#a Canadian IT leader in Microsoft Cloud-Based Solutions

Explore tagged Tumblr posts

Text

PCM Acquires Stratiform, a Canadian IT leader in Microsoft Cloud-Based Solutions

PCM adds strategic cloud-solution provider to its growing Canadian practice

EDMONTON, Alberta, January 3, 2017 – PCM, Inc. (NASDAQ:PCMI) a leading North American technology solutions provider, today announced a strategic acquisition of Stratiform, Inc. (Stratiform), an industry-leading provider of cloud IT solutions that includes consulting, professional, and managed services to clients across Canada. Stratiform, an innovative Gold Certified Microsoft Partner, has proven capabilities specializing in Microsoft cloud technology, including Azure Cloud solutions, Office 365, and Enterprise Mobility Suite.

Stratiform’s unique “build your business from the cloud up” consultative approach will significantly strengthen PCM’s position as a leader in enterprise cloud solutions, further enhancing its ability to provide clients with best-of-breed cloud strategy, advisory, onboarding and migration services, as well as on-going cloud management services.

PCM expects Stratiform to serve as a cornerstone to PCM’s strategic cloud and related solutions offerings and to quickly leverage its leading cloud expertise in Canada, into the United States and other new markets, strengthening PCM’s established leadership position as a key differentiator in the IT marketplace. The acquisition deepens PCM’s relationship with Microsoft and other leading technology companies, and increases PCM’s reach into SMB, Mid-Market, Enterprise, and Public Sector markets throughout North America.

Frank Khulusi, PCM's Chairman and CEO, stated, "The addition of Stratiform to the PCM family of companies reinforces our position as a leader of enterprise cloud solutions and services. We are thrilled to add the extremely talented Stratiform team to our Microsoft solutions focus, enhancing our Azure Cloud organization with new and innovative capabilities. Together, we are extremely well positioned to help our clients realize the business benefits of leveraging cloud technology both securely and strategically to maximize business value.”

From a Canadian perspective, the addition of Stratiform's capabilities to Acrodex and TigerDirect Canada's established Canadian presence brings together three powerful brands that provide distinct value propositions to clients of all segments and industries.

"We are thrilled to add Stratiform as a part of our Canadian transformation," stated Phil Soper, President of PCM Canada. "Along with Acrodex and TigerDirect Canada, Stratiform propels us to the next level when it comes to delivering enterprise-class Microsoft cloud solutions. The Stratiform team have established themselves as dominant players in delivering cloud technology. That expertise, backed by the depth of Acrodex, TigerDirect Canada, and PCM, means we can assist our clients with a broad range of premier IT products, services, and solutions.”

"We are very excited to be joining the PCM family. Our passion has long been to help our customers transform their businesses through the use of cloud technologies,” stated Jordan Byman, President of Stratiform. “This acquisition represents an opportunity to accelerate our growth plans and expand the Stratiform brand and presence throughout Canada and the United States. By leveraging PCM’s extensive customer relationships and operational scale, we can help even more customers transform their organizations."

For additional information, please refer to the PCM press release.

About Stratiform, Inc.

Through a full suite of IT consulting services (including Professional and Managed Services), Stratiform specializes in designing, planning, and implementing Microsoft Cloud Solutions - Azure, Office 365, and EMS. No matter the solution, Stratiform focuses on helping clients achieve greater efficiencies through their Microsoft cloud investments. Visit www.stratiform.ca for more information.

About Acrodex, Inc.

Through uncompromising integrity, passion for our customers’ success, and a commitment to excellence, Acrodex has proven their ability to offer flexible IT solutions that drive results. With over 30 years’ experience in Information Technology, Acrodex serves large and mid-tier organizations through end user device lifecycle management, data center managed services, procurement as a service, software licensing, and cloud solutions. Acrodex operates as a wholly-owned Canadian subsidiary of PCM, Inc. Visit www.acrodex.com for more information.

About PCM, Inc.

PCM, Inc., through its wholly-owned subsidiaries, is a leading technology solutions provider to small and medium sized businesses, mid market and enterprise customers, government and educational institutions and individual consumers. For more information please visit investor.pcm.com.

Raza N. Hussain Marketing & Communications Acrodex Inc. [email protected]

PCM Acquires Stratiform, a Canadian IT leader in Microsoft Cloud-Based Solutions was first available on Edmonton IT Services Firm: http://www.acrodex.com/

0 notes

Text

Database Encryption Market 2018: Global Opportunities, Growth Factors and Forecast by Regions, Types, Applications, Dynamics, Development Status and Outlook 2023

Market Highlights

Database encryption has grown in importance and demand as privacy and security has become a key concern for many business enterprises. Database encryption is vital in securing the integrity of database information and is widely being adopted. Market Research Future has conducted a detailed survey of the market and calculated various rates of growth as well as analyzed drivers, trends, and restraints of the market. Increasing data breaches in recent times have put a spotlight on database encryption and demand has exploded, driving significant growth for the global database encryption market.

Government and privacy regulations have come into effect which either endorse or mandate database encryption to reduce theft of valuable data. Increasing establishment of database security companies and the offered services are driving the growth of the market. Encryption service offerings also offer easy manageability and improved performances which have led to increased demand for database encryption services. Moreover, the increasing affordability of such services has also had a highly positive impact on market growth. The advent of the cloud and its widespread adoption has improved scalability, made deployment easy and accessible, and highly flexible which encourage database encryption adoption. Additionally, databases are increasingly being stored on the cloud which makes them more vulnerable to security threats, thus driving the need for encryption.

Notably, the high cost and complexity associated with the initial set up of database encryption are expected to challenge market growth. Moreover, there is a dire lack of awareness regarding database encryption services which is expected to restrain market growth. However, the market is flooded with opportunities as the awareness is growing gradually, and advancement of IT technology is expected to result in the rendering of highly efficient database encryption services.

Get a Free Sample @ https://www.marketresearchfuture.com/sample_request/1801

Segmentation:

Various key segments of the market have been analyzed in depth in MRFR's report. Division of the various vital market components has been performed on the basis of encryption type, deployment, vertical, and region. Encryption types implemented included column level, file system, transparent, and others.

Deployment of data encryption services can be done on-cloud and on-premise.

Verticals, where database encryption is used, include manufacturing, It & telecom, BFSI, government, retail, aerospace & defense, healthcare, and others,

The global market is divided into key geographical regional markets which include Europe, Asia Pacific, North America, and the Rest of the World.

Regional Analysis:

North America has been identified and established as the leader in the global data encryption market. The strong presence of leading market players in the region such as Intel, Symantec, Win Magic, and Microsoft has put North America at the forefront of the global market. Well-developed countries such as the U.S and Canada have a high adoption rate for cloud-based services and solutions which is expected to affect the growth of the North American market positively.

Meanwhile, the Asia Pacific market is growing rapidly and is likely to register the highest CAGR among all regional markets. The increasing trend of Bring Your Own Devices (BYOD) has played a huge role in increasing the importance of database security solutions. Countries such as China and Japan are witnessing increasing adoption of scalable database encryption services in small and medium enterprises, thus driving the growth of the market.

Competitive Dashboard:

Notable market participants included in MRFR’s analysis of the competition in the global database encryption market include Win Magic Inc., PKWARE, Inc., EMC Corporation, Symantec Corporation, Microsoft Corporation, SAS Institute Inc., IBM Corporation, Sophos Ltd., Check Point Software Technologies Ltd., Intel, and Trend Micro Inc.

Latest Industry News:

Canadian based Kalepso has entered the database encryption market with its recent company launch.

Australia has established a new anti-encryption law for national security purposes.

Browse Complete Report @ https://www.marketresearchfuture.com/reports/database-encryption-market-1801

List of Tables

Table1 Global Database Encryption Market, By Country, 2018-2023

Table2 North America: Database Encryption Market, By Country, 2018–2023

Table3 Europe: Database Encryption Market, By Country, 2018–2023

Table4 Asia-Pacific: Database Encryption Market, By Country, 2018–2023

Table5 Latin America: Database Encryption Market, By Country, 2018–2023

Table6 North America: Database Encryption Market, By Country

Table7 North America: Database Encryption Market, By Application

Table8 North America: Database Encryption Market, By Type

Table9 North America: Database Encryption Market, By Service

Table10 North America: Database Encryption Market, By Vertical

Table11 Europe: Database Encryption Market, By Country

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Contact:

Market Research Future

+1 646 845 9312

Email: [email protected]

1 note

·

View note

Text

Global Commercial Pharmaceutical Analytics Market: Industry Analysis and forecast (2019 –2027)

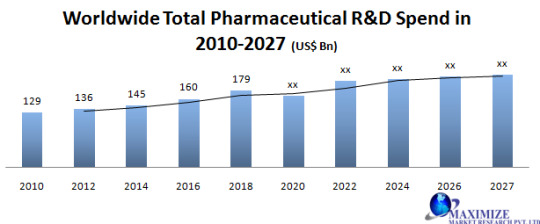

Global Commercial Pharmaceutical Analytics Market size was valued US$ XX Mn. in 2019 and the total revenue is expected to grow at 15.7% from2019 to 2027, reaching nearly US$ XX Mn.

The report study has analyzed the revenue impact of COVID -19 pandemic on the sales revenue of market leaders, market followers, and market disrupters in the report, and the same is reflected in our analysis.

Commercial pharmaceuticals analytics is the use of analytical software that helps in managing and analyzing biological and biomedical data from life science industries like hospitals, laboratories, and pharmaceutical companies.

Pharmaceutical software has an important quotient in the growth of the market for pharmaceutical. In the future, it is expected that the market for commercial pharmaceutical analytics will advance with a higher growth rate as compared to past years. The current challenges for the market are training the professionals on the software, thanks to its complexity. Henceforth, the change of workflow from manual to digital may need some time andwill result in a long-term advantage when the advanced features of pharmaceutical analytics software are applied and used regularly.

Above 40% of the global population now has access to the internet. The internet is a huge platform for people to source their data and get the preferred information. More than nearly 80% of the people with internet access search for the evidence about its treatment, drugs acting on it. Likewise, the MMR report contains a detailed study of factors that will drive and restrain the growth of the commercial pharmaceutical analytics market globally.

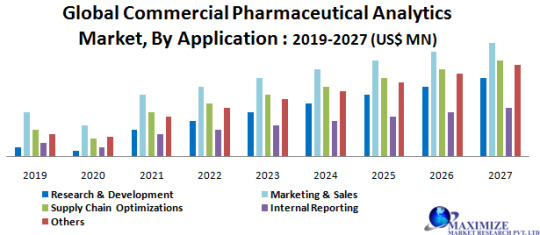

By application, the marketing & sales segment was valuedUS$ X.44 Mn. in 2019 and is expected to reach US$ XX.13 Mn by 2027 at a CAGR of XX.12% over the forecast period. The high growth of the marketing & sales segment can be attributed to the growing adoption of analytics by life science companies to align their marketing & sales companies. An increase in the use of post-marketing surveillance is also rising the utilization of analytics for marketing & sales.

Global Commercial Pharmaceutical Analytics Market1

The report offers a brief analysis of the major regions in the commercial pharmaceutical analytics market, namely, APAC, Europe, North America, South America, and the MEA. Among these, North America’s commercial pharmaceutical analytics market was valued at US$ XX.11 Mn. in 2019 and is expected to reach a value of US$ XX.63 Mn. by 2027, with a CAGR of 14.2% during 2019-2027.

The U.S. commanded the largest share of the commercial pharmaceutical analytics market in 2019 and it is expected to reach US$ XX.8 Bn. Also, at present, the U.S. is dominating the commercial pharmaceutical analytics market in North America as it has deployed most of the commercial pharmaceutical analytics solutions and its uses. The Canadian pharmaceutical industry is facing challenges and massive changes in many years.

The research study includes the profiles of leading players operating in the global commercial pharmaceutical analytics market. In 2018, Allscripts Company has publicized that it will obtain Practice Fusion, a health IT retailer proposing a cloud based EHR and data analytics tools for life science enterprises, for US$ 100 Mn in cash.

The objective of the report is to present a comprehensive analysis of the Global Commercial Pharmaceutical Analytics Marketincluding all the stakeholders of the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that includes market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report.

External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers.

The report also helps in understanding Global Commercial Pharmaceutical Analytics Marketdynamics, structure by analyzing the market segments and projects the Global Commercial Pharmaceutical Analytics Marketsize. Clear representation of competitive analysis of key players by Application, price, financial position, Product portfolio, growth strategies, and regional presence in the Global Commercial Pharmaceutical Analytics Market make the report investor’s guide.

Global Commercial Pharmaceutical Analytics Market Request For Sample Page @ : https://www.maximizemarketresearch.com/request-sample/65545 Scope of the Global Commercial Pharmaceutical Analytics Market

Global Commercial Pharmaceutical Analytics Market, By Application

• Research & Development • Marketing & Sales • Supply Chain Optimizations • Internal Reporting • Others Global Commercial Pharmaceutical Analytics Market, By Deployment

• Cloud Based • Web Based Global Commercial Pharmaceutical Analytics Market, By Type

• Descriptive analytics • Predictive analytics • Prescriptive analytics Global Commercial Pharmaceutical Analytics Market, By Region

• Asia Pacific • North America • Europe • South America • Middle East & Africa Kay layers operating in Global Commercial Pharmaceutical Analytics Market

• Allscripts • Microsoft • Wipro Limited • Northwest Analytics, Inc. • International Business Machines Corporation • ORACLE • CitiusTech Inc. • Sanofi • Cerner Corporation • Fuzzy Logix, Inc. • Exscientia Limited

About Us: Maximize Market Research provides B2B and B2C market research on 20,000 high growth emerging technologies & opportunities in Chemical, Healthcare, Pharmaceuticals, Electronics & Communications, Internet of Things, Food and Beverages, Aerospace and Defense and other manufacturing sectors.</p>

Contact info: Name: Vikas Godage Organization: MAXIMIZE MARKET RESEARCH PVT. LTD. Email: [email protected] Website:www.maximizemarketresearch.com

0 notes

Photo

Convergence of Brains and Chains – An AI View of Blockchain After many stops and starts it finally appears that we are on the verge of a true convergence explosion between Internet of Things (IOT), AI, and blockchain. Or in other words, the production of data, the consumption of data and the distribution of data. To review: IoT pertains to the interconnectivity of the world around After many stops and starts it finally appears that we are on the verge of a true convergence explosion between Internet of Things (IOT), AI, and blockchain. Or in other words, the production of data, the consumption of data and the distribution of data. To review: IoT pertains to the interconnectivity of the world around us—basically how all of our personal and home devices work together to optimize daily human life. Artificial Intelligence (AI) has previously been described as the ability of computer systems to perform tasks that previously had required human interaction, but today it pertains more to algorithms that assemble and analyze personal data which is then used to facilitate and streamline human existence. The blockchain is a digital ledger in which transactions are recorded chronologically and publicly. The technology often involves bitcoin or other similar cryptocurrencies. The main benefit of blockchain is that it catalogs data into a permanent record along with a chain that is transparent and linear. The convergence of these technologies come with both enormous benefits and also significant risks. Industries have been looking at blockchain as a way to streamline their processes and make tracking and data collection simpler and more transparent. In the past, there have been those who worried about the susceptibility of IoT and AI to the hacking of encryption services. Those security concerns are one of the main reasons why we haven’t yet seen a true explosion of the convergence of IoT, blockchain and AI but the tide has begun to turn as blockchain advances have now made the aforementioned hacking more difficult. What are the key convergence highlights? One of the main ideas at the interaction of AI and Blockchain is the data marketplace. If everyone owns their own data and can make it available as they choose in a private manner, we could have more data in aggregate. To truly achieve its potential, each of the three building blocks of AI must be made available in a centralized, private, and secure manner. Outlier Ventures explains the need for the Convergence Ecosystem by saying, “The Internet of Things is creating an unmanageable data environment, and artificial intelligence is giving those who control the most data more power than any company in history.” Outlier adds, “The integration of these technologies will see markets become increasingly open-sourced, distributed, decentralized, automated, and tokenized.” Observers are closely watching which sectors and companies will emerge atop the convergence industry bracket. Interestingly, this convergence war echoes what occurred several years ago with cloud/mobile convergence. The companies who emerged victorious from that battle were not initial sweetheart companies like Lycos and Yahoo but rather Microsoft, Amazon and surprisingly, IBM, a company once associated with hardware who has made significant inroads into this space, especially as of late. Several budding convergence sectors will undoubtedly determine the winners and losers. The Government Accountability Office recently identified eight industries where convergence has the greatest upside. They include the healthcare industry, transportation (both personal and commercial), smart homes and buildings, manufacturing, supply chains, wearables, agriculture, and energy. Other industries that appear primed to take full advantage of the technology include farming, marketing, retail and the financial services arena. So if you’re making your convergence picks who should be in your Final Four? Not surprisingly the smart money is on the companies that are already leaders in the digital economy like Google, Amazon, Microsoft, Apple and, despite their recent Cambridge Analytica issues, Facebook. These behemoths have access to a wealth of data and already have established footholds in the IoT landscape. Google, for example, has cornered the market on geographic mapping. But the companies who could become major convergence players aren’t simply limited to the GAFA Four. Metromile, for example, is a San Francisco based company which provides per-mile auto insurance along with an app called The Pulse, which collects data about trips and car health. Ecobee is a Canadian home automation company that makes thermostats and smart light switches for both residential and commercial use and a company like Ring is already a major player in the home security field. In the healthcare field, Chrono Therapeutics is focusing on improving clinical outcomes for patients battling addiction and living with neurological disorders via their Integrated Dosing Solution. The company integrates timed drug delivery with personalized, mobile-based digital support and data analytics which seeks to maximize compliance and improve overall patient health. Several smaller start-ups have a real shot at establishing and solidifying a hold on a market that escapes the view of one of the aforementioned tech giants. https://coinmarked.com/convergence-of-brains-and-chains-an-ai-view-of-blockchain/?feed_id=573&_unique_id=5d852ad893261

0 notes

Text

OneSoft Solutions Inc. Ranks No. 22 on the 2019 Startup 50

OneSoft Solutions Inc.

Thursday, September 12, 2019 9:00 AM

– Canadian Business unveils 2019 list of Canada’s Top New Growth Companies –

EDMONTON, AB / ACCESSWIRE / September 12, 2019 / OneSoft Solutions Inc. (the “Company” or “OneSoft”) (TSXV:OSS)(OTCQB:OSSIF) is pleased to announce that Canadian Business and Maclean’s today ranked OneSoft number 22 on the 2019 Startup 50 ranking of Canada’s Top New Growth Companies. Serving as a companion list to the longstanding Growth 500 ranking of Canada’s Fastest-Growing Companies and produced by Canada’s premier business and current affairs media brands, the Startup 50 ranks younger companies on two-year revenue growth. Startup 50 winners are profiled in a special print issue of Canadian Business published with Maclean’s magazine and online at CanadianBusiness.com.

OneSoft made the 2019 Startup 50 list with two-year revenue growth of 658%.

“The 2019 Startup 50 winners suggest the future of Canadian entrepreneurship is extremely bright. They have brought new offerings to market, created indelible brands and disrupted established business models-all in an extremely short period of time,” says Beth Fraser, Startup 50 and Growth 500 program manager. “Any aspiring entrepreneur should look to their stories for inspiration.”

“We are pleased that OneSoft has been recognized in the Startup 50 ranking,” says CEO Dwayne Kushniruk. “This achievement reflects the strong dedication of our team and the advancements we’ve made using our machine learning and advanced data science technologies to assist oil and gas pipeline operators to achieve their objective of zero pipeline failures.”

About the Startup 50

Ranking Canada’s Top New Growth Companies by two-year revenue growth, the Startup 50 profiles the fastest-growing startups in the country. It is a companion list to the Growth 500 ranking of Canada’s Fastest-Growing Companies, which has, for over 30 years, been Canada’s most respectable and influential ranking of entrepreneurial achievement. Both the Startup 50 and Growth 500 are published in a special issue of Canadian Business published with Maclean’s magazine and at CanadianBusiness.com. For more information on the ranking visit Growth500.ca or CanadianBusiness.com.

About Canadian Business

Founded in 1928, Canadian Business is the longest-serving and most-trusted business publication in the country. It is the country’s premier media brand for executives and senior business leaders. It fuels the success of Canada’s business elite with a focus on the things that matter most: leadership, innovation, business strategy and management tactics. Learn more at CanadianBusiness.com.

About OneSoft and OneBridge

OneSoft has developed software technology and products that have capability to transition legacy, on-premise licensed software applications to operate on the Microsoft [NASDAQ:MSFT] Azure Cloud Platform. Our business strategy is to seek opportunities to incorporate Data Science and Machine Learning, business intelligence and predictive analytics to create cost-efficient, subscription-based software-as-a-service solutions. Visit www.onesoft.ca for more information.

OneSoft’s wholly owned subsidiary, OneBridge Solutions Inc., develops and markets revolutionary new SaaS solutions that use Data Science and Machine Learning to apply predictive analytics to big data, which assist Oil & Gas pipeline operators to predict pipeline failures and thereby save lives, protect the environment, reduce operational costs and address regulatory compliance requirements. Visit www.onebridgesolutions.com for more information.

For more information, please contact

Dwayne Kushniruk, CEO [email protected] (780) 437‐4950

Sean Peasgood, Investor Relations [email protected] (647) 494-7710

Forward-looking Statements

This news release contains forward-looking statements relating to the future operations, product creation revenues and profitability of the Company, the Company’s efforts to develop and commercialize the technology with the capabilities and other statements that are not historical facts. Forward-looking statements are often identified by terms such as “may”, “should”, “anticipate”, “expects”, “believe”, “will”, “intends”, “plans” and similar expressions. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Such forward-looking information is provided for the purpose of delivering information about management’s current expectations and plans relating to the future. Investors are cautioned that reliance on such information may not be appropriate for other purposes, such as making investment decisions.

In respect of the forward-looking information and statements, the Company has placed reliance on certain assumptions that it believes are reasonable at this time, including expectations and assumptions concerning, among other things: interest and foreign exchange rates; planned synergies, capital efficiencies and cost-savings; applicable tax laws; the sufficiency of budgeted capital expenditures in carrying out planned activities; the availability and cost of labour and services; the efficacy of its software, its ability to complete projects to expected deadlines, the success of growth projects; future operating costs; that counterparties to material agreements will continue to perform in a timely manner; that there are no unforeseen events preventing the performance of contracts; and that there are no unforeseen material development or other costs related to current growth projects or current operations. Accordingly, readers should not place undue reliance on the forward-looking information contained in this press release. Since forward-looking information addresses future events and conditions, such information by its very nature involves inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to many factors and risks. These include, but are not limited to the risks associated with the industries in which the Company operates in general such as: costs and expenses; interest rate and exchange rate fluctuations; competition; human capital engagement and availability, ability to access sufficient financial capital from internal and external sources; and changes in legislation, including but not limited to tax laws.

Readers are cautioned that the foregoing list of factors is not exhaustive. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release, and the Company undertakes no obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by Canadian securities law.

This news release does not constitute an offer to sell or the solicitation of an offer to buy any securities within the United States. The securities to be offered have not been and will not be registered under the U.S. Securities Act of 1933, as amended, or any state securities laws, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of such Act or other laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: OneSoft Solutions Inc.

SHARE ARTICLE

The post OneSoft Solutions Inc. Ranks No. 22 on the 2019 Startup 50 appeared on Stocks News Feed.

source https://stocksnewsfeed.com/accesswire/onesoft-solutions-inc-ranks-no-22-on-the-2019-startup-50/

0 notes

Text

Digital Immigrants Helping to Build a Digital Nation

A instead silly fixation has actually created in our 'digital' globe today: that there is some type of divide between those who are 'digital natives,' and also those that are not.

Worse, some feel that there is no higher compliment to pay someone than to describe them as a digital local ... which it's perfectly acceptable to disregard 'non-natives' as in some way outré.

With the possible exception of Nicolas Sarkozy, that language is no much longer acceptable in the real world of constructing genuine nations. And a good idea, too.

Immigrant Nation

Little Italy...

Rocco Rossi, a previous Toronto mayoral candidate and previous Head of state of the Liberal Celebration of Canada, recently told a touching tale concerning his uncle's challenging beginnings as an 18-year-old Italian immigrant to Canada in 1951, landing at Pier 21 in Halifax, Nova Scotia. Later, after the uncle had damaged this fresh ground, others from his household and also the inadequate farming area he had emigrated from made the journey throughout. Today, 350 people from that neighborhood now call Greater Toronto home.

What struck me regarding the tale had not been concerning how various most of us are, but rather, the similarities. Outside of First Nations and also (now) a fairly little portion of those descended from those that showed up early, in the 16th as well as 17th centuries, the majority of Canadians are first, 2nd, and also 3rd generation immigrants. And many have moms and dads or grandparents that can associate tales of what life was like trying to obtain developed 'off the watercraft.'

Yet we frequently deny these similarities. Established immigrant teams typically aren't as inviting as they could be of the newer ones. The most recent ones cannot recognize the dull society of the well-known team. As well as the reputable, however still relatively new, groups like the Italians as immortalized by novelist Nino Ricci, desire to convey a Goldilocksian top quality of being not as well fresh, and also not as well stagnant, not delighting in the complete advantages of the establishment but not destitute anymore.

Everyone jockeying for placement - and also lobbing subtle putdowns at groups that showed up on a different watercraft. When in truth, we're all in the exact same boat.

The Digital Nation

That got me thinking about the "Digital Nation."

In Digital Nation, the chronology is in reverse: the newer generations are the 'citizens,' the older generations supposedly the uncomfortable, unpredictable 'immigrants.'

The Digital Nation...

In this version of truth, there is a shocking quantity of displaying around that qualifies to function as well as prosper in the sector. If you didn't just get here, possibly you're as well set in your means to really 'obtain it.' (As Dilbert when aptly shared, the older tech employee could be changed by the younger tech employee, that could subsequently be changed by a 'unborn child.')

Or on the various other hand, if you arrive far too late, maybe all the great get-rich-fast possibilities (Microsoft millionaires, Google worker # 76, obtained an excellent gig at Facebook 3 years ago) will certainly be gone!]

All of it is nonsense…

The Digital Generation Gap

At most ideal, this department offers to remind us of how younger individuals think, or ways to drop old baggage from our business techniques in order to gauge range, networks, and also the rate and also power of the info revolution.

Crossing the divide...

At its worst, it assigns excessive credit rating to any individual who merely shows comfort with using their new tablet, and also that could string a few buzzwords together from Silicon Valley startup culture.

And this underestimates simply exactly how strong the digital divide still is even among young, educated people under 25. There are those that make use of Facebook as well as jargons, and after that, those who can grasp sophisticated shows languages (as well as comply with official scholastic research study, at the very least for a while) to address hard troubles. The substantial majority of 'electronic citizens' are passive fans of the productions as well as improvements headed by a driven, accomplished few.

It's unsurprising to this Gen-X' er that it's often baby boomers who appear obsessed with electronic natives, and even desire to be viewed as digital locals. These are the ones who write books on ways to recognize those that are born electronic, or tweet constantly concerning this application or that.

How do they ever before get anything done? Some of it's downright weird, when you look closely.

Faking It Till You Make It

Most achieved individuals can take advantage of digital innovation as well as digital society - regardless of whether they are in the ideal age brace or straight able to code in the current languages. And also they do so in interesting ways.

Most notably, if they fake-it-till-they-make it hard sufficient, they're left with legions of followers that casually throw around discusses of usages of their systems as methods of faking-it-even-harder. Perhaps a few examples will certainly allow clarify.

Take Matt Drudge, publisher of a page of web links I do not know exactly what making of called the Drudge Report:

Drudge has commonly been lauded as a leader of the fast-moving electronic national politics press. Evaluating only by his age, he could have had a Commodore Pet dog in college, and also he can also do a mean pantomime of a rotating dial phone. Drudge's dad is an electronic leader, having started an on the internet study shop called refdesk. Drudge is an unlikely hero, offered that the style of his site was in fact ripped off from his Dad's.

But then once more, Techmeme's aggregation style was torn off from Drudge. It seems our heroes obtain unlikelier and also unlikelier with each passing generation.

And what about Arianna Huffington The queen of the vaguely dynamic soft-scraper empire referred to as the Huffington Blog post, is an effectively off Child Boomer. I make sure she goes to fantastic initiative to look laid-back when she utilizes her smart device (without reading glasses).

Then there's Nick Denton founder of Gawker Media. He's a splendidly creative business owner and also always exact commentator on the state of our industry. Denton is an authority of breathless, shameless, bawdy blogging.

Today's chatter is tomorrow's news

But did you recognize that Denton left his task as a financial reporter to launch just what was basically a kind of venture internet search engine modern technology? A news collector called Additionally, among a pack of very early solutions planned to transform the archaic technique of 'news clipping solutions' on its head. Denton acts all casual, but it takes a whole lot of deep understanding of the info transformation to develop a successful start-up that changes just how business works.

New York Mayor Michael Bloomberg started up something not so dissimilar to Denton's business, unlike the mildly wealthy Denton, Bloomberg got very abundant off it. Bloomberg is still a global information realm, majority-owned by Michael Bloomberg, regardless of being pre-Web in its genesis. It was started in 1981, around the same time Microsoft created MS-DOS.

A fellow named Alan Meckler belonged to a team who began up conferences with names like Internet Globe back in the early 1990's. He later went on to own companies with names like Internet.com. Before all that, he was associated with 'information changes' on media like CD-Roms. He is around 70 years old.

Google is stocked with young, wise coders. They're likewise filled with skilled Ph.D's, directed by many Silicon Valley elders, as well as have actually typically had their butts kicked by a seasoned company advisor called Costs Campbell, who not just holds a Master's level, yet was train of the Columbia University football team in the 1970's, VP of Advertising with Apple, as well as much more just recently, CEO as well as Chairman of Intuit. For every one of these factors, Googlers dubbed him 'Train.'

Sheryl Sandberg, also a vital number in the early days of Google's procedures as well as the ethical conscience of its advertising program, is currently COO of Facebook. She pertained to Google with a background in seeking advice from at McKinsey, and as an upper-level official in the Treasury Department under the Clinton Administration. Her role at Facebook has actually been so critical to the business's survival and profitability that her total (mainly stock-based) payment (until now) is valued at better compared to $1B.

Turning to non-media companies.

Amazon.com, led by the irrepressible Jeff Bezos, is today an $83 billion firm. Bezos began Amazon in 1994. He is a true digital pioneer as well as enthusiast. Yet he is not a 'digital indigenous' by today's meaning, neither was he viewed as an especially accomplished techie.

Like Steve Jobs, Bezos found out a great deal on the task, though he knew sufficient in 1994 to write job descriptions for established coders. He came down from Wall Street with a vision as well as implemented it with an outlandish degree of obsession to information. Amazon.com is so influential that its simplicity of usage ended up being a darkness under which all ecommerce suppliers lived for years.

Groupon is a 'laughable' development by a cabal of tech-agnostic financiers that take place to have actually made fairly a dent in the market. It's a digital company, kind of. Movie critics of the business appear to really feel that by slamming the company for 'not being actually electronic,' they could in some way talk down its evaluation. Best of luck with that said! Current appraisal: $11.4 billion. I'm not a follower of Groupon myself, yet it's extremely real.

How numerous various other examples would certainly you like?

In cloud computer and also SaaS, middle-aged to older conglomerates like IBM, Xerox, Oracle, and so on compose a substantial part of the value of the US stock exchanges. Also Salesforce.com, the 'startup,' is also mature to be amazing to the amazing youngsters. However it deserves $20.7 billion. Its 47-year-old founder, Marc Benioff, cut his teeth at business at Apple as well as Oracle after developing a software application firm in high school, selling games for machines like the Atari.

Digital Elders

' It's the wood that must fear your hand, not vice versa.' -Pai Mei

What's my verdict? Well, I don't suggest to reject the noticeable: that it could be a great benefit to be born right into the digital change. Several new and also important solutions will certainly be begun up by those that involve the table with a lot of the appropriate prerequisites in terms of understanding as well as disposition.

But 'digital immigrants' like Jeff Bezos, Michael Bloomberg, Marc Benioff, as well as Arianna Huffington bring something special to the table as well:

They create ventures and address problems self-consciously instead of intuitively. Perhaps it's 'you state tomato, and also I state tomahto,' but those who can bring aware, organized effort right into an area typically get to elevations that the plain virtuoso cannot.

More exceptionally, they understand just what's absolutely effective and game-changing about a fad or technology, and could evangelize that adjustment to those who aren't sure.

They could be ready to work harder, be more stressed, remain the course seemingly forever on a lengthy march to monotonous greatness.

And one more thing. Due to the fact that they're not captured up in the 'social scene' of 'being digital,' the 'digital immigrants' are suitable to inform the truth.

Alan Meckler, that somehow does not have a Wikipedia access (though his business does), uploaded merely and also directly: 'Wikipedia is a Farce' as well as Wikipedia is Dishonest:. And also just what did he need to lose? Lunch with Jimmy Wales?

Digital Nation Building

There is going to be much worth and an extraordinary amount of fresh cultural outcome rising from Digital Nation in the coming years. However Digital Country needs - desperately requires - the equilibrium, official academic histories, framework, greed, worries, planning experience, bridging abilities, and also irreverence of its 'electronic immigrants.' (' Immigrants' who represent, paradoxically, the older generations of technologies and also economic go-getters from worlds far, much away - specifically, previous years like the 1990's, 1980's, and also when it comes to IBM, long before that.)

Were you aware that good ol' Microsoft (MSFT, at $273B) is still valued more than Google to this day? Crazy, right? Resting pleasantly in the list of top 10 business by market capitalization in the Criterion as well as Poor's 500: IBM, at $238B. Google's holding its own at $203B. Facebook, after it goes public, is expected to be valued at $100B. We'll see if they have exactly what it requires to maintain. It's actually prematurely to say.

Or to sum it up most briefly: Zuckerberg, Schmuckerberg.

#business#business owner#marketing#marketing agency#search engine marketing#social media#social media management#social media news#social media strategy

1 note

·

View note

Text

Original Post from InfoSecurity Magazine Author:

BlackBerry Named Magic Quadrant Leader Four Years Running

Research giant Gartner Inc. has named BlackBerry a Magic Quadrant Leader for the forth consecutive year.

The Canadian multinational is one of six vendors to be handed the title in 2019 Gartner Magic Quadrant for Unified Endpoint Management Tools report. Other companies to emerge as leaders from the report are Citrix, IBM, Microsoft, VMWare and MobileIron, which were also awarded the title in 2018.

Magic Quadrants are used to determine the relative positions of competing players in the major technology markets through proprietary qualitative data analysis. The result is that companies are placed in one of four categories: Leaders, Visionaries, Niche Players or Challengers. Vendors that emerge as Leaders have the highest composite scores for their completeness of vision and ability to execute.

In the 2019 Magic Quadrant for Unified Endpoint Management Tools, Gartner’s main focus was on a unified endpoint management (UEM) solution’s ability to coexist with or assist in the migration away from client management tools (CMTs) and processes. This is because of the ongoing migration of PCs from legacy CMTs to UEM that Gartner stated it witnesses in a majority of end-user organizations.

BlackBerry’s UEM solutions have been adopted by leaders in highly regulated industries, including government, healthcare, energy and financial services. The solutions work by using machine learning and predictive analysis to securely enable the internet of things (IoT) with complete endpoint management and policy control for an enterprise fleet of devices and apps.

The company’s latest offering, BlackBerry Intelligent Security, is the first cloud-based solution to harness the power of adaptive security. The tech allows IT teams to alter the security requirements and functionality of enterprise devices and apps based on a user’s real-world behavior and a risk score calculated via a combination of artificial intelligence (AI) and spatial data. And all this is achieved without leaving an additional software footprint.

Go to Source Author: BlackBerry Named Magic Quadrant Leader Four Years Running Original Post from InfoSecurity Magazine Author: BlackBerry Named Magic Quadrant Leader Four Years Running Research giant…

0 notes

Text

Database Encryption Market Analysis by Key Vendors, Size, Share, Demand, Development Strategy, Future Trends and Industry Growth

Market Highlights

Database encryption has grown in importance and demand as privacy and security has become a key concern for many business enterprises. Database encryption is vital in securing the integrity of database information and is widely being adopted. Market Research Future has conducted a detailed survey of the market and calculated various rates of growth as well as analyzed drivers, trends, and restraints of the market. Increasing data breaches in recent times have put a spotlight on database encryption and demand has exploded, driving significant growth for the global database encryption market.

Government and privacy regulations have come into effect which either endorse or mandate database encryption to reduce theft of valuable data. Increasing establishment of database security companies and the offered services are driving the growth of the market. Encryption service offerings also offer easy manageability and improved performances which have led to increased demand for database encryption services. Moreover, the increasing affordability of such services has also had a highly positive impact on market growth. The advent of the cloud and its widespread adoption has improved scalability, made deployment easy and accessible, and highly flexible which encourage database encryption adoption. Additionally, databases are increasingly being stored on the cloud which makes them more vulnerable to security threats, thus driving the need for encryption.

Notably, the high cost and complexity associated with the initial set up of database encryption are expected to challenge market growth. Moreover, there is a dire lack of awareness regarding database encryption services which is expected to restrain market growth. However, the market is flooded with opportunities as the awareness is growing gradually, and advancement of IT technology is expected to result in the rendering of highly efficient database encryption services.

Get a Free Sample @ https://www.marketresearchfuture.com/sample_request/1801

Segmentation:

Various key segments of the market have been analyzed in depth in MRFR's report. Division of the various vital market components has been performed on the basis of encryption type, deployment, vertical, and region. Encryption types implemented included column level, file system, transparent, and others.

Deployment of data encryption services can be done on-cloud and on-premise.

Verticals, where database encryption is used, include manufacturing, It & telecom, BFSI, government, retail, aerospace & defense, healthcare, and others,

The global market is divided into key geographical regional markets which include Europe, Asia Pacific, North America, and the Rest of the World.

Regional Analysis:

North America has been identified and established as the leader in the global data encryption market. The strong presence of leading market players in the region such as Intel, Symantec, Win Magic, and Microsoft has put North America at the forefront of the global market. Well-developed countries such as the U.S and Canada have a high adoption rate for cloud-based services and solutions which is expected to affect the growth of the North American market positively.

Meanwhile, the Asia Pacific market is growing rapidly and is likely to register the highest CAGR among all regional markets. The increasing trend of Bring Your Own Devices (BYOD) has played a huge role in increasing the importance of database security solutions. Countries such as China and Japan are witnessing increasing adoption of scalable database encryption services in small and medium enterprises, thus driving the growth of the market.

Competitive Dashboard:

Notable market participants included in MRFR’s analysis of the competition in the global database encryption market include Win Magic Inc., PKWARE, Inc., EMC Corporation, Symantec Corporation, Microsoft Corporation, SAS Institute Inc., IBM Corporation, Sophos Ltd., Check Point Software Technologies Ltd., Intel, and Trend Micro Inc.

Latest Industry News:

Canadian based Kalepso has entered the database encryption market with its recent company launch.

Australia has established a new anti-encryption law for national security purposes.

Browse Complete Report @ https://www.marketresearchfuture.com/reports/database-encryption-market-1801

List of Tables

Table1 Global Database Encryption Market, By Country, 2018-2023

Table2 North America: Database Encryption Market, By Country, 2018–2023

Table3 Europe: Database Encryption Market, By Country, 2018–2023

Table4 Asia-Pacific: Database Encryption Market, By Country, 2018–2023

Table5 Latin America: Database Encryption Market, By Country, 2018–2023

Table6 North America: Database Encryption Market, By Country

Table7 North America: Database Encryption Market, By Application

Table8 North America: Database Encryption Market, By Type

Table9 North America: Database Encryption Market, By Service

Table10 North America: Database Encryption Market, By Vertical

Table11 Europe: Database Encryption Market, By Country

0 notes

Text

Payments Solutions Continue to Develop With the Integration of Crypto and Blockchain

Payments Solutions Continue to Develop With the Integration of Crypto and Blockchain

NEW YORK, December 21, 2018 /PRNewswire/ —

Payment solutions are becoming increasingly popular amongst both consumers and businesses. Payment solutions are offering a much more convenient method to send or receive monetary transactions between two parties. Additionally, new technologies are being integrated into payment solutions, such as blockchain and cryptocurrency. As technology continues to advance, industry leaders are reshaping the payments industry with innovative and convenient solutions. According to data compiled by Capgemini and BNP Paribas, the global non-cash transaction market grew by 10.1% from 2015 to 2016. The research now projects that the market will grow at a CAGR of 12.7% until 2021. The market is predominately being driven by developing markets such as Russia, India and China. Notably, developing markets are projected to grow at a CAGR of 21.6% over the next five years. The market is expected to be led by Asia’s CAGR of 28.8%, while already developed regions are projected to grow by approximately 7%. Glance Technologies Inc. (OTC: GLNNF), Square, Inc. (NYSE: SQ), Starbucks Corporation (NASDAQ: SBUX), Sony Corporation (NYSE: SNE), TD Ameritrade Holding Corporation (NASDAQ: AMTD)

The integration of cryptocurrency and blockchain technology is becoming prominent in the digital payment industry. According to Infoholic Research LLP, the global cryptocurrency and blockchain market is projected to reach USD 42.16 Billion by 2022. Furthermore, it is expected to grow at a CAGR of 35.2%. The market is gaining traction due to the widespread acceptance of the technology. Specifically, players in sectors like BFSI, retail, media, healthcare and others are adopting cryptocurrency to be used as a form of payment. Cryptocurrencies offer a much more secure payment process while also processing the transactions much faster, which has made it highly attractive to businesses that deal with large volume of payment transactions. “I can anticipate the day when every store will accept payment in a cryptocurrency,” said Stephen Pair, Chief Executive Officer and Co-Founder of BitPay. “It became clear that payment systems and traditional currencies were ripe for disruption by technology, the same way that email disrupted the Post Office.”

Glance Technologies Inc. (OTCQB: GLNNF) is also listed on the Canadian Securities Exchange under the ticker (CSE: GET). Earlier yesterday, the Company announced breaking news that, “it has filed a provisional patent application with the United States Patent and Trademark Office directed at methods, systems and techniques for cryptographic token transfers.

This patent application is for a foundational technology to lower costs and improve speed and efficiency of cryptocurrency transactions, even where the value of the transaction may be relatively small, as well as to facilitate converting between cryptocurrencies whose transactions are recorded on different blockchains. It also facilitates storing information of different sensitivity levels on differently permissioned blockchains, which can be useful when privacy is important.

Desmond Griffin, CEO of Glance, says ‘some of the current barriers to adopting cryptocurrencies for everyday payments are high costs per transaction for small value transactions, slow speed of execution when trying to pay in real time, and potential disclosure of more information than may be desired from a user. This patent application proposes various technological solutions that can be used to solve these problems. The aim for Glance is to make cryptocurrency payments practical for day-to-day payment situations.’

Glance believes that blockchain and cryptocurrencies are fundamentally transformative technologies, providing significant opportunities for the early pioneers in this space. In addition to facilitating cryptocurrency transactions, the technology described in this patent application is applicable to the Glance Coin loyalty reward token that will allow Glance merchants to reward and provide deals and incentives to customers.

About Glance Technologies Inc: Glance Technologies is the owner of Glance Pay and Glance PayMe, a pair of complementary smartphone payment applications that enable merchants to provide their customers with quick secure payments, digital rewards, and a better customer experience.”

Square, Inc. (NYSE: SQ) creates tools that help sellers start, run, and grow their businesses. Square enables sellers to accept card payments and also provides reporting and analytics, next-day settlement, and chargeback protection. Recently, Square, Inc. announced Square Terminal, an integrated and innovative all-in-one card processing device designed to be fast, fair, and secure. Square Terminal allows sellers to ring up sales, accept all forms of payments quickly, and print receipts, all from one affordable and elegant device. It is the best solution for businesses that use their own point-of-sale solution or manually key in a payment amount, and want to process payments with Square. Square Terminal also offers sellers a fair and flat rate for every transaction, regardless of card type. “Payment terminals are everywhere, from liquor stores to dry cleaners to dentists, and with Square Terminal we can now serve these sellers better with new, elegant hardware on top of Square’s fair and secure payments service,” said Jesse Dorogusker, Head of Hardware at Square. “Square Terminal is designed from the ground up to ensure a feeling of familiarity, so sellers and their customers can use it right away. With Square Terminal, we now offer a sophisticated and modern hardware-plus-software solution for every type of business.”

Starbucks Corporation (NASDAQ: SBUX), since 1971, has been committed to ethically sourcing and roasting high-quality arabica coffee. Intercontinental Exchange recently announced that it plans to form a new company, Bakkt, working with Starbucks, BCG, Microsoft, which intends to leverage Microsoft cloud solutions to create an open and regulated, global ecosystem for digital assets. The new company will create an integrated platform that enables consumers and institutions to buy, sell, store and spend digital assets on a seamless global network. “As the flagship retailer, Starbucks will play a pivotal role in developing practical, trusted and regulated applications for consumers to convert their digital assets into US dollars for use at Starbucks,” said Maria Smith, Vice President, Partnerships and Payments for Starbucks. “As a leader in Mobile Pay to our more than 15 million Starbucks Rewards members, Starbucks is committed to innovation for expanding payment options for our customers.”

Sony Corporation (NYSE: SNE) unlimited passion for technology, content and services, and relentless pursuit of innovation, drives it to deliver ground-breaking new excitement and entertainment in ways that only Sony can. Sony Corporation, Sony Music Entertainment (Japan) Inc., and Sony Global Education recently announced the development of a rights management system for digital content that utilizes blockchain technology. This new system is based on Sony and Sony Global Education’s previously developed system for authenticating, sharing, and rights management of educational data, and additionally features functionality for processing rights-related information. Blockchains create networks where programs and information are difficult to destroy or falsify, and are well-adapted for the free transfer of data and rights. Those traits give blockchains many potential uses across a range of services including finance, merchandise distribution management, and the sharing economy, and blockchains are expected to bring about even more innovative services in the future. At present, they are also used in public P2P network transactions, primarily involving cryptocurrencies such as Bitcoin. Sony Global Education is continuously carrying out technological development and prototyping towards the use of blockchain technology in the educational field. This newly developed system can be utilized to manage educational materials and other forms of content used in the field of education, and Sony Global Education is considering its possible commercialization as a service. Sony Group is also considering innovative ways to make use of blockchain technology for information management and data distribution in a host of different fields. Through the technological development and commercialization of blockchains, including with this new system, Sony will continue exploring the possibilities that blockchain technology holds for Sony Group’s diverse and wide-ranging business domains.

TD Ameritrade Holding Corporation (NASDAQ: AMTD) provides investing services and education to more than 11 million client accounts totaling more than USD 1.2 Trillion in assets, and custodial services to more than 6,000 registered investment advisors. After being among the first financial services firms to offer approved clients with access to bitcoin futures contracts last year, TD Ameritrade Holding Corporation recently announced it has made a strategic investment in ErisX, a regulated derivatives exchange and clearing organization that will include digital asset futures and spot contracts on one platform. With in-depth experience delivering and operating a fully regulated market place, ErisX has entered into the digital asset space with a broad offering of both spot and futures contracts on one platform. ErisX has integrated digital asset products and technology into reliable, compliant and robust capital markets workflows. With a regulated, liquid and accessible offering, ErisX enhances the digital asset space for institutional and individual traders alike. “As a strategic investor in the initiative, we look forward to working with the team at ErisX as they develop and launch digital currency products designed to fulfill the needs of retail investors,” said JB Mackenzie, managing director Futures & Forex at TD Ameritrade. “ErisX’s plan is to offer traders access to cryptocurrency spot contracts as well as futures contracts on a single exchange.”

Subscribe Now! Watch us report LIVE https://www.youtube.com/FinancialBuzzMedia Follow us on Twitter for real time Financial News Updates: https://twitter.com/financialbuzz Follow and talk to us on Instagram: http://bit.ly/2gBSd82 Facebook Like Us to receive live feeds: http://bit.ly/2hGdFO0

About FinancialBuzz.com

FinancialBuzz.com, a leading financial news informational web portal designed to provide the latest trends in Market News, Investing News, Personal Finance, Politics, Entertainment, in-depth broadcasts on Stock News, Market Analysis and Company Interviews. A pioneer in the financially driven digital space, video production and integration of social media, FinancialBuzz.com creates 100% unique original content. FinancialBuzz.com also provides financial news PR dissemination, branding, marketing and advertising for third parties for corporate news and original content through our unique media platform that includes Newswire Delivery, Digital Advertising, Social Media Relations, Video Production, Broadcasting, and Financial Publications.

Please Note: FinancialBuzz.com is not a financial advisory or advisor, investment advisor or broker-dealer and do not undertake any activities that would require such registration. The information provided on http://bit.ly/UTGs1Q (the ‘Site’) is either original financial news or paid advertisements provided [exclusively] by our affiliates (sponsored content), FinancialBuzz.com, a financial news media and marketing firm enters into media buys or service agreements with the companies which are the subject to the articles posted on the Site or other editorials for advertising such companies. We are not an independent news media provider and therefore do not represent or warrant that the information posted on the Site is accurate, unbiased or complete. FinancialBuzz.com receives fees for producing and presenting high quality and sophisticated content on FinancialBuzz.com along with other financial news PR media services. FinancialBuzz.com does not offer any personal opinions, recommendations or bias commentary as we purely incorporate public market information along with financial and corporate news. FinancialBuzz.com only aggregates or regurgitates financial or corporate news through our unique financial newswire and media platform. For glance technologies inc. financial and corporate news dissemination, FinancialBuzz.com has been compensated five thousand dollars by the company. Our fees may be either a flat cash sum or negotiated number of securities of the companies featured on this editorial or site, or a combination thereof. The securities are commonly paid in segments, of which a portion is received upon engagement and the balance is paid on or near the conclusion of the engagement. FinancialBuzz.com will always disclose any compensation in securities or cash payments for financial news PR advertising. FinancialBuzz.com does not undertake to update any of the information on the editorial or Site or continue to post information about any companies the information contained herein is not intended to be used as the basis for investment decisions and should not be considered as investment advice or a recommendation. The information contained herein is not an offer or solicitation to buy, hold or sell any security. FinancialBuzz.com, members and affiliates are not responsible for any gains or losses that result from the opinions expressed on this editorial or Site, company profiles, quotations or in other materials or presentations that it publishes electronically or in print. Investors accept full responsibility for any and all of their investment decisions based on their own independent research and evaluation of their own investment goals, risk tolerance, and financial condition. FinancialBuzz.com. By accessing this editorial and website and any pages thereof, you agree to be bound by the Terms of Use and Privacy Policy, as may be amended from time to time. None of the content issued by FinancialBuzz.com constitutes a recommendation for any investor to purchase, hold or sell any particular security, pursue a particular investment strategy or that any security is suitable for any investor. This publication is provided by FinancialBuzz.com. Each investor is solely responsible for determining whether a particular security or investment strategy is suitable based on their objectives, other securities holdings, financial situation needs, and tax status. You agree to consult with your investment advisor, tax and legal consultant before making any investment decisions. We make no representations as to the completeness, accuracy or timeless of the material provided. All materials are subject to change without notice. Information is obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. For our full disclaimer, disclosure and Terms of Use, please visit: https://ift.tt/UTGs1Q.

Media Contact: [email protected] +1-877-601-1879

Url: www.FinancialBuzz.com

SOURCE FinancialBuzz.com

Source link http://bit.ly/2Sa9Qzm

0 notes

Text

Payments Solutions Continue to Develop With the Integration of Crypto and Blockchain

Payments Solutions Continue to Develop With the Integration of Crypto and Blockchain

NEW YORK, December 21, 2018 /PRNewswire/ —

Payment solutions are becoming increasingly popular amongst both consumers and businesses. Payment solutions are offering a much more convenient method to send or receive monetary transactions between two parties. Additionally, new technologies are being integrated into payment solutions, such as blockchain and cryptocurrency. As technology continues to advance, industry leaders are reshaping the payments industry with innovative and convenient solutions. According to data compiled by Capgemini and BNP Paribas, the global non-cash transaction market grew by 10.1% from 2015 to 2016. The research now projects that the market will grow at a CAGR of 12.7% until 2021. The market is predominately being driven by developing markets such as Russia, India and China. Notably, developing markets are projected to grow at a CAGR of 21.6% over the next five years. The market is expected to be led by Asia’s CAGR of 28.8%, while already developed regions are projected to grow by approximately 7%. Glance Technologies Inc. (OTC: GLNNF), Square, Inc. (NYSE: SQ), Starbucks Corporation (NASDAQ: SBUX), Sony Corporation (NYSE: SNE), TD Ameritrade Holding Corporation (NASDAQ: AMTD)

The integration of cryptocurrency and blockchain technology is becoming prominent in the digital payment industry. According to Infoholic Research LLP, the global cryptocurrency and blockchain market is projected to reach USD 42.16 Billion by 2022. Furthermore, it is expected to grow at a CAGR of 35.2%. The market is gaining traction due to the widespread acceptance of the technology. Specifically, players in sectors like BFSI, retail, media, healthcare and others are adopting cryptocurrency to be used as a form of payment. Cryptocurrencies offer a much more secure payment process while also processing the transactions much faster, which has made it highly attractive to businesses that deal with large volume of payment transactions. “I can anticipate the day when every store will accept payment in a cryptocurrency,” said Stephen Pair, Chief Executive Officer and Co-Founder of BitPay. “It became clear that payment systems and traditional currencies were ripe for disruption by technology, the same way that email disrupted the Post Office.”

Glance Technologies Inc. (OTCQB: GLNNF) is also listed on the Canadian Securities Exchange under the ticker (CSE: GET). Earlier yesterday, the Company announced breaking news that, “it has filed a provisional patent application with the United States Patent and Trademark Office directed at methods, systems and techniques for cryptographic token transfers.

This patent application is for a foundational technology to lower costs and improve speed and efficiency of cryptocurrency transactions, even where the value of the transaction may be relatively small, as well as to facilitate converting between cryptocurrencies whose transactions are recorded on different blockchains. It also facilitates storing information of different sensitivity levels on differently permissioned blockchains, which can be useful when privacy is important.

Desmond Griffin, CEO of Glance, says ‘some of the current barriers to adopting cryptocurrencies for everyday payments are high costs per transaction for small value transactions, slow speed of execution when trying to pay in real time, and potential disclosure of more information than may be desired from a user. This patent application proposes various technological solutions that can be used to solve these problems. The aim for Glance is to make cryptocurrency payments practical for day-to-day payment situations.’

Glance believes that blockchain and cryptocurrencies are fundamentally transformative technologies, providing significant opportunities for the early pioneers in this space. In addition to facilitating cryptocurrency transactions, the technology described in this patent application is applicable to the Glance Coin loyalty reward token that will allow Glance merchants to reward and provide deals and incentives to customers.

About Glance Technologies Inc: Glance Technologies is the owner of Glance Pay and Glance PayMe, a pair of complementary smartphone payment applications that enable merchants to provide their customers with quick secure payments, digital rewards, and a better customer experience.”

Square, Inc. (NYSE: SQ) creates tools that help sellers start, run, and grow their businesses. Square enables sellers to accept card payments and also provides reporting and analytics, next-day settlement, and chargeback protection. Recently, Square, Inc. announced Square Terminal, an integrated and innovative all-in-one card processing device designed to be fast, fair, and secure. Square Terminal allows sellers to ring up sales, accept all forms of payments quickly, and print receipts, all from one affordable and elegant device. It is the best solution for businesses that use their own point-of-sale solution or manually key in a payment amount, and want to process payments with Square. Square Terminal also offers sellers a fair and flat rate for every transaction, regardless of card type. “Payment terminals are everywhere, from liquor stores to dry cleaners to dentists, and with Square Terminal we can now serve these sellers better with new, elegant hardware on top of Square’s fair and secure payments service,” said Jesse Dorogusker, Head of Hardware at Square. “Square Terminal is designed from the ground up to ensure a feeling of familiarity, so sellers and their customers can use it right away. With Square Terminal, we now offer a sophisticated and modern hardware-plus-software solution for every type of business.”

Starbucks Corporation (NASDAQ: SBUX), since 1971, has been committed to ethically sourcing and roasting high-quality arabica coffee. Intercontinental Exchange recently announced that it plans to form a new company, Bakkt, working with Starbucks, BCG, Microsoft, which intends to leverage Microsoft cloud solutions to create an open and regulated, global ecosystem for digital assets. The new company will create an integrated platform that enables consumers and institutions to buy, sell, store and spend digital assets on a seamless global network. “As the flagship retailer, Starbucks will play a pivotal role in developing practical, trusted and regulated applications for consumers to convert their digital assets into US dollars for use at Starbucks,” said Maria Smith, Vice President, Partnerships and Payments for Starbucks. “As a leader in Mobile Pay to our more than 15 million Starbucks Rewards members, Starbucks is committed to innovation for expanding payment options for our customers.”

Sony Corporation (NYSE: SNE) unlimited passion for technology, content and services, and relentless pursuit of innovation, drives it to deliver ground-breaking new excitement and entertainment in ways that only Sony can. Sony Corporation, Sony Music Entertainment (Japan) Inc., and Sony Global Education recently announced the development of a rights management system for digital content that utilizes blockchain technology. This new system is based on Sony and Sony Global Education’s previously developed system for authenticating, sharing, and rights management of educational data, and additionally features functionality for processing rights-related information. Blockchains create networks where programs and information are difficult to destroy or falsify, and are well-adapted for the free transfer of data and rights. Those traits give blockchains many potential uses across a range of services including finance, merchandise distribution management, and the sharing economy, and blockchains are expected to bring about even more innovative services in the future. At present, they are also used in public P2P network transactions, primarily involving cryptocurrencies such as Bitcoin. Sony Global Education is continuously carrying out technological development and prototyping towards the use of blockchain technology in the educational field. This newly developed system can be utilized to manage educational materials and other forms of content used in the field of education, and Sony Global Education is considering its possible commercialization as a service. Sony Group is also considering innovative ways to make use of blockchain technology for information management and data distribution in a host of different fields. Through the technological development and commercialization of blockchains, including with this new system, Sony will continue exploring the possibilities that blockchain technology holds for Sony Group’s diverse and wide-ranging business domains.

TD Ameritrade Holding Corporation (NASDAQ: AMTD) provides investing services and education to more than 11 million client accounts totaling more than USD 1.2 Trillion in assets, and custodial services to more than 6,000 registered investment advisors. After being among the first financial services firms to offer approved clients with access to bitcoin futures contracts last year, TD Ameritrade Holding Corporation recently announced it has made a strategic investment in ErisX, a regulated derivatives exchange and clearing organization that will include digital asset futures and spot contracts on one platform. With in-depth experience delivering and operating a fully regulated market place, ErisX has entered into the digital asset space with a broad offering of both spot and futures contracts on one platform. ErisX has integrated digital asset products and technology into reliable, compliant and robust capital markets workflows. With a regulated, liquid and accessible offering, ErisX enhances the digital asset space for institutional and individual traders alike. “As a strategic investor in the initiative, we look forward to working with the team at ErisX as they develop and launch digital currency products designed to fulfill the needs of retail investors,” said JB Mackenzie, managing director Futures & Forex at TD Ameritrade. “ErisX’s plan is to offer traders access to cryptocurrency spot contracts as well as futures contracts on a single exchange.”

Subscribe Now! Watch us report LIVE https://www.youtube.com/FinancialBuzzMedia Follow us on Twitter for real time Financial News Updates: https://twitter.com/financialbuzz Follow and talk to us on Instagram: http://bit.ly/2gBSd82 Facebook Like Us to receive live feeds: http://bit.ly/2hGdFO0

About FinancialBuzz.com

FinancialBuzz.com, a leading financial news informational web portal designed to provide the latest trends in Market News, Investing News, Personal Finance, Politics, Entertainment, in-depth broadcasts on Stock News, Market Analysis and Company Interviews. A pioneer in the financially driven digital space, video production and integration of social media, FinancialBuzz.com creates 100% unique original content. FinancialBuzz.com also provides financial news PR dissemination, branding, marketing and advertising for third parties for corporate news and original content through our unique media platform that includes Newswire Delivery, Digital Advertising, Social Media Relations, Video Production, Broadcasting, and Financial Publications.