#advance loss of profit insurance

Explore tagged Tumblr posts

Text

Physical Verification of Fixed Assets: Why Your Business Needs It

Introduction In the world of business, fixed assets—like machinery, buildings, and equipment—are fundamental to operations and profitability. However, without proper management and regular verification, businesses can lose track of these valuable resources. Physical verification of fixed assets is a critical process to ensure that a company’s assets are accurately recorded and maintained. In this article, we’ll delve into why physical verification of fixed assets is essential and how MAS LLP offers a streamlined approach to safeguarding these vital resources.

What is Physical Verification of Fixed Assets? Physical verification of fixed assets is a systematic process of counting and verifying a company's tangible assets to confirm their presence, condition, and alignment with accounting records. This process helps ensure assets are accounted for, thereby minimizing risks of asset misappropriation, losses, or unexpected depreciation.

Key Components of Physical Verification Inventory Count: Ensuring that all assets, big or small, are physically located and accounted for. Condition Assessment: Reviewing the status and usability of assets to determine if they need maintenance, repair, or replacement. Compliance Check: Ensuring that the asset register aligns with financial statements and legal regulations. Tagging & Labeling: Using asset tags or barcodes for easy tracking and future verification. Why Physical Verification is Essential for Businesses

Improved Financial Accuracy An accurate inventory of fixed assets ensures that the company's financial statements reflect true value. By confirming asset existence and condition, physical verification helps in producing precise data for depreciation, amortization, and insurance claims.

Asset Utilization Optimization Physical verification helps identify underutilized or idle assets, providing opportunities to redeploy them where needed. This leads to optimized resource allocation, potentially saving costs by maximizing the productivity of existing assets.

Enhanced Security and Fraud Prevention Unauthorized use, theft, or misappropriation of assets can have significant financial consequences. Regular verification protects businesses by preventing fraudulent practices and ensuring that each asset is appropriately safeguarded.

Accurate Tax Reporting Fixed assets have tax implications, especially in terms of depreciation. Accurate records enable businesses to file correct depreciation values, avoid tax penalties, and ensure compliance with local tax laws.

Supporting Business Valuation For businesses seeking investments or mergers, a well-documented and verified list of fixed assets enhances business valuation. A clean asset register is a positive indicator for potential investors, showing operational control and value transparency.

Physical Verification with MAS LLP At MAS LLP, we provide comprehensive physical verification of fixed assets services, tailored to meet your company’s unique requirements. Our process is designed to deliver accuracy, transparency, and peace of mind. Here’s how we can help:

Detailed Asset Inventory Creation Our team conducts an in-depth assessment to create an exhaustive inventory list that aligns with your company’s financial records. We account for every asset to ensure you have a clear picture of your holdings.

Customized Verification Plans MAS LLP works with clients to develop verification schedules suited to the size and nature of the business. Whether it’s annual, semi-annual, or periodic checks, we customize our approach to your operational needs.

State-of-the-Art Tracking Technology We leverage advanced tracking solutions, such as barcode tagging and RFID, to simplify the asset verification process and minimize errors. This enhances the traceability and management of assets, especially for larger organizations.

Condition and Compliance Reporting Our experts assess the physical state of assets and generate detailed reports on their condition. We also ensure compliance with relevant regulations, maintaining an accurate record of all assets in your register.

Seamless Integration with Financial Statements Once verification is complete, we update the asset register and integrate findings with your financial statements. This ensures consistency across your asset records, accounting books, and tax documents, giving you a precise and compliant asset overview.

Why Choose MAS LLP? When it comes to managing your fixed assets, MAS LLP’s expertise in physical verification of fixed assets helps you minimize risk and maximize control. With a team of seasoned professionals, we have the resources, technology, and industry knowledge to provide you with a comprehensive asset verification solution.

Benefits of Working with MAS LLP Unmatched Accuracy: Our rigorous processes ensure asset records are accurate and up-to-date. Cost-Efficiency: We help you avoid over-investment by identifying and redistributing idle assets. Compliance Assurance: Stay compliant with regulatory requirements through verified asset data. Transparent Reporting: Receive detailed, actionable reports for informed decision-making. Conclusion The physical verification of fixed assets is an indispensable aspect of asset management that safeguards your company’s resources, supports financial accuracy, and boosts compliance. With MAS LLP, businesses can gain confidence in the integrity of their asset records and optimize asset utilization for long-term success. Reach out to MAS LLP today to learn more about how we can assist you in managing your fixed assets effectively.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

6 notes

·

View notes

Text

How Professional Packers and Movers Transform Business Logistics?

The global e-commerce market has expanded rapidly over the past four years, from $5.0 trillion in sales in 2021 to a projected $6.3 trillion in 2024. This represents overall growth of 26% from 2021 to 2024. On average, the e-commerce market has grown by approximately 6-7% annually in this period. The logistics of moving goods has grown in complexity and volume, with a 25% increase in goods transported year-over-year. Professional packers and movers, integral to this ecosystem, are leveraging advanced technology to enhance delivery efficiency and reduce logistics-related complaints by up to 30%. As businesses strive to meet consumer expectations for speed and sustainability, these logistics partners are adopting eco-friendly practices and innovative solutions, making them indispensable in the online business marketplace and B2B portals like DealerBaba, where efficiency, reliability, and environmental responsibility are key to competitive advantage.

Role of Packers and Movers in Modern Logistics

Professional packers and movers are essential in modern logistics, offering comprehensive services to ensure the safe, efficient, and timely delivery of goods. Their role is especially critical in online business and B2B transactions, affecting customer satisfaction and business reputation directly. Here are five key points summarizing their contribution:

Customized Logistics Solutions: They offer bespoke logistics services for various business needs, ensuring flexibility and efficiency in handling diverse product types.

Advanced Tracking Technology: Utilizing the latest technology for shipment tracking, they provide transparency and real-time updates, enhancing decision-making and customer communication.

Safety and Security: With strict safety protocols and secure packaging, packers and movers minimize the risk of damage or loss, ensuring goods are transported safely.

Scalability: They provide scalable logistics solutions that accommodate business growth and changing needs, facilitating expansion without compromising service quality.

Regulatory Compliance: Expertise in navigating international shipping regulations and customs documentation simplifies cross-border transactions, ensuring compliance and smooth operations.

Integration with Online Business Marketplaces and B2B Portals

Integrating packers and movers services with the online business marketplace and B2B portals significantly enhances the efficiency and reliability of business logistics.

Challenges and Solutions

While integrating with online marketplaces and B2B portals offers numerous advantages for logistics, businesses often face several challenges. Here are five common issues and their solutions.

#1. Managing Costs: High logistics costs can eat into profit margins.

Solution: Utilize technology for route optimization and bulk shipping discounts. Automated systems can identify the most cost-effective routes and consolidate shipments to reduce expenses.

#2. Ensuring Goods Integrity: Maintaining the condition of goods during transit is crucial.

Solution: Customized packaging solutions tailored to the nature of goods can protect against damage. Employing quality materials and packing techniques ensures goods arrive in pristine condition.

#3. Tracking and Transparency: Customers expect real-time updates on their shipments.

Solution: Implementing advanced tracking systems that provide real-time location and status updates enhances transparency and customer trust.

#4. Customs and Regulatory Compliance: Navigating the complexities of international shipping regulations can be daunting.

Solution: Partnering with logistics providers who have expertise in regulatory compliance can streamline the process. They can handle customs clearance and ensure all international shipping regulations are met.

#5. Mitigating Risks: Loss, theft, and damage are potential risks during transit.

Solution: Comprehensive insurance coverage is essential for protecting against financial loss. It provides peace of mind and financial stability in case of unforeseen events.

Future Trends in Logistics and the Role of Packers and Movers

The logistics industry is evolving rapidly, with technology playing a key role. Packers and movers are at the heart of this change, adopting AI, blockchain, and drones to enhance efficiency and reliability. These advancements streamline operations and improve customer service by offering real-time tracking and faster deliveries. Interested in learning more? Check out the full blog here for detailed insights.

2 notes

·

View notes

Text

Postacute sequelae of COVID-19 (PASC), often referred to as Long COVID, has had a substantial and growing impact on the global population. Recent prevalence studies from the United States and the United Kingdom found that the complication has affected, on average, around 45 percent of survivors, regardless of hospitalization status.

No accurate tally of the number of people affected and its real global impact has yet been made, but conservative estimates of several hundred million and trillions in economic devastation would hardly be an exaggeration. Even in China, after the lifting of the Zero COVID policy late last fall and the tsunami of infections that followed, social media threads are now widespread with people complaining of chronic debilitating fatigue, heart palpitations and brain fog.

Yet, more than three years into the “forever” COVID pandemic, with Long COVID producing more than 200 symptoms, impacting nearly every organ system and causing such vast health problems for a significant population across the globe, it remains undefined and somewhat arbitrary in the clinical diagnosis. Additionally, the assurances given to study potential therapeutic agents have remained unfulfilled.

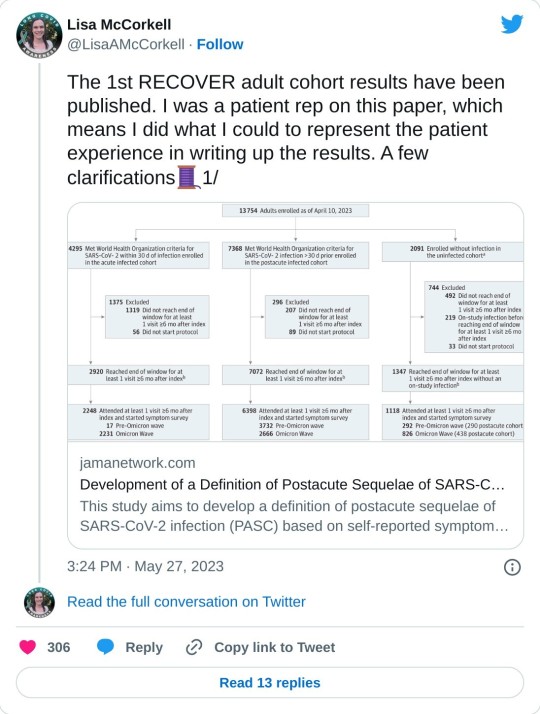

In this regard, a new Long COVID observational study called the “RECOVER [researching COVID to enhance recovery] initiative,” was published last week in the Journal of the American Medical Association, with almost 10,000 participants across the US. Funded by the National Institutes of Health (NIH), it attempts to provide a working definition for Long COVID (PASC).

While the study represents an advance from the standpoint of assessing the impact of Long COVID, and has been celebrated in media coverage, it must be viewed with several reservations and caveats. It is exclusively focused on describing the disease, rather than supporting efforts to alleviate its impact, let alone find a cure. And its definition, however preliminary, could well be misused by insurance companies and other profit-driven entities in the healthcare system to restrict diagnosis and care.

Comments by Dr. Leora Horwitz, one of the study authors and director of the Center for Healthcare Innovation and Delivery Science at New York University, give some sense of the misgivings felt by serious scientists. Horwitz stated, “This study is an important step toward defining Long COVID beyond any one individual symptom. This definition—which may evolve over time—will serve as a critical foundation for scientific discovery and treatment design.”

Certainly, a working definition that medical communities can agree on is critical. But after three years and nearly all the $1.2 billion given to the NIH already spent, one must ask how much another observational study contributes to answering pressing questions affecting patients that have not already been addressed in more than 13,000 previous reports, as tallied by the LitCOVID search engine?

Why have there been so many delays in conducting clinical trials studying potential treatments and preventative strategies in the acute phase of infection that could reduce or eliminate the post-acute sequelae? Where is the urgency at the NIH and in the Biden administration to expand funding and initiate an all-out drive to develop treatments for Long COVID like the $12.4 billion spent on the COVID vaccines?

Scoring post-acute symptoms

The findings in the recent study, published on May 25, 2023, in JAMA, titled, “Development of a Definition of Postacute Sequelae of SARS-CoV-2 Infection,” are somewhat limited and problematic in their current formulation. The authors have identified 12 primary symptoms that distinguish COVID survivors with Long COVID from those without those aftereffects. These include loss of smell or taste (8 points), post-exertional malaise (7 points), chronic cough (4 points), brain fog (3 points), thirst, (3 points), heart palpitations (2 points), chest pain (2 points), fatigue (1 point), dizziness (1 point), gastrointestinal symptoms (1 point), issues with sexual desire or capacity (1 point), and abnormal movements (1 point).

Assigning points to each of the 12 symptoms and adding them up gives a cumulative total for each patient. Anyone scoring 12 or higher would be diagnosed as afflicted with PASC, accounting for 23 percent of the total. In general, the higher the score, the greater the disability in performing daily activities.

The researchers also noted that certain symptom combinations occurred at higher rates in certain groups, leading to identifying four clusters of Long COVID based on symptomology patterns, ranging from least severe to most severe in terms of impact on quality of life. Why such clusters were seen remains uncertain.

Some symptoms were more common than others, and this did not correspond to the severity of the symptoms as measured approximately by the points. Symptoms of post-exertional malaise (87 percent), brain fog (64 percent), palpitations (57 percent), fatigue (85 percent), dizziness (62 percent), and gastrointestinal disturbances (59 percent) were most common.

The study’s lead author, Tanayott Thaweethai from Massachusetts General Hospital and Harvard Medical School, explained, “This offers a unifying framework for thinking about Long COVID, and it gives us a quantitative score we can use to understand whether people get better or worse over time.”

Andrea Foulkes, the corresponding author and principal investigator of the RECOVER Data Resource Core and professor at Harvard Medical School, said, “Now that we’re able to identify people with Long COVID, we can begin doing more in-depth studies to understand the mechanisms at play. These findings set the stage for identifying effective treatment strategies for people with Long COVID—understanding the biological underpinnings is going to be critical to that endeavor.”

The currently evolving definition could have significant implications, and not just medically. For instance, if people suffer only brain fog and post-exertional malaise and score less than 12 on their symptomology, they would not be construed as having PASC. Under such a construct, the definition could be used by employers and health insurers to deny compensation or treatment by telling people they don’t have a recognized Long COVID complication. Additionally, it is not clear how long these symptoms have to be present before the diagnosis is accepted.

Lisa McCorkell, one of the authors of the study, explained on her social media account, “If people didn’t meet the scoring threshold for PASC+, that doesn’t mean they don’t have PASC! It means they are unspecified. Unspecified includes people with Long COVID. Future iterations of the model will aim to refine this—that will include doing analysis using the updated RECOVER symptoms survey, adding in tests/clinical features and ultimately biomarkers. That is also why this isn’t meant to be an official prevalence study. The sample is not fully representative, but also, we know that there are people in the unspecified groups that have PASC.”

She continued, “It is very clear throughout the paper that in order for this to be actionable at all, iterative refinement is needed. In presenting this to NIH leadership, they are fully aware of that. But the press is not fully understanding the paper which could have dangerous downstream effects. Since the beginning of working on this paper I’ve done everything I could to ensure the model presented in this paper is not used clinically.”

Unfortunately, in the world of capitalism, such things take on a life of their own. The definitions will influence how health systems will choose to view these patients and demand their clinicians abide by prescribed diagnostic codes. This has the potential to dismiss millions with Long COVID symptoms and deny them access to potential treatments if and when they materialize.

The concerns of Elisa Perego

Dr. Elisa Perego, who suffers from Long COVID and coined the term, offered the following important observations.

In response to the publication, she wrote, “Presenting a salad of 12 symptoms, (many of which many patients might not even experience) as the most significant in #LongCOVID is also detrimental to new patients, who might be joining the community now, and might not recognize themselves in the symptom list.”

She added, “We are also in 2023. There are thousands and thousands of publications from across the world that discuss imaging, tests, clinical signs (=objective measurements), biomarkers, etc. related to acute and #LongCOVID. We have many insights into the pathophysiology already. The #LongCOVID and chronic illness community deserve more. Other diseases, including diseases linked to infections, have sadly been reduced to a checklist of symptoms in the past. This has made research, recognition, and a quest for treatment much more difficult.”

There are additional findings in the report worth underscoring as they provide a glimpse into the ever-growing crisis caused by forcing the world’s population to “live with the virus.”

Hannah Davis, a Long COVID advocate and researcher, with Dr. Eric Topol, Lisa McCorkell, and Julia Moore Vogel, wrote an important review on Long COVID in March, which was published in Nature. She said of the RECOVER study, “The overall prevalence of #LongCOVID is ten percent at six months. The prevalence for those who got Omicron (or later) AND were vaccinated is also ten percent … [However] reinfections had significantly higher levels of #LongCOVID. Even in those who had Omicron (or later) as their first infection, 9.7 percent with those infected once, but 20 percent of those who were reinfected had Long COVID at six months after infection.”

Furthermore, she said, “Reinfections also increased the severity of #LongCOVID. Twenty-seven percent of first infections were in cluster four (worst) versus 31 percent of reinfections.” These facts have considerable implications.

Immunologist and COVID advocate Dr. Anthony Leonardi wrote on these findings, “If Omicron reinfections average six months [based on current global patterns of infection], and Long COVID rates for reinfection remain 10 to 20 percent, the rate of long COVID in the USA per lifetime will be over 99.9 percent. In fact, the average person would have different manifestations of Long COVID at different times many times over. Some things reverse—like anosmia [loss of smell]. Others, like [lung] fibrosis don’t reverse so well.”

The work done by these authors deserves credit and support. Every effort to bring answers to these critical questions is vital. The criticism to be made is not directed at the researchers who work diligently putting in overtime to see the research is conducted with the utmost care and obligation it merits. Rather, it should be directed at the very institutions that have adopted “living with the virus” as a positive good for of public health.

The Biden administration neglects Long COVID

In a recent scathing critique of the Biden administration and the NIH by STAT News, Rachel Cohrs and Betsy Ladyzhets place the issue front and center. In their opening remarks, they write, “The federal government has burned through more than $1 billion to study Long COVID, an effort to help the millions of Americans who experience brain fog, fatigue, and other symptoms after recovering from a coronavirus infection. There’s basically nothing to show for it.”

They continue, “The NIH hasn’t signed up a single patient to test any potential treatments—despite a clear mandate from Congress to study them. And the few trials it is planning have already drawn a firestorm of criticism, especially one intervention that experts and advocates say may actually make some patients’ Long COVID symptoms worse.” This is in reference to a planned study where Long COVID patients would be asked to exercise as much as possible, when it has clearly been shown that such activities have exacerbated the symptoms of Long COVID patients.

As the report in STAT News explains, there has been a complete lack of accountability in how the NIH funds were used. Much of the work to run the RECOVER trial has been outsourced to major universities.

Michael Sieverts, a member of the Long COVID Patient-led Research Collaborative with expertise in federal budgeting for scientific research, told STAT, “Many of the research projects associated with RECOVER have been funded through these organizations rather than directly from the NIH. This process makes it hard to track how decisions are made or how money is spent through public databases.”

In April the Biden administration announced they were launching “Project Next Gen,” which is like the Trump-era COVID vaccine “Warp Speed Operation.” It has promised $5 billion to fund the development of the next iteration of vaccines through partnership with private-sector companies, monies freed up from prior coronavirus aid packages. Incredibly, it has left Long COVID out of the plan.

Indeed, this diverting of money back into the hands of the pharmaceuticals and selling it as the Biden administration’s continued proactive response to the ongoing pandemic, while divesting all interest in preventing or curing Long COVID, is on par with every effort the administration has made to peddle the myth that “the pandemic is really over.” Long COVID is one of the central elements of the worst public health threat in a century, in a pandemic that is far from ended.

2 notes

·

View notes

Text

BULLMES. 45% per month on AI

BULLMES

IS A GROWING BRAND ON THE MARKET OF CRYPTOCURRENCIES AND FINANCIAL TECHNOLOGY.

We created a business and arranged everything in such a way that our working system brings profit to absolutely everyone. Our company is the leading experts, traders, managers of high-yield investments in the cryptocurrency market.

Safe and reliable cryptocurrency products for investors, powered by an interaction of artificial intelligence and professional traders.

INVESTMENT TARIFS

NFTs Trade - ROI 28% in monthMin invest: $100 Max invest: $5000 Working time: 9 months

Crypto Arbitrage - ROI 30% in month Min invest: $200 Max invest: $10000 Working time: 5 months

Copy Trading - ROI 33% in monthMin invest: $300 Max invest: $15000 Working time: 6 months

Memecoins Trade - ROI 35% in month Min invest: $1000 Max invest: $25000 Working time: 7 months

Futures Trade - ROI 40% in monthMin invest: $1000Max invest: $50000Working time: 8 months

Dex-Bot - ROI 45% in monthMin invest: $700Max invest: $70000Working time: 7 months

You can invest in USDT (TRC20) BUSD (BEP20) USDT (ETH)

About company BULLMES launches advanced crypto platform with access to cryptocurrency investment products. We offer a range of products to help you make the most of your investment. Use a reputable and experienced crypto company to invest in the cryptocurrency market. Our investment opportunities give you the chance to choose where you want to invest and make money while you relax.

The profit generated by traders, bots, distribution and use of money in cryptocurrency transactions is received by three parties in this process: investors, traders and our company. Insuring against investor risk is our priority. To eliminate the possibility of investment losses, we set aside excess profits in reserve funds. And our experts are on hand at all times to help you get the most out of your investment.

The Affiliate Program Only a deposit of $100 or more opens the Affiliate Program at all five levels. By inviting partners, you can earn up to 14% profit from all 5 levels. 7% 3% 2% 1% 1%

For the turnover of partners of 1 and 2 levels you will receive a bonus.

Team turnover only from referrals of the first and second level 1 Stage - $50 000 Turnover = $1000 bonus

2 Stage - $ 150 000 Turnover = $3000 bonus

3 Stage - $ 400 000 Turnover = $8000 bonus

4 Stage - $ 1 000 000 Turnover = $20 000 bonus

Registration

3 notes

·

View notes

Text

Enhancing Revenue Cycle Management in Medical Billing with Anesthesiology Billing Services

Effective revenue cycle management in medical billing is essential for ensuring financial success and operational efficiency in healthcare. Within the realm of specialized billing, anesthesiology billing services play a critical role in managing claims, maximizing reimbursements, and reducing denials. Physicians, particularly anesthesiologists, can benefit from optimized RCM strategies that streamline financial operations and improve cash flow.

Understanding Revenue Cycle Management in Medical Billing

Revenue Cycle Management (RCM) refers to the financial process healthcare organizations use to track patient care episodes from registration and appointment scheduling to the final payment of a balance. Effective revenue cycle management in medical billing ensures that providers receive accurate and timely payments for their services while reducing administrative burdens and claim rejections.

Key Components of Revenue Cycle Management in Medical Billing:

Patient Registration & Eligibility Verification – Accurate patient data collection and insurance eligibility confirmation.

Medical Coding & Documentation – Assigning proper CPT, ICD-10, and HCPCS codes to procedures.

Claims Submission & Tracking – Sending claims to insurance payers and monitoring their status.

Denial Management & Appeals – Identifying common reasons for denials and implementing corrective actions.

Accounts Receivable (AR) Management – Monitoring outstanding payments and optimizing collections.

Regulatory Compliance & Security – Ensuring adherence to HIPAA, CMS guidelines, and other industry regulations.

The Importance of Anesthesiology Billing Services

Anesthesiology billing is highly complex due to the unique nature of anesthesia procedures, time-based coding, and intricate reimbursement models. Anesthesiology billing services are designed to ensure accurate claim submissions, prevent revenue leakage, and improve practice profitability.

Benefits of Specialized Anesthesiology Billing Services:

Accurate Time-Based Coding – Ensuring that anesthesia time units are correctly documented and billed.

Optimized Reimbursement Models – Managing different reimbursement methods, including base units and time units.

Efficient Claim Processing – Reducing errors and increasing first-pass acceptance rates for claims.

Improved Denial Management – Identifying and resolving common denial reasons specific to anesthesiology.

Regulatory Compliance Assurance – Adhering to compliance requirements and payer guidelines.

Real-Time Revenue Analytics – Providing insights into revenue performance and identifying inefficiencies.

Challenges in Revenue Cycle Management for Anesthesiology Billing

Despite advancements in medical billing, anesthesiologists face multiple challenges in revenue cycle management in medical billing, including:

Time-Based Billing Complexities – Accurately tracking and billing anesthesia time units.

High Claim Denial Rates – Errors in coding, documentation, and insurance verification can lead to increased claim rejections.

Increased Administrative Burdens – Managing billing and revenue cycle operations takes time away from patient care.

Payer-Specific Regulations – Keeping up with changing billing rules and guidelines.

Delayed Payments and Revenue Losses – Inefficient AR management leads to cash flow disruptions.

How Physicians Can Optimize Revenue Cycle Management with Anesthesiology Billing Services

1. Leverage AI-Powered Billing Solutions

AI-driven revenue cycle management in medical billing automates coding, detects errors, and optimizes claim submission processes.

2. Implement Advanced Claim Scrubbing Techniques

Using automated claim scrubbing tools reduces errors and enhances claim acceptance rates.

3. Outsource Anesthesiology Billing Services

Partnering with specialized billing experts ensures compliance, coding accuracy, and faster reimbursements.

4. Utilize Real-Time RCM Analytics for Revenue Optimization

RCM analytics tools provide deep insights into billing performance, allowing for proactive decision-making.

5. Strengthen Denial Management Strategies

Implementing a robust denial management process helps prevent recurring claim denials and improves cash flow.

Future Trends in Revenue Cycle Management for Anesthesiology Billing

The future of revenue cycle management in medical billing and anesthesiology billing services is evolving with technology-driven advancements and regulatory updates. Key trends include:

AI and Machine Learning for Billing Optimization – Automating coding processes and improving accuracy.

Blockchain for Secure Transactions – Enhancing transparency and reducing fraudulent activities.

Cloud-Based RCM Platforms – Increasing accessibility and efficiency in managing billing operations.

Telemedicine Billing Integration – Addressing billing complexities for remote anesthesiology services.

Conclusion

Optimizing revenue cycle management in medical billing with specialized anesthesiology billing services is essential for financial stability and operational success. Physicians and anesthesiologists can maximize revenue, minimize denials, and enhance compliance by adopting AI-driven billing solutions, outsourcing billing processes, and leveraging real-time analytics.

Investing in advanced RCM strategies and anesthesiology billing solutions ensures seamless revenue management, reduced administrative burdens, and improved patient care delivery. As the healthcare landscape evolves, embracing technology-driven RCM advancements will be crucial for long-term financial health and efficiency.

0 notes

Text

The Hidden Edge: Mastering Fractal Trading & Hedging Strategies for Precision Profits The Market is a Mess—But It’s a Predictable Mess If you’ve ever felt like the Forex market has a personal vendetta against you, you’re not alone. One minute, your trade is thriving. The next, it’s nosediving faster than a bad reality TV show. But what if I told you there’s a way to read these chaotic movements, predict them, and even turn them into consistent profits? Welcome to fractal trading and hedging strategies, the ultimate one-two punch for market domination. Why Most Traders Are Clueless About Fractals (And How You Can Outmaneuver Them) Most traders focus on traditional indicators—RSI, MACD, Bollinger Bands. But here’s the kicker: the real power lies in fractals, those repeating market structures that reveal hidden patterns in price action. Introduced by the legendary Bill Williams, fractals act as the market’s subconscious mind, exposing where price is likely to reverse. The Underground Guide to Fractal Trading A fractal is a five-bar pattern where the middle bar is the highest or lowest among its neighbors. The moment this pattern forms, it signals a potential reversal. How to Identify Fractals Like a Pro - Look for clusters: A single fractal is like a lone wolf—unreliable. But when you spot clusters around key levels, they scream market intent. - Align with trends: Fractals work best when combined with trend confirmation tools like the Alligator Indicator (also by Bill Williams). - Use multiple time frames: A fractal on the 1-hour chart is good. A fractal aligning across the 1H, 4H, and daily charts? That’s Forex gold. Hedging Strategies: The Secret Insurance Policy of Elite Traders Hedging is the art of making money even when you're wrong—something 95% of traders wish they had mastered before their accounts evaporated. The Smart Hedge Method - Trade Both Directions: When you place a buy, also place a sell order at a strategic level. This way, you capture breakouts regardless of direction. - Use Fractals for Entry: A fractal breakout on a higher timeframe signals where to place your hedge positions. - Adjust Lot Sizes: Your hedge shouldn’t be 1:1. Instead, weight your primary position higher while keeping the hedge smaller for controlled losses. Fractals + Hedging = A Foolproof Trading Blueprint Here’s how you can merge these two strategies for ultimate precision: - Identify a dominant fractal breakout zone. - Enter in the breakout direction while setting a hedge at the nearest opposite fractal. - Scale into winning trades—when price respects a fractal, add positions to ride the trend. - Use news events as confirmation—hedging works beautifully around major news releases like NFPs or rate decisions. Elite Trader Secrets: Why This Works When Everything Else Fails Most traders are reactive, chasing price like a cat after a laser pointer. Fractal trading and hedging make you proactive—you already know where reversals are likely to happen. You position yourself strategically, and you profit regardless of short-term noise. Pro Tip: The best fractal zones align with institutional order blocks. If you can match these, you’re essentially trading alongside hedge funds—without them knowing you exist. Final Thoughts: Are You Ready to Play Chess While Others Play Checkers? The market is ruthless to those who don’t adapt. Fractal trading and hedging strategies put you miles ahead of the herd, giving you the precision and risk control necessary for long-term success. Want more exclusive tactics? Dive deeper into advanced strategies with our free Forex education resources and join the StarseedFX community to access insider insights. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Less Expensive Dental Implants – Quality Care at a Lower Cost

Dental implants are a popular and effective solution for replacing missing teeth. They provide a natural look and feel, enhancing both function and aesthetics. However, the high cost of dental implants often discourages many people from considering them. The good news is that less expensive dental implants are available, offering quality care at a lower cost without compromising on safety or effectiveness.

Understanding Dental Implants

Dental implants are artificial tooth roots made of biocompatible materials like titanium. They are surgically placed into the jawbone, providing a strong foundation for fixed or removable replacement teeth. The implant process involves several steps: initial consultation, implant placement, healing period, and attachment of the prosthetic tooth.

Why Are Dental Implants Expensive?

The cost of dental implants can be attributed to several factors:

Materials Used: High-quality titanium and ceramic materials are costly.

Surgical Procedure: The process requires advanced surgical skills and equipment.

Customization: Each implant is tailored to fit the patient’s specific dental structure.

Laboratory Costs: Crafting crowns or dentures involves detailed work by dental technicians.

Follow-Up Care: Regular check-ups and maintenance add to the overall cost.

How to Find Less Expensive Dental Implants

Finding affordable dental implants doesn’t mean settling for poor quality. Here are some strategies to reduce costs:

Dental Schools: Many dental schools offer implant procedures at reduced rates. Supervised by experienced professionals, students perform the procedures as part of their training.

Dental Tourism: Traveling to countries with lower healthcare costs can significantly reduce expenses. Countries like Mexico, Hungary, and Thailand are popular for affordable dental care.

Insurance and Financing Plans: Some insurance plans cover part of the implant cost. Flexible financing options, such as payment plans or medical credit cards, can also make implants more affordable.

Comparing Clinics: Prices can vary widely between dental clinics. Obtaining multiple quotes helps identify competitive pricing without compromising quality.

Non-Profit Organizations: Some charitable organizations offer free or low-cost dental care, including implants, to those in need.

Factors to Consider When Choosing Less Expensive Dental Implants

While cost is a significant factor, other considerations are crucial to ensure quality care:

Credentials of the Dentist: Verify the qualifications, experience, and certifications of the dental professional.

Technology and Equipment: Advanced technology can enhance precision and reduce complications.

Patient Reviews and Testimonials: Feedback from previous patients can provide insights into the quality of care.

Warranty and Follow-Up Care: Reliable clinics often offer warranties on implants and provide comprehensive aftercare services.

Benefits of Affordable Dental Implants

Opting for less expensive dental implants can offer numerous benefits:

Improved Oral Health: Implants prevent bone loss and maintain facial structure.

Enhanced Aesthetics: They look and feel like natural teeth, boosting confidence.

Durability: With proper care, implants can last a lifetime.

Cost-Effective in the Long Run: Despite the initial investment, implants are more durable and require less maintenance than other dental solutions.

Potential Risks and How to Mitigate Them

Choosing low-cost dental implants comes with potential risks, but these can be mitigated with proper precautions:

Infection: Ensure the clinic follows strict hygiene protocols.

Implant Failure: Choose experienced professionals and high-quality materials.

Hidden Costs: Clarify all costs upfront to avoid unexpected expenses.

Conclusion

Less expensive dental implants provide a viable solution for those seeking quality dental care on a budget. By researching options, verifying credentials, and considering all associated costs, patients can achieve excellent results without compromising their health or financial well-being. Affordable dental implants are not just a dream; they are an accessible reality for many, ensuring that everyone can enjoy the benefits of a healthy, beautiful smile.

0 notes

Text

Financial Accountant Needed at Eunisell Limited (Application Deadline: 04 February 2025) – Apply Now

Eunisell Limited is a leading African provider of specialty chemicals and engineering solutions, dedicated to enhancing operational efficiency across various industries. With a strong focus on innovation and customer satisfaction, Eunisell is committed to delivering top-tier solutions tailored to clients' needs. This job opportunity offers aspiring professionals the chance to contribute to a dynamic and fast-growing organization while advancing their careers.

About Eunisell Limited

Eunisell Limited is a leading African provider of specialty chemicals and engineering solutions, committed to enhancing operational efficiency across various industries. With a strong presence in the oil and gas, manufacturing, and FMCG sectors, Eunisell offers innovative solutions tailored to clients' specific needs.

Job Title: Financial Accountant

- Location: Lagos, Nigeria - Employment Type: Full-time - Salary: ₦5,000,000 - ₦7,000,000 per annum

Job Summary

The Financial Accountant will be responsible for managing the company’s financial transactions, ensuring compliance with accounting standards, and providing insights that support business decision-making. The ideal candidate should possess strong analytical skills, attention to detail, and a thorough understanding of financial regulations.

Salary Range

Eunisell Limited offers a highly competitive salary package, with compensation based on experience, qualifications, and industry standards. The salary range for this position is between ₦5,000,000 - ₦7,000,000 per annum, along with performance-based incentives and bonuses.

Key Responsibilities

- Prepare and analyze financial statements, including profit and loss accounts, balance sheets, and cash flow statements. - Ensure compliance with regulatory standards such as IFRS and local tax laws. - Monitor financial controls and procedures to mitigate risk and improve efficiency. - Coordinate internal and external audits and provide necessary documentation. - Oversee budgeting, forecasting, and financial planning activities. - Conduct variance analysis and report financial performance to management. - Manage accounts payable and receivable processes efficiently. - Ensure timely and accurate tax filings, including VAT, corporate tax, and payroll tax. - Assist in financial strategy development to optimize the company's financial performance. - Collaborate with other departments to ensure financial alignment with business objectives.

Qualifications and Experience

- Bachelor's degree in Accounting, Finance, or a related field. - Professional certification such as ACA, ACCA, or CPA is highly desirable. - Minimum of 5 years of experience in financial accounting, preferably in the oil and gas or manufacturing sectors. - Strong knowledge of financial reporting standards (IFRS). - Proficiency in accounting software such as SAP, QuickBooks, or Sage. - Excellent analytical, organizational, and problem-solving skills. - High attention to detail and accuracy. - Strong interpersonal and communication skills.

Required Skills

- Financial Analysis: Ability to interpret financial data and provide meaningful insights. - Regulatory Compliance: Familiarity with Nigerian tax laws and financial regulations. - Budgeting and Forecasting: Experience in financial planning and control. - ERP Systems Proficiency: Working knowledge of enterprise resource planning tools. - Attention to Detail: Ensuring accuracy in financial reporting and transactions.

Benefits of Working at Eunisell

- Competitive salary package with performance-based incentives. - Health and wellness programs. - Professional growth opportunities with ongoing training. - Collaborative and dynamic work environment. - Pension and insurance benefits.

How to Apply

Interested and qualified candidates should submit their applications via email to [email protected] with the subject line: Application for Financial Accountant Position. Application Deadline: 4th February, 2025.

Selection Process

- Application Review: Shortlisted candidates will be contacted for further assessment. - Interview Process: Selected applicants will undergo a series of interviews, including technical and behavioral assessments. - Final Selection: Successful candidates will receive an offer letter and onboarding details.

Conclusion

Joining Eunisell Limited as a Financial Accountant offers an excellent opportunity to grow your career in a dynamic and innovative environment. If you meet the requirements and are passionate about financial excellence, we encourage you to apply today! Frequently Asked Questions (FAQs) Q: What are the working hours at Eunisell Limited? A: The standard working hours are from 8:00 AM to 5:00 PM, Monday to Friday. Q: Is remote work available for this role? A: Currently, this position requires on-site work; however, flexible work arrangements may be considered based on performance. Q: What is the career growth potential for this role? A: Eunisell provides structured career development programs, mentorship, and leadership training opportunities. Read the full article

0 notes

Text

5 Ways to Improve Revenue Cycle Management in Your Practice

Revenue Cycle Management (RCM) is crucial for the financial health of healthcare providers. Effective RCM ensures that healthcare organizations are paid for the services they provide, and with minimal disruptions. In this blog, we’ll explore key strategies for optimizing RCM, focusing on streamlining medical billing, enhancing claims processing, and leveraging data analytics.

We’ll also delve into the importance of patient financial engagement and the role of comprehensive RCM solutions like Waseel’s in driving efficiency and profitability.

1. Streamlining Medical Billing Processes

Efficient medical billing is the backbone of effective revenue cycle management. Errors in billing can lead to delays, claim denials, and significant financial losses. By implementing Waseel’s Revenue Cycle Management (WRCM), healthcare providers can automate billing processes, reduce errors, and ensure accurate coding. For instance, Waseel’s solution integrates seamlessly with NPHIES, providing free integration that ensures compliance with Saudi healthcare regulations. The result is a smoother billing process that enhances cash flow and reduces administrative burdens.

A clinic using WRCM reports a 10% reduction in claim rejections, directly impacting their revenue flow positively.

2. Enhancing Medical Claims Processing

Accurate and timely claims processing is critical for maintaining the financial health of any healthcare practice. Delays in claims processing can lead to cash flow problems and increased administrative costs. Waseel’s WRCM offers advanced claims management features that allow real-time tracking, quick identification of issues, and error-free submissions. This not only reduces the chances of claim denials but also speeds up the reimbursement process, improving the overall financial stability of the practice.

With Waseel’s system, healthcare providers can increase revenue by up to 30% through enhanced claims management and accurate coding.

3. Investing in Financial Data Analysis

Financial data analysis is essential for identifying trends, detecting anomalies, and making informed financial decisions. Regular analysis of financial data helps manage cash flow, reduce costs, and optimize revenue. Waseel’s WRCM provides comprehensive financial reporting tools that offer deep insights into the financial performance of healthcare organizations. By leveraging these tools, healthcare administrators can proactively address financial challenges and improve the profitability of their practices.

A hospital using Waseel’s financial reporting tools was able to identify a consistent issue with claim rejections related to a specific insurance provider, allowing them to adjust their processes and reduce these rejections.

4. Implementing Comprehensive Revenue Cycle Management Solutions

A holistic approach to RCM can significantly enhance operational efficiency. Waseel’s WRCM covers all aspects of revenue cycle management, from patient registration to final payment collection. This comprehensive solution ensures that all processes are seamlessly integrated, reducing the chances of errors and ensuring that revenue is maximized. Additionally, Waseel offers training and certification in medical coding and billing, further enhancing the effectiveness of the RCM process.

Integrating Waseel’s RCM solution resulted in a 15% reduction in administrative time spent on billing and claims processing in a mid-sized clinic.

5. Focusing on Patient Financial Engagement

Engaging patients in their financial responsibilities is key to a successful RCM strategy. Clear communication about billing, insurance coverage, and payment options can reduce confusion and improve payment rates. Waseel’s Dawy solution enables healthcare providers to offer online payment portals and flexible payment plans, which not only enhance patient satisfaction but also encourage timely payments. Additionally, Dawy integrates with existing healthcare systems to streamline appointment bookings and verify insurance eligibility in real time.

Dawy’s user-friendly interface has been shown to increase patient engagement, leading to higher payment compliance and satisfaction rates.

The Final Word

Optimizing revenue cycle management is essential for the financial health of healthcare providers. By streamlining billing processes, enhancing claims processing, investing in financial data analysis, and focusing on patient engagement, healthcare organizations can improve their profitability and operational efficiency. Waseel’s comprehensive solutions, including WRCM and Dawy, are designed to support these efforts, ensuring that healthcare providers can focus on delivering quality care while maintaining financial stability.

Interested in learning how Waseel can transform your revenue cycle management? Contact us today for a consultation and see how our solutions can benefit your practice.

Source: Ways to Improve Revenue Cycle Management for healthcare providers

0 notes

Text

The Role of Regional Expertise in Medical Billing Services

Medical billing is a cornerstone of healthcare revenue management, ensuring that providers are accurately compensated for their services. However, the complexities of billing are amplified when local regulations, payer-specific guidelines, and compliance requirements come into play. This is where the role of regional expertise becomes indispensable. A medical billing company that understands the nuances of local healthcare policies can transform the way practices manage their billing cycle, compliance, and revenue.

Regional Expertise: A Game-Changer in Medical Billing Practice Management

The medical billing cycle is intricate, requiring precise coordination between multiple stages, from patient registration to claim submission and payment posting. For healthcare providers operating in specific regions, this process is influenced by localized factors such as:

Insurance Policies: Different regions have unique payer regulations, leading to varying claim requirements.

State-Specific Laws: Each state enforces distinct healthcare compliance standards that must be adhered to during billing.

Demographics: Patient profiles and healthcare demands differ based on the region, affecting the types of claims processed.

By partnering with a billing company that specializes in regional expertise, providers can address these challenges effectively, ensuring smoother workflows and fewer bottlenecks.

Key Benefits of Regional Medical Billing Expertise

Tailored Billing Management ServicesA billing company with regional insight can adapt its processes to align with local payer guidelines, reducing claim rejections and denials. Customized billing management services also help healthcare providers navigate specific challenges unique to their area.

Seamless Compliance with FIPS StandardsCompliance is a critical aspect of medical billing, especially for safeguarding sensitive patient data. Regional expertise ensures adherence to FIPS-compliant medical billing management standards, providing both security and peace of mind.

Optimized Revenue Cycle Management (RCM)Healthcare revenue cycle management (RCM) relies heavily on efficient billing practices. Regional expertise allows for better understanding of payer relationships, claim follow-ups, and collections, ensuring providers receive timely reimbursements.

Localized Knowledge for Faster ApprovalsFamiliarity with local payer processes expedites claim approvals. A regional billing company knows how to address common payer issues, reducing delays in reimbursements and enhancing cash flow.

Proactive Denial ManagementRegional experts can anticipate common reasons for claim denials in their specific area, enabling proactive denial management. This minimizes revenue loss and improves overall practice performance.

Regional Expertise in Action: The FIPS Advantage

FIPS compliance is a federal standard critical for protecting patient data and maintaining healthcare security. Providers in the USA must work with FIPS-compliant medical billing services to ensure their operations meet the highest security standards. A regionally focused billing company ensures:

Proper encryption protocols for patient data.

Adherence to both federal and state-specific data protection guidelines.

Improved trust between patients, providers, and payers.

Technology and Regional Expertise: A Perfect Partnership

Modern healthcare RCM companies combine cutting-edge technology with local expertise to offer the best results. For example:

Data Analytics: Identifying regional claim trends to improve accuracy and speed.

Automation: Streamlining repetitive billing tasks while staying compliant with local payer requirements.

Cloud Solutions: Enhancing accessibility while ensuring data security through FIPS compliance.

By integrating advanced tools with localized insights, billing companies can offer tailored solutions that drive practice efficiency and profitability.

Why Regional Expertise is Crucial for Healthcare Management Billing and Collections

Efficient billing and collections are at the heart of every successful practice. Regional expertise ensures providers:

Stay ahead of state-specific policy updates.

Address patient billing concerns effectively.

Maximize collections by reducing disputes and improving claim accuracy.

Conclusion

Healthcare providers face an uphill battle managing the complexities of medical billing, but regional expertise offers a distinct advantage. From understanding the intricacies of the billing cycle to ensuring FIPS-compliant medical billing services, a regionally focused billing company simplifies practice management and strengthens the revenue cycle.

In an era where compliance, security, and efficiency are paramount, partnering with a provider that combines local knowledge with cutting-edge technology is the smartest choice. With the right support, practices can shift their focus back to patient care, confident that their billing processes are in expert hands.

0 notes

Text

Opening Success: How Phoenix Medical Billing Transforms Healthcare Revenue Management

Unlocking Success: How Phoenix Medical Billing Transforms Healthcare Revenue Management

In today’s complex healthcare landscape, effective revenue management is critical for the sustainability of healthcare practices. Phoenix Medical Billing has emerged as a transformative force, streamlining operations and enhancing revenue capture for medical providers. This article explores how phoenix Medical Billing helps healthcare organizations thrive by optimizing revenue management processes.

Understanding the Importance of Medical Billing

Medical billing is the process of submitting, tracking, and providing invoices for healthcare services. Efficient billing practices can lead to improved cash flow, minimized revenue losses, and increased practice profitability. Here are several reasons why it’s crucial:

Financial Health: Proper billing ensures that healthcare providers receive payments for their services, promoting financial stability.

Patient Satisfaction: Clear billing practices enhance patient trust and satisfaction, which is vital for retention.

Compliance: Effective billing ensures compliance with regulations, reducing the risk of audits and penalties.

How Phoenix Medical Billing Transforms Revenue Management

Phoenix medical Billing employs cutting-edge strategies and technologies to maximize revenue for healthcare providers. Here’s how:

1. Clear Billing Processes

Phoenix Medical Billing emphasizes openness in the billing process. They provide clear invoices and breakdowns of charges to patients, which not only enhances trust but also reduces the number of billing inquiries.

2. Advanced technology Integration

With proprietary software and integrated systems, Phoenix Medical Billing automates billing tasks.This reduces human error and speeds up claims processing. Some key technological benefits include:

electronic Claims Submission: ensures quicker processing of claims by insurance companies.

Real-Time Analytics: Provides insights into financial performance for better decision-making.

Up-to-Date Codes: Regular updates to billing codes help avoid denials and rejections.

3. Comprehensive Service offerings

Phoenix Medical Billing offers a full suite of services designed to manage every aspect of medical billing, including:

Insurance Verification

Patient Billing and Collections

Accounts Receivable Management

Denial Management

Benefits of Choosing Phoenix Medical Billing

Partnering with Phoenix Medical Billing brings multiple advantages to healthcare organizations:

Benefit

Description

Increased Revenue

Maximized billing efficiency leads to higher collections.

Reduced Administrative Burden

Streamlines workload for in-house staff,allowing focus on patient care.

Regulatory Compliance

Ensures adherence to ever-changing healthcare regulations.

enhanced Cash Flow

Faster claim processing boosts overall income.

Case Studies: Success Stories with Phoenix Medical Billing

real-world examples can illustrate the impact of Phoenix Medical Billing. Here are a few success stories:

Case Study 1: Local Medical Practice

A small family practice faced consistent cash flow problems due to delayed payments and claim denials. After partnering with Phoenix Medical Billing, they experienced:

A 40% reduction in claim denials

A 30% increase in collections over six months

Improved patient satisfaction reflected in their feedback surveys

Case Study 2: Specialty Clinic

A specialty clinic struggled with the complexity of billing for a variety of services. With Phoenix Medical Billing’s support:

They decreased the billing cycle time by 50%

Collected 95% of billed amount within 30 days

Practical Tips for Effective Revenue management

To complement the advantages of working with Phoenix Medical Billing, healthcare providers can implement the following practical tips:

Train Staff: Ensure all staff are trained in coding and compliance.

Regularly Review Denials: Understand common reasons for claim rejections to mitigate future issues.

communication: Maintain open communication lines with patients regarding their billing.

Frist-Hand experience with Phoenix Medical Billing

Here is a first-hand account of a healthcare provider who collaborated with Phoenix Medical Billing:

“Since switching to Phoenix Medical Billing, our days in accounts receivable have drastically decreased. The transparency and professionalism displayed by their team has enabled us to concentrate on providing top-notch patient care while they handle our billing process seamlessly.”

- Dr. Sarah Thompson, Family Physician, Sunnyvale Clinic

Conclusion

Phoenix Medical billing has proven to be a game-changer in the realm of healthcare revenue management. By prioritizing transparency, leveraging advanced technology, and offering comprehensive services, they help healthcare practices enhance their financial performance. For providers looking to unlock success and smoothly navigate the complexities of billing, partnering with Phoenix Medical Billing could be the key to achieving sustained growth and patient satisfaction. Embrace the chance to improve your practice’s revenue today!

youtube

https://medicalcodingandbillingclasses.net/opening-success-how-phoenix-medical-billing-transforms-healthcare-revenue-management/

0 notes

Text

Streamlining clinic billing with automated software

The one overriding determinant of operational excellence in any sort of health facility is the streamlining of clinic billing through automated software solutions. By 2025, streamlining clinic billing through automated software is one yardstick for achieving operational excellence. The tools are easier and eliminate most error-causing complications because they liberate more time for the healthcare provider to concentrate on the actual patient care.

Using automated billing software, clinics can accelerate payment cycles, maintain adherence, and provide an intact experience for the patients and employees. With time, Clinthora has been one of the pioneering leaders of healthcare management solutions to have helped the clinics successfully adopt Automated billing software into their respective systems while helping them strengthen the efficiency and fiscal stability.

Accelerated Clinic Billing by Automated Software

Automated billing software is transforming the financial management face in the healthcare arena. From claim processing to generating bills, these applications, in each respect, present unprecedented accuracy and efficiency in clinics, be it of small or any other size. Say goodbye to tedious manual mistakes and time-consuming tasks; instead, clinics are free to shift more focus onto quality patient care.

These systems integrate very complex workflows, such as insurance claims and compliance tracking, in one location using a very accessible interface. More advanced billing capabilities from Clinthora allows clinics to take advantage of everything efficiency automation has to offer to make for smoother, more profitable practices.

Healthcare Payment Automation through Automated billing software

Many areas of traditional healthcare payments are full of inefficiencies like the manual entry of data, delayed claims processing, and the list goes on. Automated billing software can deal with these challenges very easily as they provide effective and user-friendly solutions. Using these software clinics can:

Pay faster.

Reduce administrative burden.

Increase patient satisfaction by clear, transparent billing.

Clinthora and others revolutionize clinics' modes of payment into sleek, error-free systems.

Main Features and Advantages of Automated billing software

Payment Processing

With the availability of automated billing software, clinics can find copies of invoices and reminders relating to matters of payments. After the need for physical follow-ups by the clinics regarding the transactions has been set aside, clinics have cash inflows that are improved and more delayed payments.

Accounting Dedicated Errors

Generally speaking, manual billing processes often lead to errors due to inappropriate information or missing documents. Automatic billing software, such as offered by Clinthora, fundamentally removes these types of errors and, thus, losses related to such errors would decline.

Elaborated Compatibility with their Systems currently in use

Modern billing software will be integrated with other tools, such as EMR and EHR, for easy management. It is hence possible to maintain patient records on a constant update basis for uniform and effective management.

Improved Compliance

Health care regulations are challenging to maintain compliance with. Automated billing software will be designed with the updated compliance standards so as to minimize the risks while assuring that the clinics adhere to the compliance requirement.

Patient Experience

Patients demand bills with higher transparency, containing more detail and easier payment options. Automated billing software ensures greater ease and transparency of payments in handling patient information by making online access as well as mobile access friendly in enhancing their satisfaction and confidence.

Cost-Benefits

A one-time charge in the installation cost is generated for automation, whereas the immense savings over the long run are accrued. The diminished administrative cost, coupled with quickening the pace of the payment cycles and decreasing the number of errors, results in a substantial cost advantage.

Advanced Reporting and Analytics

The analytics provide the clinics with key points regarding their financials. Revenue trend analysis and performance tracking help clinics make intelligent decisions, informed by data.

Drawbacks of Traditional Billing System

Human Mistakes

Inaccurate billing from humans causes delay, dispute, and loss of money.

Lengthy Process

Submission of claims and data entry through a manual process consumes hours and the recovery of revenues.

Patient Satisfaction

Unclear billing practices disturb patients and destroy their confidence in the clinic.

Risk of Compliance

Healthcare regulations are changing constantly, and if one wants to be on top of them, it is not easy without automated billing software.

Why Automated Billing Is the Need of Clinics in 2025

The increasing patient loads and insurance protocols that start becoming unfathomable make it hard for clinics to maintain their streamlined operations. Automated billing software helps alleviate such problems by ensuring that the following occur:

There is timely payment

Administrative burdens are reduced

Patient satisfaction is increased

The systems like Clinthora bring clinics the strength of competing through excellent performance.

Case Study: Clinics That Have Benefited from Using Automated billing software

Insurance Claims Management System Simplified

A multi-specialty clinic implemented Clinthora's automated billing software to expedite claims processing. Outcomes included:

35% reduction in time taken for processing claims.

Higher accuracy in submitting reimbursements.

More satisfied patients with higher resolution rates

Patient Confidence by Being Transparent

A small family clinic used automated billing software, so it began to create accurate, plain-language invoices. This resulted in:

20% fewer complaints

Clinics get a high rating and help in enhancing the name of the clinics.

Smooth collection process via a mobile payment gateway.

How to Decide on the Greatest Automated Billing Software.

The best difference lies in availing the greatest automated billing software. Consider this:

Lowers integration complexities with the established tools and software—EMR/EHR

user-friendly interface

The interface shall be user-friendly to the personnel and patients of the clinic; it will have a minimum steep learning curve.

Scalable

Choose something that can support the growth at the pace desired by your clinics.

Security Compliances.

Data security is the top priority. A solution like Clinthora focuses on compliance and encryption.

Good Support

Good customer support ensures that there are no interruptions in the business and issues are resolved promptly.

The Future of Automated Billing in Healthcare

By 2025, AI and machine learning will redefine the term automated billing software. Some of the key changes include:

Predictive Analytics: revenue trends and inefficiencies

Smarter Payment Options: Personalized payment plans for patients.

Integration with IoT Devices: Real-time health monitoring linked with billing.

Clinthora is one step ahead with such innovations; it keeps updating its software to meet the changing needs of clinics all over.

Conclusion

It brings the clinic billing back into a good orbit. With its installation, it allows clinics to automate the entire billing process, hence eliminating errors, cycles of payments, and even recovering money. Convenience and transparency for a client are worth mentioning herein.

As the demands and regulations rise, tools like Clinthora's automated billing software are only bound to emerge. The automation will then leave clinics free to focus on what really matters: the best patient care and the bottom line of the clinic.

Nowadays, within the highly competitive environment of health, automation is no longer an improvement but a stepping stone for future success.

#automted billing software#clinthora software#clinic management system#appointment scheduling software

0 notes

Text

Mastering Risk Management in Dubai: How Agile Advisors Drive Success in a Dynamic Market

Table of Contents:

Introduction

Importance of Risk Management in Dubai

Role of Agile Advisors in Risk Management

Key Risk Management Strategies in Dubai

Regulatory Landscape in the UAE

Best Practices for Effective Risk Management

The Future of Risk Management in Dubai

Conclusion

1. Introduction

Any business operation must include risk management, which is especially true in a place as competitive and dynamic as Dubai, United Arab Emirates. Due to the city's rapid economic expansion, changing market dynamics, and constantly evolving regulatory environment, businesses in Dubai must proactively identify, evaluate, and manage risks to ensure long-term success. This blog will discuss the importance of risk management, the critical role of agile advisers, and the steps companies can take to manage risk in Dubai.

2. Importance of Risk Management in Dubai

Dubai is a major international economic centre renowned for its inventiveness, advantageous location, and wide range of sectors, from technology and tourism to real estate and banking. However, a number of risks are associated with such a thriving economy. Financial, operational, and strategic risks can affect a company's sustainability and profitability in Dubai. Businesses can reduce these risks and preserve business continuity with effective risk management.

Risk management in Dubai is vital because it allows companies to:

Identify potential threats and vulnerabilities

Minimize financial losses

Ensure compliance with local and international regulations

Enhance decision-making processes

Protect company reputation and assets

3. Role of Agile Advisors in Risk Management

Dubai's companies increasingly rely on nimble advisors for their risk management knowledge in an era of continual change. Agile consultants are experts who help companies adjust to quickly changing environments by assisting them in successfully implementing agile approaches and risk-reduction techniques.

Agile advisors bring several key benefits to risk management:

Flexibility: They help businesses adapt to shifting market conditions, regulatory changes, and technological advancements.

Efficiency: Agile advisors streamline risk management processes, ensuring that organizations remain nimble and responsive.

Collaboration: By fostering a collaborative approach, agile advisors work closely with internal teams to identify risks and formulate strategies for managing them.

Continuous Improvement: Agile advisors promote a culture of continuous assessment and improvement, ensuring that risk management practices evolve alongside the business.

4. Key Risk Management Strategies in Dubai

Risk management strategies in Dubai are diverse and multifaceted. Among the most popular methods are:

Risk Identification: Recognizing potential risks such as market volatility, regulatory changes, or cyber threats.

Risk Assessment: Evaluating the likelihood and potential impact of identified risks.

Risk Mitigation: Implementing strategies to minimize or eliminate risks, such as insurance policies, diversification, or hedging.

Risk Monitoring: Continuously tracking risk factors and ensuring early detection of emerging risks.

Crisis Management: Developing contingency plans to address crises effectively, whether they relate to financial instability, legal issues, or other operational disruptions.

5. Regulatory Landscape in the UAE

As a member of the United Arab Emirates, Dubai boasts a strong regulatory structure that encourages corporate expansion while guaranteeing that enterprises adhere to domestic and global norms. The UAE government has passed several laws and rules that have a direct impact on risk management procedures, such as:

The Dubai Financial Services Authority (DFSA): Oversees financial services and ensures compliance with international standards.

The Securities and Commodities Authority (SCA): Regulates the UAE stock markets and enforces corporate governance rules.

Data Protection Laws: With the rise of digital transformation, businesses must be compliant with laws governing data privacy and cybersecurity risks.

Understanding and navigating the regulatory landscape is a key aspect of risk management in Dubai. Agile advisors often assist organizations in staying compliant with these evolving regulations.

6. Best Practices for Effective Risk Management

To successfully manage risks, businesses in Dubai should adopt the following best practices:

Establish a Risk Management Framework: Develop a formal risk management plan that outlines risk identification, assessment, and mitigation processes.

Invest in Technology: Leverage technology to monitor and track risks in real time. Tools like enterprise risk management (ERM) software can assist in gathering data and analyzing risks.

Create a Risk-Aware Culture: Foster a company-wide mindset where employees understand the importance of risk management and contribute to identifying potential threats.

Review and Update Regularly: Risk management plans should be reviewed and updated regularly to reflect changing circumstances, new risks, and advancements in risk management practices.

Collaborate with Experts: Engage agile advisors and other risk management professionals to gain insights and guidance on best practices.

7. The Future of Risk Management in Dubai

The future of risk management will depend on creativity and flexibility as Dubai develops into a major international centre for finance and commerce. Technology like blockchain, machine learning, and artificial intelligence (AI) will become increasingly crucial in recognizing, evaluating, and reducing risks. Additionally, agile advisers will remain in high demand as companies look for flexibility and reactivity in handling uncertainty.

Since businesses must incorporate sustainability and environmental, social, and governance (ESG) factors into their risk management plans, the UAE's increasing emphasis on these topics also influences risk management methods.

8. Conclusion

In Dubai, risk management is essential for companies trying to survive in a more complicated climate. Businesses may protect themselves from possible dangers and seize opportunities in a rapidly changing market by enlisting the help of agile advisors and implementing effective risk management techniques.

A proactive approach to risk management is essential for success and preserving a competitive edge in Dubai's fast-paced economy. By putting the proper frameworks in place, businesses may reduce risks, overcome obstacles, and continue expanding and succeeding in the UAE's ever-changing business environment.

0 notes

Text

Insurance Fraud Detection Market: Technological Advancements and Key Drivers Fueling Industry Growth in 2025

The global insurance fraud detection market has seen significant growth in recent years, driven by various factors that are reshaping the industry. Fraudulent activities in the insurance sector have become more sophisticated, requiring advanced technologies and strategies to detect and prevent them. The rising prevalence of fraudulent claims and the increasing need for insurers to minimize financial losses have made fraud detection a top priority. This article explores the key drivers that are fueling the growth of the insurance fraud detection market.

Technological Advancements and AI Integration

One of the primary drivers of the insurance fraud detection market is the increasing use of advanced technologies like Artificial Intelligence (AI), Machine Learning (ML), and data analytics. These technologies enable insurers to process large volumes of data more efficiently, identify patterns, and detect suspicious claims. AI-driven solutions can analyze past fraud patterns and continuously adapt to new fraudulent tactics. As AI becomes more sophisticated, fraud detection systems are able to detect complex fraudulent activities that were once difficult to uncover. The integration of machine learning further enhances these systems, allowing them to learn from data and improve accuracy over time.

Rising Incidences of Fraudulent Claims