#Understanding the Token Economy in NFTs

Explore tagged Tumblr posts

Text

The Fundamentals of NFT Token Economics

Introduction

Token Economics plays a significant role in non-fungible tokens (NFTs). The present article will act as a beginner's guide toward the token economy in NFTs, with a deep discussion and elaboration of fundamental concepts and mechanisms driving value and utility in this new and innovative digital ecosystem. Because NFTs continue to change how we see ownership, creativity, and investment in digital assets, understanding the principles underpinning their economic framework becomes vital.

What is Token Economics in NFTs?

Toke Economics represents the economic principles and models guiding the creation, distribution, and utility of tokens, such as NFTs. As opposed to traditional assets, NFTs are unique, verifiable digital assets on a blockchain. In contrast to other assets, value is determined not just by content but also by tokenomics, which defines the mechanisms governing supply, demand, scarcity, and functionality.

The structure of tokenomics comprises elements like the supply, scarcity, utility of tokens, reward mechanisms, and governance in the NFT ecosystem. Understanding these can explain why some NFTs acquire immense value, but others go relatively unnoticed.

Read More: Understanding the Token Economy in NFTs

Functionality of NFTs

1.Supply and Scarcity

Supply and scarcity are interlinked concepts in the NFT economy. Supply refers to the total number of tokens available, whereas scarcity focuses on the limitation of such tokens. Most NFT projects consciously restrict supply to create scarcity. Here are a few examples:

Limited Editions: Capping the number of tokens available for a specific item will make the creator generate scarcity and thereby increase the desirability of the NFT.

Digital art is one-of-a-kind: such things are naturally lower and, thus command higher prices because they never existed before.

The element of scarcity triggers the sort of collector behavior such as FOMO. A situation in which scarce NFT often commands higher trading volumes in comparison to others in similar market trends.

2.Value Creation

Value in the NFT space is built upon the principles of scarcity, demand, and perception. Rarity makes an NFT extremely exclusive, allowing collectors and investors to pay more money for it. Speculative markets add more to the dynamic, whereby a buyer purchases an NFT in the hope that it will one day sell for more.

3.Utility Functionality

Utility refers to the practical application or benefit of owning an NFT. NFTs can be more than collectibles; they serve different purposes, which heightens their appeal and value.

Exclusive Access and Privileges

NFTs often give owners a right or privilege that is special to them, such as the following:

Access to Digital Content: Owners can open exclusive digital content, including songs, videos, or in-game items.

Membership and Events: Some NFTs are the pass to exclusive events, clubs, or virtual spaces.

Voting Rights: Some decentralized platforms may grant governance rights upon holding an NFT, which entitles their holders to vote on project decisions.

4.Economic Models and Community Engagement

Most NFT projects rely on innovative economic models and significant community engagement to succeed.

Royalties and Revenue Streams

Smart contracts embedded in NFTs guarantee that the creators earn royalties from each resale. This continuous revenue model will encourage the creators to make quality work and align their interests with the market performance of the NFT.

Reward Mechanisms

NFT ecosystems often include rewards to encourage user participation:

Staking: NFT holders can receive rewards by locking their assets in staking pools.

Participation Incentives: Participation in activities such as community votes or event participation can result in exclusive NFTs or tokens.

Community-Centric Engagement

Community is the lifeblood of NFT projects. Tokenomics often encourages collective growth through:

Collaboration through fractional ownership.

Loyalty through airdrops or exclusive perks for early adopters.

Governance rights, which allow users to have a say in the direction of the project.

Why is token economics important?

Token economics is playing a crucial role in the larger NFT ecosystem as it impacts its stability, growth, and innovation. The often-discussed topics include supply, scarcity, value, utility, and community engagement, but structural and functional dynamics define how NFTs interact with technological, regulatory, and financial frameworks.

One of the most important areas where token economics affects NFTs is scalability. As the NFT market grows, networks that host these tokens are becoming congested and experiencing high fees for transactions. Good tokenomics integrates solutions such as layer-2 scaling, alternative blockchains, and sharding to ensure smooth operations within the ecosystem. For example, moving NFTs to blockchains with lower transaction costs or developing solutions for batching transactions makes the ecosystem more accessible and sustainable, especially to smaller investors.

Sustainability is another key aspect. The production and trade of NFTs have sparked much debate over energy usage, especially in proof-of-work blockchains. Token economics addresses these concerns through the incentives of environmentally friendly practices, such as the shift to proof-of-stake or carbon offset programs. These measures bring technological advancement and environmental responsibility in tandem, opening the way to more widespread adoption.

Regulatory frameworks also play a significant role in token economics in NFTs. As the industry matures, governments and institutions are looking into royalties, revenue-sharing, and taxation of digital assets. A good tokenomics model should be proactive in adapting to these regulatory challenges, ensuring compliance while maintaining decentralization. This adaptability is important for building trust and attracting institutional investors into the NFT market.

Other aspects of tokenomics include innovation and technological integrations beyond the simple application of concepts. NFTs often interact with smart contracts, which enable functionalities such as dynamic pricing, conditional access, and automated royalties. These mechanics are flexible enough for projects to explore new use cases, such as combining NFTs with DeFi or integrating them into a physical good or service. Tokenomics provides the basis for these integrations, making it feasible and beneficial for the parties involved.

Finally, token economics makes the market dynamics and risk management more favorable. NFT markets often operate under speculation, creating volatility. Tokenomics may design systems that encourage long-term holding, discourage pump-and-dump schemes, and promote diversified investments. Mechanisms such as fractional ownership and liquidity pools expand participation in markets, making it possible for investors at all scales to meaningfully engage with NFTs.

In essence, token economics in NFTs goes beyond elementary factors and addresses issues such as scalability, sustainability, regulatory compliance, and market innovation. Its role is integral in shaping a robust and inclusive ecosystem that supports long-term growth and adoption. The careful nuances provide an understanding of the dynamic forces shaping this transformative potential.

Challenges and Future Developments

The token Economics has unlocked incredible potential in the NFT space, but challenges remain.

Scalability

A wave in the popularity of NFTs has emphasized the need for scalability on major blockchains. High transaction fees and network congestion can prevent participation, especially from the smaller investor base. Solutions to these issues are layer-2 scaling and alternative blockchains.

Market Volatility

The price of NFTs fluctuates wildly, not least due to speculative trading and market sentiment. Thus, creating sustainable Token Economics models that help to reduce the effects of volatility is necessary to encourage long-term adoption.

Regulatory Considerations

The NFT space resides in a regulatory gray area. Governments and institutions are starting to ask about the legality of certain Token economics practices, including royalties and revenue-sharing mechanisms. Thus, clarity about the regulatory frameworks will be paramount in achieving stability and compliance.

Sustainability

Energy consumption remains an issue of debate. Transitioning into more environmentally friendly mechanisms, such as proof-of-stake, may help to mitigate environmental concerns over NFT creation and trading.

Conclusion

To understand NFTs, it is essential to know about token economics. Scanning through supply, scarcity, value, utility, economic models, and community engagement can let the individual move through this new NFT landscape while being informed in their decisions, contributing to this transformative economy in the digital world.

The future of NFTs and their token economics is full of promise. As the ecosystem evolves, the point of intersection between creativity, technology, and economics will continue to redefine how we perceive and interact with digital assets.

Source

#non-fungible tokens#Understanding the Token Economy in NFTs#nft#nftart#nft tutorials#nftcommunity#digital nft

0 notes

Text

Bitcoin's role in the future of finance

In the ever-evolving landscape of finance, one digital currency has captured the world's attention like no other: Bitcoin. Since its inception in 2009, Bitcoin has transcended from being a mere experimental concept to a transformative force, challenging traditional financial systems and reshaping our perception of money. As we navigate through the complexities of the modern financial world, it's imperative to understand Bitcoin's role in shaping the future of finance.

Bitcoin's Rise to Prominence: Bitcoin's journey from obscurity to prominence has been nothing short of remarkable. Introduced by the pseudonymous Satoshi Nakamoto, Bitcoin was envisioned as a decentralized digital currency, free from the control of central authorities such as banks or governments. Its underlying technology, blockchain, revolutionized the way transactions are recorded and verified, offering transparency, security, and immutability.

Initially met with skepticism and skepticism, Bitcoin gradually gained traction among tech enthusiasts, libertarians, and early adopters seeking an alternative to traditional fiat currencies. As its utility and acceptance grew, Bitcoin's value soared, attracting mainstream attention and investment from institutional players and retail investors alike.

Bitcoin's Role in the Future of Finance: Now, as we stand on the precipice of a new era in finance, Bitcoin's significance cannot be overstated. Here's how Bitcoin is poised to shape the future of finance:

Decentralization and Financial Inclusion: At the heart of Bitcoin lies its decentralized nature, which empowers individuals to take control of their financial destinies. Unlike traditional banking systems, where intermediaries dictate transactions and impose fees, Bitcoin allows for peer-to-peer transactions without the need for intermediaries. This decentralization fosters financial inclusion by providing access to banking services for the unbanked and underbanked populations worldwide.

Hedge Against Inflation and Economic Uncertainty: In an era marked by economic volatility and uncertainty, Bitcoin offers a hedge against inflation and currency devaluation. With a finite supply of 21 million coins, Bitcoin is immune to the whims of central banks and government policies that often erode the value of fiat currencies. As central banks continue to print money to stimulate economies, Bitcoin's scarcity and deflationary nature make it an attractive store of value and a hedge against economic downturns.

Innovation in Financial Services: Bitcoin's underlying technology, blockchain, has paved the way for innovative financial services and applications. From decentralized finance (DeFi) platforms to non-fungible tokens (NFTs) and smart contracts, Bitcoin's ecosystem continues to expand, offering new avenues for investment, lending, and asset management. These innovations have the potential to democratize finance, making it more accessible and inclusive for individuals worldwide.

Global Payments and Remittances: As a borderless digital currency, Bitcoin facilitates fast, low-cost cross-border payments and remittances. Unlike traditional banking systems, which are plagued by high fees and long processing times, Bitcoin enables instant transactions without the need for intermediaries. This has significant implications for global commerce, enabling businesses to streamline payments and expand their reach to new markets.

Institutional Adoption and Mainstream Acceptance: In recent years, we've witnessed a surge in institutional adoption of Bitcoin, with major corporations and financial institutions incorporating Bitcoin into their investment portfolios. This institutional endorsement not only lends credibility to Bitcoin but also paves the way for mainstream acceptance. As more businesses and individuals embrace Bitcoin, its role in the future of finance is poised to become even more pronounced.

Conclusion: In conclusion, Bitcoin's role in the future of finance is multifaceted and profound. From decentralization and financial inclusion to innovation and global payments, Bitcoin has the potential to reshape the way we perceive and interact with money. As we embrace the digital revolution, Bitcoin stands at the forefront, offering a glimpse into a future where financial empowerment and freedom reign supreme. As we embark on this journey, one thing is clear: Bitcoin is not just a digital currency; it's a catalyst for change, ushering in a new era of finance for generations to come.

How will Bitcoin be used in the future?

In the ever-evolving landscape of digital currencies, Bitcoin stands tall as a pioneer, offering a glimpse into the future of finance. But how will Bitcoin be used in the future? Let's delve into the possibilities and potential of this groundbreaking cryptocurrency.

Global Transactions and Remittances: Bitcoin's borderless nature makes it ideal for facilitating international transactions and remittances. As traditional banking systems struggle with high fees and lengthy processing times, Bitcoin offers a faster, more cost-effective alternative. In the future, we can expect to see Bitcoin used as a primary means of transferring value across borders, empowering individuals and businesses alike.

Store of Value: With its finite supply and decentralized nature, Bitcoin has emerged as a reliable store of value akin to digital gold. As economic uncertainty looms and traditional fiat currencies face inflationary pressures, Bitcoin offers a hedge against depreciation. In the future, we may witness a significant portion of wealth stored in Bitcoin, safeguarding against currency devaluation and economic downturns.

Mainstream Adoption: While Bitcoin has already gained widespread recognition, its adoption is poised to skyrocket in the future. As more merchants accept Bitcoin as a form of payment and financial institutions integrate it into their services, Bitcoin will become increasingly accessible to the masses. This mainstream adoption will fuel its use in everyday transactions, from purchasing goods and services to receiving salaries.

Financial Inclusion: Bitcoin has the potential to bridge the gap between the banked and unbanked populations, particularly in developing countries. individuals who have been excluded from the formal financial system, fostering greater financial inclusion and economic empowerment.

Smart Contracts and Decentralized Finance (DeFi): Bitcoin's underlying technology, blockchain, enables the creation of smart contracts and decentralized finance applications. In the future, we can expect to see Bitcoin utilized in a variety of DeFi platforms, offering innovative financial services such as lending, borrowing, and trading. These decentralized applications will revolutionize traditional financial systems, providing greater accessibility and transparency to users.

Hedging Against Geopolitical Risks: As geopolitical tensions rise and governments impose sanctions, Bitcoin provides a means of circumventing restrictions on capital flows. In the future, we may see individuals and businesses turn to Bitcoin as a hedge against geopolitical risks, preserving their wealth in a borderless and censorship-resistant asset.

Integration with Central Bank Digital Currencies (CBDCs): While Bitcoin operates independently of central banks, it may complement the emerging trend of central bank digital currencies (CBDCs). In the future, we could see interoperability between Bitcoin and CBDCs, facilitating seamless exchange between digital and traditional currencies.

In conclusion, the future of Bitcoin is filled with promise and potential. From facilitating global transactions to fostering financial inclusion, Bitcoin is poised to revolutionize the way we think about money. As we embrace this digital frontier, Bitcoin will continue to shape the future of finance, empowering individuals, businesses, and economies worldwide.

What is the future of long term Bitcoin?

In the ever-evolving realm of cryptocurrencies, Bitcoin stands as the pioneer, the trailblazer that ignited a digital revolution. From its inception in 2009 by the mysterious Satoshi Nakamoto to its current status as a trillion-dollar asset, Bitcoin has captured the imagination of investors, tech enthusiasts, and economists alike. But what does the future hold for long-term Bitcoin? Let's embark on a journey to unravel the mysteries and explore the potential trajectory of this digital gold.

As we gaze into the crystal ball of cryptocurrency, one thing becomes clear: Bitcoin's long-term future is intricately tied to its ability to adapt and overcome challenges. Like any revolutionary technology, Bitcoin has faced its fair share of hurdles, from scalability issues to regulatory scrutiny. Yet, with each obstacle, Bitcoin has emerged stronger, more resilient, and more ingrained in the fabric of our digital economy.

So, what can we expect from long-term Bitcoin? Let's delve into the key factors that will shape its future:

Adoption and Integration: The widespread adoption of Bitcoin as a mainstream asset class is perhaps the most crucial determinant of its long-term success. As more institutions, corporations, and individuals embrace Bitcoin as a store of value and hedge against traditional financial systems' uncertainties, its long-term viability strengthens. With the recent trend of institutional adoption and the emergence of Bitcoin-based financial products, such as ETFs, the path towards mainstream acceptance becomes clearer.

Technological Advancements: The underlying technology behind Bitcoin, the blockchain, continues to evolve at a rapid pace. From scalability solutions to privacy enhancements, ongoing developments in blockchain technology promise to address Bitcoin's current limitations and unlock new possibilities. Layer 2 solutions like the Lightning Network offer faster and cheaper transactions, making Bitcoin more practical for everyday use.

Regulatory Clarity: Regulatory uncertainty has been a lingering shadow over Bitcoin's journey. However, as governments worldwide grapple with the complexities of cryptocurrency regulation, clarity begins to emerge. Clear and balanced regulatory frameworks can provide legitimacy and stability to the Bitcoin market, paving the way for greater institutional involvement and investor confidence.

Market Dynamics: The dynamics of the cryptocurrency market play a pivotal role in shaping Bitcoin's long-term trajectory. Price volatility, market sentiment, and macroeconomic factors all influence Bitcoin's price movements. However, as Bitcoin matures and its market cap grows, it becomes less susceptible to manipulation and wild price swings, leading to a more stable long-term outlook.

Global Socioeconomic Trends: Bitcoin's future is intertwined with broader socioeconomic trends, such as the shift towards digitalization, the erosion of trust in traditional financial institutions, and the quest for financial sovereignty. As individuals seek alternative forms of money and value preservation, Bitcoin's role as a decentralized, censorship-resistant asset becomes increasingly relevant.

In conclusion, the future of long-term Bitcoin is a tale of resilience, innovation, and adaptation. While challenges remain, Bitcoin's journey from obscurity to ubiquity reflects its intrinsic value and disruptive potential. As we navigate the ever-changing landscape of cryptocurrency, one thing is certain: Bitcoin's legacy will endure, shaping the future of finance and technology for generations to come.

3 notes

·

View notes

Text

NFTs and Beyond: The Evolution of Digital Ownership at the Blockchain

In latest years, Non-Fungible Tokens (NFTs) have transformed the idea of digital ownership, marking a brand new era of blockchain innovation. NFTs are particular virtual property that constitute ownership or authenticity of particular gadgets or content material, verifiable at the blockchain. This article explores the evolution of NFTs and their effect on digital possession.

Definition of NFTs

NFTs are awesome digital belongings that certify ownership or authenticity of a specific item or content. Each NFT is precise and verifiable at the blockchain, making it best for representing digital collectibles, artwork, and other assets.

Overview of Blockchain Technology

Blockchain serves as the inspiration for NFTs, providing a decentralized and immutable ledger for recording transactions. It is a allotted database that continues a constantly growing listing of statistics, or blocks, connected collectively in a chronological chain. This ledger guarantees transparency, protection, and censorship resistance, allowing the creation and transfer of digital assets correctly.

The Rise of NFTs

NFTs trace their origins to early blockchain experiments like Colored Coins and Rare Pepes. However, it become the release of CryptoKitties in 2017 that brought NFTs into the mainstream. Since then, the NFT ecosystem has seen large boom, marked by way of milestones along with the introduction of standards like ERC-721 and ERC-1155 and top notch events like Beeple’s $sixty nine million sale of a virtual artwork.

Understanding the Hype Surrounding NFTs

The hype round NFTs may be attributed to their novelty, shortage, and ability for democratizing get admission to to virtual assets. NFTs have captured the creativeness of creators, creditors, and customers, imparting new avenues for monetization and ownership inside the virtual realm.

Understanding Digital Ownership

Traditional ownership relates to tangible property, at the same time as virtual possession pertains to intangible belongings saved in digital form, like cryptocurrencies and NFTs. Establishing virtual possession offers demanding situations because of the borderless and pseudonymous nature of blockchain transactions, requiring robust security measures and regulatory oversight.

Role of Blockchain in Digital Ownership

Blockchain generation performs a important position in permitting and safeguarding virtual ownership via offering a obvious, tamper-proof, and decentralized ledger. Through cryptographic techniques and consensus algorithms, blockchain networks make sure the integrity and immutability of digital property, facilitating peer-to-peer transactions.

Exploring the Use Cases of NFTs

NFTs have found applications in artwork, gaming, and tokenizing real-global belongings. They have revolutionized the art enterprise through supplying artists with new approaches to monetize their work and engage with a global audience. In gaming, NFTs allow players to very own and change in-game belongings, developing new monetization opportunities and participant-pushed economies.

Conclusion

Advancements in NFT and blockchain technologies have reshaped the digital possession panorama, supplying progressive answers for creators, creditors, and investors. From artwork to gaming to real-global assets, NFTs have the capability to revolutionize possession and switch mechanisms, democratizing get admission to to wealth and possibilities.

2 notes

·

View notes

Text

OpenAI’s GPT-4: The Future Of AI Or Potential Threat To Jobs?

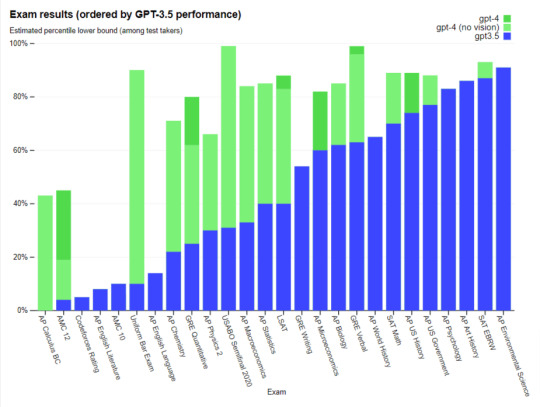

OpenAI, one of the leading companies in artificial intelligence, has recently announced the release of their latest model, GPT-4. This new model boasts impressive improvements, such as being able to process up to 25,000 words, understand images, and score high on exams designed to test knowledge and reasoning. GPT-4 is being used to power Microsoft’s Bing search engine platform, and Microsoft has invested a massive $10 billion into OpenAI. However, the model still faces significant challenges like other language models, including social biases, generating incorrect information, and exhibiting disturbing behaviors when given an “adversarial” prompt.

Key Highlights

Conor Grogan, a former director at Coinbase, claimed that he successfully embedded a live Ethereum smart contract into GPT-4 and quickly identified various “security vulnerabilities” in the code. He also explained how these vulnerabilities could be exploited.

OpenAI’s latest language model, GPT-4, offers impressive multilingual capabilities and can understand images.

GPT-4 can process up to 25,000 words and has a longer memory, but it still faces challenges like social biases and generating incorrect information.

Microsoft has invested $10 billion into OpenAI, and GPT-4 is already being used to power Bing search engine platform.

GPT-4 could potentially take over jobs currently done by humans, raising concerns about its impact on our economy.

As AI technology continues to advance, we need to ask questions about its impact on our society and ensure it is used ethically and with proper supervision.

Related: Tron and BitTorrent Team Up to Support AI Tool ChatGPT with New Payment System

Despite its limitations, GPT-4’s new capabilities could lead to new ways of exploiting it. As a generative AI, it uses algorithms and predictive text to create new content based on prompts. GPT-4 is less likely to be tricked and more stable than previous models, has a longer memory, and can remember up to 50 pages of text. Additionally, it is more multilingual and can answer thousands of multiple-choice questions in 26 languages with high accuracy. GPT-4 is a promising model that can describe images for visually impaired users through a partnership with Be My Eyes. Moreover, it can suggest an appropriate recipe if provided a photo of ingredients on a kitchen counter or explain the conclusions that can be drawn from a chart. However, there are concerns about it potentially taking over jobs currently done by humans.

It is essential to note that GPT-4 is initially only available to ChatGPT Plus subscribers who pay $20 per month for premium access. While this subscription model may seem prohibitive, it could offer an excellent opportunity for researchers and businesses to experiment with the model’s capabilities and understand its limitations.

In conclusion, GPT-4 is an impressive advancement in the field of artificial intelligence. Its multilingual capabilities, expanded token count, and longer memory offer substantial benefits. However, as with any AI model, it is not perfect and still faces significant challenges. We need to take precautions to ensure that it is used ethically and with proper supervision. As AI technology continues to advance, we must continue to ask questions about its impact on our society and our economy.

More Articles

Meta Platforms Inc. Discontinues NFT Support On Instagram And Facebook To Focus On Fintech

Square Enix Launches Symbiogenesis: A Groundbreaking NFT-Based Game With Narrative-Unlocked Entertainment

Ethereum Whale Sells 500 Moonbirds NFT, Suffers Significant Losses, And Causes Turbulence In NFT Market

Halborn Uncovers Critical Vulnerabilities In Dogecoin, Litecoin, And Other Blockchain Networks

2 notes

·

View notes

Text

Top Cryptos to Watch in 2025: Predictions & Trends

The cryptocurrency market is constantly evolving, with new innovations, regulatory shifts, and investor sentiment shaping its trajectory. As we move into 2025, several digital assets stand out as promising investment opportunities based on their technology, adoption, and growth potential. Whether you're a seasoned investor or just exploring crypto, this guide will help you identify the top cryptos to watch in 2025.

Key Trends Influencing Crypto in 2025

Before diving into the top picks, it's essential to understand the broader trends affecting the crypto space.

Regulatory Developments – Governments worldwide are refining their stance on digital assets, with clearer regulations expected to impact adoption.

Institutional Adoption – More businesses and financial institutions are integrating blockchain technology, adding legitimacy to the market.

DeFi & NFTs Evolution – Decentralized finance (DeFi) and non-fungible tokens (NFTs) continue to reshape the digital economy.

Scalability & Security Innovations – New blockchain advancements aim to enhance speed, efficiency, and security for mainstream adoption.

Now, let’s explore the cryptocurrencies expected to make an impact in 2025.

1. JetBolt (JBOLT): The Zero-Gas Crypto Revolution

Why It’s Worth Watching

JetBolt (JBOLT) is emerging as a major contender in 2025, leveraging zero-gas transactions through the Skale Network. This eliminates high transaction fees, making blockchain interactions more accessible.

Key Features

✅ Zero-Gas Transactions – Reduces costs for users and businesses. ✅ AI-Powered Aggregator – Provides real-time crypto market data. ✅ Strong Presale Demand – Over 330 million JBOLT tokens sold.

Prediction: With its innovative approach, JetBolt could see massive adoption, particularly in DeFi applications.

2. Toncoin (TON): Telegram’s Crypto Powerhouse

Why It’s Gaining Attention

Toncoin (TONUSDT), developed by Telegram, is gaining traction due to its high-speed transactions and seamless integration with the messaging platform.

Growth Factors

✅ Telegram’s Ecosystem – Direct access to millions of users. ✅ Scalability – Fast and low-cost transactions. ✅ Expanding Use Cases – Payments, staking, and DeFi integrations.

Price Prediction for 2025: Experts forecast TON’s value to range between $5.7 and $6.8, with potential upside if adoption accelerates.

3. Solana (SOL): The Speed King of Crypto

Why Solana Stands Out

Solana (SOL) remains a top blockchain for high-speed transactions and low fees, making it a preferred network for developers and DeFi projects.

Key Strengths

✅ Fast Transactions – Handles up to 65,000 transactions per second. ✅ Thriving Ecosystem – Hosts a wide range of DeFi and NFT projects. ✅ Institutional Backing – Increasing adoption among Web3 developers.

Market Outlook: Despite past network congestion issues, Solana’s continuous upgrades position it for long-term growth.

4. Dogecoin (DOGE): The Meme Coin with Staying Power

Why Dogecoin is Still Relevant

What started as a joke has turned into a serious digital asset, thanks to strong community support and mainstream adoption.

What Drives DOGE’s Popularity?

✅ Elon Musk’s Endorsements – Tesla and SpaceX accept DOGE for payments. ✅ Low Transaction Costs – Faster and cheaper than Bitcoin. ✅ Growing Utility – Expanding merchant acceptance.

2025 Prediction: If Dogecoin sees further adoption for micropayments, it could remain a strong player in the crypto market.

5. Ripple’s XRP: The Future of Cross-Border Payments

Why XRP is a Game-Changer

Ripple’s XRP aims to transform cross-border payments by offering near-instant transactions at minimal costs.

Competitive Edge

✅ Banking Partnerships – Used by over 100 financial institutions. ✅ Regulatory Developments – The outcome of legal battles could impact price growth. ✅ Fast Transactions – Settlement time of 3-5 seconds.

Expert Opinion: If regulatory clarity favors Ripple, XRP could see widespread adoption in global finance.

6. Cardano (ADA): A Scientific Approach to Blockchain

Why Cardano Stands Out

Cardano (ADA) is known for its academic research-driven development, focusing on security, sustainability, and scalability.

Notable Features

✅ Smart Contracts – Enables advanced DeFi applications. ✅ Energy-Efficient – Uses Proof-of-Stake (PoS) for sustainability. ✅ Global Development Initiatives – Aims for mass blockchain adoption.

Long-Term Potential: If Cardano successfully implements its roadmap, it could become a top player in smart contracts and enterprise blockchain solutions.

Risks & Considerations in Crypto Investing

While these cryptos show strong potential, investing in digital assets carries risks:

Market Volatility – Prices can fluctuate drastically.

Security Risks – Hacking and scams remain concerns.

Regulatory Uncertainty – Changing government policies could impact prices.

Investment Tip: Always do your own research, diversify your portfolio, and consider long-term potential over short-term hype.

Final Thoughts: Which Crypto Will Dominate 2025?

The crypto market in 2025 will be shaped by technology, adoption, and regulation. While JetBolt, Toncoin, Solana, Dogecoin, XRP, and Cardano stand out, the key to success is staying informed and making strategic investments.

🚀 Which cryptocurrency are you most excited about for 2025? Let’s discuss in the comments!

0 notes

Text

The Dark Side of the Metaverse: Cybersecurity Challenges in Virtual Worlds

The metaverse is rapidly becoming a digital extension of our physical reality, offering immersive experiences, virtual economies, and interconnected digital spaces. However, with its rise comes a host of cybersecurity challenges that threaten users, businesses, and organizations. Cybercriminals are adapting their tactics to exploit vulnerabilities in these virtual worlds, making cybersecurity a crucial concern.

If you're looking to build expertise in cybersecurity and protect virtual environments from emerging threats, enrolling in a Cyber Security Certification in Kolkata can help you understand the complexities of cybersecurity in the metaverse and beyond.

The Growing Popularity of the Metaverse

The metaverse, a convergence of augmented reality (AR), virtual reality (VR), and blockchain technology, is gaining traction across multiple industries. From gaming and social interactions to digital commerce and remote work, virtual worlds offer unprecedented opportunities. However, with this expansion comes an increase in cyber threats.

Why Is Cybersecurity Crucial in the Metaverse?

Decentralized Environments – Many metaverse platforms operate on decentralized systems, making traditional cybersecurity controls less effective.

Financial Transactions in Virtual Currencies – Cryptocurrencies and NFTs (non-fungible tokens) fuel metaverse economies, making them prime targets for cybercriminals.

Anonymity and Identity Theft – Users interact through avatars, making it easier for hackers to impersonate others and commit fraud.

Lack of Regulatory Frameworks – With metaverse governance still in its infancy, there are few established regulations to safeguard users.

Cybersecurity Challenges in Virtual Worlds

1. Identity Theft and Account Takeovers

In the metaverse, users rely on digital identities linked to virtual assets. Hackers use phishing attacks, malware, and credential stuffing to hijack accounts, leading to loss of virtual property and financial fraud.

2. Phishing and Social Engineering Attacks

Cybercriminals manipulate users into revealing personal information through fraudulent messages, fake metaverse events, or deceptive avatars impersonating trusted entities.

3. Smart Contract Vulnerabilities

Many metaverse transactions rely on smart contracts. Poorly coded contracts are susceptible to exploitation, leading to unauthorized transactions and financial losses.

4. Virtual Property and NFT Theft

Hackers target digital assets like NFTs, often by exploiting vulnerabilities in wallet security or using scam tactics to deceive users into transferring their assets.

5. Cyber Harassment and Virtual Crime

Anonymity in the metaverse enables cyberbullying, stalking, and harassment, raising concerns about user safety in digital spaces.

6. Malware and Ransomware in VR Environments

Hackers can deploy malware disguised as virtual goods or applications, infecting users' devices and holding their data for ransom.

Protecting Yourself in the Metaverse

1. Enable Multi-Factor Authentication (MFA)

Using MFA on metaverse accounts helps prevent unauthorized access, even if passwords are compromised.

2. Educate Yourself on Cyber Threats

Enrolling in a Cyber Security Certification in Kolkata can provide in-depth knowledge about emerging cyber threats in virtual worlds and how to defend against them.

3. Secure Your Digital Assets

Use hardware wallets or secure digital wallets to store cryptocurrencies and NFTs safely.

4. Be Cautious of Unverified Links and Transactions

Avoid clicking on unknown links or engaging in transactions without verifying the legitimacy of the source.

5. Report Suspicious Activity

If you encounter fraudulent behavior or cybercrime in the metaverse, report it to platform administrators and relevant authorities.

Conclusion

The metaverse presents exciting opportunities, but it also introduces new cybersecurity risks that must be addressed. As digital worlds continue to evolve, staying informed about cyber threats and implementing proactive security measures is crucial.

For those looking to develop expertise in this evolving field, pursuing a Cyber Security Certification in Kolkata can equip you with the skills needed to navigate and secure the digital frontier. The future of the metaverse depends on robust cybersecurity—make sure you're prepared to defend it.

0 notes

Text

Understanding Web3: The Future of Digital Ownership and Business

What Does Web3 Mean for Your Business?

Web3 isn’t just about cryptocurrencies, NFTs, or the metaverse. It’s a shift in how we experience and interact with the internet. Think of it as the next chapter of the digital world—one that prioritizes decentralization, ownership, and user-driven communities.

🌐 The Evolution of the Web

🔹 Web 1.0 (Read-Only Internet) → Static websites and basic information sharing. 🔹 Web 2.0 (Read-Write Internet) → Social media, user-generated content, and platform-driven interactions. 🔹 Web3 (Read-Write-Own Internet) → Decentralization, blockchain-based transactions, and digital ownership.

Right now, Web 2.0 platforms dominate. They own user data, control monetization, and act as middlemen in digital interactions. Web3 changes this by allowing users to own digital assets, control data, and participate in decentralized ecosystems.

🔑 Key Features of Web3

1️⃣ Decentralized Ownership – No central authority controls assets; users retain ownership. 2️⃣ Blockchain Transparency – Transactions are verifiable, secure, and permanent. 3️⃣ Token-Based Incentives – Users can earn rewards for participation, engagement, and contributions. 4️⃣ Smart Contracts – Automated agreements that ensure fair transactions. 5️⃣ Community-Driven Economy – Brands and users collaborate on value creation.

🏆 Why Businesses Should Care About Web3

🚀 New Revenue Streams – Digital collectibles, tokenized assets, and direct-to-user commerce. 💡 Consumer Engagement – Personalized experiences, loyalty rewards, and co-creation opportunities. 🔄 Redefined Brand Relationships – Users become stakeholders, not just consumers. 🔗 Blockchain Trust & Security – Eliminates intermediaries, reducing fraud and inefficiencies.

🔄 How Web3 Impacts Business Models

📢 Marketing & Community Engagement Traditional advertising relies on third-party data. In Web3, brands can reward users for voluntarily sharing data or engaging with content.

🏪 Retail & E-commerce Imagine purchasing a digital sneaker NFT that also grants you the real version. Or selling second-hand digital products just like physical goods.

🎟️ Loyalty Programs Instead of being locked into one brand, Web3 loyalty points could be traded or used across multiple businesses.

🌍 The Future of Digital Identity & Commerce

🔹 Virtual assets will hold real-world value. 🔹 Smart contracts will automate agreements in business and finance. 🔹 Users will have more control over their data, monetizing it on their terms. 🔹 Communities will drive brand success through collaboration, not just consumption.

Web3 is still evolving, but its potential is massive. Now is the time for businesses and creators to explore, adapt, and innovate. Those who embrace the change early could shape the next generation of the internet.

#Web3#Blockchain#Decentralization#DigitalOwnership#NFTs#Crypto#FutureOfBusiness#Metaverse#SmartContracts#DigitalTransformation

0 notes

Text

Unlock the Power of Blockchain Technology in London with Blockchain App Maker

As the vibrant capital of innovation and technology, London has long been a hub for cutting-edge solutions across various industries. At Blockchain App Maker, we bring forward the future of technology through decentralized solutions tailored to meet the unique demands of businesses in London. Whether you're an entrepreneur, startup, or established business, we are here to guide you in navigating the blockchain ecosystem and leveraging its potential.

Why Blockchain is the Future for London

London's strategic location and thriving economy make it a prime hub for technology adoption. From financial institutions to retail and healthcare, the applications of blockchain technology are vast. With its ability to streamline operations, improve transparency, and reduce costs, blockchain is revolutionizing industries across the city.

Blockchain App Maker is in the list of top blockchain development companies in London and helping businesses harness the power of this transformative technology. We specialize in delivering top-tier blockchain development services that ensure your business stays ahead of the curve.

Our Blockchain Development Services

1. Blockchain Consulting

Our team of experts provides comprehensive blockchain consulting services tailored to your business. Whether you're new to blockchain or looking to explore advanced solutions, we help you understand how blockchain can solve your unique challenges. We guide you through the entire process from ideation to execution, ensuring that your solution is scalable, secure, and tailored to your goals.

2. Custom Blockchain Development

We specialize in developing bespoke blockchain solutions that address your business's specific needs. From public and private blockchains to hybrid models, we create secure and scalable blockchain platforms that integrate seamlessly with your existing systems. Our custom blockchain solutions will empower your business to gain a competitive edge in the London market.

3. Smart Contract Development

Smart contracts are revolutionizing the way agreements are executed. Our team at Blockchain App Maker can help you develop and deploy secure, transparent, and immutable smart contracts that automate workflows and reduce human error. Whether for finance, legal, or real estate, smart contracts are changing industries, and we are here to make them work for you.

4. Blockchain for Finance (DeFi Solutions)

London's financial sector is one of the most advanced in the world, and blockchain is setting new standards for financial services. We provide decentralized finance (DeFi) solutions that offer your business the tools to offer innovative financial services with enhanced security, transparency, and efficiency. From asset management to lending and payments, we can build decentralized financial systems to revolutionize the way you conduct business.

5. NFT Development

NFTs (Non-Fungible Tokens) are becoming a massive trend in the creative, art, and entertainment industries. If you are based in London and looking to venture into the world of NFTs, Blockchain App Maker provides end-to-end NFT development services. Whether you're a creator, investor, or brand, we help you develop NFTs that showcase your assets in a secure and blockchain-powered ecosystem.

6. Blockchain for Supply Chain Management

Supply chain disruptions can severely impact business operations. Blockchain provides transparency, traceability, and efficiency in managing supply chains. We build blockchain solutions that help businesses in London track products, optimize supply chains, and reduce fraud. By implementing blockchain, your supply chain becomes more resilient, trustworthy, and efficient.

Why Blockchain App Maker is perfect for London-Based Businesses

1. Startups and Entrepreneurs

London is known for its dynamic startup ecosystem, where innovation thrives. At Blockchain App Maker, we understand the unique challenges faced by startups. Whether you're looking to create a decentralized application (dApp), tokenize assets, or launch an ICO, we help you design and deploy blockchain solutions that turn your vision into reality. With a focus on innovation, our blockchain experts will help your startup stand out in a competitive landscape.

2. Enterprises

Blockchain is not just for startups—large enterprises in London can benefit from our blockchain services too. From enhancing data security to improving operational efficiency, blockchain technology offers a wide range of solutions that align with your business goals. Our team works closely with enterprise-level businesses to implement blockchain strategies that optimize their operations.

3. Financial Institutions

London is home to one of the world’s leading financial hubs, and blockchain is revolutionizing the finance sector. Whether you're a bank, fintech, or investment firm, our decentralized finance (DeFi) solutions can transform the way you offer services, ensuring enhanced security, reduced costs, and improved customer experiences.

4. Supply Chain and Logistics

Supply chain management is critical in London’s bustling commercial environment. Our blockchain solutions for supply chain management ensure that your processes are efficient, transparent, and tamper-proof. With our expertise, you can reduce operational inefficiencies and enhance the transparency of your supply chain.

5. Tech Enthusiasts and Innovators

For tech innovators and blockchain enthusiasts in London, Blockchain App Maker is the perfect partner to take your ideas and concepts to the next level. Whether you're building dApps, launching an ICO, or creating an NFT marketplace, we offer the expertise you need to bring your blockchain project to life.

Why Choose Blockchain App Maker?

Expertise and Experience: Our team is made up of seasoned blockchain developers and consultants with years of experience in the industry.

Tailored Solutions: We understand that every business is unique. That's why we provide customized blockchain solutions that align with your specific goals.

Security Focus: Security is at the core of everything we do. Our blockchain solutions are built with the highest security standards to protect your assets and data.

End-to-End Service: From ideation to deployment and support, we offer full-cycle blockchain development services that ensure your success.

Conclusion

London stands as a beacon for technology, and Blockchain App Maker is here to ensure your business benefits from the revolutionary capabilities of blockchain. Whether you're a startup, enterprise, or financial institution, our comprehensive suite of services is designed to meet your unique needs. Let us help you unlock the full potential of blockchain technology and take your business to new heights.

#top blockchain development company in London#best blockchain development services in London#top blockchain developers in London#NFT development services in London#crypto exchange algo trading

0 notes

Text

Understanding Crypto Markets: A Deep Dive into Blockchain Trading

Crypto markets are a dynamic and evolving space, shaping the future of digital finance. From Bitcoin’s early days to the rise of decentralized exchanges, the crypto ecosystem offers a revolutionary way to trade, invest, and interact with digital assets.

But how do these markets function? What makes them different from traditional stock markets? Let’s break it down.

Primary vs. Secondary Crypto Markets

Crypto markets can be categorized into:

🔹 Primary Markets – Where new cryptocurrencies are issued. 🔹 Secondary Markets – Where existing cryptocurrencies are traded.

The primary market is where digital assets are first created, often through mechanisms like mining or token minting. In contrast, the secondary market allows traders to buy and sell these assets on exchanges.

How Cryptocurrencies Are Created

Unlike traditional currencies printed by central banks, cryptocurrencies emerge through different mechanisms:

✅ Proof-of-Work (PoW) – Used by Bitcoin, where miners solve complex mathematical problems to validate transactions and earn rewards. ✅ Proof-of-Stake (PoS) – Instead of mining, users stake their tokens to validate transactions, reducing energy consumption. ✅ Other Consensus Mechanisms – Models like Byzantine Fault Tolerance (BFT) or Proof-of-Authority (PoA) ensure security while optimizing efficiency.

Many blockchain projects use token minting to create digital assets. Platforms like Ethereum allow developers to generate tokens for various applications, from financial services to gaming.

Types of Crypto Tokens

Crypto tokens can be divided into three major categories:

🔹 Utility Tokens – Provide access to a platform or service. Example: A token granting access to a decentralized cloud storage network. 🔹 Payment Tokens – Used as a digital currency within a specific ecosystem. Example: A token required to purchase computing power on a blockchain-based network. 🔹 Security Tokens – Represent ownership or investment, similar to stocks. These are subject to financial regulations.

Crypto Fundraising: ICOs & STOs

Many companies raise capital through:

✅ Initial Coin Offerings (ICOs) – Selling utility or payment tokens to investors. ✅ Security Token Offerings (STOs) – Selling tokenized securities, often representing company shares.

Compared to traditional stock markets, tokenized assets offer advantages like instant transactions, 24/7 trading, and reduced reliance on intermediaries. However, regulations continue to evolve, shaping the future of digital asset fundraising.

Crypto Exchanges: Centralized vs. Decentralized

Exchanges facilitate crypto trading, but not all operate the same way:

🔹 Centralized Exchanges (CEXs) – Operate like traditional stock exchanges, handling trades on a central server. They offer fiat-to-crypto conversions but introduce a single point of failure. 🔹 Decentralized Exchanges (DEXs) – Operate on blockchain networks, enabling peer-to-peer trades without intermediaries. They offer greater security but lack fiat gateways and are often slower.

Both models play a crucial role in the crypto ecosystem, with CEXs dominating volume while DEXs push for decentralized financial sovereignty.

Challenges & Opportunities in Crypto Markets

While crypto markets share similarities with traditional finance, they also present unique challenges:

❌ Regulatory Uncertainty – Governments worldwide are still defining legal frameworks for digital assets. ❌ Market Manipulation – Issues like wash trading and insider trading are concerns in unregulated environments. ❌ 24/7 Trading Volatility – Unlike traditional markets, crypto trades never stop, leading to unpredictable price swings.

At the same time, these markets offer incredible opportunities:

✅ New Investment Avenues – Crypto markets introduce decentralized finance (DeFi), NFT economies, and tokenized assets. ✅ Global Accessibility – Unlike traditional markets, crypto allows anyone with an internet connection to participate. ✅ Rapid Technological Evolution – Advancements in blockchain security, efficiency, and smart contract development continue to improve the space.

Future of Crypto Markets

Crypto markets are still in their early stages, with immense room for growth. Researchers and investors are constantly exploring:

📌 Investor behavior in ICOs & STOs 📌 Trader psychology in volatile markets 📌 Regulatory frameworks for digital assets 📌 Market manipulation detection techniques

As blockchain adoption expands, the financial landscape is set to transform, making crypto markets an exciting space to watch. 🚀

0 notes

Text

Essential Guide to the DAO Legal Structuring Framework

Understanding DAOs and Their Legal Challenges

Decentralized Autonomous Organizations (DAOs) have revolutionized the way communities and businesses operate in the digital space. Built on blockchain technology, DAOs function through smart contracts, eliminating traditional hierarchical structures. However, despite their decentralized nature, DAOs face significant legal challenges, making a DAO legal structuring framework essential for compliance, governance, and operational efficiency.

Importance of a Legal Framework for DAOs

Without a proper legal structure, DAOs can face regulatory uncertainty, financial risks, and potential liabilities for their members. A well-defined DAO legal structuring framework helps address:

Legal Recognition: Many jurisdictions do not officially recognize DAOs, making legal structuring crucial for legitimacy.

Liability Protection: Members could be held personally liable for DAO-related actions without an appropriate framework.

Regulatory Compliance: Ensuring the DAO adheres to financial, tax, and corporate laws.

Operational Clarity: A clear framework defines decision-making, dispute resolution, and voting mechanisms.

Different Legal Structures for DAOs

Unincorporated DAO

Some DAOs operate without formal legal recognition. While this offers flexibility, it poses risks such as potential liability for members and difficulties in enforcing contracts.

LLC-Based DAO

In the United States, forming a Limited Liability Company (LLC) is a common way to provide DAOs with legal recognition. This structure limits liability while maintaining decentralized governance.

Foundation-Based DAO

Many DAOs register as foundations, particularly in crypto-friendly jurisdictions like Switzerland or the Cayman Islands. This structure allows DAOs to function as nonprofit entities, focusing on protocol development rather than profit-making.

Cooperative Model

Some DAOs opt for a cooperative legal structure, where members act as co-owners with voting rights. This model aligns with the decentralized ethos of DAOs while providing legal security.

Key Elements of a DAO Legal Structuring Framework

Governance and Decision-Making

A DAO must define how governance decisions are made, whether through token-based voting, delegated authority, or hybrid models. Smart contracts should outline the rules, ensuring transparency and security.

Liability and Member Protection

A structured DAO should clearly outline liability protections to safeguard individual members from legal repercussions. Using an LLC or foundation can mitigate risks.

Compliance with Financial and Tax Regulations

DAOs must comply with financial regulations such as anti-money laundering (AML) laws and tax obligations. A DAO legal structuring framework ensures proper financial reporting and compliance.

Intellectual Property Rights

If a DAO creates software, NFTs, or other digital assets, intellectual property (IP) rights should be legally assigned to the DAO entity rather than individual members.

Choosing the Right Jurisdiction for DAOs

The legal framework of a DAO depends on the jurisdiction it chooses to register in. Some of the most crypto-friendly jurisdictions include:

Wyoming, USA: Recognizes DAOs as LLCs, providing legal clarity.

Switzerland: Home to many blockchain foundations with flexible regulations.

Singapore: Offers regulatory clarity for crypto-related businesses.

Cayman Islands: Often used for DAO foundations with nonprofit objectives.

Conclusion

Creating a strong DAO legal structuring framework is essential for ensuring long-term sustainability, legal security, and regulatory compliance. As DAOs continue to evolve, adopting a well-defined legal structure will help them navigate the complexities of governance, liability, and financial regulations. By carefully selecting the right framework, DAOs can thrive in an increasingly regulated digital economy.

0 notes

Text

Unity Game Development: Building Your First Blockchain Game

Blockchain technology is revolutionizing the gaming industry, offering players true ownership of in-game assets and creating new opportunities for developers. If you're a game developer using Unity, you might be wondering how to dive into the world of blockchain game development. This guide will walk you through the process of building your first blockchain game using Unity, covering everything from setup to integration with blockchain networks.

Why Combine Unity Game Development with Blockchain?

Unity is one of the most popular game engines, known for its versatility, ease of use, and robust community support. When paired with blockchain technology, Unity game development opens up exciting possibilities:

True Ownership: Players can own, trade, and sell in-game assets as NFTs.

Decentralized Economies: Create player-driven economies with transparent transactions.

Cross-Game Compatibility: Assets can be used across multiple games and platforms.

By combining Unity game development with blockchain, you can create immersive, player-centric experiences that stand out in the gaming market.

Getting Started with Unity Game Development for Blockchain

1. Setting Up Your Unity Environment

Before diving into blockchain game development, ensure your Unity environment is ready:

Download and install the latest version of Unity Hub and Unity Editor.

Choose a template that suits your game idea (2D, 3D, or AR/VR).

Familiarize yourself with Unity’s interface and scripting tools (C#).

2. Understanding Blockchain Basics

To integrate blockchain into your Unity game, you need a basic understanding of:

Smart Contracts: Self-executing contracts that manage asset ownership and transactions.

NFTs (Non-Fungible Tokens): Unique digital assets stored on the blockchain.

Blockchain Networks: Popular options include Ethereum, Polygon, and Solana.

Integrating Blockchain into Your Unity Game

1. Choosing a Blockchain Network

Select a blockchain network that aligns with your game’s needs:

Ethereum: High security but higher transaction fees.

Polygon: Low fees and faster transactions, ideal for gaming.

Solana: High-speed and scalable, perfect for real-time games.

2. Using Blockchain SDKs for Unity

Several SDKs simplify blockchain integration in Unity game development:

ChainSafe Gaming SDK: A popular tool for connecting Unity games to Ethereum-based blockchains.

Moralis Unity SDK: Offers seamless integration with multiple blockchains and NFT functionality.

Enjin Unity SDK: Focused on creating and managing blockchain-based assets.

3. Creating and Minting NFTs

Design in-game assets (characters, weapons, skins) using Unity’s tools.

Use smart contracts to mint these assets as NFTs on your chosen blockchain.

Ensure metadata (e.g., asset details) is stored securely on decentralized storage like IPFS.

Best Practices for Blockchain Game Development in Unity

1. Optimize for Performance

Blockchain transactions can be resource-intensive. Optimize your Unity game by:

Reducing unnecessary blockchain calls.

Using batch transactions for multiple actions.

Implementing off-chain solutions for non-critical data.

2. Ensure Security

Blockchain game development requires robust security measures:

Use tested and audited smart contracts.

Protect player wallets with encryption and secure authentication.

Educate players about phishing and scams.

3. Focus on User Experience

Simplify blockchain interactions for players (e.g., one-click wallet connections).

Provide clear instructions for managing NFTs and in-game assets.

Offer tutorials or guides for players new to blockchain gaming.

Challenges in Unity Game Development for Blockchain

While blockchain game development offers exciting opportunities, it also comes with challenges:

Scalability: Handling a large number of transactions without slowing down the game.

Cost: High gas fees on some blockchains can deter players.

Adoption: Many players are still unfamiliar with blockchain technology.

To overcome these challenges, choose scalable blockchains, optimize transaction costs, and educate your audience about the benefits of blockchain gaming.

Future of Unity Game Development and Blockchain

The combination of Unity game development and blockchain is still in its early stages, but the potential is immense. As blockchain technology evolves, we can expect:

More user-friendly tools for developers.

Greater adoption of blockchain games by mainstream players.

Innovative gameplay mechanics centered around player ownership.

By starting your journey in blockchain game development today, you can position yourself at the forefront of this exciting industry.

Conclusion

Building your first blockchain game with Unity is an ambitious but rewarding endeavor. By leveraging Unity’s powerful tools and integrating blockchain technology, you can create games that offer players unprecedented ownership and engagement. Whether you’re a seasoned Unity developer or just starting out, now is the perfect time to explore the possibilities of blockchain game development.

Ready to take the plunge? Start experimenting with Unity and blockchain today, and who knows—your game could be the next big hit in the world of blockchain gaming!

Visit our site to develop your game

0 notes

Text

Are Meme Coins the Next Big Trading Opportunity or Just a Fad?

I’ve always been skeptical about meme coins. Are they really worth the risk, or are they just another market fad? After deep-diving into the altcoin space and refining my strategies with ORION, I’ve come to see that meme coins have evolved far beyond their early reputation. They’re no longer just internet jokes — they now offer staking rewards, play-to-earn (P2E) games, and even DeFi utilities that make them serious contenders for long-term investments.

The Rise of Utility-Driven Meme Coins

Tokens like BTFD, DOGS, and BOME are pushing the boundaries of what meme coins can do. For example, BTFD isn’t just another token riding the hype wave — it offers a 3650% ROI potential, staking rewards at 90% APY, and a live P2E gaming ecosystem. Meanwhile, DOGS integrates DeFi mechanics, and BOME is tapping into the growing meme economy with NFTs and Web3 innovations.

With all these developments, the key takeaway is timing and strategy. Just like any trade, understanding market sentiment, volume trends, and utility matters when entering meme coin positions. While the volatility is high, the potential for massive gains exists — especially for traders who can spot trends early.

Learn, Trade, and Grow with a Strong Community

I’ve been refining my skills with ORION Wealth Academy, and one of the biggest advantages is being part of a trading community that actively discusses market shifts, risk management, and emerging opportunities. If you want to stay ahead of the curve, I highly recommend joining the community and learning alongside experienced traders. Whether you’re trading meme coins or blue-chip assets, having a solid strategy is everything.

0 notes

Text

Best Web3 Game Development Company in the USA: Why Malgo is the Perfect Choice for Your Blockchain Game

What is Web3 Game Development?

Web3 game development is the process of creating decentralized games that integrate blockchain technology, offering players true ownership of in-game assets. These games utilize smart contracts, cryptocurrencies, and Non-Fungible Tokens (NFTs), allowing players to trade, sell, or even mint unique digital items within the game. By leveraging blockchain, Web3 games provide transparency, security, and a sense of real-world value, significantly enhancing the gaming experience. In essence, Web3 gaming marks a pivotal shift in how digital entertainment is created, owned, and experienced.

Introduction

The gaming industry is evolving rapidly, with traditional game models being challenged by decentralized alternatives. Web3 game development, underpinned by blockchain technology, is redefining the way players engage with digital content. In this landscape, choosing the right Web3 game development company is crucial for the success of your project. As the leading Web3 game development company in the USA, Malgo stands out for its expertise in creating innovative and secure blockchain-based games. Let’s explore why Malgo is the perfect choice for your next Web3 game.

Overview of Web3 Gaming and Its Importance

Web3 gaming is gaining traction due to its ability to offer players greater control over in-game assets. Unlike traditional gaming, where all assets are owned by the game developers, Web3 games allow players to own their items, whether it’s a character skin, an in-game currency, or a weapon, by utilizing NFTs. This introduces the concept of true digital ownership. The decentralization aspect also ensures that no single entity controls the game, empowering players with a stake in the game’s economy.

The Rise of Blockchain Games in the USA

Blockchain gaming has seen substantial growth in the USA, with several high-profile titles gaining mainstream attention. Games like Axie Infinity, Decentraland, and The Sandbox have demonstrated the vast potential of Web3 games. The combination of blockchain’s security features and the immersive experience offered by gaming has opened new avenues for developers to create compelling, interactive worlds. As a result, Web3 games are now considered not just a novelty but a key component of the future of gaming.

What Sets Malgo Apart?

When it comes to Web3 game development, Malgo is a top choice for game studios, independent developers, and entrepreneurs. Here’s why:

Expertise in Blockchain Technology

Malgo has deep expertise in blockchain technology, ensuring that every game developed is secure, scalable, and decentralized. The integration of smart contracts, tokenomics, and NFTs in games is handled seamlessly, allowing developers to focus on creating engaging content while Malgo takes care of the technical side.

Client-Centric Approach and Innovation

At Malgo, the development process is highly collaborative. The company works closely with clients to understand their vision and goals, offering innovative solutions that align with the latest trends in the Web3 space. This ensures that each game not only meets but exceeds client expectations.

Why Malgo is the Leading Web3 Game Development Company

Malgo offers a full suite of Web3 game development services, making it an ideal partner for building blockchain-based games. Here’s why Malgo is a standout in the industry:

Cutting-Edge Technologies Utilized

Malgo uses industry-leading technologies, including Ethereum, Unity, Unreal Engine, and Polygon, to develop Web3 games. By staying ahead of technological trends, Malgo ensures that every game is optimized for performance and scalability.

Comprehensive Web3 Game Development Services

From concept development and UI/UX design to smart contract development and blockchain integration, Malgo covers every aspect of Web3 game development. The company offers end-to-end services, which makes the development process streamlined and efficient.

Strong Focus on Security and Player Ownership

Security is at the core of Malgo’s development process. All in-game transactions and assets are protected by blockchain’s decentralized nature, ensuring that players’ investments are secure. Malgo also emphasizes player ownership, enabling gamers to have full control over their in-game assets, which fosters greater engagement and retention.

Malgo's Web3 Game Development Methodology

At Malgo, game development follows a structured methodology that guarantees the delivery of high-quality Web3 games. Here’s how Malgo handles every stage of the game development process:

Concept to Launch: A Structured Approach

The journey begins with concept development, where the Malgo team collaborates with clients to understand the game’s vision. Market research, competitor analysis, and brainstorming sessions are conducted to define the core mechanics and design elements.

Iterative Development and Continuous Testing

Using agile methodologies, Malgo iterates on the game’s design, continuously testing features to ensure that every aspect of the game is optimized for performance and user experience. The development process is flexible, allowing for feedback-driven adjustments along the way.

Blockchain Integration and Smart Contract Solutions

Blockchain integration is a vital component of Web3 game development. Malgo incorporates secure smart contracts to facilitate player transactions, asset ownership, and in-game economies. Blockchain ensures the integrity of these interactions, fostering trust among players.

The Benefits of Choosing Malgo for Your Web3 Game

Choosing Malgo for your Web3 game development brings numerous advantages:

High-Quality, Engaging Games

Malgo’s team of experienced game designers and developers creates visually stunning and interactive games that captivate players. The focus on engagement ensures that every game is not only playable but also highly enjoyable.

Scalable and Secure Blockchain Solutions

Whether you’re building a small-scale indie game or a large MMO, Malgo ensures that the blockchain infrastructure scales with your game’s needs. The solutions are also highly secure, providing peace of mind to both developers and players.

Full-Cycle Support: From Concept to Post-Launch

Malgo’s support doesn’t end at the launch. The company provides ongoing maintenance, updates, and community engagement services to ensure the longevity of the game in a dynamic Web3 environment.

The Future of Web3 Gaming and How Malgo is Paving the Way

Web3 gaming is an emerging sector, and the potential is immense. The integration of virtual reality (VR), artificial intelligence (AI), and other immersive technologies will further enhance the player experience. Malgo is actively exploring these trends and paving the way for the next generation of blockchain games.

Emerging Trends in Web3 Game Development

The rise of Play-to-Earn (P2E) models, Metaverse integration, and NFT-based gaming is shaping the future of Web3 gaming. Malgo is prepared to integrate these features into its games, staying at the forefront of innovation.

Malgo’s Vision for the Future of Blockchain Games

Malgo envisions a future where gaming is fully decentralized, and players have full control over their assets and experiences. The company is working toward building more interactive, engaging, and immersive blockchain games that redefine the digital entertainment landscape.

How to Get Started with Malgo

Getting started with Malgo is easy and efficient. The first step is to reach out for an initial consultation, where the team will discuss your game’s concept and vision. Malgo then crafts a development strategy that aligns with your goals, providing a clear roadmap for the entire process.

Initial Consultation and Strategy Development

The consultation process includes a deep dive into your project, discussing gameplay mechanics, art styles, tokenomics, and blockchain features. From here, Malgo creates a development plan that outlines each phase of the project.

Seamless Onboarding and Development Process

Once the project is approved, Malgo begins the development phase, following a structured methodology to bring your game to life. The team ensures that everything is on track, from design and development to testing and launch.

About Malgo

Malgo is a leading Web3 game development company in the USA, specializing in creating blockchain-powered games that offer players true ownership of digital assets. With a focus on security, scalability, and player engagement, Malgo is committed to delivering high-quality games that stand out in the competitive Web3 gaming space. The company offers end-to-end services, including game development, UI/UX design, blockchain integration, NFT marketplace development, and more.

Contact Us

Ready to turn your Web3 game idea into reality? Contact Malgo today and start your Web3 game development journey with a trusted partner.

Conclusion

Choosing the right Web3 game development company is crucial to the success of your blockchain game. With Malgo , you gain a partner that offers expertise, cutting-edge technologies, and a client-focused approach. From concept to launch and beyond, Malgo provides full-cycle support to ensure your Web3 game is a hit. Reach out today and take the first step toward building a game that will captivate players and shape the future of gaming.

#blockchaingaming#Web3GameDevelopment#Web3Technology#PlayToEarn#GameDevelopmentCompany#BlockchainTechnology

0 notes

Text

5 Key Trends in Blockchain Technology

5 Key Trends in Blockchain Technology

5 Key Trends in Blockchain Technology explores how blockchain is transforming the metaverse, driving innovation across virtual economies, digital ownership, and cross-platform experiences.

It highlights the best blockchain development trends, emphasizing blockchain trends like the rise of virtual economies and digital assets, the integration of AR, VR, and XR, and the growing role of blockchain and NFTs in securing digital ownership.

It also covers AI-powered virtual environments and the importance of interoperability across metaverse platforms. The article concludes by stressing that new blockchain technology and blockchain technology trends will shape the future, encouraging businesses to modify blockchain development trends to stay competitive in the digital era.

The Rapid Evolution of Metaverse Technology

The metaverse is transforming how we interact with digital spaces, and at the heart of this evolution lies blockchain technology. The rise of the best blockchain development trends is reshaping virtual worlds, enabling secure transactions, ownership verification, and decentralized control.

Businesses are closely watching blockchain trends as they drive new innovations in the metaverse. With new blockchain technology emerging fast, the landscape of blockchain technology trends is evolving faster than ever. Understanding blockchain development trends is important for staying ahead in this digital revolution.

Trend 1: Rise of Virtual Economies and Digital Assets

One of the most notable blockchain trends is the creation of virtual economies powered by blockchain technology. Virtual currencies, tokenized assets, and decentralized marketplaces are redefining ownership in digital environments.

This aligns with the best blockchain development trends as businesses explore ways to monetize digital goods and services. Using new blockchain technology, these virtual economies ensure security, transparency, and verifiability, strengthening blockchain technology trends across industries.

Blockchain development trends show a growing demand for secure and efficient digital asset transactions.

Trend 2: Integration of AR, VR, and Extended Reality (XR)

The seamless integration of AR, VR, and XR into metaverse platforms is one of the leading blockchain trends. These immersive technologies, supported by blockchain, enhance user experiences and enable secure virtual transactions.

The best blockchain development trends highlight the need for smooth data integrity and privacy solutions within XR environments. As new blockchain technology progresses, it plays a critical role in maintaining the authenticity and security of virtual experiences.

Observing blockchain technology trends, companies are increasingly adopting blockchain to safeguard virtual interactions and identities. Blockchain development trends reflect this growing convergence of immersive tech and blockchain.

Trend 3: Blockchain and NFTs Powering Ownership in the Metaverse

The adoption of NFTs is a key example of blockchain trends revolutionizing digital ownership. NFTs leverage new blockchain technology to provide verifiable ownership and scarcity for digital assets. The best blockchain development trends emphasize the importance of using NFTs for asset protection and monetization within the metaverse.

Blockchain technology trends demonstrate that NFTs are not limited to art but extend to real estate, gaming, and digital identities. Blockchain development trends show continuous innovations in token standards, enabling broader adoption of NFTs across sectors.

Trend 4: AI-Powered Virtual Environments and Avatars