#accounting&bookkeepingservices

Explore tagged Tumblr posts

Text

Optimize Your Firm’s Financial Management with White Bull! Accounting and CPA firms: Discover the efficiency of outsourced financial solutions. From bookkeeping and payroll to tax preparation, White Bull provides seamless support tailored to the unique needs of professional firms. Let us handle the details so you can focus on what matters most—serving your clients!

👉 Visit us: white-bull.com

#accounting#bookkeeping#payroll#tax returns#outsourced accounting services#AccountingFirms#CPAFirms#OutsourcedAccounting#BookkeepingServices#PayrollSolutions

2 notes

·

View notes

Text

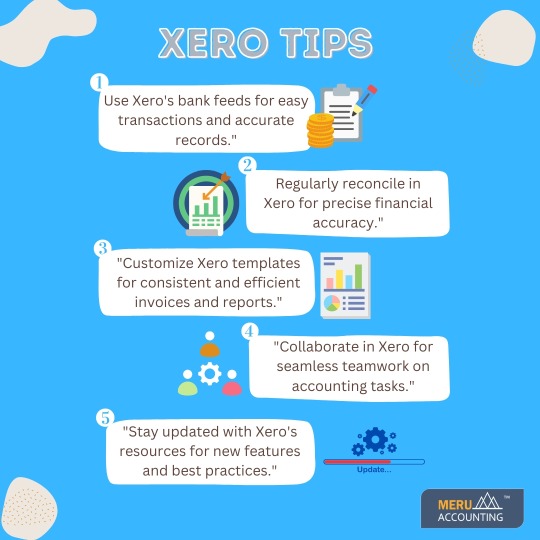

The power of seamless financial management with Xero! Our top tips help you to grow your business.

Meru Accounting is your trusted partner for top-notch accounting and bookkeeping services in the USA, UK, Canada, Australia, UAE, and New Zealand.

#MeruAccounting#xero#xerbookkeeping#xeroaccounting#bookkeepingtips#bookkeepingservices#bookkeepingandaccounting#accounting#accountingservices#usa#uk#canada#uae#australia#newzealand#india

2 notes

·

View notes

Text

#accounting#business#finance#accountants#bookkeeping#financial growth#BookkeepingServices#AccountingSolutions#SmallBusinessFinances#ExpenseManagement#PayrollProcessing#BusinessGrowth#BrushmableBookkeeping

0 notes

Text

At Globus Finanza, we take great pride in being a part of Jacksonville, FL's vibrant business community by offering top-notch outsourced bookkeeping services. Our dedicated team understands the unique needs of local businesses and works tirelessly to ensure that your financial records are handled with care and expertise. By entrusting us with your bookkeeping needs, you can focus on what you do best - running and growing your business. With a team of friendly and experienced professionals who are committed to providing accurate and timely service, Globus Finanza is your trusted partner for outsourced bookkeeping services in Jacksonville, FL.

#accountancy#accounting#accountingfirms#accountingservices#accountingsolutions#bookkeepernearme#bookkeepingandaccountingservices#finance#bookkeeper#bookkeeping#BookkeepingServices#AccountingServices#AccountingFirms#CPAOfficeNearMe#OutsourceAccounting#BookkeeperNearMe#CPAAccountantNearMe#CertifiedPublicAccountantNearMe#Accountancy#OutsourceTaxPreparationServices#TopAccountingFirms#TaxAndAccountingServices#BookkeepingAndAccountingServices#OutsourcingAccountingServices#OutsourcedAccountingFirms#AccountingSolutions#VirtualCFO

0 notes

Text

We help you with the best service for your requirements

Contact Us Today!

#bookkeepingservices#taxation#taxprofessional#marketing#taxplanning#ca#taxrefund#motivation#success#covid#accountingstudent#smallbusinessowner#taxtips#financialfreedom#accountancy#irs#accountingtips#taxpreparation

0 notes

Text

Advanced Bookkeeping Services

0 notes

Text

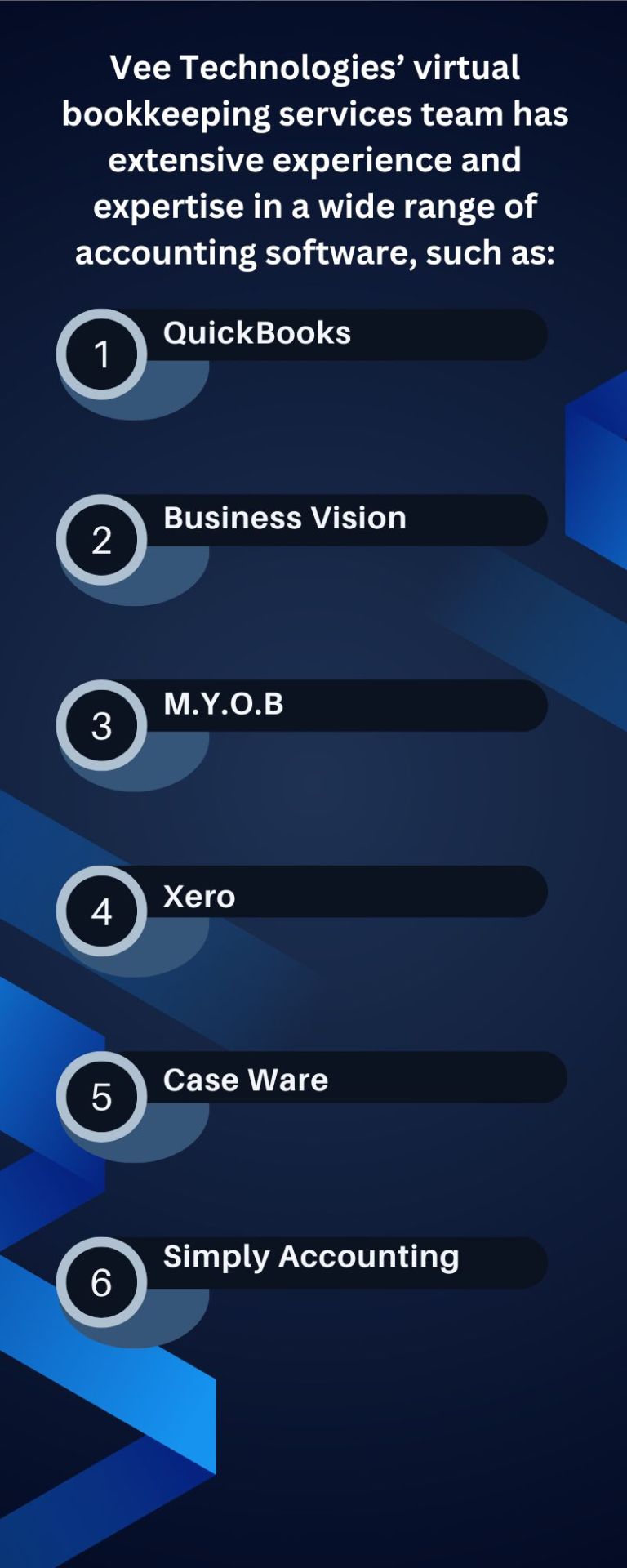

Book Keeping Services - Vee Technologies

Vee Technologies offers a wide array of virtual bookkeeping services that help your organization stay up to date on its finances.

0 notes

Text

Income Tax Return

Income Tax Return(s)

Filing your income tax return (ITR) seems hard, but it’s easier than you think! Here’s how to make it simple: 1. 📂 Get Your Documents Ready: – Form 16 from your employer – Bank statements – Proof of investments – Rent receipts for HRA (House Rent Allowance) – PGBP Income 2. 💸 Claim Your Deductions: – Section 80C: Investments like PPF,…

View On WordPress

#accountingsoftware accountingtips businessmanagement bookkeepingservices accountingservices bookkeeper accountants accountant accou#accountancy#Accounting#business#filing#finance#financial accounting#growth#GST#gyankabhandaar#incometax#itr#itrforms#jhatumkaho#return#salary#TAX#Taxation

0 notes

Text

0 notes

Text

Free QuickBooks Online Setup w/ Month-end Close

Please like, share, comment & follow my post and I'll follow back.

Free QuickBooks Online Setup and month-end close for the month of March only. Get your business setup in QuickBooks Online for free. We will move your Financial Statement from your current financial software to QuickBooks online and produce your company March 2024 Financial Statement for free. This offer is for a limited time only, first come first serviced. Act now! Website like:…

View On WordPress

#accountant#accountantlife#Accountants#Accounting#accountinglife#accountingservices#accountingsoftware#accountingtips#audit#bookkeeper#Bookkeeping#bookkeepingservices#bookkeepingtips#budget#budgeting#business#businessowner#businessowners#cloudaccounting#consulting#covid#CPA#entrepreneur#entrepreneurs#Finance#financialfreedom#financialplanning#financialservices#financialstatements#incometax

0 notes

Text

Jacksonville, FL’s Reliable Outsource Bookkeeping Service

At Globus Finanza, we take great pride in being a part of Jacksonville, FL's vibrant business community by offering top-notch outsourced bookkeeping services. Our dedicated team understands the unique needs of local businesses and works tirelessly to ensure that your financial records are handled with care and expertise. By entrusting us with your bookkeeping needs, you can focus on what you do best - running and growing your business. With a team of friendly and experienced professionals who are committed to providing accurate and timely service, Globus Finanza is your trusted partner for outsourced bookkeeping services in Jacksonville, FL.

#accounting#accountancy#accountingfirms#accountingservices#accountingsolutions#bookkeepernearme#bookkeepingandaccountingservices#finance#bookkeeper#bookkeeping#BookkeepingServices#AccountingServices#AccountingFirms#CPAOfficeNearMe#OutsourceAccounting#BookkeeperNearMe#CPAAccountantNearMe#CertifiedPublicAccountantNearMe#Accountancy#OutsourceTaxPreparationServices#TopAccountingFirms#TaxAndAccountingServices#BookkeepingAndAccountingServices#OutsourcingAccountingServices#OutsourcedAccountingFirms#AccountingSolutions#VirtualCFO

0 notes

Text

What Triggers An IRS Audit?

Preparing a tax return can be stressful. If you are being honest or use a professional you can breathe a little easier since IRS audits don’t happen to many people.

The IRS has audited fewer returns since 2010 due to federal budget cuts that have affected staff size. According to a 2022 GAO report, only 0.25% of all individual returns were audited in 2019, down from 0.9% in 2010.1

That said, taxpayers commonly make a few mistakes that increase the chance that an agent will take a second look at their returns.

IRS computer System Can Trigger An Audit.

The IRS computer system called the Discriminant Information Function (DIF) is designed to detect anomalies in tax returns. It scans every tax return the IRS receives. It’s looking for things like duplicate information—maybe two or more people claimed the same dependent—as well as deductions and credits that don’t make sense for the tax filer.

The computer compares each return to those of other taxpayers who earned approximately the same income. For example, most people who earn $40,000 a year don’t give $30,000 of that money to charity and claim a deduction for it, so your tax return is more likely to be flagged by the DIF system.

Can income Affects Triggering Of Audits?

The IRS isn’t going to waste its time on an audit unless agents are reasonably sure that the taxpayer owes additional taxes and there’s a good chance that the IRS can collect that money. This puts a focus on high-income earners.

According to the IRS Data Book, the majority of audited returns in 2019 were for taxpayers who earned $500,000 a year or more, and most of them had incomes of over $1 million. Additionally, the only income ranges that were subject to more than a 1% chance of an audit were $5,000,000 and over.

According to IRS statistics, you’re safest if you report income in the neighborhood of $25,000 to less than $500,000. These taxpayers were audited the least in 2019.

Additional Items That Can Trigger An Audit.

Large Cash Deposits Under the Bank Secrecy Act, various types of businesses are required to notify the IRS and other federal agencies whenever anyone engages in large cash transactions that involve more than $10,000. The idea is to thwart illegal activities.A side effect is that you can expect the IRS to wonder where that money came from if you plunk down or deposit a lot of cash for some reason, particularly if your reported income doesn’t support it. The IRS will be notified if you make a large deposit over the $10,000 amount. You should be prepared to show how and why you received that money if you file a tax return.Also “structuring” your deposit can trigger this. If you make two or more transactions that are less than $1,000 individually but that adds up to more than the $10,000 threshold. Banks are required to report deposits that are for amounts less than the threshold if they might indicate illegal activity.

Claiming Too Many Itemized Deductions You may trigger an audit if you’re spending and claiming tax deductions for a significantly larger amount of money than most people in your financial situation do.

You’re Self-Employed Deductions that are above the norm for your profession can trigger an audit. Don’t stretch the truth when filling out your tax returns. If you use your car for business and you want to deduct your expenses or mileage, don’t say that 100% of your travel was solely for business purposes if you have no other vehicle available for personal use. You presumably drove to do personal errands at some point.

Your Business Is Home-Base You must use your home office area only for business. You and your family members should not do anything else in that space. Review IRS Publication 587 if you’re planning to claim a deduction for a home office.

You Own A Cash Business Operating a mostly cash business can put you on the IRS’s radar as well. Businesses that fall into this category include salons, restaurants, bars, car washes, and taxi services, according to the IRS. Because there’s so much cash, it would be easier for these business owners to hide some of their income from the IRS.

You Have Investment Income Keep track of all your investment income so you can accurately report it to the IRS.

Have You Considered Hiring A Bookkeeper?

A professional bookkeeper does not need to be a full-time employee. These services are often best outsourced to firms who have strategies in place to help small to medium-sized businesses excel at what they do best, providing services and solutions to their clients. Bookkeepers are perfect workers to work remotely.

Stash Bookkeeping es has a knack for designing or re-designing bookkeeping systems that help owners take their business to greater levels. Using common sense as our greatest weapon, we love to find new ways to take the work out of paperwork.

Stash Bookkeeping has been established for nine-plus years, managing small to medium-sized businesses’ books ranging from $1,000,000 to $20,000,000 in annual revenue, and serving 100’s of happy clients in a variety of industries nationwide. With extensive experience in building/maintaining a solid set of books, we are able to produce an accurate set of financial statements every month.

0 notes

Text

Professional Financial Advisory - Zecay

Our ethos is grounded in a professional, client-centric approach. We begin by gaining an insightful understanding of your individual financial aspirations and needs. With a robust arsenal of proven methodologies and sophisticated skill sets, we meticulously synthesize information to customize a portfolio of products and services that accurately align with your financial targets.

#financialadvisory#financialadvisor#finance#financialadvisors#financialadvisortips#accounting#bookkeeping#financial#investment#financialplanning#insurance#audit#financialadvisorcoaching#professional#insurancebroker#bookkeepingservices#invest#investors#taxplanning#business#irs#cashflow#income#balancebookkeepingp#daybookmaintenance#taxexpense#wallstreet#streamsofincome#financialreporting#stakeholders

0 notes

Text

With Better-Ledger, you can say goodbye to the stress of handling outsourced bookkeeping services internally. Our team of expert professionals is dedicated to ensuring that your financial records are accurate, up-to-date, and compliant with all regulations. We understand that every business is unique, which is why we tailor our services to meet your specific needs.

1 note

·

View note

Text

Digital accounting systems have transformed the way businesses manage their finances. With just a simple click on your phone or laptop, you can now accomplish various financial tasks online. From invoice generation to tracking finances and making data-driven decisions, digital accounting systems offer a host of benefits that streamline financial management for businesses. Check the blog link to learn more.

0 notes

Text

How Accountants in Birmingham Can Help Your Business Thrive

In the bustling city of Birmingham, businesses of all sizes are constantly seeking ways to optimize their operations, improve financial management, and drive growth. One of the most effective strategies for achieving these goals is partnering with a professional accounting firm. Accountants in Birmingham offer a range of services that can significantly enhance your business's financial health and overall success.

Expertise and Local Knowledge

Accountants in Birmingham bring a wealth of expertise and a deep understanding of the local business landscape. Their knowledge of regional tax laws, regulations, and economic conditions allows them to provide tailored advice and solutions. This local insight is invaluable for businesses looking to navigate the complexities of the Birmingham market and capitalize on opportunities for growth.

Comprehensive Financial Management

Effective financial management is crucial for any business. Accountants in Birmingham offer comprehensive services that cover all aspects of financial management, including bookkeeping, payroll, tax planning, and financial reporting. By maintaining accurate and up-to-date financial records, accountants help businesses make informed decisions, manage cash flow, and ensure compliance with regulatory requirements.

Strategic Tax Planning

Tax planning is a critical component of financial strategy. Accountants in Birmingham are well-versed in local and national tax laws and can develop strategies to minimize tax liabilities. They provide guidance on tax-efficient business structures, available deductions, and credits, ensuring that your business remains compliant while optimizing its tax position. Effective tax planning can result in significant savings, freeing up resources for reinvestment and growth.

Business Advisory Services

Beyond traditional accounting functions, many Birmingham accountants offer business advisory services. These services are designed to help businesses identify opportunities for improvement, streamline operations, and achieve long-term objectives. Accountants can assist with budgeting, financial forecasting, risk management, and performance analysis. By providing strategic insights and actionable recommendations, they empower business owners to make informed decisions that drive growth and profitability.

Enhanced Efficiency and Productivity

Outsourcing accounting functions to a professional firm can lead to enhanced efficiency and productivity. By leveraging the expertise of accountants, businesses can reduce the burden of administrative tasks, allowing owners and managers to focus on core business activities. This streamlined approach not only improves operational efficiency but also contributes to better financial outcomes.

Access to Advanced Technology

Modern accounting firms in Birmingham utilize advanced technology and software to deliver their services. These tools enable real-time financial reporting, seamless data integration, and enhanced accuracy. By adopting these technologies, businesses can gain a clearer view of their financial health and make data-driven decisions.

Support During Growth and Transitions

Whether your business is expanding, undergoing a merger, or facing other significant changes, accountants can provide crucial support during these transitions. They offer guidance on financing options, regulatory compliance, and strategic planning, ensuring that your business remains stable and poised for growth.

In conclusion, accountants in Birmingham play a vital role in helping businesses thrive. Their expertise, comprehensive services, and strategic insights enable businesses to manage their finances effectively, optimize tax positions, and achieve long-term success. By partnering with a professional accounting firm, businesses in Birmingham can unlock their full potential and navigate the path to sustained growth and prosperity.

0 notes