#aadhar pan link last date

Explore tagged Tumblr posts

Text

Aadhar Pan Link Update : આધાર અને પાન કાર્ડ લિંક ન હોવા પર ₹10,000નો દંડ, પરંતુ આ લોકોને રાહત

Aadhar Pan Link Update : જો તમે હજુ સુધી PAN કાર્ડ અને આધાર કાર્ડને લિંક કર્યા નથી , તો જલ્દીથી તેને લિંક કરો. 30 જૂન છેલ્લી તારીખ છે, ત્યારપછી જો તમારું PAN આધાર લિંકિંગ નથી, તો તમારું PAN નિષ્ક્રિય થઈ જશે. આ સાથે તમારી અનેક પ્રકારની સુવિધાઓ પણ બંધ થઈ શકે છે અને તમને ભારે દંડ પણ થઈ શકે છે. દંડની રકમ 10 હજાર રૂપિયા સુધી હોઈ શકે છે. આ સિવાય તમે પૈસાની લેવડ-દેવડ પણ કરી શકશો નહીં. તમને જણાવી દઇએ કે…

View On WordPress

#Aadhar Card#Aadhar Card Loan#Aadhar Pan Card Link#Aadhar pan card link date#Pan Card#Pan card Link Last Date

0 notes

Text

NDA Exam Form Filling Procedure 2025: A Step-by-Step Guide for Aspirants Introduction

Aspirants dream of joining this elite institution to serve the nation with pride and honor.

Filling out the NDA exam form accurately is a crucial step in realizing this dream.

A single mistake could jeopardize your chances, so it's vital to be meticulous.

The Manasa Defence Academy is a trusted name among NDA aspirants.

Along with top-notch training, the academy offers comprehensive support, including guidance for the application process.

This guide will walk you through the NDA exam form-filling procedure for 2025, ensuring you avoid common pitfalls. Eligibility Criteria: Age: 16.5 to 19.5 years

Educational Qualification: 12th pass or appearing with relevant subjectsCitizenship: Indian nationals or subjects of Bhutan/Nepal

The 2025 NDA exam promises to continue its tradition of selecting the best minds and bodies for India's defense forces. Important Dates for NDA Exam 2025 Mark these important dates on your calendar: Event NDA 1 Dates NDA 2 Dates Notification Release January 2025 June 2025 Application Start Date January 2025 June 2025 Application End Date February 2025 July 2025 Exam Date April 2025 September 2025

Ensure you adhere to these deadlines to avoid last-minute hassles. Documents Required for NDA Application

Before beginning the application process, keep the following documents ready: Personal Identification: Aadhar card, PAN card, or Passport Educational Certificates: 10th and 12th-grade mark sheets Photographs: Recent passport-sized photograph (as per UPSC specifications) Signature: Scanned signature on a white background

Other Certificates: For reserved categories, proof of category is essential

Pro Tip: Ensure scanned copies of your documents are clear and adhere to the specified file size and format requirements.

Step-by-Step Guide to Fill the NDA Exam Form 2025 Follow these steps for a smooth application process: Visit the Official Website: Go to the UPSC’s official website (www.upsc.gov.in). Look for the NDA 2025 application link. Registration Process: Click on "New Registration."

You will be provided with a distinct registration identification number and password. Fill Personal and Academic Details: Log in with your registration credentials.

Fill in your personal details (address, parents' names, etc.) and educational qualifications. Upload Documents:

Please submit a scanned version of your photograph and signature. Upload any other required documents (e.g., category certificate). Fee Payment Process: Pay the application fee online or offline. Save the payment receipt for future reference. Submit the Application Form: Review all the details carefully. Why Choose Manasa Defence Academy for NDA Training?

NDA preparation has become a priority at Manasa Defence Academy.

It offers a comprehensive training program, blending academic rigor with physical conditioning.

Experienced Faculty: Trainers with deep expertise in NDA syllabus and preparation.

Holistic Approach: Focus on both written exam and SSB interview preparation.

Numerous students from the academy have successfully passed the NDA examination. Preparation Tips for NDA 2025

Success in the NDA exam requires dedication and the right strategy:

Understand the Syllabus: Cover all sections, including Mathematics, General Ability, and English.

Engage in Consistent Practice: Work through past examination papers and participate in simulated tests.

Stay Physically Fit: Maintain a daily exercise routine to ace the physical tests.

Seek Professional Guidance: Join a reputed academy like Manasa Defence Academy for structured preparation. Conclusion

Filling out the NDA exam form is the first step toward a glorious career in the Indian armed forces.

By following the correct procedure and preparing effectively, you can make your dream a reality.

Manasa Defence Academy stands ready to guide you every step of the way, ensuring you're fully equipped to take on this challenge.

0 notes

Text

Biocon Biologics Recruitment Drive Ahmedabad Biocon Biologics, a leader in innovative biopharmaceutical solutions, is hosting a walk-in interview event in Ahmedabad. This is a prime opportunity for experienced professionals in Quality Assurance (QA), Quality Control (QC), and Manufacturing to join a dynamic team in Bengaluru. The walk-in interview is scheduled for 16th June 2024, from 8 AM to 12 NOON at Lemon Tree Premier: The Atrium, Ahmedabad. Biocon Biologics Walk in interview Details Date & Time: 16th June 2024 (Sunday), 8 AM to 12 NOON Venue: Lemon Tree Premier: The Atrium, Ahmedabad, Off Nehru Bridge, Sabarmati River Front, Ahmedabad 380 001, Gujarat Registration Link: Register Here Open Positions and Departments Quality Assurance (QA) Positions: IPQA, QMS, AQA, Sterile Experience: 2-10 years Qualifications: M.Pharm, B.Pharm, MSc (Chemistry, Biotechnology, Life Science), M.Tech Responsibilities: Ensure compliance with quality standards and regulations. Oversee quality assurance processes and documentation. Conduct internal audits and manage quality control systems. Quality Control (QC) Positions: HPLC, UPLC, Bioassay, Molecular Biology Experience: 2-10 years Qualifications: M.Pharm, B.Pharm, MSc (Chemistry, Biotechnology, Life Science), M.Tech Responsibilities: Perform advanced analytical testing using HPLC, UPLC, and other techniques. Conduct bioassays and molecular biology tests. Ensure the accuracy and reliability of test results. Manufacturing Positions: Aseptic Manufacturing, DP Medical Device, Packing & Visual Inspection, Engineering & Maintenance, Upstream & Downstream Process - Biosimilars Experience: 2-10 years Qualifications: B.E/B.Tech, M.E/M.Tech, Diploma, BSc Responsibilities: Oversee aseptic manufacturing processes and ensure compliance with GMP. Manage packing and visual inspection operations. Handle upstream and downstream processes for biosimilars. Maintain and repair manufacturing equipment. How to Apply for Biocon Biologics walk in Interested candidates are encouraged to attend the walk-in interview with their updated resume, relevant certificates, and other necessary documents. For those unable to attend, resumes can be emailed to the following contacts: Quality: [email protected] Manufacturing: [email protected], [email protected] Required Documents for appearing Biocon Biologics walk in Please bring the following documents to the interview: Latest resume Recent photograph Photocopies of all educational mark sheets and certificates Experience and relieving letters from previous organizations Current company's appointment letter and increment letter Last 3 months' salary slips PAN Card and Aadhar Card [caption id="attachment_56303" align="aligncenter" width="930"] Biocon Recruitment Notification[/caption]

0 notes

Text

Rising to the Challenge: Winning at IIT JEE for a Better Tomorrow.”

The Joint Entrance Examination (JEE) is a very competitive exam in India for admission to top engineering institutes, especially IITs. It is designed in two phases – JEE Main and the Advanced, testing students’ understanding of physics, chemistry & Mathematics. Class 11-Inography is based upon an imposing syllabus that deals with the subjects of Class 12 and tests its examination of conceptual understanding in problem-solving skills. Eligible candidates need to be of the required age and level of education. Success in the JEE exam is an outlet towards auspicious career opportunities in engineering, making it a notable level for all the young students around India.

Do You Know About The Last Date For Registration and Dates For Examination?

The Joint Entrance Exam Main (Session 2) registration period opened on February 2, 2024, with the NTA handling the registration. Candidates can register themselves till the deadline of 2 March 2024.

The National Testing Agency has announced the JEE Main 2024 examination date. The examination will be conducted in two sessions. Session 1 will be held from 24th January 2024 to 1st February 2024, and the second session will be held between 1st April and 15 April 2024.

Now let us Discuss The Process of Entrance For IIT and JEE

THE IIT JEE examination is a highly competitive entrance test for getting admission to undergraduate engineering in Indian Institutes of Technology (IITS) all over the nation. It is divided into two stages: For grace to reign over sin, of course, the Bible will warn against a relapse.

JEE Main: JEE Main is the preliminary level of examination conducted by NTA. It acts as a gain entry test for NITs, IITS, and other centrally funded technical institutes along with a qualifying examination for JEE Advanced.

JEE Advanced: Those who qualify in JEE main can appear for the later round of national-level examinations known as JEE Advanced which is conducted by one of the IITs on a rotational basis. JEE Advanced is the backdoor to IITs.

Let’s Discuss The Syllabus To be Covered For IIT JEE

The syllabus of both JEE Mains and Advanced constitutes topics from previously studied in Class 11 and 12 by the Central Board of Secondary Education (CBSE). The syllabus is also overwhelming and subjects discussed include Physics, Chemistry among other Mathematics. Here's a brief overview of the topics covered: Clairascent, even at this point was on a business assignment

Physics: Mechanics, Thermodynamics, Optics Electricity, Magnetism Modern Physics, etc.

Chemistry: Its Physical Chemistry, Organic Chemistry, InorganicChemistr etc.

Mathematics: Algebra, Calculus Trigonometry Coordinate Geometry, etc.

Aspirants must be well-versed in the concepts and attempt a variety of problems to solve essay-type questions in an examination.

Eligibility Criteria For IIT JEE

For appearing in the JEE (Main) – 2023, there is no age limit for the candidates. The candidates who have passed the class 12/equivalent examination in 2021, 2022, or appearing in 2023 irrespective of their age can appear in JEE (Main) – 2023 examination. However, the candidates may be required to fulfill the age criteria of the Institute(s) to which they are desirous of taking admission.

How to Register for the Jee Examination

Visit the official JEE Main Registration NTA website jeemain.nta.ac.in 2024 registration link

Select the JEE Mains Apply Online option that says "New Candidate Registration."

Select the preferred registration mode through Aadhar enrollment number/PAN/Passport or ABC ID.

Fill the registration form with the necessary data, and create a passport of your choice.

Click on the "submit" button.

Candidate will receive the JEE Main registration number and password on the registered mobile phone and email ID.

Login using the details provided and fill in all the information asked in the application form. After which the documents and photographs should be scanned and uploaded.

The next step is to pay the JEE Main fees 2024 through Net Banking/Credit Card/Debit Card/UPI.

After the JEE Mains 2024 registration fees is successfully paid, the application form will be instantly submitted. The confirmation page or PDF of the completed form will be sent to the candidate’s email ID.

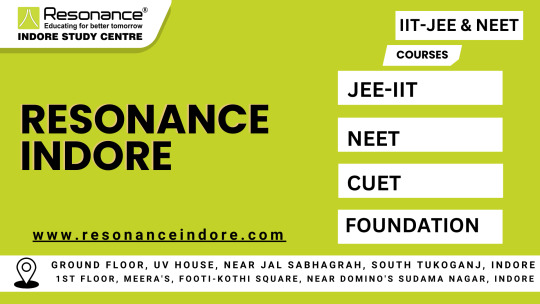

Something About Us

IIT JEE is a tough competition to beat, Prepare for the fearsome face-off with Resonance Coaching Indore. We offer professional advice and in-depth study materials to future engineers. With an enviable track record, Resonance ensures that the students of competitive exams learn not only what to do but also how it should be done. Their faculty is experienced and their approach focuses on individualized student preparation for every element of the JEE. When students pick Resonance Coaching, Indore they acquire a crucial advantage in the process of applying to become an engineer at premier Indian engineering colleges.

0 notes

Text

Name of Post:

Chhattisgarh Police Constable Online Form 2024

Post Date:06 January 2024 | 09:37 PMShort Information :Chhattisgarh Police Department has Recently Invited to the Online Application Form for the Post CG Police Constable (GD / Trade / Driver) Posts Recruitment 2024.

Chhattisgarh Police Department

CG Chhattisgarh Police Constable Recruitment 2024

Important Dates

Start Date of Application Form: 01/01/2024

Last Date of Application Form : 15/02/2024

Exam Date : Notify later

Application Fee

General/OBC :Rs. 200/-

SC/ST/EWS :Rs. 125/-

ExSM : Rs. 0/-

Pay the Exam Fee Through Debit Card / Credit Card / Net Banking / UPI Fee Mode Only.

Age Limit as on (01/01/2023)

Minimum Age : 18 Years

Maximum Age : 28 Years

Age Relaxation read the notification.

Education Qualification

10th Passed From CG /MP Board ( 8th Pass for ST and 5th Pass for Naxalite Areas Only)

Vacancy Details

Total Post : 5967 Posts

Physical Standard

Height: 168 cm (Male), 158Cm (Female)

Chest : 81cm -86 Cm

Race- 1500 Meter (Driver & Trade) , (800 meter, 100 meter )-GD

Selection Process

PET/PST/ DV

Written Test

Medical Examination

Required Documents

Candidates Photograph

Candidates signature

08th / 10th Mark sheet And Certificatest

Aadhar Card / Pan Card

Pay Scale

Rs. 19500- 62000/- (Level-4 Pay Matrix).

How To Apply CG Police Constable

These are following step.

Click on the Apply Online Link given below.

Fill out the application form.

Upload the required documents

Pay Fees

Print the Application Form.

USE IMPORTANT LINKS

Apply Online

0 notes

Text

Simplifying Your Tax Season: Finding Income Tax Filing Services Near You

Introduction:

As tax season approaches, the task of filing your income tax returns might seem daunting. Whether you're a seasoned taxpayer or a first-timer, having a reliable and convenient income tax filing service near you can make the process smoother. In this blog post, we'll explore the importance of timely tax filing, the benefits of using professional services, and how to find the right income tax filing assistance in your local area.

1. The Importance of Timely Income Tax Filing:

Filing your income tax returns on time is crucial to avoid penalties and legal consequences. Many individuals delay the process due to its complexity or lack of understanding, but with the right assistance, you can ensure compliance with tax regulations and enjoy peace of mind.

2. Benefits of Using Professional Income Tax Filing Services:

a. Expertise: Professional tax preparers are well-versed in tax laws and regulations. Their expertise can help you navigate the complexities of the tax code, ensuring accurate and efficient filing.

b. Time Savings: Filing taxes can be time-consuming, especially if you have a complex financial situation. Professional services can save you time and effort, allowing you to focus on other important aspects of your life.

c. Maximizing Deductions: Tax professionals are adept at identifying eligible deductions and credits, potentially saving you money. They can help you optimize your return and ensure you're not missing out on any available benefits.

d. Peace of Mind: With a qualified tax professional handling your filing, you can have peace of mind knowing that your returns are accurate and in compliance with tax laws.

3. How to Find Income Tax Filing Services Near You:

a. Local Tax Firms: Research local tax firms or accounting offices in your area. Many firms offer income tax filing services and can provide personalized assistance.

b. Online Platforms: Explore online platforms that connect you with tax professionals in your locality. These platforms often allow you to read reviews and compare services before making a decision.

c. Recommendations: Ask friends, family, or colleagues for recommendations. Personal experiences can offer valuable insights into the reliability and efficiency of local tax filing services.

d. Community Centers and Nonprofits: Some community centers and nonprofit organizations offer free or low-cost tax preparation services. Check with local community resources to see if such programs are available in your area.

Conclusion:

Filing your income tax returns doesn't have to be a stressful experience. By utilizing professional income tax filing services near you, you can simplify the process, ensure accuracy, and potentially maximize your returns. Take the proactive step of finding reliable assistance, and make this tax season a smoother and more rewarding experience.

Confused? Talk to our experts. Explore our guides and tools for a smooth filing experience:

- Income Tax e-Filing for FY 2022-23

- Income Tax Slabs for FY 2023-24

- Income Tax Calculator

- Section 80 Deductions

- Old vs New Tax Regime

- Check Aadhar PAN Card Link Status

- ITR Filing Last Date for FY 2022-23

- Capital Gains Tax in India

Have questions? Check out our FAQs or reach out to us. Let's make this tax season stress-free and rewarding for you! 💰📅

0 notes

Text

PAN-AADHAR LINK

PAN-Aadhaar Link: Now is the last chance to link PAN with Aadhaar! In this way, sitting at home, you can do this work in a jiffy… The government of India has given many opportunities till now to link PAN with Aadhaar. Initially, the end date for this was fixed by the government till March 31, 2022. It was later extended till March 31, 2023, with a fee of Rs 1,000. Now again the deadline to link…

View On WordPress

0 notes

Text

UPSC NDA & Naval Academy (NA) Examination (II) 2023 (395 Vacancy)

UPSC NDA & Naval Academy (NA) Examination (II) 2023: The Union Public Service Commission (UPSC) has released an employment notification for the recruitment of 395 vacancies for the National Defence Academy (NDA) and Naval Academy (NA) Examination (II), 2023. The last date for submission of the application is June 06, 2023. 1. National Defence Academy (NDA) - No. of posts: 370 - Qualification: 12th Class pass of the 10+2 pattern of School Education or equivalent examination conducted by a State Education Board or a University. 2. Naval Academy (10+2 Cadet Entry Scheme) - No. of posts: 25 (including 07 for female) - Qualification: 12th Class pass with Physics, Chemistry, and Mathematics of the 10+2 pattern of School Education or equivalent conducted by a State Education Board or a University. Age limit for UPSC NDA & Naval Academy (NA) Examination (II) 2023 - Only unmarried male/female candidates born not earlier than 02nd January 2005 and not later than 1st January 2008 are eligible. - The date of birth accepted by the Commission is that entered in the Matriculation or Secondary School Leaving Certificate or in a certificate recognized by an Indian University as equivalent to Matriculation or in an extract from a Register of Matriculates maintained by a university which must be certified by the proper authority of the University or in the Secondary School Examination or an equivalent examination certificate. These certificates are required to be submitted only as the declaration of the result of the written part of the examination. No other document relating to age like horoscopes, affidavits, birth extracts from Municipal Corporation, service records, and the like will be accepted. The expression Matriculation/ Secondary School Examination Certificate in this part of the instruction includes the alternative certificates mentioned above. Application Fee of UPSC NDA & Naval Academy (NA) Examination (II) 2023 - Candidates (excepting SC/ST candidates/female candidates/Wards of JCOs/NCOs/ORs specified in Note 2 below who are exempted from payment of fee) are required to pay a fee of Rs. 100/- (Rupees one hundred only) either by remitting the money in any Branch of State Bank of India by cash or by using Visa/Master/RuPay Credit/Debit Card/UPI Payment or by using internet banking of any Bank. How to Apply for UPSC NDA & Naval Academy (NA) Examination (II) 2023? - Candidates are required to apply online by using the website upsconline.nic.in. The applicant needs to register himself/herself first at the One Time Registration (OTR) platform, available on the Commission’s website, and then proceed for filling up the online application for the examination. OTR has to be registered only once in a lifetime. This can be done anytime throughout the year. If the candidate is already registered, he/she can proceed straightway for filling up the online application for the examination. - Candidate should also have details of one photo ID viz. Aadhar Card/Voter Card/PAN Card/Passport/ Driving License/School Photo ID/Any other photo ID Card issued by the State/Central Government. The details of this photo ID will have to be provided by the candidate while filling up the online application form. The same photo ID card will also have to be uploaded with the Online Application Form. This photo ID will be used for all future reference and the candidate is advised to carry this ID while appearing for examination/SSB. - Online Applications can be filled up to 06th June 2023 till 6:00 PM. Those who wish to apply are advised to go through the below official notification in detail before submitting applications. Online Application Link Click Here Download Official Notification Click Here Job Updates on Telegram Click Here Read the full article

0 notes

Text

Pan Aadhar linking हुआ आसान, सिर्फ एक s.m.s. से होगा लिंक

Pan Aadhar linking: पैन कार्ड को आधार कार्ड से लिंक करने का तरीका काफी आसान है सिर्फ एक s.m.s. करके अपने पैन कार्ड को आधार कार्ड से लिंक कर सकते हैं पैन कार्ड को आधार कार्ड से लिंक करवाने के लिए सरकार के द्वारा कई सारे निर्देश दिए गए हैं जिसमें समय-समय पर पैन कार्ड धारकों को सरकार ने अपने पैन कार्ड को आधार कार्ड से लिंक करने का मौका भी प्रदान किया है लेकिन बहुत सारे ऐसे व्यक्ति हैं जिन्होंने अपने पैन कार्ड को आधार कार्ड से लिंक नहीं करवाया है यदि आपने भी अपने पैन को आधार से लिंक नहीं करवाया है तो आपको परेशान होने की जरूरत नहीं है क्योंकि आज हम आपको वह तरीका बताएंगे जिससे आप सिर्फ एक एसएमएस के माध्यम से अपने पैन कार्ड को आधार से लिंक कर सकेंगे

Pan Aadhar linking 2023

यदि आप एक पैन कार्ड धारक है तो आपके लिए 2023 में अपने पैन कार्ड को आधार कार्ड से लिंक करवाना बहुत ही जरूरी है इससे आपको कई सारे बड़े फायदे होने वाले हैं यहीं पर यदि आप अपने पैन कार्ड को आधार कार्ड से लिंक नहीं करवाते हैं तो आपको कई सारी समस्याओं का सामना करना पड़ता है जिसके अंतर्गत फिक्स डिपॉजिट या फिर किसी बैंक के अन्य कार्यों को करवाने में भी परेशानी हो सकती है पैन कार्ड इतना जरूरी डॉक्यूमेंट है जो कि आज के समय में कई सारी कार्यों में उपयोग किया जाता है ऐसे में यदि आपका पैन कार्ड आधार कार्ड से लिंक नहीं है तो आप जिन सुविधाओं का लाभ ले रहे हैं उन सुविधाओं का लाभ लेने से वंचित भी हो सकते हैं सिर्फ इतना ही नहीं बल्कि इनकम टैक्स डिपार्टमेंट के द्वारा भी पैन को आधार से लिंक करने पर जोर दिया गया है और इसके लिए गाइडलाइन भी जारी रही है

Pan Aadhar linking के लिए जरूरी है यह चीजें

पैन कार्ड को आधार कार्ड से लिंक करने के लिए कई सारे व्यक्ति इस बात को लेकर कंफ्यूज है कि आखिर वह किन चीजों की आवश्यकता होगी यानी कि वह कौन कौन से डॉक्यूमेंट है जोकि पैन कार्ड को आधार कार्ड से लिंक करवाने के समय आवश्यक होंगे ऐसे में यदि आप भी यह सोच रहे हैं कि पैन को आधार से लिंक करवाने में कौन सा डॉक्यूमेंट जरूरी है तो आपको बता दें कि इसके लिए डॉक्यूमेंट की आवश्यकता नहीं है पैन कार्ड को आधार कार्ड से लिंक करवाते समय आपको किसी दूसरी डॉक्यूमेंट की जरूरत नहीं पड़ती है यदि आपको अपने पैन को आधार कार्ड से लिंक करवाना है तो इसके लिए आपके पास पैन कार्ड आधार कार्ड और मोबाइल नंबर होना अनिवार्य है यदि आपके पास यह तीन चीजें उपलब्ध है तो आप बहुत ही आसानी से pan Aadhar linking कर सकते हैं

पैन कार्ड को आधार कार्ड से लिंक करने की अंतिम तिथि

Pan Update: पैन कार्ड को आधार कार्ड से लिंक करने के लिए लगातार आ रहे हैं पैन कार्ड अपडेट में कई बार पैन कार्ड को आधार कार्ड से लिंक करवाने के लिए अंतिम तिथि निर्धारित की गई है और इसे कई बार बढ़ाया भी गया है जिसकी वजह से जिन लोगों ने अपने पैन कार्ड को आधार कार्ड से लिंक नहीं करवाया है वह लोग आसानी से समय रहते pan Aadhar link करवा सकें केंद्रीय प्रत्यक्ष कर बोर्ड के द्वारा पैन कार्ड को आधार कार्ड से लिंक ना करवाने पर पैन कार्ड को निष्क्रिय होने की बात भी सामने आई है वहीं पर केंद्रीय प्रत्यक्ष कर बोर्ड के द्वारा यह बात साफ तौर पर कही गई है कि यदि कोई व्यक्ति पैन कार्ड को आधार कार्ड के द्वारा लिंक नहीं करवाता है तो उसका पैन कार्ड पूरी तरह से निष्क्रिय हो सकता है साथ ही साथ उसे दोबारा सक्रिय करवाने के लिए व्यक्ति को ₹10000 की मोटी रकम जुर्माने के रूप में भी भरना पड़ सकता है इसके लिए आयकर विभाग अधिनियम 1961 के धारा 273N भी लागू की गई है Pan Aadhar linking last date 30 jun 2023 निर्धारित किया गया है जिसके अनुसार सभी व्यक्तियों को 30 जून 2023 तक अपने पैन कार्ड को आधार कार्ड से लिंक करवाना अनिवार्य है

s.m.s. के द्वारा कर सकते हैं पैन कार्ड को आधार कार्ड से लिंक

Pan Aadhaar link करने को और भी ज्यादा सुलभ बनाने के लिए नई सुविधा शुरू की गई है जिसके अनुसार जो व्यक्ति अपने पैन कार्ड को आधार कार्ड से लिंक करवाना चाहते हैं वह बहुत ही आसानी से सिर्फ एक s.m.s. के माध्यम से अपने पैन कार्ड को आधार कार्ड से लिंक कर सकते हैं यदि आप पैन कार्ड को आधार कार्ड से लिंक करने के लिए s.m.s. माध्यम का उपयोग करना चाहते हैं तो नीचे दिए गए स्टेप्स को फॉलो करके पैन आधार लिंकिंग कर सकते हैं - s.m.s. के द्वारा पैन आधार लिंक करने के लिए आपको सबसे पहले अपना s.m.s. बॉक्स ओपन करना होगा - ध्यान रखें कि इसके लिए आपको उसी मोबाइल नंबर का उपयोग करना है जो कि आपके आधार कार्ड से लिंक है - इसके बाद आपको भेजने वाले की जगह पर 567678 या 56161 दर्ज करना होगा - यहां पर आपको UIDPAN (space) aadhaar number (space) pan card number दर्ज करना होगा - इसके बाद सबमिट बटन पर क्लिक करना होगा जिसके बाद आपके पैन कार्ड को आधार कार्ड से लिंक कर दिया जाएगा पैन कार्ड को आधार कार्ड से लिंक करने के लिए आपके पास दूसरा विकल्प भी उपलब्ध है यदि आप ऑनलाइन पैन को आधार से लिंक करना चाहते हैं तो Income Tax Department की ऑफिशियल वेबसाइट NSDL का उपयोग करके भी लिंक कर सकते हैं अस्वीकरण: Nikat news का किसी भी सरकारी वेबसाइट से कोई संबंध नहीं है यहां पर दी गई जानकारी लोगों तक समय पर सही सुविधाओं से अवगत कराने के लिए है जिससे लोग सरकार के द्वारा शुरू की गई नई सुविधाओं और जारी की गई गाइडलाइन के बारे में जान सके और इनका उपयोग कर सकें यदि आप इसके बारे में विस्तृत जानकारी चाहते हैं तो सरकार के द्वारा जारी की गई ऑफिशियल वेबसाइट पर विजिट करके अधिक जानकारी प्राप्त कर सकते हैं follow on: google news Read the full article

#Aadhaar#IncomeTaxDepartment#newpancard#NSDL#PAN#Panaadhaarlinkingstatus#PANAadhar#PANAadharLink#PANAadharLinking#pancard#Pancardaadhaarcardlink#PANCardKoAadharCardKaiseKaren#pancardnews#pancardupdate

0 notes

Text

0 notes

Text

Link Aadhar Pan Card Online 2023

Check Aadhar Pan Card Link Status OR Link Aadhar Pan Card Online 2023 Income Tax Department has set March 31, 2023 as the last date for all citizens to link PAN card with Aadhaar card. Any person who has a PAN card should check their status immediately whether their PAN card is linked to their Aadhaar card or not. Those who do not have it, they can link their PAN card with Aadhaar online before…

View On WordPress

0 notes

Text

क्या आपने आधार कार्ड को पैन कार्ड से जोड़ लिया है ? | Check Status Now Link Aadhar to Pan Card | Last Date Extended: 30th June 2023

0 notes

Text

Aadhar and Pan Card Extension.

Three more months to link #PANcard with #Aadhar card. Last date now extended to June 30, 2023 from March 31 @XpressBengaluru

@NewIndianXpress

@XpressBengaluru Image 4 16 28

K.RAGAVAN.. @write2ragavan Latest on the linking of Pancard extension. Despite the earlier announcement from the government thousands have not done and paid 1000Rs. Many senior citizens have not done because they are not paying tax and non pensioners with depending on their retirement benefit interest. 7:07 PM · Mar 28, 2023 · 1 View View Tweet analytics K.RAGAVAN.

0 notes

Text

Last date for Aadhar link to PAN card 31-03-2023 | How to link Aadhaar with PAN card | PAN Aadhaar

youtube

#incometax#aadhaarpanlinking#taxguidenilesh#nilesh ujjainkar#tax guide nilesh#new tax regime#income tax return#Youtube

0 notes

Text

Canada Visa Medical Doctors in India | Find Panel Physicians

Canada Visa Medical Check-ups are mandatory for Indians for Visas, such as Student, Worker, Visitor and Immigration.

The Canada Medical Examination can be scheduled before submitting a visa application to speed up the Embassy/Consulate procedure. As a result, most applicants prefer to submit an e-Medical sheet along with their visa applications. Additionally, the hospital submits the medical reports straight to IRCC for validation. Some hospitals even submit the reports right away after your check-up is complete.

How to book an appointment for Canada Medical Check-up?

First, you have to look for a panel physician nearby (The list is available below). Then you have to either Call, Email or book an appointment online and pay the charges depending on the facility.

What documents to carry for the Canada Visa Medical Test?

1. Original Passport (If the passport is submitted to the Embassy for any reason, you must carry a photocopy of your Aadhar Card and PAN Card for verification)

2. Two Copies of Passport (Front & Last page)

3. Two Passport-Sized photos

4. Vaccination Certificate (Both Doses)

Is Fasting required before Medical Test?

No, fasting is not required. It would be best if you had a normal breakfast before your examinations. If you have Diabetes, it's suggested to avoid high-sugar foods at least 12 hours before the appointment time.

What kind of tests will be done for Canada Medical?

Height and Weight Measurement

EyeSight Vision Test

X-Ray

Blood and Urine Test

What is the validity of Canada Medical Check-up Report?

The e Medical Report for Canada is valid for 1 year from the date of examination. So, in case of Refusal and Re-Apply, you can use the same medical check-up report within 1 year validity.

To know more information visit this link https://abroadcube.com/blog/canada-visa-medical-doctors-in-india-find-panel-physicians

0 notes

Text

Name of Post:

Indian Navy 12th & B.Tech Recruitment Online Form 2024

Post Date:04 January 2024 | 05:17 AMShort Information :Indian Navy has Recently Invited to the Online Application Form for the Post 10+2 (B.TECH) Cadat Entry Scheme Recruitment 2024.

The Indian Navy

Indian Navy 10+2 B.Tech CES Recruitment 2024

Important Dates

Start Date: 06 /01 /2024

Last Date : 20/ 01/2024

Exam Date : Notify Soon

Application Fee

General/OBC/EWS :Rs. 0/-

SC / ST / Female : Rs. 0/-

You can not pay through:

No Fee Pay

Age Limit as on (02/01/2005 to 01/07/2007)

Minimum Age : 17 Years

Maximum Age : 19.5 Years

Age Relaxation read the notification.

Education Qualification.

Passed Senior Secondary Examination (10+2 Pattern) or its equivalent examination from any Board with at least 70% aggregate marks in Physics, Chemistry and Mathematics (PCM) and at least 50% marks in English (either in Class X or Class XII).

Candidates Must be Enrolled and Appeared in JEEMAIN 2023 Entrance Examination..

Vacancy Details

Total Post : 35 Post

Selection Process

Short List

SSB Interview

Final Merit List

Required Documents

Candidates Photograph

Candidates signature

10th / 12th Mark sheet

Aadhar Card / Pan Card

Pay Scale

₹15,600-39,100/- with a Grade Pay of ₹5400/-

How To Apply Indian Navy

These are following step.

Click on the Apply Online Link given below.

Fill out the application form.

Upload the required documents

Print the Application Form.

USE IMPORTANT LINKS

Apply Online

0 notes