#Uterine Fibroid Treatment Drugs Market Revenue

Explore tagged Tumblr posts

Text

Uterine Fibroid Treatment Drugs Market Segment Analysis By Drug Class, Type, End-User, Region And Forecast Till 2030: Grand View Research Inc.

San Francisco, 17 Aug 2023: The Report Uterine Fibroid Treatment Drugs Market Size, Share & Trends Analysis Report By Drug Class (GnRH Agonists, GnRH Antagonists), By Type (Submucosal Fibroids, Intramural Fibroids), By End-user, And Segment Forecasts, 2023 – 2030 The global uterine fibroid treatment drugs market size is expected to reach USD 3.91 billion by 2030, expanding at a CAGR of 10.2%…

View On WordPress

#Uterine Fibroid Treatment Drugs Industry#Uterine Fibroid Treatment Drugs Market#Uterine Fibroid Treatment Drugs Market 2023#Uterine Fibroid Treatment Drugs Market Revenue#Uterine Fibroid Treatment Drugs Market Share#Uterine Fibroid Treatment Drugs Market Size

0 notes

Text

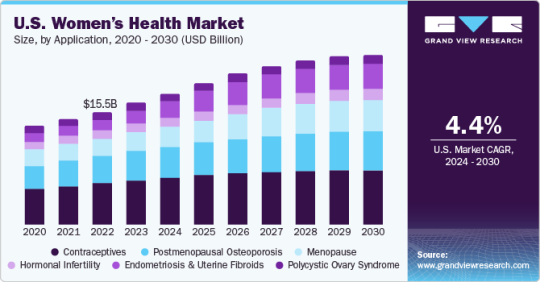

Women’s Health Market Size, Share & Trends Analysis Report, 2030

Women's Health Market Growth & Trends

The global women’s health market size is expected to reach USD 67.07 billion by 2030, registering a CAGR of 5.7% from 2024 to 2030, according to a new report by Grand View Research, Inc. The introduction of innovative novel products and the presence of a strong pipeline of women’s health products are prime factors driving the market growth. For instance, in May 2021, the Food & Drug Administration approved Myfembree, developed by Pfizer Inc. in collaboration with Myovant Sciences, for uterine fibroids associated with heavy menstrual bleeding. An increase in the incidence of endometriosis and a rise in support from non-profit organizations are expected to fuel the market growth over the forecast period.

For instance, the Bill & Melinda Gates Foundation pledged USD 280 million every year from 2021 to 2030 for the development of new contraceptive technologies and to support family planning initiatives. According to the WHO report 2021, globally, around 10% (190 million) of reproductive-age girls and women are affected by endometriosis. It is a chronic disease related to severe pain during periods, bowel movements and/or urination, abdominal bloating, nausea, fatigue, etc. The COVID-19 pandemic had a negative impact on the market. Strict measures undertaken by governments to control the spread of the SARS-CoV-2, such as social distancing and community-wide lockdowns, have had a detrimental impact on treatment facilities & gynecological clinics.

For instance, in low- and middle-income countries there has been a decline in the usage of long- and short-acting reversible contraceptives. Strategic initiatives undertaken by key players, such as collaborations, agreements, and partnerships, for the development and commercialization of products are anticipated to drive market growth. For instance, in October 2021, Richter and Hikma signed an exclusive licensing agreement to commercialize denosumab, comprising biosimilar of Xgeva and Prolia in the U.S. Moreover, the growing competition from generic drugs increases the pricing pressure after patent expiration, which is anticipated to impede market growth.

For instance, after the patent expiry, the revenue of Forteo declined by 23% between 2020 and 2021. North America dominated the global market in 2021 owing to favorable reimbursement policies, the presence of key market players, supportive government regulations, approval & commercialization of products, and high usage of contraceptives among women. The Asia Pacific region is expected to grow at the fastest CAGR during the forecast period due to rising government spending on women’s health. For instance, the Australian Government announced an investment of USD 333 million to support health services and support.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/womens-health-market

Women's Health Market Report Highlights

The contraceptives segment held the highest market share of more than 35.25% of the global revenue in 2023 due to increased awareness about family planning and rapid technological advancements in contraception

The University of California Bixby Center released a reimbursement guide to help health providers offer women a full range of contraceptives

The endometriosis segment is expected to witness significant growth over the forecast period due to the launch of products, such as Relugoliz and the impending launch of Linzagolix for the treatment of women with uterine fibroids

Based on age, the 50 years and above segment is expected to register the fastest growth rate of 6.7% over the forecast period as an increase in life expectancy is boosting the overall menopausal population across the globe

According to the International Menopause Society, globally, women aged between 45 and 55 years typically experience menopause, with the average age of onset at 51.5 years

Women's Health Market Segmentation

Grand View Research has segmented the global Women's Health market on the basis age, application, drugs, and region:

Women's Health Application Outlook (Revenue, USD Million, 2018 - 2030)

Hormonal Infertility

Contraceptives

Postmenopausal Osteoporosis

Endometriosis & Uterine Fibroids

Menopause

Polycystic Ovary Syndrome (PCOS)

Women's Health Drug Outlook (Revenue, USD Million, 2018 - 2030)

ACTONEL

YAZ,Yasmin,Yasminelle

FORTEO

Minastrin 24 Fe

Mirena

NuvaRing

ORTHO TRI-CY LO

Premarin

Prolia

Reclast/Aclasta

XGEVA

Zometa

Others

Women's Health Age Outlook (Revenue, USD Million, 2018 - 2030)

50 years and above

Postmenopausal Osteoporosis

Endometriosis & Uterine Fibroids

Menopause

Others

Others

Women's Health Regional Outlook (Revenue, USD Million; 2018 - 2030)

North America

S.

Canada

Europe

Germany

K.

France

Italy

Spain

Denmark

Sweden

Norway

Asia Pacific

China

India

Japan

Australia

South Korea

Thailand

Latin America

Brazil

Mexico

Argentina

Middle East & Africa

South Africa

Saudi Arabia

UAE

Kuwait

List of Key Players of Women’s Health Market

AbbVie, Inc.

Bayer AG

Merck & Co., Inc.

Pfizer, Inc.

Teva Pharmaceutical Industries Ltd.

Agile Therapeutics

Amgen, Inc.

Apothecus Pharmaceutical Corp.

Blairex Laboratories, Inc.

Ferring B.V.

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/womens-health-market

#Women’s Health Market#Women’s Health Market Size#Women’s Health Market Share#Women’s Health Market Trends

0 notes

Text

Uterine Fibroids Drug Market Size, Business Revenue Forecast, Leading Competitors and Growth Trends 2026

Global uterine fibroids drug market is expected to grow at a substantial CAGR in the forecast period of 2020-2026. Uterine fibroids are also known as leiomyoma or myomas, can be characterized by the formation of abnormal non-cancerous tissue growth inside the wall of the uterus.

Competitive Analysis: Global Uterine Fibroids Drug Market

Global uterine fibroids drug market is highly fragmented and the major players have used various strategies such as new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, and others to increase their footprints in this market. The report includes market shares of uterine fibroids drug market for Global, Europe, North America, Asia-Pacific, South America and Middle East & Africa.

Download PDF Sample report @ https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-uterine-fibroids-drug-market

A woman may develop one or many fibroids in uterus and these can vary in sizes depending upon the condition and level. Uterine fibroids symptoms include heavy bleeding between or during the menstrual cycle, pain in pelvis or lower back, increased menstrual cramping and enlargement of the abdomen.

Segmentation: Global Uterine Fibroids Drug Market

· By Types (Subserosal Fibroids, Submucosal Fibroids, Intramural Fibroids and Pedunculated Fibroids)

· By Mechanism of Action (GnRH Agonists, Steroids, Contraceptives, NSAIDs and Vitamins)

· By Drugs Type (Progesterone, Levonorgestrel, Mefenamic, Raloxifene and Others)

· By Diagnosis (Ultrasound, Lab Tests and Imaging Tests)

· By Treatment (Medication, Dietary Supplements and Surgery)

· By Route of Administration (Oral, Intravenous and Others)

· By End-Users (Hospitals, Homecare, Specialty Clinics and Others)

· By Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa)

Key Market Players: Global Uterine Fibroids Drug Market

The key market players in the global uterine fibroids drug market are GlaxoSmithKline plc, F. Hoffmann-La Roche Ltd, Pfizer Inc, Novartis AG, Bristol-Myers Squibb Company, Sanofi, Teva Pharmaceutical Industries Ltd., Amgen Inc, Medtronic, Endo Pharmaceuticals Inc, Mylan N.V, Sun Pharmaceutical Industries Ltd, Hologic, Inc, Smith & Nephew, Merck & Co., Inc, ALLERGAN, Bayer AG, Koninklijke Philips N.V, IceCure Medical Ltd and others.

Market Drivers

· Increasing prevalence of uterine fibroids is driving the market growth

· Rising female population across the globe is driving the market growth.Growing screening across the world can also acts as a market driver

· Rising awareness amongst people about the uterine fibroids and its treatment is also boosting the market growth

Market Restraints

· Side effects of treatment such as bleeding and infection during surgery can hamper the market growth

· Low healthcare expenditure in developing regions also restricts the market growth

· High cost-containment measures undertaken by governments along with the ongoing healthcare reforms.

· Limited treatment options for uterine fibroids are restricting the market growth.

Inquiry Before Buying @ https://www.databridgemarketresearch.com/inquire-before-buying/?dbmr=global-uterine-fibroids-drug-market

Reasons to Purchase this Report:

· Current and future of global uterine fibroids drug market outlook in the developed and emerging markets.

· The segment that is expected to dominate the market as well as the segment which holds highest CAGR in the forecast period.

· Regions/Countries that are expected to witness the fastest growth rates during the forecast period.

· The latest developments, market shares, and strategies that are employed by the major market players.

About Us:

Data Bridge Market Research set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge Market Research provides appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact:

Data Bridge Market Research

US: +1 888 387 2818

Related Reports:

Opioids Drug Market

Monoamine Oxidase (MAO) Inhibitor Drugs Market

#Uterine Fibroids Drug Market#Uterine Fibroids Drug#Uterine Fibroids Drug Market Trends#Uterine Fibroids Drug Market Industry#Uterine Fibroids Drug Market News

0 notes

Text

Allergan abandons women’s health sale plan as profit slumps

Shares in Allergan fell after the company said it had swung to a loss in the last quarter of 2018, and forecast 2019 revenues below analyst expectations.

The Ireland-headquartered specialty drugmaker, best known for its Botox wrinkle treatment, reported a loss of $4.3 billion that reversed a profit of over $3 billion a year ago, even though sales were a little better than expected at $4.08 billion.

The loss resulted from big write-offs to the tune of a whopping $5.4 billion, in part resulting from lower-than-expected sales of double chin treatment Kybella/Belkyra – the main asset in the company’s $2.1 billion acquisition of Kythera – which brought in just $8 million in the quarter.

It also revealed that it had dropped plans to sell off its female health division, which was put on the block last year along with its anti-infectives business. CEO Brent Saunders said on a conference call that it made more sense at the moment to continue “managing and optimising” the women’s health business, but that he still expected anti-infectives to be sold as planned.

It’s possible that the volte-face on women’s health is related to the failure by Allergan to get FDA approval for uterine fibroids therapy Esmya (ulipristal acetate) last year, which had been tipped as a potential blockbuster. Approval would have made the division much more valuable.

Allergan’s cash-cow Botox (onabotulinumtoxinA) had a good quarter, rising 9% to $946m, but its second biggest product – Restasis (cyclosporine) for dry eye disease – fell 18% to $341m thanks to the start of generic competition in some international markets, lower demand and pricing pressure.

For the full year, the company is predicting net revenues of between $15 billion and $15.3 billion, which is a little lower than analysts’ projections.

The fall-off in Restasis sales is likely to gather pace as patent protection is lost in other countries, particularly the US which accounts for 95% of its sales. US exclusivity for the drug is due to be lost in March of this year.

Meanwhile, Botox is also facing the threat of biosimilar competition from US biotech Evolus, which resubmitted a marketing application in the US last August after its first attempt was rejected because of manufacturing issues. It’s hoping for a positive verdict from the FDA second time around in the spring.

In a bid to protect its franchise, Allergan acquired privately-held biotech Bonti last year for an upfront payment of $195 million, gaining control of a new botulinum toxin ingredient with a rapid onset of action (within 24 hours) and a two- to four-week duration of effect.

Shares in Allergan fell almost 9% after the results announcement to their lowest level for almost three years.

Some analysts attributed that in part to what they perceived as downbeat discussion by Allergan’s management on NMDA-targeting antidepressant rapastinel, which is due to report pivotal data later in 2019 and is in a race to market with Johnson & Johnson’s esketamine.

The post Allergan abandons women’s health sale plan as profit slumps appeared first on Pharmaphorum.

from Pharmaphorum https://pharmaphorum.com/news/allergan-abandons-womens-health-sale-plan-as-profit-slumps/

0 notes

Text

AbbVie: This Dividend Aristocrat Offers Double-Digit Total Return Potential

New Post has been published on http://khalednaser.com/abbvie-this-dividend-aristocrat-offers-double-digit-total-return-potential/

AbbVie: This Dividend Aristocrat Offers Double-Digit Total Return Potential

Source: Abbvie Media Resources

With the financial markets likely to enter 2019 having just had the worst December since the Great Depression, there have been many stocks that have taken a beating the past month.

Abbvie (ABBV) has not been exempt from this market plunge as it has fallen nearly ~27.6% from its all-time high of $125.86 a share in January 2018. Moreover, Abbvie has fallen ~3.3% since the beginning of December, from $94.27 a share to $91.12 as of close on December 28, meaning the company has been hit harder than other pharma stocks this year. In addition to concerns over Abbvie’s concentration risk with Humira, another concern in the past 9 months to the investor community was Abbvie’s announcement this past March that it wouldn’t pursue accelerated approval for Rova T to treat RR SCLC, due to disappointing Phase 2 results. Although the company will move forward with the ongoing Phase 3 studies, investor consensus is that the $10.2 billion StemCentryx acquisition, once thought to be a promising oncology acquisition, will instead prove to be a bust. Consequently, the company’s shares have not rebounded to the $110+ range the shares were at January through most of March.

As such, I believe that Abbvie is currently worthy of a dividend growth investor’s consideration. There are three main reasons to support my opinion that Abbvie is an attractive investment, worthy of further due diligence from a potential investor. The first reason is that although its dividend history as an independent company has been brief, it has been spectacular, and I believe it will continue to deliver solid dividend increases going forward. This leads me into my second point that Abbvie has the appropriate drug pipeline to offset the eventual declines in revenue from Humira, which would lead to continued strong dividend increases. Lastly, the company’s current valuation is appealing.

Reason #1: Abbvie’s Safe And Growing Dividend

Since the formation of the company in 2013 as a spin-off of the biopharmaceuticals division of Abbott Laboratories, Abbvie has raised its dividend each year. Abbvie is technically a dividend aristocrat when we factor in its former parent company’s 46 years of consecutive dividend increases.

The company recently announced an 11.5% dividend increase from $0.96/share quarterly to current quarterly dividend of $1.07. Using the company’s midpoint earnings guidance of adjusted diluted EPS of $7.91/share for FY 2018, we can see that the payout ratio in terms of EPS is 54.1%. This is about where I’d like a pharma dividend payer to be at as it leaves the company plenty of capital to invest in the research and development that will be necessary to develop new blockbuster drugs in the future, not to mention also returning capital to shareholders in the form of share buybacks when the company’s shares are attractively priced.

Moreover, we can examine the company’s free cash flow numbers to arrive at the FCF dividend payout ratio. Per the company’s most recent financial release, Abbvie has generated FCF of $9.5 billion while paying $4.1 billion in dividends during that time. This would mean the payout ratio using FCF is roughly 43%.

Both methods of gauging the company’s payout ratio show us that the dividend is clearly safe and reasonable, allowing raises fairly similar to the most recent of 11.5%, while still heavily investing in the company’s future through R&D.

With a dividend yield of 4.7%, it is wise to question why the yield is so high currently. This leads us into our next point in which we’ll discuss the risks that Abbvie is facing, and why I believe these risks are being more than factored into the company’s stock price.

Reason #2: While Bears Argue Abbvie Will Not Be Able To Offset Humira’s Eventual Revenue Declines, I Believe The Contrary Is True

The primary concern that investors have had with Abbvie for several years is that Abbvie is too reliant on Humira. They conclude that because Humira accounts for 62% of Abbvie’s revenue as of Q3 2018 and 70%+ of its profits, when Humira sales eventually decline, the company’s prospects will also decline.

Fortunately, per company forecasts for the remainder of 2018, sales of Humira are as follows:

International: $6.3 billion (32%)

US: $13.7 billion (68%)

Total Humira sales: $20 billion

The company is currently facing tough biosimilar competition in the European Union as competitors such as Amgen, Biogen, Mylan, and Norvartis releasing biosimilar versions of Humira. With discounting of Humira ranging from as low as 10%, to as high as 80% in Nordic countries, international Humira sales are expected to decline 26-27% in 2019, per Reuters.

Source: Abbvie Investor Presentation

Although this isn’t the most encouraging news, the bulk of Humira’s sales are generated in the United States. Assuming a 27% decline in international Humira sales, the company’s international sales will decline by $1.7 billion. This would equate to a ~5% sales overall sales decline by itself. However, with strong Humira patent protection in the US, Abbvie won’t face any rival biosimilar Humira drugs in the US until 2023. In the meantime, Humira sales will continue to grow at a clip of roughly 10-12% in the US, before peaking at $21 billion in total sales in 2020. This would equate to an increase in Humira sales of nearly $1.4 billion to $1.6 billion. An overall decline in Humira sales of $100 million to $300 million would mean that the company will see a revenue decline of less than 1% in 2019, not accounting for any growth experienced from other drugs on the market or in the pipeline.

Source: Abbvie Investor Presentation

Abbvie’s management recognizes the threats posed by concentration risk from Humira and they have developed a corporate strategy focused on extensive research and development to drive innovation, and deliver results to shareholders in the process.

Even if we assume that Rova T will be a complete bust, producing no revenue for Abbvie, and that Humira’s sales will fall considerably in the next 5 years, Abbvie has several promising drugs at various phases of development and marketing, as shown by the above illustration including:

Venclexta

Imbruvica

Risankizumab

Upadacitinib

Orilissa

In the Oncology division, Venclexta and Imbruvica offer a lot of promise to Abbvie. Venclexta earned FDA approval for the treatment of chronic lymphocytic leukemia (CLL) in April 2016. Upon examining Venclexta, we can see that Fierce Biotech is estimating that Venclexta could generate peak sales of $2 billion if it earns up to three separate breakthrough designations, which could potentially occur. Moreover, Imbruvica has shown tremendous promise and it appears as though the 2022 sales forecast by Fierce Biotech of $8.29 billion could prove to be accurate. According to the Abbvie news release, sales of Imbruvica totaled $972 million, representing a 41.3% YOY growth. It’s easy to see how these two oncology drugs alone could offset quite a bit of revenue decline in Humira over the coming years.

Moving to the immunology segment, the two most promising late-stage assets include Risankizumab and Upadacitinib. After a Phase III sweep by Risankizumab, it is reasonable to conclude that Risankizumab will be able to easily take market share from older drugs, such as Stelara and Abbvie’s own Humira. The only question regarding how much Abbvie is able to monetize this drug lies in how well it can compete with other newer, similar drugs including Eli Lilly’s Taltz, and Novartis’ Cosentyx as both of those drugs also delivered promising results in treating psoriasis. The blockbuster potential is there as Abbvie projects that Risankizumab could mature into a drug with peak sales of $4-5 billion. Regarding Upadacitinib, there is guidance from Abbvie that the drug could mature into $6.3 billion in sales by 2025.

This seems like a reason estimate, given that recent studies have shown the drug’s remission rates are 66%, double that of the standard of care (Methotrexate). The concern with Upadacitinib is the possibility that it may not be able to avoid fate of the black box warning cautioning against thrombosis that Eli Lilly’s Olumiant was forced to comply with when the FDA approved Olumiant with that caveat, in addition to only clearing the use of Olumiant in patients that have already tried drugs, such as Humira and Enbrel. If Upadacitinib is able to avoid the black box warning, it absolutely could become a $6+ billion blockbuster for Abbvie. I believe that the data of one adverse event out of the 631 patients treated with Upadacitinib in the trial is encouraging, but as with all pharma stocks, we won’t know for certain what the future holds for Abbvie’s recent Upadacitinib submission to the FDA until the company receives a decision from the FDA.

Finally, moving into the focused investment segment of Abbvie, we will discuss the most promising drug in that segment. As seen above, that drug is Elagolix aka Orilissa. Orilissa is the first FDA approved oral treatment for moderate to severe endometriosis pain in over a decade. The most encouraging news to come out of the FDA approval is that regulators green-lighted the product at two dosage strengths, without adding a black box warning for bone mineral density changes. This likely de-risks Orilissa and means that it could become the standard of care in treating moderate to severe endometriosis, a largely under-served market. Ultimately, Goldman Sachs analyst Jami Rubin believes that the drug could generate sales of $1 billion a year by 2020, and $2 billion a year by 2025 if industry experts are correct in their prediction of a uterine fibroids OK from the FDA by 2020.

Although the above figures that have been provided on the sales potential of the aforementioned drugs are just estimates, I believe these estimates are reasonable and even if some prove to be incorrect, it only takes one or two blockbuster drugs to be able to offset the eventual revenue declines in Humira, and drive earnings growth for years to come.

One final bearish concern present in the entire pharma industry is the worry that the government will eventually place more stringent pricing regulations on the drugs that Abbvie and other pharma giants produce. Back in July 2018, President Trump criticized and vaguely threatened Pfizer after it announced price hikes on over 40 of its drugs. Although this has been an issue that politicians have talked about for some time, as prescription expenditures rise and threaten to destroy Medicare budgets, it is reasonable to conclude the government will face no choice but to eventually take action to more stringently regulate drug price hikes, unless the billions of lobbying dollars by pharma continue to convince legislators to continue to ignore the issue. If/when this more stringent pricing regulation does happen, this would be a blow to the pharma industry as a whole, causing margins to crater. I don’t believe that this is an immediate threat to Abbvie or other pharma companies because as we all know, the federal government generally defers issues for years at a time. However, I do believe this is a risk that must be carefully monitored by investors in the pharma industry, in order to be proactive rather than reactive to a potential headwind in the industry.

Source: Abbvie Investor Presentation

In summary in regards to Abbvie’s growth story moving forward, I believe that Abbvie’s growth platform pitched in the above slide isn’t just another rosy picture that is portrayed by management. We haven’t even covered promising drugs in Abbvie’s early to mid stage development phase, so the thought that Abbvie could reach $35 billion in non-Humira sales by 2025 seems reasonable. The growth that is likely to occur in Imbruvica of another $4+ billion in sales by 2022, in combination with Venclexta peak sales of $2 billion, $4-5 billion from Risankizumab, $6+ billion from Upadacitinib, and $1-2 billion from Orilissa more than offset the projected $9 billion decline in Humira sales from 2020 to 2025. Even factoring in a couple of disappointing results in Abbvie’s pipeline, Abbvie shouldn’t face the same fate of over-reliance on one drug as Gilead Sciences did when its blockbuster Hep C drug, Harvoni experienced a sudden decline in sales. Having examined various drugs of Abbvie’s, both currently on the market and in development, there is certainly a lot of potential for growth moving forward. Having examined the company’s current dividend yield and the risks/opportunities that Abbvie is presented with, this leads me into my next point.

Reason #3: Abbvie’s Valuation is Currently Attractive

The above analysis would be all for naught if I didn’t believe that Abbvie’s current price is compelling for those willing to tolerate the risks mentioned above.

Though the stock has since rebounded strongly from its 52 week low of $77.50 a share, the December 28 share price of $91.12 represents a solid buying opportunity.

Abbvie’s current dividend yield of 4.7% compares very favorably to the 5 year average yield of 3.5%. If the company’s yield reverts back to its average yield of around 3.5%, this would result in a 34.3% increase in the stock price. This would translate into a current stock price of $122.36, which isn’t far off of what the stock’s 52 week high was in January. Of course, I can’t accurately predict if or when the company’s yield will revert back to 3.5%. It may take several years for Abbvie’s yield to revert to around 3.5% as the market waits for Abbvie’s diversification away from Humira to play out.

Moreover, the company’s earnings midpoint of $7.91 for FY 2018 compared against the current price of $91.12 means that Abbvie is sporting an 11.5 PE ratio. For a large-cap pharma stock with a projected 5 year annual growth rate of nearly 17%, this is an attractive entry point.

Summary:

It is my opinion that Abbvie’s dividend is currently safe and unless Abbvie is unable to offset eventual declines in Humira revenue (which I view as unlikely), the dividend should remain safe and continue to grow going forward.

As with any company, an investor must consider the future of the company, industry/company risks, and valuation, before making an investment. The biotech space faces their own set of risks, including concentration risk, patent expirations, generic competition, pipeline issues, and regulatory risks.

Despite Humira set to face stiff biosimilar competition in the United States starting in 2023, I believe Abbvie has the pipeline necessary to more than offset the eventual revenue declines in Humira, driving future growth.

As far as regulatory risks go, the risks that Abbvie faces are risks that its industry peers are also facing. Increased public and government scrutiny regarding drug price increases is a concern, but without rewarding companies such as Abbvie for serving the unmet health needs of patients, the outcome of a full-fledged regulatory backlash against pharma companies is one the United States and the world in general can’t afford. I don’t view this risk as an immediate risk, but one for investors to monitor coming years.

At the current stock price, I believe that the bearish arguments are being given too much credence, while the bullish arguments are not being given enough. This is the reason for the current disconnect between Abbvie’s stock price and its true valuation, from an objective standpoint. Abbvie’s 4.7% dividend yield and an 8% 5 year earnings growth rate (less than half the projected ~17% and just over a third of the previous 5 year growth rate), offers a 12.7% annual return over the next 5 years, assuming a static valuation multiple. Despite these perhaps overly conservative assumptions, Abbvie still offers one of the more compelling investment opportunities in today’s market for those who can tolerate the risks. I believe this creates an attractive entry point for both those considering initiating a position in Abbvie or those looking to add to their position.

Disclosure: I am/we are long ABBV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

0 notes

Text

AbbVie: This Dividend Aristocrat Offers Double-Digit Total Return Potential

New Post has been published on http://loanstop20.com/2019/01/04/abbvie-this-dividend-aristocrat-offers-double-digit-total-return-potential/

AbbVie: This Dividend Aristocrat Offers Double-Digit Total Return Potential

Source: Abbvie Media Resources

With the financial markets likely to enter 2019 having just had the worst December since the Great Depression, there have been many stocks that have taken a beating the past month.

Abbvie (ABBV) has not been exempt from this market plunge as it has fallen nearly ~27.6% from its all-time high of $125.86 a share in January 2018. Moreover, Abbvie has fallen ~3.3% since the beginning of December, from $94.27 a share to $91.12 as of close on December 28, meaning the company has been hit harder than other pharma stocks this year. In addition to concerns over Abbvie’s concentration risk with Humira, another concern in the past 9 months to the investor community was Abbvie’s announcement this past March that it wouldn’t pursue accelerated approval for Rova T to treat RR SCLC, due to disappointing Phase 2 results. Although the company will move forward with the ongoing Phase 3 studies, investor consensus is that the $10.2 billion StemCentryx acquisition, once thought to be a promising oncology acquisition, will instead prove to be a bust. Consequently, the company’s shares have not rebounded to the $110+ range the shares were at January through most of March.

As such, I believe that Abbvie is currently worthy of a dividend growth investor’s consideration. There are three main reasons to support my opinion that Abbvie is an attractive investment, worthy of further due diligence from a potential investor. The first reason is that although its dividend history as an independent company has been brief, it has been spectacular, and I believe it will continue to deliver solid dividend increases going forward. This leads me into my second point that Abbvie has the appropriate drug pipeline to offset the eventual declines in revenue from Humira, which would lead to continued strong dividend increases. Lastly, the company’s current valuation is appealing.

Reason #1: Abbvie’s Safe And Growing Dividend

Since the formation of the company in 2013 as a spin-off of the biopharmaceuticals division of Abbott Laboratories, Abbvie has raised its dividend each year. Abbvie is technically a dividend aristocrat when we factor in its former parent company’s 46 years of consecutive dividend increases.

The company recently announced an 11.5% dividend increase from $0.96/share quarterly to current quarterly dividend of $1.07. Using the company’s midpoint earnings guidance of adjusted diluted EPS of $7.91/share for FY 2018, we can see that the payout ratio in terms of EPS is 54.1%. This is about where I’d like a pharma dividend payer to be at as it leaves the company plenty of capital to invest in the research and development that will be necessary to develop new blockbuster drugs in the future, not to mention also returning capital to shareholders in the form of share buybacks when the company’s shares are attractively priced.

Moreover, we can examine the company’s free cash flow numbers to arrive at the FCF dividend payout ratio. Per the company’s most recent financial release, Abbvie has generated FCF of $9.5 billion while paying $4.1 billion in dividends during that time. This would mean the payout ratio using FCF is roughly 43%.

Both methods of gauging the company’s payout ratio show us that the dividend is clearly safe and reasonable, allowing raises fairly similar to the most recent of 11.5%, while still heavily investing in the company’s future through R&D.

With a dividend yield of 4.7%, it is wise to question why the yield is so high currently. This leads us into our next point in which we’ll discuss the risks that Abbvie is facing, and why I believe these risks are being more than factored into the company’s stock price.

Reason #2: While Bears Argue Abbvie Will Not Be Able To Offset Humira’s Eventual Revenue Declines, I Believe The Contrary Is True

The primary concern that investors have had with Abbvie for several years is that Abbvie is too reliant on Humira. They conclude that because Humira accounts for 62% of Abbvie’s revenue as of Q3 2018 and 70%+ of its profits, when Humira sales eventually decline, the company’s prospects will also decline.

Fortunately, per company forecasts for the remainder of 2018, sales of Humira are as follows:

International: $6.3 billion (32%)

US: $13.7 billion (68%)

Total Humira sales: $20 billion

The company is currently facing tough biosimilar competition in the European Union as competitors such as Amgen, Biogen, Mylan, and Norvartis releasing biosimilar versions of Humira. With discounting of Humira ranging from as low as 10%, to as high as 80% in Nordic countries, international Humira sales are expected to decline 26-27% in 2019, per Reuters.

Source: Abbvie Investor Presentation

Although this isn’t the most encouraging news, the bulk of Humira’s sales are generated in the United States. Assuming a 27% decline in international Humira sales, the company’s international sales will decline by $1.7 billion. This would equate to a ~5% sales overall sales decline by itself. However, with strong Humira patent protection in the US, Abbvie won’t face any rival biosimilar Humira drugs in the US until 2023. In the meantime, Humira sales will continue to grow at a clip of roughly 10-12% in the US, before peaking at $21 billion in total sales in 2020. This would equate to an increase in Humira sales of nearly $1.4 billion to $1.6 billion. An overall decline in Humira sales of $100 million to $300 million would mean that the company will see a revenue decline of less than 1% in 2019, not accounting for any growth experienced from other drugs on the market or in the pipeline.

Source: Abbvie Investor Presentation

Abbvie’s management recognizes the threats posed by concentration risk from Humira and they have developed a corporate strategy focused on extensive research and development to drive innovation, and deliver results to shareholders in the process.

Even if we assume that Rova T will be a complete bust, producing no revenue for Abbvie, and that Humira’s sales will fall considerably in the next 5 years, Abbvie has several promising drugs at various phases of development and marketing, as shown by the above illustration including:

Venclexta

Imbruvica

Risankizumab

Upadacitinib

Orilissa

In the Oncology division, Venclexta and Imbruvica offer a lot of promise to Abbvie. Venclexta earned FDA approval for the treatment of chronic lymphocytic leukemia (CLL) in April 2016. Upon examining Venclexta, we can see that Fierce Biotech is estimating that Venclexta could generate peak sales of $2 billion if it earns up to three separate breakthrough designations, which could potentially occur. Moreover, Imbruvica has shown tremendous promise and it appears as though the 2022 sales forecast by Fierce Biotech of $8.29 billion could prove to be accurate. According to the Abbvie news release, sales of Imbruvica totaled $972 million, representing a 41.3% YOY growth. It’s easy to see how these two oncology drugs alone could offset quite a bit of revenue decline in Humira over the coming years.

Moving to the immunology segment, the two most promising late-stage assets include Risankizumab and Upadacitinib. After a Phase III sweep by Risankizumab, it is reasonable to conclude that Risankizumab will be able to easily take market share from older drugs, such as Stelara and Abbvie’s own Humira. The only question regarding how much Abbvie is able to monetize this drug lies in how well it can compete with other newer, similar drugs including Eli Lilly’s Taltz, and Novartis’ Cosentyx as both of those drugs also delivered promising results in treating psoriasis. The blockbuster potential is there as Abbvie projects that Risankizumab could mature into a drug with peak sales of $4-5 billion. Regarding Upadacitinib, there is guidance from Abbvie that the drug could mature into $6.3 billion in sales by 2025.

This seems like a reason estimate, given that recent studies have shown the drug’s remission rates are 66%, double that of the standard of care (Methotrexate). The concern with Upadacitinib is the possibility that it may not be able to avoid fate of the black box warning cautioning against thrombosis that Eli Lilly’s Olumiant was forced to comply with when the FDA approved Olumiant with that caveat, in addition to only clearing the use of Olumiant in patients that have already tried drugs, such as Humira and Enbrel. If Upadacitinib is able to avoid the black box warning, it absolutely could become a $6+ billion blockbuster for Abbvie. I believe that the data of one adverse event out of the 631 patients treated with Upadacitinib in the trial is encouraging, but as with all pharma stocks, we won’t know for certain what the future holds for Abbvie’s recent Upadacitinib submission to the FDA until the company receives a decision from the FDA.

Finally, moving into the focused investment segment of Abbvie, we will discuss the most promising drug in that segment. As seen above, that drug is Elagolix aka Orilissa. Orilissa is the first FDA approved oral treatment for moderate to severe endometriosis pain in over a decade. The most encouraging news to come out of the FDA approval is that regulators green-lighted the product at two dosage strengths, without adding a black box warning for bone mineral density changes. This likely de-risks Orilissa and means that it could become the standard of care in treating moderate to severe endometriosis, a largely under-served market. Ultimately, Goldman Sachs analyst Jami Rubin believes that the drug could generate sales of $1 billion a year by 2020, and $2 billion a year by 2025 if industry experts are correct in their prediction of a uterine fibroids OK from the FDA by 2020.

Although the above figures that have been provided on the sales potential of the aforementioned drugs are just estimates, I believe these estimates are reasonable and even if some prove to be incorrect, it only takes one or two blockbuster drugs to be able to offset the eventual revenue declines in Humira, and drive earnings growth for years to come.

One final bearish concern present in the entire pharma industry is the worry that the government will eventually place more stringent pricing regulations on the drugs that Abbvie and other pharma giants produce. Back in July 2018, President Trump criticized and vaguely threatened Pfizer after it announced price hikes on over 40 of its drugs. Although this has been an issue that politicians have talked about for some time, as prescription expenditures rise and threaten to destroy Medicare budgets, it is reasonable to conclude the government will face no choice but to eventually take action to more stringently regulate drug price hikes, unless the billions of lobbying dollars by pharma continue to convince legislators to continue to ignore the issue. If/when this more stringent pricing regulation does happen, this would be a blow to the pharma industry as a whole, causing margins to crater. I don’t believe that this is an immediate threat to Abbvie or other pharma companies because as we all know, the federal government generally defers issues for years at a time. However, I do believe this is a risk that must be carefully monitored by investors in the pharma industry, in order to be proactive rather than reactive to a potential headwind in the industry.

Source: Abbvie Investor Presentation

In summary in regards to Abbvie’s growth story moving forward, I believe that Abbvie’s growth platform pitched in the above slide isn’t just another rosy picture that is portrayed by management. We haven’t even covered promising drugs in Abbvie’s early to mid stage development phase, so the thought that Abbvie could reach $35 billion in non-Humira sales by 2025 seems reasonable. The growth that is likely to occur in Imbruvica of another $4+ billion in sales by 2022, in combination with Venclexta peak sales of $2 billion, $4-5 billion from Risankizumab, $6+ billion from Upadacitinib, and $1-2 billion from Orilissa more than offset the projected $9 billion decline in Humira sales from 2020 to 2025. Even factoring in a couple of disappointing results in Abbvie’s pipeline, Abbvie shouldn’t face the same fate of over-reliance on one drug as Gilead Sciences did when its blockbuster Hep C drug, Harvoni experienced a sudden decline in sales. Having examined various drugs of Abbvie’s, both currently on the market and in development, there is certainly a lot of potential for growth moving forward. Having examined the company’s current dividend yield and the risks/opportunities that Abbvie is presented with, this leads me into my next point.

Reason #3: Abbvie’s Valuation is Currently Attractive

The above analysis would be all for naught if I didn’t believe that Abbvie’s current price is compelling for those willing to tolerate the risks mentioned above.

Though the stock has since rebounded strongly from its 52 week low of $77.50 a share, the December 28 share price of $91.12 represents a solid buying opportunity.

Abbvie’s current dividend yield of 4.7% compares very favorably to the 5 year average yield of 3.5%. If the company’s yield reverts back to its average yield of around 3.5%, this would result in a 34.3% increase in the stock price. This would translate into a current stock price of $122.36, which isn’t far off of what the stock’s 52 week high was in January. Of course, I can’t accurately predict if or when the company’s yield will revert back to 3.5%. It may take several years for Abbvie’s yield to revert to around 3.5% as the market waits for Abbvie’s diversification away from Humira to play out.

Moreover, the company’s earnings midpoint of $7.91 for FY 2018 compared against the current price of $91.12 means that Abbvie is sporting an 11.5 PE ratio. For a large-cap pharma stock with a projected 5 year annual growth rate of nearly 17%, this is an attractive entry point.

Summary:

It is my opinion that Abbvie’s dividend is currently safe and unless Abbvie is unable to offset eventual declines in Humira revenue (which I view as unlikely), the dividend should remain safe and continue to grow going forward.

As with any company, an investor must consider the future of the company, industry/company risks, and valuation, before making an investment. The biotech space faces their own set of risks, including concentration risk, patent expirations, generic competition, pipeline issues, and regulatory risks.

Despite Humira set to face stiff biosimilar competition in the United States starting in 2023, I believe Abbvie has the pipeline necessary to more than offset the eventual revenue declines in Humira, driving future growth.

As far as regulatory risks go, the risks that Abbvie faces are risks that its industry peers are also facing. Increased public and government scrutiny regarding drug price increases is a concern, but without rewarding companies such as Abbvie for serving the unmet health needs of patients, the outcome of a full-fledged regulatory backlash against pharma companies is one the United States and the world in general can’t afford. I don’t view this risk as an immediate risk, but one for investors to monitor coming years.

At the current stock price, I believe that the bearish arguments are being given too much credence, while the bullish arguments are not being given enough. This is the reason for the current disconnect between Abbvie’s stock price and its true valuation, from an objective standpoint. Abbvie’s 4.7% dividend yield and an 8% 5 year earnings growth rate (less than half the projected ~17% and just over a third of the previous 5 year growth rate), offers a 12.7% annual return over the next 5 years, assuming a static valuation multiple. Despite these perhaps overly conservative assumptions, Abbvie still offers one of the more compelling investment opportunities in today’s market for those who can tolerate the risks. I believe this creates an attractive entry point for both those considering initiating a position in Abbvie or those looking to add to their position.

Disclosure: I am/we are long ABBV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

0 notes

Text

AbbVie: This Dividend Aristocrat Offers Double-Digit Total Return Potential

New Post has been published on http://brummy80.com/abbvie-this-dividend-aristocrat-offers-double-digit-total-return-potential/

AbbVie: This Dividend Aristocrat Offers Double-Digit Total Return Potential

Source: Abbvie Media Resources

With the financial markets likely to enter 2019 having just had the worst December since the Great Depression, there have been many stocks that have taken a beating the past month.

Abbvie (ABBV) has not been exempt from this market plunge as it has fallen nearly ~27.6% from its all-time high of $125.86 a share in January 2018. Moreover, Abbvie has fallen ~3.3% since the beginning of December, from $94.27 a share to $91.12 as of close on December 28, meaning the company has been hit harder than other pharma stocks this year. In addition to concerns over Abbvie’s concentration risk with Humira, another concern in the past 9 months to the investor community was Abbvie’s announcement this past March that it wouldn’t pursue accelerated approval for Rova T to treat RR SCLC, due to disappointing Phase 2 results. Although the company will move forward with the ongoing Phase 3 studies, investor consensus is that the $10.2 billion StemCentryx acquisition, once thought to be a promising oncology acquisition, will instead prove to be a bust. Consequently, the company’s shares have not rebounded to the $110+ range the shares were at January through most of March.

As such, I believe that Abbvie is currently worthy of a dividend growth investor’s consideration. There are three main reasons to support my opinion that Abbvie is an attractive investment, worthy of further due diligence from a potential investor. The first reason is that although its dividend history as an independent company has been brief, it has been spectacular, and I believe it will continue to deliver solid dividend increases going forward. This leads me into my second point that Abbvie has the appropriate drug pipeline to offset the eventual declines in revenue from Humira, which would lead to continued strong dividend increases. Lastly, the company’s current valuation is appealing.

Reason #1: Abbvie’s Safe And Growing Dividend

Since the formation of the company in 2013 as a spin-off of the biopharmaceuticals division of Abbott Laboratories, Abbvie has raised its dividend each year. Abbvie is technically a dividend aristocrat when we factor in its former parent company’s 46 years of consecutive dividend increases.

The company recently announced an 11.5% dividend increase from $0.96/share quarterly to current quarterly dividend of $1.07. Using the company’s midpoint earnings guidance of adjusted diluted EPS of $7.91/share for FY 2018, we can see that the payout ratio in terms of EPS is 54.1%. This is about where I’d like a pharma dividend payer to be at as it leaves the company plenty of capital to invest in the research and development that will be necessary to develop new blockbuster drugs in the future, not to mention also returning capital to shareholders in the form of share buybacks when the company’s shares are attractively priced.

Moreover, we can examine the company’s free cash flow numbers to arrive at the FCF dividend payout ratio. Per the company’s most recent financial release, Abbvie has generated FCF of $9.5 billion while paying $4.1 billion in dividends during that time. This would mean the payout ratio using FCF is roughly 43%.

Both methods of gauging the company’s payout ratio show us that the dividend is clearly safe and reasonable, allowing raises fairly similar to the most recent of 11.5%, while still heavily investing in the company’s future through R&D.

With a dividend yield of 4.7%, it is wise to question why the yield is so high currently. This leads us into our next point in which we’ll discuss the risks that Abbvie is facing, and why I believe these risks are being more than factored into the company’s stock price.

Reason #2: While Bears Argue Abbvie Will Not Be Able To Offset Humira’s Eventual Revenue Declines, I Believe The Contrary Is True

The primary concern that investors have had with Abbvie for several years is that Abbvie is too reliant on Humira. They conclude that because Humira accounts for 62% of Abbvie’s revenue as of Q3 2018 and 70%+ of its profits, when Humira sales eventually decline, the company’s prospects will also decline.

Fortunately, per company forecasts for the remainder of 2018, sales of Humira are as follows:

International: $6.3 billion (32%)

US: $13.7 billion (68%)

Total Humira sales: $20 billion

The company is currently facing tough biosimilar competition in the European Union as competitors such as Amgen, Biogen, Mylan, and Norvartis releasing biosimilar versions of Humira. With discounting of Humira ranging from as low as 10%, to as high as 80% in Nordic countries, international Humira sales are expected to decline 26-27% in 2019, per Reuters.

Source: Abbvie Investor Presentation

Although this isn’t the most encouraging news, the bulk of Humira’s sales are generated in the United States. Assuming a 27% decline in international Humira sales, the company’s international sales will decline by $1.7 billion. This would equate to a ~5% sales overall sales decline by itself. However, with strong Humira patent protection in the US, Abbvie won’t face any rival biosimilar Humira drugs in the US until 2023. In the meantime, Humira sales will continue to grow at a clip of roughly 10-12% in the US, before peaking at $21 billion in total sales in 2020. This would equate to an increase in Humira sales of nearly $1.4 billion to $1.6 billion. An overall decline in Humira sales of $100 million to $300 million would mean that the company will see a revenue decline of less than 1% in 2019, not accounting for any growth experienced from other drugs on the market or in the pipeline.

Source: Abbvie Investor Presentation

Abbvie’s management recognizes the threats posed by concentration risk from Humira and they have developed a corporate strategy focused on extensive research and development to drive innovation, and deliver results to shareholders in the process.

Even if we assume that Rova T will be a complete bust, producing no revenue for Abbvie, and that Humira’s sales will fall considerably in the next 5 years, Abbvie has several promising drugs at various phases of development and marketing, as shown by the above illustration including:

Venclexta

Imbruvica

Risankizumab

Upadacitinib

Orilissa

In the Oncology division, Venclexta and Imbruvica offer a lot of promise to Abbvie. Venclexta earned FDA approval for the treatment of chronic lymphocytic leukemia (CLL) in April 2016. Upon examining Venclexta, we can see that Fierce Biotech is estimating that Venclexta could generate peak sales of $2 billion if it earns up to three separate breakthrough designations, which could potentially occur. Moreover, Imbruvica has shown tremendous promise and it appears as though the 2022 sales forecast by Fierce Biotech of $8.29 billion could prove to be accurate. According to the Abbvie news release, sales of Imbruvica totaled $972 million, representing a 41.3% YOY growth. It’s easy to see how these two oncology drugs alone could offset quite a bit of revenue decline in Humira over the coming years.

Moving to the immunology segment, the two most promising late-stage assets include Risankizumab and Upadacitinib. After a Phase III sweep by Risankizumab, it is reasonable to conclude that Risankizumab will be able to easily take market share from older drugs, such as Stelara and Abbvie’s own Humira. The only question regarding how much Abbvie is able to monetize this drug lies in how well it can compete with other newer, similar drugs including Eli Lilly’s Taltz, and Novartis’ Cosentyx as both of those drugs also delivered promising results in treating psoriasis. The blockbuster potential is there as Abbvie projects that Risankizumab could mature into a drug with peak sales of $4-5 billion. Regarding Upadacitinib, there is guidance from Abbvie that the drug could mature into $6.3 billion in sales by 2025.

This seems like a reason estimate, given that recent studies have shown the drug’s remission rates are 66%, double that of the standard of care (Methotrexate). The concern with Upadacitinib is the possibility that it may not be able to avoid fate of the black box warning cautioning against thrombosis that Eli Lilly’s Olumiant was forced to comply with when the FDA approved Olumiant with that caveat, in addition to only clearing the use of Olumiant in patients that have already tried drugs, such as Humira and Enbrel. If Upadacitinib is able to avoid the black box warning, it absolutely could become a $6+ billion blockbuster for Abbvie. I believe that the data of one adverse event out of the 631 patients treated with Upadacitinib in the trial is encouraging, but as with all pharma stocks, we won’t know for certain what the future holds for Abbvie’s recent Upadacitinib submission to the FDA until the company receives a decision from the FDA.

Finally, moving into the focused investment segment of Abbvie, we will discuss the most promising drug in that segment. As seen above, that drug is Elagolix aka Orilissa. Orilissa is the first FDA approved oral treatment for moderate to severe endometriosis pain in over a decade. The most encouraging news to come out of the FDA approval is that regulators green-lighted the product at two dosage strengths, without adding a black box warning for bone mineral density changes. This likely de-risks Orilissa and means that it could become the standard of care in treating moderate to severe endometriosis, a largely under-served market. Ultimately, Goldman Sachs analyst Jami Rubin believes that the drug could generate sales of $1 billion a year by 2020, and $2 billion a year by 2025 if industry experts are correct in their prediction of a uterine fibroids OK from the FDA by 2020.

Although the above figures that have been provided on the sales potential of the aforementioned drugs are just estimates, I believe these estimates are reasonable and even if some prove to be incorrect, it only takes one or two blockbuster drugs to be able to offset the eventual revenue declines in Humira, and drive earnings growth for years to come.

One final bearish concern present in the entire pharma industry is the worry that the government will eventually place more stringent pricing regulations on the drugs that Abbvie and other pharma giants produce. Back in July 2018, President Trump criticized and vaguely threatened Pfizer after it announced price hikes on over 40 of its drugs. Although this has been an issue that politicians have talked about for some time, as prescription expenditures rise and threaten to destroy Medicare budgets, it is reasonable to conclude the government will face no choice but to eventually take action to more stringently regulate drug price hikes, unless the billions of lobbying dollars by pharma continue to convince legislators to continue to ignore the issue. If/when this more stringent pricing regulation does happen, this would be a blow to the pharma industry as a whole, causing margins to crater. I don’t believe that this is an immediate threat to Abbvie or other pharma companies because as we all know, the federal government generally defers issues for years at a time. However, I do believe this is a risk that must be carefully monitored by investors in the pharma industry, in order to be proactive rather than reactive to a potential headwind in the industry.

Source: Abbvie Investor Presentation

In summary in regards to Abbvie’s growth story moving forward, I believe that Abbvie’s growth platform pitched in the above slide isn’t just another rosy picture that is portrayed by management. We haven’t even covered promising drugs in Abbvie’s early to mid stage development phase, so the thought that Abbvie could reach $35 billion in non-Humira sales by 2025 seems reasonable. The growth that is likely to occur in Imbruvica of another $4+ billion in sales by 2022, in combination with Venclexta peak sales of $2 billion, $4-5 billion from Risankizumab, $6+ billion from Upadacitinib, and $1-2 billion from Orilissa more than offset the projected $9 billion decline in Humira sales from 2020 to 2025. Even factoring in a couple of disappointing results in Abbvie’s pipeline, Abbvie shouldn’t face the same fate of over-reliance on one drug as Gilead Sciences did when its blockbuster Hep C drug, Harvoni experienced a sudden decline in sales. Having examined various drugs of Abbvie’s, both currently on the market and in development, there is certainly a lot of potential for growth moving forward. Having examined the company’s current dividend yield and the risks/opportunities that Abbvie is presented with, this leads me into my next point.

Reason #3: Abbvie’s Valuation is Currently Attractive

The above analysis would be all for naught if I didn’t believe that Abbvie’s current price is compelling for those willing to tolerate the risks mentioned above.

Though the stock has since rebounded strongly from its 52 week low of $77.50 a share, the December 28 share price of $91.12 represents a solid buying opportunity.

Abbvie’s current dividend yield of 4.7% compares very favorably to the 5 year average yield of 3.5%. If the company’s yield reverts back to its average yield of around 3.5%, this would result in a 34.3% increase in the stock price. This would translate into a current stock price of $122.36, which isn’t far off of what the stock’s 52 week high was in January. Of course, I can’t accurately predict if or when the company’s yield will revert back to 3.5%. It may take several years for Abbvie’s yield to revert to around 3.5% as the market waits for Abbvie’s diversification away from Humira to play out.

Moreover, the company’s earnings midpoint of $7.91 for FY 2018 compared against the current price of $91.12 means that Abbvie is sporting an 11.5 PE ratio. For a large-cap pharma stock with a projected 5 year annual growth rate of nearly 17%, this is an attractive entry point.

Summary:

It is my opinion that Abbvie’s dividend is currently safe and unless Abbvie is unable to offset eventual declines in Humira revenue (which I view as unlikely), the dividend should remain safe and continue to grow going forward.

As with any company, an investor must consider the future of the company, industry/company risks, and valuation, before making an investment. The biotech space faces their own set of risks, including concentration risk, patent expirations, generic competition, pipeline issues, and regulatory risks.

Despite Humira set to face stiff biosimilar competition in the United States starting in 2023, I believe Abbvie has the pipeline necessary to more than offset the eventual revenue declines in Humira, driving future growth.

As far as regulatory risks go, the risks that Abbvie faces are risks that its industry peers are also facing. Increased public and government scrutiny regarding drug price increases is a concern, but without rewarding companies such as Abbvie for serving the unmet health needs of patients, the outcome of a full-fledged regulatory backlash against pharma companies is one the United States and the world in general can’t afford. I don’t view this risk as an immediate risk, but one for investors to monitor coming years.

At the current stock price, I believe that the bearish arguments are being given too much credence, while the bullish arguments are not being given enough. This is the reason for the current disconnect between Abbvie’s stock price and its true valuation, from an objective standpoint. Abbvie’s 4.7% dividend yield and an 8% 5 year earnings growth rate (less than half the projected ~17% and just over a third of the previous 5 year growth rate), offers a 12.7% annual return over the next 5 years, assuming a static valuation multiple. Despite these perhaps overly conservative assumptions, Abbvie still offers one of the more compelling investment opportunities in today’s market for those who can tolerate the risks. I believe this creates an attractive entry point for both those considering initiating a position in Abbvie or those looking to add to their position.

Disclosure: I am/we are long ABBV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

0 notes

Text

Female Infertility: Opportunity Analysis and Forecasts to 2028 published on

http://www.sandlerresearch.org/female-infertility-opportunity-analysis-and-forecasts-to-2028.html

Female Infertility: Opportunity Analysis and Forecasts to 2028

Female Infertility: Opportunity Analysis and Forecasts to 2028

Summary

Female infertility (FI) is a complex disorder defined as the inability to conceive after at least one year of timed, unprotected intercourse. The etiology of the condition spans a wide range of disorders that can be broadly classified into the following categories: diminished ovarian reserve & ovulation disorders, endometriosis, fallopian tube abnormalities, uterine factors and unexplained infertility. Several factors may be considered before a treatment decision is made, including treatment effectiveness (live birth rate), treatment burden (such as number of required injections and monitoring appointments), safety (such as risk of multiple gestation or ovarian hyperstimulation), and cost of therapy. Overall, the most common treatments include ovulation induction drugs and/or advanced techniques, referred to as Assisted Reproductive Technology (ART), such as in vitro fertilization (IVF).

Key Highlights

The greatest drivers of growth in the global FI market are a growing number of women are postponing pregnancy until later in life and at a reproductively older age when fertility has generally decreased and the launch of nolasiban in the US and 5EU, the first major innovation in this indication in many years. The main barriers to growth in the female infertility market include the sparse pipeline for new female infertility treatments, and the limited number of innovative drugs under development. Among the late-stage pipeline products, the launch of nolasiban early in the forecast period will add significant growth to sales by 2028. The most important unmet needs in FI include further improving IVF success rates, orally and less frequently administered drugs involved in IVF, additional treatment options for reproductively older infertile women and young women with diminished ovarian reserve (DOR), development of novel non-surgical treatment options for the management of uterine fibroid-related infertility and reducing high IVF treatment patient dropout rates.

KEY QUESTIONS ANSWERED

Despite progress made in the management of female infertility since the introduction of ART and other improvements in treating patients, KOLs thought challenges associated with treatment remain, throughout the 7MM. – Which unmet needs are the most pressing in the 7MM? – Where should pharmaceutical companies focus drug development efforts in order to become a significant player in the space? GlobalData expects that pipeline development of nolasiban will contribute significantly to the growth of the FI market going forward. – How much is nolasiban expected to generate over the forecast period? – What other assets are under development and how do KOLs see them competing against current treatment options? – Although female infertility is a prevalent condition, it remains a niche indication on the industry level. – Which have been historically the companies leading the way? – What new companies are emerging in the space?

Scope

– Overview of Female Infertility including epidemiology, etiology and current treatment options, namely ovulation induction and ART – Topline Female Infertility market revenue, annual cost of therapy, and major pipeline product sales in the forecast period. – Key topics covered include current treatment and pipeline therapies, unmet needs and opportunities, and the drivers and barriers affecting Female Infertility therapeutics sales in the 7MM. – Pipeline analysis: Comprehensive data split across different phases, emerging novel trends under development, and detailed analysis of late-stage pipeline drugs. – Analysis of the current and future market competition in the global Female Infertility therapeutics market. Insightful review of the key industry drivers, restraints and challenges. Each trend is independently researched to provide qualitative analysis of its implications.

Reasons to buy

The report will enable you to – – Develop and design your in-licensing and out-licensing strategies, using a detailed overview of current pipeline products and technologies to identify companies with the most robust pipelines. – Develop business strategies by understanding the trends shaping and driving the global Female Infertility therapeutics market. – Drive revenues by understanding the key trends, innovative products and technologies, market segments, and companies likely to impact the global Female Infertility market in the future. – Formulate effective sales and marketing strategies by understanding the competitive landscape and by analyzing the performance of various competitors. – Identify emerging players with potentially strong product portfolios and create effective counter-strategies to gain a competitive advantage. – Track drug sales in the global Female Infertility therapeutics market from 2018-2028. – Organize your sales and marketing efforts by identifying the market categories and segments that present maximum opportunities for consolidations, investments and strategic partnerships.

0 notes

Text

Women’s Health Market to Expand at a Modest CAGR of 5.7% by 2025

The global women’s health market has been analyzed on the basis of treatment type, disease indication and geography. Major treatment type segments are hormonal treatment and non-hormonal treatment. Hormonal treatment segment is subdivided into estrogen therapy, progestin therapy, combination therapy, thyroid replacement therapy, parathyroid hormone therapy, and others. While non-hormonal treatment segment considers cancer targeted therapy drugs, antibiotics, bisphosphonates, vitamin D treatment, calcitonin, RANK-Ligand, non-steroidal anti-inflammatory drugs and others. The disease indication segment of global women’s health market bifurcated into breast cancer, cervical cancer, ovarian cancer, hypothyroidism, post-menopausal syndrome, osteoporosis, contraceptive, uterine fibroid, urinary tract infection, and other disease indications. Geographically, global women’s health market is divided into major five geographical regions, including North America, Europe, Asia-Pacific, Latin America and Middle East and Africa.

Obtain Report Details @

https://www.transparencymarketresearch.com/women-health-therapeutics-market.html

Non-hormonal Treatments to Remain Popular Segment Under Global Women’s Health Market

The non-hormonal treatment segment accounted for significant share of the global women’s health market in 2016. The segment is projected to be the most lucrative market for global women’s health market during the forecast period owing to the effectiveness of the products, growing adoption of these products, and new product development are the key factors for the segment growth. The decreasing use of hormonal products due to the risk of breast cancer has boosted the demand for non-hormonal pharmaceutical products. According to eHealthMe, about 52.3% of women with menopause uses antidepressant therapy between the age of 50 and 59.

Request for Sample Copy of Report @

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=214

Asia Pacific to Show Keen Interest in Women’s Health as Awareness Increases

The U.S. is estimated to remain the largest market for women’s health therapeutics due to high investments made in cutting-edge drug research resulting in new, sophisticated treatments with specific mechanism of action; rising emphasis on cancer care, and concentration of some of the world’s major pharmaceutical and biotechnology organizations in the region. While Asia pacific market is anticipated to grow with highest CAGR during forecast period. Emerging markets with their populations in billions have become a potent source of revenue. Health care in developing countries is undergoing rapid changes.

Request Report Brochure @

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=214

The BRICS (Brazil, Russia, India, China, and South Africa) countries are among the fastest-growing economies in the world. According to Siemens Healthineers, health care expenditure in emerging economies has increased 11% from 1995 to 2012 and expected to reach 33% in 2022. Rising population in emerging countries will lead to increased demand for pharmaceutical and biopharmaceutical products in the near future. Rising geriatric female population and economic growth are likely to create large opportunity in the women’s health market.

About Us

Transparency Market Research (TMR) is a global market intelligence company providing business information reports and services. The company’s exclusive blend of quantitative forecasting and trend analysis provides forward-looking insight for thousands of decision makers. TMR’s experienced team of analysts, researchers, and consultants use proprietary data sources and various tools and techniques to gather and analyze information. Our business offerings represent the latest and the most reliable information indispensable for businesses to sustain a competitive edge.

Contact Us

Transparency Market Research State Tower, 90 State Street, Suite 700 Albany, NY 12207 United States Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Email: [email protected] Website: www.transparencymarketresearch.com

0 notes

Link

Embolization Particle or embolisation refers to the passage and lodging of an embolus within the bloodstream. It may be pathological (in which sense it is also called embolism), for example a pulmonary embolism, or therapeutic, as a hemostatic treatment for bleeding or as a treatment for some types of cancer by deliberately blocking blood vessels to starve the tumor cells. Scope of the Report: This report focuses on the Embolization Particle in Global market, especially in North America, Europe and Asia-Pacific, South America, Middle East and Africa. This report categorizes the market based on manufacturers, regions, type and application. Market Segment by Manufacturers, this report covers Sirtex Medical Merit Medical Cook Medical BTG Medical Boston Scientific Corporation Terumo Corporation HENGRUI Medical INterface BIOmaterials B.V. Alicon Market Segment by Regions, regional analysis covers North America (United States, Canada and Mexico) Europe (Germany, France, UK, Russia and Italy) Asia-Pacific (China, Japan, Korea, India and Southeast Asia) South America (Brazil, Argentina, Colombia etc.) Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa) Market Segment by Type, covers Microspheres Particles (e.g. PVA Particles, Gelfoam Particles) Drug-eluting Beads (DEBs) Radio-Embolic Microspheres (e.g. Therasphere and SIRSphere) Market Segment by Applications, can be divided into Uterine Fibroid Embolization Prostatic Artery Embolization (treatment for Benign Prostatic Hyperplasia or BPH) Liver Tumor Embolization Trauma Embolization Other There are 15 Chapters to deeply display the global Embolization Particle market. Chapter 1, to describe Embolization Particle Introduction, product scope, market overview, market opportunities, market risk, market driving force; Chapter 2, to analyze the top manufacturers of Embolization Particle, with sales, revenue, and price of Embolization Particle, in 2016 and 2017; Chapter 3, to display the competitive situation among the top manufacturers, with sales, revenue and market share in 2016 and 2017; Chapter 4, to show the global market by regions, with sales, revenue and market share of Embolization Particle, for each region, from 2013 to 2018; Chapter 5, 6, 7, 8 and 9, to analyze the market by countries, by type, by application and by manufacturers, with sales, revenue and market share by key countries in these regions; Chapter 10 and 11, to show the market by type and application, with sales market share and growth rate by type, application, from 2013 to 2018; Chapter 12, Embolization Particle market forecast, by regions, type and application, with sales and revenue, from 2018 to 2023; Chapter 13, 14 and 15, to describe Embolization Particle sales channel, distributors, traders, dealers, Research Findings and Conclusion, appendix and data source

#(north america#asia-pacific#america#and africa) embolization particle market#and africa) embolization particle market trends#and africa) embolization particle market size#and africa) embolization particle market data#and africa) embolization particle market structure#and africa) embolization particle industry analysis#and africa) embolization particle market research

0 notes

Text

Uterine Fibroid Diagnostics and Therapeutics Market to Garner Brimming Revenues by 2024

Uterine fibroid is a type of tumor that arises from the smooth muscle tissues of uterus. Common non-cancerous growths that develop in the muscular wall of the uterus, they are also known as leiomyoma (benign tumor), fibroleiomyoma, fibromyoma and myoma. They vary in size from tiny to larger than a cantaloupe. Sometimes, they led the uterus to grow to the size of a five-month pregnancy. Fibroids presence usually is multiple is number and if its number is uncountable, it is referred to as uterine leiomyomatosis. Fibroids are amongst the most common form of benign tumors and usually affect the females during the middle of reproductive age and later reproductive age. The malignant form of fibroid, known as leiomyosarcoma, is very uncommon.