#aeps business startup

Explore tagged Tumblr posts

Text

If you are planning to start your own brand Aeps business as an admin and looking for step by step guide then this is for you.

Here In this blog, I have explained how you can setup your own b2b Aeps admin business with a systematic manner.

These steps will help you to start, run and explore your business seamlessly.

So without skipping a single minute, jump into our informational blog and become AEPS business entrepreneur.

If you want to learn more and need any suggestion, feel free to call at (+91)7230001612 Our Dedicated Support Team.

#aeps business#aeps admin business#aeps b2b business#aeps business startup#fintech business startup#aeps business guide

2 notes

·

View notes

Text

[ad_1] The Indian fintech sector has witnessed an unprecedented revolution over the last decade, driven by innovative startups and rapid technological advancements. Among these changemakers, Hyderabad-based Viyona Fintech has emerged as a leader in financial inclusion, particularly in rural and semi-urban India. With its flagship products, ViyonaPay and GraamPay, the company is not only bridging financial gaps but also redefining the role of fintech in empowering underserved communities. Fintech and Rural India: A New Dawn Rural India has historically faced significant challenges in accessing formal financial services. Limited banking infrastructure, low digital literacy and geographical barriers have created a persistent divide between urban and rural economies. However, fintech solutions have begun to change this narrative. By leveraging technology, companies like Viyona Fintech have brought banking and payment services to the fingertips of millions. The proliferation of smartphones and internet connectivity in rural regions has further accelerated this transformation, enabling even small villages to access digital financial services and fostering economic inclusion. Viyona Fintech: Pioneering Innovation for Financial Inclusion Founded in Hyderabad, Viyona Fintech has made its mark with a mission to empower rural and semi-urban India through cutting-edge digital platforms. Its flagship products, ViyonaPay and GraamPay, are reshaping how financial services are delivered. ViyonaPay: Aimed at businesses and organizations, ViyonaPay offers comprehensive payment and banking solutions, including PayIn and Payout platforms, UPI integration, and Connected Banking APIs. It enables seamless fund transfers, merchant payments, and real-time reconciliation. With robust security features and regulatory compliance, ViyonaPay is a trusted platform for enterprises looking to streamline financial operations. GraamPay: Focusing on individuals and small communities in rural areas, GraamPay is a neo-banking platform that provides services such as micro-loans, micro-insurance, UPI payments, digital gold investments, and utility bill payments. By integrating features like AEPS (Aadhaar-Enabled Payment System) and DMT (Domestic Money Transfer), GraamPay has simplified daily financial transactions for users. Its digital onboarding process, combined with an intuitive KYC system, has significantly lowered barriers to access. Impact on Rural Communities: Viyona Fintech’s platforms have made a tangible difference in the lives of rural Indians Financial Inclusion: GraamPay has revolutionized access to essential services, including micro-loans, insurance, UPI payments, and utility bill payments. Rural users can now pay for electricity, water and other utilities digitally, saving time and effort. This integration has enhanced financial literacy and empowered users to better manage their resources. Economic Empowerment: ViyonaPay has enabled businesses in rural areas to expand their operations by providing secure and efficient financial tools. Small businesses and self-help groups have particularly benefited from streamlined payment processes, enabling them to focus on growth and productivity. Job Creation: By introducing local digital banking agents and financial literacy initiatives, Viyona Fintech has created employment opportunities. These agents act as a bridge between the platform and rural communities, ensuring last-mile connectivity while contributing to local economic development. Redefining the Indian Fintech Landscape Viyona Fintech’s success mirrors the broader evolution of India’s fintech ecosystem. Once dominated by urban-centric solutions, the sector is now embracing rural India as a critical growth driver. The company’s work aligns seamlessly with the Indian government’s vision of Digital India and Atmanirbhar Bharat, fostering self-reliance and economic empowerment.Hyderabad,

often called India’s “Silicon Valley of the South,” has played a crucial role in nurturing startups like Viyona Fintech. Its robust tech infrastructure and skilled talent pool have enabled companies to innovate and scale rapidly, driving the city’s reputation as a hub for fintech innovation. Looking Ahead Viyona Fintech’s journey is far from over. The company is exploring advanced technologies such as artificial intelligence (AI) and blockchain to further enhance efficiency and security across its platforms. Additionally, plans to introduce multilingual support in GraamPay aim to make the platform even more accessible to users across diverse regions. As digital payments and financial inclusion continue to shape India’s economic landscape, Viyona Fintech is a torchbearer of change. By combining innovation with a deep understanding of grassroots challenges, the company is not only redefining the fintech landscape but also paving the way for a more inclusive and equitable future. C V K Madhu, CFO, Viyona Fintech, said “our financial strategy at Viyona Fintech focuses on blending innovation with fiscal discipline. By leveraging technology to optimize cash flows, reduce operational costs, and enhance financial transparency, we aim to deliver sustainable value while expanding access to modern financial services for every Indian”. B Nagaraj, CTO, Viyona Fintech, said “we are building a future where financial services are driven by data, powered by AI, and secured through blockchain. At Viyona Fintech, our focus is on developing resilient and adaptive systems that can handle the complexity of modern digital banking while ensuring seamless and secure experiences for users across urban and rural India”. [ad_2] Source link

0 notes

Text

[ad_1] The Indian fintech sector has witnessed an unprecedented revolution over the last decade, driven by innovative startups and rapid technological advancements. Among these changemakers, Hyderabad-based Viyona Fintech has emerged as a leader in financial inclusion, particularly in rural and semi-urban India. With its flagship products, ViyonaPay and GraamPay, the company is not only bridging financial gaps but also redefining the role of fintech in empowering underserved communities. Fintech and Rural India: A New Dawn Rural India has historically faced significant challenges in accessing formal financial services. Limited banking infrastructure, low digital literacy and geographical barriers have created a persistent divide between urban and rural economies. However, fintech solutions have begun to change this narrative. By leveraging technology, companies like Viyona Fintech have brought banking and payment services to the fingertips of millions. The proliferation of smartphones and internet connectivity in rural regions has further accelerated this transformation, enabling even small villages to access digital financial services and fostering economic inclusion. Viyona Fintech: Pioneering Innovation for Financial Inclusion Founded in Hyderabad, Viyona Fintech has made its mark with a mission to empower rural and semi-urban India through cutting-edge digital platforms. Its flagship products, ViyonaPay and GraamPay, are reshaping how financial services are delivered. ViyonaPay: Aimed at businesses and organizations, ViyonaPay offers comprehensive payment and banking solutions, including PayIn and Payout platforms, UPI integration, and Connected Banking APIs. It enables seamless fund transfers, merchant payments, and real-time reconciliation. With robust security features and regulatory compliance, ViyonaPay is a trusted platform for enterprises looking to streamline financial operations. GraamPay: Focusing on individuals and small communities in rural areas, GraamPay is a neo-banking platform that provides services such as micro-loans, micro-insurance, UPI payments, digital gold investments, and utility bill payments. By integrating features like AEPS (Aadhaar-Enabled Payment System) and DMT (Domestic Money Transfer), GraamPay has simplified daily financial transactions for users. Its digital onboarding process, combined with an intuitive KYC system, has significantly lowered barriers to access. Impact on Rural Communities: Viyona Fintech’s platforms have made a tangible difference in the lives of rural Indians Financial Inclusion: GraamPay has revolutionized access to essential services, including micro-loans, insurance, UPI payments, and utility bill payments. Rural users can now pay for electricity, water and other utilities digitally, saving time and effort. This integration has enhanced financial literacy and empowered users to better manage their resources. Economic Empowerment: ViyonaPay has enabled businesses in rural areas to expand their operations by providing secure and efficient financial tools. Small businesses and self-help groups have particularly benefited from streamlined payment processes, enabling them to focus on growth and productivity. Job Creation: By introducing local digital banking agents and financial literacy initiatives, Viyona Fintech has created employment opportunities. These agents act as a bridge between the platform and rural communities, ensuring last-mile connectivity while contributing to local economic development. Redefining the Indian Fintech Landscape Viyona Fintech’s success mirrors the broader evolution of India’s fintech ecosystem. Once dominated by urban-centric solutions, the sector is now embracing rural India as a critical growth driver. The company’s work aligns seamlessly with the Indian government’s vision of Digital India and Atmanirbhar Bharat, fostering self-reliance and economic empowerment.Hyderabad,

often called India’s “Silicon Valley of the South,” has played a crucial role in nurturing startups like Viyona Fintech. Its robust tech infrastructure and skilled talent pool have enabled companies to innovate and scale rapidly, driving the city’s reputation as a hub for fintech innovation. Looking Ahead Viyona Fintech’s journey is far from over. The company is exploring advanced technologies such as artificial intelligence (AI) and blockchain to further enhance efficiency and security across its platforms. Additionally, plans to introduce multilingual support in GraamPay aim to make the platform even more accessible to users across diverse regions. As digital payments and financial inclusion continue to shape India’s economic landscape, Viyona Fintech is a torchbearer of change. By combining innovation with a deep understanding of grassroots challenges, the company is not only redefining the fintech landscape but also paving the way for a more inclusive and equitable future. C V K Madhu, CFO, Viyona Fintech, said “our financial strategy at Viyona Fintech focuses on blending innovation with fiscal discipline. By leveraging technology to optimize cash flows, reduce operational costs, and enhance financial transparency, we aim to deliver sustainable value while expanding access to modern financial services for every Indian”. B Nagaraj, CTO, Viyona Fintech, said “we are building a future where financial services are driven by data, powered by AI, and secured through blockchain. At Viyona Fintech, our focus is on developing resilient and adaptive systems that can handle the complexity of modern digital banking while ensuring seamless and secure experiences for users across urban and rural India”. [ad_2] Source link

0 notes

Text

Ecuzen software pricing structure for its AEPS software is designed to be transparent and flexible. Whether you're a small business looking to integrate AEPS services into your operations or a larger organization seeking a robust solution, Ecuzen ensures that its pricing remains accessible. Ecuzen Software's affordable AEPS software pricing in India is not just about the numbers; it's about the value and support that come with it. By choosing Ecuzen, businesses can empower themselves with cutting-edge AEPS technology without straining their budgets. So, if you're considering integrating AEPS services into your operations, now is the time to explore what Ecuzen has to offer. Whether you're a small startup with aspirations for growth or an established enterprise with complex needs, Ecuzen's AEPS software is designed to scale alongside your business. This scalability and flexibility ensure that you're not limited by your current requirements and can adapt as your operations expand. Ecuzen software understands the importance of a user-friendly interface, especially in a market as diverse as India. Their AEPS software is designed with the end-user in mind, best software company in jaipur, making it intuitive and easy to navigate. This is particularly crucial for businesses serving customers who may not be tech-savvy.

0 notes

Text

Aeps Software - Definition, Work & Benefits

Are you planning to start your own Aeps admin business and looking for a genuine service provider, this is for you?

Ezulix Software is a leading AEPS software provider who facilitate you standard AEPS software solution with all AEPS services and advanced features.

Check out how AEPS helps individual as well as businesses. And how you can get benefit of its features and functionalities to boost your business.

#aeps software#aeps software provider#aeps software company#best aeps software#aeps software developer#aeps software development company#aeps admin software#aeps admin business

0 notes

Text

In recent years, India has emerged as one of the world’s fastest-growing markets for fintech companies. Fintech, short for financial technology, refers to the innovative use of technology to provide financial services and solutions. The fintech revolution in India has disrupted traditional banking and financial services, offering consumers and businesses new and more convenient ways to manage their finances.

The Fintech Boom in India

India’s fintech journey can be traced back to the early 2000s when online banking and digital payment systems began to gain traction. However, the government’s push for financial inclusion and the proliferation of smartphones truly accelerated the fintech revolution. The introduction of the Aadhaar biometric identification system and the Unified Payments Interface (UPI) played pivotal roles in making financial services accessible to millions of Indians. There are many Fintech companies like Bankit, Paynearby, Rapipay in the market providing financial assistance such as MATM, AePS as well and DMT services.

Key Drivers of Fintech Growth in India

Government Initiatives: The Indian government has actively promoted fintech through initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY), Digital India, and Make in India. These initiatives have aimed to increase financial inclusion, digitize the economy, and encourage domestic fintech innovation.

Digital Transformation: The widespread adoption of smartphones and affordable mobile data plans has enabled fintech companies to reach even the remotest parts of the country, making digital financial services accessible to all.

Regulatory Support: The Reserve Bank of India (RBI) and other regulatory bodies have crafted fintech-friendly policies, fostering an environment conducive to innovation and growth.

Rising Consumer Demand: Indian consumers are increasingly looking for convenient and secure digital solutions for their financial needs, from payments and lending to insurance and wealth management.

Impact on the Indian Economy

The rise of fintech companies in India has had a profound impact on the economy:

Financial Inclusion: Fintech has brought millions of unbanked and underbanked Indians into the formal financial system, fostering economic growth and reducing poverty.

Ease of Doing Business: Fintech has simplified financial transactions for businesses, leading to increased efficiency and productivity.

Job Creation: The fintech sector has created a significant number of jobs in areas such as software development, data analytics, and customer support.

Increased Competition: Fintech has forced traditional financial institutions to innovate and improve their services to stay competitive, ultimately benefiting consumers.

Challenges and Future Outlook

Despite the remarkable growth, the Indian fintech sector faces data security, regulatory compliance, and competition challenges. However, the future looks promising with ongoing innovation and support from the government and regulators. We can expect to see more collaboration between traditional banks and fintech startups, further enhancing the financial services landscape.

Conclusion

The fintech revolution in India has not only transformed the way Indians manage their finances but has also positioned the country as a global fintech hub. With continued innovation, collaboration, and regulatory support, India’s fintech sector is poised for sustained growth, contributing to the country’s economic development and financial inclusion. As fintech companies continue to disrupt and redefine the financial services industry, they are playing a pivotal role in shaping India’s digital future.

0 notes

Text

What is FINTECH-AS-A-SERVICE: Future of Financial Solutions

Fintech refers to the innovation of technology to improve and automate financial transaction services. Fintech startups have been disrupting the traditional banking industry by offering innovative and user-friendly digital solutions. One of the latest trends in fintech is the emergence of Fintech as a Service (FaaS), which allows businesses to integrate financial services into their platforms.

FAAS provides a wide range of services including AEPS balance check & AEPS cash withdrawal, an online recharge portal for retailers, online DTH recharge, BBPS service, online flight ticket booking, Micro ATM services, and assistance with money transfers from India to Nepal.

Read More at- https://www.soulpay.in/blogs/what-is-fintech-as-a-service-future-of-financial-solutions/

#fintech service#fintech#consumer#retailer business idea#Soulpay#digitalvypari#ticketbooking#flightbooking#business ideas

0 notes

Text

API provider company across the Pune,India-Paytrav

Looking for API integration? Paytrav is a Direct API provider company across the India. We provide API for the products like AEPS, MATM, DMT, BBPS and Fastag. If you want to plug API solutions then don’t think it’s time to integrate. We are available with dedicated software and digital solutions as well.

Paytrav offers FinTech- based APIs and software that can be used by hundreds of businesses from startups to large established enterprises to bring advancement in the finance industry. In FinTech industry API serves as the bridge between software and enables them to connect safely and exchange data. It is to re-explore how to serve customers in a dynamic, digitally centric world.

Call @ +91 89763 15910 https://paytrav.in/

0 notes

Text

AePS API provider in India | Aadhaar based transactions

To speed up the track of financial inclusion, RBP Finivis, an AePS API provider in India offers Aadhaar based payments solutions for Aadhaar linked Bank account holders

#aeps api#aeps portal#aeps commission#aeps api provider#aeps api provider company#aeps api provider company in india#aeps service provider#dmt api#aeps service#mego pay#aeps software#fintech#aeps business#aeps registration#aeps cash withdrawal api#money transfer api#digital banking#neo banking#fintech startup business#aeps balance enquiry api#aadhar pay api#aadhaar enabled payment system

1 note

·

View note

Text

Do you want to start your own b2b fintech business and looking for best solution then this is for you?

Ezulix software is a leading b2b fintech software development company in India. We offer multipls software solutions in a singel b2b admin portal. Here we have mulitple packages with multiple features.

By choosing our b2b software silver package, you can get all multi recharge, aeps, bbps, pancard and money transfer services into your admin panel with integrated mobile app and your brand website.

You can offer all services to your agents and can earn highest commission in the market.

For more details visit our website now or request a free live demo. www.ezulix.com or call at (+91)7230001612

#b2b fintech software#b2b software silver package#mobile recharge software#aeps software#bill payment software#money transfer software#pancard software#b2b fintech business#fintech startup

3 notes

·

View notes

Photo

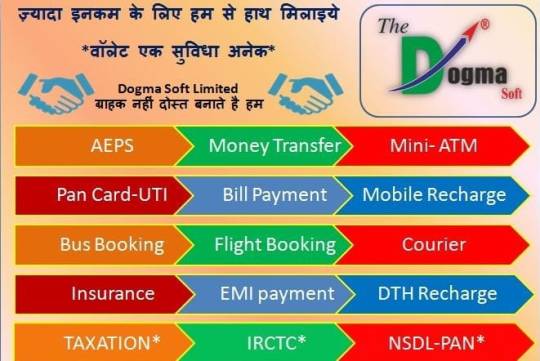

Do you want to start a business for less investment?

If yes, then join now Dogma Soft and use 100 + services like AEPS center, bill payment system, car & bike insurance, PAN center etc. to earn more commissions and increase your monthly income.

कब तक भाग दोड़ करतें रहोगे ?

अब आप अपना खुद का Business Start करें! लेकिन आप सोच रहें होंगें कि खुद के बिज़नेस के लिए सब से पहले आपको बड़ा Invest करना होगा, Infrastructure चाहिए होगा, इन सबके लिए आप मे Risk लेने की क्षमता भी होनी चाहिए और सबसे Important आपके पास Product/Services भी होनी चाहिए| इन सबके आलावा भी सबसे पहले इसके लिए पैसा चाहिए वो कहाँ से लाए, क्योकि आज का दौर Competition का हैं जिसमे New Startups को बहुत कठिनाइयों का सामना करना पड़ता है| हर कोई कहता है की अगर Product या Business Concept अच्छा हो तो हम ये कर देंगे वो कर देंगे, घर-घर जाकर 100 % मेहनत कर के जन-जन तक पहुंचादेंगे|

और अगर आप पहले से कोई बिज़नेस कर रहें हैं तो जो आपका Existing Business है उस पर कोई Effect नही आएगा बल्कि बढेगा ही और सबसे अच्छी बात ये है कि इसमे कोई समय सीमा नही है व ना ही कोई Boundation हैं|

Provide all the facilities under one roof in your office such as money transfer, Bill payment, PAN card, Car & Bike Insurance, Money transfer, Mobile recharge, etc. and get more commission by offering services.

इसके लिए आपको Special Office की ज़रूरत नही है, ना के बराबर Invest करना हैं| बस आपकों हमारी वेबसाइट पर Registration करना हैं जिससे आपको एक Login Id मिलेगा जहाँ आपके पास आपका Certificate, Visiting Card, Marketing Material, 100+ Services etc. सब कुछ है,आपका ऑफीस एक Virtual Office है|

लो अब हमने हमारा काम कर दिया है अब आपकी बारी है|

#AEPS#MicroATM#BBPS#ServiceProviderCompany#ElectricityBillPayment#SmallBusiness#MobileRecharge#MoneyTransfer#NewBusiness#PanCenter#SocialMarketingBusiness#entrepreneurship#entrepreneur#DogmaSoft#StartupIndia#Startupds

1 note

·

View note

Text

Ecuzen software pricing structure for its AEPS software is designed to be transparent and flexible. Whether you're a small business looking to integrate AEPS services into your operations or a larger organization seeking a robust solution, Ecuzen ensures that its pricing remains accessible. Ecuzen Software's affordable AEPS software pricing in India is not just about the numbers; it's about the value and support that come with it. By choosing Ecuzen, businesses can empower themselves with cutting-edge AEPS technology without straining their budgets. So, if you're considering integrating AEPS services into your operations, now is the time to explore what Ecuzen has to offer. Whether you're a small startup with aspirations for growth or an established enterprise with complex needs, Ecuzen's AEPS software is designed to scale alongside your business. This scalability and flexibility ensure that you're not limited by your current requirements and can adapt as your operations expand. Ecuzen software understands the importance of a user-friendly interface, especially in a market as diverse as India. Their AEPS software is designed with the end-user in mind, best software company in jaipur, making it intuitive and easy to navigate. This is particularly crucial for businesses serving customers who may not be tech-savvy.

aeps software provider in jaipur

0 notes

Text

AePS Software Provider

Do you want to settle your own AEPS business and looking for best AEPS software company then this is for you?

Here in this blog I have explained how you can choosing right AEPS software provider in India for your business startup.

#aeps software provider#aeps software provider company#best aeps software provider#aeps software provider in India

1 note

·

View note

Text

Top 3 Benefit of Micro Lending

In India, the lending system works on the CIBIL score or history of the borrower. Micro lending is a way to provide small entrepreneurs and business owners access to funds on loan. Often, village-level entrepreneurs and small business owners with poor creditworthiness do not have access to conventional financial resources from banks and major institutions.

Micro-lending platforms are an effective solution for this. These platforms are designed to offer capital support to people who are financially underserved. They serve as a substitute for the traditional loan system and are normally used by small companies and new businesses that would otherwise cannot easily get approval for a loan. Any retailers and partners with good transaction volume and two months on boarding can apply for a micro loan online via a micro-lending platform.

Key Features of Micro Lending:

The loan tenure is short

Flexible EMI module

Nominal interest rates

Zero risk

No late repayment fees

The borrowers are commonly from low-income backgrounds

Simple application procedures

The repayment schedule is decided by the partners

Advantages of Micro Lending:

Fast loan approval For startups, access to a traditional lending system could be difficult as most institutions ask for proven trading success. However, microloans work in a different way. They provide capital support without necessarily requiring history of years of successful trading. Also, the application process is easy, allowing people to apply for microloan online or over the phone in just a few minutes.

Eligibility The eligibility needs for microloans are easier than that for small business loans. Micro lending allows people to purchase raw materials, equipment, inventory, and other items, and so borrowers do not need to denote the exact purpose for taking the loan.

Fewer complications There are no or little complications related to this kind of loan system, with vital decisions being about the amount to use and the repayment schedule. Micro lending has been praised by many as it offers a clear way to reduce unemployment, help the marginalized sections, and end the cycle of poverty. In addition, the best AEPS portal, available at reasonable prices, enables people to access banking services quite easily with their Aadhar card.

1 note

·

View note

Text

BUSINESS NEWS: FATE Foundation announces entrepreneurship competition winners

BUSINESS NEWS: FATE Foundation announces entrepreneurship competition winners

Publish date: 2022-07-07 23:16:43 | Author: Henry Falaye | Source: punchng.com The FATE School of FATE Foundation has announced the winners of the Mitsubishi Corporation sponsored aspiring entrepreneurs programme: sustainability (AEP Sustainability) business pitch. The organisation said the winners were selected after a 12-week hybrid programme with 30 Startups within the sustainability space.…

View On WordPress

0 notes

Text

Leading AEPS micro ATMs Service Provider - RBP Finivis

RBP Finivis Micro ATMs is the best AEPS micro ATMs Service Provider that aims to connect rural areas by permitting clients to provide basic banking services by engaging neighborhood retailers and Kirana storekeepers with these devices. The AEPS frameworks include both unbanked and underbanked Indians. RBP Finivis Pvt. Ltd. offers FinTech-based APIs and software that can be used by hundreds of businesses from startups to large established enterprises to bring advancement in the finance industry.

0 notes