#Unclaimed Dividend

Explore tagged Tumblr posts

Text

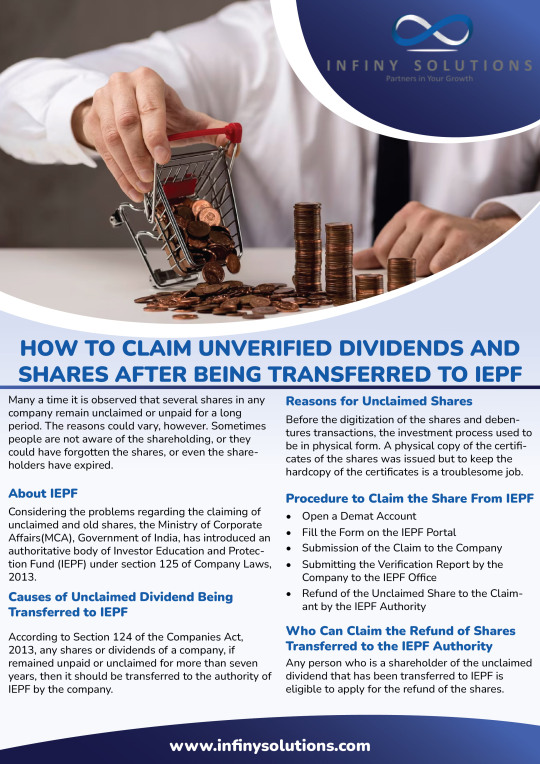

Infiny Solutions offers a wide range of financial services, including assistance with handling unclaimed dividends. Their expertise helps individuals and organizations reclaim funds that may have gone unnoticed or unclaimed for years. By leveraging advanced tools and a thorough understanding of the financial landscape, Infiny Solutions ensures clients are aware of any potential unclaimed dividends they may be entitled to. Their professional team guides clients through the process of locating, verifying, and retrieving these funds, making sure that no valuable dividend is left behind.

0 notes

Text

The responsibility of educating people about the refunds and administration of unclaimed dividends and helping them to make the process easier. The IEPF also ensures the transfer or claim of the transferred IEPF unclaimed dividend to the right person.

For More Visit :- https://infinysolutions.com/how-to-claim-unverified-dividends-and-shares-after-being-transferred-to-iepf/

0 notes

Text

Unclaimed Bank Deposit - Role of Financial Experts to Get It Back

In the hustle and bustle of our busy lives, financial assets can sometimes slip through the cracks, left unclaimed and forgotten. Unclaimed bank deposits, dividends, and insurance claims are more common than you might think. It's like losing keys in the crevices of your couch, only the stakes are much higher.

What happens to these forgotten financial treasures? They end up in a state of limbo, often stored in financial institutions, unattended and neglected.

If you're one of the many individuals facing the predicament of unclaimed funds, and worried about how to get unclaimed bank deposits back, fear not! There's a beacon of hope shining through the labyrinth of forgotten finances - enter the trusted investment guidance-providing companies. Presenting their role in getting back that fund from the following segment.

How Financial Consultants Help to Gain Back Unclaimed Bank Deposits?

Certainly, financial consultants play a vital role in assisting individuals in reclaiming their unclaimed money, especially bank deposits, dividends, and insurance claims. Their expertise and in-depth knowledge of financial mechanisms and regulatory processes make them essential in the endeavor to reclaim lost finances.

1. Expert Guidance and Knowledge: Financial consultants with expertise in fund management possess comprehensive knowledge about the procedures and requirements for reclaiming dormant assets. They guide individuals through the complex procedures and legal formalities associated with claiming unclaimed bank deposits, dividends, or insurance claims.

2. Identification and Verification: They aid in the identification and verification of assets like unclaimed bank deposits. They assist in determining if individuals have any unclaimed assets by leveraging databases and resources that might not be easily accessible to the public.

Consultants undertake the necessary due diligence to verify the authenticity of claims, ensuring a legitimate and efficient reclaiming process.

3. Navigating Legal Procedures: Financial experts are well-versed in the legalities involved in the reclaiming process. They provide crucial assistance in handling paperwork, compliance, and adhering to the regulatory framework required for reclaiming lost assets. Their familiarity with the legal landscape helps expedite the process, avoiding unnecessary delays.

4. Maximizing Recovery: These experts have the skill to ensure that all potential sources of unclaimed money are explored. They go through thorough investigations on different insurance companies, and other avenues where dormant assets might reside. Through their professional networks and resources, they optimize the chances of reclaiming the maximum amount possible.

5. Personalized Assistance: Financial consultants offer personalized assistance, considering the unique circumstances of each client. They provide tailored guidance and support, ensuring that individuals are well-informed and empowered throughout the process.

6. Identifying Unclaimed Assets: The Search Begins

One of the primary challenges in reclaiming unclaimed assets is the initial identification process. Financial consultants or guidance services leverage sophisticated tools and techniques that are otherwise inaccessible to the general public.

These professionals delve into vast databases and utilize specialized search mechanisms, employing a wide array of sources and information to determine whether an individual has dormant finances awaiting reclamation.

Conclusion Unclaimed bank deposits need not remain lost forever. With the assistance of adept financial consultants, reclaiming unclaimed bank deposits, dividends, or insurance claims becomes a tangible reality. Don't let your finances remain dormant—secure your financial future by reclaiming what's rightfully yours.

#search unclaimed dividend#unclaimed dividend#unclaimed insurance claims#unclaimed money in india#unclaimed money#unclaimed bank deposits#financial consultant#how to claim dividend#fund management#indian post unclaimed deposits#provident fund claim

0 notes

Text

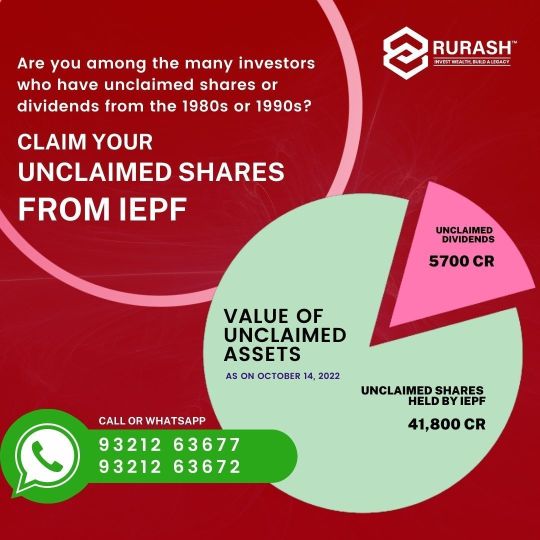

IEPF Claim Shares Services Today | IEPF Search

#iepf claim#rurash financials#unclaimed shares#recovery of forgotten investments#unclaimed dividend#reclaim your funds

0 notes

Text

How much unclaimed dividend is in India?

As of March 31, 2023, there is INR 12,778.24 crore (US$ 1.6 billion) in unclaimed dividend in India. This amount is held by the Investor Education and Protection Fund (IEPF), which is managed by the Ministry of Corporate Affairs.

The IEPF was established in 2001 to protect the interests of investors. It receives unclaimed dividends, shares, and other investor monies from companies. The IEPF uses these funds to promote investor education and protection activities.

You can check if you have any unclaimed dividends by visiting the IEPF website. You can also claim your unclaimed dividends online or by post.

Here are the steps on how to claim unclaimed dividends online:

Go to the IEPF website.

Click on the “Unclaimed Dividends” tab.

Enter your PAN number or DIN number.

Click on the “Search” button.

If you have any unclaimed dividends, you will see them listed on the screen.

Click on the “Claim” button to start the claim process.

You can also claim your unclaimed dividends by post. To do this, you will need to download the “Unclaimed Dividend Claim Form” from the IEPF website and fill it out. You will then need to send the form along with a copy of your PAN card or DIN card to the IEPF address.

0 notes

Text

https://www.thewealthfinder.in/infographics/dematerialisation/

#recovering the unclaimed shares and dividends#recovery of shares#unclaimed shares#lostsharesrecovery#finance#thewealthfinder#shares#leagal

0 notes

Text

claim shares from iepf

At Asset Retrieval Advisors, we specialize in helping individuals and entities recover unclaimed shares, stocks claim shares from iepf, and dividends from the Investor Education and Protection Fund (IEPF). If you are one of the millions of shareholders who have forgotten or lost track of your unclaimed assets, we are here to guide you through every step of the IEPF claims process. Our experienced team ensures a seamless, efficient, and hassle-free recovery of your IEPF shares, unclaimed dividends, and other securities that have been transferred to the IEPF due to non-encashment of dividends or due to death cases over the years.

In this comprehensive guide, we will walk you through the IEPF claims process, explaining each stage in detail, and outlining how we can help you claim shares from IEPF or recover your unclaimed dividend from IEPF. Whether you are looking to recover IEPF shares or get back lost dividends, we are here to make the process as easy and straightforward as possible.

What is IEPF (Investor Education and Protection Fund)?

The Investor Education and Protection Fund (IEPF) is a government initiative under the Ministry of Corporate Affairs (MCA) created to protect investors’ interests. The fund holds assets such as unclaimed dividends, shares, debentures, and other securities that have remained unclaimed by the rightful owners for a specified period, usually seven years.

When shareholders fail to encash their dividends or claim their shares, the companies are required by law to transfer those assets to the IEPF. This includes dividends that have not been claimed, as well as shares or securities that have remained unclaimed by their owners. The primary purpose of the IEPF is to safeguard these unclaimed assets and return them to the rightful shareholders when they come forward with a legitimate claim Duplicate share certificate.

Why You Should File an IEPF Claim

If you have unclaimed shares or dividends, it is crucial to file an IEPF claim to recover these assets. If you don’t act, your shares or dividends may remain in the IEPF, out of your reach. By filing a claim, you regain control over your investments and ensure your rightful ownership of those shares or dividends.

Here are some reasons why filing an IEPF claim is important:

Recover Unclaimed Dividends:

If you have not encashed dividends over the years, these may have been transferred to the IEPF. Filing an unclaimed dividend IEPF claim allows you to recover these amounts.

Regain Ownership of Shares:

If your shares have been transferred to the IEPF due to inactivity, IEPF shares recovery will allow you to regain ownership.

Secure Your Financial Future:

By recovering unclaimed shares and dividends, you can potentially increase your financial assets and reinvest them in lucrative opportunities.

Avoid Missing Out:

While unclaimed shares and dividends do grow and generate value if left in the IEPF but in case there is a need they cannot be used. A timely claim ensures you to have access of your legitimate wealth, when needed iepf.

Step-by-Step Process of Filing an IEPF Claim

The IEPF claims process involves several stages, each requiring detailed documentation and compliance with regulatory guidelines. At Asset Retrieval Advisors, we streamline this process for you, ensuring your claim is processed efficiently. Below is a detailed explanation of the steps involved in IEPF claims:

Data Gathering for Old Holdings

Before you can file an IEPF claim, the first step is to gather all relevant details about your shareholding and unclaimed dividends. This information is crucial for verifying your ownership and initiating the recovery process. What you will need is:-

Folio Number: The folio number associated with your shareholding.

Shareholding Details: The number of shares you hold and the companies in which you hold them.

Dividend History: Information about any unclaimed dividends that may have been transferred to the IEPF.

Personal Details: Your name, address, contact information, PAN (Permanent Account Number), bank details and demat account details.

2. Updation of KYC

The second step is updating your KYC (Know Your Customer) details with the relevant authorities. This ensures that the IEPF Authority has the most up-to-date information about your identity and shareholding status. Incomplete or outdated KYC details can delay the claim process. Documents required are:-

PAN Card: A copy of your PAN card.

Address Proof: A recent utility bill, Aadhaar card, passport, or bank statement as proof of address.

Bank Account Details: A canceled cheque or passbook showing your bank account details for the dividend credit.

Demat Account Details: Client Master List having all the details related to your Demat account.

3. Company Confirmation of Shares/Stocks Holdings

Once you’ve updated your KYC details, the next step is to obtain confirmation from the company where your shares are held. You will need to verify whether your shares or dividends have been transferred to the iepf claim .

Contact the Company: Reach out to the registrar or transfer agent of the company.

Obtain Confirmation Letter: Request an official letter from the company confirming that your shares or dividends have been transferred to the IEPF.

4. Filing of IEPF Form-5

Once you have the necessary information and confirmation, the next step is to fill out and file IEPF Form-5. This is the official application used to claim shares or unclaimed dividends from the IEPF.

Form Completion: Complete the form accurately, providing all required details such as your shareholding information, company details, and confirmation from the company.

Document Submission: Attach all relevant documents, including KYC proof, the confirmation letter from the company, and proof of your unclaimed shares or dividends.

5. Credit of Shares or Unclaimed Dividends to Your Demat Account

The final step in the IEPF claims process is the credit of your recovered shares or unclaimed dividends into your demat account.

Shares Credit: Your recovered shares will be credited electronically to your demat account.

Dividend Credit: Any unclaimed dividends will be transferred to your bank account linked to your demat account.

Final Confirmation: Once the shares or dividends are credited, you will receive confirmation from the company or your depository participant.

Why Choose Asset Retrieval Advisors for Your IEPF Claims?

Navigating the IEPF claims process can be complex, but with Asset Retrieval Advisors on your side, you have expert guidance at every step. Our team brings years of experience and in-depth knowledge of the regulatory landscape surrounding IEPF shares recovery and unclaimed dividend from IEPF claims. Here’s why you should choose us:

Expert Guidance

Our experienced professionals help you navigate the complexities of IEPF claims, from gathering data to filing IEPF Form-5.

Common Challenges in the IEPF Claims Process

While the IEPF claims process is straightforward, there are common challenges that many claimants face. These include:

Discrepancies in Shareholding Records: Sometimes, companies maintain outdated or inaccurate shareholder records, leading to difficulties in confirming the transfer of shares to the IEPF.

Incomplete KYC Details: Outdated or incomplete KYC information can delay or prevent the processing of your claim.

Documentation Issues: Missing or incorrect documents can cause delays in the approval of your claim.

Delays in Processing: While the process can take time, delays are often due to incomplete or incorrect filings, or backlogs at the company or IEPF office.

Our team at Asset Retrieval Advisors is here to address these challenges and ensure that your IEPF shares recovery is handled as smoothly and efficiently as possible iepf share transfer.

FAQs About IEPF Claims

Get Started with Your IEPF Claims Today

Don’t let your unclaimed shares or dividends stay in the IEPF any longer. Asset Retrieval Advisors is here to help you recover your assets with ease. Our team of experts will guide you through every step of the IEPF claims process and ensure that your claim is processed efficiently and effectively iepf shares.

#Demat of physical shares#how to claim iepf shares#iepf claim process#iepf unclaimed shares#recovery of shares from iepf#recovery of unclaimed dividend from iepf#transfer of shares after death of shareholder#unclaimed dividend iepf#unclaimed dividend transfer to iepf

0 notes

Text

Recover Your Unclaimed Dividend IEPF Shares Effortlessly

Have unclaimed dividend IEPF shares? Share Claim Dost makes it simple to reclaim them. Follow our guided steps to update your details, verify records, and submit your claim, ensuring a smooth recovery of your dividends and shares.

0 notes

Text

Filfox Share Solutions provides top-notch Legal Documentation Services for businesses looking to streamline their compliance processes. Our experienced team of professionals ensures accurate and reliable documentation tailored to your specific needs. Trust us to handle all your legal paperwork efficiently and effectively.

Visit here: https://www.filfoxsharesolutions.com/

#assistance in demat of physical shares#estate planning advisory services in india#international inheritance advisory#legal documentation services#iepf claim advisory#recovery of unclaimed and lost shares in india#recovery of unclaimed shares#succession and inheritance planning in india#dividends and mutual funds in india

0 notes

Text

Infiny Solutions is a leading provider of innovative financial services, specializing in unclaimed dividends. Their expert team helps clients track and recover dividends that have not been claimed, ensuring that individuals and businesses do not miss out on potential financial benefits. By offering comprehensive solutions, Infiny Solutions guides customers through the process of locating and reclaiming their unclaimed dividends with ease. Their customer-centric approach and in-depth knowledge of financial regulations make them a trusted partner for those seeking to retrieve their unclaimed funds efficiently and securely.

0 notes

Text

Avoiding Pitfalls: Tips for a Smooth Mutual Fund Claim

Ensuring a hassle-free claim process for your mutual fund is crucial to be aware of potential pitfalls that may arise. By understanding these potential challenges, you can take proactive steps to streamline your claim and avoid unnecessary delays or complications. This section will provide valuable tips and best practices for navigating the mutual fund claim process more efficiently.

First and foremost, it is important to stay updated with the terms and conditions of your mutual fund. Familiarize yourself with the specific requirements and procedures for making a claim. This includes understanding the documentation that needs to be submitted, the timeframe within which the claim needs to be filed, and any additional supporting information that may be required. By being well-informed, you can ensure that you are fully prepared to initiate the claim process.

Accurate documentation is another crucial aspect of a hassle-free claim process. Make sure to keep all relevant documents in order and up to date. This may include account statements, transaction records, purchase confirmations, and any other supporting evidence. Maintaining organized and accurate documentation will not only facilitate a smooth claim process but also help in providing the necessary evidence to support your claim.

In addition to accurate documentation, it is advisable to maintain open lines of communication with your mutual fund provider. Regularly check in with them to stay informed about any updates or changes that may impact your claim. This can help you stay ahead of any potential issues and address them promptly.

Furthermore, it is essential to promptly report any losses, damages, or other incidents that may give rise to a claim. Delaying the reporting of such incidents can lead to complications and may result in a denial of your claim. As soon as you become aware of an incident, notify your mutual fund provider and initiate the claim process as per their instructions.Lastly, it is always a good practice to seek professional advice when navigating the mutual fund claim process. Consulting with a financial advisor or legal expert can provide valuable insights and guidance, ensuring that you are taking the right steps to maximize your chances of a successful claim.

#missing money india#share recovery#unclaimed money in india#search unclaimed dividend#unclaimed dividend#unclaimed insurance claims#how to find lost investments#transfer of shares and transmission of shares#transmission of shares#unclaimed dividend transfer to iepf#provident fund claim#indian post unclaimed deposits#unclaimed bank deposit

1 note

·

View note

Text

Unveiling the Truth: The Rise of Share Claimers in the Digital Age

In the dynamic landscape of the digital age, the sharing of information has become an integral part of our daily lives. Social media platforms, news websites, and online forums serve as virtual arenas where ideas, news, and opinions are exchanged at an unprecedented pace. However, this rapid exchange has given rise to a new phenomenon: the Share Claimers. This article delves into the growing trend of individuals who not only share content but assert claims and take ownership of information in the vast realm of the internet.

The Share Claimers Defined:

Share Claimers are individuals who go beyond the conventional act of sharing content on social media. They not only distribute information but also attach personal beliefs, opinions, or even false claims to the shared content. This phenomenon is characterized by the assertion of ownership or alignment with the shared material, shaping the narrative to fit their perspective.

The Influence of Share Claimers:

Share Claimers wield a significant influence over online discourse. As shared content spreads across social networks, the attached claims can shape public opinion, create echo chambers, and even contribute to the dissemination of misinformation. Understanding the psychology behind Share Claiming is crucial to navigating the complexities of online communication.

Psychological Motivations:

Several psychological factors drive individuals to become Share Claimers. The desire for validation, the need to conform to social groups, and the pursuit of a sense of belonging play pivotal roles. Share Claimers often use shared content as a tool to express their identity, reinforcing their beliefs and values within their online communities.

Impact on Information Credibility:

The rise of Share Claimers raises concerns about the credibility of information circulating on the internet. The blending of facts with personal interpretations can distort the truth, leading to the perpetuation of myths and the spread of misinformation. This poses a challenge for individuals seeking reliable information in an era where the lines between fact and fiction can blur effortlessly.

Navigating the Digital Landscape:

To navigate the digital landscape effectively, it is essential for users to be discerning consumers of information. Critical thinking, fact-checking, and a healthy skepticism towards sensational claims can help mitigate the impact of Share Claimers. Additionally, fostering a culture of responsible sharing and promoting media literacy are key steps toward a more informed online community.

Our Service:-

Demat of Physical Share Certificate

How to Claim Unclaimed Dividends

IEPF 5 Filing Requirements

Conclusion:

The rise of Share Claimers underscores the evolving nature of online communication. As we navigate this digital era, it is crucial to be aware of the influence wielded by those who go beyond merely sharing content. By understanding the motivations and impact of Share Claimers, we can collectively work towards fostering a more informed, discerning, and responsible online community.

How to Claim Unclaimed Dividends

0 notes

Text

Unclaimed shares or money lying with IEPF? These are the steps to follow to reclaim them

Do you have some money or shares that you forgot to keep track of, and are now locked with the IEPF? If that is the case, you would wonder what exactly can be done to reclaim the assets you rightfully own but sadly — don’t possess anymore?

First of all, you need to understand where the securities go when you lose track of them as they remain unclaimed.

Any dividend money, interest income, matured debentures, matured deposits, redemption amount of preference shares and sale proceeds of fractional shares when remains unclaimed for seven years is transferred to the IEPF

What is IEPF?

IEPF stands for Investor Education and Protection Fund which is maintained by the IEPF Authority, a division of the Ministry of Corporate Affairs, Government of India.

This authority (IEPFA) is responsible to carry out refunds of shares, unclaimed dividends, matured deposits and debentures to investors, and also to promote awareness among investors..

Proposed integrated portal

In the Budget 2023, Finance Minister Nirmala Sitharaman announced an integrated IT portal to enable small investors to reclaim their unclaimed dividend and unpaid dividends from the IEPF in a speedy and seamless way.

���The proposed method will be a Straight Through Process (STP) whereby their Aadhaar and PAN linked demat accounts will be directly credited with shares after the Approved Verification Report is filed by the Company,” says Ankit Garg, Founder of Garg Law Chambers and Advisor, GLC Wealth

“There will be less physical verification of documents by the IEPF Officials resulting in drastic reduction of time taken to approve a claim below the threshold decided,” he adds.

How to reclaim your securities?

Any individual whose unclaimed or unpaid amount has been transferred by the company to IEPF may claim their refunds to the IEPF authority. In order to claim such an amount, claimants need to file form IEPF-5 along with other necessary documents.

Mr Garg says there could be a number of reasons for losing control over some securities e.g., some investors forget to keep their KYC updated.

To explain this, he shares an example of one of his clients where a company’s CEO – for not keeping the KYC updated – lost track of his securities, which were later transferred to IEPF.

“A CEO of a leading FMCG company purchased shares in his and his wife’s demat account and forgot to keep his KYC updated. Due to dividends not getting credited to their account over a long number of years during which they were posted in many countries, the shares were transferred to the IEPF Authority,” said Mr Garg.

“When he approached us, we followed up with the respective companies to get accurate details of shares and unclaimed dividends and filed their claims with the government authority. After consistent follow ups with the company and the IEPFA we were able to get their claim approved and recovery of shares credited to their demat accounts,” he elaborates.

These are the steps to follow to reclaim your assets:

I. Fill the form: First of all, access the IEPF-5 webform to file the claim for refund. And needless to mention that one must read the instructions carefully along with the form before filling the form.

II. Acknowledgement: Once you have filled the form, you can submit the same. Upon successful submission, an acknowledgement is generated indicating the SRN, which is used for tracking the form in future.

III. Printout: After uploading the form, one must take a printout of the duly filled IEPF-5 and the acknowledgement issued.

IV. Send documents: Now you should send an envelope marked “Claim for refund from IEPF Authority” to the Nodal Officer (IEPF) of the company at its registered office.

In this envelope, you should ensure to send indemnity bond in original, copy of acknowledgement and IEPF-5 form along with the other documents as mentioned in the Form IEPF-5.

V. Verification: Once these claim forms are completed in all aspects, they will be verified by the concerned company. Later, on the basis of the company's verification report, refund will be carried out by the IEPF Authority in favour of claimants’ account via electronic money transfer.

0 notes

Text

https://www.thewealthfinder.in/iepf-claims/

#recovering the unclaimed shares and dividends#lostsharesrecovery#recovery of shares#unclaimed shares#finance

0 notes