#Wage Garnishment Attorney

Explore tagged Tumblr posts

Text

Garnish Wages Attorney: Expert Legal Defense Against Wage Garnishment and Financial Relief

A wage garnishment is stressful and affects an individual’s financial balance and quality of life. Whether it is debt, tax, or child support arrears, having a guaranteed attorney to stop a wage garnishment may make the difference between getting back finances under control and facing a lifetime battle of being unable to get ahead. Understanding legal knowledge about your rights will be key, and professional legal service is often best to finally end wage garnishments effectively.

Protecting Your Income: How an Attorney to Stop Wage Garnishment Assists

When facing wage garnishment, a knowledgeable attorney is invaluable. With an understanding of federal and state laws, they can help file the necessary legal motions, negotiate settlements, or even file for bankruptcy if needed to stop garnishment. Hiring an attorney to stop wage garnishment can also prevent creditors from taking excessive amounts, ensuring that only fair amounts are deducted from your income.

5 Ways an Income Tax Audit Attorney Can Help You Stop Wage Garnishment

If you’re struggling financially, wage garnishment can make it even harder to manage. Fortunately, an income tax audit attorney can help you navigate this difficult process and, in some cases, stop garnishment. Here are five ways a lawyer can assist:

Challenge the Garnishment In certain cases, it may be possible to contest the garnishment order. For example, if the debt isn’t yours or the garnishment amount is incorrect, a lawyer can represent you in court to contest the order. However, if the order is valid, it cannot be challenged based on financial hardship alone.

Reduce the Withholding Amount Both federal and state laws limit how much can be taken from your wages. If the garnishment exceeds these limits, an attorney can advocate to reduce the amount withheld. Although this won’t stop garnishment, it can help reduce the financial strain.

Request an Exemption Certain income sources, like Social Security, disability, retirement funds, alimony, and child support, are exempt from garnishment. If your income qualifies, an attorney can request an exemption to protect your wages. Additionally, if other garnishments are already in place, you may qualify for a reduction.

Negotiate with Creditors Attorneys can work with creditors to negotiate alternative solutions, such as a payment plan or a one-time lump-sum settlement, that may prevent garnishment. Keep in mind, though, that creditors are not required to negotiate, so results may vary.

File for Bankruptcy Filing for bankruptcy can immediately halt wage garnishment. Although bankruptcy has serious financial implications, an attorney can help you determine if it’s the best course of action for you and guide you through the process if you decide to proceed.

An income tax audit attorney provides legal expertise and guidance, ensuring you understand all your options and make the best choice for your financial well-being.

Seeking Relief with a Garnish Wages Attorney

When facing multiple wage garnishments or a significant financial burden, a garnish wages attorney can offer guidance on legal remedies, including debt consolidation, settlement agreements, or filing for bankruptcy if necessary. They will review your unique situation and determine the best course of action to stop garnishments, protecting your assets and income.

Why This Is a Premier Choice:

An efficient garnish wages attorney will not only temporarily reduce the pain but also help guide a long-term plan for recovery. That is because the attorney will assist the client to return on their feet by helping them gain back financial stability and to avoid future legal consequences of failing to comply with garnishment orders.

Specialized Support with IRS Wage Garnishment Attorneys

IRS wage garnishment attorneys are specialized professionals trained to address garnishments imposed by the IRS due to unpaid taxes. The IRS has broad authority to garnish wages for tax collection, often without the same restrictions as other creditors. These attorneys negotiate directly with the IRS, often obtaining more favorable terms through installment plans, offer-in-compromise arrangements, or even halting garnishment during appeals.

Benefits of Hiring an IRS Wage Garnishment Attorney:

Expert IRS Negotiation: Skilled at reducing total tax liabilities.

Long-Term Solutions: Prevent future garnishments through structured tax solutions.

Financial Relief: Immediate impact on monthly cash flow and budgeting.

Why a Wage Garnishment Attorney Is a Premier Choice

A decision to hire wage garnishment attorney is very prudent for individuals who are swamped with garnishments. An attorney can enlighten his clients on the rights, and can help fight improper or excessive garnishment. Eventually, an attorney will take action to limit such financial risks further from arising in future. A wage garnishment attorney truly cares about his client’s financial condition by diligently pursuing instantaneous and long-term relief from all garnishment orders.

Attorney to Fight Garnishment: How They Can Help Protect Your Earnings

A IRS wage garnishment attorneys plays a critical role in helping individuals who are facing wage or bank account garnishment. When creditors win a judgment against you, they can request the court to garnish your wages or bank accounts to satisfy the debt. By hiring an experienced attorney, you can potentially stop the garnishment or negotiate for a more favorable payment plan.

Lawyer to Stop Garnishment: Why Professional Legal Help is Essential

If you are looking for a lawyer to stop garnishment, it’s crucial to find someone who specializes in debt relief and consumer protection law. A lawyer can explore various legal options available to you, including filing for bankruptcy, challenging the garnishment on legal grounds, or negotiating a settlement with creditors.

Why Hiring an Attorney is the Premier Choice for Stopping Garnishment

Legal Expertise: Attorneys who specialize in garnishment cases have in-depth knowledge of federal and state laws regarding debt collection and garnishment procedures. They understand the complexities of the law and can find the most effective solution to stop garnishment.

Protection of Rights: A qualified lawyer ensures your rights are not violated during the garnishment process, offering legal representation to fight back against unfair or incorrect garnishments.

Negotiation Skills: Experienced attorneys have strong negotiation skills that can help you reach a settlement with creditors or propose alternative payment plans that are more manageable.

Peace of Mind: Hiring a lawyer to stop garnishment can give you peace of mind, knowing that you have a professional fighting for your financial well-being.

Benefits of Hiring a Lawyer to Fight Garnishment

Faster Resolution: Attorneys can expedite the process of stopping garnishment and help prevent further action from creditors.

Reduced Financial Burden: A lawyer can negotiate for a lower garnishment amount or help prevent a garnishment altogether, which can help restore financial stability.

Avoidance of Further Legal Issues: By hiring an attorney, you reduce the risk of making costly mistakes that could lead to additional legal problems or financial penalties.

Conclusion: One of the best things you can do if your wages or your bank account is being garnished is to hire an attorney to fight back against a garnishment or a lawyer to stop a garnishment from going forward. This will help you receive professional legal assistance in protecting your income while resolving debt issues and getting you on track with a clear financial plan. Remember, a garnishment is not a light matter, and to consult with an attorney can turn out to be the road to getting back your finances in control. Don’t wait; take action today to protect your rights and stop the fight against the garnishment.

0 notes

Text

A major factor in the decision to file bankruptcy for many people is overwhelming medical debt. Certainly, some people are left with enormous amounts of medical debt because they don’t have health insurance. If you are struggling with debt, contact us today at 636-245-0494.

#Foreclosure Attorneys#Foreclosure Lawyers#Chapter 7 Bankruptcy Attorney#Chapter 7 Bankruptcy Lawyer#Chapter 7 Bankruptcy Lawyers#Debt Relief Attorney#Debt Relief Attorneys#Debt Relief Lawyer#Foreclosure Lawyer#Repossession Attorneys#Wage Garnishment Attorney#Wage Garnishment Lawyer

0 notes

Text

A Towson, Maryland Wage Garnishment Attorney is a legal expert who specializes in helping individuals facing wage garnishment issues. If you're dealing with wage garnishment problems in Towson, Maryland, contact us at 410-505-0413.

#Wage Garnishment Attorney#Towson Wage Garnishment Attorney#Maryland Wage Garnishment Attorney#Towson bankruptcy law firm#bankruptcy attorneys in towson#towson bankruptcy lawyers

0 notes

Text

#chapter 7 bankruptcy attorney#debt relief attorney altamonte springs#bankruptcy law firm altamonte springs#bankruptcy lawyers#debt consolidation lawyer altamonte springs#foreclosure defense lawyer altamonte springs#stop wage garnishment lawyer altamonte springs#bankruptcy lawyer in altamonte springs#chapter 13 bankruptcy lawyer in altamonte springs#chapter 7 bankruptcy lawyer in altamonte springs

0 notes

Text

If you want to know about the Missouri homestead exemption, Schedule a free consultation with our experienced Kansas City Bankruptcy Attorney at (816) 330-2252.

#Chapter 7 Bankruptcy Attorneys#Kansas City Bankruptcy Attorney#Chapter 7 Bankruptcy Lawyers Kansas City#Kansas City Chapter 7 Bankruptcy Lawyers#Debt Relief Lawyer Kansas City#Bankruptcy Attorney In Kansas City#Chapter 13 Bankruptcy#Attorney In Kansas City#Chapter 13 Bankruptcy Lawyers Kansas City#Debt Relief Lawyers#Personal Bankruptcy Attorneys#Wage Garnishment Lawyers

0 notes

Text

It can be stressful if money is being taken from your paycheck because of debts, like taxes or child support. But knowing your rights is crucial. And our wage garnishment attorney can help you figure out if there are ways to stop or lessen the amount taken from your pay. That means you might get more of the money you worked hard for.

0 notes

Text

#bankruptcy law firm rockville md#rockville md bankruptcy attorneys#bankruptcy law firm in rockville md#rockville md bankruptcy law firm#bankruptcy law firm#chapter 11 bankruptcy lawyers rockville md#bankruptcy lawyers in rockville md#chapter 13 bankruptcy lawyers in rockville md#bankruptcy attorneys rockville md#rockville md chapter 11 bankruptcy attorney#Wage Garnishment Attorney in Rockville#Wage Garnishment Attorney in Maryland

0 notes

Text

#Bankruptcy Attorney#bankruptcy lawyer Wyandotte MI#bankruptcy attorney free consultation#bankruptcy attorneys in Wyandotte#Wyandotte bankruptcy attorneys#bankruptcy chapter 13 lawyer near me#free consultation bankruptcy attorney#Wage Garnishment in Bankruptcy#Wage Garnishment in Michigan

0 notes

Photo

Can I STOP my wage garnishment? YES. Bankruptcy has the potential to put a stop to wage garnishment in some situations. With many bankruptcy cases, an automatic stay will go into effect after filing the bankruptcy petition. The automatic stay is a court order that stops most creditors from continued debt collection activities—wage garnishment included. Source of Info: Bankrate

U.S. Chapter 7 Bankruptcy 200.00 | Excludes Court Filing Fee

Uncontested Documents 801 E. Douglas, 2nd Fl., Wichita https://www.uncontesteddocuments.com (316) 312-4748 | Call or Text Since 2011, Thank You Grateful To Be Of Service

#Wichita wage garnishment#kansas garnishment#bankruptcy wichita#bankruptcy attorney#bankruptcy lawyer#kansas garnishment help

0 notes

Text

Georgia Lawmakers To Rein In Aggressive Home Owners Associations After Hearing Homeowner Horror Stories – Atlanta Georgia reporting

You can be up to date on your mortgage, never missed a loan payment, and lose your home to foreclosure by your Homeowners Association.

▶︎ Each month Karyn Gibbons mailed a check for HOA dues on her Gwinnett County condo to the address provided in writing at closing. But she said she never knew when or if it would be cashed.

“It was just random. I mean there’d be two, three, four, five months go in between checks being cashed,” said Gibbons. Then out of the blue she was served with a notice of foreclosure by her Home Owners Association, with late fees and thousands of dollars in attorney fees.

She owed more than $30,000.

“Did you even know you could be foreclosed on by an HOA?” Gray asked Gibbons.

“No. Never heard of it,” Gibbons said.

▶︎ “It’s totally insane. It’s totally insane,” said Tricia Quigley, a former Cherokee County homeowner.

She learned it can happen the hard way.

When Quigley’s Cherokee County home of 18 years was sold at foreclosure on the courthouse steps for about the amount of spare change on her coffee table as Gray interviewed her.

“It went for $3.25,” Quigley said.

She admitted she did not pay two of her biannual homeowner association dues payments totaling $800.

She ended up paying more than $10,000 trying to get right with the HOA but the late fees and attorney fees kept growing.

“I kept thinking I paid all this money; how come it’s not stopping?” Quigley said.

A big reason is attorney costs.

Every email, every inquiry, every attempt to contest, fix, or even pay the overdue bill adds to the bill.

Channel 2 Action News checked foreclosure records and found that ▶︎ just two metro Atlanta law firms that specialize in representing HOAs have filed 279 notices seeking damage and foreclosure notices in just the past three years.

By the time Juliet Graham finally sold her downtown Atlanta condo her HOA bill had reached $250,000.

“You broke us. We’re broke,” Graham said.

“I can’t imagine the mafia having been any worse than what my experience was with this,” Graham said.

State Senator Donzella James, a Democrat who represents South Fulton County, introduced multiple bills this legislative session trying to reign in overly aggressive HOAs.

“People need to be protected and safeguarded against foreclosures,” said State Senator James.

“This is where I resodded the whole thing,” said James McAdoo, a homeowner in South Fulton County.

The only way he could stop his HOA from intercepting his paycheck was by filing for bankruptcy.

“They garnished my wages,” McAdoo said.

He owes $36,000 and counting predominantly because of weeds in his front yard.

They were garnishing $600 from his paycheck every two weeks until he started the bankruptcy process.

“What way do you see out of this?” Gray asked McAdoo.

“Selling my home and just getting out of this neighborhood,” McAdoo said.

That is what Karyn Gibbons did earlier this year even though she still does not believe she did anything wrong.

“I just said enough. I can’t do it anymore,” Gibbons said.

She paid $34,000 in fines, interest, and attorney fees to end the nightmare.

“I don’t know how it’s legal,” Gibbons said.

And it’s not just happening to homeowners. Gray also spoke with a couple who said just because they were renting a home, they were not safe from an HOA.

Jasmine Latson and Jaquan Hunter said their HOA in their South Fulton neighborhood came after them over the condition of their yard.

They ended up hiring a lawn service to take care of everything. But that wasn’t enough for the HOA.

“I was like, maybe it’s me. Maybe I’m not doing good enough, I don’t know. So I went ahead and just hired an outside resource that my neighbor used. He’s been pretty consistent and good, but the fines keep happening,” Latson said.

Last year, they received a foreclosure letter saying the home’s owners owed fines and fees of more than $23,000.

“Never, never in a million years would I have thought that I would have would be dealing with this. You know? I pay my rent every month,” Latson said.

First Key Homes, Latson, and Hunter’s landlord negotiated down the fines to about $12,000 to prevent foreclosure. But the company has now passed that bill onto the couple along with an eviction notice.

Latson has fired an attorney and has a court date set for Friday.

Now, these renters are hoping state lawmakers can do something about these aggressive HOAs.

▶︎ A bipartisan bill sponsored by state senator and Rules Committee Chair Matt Brass, a Republican representing Newnan, did pass at the Gold Dome this year to create a study committee examining how to change laws to better protect homeowners.

Brass told Gray the No. 1 topic on the study committee’s agenda will be HOA foreclosures that he said are taking families’ generational wealth.

“To have some outside group come and take that away from me is again, it’s un-American. And we’re not going to stand for it in this state,” Brass said.

Several states have put in place laws limiting HOA foreclosure.

5 notes

·

View notes

Text

Wage Garnishment Relief Guide: Protect Income, Regain Stability

Wage garnishment is a challenging financial situation in which a court orders your employer to withhold a portion of your earnings to repay a debt. In many cases, the IRS may enforce wage garnishment to collect on tax debts. Navigating the complexities of wage garnishment can be overwhelming, but it's important for taxpayers facing this issue to explore their options for relief and take action to protect their income and financial stability.

In this comprehensive guide, we will cover strategies for wage garnishment relief that can help you safeguard your income and work towards regaining control of your finances. We will discuss the reasons behind IRS wage garnishment, identify steps to take upon receiving a garnishment notice, and detail what options are available to negotiate for a more favorable repayment arrangement. By gaining a deeper understanding of wage garnishment relief strategies, you will be better equipped to tackle this challenging financial situation head-on and begin rebuilding a stronger financial future.

Understanding IRS Wage Garnishment: Reasons and Procedures

Wage garnishment by the Internal Revenue Service (IRS) happens when a taxpayer fails to resolve their outstanding tax debts, typically after multiple attempts by the IRS to collect the due amount through notices. The IRS follows a series of steps before initiating wage garnishment, ensuring that the taxpayer has ample notice and opportunity to address the issue. The process usually includes:

1. Assessment and Demand for Payment: The IRS assesses the tax debt and sends a demand for payment notice.

2. Final Notice of Intent to Levy: If the taxpayer ignores the initial notice or fails to arrange a payment plan, the IRS sends a final notice of intent to levy, providing the taxpayer with 30 days to respond.

3. Issuing Wage Garnishment: If no response or payment arrangement is made within 30 days, the IRS can issue a wage garnishment, notifying the employer of the requirement to withhold a portion of the employee's wages.

Steps to Take Upon Receiving a Wage Garnishment Notice

If you receive notice of an impending wage garnishment, it is essential to act quickly to address the situation and minimize its impact on your financial stability. Here are some crucial steps to take:

1. Review the Notice: Carefully read the wage garnishment notice to ensure its accuracy, checking for potential mistakes or discrepancies in the tax debt amount. Report any errors to the IRS promptly.

2. Consult with a Tax Professional: Seek the advice of a tax professional, such as an enrolled agent, CPA, or tax attorney, who specializes in wage garnishment and tax debt resolution. They can help you understand your options and develop a plan to address your tax debt.

3. Communicate with the IRS: Open a line of communication with the IRS to discuss your situation and negotiate payment arrangements or other solutions.

Exploring Tax Relief Options to Stop Wage Garnishment

Thankfully, several tax relief options can help stop wage garnishment and enable you to regain control of your finances. These options include:

1. Full Payment of the Tax Debt: If you can pay the outstanding tax debt in full, wage garnishment will stop. However, this option may not be feasible for taxpayers facing financial difficulties.

2. Installment Agreement: Negotiating an installment plan with the IRS allows you to repay your tax debt over time while stopping wage garnishment.

3. Offer in Compromise: An Offer in Compromise is an agreement between you and the IRS to settle your tax debt for less than the full amount owed, effectively stopping the wage garnishment.

4. Currently Not Collectible: If the IRS determines that your financial situation prevents you from paying your tax debt, they may place your account in a Currently Not Collectible status, temporarily stopping wage garnishment.

Hiring a Tax Professional to Help Resolve Wage Garnishment

Seeking the expertise of a tax professional can be invaluable in resolving wage garnishment and addressing tax debt. A qualified tax expert can offer several benefits, including:

1. Expert Representation: Tax professionals are equipped to represent you in dealings with the IRS, ensuring your rights are protected and helping negotiate favorable repayment arrangements.

2. Comprehensive Solutions: An experienced tax professional can help you explore all available options to address wage garnishment, leveraging their expertise and knowledge of the tax system.

3. Reduced Stress: Knowing that your wage garnishment case is being handled by a qualified expert can help alleviate the stress and anxiety associated with tax debt problems.

4. Financial Stability: By working with a tax professional to resolve your wage garnishment issue, you can take a proactive approach to regaining financial stability.

Prevention: Tips for Avoiding Wage Garnishment in the Future

To minimize the risk of future wage garnishment, consider implementing the following practices:

1. Timely Tax Filing and Payment: Ensure that you file your tax returns on time and pay any outstanding tax debts promptly to avoid accruing penalties and interest.

2. Communication with the IRS: If you're unable to pay your tax debt, communicate with the IRS to discuss potential payment plans or other relief options.

3. Periodic Tax Review: Regularly review your tax situation to ensure compliance and identify potential problems early on.

4. Seek Professional Tax Advice: Utilize the services of a tax professional to stay informed about tax laws, deductions, and credits, keeping your financial situation in check.

By being proactive and addressing potential tax issues before they escalate, you can avoid wage garnishment and maintain control over your financial stability.

Regain Control of Your Income with Advance Tax Relief LLC

Understanding your options and taking swift action is crucial when facing wage garnishment due to tax debt. By seeking the guidance of a reputable tax professional and exploring available tax relief options, you can protect your income and work towards regaining financial stability.

Advance Tax Relief LLC is a trusted tax resolution company dedicated to helping individuals and businesses overcome their tax challenges. With our team of experienced tax professionals, we offer personalized solutions tailored to your unique situation, ensuring your best interest is always at the forefront.

Don't let wage garnishment control your financial future. Contact Advance Tax Relief LLC today for a free confidential consultation and discover how our expert team can help you with wage garnishment release, resolve your tax debt, and reclaim your financial stability. Visit our website to take the first step towards a brighter financial future.

3 notes

·

View notes

Text

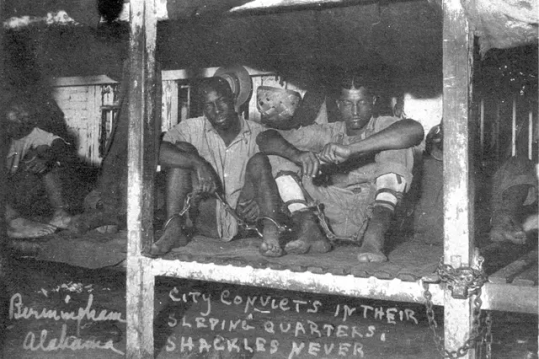

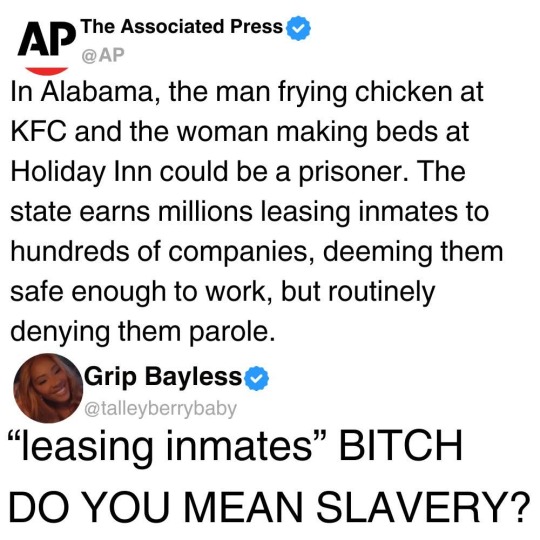

Pulling information from this article to highlight because this is unconscionable and deserves more attention (all emphasis mine).

"Many choose work to being confined to a facility all day,” Betts [ of the corrections department ] said. “In many cases, it is a matter of quality of life. But ultimately, the inmate chooses and is not penalized for non-participation.”

No state has a longer, more profit-driven history of contracting prisoners out to private companies than Alabama.

Best Western, Bama Budweiser and Burger King are among the more than 500 businesses to lease incarcerated workers from one of the most violent, overcrowded and unruly prison systems in the U.S. in the past five years alone

The cheap, reliable labor force has generated more than $250 million for the state since 2000 through money garnished from prisoners’ paychecks.

Most jobs are inside facilities, where the state’s inmates — who are disproportionately Black — can be sentenced to hard labor and forced to work for free doing everything from mopping floors to laundry.

[Iᴍᴀɢᴇ ᴀᴅᴅᴇᴅ ʙʏ ᴍᴇ]

In Alabama, for instance, those shifts can offer a reprieve from the excessive violence inside the state’s institutions. Last year, and in the first six months of 2024, an Alabama inmate died behind bars nearly every day, a rate five times the national average.

Turning down work can jeopardize chances of early release in a state that last year granted parole to only 8% of eligible prisoners — an all-time low, and among the worst rates nationwide — though that number more than doubled this year after public outcry.

[ɪᴍᴀɢᴇ ᴀᴅᴅᴇᴅ ʙʏ ᴍᴇ]

Prisoners nationwide cannot organize, protest or strike for better conditions. They also aren’t typically classified as employees whether they’re working inside [or outside] [...] And unless they are able to prove “willful negligence,” it is almost impossible to successfully sue when incarcerated workers are hurt or killed.

[Iᴍᴀɢᴇ ᴀᴅᴅᴇᴅ ʙʏ ᴍᴇ]

[...]Gov. Kay Ivey signed an executive order last year giving the corrections department the authority to revoke good-time credits — days shaved off sentences rewarding model behavior — for “refusing to work"

[Iᴍᴀɢᴇ ᴀᴅᴅᴇᴅ ʙʏ ᴍᴇ]

[...] For the hundreds of private companies [...] the benefits are robust. Businesses pay at least minimum wage, but can earn up to $2,400 in tax credits for some inmates hired. Amid crushing staff shortages, they can rely on a steady, pliable workforce available to take extra shifts, fill in at the last minute when civilian workers call in sick and also work holidays. And if an incarcerated worker is injured or even killed on the job, the company may not be liable.

[Iᴍᴀɢᴇ ᴀᴅᴅᴇᴅ ʙʏ ᴍᴇ]

Alabama collected more than $13 million in work release fees in fiscal year 2024. But the prisoner lawsuit filed in federal court late last year with backing from the powerful AFL-CIO federation of unions, estimates the corrections department actually rakes in about $450 million in benefits from prison labor annually. That takes into consideration money saved by not having to hire civilians to maintain the sprawling prison system or work for government agencies.

Alabama’s attorney general’s office did not respond to a request for comment. But in successfully moving for dismissal of a similar state lawsuit filed by inmates last year, it said “slavery and involuntary servitude do not exist in the state’s prison system.”

That was true of Braxton Moon, his mother said. He told her how terrified he was by how dangerously close cars whizzed past him, even as he held a sign warning drivers to slow down.

Angela Lindsey pleaded with her son to quit — he was making only $2 a day. But he told her that working beat being locked up around the clock.

Two weeks later, in August 2015, Lindsey received a phone call from her cousin asking: “‘Is it true?’”

She frantically called the center over and over, only to be hung up on each time. “All of this was before I even got anything — anything — from the state,” she said. “It was on social media. It was on the news.”

And then it was confirmed: Her son had been struck by a tractor-trailer in a hit and run along the side of Interstate 65.

He had died instantly. He was just 21.

#prison labor#prison slavery#13th amendment#modern day slavery#alabama prisons#kay ivey#us politics#alabama department of corrections#long post#id later#racism#antiblackness#systemic racism

50K notes

·

View notes

Text

In Chapter 13 bankruptcy, you and your lawyer must establish your debt restructuring eligibility to a bankruptcy trustee. You’ll seek court approval for a repayment plan for both unsecured and secured debts. If you are struggling with debt, contact us today at 636-245-0494.

#Wage Garnishment Lawyers#Wage Garnishment Lawyer#Wage Garnishment Attorneys#Wage Garnishment Attorney#Repossession Lawyers#Repossession Attorneys#Foreclosure Attorney#Debt Relief Lawyer#Debt Relief Attorney#Chapter 13 Bankruptcy Attorney#Chapter 7 Bankruptcy Lawyer

0 notes

Text

#towson bankruptcy attorney#towson bankruptcy attorneys#towson chapter 7 bankruptcy attorneys#towson business bankruptcy lawyers#bankruptcy attorneys in towson#bankruptcy attorneys towson maryland#towson chapter 13 bankruptcy lawyers#Wage Garnishment Lawyer in Maryland?#Wage Garnishment Attorney in Towson#Maryland

0 notes

Text

Will I lose My Social Security If I file Bankruptcy?Discover whether filing for bankruptcy affects your Social Security benefits in this informative post from Fresh Start Law. Learn about the protections in place for your benefits and how bankruptcy laws apply to different types of Social Security income. If you need a Bankruptcy attorney contact us today at 877-595-0942.

#Stop Wage Garnishment Lawyer Altamonte Springs#Debt Relief Attorney Altamonte Springs#Debt Consolidation Lawyer Altamonte Springs#Chapter 7 Bankruptcy Attorney#Bankruptcy Lawyers#Foreclosure Defense Lawyer Altamonte Springs

0 notes

Text

Learn how to file for bankruptcy without involving your spouse. Expert guidance with our experienced Kansas City bankruptcy attorney.

#Chapter 7 Bankruptcy Attorneys#Kansas City Bankruptcy Attorney#Chapter 7 Bankruptcy Lawyers Kansas City#Kansas City Chapter 7 Bankruptcy Lawyers#Debt Relief Lawyer Kansas City#Bankruptcy Attorney In Kansas City#Chapter 13 Bankruptcy#Attorney In Kansas City#Chapter 13 Bankruptcy Lawyers Kansas City#Debt Relief Lawyers#Personal Bankruptcy Attorneys#Wage Garnishment Lawyers

0 notes