#VantageFX Trading Platforms

Explore tagged Tumblr posts

Text

VantageFX Broker

Introduction:

In a competitive trading landscape, choosing the right broker can significantly enhance a trader's journey, offering a streamlined platform for robust trading opportunities. VantageFX Broker has been a notable player in the market, drawing attention with its tight spreads, fast execution, and a variety of trading instruments. This review aims to delve into the various aspects of Vantage FX, providing an insightful look at its offerings and operational efficiency based on user experiences and thorough analysis.

Vantagefx Trading Platform and Tools:

Vantage FX boasts a sophisticated yet user-friendly trading platform, leveraging the power of MetaTrader 4 and MetaTrader 5. This offers traders an intuitive interface, paired with powerful analytical tools and superior execution speeds. The integration of these platforms is smooth, offering both novice and seasoned traders a robust trading environment.

Additionally, traders can take advantage of the mobile trading feature, which is a boon for those who prefer to trade on the go. Vantage carves a niche for itself amidst other MetaTrader-centric brokers by presenting a myriad of additional add-ons and endorsing the integration of compatible third-party platforms and tools like TradingView. This strategic diversification has propelled Vantage into the Best in Class cadre in our 2023 assessment of the best MetaTrader brokers.Platform Synopsis: At its core, Vantage operates as a MetaTrader broker, extending a comprehensive suite of desktop and web trading platforms encompassing MetaTrader 4 (MT4) and MetaTrader 5 (MT5), users can download vantagefx trading apps on the mobileCharting Capabilities: Beyond the conventional charting facilitated on MT4 and MT5, Vantage also integrates the CHARTS platform from TradingView. This integration is seamless, allowing traders to access it directly using their MetaTrader credentials, thereby expanding the graphical analysis horizon.Tool Assortment:Enhancing the MetaTrader experience, Vantage introduces the SmartTrader Tools, part of FX Blue LLP’s plethora of platform augmentations. Moreover, a continuous stream of forex news headlines from FxWire Pro and FxStreet enriches the trading milieu, making Vantage's MetaTrader offerings notably robustSocial and Copy Trading Expanding beyond MetaTrader's inherent Signals market, Vantage brings forth three platforms dedicated to social copy trading. This ensemble of auto-trading platforms - ZuluTrade, DupliTrade, and Myfxbook’s AutoTrade, bolsters the social trading ecosystem, albeit these platforms are not accessible to Australian tradersThis well-rounded offering makes Vantage not just a platform for trading but a conducive environment for learning, analyzing, and strategizing, significantly enriching the trader's journey from inception to execution.

VantageFx Broker Asset Coverage:

VantageFX provides a broad spectrum of trading instruments, including Forex, Indices, Commodities, and Share CFDsIn total Vantage can trade up to 57 Currency pairs, 26 Indices , 51 ETFs , 22 Commodities and 800+ Share CFDsThis diverse range of assets allows traders to diversify their portfolio, thereby managing risks while maximizing potential gainsThe extensive market coverage is indeed a highlight, catering to the varied interests of the trading community

Account Types and Customer Suppor

VantageFX offers multiple account types catering to different trader preferences, including Standard STP, Raw ECN, and Pro ECN accounts. This segmentation helps in accommodating traders with varying levels of expertise and investment capabilities. When it comes to customer support, Vantage FX provides a responsive and knowledgeable team. The support is available via live chat, email, and phone, ensuring that traders' inquiries and issues are addressed promptly.

VantageFx PAMM

In forex markets, staying ahead of the curve is essential. And now, with the innovative VantageFX PAMM Copy Trade feature, you can transform your trading experience and maximize your profits like never before. Imagine having access to the strategies of some of the most skilled and successful traders in the industry, all at your fingertips. That's precisely what VantageFX PAMM Copy Trade brings to the table. It's a game-changer, a paradigm shift in how traders can harness the wisdom of experts without having to become one themselves. Check how to invest with Vantagefx PAMM to maximize your trading profit.

Education and Research Resources:

The broker provides various educational resources, including webinars, tutorials, and market analysis. These resources are invaluable for traders keen on honing their skills and staying updated with market trends. The emphasis on education and empowering traders is a commendable aspect of Vantage FX.

Fees and Spreads:

VantageFX is known for its competitive spreads, which is a significant advantage for cost-sensitive traders. The transparent fee structure with no hidden charges provides a fair trading environment, which is appreciated by its user base. At Vantage FX, the trading costs are primarily determined by the type of account you opt for, coupled with the specific Vantage entity managing your account. The broker presents three distinct account options: the spread-only Standard STP account, alongside the commission-based RAW ECN, and PRO ECN accounts. Generally, the pricing structure at Vantage aligns well with the industry norms.

Comparing Standard and Raw Accounts: For traders utilizing the spread-only Standard account, Vantage recorded typical spreads of 1.22 pips on the EUR/USD pair (as observed in August 2021). On the other hand, the Raw account showcased average spreads of 0.15 pips, along with a commission fee of $3 per side (amounting to $6 per round turn), bringing the total to 0.75 pips during the identical timeframe.Exploring the PRO Account: Vantage's PRO account emerges as a competitively priced offering, with a per-side commission of merely $2 (or $4 per round turn). However, the requisites for inaugurating a PRO ECN account vary across Vantage's regulating entities. For instance, under its Australian entity, traders need to qualify as a wholesale client, while under the Cayman Islands entity, an initial account funding of at least $10,000 is mandated. Meeting these varied account prerequisites renders the PRO ECN account as the most cost-effective option provided by Vantage.Incentives for Active Traders: Vantagefx extends an active trader program, presenting rebates ranging from $2 to a lofty $8 per standard lot, contingent on your account balance and monthly trading volume. The rebate tiers commence at $10,000, escalating to the apex tier necessitating a minimum of $300,000 in equity. It's notable, however, that this program is exclusively accessible to Standard account holders, which inherently possess the highest spreads among all available account options. This arrangement is something active traders might want to weigh against the potential rebates when deciding on the account type that best fits their trading strategy and financial standing.

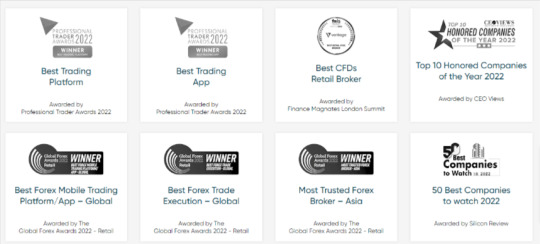

Award & Regulatory Compliance

Vantagefx Markets has won a variety of awards across a wide range of categories, including Best CFD Broker and Best MT4/MT5 Broker, and Lowest Trading Costs.

Vantagefx is one of the best broker that obtained fews international broker licenses and strickly followed the broker's regulations and requirements.Being regulated by the Australian Securities and Investments Commission (ASIC) and the Cayman Islands Monetary Authority (CIMA), Vantage FX adheres to high standards of operation, ensuring a secure and trustworthy trading environmen

Conclusion:

VantageFX has made a positive impression in the trading community with its comprehensive trading environment, a wide range of assets, and strong regulatory framework. While there is always room for improvement, especially in expanding educational resources, the broker stands as a reliable choice for individuals keen on navigating the financial markets. With its client-centric approach, Vantage FX is well-positioned to continue growing its presence in the global trading arena. Read the full article

#vantagefx#vantage fx#vantagefx broker review#vantagefx review#forex broker#vantage fx broker review#best forex broker#vantage review

0 notes

Text

Best Forex Brokers Thailand 2021

If you are interested in getting involved in the trillion-dollar a day foreign exchange market, then choosing a top forex broker is extremely important. Finding the best forex brokers in Thailand with the best commissions, fees, platforms and customer support can be difficult as well as time-consuming. This is why we have done the work for you!To get more news about best forex brokers in thailand, you can visit wikifx.com official website.

How do you find the best forex broker in Thailand? Which Thai forex broker offers the best commissions and fees? Are they regulated to ensure your capital is safe?

Find the best Thai forex broker isn’t as easy as it seems. It requires detailed research, testing and analysis which can take some time. Fortunately, we have done this for you! Below we review the 5 best forex brokers in Thailand.

eToro – Overall Best Forex Broker in Thailand with Largest Copy Trading Service etoro best forex broker thailandIf you want to trade with the best forex broker in Thailand then eToro should be at the top of your list. The broker boasts the best and largest social trading platform in the world with more than 20 million users.

If you’re not familiar with social or copy trading, it basically means that you can view the performance of other traders and have their trades copied onto your own account. It’s the fastest-growing trend in the forex industry and one you seriously want to think about – take a look at some of the results below. 2. VantageFX – Best Forex Broker for ECN Trading Accounts vantagefx broker thailandVantageFX is considered one of the best forex brokers in Thailand for ECN trading accounts. ECN stands for ‘electronic communication network.��� It allows you to trade directly with the interbank market with no middleman, thereby accessing raw spreads. 3. Capital – Best Forex Broker in Thailand with Low Minimum Deposit ($20) capital best forex brokers in thailandCapital is the best Thailand forex broker for beginner traders. To open an account you only need a minimum deposit of $20 to start trading on more than 3,000+ global markets including foreign exchange, stocks, indices, commodities and cryptocurrencies. 4. Libertex – Best Forex Broker in Thailand with Tight Spreads forex broker thailand libertexLibertex is one of the best forex brokers in Thailand because it allows you to trade with tight spreads! The spread is the difference between the buy and sell price of an asset. It’s a cost every broker will charge – unlike Libertex which is considered a top-quality low spread broker. 5. AvaTrade – Best Broker for Account Types (CFD, Copy, Options) avatrade forex broker thailandAvaTrade is one of the best forex brokers in Thailand due to the range of account types they provide. For example, you can trade forex from a CFD, options or copy trading account. The options trading account is particularly useful as it’s not provided by many brokers.

1 note

·

View note

Text

Learn more about the popular copy trading platform "DupliTrade"

DupliTrade is a software company founded in 2017, based in London and operated by the D.T. Direct Investment Hub Ltd. DupliTrade is a software company with 11 to 50 employees, an increasing number of affiliated brokers and a copy trading platform that is becoming well known in the broker industry. DupliTrade has already partnered with several brokers, especially AvaTrade, FXDD, MEXGroup, VantageFX, Moneta Markets and others. DupliTrade provides these securities companies with a fully automated trading system that utilizes a highly automated execution mirror system that allows traders to automate trading on the Forex, Index, Commodity, and Cryptocurrency markets. DupliTrade hasn't won many awards since it started offering automated trading softwares in 2017, but it is a very promising company that provide the advantageous and robust automated trading system with brokers and traders. DupliTrade software is available to traders and brokers around the world and supports nine languages including English, Arabic, Spanish, Chinese, Russian, Japanese, Italian and more. DupliTrade exposes about 10 signal providers that DupliTrade itself has strictly assessed and selected, allowing investors to copy from these strategies for free and get a profit. The vision of DupliTrade is to become the leading automated trading platform by simplifying the trading world in order for clients to find professional traders or proven strategy providers easily. The aim of DupliTrade is to provide the experience of a professional trader with everyone. Trading is a difficult area that requires expertise and we need to invest a significant amount of time and energy to obtain expertise, but some people are already aware of market movements and obtain profits. DupliTrade gives all clients the opportunity to follow and learn from professional traders, so clients can start trading like a professional traders from the beginning. To achieve such aims, DupliTrade offers an advanced copy trading system. This allows clients to automate to trade assets such as forex, stock indices, commodities, cryptocurrencies by copying the trading of traders, what is called strategy providers, carefully selected by DupliTrade. All DupliTrade strategies are available free of charge. It is also very popular in the world. To open a free account and start investing with DupliTrade, please visit the page from the button below.

youtube

ProsCons・Easy to use thanks to adopting minimal simple interface ・Carefully selected strategy providers ・Excellent support for multiple languages・Minimum deposit $5,000

License owned by Duplitrade

DupliTrade is operated by DT Direct Investment Hub Ltd. The official address is as follows: 74 Archiepiskopou Makariou C’, Amaranton Court, 2nd Floor, Mesa Geitonia, Limassol DupliTrade is Cyprus Investment Companies (CIF) licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number 347/17. The license is as follows.

FAQ about Duplitrade

What is DupliTrade?

DupliTrade is a software company founded to provide the best possible automated trading solutions. DupliTrade offers clients a simple and innovative system to automate trading in any financial market. DupliTrade bridges the gap between inexperienced beginner traders and experienced professional traders. DupliTrade's unique solution allows us to copy the exact trades of a professional trader who trades with our own money in a real trading account.

Is DupliTrade a brokerage?

No, DupliTrade is a software company offering technical solutions for automated trading, not a broker offering financial assets or derivatives. In order to use the platform provided by DupliTrade, we need to set up a trading account with a regulated broker partner. The recommended brokerages are AvaTrade, FXDD, VantageFX, and Moneta Markets.

Do we need to install DupliTrade?

The DupliTrade platform is based on the web browser, so we don't have to install any programs or download files to use it, and we never have the inconvenience of being unavailable by our operating system such as Windows, MacOS and Linux.

How can we contact the DupliTrade support team?

Please send an e-mail to "support @ duplitrade.com".

How to get the password

If we need to get a password for the DupliTrade website, please contact DupliTrade support team. If you need to get a password for your own MT4 account, please contact broker you use. As far as your account is linked to DupliTrade's platform, be sure to notify DupliTrade support team in advance in case you change your MT4 password.

How to set up a live trading account with Duplitrade

Register with Duplitrade to link your existing broker's MT4 trading account or choose your preferred broker from the list of available brokers in your country.

Once you open your broker's MT4 trading real account, please deposit your funds.

The minimum initial deposit for live MT4 accounts linked to DupliTrade is $5,000 or the equivalent fiat currency. You will be automatically disconnected from the trading system when it falls below $5,000 or equivalent fiat currency.

I have one account with a broker, can I use it with DupliTrade?

The broker you use must be a DupliTrade partner. Most brokers make you open a different real account and you need to link it with DupliTrade. Contact the broker you use for more details.

Where can I check the trading activity of my live MT4 account?

All trading activity of the linked MT4 live accounts will automatically be displayed on the DupliTrade website or the MT4 terminal of the broker used by the client.

I use a broker that is not a partner with DupliTrade. Can I use DupliTrade?

No. You need to open a live trading account for MT4 of a broker that is affiliated with DupliTrade. The recommended brokerages are AvaTrade, FXDD, VantageFX, and Moneta Markets.

Can I open an account in other basic currencies except US dollars?

Yes. You can become a partner with DupliTrade by using a currency account provided by the broker you use.

Can I trade manually?

Of course, yes. You can trade manually. Through the broker's MT4 terminal/app, you can manually open new trades and close/change the positions of your strategy providers at any time.

Is the client's money kept safe?

DupliTrade is a copy trading platform that helps automate trading. DupliTrade cannot manage your funds that you deposit directly into your account of one of partner brokers of DupliTrade. The recommended brokerages are AvaTrade, FXDD, VantageFX, and Moneta Markets. The 4 brokers mentioned above completely segregate client's money in Tier 1 banks, so NEITHER brokers NOR DupliTrade can use client's money for any reason or method.

Can I withdraw all the money at any time without limits?

Yes. You can withdraw all the money at any time. You can make as many partial withdrawals as you need by ordering directly from broker you use. You can also fully withdraw all assets in your individual broker's MT4 account.

How to disconnect from an active trading system?

You can disconnect at any time from the DupliTrade settings page. If you deselect a strategy, no new trades will be executed, but outstanding transactions are still processed by the strategy provider. Clients with a real account have the option to manually overwrite the trade via the MT4 platform.

What is the strategy of DupliTrade?

DupliTrade's strategy providers are professional traders with many years of experience, and all of them trade with real MT4 accounts and real money. These pro traders have been carefully selected as a result of a lengthy evaluation process by the DupliTrade team. Users can view real-time positions and get updates of e-mail, weekly reports, and enhanced trading analysis. You can create your own bespoke portfolio based on DupliTrade's choice of strategy providers and automatically copy tradings directly to your MT4 account using your chosen broker. The account of the strategy provider is a real account. All strategy providers have real trading with their own money. If the strategy provider you copied makes money on the trade, you also make money, and if the strategy provider you copied makes money on the trade, you also make a loss.

Are the trading activities that clients see on the website "live"?

Yes, it's completely live. Real tradings are displayed in real time toward all active users. State-of-the-art technology allows you to recreate the experts applying trading strategies to different assets. After trying out the free demo, you can set up your own settings and fully automate your trading portfolio with a real MT4 account.

Can I automate trades based on trades by pro traders? Can I control the transaction manually?

Of course. Changes in executions and transactions are automatically reflected in the client's account without client intervention. You can also be in charge of trading at any time and manually change or close outstanding transactions in your account using the MT4 platform.

How does DupliTrade work?

DupliTrade offers you a simple yet innovative way to automate your trading by copying expert traders' activity according to your selected duplication setup.

How to audit strategy providers

DupliTrade has been approached by hundreds of trader candidates and is under the oversight of the fund manager's elite. To become a strategy provider, traders must pass a long and transparent audit process before being activated for their customers. The audit is a continuous and continuous process, ensuring that the audit continues to meet DupliTrade's quality standards.

Audio Process

1:Technical feasibility and account verification ・Validate credibility by conducting a rigorous direct survey into the live trading account status of all candidates. ・Each candidate's trading account is tracked and monitored by the audit team for months. 2:Know the people behind the trader ・A series of contacts and discussions with candidate traders will be conducted to ensure that the candidate traders' knowledge, skills and proficiency about trading in the trading area are genuine. ・Make sure your candidate's profiles and criteria match to understand your maturity as an individual and as an asset manager. 3:Stress test and simulation ・All systems are used for a long time before they are considered in service. ・Check the suitability of your trading strategy for your platform. ・The month DupliTrade team audit gives you a real-time view of how traders react to macroeconomic events and the constantly evolving markets. There are many platforms on the market, not really representing customers, but we can follow dozens or even hundreds of traders. The advantage of using DupliTrade lies in the absolute candidate list of experienced traders we can find on DupliTrade.

Become a DupliTrade Strategy Provider

If you are an experienced trader and want to use your trading skills and become a trading strategy, you can become a strategy provider for DupliTrade. In addition, once you earn revenue from your trades, you'll be able to earn extra income not only from your trades, but also from DupliTrade. DupliTrade's innovative copy trading solution allows your MT4 live account to automatically copy signal providers that client generated.

As a strategic provider of DupliTrade, we can get the following benefits: ・exposed to thousands of clients around the world and become famous ・Thanks to DupliTrade's generous support for clients, we can focus on our trading. ・There is Live Trading Room, where real-time results are displayed toward DupliTrade clients. ・You obtain an additional income of 5 USD per standard 1 lot (= 100,000 currency) trading in the account of 1 follower. However, you can obtain additional income for ONLY profitable transactions, but you NEVER obtain additional income for lost transactions. Try to carry out profitable transactions. EXAMPLE:

The number of followers of trading strategy\( n \)Trading volume of trading strategy\( a \)Additional income from Dupli Trade・\( 5\times n \times a \)USD if you gain profits ・0USD if you gain NO profits

Minimum requirements to become a trading strategy ・You must have an MT4 / MT5 live trading account of the top regulated broker with a minimum balance of above 2000USD. ・To have at least 3 months of transaction history data available for auditing ・Drawdown of 20% or less in the entire transaction period of the account ・To have a net profit of 10% or more during the entire period of opening a real account Revenue calculation method: (Numerical example)

Total trading volume executed in the trading account(Lots)10 lotsTotal trading volume of profitable transactions(Lots)7 lots(70%)Number of followers500Profitable Transaction Generation Volume7(lots) x 500(followers)=3500 lots Total monthly income3500Lotsx5(USD/Lot)= $ 17,500

Please contact [email protected] when applying to become a DupliTrade strategic provider. If you do not have a DupliTrade account yet, you can open a DupliTrade account by clicking the button below.

The Main Functions of The Strategy Provider

The following are the main features of the strategy provider.

Strategy provider terms:

・Balance - The account balance ・Net Profit – The net profit of all closed and current open positions with interests and commissions ・Floating P/L – The net profit of the current open positions including interests and commissions. ・Equity – The account current equity ・Margin - The account used margin ・Free Margin – The usable margin ・Margin Level – The usable margin level in percent (Equity/Margin)

Market Overview

You can see live quotes and charts of related financial instruments and trading signals. There are four types of trading signals:

Open Buy (Long)-Open a long position, spot buy

Open Sell(Short)-Open a short position, sell credit

Close Buy -Long position closed, spot sale

Close Sell -Close short position,

Partners of DupliTrade

The recommended brokerages are AvaTrade, FXDD, VantageFX, and Moneta Markets.

4 Reasons to Use DupliTrade

Proven transaction performance

If we use DupliTrade, we don't have to be a professional trader to get the same trading performance as a professional trader. Information and historical performance of each trading strategy is available to all investors. Followers can test the past results of professional traders and see how much they can make money by simulating all of them.

Saving time

With DupliTrade, you don't have to waste your own time as you have only to copy a lot of trading strategies. All that followers have to do is set up a followers' own real accounts, deposit and select signal providers to copy professional traders. Next, you need to wait for your account until trading automatically starts.

Reduction of emotional burden

When we make a profit or loss in some transactions, we tend to trade emotionally. DupliTrade improves trading decisions by removing the emotional component and allowing proven strategies to work unaffectedly by such emotion. Trading psychology can be much more complicated than the everyone generally know. If you rely on professional signal providers with a long-term stable strategy, you don't have to worry the happiness and sadness due to tradings.

Reduction of failures of transaction

For newbies, a copy trading service DupliTrade is a very useful trading tool when trading. If newbies suddenly trade, they seem to fail to make money by trading, but DupliTrade allows you to avoid failure of transaction.

How to sign up and start copying transactions

Register DupliTrade fromHERE

Open a brokerage account and link to Dupli Trade

The recommended brokerages are AvaTrade, FXDD, VantageFX, and Moneta Markets.

Select and follow public trading strategies

Real-time tracking and analysis of trading accounts

You must deposit 100USD when you use DupliTrade's services, but you need at least $ 5,000 or currency equivalent for your initial deposit.

Conclusion

A copy trading platform "Duplitrade" is very sophisticated and is trusted and become a partner with many reliable brokers. Duplitrade has always 10 different strategy providers to copy, and they have passed rigorous assessments and are carefully selected, so you can copy with confidence. The user interface provides excellent user friendliness. Duplitrade also provides a large amount of statistical data that provides information about strategy providers' transaction history, reputation, and assets. Traders can track their investments carried out in real time, so they can change automated trading parameters to protect their investments and customize their portfolio for their own convenience. Duplitrade's automated trading system is generally regarded as a high quality and highly advantageous system and is favored by many traders. Please don't hesitate to use Duplitrade. source https://kaigai-invest.blog.jp/duplitrade/introduction/en

0 notes

Link

VantageFX is indeed a major brokerage based in Australia, operating under one of the strictest regulatory jurisdictions and thriving. Vantage FX is an innovative Australian financial services provider that strives to offer the best in online Forex and Binary Options trading solutions

0 notes

Text

Top 10 Forex Brokers 2023: Unbiased Reviews & Expert Insights

Navigating the Currency Waves: A Review of the Top 10 Forex Brokers Criteria for Ranking On Each Forex Broker Brief Overview Of Top 10 Forex Broker Vantagefx: GMI Edge Broker: FBS Broker: Pepperstone: IC Markets: OctaFX: Tickmill: TMGM: Lirunex: FXCM (Forex Capital Markets): Summary

Navigating the Currency Waves: A Review of the Top 10 Forex Brokers

The world of foreign exchange trading, or Forex, is a realm where currency pairs are traded 24 hours a day, offering a dynamic and lucrative avenue for seasoned traders and newcomers alike. The pulse of the global economy resonates through the Forex market, where over $6 trillion of currency exchanges hands each day. At the core of this bustling marketplace is an array of Forex brokers, the linchpins that connect individual traders to the vast currency exchange network. Choosing a reliable and well-suited broker is a crucial stepping stone on the path to trading success, as the right broker can significantly enhance the trading experience, offering superior platforms, insightful market analysis, and robust customer support. The essence of this article unfolds as a meticulous review of the top 10 Forex brokers specified in Asian region, shining a spotlight on the brokerage firms. Through a prism of defined criteria encompassing trading platforms, trading conditions, regulatory adherence, and customer support, we embark on a quest to sieve through the brokerage landscape and present a curated list of elite brokers. Whether you are a novice trader setting sail on your trading voyage, or a seasoned trader looking to switch brokers, this article aims to provide a well-rounded perspective to aid in making an informed decision.

As we delve deeper into the intricacies of each broker, we'll explore their unique selling propositions, evaluate their service offerings, and analyze user reviews to paint a vivid picture of what traders can expect. The culmination of this exploration is a comprehensive compilation that not only reviews but ranks these brokers, offering a beacon of insight in the stormy seas of Forex trading. So, without further ado, let’s navigate through the waves of the Forex brokerage world, and set a course towards finding a broker that’s the perfect co-pilot on your trading journey.

Criteria for Ranking On Each Forex Broker

These criteria serve as the yardstick to gauge the competence, reliability, and overall excellence of the brokers in question. Let’s navigate through the key parameters that will steer the evaluation and ranking of the top 10 Forex brokers: - Trading Platforms: - A broker's trading platform is the trader's gateway to the Forex markets. The evaluation will consider the user-friendliness, stability, and technological prowess of the trading platforms offered. - Features like charting tools, market analysis, order execution speed, and mobile trading capabilities will be scrutinized. - Trading Conditions: - Trading conditions encapsulate aspects like spreads, leverage, and order types available. - The transparency and competitiveness of a broker's trading conditions are paramount for ensuring traders can maximize their potential profits while minimizing costs. - Regulation and Licensing: - A broker's adherence to regulatory standards and licensing by reputable financial authorities is a testimony to its credibility and the safety of traders' funds. - The geographical extent of regulation and compliance with international financial standards will also be assessed. - Customer Support: - Exceptional customer support is the backbone of a satisfactory trading experience. - The availability, responsiveness, and expertise of the customer support team, alongside the variety of channels available for support (e.g., live chat, email, phone), will be evaluated. - Educational Resources: - An array of educational resources is crucial for helping traders hone their skills and stay updated with market trends. - The quality, accessibility, and variety of educational materials, including webinars, articles, and interactive learning tools, will be assessed. - Asset Variety: - A diverse offering of tradable assets, including currency pairs, commodities, indices, and cryptocurrencies, provides traders with ample opportunities to diversify their trading portfolio. - The evaluation will also consider the market access and the ease of trading different assets. - Deposit and Withdrawal Options: - Seamless and flexible deposit and withdrawal options enhance the overall trading experience. - The security, speed, and variety of payment methods, alongside the transparency of the fee structure, will be examined. - User Reviews and Reputation: - The reputation of a broker within the trading community and the overall user satisfaction are indicative of the broker's quality and reliability. - Authentic user reviews and testimonials, alongside ratings on reputable review platforms, will be taken into account. - Additional Features: - Brokers that offer additional features like social trading, automated trading, or personalized account management services add a layer of value to their offerings. - The usability and benefits of these additional features will be evaluated. The meticulous examination of these criteria aims to provide a holistic insight into the brokers' service quality, reliability, and potential to provide a conducive trading environment. Each of the aforementioned parameters will be dissected and analyzed, laying the foundation for a comprehensive and enlightening review of the top 10 Forex brokers that aim to steer traders towards a rewarding trading journey.

Brief Overview Of Top 10 Forex Broker

Vantagefx:

- Country of Operation: Headquartered in Sydney, Australia, and operates in 172 countries. - Regulatory Status: Regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Services Authority (FSA). - Trading Platform: Offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the Vantage FX app for trading. - Trading Conditions: - Minimum Deposit: £200. - Maximum Leverage: 1:30 for retail clients on major forex currency pairs, and up to 1:500 for professional clients. - Spreads: As low as 1 pip for EUR/USD. - Commission: Offers commission-free trading account. - Negative Balance Protection: Available for both retail and pro clients. - Asset Variety: - Offers trading on a wide variety of assets including forex, indices, metals, energies, cryptocurrencies, commodities, and shares. - Deposit and Withdrawal Options: - Deposit Methods: The specific methods aren't mentioned, but they offer a wide range of deposit methods according to their official website. - Withdrawal Fees: Neteller withdrawals incur a 2% fee; Skrill withdrawals incur a 1% fee. A Neteller deposit fee covered by Vantage of 4.9% + 0.29 USD will be deducted from the withdrawal amount for clients residing in Vietnam. - Customer Support: - Award-winning 24/5 customer support is available to assist traders, although 24/7 support is not provided. - Copy Trade Features: - Copy Trading Program: Vantage has a program where experienced traders (League Traders) share their portfolio, and other traders (Copiers) can follow these experienced traders’ portfolios via PAMM technology.. - AutoTrade: An account mirroring service where only successful FOREX traders are available for auto copying. All traders must be verified and have a proven successful track record before being approved by AutoTrade. - DupliTrade: An automatic trade copying service where traders can copy experienced traders by connecting to DupliTrade with a minimum account funding of $2,000. - Upgraded Copy Trading Features: Vantage has upgraded its copy trading features allowing traders to copy trades from signal providers at the click of a button or apply to become signal providers themselves. - Users Review and Reputation: - BrokerChooser awarded VantageFX a rating of 4.2 out of 5, highlighting the pros such as low non-trading fees, quick account opening, and smooth deposit and withdrawal processes. However, they also mentioned some cons like a limited product selection and room for improvement in customer service. - VantageFX has garnered a reputable standing in the forex trading community based on various reviews and ratings from different platforms. Here's a summary of the reviews and reputation of VantageFX: - Global Reputation: - VantageFX is recognized as a top forex broker with an excellent global reputation. Having commenced operations in 2009 based out of Australia, it has since expanded to numerous locations and has built a substantial worldwide trader base. - Customer Reviews: - On Trustpilot, a user praised VantageFX for being a good broker with friendly customer support and prompt payout processes. They also appreciated the sufficient range of trading instruments provided by the broker. - Regulatory Standing: - Forex Peace Army mentions that Vantage Markets (VantageFX) is regulated by ASIC (Australia), FCA (UK), and CIMA (Cayman Islands), which is a strong indicator of its legitimacy and adherence to international financial standards. - Industry Recognition: - VantageFX, noted for being a well-established and often awarded Australian FX/CFD broker, has undergone evolution over the years to foster a more serious and reputable appearance within the trading community.

VantageFX seems to provide a well-rounded trading environment with a variety of trading conditions, a broad spectrum of assets, multiple deposit and withdrawal options, responsive customer support, and robust copy trading features to cater to different types of traders. Read more details review for Vantagefx broker to learn more. Register Vantagefx GMI Edge Broker:

- Country of Operation: Initially established in Shanghai, it expanded to have offices within China, Auckland, and London. - Regulatory Status: Regulated by the Financial Conduct Authority (FCA) and the Financial Services Commission (FSC) of Mauritius. - Trading Platform: Offers MT4, Alpine Trader, ClearPro, MTF, and Currenex platforms for trading. - Trading Conditions: - Minimum Deposit: The minimum deposit required to open a standard trading account is $25, and for social trading, the minimum deposit is $500. - Leverage: Up to 1:2000 leverage is available for trading. - Commission: There is no commission charged on trades, and the broker offers contract sizes of 100,000 base currency. - Asset Variety: - GMI Broker provides over 40 forex currency pairs, indices, energy, gold, and silver for trading. - Deposit and Withdrawal Options: - The broker facilitates simple and secure deposit and withdrawal methods. Deposit top-ups are quick, especially during low margin calls, and withdrawals are processed within 24 hours without any extra fees. - Deposit methods include Local Bank Transfer, Neteller, Skrill, Perfect Money, DragonPay, and FasaPay. - Customer Support: - GMI Broker offers online customer support available 24/5 to assist traders with account management and other queries. - Copy Trade Features: - Platform: GMI Social Trading Edge platform is used for copy trading with MAM technology , which allows traders to copy the trades of master traders directly. - Master Traders: A global community of experienced 'Master Traders' are available to be followed. - Profit Sharing: Traders share a percentage of their profits with the Master Traders they choose to follow, with the percentage agreed upon in advance. - Control: Traders have complete control over which trades they want to copy, with real-time monitoring of Master Traders’ performances to help decide when to start and stop following their trades. - User Reviews and Reputation: GMI edge broker is well trusted and have a good reputation in overall in markets according to our research and analysis with more than ten years of history in the forex market. - User Reviews: User reviews can provide a glimpse into the experiences of individuals who have used GMI broker. You can find reviews on platforms like Trustpilot, Forex Peace Army, wikifx or similar review sites. - Global Reputation: GMI egge broker, or Global Market Index, seems to have established a presence in the Forex trading industry. They may have a strong reputation in certain regions, but like many brokers, their reputation may vary across different geographic locations. - Regulatory Standing: GMI brokers is regulated by financial authorities like FCA and VFSC. Regulatory information can be found on the broker's official website or through financial regulatory authorities' websites. - Industry Recognition: GMI broker has received industry awards, including recognition as the Best Liquidity Provider Platform, Best Broker Support for Traders, Best Trading Platform for Traders, and Best Trading Environment for Traders within the financial trading industry, which can be indicative of their standing within the industry.

The GMI Broker's offering seems to cater to a wide range of traders from beginners to advanced, providing various trading conditions and features to enhance the trading experience, read more details review for GMI Edge broker to learn more. Register GMI Broker Read more review here https://eagleaifx.com/best-forex-broker-for-trading-2023/ Read the full article

0 notes

Text

VantageFX PAMM: Step-by-Step Guide For Copy Trade

Introduction Vantagefx PAMM: Step-by-Step Guide to Copy Trading with PAMM on VantageFX: Summary:

Introduction Vantagefx PAMM:

This article we will guide you to start with Vantagefx PAMM cop trade. VantageFX is a reputable broker regulated by multiple financial authorities worldwide , including the VFSC, CIMA, ASIC, and the FCA, ensuring a secure and transparent trading environment. It offers a range of trading services, including the opportunity to engage in copy trading through its Percent Allocation Management Module (PAMM) accounts. PAMM accounts allow investors to pool their funds together under the management of a professional trader, known as the PAMM manager, who executes trades on behalf of the investors.

Step-by-Step Guide to Copy Trading with PAMM on VantageFX:

- Sign Up for a Vantagefx : Begin by signing up for a Vantagefx account here. If you are new to VantageFX, you must create an investor account first. Register Vantagefx PAMM Account - Setup PAMM Investor Account : Once your account is fully verified, log in to your Vantagefx account, and setup Vantagefx Investor MT4 account: - Select a PAMM manager you wish to copy trade from. Here is the steps details : - Click on the ‘Offer link’ provided by your PAMM Master - (Example: https://pamm.vantagemarkets.com/app/join/1/offername) - Here is two Vantagefx PAMM offer you can join : - Offer 1 : EagleAIFx Vantage PAMM - Offer 2: FxMaster Vantage PAMM - Use your Investor MT4's Username and Password in the email to join the offer.

- Link Your Vantagefx Account To PAMM Manager: After joining a PAMM manager, your account will be linked, and you can view your current investments. Here is the steps details. - Click ‘Invest’ after reading and checking the box of the terms. - Once successful, you will see a notification on the bottom right corner.

- Check Your Account Linking: Click on the investment you want to check.

- Deposit & Withdraw Funds: Deposit the funds you wish to allocate for copy trading into your PAMM account. These funds will be managed by the PAMM manager you selected. You can make withdrawal from the account also. Here are the steps.

- Monitor Your Investments: You can monitor your investments' performance and your PAMM manager's trading activities through the VantageFX platform. - Communicate: If you have any further questions or need assistance with your PAMM account, reach out to VantageFX's support team for help. With these steps, you are well on your way to exploring the benefits of copy trading on VantageFX using PAMM accounts. By aligning with skilled PAMM managers, you can potentially enhance your trading outcomes while learning from seasoned traders.

Summary:

Explore the realm of copy trading on VantageFX through its PAMM accounts, overseen by regulated financial authorities like VFSC, CIMA, ASIC, and FCA for secure trading endeavors, check the Vantagefx review. Kickstart your journey by signing up for a PAMM account, linking it to a chosen PAMM manager, and depositing funds for trade activities. Stay updated with your investment's performance and have the liberty to deposit or withdraw funds as needed. With VantageFX's support team at your beck and call, navigate through the PAMM trading landscape, aligning with adept managers for potential lucrative trading experiences. Read the full article

0 notes

Text

VantageFX(ヴァンテージFX)の「リベートプログラム」を詳しく解説!

Vantage FXでは、リベートプログラムを用意しています。Vantage FXのリベートプログラムに参加すると、MT4の取引アカウントに直接的にキャッシュリベートが支払われるので、取引費用が低下し、FX取引の費用対効果が更に高まります。 Vantage FXが提供している口座「MT4のスタンダードSTP口座」を開設し、$1,000以上を入金すると、Forexリベートとして最大10%のボーナスを獲得できます。 そして、クライアントが外国為替取引をするとき、あなたのリベートはあなたの口座残高へ現金としてキャッシュバックされます。180以上の金融商品を取引して、リベートをもらいましょう。 リベートを請求するには、1,000ドル以上を「MT4のスタンダードSTP口座」に入金して、こちらからリベートを申請するだけです。

VantageFXのリベートプログラムの概要

1ロットごとに2ドルをゲット

Vantage FXのリベートプログラムを利用すれば、スタンダードSTP口座で1Lot取引するごとにMT4のスタンダードSTP口座へ直接最大で2AUDのキャッシュリベートが支払われます。 \[ もらえるキャッシュバック=スタンダード\text{STP}口座での取引量(\text{Lot}) \times 2\text{AUD} \]

透明性抜群

VantageFXは、毎日リベートを計算して、MT4のスタンダードSTP口座に実際の資金として残高口座に振り込んでいるので、いつでも出金したり取引したり、ご自由に利用したりできます。

無制限に利用可能

取引の頻度が多寡に無関係です。いつでも無制限に実際のキャッシュリベートをゲットできます。

取引量に制限が無い

取引量が、0.01ロットでも40ロットでも無関係です。取引するたびにMT4のスタンダードSTP口座に実際の現金を残高口座で受け取ることができるので、取引費用をかなり引き下げる事ができます。

キャンペーンのタイプキャッシュバックキャッシュバック額往復1lot取引あたり170円対象者VantageFXのスタンダーSTP口座のトレーダー受け取り方法1,000ドル以上の入金後、参加申請するだけキャッシュバックの反映時間毎日キャッシュバックの受け取り期間入金額の10%に達するまで出金制限制限なしキャッシュバックの出金出金できる

例えば、1,000ドルを入金した場合は、最大100ドルがキャッシュバックされます。そして、キャッシュバック額は、往復1lot取引あたり170円です。 \[ もらえるキャッシュバック=スタンダード\text{STP}口座での取引量(\text{Lot}) \times 2\text{AUD} \] が基本で、日本円に換算すると、 \[ もらえるキャッシュバック=スタンダード\text{STP}口座での取引量(\text{Lot}) \times 170\text{JPY} \] が日本円で口座残高へ反映されます。 リベートプログラムのプロモーションに参加する方法は、非常に簡単で、以下の3つのステップを踏むだけです。

アカウント��開設と入金

ライブアカウントをコチラから開設し、1000ドル以上の入金をする。

10%ボーナスの請求

Vantage FXのリベートプロモーションにコチラからオプトインする。

取引の開始

スタンダードSTP口座での取引量(Lot)の各通貨単位の乗数のボーナスが実際のキャッシュになります!

リベートの計算方法の具体例

もらえるリベートは、上記でも述べたように以下の数式になります。 \[ もらえるリベート=取引標準ロット(\text{Lot}) \times 2\text{AUD} \] KYC(身分証明)の書類の提出を通過してリアル口座を保有する全てのクライアントは、入金額に対して10%のリベートを受け取る事ができます。

「Aさん」がVantage FXのスタンダードSTPのリアル口座を開設し、5,000ドルを入金したと仮定。

「Aさん」は、10%の入金ボーナス5000×0.1=500ドルをボーナスクレジットとして受け取り、「Aさん」のリアル口座に追加されます。

「Aさん」がFXで200ロットを取引したと仮定します。

200ロット×2.00ドル=400ドルのFXのリベートが自動的に「Aさん」の残高口座に追加されます。このFXのリベートは、実際の資金なので、いつでも出金できます。

すると、「Aさん」には、今後のFXのリベートに利用できるボーナスが、当初の500ドルから既に支払った400ドルを差し引いた額として、100ドル残っています。

VantageFXのリベートプログラムの利用規約

VantageFXのリベートプログラムの利用規約は、全て英語で以下のように書かれています。

Forex Volume Rebates / 10% Bonus Offer Use your existing STP account or open an STP account and deposit any amount between $1,000 and $200,000, and we’ll give you a 10% trading credit bonus. For every standard FX lot you trade, we’ll convert $2 of your trading credit into real equity on your account.

This offer is only eligible on valid MT4 STP accounts.

Traders must deposit at least $1,000 AUD (or equivalent) into a new Vantage FX standard account to participate (“original deposit”).

Vantage FX will offer this to new and existing clients at their discretion. If you have been emailed this offer, you qualify. Other existing clients who wish to participate, please contact [email protected].

The trading credit is 10% of your original deposit and the credit is capped at a maximum of $200,000. This will be credited to your account within 24 working hours after the deposit is received by Vantage FX. Internal transfers, balance adjustments, Introducer/Affiliate rebates or commissions of any kind will not be considered new funds.

Traders must opt-in to be part of this promotion by expressly confirming his or her decision by submitting the online form above, or by emailing [email protected]. They are to then contact their account manager to confirm eligibility.

“1 standard FX lot” means a round-turn trade of 1 standard lot on currency pairs only.

Trading credit cannot be converted to real balance. However, each time you trade you can earn a trading rebate (cash) which is then transferred to your MT4 balance as real equity. Your trading credit is adjusted as you earn rebate (up to the same amount of rebate). For example, if you earn $10 AUD dollars in rebate, we will reduce your trading credit by 10 Credit Units. Refer to table 1.0 for more details.

“Real equity” can be withdrawn at any point in time.

Unconverted trading credit cannot be withdrawn as cash.

You may withdraw your original deposit at any time – however, if you opt to withdraw, your 10% trading credit will also be removed from your account accordingly. If part of your original deposit is withdrawn, your 10% bonus will be removed on a pro-rata basis, therefore a partial trading credit removal will take place.

If your account equity is less than the trading credit on your account, the remaining credit may be withdrawn at our discretion, which could in turn force a stop out of all open positions on your account.

Daily calculation of lots is made at 00:50 platform time GMT+2 and is calculated to end of day. The trading credit will convert as a cash deposit into the client’s existing trading account automatically on a daily basis.

This promotion commenced on June 17th, 2013. Any trading activity before this date will not qualify for this promotion unless specifically authorised by Vantage FX. It is at Vantage FX’s sole discretion to decide if a client’s previous activity will qualify for this promotion

This program can be retracted at any time of Vantage FX’s choosing and account eligibility will be subject to our discretion.

Table 1.0: Rebate Calculation

Base CurrencyRebate amount per Standard FX lotAUD 豪ドル2USD 米ドル1.5EUR ユーロ1.30GBP 英ポンド1.10JPY 日本円170NZD ニュージーランドドル2.20SGD シンガポールドル2CAD カナダドル2

以上の内容を、日本語に翻訳すると、以下の内容になります。 既存のSTPアカウントを使用するか、コチラからSTPアカウントを開設して、最小入金額$1,000から最大入金額$200,000の間の任意の金額をSTPアカウントに入金すると、10%の取引クレジットボーナスが提供されます。 すべてFX取引の取引量1ロットあたり、2ドルの取引クレジットが実際の現金へ変換され、STPアカウントに入金されます。

このオファーは、MT4 STPのリアル口座でのみ利用できます。

このオファーに参加するためには、トレーダーは、新しいVantage FXのMT4 STPのリアル口座に少なくとも1,000豪ドル(または同等のもの)を入金しなければなりません。

Vantage FXは、このオファーを新規および既存のクライアントに対して自由裁量で提供します。 このオファーをメールで受け取った場合は、このオファーの参加資格があります。 参加を希望する他の既存のクライアントについては、[email protected]までご連絡ください。

提供される取引クレジットボーナスは、入金額の10%であり、もらえるクレジットの上限額は、最大200,000ドルまでです。 これは、Vantage FXのMT4 STPのリアル口座に入金されてから24営業時間以内にそのMT4 STPのリアル口座にボーナスとして入金されます。 内部送金、残高調整などの入金やその他のリベートは、このオファーに参加するための新しい入金とは見なされません。

このオファーに参加したいトレーダーは、コチラからオンラインフォームを送信するか、または[email protected]に電子メールを送信することにより、意思決定を明示的に確認することにより、このプロモーションへの参加をオプトインする必要があります。 その後、アカウントマネージャーに連絡して、適格性を確認します。

「1標準FXロット」とは、通貨ペアのみでの1標準ロットの往復取引を意味します。

取引クレジットボーナスは、何もせずにそのまま実際の現金に変換することはできません。 ただし、取引するたびに、取引リベート(現金)を獲得できます。これは、実際の現金としてMT4のSTPのリアル口座に転送されます。 リベートを獲得すると、最大のリベート額まで、取引クレジットが調整されます。 例えば、リベートで10豪ドルを獲得すると、取引クレジットが10クレジットユニット引き下げられます。 詳細については、次の表を参照してください。

基軸通貨1標準FXロットあたりのリベートされる乗数AUD 豪ドル2USD 米ドル1.5EUR ユーロ1.30GBP 英ポンド1.10JPY 日本円170NZD ニュージーランドドル2.20SGD シンガポールドル2CAD カナダドル2

取引によってもらった「リベート」は現金なので、いつでも出金することができます。

未変換の取引クレジットは、現金として出金することはできません。

元の入金額はいつでも出金することができますが、出金することを選択した場合は、出金額の10%の取引クレジットボーナスが口座から削除されます。 元の入金額の一部を出金した場合、このリベートボーナスは出金額に比例して削除されるので、部分的な取引クレジットの削除が行われます。

口座残高が、取引クレジット残高より少ない場合、残りのクレジットはVantageFXの裁量で取り消される可能性があり、それにより、口座のすべてのオープンポジションが強制的に停止される可能性があります。

ロットの毎日の計算は、GMT+2のサーバー時間(日本時間であれば、日本時刻の7時間前)のプラットフォーム時間00:50に行われ、1日の終わりまで計算されます。 トレーディングクレジットは、毎日自動的に現金としてクライアントの「リベートボーナス」対象のMT4 STPのリアル口座に変換されます。

このプロモーションは2013年6月17日に開始しました。この日付より前の取引活動は、Vantage FXによる特別な承認がない限り、このプロモーションの対象にはなりません。 Vantage FXの独自の裁量により、クライアントの以前のアクティビティがこのプロモーションの対象となるかどうかを決定します

このプログラムは、Vantage FXの選択によりいつでも撤回でき、アカウントの適格性はVantageFXの裁量の対象となります。

VantageFXが開��する全てのプロモーションについての一般規約について

特に明記されていない限り、以下の条件がVantageFXが開催する全てのプロモーションに適用されます。

プロモーションは、別のプロモーションと併用できません。

すべてのVantage FXオファーは、適用法に従ってのみ利用できます。

Vantage FXが提供するプロモーションは、個人のリスク選好を変更または修正したり、個人個人が自分たちの取引戦略と矛盾する方法で取引することを奨励するように設計されていません。

クライアントは、取引の快適性レベルと一貫した方法で取引口座を操作する必要があります。

新しい口座は、Vantage FXの口座開設手順に従って承認を受ける必要があります。 口座を申請する個人は、Vantage FXで口座を申請する前に、現地の法律と規制を確認する必要があります。

紹介ブローカー、PAMM / MAM、またはマネーマネージャーによって紹介されたクライアントは、Vantage FXが提供するプロモーションに参加できません。

Vantage FXは、正当な理由を提供したり、クライアントに連絡することなしに、独自の裁量で、プロモーションへの参加の申し込みまたは表示を拒否する権利を保有します。

Vantage FXは、以下の2つの場合が当てはまる場合、VantageFXノプロモーションにクライアントが参加することを却下する権利を留保します。 a)チャーニング・アービトラージ(FXまたはCFDの証拠金取引を不正にして利益をえた場合); b)クライアントがクライアント契約に違反していることが判明したか、プロモーションの利用規約に違反した場合、Vantage FXは取引口座からボーナス額を差し引く権利を有します。

Vantage FXはいつでもプロモーションの条件を変更したり、変更された条件をVantage FXのWebサイトに掲載することによって、プロモーションの条件の変更を通知します。 これらの条件を定期的にチェックしてください。また、Vantage FXのWebサイトおよびサービスを継続して使用することにより、変更された条件に同意してください。 Vantage FXは、独自の裁量でいつでもオファーを変更またはキャンセルする権利を留保します。

Vantage FX may at any time, at its sole discretion, cease or discontinue any of its promotions.

Vantage FXは、その単独の裁量により、いつでもそのプロモーションを中止できます。

Vantage FXは、プロモーションに関連してクライアントが被った損害や、法律により本規約により除外されない損失、費用、費用、または損害について責任を負いません。

これらの利用規約が英語以外の言語に翻訳されている場合、もしくは矛盾がある場合、利用規約の英語版が優先されます。

このプロモーションの提供者は、Vantage International Group Limited(SIBL 1383491)です。

クライアントがVantage FXで保有できる取引口座の数に関係なく、適用できるプロモーションは、一人のクライアントに対して1つの口座にのみ適用されます。

source http://kaigai-invest.blog.jp/vantagefx/promotions/fx-rebates-bonus

0 notes

Text

VantageFX(ヴァンテージFX)の「50%入金ボーナス」を詳しく解説!

VantageFX(ヴァンテージFX)では、初めてVantage FXの口座開設した新規のクライアントたちに対して、「ウェルカムボーナス」を提供しています。 この「ウェルカムボーナス」は、スタンダードSTP口座のみに適用されるボーナスです。最大500ドルまでの入金に適用され、500ドルまでの入金額で、入金額の50%がボーナスとしてもらえるので取引できる必要証拠金は、入金額とボーナスの合計金額となります。 この記事では、VantageFX(ヴァンテージFX)の「ウェルカムボーナス」についての概要と詳細、利用規約を解説します。

VantageFX(ヴァンテージFX)の「ウェルカムボーナス」についての概要

ウェルカムボーナスの性質初回入金ボーナスボーナス額入金額の50%(最大250ドルまで)対象者 VantageFXの新規トレーダー全員 (既存トレーダーの場合は要相談)受け取り方法「OPT IN NOW」のボタンをクリックして申し込み後に入金するのみボーナスの反映タイミング入金後即座ボーナスの受け取り期間制限なし出金制限なしボーナスの出金170円/lot (MT4 STP口座限定)

1Lotの取引をすると、MT4 STP口座のみ、受け取ったボーナス額の170円が現金出金できるようになります。MT4 ECN や MT5口座では、取引クレジットボーナスは、残高に変換できません。 MT4 STP口座のみ、ボーナス額が「クレジット(またはクレジット計)」から出金可能な「残高」に移動します。また、VantageFXの50%入金ボーナスは、最大250ドルまでしか受け取れません。

具体例入金額もらえるボーナス$200$100$300$150$400$200$500$250$500+$250

VantageFXの50%入金ボーナスには出金制限はありませんが、出金すると受け取ったボーナス額の一部が自動的に減りますので���注意下さい。 500ドル相当額以上の入金をしても、250ドル以上のボーナスは受け取れません。 今すぐライブアカウントを開設して、ウェルカムボーナスをゲットしましょう! ウェルカムボーナスのもらい方は非常に簡単で、以下の3つのステップを踏むだけです。

アカウントの開設と入金

ライブアカウントをコチラから開設し、500ドル以上の入金をする。

ボーナスを請求する

Vantage FXのウェルカムボーナスのプロモーションにコチラからオプトインする。

取引する

ボーナスを利用した取引をすると、自動的にクレジットボーナスが残高口座へキャッシュバックされる。

VantageFX(ヴァンテージFX)の「ウェルカムボーナス」についての利用規約

VantageFX(ヴァンテージFX)の「ウェルカムボーナス」についての利用規約は、以下のように全て英語で書かれています。

This offer is available to the following account types: MT4 STP, MT4 ECN and MT5 accounts.

Vantage FX will offer this to new and existing clients at its discretion. If you have been emailed this offer, you qualify. Other existing clients who wish to participate, please contact [email protected].

To participate in this offer, clients must make a minimum initial deposit of $200, and up to $500 to participate (original deposit) in this offer. Valid for deposits from 24 January 2018.

Clients must submit the opt-in form within 10 business days after they are qualified for the promotion. If the period exceeds 10 days, Vantage FX will determine at its discretion as to whether the account qualifies for the promotion.

At the time of opting-in to this promotion your account must have a minimum balance of $100 (base currency).

Clients must opt-in to be part of this promotion by expressly confirming his or her decision by submitting the online form above. They are to then contact their account manager to confirm eligibility.

The trading credit is 50% of your original deposit, up to $250 Credit. The credit amount will be credited to your account within 24 business hours after the deposit is received and verified by our team. Internal transfers, balance or cash adjustments, Introducer/Affiliate rebates or commissions of any kind will not be considered new deposits and therefore will not be counted towards this offer.

Credit amounts cannot be withdrawn. Profits made will be reflected in your account value. Similarly, any losses made will be deducted from your account value.

This offer can only be redeemed once per client account.

Applicable to MT4 STP accounts only:

For every 1 standard lot that is traded on your FX account, Vantage FX will convert 2 units of Credit in your FX account to 2 units of real balance in your Account’s denominated currency. Only transactions in relation to maintaining open positions will be counted towards lots calculation. Please note that 1 lot = 100,000 units of the first named currency (i.e. the base currency) of the currency pair.

Your trading credit is adjusted as you earn rebate (up to the same amount of rebate). For example, if you earn $10 AUD dollars in rebate, we will reduce your trading credit by 10 Credit Units.

Unconverted trading credit cannot be withdrawn and will be reset to zero at the end of this offer.

For clarity, trading credits cannot be converted to balance if you hold a MT4 ECN or MT5 account.

You may withdraw your original deposit at any time – however, if you opt to withdraw, your 50% trading credit will also be removed from your account accordingly. If part of your original deposit is withdrawn, your 50% bonus will be removed on a pro rata basis, therefore a partial trading credit removal will take place.

If your account equity is less than the trading credit on your account, the remaining credit may be withdrawn at our discretion, which could in turn force a stop out of all open positions on your account.

Daily calculation of lots is made at 00:50 platform time GMT+2 and is calculated to end of day. The trading credit will convert as a cash deposit into the client’s existing trading account automatically daily.

This promotion commenced on Monday, 22nd January 2018 and updated 25th February 2020. Any trading activity before this date will not qualify for this promotion unless specifically authorised by Vantage FX.

This program can be retracted at any time of Vantage FX’s choosing and account eligibility will be subject to our discretion.

Base CurrencyRebate amount per Standard FX lotAUD Australian Dollar2USD US Dollar1.5EUR Euro1.30GBP Pound Sterling1.10JPY Japanese Yen170NZD New Zealand Dollar2.20SGD Singapore Dollar2CAD Canadian Dollar2

上記の内容を日本語に翻訳すると、以下のようになります。

このオファーは、MT4 STP、MT4 ECN、およびMT5アカウントの口座タイプで利用できます。

Vantage FXは、独自の裁量でこのオファーを新規および既存のクライアントに提供します。 このオファーをメールで受け取った場合は、資格があります。このオファーに参加を希望する既存のクライアントは、「[email protected]」にお問い合わせください。

このオファーに参加するには、クライアントは200ドル以上の初回入金を行う必要があります。500ドル以上を入金してももらえるボーナスは250ドルとなります。このオファーは、2018年1月24日以降の入金に対して有効です。

クライアントは、このプロモーションの資格を得てから10営業日以内にオプトインフォームを送信する必要があります。 このプロモーションの資格を得てから10営業日を超えた場合、Vantage FXは、クライアントの保有口座��プロモーションの対象かどうかを裁量で決定します。

このプロモーションにオプトインする時点で、対象となる口座残高は100ドル以上である必要があります。

クライアントは、上記のオンラインフォームを送信して決定を明示的に確認し、このプロモーションへの参加をオプトインする必要があります。 その後、アカウントマネージャーに連絡して、適格性を確認します。

取引するためのクレジットボーナスは、入金額の50%で、最大250ドルまで適用されます。 クレジットボーナスは、入金額を受け取ってチームが確認した後、24営業時間以内に口座に入金されます。 内部送金は、新規入金とは見なされないので、このオファーに適用される入金としてみなされません。

クレジットボーナスは出金できません。 利益は口座残高に反映されます。 同様に、発生した損失は口座残高から差し引かれます。

このプロ��ーションは、クライアントの口座ごとに1回のみ適用できます。

以下の内容は、「MT4のSTP口座」にのみ適用されます

(キャッシュバック)MT4のSTP口座でクライアントが取引量1Lotを取引するたびに、Vantage FXは、MT4のSTP口座の2単位のクレジットボーナスをMT4のSTP口座の通貨建ての2単位の現金へ変換します。 オープンポジションの維持に関連する取引のみが、ロット計算にカウントされます。 ただし、1ロット=100,000通貨です。

基軸通貨標準取引量(=1Lot)あたりのリベート金額AUD Australian Dollar2USD US Dollar1.5EUR Euro1.30GBP Pound Sterling1.10JPY Japanese Yen170NZD New Zealand Dollar2.20SGD Singapore Dollar2CAD Canadian Dollar2

具体例:

MT4のSTP口座で、1Lot取引すると、2AUD=170円キャッシュバックされます。

MT4のSTP口座で、10(Lot)取引すると、10×2AUD=20AUD=1700円キャッシュバックされます。

同額のリベートまでリベートを獲得すると、取引クレジットが調整されます。たとえば、リベートで10AUDを獲得すると、取引クレジットが10クレジットユニットに減額されます。

現金に変換されていないクレジットボーナスは出金することができず、このオファーの最後にゼロにリセットされます。

MT4 ECNまたはMT5口座で取引しても、取引クレジットボーナスは口座残高に現金として変換されません。

入金した金額はいつでも出金することができますが、出金する場合は、それに応じて50%の取引クレジットも口座から削除されます。 入金額の一部を出金した場合、50%のボーナスは入金額に比例して削除されるので、部分的な取引クレジットボーナスの削除が行われます。

口座残高が口座のクレジット残高より少ない場合、残りのクレジット残高は、VantageFXの裁量で取り消される可能性があります。それにより、口座のすべてのオープンポジションが強制的にクローズされる可能性があります。

ロットの毎日の計算は、(GMT+2)時間のプラットフォーム時間00:50(日本時間では、AM7:50)に行われ、1日の終わりまで計算されます。 MT4のSTP口座における取引クレジットボーナスのみが、毎日自動的に現金としてクライアントの既存の取引口座に変換されます。

このプロモーションは、2018年1月22日月曜日に開始され、2020年2月25日に更新されました。この日付より前の取引活動は、Vantage FXによる特別な承認がない限り、このプロモーションの対象にはなりません。

このプログラムは、Vantage FXによりいつでも終了させることでき、対象となる口座の適格性は、Vantage FXの裁量で決まります。

VantageFXが開催する全てのプロモーションについての一般規約について

特に明記されていない限り、以下の条件がVantageFXが開催する全てのプロモーションに適用されます。

プロモーションは、別のプロモーションと併用できません。

すべてのVantage FXオファーは、適用法に従ってのみ利用できます。

Vantage FXが提供するプロモーションは、個人のリスク選好を変更または修正したり、個人個人が自分たちの取引戦略と矛盾する方法で取引することを奨励するように設計されていません。

クライアントは、取引の快適性レベルと一貫した方法で取引口座を操作する必要があります。

新しい口座は、Vantage FXの口座開設手順に従って承認を受ける必要があります。 口座を申請する個人は、Vantage FXで口座を申請する前に、現地の法律と規制を確認する必要があります。

紹介ブローカー、PAMM / MAM、またはマネーマネージャーによって紹介されたクライアントは、Vantage FXが提供するプロモーションに参加できません。

Vantage FXは、正当な理由を提供したり、クライアントに連絡することなしに、独自の裁量で、プロモーションへの参加の申し込みまたは表示を拒否する権利を保有します。

Vantage FXは、以下の2つの場合が当てはまる場合、VantageFXノプロモーションにクライアントが参加することを却下する権利を留保します。 a)チャーニング・アービトラージ(FXまたはCFDの証拠金取引を不正にして利益をえた場合); b)クライアントがクライアント契約に違反していることが判明したか、プロモーションの利用規約に違反した場合、Vantage FXは取引口座からボーナス額を差し引く権利を有します。

Vantage FXはいつでもプロモーションの条件を変更したり、変更された条件をVantage FXのWebサイトに掲載することによって、プロモーションの条件の変更を通知します。 これらの条件を定期的にチェックしてください。また、Vantage FXのWebサイトおよびサービスを継続して使用することにより、変更された条件に同意してください。 Vantage FXは、独自の裁量でいつでもオファーを変更またはキャンセルする権利を留保します。

Vantage FX may at any time, at its sole discretion, cease or discontinue any of its promotions.

Vantage FXは、その単独の裁量により、いつでもそのプロモーションを中止できます。

Vantage FXは、プロモーションに関連してクライアントが被った損害や、法律により本規約により除外されない損失、費用、費用、または損害について責任を負いません。

これらの利用規約が英語以外の言語に翻訳されている場合、もしくは矛盾がある場合、利用規約の英語版が優先されます。

このプロモーションの提供者は、Vantage International Group Limited(SIBL 1383491)です。

クライアントがVantage FXで保有できる取引口座の数に関係なく、適用できるプロモーションは、一人のクライアントに対して1つの口座にのみ適用されます。

source http://kaigai-invest.blog.jp/vantagefx/promotions/50percent-deposit-bonus

0 notes