#algotradingbot

Text

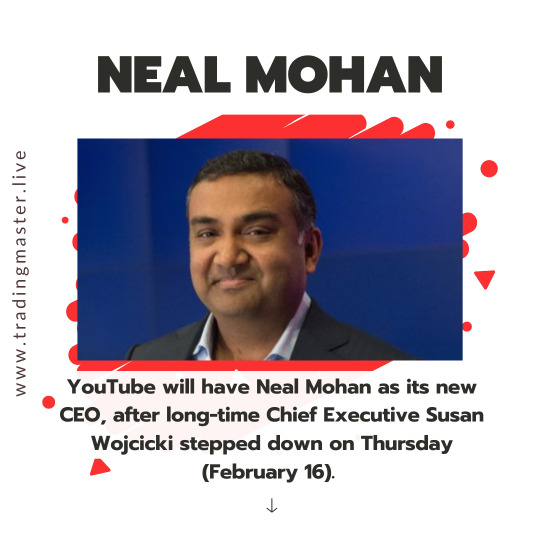

New CEO of YouTube - Neal Mohan http://tradingmaster.live

2 notes

·

View notes

Text

AI Crypto Trading Bot Development leverages artificial intelligence to automate trading strategies in cryptocurrency markets. These bots use advanced algorithms to analyze market trends, execute trades, and manage risks autonomously. They aim to optimize trading outcomes by leveraging machine learning and real-time data analysis, offering traders and investors efficiency and potential profit opportunities.

Explore More>> https://www.firebeetechnoservices.com/crypto-trading-bot-development

#crypto trading bot development#crypto bot#tradingbot#ai crypto traing bot#arbitragetradingbotdevelopment#algotradingbot#algotradingbotdevelopment

0 notes

Photo

Ninjatrader Algorithmic Trading Robot Trades E-MINI Futures ES - Profit $4500 in 2 hours! http://ehelpdesk.tk/wp-content/uploads/2020/02/logo-header.png [ad_1] Ninjatrader Algorithmic Trading ... #accounting #algotrading #algotradingbot #algotradingrobot #algorithmictrading #algorithmictradingrobot #altredo #altredo.com #bot #cfa #daytrading #excel #finance #financefundamentals #financialanalysis #financialmanagement #financialmodeling #financialtrading #forex #investing #investmentbanking #ninjatrader #ninjatraderalgotrading #ninjatraderalgotradingrobot #ninjatraderalgorithmictrading #ninjatraderautomatedstrategy #ninjatraderautomatictrading #ninjatraderbot #ninjatraderrobot #ninjatraderstrategy #optionstrading #personalfinance #robot #stocktrading #technicalanalysis #trading #tradingbot #tradingrobot

0 notes

Text

What Are the Challenges of Implementing a Crypto Trading Bot in Business?

As technology advances and the nature of financial industries changes, companies are now depending more on the process of automation. There is, however, one particular domain that is starting to quickly involve automation, and that is cryptocurrency trading Bot. Automated crypto trading platforms use proposals of algorithms and Artificial Intelligence to manage trading in cryptocurrencies and generate profits given the changeable nature of the market.

What is a Crypto Trading Bot?

Crypto Trading Bot Development is all about designing and implementing an automated algorithm that makes trades in cryptocurrency markets. These bots are AI-controlled and their goal is to trade in markets depending on price and volume data, rules of operations, and signal processing algorithms. The purpose is to collect profits out of market opportunities and make trades at a much faster pace than human traders. Such factors involve the choice of algorithms, interaction with exchange APIs, approaches to risk management, as well as the monitoring and fine-tuning of operations to reflect continued market variations.

Why Crypto Trading Bots are Attractive to Businesses

Increase Efficiency: In trading, bots can perform trades faster than manual operations because they can respond to changes in the market immediately.

Reduce Emotional Trading: A primary advantage of automation is the extermination of mistakes arising from emotions such as fear and greed.

Operate Around the Clock: It is better than trading by human traders because bots can work 24/7 and make trades during employees’ absence.

Challenges in Implementing Crypto Trading Bots

However, their advantages, integrating crypto trading bots into business operations presents several challenges:

Complexity of Algorithm Development

Trading algorithms are an important component of an effective trading strategy and writing them is a job that needs both a financial and a programming background. It is challenging for firms to design algorithms that will have better returns than the market, primarily because of cryptocurrency price fluctuation and other factors such as view.

Data Integration and Quality

Bot operation, to be effective, requires the right data and most importantly, data that is presented at the right time. Organizations need to connect to accurate and real-time data feeds while containing such problems as data delay and differences in data quality which may harm trading.

Risk Management

Risk management is of main importance when it comes to trading in cryptocurrencies. Special attention should be paid to such an essential part of the bots’ functioning as risk management to minimize the risks and avoid financial disasters during falls or any other unpredictable situation.

Regulatory Compliance

An extra challenge is the uncertainty regarding cryptocurrency regulation around the world. Organizations need to remain informed of changes in laws so that bot activities do not break the law.

Technical Infrastructure

It is always crucial to have a strong, sound, and constant technical foundation which is required to keep the bots running all the time. This includes aspects like the availability of servers, measures put in place to counter cyber threats and adaptability to changes in trading volumes.

Conclusion

Therefore, it is a great advantage for a business to integrate a crypto trading bot for improved performance, productivity, and outlined high profitability within the crypto markets. Still, several factors come with these advantages, and their execution warrants the efficiency of the business. Starting from compliance issues, technological difficulties, fluctuations in demand, or threats related to information security, every problem should be approached with proper analysis and management strategies.

Thus, Fire Bee Techno Services can be recognized as a credible partner for businesses that want to address the challenges of implementing a crypto trading development Company. Being one of the leading algorithm development companies, Our Services guarantee reliable data integration, strict risk management, and up-to-date knowledge of the regulations necessary for the successful functioning of your business.

#crypto trading bot development#crypto bot#tradingbot#ai crypto traing bot#algotradingbot#arbitrage bot

0 notes

Text

Arbitrage trading bot development companies specialize in creating automated systems to capitalize on price differentials across markets.

Explore More>> https://www.firebeetechnoservices.com/crypto-arbitrage-trading-bot-development

0 notes

Text

The Business Case for Algo Trading Bots: Efficiency, Accuracy, and Profits

In the dynamic and competitive world of monetary trading, technological improvements are constantly changing how business is performed. Among these improvements, algorithmic trading bots have emerged as a game-changer. These bots leverage advanced algorithms to execute trades with extremely good efficiency and accuracy and, in the end, forceful good-sized earnings for groups.

What Are Algo Trading Bots?

Algo trading bots, short for algorithmic trading bots, are automatic structures that use pre-described rules and complicated mathematical fashions to execute trades in monetary markets. These bots can analyze extensive amounts of records, perceive trading possibilities, and execute orders quicker and greater properly than any human dealer. They are utilized in numerous markets, including shares, foreign exchange, and cryptocurrencies.

Efficiency: The Speed and Scalability of Algo Trading Bots

One of the maximum extensive benefits of algo trading bots is their performance. Human investors are limited by way of their physical and cognitive talents; they can only analyze a lot of information and execute a positive number of trades within a given timeframe. In comparison, algo trading bots can:

Execute Trades in Milliseconds: Speed is essential in trading. Algo trading bots can process and react to market records in milliseconds, executing trades at the most opportune moments. This speed can be the distinction between a profitable alternate and an overlooked opportunity.

Analyze Large Data Sets: Algo trading bots can examine large amounts of statistics from more than one source simultaneously. This capability permits them to perceive trends and styles that won't be apparent to human traders.

Operate 24/7: Unlike human traders who need rest, algo trading bots can function around the clock. This non-stop operation is especially valuable in markets like cryptocurrencies, which in no way near.

Accuracy: Minimizing Human Error and Emotional Bias

Accuracy in trading is paramount, and algo trading bots excel in this area by minimizing human error and emotional bias:

Precision: Algo trading bots comply with predefined rules and algorithms to execute trades. This precision ensures that trades are performed exactly as planned, without deviation because of human errors.

Consistent Decision-Making: Human traders can be motivated by emotions, mainly by inconsistent choice-making. Fear and greed can bring about poor trading decisions. Algo trading bots, but, operate based totally on good judgment and data, ensuring regular and goal selection-making.

Backtesting Capabilities: Before deploying a trading strategy, algo trading bots can backtest with the usage of ancient statistics. This method enables refining the approach, making sure of its effectiveness in diverse marketplace conditions.

Risk Management: Algo trading bots can control advanced threat control strategies, automatically adjusting positions to mitigate losses and shield earnings. This computerized threat management is more efficient and reliable than guide procedures.

Profits: Unlocking Greater Financial Gains

The closing purpose of any trading activity is to maximize earnings, and algo trading bots offer numerous ways to obtain this:

Exploiting Market Inefficiencies: Algo trading bots can pick out and take advantage of market inefficiencies that may be too delicate for human investors to trip on. These inefficiencies can offer opportunities for profitable trades.

High-Frequency Trading: Some algo trading bots are designed for high-frequency trading (HFT), executing lots of trades in line with the second. This approach can generate significant profits with the advance of capturing small rate discrepancies throughout one-of-a-kind markets.

Diversification: Algo trading bots can manage a couple of techniques throughout diverse markets simultaneously. This diversification reduces risks and will increase the ability for earnings by no longer trust on an single market or strategy.

Cost Efficiency: By automating trading procedures, companies can lessen the prices related to guide trading, consisting of salaries for investors and operational costs. This price performance contributes to higher usual profitability.

Conclusion

In the quick-paced world of monetary trading, algo trading bots have turn out to be classic tools for groups searching for to decorate performance, accuracy, and profitability. These bots provide extraordinary speed, precision, and scalability, allowing organizations to execute trades greater successfully and capitalize on market opportunities. By minimizing human blunders and emotional bias, algo trading bots make sure regular and objective choice-making, leading to higher trading effects. Moreover, their capacity to perform across the clock and manipulate a couple of techniques together unlocks extra monetary profits and cost efficiency.

When it involves choosing the proper algo trading bot company, Fire Bee Techno Services could be a nice choice. Their superior technology, customizable answers, robust guide, and revealed track record cause them to be the precise associate for groups looking to leverage the energy of algorithmic trading.

0 notes

Text

Fire Bee Techno Services stands as a premier provider, delivering reliable and robust Algo Trading Bots. Crypto algorithmic trading bots offer advantages like speed, executing trades in milliseconds; accuracy, removing emotional bias; efficiency, running 24/7 without human intervention; and diversification, handling multiple strategies simultaneously for potentially higher returns.

Explore More>> https://www.firebeetechnoservices.com/blog/crypto-algo-trading-bot

0 notes

Text

On #Tuesday, the #SupremeCourt used #ArtificialIntelligence (AI) & Natural Language Processing(NLP) #tools to record live oral argument & to trade with AI - http://tradingmaster.live

1 note

·

View note

Text

youtube

#video#Trending#trend#tradingmaster#trade#algotradingbot#tradingsoftware#YouTube#StockMarket#market#Youtube

1 note

·

View note