#Viva Money

Explore tagged Tumblr posts

Text

Viva Money Successfully Launched in Maharashtra, After Gujarat & Karnataka

We are delighted to announce the launch of Viva Money in Maharashtra, a pivotal step towards enhancing financial accessibility across the state. Whether you are an entrepreneur striving for growth or a consumer seeking seamless banking solutions, Viva Money is set to redefine your financial journey.

Viva Money is at the forefront of fintech, committed to democratizing financial services for all segments of society. With a comprehensive range of services including microloans, digital wallets, and streamlined payment solutions, Viva Money empowers individuals and businesses traditionally underserved by conventional banking systems.

Maharashtra, as India’s economic powerhouse, presents a strategic entry point for Viva Money’s transformative services. Despite its economic prominence, significant segments of the state still face barriers to financial inclusion. Viva Money’s presence aims to bridge this gap, ensuring that every resident can access essential financial tools with ease and efficiency. Viva is bringing instant personal loans in Maharashtra and in Mumbai.

Key Features Driving Change:

• Microloans for Growth: Designed to fuel entrepreneurial aspirations and alleviate financial constraints, Viva Money offers microloans with flexible terms and swift approvals, empowering local businesses to thrive.

• Efficient Digital Wallets: Simplifying everyday transactions, Viva Money’s digital wallet facilitates secure money storage and seamless payments, ideal for navigating Maharashtra’s dynamic economic landscape.

• Seamless Payment Solutions: From utility payments to peer-to-peer transfers, Viva Money streamlines financial transactions through intuitive interfaces and robust security protocols, ensuring reliability at every step.

• User-Friendly Experience: With a focus on user-centric design, Viva Money’s mobile app is crafted to be intuitive and accessible, making financial management straightforward for individuals across diverse demographics.

By enhancing financial access, Viva Money catalyzes economic growth within Maharashtra. Microloans empower small businesses to expand operations and create employment opportunities, while digital transactions enable efficiency and transparency in financial interactions across the state. It’ll get easier for people to take home loans or personal loans in Maharashtra or its capital, Mumbai.

The launch of Viva Money in Maharashtra marks the beginning of an expansive journey towards nationwide financial inclusion. With a commitment to innovation and customer-centricity, Viva Money is poised to set new benchmarks in India’s fintech landscape, creating sustainable value and fostering economic resilience.

As Maharashtra embraces Viva Money’s transformative solutions, a future of enhanced financial freedom and prosperity beckons. Together, we embark on a journey where technology meets societal impact, empowering individuals and businesses to realize their full potential in a rapidly evolving digital economy. Join us as we redefine financial inclusion, one transaction at a time

0 notes

Text

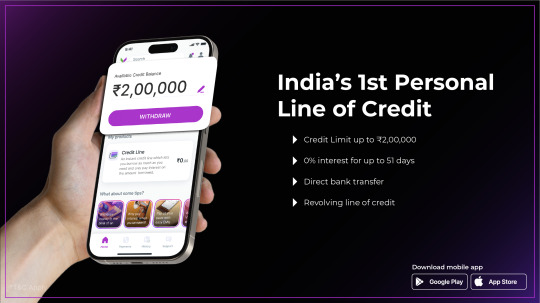

VIVA Money Celebrates Milestone: Serving Over 600 Customers with Approved Credit Lines

We at VIVA Money proudly announce a significant milestone: serving over 600 customers with approved credit lines to date. This achievement highlights the platform's unwavering dedication to empowering individuals with accessible and flexible financial solutions.

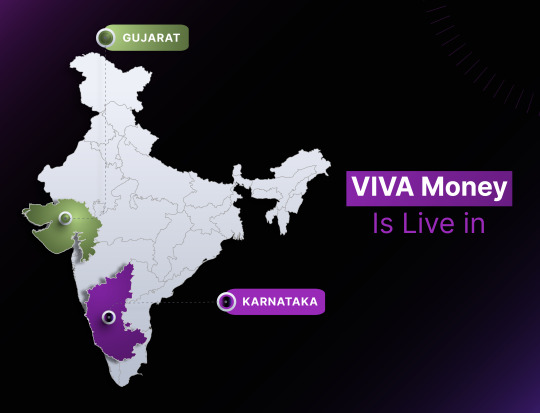

As VIVA Money commemorates the success of its first credit line pilot phase, launched on December 20th in Gujarat and Karnataka, the platform's impact in the digital lending landscape becomes even more apparent. With approved credit limits and swift disbursals, VIVA Money continues to redefine the borrowing experience for its diverse user base.

Innovative features such as interest-free credit lines and revolving credit options have resonated strongly with customers, enabling them to navigate their financial needs with greater ease and confidence. By offering credit line limits ranging from ₹5,000 to ₹2,00,000, VIVA Money ensures that individuals have the flexibility to borrow according to their unique requirements.

George Donchenko, Managing Director of VIVA Money, expressed his delight at the platform's latest achievement. He commented, "We are thrilled to have served over 600 customers with approved credit lines, marking a significant milestone in our Pilot. At VIVA Money, our mission is to empower individuals with seamless and accessible financial solutions. As we continue to expand our reach and enhance our offerings, we are remain steadfast in our committed to delivering exceptional service and value to our customers."

As VIVA Money looks ahead to the future, the platform remains dedicated to driving positive change in the digital lending space. With a focus on innovation, customer satisfaction, and financial empowerment, VIVA Money is poised to build on its success and redefine the standards of excellence in the industry.

1 note

·

View note

Text

New Trolls Fun Fair clip, that I could only check out now.

THEY MAKE ME INSANE, I'm not even kidding!

Of couse the animation is kinda off, I'm gonna be honest its giving Remix Rescue. But considering the budget probably consists of a pastel and sugarcane juice I'm not judging.

THEY LOOK SO CUTE, I LOVE WHEN THEY GIVE NEW CLOTHES TO CHARACTERS (I'm a sucker for wardrobe expansion).

#I NEED TO RIP THEM APART/Affectionate#BRANCH AND VIVA AND POPPY#MY LOVELS#I cant contain myself people I need to destroy everything in my way#they finally had the money to give Branch new shorts and it ended the budget#don't mind me I love them#paaelle random yapping#trolls#trolls band together#trolls viva#trolls poppy#trolls branch#trolls fun fair surprise

509 notes

·

View notes

Text

tangled au refs 2: big sister and the guy she'd rip to shreds

#trolls#trolls au#trolls viva#trolls creek#trolls tangled au#sketch's sketches#i can't stop thinking abt branch and poppy arriving at the tavern and viva's like ''woah girl ur giving me a run for my money!'' to branch#bc long hair. and branch is both ??? and having an egg crack moment#branch gets called girl for the first time and has a lot of feelings about it askjdhajkhkjd#anyways i fucking hate creek im gonna put him in a blender#dreamworks trolls#sketch's critter trolls

123 notes

·

View notes

Text

Yesterday was Ibrahim’s 20th birthday. Donations have stalled and he’s only had 4 donations in the past few days. Please match my donation of 20$ to give this young man a present in his time of need.

https://www.gofundme.com/f/help-ibrahim-and-his-leave-gaza-and-complete-their-dreams?viewupdates=1&rcid=r01-172474968272-e32a4c66645311ef&utm_medium=email&utm_source=customer&utm_campaign=p_email%2B1137-update-supporters-v5b

Tagging for reach: @90-ghost @stuckinapril @gaza-evacuation-funds @nabuls @sar-soor @sayruq @queerstudiesnatural @appsa @communistchilchuck @fairuzfan @neptunerings @just-browsing1222 @appsa @akajustmerry @feluka @marnota @annoyingloudmicrowavecultist @tortiefrancis @flower-tea-fairies @tsaricides @riding-with-the-wild-hunt @vivisection-gf @belleandsaintsebastian @ear-motif @animentality @kordeliiius @brutaliakhoa @raelyn-dreams @troythecatfish @violetlyra @the-bastard-king @tamaytka @4ft10tvlandfangirl @northgazaupdates @skatehan @awetistic-things @nightowlssleep @baby-girl-aaron-dessner @friendshapedplant @mangocheesecakes @commissions4aid-international

#palestine#money for good#things i’ve said#important#free Gaza#free palestine#mmd#from the river to the sea palestine will be free#viva palestina

20 notes

·

View notes

Text

Day One of Pressing Shuffle On My Spotify Playlist And Seeing What Character(s) Or Ship(s) That Songs Remind Me Of | Multi-Fandom

Song One: Money, Money, Money (by ABBA) — Kaz Brekker from Leigh Bardugo’s Six of Crows series.

Song Two: Viva la Vida (by Coldplay) — The Pevensie siblings from C. S. Lewis‘s Chronicles of Narnia.

Song Three: Dirty Imbecile (by The Happy Fits) — Tim Drake (the third Robin/Red Robin) from DC Comics.

Song Four: Little Talks (by Of Monsters and Men) — Finnick and Annie, or Odesta, from Susan Collins’ The Hunger Games trilogy.

Song Five: Hooked (by Why Don’t We) — Rowena and Waysa, or Rowaysa, from Robert Beatty’s Serafina Series.

Song Six: Marry You (by Bruno Mars) — Callum Hunt and Aaron Stewart, or Calron, from Cassandra Clare and Holly Black’s Magisterium series.

Song Seven: Perfect (by Ed Sheeran) — Braeden Vanderbilt and Serafina, or Braedafina/Serafaeden, from Robert Beatty’s Serafina Series.

Song Eight: Everything Moves (by Bronze Radio Return) — Elliot Cardale, or Eli Ever, from V. E. Schwab’s Villains series.

Song Nine: Kiss Me (from Sweeny Todd: the Demon Barber of Fleet Street) — Malcolm Fade and Annabel Blackthorn, or Malcabel, from Cassandra Clare’s Shadowhunter Chronicles.

Song Ten: The Ghost (by NIVIRO) — Callum Hunt from Cassandra Clare and Holly Black’s Magisterium series.

#this is going to be a pain to tag#here goes nothing#six of crows duology#kaz dirtyhands brekker#money money money#abba#the pevensies#peter pevensie#susan pevensie#edmund pevensie#lucy pevensie#viva la vida#coldplay#chronicles of narnia#tim drake#dc comics#dirty imbecile#the happy fits#the hunger games#finnick odair#annie cresta#odesta#little talks#of monsters and men#the serafina series#hooked#perfect#why don’t we#ed sheeran#serafina

17 notes

·

View notes

Text

why am I just now finding out that dico used to smoke???

#was I just blind this whole time? probably#cky vids are Not helping me stay off substances#cigarettes I miss you so much you were my first love but I do not have the money to support an addiction#z rambles#dico#brandon dicamillo#cky#viva la bam

4 notes

·

View notes

Text

Hello one and all.

I am Armand, if you did not know and I returned from my trip to Las Vegas two nights ago. The nights have been pouring on so incredibly fast since returning. Vegas beats every neuron in my small mind to death and upon leaving, I’m so entirely burnt. I can’t stop thinking morbid thoughts and drowning myself in my phone.

But this is all in a good way. It was fun. We met Sybelle there, at the airport and she stayed the entire two weeks with us three.

I still don’t have the energy to write about it now, but I wanted to say it was more satisfying than my trips to Vegas with Daniel in the 80s. Though much more expensive, and much cleaner and there were children! My lord, save these children! Hahaha! Maybe this is a sign of the age we’re in, but Daniel was morbidly describing a past horrible time he was having with cocaine “Right here! Right where you’re standing!” to Benji and a topless nun, on Fremont street, and right behind me someone’s toddler walked by! A fun time for all!

I’m still shaking my head in disbelief at the daycare center that has become Las Vegas.

Omega Mart was fun. The Grand Pool Complex was amazing. And I don’t think Benji and Sybelle were expecting to see Daniel and I so feral.

Anyway.

Ciao again, friends.

-A.

#also Daniel won a ton of money#the vampire armand#the vampire chronicles#interview with the vampire#iwtv#queen of the damned#daniel molloy#journal entry#tvc#las Vegas#viva Las Vegas

7 notes

·

View notes

Text

Viva Money Launches in Maharashtra, Bringing Forth a New Era of Financial Inclusions

In an exciting development this May, Viva Money launched in Maharashtra, promising to revolutionize the financial landscape of the state. This innovative digital platform is designed to make financial services like instant personal loans more accessible, secure, and personalized for everyone, from urban professionals to rural communities.

Seamless Access to Financial Services:

Gone are the days when banking meant long queues and endless paperwork. Here comes instant personal loan aps to your rescue. Viva Money being among one of these instant personal loan apps brings the bank to your fingertips with its user-friendly mobile app. Whether you need to open an account, transfer funds, or pay bills, Viva Money makes it simple and quick. This ease of access is a game-changer, especially for those in remote areas with limited banking infrastructure. You don’t need to look further to get instant personal loans in Mumbai or any other cities of Maharashtra.

Empowering Users with Financial Literacy:

Financial literacy is the cornerstone of financial independence, and Viva Money is committed to educating its users. The platform offers a plethora of resources, including tutorials, articles, and interactive tools, to help users understand budgeting, saving, and investing. This educational focus ensures that users are not just managing their money but doing so wisely.

Customized Solutions for Diverse Needs:

Understanding that financial needs vary, Viva Money offers a range of tailored services. Small business owners can find financial solutions that support their growth, while students can access education loans and savings plans designed specifically for them. This personalized approach ensures that Viva Money caters to the unique financial needs of every user.

Ensuring Top-Notch Security:

In the digital age, security is paramount. Viva Money employs advanced encryption technologies and rigorous security protocols to safeguard user data. With partnerships with leading financial institutions, Viva Money guarantees a secure and reliable financial experience, giving users peace of mind.

Driving Economic Growth:

While looking or personal loans in Mumbai or other cities, people often look for loan agency in Mumbai which have aggressive interest rates but with Viva Money's launch it will act as a catalyst for Maharashtra’s economic growth by facilitating easier access to credit, encouraging savings, and promoting financial literacy, Viva Money is set to boost economic activity across Maharashtra. This initiative can drive entrepreneurship, create jobs, and foster overall economic development in the region.

Fostering Community Engagement:

Viva Money believes in giving back to the community. The platform is committed to supporting local initiatives and collaborating with community organizations. This community-centric approach not only strengthens user trust but also contributes to the socio-economic upliftment of the regions it serves.

Looking Towards the Future:

As Viva Money embarks on its journey in Maharashtra, the future looks promising. With its innovative approach and commitment to financial inclusion and education, Viva Money is poised to become a vital part of the state's financial ecosystem. Its success in Maharashtra could serve as a model for expansion, potentially transforming the financial lives of millions across India.

0 notes

Text

VIVA Money App Hits 100K+ Downloads in Lightning Speed!

VIVA Money, the revolutionary fintech startup from Bengaluru, has stormed into the digital finance scene with a bang! In just four months since its launch in Gujarat and Karnataka, the VIVA Money app has surpassed a staggering 100,000 downloads, setting a new benchmark for rapid growth and user engagement.

But what's fueling this meteoric rise? Let's dive into the heart of VIVA Money's offerings:

Freedom to Borrow, No Strings Attached: VIVA Money offers an exclusive grace period of up to 51 days, allowing users to borrow without worrying about hefty interest charges.

Revolutionary Revolving Credit: Unlike traditional loans, VIVA Money offers a revolving credit limit, giving you the power to borrow, repay, and borrow again, all with unparalleled ease.

Flexible EMI Plans: Choose from three flexible EMI plans ranging from 5 to 20 months, tailored to fit your unique financial needs and goals.

Digitally Driven Convenience: Embrace the future of finance with VIVA Money's 100% digital process, eliminating paperwork and streamlining your borrowing experience.

Seamless Bank Transfers: Say goodbye to traditional credit card limitations! With VIVA Money, your credit line can be seamlessly transferred to your bank account, putting financial freedom at your fingertips.

Lightning-Fast Approval: With VIVA Money, there's no waiting game. Experience lightning-fast approval and disbursal within a mere 15 minutes, ensuring you get the funds you need when you need them.

VIVA Money goes beyond just offering a Credit Line; it's dedicated to transforming how Indians handle their financial matters and boasts extensive experience in the lending sector. As the fintech landscape continues to evolve, VIVA Money remains committed to innovation, customer satisfaction, and financial inclusion.

Looking ahead, VIVA Money has its sights set on Rajasthan and Maharashtra, gearing up to extend its innovative financial solutions to even more eager users across India. With a personalized loan product in the pipeline, offering higher loan amounts and extended repayment periods, VIVA Money is poised to make a lasting impact on the Indian fintech ecosystem.

So, what's next for VIVA Money? With an estimated 40,000 credit lines and a projected loan book value of ₹1400 million by year's end, the journey is just beginning. Join the VIVA Money revolution today and experience the future of finance, redefined.

About VIVA Money:

VIVA Money stands at the forefront of digital financial lending, offering India's premier Line of Credit. Powered by cutting-edge technology and a customer-centric approach, VIVA Money provides seamless access to financial solutions through its mobile application and website.

As a subsidiary of the holding company Tirona Limited, with its headquarters in Cyprus, Viva Money benefits from a global perspective. Tirona Ltd operates across Europe, Asia, and South America, investing in fintech opportunities and established companies in banking and IT. Notable investments within Tirona's portfolio include 4 finance, the world's leading digital consumer finance company, and TBI Bank, a next-generation digital bank operating in multiple countries.

With assets spanning more than 20 projects in 22 countries, Tirona's financial prowess is evident. The group's total assets saw a 30% increase in 2022, reaching 1.44 billion euros, while revenue surpassed 490 million euros. This growth trajectory underscores Tirona's commitment to innovation and excellence in the financial sector, driving progress and prosperity across diverse markets.

0 notes

Text

where tf do ppl watch living will

11 notes

·

View notes

Text

im fucking winning today guys look what i just bought for myself teehee teeheehee

also yes i bought the dlc what kind of animal do you think i'd am? as floyds boyfriend i have to buy the dlc bc hes in it

#issak.txt#IM SO FUCKINH HAPPY GENUINELY#IM SOOOO GLAD MY MONEY CAME IN TODAY B4 THE SALE ENDED#WOOHOOO#I AM VERY HAPPY#mr happy camper here#anyway#trolls#trolls remix rescue#trolls dreamworks#dreamworks#queen poppy#branch#viva#chaz

19 notes

·

View notes

Text

I GOT COLDPLAY TICKETS

#which is wild considering that i was driving on the highway at the time#i kept having to pull over on the rumble strip to check my spot in the queue#got kicked out of the waiting room once. app signed me out?? didn't have data for a while in the middle of nowhere.#ended up stabbing randomly at my phone and buying Nice Luxury seats for an absurdly reasonable amount of money#i am VIBRATING#this is also the funniest possible time for me to see coldplay though#i hardly listen to them anymore. i finally retired the tattered viva la vida poster that had been on my wall for a decade#my music taste has moved on to pastures new and considerably more emo#i haven't listened to moon music yet because...uh..tbh i've heard it's not very good and after music of the spheres i didn't expect it to b#BUT this is something i've wanted since i was 15 and in a fit of conscientious pique *didn't even ask my parents*#if i could go see them on the mx tour. didn't even ask!!! as an adult that's wild to me.#they didn't even forbid me!! they almost certainly wouldn't have!! but we had extremely minor plans for that night already and i was like#'i cannot disappoint them'#so instead i sat there and sulked through the minor event!#baffling behavior on my part#but anyway! i have since been thwarted in seeing coldplay for TWELVE YEARS because they just haven't come anywhere near where i'm living#BUT NOW I'M GOING#this is like if most people my age had never gotten to see one direction or something as a teen#that's the level of obsession we're talking about and#also the level of 'mostly this is a gift to a past version of myself but also i will still cry'#personal

1 note

·

View note

Text

Io ed i miei 380 euro sul conto corrente (di cui 70 effettivamente miei il resto una rimanenza di un regalo dei genitori) ce la stiamo proprio vivendo bene sta vita. 🥲🍷

#money#bonifico#stipendio#situazione attuale#considerazioni#wine#viva il vino#daje#non c'ho manco voglia di lamentarmi

2 notes

·

View notes

Text

the romancing mini games in viva pinata actually become way easier when you realize getting the coins is not really worth the trouble

#Viva pinata#you can just make most of your money selling stray raisants and buzzlegums and redd hots#hope you're all liking these post about this 17 year old game btw

4 notes

·

View notes

Note

HI COBRA STARSHIP MUTUAL HOW WE FEELING RN??

I AM. SO GOOD ITS BAD.

#and to clarify what the hell i mean by that!!!#i am BEYOND EXCITED LIKE SO SO SO EXCITED#but also i am aware that i don’t reallyyyyy have the money to get tickets + hotel + plane tix#and i think i still am going to.#i am not known for making the best financial decisions ever but i am going to try and make this work#and by that i mean paying for all the expenses of going to this festival that i don’t even ideologically agree with#plus saving at the same time for moving out of the house and into my own place#+ saving for steel city comic con in pittsburgh as i promised erie i would go#and i do WANT to go!!!#ALL THAT TO SAY. I AM SO SO SO EXCITED AAAAAAAAA#VIVA LA COBRA IS MY FAVORITE ALBUM I HAVE A ONE DAY ROBOTS WILL CRY TATTOO COBRA STARSHIP IS ONE OF MY FAVORITE BANDS IN THE WORLD#so i am THRILLED i am SO EXCITED and i will FIGURE OUT the financial aspect of it!!!#pi's personal#query on top#marz tag 🔮

3 notes

·

View notes