#Zepbound Injection

Explore tagged Tumblr posts

Text

Eli Lilly’s daily anti-obesity pill orforglipron appears to be as good at spurring weight loss and lowering blood sugar in diabetes patients as popular injectable GLP-1 drugs like Ozempic, according to new data from a Phase 3 trial. The results were announced today at the annual meeting of the American Diabetes Association and published in the New England Journal of Medicine.

Eli Lilly is the maker of the blockbuster GLP-1 drug tirzepatide, approved as Mounjaro for type 2 diabetes and Zepbound for chronic weight management and obstructive sleep apnea. Like Novo Nordisk’s Ozempic and Wegovy, both of Eli Lilly’s tirzepatide drugs are injected on a weekly basis. But some patients have a fear of needles or would prefer to take a pill out of convenience.

“What we see is that the efficacy, safety, and tolerability are really consistent with the very best injectable GLP-1s,” says Kenneth Custer, president of cariometabolic health at Eli Lilly, of the company’s experimental pill. “We think this is a big deal.” The company plans to seek regulatory approval for orforglipron for weight management by the end of this year and for the treatment of type 2 diabetes in 2026.

The 40-week trial tested three doses of orforglipron—3 milligrams, 12 milligrams, and 36 milligrams—against a placebo in 559 patients with type 2 diabetes. All three doses were effective at lowering blood sugar, while the middle and highest doses showed clinically meaningful and statistically significant reductions in body weight. The highest dose of orforglipron led to an average weight loss of 7.9 percent, or 16 pounds—comparable to the amount of weight loss seen over the same period in trials of semaglutide and tirzepatide. Eli Lilly is studying the pill in a longer study in people who are overweight or have obesity to see if the weight loss continues.

In the current trial, participants took the pill once a day with no food or water restrictions. Those who were randomly assigned to orforglipron started the study at a dose of 1 milligram a day and slowly increased the dose at four-week intervals. Current GLP-1 drugs are gradually stepped up in dose as well to minimize potential side effects.

Orforglipron showed similar gastrointestinal side effects as other GLP-1 drugs, with the most common being diarrhea, nausea, indigestion, and constipation. Between 4 and 8 percent of participants across the different dosing groups dropped out because of side effects, while 1 percent in the placebo group discontinued the study.

An oral version of semaglutide, sold under the brand name Rybelsus, has been on the market since 2019 but is not approved for weight management and isn’t as effective for weight loss as injectable GLP-1s. A pill specifically for obesity would give patients more treatment options and potentially make these drugs more accessible.

Pills are typically less expensive to manufacture, and they can be mass-produced more easily, making them less prone to shortage. (Injected GLP-1 drugs were in shortage until recently.) Pills can also be transported more readily. Current GLP-1 injector pens need to be shipped and stored in a refrigerator to maintain their potency. A GLP-1 pill wouldn’t need sophisticated cold-chain distribution and storage, meaning it could be sold in countries that don’t have that infrastructure.

“With orforglipron offering additional advantages such as the elimination of strict pre-dosing requirements, potential lower cost, and easier storage, it will be important to see whether these features lead to even greater adherence,” says Priya Jaisinghani, a diabetes and obesity medicine specialist at NYU Langone. “Like most chronic therapies, GLP-1s are most effective when used consistently, so a formulation that encourages long-term use could have a meaningful impact on patient outcomes.”

11 notes

·

View notes

Note

I got prescribed Zepbound (it’s an injectable thing kinda like ozempic or wegovy) and tried to do my first injection but flinched so hard I messed it up and barely got any in— I wish you were here to do my injections for me and keep me calm, soothing me so I don’t tense up and I don’t feel scared

-💝

Oh you poor thing… I wish I could help you. Softly cooing over you and kissing you while I inject you, gently holding you nice and still so you don’t move away from the needle. I’m sure you’d be so good for me wouldnt you? 🖤

9 notes

·

View notes

Note

hey mckenzie, this isn’t the usual type of asks you get but I’m just wondering what are your thoughts on drugs like wegovy or ozrmpic as a nurse? i need to lose weight and my doctor talked to me about it.

Hey nonny!

So I don’t deal with those types of meds with the specialty I work in, but this is what I do know/have heard:

All of them (ozempic, mounjaro, wegovy, zepbound, etc.) are expensive (insurance covers them for type 2 diabetes, not weight loss) and they’re hard to get because they’re in high demand.

They can make you really nauseous/sick to your stomach…which sucks, especially if you have emetophobia.

They’re injections, so if you don’t do well with needles, it’s probably not for you.

Without lifestyle changes, weight gain is likely after stopping it. Though, I have heard it does help some peoples “relationship” with food.

My biggest worry is the possible long-term effects that haven’t been discovered yet.

I’m sorry, this probably isn’t very helpful, but I don’t want to persuade you one way or the other.

Losing weight is hard 😩 But, you’re not alone. I too need to lose some. Here’s to achieving our goals in 2025 😘

*Disclaimer: this isn’t medical advice, these are just my opinions. I could be wrong 🤷🏻♀️ Please talk to your doctor or a pharmacist further…they know a LOT more than I do.*

12 notes

·

View notes

Text

A new generation of obesity drugs often delivers dramatic weight loss, but many patients wonder what happens when they stop treatment. One study published Monday in the Journal of the American Medical Association provides an answer: much of the weight comes back, signaling patients may be locked into long term dependence on the drugs. The research was based on weekly injections of tirzepatide, the compound in Eli Lilly's new weight loss drug Zepbound that was approved by the United States last month.

Continue Reading.

50 notes

·

View notes

Text

How does Zepbound (tirzepatide) Injection Work? Warrenton

Zepbound (tirzepatide) Injection mimics the action of two natural hormones, GLP-1 and GIP. These hormones help regulate blood sugar, appetite, and weight.

When injected, Zepbound binds to specific receptors in the body, leading to: 1. Reduced blood sugar: By stimulating insulin production and decreasing glucagon secretion. 2. Decreased appetite: By making you feel fuller for longer. 3. Weight loss: By helping you eat less and burn more calories.

Source Page: https://lifestylephysicians.com/zepbound-injections/

Contact Page Form

#Zepbound Injection#Zepbound Injection warrenton#Zepbound Injection culpeper#Zepbound Injection usa#Zepbound Injection vrginia

0 notes

Text

The booming popularity of Ozempic and other GLP-1 drugs for weight loss has led to a flurry of companies vying to make new and improved anti-obesity medications.

One of those is Boston-based Syntis Bio, which is working on a daily pill that mimics the effects of gastric bypass—no actual surgery required. Today, the company announced early data from animals and a small group of human volunteers showing that its approach is safe and may be able to suppress hunger. The company presented the findings Thursday at the European Congress on Obesity and Weight Management.

“We're at a stage with obesity treatment where it's important for us to figure out, how do we now tune it to be more effective?” says Rahul Dhanda, Syntis Bio’s CEO and cofounder.

A poll conducted in April and May of 2024 found that around 12 percent of Americans have tried a GLP-1 drug such as Ozempic, Wegovy, Zepbound, or Mounjaro—a number that has likely only grown over the past year. But many people eventually stop using these drugs. Cost and insurance coverage is one factor. Another is that GLP-1s can cause nausea, vomiting, and other unpleasant side effects. And some patients would prefer a pill over a weekly injection.

Syntis is aiming to develop another option for people looking to lose weight. The company’s drug is designed to redirect the absorption of nutrients from the beginning of the small intestine to its end. The effect is similar to gastric bypass, in which surgeons make the stomach smaller and shorten the small intestine. As a result, food bypasses much of the small intestine. The procedure changes how the body absorbs food, and leaves people feeling fuller from eating less.

Gastric bypass is a type of bariatric surgery, which an estimated 280,000 people received in 2022. But fewer people are turning to surgery with the advent of new anti-obesity medications. A study published last year in JAMA Open Network found that as prescriptions for GLP-1s skyrocketed between 2022 and 2023, rates of bariatric surgery dropped 25.6 percent.

The drug Syntis is working on does not actually shorten the intestine, like gastric bypass does. Instead, it creates a temporary coating in the upper part of the small intestine, blocking the absorption of nutrients there. This moves nutrients down to the lower part of the small intestine, where satiety hormones—including GLP-1—are triggered.

It does this with two main ingredients: dopamine, a small molecule best known for its relation to the brain, and a tiny amount of hydrogen peroxide. When this combination reaches the small intestine, it comes into contact with a naturally occurring enzyme called catalase. The job of catalase is to break down hydrogen peroxide, which is harmful to the body in high amounts, into water and oxygen. The process converts the dopamine into polydopamine, a biocompatible polymer. Within minutes, a thin film of polydopamine forms that coats the lining of the small intestine. The cells in this lining turn over quickly, so the coating is only temporary. It’s designed to last around 24 hours.

The drug is based on research conducted at MIT by Giovanni Traverso, a gastroenterologist and mechanical engineer, and Robert Langer, a chemical engineer who has launched more than two dozen biotech companies.

The two discovered the mechanism when working on a way to develop liquid drug formulations that could be given to children. They soon realized they could make this temporary synthetic coating more or less permeable, to either enhance absorption or slow it down. That latter ability was appealing as a treatment for obesity.

“This material is something you would take as a capsule or liquid, but the next day it's gone because of the natural turnover of our mucosal surface in the GI tract,” Traverso says. He and Langer cofounded Syntis with Dhanda in 2022. He likens this coating to what mussels and other shellfish use to stick to rocks or the ocean floor.

In the results Syntis announced, the drug was delivered in a liquid form via a tube directly to the small intestine so that researchers could check that the polymer coating formed as expected. A tablet form has already been tested in pigs and dogs, and it’s what Syntis plans to test in future human studies.

In rats, the drug produced a consistent 1 percent weekly weight loss over a six-week study period while preserving 100 percent of lean muscle mass.

In a first-in-human pilot study of nine participants, the drug was safe with no adverse effects. Tissue samples taken from the intestine were used to confirm that the coating formed and was also cleared from the body within 24 hours. The study wasn’t designed to assess weight loss, but blood testing showed that after the drug was given, glucose levels and the “hunger hormone” ghrelin were lower while the levels of leptin, an appetite-regulating hormone, were higher.

“When nutrients are redirected to later in the intestine, you're activating pathways that lead towards satiety, energy expenditure, and overall healthy, sustainable weight loss,” Dhanda says.

Syntis Bio’s findings in animals also hint at the drug’s potential for weight loss without compromising muscle mass, one of the concerns with current GLP-1 drugs. While weight loss in general is associated with numerous health benefits, there’s growing evidence that the kind of drastic weight loss that GLP-1s induce can also lead to a loss of lean muscle mass.

Louis Aronne, an obesity medicine specialist and professor of metabolic research at Weill-Cornell Medical College, says that while GLP-1s are wildly popular, they may not be right for everyone. He predicts that in the not-so-distant future there will be many drugs for obesity and treatment will be more personalized. “I think Syntis’ compound fits in perfectly as a treatment that could be used early on. It’s a kind of thing you could use as a first-line medication,” he says. Arrone serves as a clinical adviser to the company.

Vladimir Kushnir, professor of medicine and director of bariatric endoscopy at Washington University in St. Louis, who isn’t involved with Syntis, says the early pilot data is encouraging, but it’s hard to draw any conclusions from such a small study. He expects that the drug will make people feel fuller but could also have some of the same side effects as gastric bypass surgery. “My anticipation is that this is going to have some digestive side effects like bloating and abdominal cramping, as well as potentially some diarrhea and nausea once it gets into a bigger study,” he says.

It’s early days for this novel technique, but if it proves effective, it could one day be an alternative or add-on drug to GLP-1 medications.

9 notes

·

View notes

Text

Pharmaceutical giant Eli Lilly earned praise this week with an announcement that it is now selling starter dosages of its popular weight-loss drug tirzepatide (Zepbound) at a price significantly lower than before. But the cheers were short-lived as critics quickly noticed that Lilly also quietly raised the price on current versions of the drug—a move that was notably missing from the company's press release this week.

In the past, Lilly sold Zepbound only in injectable pens with a list price of $1,060 for a month's supply. Several dosages are available—2.5 mg, 5 mg, 7.5 mg, 10 mg, 12.5 mg, or 15 mg—and patients progressively increase their dosage until they reach a maintenance dosage. The recommended maintenance dosages are 5 mg, 10 mg, or 15 mg. The higher the dose, the more the weight loss. For instance, people using the 15 mg doses lost an average of 21 percent of their weight over 17 months in a clinical trial, while those on 5 mg doses only lost an average of 15 percent of their weight.

On Tuesday, Lilly announced that it will now sell Zepbound in vials, too. And a month's supply of vials with the 2.5 mg doses will cost $399, while a month's supply of 5 mg doses is priced at $549—a welcome drop from the $1,060 price tag. These prices are for a self-pay option, meaning that patients with a valid, on-label prescription can buy them directly from Lilly if they have no insurance or have insurance that does not cover the drug.

[...]

“No rational reason, other than greed”

But, that wasn't the end of the news. When Lilly released its press release, people noticed that the company had also increased the price of Zepbound pens for those who have insurance plans that don't cover the drug. In the past, Lilly offered a "savings card" that allowed these patients to buy a month's supply of any dosage of Zepbound pens for $550. Now the price is $650, a nearly 20 percent increase.

Lilly did not respond to Ars' request for comment or questions about why the company increased the price for some patients.

Sen. Bernie Sanders (I-Vt.), a longtime critic of the pharmaceutical industry and their drug pricing, was quick to weigh in. He called the vial prices a "modest step forward" but noted that, even with the price reduction, millions of Americans still won't be able to pay for the drug. At $549 a month, the price of the drug is a little over the average monthly payment for a used car, which was $523 in the first quarter of this year, according to Experian. As for the increase in pen pricing, Sanders called it "bad news."

"In addition, Eli Lilly has still refused to lower the outrageous price of Mounjaro that Americans struggling with diabetes desperately need," Sanders went on. "There is no rational reason, other than greed, why Mounjaro should cost $1,069 a month in the United States but just $485 in the United Kingdom and $94 in Japan."

In May, a Senate committee report concluded that uptake of such weight-loss and diabetes drugs stands to "bankrupt our entire health care system," given the high prices and large demand in the US. The report was produced by the Senate's Health, Education, Labor, and Pensions (HELP) committee, which is chaired by Sanders.

1 note

·

View note

Text

GLP-1s are more than just “weight loss drugs that make you not eat”. For me, they have been life saving. I have an eating disorder. I struggle with bulimia and binging. Food has always been a source of obsession and extreme stress for me. I am about 100 lbs overweight, and no matter how active i am , i always just kept gaining from an early age. This has been a source of extreme stress.

But with Zepbound (a different injectable med similar to Ozempic) i have been able to find freedom

It changes how i think about food, it takes away the obsessive compulsive urge associated with food and just allows me to eat without worrying, and tells me to stop when in full. It has improved my quality of life exponentially.

So respectfully, please have some understanding that ozempic and similar drugs are more than just a weight loss fad. For some, like myself, they are offer changing

theyre inventing the opposite of ozempic that actually makes you happy. and theyre calling it yummy foods and treats

19K notes

·

View notes

Text

Wegovy vs. Zepbound: Which Weight Loss Shot Is Right for You?

Looking for an extra boost in your weight loss journey? Discover the key differences between Wegovy (semaglutide) and Zepbound (tirzepatide)—two popular weekly weight loss injections that can help you reach your goals when combined with healthy habits. Learn about how they work, effectiveness, side effects, and who they’re best for.

#Wegovy #Zepbound #WeightLossJourney #Semaglutide #Tirzepatide #GLP1 #HealthyLiving #ObesityTreatment #LoseWeight #WeightLossSupport

0 notes

Text

How to Lose Weight with Zepbound and Injectable Glutathione

What is Zepbound and Injectable Glutathione?

Are you looking for ways to lose weight that really work? You may have come across some promising solutions, including Zepbound for weight lossand injectable glutathione. These two powerful tools are gaining popularity among individuals aiming to shed pounds and improve their overall health. But what exactly are they? And how can they help you achieve your weight loss goals? Let’s dive into the science and benefits behindZepbound for weight lossand injectable glutathione to understand why these innovative approaches could transform your journey to a healthier life..

What is Glutathione and how can it help you lose weight?

Glutathione is a strong antioxidant that the body makes on its own. Cysteine, glutamine, and glycine are the three amino acids that make it up. This amazing chemical is very important for detoxifying and repairing cells.

Glutathione can really help you lose weight. It helps lower oxidative stress and inflammation, which are two things that are commonly associated to problems that come with being overweight. Glutathione helps the body use fat for energy more efficiently by speeding up metabolic processes.

Also, having more of this antioxidant may make your body more sensitive to insulin. Better insulin function means better control of blood sugar, which is important for people who want to lose weight.

Adding injectable glutathione to your daily routine can swiftly and efficiently raise its levels. As you think about zepbound as a way to lose weight, learning how glutathione works will help you live a healthier life.

Using Zepbound and injectable glutathione to lose weight has many benefits.

People in the weight reduction community are interested in Zepbound and injectable glutathione because they might help. Zepbound is recognised for making people less hungry, which makes it easier to stick to their diet goals. When cravings are kept under check, it is easier to stick to a better way of life.

As an antioxidant, injectable glutathione is very important. It helps the body get rid of toxins and speeds up fat metabolism. Glutathione helps keep your liver healthy, which is important for managing your weight.

Adding these two things to your wellness journey can make it better. Many users say they have more energy, which can lead to more physical activity, which is an important part of any weight loss regimen.

Both strategies may also assist reduce eating that is caused by stress by making you feel better and clearer in your mind. This all-encompassing strategy means that you're not just trying to lose weight, but also improve your quality of life by making better choices and developing better habits.

People Who Have Used Zepbound and Injectable Glut Have Had Good Results

Many people have used Zepbound and injectable glutathione to help them lose weight, and many have seen amazing changes. For instance, Sarah. She had been having trouble with her weight for years, so she decided to try Zepbound with injectable glutathione to help her lose weight. She lost weight in just a few months and also felt more energetic and healthy overall.

Mark is another person who has tried a lot of diets but hasn't been able to lose weight. He was upset until he learnt how helpful it was to take these two strong supplements together. Mark said that his metabolism and ability to burn fat got a lot better when he used Zepbound and got regular injections of glutathione.

These stories are just a small sample of people who have been able to use zepbound and injectable glutathione in their daily lives. Their stories show how these items can help when people make healthy choices.

If you're thinking about utilising this method to help you lose weight, you should think about the possible benefits of taking Zepbound and injectable glutathione combined. Many reviews talk about how it changes body composition for the better and boosts confidence at the same time.

As you start your own journey to better health, keep in mind that everyone's experience is different. What works great for one person may not work as well for another. Stay up to date on things like zepbound and look for safe locations to buy injectable glutathione online to get started on the path to reaching your goals.

0 notes

Text

Cigna reaches new deal on Eli Lilly and Novo Nordisk weight loss drugs

Wegovy Injection pens arranged in Waterbury, Vermont, US, on Monday, April 28, 2025. Shelby Knowles | Bloomberg | Getty images Only Half of Health Insurer CucaThat clients cover the popular GLP-1 weight lsters wegovy and Zepbound predaause of their High costs. But the company pharmacy benefits unit awnethorth speak a deal with drug makers Ely lilly And Novo Nordisk With that it said will bring…

0 notes

Text

Michael Futter was desperate to lose weight. In February 2022, the 46-year-old from New Jersey had prediabetes and high blood pressure when his doctor asked if he had considered trying a GLP-1 medication. She prescribed him Wegovy, the blockbuster anti-obesity drug made by Novo Nordisk.

At the time, Futter’s health insurance plan covered the drug, which costs $1,350 a month. He was only on the hook for a $25 copay. But when he changed jobs, none of the plans offered by his new employer covered Wegovy. He was crushed. He was losing weight fast and felt better than he had in years. He turned to an online telehealth provider, Henry Meds, to get a compounded GLP-1 instead. He switched to tirzepatide, the active ingredient in Eli Lilly’s Zepbound, at a dosage that cost $450 a month, then stepped up to a higher dosage at $550.

The injectable medications have become so popular that their manufacturers have had trouble keeping up with demand. The drugs went into shortage back in 2022 and remained in short supply until recently. When drugs are in shortage, pharmacies in the United States are legally allowed to create “compounded” versions—essentially, full-blown copies—so that people can still access the medications. In the years these drugs have been in shortage, a cottage industry of telehealth companies and medical spas has sprung up offering compounded GLP-1 products for a fraction of the cost of the brand-name counterparts. Now, that may be coming to an end.

At the end of 2024 the Food and Drug Administration announced that tirzepatide was no longer in shortage. Then, in February, the FDA determined that the shortage of semaglutide, the active ingredient in Ozempic and Wegovy, had also been resolved. It meant compounding pharmacies had to stop making copies of the drugs. The FDA gave small pharmacies until February 18 to stop making tirzepatide, while larger outsourcing facilities had until March 19. For semaglutide, small pharmacies had to stop production by April 22, while large compounders have until May 22.

The move has left many US patients scrambling for alternative options. GLP-1s are so effective at helping people lose weight and improve their health that many patients fear going off of them. Some have stockpiled compounded versions before losing access. Others are relying on telehealth companies that are continuing to sell compounded versions after adding extra ingredients or changing the format from injectable to oral. And then some people are turning to more dubious sources for the drugs rather than shelling out full price for the branded versions.

“I don't know if I'm going to be able to absorb the full cost of over-the-counter. I'm really worried,” Futter says. “I don't want to gain the weight back.” He’s lost about 90 pounds since he started taking GLP-1s in March 2022 and is no longer prediabetic. While Novo Nordisk and Eli Lilly have started offering certain doses of their products for $500, that’s still higher than those offered by compounders. The dose Futter is on, 12.5 mg, isn’t available under Lilly’s self-pay program, and he worries that a lower dose will be less effective.

Futter’s provider, Henry Meds, no longer offers compounded tirzepatide injections, but allowed patients to place bulk orders before phasing it out. He went ahead and ordered several months’ worth of vials but doesn’t know what he’s going to do when he runs out. “I’m extremely nervous about what’s going to happen,” he says. “I'm eking every drop I can out of every vial to make it stretch a little bit longer.” (As of publication, Henry Meds is offering new and current patients the ability to bulk order 40 weeks of semaglutide injections. Henry Meds did not respond to a request for comment.)

Jim Bertel, a 41-year-old who lives in Colorado and credits tirzepatide for changing his life, was also able to stockpile his compounded GLP-1 medication before his provider stopped selling it. He’s unsure of what he’s going to do when he runs out later this month, and he is spending time scouring Reddit and Facebook forums to find which telehealth companies are still offering versions of the drugs. “Right now my plan is to take it month by month,” he says. “Hopping from provider to provider.”

Jessie, 40, who asked to be identified by her first name only, turned to a medical spa to get compounded medications when she couldn’t get consistent access through her insurance or primary care provider. Her provider initially wrote her a prescription for Wegovy, but she says it was “touch and go” getting it filled. She was able to supplement with a compounded version from the med spa when it wasn’t available. But at the end of last year, Jessie received a letter from her insurance company saying it would no longer cover Wegovy. Then her primary care provider stopped writing prescriptions for weight loss medications, saying they were too much of a hassle. She went back to the med spa and was able to get compounded semaglutide as recently as April, but the facility said it couldn’t guarantee supply moving forward. She’s now considering buying the drug from Mexico since she travels often to San Diego for work. “It's the same meds, you don't need a prescription, and it's cheaper,” she says. In Mexico, brand-name Wegovy can be purchased for around $200 a month.

Spotty insurance coverage has helped drive demand for compounded GLP-1 products. Despite Wegovy and Zepbound being approved for patients with a body mass index of 30 or greater, and 27 or greater for those with at least one weight-related ailment, some insurance plans require a higher BMI or additional criteria for coverage—if they cover medications for obesity at all. “The whole underlying theme here is this stigma and bias of not recognizing obesity as a disease like we do cancer and diabetes and everything else,” says Florencia Halperin, an endocrinologist and chief medical officer at Form Health, an online medical weight loss clinic, “For cancer, you would never have an employer who says, ‘We're not covering this.’”

Amanda Bonello, founder and CEO of the GLP-1 Collective, a nonprofit organization aiming to help patients access these medications, is not surprised at the lengths patients are going to. Bonello, who herself has taken compounded GLP-1 products, says for many patients she’s spoken to, the impact of these medications is not just about the weight itself.

“It's about the freedom of mind,” she says. “It's absolutely like having a second chance at life, one that you never thought that you could have. These are people who gave up hope. They spent their entire lives being treated like a punchline, being neglected, treated like the ‘other,’ even from sometimes their own doctors, their own family members.”

Bonello founded the GLP-1 Collective in January, shortly after the FDA first removed tirzepatide from the shortage list, signaling that the national supply had stabilized. The organization recently sent a letter to the FDA requesting to meet with the agency about the impact that the end of compounding is having on patients. In the meantime, the GLP-1 Collective is raising money to help people pay for their prescriptions. It has an initial fundraising goal of $20,000. “These people need access. They need affordable access and sustained access,” she says.

Some former compounding patients are turning to questionable online sellers operating on shaky legal footing. Dustin Olsen, a nutritionist and personal trainer who works with clients taking GLP-1 medications, says he’s already seen people on compounded meds seek out cheaper and more dubiously sourced alternatives online, rather than switching to name brands. “It’s all about the gray market,” he says. Even prior to the crackdown on compounded medications, there was a robust online ecosystem of unlicensed pharmacies selling counterfeit drugs or “research-grade” ingredients meant to be used in a lab rather than taken by humans—and as compounded semaglutide and tirzepatide get harder to find, people who were previously taking legal copycats are considering more extreme options. Olsen understands the economic factors driving people “gray” but worries about the health risks. “You just don’t know what you’re taking at all,” he says. “It could be sugar water.”

Bonello says she’s hearing from more and more patients who are turning to the gray market. “I can't imagine that the FDA would rather people use completely unregulated sources than at the very least, state-regulated ones,” she says. “Yes, there are some bad apples out there, but you find them and go after them.” While compounding pharmacies are primarily regulated at the state level, the FDA has the authority to conduct inspections of compounding facilities to monitor ongoing compliance or investigate a specific problem or product complaint that the agency has received.

Although FDA’s rules require that compounders stop making exact copies of Eli Lilly and Novo Nordisk’s drugs, that doesn’t mean compounding is going to go away altogether. There’s a loophole for companies to continue selling compounded versions. It’s still legal to create custom compounds for people who need them, whether they need a special ingredient or a dosage not offered by pharmaceutical companies—and some telehealth companies are leaning into selling these not-quite-copies. While some telehealth companies have completely ceased offering tirzepatide and semaglutide, others have adjusted their offerings so that they are either in oral formats (like dissolving tablets) that are different than injectables, in custom dosages, or sold with additives like vitamin B. “There will be lots of options,” says Sabina Hemmi, who runs a startup called GLP Winner that allows patients to compare telehealth providers. “I think we’ll see a lot more versions of the drugs that are taken by mouth, either dissolving or sublingual.”

Some of these companies have already run into legal issues as they’ve continued to sell the compounds; Eli Lilly recently sued four major telehealth outfits, alleging that they were illegally selling compounds with added ingredients and different formats and dosages. In a highly litigious atmosphere, with several major compounding players opting not to test the limits of what’s legally permissible, there will indeed be a significant subset of patients who struggle to find accessible, affordable meds. As Hemmi notes: “Some people will lose access.”

In an emailed statement to WIRED, a spokesperson for Novo Nordisk says, “Moving forward, any compounder that mass produces or sells knockoff drugs is breaking the law and compromising patient safety.” A spokesperson for Eli Lilly echoed that sentiment, saying via email that the “FDA and a federal court have both made clear that compounders ‘must cease production’ of compounded tirzepatide knockoffs.”

Anthony Comuzzie, CEO of the Obesity Society, recognizes that there are legitimate access issues to GLP-1 medications, but he worries that some people who have sought out compounded versions may not meet the medical definition of obesity and are using them more casually for weight loss. “Obesity in and of itself is a legitimate, serious chronic disease, but people often confuse the accumulation of excess adipose tissue as a disease. In reality, it's the physical symptom of the underlying metabolic problem, and that's what these drugs address,” he says.

A WIRED investigation last year showed that it was shockingly easy to purchase compounded GLP-1 drugs online, with some telehealth outfits doing little vetting before issuing a prescription.

Halperin understands that people might be tempted to seek out lower-cost alternatives, but she recommends that patients work with a healthcare provider who has experience in treating obesity, even if they can’t get access to a specific medication at the moment. “Taking the risk of using a compounded medication, I don’t think that’s the right approach,” she says. But for many Americans who feel like they’ve tried everything else to lose weight, compounded medications seemed to offer a solution. Now access to those medications is anything but certain.

3 notes

·

View notes

Text

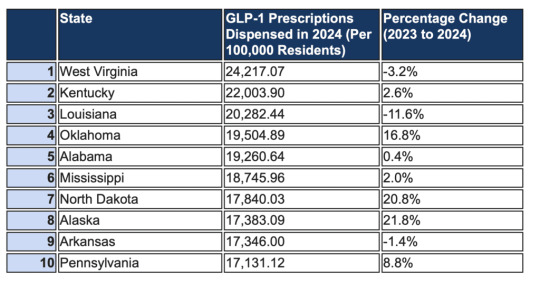

The U.S. State With the Most GLP-1 Users Isn’t What You’d Expect

It’s easy to think the states leading the charge on buzzy weight-loss injectables like Ozempic and Zepbound are California or New York, after all, that’s where many of the viral headlines and celebrity rumors are born. But new data tells a different story, and it starts in a part of the country you might not expect. According to new numbers from research done by the Whitley Law Firm, West…

View On WordPress

0 notes

Text

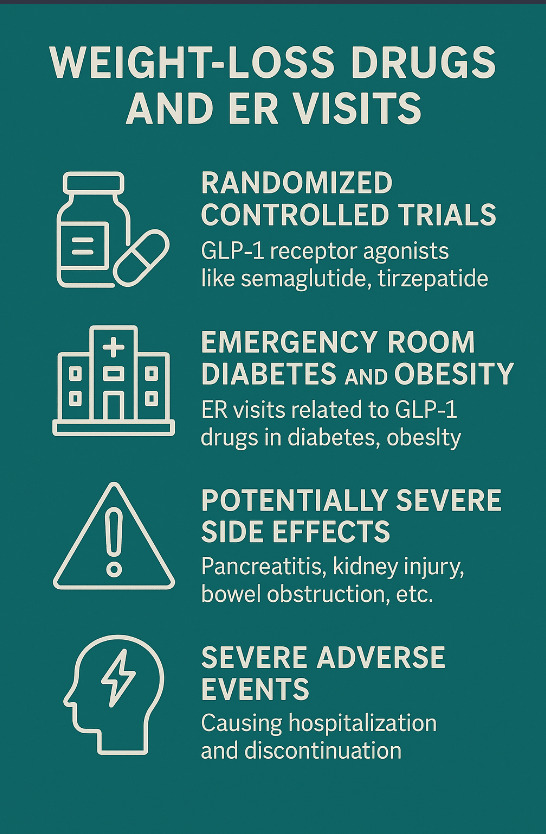

Weight-loss drugs like Mounjaro, Ozempic, Wegovy, and Zepbound have been associated with potential side effects, some of which may lead to emergency room visits. Here's a breakdown of these medications and their possible severe side effects: Medications and Their Side Effects Mounjaro (Tirzepatide): Common side effects include nausea, diarrhea, reduced appetite, vomiting, constipation, indigestion, and belly pain. It's a GLP-1 and GIP receptor agonist, approved for type 2 diabetes and weight management. Ozempic (Semaglutide): Common side effects include nausea, vomiting, diarrhea, belly pain, and constipation. It's a GLP-1 receptor agonist, approved for type 2 diabetes and heart disease prevention, with off-label use for weight loss. Wegovy (Semaglutide): Common side effects include nausea, diarrhea, vomiting, constipation, belly pain, headache, fatigue, indigestion, dizziness, and bloated stomach. It's approved for weight management in adults and children over 12 with obesity. Zepbound (Tirzepatide): Common side effects include nausea, diarrhea, vomiting, constipation, belly pain, indigestion, injection site reactions, fatigue, hypersensitivity reactions, burping, hair loss, and GERD. It's approved for weight management in adults with obesity. Severe Side Effects and Emergency Room Visits While these medications can be effective for weight loss and managing diabetes, they may also lead to severe side effects, such as: Pancreatitis: Although not explicitly listed as a common side effect, these medications haven't been studied in people who've had pancreatitis in the past. Low Blood Sugar (Hypoglycemia): Listed as a common side effect for Wegovy and potentially associated with other GLP-1 receptor agonists. Gastrointestinal Issues: Severe nausea, vomiting, diarrhea, and belly pain may require medical attention. Randomized Controlled Trials and Safety A phase 2 randomized clinical trial for bimagrumab, a different medication, showed promising results for weight loss and glycemic control in patients with type 2 diabetes and excess adiposity. However, the medications mentioned earlier (Mounjaro, Ozempic, Wegovy, and Zepbound) have also demonstrated efficacy in clinical trials, with some studies comparing their effectiveness ¹ ². Considerations When considering these medications, it's essential to: Consult with your doctor to discuss potential benefits and risks. Monitor your body's response to the medication and report any severe side effects. Follow the recommended dosage and administration guidelines. Be aware of potential interactions with other medications or health conditions. Keep in mind that these medications are relatively new, and long-term effects are still being studied. As with any medication, it's crucial to weigh the potential benefits against the potential risks and side effects.

1 note

·

View note

Text

How to Get Oral Semaglutide Online with Zepbound to Reach Your Weight Loss Goals

What is Oral Semaglutide?

Are you trying to lose weight and get rid of those extra pounds? If so, you may have heard about the increased interest in oral semaglutide. This new medicine is making a big splash in the field of weight management. It's a new way for people who are overweight or want to improve their body composition to do it. Getting this cutting-edge treatment is easier than ever thanks to internet solutions like Zepbound. Let's look more closely at what makes oral semaglutide different and how it can help you attain your weight loss goals while keeping you healthy. This is where your quest to losing weight starts!

What is Zepbound and how does it work?

Zepbound is a new drug that helps people lose weight. It has oral semaglutide in it, which is like a hormone that controls hunger and how much food you eat.

When you take Zepbound, it turns on receptors in your brain that control appetite and fullness. This two-part action helps to lower cravings and make you feel full after meals.

What happened? A more restricted way of eating that can help you lose weight and keep it off over time. Many people say they are less likely to snack between meals or eat foods that are rich in calories.

Also, Zepbound's composition makes it easy to take every day. You don't have to worry about getting shots, which makes it easier to stick to than other techniques. People who want to lose weight quickly and easily love this product because it is so easy to use.

The advantages of taking Oral Semaglutide and Zepbound to lose weight

Zepbound contains oral semaglutide, which is a new way to lose weight. This drug works like GLP-1, a hormone that controls hunger and how much food you eat.

One big benefit is that it can help people lose a lot of weight. Users often feel less hungry and more satisfied after meals. This can help you eat well without having to fight desires all the time.

Zepbound may also assist your metabolism by reducing blood sugar levels and making your body more sensitive to insulin. Because of this, it not only helps you lose weight but also improves your health in general.

A lot of people like that an oral option is easier to utilise than an injection one. Zepbound is easy to take every day and doesn't draw attention to itself, which makes it easier for people who are trying to lose weight to stick with it.

How to Buy Zepbound Online for Oral Semaglutide

Zepbound makes it easy and convenient to get oral semaglutide online. First, go to the official Zepbound website to see what they have to offer.

You will need to do a health check. This step makes sure that you are a good candidate for oral semaglutide. It's very important to give correct information about your medical history and zepbound for weight loss goals.

Talk to a licensed healthcare practitioner after you send in your information. They will look over your information and decide if this treatment is right for you.

You can place an order right on the site after you get the go-ahead. The process is easy to follow, so you can be sure that your medicine will arrive quickly at home.

Zepbound gives you clear instructions on how to use it and helps you every step of the way while you lose weight. Take advantage of this chance to take charge of your health from the comfort of your own home!

Conclusion: How to Reach Your Weight Loss Goals with the Help of

Getting to your weight loss goals is a journey that needs the correct tools and help. Zepbound's oral semaglutide is a new way for people who want to lose weight to do so effectively. It stands out as a useful tool for losing weight since it has a scientifically proven way to control hunger and boost metabolic health.

Zepbound makes it easier to get oral semaglutide online, which is a potent drug. You can stay committed without any problems because it's easy to get from reliable online sources. As you start along this path to a healthier life, keep in mind that combining medication with adjustments to your food and activity will make your outcomes even better.

Be confident in the opportunities that lie ahead of you. You can change your life with hard work and the help of Zepbound's oral semaglutide. It's time to take that initial step towards making your aspirations come true.

0 notes