#What Value Does JPMorgan Chase (JPM) offer?

Explore tagged Tumblr posts

Text

Incredible Growth at JPMorgan Chase (JPM)

America’s largest bank, JPMorgan Chase (JPM) is experiencing incredible growth. For example, JPMorgan’s revenues grew by 78.69% in the quarter ending on 30 June 2023, Stockrow estimates. Chase’s growth rate is rising. For example, the revenue growth rate rose from 68.96% in the quarter ending on 31 March 2023. Moreover, the quarterly revenue growth rate rose from 7.54% in the quarter ending on…

View On WordPress

#How Much Cash is JPMorgan (JPM) generating?#Incredible Growth at JPMorgan Chase (JPM)#Is JPMorgan Chase (JPM) vital to America’s future?#JPM Morgan (JPM) Chase is a Phenomenal Growth Stock#JPMorgan Chase (JPM)#What Value Does JPMorgan Chase (JPM) offer?

0 notes

Text

Stock-market investors are banking on this sector in the COVID recovery, while JPMorgan steps up its ETF game

Hello again: Quickly! What is the best performing sector in the S&P 500 SPX, + 0.04% 11 this week? It’s finance (with materials right behind it). By the way, financials are also the best-performing sector to date, up over 5% in August. Morgan Stanley MS, + 0.23%, JPMorgan Chase JPM, + 0.07% and Goldman Sachs Group GS, -0.25% helps add value to exchange traded funds that offer exposure to this sector.

Investors are betting heavily on the banking sector’s rebound amid the COVID-19 economic rebound and it shows in ETF movements with the week this week Invesco KBW Bank ETF and SPDR S&P Regional Banking ETF. Check out the ETF Wraps table of this week’s top performers below. The outperformance of financial ETFs even comes from the fact that interest rates haven’t necessarily cooperated.

Rising interest rates are good for bank profitability, but currently the 10-year government bond TMUBMUSD10Y is 1.360%, used to price everything from mortgages to car loans is around 1.35%. Banks borrow short-term debt and make longer-term loans. It is expected that the longer-term interest rates will eventually rise and that the economy will also benefit from a broader recovery if the delta variant does not derail this.

We’ll also talk a little about the playbook for new infrastructure laws, betting on small caps versus large, and JPMorgan Chase’s change of power in ETFs.

As usual, send tips or feedback and find me on Twitter @mdecambre to tell me what to jump at. Sign up for ETF Wrap here.

JPM and ETFs

A recent announcement by JPMorgan Chase that it will convert a portion of its actively managed mutual funds into ETFs, about $ 10 billion, is sweeping the fund market. Todd Rosenbluth, Head of ETF and Investment Fund Research at CFRA, says JPMorgan is currently number 9 in 2020 (currently number 7) but could be near the top of ETF providers in the next half decade.

“JPMorgan could be in the top five providers for the next five years,” Rosenbluth told ETF Wrap.

CFRA

The move comes as fund providers are increasingly restructuring mutual funds into ETFs due to increased interest in the benefits of the ETF wrapper, including tax efficiency and transparency.

However, Rosenbluth notes that JPMorgan’s tactics are different from competitors like American Century and Fidelity, which recently launched semi-transparent ETFs under the same name as popular mutual funds.

Overall, the CFRA analyst says that actively managed ETFs have generated a lot of interest, raising $ 38 billion since the start of the year as of August 10, according to CFRA data.

The good and the bad

Last week’s top 5 winners %To return

SPDR S&P Metals & Mining ETF XME, -2.25%

8.5

Amplify Transformational Data Sharing ETF BLOK, -2.77%

6.4

Invesco KBW Bank-ETF KBWB, -0.15%

5.9

SPDR S&P Regional Banking ETF KRE, -0.69%

5.2

SPDR S&P Bank-ETF KBE, -0.47%

5.1

Source: FactSet, until Wednesday, August 11, excluding ETNs and leverage products. Includes ETFs traded by NYSE, Nasdaq, and Cboe of $ 500 million or more

Top 5 relegators in the last week %To return

Aberdeen Standard Physical Silver Shares ETF SIVR, -1.43%

-6.3

iShares Silver Trust SLV, -1.48%

-6.3

ARK Genomic Revolution ETF ARKG, + 0.19%

-6.1

Invesco DWA Healthcare Momentum ETF PTH, +1.28%

-5.3

iShares MSCI Global Gold Miners ETF RING, -2.24%

-4.8

Source: fact set

Pictures of the week

via Frank Cappelleri. by Instinet

Instinet’s Frank Cappelleri, a technical analyst, notes that the Utilities Select Sector SPDR Fund XLU hit a 52-week high of -0.07% on Wednesday. However, the tech notes that while government bond yields have risen lately, they haven’t necessarily confirmed the move in utilities that historically tended to be, along with fixed income assets like the benchmark 10-year government bond TMUBMUSD10Y, 1.360% increase., for example.

“The XLU was of course a bond proxy in the past. But its correlation with the 10-year note largely diverged in 2021. Whether we blame the Fed or not, we shouldn’t ignore the move just because rates don’t confirm it, ”Cappelleri writes.

We’ll have to see how that plays out as returns pick up some pace.

Do you think small?

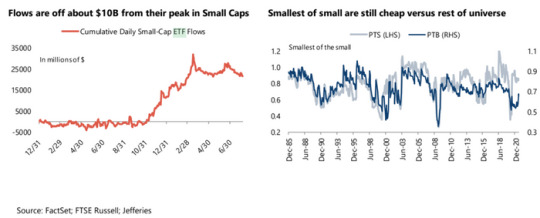

Jefferies’ equity strategist Steven DeSanctis believes that small caps continue to be value even though inflows into small cap ETFs have cooled in recent weeks. Here is his take on the matter in a research note posted on Wednesday.

“Inflows into small-cap ETFs may have peaked in mid-March and hurt performance … But we believe institutional investors are interested in size segments. For every dollar invested in small caps, 45 cents go into the passive, that creates tailwind for smaller small caps, ”he writes.

via Jefferies

“If value continues to outperform, reviews drive performance,” he writes. The most popular and largest small-cap ETFs include the iShares Core S&P Small-Cap ETF IJR, -0.72%, the iShares Russell 2000 ETF IWM, -0.55% and the Vanguard Small-Cap ETF VB, -0.50%, and the Vanguard Small-Cap Value ETF VBR, -0.66%.

DeSanctis and his crew expect small caps to outperform large caps by 5.50 percentage points in the next year.

Build on infrastructure

After the U.S. Senate passed an infrastructure package worth roughly $ 1 trillion on Tuesday with broad bipartisan support, the immediate question was: Do ETFs that have been used to bet on infrastructure games still have room to run?

The Global X US Infrastructure Development ETF PAVE is a popular exchange traded fund that offers exposure to stocks that would likely benefit from an infrastructure bill, data shows.

Other areas such as renewable energy and electric vehicles have not seen a boom recently. The Invesco Solar ETF TAN, -0.94%, was down 1.1% over the course of the week, while the Global X Autonomous & Electric Vehicles ETF DRIV, -0.29% was practically unchanged this week. TAN, which refers to the ticker symbol of the solar ETF, is down 17% since the start of the year, while the EV-ETF is up 21% so far in 2021.

However, it remains questionable how quickly the House will react to the bill.

Ally Invest’s Lindsey Bell says there may still be upside potential if the bill is ultimately signed by President Joe Biden.

“Sector ETFs, which have cooled in recent months due to growth uncertainty, in industries, materials, construction equipment, semiconductors and electric vehicles, could see a boost as the bill moves closer to President Biden’s desk,” she wrote.

source https://seedfinance.net/2021/08/12/stock-market-investors-are-banking-on-this-sector-in-the-covid-recovery-while-jpmorgan-steps-up-its-etf-game/

0 notes

Text

Even $1,400 checks aren't exciting Wall Street

New Post has been published on https://appradab.com/even-1400-checks-arent-exciting-wall-street/

Even $1,400 checks aren't exciting Wall Street

US stocks slid on Thursday, and futures indicate they could lose more ground Friday. The S&P 500 has shed 0.8% this week, setting it up for its first weekly decline of the year.

What’s happening: Markets are in a holding pattern as the impeachment of President Donald Trump unfolds in Washington. Given the looming trial in the Senate, it’s not clear whether lawmakers will be able to give their full attention to Biden’s economic agenda, despite the urgent need for additional support.

When unveiling his plan on Thursday, Biden emphasized that he views it as a top priority. That’s no surprise, given the news that 965,000 people filed for first-time unemployment benefits last week — the highest level since August.

“It’s not hard to see that we are in the middle of [a] once-in-several-generations economic crisis, with the once-in-a-generation public health crisis,” Biden said. “The crisis of deep human suffering is in plain sight. There is no time to waste. We have to act and we have to act now.”

He wants Congress to pass a bill that includes:

Another $1,400 check for eligible Americans, bringing the recent total to $2,000 per person

An extra $400 per week for those who are unemployed, up from the $300 weekly benefit approved in December

$25 billion in additional rental assistance and an extension of the federal eviction moratorium

$350 billion for state and local governments to maintain vital services

$20 billion for a national vaccination program and $50 billion for more coronavirus testing

Wall Street doesn’t expect the full package to survive negotiations. Goldman Sachs political economist Alec Phillips notes that if Biden wants to pass the package by regular order and not via budget reconciliation process, as his team has indicated, he’ll need 60 votes in the Senate. That would require 10 Republicans to come on board.

“We do not expect ten Republicans to support a $1.9 trillion relief package,” he said in a note to clients late Thursday.

Some are already pushing back on the wisdom of mailing out more cash.

“History shows such spending does nothing to stimulate the economy. In the end, it only adds to the federal debt,” John Cogan and John Taylor, two senior fellows at the conservative Hoover Institution, wrote in a Wall Street Journal op-ed published Thursday.

Goldman Sachs thinks Biden can still score a roughly $1.1 trillion deal, up from its previous expectation of a package worth $750 billion.

Yet investors may hold off on cheering the news until they get a better sense of the timeline for turning plans into reality — and whether corporate tax increases are also on the horizon.

Big banks are staging a comeback. It’s on rocky footing

America’s banks have weathered the coronavirus storm better than some expected. But with the US economy buckling again, the next year looks anything but certain.

Breaking it down: Banks saw shares tumble last spring as investors fretted about a flood of bad loans and rock-bottom interest rates. Since October, though, the KBW Bank Index has jumped 50%, thanks to the IPO boom, huge demand for mortgages and stimulus spending, which has raised hopes that the economy will see an explosion of activity in 2021.

Can the rally last? That’s the big question for investors as JPMorgan Chase (JPM), Citigroup (C) and Wells Fargo (WFC) report earnings Friday.

The results from the latest quarter aren’t expected to be great, but Wall Street is prepared to write them off. Instead, much of what happens next will depend on what executives have to say about the outlook.

“We still see signs that focusing on earnings results (what happened) is less profitable than what is going to happen (guidance),” Bank of America analysts told clients in a recent note.

Watch this space: After a difficult year, banks are eager to start rewarding investors by repurchasing shares again. The Federal Reserve suspended bank buybacks last year but said in December it will allow them to resume.

With the economy in dire straits, banks will have to strike a careful balance between deploying cash to help shareholders and guarding against ongoing credit risks.

JPMorgan CEO Jamie Dimon, for one, is confident his bank can do this.

“We will continue to maintain a fortress balance sheet that allows us to safely deploy capital by investing in and growing our businesses, supporting consumers and businesses, paying a sustainable dividend, and returning any remaining excess capital to shareholders,” Dimon said in a statement after the bank announced it would launch a $30 billion buyback program in early 2021.

The 55-year-old pet store coming for Chewy

Banking on a pandemic pet boom, Petco has launched the third IPO in company history — and investors are lapping it up.

Details, details: The pet store, which has been around for more than five decades, raised $817 million from investors through its share issue. The stock — which trades under the ticker symbol “WOOF,” naturally — surged more than 60% in its latest Wall Street debut, giving the company a valuation of $6.45 billion.

Petco has undergone a makeover since it went private in early 2016 through a leveraged buyout, my Appradab Business colleague Matt Egan reports. The company, now known as Petco Health and Wellness, invested heavily in e-commerce and building veterinary and other on-site services aimed at making it a one-stop shop for pet owners.

“We are the only retailer that offers all the pet parents’ needs in one place,” Petco CEO Ron Coughlin told Appradab Business.

But Petco faces heavy competition from the likes of online retailer Chewy, which has emerged as one of the biggest winners of the pandemic. Chewy’s shares skyrocketed 210% last year and have kicked off 2021 with another 28% rally. It now has a value of $47.3 billion.

Both companies are benefiting from an increase in pet adoption during the pandemic. But Chewy’s sales are growing much faster — posing a challenge to Petco as it tries to solidify its place in the market.

Up next

Citigroup, JPMorgan Chase, PNC and Wells Fargo report earnings before US markets open.

Also today: US retail sales and industrial production data for December arrives at 8:30 a.m. ET.

Coming next week: Earnings season gets into full swing as Bank of America (BAC), Netflix (NFLX), Procter & Gamble (PG), United Airlines (UAL), Intel (INTC) and IBM (IBM) share results.

0 notes

Text

JP Morgan Says Bitcoin Is 25% Below Its Intrinsic Value: Here’s Why It Can Catch Up

Although JP Morgan may not trade Bitcoin or offer crypto-specific services to its clientele, the company does analyze this nascent market once in a while. This much was made clear very recently. One individual this week shared a report from JP Morgan, dated May 22nd, that included a post-halving analysis of the Bitcoin mining scene. Analysts at the multinational financial institution found that through their analysis of Bitcoin’s intrinsic value, BTC is currently trading “25% below what the intrinsic price would be after the halving.” The intrinsic price JP Morgan found was derived through the average cost of mining one BTC. While the analysts suggested that no concrete signals can be garnered from the fact that the cryptocurrency is below its intrinsic value, analysts think BTC will eventually catch up. Related Reading: The $90 Million Bitcoin Pizza Story Has an Unexpected Silver Lining Bitcoin Will Catch Up to Intrinsic Value, Analysts Think As it stands according to JP Morgan analysts, Bitcoin’s intrinsic value sits somewhere around $11,500 — over $2,500 higher than the current market price. While this price may seem miles away, it’s attainable due to fundamental trends. Blockchain insights firm Santiment shared on May 21st that Bitcoin’s Network Value to Transactions Ratio (NVT) remains “healthy,” suggesting prices may soon resume higher despite the recent drop: “In spite of BTC’s mild -4.4% downswing today, its NVT looks healthy, and our model is showing a semi-bullish signal. The amount of unique tokens being transacted on Bitcoin network is slightly above average for in May, according to where price levels currently sit,” Santiment wrote. BlockTower Capital, a cryptocurrency and blockchain investment fund, echoed the optimism. In a note, the firm said that the “macro case” for BTC has “never been more obvious.” It attributed its optimism to multiple trends, such as growing distrust in central banks, the world’s adoption of digital technologies amid the ongoing illness, and growing geopolitical tensions as economies break down. Related Reading: Crypto Tidbits: Satoshi Isn’t Dumping His Bitcoin, China ‘Bans’ Cryptocurrency Mining JP Morgan & Chase Supports Crypto Firms JP Morgan’s latest report about Bitcoin comes as JPMorgan & Chase — the banking division of the firm — has begun to service “crypto-native” clients for the first time ever. As reported by the Wall Street Journal ten days ago, the bank has taken on two top Bitcoin exchanges, Coinbase and Gemini Trust, as clients. “People familiar with the matter,” said that the accounts were opened and approved in April, and transactions through the account have just started to be processed. “The bank is primarily providing cash-management services to the firms and handling dollar-based transactions for the exchanges’ U.S.-based customers, according to the people.” According to Mike Novogratz — CEO of Galaxy Digital and a former partner at Goldman Sachs — this news is a massive deal, a “big deal” in fact. The Wall Street investor remarked that the firm’s acceptance of cryptocurrency clients is a sign of “recognition that the future will include crypto currencies, digital assets, and blockchain based systems.” The JPM announcement that they will provide banking services to Coinbase and Gemini is a big deal. Go $BTC. It is recognition that the future will include crypto currencies, digital assets, and blockchain based systems. — Michael Novogratz (@novogratz) May 12, 2020 Featured Image from Shutterstock from Cryptocracken Tumblr https://ift.tt/2X2OJnm via IFTTT

0 notes

Text

JP Morgan Says Bitcoin Is 25% Below Its Intrinsic Value: Here’s Why It Can Catch Up

Although JP Morgan may not trade Bitcoin or offer crypto-specific services to its clientele, the company does analyze this nascent market once in a while. This much was made clear very recently. One individual this week shared a report from JP Morgan, dated May 22nd, that included a post-halving analysis of the Bitcoin mining scene. Analysts at the multinational financial institution found that through their analysis of Bitcoin’s intrinsic value, BTC is currently trading “25% below what the intrinsic price would be after the halving.” The intrinsic price JP Morgan found was derived through the average cost of mining one BTC. While the analysts suggested that no concrete signals can be garnered from the fact that the cryptocurrency is below its intrinsic value, analysts think BTC will eventually catch up. Related Reading: The $90 Million Bitcoin Pizza Story Has an Unexpected Silver Lining Bitcoin Will Catch Up to Intrinsic Value, Analysts Think As it stands according to JP Morgan analysts, Bitcoin’s intrinsic value sits somewhere around $11,500 — over $2,500 higher than the current market price. While this price may seem miles away, it’s attainable due to fundamental trends. Blockchain insights firm Santiment shared on May 21st that Bitcoin’s Network Value to Transactions Ratio (NVT) remains “healthy,” suggesting prices may soon resume higher despite the recent drop: “In spite of BTC’s mild -4.4% downswing today, its NVT looks healthy, and our model is showing a semi-bullish signal. The amount of unique tokens being transacted on Bitcoin network is slightly above average for in May, according to where price levels currently sit,” Santiment wrote. BlockTower Capital, a cryptocurrency and blockchain investment fund, echoed the optimism. In a note, the firm said that the “macro case” for BTC has “never been more obvious.” It attributed its optimism to multiple trends, such as growing distrust in central banks, the world’s adoption of digital technologies amid the ongoing illness, and growing geopolitical tensions as economies break down. Related Reading: Crypto Tidbits: Satoshi Isn’t Dumping His Bitcoin, China ‘Bans’ Cryptocurrency Mining JP Morgan & Chase Supports Crypto Firms JP Morgan’s latest report about Bitcoin comes as JPMorgan & Chase — the banking division of the firm — has begun to service “crypto-native” clients for the first time ever. As reported by the Wall Street Journal ten days ago, the bank has taken on two top Bitcoin exchanges, Coinbase and Gemini Trust, as clients. “People familiar with the matter,” said that the accounts were opened and approved in April, and transactions through the account have just started to be processed. “The bank is primarily providing cash-management services to the firms and handling dollar-based transactions for the exchanges’ U.S.-based customers, according to the people.” According to Mike Novogratz — CEO of Galaxy Digital and a former partner at Goldman Sachs — this news is a massive deal, a “big deal” in fact. The Wall Street investor remarked that the firm’s acceptance of cryptocurrency clients is a sign of “recognition that the future will include crypto currencies, digital assets, and blockchain based systems.” The JPM announcement that they will provide banking services to Coinbase and Gemini is a big deal. Go $BTC. It is recognition that the future will include crypto currencies, digital assets, and blockchain based systems. — Michael Novogratz (@novogratz) May 12, 2020 Featured Image from Shutterstock from Cryptocracken WP https://ift.tt/2X2OJnm via IFTTT

0 notes

Text

JP Morgan Says Bitcoin Is 25% Below Its Intrinsic Value: Here’s Why It Can Catch Up

Although JP Morgan may not trade Bitcoin or offer crypto-specific services to its clientele, the company does analyze this nascent market once in a while. This much was made clear very recently. One individual this week shared a report from JP Morgan, dated May 22nd, that included a post-halving analysis of the Bitcoin mining scene. Analysts at the multinational financial institution found that through their analysis of Bitcoin’s intrinsic value, BTC is currently trading “25% below what the intrinsic price would be after the halving.” The intrinsic price JP Morgan found was derived through the average cost of mining one BTC. While the analysts suggested that no concrete signals can be garnered from the fact that the cryptocurrency is below its intrinsic value, analysts think BTC will eventually catch up. Related Reading: The $90 Million Bitcoin Pizza Story Has an Unexpected Silver Lining Bitcoin Will Catch Up to Intrinsic Value, Analysts Think As it stands according to JP Morgan analysts, Bitcoin’s intrinsic value sits somewhere around $11,500 — over $2,500 higher than the current market price. While this price may seem miles away, it’s attainable due to fundamental trends. Blockchain insights firm Santiment shared on May 21st that Bitcoin’s Network Value to Transactions Ratio (NVT) remains “healthy,” suggesting prices may soon resume higher despite the recent drop: “In spite of BTC’s mild -4.4% downswing today, its NVT looks healthy, and our model is showing a semi-bullish signal. The amount of unique tokens being transacted on Bitcoin network is slightly above average for in May, according to where price levels currently sit,” Santiment wrote. BlockTower Capital, a cryptocurrency and blockchain investment fund, echoed the optimism. In a note, the firm said that the “macro case” for BTC has “never been more obvious.” It attributed its optimism to multiple trends, such as growing distrust in central banks, the world’s adoption of digital technologies amid the ongoing illness, and growing geopolitical tensions as economies break down. Related Reading: Crypto Tidbits: Satoshi Isn’t Dumping His Bitcoin, China ‘Bans’ Cryptocurrency Mining JP Morgan & Chase Supports Crypto Firms JP Morgan’s latest report about Bitcoin comes as JPMorgan & Chase — the banking division of the firm — has begun to service “crypto-native” clients for the first time ever. As reported by the Wall Street Journal ten days ago, the bank has taken on two top Bitcoin exchanges, Coinbase and Gemini Trust, as clients. “People familiar with the matter,” said that the accounts were opened and approved in April, and transactions through the account have just started to be processed. “The bank is primarily providing cash-management services to the firms and handling dollar-based transactions for the exchanges’ U.S.-based customers, according to the people.” According to Mike Novogratz — CEO of Galaxy Digital and a former partner at Goldman Sachs — this news is a massive deal, a “big deal” in fact. The Wall Street investor remarked that the firm’s acceptance of cryptocurrency clients is a sign of “recognition that the future will include crypto currencies, digital assets, and blockchain based systems.” The JPM announcement that they will provide banking services to Coinbase and Gemini is a big deal. Go $BTC. It is recognition that the future will include crypto currencies, digital assets, and blockchain based systems. — Michael Novogratz (@novogratz) May 12, 2020 Featured Image from Shutterstock from CryptoCracken SMFeed https://ift.tt/2X2OJnm via IFTTT

0 notes

Link

Python is an excellent programming language for creating data visualizations. However, working with a raw programming languages like Python (instead of more sophisticated software like, say, Tableau) presents some challenges. Developers creating visualizations accept more technical complexity in exchange for vastly more input into how their visualizations look. In this tutorial, I will teach you how to create automatically-updating Python visualizations using data from IEX Cloud using the matplotlib library and some simple Amazon Web Services product offerings.

Step 1: Gather Your Data

Automatically updating charts sound appealing, but before you invest the time in building them it is important to understand whether or not you need your charts to be automatically updated. To be more specific, there is no need for your visualizations to update automatically if the data they are presenting does not change over time. Writing a Python script that automatically updates a chart of Michael Jordan's annual points-per-game would be useless - his career is over, and that data set is never going to change. The best data set candidates for auto-updating visualizations are time series data where new observations are being added on a regular basis (say, each day). In this tutorial, we are going to be using stock market data from the IEX Cloud API. Specifically, we will be visualizing historical stock prices for a few of the largest banks in the US:

JPMorgan Chase (JPM)

Bank of America (BAC)

Citigroup (C)

Wells Fargo (WFC)

Goldman Sachs (GS)

The first thing that you'll need to do is create an IEX Cloud account and generate an API token. For obvious reasons, I'm not going to be publishing my API key in this article. Storing your own personalized API key in a variable called IEX API Key will be enough for you to follow along. Next, we're going to store our list of tickers in a Python list:

tickers = [ 'JPM', 'BAC', 'C', 'WFC', 'GS', ]

The IEX Cloud API accepts tickers separated by commas. We need to serialize our ticker list into a separated string of tickers. Here is the code we will use to do this:

#Create an empty string called `ticker_string` that we'll add tickers and commas to ticker_string = '' #Loop through every element of `tickers` and add them and a comma to ticker_string for ticker in tickers: ticker_string += ticker ticker_string += ',' #Drop the last comma from `ticker_string` ticker_string = ticker_string[:-1]

The next task that we need to handle is to select which endpoint of the IEX Cloud API that we need to ping. A quick review of IEX Cloud's documentation reveals that they have a Historical Prices endpoint, which we can send an HTTP request to using the charts keyword. We will also need to specify the amount of data that we're requesting (measured in years). To target this endpoint for the specified data range, I have stored the charts endpoint and the amount of time in separate variables. These endpoints are then interpolated into the serialized URL that we'll use to send our HTTP request. Here is the code:

#Create the endpoint and years strings endpoints = 'charts' years = '10' #Interpolate the endpoint strings into the HTTP_request string HTTP_request = f'https://cloud.iexapis.com/stable/stock/market/batch?symbols={ticker_string}&types={endpoints}&range={years}y&token={IEX_API_Key}'

This interpolated string is important because it allows us to easily change our string's value at a later date without changing each occurrence of the string in our codebase. Now it's time to actually make our HTTP request and store the data in a data structure on our local machine. To do this, I am going to use the pandas library for Python. Specifically, the data will be stored in a pandas DataFrame. We will first need to import the pandas library. By convention, pandas is typically imported under the alias pd. Add the following code to the start of your script to import pandas under the desired alias:

import pandas as pd

Once we have imported pandas into our Python script, we can use its read_json method to store the data from IEX Cloud into a pandas DataFrame:

bank_data = pd.read_json(HTTP_request)

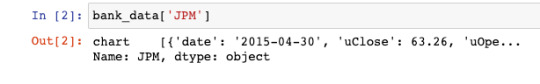

Printing this DataFrame inside of a Jupyter Notebook generates the following output:

It is clear that this is not what we want. We will need to parse this data to generate a DataFrame that's worth plotting. To start, let's examine a specific column of bank_data - say, bank_data['JPM']:

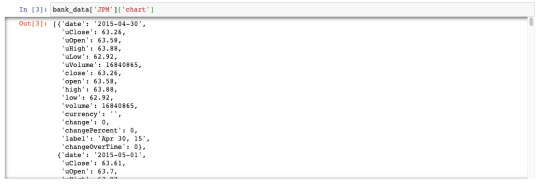

It's clear that the next parsing layer will need to be the chart endpoint:

Now we have a JSON-like data structure where each cell is a date along with various data points about JPM's stock price on that date. We can wrap this JSON-like structure in a pandas DataFrame to make it much more readable:

This is something we can work with! Let's write a small loop that uses similar logic to pull out the closing price time series for each stock as a pandas Series (which is equivalent to a column of a pandas DataFrame). We will store these pandas Series in a dictionary (with the key being the ticker name) for easy access later.

for ticker in tickers: series_dict.update( {ticker : pd.DataFrame(bank_data[ticker]['chart'])['close']} )

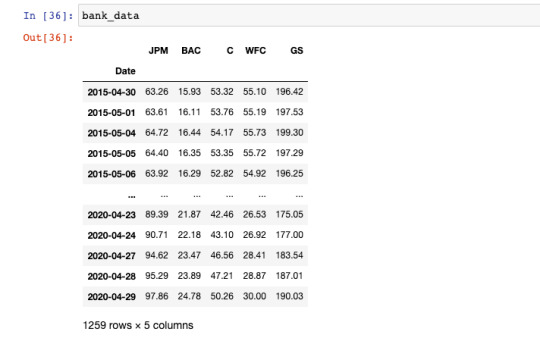

Now we can create our finalized pandas DataFrame that has the date as its index and a column for the closing price of every major bank stock over the last 5 years:

series_list = [] for ticker in tickers: series_list.append(pd.DataFrame(bank_data[ticker]['chart'])['close']) series_list.append(pd.DataFrame(bank_data['JPM']['chart'])['date']) column_names = tickers.copy() column_names.append('Date') bank_data = pd.concat(series_list, axis=1) bank_data.columns = column_names bank_data.set_index('Date', inplace = True)

After all this is done, our bank_data DataFrame will look like this:

Our data collection is complete. We are now ready to begin creating visualization with this data set of stock prices for publicly-traded banks. As a quick recap, here's the script we have built so far:

import pandas as pd import matplotlib.pyplot as plt IEX_API_Key = '' tickers = [ 'JPM', 'BAC', 'C', 'WFC', 'GS', ] #Create an empty string called `ticker_string` that we'll add tickers and commas to ticker_string = '' #Loop through every element of `tickers` and add them and a comma to ticker_string for ticker in tickers: ticker_string += ticker ticker_string += ',' #Drop the last comma from `ticker_string` ticker_string = ticker_string[:-1] #Create the endpoint and years strings endpoints = 'chart' years = '5' #Interpolate the endpoint strings into the HTTP_request string HTTP_request = f'https://cloud.iexapis.com/stable/stock/market/batch?symbols={ticker_string}&types={endpoints}&range={years}y&cache=true&token={IEX_API_Key}' #Send the HTTP request to the IEX Cloud API and store the response in a pandas DataFrame bank_data = pd.read_json(HTTP_request) #Create an empty list that we will append pandas Series of stock price data into series_list = [] #Loop through each of our tickers and parse a pandas Series of their closing prices over the last 5 years for ticker in tickers: series_list.append(pd.DataFrame(bank_data[ticker]['chart'])['close']) #Add in a column of dates series_list.append(pd.DataFrame(bank_data['JPM']['chart'])['date']) #Copy the 'tickers' list from earlier in the script, and add a new element called 'Date'. #These elements will be the column names of our pandas DataFrame later on. column_names = tickers.copy() column_names.append('Date') #Concatenate the pandas Series together into a single DataFrame bank_data = pd.concat(series_list, axis=1) #Name the columns of the DataFrame and set the 'Date' column as the index bank_data.columns = column_names bank_data.set_index('Date', inplace = True)

Step 2: Create the Chart You'd Like to Update

In this tutorial, we'll be working with the matplotlib visualization library for Python. Matplotlib is a tremendously sophisticated library and people spend years mastering it to their fullest extent. Accordingly, please keep in mind that we are only scratching the surface of matplotlib's capabilities in this tutorial. We will start by importing the matplotlib library.

How to Import Matplotlib

By convention, data scientists generally import the pyplot library of matplotlib under the alias plt. Here's the full import statement:

import matplotlib.pyplot as plt

You will need to include this at the beginning of any Python file that uses matplotlib to generate data visualizations. There are also other arguments that you can add with your matplotlib library import to make your visualizations easier to work with. If you're working through this tutorial in a Jupyter Notebook, you may want to include the following statement, which will cause your visualizations to appear without needing to write a plt.show() statement:

%matplotlib inline

If you're working in a Jupyter Notebook on a MacBook with a retina display, you can use the following statements to improve the resolution of your matplotlib visualizations in the notebook:

from IPython.display import set_matplotlib_formats set_matplotlib_formats('retina')

With that out of the way, let's begin creating our first data visualizations using Python and matplotlib!

Matplotlib Formatting Fundamentals

In this tutorial, you will learn how to create boxplots, scatterplots, and histograms in Python using matplotlib. I want to go through a few basics of formatting in matplotlib before we begin creating real data visualizations. First, almost everything you do in matplotlib will involve invoking methods on the plt object, which is the alias that we imported matplotlib as. Second, you can add titles to matplotlib visualizations by calling plt.title() and passing in your desired title as a string. Third, you can add labels to your x and y axes using the plt.xlabel() and plt.ylabel() methods. Lastly, with the three methods we just discussed - plt.title(), plt.xlabel(), and plt.ylabel() - you can change the font size of the title with the fontsize argument. Let's dig in to creating our first matplotlib visualizations in earnest.

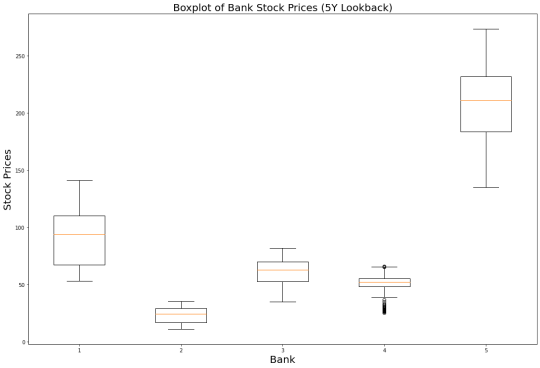

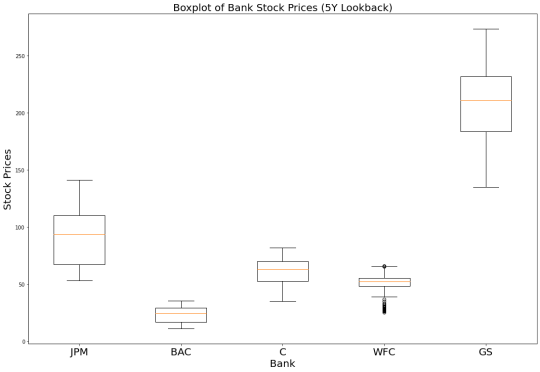

How to Create Boxplots in Matplotlib

Boxplots are one of the most fundamental data visualizations available to data scientists. Matplotlib allows us to create boxplots with the boxplot function. Since we will be creating boxplots along our columns (and not along our rows), we will also want to transpose our DataFrame inside the boxplot method call.

plt.boxplot(bank_data.transpose())

This is a good start, but we need to add some styling to make this visualization easily interpretatable to an outside user. First, let's add a chart title:

plt.title('Boxplot of Bank Stock Prices (5Y Lookback)', fontsize = 20)

In addition, it is useful to label the x and y axes, as mentioned previously:

plt.xlabel('Bank', fontsize = 20) plt.ylabel('Stock Prices', fontsize = 20)

We will also need to add column-specific labels to the x-axis so that it is clear which boxplot belongs to each bank. The following code does the trick:

ticks = range(1, len(bank_data.columns)+1) labels = list(bank_data.columns) plt.xticks(ticks,labels, fontsize = 20)

Just like that ,we have a boxplot that presents some useful visualizations in matplotlib! It is clear that Goldman Sachs has traded at the highest price over the last 5 years while Bank of America's stock has traded the lowest. It's also interesting to note that Wells Fargo has the most outlier data points. As a recap, here is the complete code that we used to generate our boxplots:

######################## #Create a Python boxplot ######################## #Set the size of the matplotlib canvas plt.figure(figsize = (18,12)) #Generate the boxplot plt.boxplot(bank_data.transpose()) #Add titles to the chart and axes plt.title('Boxplot of Bank Stock Prices (5Y Lookback)', fontsize = 20) plt.xlabel('Bank', fontsize = 20) plt.ylabel('Stock Prices', fontsize = 20) #Add labels to each individual boxplot on the canvas ticks = range(1, len(bank_data.columns)+1) labels = list(bank_data.columns) plt.xticks(ticks,labels, fontsize = 20)

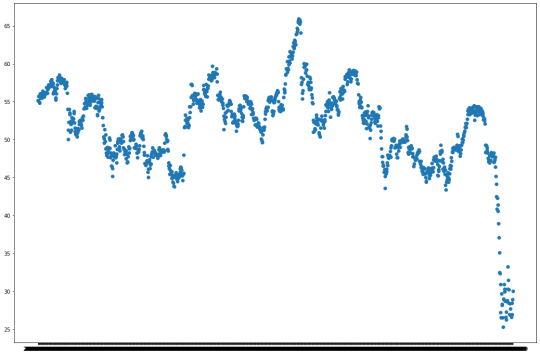

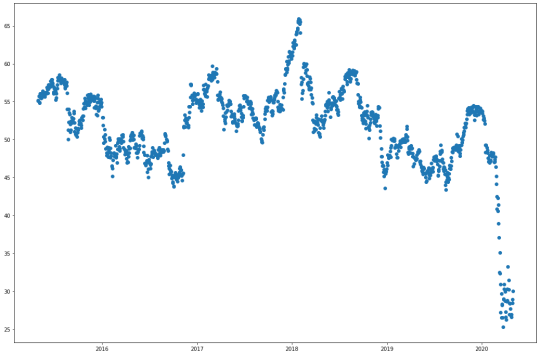

How to Create Scatterplots in Matplotlib

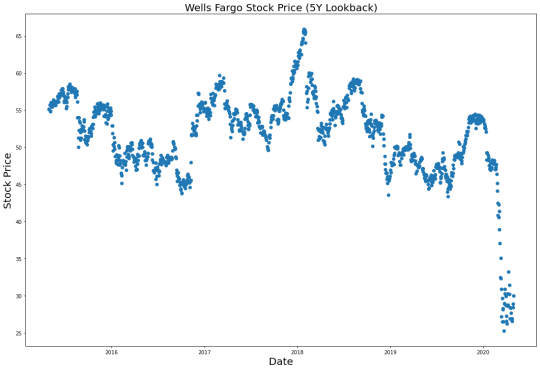

Scatterplots can be created in matplotlib using the plt.scatter method. The scatter method has two required arguments - an x value and a y value. Let's plot Wells Fargo's stock price over time using the plt.scatter() method. The first thing we need to do is to create our x-axis variable, called dates:

dates = bank_data.index.to_series()

Next, we will isolate Wells Fargo's stock prices in a separate variable:

WFC_stock_prices = bank_data['WFC']

We can now plot the visualization using the plt.scatter method:

plt.scatter(dates, WFC_stock_prices)

Wait a minute - the x labels of this chart are impossible to read! What is the problem? Well, matplotlib is not currently recognizing that the x axis contains dates, so it isn't spacing out the labels properly. To fix this, we need to transform every element of the dates Series into a datetime data type. The following command is the most readable way to do this:

dates = bank_data.index.to_series() dates = [pd.to_datetime(d) for d in dates]

After running the plt.scatter method again, you will generate the following visualization:

Much better! Our last step is to add titles to the chart and the axis. We can do this with the following statements:

plt.title("Wells Fargo Stock Price (5Y Lookback)", fontsize=20) plt.ylabel("Stock Price", fontsize=20) plt.xlabel("Date", fontsize=20)

As a recap, here's the code we used to create this scatterplot:

######################## #Create a Python scatterplot ######################## #Set the size of the matplotlib canvas plt.figure(figsize = (18,12)) #Create the x-axis data dates = bank_data.index.to_series() dates = [pd.to_datetime(d) for d in dates] #Create the y-axis data WFC_stock_prices = bank_data['WFC'] #Generate the scatterplot plt.scatter(dates, WFC_stock_prices) #Add titles to the chart and axes plt.title("Wells Fargo Stock Price (5Y Lookback)", fontsize=20) plt.ylabel("Stock Price", fontsize=20) plt.xlabel("Date", fontsize=20)

How to Create Histograms in Matplotlib

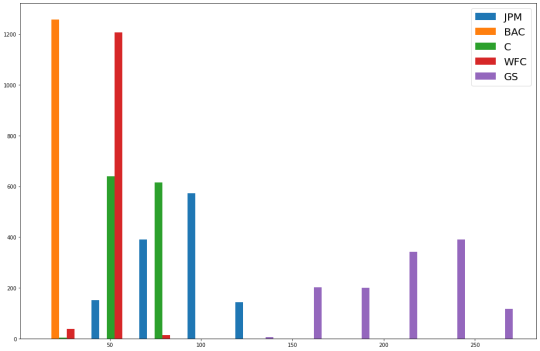

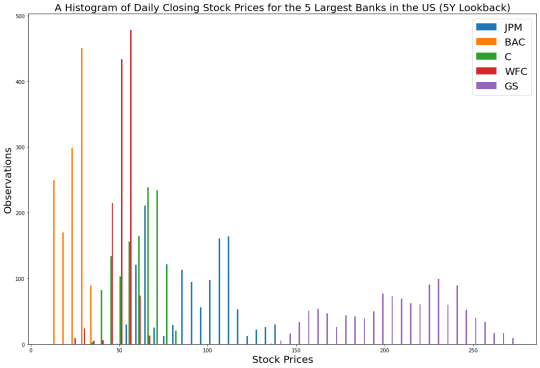

Histograms are data visualizations that allow you to see the distribution of observations within a data set. Histograms can be created in matplotlib using the plt.hist method. Let's create a histogram that allows us to see the distribution of different stock prices within our bank_data dataset (note that we'll need to use the transpose method within plt.hist just like we did with plt.boxplot earlier):

plt.hist(bank_data.transpose())

This is an interesting visualization, but we still have lots to do. The first thing you probably noticed was that the different columns of the histogram have different colors. This is intentional. The colors divide the different columns within our pandas DataFrame. With that said, these colors are meaningless without a legend. We can add a legend to our matplotlib histogram with the following statement:

plt.legend(bank_data.columns,fontsize=20)

You may also want to change the bin count of the histogram, which changes how many slices the dataset is divided into when goruping the observations into histogram columns. As an example, here is how to change the number of bins in the histogram to 50:

plt.hist(bank_data.transpose(), bins = 50)

Lastly, we will add titles to the histogram and its axes using the same statements that we used in our other visualizations:

plt.title("A Histogram of Daily Closing Stock Prices for the 5 Largest Banks in the US (5Y Lookback)", fontsize = 20) plt.ylabel("Observations", fontsize = 20) plt.xlabel("Stock Prices", fontsize = 20)

As a recap, here is the complete code needed to generate this histogram:

######################## #Create a Python histogram ######################## #Set the size of the matplotlib canvas plt.figure(figsize = (18,12)) #Generate the histogram plt.hist(bank_data.transpose(), bins = 50) #Add a legend to the histogram plt.legend(bank_data.columns,fontsize=20) #Add titles to the chart and axes plt.title("A Histogram of Daily Closing Stock Prices for the 5 Largest Banks in the US (5Y Lookback)", fontsize = 20) plt.ylabel("Observations", fontsize = 20) plt.xlabel("Stock Prices", fontsize = 20)

How to Create Subplots in Matplotlib

In matplotlib, subplots are the name that we use to referring to multiple plots that are created on the same canvas using a single Python script. Subplots can be created with the plt.subplot command. The command takes three arguments:

The number of rows in a subplot grid

The number of columns in a subplot grid

Which subplot you currently have selected

Let's create a 2x2 subplot grid that contains the following charts (in this specific order):

The boxplot that we created previously

The scatterplot that we created previously

A similar scatteplot that uses BAC data instead of WFC data

The histogram that we created previously

First, let's create the subplot grid:

plt.subplot(2,2,1) plt.subplot(2,2,2) plt.subplot(2,2,3) plt.subplot(2,2,4)

Now that we have a blank subplot canvas, we simply need to copy/paste the code we need for each plot after each call of the plt.subplot method. At the end of the code block, we add the plt.tight_layout method, which fixes many common formatting issues that occur when generating matplotlib subplots. Here is the full code:

################################################ ################################################ #Create subplots in Python ################################################ ################################################ ######################## #Subplot 1 ######################## plt.subplot(2,2,1) #Generate the boxplot plt.boxplot(bank_data.transpose()) #Add titles to the chart and axes plt.title('Boxplot of Bank Stock Prices (5Y Lookback)') plt.xlabel('Bank', fontsize = 20) plt.ylabel('Stock Prices') #Add labels to each individual boxplot on the canvas ticks = range(1, len(bank_data.columns)+1) labels = list(bank_data.columns) plt.xticks(ticks,labels) ######################## #Subplot 2 ######################## plt.subplot(2,2,2) #Create the x-axis data dates = bank_data.index.to_series() dates = [pd.to_datetime(d) for d in dates] #Create the y-axis data WFC_stock_prices = bank_data['WFC'] #Generate the scatterplot plt.scatter(dates, WFC_stock_prices) #Add titles to the chart and axes plt.title("Wells Fargo Stock Price (5Y Lookback)") plt.ylabel("Stock Price") plt.xlabel("Date") ######################## #Subplot 3 ######################## plt.subplot(2,2,3) #Create the x-axis data dates = bank_data.index.to_series() dates = [pd.to_datetime(d) for d in dates] #Create the y-axis data BAC_stock_prices = bank_data['BAC'] #Generate the scatterplot plt.scatter(dates, BAC_stock_prices) #Add titles to the chart and axes plt.title("Bank of America Stock Price (5Y Lookback)") plt.ylabel("Stock Price") plt.xlabel("Date") ######################## #Subplot 4 ######################## plt.subplot(2,2,4) #Generate the histogram plt.hist(bank_data.transpose(), bins = 50) #Add a legend to the histogram plt.legend(bank_data.columns,fontsize=20) #Add titles to the chart and axes plt.title("A Histogram of Daily Closing Stock Prices for the 5 Largest Banks in the US (5Y Lookback)") plt.ylabel("Observations") plt.xlabel("Stock Prices") plt.tight_layout()

As you can see, with some basic knowledge it is relatively easy to create beautiful data visualizations using matplotlib. The last thing we need to do is save the visualization as a .png file in our current working directory. Matplotlib has excellent built-in functionality to do this. Simply add the follow statement immediately after the fourth subplot is finalized:

################################################ #Save the figure to our local machine ################################################ plt.savefig('bank_data.png')

Over the remainder of this tutorial, you will learn how to schedule this subplot matrix to be automatically updated on your live website every day.

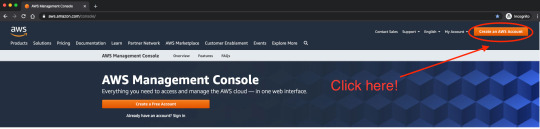

Step 3: Create an Amazon Web Services Account

So far in this tutorial, we have learned how to:

Source the stock market data that we are going to visualize from the IEX Cloud API

Create wonderful visualizations using this data with the matplotlib library for Python

Over the remainder of this tutorial, you will learn how to automate these visualizations such that they are updated on a specific schedule. To do this, we'll be using the cloud computing capabilities of Amazon Web Services. You'll need to create an AWS account first. Navigate to this URL and click the "Create an AWS Account" in the top-right corner:

AWS' web application will guide you through the steps to create an account. Once your account has been created, we can start working with the two AWS services that we'll need for our visualizations: AWS S3 and AWS EC2.

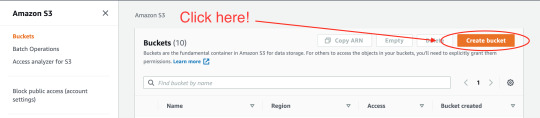

Step 4: Create an AWS S3 Bucket to Store Your Visualizations

AWS S3 stands for Simple Storage Service. It is one of the most popular cloud computing offerings available in Amazon Web Services. Developers use AWS S3 to store files and access them later through public-facing URLs. To store these files, we must first create what is called an AWS S3 bucket, which is a fancy word for a folder that stores files in AWS. To do this, first navigate to the S3 dashboard within Amazon Web Services. On the right side of the Amazon S3 dashboard, click Create bucket, as shown below:

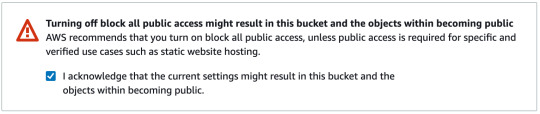

On the next screen, AWS will ask you to select a name for your new S3 bucket. For the purpose of this tutorial, we will use the bucket name nicks-first-bucket. Next, you will need to scroll down and set your bucket permissions. Since the files we will be uploading are designed to be publicly accessible (after all, we will be embedding them in pages on a website), then you will want to make the permissions as open as possible. Here is a specific example of what your AWS S3 permissions should look like:

These permissions are very lax, and for many use cases are not acceptable (though they do indeed meet the requirements of this tutorial). Because of this, AWS will require you to acknowledge the following warning before creating your AWS S3 bucket:

Once all of this is done, you can scroll to the bottom of the page and click Create Bucket. You are now ready to proceed!

Step 5: Modify the Python Script to Save Your Visualizations to AWS S3

Our Python script in its current form is designed to create a visualization and then save that visualization to our local computer. We now need to modify our script to instead save the .png file to the AWS S3 bucket we just create (which, as a reminder, is called nicks-first-bucket). The tool that we will use to upload our file to our AWS S3 bucket is called boto3, which is Amazon Web Services Software Development Kit (SDK) for Python. First, you'll need to install boto3 on your machine. The easiest way to do this is using the pip package manager:

pip3 install boto3

Next, we need to import boto3 into our Python script. We do this by adding the following statement near the start of our script:

import boto3

Given the depth and breadth of Amazon Web Services' product offerings, boto3 is an insanely complex Python library. Fortunately, we only need to use some of the most basic functionality of boto3. The following code block will upload our final visualization to Amazon S3.

################################################ #Push the file to the AWS S3 bucket ################################################ s3 = boto3.resource('s3') s3.meta.client.upload_file('bank_data.png', 'nicks-first-bucket', 'bank_data.png', ExtraArgs={'ACL':'public-read'})

As you can see, the upload_file method of boto3 takes several arguments. Let's break them down, one-by-one:

bank_data.png is the name of the file on our local machine.

nicks-first-bucket is the name of the S3 bucket that we want to upload to.

bank_data.png is the name that we want the file to have after it is uploaded to the AWS S3 bucket. In this case, it is the same as the first argument, but it doesn't have to be.

ExtraArgs={'ACL':'public-read'} means that the file should be readable by the public once it is pushed to the AWS S3 bucket.

Running this code now will result in an error. Specifically, Python will throw the following exception:

S3UploadFailedError: Failed to upload bank_data.png to nicks-first-bucket/bank_data.png: An error occurred (NoSuchBucket) when calling the PutObject operation: The specified bucket does not exist

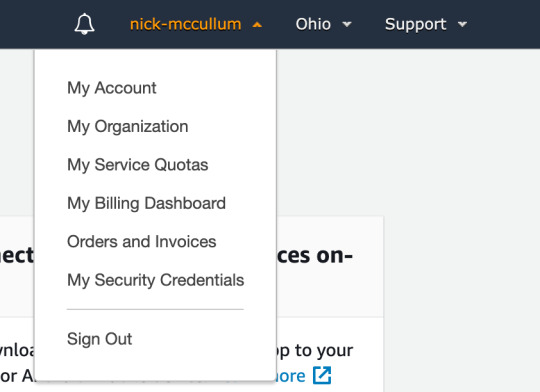

Why is this? Well, it is because we have not yet configured our local machine to interact with Amazon Web Services through boto3. To do this, we must run the aws configure command from our command line interface and add our access keys. This documentation piece from Amazon share more information about how to configure your AWS command line interface. If you'd rather not navigate off freecodecamp.org, here are the quick steps to set up your AWS CLI. First, mouse over your username in the top right corner, like this:

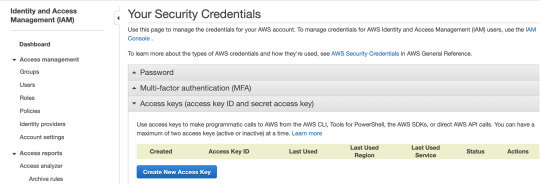

Click My Security Credentials. On the next screen, you're going to want to click the Access keys (access key ID and secret access key drop down, then click Create New Access Key.

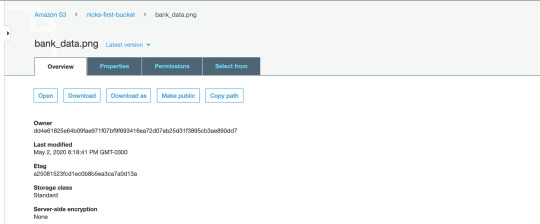

This will prompt you to download a .csv file that contains both your Access Key and your Secret Access Key. Save these in a secure location. Next, trigger the Amazon Web Services command line interface by typing aws configure on your command line. This will prompt you to enter your Access Key and Secret Access Key. Once this is done, your script should function as intended. Re-run the script and check to make sure that your Python visualization has been properly uploaded to AWS S3 by looking inside the bucket we created earlier:

The visualization has been uploaded successfully. We are now ready to embed the visualization on our website!

Step 6: Embed the Visualization on Your Website

Once the data visualization has been uploaded to AWS S3, you will want to embed the visualization somewhere on your website. This could be in a blog post or any other page on your site. To do this, we will need to grab the URL of the image from our S3 bucket. Click the name of the image within the S3 bucket to navigate to the file-specific page for that item. It will look like this:

If you scroll to the bottom of the page, there will be a field called Object URL that looks like this:

https://nicks-first-bucket.s3.us-east-2.amazonaws.com/bank_data.png

If you copy and paste this URL into a web browser, it will actually download the bank_data.png file that we uploaded earlier! To embed this image onto a web page, you will want to pass it into an HTML img tag as the src attribute. Here is how we would embed our bank_data.png image into a web page using HTML:

<img src="https://nicks-first-bucket.s3.us-east-2.amazonaws.com/bank_data.png">

Note: In a real image embedded on a website, it would be important to include an alt tag for accessibility purposes. In the next section, we'll learn how to schedule our Python script to run periodically so that the data in bank_data.png is always up-to-date.

Step 7: Create an AWS EC2 Instance

We will use AWS EC2 to schedule our Python script to run periodically. AWS EC2 stands for Elastic Compute Cloud and, along with S3, is one of Amazon's most popular cloud computing services. It allows you to rent small units of computing power (called instances) on computers in Amazon's data centers and schedule those computers to perform jobs for you. AWS EC2 is a fairly remarkable service because if you rent some of their smaller computers, then you actually qualify for the AWS free tier. Said differently, diligent use of the pricing within AWS EC2 will allow you to avoid paying any money whatsoever. To start, we'll need to create our first EC2 instance. To do this, navigate to the EC2 dashboard within the AWS Management Console and click Launch Instance:

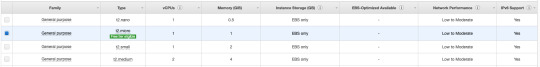

This will bring you to a screen that contains all of the available instance types within AWS EC2. There is an almost unbelievable number of options here. We want an instance type that qualifies as Free tier eligible - specifically, I chose the Amazon Linux 2 AMI (HVM), SSD Volume Type:

Click Select to proceed. On the next page, AWS will ask you to select the specifications for your machine. The fields you can select include:

Family

Type

vCPUs

Memory

Instance Storage (GB)

EBS-Optimized

Network Performance

IPv6 Support

For the purpose of this tutorial, we simply want to select the single machine that is free tier eligible. It is characterized by a small green label that looks like this:

Click Review and Launch at the bottom of the screen to proceed. The next screen will present the details of your new instance for you to review. Quickly review the machine's specifications, then click Launch in the bottom right-hand corner. Clicking the Launch button will trigger a popup that asks you to Select an existing key pair or create a new key pair. A key pair is comprised of a public key that AWS holds and a private key that you must download and store within a .pem file. You must have access to that .pem file in order to access your EC2 instance (typically via SSH). You also have the option to proceed without a key pair, but this is not recommended for security reasons. Once this is done, your instance will launch! Congratulations on launching your first instance on one of Amazon Web Services' most important infrastructure services. Next, you will need to push your Python script into your EC2 instance. Here is a generic command state statement that allows you to move a file into an EC2 instance:

scp -i path/to/.pem_file path/to/file username@host_address.amazonaws.com:/path_to_copy

Run this statement with the necessary replacements to move bank_stock_data.py into the EC2 instance. You might believe that you can now run your Python script from within your EC2 instance. Unfortunately, this is not the case. Your EC2 instance does not come with the necessary Python packages. To install the packages we used, you can either export a requirements.txt file and import the proper packages using pip, or you can simply run the following:

sudo yum install python3-pip pip3 install pandas pip3 install boto3

We are now ready to schedule our Python script to run on a periodic basis on our EC2 instance! We explore this in the next section of our article.

Step 8: Schedule the Python script to run periodically on AWS EC2

The only step that remains in this tutorial is to schedule our bank_stock_data.py file to run periodically in our EC2 instance. We can use a command-line utility called cron to do this. cron works by requiring you to specify two things:

How frequently you want a task (called a cron job) performed, expressed via a cron expression

What needs to be executed when the cron job is scheduled

First, lets start by creating a cron expression. cron expressions can seem like gibberish to an outsider. For example, here's the cron expression that means "every day at noon":

00 12 * * *

I personally make use of the crontab guru website, which is an excellent resource that allows you to see (in layman's terms) what your cron expression means. Here's how you can use the crontab guru website to schedule a cron job to run every Sunday at 7am:

We now have a tool (crontab guru) that we can use to generate our cron expression. We now need to instruct the cron daemon of our EC2 instance to run our bank_stock_data.py file every Sunday at 7am. To do this, we will first create a new file in our EC2 instance called bank_stock_data.cron. Since I use the vim text editor, the command that I use for this is:

vim bank_stock_data.cron

Within this .cron file, there should be one line that looks like this: (cron expression) (statement to execute). Our cron expression is 00 7 * * 7 and our statement to execute is python3 bank_stock_data.py. Putting it all together, and here's what the final contents of bank_stock_data.cron should be:

00 7 * * 7 python3 bank_stock_data.py

The final step of this tutorial is to import the bank_stock_data.cron file into the crontab of our EC2 instance. The crontab is essentially a file that batches together jobs for the cron daemon to perform periodically. Let's first take a moment to investigate what in our crontab. The following command prints the contents of the crontab to our console:

crontab -l

Since we have not added anything to our crontab and we only created our EC2 instance a few moments ago, then this statement should print nothing. Now let's import bank_stock_data.cron into the crontab. Here is the statement to do this:

crontab bank_stock_data.cron

Now we should be able to print the contents of our crontab and see the contents of bank_stock_data.cron. To test this, run the following command:

crontab -l

It should print:

00 7 * * 7 python3 bank_stock_data.py

Final Thoughts

In this tutorial, you learned how to create beautiful data visualizations using Python and Matplotlib that update periodically. Specifically, we discussed:

How to download and parse data from IEX Cloud, one of my favorite data sources for high-quality financial data

How to format data within a pandas DataFrame

How to create data visualizations in Python using matplotlib

How to create an account with Amazon Web Services

How to upload static files to AWS S3

How to embed .png files hosted on AWS S3 in pages on a website

How to create an AWS EC2 instance

How to schedule a Python script to run periodically using AWS EC2 using cron

0 notes

Link

I run an online platform that helps people buy and sell digital assets (like Bitcoin and other cryptocurrencies). In 2016, I knew little about the industry, and today I lead one of the foremost digital asset marketplaces in the U.S. I’m evidence that anyone can learn about crypto.

For the most part, the world of crypto has operated in a strange lane all by itself, confined to Twitter and Telegram private chats. But in 2020—amid the coronavirus pandemic—interest in crypto has boomed. Whether it’s been TikTok cheering on DogeCoin or a twenty-something hacking into high-profile Twitter accounts and asking for Bitcoin, 2020 might just be the year everyone from teens to nonagenarians learns about cryptocurrencies and digital money.

There are a few factors contributing to this change, and they are important enough that Americans should be paying attention. First, government payments to individuals and businesses alike are weakening the U.S. fiat (physical cash) system. Second, large banking institutions like JPMorgan Chase are condoning and even welcoming digital currencies onto their platforms. And third, more Americans are home, witnessing the discrepancy in the market’s growth and the nation’s unemployment rate.

The weakening dollar

With numerous sports and large events canceled, and many Americans receiving government aid, the U.S. has a captive audience for financial change. While most things we took for granted have halted, two things have stayed the same: the Internet and the exchange of money.

What has changed notably is the value of money, in particular the U.S. dollar. As Americans continue to receive public financial assistance and businesses utilize Payroll Protection Program (PPP) loans, the inherent value of the dollar is dropping. Earlier this week, the U.S. Dollar Index reported that the value of the dollar dropped to its lowest level since May 2018.

What does this mean? More people will hedge their bets on currencies that act outside the confines of the dollar and buy other fiat currencies. However, we are also seeing more people invest in cryptocurrencies: Some even had an influx of exact deposits of $1,200 in the weeks after initial stimulus checks were received.

Bank momentum

The best performing asset of the last decade was not Amazon, Apple, Microsoft, real estate investment trusts (REIT), or real estate—it was Bitcoin. When the best performing asset doesn’t even exist in traditional banking models, banks get interested.

In May, the largest retail bank in America, JPMorgan, which has historically been a staunch opponent of Bitcoin, announced it is already processing crypto transactions on its platforms, and has plans to create JPM Coin, a digital currency tied to the dollar, that would expedite global payment transfers. In June, CoinDesk reported that PayPal and Venmo might be joining the crypto community by offering direct sales of cryptocurrencies. Earlier in August, we saw Goldman Sachs bring in a new head of digital assets to scale up its crypto operations.

Crypto—once reserved for the gamers, coders, and early tech millionaires—is now a place where more people have the opportunity to participate in an alternative system where they can have more control over their wealth. Anyone with a smartphone can access crypto without waiting for banks to open up or for a debit card to be mailed to them. What’s more, because crypto is decentralized and uses a public ledger to notate payments, there is an opportunity for a level of transparency government assistance programs do not provide.

Disconnect between actual wealth and the stock market

Many Americans remain unemployed and feel the disconnect between the stock market’s success and the financial reality of their lives. New personalities entering the crypto world—from Paul Tudor Jones to William Shatner to Olympian Christie Rampone—are helping initiate an honest conversation about whether our financial systems are helping or hurting us all.

These names are also an important part of showing everyone that cryptocurrencies and digital currencies are real. Although there may not be a Tom Brady of crypto due to the fact that the originator of Bitcoin is anonymous, everyone who talks about cryptocurrencies and digital assets helps validate the industry. Because crypto and Bitcoin were built to be decentralized and without one governing body, there are impassioned contributors across the globe who work constantly to improve access to digital assets. I expect that soon there will be more who come forward to provide credibility to crypto and digital assets, as their relevance and benefits are unavoidable.

The future of Bitcoin

Whether or not you’ve heard of Bitcoin, it’s a word and a concept that is not going anywhere. There is a reason why the most prestigious university endowments, such as those affiliated with Harvard, Stanford, and MIT, all invest in crypto funds.

Crypto is building in credibility. If for no other reason than curiosity, investigate Bitcoin and digital assets and see what everyone is talking about. After all, crypto will keep going while we are locked in our homes—a surefire sign that, pandemic or not, crypto is a huge part of our future.

Catherine Coley is CEO of Binance.US.

More opinion in Fortune:

Generation Z is ‘traumatized’ by climate change—and they’re the key to fighting it

Why a year later, the Business Roundtable’s updated statement of purpose is more relevant than ever

I’m a Black female CEO. What makes me ‘different’?

What’s the backup plan if a COVID-19 vaccine comes up short?

Americans don’t trust contact tracing apps. Here’s how we can fix that

from Fortune https://ift.tt/3ln0PSD

0 notes

Text

Can JPMorgan Chase (JPM) Survive the Banking Crisis?

Most people think America faces a banking crisis that could bring down the entire economy. Consequently, some investors are dumping bank stocks such as JPM. People fear a banking crisis because of the Silicon Valley Bank collapse. For example, analysts estimate consumers spent less in the weeks after the Silicon Valley Bank debacle went viral. In particular, March 2023 new business loans fell to…

View On WordPress

#A Safe Dividend Stock#Are Monster Banks Immune to the Banking Crisis?#Can JPMorgan Chase (JPM) Survive the Banking Crisis?#How Chase Profits from Social Security#How Much Debt is Chase (JPM) Accumulating?#How Much Money is JPMorgan (JPM) making?#How the FDIC adds Value to Chase#JPMorgan Chase (JPM)#JPMorgan Chase & Co (NYSE: JPM)#The Value Case for JPMorgan Chase (JPM)#What Value Does JPMorgan Chase (JPM) offer?

0 notes

Text

Goldman Sachs StableCoin Cryptocurrency May Become A Reality Soon

Goldman Sachs Stablecoin Cryptocurrency is the talk of the town! One of the biggest investment banking firms in the world, Goldman Sachs, may venture into launching its own cryptocurrency in the form of a stable coin pegged to the US dollar. Stable coins have the benefit of maintaining its stability of value, and at the same uses blockchain to increase decentralization, efficiency, transparency and trust.

Stablecoin functions as a store of value with low volatility in comparison with mainstream cryptocurrencies such as Bitcoin and Ethereum. In essence, it is not a “Stablecoin vs Bitcoin” or “Stablecoin vs Cryptocurrency” situation. Stablecoin is helping stabilize the volatility of cryptocurrencies. Stable coin will also be used heavily by businesses, for faster and cheaper transaction settlements, once the regulation becomes clear.

Goldman Sachs follows JP Morgan’s lead in developing its own stable coin for cross border transactions on a distributed network. JP Morgan last year introduced JPM Coin, a crypto stablecoin token, on the Quorum blockchain, a private fork of Ethereum. It can be utilised make instantaneous transfers between global companies as buyers and sellers.

To develop the currency, the firm has hired Mathew McDermott as the worldwide head of digital assets. He has extensive experience in the financial industry. Before we jump into details, let’s quickly see what a stablecoin is for newbies.

What is Stablecoin?

Stablecoins are cryptocurrencies designed to minimize the volatility of the price of the stablecoin, relative to some “stable” asset or basket of assets. A stablecoin can be pegged to a cryptocurrency, fiat money, or to exchange-traded commodities

Stablecoins have gained traction as they attempt to offer the best of both worlds. They offer instant processing and security, privacy of payments of cryptocurrencies, and the volatility-free stable valuations of fiat currencies.

Executive At Goldman Sachs With Pro Blockchain View

The large American multinational bank Goldman Sachs has appointed a pro-blockchain head of its digital asset department – Mathew McDermott. In a recent interview with CNBC, McDermott expressed his company’s deep interest in the technology told that digital assets would serve as the backbone of the financial industry in the coming years.

There’s a lot of legacy processes in the vast movement of collateral that makes them very cost inefficient, so by leveraging distributed ledger technology, you can standardize processes to manage collateral across the system, and you have a much more efficient settlement process given the real time settlement.

McDermott views the global financial scene should be digitized. He even hints that Goldman is exploring the possibility of launching its own stable coin. He expresses his optimism in building a digital financial economy, running primarily on blockchain.

“In the next five to ten years, you could see a financial system where all assets and liabilities are native to a blockchain, with all transactions natively happening on-chain. So what you are doing today in the physical world, you just do digitally, creating huge efficiencies. All that can be debt issuances, securitization, loan origination; essentially, you will have a digital financial markets ecosystem, the options are pretty vast.”

He adds that many current legacy processes in traditional finance world are slow and cost-inefficient. By leveraging distributed ledger technology, companies can standardize processes to manage collateral across the system and have faster real time gross settlement.

Goldman Sachs Stablecoin Soon?

Upon his appointment, McDermott has reportedly brought in the head of digital assets strategy from JPMorgan Chase – Oli Harris. Harris has been instrumental in launching the first digital coin by a major bank – JPM Coin.

Consequently, this has raised speculations whether Goldman is examining a similar path of creating their own stablecoin. McDermott confirms,

We are exploring the commercial viability of creating our own fiat digital token. It’s early days as we continue to work through the potential use cases. We have definitely seen an uptick in interest across some of our institutional clients who are exploring how they can participate in the space.

As a result, the cryptocurrency field is experiencing a resurgence of interest, from retail and institutional investors. Goldman Sachs Stablecoin is the boost that institutional investors need to get a confidence and consider allocating a portion of their portfolio.

Crypto Community’s Shaky Trust In Goldman Sachs

Goldman Sachs, with its NYC headquarters, did not have this much interest towards the cryptocurrency industry until now. In fact, just recently in a recent conference call, headlined US Economic Outlook & Implications of Current Policies for Inflation, Gold, and Bitcoin, the investment bank does not consider cryptocurrency as an asset class.

However, Goldman may be more supportive of digital economies and digital currencies. McDermott could be the one driving the change, at least judging by the developments around the bank’s digital assets department.

In conclusion, Goldman Sachs experiences FOMO into Cryptocurrencies suddenly and wants to have a piece of the pie.

The post Goldman Sachs StableCoin Cryptocurrency May Become A Reality Soon appeared first on Crypto and FIRE.

from WordPress https://ift.tt/31HPIdI via IFTTT

0 notes

Text

Bitcoin (BTC), Facebook, JPM Coin, the Cincinatti Time Store And The Payments Revolution

New Post has been published on http://bitcoingape.com/bitcoin-btc-facebook-jpm-coin-the-cincinatti-time-store-and-the-payments-revolution/

Bitcoin (BTC), Facebook, JPM Coin, the Cincinatti Time Store And The Payments Revolution

Bitcoin, Facebook Coin and JPM Coin could together usher in a crypto default for value transfer. And to help see why, there is a crypto adoption lesson from America’s utopian past.

Be it the internet of value trumpeted by Ripple or the peer-to-peer electronic cash of Satoshi Nakamoto’s bitcoin whitepaper, the premise that underlies crypto valuation assumptions is the notion that money will in time be brought into the digital age.

Just as Netflix makes watching what you want when you want possible in a way that the analogue TV networks couldn’t, or the iPod and then Spotify began to deliver similar instant gratification in the realm of music, so too will money get the consumer-first digital makeover.

The last week of February 2019 may in retrospect signal a pivotal moment in the history of, and revolution in, payments

The commodification of payments

It was the week in which a report by MoffettNathanson analyst Lisa Ellis predicted the possible commoditisation of current private payment systems as a direct result of inroads by crypto.

She didn’t mention, judging by the reports on her client note, the giant step towards this when Facebook’s coin launches in the next four months, assuming this week’s report in the New York Times is accurate.

As seems fairly certain, Facebook will turn on a crypto-based payments system for WhatsApp, and no doubt, in time, for its other properties. When it does the future that Ellis dwells upon as an “existential threat” to payment incumbents such as Visa, Mastercard and PayPal, determining that it “is unlikely to occur soon”, may in fact be much closer than she expects.

We don’t know exactly how Facebook’s coin will work but it seems likely it will be a stablecoin and perhaps using a delegated proof-of-stake consensus system, or it could go down the sharding road that Telegram is using in its Telegram Open Network (TON) protocol.

Facebook’s and other future distributed ledger systems may not be on blockchain at all.

They could use so-called post-blockchain approaches, such as hashgraph in which virtual voting establishes consensus; direct acyclic graph where a previous transaction validates a succeeding one; or Holochain-esque decentralised edge architecture, where nodes have their own chains and even unique consensus systems as well

Whichever direction Facebook goes in is of course dependent only partly on what is most convenient for the consumer and probably mostly on what is most profitable in the long run for the company. For the phrase “profitable in the long run” we might supplant with the word “controllable”.

Two Facebook coins to rule them all?

Facebook will be acutely aware of the danger of creating a system that competitors will be able to piggy back on, although if it is, as reported, looking at listing its cryptoasset on exchanges then perhaps it wants to see its stablecoin used beyond its ecosystem so that it can suck into its gravitational field the rest of the cryptoasset economy.

Or maybe it will create a free-floating coin alongside its putative stablecoin; one that will reward content creators or perhaps with a portion of supply given to its customers for a utility function in a new blockchain-based Facebook Connect ID verification system?

Although some might in the distant past have been fooled by Facebook’s supposed mission to do good in the world, or for that matter Google’s mission to forestall evil, that’s all for the birds. A payments system built by Facebook will necessarily limit the extent to which it is decentralised. However, if it is too centralised it would defeat the purpose of putting in place a decentralised architecture in the first place. So perhaps we should expect some sort of halfway house from Facebook.

However, although not the intention of whatever system emerges from Facebook, it could in fact come to be a necessary staging post on the road to “free money” by introducing the masses to crypto, an introduction from which there will be no turning back.

Bitcoin – commoditisation’s reserve currency

But where does bitcoin fit in? Well that’s where Ellis’s commoditisation thesis comes in.

Ellis thinks it is much less likely that the payment incumbents will be disintermediated. Instead she expects commoditisation but if those incumbents incorporate blockchain tech then they can protect and advance their positions (she has a buy recommendation on Visa, Mastercard and PayPal).

“Cryptocurrency systems (e.g., Bitcoin, Ethereum, Ripple) are potentially disruptive to private payment systems. Their core design characteristics – which are aimed at enabling ‘freedom of money’ – are in direct contrast to the characteristics of most traditional, private payment systems,” says Ellis, but how can we expect that to play out?

Commodification of payments means the feature differences between the offerings in the marketplace vanish, with competition reduced to price alone. Payments commodification in the age of crypto implies the reduction of all service providers to delivering over the cheapest and most efficient protocol.

Company-centric coins repeat Web 1.0 mistakes?

In a world that’s coming rapidly into view, where we could have a jumble of private money forms – from Facebook to JPM Coin, from BTC to XRP, from retail to wholesale, which one is likely to be the most useful and therefore most widespread?

It will surely be the one that has staked out the ground in such a way that it can speak to all others, not the one trying to define its own universe.

In a way, we’ve been here before. At the beginnings of the internet in the 1980s we had walled-garden worlds, courtesy of the likes of Compuserve and AOL , in which each tried to fashion its own corner of the internet that users had to pay to play in, but as there was nothing else useable around for the layperson it sort of worked for a bit (no pun intended).

But then came the Netscape web browser to make sense of the protocols of the public internet so that mere mortals were not required to know what transmission control protocol, internet protocol and hypertext transfer protocol meant or did.

Compuserve and the rest became redundant.

Returning to the world of value transmission, it is today possible to imagine an online universe where the interfacing between Facebook Coin, JPM Coin, TON, Amazon Coin (yes, Bezos might want to keep his value transfer options open) etc is not a void made passable only by fiat entries and exits, but by the internet of value’s ultimate reserve currency, bitcoin.

That doesn’t mean that fiat and its payment rails, including steps towards the non-crypto “omnichannel” combining offline point-of-sale and online, as PayPal is trying to do, will disappear, primarily because nation states and will not disappear.

Payments arms race is upon us