#What is the largest personal loan I can get?

Explore tagged Tumblr posts

Text

as of 8/3, the most recently updated version of this post is here (it's a reblog of this exact post with more info added)

as a lot of you know, limbus company recently fired its CG illustrator for being a feminist, at 11 pm, via phone call, after a bunch of misogynists walked into the office earlier that day and demanded she be fired. on top of this, as per korean fans, her firing went against labor laws---in korea, you must have your dismissal in writing.

the korean fandom on twitter is, understandably, going scorched earth on project moon due to this. there's a lot currently going on to protest the decision, so i'm posting a list here of what's going on for those who want to limit their time on elon musk's $44 billion midlife crisis impulse purchase website (if you are on twitter, domuk is a good person to follow, as they translate important updates to english). a lot of the links are in korean, but generally they play nicely with machine translators. this should be current as of 8/2.

Statements condemning the decision have been issued by The Gyeonggi Youth Union and IT Union.

A press conference at the Gyeonggido Assembly will occur on 8/3, with lawmakers of the Gyeonggi province (where Project Moon is based) in attendance. This appears driven by the leader of the Gyeonggi Youth Union.

The vice chairman of the IT union--who has a good amount of experience with labor negotiations like these--has expressed strong support for the artist and is working to get media coverage due to the ongoing feminist witch hunts in the gaming industry. Project Moon isn't union to my knowledge, but he's noted that he's taken on nonunion companies such as Netmarble (largest mobile game dev in South Korea) by getting the issue in front of the National Assembly (Korea's congress).

Articles on the incident published in The Daily Labor News, Korean Daily, multiple articles on Hankyoreh (one of which made it to the print edition), and other news outlets.

Segments about the termination on the MBN 7 o' clock news and MBC's morning news

Comments by Youth Union leaders about looking into a loan made to Project Moon via Devsisters Ventures, a venture capital firm. Tax money from Gyeonggi province was invested in Devsisters in 2017, and in 2021, Devsisters gave money to Project Moon. The Gyeonggi Youth Union is asking why hard-earned tax money was indirectly given to a company who violates ESG (environmental, social and governance) principles.

Almost nonstop signage truck protests outside Project Moon's physical office during business hours until 8/22 or the company makes a statement. This occurs alongside a coordinated hashtag campaign to get the issue trending on Twitter in Korea. The signage campaign was crowd-funded in about 3 hours.

A full boycott of the Limbus Company app, on both mobile and PC (steam) platforms. Overseas fans are highly encouraged to participate, regardless if whether they're F2P or not. Not opening the app at all is arguably the biggest thing any one person can do to protest the decision, as the app logs the number of accounts that log on daily. For a new gacha such as Limbus, a high number of F2P daily active users, but a small number of paying users is often preferable to having a smaller userbase but more paying users. If the company sees the number of daily users remain stable, they will likely decide to wait out any backlash rather than apologize.

Digging up verified reviews from previous employees regarding the company's poor management practices

Due to the firing, the Leviathan artist has posted about poor working conditions when making the story. As per a bilingual speaker, they were working on a storyboard revision, and thought 'if I ran into the street right now and got hit by a car and died, I wouldn't have to keep working.' They contacted Project Moon because they didn't want their work to be like that, and proposed changes to serialization/reduction in amount of work per picture/to build up a buffer of finished images (they did not have any buffer while working on Leviathan to my knowledge). They were shut out, and had to suck it up and accept the situation.

Hamhampangpang has a 'shrine' section of the restaurant for fans to leave fan-created merch and other items. They also allow the fans to take this merch back if they can prove it's theirs. Fans are now doing just that.

To boost all of the above, a large number of Korean fanartists with thousands of followers have deleted their works and/or converted their accounts from fanart accounts to accounts supporting the protests. Many of them are bilingual, and they're where I got the majority of this information.

[note 1: there's a targeted english-language disinformation campaign by the website that started the hate mob. i have read the artist's tweets with machine translation, and they're talked about in the second hankyoreh article linked above: nowhere does she express any transphobic or similarly awful beliefs. likewise, be wary of any claims that she supported anything whose description makes you raise eyebrows--those claims are likely in reference to megalia, a korean feminist movement. for information on that, i'd recommend the NPR/BBC articles below and this google drive link of english-language scholarly papers on them. for the love of god don't get your information about a feminist movement from guys going on witch hunts for feminists.]

[note 2: i've seen a couple people argue that the firing was for the physical safety of the employees, citing the kyoani incident in japan. as per this korean fan, most fans there strongly do not believe this was the case. we have english-translated transcripts of the meeting between the mob and project moon; the threats the mob was making were to......brand project moon as a feminist company online. yes, really. male korean gamers aren't normal about feminism, and there's been an ongoing witch hunt for feminists in the industry since about 2016, something you see noted in both the labor union statements. both NPR and the BBC this phenomenon to gamergate, and i'd say it's a pretty apt comparison.]

let me know if anything needs correction or if anything should be added.

#project moon#limbus company#obligatory text post tag#that's all i've got for now. highly encourage y'all to not open limbus until they make a statement

4K notes

·

View notes

Text

TBOSAS AU ✨CRACK! TAKE✨: The 10th HG Mentors According to Drunk Dean Highbottom. (Part 1)

⭐️❄️⭐️

In my TBOSAS Crack!AU (Read [this] & [this] for context), Drunk!Casca Highbottom has a major problem when it comes to pronouncing people’s names right (intentionally and unintentionally). Many even accepted the fact that the Dean just gave up correcting himself after the last PTA meeting.

Moreover, most of the time, drunk Highbottom thinks that his top student, Coriolanus Snow is the 2nd coming of the ever gorgeous Crassus Xanthos Snow. And yes, Crassus was in fact Casca’s former super dead lover, drinking buddy, and karaoke pal.

In addition, the Dean hates the Plinths with a passion. However, it is not because they’re District. Casca simply hates them because according to rumors, Strabo Plinth, who was also serving in the army with Crassus Snow at that time, stole (dated) Casca’s ex boyfriend after the infamous Crasca University Breakup.

And now, Coriolanus Crassus Snow is going to marry the rich bastard Sejanus Plinth after graduation. And Casca is still swimming in DENIAL. How the odds were never in Highbottom’s favor.😭🔪

So here are our Mentors according to Drunk Delusional Dean Casca Highbottom (plus with his personal side notes and opinions about them).

Here are the other parts: [2] [3] [4]

⭐️MENTORS⭐️

Crassus Xanthos Snow (Coriolanus Snow)

I hate you, I love you, Crassus!😭🔪

You smell like roses and cabbages.

Poor AF. That’s what you get for breaking up with me!!

Is currently dating that idiot Plinth. I don’t know which one.😩😭

Obviously, you only did it for the filthy money!

Has a severe case of OCD and Paranoia.

Depressed & Obsessed AF.

War orphan who can’t pay his taxes.

Can’t even pay for therapy.

Can’t afford to buy f*ckin’ shoes.

Wears old clothes from the last century.

I want to spoil you so bad!😩

I too have money, please 🙏 marry me!

Extremely smart, but stupid.

Sucks at Physical Education.

Can and will malfunction when in a state of confusion.

Needs to pet a fluffy fat cat to avoid going batsh*t crazy.

Snow lands on top?? He’s a freaking “bottom”😏 for goodness sake.

Almost got evicted by loan sharks.

Can be easily hoodwinked into marriage.

I miss our ✨Thursday Clubbing✨!😭

Come back to me, Snow Bae!

I’m still single and waiting for you!

We’re technically still dating, right?🥺

That infamous “University Breakup” NEVER happened!!😫

CRASCA FOREVER!!

Will most likely win the Hunger Games by acting like a weak (but hot) little meow meow before poisoning everyone with Nightlock Berries.

Syllabus Plinth (Sejanus Plinth)

Ughhh!😩 Just go back to District 2 already!

You rich social climbing bastard!

Stole my gorgeous boyfriend!😡🔪

Is reckless AF.

Is wasteful AF.

Is a natural born menace to me.

The idiot heir to the largest munitions empire of Panem.

Wants to become the President of Panem for some reason?🧐

Throws bread to the dead.

No fashion sense at all.

Dr. Gaul hates him for being too nice.

His boyfriend stealing father throws money at me all the time.

Does not know what “personal space” is.

Doesn’t deserve to date my Snow Bae!

How dare you steal my boyfriend!!

I’ll crash your f*ckin’ wedding!!🤬🔪

How dare you stand where I stood!

You have daddy issues!

Peace loving?! Your family sells guns and nuclear missiles for a living!

The audacity! Give me your sandwich recipe!

Once choked my former boyfriend with gumdrops.

Will NEVER WIN the Hunger Games!!🤬🔪 I won’t allow this boyfriend stealing bastard to win anything!

Fetus Creed (Festus Creed)

A self proclaimed “Professional Dumpster Diver.”

Panem’s garbage boy.

A menace to society and the food industry.

Likes to act innocent & clueless.🙄

A natural born leader for fools.

President of the Losers Club.

King of delinquents.

Loves to steal and eat my hamburgers.

Can’t afford to buy a slice of cheesecake.

Is currently dating the cannibal.

Breaks the law everyday, all day.

Peacekeepers loathe him but can’t arrest him.

The Academy’s very own village idiot.

Your family owns the largest construction company in all of Panem, but reconstruction is still slow AF because of your very existence.

Your family members are super weird and super annoying.

Claimed to have never received the 200+ expulsion letters that I’ve personally written and sent to his parents.😫🔪

Has received at least 70+ demerits from me.

Why can’t you attend at least one f*ckin’ detention?!😡

Hangs out with cabbage boy and Plinth’s idiot heir all the time.

Needs to be expelled ASAP.

Why do you succeed and fail at the same time?!

Your ODDS are a piece of sh*t.

Will most likely win the Hunger Games through sheer DUMB LUCK.😩🔪

Listerina Listerine Vickers (Lysistrata Vickers)

Gives free hugs drugs to friends.

Does not prescribe morphling bottles for free.😭

Founder and leader of the “Snowjanus” fan club.🙄🔪

Started the “shipping” war of the century.

Very responsible, but unpredictable.

Suspicious AF.

You’re super lucky that your mommy and daddy are working under the President.

Stop using your “My parents are famous doctors” card to get out of trouble!

Biology is her forte.

Broke my expensive office aquarium on accident purpose.

Gave me weird looking vitamins as an “apology” gift.

Will stab people for medical reasons.

Knows how to manipulate the law.

Your wannabe local drug dealer doctor.

Has a neat appearance, just like her parents.

Might be the leader of an underground illegal drug company that I can’t name.

May have manufactured medicine without the President’s consent.

Is secretly a cry baby.

Hangs out with stupid garbage boys.

Girl, your so called “Miracle Pills” might be lethal and illegal.

Empathetic, I guess.

Will most likely win the Hunger Games by secretly slowly hugging drugging everyone to death.

Philip Raven’s Bill (Felix Ravinstill)

Ultimate Nepo Baby of the century.

Everyone’s favorite boy by default.

Very cool and competent.

Was given the biggest bedroom in the President’s Mansion for some reason.

President Gran Gran’s favorite grandnephew.

Is very rich, but don’t ask why.

Can win a war through the power of friendship and stupidity.

Extremely likable AF.

Must be protected at all cost.

VIP student who can’t be arrested.

Is the Class President.

If he gets hurt, we all get hurt.

I’ll be dead before you get kidnapped.

Haven’t you heard? His granduncle is the current President of Panem.

Has common sense.

Your bromantic boyfriend is a freaking kleptomaniac.

What’s with the Hello Kitty merch?!

Your family is corrupt AF.

Hates his shady & scheming relatives.

Half of your uncles are banned from entering The Academy.

Can you file a very powerful restraining order for me?🥺

Needs to work on his “begging” skills.

Might have the power to end the Hunger Games forever.

Will most likely win the Hunger Games by hiding and having a lot of sponsors to keep him alive.

Andrew Keys Under Sun (Androcles Anderson)

A wannabe reporter like his mama.

A self proclaimed “professional kleptomaniac.”

Stole my morphling bottles.😠🔪

Stole my very expensive wristwatch.

Stole my personal diary journal.

Where is my freaking wallet, Andrew Keys?!

Is straight up a criminal.

Knows how to pickpocket like a pro.

Never give him a hairpin.

I gave you an inch, you f*ckin’ ran a mile.

You’re lucky that your mama can destroy my reputation.

Stole a thousand & plus items from school.

Is maybe secretly dating the Class President.

The only reason why you haven’t been arrested by the authorities is because of your bromantic boyfriend.

Your family only got filthy rich by blackmailing powerful people.

Can break into anyone’s house without being detected.

Dammit! Why do you have natural luck?!

The odds are always in your favor!😩

Can bribe anyone with a slice of pizza.

Will most likely win the Hunger Games by literally stealing everyone’s weapons, sponsors, lovers, mothers, fathers, and of course, your life.

#tbosas#crack post#coriolanus snow#president snow#sejanus plinth#lucy gray baird#hunger games#the hunger games#the ballad of songbirds and snakes#ballad of songbirds and snakes#suzanne collins#thg#thg fandom#thg fanfiction#thg fic#thg series#casca highbottom#dean highbottom#festus creed#lysistrata vickers#crassus snow#felix ravinstill#androcles anderson#snowplinth#crack treated seriously#coriolanus x sejanus#snowjanus#crackship#alternative universe

35 notes

·

View notes

Text

Hello, Oldie Chinese Diaspora Anon™️ here. I have to say, I was really surprised with the response to my last post – thank you for all the responses! And thank you for the questions as well. As I’ve always said, I really appreciate the questions. I hope you will find the answers adequate, too.

Q: “I thought the social credit system was mostly about crime and financial metrics? why would the government care about what’s going on in the bjd hobby?”

A: R-vv has it right! The Government doesn’t really care about BJDs. It cares about people’s aggregate behaviour, both online and in person. However, since you need your real information (name/age/address/etc.) in order to apply for an online account (of any kind), it’s easy to link the two. After that, anything you post online can be linked to you, there is no anonymity. The government, therefore, tracks online activity like the pulse of the nation. One’s online behaviour can lead to significant real-life consequences. For a more exaggerated example, you may remember how the popular fanfiction repository, Archive of Our Own, was completely shut out of China several years back. Most folks chalk it up to China activating its infamous Great Firewall and start clamouring about free speech and all, but the reality is nothing of the sorts. The reason why AO3 was shut out of China was due to rabid fan behaviour leading to large luxury brands dropping their Chinese spokesperson and losing a large amount of money (for more information, here: https://www.sixthtone.com/news/1005262/fan-fiction-site-blocked-in-china-after-celebs-stans-complain ). The reason why the government is interested in anything in specific is because of their social implication and financial impact. Simply put, China is a place that cannot stand social dissidence. It doesn’t matter why there was dissidence, dissidence simply cannot be tolerated.

Q: If that’s how their credit system works and it effects them that much and they hate recasts then why don’t they all just bully Luo into a lower social credit rating and stop his business from operating?

A: Well, you see… there’s a simple answer to this question that, and when broken down to its basic elements, can be rather silly. Without an interaction, you cannot contribute to someone’s social credit score – it can be something physical like an altercation, something systematic like the hiring or firing of a person, or it can be financial like a purchase. Since the Chinese doll circle detest Luo, they refuse to have anything to do with anything related to him. If there’s no interaction, there’s no way to contribute to the downfall of his social credit system. Besides, online bullying (like the AO3 example above) actually lowers the scores of all people who were involved, including the complaining stans (they are “rabble rousers” and a “mob”). It’s a lose-lose situation if anyone even attempts it in the first place.

Q: Social credit applies when you want to get a loan? / I know in US your personal finances and credit is separate from your company if you own an LLC. There must be some loophole he is using if it’s not affecting him.

A: Interestingly, Luo would have a pretty good social credit score – it has something to do with the marking scheme being based on what is “socially productive” for China. It’s only got tangential ties to morals. Luo’s factory has an annuals sales volume of $2.5 to 5 million USD, according to his own company profile (https://chinabjd.en.alibaba.com/company_profile.html ). This is on the background of a region where the yearly average income is $50,147RMB ($7035USD) per year (http://tjj.jiangxi.gov.cn/art/2022/6/2/art_38582_3982696.html ). He is considered one of the largest factories in the region, supporting not just the families of his workers but also both upstream and downstream manufacturers. Even if he needs a loan, it’d be more than easy to get one (Chinese people do not like leverage much when doing business, it’s considered highly risky behaviour – over-leveraging caused the housing market to crash in 2022.) One of the Tieba members from a previous link (this one: http://c.tieba.baidu.com/p/7792470874?pn=1 ) where a commentator mentioned that Luo’s factory is considered a “protected” business by the local government. Normal companies simply cannot compete.

Note 1: Online selling platforms such as Taobao and Xianyu are touted as being safer due to their customer service and protection policies. Therefore most doll owners strongly urge other (usually new) users to use a platform instead of sending money through transfer services such as Weixin or Zuan-zuan (think of them as F&F Paypal and Venmo). On these platforms, every transaction leaves a record. And if you have been blocked by another user, or you have a history of returns, complaints or bad ratings, these records will directly impact your social credit score. The system is set up for you to follow it and be voluntarily tracked because following the rules is considered “safer”.

Note 2: Just like what I said in the last post (https://the-bjd-community-confess.tumblr.com/post/707455091551109120/hello-oldie-chinese-diaspora-anon-here-where ), the Chinese boomers don’t share the same moral values as their children do (or their children’s children). The boomers in the government are more interested in keeping the nation docile and productive (read: keep earning foreign currency) than worrying about copyright. It’s a process that’s still happening today: https://lisamerriam.com/kfcs-success-in-china-breeds-imitators/ There has been changes to copyright law and better enforcement, but this should not be taken as a change of heart. There’s nothing like Chinese pragmatism – these changes are made to ensure that it can still attract outside investors without them running away in fear of imitators and other malicious competitors.

~Anonymous

33 notes

·

View notes

Note

Helloo

So i just finished reading that ask about Harry as a wizard-cop, and i totally needed to read that. Like two days ago a friend told me she stopped reading HP when she found out that Harry wanted to be a cop (yeah she's dramatic like that, i love her). We talked about it a bit, and, like i always say to my friends "Yeah, JKR sucks, but fanfiction is awesome!" . And i remember mentioning castles to her, and one part that i can't find right now, it was very short, and it was harry working as part of the crowd-control team of people manifesting (is that how you say it?), he was in disguise i think (was that in castles? man! i read a lot of things at the same time and get confused ). And THAT was when the "WOW he's a cop" really sunk in, because, well i've been on the other side of that hittin-stick when i was a teenager (what's the name of that stick? you know, the stick that cops use to hit people) and well, i sort of wanted to burn all of my HP books after that (i didn't of course🫣).

Anyway i don't think i've ever read a canon compliant fic that adressed Harry's carreer choice the way you do, which i find sooo interesting and necessary. I have (i hope) grown up a bit since a was 16, and talked to a few cops (yeah teenage me is 😲), and some of them really start working in the police because they genuinely want to help. I didn't know what to say, because that's the same person who hits teenagers manifesting for more founds to public schooling, but also rescued a friend's mom from a violent relationship, which is, you know, a really good thing. I devoured those parts, when you describe this internal moral fight Harry has and the way he also grows up, from wanting to be an auror to "catch the bad guys", like a videogame, to facing all these dilemmas with it being a part of a goverment, with laws, regulations and obligations. Pffffff can you imagine dear Harry James following all those RULESSS?

ok so i've talked enough, love all your work!! i hope some of this makes sense lol. Have a great week!!

oh, i'm so glad you resonated with that! obviously, i have a lot of thoughts!

so, yes, that is in castles! it's chapter 11 after Kingsley's Ministry grants are handed out, thanks to the Blair loan:

Officially (and, for what it’s worth, even knowing his own feelings towards Kingsley, Harry honestly believes him on that one), most of the recovery grants were distributed to a selection of wizarding businesses deemed to have suffered the largest losses during the war. Applications were submitted in the month that followed the passing of the bill and the list of successful applications was compiled by Ministry staff on the basis of a complex matrix including the difference between pre-war and post-war turnovers, expenses incurred to repair the sometimes extensive damages suffered within the premises, the viability of their recovery plans, etc. It all sounded good - at least on paper. In actual fact, this thorough assessment led to an overwhelming number of grants being awarded to businesses owned by people generally known to have been on Kingsley and the Order’s so-called “side,” during the war.

The moment the allocation decisions were made public, a wave of disgruntled Knockturn Alley shop owners found their way into the many offices of different press outlets across the country, soon expressing their innumerable grievances, and less-than-favourable opinions of the current government which, according to them, was operating under unconscionable biases. At the Burrow, this strategy enraged George (and, in her correspondence, Ginny, who’d spent hours with he and Ron going over Weasleys’ Wizard Wheezes’ accounting and writing their application) who slammed The Prophet against the kitchen table and expressed what sounded like a rather fair point: ‘Their bloody shops weren’t torched, were they?’

In response to this latest wave of criticism, the Head of Kingsley’s new Money Matters Department, Bernardus Dee-Poquets, gave a rather unfortunate interview on Radio 5, attempting to ‘give more context’ on the decisions made. Instead of smoothing things over, this position only further enraged the opposition, prompting a spontaneous protest to take place in Knockturn Alley with placards that read: WE DON’T NEED CONTEXT WE NEED GALLEONS! (which, frankly, Harry also couldn’t help but think was a fair point).

He and the other Aurors were soon called in for ‘crowd control,’ an idea that began sounding terrible as soon as they were asked to put on their riot gear. On the way there, Robards added fuel to the fire by making it abundantly clear to whoever was willing to listen that this ‘peacekeeping’ operation had been forced upon him by the Head of the DMLE and was neither his choice, nor his idea, which in turn meant that no one in the Auror ranks actually wanted to go in. That day, Harry’s afternoon began with their unit chief whispering in his ear to make his hair blond and hide his scar with make-up again, ‘just-in-case,’ and ended with incapacitating shots being fired from all sides, fumigation potions thrown at a mob they’d kettled in on Burke Street, and a spell that sliced Harry’s arm open, landing him in the mediwizards’ tent for the second time in less than six months. Until he regained the full use of his fingers a couple days later, the letters he wrote to Ginny looked like they had been drafted by a six year old child.

Since then, most of the office has been reluctant to do - well - anything beyond the bare minimum, doing nothing to help Robards’ staffing problems. Half the Aurors on Harry’s floor have now repeatedly called in sick for a few days at a time with increasingly more outrageous excuses ranging from ‘sleepiness,’ to ‘dragon pox,’ and even once: ‘wandrot’ - a wizarding disease that Harry unfortunately decided to ask about at lunchtime in the middle of the trainees’ table. Katie Bell almost choked on a piece of broccoli and Ron’s whole face turned scarlet. The resulting explanation made Harry feel irrationally protective of the most intimate parts of his body for the rest of the afternoon.

---

and, like, yeah, it's funny, but it's also - not, you know? i think i want this moment to sound like a "fun" anecdote but i think it also feeds into what i was saying in the original post, about the post-war low-level "crime" that feels somewhat endemic and unsolvable. here, of course, it's knockturn alley shop owners, which i suppose we all don't have much sympathy for, but perhaps, we should? the thing about the post-war wizarding economy is that it's full of petty crime and black market stuff and disgruntled demonstrations - because these people have spent years trying to survive and make a living under the hold of an authoritative government, and now not only is democracy not really bringing in money, but it's also preventing them from operating the way they used to. and even if it's nothing at scale, i think the endlessness of it kind of wears down your morale, as a ministry employee.

as you very rightly say, i think most people who join police forces aren't horrible people. like, sure, a percentage of them just wants to beat people up and get paid to do it, but that's not the majority. i think for the most part, there's a lot of big-eyed kids like harry who just want to "save" people. and then, you get called in to these ops and you start realising that "crowd control" is a scam and that putting people in jail is a bit pointless when what is being held against them is just trying to survive and feeding their families. and, of course, there's also multiple aspects to this, because they also sometimes do intervene in stuff that is useful like domestics and stuff (although, there's this whole thing about how police often doesn't believe women, but that's a whole different debate). so, i think, with harry's "early" time at the ministry, i wanted to show the different layers to that.

and, it's funny cause i expected to get a lot of angry comments about harry becoming a hit wizard because of the sort of violence that is associated with those kinds of departments, but i actually didn't. i think the above is sort of the reason why he joins though. it's like: he wants to save people, and that's what they do. their operations are big enough, it's never petty crime, they have a lead (hawk) who knows what he's doing and who can make difficult decisions, and they get in, intervene, and get out. it's not about fighting disgruntled shop owners, you know? or pointless trafficking of magical objects. and, it’s also not detective-like investigative work which, frankly, i don’t think he has much patience or focus for. especially, feeling kind of like a nameless cog in the investigative machine. to me, the hit wizards was the only way to make auror!harry work within the "reality" of what the police force is.

(i think that stick is called a "baton?" i know the term to "baton charge". english speakers - please confirm 😆. in french, it's a matraque.)

but anyway, thank you so much for your kind words, i'm so glad you enjoyed those parts. i have a lot more in store for harry-as-an-auror throughout the fic, so it's lovely to see people enjoy it!

7 notes

·

View notes

Text

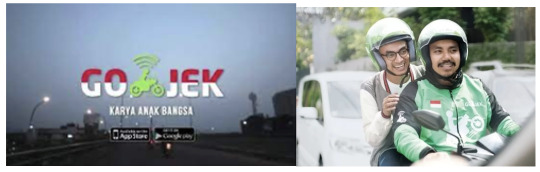

A brand mythology that brought a startup into the heart of the nation’s children

I thought for my first belated post, I’d talk about a story of rebranding from an Indonesian start up where I spent four years as VP of Product and reflect how Go-jek’s branding story touches on the concepts of brand mythology and equity, brand architecture, and even friction.

A bit of context

Go-jek was founded in 2010 and is on-demand “super-app” platform that started as motorcycle ride-hailing but now one of the largest SEA tech giants, providing more than 20+ services extending beyond transportation to logistics, food-delivery, grocery-delivery, digital payments and lending, entertainment, e-commerce, and more.

Brand mythology

Go-jek’s registered company name reads “Aplikasi Karya Anak Bangsa” which translates to “an application that is the work of the nation’s children.” This tagline resonated with many people in Indonesia; the fourth-most populous country in the world which was in the midst of the smartphone revolution and which had yet to produce a “unicorn” (tech company valued over $1Bn). By using this tag line as part of their brand mythology, it allowed the company to become more than its on-demand transport and delivery products. It sought to enter the consumer psyche as something that they can be proud of. Go-jek aspired not just to be the story of a company but a story of the nation. The emotional implication was that using the services would feel like an act of patriotism.

Exhibit 1: Photos below show the tag line “Karya Anak Bangsa” as well as the Indonesian flag (and colors, red/white) featured prominently on advertisements as well as the Gojek driver jackets.

The following excerpt from a 2018 blogposts describes this well “There is pride in what GO-JEK has done in Indonesia. And when you talk to Indonesian’s about GO-JEK, you will notice a particular phenomenon: The brand is theirs, their home-grown star, a reflection of a new era in technology.” Source: Medium Blogpost (2018) - “Why Go-Jek is the operating system of Indonesia”

Brand equity and extensions

The mythology as well as smart use of words, was in-part, one of the reasons why Go-Jek was able to expand from 3 services to 20+ within a span of three years. Subsequent product launches included Go-Car (car ride-hailing, think Uber/Lyft), Go-Food (food delivery), Go-Beauty (on-demand haircuts and beauty services, beauticians would come to you!), Go-Pay (peer-to-peer transactions, digital wallets, and more) and so-forth. Because Go-Jek had so much brand power and recognition, there was a lot of built-up trust and it reduced the hurdle for consumers to try out new services immediately after they were launched, even if it was in a completely new vertical. For example, one may not think that a company you trust to get you from place a to b is one that you might also trust to get you a good haircut or one that you may trust with sending money or taking loans.

I personally find it hard to imagine if Uber or Lyft launched a peer-to-peer transaction or money lending service in the US that their brand equity would carry over and consumers would try out those new services. I think if this happened, this would end up like the failed brand extensions that we discussed in class (e.g. the fate of Bic’s perfume and Levi’s suits).

This brand mythology was not a one-time play but a strategy that we continued to invest in as a company. In 2018, eight years after the company was founded, Go-jek launched a campaign titled #AnakBangsaBisa (translates to: Children of the Nation Can) to celebrate the 73rd independence day of Indonesia. Source: Gojek Blog

And in the Youtube comments of the campaign video, we can glean that the emotional impact of national pride is still very much alive:

This perspective of brand mythology / equity / extensions adds a new dimension to my previous reflections on our work at Gojek. What I thought was more of a branding strategy for recruiting and “feel-good” emotional aspect with using our services may have also played a significant role in enabling us to extend to so many different services in such a short time and become the “super-app” that it is today.

Final thoughts on friction

In 2019, Gojek did a rebranding with a new logo, a new look, and new in-app landing page. The new company mission was to “remove friction from people’s lives.” Refer to the LinkedIn post below by one of the CEOs at the time announcing the new homepage. Source: LinkedIn.

In thinking how this squares with the discussions in our last class. In a country where life is chaotic (ask any Indonesian or person who has been to Jakarta, the capital city, and chaotic will be an adjective that is certain to come up), daily life is fraught with friction. In that sense, I do believe that the overall mission to remove friction was aspirational and is still relevant.

However, when thinking of the work I did day-to-day as a product manager considering today’s era of surveillance capitalism, and given the lessons learned in our last class, I am becoming increasingly more cognizant that removing friction in the design of products and applications should not be done at the expense of the user’s agency and should not exploit their resources including their data, time, and money. Sources: “The Age of Surveillance Capitalism” by Shoshana Zuboff and Renee Richardson Gosline’s MIT Sloan 15.846 Branding lecture.

2 notes

·

View notes

Photo

I was a "gifted" student. I worked my entire life in magnet and international baccalaureate and AP classes - I took courses above college level all through high school, I spent so many sleepless nights juggling working until 10pm and doing homework until the sun came up. I had a 6.5 GPA. I was accepted to prestigious colleges across the country, but I couldn't afford the out of state costs even with scholarship. So I took the best academic scholarship available at a state university.

It didn't even cover the tuition and book costs. I got charged my entire life savings, every birthday gift and hour working I'd saved up, for dropping out of a dorm that hadn't even been assigned to me yet to live in section 8 housing instead because it was cheaper.

It was miserable. I spent all my time working or in class, and was still living in poverty. My previously somewhat manageable mental and physical illnesses metastasized, I started getting sicker and sicker. I had panic attacks every day. The accessibility office first gave me a medical withdrawal form, then wh3n I insisted I didnt want to drop out i wanted Help, told me that since I didn't have a broken wrist or diagnosed ADHD I wasn't eligible for notetakers. I reached out to teachers, and one told me if I couldn't come in every day I didn't deserve to be in college and implemented an in class participation grade halfway through the term. I pushed myself too hard, and brutally sprained my ankle - I had to navigate the 2nd largest campus in the country on crutches in 100 degree weather for exams, they only had one wheelchair and it wasn't available until after 11am if I got it across campus myself. My GPA tanked. My health has never recovered.

Taking a year off, or going to a small community College where loans and scholarships could've paid for tuition and given me some breathing room, would've saved my life. It would've given me time to adjust to living on my own and managing my health, to figure out what I wanted from college, to get my AA for 1/8th the price. Most community colleges have infinitely better accessibility offices than the flaming ball of trash and sports funds state university I was at. Many have teachers that are just as if not more passionate about their work, doing globally important shit. I would've been able to ease into things instead of lose everything I'd ever saved and earned, including a semblance of health. But it wasn't presented as an option to me by my schools or my parents- I was the first person in my family to go to college, and I had "so much potential," you see, and that would've been "wasted" had I taken another option.

It's bullshit. If you take time off, your GPA remains the same instead of tanking under your overwhelm. You can save money, spend much more time applying for scholarships (there are so many that go unused every year bc students didn't know they were there/didn't have time and energy), you can try different interests, you can even audit classes for free and get used to the campus/chaos/expectations. You can celebrate getting as far as you've gotten. You can BREATHE.

Please please please please please believe me, there are so many benefits to not immediately going to state university. Or sometimes ever going, depending on what you want to do!!! Don't let them hem you into a box where you suffocate and die, because honey none of the people who put you there are coming to help when they see you faltering and "giving up your gifts."

every year we have to say it

143K notes

·

View notes

Text

Best Crowdfunding Platforms in Europe

The recent field of crowdfunding platforms in Europe has witnessed significant growth. Crowdfunding is used for charities, investments, financing companies, and personal needs. Many people spend their fair share of time using crowdfunding to donate to countless causes for philanthropic activities.

With the rough usage of technologies, especially social media, crowdfunding has developed to a new level. But with several options, there are just a few reliable options among the best crowdfunding platforms in Europe. That is why knowing which crowdfunding platform suits your needs is essential.

Even after the Covid-19 pandemic, many crowdfunding platforms have remodelled their business models for their users and have seen a substantial crowdfunding market volume in 2020-21. This blog will help you choose the ideal platform for you among the best crowdfunding sites.

Start your Crowdfunding Campaign with WhyDonate and experience the most hassle-free fundraising!

Table of Contents

What Do Crowdfunding Platforms Do?

How Do I Choose A Crowdfunding Platform?

Which Crowdfunding Site Is The Best?

WhyDonate

FundedByMe

Funding Circle

Crowdcube

Goteo

Booomerang

Ulule

Companisto

Seedrs

Betterplace.org

Popular Crowdfunding FAQs

Which Crowdfunding Site Has The Lowest Fees?

Is Crowdfunding A Good Idea?

Which Type Of Crowdfunding Is Most Popular?

What Do Crowdfunding Platforms Do?

Crowdfunding Europe allows people to contribute to a campaign, project, or company. It involves gathering small amounts of money to provide the necessary capital to get the project or company off the ground. Individuals can also contribute to a campaign for their favourite cause.

Instead of relying on traditional funding sources, such as bank loans, fundraising is a more innovative approach to raising funds. It allows individuals and organisations to start a new business or fund a charity without going through the laborious process of creating a business plan and market research.

Using the best crowdfunding websites can help achieve their goal in less time and with the utmost ease. Another thing about reliable crowdfunding platforms in Europe is that you know where your money is going or where it comes from.

Join us in making a difference through crowdfunding!

How Do I Choose A Crowdfunding Platform?

Your first thought might be to Google this. However, if you type “crowdfunding Europe” or “crowdfunding charity,” you will get tons of hits. On the one hand, it’s fantastic that you get so many results on your search; on the other hand, you still don’t know where to look for answers and which one to choose among the best crowdfunding sites.

That’s why we want to give you a little hand. We’ll provide you with 10 top crowdfunding sites that will show you which crowdfunding platforms are the most prominent crowdfunding platforms that can ease the pain and help you to donate sooner.

By the end of this informative writing, you will likely choose your favourite platform from the best crowdfunding platforms in Europe.

Which Crowdfunding Site Is The Best?

There are several criteria to consider before starting a fundraiser through a fundraising platform. Number one is the reliability of the crowdfunding platform. The other options to consider are accessibility, user experience, and understanding of the system behind the platforms. Let us now have a look at the most prevalent crowdfunding platforms in Europe.

1. WhyDonate

WhyDonate is one of the largest crowdfunding platforms in Europe. The platform is specifically designed to raise money for any cause. Here you can donate money or start fundraising for a charity yourself. It also supports private fundraising projects. Among the best crowdfunding websites, this platform is undoubtedly the best one.

If you’re a registered company crowdfunding on WhyDonate, they will check if you are registered with ANBI and have a CBF quality label. WhyDonate, one of the free crowdfunding platforms, also facilitates companies and organisations that want to set up their crowdfunding platform. If you want a perfect space to help you with crowdfunding in Europe, consider WhyDonate and start donating to your cause without hassle.

2. FundedByMe

In March 2011, FundedByMe was founded in Stockholm, Sweden, and is one of the world’s first crowdfunding platforms to provide both reward-based and equity crowdfunding in Europe. To promote cross-border investments that support entrepreneurs and investors to help job creation and economic development, the platform has a significant focus on European entrepreneurs.

3. Funding Circle

This platform gives out loans of €5,000 to €250,000 to entrepreneurs. Funding Circle is an excellent platform to invest in if you have a project you’re confident about and want to start crowdfunding in Europe. The best part is that the registration is free, and financial returns can get as high as 18.9% yearly. You can start investing with as little as €100.

4. Crowdcube

Crowdcube is an equity crowdfunding platform in Europe aimed solely at investors who are sufficiently savvy to consider these risks and make their own investment choices. Via Crowdcube, over £26 million has been successfully invested so far.

Crowdcube launched the ‘Crowdcube Venture Fund’ in February 2014, which enables investors to crowdfund start-ups with the extra reassurance that an independent skilled fund manager invests, manages, and tracks their capital. Companies like Crowdcube have made crowdfunding in Europe easier with their fantastic options.

5. Goteo

Goteo is a crowdfunding or collective financing platform (monetary contributions) and distributed collaboration (services, infrastructures, microtasks) for projects that, in addition to giving individual rewards, also generate performance through promoting common goods, open-source, and knowledge free.

You can have one or more roles as a network member: present a project, be a co-founder, or collaborate on one. Goteo, one of the tremendous crowdfunding platforms, offers some excellent perspectives while crowdfunding in Europe.

6. Booomerang

Another great option among the top crowdfunding sites is Booomerang. It is the first and largest reward-based crowdfunding platform in Denmark. Entrepreneurs, musicians, groups, and other artists can raise money from new and old networks through financial support. Booomerang is one of the largest crowdfunding platforms in Europe, which began four years ago.

Establishing an office in Berlin, Germany, by the end of 2014 and expanding quickly, the latest twist that separates Booomerang from other sites is a collaboration with crowdfunding. In Denmark, when legislation is in place that will turn Booomerang into a legitimate hybrid crowdfunding site, equity and lending platforms are in the works.

7. Ulule

One of the pioneering crowdfunding platforms in Europe, Ulule allows creative, innovative, and community-minded projects to test their idea, build a community, and grow it—our goal is to empower creators and entrepreneurs in general.

How does it work? It’s simple: individuals, associations, and companies create your project, detailing its financial goal, duration, and non-financial rewards offered in exchange for support. If they reach their goal, they receive the funds collected and give their rewards to those who support them. If not, those who are supported receive a refund without any fee. Ulule takes a commission from funds transferred.

8. Companisto

With many renowned business supporters, corporate finance professionals, and venture capital firms in its network, Companisto is one of the leading equity-based crowdfunding platforms in Europe. The platform offers many globally available payment methods, such as credit card payment, instant money transfer, and bank transfer (advance payment), so that investors can be global. Investors can invest upwards of €5 in innovative start-ups.

The platform has successfully funded 30 startups, invested almost €6 million, and is considered one of the best crowdfunding sites in Europe.

9. Seedrs

Another great option among the best crowdfunding websites is Seedrs. It is an international crowdfunding platform that helps entrepreneurs sell their company’s shares. This is an excellent way for medium to large companies to increase their capital. To start crowdfunding in Europe, you can invest from as little as €10 onwards via Seedrs.

10. Betterplace.org

All the top crowdfunding sites are committed to transparency and state which donations are needed and used. They report on the progress of the project through photos and video. While crowdfunding in Europe, Betterplace offers companies more reach through marketing campaigns, partner portals, or additional donations from our business partners. Donors can also set up permanent contributions. This is why it made it to the best crowdfunding sites list.

Popular Crowdfunding FAQs

Which Crowdfunding Site Has The Lowest Fees?Among all the great options above, WhyDonate has the lowest cost of all time regarding crowdfunding in Europe. They are crafted with careful strategies, and WhyDonate charges only a minimum transaction fee of 1.9% + €0.25 for its fundraisers. At the same time, donors only pay the amount they prefer to donate and nothing more than that.

Is Crowdfunding A Good Idea?Yes. The sole purpose of crowdfunding is to provide people with a platform to ask for funds to fulfil their absolute needs. However, finding a legitimate crowdfunding platform for any fundraising campaign is essential.

Which Type Of Crowdfunding Is Most Popular?There are primarily four types of crowdfunding models that are popular globally. These are:

Donation-based crowdfunding

Reward-based crowdfunding

Equity crowdfunding

Loan crowdfunding

0 notes

Text

How to buy Credit card in India 2024

How to buy a Credit card: Welcome to the ultimate guide on how to buy a credit card! Whether you’re a seasoned shopper or a credit card newbie, this guide will walk you through everything you need to know. We’ll cover the basics, where to buy them (including a special mention of Paisainvests), the top providers, types of credit cards, and what to check before making that all-important decision. So, grab a cup of coffee, and let’s dive into the world of credit cards!

What is a Credit Card?

A credit card is more than just a piece of plastic. It’s a financial tool that offers convenience, rewards, and a way to manage your money. But let’s not forget; that it’s also a form of borrowing. When you use a credit card, you’re essentially taking a short-term loan from the issuer, which you promise to pay back later. The catch? If you don’t pay it off in time, you’ll owe interest.

How to Buy a Credit Card

Determine Your Needs

Before you start shopping for a credit card, ask yourself: What do I need it for? Are you looking for rewards, cashback, or perhaps travel perks? Maybe you’re building credit for the first time. Understanding your financial goals will help you choose the right card.

Research and Comparison

Don’t just settle for the first card you come across. Take your time to research and compare different options. Look at the interest rates, annual fees, rewards, and other features. Websites like Paisainvests can be a treasure trove of information, offering comparisons and reviews.

Applying for a Credit Card

Once you’ve made your choice, it’s time to apply. You can do this online or visit a branch if you prefer a more personal touch. Online applications are quick and easy; you’ll usually get a response within minutes. For offline applications, you might need to fill out a form and wait a few days for approval.

From Where to Buy a Credit Card

Banks and Financial Institutions

Traditional banks and financial institutions are the go-to places for buying credit cards. You can visit a branch, talk to a representative, and get all the details. It’s a great option if you prefer face-to-face interactions and personalised service.

Online Marketplaces

In this digital age, buying a credit card online is as easy as ordering pizza. Platforms like Paisainvests offer a convenient way to compare different cards, read reviews, and apply online. It’s a one-stop-shop for all your credit card needs, saving you time and effort.

Top 5 Credit Card Providers

Provider 1: Paisainvests

Paisainvests is a leading online marketplace for financial products, including credit cards. They offer a wide range of options, from cashback cards to premium rewards cards. The platform is user-friendly, making it easy to compare different cards and apply online. Check Out: Paisa Invests – Your Trusted Financial Advisor

Provider 2: HDFC Bank

HDFC Bank is one of India’s largest private sector banks, offering a variety of credit cards. From shopping and dining to travel and fuel, they’ve got a card for every need. Their customer service is top-notch, making it a reliable choice. Check Out: HDFC Bank – Personal Banking & Netbanking Services

Provider 3: SBI Card

SBI Card, a subsidiary of the State Bank of India, offers a range of credit cards tailored to different lifestyles. Whether you’re a frequent traveller or a shopaholic, SBI Card has options that come with attractive rewards and benefits. Check Out: SBI Credit Card Online – SBI Credit Card Services | SBI Card

Provider 4: ICICI Bank

ICICI Bank offers a diverse range of credit cards, including travel, shopping, and cashback cards. Known for their competitive interest rates and customer service, they are a popular choice among Indian consumers. Check Out: ICICI Bank – Personal, Business, Corporate and NRI Banking Online

Provider 5: Axis Bank

Axis Bank offers credit cards that cater to various needs, from premium lifestyle to student cards. Their rewards program is generous, and they often have tie-ups with popular brands, offering additional discounts and perks. Check Out: https://www.axisbank.com/

Types of Credit Cards

Rewards Credit Cards

These cards are perfect for those who love to earn points on every purchase. The points can be redeemed for various rewards, including travel, merchandise, and cashback. The more you spend, the more you earn!

Travel Credit Cards

If you’re a globetrotter, a travel credit card is your best friend. These cards offer rewards and perks like free lounge access, travel insurance, and discounts on flights and hotels. They also come with lower foreign transaction fees.

Cashback Credit Cards

Who doesn’t love getting cash back on purchases? Cashback credit cards offer a percentage of your spending back as cash, making them perfect for everyday expenses. It’s like getting paid to shop!

Student Credit Cards

These cards are designed for students who are new to credit. They usually have lower credit limits and fewer perks but are a great way to build credit history. Plus, they often come with student-specific benefits like discounts on textbooks and online courses.

Secured Credit Cards

If you have a low credit score or no credit history, a secured credit card can be a good option. These cards require a security deposit, which serves as your credit limit. They are a great way to build or rebuild credit.

What to Check Before Buying a Credit Card

Annual Fees and Charges

Some credit cards come with annual fees, while others don’t. Make sure to read the fine print and understand all the charges involved. Sometimes, the benefits of a card with a fee outweigh the cost, but it’s essential to know what you’re getting into.

Interest Rates

Interest rates can vary significantly between cards. A lower interest rate can save you a lot of money if you carry a balance. Make sure to compare rates and choose a card that offers the best terms for your financial situation.

Credit Limit

Your credit limit is the maximum amount you can borrow on your card. It’s essential to choose a card with a credit limit that suits your needs. A higher limit can be tempting, but it’s crucial to manage your spending and not go overboard.

Rewards and Benefits

Different cards offer different rewards and benefits. Make sure to choose a card that aligns with your spending habits. Whether it’s travel rewards, cashback, or shopping discounts, pick a card that offers what you value most.

Customer Service

Good customer service can make or break your credit card experience. Choose a provider known for excellent customer support. Whether you have a billing issue or need to report a lost card, you want a provider that handles your concerns efficiently.

Conclusion

Buying a credit card is a significant decision that requires careful consideration. From understanding your needs and researching different options to choosing the right provider and card type, every step matters. Remember, a credit card can be a powerful financial tool when used responsibly. So, take your time, do your research, and choose wisely.

By Paisainvests.com

0 notes

Text

Personal Debt and Communications

The average American debt is currently $58,604 and 77% of American households have at least some type of debt (data.census.gov; newyorkfed.org; federalreserve.gov). I could find no specific data on the communications industry specifically, but it is likely very close to these numbers. Even more startling is that the average annual wage for a tower climber is about $57,910 per year according to the Bureau of Labor Statistics.

I would define debt as owing money to anybody for any reason, the large categories being: student loans, credit card debt, home equity lines of credit, mortgages, and auto loans.

The average APR (annual percentage rate) on credit cards in 2021 was about 17.13%. Eight out of ten adults (80%) have at least one credit card and carry a balance. The total amount of American debt is $14.96 trillion including all forms of debt, and $787 billion of that is credit card debt. This means that Americans paid $134.81 billion in interest alone to credit card companies (this is based on data provided by the Federal Reserve Bank of New York for 2021).

That is a staggering amount of debt and a mind-numbing amount of interest being paid every year by working Americans just trying to make a living. Even more important is the fact that our workforce in the wireless industry is living paycheck to paycheck (78% of Americans), and likely carrying close to the US average in credit card and other debt as they are building out our infrastructure. It is important to note that many of these tower climbers and other telecom technicians must take out loans to pay for their training and equipment.

I see the solution as simple. We need to educate our tower climbers, technicians, CM’s, and other Telecommunication employees on the importance, and methods, of staying out of debt. An employee who is distracted by money problems and concerned about feeding their family is not going to be an effective team member.

If we can educate our team members on how to get out of debt and stay out of debt, it is like giving them an immediate raise. Furthermore, it empowers those team members to understand that they can control where their money goes.

According to the 2022 SmartDollar Employee Benefits Study performed by the Ramsey team (Dave Ramsey) 45% of employees are distracted by their financial problems while they are at work. The effects of financial problems can be multiple:

Anxiety

Worry

Depression

Difficulty Sleeping

Gaining/Losing Weight

Physical and Health Issues

Poor Coping Habits

Dave Ramsey recommends using these tools to get out of debt:

Budgeting – Create a detailed budget every month and allocate every dollar where it needs to go.

Create an Emergency Fund – There are two stages to this. A small emergency fund of $1,000 to start, until you pay off all of your debt, and a fully funded emergency fund equivalent to 3-6 months of expenses.

Negotiate with creditors – If you are in default, or cannot pay your debt, this can help. This does not usually happen unless you are six months behind.

Cut up all credit cards and get rid of all debt.

Debt Snowball – list all your debts from smallest to largest and pay them off in that order. As you pay off one debt, take the payment from that debt and roll it to the next debt.

Some methods that I do not recommend, but people have used are:

Debt Consolidation – this generally does not accomplish anything but move your debt around.

Credit Counseling – most of these companies want to charge you to make payments.

Bankruptcy – I never recommend this option.

In full disclosure, I am a Dave Ramsey Financial Coach, and I follow his methodologies. It is the only method I recommend for getting out of debt. https://www.ramseysolutions.com/

One of the key methods for getting out of debt, and staying out of debt, is to act your “wage,” this is why doing a budget is critical. Make sure you are not living above your means. Even if you are not making much right now, knowing what you can spend is critical to making sure that you do not go into debt.

There are multiple positive effects of helping your team members get out and stay out of debt. This will reduce their overall financial stress and increase overall job satisfaction. Employees that are financially stable can focus their energy and attention on job responsibilities, and allow them to save for the future, including investing in their educational or professional development. This in turn will result in increased employee retention and growth within the organization.

There are training, apps, and other tools that companies can use to keep employees focused on getting and staying out of debt. One app that companies can promote is called SmartDollar (https://www. ramseysolutions.com/corporate-wellness/smartdollar). It provides tools for the employee’s educational, budgeting, tracking, and financial needs. It offers coaching and a user-friendly dashboard. Other apps include Goodbudget (https://goodbudget.com/), YNAB (https://www.ynab.com/), Everydollar (https://www. ramseysolutions.com/ramseyplus/everydollar/home), and PocketGuard (https://pocketguard.com/), all of which employees can get for themselves (items rated in Nerdwallet).

I think as an industry, if we take these financial concerns seriously and educate field and office teams about how to avoid debt, the results will be a well-focused and motivated team that is happy to be at work. ●

Wayne Murray is a member of the Military of NATE Committee and is the Vice President of Construction at Resound Networks, LLC, in Pampa, Texas. He can be reached at 1-800-806-1719 x 516 or [email protected].

0 notes

Text

10 Best Crowdfunding Platforms In Europe

The recent field of crowdfunding platforms has witnessed significant growth in Europe. Crowdfunding is used for charities, investments, financing companies, and personal needs. Many people spend their fair share of time using crowdfunding to donate to countless causes for philanthropic activities.

With the rough usage of technologies, especially social media, crowdfunding has developed to a new level. But with several options, there are just a few reliable options for crowdfunding platforms in Europe. That is why knowing which crowdfunding platform suits your needs is essential.

Even after the Covid-19 pandemic, many crowdfunding platforms have remodelled their business models for their users and have seen a substantial crowdfunding market volume in 2020-21. This blog will help you to choose the ideal platform for you among the best crowdfunding sites.

What Do Crowdfunding Platforms Do?

Crowdfunding Europe allows people to contribute to a campaign, project or company. It involves gathering small amounts of money to provide the necessary capital to get the project or company off the ground. Individuals can also contribute to a campaign for their favourite cause.

Instead of relying on traditional funding sources, such as bank loans, crowdfunding is a more innovative approach to raising funds. It allows individuals and organisations to start a new business or fund a charity without going through the laborious process of creating a business plan and market research.

Using the best crowdfunding websites can help achieve their goal in less time and with the utmost ease. Another thing about reliable crowdfunding platform europe is that you know where your money is going or where it comes from.

How Do I Choose A Crowdfunding Platform?

Your first thought might be to Google this. However, if you type “crowdfunding Europe” or “crowdfunding charity”, you will get tons of hits. On the one hand, it’s fantastic that you get so many results on your search; on the other hand, you still don’t know where to look for answers and which one to choose among the best crowdfunding sites.

That’s why we want to give you a little hand. We’ll provide you with 10 top crowdfunding sites that will show you which crowdfunding platforms are the most prominent crowdfunding platforms that can ease the pain and help you to donate sooner.

By the end of this informative writing, you will likely choose your favourite platform from the best crowdfunding platforms Europe.

Which Crowdfunding Site Is The Best?

There are several criteria to consider before starting a fundraiser through a fundraising platform. Number one is the reliability of the crowdfunding platform. The other options to consider are accessibility, user experience, and understanding of the system behind the platforms. Let us now have a look at the most prevalent crowdfunding platforms Europe.

1. WhyDonate

WhyDonate is one of the largest crowdfunding platforms in Europe. The platform is specifically designed to raise money for any cause. Here you can donate money or start fundraising for a charity yourself. It also supports private fundraising projects. Among the best crowdfunding websites, this platform is undoubtedly the best one.

If you’re a registered company crowdfunding on WhyDonate, they will check if you are registered with ANBI and have a CBF quality label. WhyDonate, one of the free crowdfunding platforms, also facilitates companies and organisations who want to set up their crowdfunding fundraising platform. If you want a perfect space to help you with crowdfunding in Europe, consider WhyDonate and start donating to your cause without hassle.

2. FundedByMe

In March 2011, FundedByMe was founded in Stockholm, Sweden, and is one of the world’s first crowdfunding platforms to provide both reward-based and equity crowdfunding Europe. To promote cross-border investments that support entrepreneurs and investors to help job creation and economic development, the platform has a significant focus on European entrepreneurs.

3. Funding Circle

This platform gives out loans of €5.000 to €250.000 to entrepreneurs. Funding Circle is an excellent platform to invest in if you have a project you’re confident about and start crowdfunding Europe. The best part is that the registration is free, and financial returns can get as high as 18.9% yearly. You can start investing with as little as €100.

4. Crowdcube

Crowdcube is an equity crowdfunding platform in Europe aimed solely at investors who are sufficiently savvy to consider these risks and make their own investment choices. Via Crowdcube, over £ 26 million has been successfully invested so far.

Crowdcube launched the ‘Crowdcube Venture Fund’ in February 2014, which enables investors to crowdfund start-ups with the extra reassurance that an independent skilled fund manager invests, manages and tracks their capital. Companies like Crowdcube have made crowdfunding in Europe easier with their fantastic options.

Launched in 2010, the company of Darren and Lang led the pack for equity-based crowdfunding.

5. Goteo

Goteo is a crowdfunding or collective financing platform (monetary contributions) and distributed collaboration (services, infrastructures, microtasks) for projects that, in addition to giving individual rewards, also generate performance through promoting common goods, open-source and knowledge free.

You can have one or more roles as a network member: present a project, be a co-founder or collaborate on one. Goteo, one of the tremendous crowdfunding platforms, offers some excellent perspectives while crowdfunding in Europe.

6. Booomerang

Another great option among the top crowdfunding sites is Booomerang. It is the first and largest reward-based crowdfunding platform in Denmark. Entrepreneurs, musicians, groups and other artists can raise money from new and old networks through financial support. Booomerang is one of the largest crowdfunding platforms in Europe, which began four years ago.

Establishing an office in Berlin, Germany, by the end of 2014 and expanding quickly, the latest twist that separates Booomerang from other sites is a collaboration with crowdfunding. In Denmark, when legislation is in place that will turn Booomerang into a legitimate hybrid crowdfunding site, equity and lending platforms are in the works.

7. Ulule

One of the pioneering crowdfunding platforms in Europe, Ulule allows creative, innovative and community-minded projects to test their idea, build a community and grow it—our goal: is to empower creators and entrepreneurs, in general.

How does it work? It’s simple: individuals, associations, and companies create your project, detailing its financial goal, duration, and non-financial rewards offered in exchange for support. If they reach their goal, they receive the funds collected and give their rewards to those who support them. If not, those who are supported receive a refund without any fee. Ulule takes a commission from funds transferred.

8. Companisto

With many renowned business supporters, corporate finance professionals, and venture capital firms in its network, Companisto is one of the leading equity-based crowdfunding platforms in Europe. The platform offers many globally available payment methods, such as credit card payment, instant money transfer, and bank transfer (advance payment), so that investors can be global. Investors can invest upwards of €5 in innovative start-ups.

The platform has successfully funded 30 startups, invested almost €6 million, and is considered one of the best crowdfunding sites in Europe.

9. Seedrs

Another great option among the best crowdfunding websites is Seedrs. It is an international crowdfunding platform that helps entrepreneurs sell their company’s shares. This is an excellent way for medium to large companies to increase their capital. To start crowdfunding in Europe, you can invest from as little as €10 onwards via Seedrs.

10. Betterplace.org

All the top crowdfunding sites are committed to transparency and state which donations are needed and used. They report on the progress of the project through photos and video. While crowdfunding in Europe, Betterplace offers companies more reach through marketing campaigns, partner portals or additional donations from our business partners. Donors can also set up permanent contributions. This is why it made it to the best crowdfunding sites list.

Crowdfunding FAQs

Which Crowdfunding Site Has The Lowest Fees?

Among all the great options above, WhyDonate has the lowest cost of all time regarding crowdfunding in Europe. They are crafted with careful strategies, WhyDonate charges only a minimum transaction fee of 1.9% + €0,25 for its fundraisers. At the same time, donors only pay the amount they prefer to donate and nothing more than that.

Is Crowdfunding A Good Idea?

Yes. The sole purpose of crowdfunding is to provide people with a platform to ask for funds to fulfil their absolute needs. However, finding a legitimate crowdfunding platform for any fundraising campaign is essential.

Which Type Of Crowdfunding Is Most Popular?

There are primarily four types of crowdfunding models that are popular globally. These are

Donation-based crowdfunding

Reward-based crowdfunding

Equity crowdfunding

Loan Crowdfunding

Check Out Our European crowdfunding platforms Now!

#Best Crowdfunding Platforms in Europe#European crowdfunding platforms#Crowdfunding Platforms in Europe

0 notes

Text

Best Crowdfunding Platforms in Europe

The recent field of crowdfunding platforms in Europe has witnessed significant growth. Crowdfunding is used for charities, investments, financing companies, and personal needs. Many people spend their fair share of time using crowdfunding to donate to countless causes for philanthropic activities.

With the rough usage of technologies, especially social media, crowdfunding has developed to a new level. But with several options, there are just a few reliable options among the best crowdfunding platforms in Europe. That is why knowing which crowdfunding platform suits your needs is essential.

Even after the Covid-19 pandemic, many crowdfunding platforms have remodelled their business models for their users and have seen a substantial crowdfunding market volume in 2020-21. This blog will help you choose the ideal platform for you among the best crowdfunding sites.

Start your Crowdfunding Campaign with WhyDonate and experience the most hassle-free fundraising!

Table of Contents

What Do Crowdfunding Platforms Do?

How Do I Choose A Crowdfunding Platform?

Which Crowdfunding Site Is The Best?

WhyDonate

FundedByMe

Funding Circle

Crowdcube

Goteo

Booomerang

Ulule

Companisto

Seedrs

Betterplace.org

Popular Crowdfunding FAQs

Which Crowdfunding Site Has The Lowest Fees?

Is Crowdfunding A Good Idea?

Which Type Of Crowdfunding Is Most Popular?

What Do Crowdfunding Platforms Do?

Crowdfunding Europe allows people to contribute to a campaign, project, or company. It involves gathering small amounts of money to provide the necessary capital to get the project or company off the ground. Individuals can also contribute to a campaign for their favourite cause.

Instead of relying on traditional funding sources, such as bank loans, fundraising is a more innovative approach to raising funds. It allows individuals and organisations to start a new business or fund a charity without going through the laborious process of creating a business plan and market research.

Using the best crowdfunding websites can help achieve their goal in less time and with the utmost ease. Another thing about reliable crowdfunding platforms in Europe is that you know where your money is going or where it comes from.

Join us in making a difference through crowdfunding!

How Do I Choose A Crowdfunding Platform?

Your first thought might be to Google this. However, if you type “crowdfunding Europe” or “crowdfunding charity,” you will get tons of hits. On the one hand, it’s fantastic that you get so many results on your search; on the other hand, you still don’t know where to look for answers and which one to choose among the best crowdfunding sites.

That’s why we want to give you a little hand. We’ll provide you with 10 top crowdfunding sites that will show you which crowdfunding platforms are the most prominent crowdfunding platforms that can ease the pain and help you to donate sooner.

By the end of this informative writing, you will likely choose your favourite platform from the best crowdfunding platforms in Europe.

Which Crowdfunding Site Is The Best?

There are several criteria to consider before starting a fundraiser through a fundraising platform. Number one is the reliability of the crowdfunding platform. The other options to consider are accessibility, user experience, and understanding of the system behind the platforms. Let us now have a look at the most prevalent crowdfunding platforms in Europe.

1. WhyDonate

WhyDonate is one of the largest crowdfunding platforms in Europe. The platform is specifically designed to raise money for any cause. Here you can donate money or start fundraising for a charity yourself. It also supports private fundraising projects. Among the best crowdfunding websites, this platform is undoubtedly the best one.

If you’re a registered company crowdfunding on WhyDonate, they will check if you are registered with ANBI and have a CBF quality label. WhyDonate, one of the free crowdfunding platforms, also facilitates companies and organisations that want to set up their crowdfunding platform. If you want a perfect space to help you with crowdfunding in Europe, consider WhyDonate and start donating to your cause without hassle.

2. FundedByMe

In March 2011, FundedByMe was founded in Stockholm, Sweden, and is one of the world’s first crowdfunding platforms to provide both reward-based and equity crowdfunding in Europe. To promote cross-border investments that support entrepreneurs and investors to help job creation and economic development, the platform has a significant focus on European entrepreneurs.

3. Funding Circle

This platform gives out loans of €5,000 to €250,000 to entrepreneurs. Funding Circle is an excellent platform to invest in if you have a project you’re confident about and want to start crowdfunding in Europe. The best part is that the registration is free, and financial returns can get as high as 18.9% yearly. You can start investing with as little as €100.

4. Crowdcube

Crowdcube is an equity crowdfunding platform in Europe aimed solely at investors who are sufficiently savvy to consider these risks and make their own investment choices. Via Crowdcube, over £26 million has been successfully invested so far.

Crowdcube launched the ‘Crowdcube Venture Fund’ in February 2014, which enables investors to crowdfund start-ups with the extra reassurance that an independent skilled fund manager invests, manages, and tracks their capital. Companies like Crowdcube have made crowdfunding in Europe easier with their fantastic options.

5. Goteo

Goteo is a crowdfunding or collective financing platform (monetary contributions) and distributed collaboration (services, infrastructures, microtasks) for projects that, in addition to giving individual rewards, also generate performance through promoting common goods, open-source, and knowledge free.

You can have one or more roles as a network member: present a project, be a co-founder, or collaborate on one. Goteo, one of the tremendous crowdfunding platforms, offers some excellent perspectives while crowdfunding in Europe.

6. Booomerang