#accountant firm in janakpuri

Explore tagged Tumblr posts

Text

Business Tax Filing Services in Delhi

Vishal Madan CA offers expert Business Tax Filing Services in Delhi. As a seasoned Chartered Accountant, Vishal Madan specializes in navigating the complexities of tax regulations for businesses. His services include meticulous organization of financial records, strategic tax planning, and ensuring compliance with local tax laws. With a focus on efficiency and accuracy, Vishal Madan CA provides businesses in Delhi with the expertise needed for seamless tax filing, enabling clients to optimize their financial processes and meet their tax obligations with confidence.

Read more:-

#GST Registration Services in Delhi#Business Tax Filing Services in Delhi#Personal Tax Filing Service in Delhi#Partnership Firm Registration Service in Delhi#Best Chartered Account in Janakpuri#Chartered Account in Janakpuri#Best Chartered Account in West Delhi#Best CA Firm in West Delhi#CA in west Delhi#CA in janakpuri#accountants in west delhi#accountants in janakpuri#best accountant in janakpuri#accountant firm in west delhi#accountant firm in janakpuri

0 notes

Text

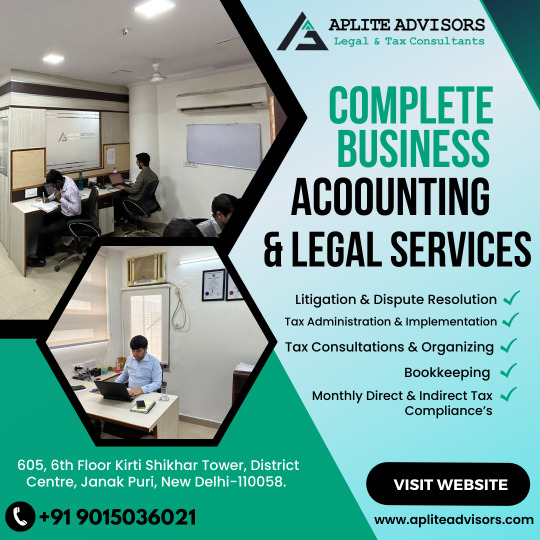

Best Accounting and Bookkeeping service

Aplite Advisors is a professional accounting and bookkeeping service provider that offers financial solutions to individuals, small businesses, and organizations of all sizes. The company is committed to delivering reliable, efficient, and cost-effective accounting and bookkeeping services that meet the unique needs of each client.

With Aplite Advisors, you can expect to receive personalized attention from a team of experienced accounting professionals who are dedicated to helping you achieve your financial goals. The company offers a range of services that include bookkeeping, payroll processing, tax preparation, and financial consulting, among others.

One of the key benefits of working with Aplite Advisors is their focus on using the latest technology to streamline accounting processes and improve efficiency. They use cloud-based accounting software and online tools that make it easy for clients to access their financial data anytime, anywhere.

Another advantage of working with Aplite Advisors is their flexible pricing structure. They offer a range of packages that can be customized to suit the specific needs and budget of each client. Whether you need a full-service accounting solution or just a few specific services, Aplite Advisors can help you find the right package for your needs.

In addition to their Accounting and Bookkeeping Services Delhi, Aplite Advisors also offers financial consulting services. This can be particularly useful for small businesses or individuals who are looking to grow their wealth and improve their financial management skills. The company's team of financial experts can provide guidance and advice on everything from budgeting and cash flow management to investment strategies and retirement planning.

Overall, Aplite Advisors is an excellent choice for anyone who is looking for high-quality accounting and bookkeeping services. With their focus on personalized attention, cutting-edge technology, and flexible pricing, they are well-equipped to help clients achieve their financial goals and take their businesses to the next level.

youtube

#CA Firm in Delhi#CA in Janakpuri#Financial Accounting Advisory Services in Delhi#Company Registration in Delhi#Accounting and Bookkeeping Services Delhi#GST Return Filing Delhi#Income Tax Return Filing Delhi#Youtube

0 notes

Text

0 notes

Text

#CAFirminDelhi#CAinJanakpuri#FinancialAccountingAdvisoryServicesinDelhi#CompanyRegistrationinDelhi#AccountingandBookkeepingServicesDelhi#GSTReturnFilingDelhi#IncomeTaxReturnFilingDelhi

1 note

·

View note

Link

We, at MAG help in providing top audit and assurance services in delhi and engage our prestigious clients on an ongoing basis to ensure that statutory and regulatory requirements are adhered to.

#audit firm in delhi#best audit services in delhi#audit and assurance services india#top audit and assurance services in delhi#chartered accountant firm in janakpuri#ca firm in janakpuri#best accounting audit services in delhi

0 notes

Text

Why you should hire a CA even if you don’t own a large business?

You may not find filing your own taxes difficult and you may be able to manage a small business on your own. But, there are still some situations wherein you may highly benefit from hiring a certified CA in Janakpuri. The money that you spend in hiring a CA must be considered as an investment rather than an added expense. Here are some common situations where you may benefit from hiring a CA or an audit firm in Delhi.

1. You have complex taxes

You may feel reluctant to hire a CA and hand over the task of handing taxes. But in all honesty, taxes can be complex and if you are a self-employed professional, get income from multiple streams or are receiving investment income, a top CA in West Delhi may come handy. A CAcan help you in navigating the taxes properly so that you don’t pay anything more than you owe.

2. You are planning to start a business

If you are planning to start a business any time soon, chances are you may want to do everything on your own to save as much money as possible. But, it is important that you don’t cut out the budget for CA. A certified CA will ensure that all the financial and legal preparations are done properly before the launch of the business.

3. You need help with budgeting

If you are in debt and need to improve your credit score, a CA in Janakpuri can come to your rescue. While you may not feel like spending a penny extra to hire a CA, a professional can largely help you set foot in the right direction. A CAcannot just give you budgeting advice but will also help you in setting up a plan so that you become debt free asap.

4. You have received a large inheritance

Not everyone is lucky enough to receive a large inheritance. But, if you have been lucky, it may not be as simple a transaction as you may think. Without a required guidance, you may have to pay an exorbitant amount of tax and the same can even lead to an increased tax rate in future. A CAcan guide you how to reduce the taxes that you need to pay in future. The cost of CA when hired for inheritance may vary based on complexity of your case.

5. You want to give a huge some of monetary gift

Not just receiving, but even giving a large inheritance may come with financial implications. A CAcan help by advising different ways of giving the gift like making a charitable donation, using retirement funds in order to minimise the gift tax you will have to pay.

Now that you know the benefits of hiring a certified CA in Janakpuri, will you hire one for yourself? How much are you willing to pay? Do let us know your thoughts in the comment section below!

If you are looking for a CA for personal taxes, look nowhere. www.manishanilgupta.com are subject matter experts in handling personal taxes and company registrations. The team of experts is known for its tailor made solutions for every client.

Source: https://www.prlog.org/12778735-why-you-should-hire-ca-even-if-you-dont-own-large-business.html

#top CA in West Delhi#CA in Janakpuri#audit firm in Delhi#Trademark Registration in Delhi#Accounting services in west delhi

0 notes

Text

Ca Services Provider Company in Janakpuri delhi

Lexntax are the affordable and Best CA in Janakpuri delhi, offer accountant services, GST tax return services and company registration services. Looking for best Chartered Accountant in delhi NCR, top CA firms / Company in delhi with online services and affordable price for business in delhi NCR.

0 notes

Link

It is important to look into best CA firms in Delhi and Delhi being the capital of the country it has many good Ca firms. There will be lots of options available but you have to choose the best one for your purpose. When talking about CA firms then Delhi has the best CA firms in India. Amongst the various options available you will have to compare the different CA firms and choose one which will be best for you.

There are various reasons due to which a person would wish to start a new CA firm and it might also turn into the best CA firm in India but for that lots of efforts and hard work is required. In the present time, more and more CA are entering into field and the competition is proliferated because of that. But because of the increasing competition there has been an increase in demand for the best CA and best CA firms. It Is being a dream for many people to start their own CA firm but sometimes people would be unable to fulfill their dreams. For CA, GST has become a best opportunity for them to excel in their filed.

It is not an easy job to become the top and best CA in Delhi and for that completing your education might not be enough and for that you would have to be more expertise in your field so that many more clients will be impressed by your work and approach you to get the work done.

GST is the main taxation reform and many more companies would require to pay the taxes and get the work done successfully and for that highly educated and qualified top and best CAs of the country would be required. There are various courses for CAs to excel in their domain and get more professional into the work.

If you want to start your own CA firm then you will have to do lots of research on it so that your CA firm would turn into the best CA firm in Delhi and India. It might not be possible to look into every aspect of opening of a CA firm but you can surely look into some of the ways through which you can have a better idea to do it successfully.

There are various options available for CA firms and it will not be an easy task to become the best CA firm in Delhi and India. If you are planning to start a new CA firm then there will be lots of hurdle that you would have to face and you would have to look into various factors before that so that no problems will be occurred after initiating the business. You will also have to look for the capital that would be required to start the business. If you will not have the sufficient amount of capital with you then it will be difficult for you to manage the business successfully. To establish the new business and to become the top and best CA firm in Delhi and India then there will be various things that has to be followed so that you can attain success. The proper strategy should be used to become the best and finest CA firms in India so that many customers can take services from you.

0 notes

Video

tumblr

Best Chartered Accountant (CA) Firm in Janakpuri Delhi India

talwarassociates.co.in is one of the best Chartered Accountant (CA) Firm in Janakpuri Delhi India. If you are looking for CA related service then you can contact @ [email protected] or Phone: 011-42815333. Source: http://talwarassociates.co.in/

0 notes

Text

Expert Chartered Accountancy Services by Leading CA Firm in Delhi

Vishal Madan & Co is a trusted CA firm in Delhi, offering a wide range of financial and legal services to individuals, startups, and businesses. Our experienced team ensures that all legal requirements are met efficiently, allowing you to focus on growing your business.

We specialize in Partnership Firm Registration Service in Delhi, assisting entrepreneurs with expert guidance on compliance, documentation, and seamless registration processes. In addition to registration services, we provide comprehensive solutions in auditing, tax planning, accounting, and business advisory to support your financial growth and stability.

With a client-centric approach and in-depth knowledge of regulatory frameworks, Vishal Madan & Co is committed to delivering reliable and personalized services. Whether you’re starting a partnership firm or looking for expert financial advice, we are your trusted partner in success. Choose Vishal Madan & Co for efficient, transparent, and professional solutions tailored to your business needs.

#CA firm in delhi#Partnership Firm Registration Service in Delhi#Vishal Madan & Co#best chartered account in janakpuri

0 notes

Text

Who is the best CA in Janakpuri and CA firm in Delhi?

Doing business has never been easy in a regime like India which has thousands of Acts and regulations. Operating a business, thus, becomes difficult as business owners find it challenging to keep pace with ever-changing and complex laws. This is where Aplite, one the best CA firm in Delhi, comes into the picture.

youtube

Aplite is a firm of Chartered Accountants and other finance professionals providing business registration, tax consultation, return filing and other allied services under one roof. With experience of serving clients for more than 10 years, we bring to the table invaluable expertise that helps businesses flourish. Based in Janakpuri, Delhi, we serve all types of clients from all across the world and provide all types of financial services. We have always been regarded as one the best CA firms in Delhi by all our clients and were felicitated with award for “Excellence in Tax Advisory & Compliance, 2021”.

Our Services

Business Set-up and Registration: We provide complete hand holding to help businesses setup their presence smoothly in their initial phase. We offer registration services for all types of companies, partnerships, not-for-profit organisations, trusts and societies. Our team handles all documentation and filings till the registration is granted by the concerned authorities. We are one the best CA in Janakpuri Delhi/ NCR for business registration services.

Audit and Assurance: We conduct all types of audits for all types of businesses, be it statutory audits, managements audits, internal audits, GST audits and others. Our firm is one of the best CA firm in Delhi recognised for its quality audit services. We ensure complete transparency and attention to detail in all our deliverables.

Tax Consultancy: Tax, be it direct or indirect, has always been a burden on businesses, both in terms of tax outflow and compliances it brings along. Aplite provides best and comprehensive tax consultancy services which helps you optimise your tax structure and makes you fully tax compliant.

Others: Abusiness is a gamut of multiple activities which needs to be managed with utmost care. It is always difficult to focus on multiple activities at same time. Thus, Aplite offer a wide range of allied business services to help you focus more upon the core business activities. Our services include payroll outsourcing, bookkeeping, remuneration planning and corporate training to name a few.

Why Aplite?

Your search for best Accounting and Bookkeeping Services Delhi ends at Aplite. Aplite is a team of professionally driven and committed professionals whose aim is to serve their clients in the best possible manner. Aplite has a proven track record of delivering quality and timely services to its clients. We strive to become business partners, rather than just being a consultant. We offer all what your business need at one place and that is what makes us the best CA firm.

#CA Firm in Delhi#CA in Janakpuri#Financial Accounting Advisory Services in Delhi#Company Registration in Delhi#Accounting and Bookkeeping Services Delhi#GST Return Filing Delhi#Income Tax Return Filing Delhi#Youtube

1 note

·

View note

Text

Audit firm in delhi

M/S Manish Anil Gupta & Co. is a Delhi based CA firm in Janakpuri, well known for its company registration in India as well as financing, taxation and accounting services. Founded by Mr. Manish Gupta, the company has immense experience in serving its clients for accounting services, income tax consultancy, GST consultancy, company law matters, audit and assurance services, project finance services and ROC filing services in Delhi.

0 notes

Text

Best Multi Speciality Clinics in Delhi | ElaWoman

Dr. Meera Chawla in Delhi is honing as an Obstetrician and Gynecologist in a private setup in Vasant Kunj, New Delhi since 1991. She owes a significant ordeal of 32 years in her space. She gives her opportunity in different nursing homes in Delhi, for example, Orthonova Hospital (SDA), Sukhmani Hospital (Safdarjung Enclave) and Rockland Hospital (Qutab Institutional Area). She has worked in Iran too. Dr. Meera Chawla took preparing from Hysteroscopy Workshop at Sitaram Bhartiya Institute of Science and Research. She guarantees general updates in the field by going to different Gynecology updates and courses.

Dr. Meera Chawla is a confided in Gynecologist in New Delhi, Delhi. She has had numerous cheerful patients in her 40 long periods of voyage as a Gynecologist. She is a MBBS, Diploma in Obstetrics and Gynecology, Post Graduate Certificate Course in Health and Family Welfare Management . You can meet Dr. Meera Chawla by and by at Dr. Chawla's Clinic in New Delhi, Delhi.

One of the main gynecologists of the city, Dr. Meera Chawla in Vasant Kunj Sector-B has built up the clinic in 1990 and has picked up an unwavering customers in the course of recent years and is likewise habitually gone to by a few superstars, trying models and other good customers and universal patients also. They additionally anticipate extending their business further and giving administrations to a few more patients attributable to its prosperity in the course of recent years. The productivity, devotion, exactness and sympathy offered at the clinic guarantee that the patient's prosperity, solace and needs are kept of best need.

Health First Poly Clinic in Delhi is a Multi Speciality Hospital in Chattarpur, Delhi. The clinic is gone to by gynecologist like Dr. Rita Agarwal ,Dr. Rajat Gupta and Dr. Lalita . The timings of Health First Poly Clinic are: Mon-Sat: 09:00-21:00 and Sun: 09:00-13:00. A portion of the administrations gave by the Hospital are: Face Lift/Rhytidectomy,Hyper Pigmentation Treatment,Weight Management Counseling,Stretch Marks Treatment and Mole Removal and so on.

Built up in the year 2014, Health First Poly Clinic in Chattarpur, Delhi is a best player in the class Dermatologists in the Delhi. This outstanding foundation goes about as a one-stop goal overhauling clients both neighborhood and from different parts of Delhi. Through the span of its excursion, this business has set up a firm a dependable balance in it's industry. The conviction that consumer loyalty is as essential as their items and administrations, have helped this foundation earn an immense base of clients, which keeps on developing continuously. This business utilizes people that are committed towards their individual parts and put in a great deal of push to accomplish the regular vision and bigger objectives of the organization. Sooner rather than later, this business plans to extend its line of items and administrations and take into account a bigger customer base. In Delhi, this foundation involves a noticeable area in Chattarpur.

Health First Poly Clinic is known for lodging experienced General Surgeons. Dr. Vishal Diddi, a very much rumored General Surgeon, rehearses in Delhi. Visit this restorative health place for General Surgeons suggested by 94 patients.

Dr. Minoo Bhagia in Delhi is an independent obstetrician and gynecologist of Delhi hailing from Agra and by and by situated as senior gynecologist AIP F mission healing center new Delhi low maintenance and Anahat multi claim to fame clinic Gurgaon. I worked under NRHM contract at common doctor's facility, Palwal (Haryana ) for a long time.

She has been nearly and effectively connected with different family planning programs including training of the medicinal and paramedical staff in my present limit at Palwal. I was likewise granted for pioneering and promoting PP IUCD application program in Palwal area. I have aggregated my perceptions on obvious and false PP IUCD removals in common doctor's facility Palwal, which has been affirmed by an international diary of propagation, contraception, obstetrics and gynecology (IJRCOG ) for production. It is in the waiting for finishing work at my end by and by.

Dr. Minoo Bhagia is a prestigious Gynecologist in Janakpuri, Delhi. She is right now practicing at Dr Minoo Bhagia's Clinic in Janakpuri, Delhi.

One of the leading gynecologists of the city, Dr. Minoo Bhagia (Health First Poly Clinic) in Chattarpur has built up the clinic and has gained a steadfast customer base in the course of recent years and is additionally much of the time went to by a few big names, aspiring models and other noteworthy customers and international patients too. They additionally anticipate expanding their business further and providing administrations to a few more patients owing to its prosperity in the course of recent years. The proficiency, commitment, accuracy and sympathy offered at the clinic guarantee that the patient's prosperity, solace and needs are kept of best need.

Dr. Chawla Clinic in Delhi is known for lodging experienced General Physicians. Dr. Rinkesh Chawla, an all around rumored General Physician, hones in Delhi. Visit this restorative wellbeing place for General Physicians suggested by 99 patients.

Situated in the core of Vasant Kunj, this inside was set up in 1991 by Dr. Meera Chawla, with the sole target of giving customized and reasonable quality administrations to the general population.

It gives proficient administrations in the field of Obstetrics and Gynecology, General and Laparoscopic Surgery, Cosmetic Surgery and Dermatology. It has now additionally rose as a tried and true focus to satisfy little restorative needs too. We have been a confided in establishment of Dr. Lal Path Labs since 1994.

We have a devoted group for conveyance of patients with most extreme care and ability alongside individual touch. We trust that typical conveyance is the most ideal method for labor. Anyway we do need to embrace caesarian in perspective of mother or infant.

It has cut a specialty for itself by devoted administrations of its specialists and staff in routine and crisis hours. Here we go an additional mile to decrease the agony of patients by our own and incite administrations.

On the off chance that you are searching for a spending doctor's facility, with customized consideration, this is correct place for you. For restoratively safeguarded patients we are on board of different clinics for tasks and conveyances.

The inside has been set up under the master direction of eminent Dr. Rashmi Sharma driving a group of IVF pros, Gynecologists, Embryologist, Psychological IVF advocates, Dieticians and Nutritionist, and a board of interchange pharmaceuticals as well, for example, pressure point massage, needle therapy, naturopathy and Yoga. Origyn Fertility and IVF under the Umbrella of super specific Origyn Fertility is one stop to infertility patients, where we give arrangement under one rooftop . From guiding to interview, exhaustive examinations, pharmaceuticals, USG and appropriate day nurture IVF patients is on one story with no circling. The inside is all around furnished with most recent innovation and instruments from Japan, UK and Germany empowering to give best IVF treatment. Dr. Rashmi Sharma is known for her patient cordial nature and her moral, straightforward and merciful therapeutic practice makes her among the Best IVF Specialist Doctors in Delhi, India. Dr Rashmi herself at each phase of their treatment gives every one of the patients individual consideration. Dr Rashmi Sharma manages part of muddled instances of different IVF disappointments, Low responder patients, Male Infertility issues and so forth effectively .We have various patients with numerous IVF disappointments who have accomplishment with us. These outcomes are accomplished with cautious investigation of the case history, exhaustive directing, world class offices and joined approach of pre IVF endometrial scratching, Blastocyst exchange, Embryoglue and if required PGD/PGS and so on. Our Sole exertion is to empower the bothered couples to come at a finishing up point for a basic issue and imperative choice of their Life.

Origyn Fertility and IVF in Delhi is a Multi Speciality Clinic in Pitampura, Delhi. The center is gone by specialists like Dr. Rashmi Sharma . The timings of Origyn Fertility and IVF Pitampura are: Mon-Sat: 11:00-14:00. A portion of the administrations gave by the Clinic are: Artificial Insemination,Infertility,In-Vitro Fertilization (IVF) and Intra-Uterine Insemination (IUI) and so forth. Tap on guide to discover headings to achieve Origyn Fertility and IVF Pitampura.

Dr. Rashmi Sharma is an eminent Gynecologist in Pitampura, Delhi. She has been a honing Gynecologist for a long time. She has done FICOG, Training in IVF , MD - Obstetrtics and Gynecology, DNB (Obstetrics and Gynecology), MBBS . You can visit her at Max Hospital, Pitampura in Pitampura, Delhi.

Dr. Rashmi Sharma in Delhi is an Infertility Specialist in Pitampura, Delhi and has an ordeal of 22 years in this field. Dr. Rashmi Sharma hones at Origyn Fertility and IVF Pitampura in Pitampura, Delhi. She finished MBBS from Institute of Medical Sciences, Banaras Hindu University (IMS-BHU) in 1996 and DNB from Institute of Medical Sciences, Banaras Hindu University (IMS-BHU) in 1999.

She is an individual from Indian Fertility Society (IFS),Federation of Obstetrics and Gynecological Societies of India (FOGSI),Association of Obstetricians and Gynecologists of Delhi (AOGD) and National Association for Reproductive and Child Health of India (NARCHI). A portion of the administrations gave by the specialist are: Intra-Uterine Insemination (IUI),In-Vitro Fertilization (IVF) and Artificial Insemination and so on.

A qualified restorative expert, Dr. Rashmi Sharma in Vikaspuri, Delhi is one among the observed IVF Centers, having rehearsed the restorative specialization for a long time. This medicinal professional's center was built up in 2001 and from that point forward, it has drawn scores of patients from in and around the area as well as from the neighboring zones also. This restorative expert is capable in distinguishing, diagnosing and treating the different medical problems and issues identified with the medicinal field. This specialist has the imperative information and the ability not simply to address an assorted arrangement of wellbeing diseases and conditions yet in addition to anticipate them. As a prepared restorative expert, this specialist is likewise acquainted with the most recent progressions in the related field of drug.

For more information, Call Us : +91 – 7899912611

Visit Website : www.elawoman.com

Contact Form : https://www.elawoman.com/contact

Ela Facebook Ela Twitter Ela Instagram Ela Linkedin Ela Youtube

0 notes

Text

Trusted Excellence: CA Vishal Madan, Your Premier CA Firm in Delhi

CA Vishal Madan is a distinguished CA firm in Delhi, renowned for its excellence in accounting, taxation, and financial advisory services. With a commitment to integrity and client satisfaction, we offer expert guidance tailored to meet the diverse needs of businesses and individuals.

Our team of experienced professionals provides comprehensive solutions, including audit and assurance, corporate taxation, GST compliance, and business advisory. At CA Vishal Madan, we prioritize accuracy, efficiency, and proactive strategies to optimize financial outcomes and ensure compliance with regulatory requirements. Trust us to navigate complex financial challenges and achieve your business goals with confidence and precision.

#best ca firm in west delhi#best chartered account in janakpuri#accountant#best chartered account in west delhi

0 notes

Text

Top CA in Firm in Delhi | Expert CA Services

CA Vishal Madan is a distinguished CA in Firm in Delhi, renowned for his comprehensive expertise in financial management and consultancy. With years of experience in auditing, taxation, and corporate finance, he has built a reputation for delivering meticulous and reliable services to a diverse clientele.

His firm excels in providing tailored solutions that align with clients' unique business needs, ensuring compliance and optimizing financial performance. Known for his strategic insights and ethical approach, CA Vishal Madan is committed to fostering long-term relationships and guiding clients through complex financial landscapes. Whether it's for individual financial planning or corporate advisory, his professional acumen and dedication make him a trusted advisor in the industry.

#gst registration services in delhi#best ca firm in west delhi#best chartered account in janakpuri#ca#accountant#best chartered account in west delhi#CA Vishal Madan#Delhi

0 notes