#U.S.10YearTreasury

Explore tagged Tumblr posts

Photo

Stock futures muted after a tech-driven sell-off on Wall Street

#BreakingNewsMarkets#businessnews#futures#Investmentstrategy#JoeBiden#Markets#muted#SP500Index#selloff#Stock#Stockmarkets#street#techdriven#U.S.10YearTreasury#wall#WallStreet

0 notes

Text

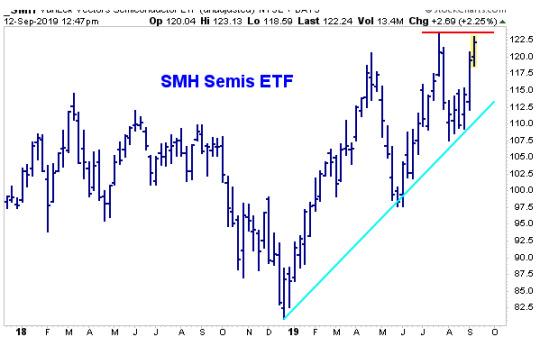

The market's trip to new highs is different this time

Strength in semiconductors and a whole host of other sleeper stocks is a telling sign that the market will not only make it to new highs but could remain in an uptrend, according to technical analysts. For a couple years, investors could simply look to the performance of the favorite FANG names — Facebook, Amazon, Netflix and Alphabet — for clues to market performance, but now the fact that a broad range of stocks are being swept higher is a very positive sign. "This is different than the past few moves back to highs. You have a bigger base. When you have one group that's leading and everything else is left behind it's easy to lose that one group, and you hit an air pocket," said Scott Redler, technical analyst and partner with T3Live.com. "When you have a lot of groups and they're taking turns, it's harder to break the back of the bull." The S&P 500 ended Thursday at 3,009, up 8, and just 0.6% away from its all-time high. The Dow, which is also less than a percent from its high, ended at 27,182, up 0.2%. The S&P's high from late July was 3,027.98, and Redler said it would be a positive if it can continue to hold above the psychological 3,000 level. The small-cap Russell 2000 ended off by less than a point at 1,575, but it is up 4.6% for the week, in its best weekly performance so far since January. Stocks are powering higher amid positive developments in the trade wars, with U.S. officials preparing to meet Chinese counterparts next month. Analysts have said the market's run higher could be disrupted if there is negative news on the trade front. For now, both the U.S. and China have held off on some new tariffs in a show of good faith. Trading in recent sessions has been markedly different than in other phases of the bull market. Value stocks, or those less loved and with lower price-to-earnings ratios, have been gaining favor. At the same time, the momentum stock winners underperformed, though some are moving higher after falling at the beginning of the week. "I think the general view out there is growth and value are mutually exclusive ideas. I disagree. I think they can work in tandem," said Chris Verrone, Strategas Research head of technical strategy. "We call that a broader market." A number of those momentum names were higher Thursday, including Visa, up 2.3%, and Mastercard, up 2.4%, and the iShares Edge MSCI USA Momentum Factor ETF was up 1.4%. At the same time, the iShares S&P 500 Value ETF IVE had been moving opposite momentum, but it was slightly higher in afternoon trading. Some strategists say the big rotation, which was not so obvious in Thursday's trading, was kicked off by the belief that interest rates are rising after finding a bottom this summer. The 10-year yield Thursday was at 1.78%, just weeks after hitting a low of 1.42%. Yields move opposite price. In the recent past, when the stock market returned to highs, it was led by FANG, Redler said. "This time tech and FANG are kind of in line and not a headwind," he said, "but it's the broad-based nature of the value names, small caps and banks that lifted the S&P to play catch up, and lifted it back to its highs." "Now in order to power above it, it's time for FANG to wake back up. Semiconductors are considered the backbone of tech. The semiconductors are giving clues that things aren't so bad and China is still ordering, and there's the potential for a deal ... Semis are the backbone of tech, and FANG is the heart of it," he said. Frank Cappelleri, executive director at Instinet, said the best-case scenario for the market is for the momentum laggards from earlier in the week to join the value and other stocks that are moving higher. He said the software sector is a key group to regain ground. Microsoft was up 1.4% Thursday after getting knocked down earlier in the week. "I think you always have to watch tech, how semiconductors are doing going forward. SMH has quietly gotten back to its highs of the summertime," said Capelleri. "If you looked at what happened last year, they lagged since March of 2018."

Source: Instinet Cappelleri said in a week where momentum got hit so hard, the sector "was stubborn in terms of not losing its bid." SMH was up 2.6% for the week and is now up 7.1% for September so far. "The semis have been quiet for months, but over the last two weeks they're making all-time highs," said Verrone. "Really over the last two years they've been sideways and ... over the last couple of weeks they've been waking up." Verrone said the leaders in the group are behaving well, as the sector reasserts its market leadership. "Texas Instrument and Taiwan Semiconductor are big global bellwethers that behaved resoundingly well, despite what many people believe is a tense trade and global growth environment," he said. Verrone said the two chip names are part of a handful of stocks he is watching to gauge the market's health. The others are Alibaba, J.P. Morgan and Apple. "Two weeks ago, they had these bank stocks on the ropes. The referee was about to stop the fight. But the way they've come back from that is impressive. J.P. Morgan, in particular, is literally on the doorstep of a new all-time high," he said. "They had every opportunity to just finish that one off a couple of weeks ago. They couldn't keep it down." Alibaba, Chinese e-retailer, is at the center of the trade conflict. "It's ground zero for the Chinese consumer stocks and growth," he said. Apple, a U.S. tech and consumer bellwether, has also been behaving well, and was up for three days around a product announcement of new iPhones and iPads. That is unusual for the company's shares, which often sag around product announcements. Verrone said Wall Street's current lack of love for the one-time darling is a positive for a further move higher. "Apple has the fewest number of buy ratings from the sell side at any point in about a decade," he said. "All during the summer you saw all the analysts capitulate," he said. Verrone said he expects the market to continue moving higher and the S&P 500 to reach 3,150 by the end of the year. Besides the strong behavior of those select stock names, Verrone said, there are plenty of other positives. "I just can't remember a time when the divide between perception and reality has been so wide," said Verrone. "People have been very uncomfortable all summer, but the stocks don't act bad. That tells us the market is heading higher." Improvements in such indicators as the advancing shares over declining is also a good sign for further gains. Verrone said earlier this week the percent of stocks with an upward sloping 200-day moving average is the best of the year so far, and new highs are show up in transports, discretionary and banks. "A breadth surge over the last two weeks is as good as anything we've seen in the days and weeks coming off the December 2018 lows," he said. "That's true in Europe and domestically as well." Read the full article

#AlibabaGroupHoldingLtd#AlphabetClassA#Amazon.comInc#AppleInc#businessnews#DowIndustrials#earnings#Facebook#iSharesEdgeMSCIUSAMomentumFactorETF#iSharesS&P500ValueETF#JPMorganChase&Co#MarketInsider#markets#NetflixInc#Russell2000Index#S&P500Index#U.S.10YearTreasury#VanEckVectorsSemiconductorETF#wallstreet

0 notes

Photo

Dow futures rise more than 150 points as stocks go for 4-day winning streak

#4Day#AlphabetClassA#Amazon.comInc#AppleInc#BreakingNewsMarkets#businessnews#Dow#Facebook#futures#Investmentstrategy#Markets#MicrosoftCorp#points#rise#Salesforce.ComInc#Stockmarkets#stocks#streak#TwitterInc#U.S.10YearTreasury#UnitedStates#WallStreet#WINNING

0 notes

Photo

Fed could be a surprise catalyst for the markets in holiday week

#businessnews#catalyst#CoronavirusBusiness#DowJonesIndustrialAverage#Earnings#Economy#Fed#GlobalXCybersecurityETF#HOLIDAY#iSharesCybersecurityandTechETF#MarketInsider#Markets#NASDAQComposite#SP500Index#Stockmarkets#surprise#U.S.10YearTreasury#WallStreet#week

0 notes

Text

Stocks look to reclaim their all-time highs in the week ahead

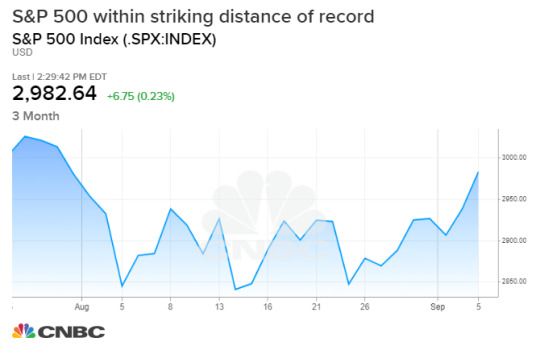

Stocks will look to build on their strong recent momentum and reclaim their record highs next week amid a slew of economic data while trade war fears decrease.The S&P 500 is about 1.6% from an intraday record reached on July 26 after notching back-to-back weekly gains. The broad index is up 1.8% this past week after surging 2.8% in the last week of August.Wall Street's move toward all-time highs comes as recent U.S. economic data suggests a recession may not be in the cards, and the Federal Reserve is expected to cut interest rates later this month. Easing fears around the U.S.-China trade war are also lifting investor sentiment. If the data remains solid, Fed rate cut expectations stay high and U.S.-China trade tensions lower, the market could climb back to all-time highs."You cannot sell the market ahead of the Fed and you cannot sell the market ahead of the trade talks in October," Steve Grasso, director of institutional sales at Stuart Frankel and a CNBC contributor, told "Power Lunch." "For now, it's a bull run."

The U.S. services sector grew at a faster rate than expected in August, the Institute for Supply Management said Thursday. The data offset worries from the manufacturing sector. The ISM said Tuesday that the U.S. manufacturing sector contracted for the first time since early 2016.Meanwhile, the Labor Department on Friday reported better-than-expected U.S. wage growth for August at a time when consumer spending is strong. However, the report also showed jobs growth slowed for a third straight month."The U.S. economy should avoid recession," Gus Faucher, chief economist at PNC, wrote in a note. "With slower, but still-solid job gains and good wage growth, households will continue to spend; consumer spending accounts for almost 70 percent of the U.S. economy."Investors will get more information on the state of the consumer next Friday with the release of August retail sales and a preliminary look at September consumer sentiment. Positive data on that front could lift stocks to their records.Next week will be important as investors get more clues about the Federal Reserve's next policy move. August readings for the producer and consumer price indexes are scheduled for release Wednesday and Thursday, respectively.The Fed has cited persistently low inflation as one of the reasons for easing monetary policy in the U.S. In July, the Fed cut rates by 25 basis points. Market expectations for another quarter-point rate trim in September are at 93.5%, according to the CME Group's FedWatch tool.However, stronger-than-expected inflation could raise questions about whether the Fed will reduce rates later this month."Anything that is speaking directly to inflation is going to be most important" for the market, said James Masserio, co-head of equities in the Americas at Societe Generale. "That's going to be weighted most heavily in the central bank's monetary policy decision-making process.""Right now, all asset classes are being greatly influenced by the expectations of changes in monetary policy," Masserio said.The Fed is not slated to meet until the week of Sept. 17, but the European Central Bank will announce its latest monetary policy decision on Thursday. The ECB is largely expected to cut rates with some experts forecasting a restart to its quantitative easing program.News around U.S.-China trade talks will continue to play a role in the market next week as investors look for signs of progress in the negotiations. On Thursday, China's Ministry of Commerce said Chinese trade officials will meet their U.S. counterparts in Washington next month."If there's a bit more optimism around trade, I think we could get back to those previous highs," said Jon Adams, senior investment strategist at BMO Global Asset Management. "We're not far from the previous highs. It wouldn't take much to get there."

Week ahead calendar

Monday3 p.m. Consumer creditTuesday6 a.m. NFIB small business survey10 a.m. JOLTS1 p.m.: Apple eventWednesday8:30 a.m. Producer price index10 a.m. Wholesale tradeThursday7:45 a.m. European Central Bank policy announcement8:30 a.m. Initial jobless claims8:30 a.m. Consumer price indexFriday8:30 a.m. Retail sales8:30 a.m. Import prices10 a.m. Consumer sentiment10 a.m. Business inventories Read the full article

#AmericanEagleOutfittersInc#AsiaEconomy#businessnews#CienaCorp#CoupaSoftwareInc#Dave&Buster'sEntertainmentInc#earnings#MarketInsider#markets#S&P500Index#SignetJewelersLtd#U.S.10YearTreasury#U.S.2YearTreasury#U.S.30YearTreasury#VeraBradleyInc#wallstreet

0 notes