#XTB BTC Trading

Explore tagged Tumblr posts

Text

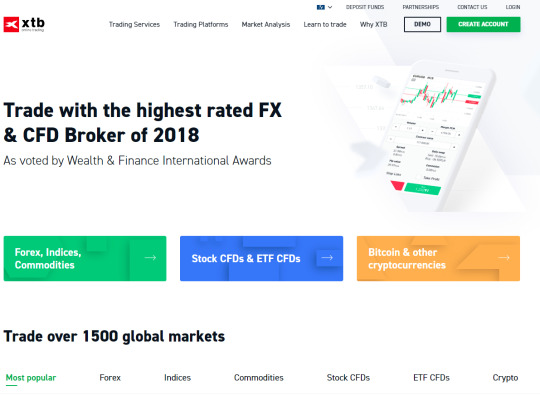

XTB Bitcoin Online Trading Review

New Post has been published on https://bitcoinonlinetrading.com/xtb-bitcoin-online-trading-review/

XTB Bitcoin Online Trading Review

[vc_row][vc_column width=”1/3″][vc_column_text][/vc_column_text][/vc_column][vc_column width=”1/3″][vc_column_text]

Regulated By the FCA

Headquarters Located in United Kingdom

Foundation Year in the Year 2002

Tel:+44 (0) 20 3695 3085

Web:https://xtb.co.uk

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_btn title=”Visit XTB website” color=”info” i_icon_fontawesome=”fa fa-home” add_icon=”true” link=”url:http%3A%2F%2Fgo.xtb.com%2Fvisit%2F%3Fbta%3D35439%26nci%3D5983|title:Visit%20XTB%20for%20Bitcoin%20Online%20Trading|target:%20_blank|”][vc_btn title=”Open XTB Bitcoin Demo account” color=”green” i_icon_fontawesome=”fa fa-signal” add_icon=”true” link=”url:http%3A%2F%2Fgo.xtb.com%2Fvisit%2F%3Fbta%3D35439%26nci%3D5980|title:Open%20XTB%20Bitcoin%20Demo%20Account|target:%20_blank|”][/vc_column][/vc_row][vc_row][vc_column][vc_row_inner][vc_column_inner][vc_column_text]

XTB Bitcoin Online Trading Conditions

[/vc_column_text][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row][vc_row][vc_column][vc_row_inner][vc_column_inner width=”1/2″][vc_btn title=”Visit XTB website” color=”info” i_icon_fontawesome=”fa fa-home” add_icon=”true” link=”url:http%3A%2F%2Fgo.xtb.com%2Fvisit%2F%3Fbta%3D35439%26nci%3D5983|title:Visit%20XTB%20for%20Bitcoin%20Online%20Trading|target:%20_blank|”][/vc_column_inner][vc_column_inner width=”1/2″][vc_btn title=”Open XTB Bitcoin Demo account” color=”green” i_icon_fontawesome=”fa fa-signal” add_icon=”true” link=”url:http%3A%2F%2Fgo.xtb.com%2Fvisit%2F%3Fbta%3D35439%26nci%3D5980|title:Open%20XTB%20Bitcoin%20Demo%20Account|target:%20_blank|”][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row][vc_row][vc_column width=”1/2″][vc_column_text]

XTB Bitcoin Instrument specification

[/vc_column_text][vc_column_text]Nominal Value of one Lot – BTC 1

Size of one PIP – 0.01

Minimum Quotation in Step (in points) – 0.01

Minimum/Maximum Order Size in Lots – 0.1, max 50

Minimum Transaction Step in Lots – 0.1

Trading Hours – 24 h from Saturday 4:00 am to Friday 10:00 pm

[/vc_column_text][/vc_column][vc_column width=”1/2″][vc_column_text]Target Spread

INSTRUMENT BASIC (FIX) STANDARD (FLOAT) PRO BTCUSD 15 7

Basic & Pro – General provisions:

1. Instruments BTCUSD, ETHUSD, XPRUSD, LTCUSD and DSHUSD ara available only on xStation platform on STANDARD (market execution only) and PRO offer.

2. The maximum amount of Client involvement in Open Positions (either long or short) on BTCUSD, may not exceed 100000 EUR[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]the Spread of Bitcoin is variable meaning it will jump all the time .

from what we have seen it goes between 15 till 20 Pips

up to 20:1 leverage

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

XTB BITCOIN BROKER REVIEW WILL EXPLAIN AS TO WHY THIS BROKER IS ONE OF THE BEST CHOICES YOU CAN MAKE WHEN SELECTING A BROKERAGE.

XTB was founded originally under another namey called X-Trade. this was taking place in 2002 and there were the first forex broker that was established in Poland.

Today, they have become the 4th largest stock exchange listed forex and CFD brokerage firm in the world.

XTB’s operations cover most of the world and have offices in more than 13 different countries including Poland, France, Germany, Turkey and the UK.

Like most brokers that are located In different countries even continents, they are regulated with different entities in roder to be able to provide legal Trading services to the people in those countries.

They hold licenses at BaFin, CMB, FCA and KNF. They have build a good relationship reputations a re winning prizes all ove the financial world for the best trading platform and best service. In short this is a broker you should take serious as much as he is taking his traders serious.

XTB Reliability

Established in 2002 as X-Trade, XTB is one the largest publicly owned forex brokerage in Europe. The broker has its headquarters in London and is regulated by the UK’s Financial Conduct Authority (FCA) as well as various other financial regulatory agencies in Europe such as the KNF, BaFin and CMB. Since they have been in the business for over 15 years they have established themselves as a reputed and serious brokerage and one of the better retail forex brokers in the industry

The regulatory oversight provided by the regulatory entities provides the traders with the insurance that this broker is on the level.

Also in a worst-case scenario, the traders are insured under a compensation scheme known as the Financial Services Compensation Scheme (FSCS) for up amount of £50,000. Most of the brokers in Europe that are not under the same regulation will have a compensation insured for around half that amount so this is again something that will give traders peace of mind.

SUPPORT

XTB offers support to their traders during the entire week that the markets are open. this means 24 hours a day for Monday till Friday. This makes sense if you are a global brokerage that has clients in all regions in the world

The support is also offered on a local level in 12 different countries.

One of their sales propositions is that they truly believe and implement transparency and clarity, especially when it comes to their spreads and trading conditions. This is a broker that will appeal more to the traders that have been shopping around and are looking for a broker that is able to handle their volume and provide trader related service of the quality they need.

XTB Bitcoin Trading Platforms

XTB has 2 main types of trading platforms for its traders to choose from, the MetaTrader 4 (MT4) platform and the xStation 5 platform.

The MT4 trading platform is the most popular trading platform in the industry and comes with a wide range of trading tools.

They allow expert advisors and the Their MT4 comes with all the bells and whistles that you are able to get. the platform is of course also available on mobile allow you to trade on the go and where ever and whenever you want.

Thou most people prefer to trade on the metatrader 4 there are people that feel more comfortable trading on a web-based trading platform. And for this they have the xStation 5.

For a web-trader this is one of the better ones in the market and has won several awards. It is extremely fast and includes numerous trading features such as a trading calculator, advanced chart, trader statistics and equity screener. And of course, this platform is also available in a version for mobile and tablet. Which would in my opinion be a better solution then the MT4 mobile application.

Account Types

To make sure that they are able provide everything a traders needs regardless of the level of the trader or investment, XTB offers 3 different accounts Basic account, Standard account and Pro account.

Basic Account

Minimum initial deposit requirement $250

Fixed Spread

Instant Trade Execution

Personal Account Manager

Guaranteed Stop Loss

Standard Account

Minimum Initial Deposit of $250

Floating Spread

Market Execution

Personal Account Manager

Automated Trading

Pro Account

Minimum Initial Deposit of $250

Market Spread

Market Execution

Personal Account Manager

Automated Trading

Commission Applicable

Commission & Spreads

The biggest difference between the accounts is actually how the spread is offered and calculated

The minimum spread for major currency pairs such as the EUR/USD starts from as low as 0.0002 pips for the Basic account and 0.00009 pips for the Standard account and 0.00003 pips for the Pro account.

For more information about the market spreads, Traders can check out the XTB’s Price Table on their site. The information on the price table is constantly being updated in real time.[/vc_column_text][vc_row_inner][vc_column_inner width=”1/2″][vc_btn title=”Visit XTB website” color=”info” i_icon_fontawesome=”fa fa-home” add_icon=”true” link=”url:http%3A%2F%2Fgo.xtb.com%2Fvisit%2F%3Fbta%3D35439%26nci%3D5983|title:Visit%20XTB%20for%20Bitcoin%20Online%20Trading|target:%20_blank|”][/vc_column_inner][vc_column_inner width=”1/2″][vc_btn title=”Open XTB Bitcoin Demo account” color=”green” i_icon_fontawesome=”fa fa-signal” add_icon=”true” link=”url:http%3A%2F%2Fgo.xtb.com%2Fvisit%2F%3Fbta%3D35439%26nci%3D5980|title:Open%20XTB%20Bitcoin%20Demo%20Account|target:%20_blank|”][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

Read the Reviews of the Best Bitcoin Online Trading Brokers

[/vc_column_text][vc_separator color=”orange” border_width=”2″][/vc_column][/vc_row][vc_row][vc_column width=”1/3″][vc_single_image image=”47″ img_size=”full” alignment=”center” onclick=”custom_link” link=”http://bitcoinonlinetrading.com/etoro-bitcoin-online-trading-review/”][/vc_column][vc_column width=”1/3″][vc_single_image image=”45″ img_size=”full” alignment=”center” onclick=”custom_link” link=”http://bitcoinonlinetrading.com/avatrade-bitcoin-online-trading-review/”][/vc_column][vc_column width=”1/3″][vc_single_image image=”46″ img_size=”full” alignment=”center” onclick=”custom_link” link=”http://bitcoinonlinetrading.com/XTB-bitcoin-online-trading-review/”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Bitcoin Brokers List | Resources and Industry Relevant Sites[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column width=”1/3″][vc_column_text]

Coindesk, Get the Latest Accurate Rates

Bitcoin – Wikipedia

the Home of Bitcoin

the one and true Bitcoin Wallet

Bitcoin: Reddit News about Bitcoin

Best Mt4 Broker for Top Trading experience

the Best brokers to Trade Litecoin

Top Dash Broker | for Trading Dash Online

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_column_text]

Ethereum Broker review | for Trading Ethereum Online

Forex Broker Demo Accounts

Trade Ripple Online

Forex Islamic Accounts for Halal Trading

Best Forex Trading signals

CFD Trading for those that are into coffee

Ripple news & Update from the Source

Financial Media and exposure possibilities

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_column_text]

Trade Coffee Online | CFD Trading

Best Forex demo accounts for trading

best FX Broker Regulated Trading IN US

CryptoCurrencies Trading explained

Bitcoin Brokers List for Bitcoin Education and explanations

Top Bitcoin Broker for online Trading

the latest news about the Fore industry, Brokers, News & updates

Bitcoin Brokers Review | Where should you Trade Bitcoin

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Trading Forex, Stocks and CFDs carries risk and could result in the loss of your deposit, please trade wisely.[/vc_column_text][/vc_column][/vc_row]

0 notes

Text

Bitcoin Surges for Second Day With Crypto in Demand as a Haven

(Bloomberg) -- Bitcoin extended a two-day rally, leading broad-based gains in cryptocurrencies as digital assets reasserted themselves as haven assets -- and emerged as a potential vehicle for getting around sanctions -- amid the intensifying war between Russia and Ukraine.

The largest digital coin by market value rose as much as 8% Tuesday to $44,964 in New York trading hours, with its rally over the past two sessions adding 20% to its market value at one point and its total market capitalization crossing above $840 billion once again. Other cryptocurrencies also advanced, with Ether crossing above $3,000. It also broke above its average price over the last 50 days, typically seen as a bullish development.

Analysts watching the market say the stunning breakthrough can be ascribed to the idea that cryptocurrencies could act as a type of refuge as the war in Ukraine intensifies. Its appeal lies with the fact, the argument goes, that cryptocurrencies are detached from governmental control and therefore not beholden to any of their actions.

Bitcoin “has gold-like properties in that if you hold it you directly control the assets as opposed to governments and banks being in between,” said Stéphane Ouellette, chief executive of FRNT Financial Inc. “In a period where banking is destabilized in a region, which is obviously happening in Europe right now, it would make sense to see some flows into BTC as people diversify away from the banking system,” he said, adding that speculators can get in front of such trends, which can drive prices higher.

A fresh wave of turbulence hit global markets on Tuesday as the war in Ukraine intensified amid mounting penalties against Russia. Russian troops continued to shell military and civilian facilities alike, Bloomberg News reported, as Ukraine’s President Volodymyr Zelenskiy accused Russian forces of committing acts of terror, and as the Kremlin stepped up its offensive despite a barrage of sanctions directed at Moscow.

The rally is about “the utility of these assets to serve as a potential workaround for Russia sanctions and also a point of proof that virtual currencies are viable alternatives to fiat currencies like the Russian ruble,” said Nicholas Colas, co-founder of DataTrek Research.

Stocks in Europe fell along with U.S. equities, with the S&P 500 declining for the second straight day. Wall Street’s fear gauge, the VIX, also spiked.

Many analysts have long posited that Bitcoin can be a useful asset during geopolitical turmoil. Its outperformance amid the volatility has some bulls pointing to a break from the narrative that crypto is just another risk asset. Adam Farthing, chief risk officer for Japan at crypto trading firm B2C2, said Bitcoin could “de-link from risk” and start trading more like a hedge to geopolitical instability and inflation.

“Bitcoin saw a significant upward move today as it appears to have slightly regained its safe haven status while the Russia-Ukraine conflict continues to intensify,” said Walid Koudmani, an analyst at XTB Market.

Other influences may also be at play.

“We’ve never had a group of nations in essence confiscate real estate from Russian tycoons, taking a country’s money,” said Mike Novogratz, CEO and founder of crypto platform Galaxy Digital. “That’s why Bitcoin was created, because people don’t trust governments. This is a big deal -- in a lot of ways, this is starting the acceleration of de-dollarization of the world.”

Trading volumes in Bitcoin using the ruble have surged to the highest level since May, suggesting Russians are potentially moving their money into crypto as the ruble plunges to a record low. Meanwhile, trading volumes overall for Bitcoin and Ether, the second-largest cryptocurrency by market value, have dropped even as their prices rose over the last month, according to a report from CryptoCompare. Average daily aggregate trading volume on crypto products stood around $353 million, down more than 24% from January.

Read more: Bitcoin Volume Spikes in Russia and Ukraine as Sanctions Hit

Because Bitcoin’s fundamental and intrinsic value can be elusive, “technicals, a map of market psychology, may be critical,” said Marc Chandler, chief market strategist at Bannockburn Global Forex. He notes that some technicians point to a break above February’s highs potentially being key and possibly signaling a move above $50,000.

While still elevated at 0.55, Bitcoin’s correlation with the S&P 500 has come off after surpassing 0.7 earlier this year, data compiled by Bloomberg show. A correlation of 1 means two assets move perfectly in tandem, while a zero correlation displays their fluctuations are wholly independent.

“It seems the link to risk assets has temporarily been broken,” said Craig Erlam, a senior markets analyst at Oanda. Still, he says any evidence of crypto use as a way to skirt sanctions could drive policy makers to crack down with more regulations.

Amid the price spike, Bitcoin’s 90-day volatility has been trending high as well, Bloomberg data show.

Adam Phillips, managing director of portfolio strategy at EP Wealth Advisors, urges caution, saying that its volatility is the reason he’s being wary.

“It is going to behave somewhat radically,” he said in an interview. “Let’s remember, it hasn’t been around for that long, and we kind of view it as a teenager in a world full of mature assets. And so teenagers are going to behave erratically from of time and you can’t really understand their behavior, and this is really one of those days.”

0 notes

Text

The gains accompanied a sharp overnight spike in the number of Bitcoin whale addresses. Bitcoin (BTC) extended its gains nearly hitting $45K on March 1 as interest rate speculators reduced their bets on aggressive rate hikes in 2022, the number of whale addresses spiked, and amid speculations that BTC is proving itself as an apolitical safe-haven.Traders reduce half-point bets for MarchBTC's price surged more than 4% to reach nearly $45,000, a day after recording its biggest one-day increase since February 2021 as a flurry of sanctions on Russia, including a ban from accessing the global banking system SWIFT, raised concerns over their impact on global growth and inflation. For instance, swaps tied to the Federal Reserve's mid-March meeting anticipated a 24.5 basis point (bps) tightening as of March 1, 2022. That indicated a 0.5 bps rate increase — which had a 100% approval from interest rate traders last month — is less likely to happen.US Forward Swaps - Federal Funds Effective Rate. Source: BloombergMeanwhile, traders also reduced their expectations of the number of rate hikes in 2022 to five from seven just days ago, according to Bloomberg's Lisa Abramowicz, who shared the following chart.Implied overnight rate and number of hikes/cuts. Source: Lisa AbramowiczThe repricing of the Fed outlook appeared as investors' demand for safe-havens, including U.S. Treasuries and gold, boomed in the past few days. Bitcoin, which had earlier lost more than half of its value due to fears surrounding aggressive Fed rate hikes, also responded with a sharp recovery, further in part due to reports that Russians were buying the crypto to bypass sanctions.“Bitcoin saw a significant upward move today as it appears to have slightly regained its safe-haven status while the Russia-Ukraine conflict continues to intensify,” Walid Koudmani, an analyst at XTB Market, told Bloomberg.Data provided by crypto research firm CoinMetrics also showed a significant spike in the number of addresses holding at least 1,000 BTC, typically considered "whales" by the industry. Their number jumped from 2,127 on Feb. 27, to 2,266 on Feb. 28.Bitcoin addresses with balance greater than 1K BTC. Source: CoinMetrics, MessariTo 25bps or not to 25bpsRaphael Bostic, president of the Federal Reserve Bank of Atlanta, favored a 25 bps rate hike at the Federal Open Market Committee's meeting at the end of February. Nonetheless, he also said that a higher than anticipated inflation reading could have him "look at a 50-basis-point move for March."Related: 2 key derivatives metrics signal that Bitcoin traders expect BTC to hold $40KBut Ecoinometrics analyst Nick argues that the Russia-Ukraine crisis has now forced the Fed to walk on shaky ground. With inflation likely to remain higher due to higher oil prices, he explained, a too aggressive rate hike in March could risk crashing the stock market."Inflation is so high that we can probably afford a stock market dip all the way down to -20%," he wrote. "But below that, they'll have to call back the tightening or risk a multiyear bear market [...] Of course that's not good for Bitcoin."The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision. Go to Source

0 notes

Text

The Bitcoin Perpetuals Swaps Market is Growing - What You Need to Know

New Post has been published on https://coinmakers.tech/markets/the-bitcoin-perpetuals-swaps-market-is-growing-what-you-need-to-know

The Bitcoin Perpetuals Swaps Market is Growing - What You Need to Know

The perpetual swaps market for cryptoassets is growing. First brought to market by leading crypto derivatives exchange BitMEX in 2016, perpetual swaps on bitcoin have started to gain more traction among crypto traders in the past twelve months. Today, several exchanges offer perpetuals while market leader BitMEX claims its perpetual contract sees five to ten billion dollars notional per day.

In this guide, you will discover what perpetual swaps are and why they have become so popular among experienced bitcoin traders.

What are perpetual swaps on bitcoin?

Perpetual swaps, also known as perpetual contracts, enable traders to bet on the price developments of bitcoin using leverage without having to own physical bitcoin.

Perpetual swaps are financial derivatives that are very similar to a futures contract. The key differences between the two are that perpetual swap contracts have no expiry date and that the price of a perpetual contract trades closer to the spot price of bitcoin than a futures contract.

Watch the latest reports by Block TV.

As the name suggests, perpetual contracts go on “forever” and do not come with an expiry date, such as futures or options. The main idea behind perpetual swaps on bitcoin is to enable traders to trade bitcoin without having to own the asset using high leverage. BitMEX, for example, offers up to 100x leverage for its XTB/USD perpetual contracts.

Futures are a contract between two parties to buy or sell an underlying asset at a specific date for a predetermined price in the future. Perpetual swaps have no expiry or settlement date. Instead, traders can buy and sell them at any time for the prevailing price.

Moreover, the price of bitcoin perpetual contracts trades closer to the underlying reference index (i.e. the spot price) than futures contracts because the difference between the perp and the spot price is only the funding rate. Futures contracts, on the other hand, has a basis that creates the difference between the futures and spot price.

The funding rate for perpetual swaps is either paid or received by the holder depending on whether their position goes against or with the current market trend. The perp’s funding rate exists to mimic interest payments between margin trading on spot markets with long and short positions. The funding rate can make trading perpetuals more expensive than other bitcoin derivatives when traders hold onto their positions for a longer period of time.

Aside from pioneer BitMEX, other cryptoasset derivatives trading platforms that offer perpetual contracts include Deribit, OKEx, and bitFlyer.

Futures are generally cheaper than perpetual swaps for taking long positions or hedging digital asset portfolios. However, perpetual contracts are substantially more popular among traders (most likely) due to their ease-of-use.

While perpetual swaps are relatively easy to use and understand, for the inexperienced investor, buying digital assets outright is probably the better option due to the somewhat advanced funding mechanism that perpetual swaps use. Moreover, a perpetual contract position can end up becoming quite costly over time. Hence, for hodlers and newcomers, buying the “physical” cryptoasset is probably the better option.

OKex launches crypto derivatives market data platform

A clear sign of the growing crypto derivatives market is OKEx’s recent launch of a derivatives big data platform that provides “trading data for customers to understand the derivatives market.”

OKEx’s Futures & Perpetual Swap Market Data platform enables traders to monitor real-time data of OKEx’s futures and perpetual swap markets for nine cryptoassets, including BTC, LTC, ETH, ETC, XRP, EOS, BCH, BSV, and TRX.

The idea behind the new data platform is to provide insight into key crypto derivatives market indicators, including basis, open interest, trading volume, buy/sell taker volume, long/short positions ratio, and more.

Andy Cheung, Head of Operations of OKEx, stated: “Derivatives trading requires a steeper learning curve, as it involves the use of margin and leverage. Once we realized that there isn’t really much data available in the market to help users analyze market trends, we decided to build a tool that can benefit our users.”

The more sophisticated the cryptoasset market becomes, the more advanced crypto trading products will emerge. The perpetual swap is one of several bitcoin derivatives on offer at the moment, but we can expect more innovation in the product space as the market continues to mature.

Source: cryptonews.com

0 notes

Text

Shocking! ‘Bitcoin Wins the Trade War’ as Chinese Investors Pile In

Source: https://www.ccn.com/bitcoin-trade-war-chinese-investors

By CCN: Bitcoin is on a tear as the price of the flagship cryptocurrency has gone supersonic in 2019. It is widely believed that bitcoin’s remarkable rally is a result of booming institutional interest in the cryptocurrency, as investors are looking for alternative asset classes to park their funds at a time when the stock market is in turmoil and the global economy is on edge.

But it looks like institutional buying isn’t the only catalyst driving bitcoin’s price. The Chinese are reportedly piling into bitcoin, believing it to be a safe investment at a time when the yuan is taking a hit thanks to the U.S.-China trade war.

In a period where: —political tensions escalate between US and China, —global equity markets fall sharply —VIX largest spike in many months —global yield curves flatten/invert#bitcoin has RISEN and >$6,000

Crypto showing its value as an uncorrelated asset.

— Thomas Lee (@fundstrat) May 9, 2019

China Suddenly Loves Bitcoin

The Chinese government has a hostile approach toward bitcoin, delivering blow after blow to the cryptocurrency industry in general. From shuttering exchanges to outlawing ICOs and considering a ban on mining activities, the Chinese government has made it clear that it doesn’t love crypto.

But the Chinese people are counting on bitcoin a time when the yuan is crumbling under the pressure of the trade war.

The Chinese yuan slipped to its lowest level in the last six months earlier this week after the country announced countermeasures against Trump’s tariffs.

The yuan suffered its steepest single-day drop since last July after China announced that it will impose tariffs in the range of 5% to 25% on $60 billion worth of U.S. goods. Analysts believe that the Chinese are dumping the yuan in favor of BTC.

According to David Cheetham, the chief market analyst at trading platform XTB cited in Yahoo Finance:

“Rather than investors seeking out inherently risky assets as safe havens, a more likely explanation is the recent drop in the Chinese yuan and the expectation of a further depreciation when Beijing seeks to make exports more attractive in response to the latest round of U.S. tariffs.”

Dovey Wan, who is the co-founder of crypto holding firm Primitive Ventures, has a similar view.

Maybe just a coincidence but you tell me

Bitcoin is winning the trade war while China and US is a lose-lose pic.twitter.com/8FmVcaHjjh

— Dovey Wan 🗝 🦖 (@DoveyWan) May 13, 2019

Traders Confirm the Chinese Are Buying Crypto

The Chinese government has stringent measures in place to prevent the dumping of yuan, limiting the yuan’s outflow to just $50,000 a year.

But bitcoin gives them a way to circumvent that limit despite a ban on cryptocurrency exchanges, with the help of over-the-counter dealers and peer-to-peer exchanges such as LocalBitcoins.

According to Philippe Bekhazi, CEO of crypto trading firm XBTO cited in Forbes:

“I’ve talked to a bunch of traders on the ground in Hong Kong. There’s a booming business in stablecoins because people are getting money out of China and Hong Kong.”

Not surprisingly, weekly bitcoin volumes on LocalBitcoins have spiked. In March, China was the fifth-largest country in terms of bitcoin volumes on the peer-to-peer platform. What’s more, a closer look indicates that Chinese bitcoin buying on LocalBitcoins has gathered pace in recent weeks.

Chart showing higher LocalBitcoins volumes in China in recent weeks | Source: Coin Dance

If the U.S.-China trade war takes a turn for the worse, the price of bitcoin can spike further and possibly reclaim the peak $20,000 level once again.

Source: https://www.ccn.com/bitcoin-trade-war-chinese-investors

source https://www.initialcoinlist.com/shocking-bitcoin-wins-the-trade-war-as-chinese-investors-pile-in/

0 notes

Text

Why an ex-NFL player and actor worth millions still drives the 20-year-old car he took to prom

New Post has been published on https://www.paraexpres.com/bs-why-an-ex-nfl-player-and-actor-worth-millions-still-drives-the-20-year-old-car-he-took-to-prom/

Why an ex-NFL player and actor worth millions still drives the 20-year-old car he took to prom

Bitcoin cash, the cryptocurrency that split off from bitcoin earlier this year, jumped against the dollar on Friday. Investors have cash to burn right now, and based on the astronomical performance of cryptocurrencies like bitcoin and Ethereum, that’s where a lot of it is getting funneled.

This is coming at the expense of gold, says Tom Lee, the managing partner and head of research at Fundstrat Global Advisors. In fact, he thinks that the growing preference for the cryptocurrencies over gold is actually helping contribute to the torrid gains in the fledgling products.

One main factor driving demand for cryptocurrencies is the reduction in supply that’s been seen in recent months, according to Lee. He notes that the rate of bitcoin units added has been more than halved over the past year, to 4.4% from 9.3%. With mining slowing down, bitcoin won’t reach its theoretical maximum number of units until 2045 or later.

[bs-quote quote=”It’s better to hang out with people better than you. Pick out associates whose behavior is better than yours and you’ll drift in that direction.” style=”style-23″ align=”left” author_name=”Warren Buffett” author_job=”CEO of Berkshire Hathaway” author_avatar=”https://www.paraexpres.com/wp-content/uploads/2018/12/business-times-qoute-avatar.png”]

Meanwhile, Lee finds that gold production has risen “sharply” since 2009, and now sits at 3,100 metric tons, the highest on record. Meanwhile, Lee finds that gold production has risen “sharply” since 2009, and now sits at 3,100 metric tons, the highest on record.

Fundstrat’s base case calls for the cryptocurrency to expand eight to roughly $20,000 per unit by 2022. But in the most bullish scenario, bitcoin could reach as high as $55,000 over the same period. “Our model shows gold’s value being relatively static against a rise in bitcoin,” Lee says. One potential wild card that may speed up investor allocation into cryptocurrencies could be buying by central banks.

“Already central banks have looked into this possibility,” Lee says. “In our view, this is a game changer, enhancing the legitimacy of the currency and likely accelerating the substitution for gold.”

Investors have cash to burn right now, and based on the astronomical performance of crypto currencies like bitcoin and Ethereum, that’s where a lot of it is getting funneled.

SegWit2x was intended to speed up transactions on bitcoin’s network, but not enough partic ipants agreed on the proposal, and its implementation risked splitting the network again. As a result, the project was abandoned Wednesday.

Joshua Raymond, a director at the foreign-exchange and CFD broker XTB, told Business Insider: “The delay to Segwit2x has damaged confidence amongst bitcoin investors concerning the much-needed resolution to speed up bitcoin’s slow processing speed.

Mati Greenspan, an analyst with the trading platform eToro, said: “After the 2x hard fork was called off, BCH is now being seen as a favourite to one day replace BTC. If the Bitcoin community doesn’t come to a consensus about how to scale the network soon, it may run into congestion, in which case people will need an alternative.”

Investors have cash to burn right now, and based on the astronomical performance of cryptocurrencies like bitcoin and Ethereum, that’s where a lot of it is getting funneled. SegWit2x was intended to speed up transactions on bitcoin’s network, but not enough participants agreed on the proposal, and its implementation risked splitting the network again. As a result, the project was abandoned Wednesday.

0 notes

Text

CryptoPremier – Scam Broker or Best Cryptocurrency Trading Platform?

CryptoPremier Review – We all know of a nasty expertise involving cryptocurrency brokers or exchange platforms. While they do permit a majority of us to trade within the digital currencies, not all dwell as much as the user’s expectations and more often some end up turning into outright scams. Consequently, this implies there are only a few cryptocurrency brokers which have the reputation to offer what they’ve promised certainly.

Luckily for crypto traders, there are always ways to get into trading your Bitcoin without placing your self at risk. Rather than try out all of the crypto brokers available in the market, it’s still clever to first get a review or check of the broker offering the cryptocurrency trading options. Today we get to look at a recently-launched crypto broker that offer many widespread services.

What Is CryptoPremier?

CryptoPremier is a cryptocurrency broker that prides itself as the world’s first premier crypto trading platforms to offer the trading of Bitcoin (BTC), Litecoin (LTC) and Ethereum (ETH) on the ease of the user. Additionally, the broker allows for trading services throughout some instruments and portals it offers within the platform. And though CryptoPremier features primarily on the digital currency, the platform additionally supplies fiat payment options comparable to Skrill, PayPal, MasterCard and Visa.

How CryptoPremier Cryptocurrency Broker Works

As a global crypto trading platform, CryptoPremier plans to cater for a broad class of clients on different gadgets such as PC, Android, Mac and IOS devices. Apart from the complete vary of applications, CryptoPremier will also include:

An e-wallet for the users to securely hold multiple digital currencies and conduct online trading

An academic e-book supplies insights on how to come up with cryptocurrency trading sessions and move from the beginner tag

PAMM trading platform-CryptoPremier clients additionally get to participate in High-Frequency Trading (HFT), and PAMM counts to invest for them within the trading schemes automatically

CFD trading software-the broker additionally offer a unique approach of trading cryptocurrency pairs by means of the software

The registration part is fairly simple with the person only needing to register and to fund his CryptoPremier account. Depending on the kind of account, the deposits vary from an ordinary of $5,000 to $50,000 for the VIPs.

Why Use CryptoPremier And What Are The Risks

The brokerage platform presents a number of medium benefits for the cryptocurrency fanatics. Some of the mentioned advantages embrace:

Micro-fast trading choices enable for seamless trading

The PAMM technology creates a multifunctional platform for active but subtle crypto trading

The exchange hub supplies for interplay between traders and could consequently lead to constructive crypto relationships

The dangers of using CryptoPremier:

There isn’t any proof of license operation that means there’s a risk of lossing capital

The scalability of the cryptocurrencies remains to be in questions

Use of automated trading software doesn’t assure the most effective bet for those looking for returns

CryptoPremier Review Verdict

3 Total Score

Not a trustworthy broker to invest

There are plenty of reasons I would not recommend using the CryptoPremier platform as a crypto broker. For starters, there are plenty of scam signs with the project starting with the enormous deposits, to the type of errors made on their website. While these aren't sure signs, it is always better to be safe than sorry. In conclusion, the CryptoPremier platform is not a trustworthy broker to invest in your finances.

PROS

Available everywhere to steal your money as quickly as you deposit

CONS

Unlicensed broker

Credential can't be ensured

Lack of community endorsement

User Rating: 1.5 (2 votes)

Recommended Read

Editors' Picks

BinBot Pro – Safest & Highly Recommended Binary Options Auto Trading Robot

Do you live in a country like USA or Canada where using automated trading systems is a problem? If you do then now we ...

User rating:

9.5

Demo & Pro Version Get It Now Hurry!

Read full review

Most Popular 2

Bit Bubble Tech – Learn How To Profit Big When Bitcoin Bubble Bursts?

If you have not already heard of the Bit Bubble Tech App, you undoubtedly wish to read this Bit Bubble Tech Review. We ...

User rating:

9.3

Free For 90 Days Get It Now

Read full review

This post Crypto Premier Review – Scam Broker or Best Cryptocurrency Trading Platform? is also available in YouTube as video CryptoPremier Software Review Crypto Premier Software Scam Review Result ➤➤ https://www.youtube.com/watch?v=n2TQ6p04a1M

Crypto Premier related searches you may like

What is the best platform for bitcoin trading?

Now that it’s harder to tell if there’s more currencies or exchanges, answering this question is particularly difficult. Furthermore, it would be impossible to give the full list of all the exchanges which have earned some reputation.

10 Best Bitcoin Trading Platforms & Bitcoin Brokers in 2018

Compare top UK regulated Bitcoin brokers (including eToro, Plus500, XTB & more) that allow you to buy, sell and trade Bitcoin [BTC] with a credit card & other easy payment methods. As of April 2018, most of these brokers offer Bitcoin, Ripple, Ethereum, Dash, Litecoin, Stellar, Monero, Caradano, NEM & Tron.

The post CryptoPremier – Scam Broker or Best Cryptocurrency Trading Platform? appeared first on Review: Legit or Scam?.

Read more from → https://legit-scam.review/crypto-premier-review-scam

0 notes

Text

XTB Bitcoin Online Trading Review

New Post has been published on https://bitcoinonlinetrading.com/xtb-bitcoin-online-trading-review/

XTB Bitcoin Online Trading Review

[vc_row][vc_column width=”1/3″][vc_column_text][/vc_column_text][/vc_column][vc_column width=”1/3″][vc_column_text]

Regulated By the FCA

Headquarters Located in United Kingdom

Foundation Year in the Year 2002

Tel:+44 (0) 20 3695 3085

Web:https://xtb.co.uk

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_btn title=”Visit XTB website” color=”info” i_icon_fontawesome=”fa fa-home” add_icon=”true” link=”url:http%3A%2F%2Fgo.xtb.com%2Fvisit%2F%3Fbta%3D35439%26nci%3D5983|title:Visit%20XTB%20for%20Bitcoin%20Online%20Trading|target:%20_blank|”][vc_btn title=”Open XTB Bitcoin Demo account” color=”green” i_icon_fontawesome=”fa fa-signal” add_icon=”true” link=”url:http%3A%2F%2Fgo.xtb.com%2Fvisit%2F%3Fbta%3D35439%26nci%3D5980|title:Open%20XTB%20Bitcoin%20Demo%20Account|target:%20_blank|”][/vc_column][/vc_row][vc_row][vc_column][vc_row_inner][vc_column_inner][vc_column_text]

XTB Bitcoin Online Trading Conditions

[/vc_column_text][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row][vc_row][vc_column][vc_row_inner][vc_column_inner width=”1/2″][vc_btn title=”Visit XTB website” color=”info” i_icon_fontawesome=”fa fa-home” add_icon=”true” link=”url:http%3A%2F%2Fgo.xtb.com%2Fvisit%2F%3Fbta%3D35439%26nci%3D5983|title:Visit%20XTB%20for%20Bitcoin%20Online%20Trading|target:%20_blank|”][/vc_column_inner][vc_column_inner width=”1/2″][vc_btn title=”Open XTB Bitcoin Demo account” color=”green” i_icon_fontawesome=”fa fa-signal” add_icon=”true” link=”url:http%3A%2F%2Fgo.xtb.com%2Fvisit%2F%3Fbta%3D35439%26nci%3D5980|title:Open%20XTB%20Bitcoin%20Demo%20Account|target:%20_blank|”][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row][vc_row][vc_column width=”1/2″][vc_column_text]

XTB Bitcoin Instrument specification

[/vc_column_text][vc_column_text]Nominal Value of one Lot – BTC 1

Size of one PIP – 0.01

Minimum Quotation in Step (in points) – 0.01

Minimum/Maximum Order Size in Lots – 0.1, max 50

Minimum Transaction Step in Lots – 0.1

Trading Hours – 24 h from Saturday 4:00 am to Friday 10:00 pm

[/vc_column_text][/vc_column][vc_column width=”1/2″][vc_column_text]Target Spread

INSTRUMENT BASIC (FIX) STANDARD (FLOAT) PRO BTCUSD 15 7

Basic & Pro – General provisions:

1. Instruments BTCUSD, ETHUSD, XPRUSD, LTCUSD and DSHUSD ara available only on xStation platform on STANDARD (market execution only) and PRO offer.

2. The maximum amount of Client involvement in Open Positions (either long or short) on BTCUSD, may not exceed 100000 EUR[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]the Spread of Bitcoin is variable meaning it will jump all the time .

from what we have seen it goes between 15 till 20 Pips

up to 20:1 leverage

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

XTB BITCOIN BROKER REVIEW WILL EXPLAIN AS TO WHY THIS BROKER IS ONE OF THE BEST CHOICES YOU CAN MAKE WHEN SELECTING A BROKERAGE.

XTB was founded originally under another namey called X-Trade. this was taking place in 2002 and there were the first forex broker that was established in Poland.

Today, they have become the 4th largest stock exchange listed forex and CFD brokerage firm in the world.

XTB’s operations cover most of the world and have offices in more than 13 different countries including Poland, France, Germany, Turkey and the UK.

Like most brokers that are located In different countries even continents, they are regulated with different entities in roder to be able to provide legal Trading services to the people in those countries.

They hold licenses at BaFin, CMB, FCA and KNF. They have build a good relationship reputations a re winning prizes all ove the financial world for the best trading platform and best service. In short this is a broker you should take serious as much as he is taking his traders serious.

XTB Reliability

Established in 2002 as X-Trade, XTB is one the largest publicly owned forex brokerage in Europe. The broker has its headquarters in London and is regulated by the UK’s Financial Conduct Authority (FCA) as well as various other financial regulatory agencies in Europe such as the KNF, BaFin and CMB. Since they have been in the business for over 15 years they have established themselves as a reputed and serious brokerage and one of the better retail forex brokers in the industry

The regulatory oversight provided by the regulatory entities provides the traders with the insurance that this broker is on the level.

Also in a worst-case scenario, the traders are insured under a compensation scheme known as the Financial Services Compensation Scheme (FSCS) for up amount of £50,000. Most of the brokers in Europe that are not under the same regulation will have a compensation insured for around half that amount so this is again something that will give traders peace of mind.

SUPPORT

XTB offers support to their traders during the entire week that the markets are open. this means 24 hours a day for Monday till Friday. This makes sense if you are a global brokerage that has clients in all regions in the world

The support is also offered on a local level in 12 different countries.

One of their sales propositions is that they truly believe and implement transparency and clarity, especially when it comes to their spreads and trading conditions. This is a broker that will appeal more to the traders that have been shopping around and are looking for a broker that is able to handle their volume and provide trader related service of the quality they need.

XTB Bitcoin Trading Platforms

XTB has 2 main types of trading platforms for its traders to choose from, the MetaTrader 4 (MT4) platform and the xStation 5 platform.

The MT4 trading platform is the most popular trading platform in the industry and comes with a wide range of trading tools.

They allow expert advisors and the Their MT4 comes with all the bells and whistles that you are able to get. the platform is of course also available on mobile allow you to trade on the go and where ever and whenever you want.

Thou most people prefer to trade on the metatrader 4 there are people that feel more comfortable trading on a web-based trading platform. And for this they have the xStation 5.

For a web-trader this is one of the better ones in the market and has won several awards. It is extremely fast and includes numerous trading features such as a trading calculator, advanced chart, trader statistics and equity screener. And of course, this platform is also available in a version for mobile and tablet. Which would in my opinion be a better solution then the MT4 mobile application.

Account Types

To make sure that they are able provide everything a traders needs regardless of the level of the trader or investment, XTB offers 3 different accounts Basic account, Standard account and Pro account.

Basic Account

Minimum initial deposit requirement $250

Fixed Spread

Instant Trade Execution

Personal Account Manager

Guaranteed Stop Loss

Standard Account

Minimum Initial Deposit of $250

Floating Spread

Market Execution

Personal Account Manager

Automated Trading

Pro Account

Minimum Initial Deposit of $250

Market Spread

Market Execution

Personal Account Manager

Automated Trading

Commission Applicable

Commission & Spreads

The biggest difference between the accounts is actually how the spread is offered and calculated

The minimum spread for major currency pairs such as the EUR/USD starts from as low as 0.0002 pips for the Basic account and 0.00009 pips for the Standard account and 0.00003 pips for the Pro account.

For more information about the market spreads, Traders can check out the XTB’s Price Table on their site. The information on the price table is constantly being updated in real time.[/vc_column_text][vc_row_inner][vc_column_inner width=”1/2″][vc_btn title=”Visit XTB website” color=”info” i_icon_fontawesome=”fa fa-home” add_icon=”true” link=”url:http%3A%2F%2Fgo.xtb.com%2Fvisit%2F%3Fbta%3D35439%26nci%3D5983|title:Visit%20XTB%20for%20Bitcoin%20Online%20Trading|target:%20_blank|”][/vc_column_inner][vc_column_inner width=”1/2″][vc_btn title=”Open XTB Bitcoin Demo account” color=”green” i_icon_fontawesome=”fa fa-signal” add_icon=”true” link=”url:http%3A%2F%2Fgo.xtb.com%2Fvisit%2F%3Fbta%3D35439%26nci%3D5980|title:Open%20XTB%20Bitcoin%20Demo%20Account|target:%20_blank|”][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

Read the Reviews of the Best Bitcoin Online Trading Brokers

[/vc_column_text][vc_separator color=”orange” border_width=”2″][/vc_column][/vc_row][vc_row][vc_column width=”1/3″][vc_single_image image=”47″ img_size=”full” alignment=”center” onclick=”custom_link” link=”http://bitcoinonlinetrading.com/etoro-bitcoin-online-trading-review/”][/vc_column][vc_column width=”1/3″][vc_single_image image=”45″ img_size=”full” alignment=”center” onclick=”custom_link” link=”http://bitcoinonlinetrading.com/avatrade-bitcoin-online-trading-review/”][/vc_column][vc_column width=”1/3″][vc_single_image image=”46″ img_size=”full” alignment=”center” onclick=”custom_link” link=”http://bitcoinonlinetrading.com/XTB-bitcoin-online-trading-review/”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Bitcoin Brokers List | Resources and Industry Relevant Sites[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column width=”1/3″][vc_column_text]

Coindesk, Get the Latest Accurate Rates

Bitcoin – Wikipedia

the Home of Bitcoin

the one and true Bitcoin Wallet

Bitcoin: Reddit News about Bitcoin

Best Mt4 Broker for Top Trading experience

the Best brokers to Trade Litecoin

Top Dash Broker | for Trading Dash Online

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_column_text]

Ethereum Broker review | for Trading Ethereum Online

Forex Broker Demo Accounts

Trade Ripple Online

Forex Islamic Accounts for Halal Trading

Best Forex Trading signals

CFD Trading for those that are into coffee

Ripple news & Update from the Source

Financial Media and exposure possibilities

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_column_text]

Trade Coffee Online | CFD Trading

Best Forex demo accounts for trading

best FX Broker Regulated Trading IN US

CryptoCurrencies Trading explained

Bitcoin Brokers List for Bitcoin Education and explanations

Top Bitcoin Broker for online Trading

the latest news about the Fore industry, Brokers, News & updates

Bitcoin Brokers Review | Where should you Trade Bitcoin

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Trading Forex, Stocks and CFDs carries risk and could result in the loss of your deposit, please trade wisely.[/vc_column_text][/vc_column][/vc_row]

0 notes

Text

XTB Bitcoin Brokers List Review | | Everything what you should Know about this Broker

New Post has been published on https://bitcoinbrokerslist.com/xtb-bitcoin-brokers-list-review/

XTB Bitcoin Brokers List Review | | Everything what you should Know about this Broker

/* custom css */ .td_uid_541_5dd753349393b_rand min-height: 0;

/* custom css */ .td_uid_542_5dd7533493c47_rand vertical-align: baseline;

XTB Bitcoin Broker for online Bitcoin Trading

jQuery(window).load(function () jQuery('body').find('#td_uid_397_5dd75334938ea .td-element-style').each(function (index, element) jQuery(element).css('opacity', 1); return; ); ); jQuery(window).ready(function () // We need timeout because the content must be rendered and interpreted on client setTimeout(function () var $content = jQuery('body').find('#tdc-live-iframe'), refWindow = undefined; if ($content.length) else $content = jQuery('body'); refWindow = window; $content.find('#td_uid_397_5dd75334938ea .td-element-style').each(function (index, element) jQuery(element).css('opacity', 1); return; ); ); , 200);

/* custom css */ .td_uid_544_5dd7533495402_rand min-height: 0;

/* custom css */ .td_uid_545_5dd75334956aa_rand vertical-align: baseline;

/* custom css */ .td_uid_547_5dd7533496ca6_rand vertical-align: baseline;

XTB (Bitcoin) is a brokerage where traders can trade with ease of mind. XTB provides a great experience which will satisfy you for sure. As they too added bitcoin recently, we had to check them out and found that trading cryptocurrencies here can be done with ease and comfort!

Start Trading Bitcoin with XTB

jQuery(window).load(function () jQuery('body').find('#td_uid_399_5dd75334953bd .td-element-style').each(function (index, element) jQuery(element).css('opacity', 1); return; ); ); jQuery(window).ready(function () // We need timeout because the content must be rendered and interpreted on client setTimeout(function () var $content = jQuery('body').find('#tdc-live-iframe'), refWindow = undefined; if ($content.length) else $content = jQuery('body'); refWindow = window; $content.find('#td_uid_399_5dd75334953bd .td-element-style').each(function (index, element) jQuery(element).css('opacity', 1); return; ); ); , 200);

/* custom css */ .td_uid_549_5dd75334986c7_rand min-height: 0;

/* custom css */ .td_uid_550_5dd753349898d_rand vertical-align: baseline;

jQuery(window).load(function () jQuery('body').find('#td_uid_402_5dd7533498680 .td-element-style').each(function (index, element) jQuery(element).css('opacity', 1); return; ); ); jQuery(window).ready(function () // We need timeout because the content must be rendered and interpreted on client setTimeout(function () var $content = jQuery('body').find('#tdc-live-iframe'), refWindow = undefined; if ($content.length) else $content = jQuery('body'); refWindow = window; $content.find('#td_uid_402_5dd7533498680 .td-element-style').each(function (index, element) jQuery(element).css('opacity', 1); return; ); ); , 200);

/* custom css */ .td_uid_552_5dd7533498bbf_rand min-height: 0;

/* custom css */ .td_uid_553_5dd7533498e9a_rand vertical-align: baseline;

XTB Bitcoin Broker Review

Unlike certain Forex Brokers that offer Bitcoin, XTB does not treat you as just a number but a valued partner – they aim to establish a long-term relationship with you to help you trade successfully.

XTB was founded originally as a company called X-Trade. The were founded in 2002 and were the first forex brokerage to established itself in Poland.

Today, they have become the 4th largest stock exchange listed forex and CFD brokerage firm in the world. XTB’s operations cover most of the world and they have offices in more than 13 different countries including Poland, France, Germany, Turkey and the UK.

Like most brokers that are located In different countries even continents, they are regulated with different entities in roder to be able to provide legal Trading services to the people in those countries.

They hold licenses at BaFin, CMB, FCA and KNF. They have built a good reputation by winning many awards in the financial world for for example the best trading platform and best service. In short this is a broker you should take serious as much as they are taking trading and their traders serious.

XTB Reliability

Established in 2002 as X-Trade, XTB is one the largest publicly owned forex brokerage in Europe. The broker has its headquarters in London and is regulated by the UK’s Financial Conduct Authority (FCA) as well as various other financial regulatory agencies in Europe such as the KNF, BaFin and CMB. Since they have been in business for over 15 years they have established themselves as a reputed and serious brokerage and as one of the better retail forex brokers in the industry

The regulatory oversight provided by the regulatory entities provides the traders with the insurance that this broker is on the level.

Also in case of a worst-case scenario, the traders are insured under a compensation scheme known as the Financial Services Compensation Scheme (FSCS) for up amount of £50,000 per person. Most of the brokers in Europe that are not under the same regulation will have a compensation insured for around half that amount so this is again something that should give you peace of mind.

Support

XTB offers support to their traders during the entire week that the markets are open. This means 24 hours a day from Monday till Friday. This makes sense if you are a global brokerage that has clients in all regions in the world. Their support is also offered on a local level in 12 different countries.

One of their sales propositions is that they truly believe and implement transparency, especially when it comes to their spreads and trading conditions. This is a broker that will appeal more to the traders that have been shopping around and are looking for a broker that is able to handle their volume and provide trader related service of the quality they expect.

XTB Bitcoin Trading Platforms

XTB has 2 main types of trading platforms for its traders to choose from, the MetaTrader 4 (MT4) platform and the xStation 5 platform.

The MT4 trading platform is the most popular trading platform in the industry and comes with a wide range of trading tools.

They allow expert advisors and their MT4 comes with all the bells and whistles that you are able to get. The platform is of course also available on mobile allowing you to trade on the go and where ever and whenever you want.

Thou most people prefer to trade on metatrader 4 there are people that feel more comfortable trading on a web-based trading platform. For this, they have the xStation5.

For a web-trader this is one of the better ones in the market and has won several awards. It is extremely fast and includes numerous trading features such as a trading calculator, advanced chart, trader statistics and equity screener. Of course, this platform is also available in a version for mobile and tablet which would be a better solution then the MT4 mobile application in our opinion.

Account Types

To make sure that they are able provide everything a traders needs regardless of the level of the trader or investment, XTB offers 3 different accounts Basic account, Standard account and Pro account.

Basic Account

Minimum initial deposit requirement $250

Fixed Spread

Instant Trade Execution

Personal Account Manager

Guaranteed Stop Loss

Standard Account

Minimum Initial Deposit of $250

Floating Spread

Market Execution

Personal Account Manager

Automated Trading

Pro Account

Minimum Initial Deposit of $250

Market Spread

Market Execution

Personal Account Manager

Automated Trading

Commission Applicable

Commission & Spreads

The biggest difference between the accounts is actually how the spread is offered and calculated. The minimum spread for major currency pairs such as the EUR/USD starts from as low as 0.0002 pips for the Basic account and 0.00009 pips for the Standard account and 0.00003 pips for the Pro account.

For more information about the market spreads, Traders can check out the XTB’s Price table on their site. The information on the price table is constantly being updated in real time.

Pros of XTB

Multiple Account Choices

FCA Regulated

Low Minimum Deposit Requirement for all accounts

Award Winning Trading Platform

Cash Back and Refer a Friend Promotion

Localized Support

Reputable Broker

Ultra Tight Spreads

Cons

Social Trading Not Available

Support only available 5 days a week

In Short this is a premium Brokerage that is above average in every aspect that is relevant to traders. XTB Bitcoin Trading, in addition to the other cryptocurrencies they offer, is one of the better solutions for those looking to start trading cryptocurrencies.

youtube

/* custom css */ .td_uid_555_5dd753349ad58_rand position: relative !important; top: 0; transform: none; -webkit-transform: none;

/* custom css */ .td_uid_556_5dd753349afd7_rand vertical-align: baseline;

Start Trading Bitcoin with XTB

/* custom css */ .td_uid_557_5dd753349b590_rand vertical-align: baseline;

jQuery(window).load(function () jQuery('body').find('#td_uid_405_5dd7533498b7f .td-element-style').each(function (index, element) jQuery(element).css('opacity', 1); return; ); ); jQuery(window).ready(function () // We need timeout because the content must be rendered and interpreted on client setTimeout(function () var $content = jQuery('body').find('#tdc-live-iframe'), refWindow = undefined; if ($content.length) else $content = jQuery('body'); refWindow = window; $content.find('#td_uid_405_5dd7533498b7f .td-element-style').each(function (index, element) jQuery(element).css('opacity', 1); return; ); ); , 200);

/* custom css */ .td_uid_558_5dd753349b71b_rand min-height: 0;

/* custom css */ .td_uid_559_5dd753349b972_rand vertical-align: baseline;

XTB Broker Details | XTB Bitcoin Trading broker details

jQuery(window).load(function () jQuery('body').find('#td_uid_410_5dd753349b6d9 .td-element-style').each(function (index, element) jQuery(element).css('opacity', 1); return; ); ); jQuery(window).ready(function () // We need timeout because the content must be rendered and interpreted on client setTimeout(function () var $content = jQuery('body').find('#tdc-live-iframe'), refWindow = undefined; if ($content.length) else $content = jQuery('body'); refWindow = window; $content.find('#td_uid_410_5dd753349b6d9 .td-element-style').each(function (index, element) jQuery(element).css('opacity', 1); return; ); ); , 200);

/* custom css */ .td_uid_561_5dd753349d0d4_rand min-height: 0;

/* custom css */ .td_uid_562_5dd753349d3c4_rand vertical-align: baseline;

jQuery(window).load(function () jQuery('body').find('#td_uid_412_5dd753349d08e .td-element-style').each(function (index, element) jQuery(element).css('opacity', 1); return; ); ); jQuery(window).ready(function () // We need timeout because the content must be rendered and interpreted on client setTimeout(function () var $content = jQuery('body').find('#tdc-live-iframe'), refWindow = undefined; if ($content.length) else $content = jQuery('body'); refWindow = window; $content.find('#td_uid_412_5dd753349d08e .td-element-style').each(function (index, element) jQuery(element).css('opacity', 1); return; ); ); , 200);

/* custom css */ .td_uid_564_5dd753349d60a_rand min-height: 0;

/* custom css */ .td_uid_565_5dd753349d966_rand vertical-align: baseline;

Broker Details Info Regulated By FCA Headquarters United Kingdom Foundation Year 2002 Publicly Traded No Number Of Employees 400 Contact Information Tel:+44 (0) 20 3695 3085 Web:https://xtb.co.uk Email:[email protected] Account Type Info Min. Deposit $250 Max. Leverage 1:200 Mini Account No Demo Account Yes Premium Account Yes Islamic Account No Deposit Options Credit Card, Neteller, PayPal, Skrill, Wire Transfer Withdrawal Options Wire Transfer Trader Level Yes/No Beginners Yes Professionals Yes Scalping Yes Day Trading Yes Weekly Trading Yes Swing Trading Yes Social Trading No CUSTOMER SERVICE Yes/No 24 Hours Support Yes Support During Weekends No Customer Support Languages Chinese, English, Spanish Instrument Type Yes/No Forex Yes Commodities Yes CFDs Yes Indices Yes ETFs Yes Stocks Yes Cryptocurrencies Yes Bonds Yes TRADING SERVICES Info Supported Trading Platforms MT4 Commission On Trades Yes Fixed Spreads Yes Educational Service Yes Trading Signals Yes Email Alerts Yes Guaranteed Stop Loss Yes Guaranteed Limit Orders Yes Guaranteed Fills/Liquidity No OCO Orders No Trailing SP/TP Yes Automated Trading Yes API Trading Yes Has VPS Services No

/* custom css */ .td_uid_567_5dd753349f3e8_rand position: relative !important; top: 0; transform: none; -webkit-transform: none;

/* custom css */ .td_uid_568_5dd753349f638_rand vertical-align: baseline;

Start Trading Bitcoin with XTB

/* custom css */ .td_uid_569_5dd753349fc3d_rand vertical-align: baseline;

jQuery(window).load(function () jQuery('body').find('#td_uid_415_5dd753349d5cc .td-element-style').each(function (index, element) jQuery(element).css('opacity', 1); return; ); ); jQuery(window).ready(function () // We need timeout because the content must be rendered and interpreted on client setTimeout(function () var $content = jQuery('body').find('#tdc-live-iframe'), refWindow = undefined; if ($content.length) else $content = jQuery('body'); refWindow = window; $content.find('#td_uid_415_5dd753349d5cc .td-element-style').each(function (index, element) jQuery(element).css('opacity', 1); return; ); ); , 200);

/* custom css */ .td_uid_570_5dd753349fe33_rand min-height: 0;

/* custom css */ .td_uid_571_5dd75334a0124_rand vertical-align: baseline;

Read More reviews of the Best Bitcoin Brokers

Broker review

Broker review

Broker review

Broker review

Broker review

Broker review

Broker review

Broker review

Broker review

Bitcoin Brokers List | Resources and Industry Relevant Sites

jQuery(window).load(function () jQuery('body').find('#td_uid_420_5dd753349fdf3 .td-element-style').each(function (index, element) jQuery(element).css('opacity', 1); return; ); ); jQuery(window).ready(function () // We need timeout because the content must be rendered and interpreted on client setTimeout(function () var $content = jQuery('body').find('#tdc-live-iframe'), refWindow = undefined; if ($content.length) else $content = jQuery('body'); refWindow = window; $content.find('#td_uid_420_5dd753349fdf3 .td-element-style').each(function (index, element) jQuery(element).css('opacity', 1); return; ); ); , 200);

/* custom css */ .td_uid_576_5dd75334a3316_rand min-height: 0;

/* custom css */ .td_uid_577_5dd75334a3632_rand vertical-align: baseline;

Coindesk, Get the Latest Accurate Rates

Bitcoin – Wikipedia

the Home of Bitcoin

the one and true Bitcoin Wallet

Bitcoin: Reddit News about Bitcoin

Best Mt4 Broker for Top Trading experience

the Best brokers to Trade Litecoin

Top Dash Broker | for Trading Dash Online

/* custom css */ .td_uid_579_5dd75334a4fb9_rand vertical-align: baseline;

Ethereum Broker review | for Trading Ethereum Online

Forex Broker Demo Accounts

Trade Ripple Online

Forex Islamic Accounts for Halal Trading

Best Forex Trading signals

CFD Trading for those that are into coffee

Ripple news & Update from the Source

Financial Media and exposure possibilities

/* custom css */ .td_uid_581_5dd75334a67c2_rand vertical-align: baseline;

Trade Coffee Online | CFD Trading

Best Forex demo accounts for trading

best FX Broker Regulated Trading IN US

CryptoCurrencies Trading explained

Bitcoin Brokers List for Bitcoin Education and explanations

Top Bitcoin Broker for online Trading

the latest news about the Fore industry, Brokers, News & updates

Bitcoin Brokers Review | Where should you Trade Bitcoin

jQuery(window).load(function () jQuery('body').find('#td_uid_424_5dd75334a32d0 .td-element-style').each(function (index, element) jQuery(element).css('opacity', 1); return; ); ); jQuery(window).ready(function () // We need timeout because the content must be rendered and interpreted on client setTimeout(function () var $content = jQuery('body').find('#tdc-live-iframe'), refWindow = undefined; if ($content.length) else $content = jQuery('body'); refWindow = window; $content.find('#td_uid_424_5dd75334a32d0 .td-element-style').each(function (index, element) jQuery(element).css('opacity', 1); return; ); ); , 200);

/* custom css */ .td_uid_583_5dd75334a7fbf_rand min-height: 0;

/* custom css */ .td_uid_584_5dd75334a82ab_rand vertical-align: baseline;

Trading Forex, Stocks and CFDs carries risk and could result in the loss of your deposit, please trade wisely.

jQuery(window).load(function () jQuery('body').find('#td_uid_428_5dd75334a7f7a .td-element-style').each(function (index, element) jQuery(element).css('opacity', 1); return; ); ); jQuery(window).ready(function () // We need timeout because the content must be rendered and interpreted on client setTimeout(function () var $content = jQuery('body').find('#tdc-live-iframe'), refWindow = undefined; if ($content.length) else $content = jQuery('body'); refWindow = window; $content.find('#td_uid_428_5dd75334a7f7a .td-element-style').each(function (index, element) jQuery(element).css('opacity', 1); return; ); ); , 200);

#free trading signals#XTB activ8#XTB bitcoin#XTB bitcoin signals#XTB bitcoin trading#XTB broker#XTB BTC#XTB BTC Trading#XTB crypto#XTB crypto signals#XTB cryptocurrencies#XTB cryptocurrency signals#XTB cypto currencies#XTB cypto currency#XTB cyptocurrencies#XTB cyptocurrency#XTB demo#XTB demo account#XTB ethereum signals#XTB forex#XTB forex signals#XTB login#XTB review#XTB reviews#XTB signals#XTB signals account#XTB sirix#XTB trading#XTB trading signals#XTBfree forex signals

0 notes

Text

XTB Bitcoin mäklare recension | BTC-handel med XTB

New Post has been published on https://bitcoinnyheter.com/maklare-recensioner/xtb-bitcoin-maklare-recension/

XTB Bitcoin mäklare recension | BTC-handel med XTB

[vc_row][vc_column][vc_column_text]

XTB Bitcoin mäklare för online Bitcoin Trading

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][vc_column_text]

XTB (Bitcoin) är en mäklarfirma där handlare kan handla med lätthet. XTB ger en bra upplevelse som kommer att tillfredsställa dig säkert. Eftersom de också lagt Bitcoin nyligen, var vi tvungna att kolla upp dem och fann att handel kryptovalutor här kan göras med lätthet och komfort!

[/vc_column_text][vc_btn title=”Börja handla Bitcoin med XTB” color=”warning” align=”center” i_icon_fontawesome=”fa fa-signal” button_block=”true” add_icon=”true” link=”url:http%3A%2F%2Fgo.xtb.com%2Fvisit%2F%3Fbta%3D35439%26nci%3D5895|title:XTB%20Bitcoin%20Broker|target:%20_blank|”][/vc_column][/vc_row][vc_row][vc_column][vc_separator color=”black” border_width=”2″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

XTB Bitcoin instrument specifikation

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column width=”1/2″][vc_column_text]Nominellt värde av ett parti-BTC 1

Storlek på en PIP-0,01

Minsta offert i steg (i Poäng)-0,01

Minsta/högsta beställnings storlek i partier-0,1, max. 50

Minsta transaktionssteg i partier-0,1

Öppettider-24 timmar från lördag 4:00 timmar till fredag 10:00 timmar[/vc_column_text][vc_row_inner][vc_column_inner width=”1/2″][vc_btn title=”Börja handla Bitcoin med XTB” color=”warning” align=”center” i_icon_fontawesome=”fa fa-signal” button_block=”true” add_icon=”true” link=”url:http%3A%2F%2Fgo.xtb.com%2Fvisit%2F%3Fbta%3D35439%26nci%3D5895|title:XTB%20Bitcoin%20Broker|target:%20_blank|”][/vc_column_inner][vc_column_inner width=”1/2″][/vc_column_inner][/vc_row_inner][/vc_column][vc_column width=”1/2″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

XTB Bitcoin mäklare recension

Till skillnad från vissa Forex mäklare som erbjuder Bitcoin, behandlar XTB inte dig som bara ett antal utan en uppskattad partner-de syftar till att etablera en långsiktig relation med dig för att hjälpa dig att handla framgångsrikt.

XTB grundades ursprungligen som ett företag som hette X-Trade. Den grundades 2002 och var den första Forex mäkleri att etablerat sig i Polen.

Idag har de blivit den 4: e största börsen noterade Forex och CFD mäklarfirma i världen. XTB: s verksamhet omfattar större delen av världen och de har kontor i mer än 13 olika länder, däribland Polen, Frankrike, Tyskland, Turkiet och Storbritannien.

Liksom de flesta mäklare som finns i olika länder även kontinenter, de regleras med olika enheter i roder för att kunna tillhandahålla lagliga handelstjänster till folket i dessa länder.

De innehar licenser på BaFin, CMB, FCA och KNF. De har byggt upp ett gott rykte genom att vinna många utmärkelser i den finansiella världen för exempelvis den bästa handelsplattformen och bästa service. Kort sagt detta är en mäklare bör du ta allvarligt så mycket som de tar handel och deras handlare allvarliga.

XTB tillförlitlighet

Etablerad i 2002 som X-handel, XTB är en den största offentligägda Forex mäkleri i Europa. Mäklaren har sitt högkvarter i London och regleras av Storbritanniens Financial Conduct Authority (FCA) samt diverse andra finansiella tillsynsmyndigheter i Europa som KNF, BaFin och CMB. Eftersom de har varit i branschen i över 15 år har de etablerat sig som en välrenommerade och seriösa mäkleri och som en av de bättre detaljhandeln Forex mäklare i branschen

Den regulatoriska tillsynen som tillhandahålls av regleringsorganen ger handlarna med den försäkring som denna mäklare är på nivån.

Även i fall av ett värsta-fall-scenario, handlarna är försäkrade enligt ett kompensationssystem som kallas Financial Services ersättning Scheme (FSCS) för upp belopp på $ £50,000 per person. De flesta av de mäklare i Europa som inte omfattas av samma förordning kommer att ha en ersättning som är försäkrad för ungefär hälften av detta belopp så detta är återigen något som bör ge dig sinnesfrid.

Kundsupport

XTB erbjuder stöd till sina handlare under hela veckan som marknaderna är öppna. Detta innebär 24 timmar om dygnet från måndag till fredag. Detta är vettigt om du är en global mäklarfirma som har kunder i alla regioner i världen. Deras stöd erbjuds också på lokal nivå i 12 olika länder.

En av deras försäljning propositioner är att de verkligen tror och genomföra transparens, särskilt när det gäller deras spreadar och handelsvillkor. Detta är en mäklare som kommer att överklaga mer till de handlare som har shoppat runt och letar efter en mäklare som kan hantera sin volym och ge Trader relaterade tjänster av den kvalitet de förväntar sig.

XTB Bitcoin handelsplattformar

XTB har två huvudsakliga typer av handelsplattformar för sina handlare att välja mellan, MetaTrader 4 (MT4) plattform och xStation 5 plattform.

MT4 handelsplattform är den mest populära handelsplattformen i branschen och kommer med ett brett utbud av handelsverktyg.

De tillåter expert rådgivare och deras MT4 kommer med alla klockor och visselpipor som du kan få. Plattformen är naturligtvis också tillgänglig på mobilen så att du kan handla på språng och var som helst och när du vill.

Du flesta människor föredrar att handla på MetaTrader 4 det finns människor som känner sig mer bekväm handel på en webbaserad handelsplattform. För detta har de xStation5.

För en Web-Trader detta är en av de bättre på marknaden och har vunnit flera utmärkelser. Det är extremt snabb och innehåller många handelsfunktioner såsom en handel kalkylator, avancerad diagram, Trader statistik och equity Screener. Naturligtvis är denna plattform också tillgänglig i en version för mobil och surfplatta som skulle vara en bättre lösning då MT4 mobil applikation enligt vår mening.

Kontotyper

För att se till att de kan ge allt en näringsidkare behöver oavsett nivån på näringsidkaren eller investeringar, XTB erbjuder 3 olika konton Basic-konto, standard konto och Pro-konto.

Basic-konto

Minsta initiala insättningskrav $250 Fast spread Instant Trade Execution Personlig Account Manager Garanterad stop loss

Standard konto

Minsta initiala insättning på $250 Flytande spridning Genomförande av marknaden Personlig Account Manager Automatiserad handel

Pro-konto

Minsta initiala insättning på $250 Marknadsspridning Genomförande av marknaden Personlig Account Manager Automatiserad handel Kommissionen tillämplig

Provision & Spreads

Den största skillnaden mellan kontona är faktiskt hur spridningen erbjuds och beräknas. Den minsta spridningen för större valutapar såsom EUR/USD börjar från så lågt som 0,0002 pips för Basic-kontot och 0,00009 pips för standard kontot och 0,00003 pips för Pro-kontot.

För mer information om marknaden sprider, handlare kan kolla in XTB: s Pristabell på deras webbplats. Informationen på pristabellen uppdateras ständigt i realtid.

Fördelar med XTB

Flera konto alternativ

FCA reglerad

Lägsta insättningskrav för alla konton

Prisbelönt handelsplattform

Cashback och värva en vän-kampanj

Lokaliserat stöd

Välrenommerade mäklare

Ultra tight sprider

Nackdelar

Social handel ej tillgänglig

Support endast tillgänglig 5 dagar i veckan

Kort sagt är detta en premie mäkleri som är över genomsnittet i varje aspekt som är relevant för handlarna. XTB Bitcoin Trading, förutom de andra kryptovalutor de erbjuder, är en av de bättre lösningarna för dem som vill börja handla kryptovalutor.[/vc_column_text][vc_video link=”https://youtu.be/F_-gmK5qRrY”][/vc_column][/vc_row]

#handel Bitcoin med XTB#köpa Bitcoin med XTB#XTB Bitcoin handelsplattformar#XTB Bitcoin Trading#XTB crypto#XTB Forex#XTB Forex mäklare#XTB granskning#XTB mäklare#XTB översikt#XTB recensioner#XTB tillförlitlighet#XTB-klass#Bitcoin Nyheter#bitcoinhandel

0 notes

Text

When the unexpected strikes, here are 5 ways to avoid financial disaster during a disability

New Post has been published on https://www.paraexpres.com/bs-when-the-unexpected-strikes-here-are-5-ways-to-avoid-financial-disaster-during-a-disability/

When the unexpected strikes, here are 5 ways to avoid financial disaster during a disability

Bitcoin cash, the cryptocurrency that split off from bitcoin earlier this year, jumped against the dollar on Friday. Investors have cash to burn right now, and based on the astronomical performance of cryptocurrencies like bitcoin and Ethereum, that’s where a lot of it is getting funneled.

This is coming at the expense of gold, says Tom Lee, the managing partner and head of research at Fundstrat Global Advisors. In fact, he thinks that the growing preference for the cryptocurrencies over gold is actually helping contribute to the torrid gains in the fledgling products.

One main factor driving demand for cryptocurrencies is the reduction in supply that’s been seen in recent months, according to Lee. He notes that the rate of bitcoin units added has been more than halved over the past year, to 4.4% from 9.3%. With mining slowing down, bitcoin won’t reach its theoretical maximum number of units until 2045 or later.

[bs-quote quote=”It’s better to hang out with people better than you. Pick out associates whose behavior is better than yours and you’ll drift in that direction.” style=”style-23″ align=”left” author_name=”Warren Buffett” author_job=”CEO of Berkshire Hathaway” author_avatar=”https://www.paraexpres.com/wp-content/uploads/2018/12/business-times-qoute-avatar.png”]

Meanwhile, Lee finds that gold production has risen “sharply” since 2009, and now sits at 3,100 metric tons, the highest on record. Meanwhile, Lee finds that gold production has risen “sharply” since 2009, and now sits at 3,100 metric tons, the highest on record.

Fundstrat’s base case calls for the cryptocurrency to expand eight to roughly $20,000 per unit by 2022. But in the most bullish scenario, bitcoin could reach as high as $55,000 over the same period. “Our model shows gold’s value being relatively static against a rise in bitcoin,” Lee says. One potential wild card that may speed up investor allocation into cryptocurrencies could be buying by central banks.