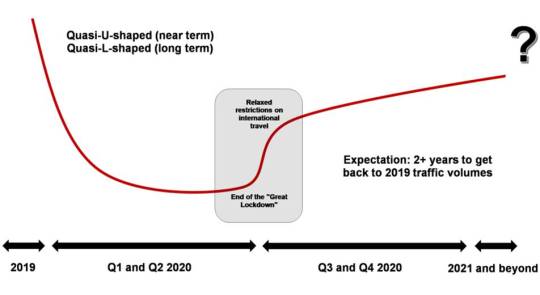

AVIATION INDUSTRY: A ROAD MAP TO RECOVERY

The Covid-19 pandemic has not just impacted the aviation industry but also brought it to a virtual halt in some parts of the world. The loss in air traffic has been almost two billion passengers at the global level by the end of the second quarter of 2020 and is expected to reach over 4.6 billion passengers by the end of 2020.

Since airport revenues are a function of traffic, there has been a continuous decline in total airport revenues on a global scale which amounted to more than $39 billion USD in the second quarter of 2020 and will cross $97 billion USD by the end of 2020.

STRUCTURAL CHANGES AND RISKS:Apart from the immediately apparent economic impact of the COVID-19 pandemic, which is reflected through airport revenues and air traffic, there are some structural changes too that can risk the long-term growth potential of this industry.

Restructuring and Consolidation of Airlines:Ever since the September 11 attacks and Great Recession of 2008-09, the aviation industry observed the trend of airline restructuring and consolidation. These changes can act as a double-edged sword, because the reduction in risk of individual airline bankruptcies can easily be circumvented by lesser competition and higher air fares in the medium term, hence negatively affecting passenger demand.

Those countries whose aviation sectors are more reliant on domestic traffic are likely to fare better as it is them who will lead the short-term recovery. Larger players in the market could use this as an advantage in redevelopment of international routes by potentially crowding out weaker players and reducing competition.

Airline fleet restructuring: Large airlines are now retiring four-engine passenger wide body aircraft—the Airbus A380 and Boeing B747 in particular—and this will lead to an immediate reduction in the demand for airport infrastructure to serve these aircraft. With the accelerated trend towards smaller and more efficient long-haul aircraft such as Airbus A321LR and Boeing B787, several airports will find themselves over equipped (while being obligated to maintain such infrastructure), leading to higher costs which are not reflective of demand.

Shifts in consumer behaviors: Consumer behavior may change with respect to business travel segment of passengers which can be a huge concern for the industry.Increased use of virtual meeting technology, demand for business travel could decrease even if travel restrictions are lifted. This could be partially offset as the real value of face-to-face business meetings is recognized.

As for leisure travel, a comparative lack of confidence in air travel as a result of the spread of COVID-19 may be partially offset by a pent-up desire to travel in some markets. The impact of enhanced health screening measures or new processes and procedures introduced in the wake of the pandemic on the ease-of-travel is also difficult to determine at this stage.

Impact of the environment: Environmental pressures and carbon commitments are not going away anytime soon, but are rather expected to accelerate. Financial difficulties can be slowed down by acquisition of new fleet rather than using the old, less efficient aircraft and investing in sustainable technologies. Climate change commitments are likely to play a vital role in the long run. Environment sustainability is going to play an extremely important role in ensuring that customers who are environment-conscious continue to fly.

PATH TO RECOVERY (GLOBAL OUTLOOK)

The air transport industry felt a triple shock in the sense that administrative travel restrictions were superimposed on a steep global economic downturn and exacerbated by significant behavioral shifts. As reported in Forbes magazine, a consumer confidence survey conducted by International Air Transport Association(IATA) found that only 14% of passengers said they would fly right away. Recovery in the aviation sector will greatly depend on sustainable and effective measures undertaken to restore consumer confidence in travel.

Initially, it will all depend on when countries will start lifting travel restrictions.National governments will likely progress gradually from permitting non-essential domestic travel and reviewing advice against international travel towards coordinated reciprocal arrangements to reassure smooth flow of passengers in both directions, as illustrated below.

In addition to this, consumer confidence will need to be re-established and fostered in terms of health and safety and confidence in travel bookings. Mitigation measures have been introduced in airports with regard to cleanliness, social distancing and other hygiene measures, along with mandatory screening procedures on arrival and departure.

virtualACI World is working with the International Civil Aviation Organization (ICAO), the World Health Organization (WHO), the International Air Transport Association (IATA) and other global stakeholders to push for guidelines that will provide for a smoother recovery.

As regards travel bookings, there is a perceived risk of airline and tour operator bankruptcies, booking inflexibility and rigid flight cancellation policies, which may prolong the reticence of people to plan non-essential travel. Similarly, falling household incomes and corporate revenues will make initial demand fragile and airlines may find it difficult to price their product at affordable levels yet recover their costs.

COORDINATED RECOVERY LED BY INTERNATIONAL INSTITUTIONS

The response to the COVID-19 crisis has differed across the world. While some parts of the world showed the capacity to control and minimize the outbreak in a few months, it could take longer in other countries, due to differing approaches of the government, contrast in cultural patterns and difference in economic capacities.

Coordination between and international organizations and states is extremely essential in order to ensure global recovery of the aviation industry.At the individual state level, this needs synchronized policy and decision-making between various government agencies, including public health agencies and ministries of transportation.At the global level, coordination is two-fold: it requires reciprocal agreements to reopen commercial air services, on a bilateral or multilateral bases, and the standardization of procedures to facilitate air services in both directions.

International institutions have an important role to play in leading recovery. The two specialized agencies of the UN —ICAO and the WHO are expected to continue working closely with industry trade groups representing the major stakeholders—ACI, CANSO, IATA, TIACA—on aviation-specific guidelines with the objective of ensuring appropriate planning and coordinated recovery procedures.

In April, ICAO Council established the COVID-19 Aviation Recovery Task force in response to the need for wide-ranging government and industry coordination to reconnect the world once the outbreak is brought under control. The task force is set to identify and recommend strategic priorities and policies for States and major industry players in working towards immediate solutions coupled with those that address the long-term structural challenges and risks of recovery.

The industry is stronger together and by coming together it will lay the foundations of recovery to ensure that the aviation industry can deliver the economic and social benefits to the local, national, and global communities that it serves.

MEASURES TAKEN BY THE INDIAN GOVERNMENT

The finance minister, Nirmala Sitharaman, recently announced reforms to kickstart the civil aviation industry which have been grounded due to the lockdown initiated to control the pandemic[1].These included:

Easing of restrictions on Indian Air Space utilisation so that civilian flying becomes more efficient. This would directly help in shortening of routes, lowering fuel costs and shorter flights, hence saving over Rs. 1,000 crores in flying cost.

Airports Authority of India has awarded 3 airports out of 6 bids for operation & maintenance on (PPP) basis. Additional investment by private players in 12 airports in first & second rounds is expected around Rs 13,000 crores, while state-owned Airports Authority of India (AAI) will receive ₹2,300 crore down payment from airport privatization processes.

India will also be developed as a hub of maintenance, repair and overhaul operations both for both the private aviation and the defense aviation sector.

A number of experts welcomed the announcement claiming that rationalizing Indian airspace is a significant step that would benefit not only the entire sector but also bring down travel time for passengers.[2] Privatizing 6 airports under the PPP (Public Private Partnership) model may help in employment generation.

Making India a global MRO hub can help us save foreign exchange and enable the servicing of Indian airlines locally. Also, tax incentives for the MRO sector will not just bring foreign investment but will also impact economies of scale for airlines and bring newer opportunities for the youth.

However, contrary to big ticket expectations of the aviation sector such as direct cash infusion, bringing Aviation Turbine Fuel (ATF) under the ambit of GST and suspending infrastructure charges at airports, some experts were of the opinion that the measures announced by the Center were all long-term. The industry at large needed immediate direct benefit to survive from the impact of COVID-19 pandemics some of the airlines are on the verge of going bankrupt. [3]

One challenge for private airlines in India is that these airlines have nearly all borrowings in forex (by way of foreign aircraft leases or foreign EXIM backed loans) and have little collateral to offer for new loans (as they own a low percentage of aircraft, which are anyway mortgaged, and typically have negative working capital) and hence they may have difficulty in raising unsecured debt from Indian banking system to tide over these COVID problems.Therefore, there was need for a second phase of reforms in taxes on fuel, reducing airport charges, guarantees by the government for unsecured borrowings of private airlines and many more.

Analysts from CARE Ratings also raised questions on the government's expectation of big investment in airports. Aviation has incentives as 6 airports to have PPP. However, investment in these times seems uncertain. The sector might be able to garner some investment but it is highly unlikely that the expected figure of Rs 13,000 crore will materialize any time soon.

WHAT GOVERNMENTS CAN DO FOR AIRPORTS

In a scenario where airports are facing dwindling traffic as well as revenues, state aid comes across as a necessary measure in order to ensure that airports, and hence the aviation industry has a whole survives this pandemic.

Governments can implement an array of creative solutions to help airports to stay afloat. These can include the following:[4]

Grants and subsidies: These are basically, non-recurring and non-refundable money allocated with specific short-term objectives, such as keeping airports open to commercial traffic and maintaining a minimal required level of staffing. Wage subsidies are a particular form of government subsidies and can be effective in retaining airport employees. Grants, on the other hand, can be used by airports to pay the rest of the bills – for the contracted services, maintenance, utilities and so on.In general, grants and subsidies are the preferred mechanism of state support, especially for smaller airports with smaller capital needs and stronger focus on operating expenses and immediate survival.

Secured financing: From a narrow and maybe even a cynical point of view, airports are very expensive pieces of real estate on vast land areas. In case the borrower airports make a default in payments, the creditor has the right to take possession of the collateral (airport assets) and can sell them to recover the amount loaned.

The secured type of financing is very comparable to the more familiar mortgage operations with a repossession mechanism as a safeguard and reassurance for the lending institution.

Loans at preferential rates: Such loans imply rates that are lower than commercial banks would normally charge, typically a couple of percentage points below the standard interest rates of commercial banks.

Deferment of loan repayments: In those cases where debt service on the existing obligations is impossible or impractical from the financial management perspective, deferment of loan repayments should be considered.

Bank guarantees: As for bank guarantees, such mechanisms can assure lending institutions that the liabilities of an airport debtor will be met in case the debtor fails to settle a debt. Such guarantees can either be direct (can be issues directly to the beneficiary airport) or indirect (using a second bank, usually a foreign bank with legal representation in the home country of the beneficiary).

#aviation#aviationtraining#pilot#aviation industry#aviation sector#aviators#student#aircraft#aircraft training#pilotslife#covid19#student life

2 notes

·

View notes

Text

Corporate Dems want to bail out lobbyists and dark money orgs

Congressional Dems have tabled their version of the third bailout, and as feared, it contains a bailout for lobbyists.

Congress wants to give money to people whose job is literally to bribe Congress.

https://pluralistic.net/2020/05/06/moloch-demands-death/#human-centipede

But as David Sirota points out, corporate Dems found a way to discredit the bailout even more: in addition to earmarking money for corporate lobbyists working at 501(c)6 orgs, they're also gonna give millions to 501(c)4 "dark money" orgs.

https://sirota.substack.com/p/war-is-peace-and-k-street-is-a-small

These are the preferred vehicle for anonymously funneling unlimited money from plutes and mega-corporations into influence campaigns that are allowed to lie to the American people to influence the outcomes of elections and regulatory proceedings.

They're getting a bailout.

Some of the eligible orgs: America’s Health Insurance Plans, Partnership for America’s Health Care Future (dark money anti-Medicare for All), PhRMA, Institute for Legal Reform (lobbies for no liability for employers whose workers die of coronavirus due to inadequate PPE), Stand Together (the Koch network) and the American Chemistry Council (fossil fuel, big chem lobbyists).

What's more, many of the companies that fund these orgs are already getting a a bailout, so they get to double-dip their snouts in the public trough.

* Private equity lobbied to allow it to snaffle up the lion's share of small business PPP relief; its lobbying front, the American Investment Council, can get PPP relief as well under this proposal.

* Banks are getting billions to administer PPP. This proposal makes the American Bankers Association eligible for PPP as well.

* Airlines got a $50B bailout. Airlines For America can get a PPP bailout.

* For-profit colleges lobbied to get to keep tuition money from students who drop out due to financial hardship. Their lobbying group, Career Education Colleges and Universities, can get a PPP bailout.

* Boeing's getting billions in bailout money. Its lobbyist, The General Aviation Manufacturers Association, can get PPP.

Sirota: "Allowing corporate lobbying organizations and dark money groups to grab this money is akin to feudal lords gorging themselves at a lavish banquet, and then raiding the last basket of bread that starving peasants are relying on to survive outside the palace walls."

Image: Mike Goad (modified) https://www.flickr.com/photos/exit78/32777804894

CC BY-SA https://creativecommons.org/licenses/by-sa/2.0/

27 notes

·

View notes

Text

‘Scared to Death’ by Arbitration: Companies Drowning in Their Own System

DoorDash requires all employees to sign an arbitration clause that bars them from joining together to mount class-action lawsuits, making it more difficult for employees to sue due to individual costs. What would you do if an entrepreneurial lawyer figured out how to efficiently have 6,000 employees individually file claims to the arbitration company and you received a $9 million bill, which a federal judge ruled that the company must pay: (1) continue having new employees sign arbitration clauses, (2) no longer require it, or (3) something else, if so, what? Why? What are the ethics underlying your decision?

Teel Lidow couldn’t quite believe the numbers. Over the past few years, the nation’s largest telecom companies, like Comcast and AT&T, have had a combined 330 million customers. Yet annually an average of just 30 people took the companies to arbitration, the forum where millions of Americans are forced to hash out legal disputes with corporations.

Mr. Lidow, a Silicon Valley entrepreneur with a law degree, figured there had to be more people upset with their cable companies. He was right. Within a few months, Mr. Lidow found more than 1,000 people interested in filing arbitration claims against the industry.

About the same time last year, Travis Lenkner, a lawyer in Chicago, had a similar realization. Arbitration clauses bar employees at many companies from joining together to mount class-action lawsuits. But what would happen, Mr. Lenkner wondered, if those workers started filing tens of thousands of arbitration claims all at once? Many companies, it turns out, can’t handle the caseload.

Hit with about 2,250 claims in one day last summer, for example, the delivery company DoorDash was “scared to death” by the onslaught, according to internal documents unsealed in February in federal court in California.

Driven partly by a legal reformist spirit and entrepreneurial zeal, Mr. Lidow and Mr. Lenker are leaders in testing a new weapon in arbitration: sheer volume. And as companies face a flood of claims, they are employing new strategies to thwart the very process that they have upheld as the optimal way to resolve disputes. Companies, in a few instances, have refused to the pay fees required to start the arbitration process, hoping that would short-circuit the cases.

“There is no way that the system can handle mass arbitrations,” said Cliff Palefsky, a San Francisco employment lawyer who has worked to develop fairness standards for arbitration. “The companies are trying to weasel their way out of the system that they created.”

Even as Supreme Court rulings over the last two decades have enshrined arbitration as the primary way that companies can hash out disputes, giving them enormous sway, consumer advocates and labor rights groups have criticized its inequities.

One of the biggest obstacles for consumers and workers is that payouts on individual arbitration judgments don’t justify the costs of mounting a complex case against a big company.

Some of the mass arbitration strategies may be changing that calculus.

Mr. Lidow runs FairShake, a start-up that uses an automated system to get the arbitration process started. If the claim results in a payout, the start-up takes a cut.

Mr. Lidow got interested in arbitration after the e-commerce company he founded to sell ethically sourced clothing shut down. A former mergers and acquisitions lawyer, he wanted to use some of his digital know-how to disrupt the cumbersome, clubby legal system that nearly every American must agree to use instead of going to court against their employer, rental car provider or cable company.

In the spring of 2018, FairShake bought targeted Google ads that invited anyone with gripes against a cable and internet company to start the arbitration process through its website. Over two months, FairShake notified companies like AT&T and Comcast that it was filing 1,000 arbitration claims.

The companies were caught off guard. It took six months for many of the claims to move through arbitration. And some were still making their way through the system two years later. To Mr. Lidow, that seemed like a long time for two of the nation’s largest companies, with ample legal resources, that have vouched publicly for the efficiencies of arbitration over court.

It was particularly notable because AT&T was at the center of a landmark 2011 Supreme Court ruling that anointed arbitration as a fair forum for legal disputes.

“From our perspective, the companies weren’t prepared to administratively handle that volume,” Mr. Lidow said. “The whole system wasn’t prepared.”

An AT&T spokesman said FairShake’s “system is unnecessary because our process is so easy to follow and efficient for consumers.”

FairShake is expanding its focus to other industries, like consumer finance and home security. For the arbitration claims that FairShake has settled, consumers have gotten an average payout of $700.

Mr. Lenkner also sees a potentially viable legal niche in mass arbitration.

A former lawyer at Boeing who clerked for Justice Anthony M. Kennedy on the Supreme Court, Mr. Lenkner said most companies never expected that people would actually use arbitration.

“The conventional wisdom might say that arbitration is a bad development for plaintiffs and an automatic win for the companies,” he said. “We don’t see it that way.”

His firm’s first wave of cases have focused on workers in the gig economy. Many of these workers, particularly at food delivery companies, have been thrust onto the front line of the coronavirus crisis by ferrying food and supplies to housebound consumers, while risking getting sick. A large number of their employers require these workers to sign arbitration clauses.

Mr. Lenkner said he believed that his firm could economically mount arbitration claims, one by one, because the gig workers had similar allegations against companies like Uber and Postmates — namely that they have been misclassified as independent contractors.

One of the firm’s latest showdowns is with DoorDash, a leading food delivery app in the United States. It shows the traction that mass arbitration is gaining with judges and the lengths that companies will go trying to stop it.

It began last summer when Mr. Lenkner’s firms filed more than 6,000 arbitration claims on behalf of couriers for DoorDash, known as “dashers.”

Among them was Victoria Diltz, a single mother in the Bay Area who works at a fast-food restaurant and as a housekeeper, and relies on making deliveries for DoorDash to generate extra cash for a tank of gas, groceries or car payments.

She said the company’s formula for paying workers was inconsistent, but as an independent contractor she had no way to challenge that.

“They know we are desperate for the cash, so we will do whatever,” said Ms. Diltz, 46, who lived out of her car for a period while working for DoorDash.

The cases were taken to the American Arbitration Association, an entity that provides the judges and sets up the hearings for such disputes.

DoorDash specified in its contracts with its roughly 700,000 dashers that they had to use the association when filing an arbitration claim. The company also told the dashers that it would pay any fees that the association required to start the legal process.

Then DoorDash got the bill for the 6,000 claims — more than $9 million.

DoorDash balked, arguing in court that it couldn’t be sure that all of the claimants were legitimate dashers. The American Arbitration Association said the company had to pay anyway. It refused, and the claims were essentially dead.

The company made other moves seeking to limit the damage from mass arbitration.

DoorDash’s lawyers at the Gibson Dunn firm reached out to another arbitration provider, which turned out to be more accommodating on some issues important to the company.

The International Institute for Conflict Prevention & Resolution, or C.P.R., was willing to allow DoorDash to arbitrate “test cases” and avoid having to pay the fees all at once. C.P.R. also took feedback from Gibson Dunn on the proposed new rules, though it did not consult with the dashers’ lawyers.

In a statement, C.P.R. said the new rules for mass arbitration were broad based and not specific to the DoorDash case. It also said the new rules had provisions that were generally favorable to plaintiffs.

If they wanted to keep “dashing” for DoorDash, workers had to sign a new contract designating C.P.R. as the new arbitrator.

But a federal judge in San Francisco wasn’t willing to go along with it. The judge, William Alsup, ordered DoorDash in February to proceed with the American Arbitration Association cases and pay the fees.

In a statement, a spokeswoman for DoorDash said the company “believes that arbitration is an efficient and fair way to resolve disputes.”

But in a hearing, Judge Alsup questioned whether the company and its lawyers really believed that.

“Your law firm and all the defense law firms have tried for 30 years to keep plaintiffs out of court,” the judge told lawyers for Gibson Dunn late last year. “And so finally someone says, ‘OK, we’ll take you to arbitration,’ and suddenly it’s not in your interest anymore. Now you’re wiggling around, trying to find some way to squirm out of your agreement.”

“There is a lot of poetic justice here,” the judge added.

4 notes

·

View notes

Text

The United States is passing the "Temporary Economic Relief Act" to launch the second round of "trade war"

Looking at every major crisis in human society, it will reshape the global economic and political operation system. Take the global development in the past half a century or so as an example, World War II led to the decline of British hegemony and the rapid rise of the United States. The Korean War and the Vietnam War have made Japan, South Korea, and many Southeast Asian countries and regions the OEM bases of American manufacturing industry, laying the foundation for their economic take-off (with the Four Little Dragons of Asia). The September 11, 2001 terrorist attacks shifted the focus of the United States to the Middle East.

The crisis triggered by this epidemic is a human disaster and is purely a black swan incident. However, this time is under the strategic background that the United States is reviving its manufacturing industry, returning to Asia, and encircling the EU and China. How the EU and China face the US encircling after this crisis, and whether the United States can revive the real economy and regain the position of global manufacturing leader from China, to a large extent, depends on the measures the United States is taking to rescue the market and also depends on China's ongoing economic stimulus plan.

Next, we will carefully analyze the different stimulus policies that will affect the economic development in the coming decades.

let's look at America's big plan.

U.S. President Trump has signed into force a massive stimulus bill to deal with the coronavirus epidemic. The bill has 880 pages and a total size of 2 trillion U.S. dollars. At the same time, the Federal Reserve will also introduce 4 trillion US dollars to stabilize financial markets.

Trump made a social media statement after signing the bill:This is the largest economic stimulus package in the history of the United States and twice as much as any rescue bill ever enacted. In other words, if the stimulus plans of the White House and the Federal Reserve are all combined, it is equivalent to the US providing more than 6 trillion US dollars to the market in the next year or so. What concept is this? Japan is now the world's third largest economy, but Japan's total GDP for the whole year is less than 6 trillion US dollars. In other words, the US injection of funds into the market this time can buy out the output and transactions of all economic activities in Japan for the whole year.

Where are all these funds spent?

Perhaps you don't know, the White House this 2 trillion dollar stimulus bill, when the Senate debate, the Democratic Party is particularly opposed to giving money directly to large enterprises such as Boeing, the Democratic Party itself has also proposed a similar bill, but more emphasis on tax cuts and support for small and medium-sized enterprises.

I can tell you this: on the one hand, the passage of the U.S. bill is due to the intensification of market panic. if the bill is not rescued, the U.S. may have a big problem. the number of people applying for unemployment benefits in a week has reached 3.28 million, which is 6 times the historical high.

Therefore, the large-scale stimulus bill of the United States is, of course, to save the United States economy in the first place, but there is also an important problem that businesses will take this opportunity to receive substantial financial and personnel support and sustained subsidies. Do you believe that the 880-page bill was deliberated by lawmakers word by word in the light of the trauma suffered by the U.S. economy? No, these bills are the representatives of all interests. They put their needs together, put them together and seek approval.

In other words, the reason why the two parties did not have much argument (symbolic argument) is that the demands fed back by the interest groups they represent are reflected in the bill. In this bill, Republicans are representatives of traditional large enterprises such as oil, aviation and real estate finance, while Democrats are representatives of trade unions and small and medium-sized enterprises such as new energy and artificial intelligence. The Republican Party hopes to take this opportunity to expand the competitiveness of traditional large enterprises in the United States. The Democratic Party hopes to take this opportunity to expand the strength of trade unions to check and balance large enterprises, and then to make small and medium-sized enterprises more active.

Therefore, the US stimulus bill, in a strategic sense, should attract the attention of China, EU and Japan. This is because this bill is not a simple bill on the response to the epidemic, but a bill that has long wanted to push forward, but is usually impossible to pass, to comprehensively improve the competitiveness of the entire American enterprise.

If these economies cannot do a better job of coping with the situation, they may face a new round of globalization suppression by American enterprises in the future.