#U.S. Veterinarians Market Growth Forecast

Explore tagged Tumblr posts

Text

U.S. Veterinarians Market Positively Impacted By Tests And Veterinary Telehealth Services During COVID-19

The U.S. veterinarians market size is poised to reach USD 23.3 billion by 2030, expanding at a CAGR of 8.7% during the forecast period, as per a new report by Grand View Research, Inc. The rising cases of zoonotic and chronic diseases, increasing animal health expenditure, and growing pet health concerns are the key factors driving the market. An estimated total of around 132,138 professionals were actively involved in the veterinary profession in the U.S. Approximately 57% of the U.S. veterinarians were employed in private practices in 2020. This number is estimated to increase in the coming years, owing to a rise in demand for veterinary services.

Although the COVID-19 pandemic presented several challenges to the animal health industry, it highlighted the need to secure the health of pets as well as food animals. With containment measures such as lockdowns & movement restrictions, manufacturing companies and veterinary service providers were significantly affected. Animal disease surveillance and reporting activities, such as outbreak investigation & disease reporting, were also disrupted due to logistical issues. This included restrictions & constraints on access to farms & transport of samples and veterinary equipment & PPE kits during the pandemic.

Gain deeper insights on the market and receive your free copy with TOC now @: U.S. Veterinarians Market Report

However, companies manufacturing products or providing services that helped ease the pandemic burden, such as COVID-19 tests and veterinary telehealth services, were positively impacted. Veterinary visits too plunged due to the pandemic. However, the numbers soon recovered as veterinary services were recognized as an essential service. The U.S. government also announced several financial stimulus packages, flexible norms, and guidelines to ensure business continuity.

The Coronavirus Response and Relief Supplemental Appropriations Act & the Coronavirus Aid, Relief, and Economic Security (CARES) Act came into force to provide rapid & direct economic assistance to workers, families, & small businesses, and to preserve jobs in the U.S. Among other provisions, this included the Paycheck Protection Program to assist small businesses. C4, or the fourth COVID-19 relief bill, passed by the U.S. Congress in December 2020, included additional relief measures. Key provisions of C4 included a simplified loan waiver of up to USD 150,000, applicable to most veterinary practices.

With the growing number of pet parents in the U.S. and adoption of pet insurance, demand for animal health services is rising amongst people. In 2020, about 3.45 million pets had insurance coverage across North America, as per the North American Pet Health Insurance Association. Out of these, 3.1 million pets were insured in the U.S. alone. The highest percentage of insured pets were found to reside in California, New York, and Florida.

Dogs were the most frequently insured pets as compared to cats.Among the many available career paths, a notable number of U.S. veterinarians pursue teaching and/or research careers as faculty, thus contributing to the significant revenue share of the academics segment. New graduates are also inclined to enter internships and residencies at private veterinary practices or veterinary medicine colleges.

#U.S. Veterinarians Market Size & Share#U.S. Veterinarians Market Latest Trends#U.S. Veterinarians Market Growth Forecast#COVID-19 Impacts On U.S. Veterinarians Market#U.S. Veterinarians Market Revenue Value

0 notes

Text

Veterinary Rapid Test Market Expansion 2024-2033: Growth Drivers and Dynamics

The veterinary rapid test global market report 2024from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Veterinary Rapid Test Market, 2024report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size - The veterinary rapid test market size has grown rapidly in recent years. It will grow from $0.72 billion in 2023 to $0.80 billion in 2024 at a compound annual growth rate (CAGR) of 11.3%. The growth in the historic period can be attributed to growth in veterinary rapid tests, rise in demand for rapid test diagnosis over other test, rise in adoption of pet insurance, increased demand for animal-based protein source, rise in numbers of veterinarians and veterinary visits.

The veterinary rapid test market size is expected to see rapid growth in the next few years. It will grow to $1.24 billion in 2028 at a compound annual growth rate (CAGR) of 11.6%. The growth in the forecast period can be attributed to increasing pet ownership, increasing consumer awareness regarding scientific animal nutrition, increase in industrialized livestock production, increasing diagnostic testing of livestock diseases, increasing prevalence of zoonotic diseases in animals. Major trends in the forecast period include product innovation, advancements in biotechnology, demand for quick and accurate diagnostic solutions, innovative veterinary diagnostics, technological advancements in diagnostic technologies.

Order your report now for swift delivery @ https://www.thebusinessresearchcompany.com/report/veterinary-rapid-test-global-market-report

Scope Of Veterinary Rapid Test MarketThe Business Research Company's reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market's historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6. Macro Economic Factors: Assessment of broader economic elements impacting the market.

Veterinary Rapid Test Market Overview

Market Drivers -The increasing pet ownership is expected to propel the growth of the growth of the veterinary rapid test market going forward. Pet ownership refers to the relationship in which an individual or household takes responsibility for a pet animal's care, welfare, and maintenance. The increase in pet ownership can be attributed to social trends, urbanization, and a rise in young adults delaying parenthood. Veterinary rapid tests provide pet owners with timely and accurate diagnostic information, facilitating proactive healthcare management and ultimately promoting their animal companions' health, happiness, and longevity. For instance, according to The American Pet Products Association (APPA), a US-based organization, pet ownership in the United States rose from 67% of households owning a pet in 2021-2022 to 70%. Additionally, from 2023 to 2024, 66% of U.S. households owned a pet, which equates to 86.9 million households. Therefore, increasing pet ownership drives the veterinary rapid test market.

Market Trends - Major companies operating in the veterinary rapid test market are developing advanced solutions such as AI-based rapid tests to enhance diagnostic accuracy and improve overall efficiency in veterinary healthcare. AI-based rapid tests represent a significant advancement in veterinary diagnostics, offering veterinarians powerful tools to expedite the diagnostic process, improve diagnostic accuracy, and ultimately enhance the quality of care provided to animals. For instance, in November 2023, Micron Agritech, an Ireland-based sustainable health company, launched the Micron Kit Fluke Test, an innovative AI-powered rapid test for liver fluke in livestock. This breakthrough solution allows farmers and veterinarians to quickly test animals on-site using their smartphones for both liver fluke (Fasciola hepatica) and rumen fluke (Calicophoron daubneyi) infections

The veterinary rapid test market covered in this report is segmented –

1) By Product: Rapid Test Kits, Rapid Test Readers 2) By Animal Type : Companion Animal, Production Animal 3) By Technology : Immunoassays, Polymerase Chain Reaction(PCR) 4) By Application: Viral Diseases, Bacterial Diseases, Parasitic Diseases, Allergies, Other Applications 5) By End-User: Veterinary Hospitals And Clinics, Homecare Settings, Other End Users

Get an inside scoop of the veterinary rapid test market, Request now for Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=15956&type=smp

Regional Insights - North America was the largest region in the veterinary rapid test market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the veterinary rapid test market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

Key Companies - Major companies operating in the veterinary rapid test market are Thermo Fisher Scientific Inc., Zoetis Inc., bioMérieux SA, IDEXX Laboratories Inc., Sysmex Corporation, Bio-Rad Laboratories Inc., QIAGEN GmbH, Virbac Corp., Neogen Corporation , Antech Diagnostics Inc., Heska Corporation, Ring Biotechnology Co Ltd., Woodley Equipment Company Ltd., Prometheus Biosciences Inc., BioChek, Bionote Usa Inc., Agrolabo S.p.A., Shenzhen Bioeasy Biotechnology Co. Ltd., Fassisi GmbH, MEGACOR Diagnostik GmbH, Biopanda Reagents Ltd., Boster Biological Technology Co. Ltd., Swissavans AG, Secure Diagnostics Pvt. Ltd., Eurolyser Diagnostica GmbH

Table of Contents 1. Executive Summary 2. Veterinary Rapid Test Market Report Structure 3. Veterinary Rapid Test Market Trends And Strategies 4. Veterinary Rapid Test Market – Macro Economic Scenario 5. Veterinary Rapid Test Market Size And Growth ….. 27. Veterinary Rapid Test Market Competitor Landscape And Company Profiles 28. Key Mergers And Acquisitions 29. Future Outlook and Potential Analysis 30. Appendix

Contact Us: The Business Research Company Europe: +44 207 1930 708 Asia: +91 88972 63534 Americas: +1 315 623 0293 Email: [email protected]

Follow Us On: LinkedIn: https://in.linkedin.com/company/the-business-research-company Twitter: https://twitter.com/tbrc_info Facebook: https://www.facebook.com/TheBusinessResearchCompany YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ Blog: https://blog.tbrc.info/ Healthcare Blog: https://healthcareresearchreports.com/ Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

0 notes

Text

Beyond the Clinic: Innovative Teleradiology for Veterinary Practices

The global veterinary teleradiology market is witnessing steady growth, reflecting the increasing demand for remote diagnostic services in veterinary medicine. According to the report, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 7% over the forecast period of 2022-2028. Valued at around USD 300 million in 2022, the market is expected to reach nearly USD 500 million by 2028.

What is Veterinary Teleradiology?

Veterinary teleradiology involves the remote interpretation of radiological images (X-rays, MRIs, CT scans, and ultrasounds) for animals. Veterinarians send the images to specialized radiologists who analyze and diagnose the images, providing detailed reports to aid in the treatment of animals. This service is especially beneficial for veterinary clinics and hospitals that may not have full-time radiologists on staff.

Get Sample pages of Report: https://www.infiniumglobalresearch.com/reports/sample-request/35313

Market Dynamics and Growth Drivers

Several factors are contributing to the growth of the global veterinary teleradiology market:

Increasing Pet Ownership and Pet Care Expenditures: The rising number of pets globally, particularly in developed regions, is driving the demand for advanced veterinary services. As pet owners invest more in the health and well-being of their animals, the need for efficient diagnostic solutions like teleradiology is growing.

Shortage of On-site Veterinary Radiologists: Many veterinary clinics and hospitals, especially in rural or less populated areas, lack access to in-house radiologists. Veterinary teleradiology addresses this issue by providing access to specialists remotely, improving diagnostic accuracy and treatment outcomes.

Technological Advancements in Veterinary Imaging: Advances in imaging technology, such as high-definition scanners and cloud-based platforms for transmitting images, are enhancing the capabilities and convenience of teleradiology services. These innovations are improving the speed and accuracy of diagnoses, driving demand for teleradiology solutions.

Rising Awareness of Animal Health: Increased awareness about animal health, particularly in regions like North America and Europe, is contributing to the growth of the veterinary teleradiology market. Pet owners are becoming more proactive about diagnosing and treating their pets' ailments, and veterinarians are using teleradiology to provide better care.

Demand for Specialized Diagnostic Services: Veterinary practices are increasingly relying on specialized teleradiologists to provide expert analysis of complex imaging studies. This demand is driven by the need for more accurate diagnoses and better patient outcomes, particularly for pets with complicated or serious health issues.

Regional Analysis

North America: North America is the largest market for veterinary teleradiology, driven by high pet ownership, significant investment in veterinary care, and the widespread adoption of advanced technologies. The U.S. and Canada are key markets where demand for remote diagnostic services is increasing steadily.

Europe: Europe represents another significant market, with countries like the U.K., Germany, and France at the forefront of adopting veterinary teleradiology services. The region’s well-established veterinary infrastructure and growing pet care expenditures are contributing to market growth.

Asia-Pacific: The Asia-Pacific region is experiencing moderate growth in the veterinary teleradiology market. Countries such as China, Japan, and Australia are seeing increased adoption of veterinary telemedicine solutions due to rising pet ownership and the growing need for better veterinary services.

Latin America and Middle East & Africa: These regions are witnessing gradual growth, supported by increasing awareness of pet healthcare and improving veterinary infrastructure. However, the market remains relatively untapped, presenting future growth opportunities.

Competitive Landscape

The veterinary teleradiology market is competitive, with key players offering a range of diagnostic solutions. Major companies include:

VetRad: A leading provider of veterinary teleradiology services, offering quick and reliable image interpretations for veterinary practices worldwide.

Antech Imaging Services (AIS): Known for its innovative teleradiology platform that connects veterinarians with board-certified radiologists for comprehensive diagnostic reports.

VetCT: Provides a full range of teleradiology services, specializing in advanced imaging modalities and offering 24/7 support to veterinary clinics.

VitalRads: A company that focuses on providing teleradiology services tailored to small animal practices, offering high-quality and cost-effective diagnostic solutions.

IDEXX Laboratories: A major player in the veterinary diagnostic industry, offering teleradiology services as part of its comprehensive suite of veterinary healthcare solutions.

Report Overview : https://www.infiniumglobalresearch.com/reports/global-veterinary-teleradiology-market

Challenges and Opportunities

While the veterinary teleradiology market is poised for growth, it faces several challenges. The high cost of imaging equipment and services may limit adoption, particularly in developing regions. Additionally, concerns over data security and the integration of teleradiology platforms with existing systems may present hurdles for some veterinary practices.

However, there are significant opportunities for market expansion. The growing adoption of telemedicine in veterinary care, along with technological advancements in cloud-based diagnostics and artificial intelligence, offers promising avenues for growth. Companies that invest in enhancing the accessibility, affordability, and reliability of teleradiology services are likely to thrive in this expanding market.

Conclusion

The global veterinary teleradiology market is on a solid growth trajectory, driven by rising pet ownership, technological advancements, and the need for specialized diagnostic services. With revenue expected to reach nearly USD 500 million by 2028, the market presents substantial opportunities for innovation and investment. As veterinary practices continue to seek more efficient and accurate diagnostic solutions, teleradiology is set to play an increasingly important role in the future of animal healthcare.

0 notes

Text

Veterinary Services Market is Estimated to Witness High Growth

The veterinary services market involves a wide range of important medical services for animals including preventive care, medication, surgeries and other treatment procedures. Regular veterinary exams help monitor animal health and detect problems early. Veterinary professionals also play a key role in disease prevention through vaccination programs. Emerging technologies are revolutionizing veterinary treatment with treatments such as regenerative medicine gaining popularity.

The global veterinary services market is estimated to be valued at US$ 130.16 billion in 2024 and is expected to exhibit a CAGR of 5.0% over the forecast period from 2024 to 2031.

Key Takeaways

Key players operating in the veterinary services are Fagron Sterile Services US, New Drug Loft & VLS Pharmacy, Nora Apothecary, Lifecare Pharmacy, Avella Specialty Pharmacy, Triangle Compounding Pharmacy, O€TMBrien Pharmacy, Tache Pharmacy, Northmark Pharmacy, Edge Pharma, and ImprimisRx. The veterinary services market presents significant opportunities owing to rising pet ownership globally and increasing per capita spending on pet care. Technological advancements are also supporting market growth with emerging therapies such as regenerative medicine gaining popularity for conditions which were earlier untreatable.

The key opportunities in the Veterinary Services Market Demand include rising penetration in developing countries with growing pet adoption, opportunities for multi-specialty services with urbanization and nuclear families, and scope for preventive healthcare programs. Technological innovation is a key enabler in the market with emerging technologies such as regenerative medicines, biologics and stem cell treatment impacting disease management.

Market drivers

One of the key drivers for the veterinary services market is growing pet population globally coupled with rising pet care expenditure. Pet humanization trends have significantly increased spending on pet food, healthcare, insurance and accessories. According to the latest APPA National Pet Owners Survey, U.S. pet industry expenditure reached a record $103.6 billion in 2019, with over $31 billion spent on veterinary care. Growing pet ownership and increasing willingness to spend on pet healthcare is a major market driver.

Current challenges in the Veterinary Services Market:

The veterinary services market is facing several challenges currently. One of the major challenges is the shortage of veterinarians globally. There is currently an unmet demand for veterinary care due to lack of sufficient veterinary professionals. This leads to delay in delivery of care. Another challenge is rising veterinary care costs. The costs associated with veterinary medicine and surgeries have increased significantly over the years. This pressure on budgets restricts access to quality care for many pet owners. Lack of awareness among pet owners regarding veterinary preventive healthcare is also a challenge. Many pet owners only seek treatment when their pet falls sick rather than focusing on preventive healthcare checkups. This affects timely diagnosis and treatment.

SWOT Analysis

Strength: Strong bond between veterinarians and pet owners leads to loyalty; Growing pet humanization trend boosts demand.

Weakness: Shortage of vets causes delay in care; Higher costs restrict broader access to care.

Opportunity: Rising pet adoption during COVID drives future growth; Scope for preventive healthcare awareness programs.

Threats: Threat from illegal or unqualified Veterinary Services Market Analysis offering low-cost services; Risk of new pet diseases and virus outbreaks.

Geographical Regions

North America dominated the veterinary services market in terms of value in the historical period due to high pet ownership and growing expenditure on pet care in countries like the US and Canada. Asia Pacific is expected to be the fastest growing region during the forecast period driven by factors like rising affluence, nuclearization of families and increasing awareness about animal health in major countries.

The United States represents the most concentrated geographical region for the veterinary services market currently. Within the country, states like California, Texas and New York have emerged as major hubs for both veterinary practices and companion animal care expenditures. Other developed countries within North America and Western Europe also exhibit high demand density due to high pet ownership.

Get more insights on Veterinary Services Market

About Author:

Vaagisha brings over three years of expertise as a content editor in the market research domain. Originally a creative writer, she discovered her passion for editing, combining her flair for writing with a meticulous eye for detail. Her ability to craft and refine compelling content makes her an invaluable asset in delivering polished and engaging write-ups.

(LinkedIn: https://www.linkedin.com/in/vaagisha-singh-8080b91)

#CoherentMarketInsights#VeterinaryServices#VeterinaryServicesMarket#VeterinaryServicesMarketOutlook#VeterinaryServicesMarketForecasts#DiagnosticTests#DiagnosticImaging#PhysicalHealthMonitoring#PreventativeCare

0 notes

Text

The Growing Field of Animal Ultrasound: A Game Changer in Veterinary Medicine

The global animal ultrasound market size reached USD 286.2 Million in 2020 and is expected to register a revenue CAGR of 8.2% during the forecast period, according to latest analysis by Emergen Research. Increasing number of companion animals and rising demand for pet insurance are some key factors projected to support market revenue growth between 2021 and 2028.

In addition, increasing number of veterinary doctors in developed and developing countries is expected to boost revenue growth of the market going ahead.Increasing number of veterinarians has also resultedin increasingnumberof new treatment facilities, which is expected to boost demand for various treatmentequipment for animals, including animal ultrasound devices.In addition, veterinarians' incomes in developed countries have significantly risen in recent years, and this is strengthening their purchasing power, which is expected to boostadoption of animalultrasound devices in private clinics.

Request a Sample Report with Table of Contents and Figures to click Here: https://www.emergenresearch.com/request-sample/866

Competitive Terrain:

The section on the competitive landscape offers valuable and actionable insights related to the business sphere of the Animal Ultrasound market, covering extensive profiling of the key market players. The report offers information about market share, product portfolio, pricing analysis, and strategic alliances such as mergers and acquisitions, joint ventures, collaborations, partnerships, product launches and brand promotions, among others. The report also discusses the initiatives taken by the key companies to combat the impact of the COVID-19 pandemic.

The leading market contenders listed in the report are:

IDEXX Laboratories, Inc., Carestream Health, Inc., Fujifilm Holdings Corporation, Esaote SpA, GE Healthcare, Heska Corporation, Diagnostic Imaging Systems, Inc., Clarius Mobile Health Corp., DRAMIÑSKI S.A., and Hallmarq Veterinary Imaging Limited

Click to access the Report Study, Read key highlights of the Report and Look at Projected Trends: https://www.emergenresearch.com/industry-report/animal-ultrasound-market

Emergen Research has segmented the global Animal Ultrasound market on the basis of type, application, end-use, and region:

Segments Covered in this report are:

Animal Type Outlook (Revenue, USD Million; 2018–2028)

Large Animals

Small Companion Animals

Imaging Type Outlook (Revenue, USD Million; 2018–2028)

Doppler Imaging

2D Ultrasound Imaging

3D & 4D Ultrasound Imaging

Scanner Type Outlook (Revenue, USD Million; 2018–2028)

Handheld Ultrasound Scanners

Cart-based Ultrasound Scanners

The various regions analyzed in the report include:

North America (U.S., Canada)

Europe (U.K., Italy, Germany, France, Rest of EU)

Asia Pacific (India, Japan, China, South Korea, Australia, Rest of APAC)

Latin America (Chile, Brazil, Argentina, Rest of Latin America)

Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of MEA)

Key Objectives of the Report:

Analysis and estimation of the Animal Ultrasound Market size and share for the projected period of 2022-2030

Extensive analysis of the key players of the market by SWOT analysis and Porter’s Five Forces analysis to impart a clear understanding of the competitive landscape

Study of current and emerging trends, restraints, drivers, opportunities, challenges, growth prospects, and risks of the global Animal Ultrasound Market

Analysis of the growth prospects for the stakeholders and investors through the study of the promising segments

Strategic recommendations to the established players and new entrants to capitalize on the emerging growth opportunities

Request Customization as per your specific requirement@ https://www.emergenresearch.com/request-for-customization/866

0 notes

Text

Veterinary Consumables Market 2023 Share, Size and Industry Growth

Veterinary consumables refer to a wide range of essential supplies and materials used by veterinarians, veterinary technicians, and other animal healthcare professionals in the course of providing medical care and services to animals. These consumables are used in veterinary clinics, animal hospitals, research laboratories, and other veterinary settings. They are typically disposable items that are used once or for a limited number of times before being discarded.

The global veterinary consumables market size was USD 1.63 billion in 2020. The market is projected to grow from USD 1.71 billion in 2021 to USD 2.83 billion by 2028 at a CAGR of 7.4% in the 2021-2028 period.

List of Key Companies Operating in Veterinary Consumables Market:

Avante Animal Health (Louisville, U.S.)

Midmark Corporation (Dayton, U.S.)

Smiths Medical (Minneapolis, U.S.)

Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (Shenzhen, China)

B. Braun Melsungen AG (Melsungen, Germany)

VETLAND MEDICAL SALES & SERVICES (Louisville, U.S.)

SunTech Medical, Inc. (Morrisville, U.S.)

Common examples of veterinary consumables include:

Syringes and Needles: Used for administering medications, vaccines, or extracting bodily fluids for diagnostic purposes.

Surgical Instruments: Instruments used in various veterinary surgeries, such as forceps, scalpels, scissors, and retractors.

Medical Gloves: Disposable gloves worn by veterinary professionals to maintain a sterile and hygienic environment and protect against the transmission of pathogens.

Bandages and Dressings: Used to dress wounds, support injured limbs, and promote healing in animals.

Catheters and Intravenous (IV) Sets: Used for administering fluids, medications, or nutrients directly into an animal's bloodstream.

What is the goal of the report?

The market report presents the estimated size of the Veterinary Consumables Market at the end of the forecast period. The report also examines historical and current market sizes.

During the forecast period, the report analyzes the growth rate, market size, and market valuation.

The report presents current trends in the industry and the future potential of the North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa markets.

The report offers a comprehensive view of the market based on geographic scope, market segmentation, and key player financial performance.

Furthermore, a detailed study of the competitive landscape of the Global Veterinary Consumables Market has been given, presenting insights into the company profiles, financial status, recent developments, mergers and acquisitions, and the SWOT analysis. This research report will give a clear idea to readers about the overall Global Veterinary Consumables Market scenario to further decide on this market project.

Geography Analysis

By region, the global Veterinary Consumables Market is segmented into North America, South America, Europe, Asia-Pacific (APAC), South Africa, Middle East and Africa (MEA). The North America is further classified into U.S., Canada and Mexico. South America is segmented into Peru, Brazil, Argentina, Europe is further segmented into Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Hungary, Lithuania, Austria, Ireland, Norway, Poland. Asia-Pacific is segmented into China, Japan, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Vietnam. MEA is segmented into South Africa, Saudi Arabia, U.A.E, Kuwait, Israel, Egypt, Rest of Middle East and Africa. Currently, North America dominates the global Veterinary Consumables Market.

0 notes

Text

Veterinarians—a Deep Dive into Number of Animal Doctors Based on Countries

Veterinary services have witnessed an unprecedented spike on the back of surging demand for quality pet care. Some factors, such as an uptick in pet adoption, the prevalence of chronic diseases and growing pet insurance services, have spurred the market penetration of animal doctors. For instance, Europe has around 309,144 veterinarians (39 FVE member countries), according to a European Federations of Veterinarians survey. Clinical practice (contributing to 58% of all respondents’ occupations) is the most prevalent employment sector.

The database lists the U.S. with the maximum number of veterinarians. The U.S. houses over 45,857 animal health organizations. The final report, along with the database, will peruse the following dynamics:

• Insights on leading countries, including U.S., France, Germany, Belgium, Spain, Netherlands and Malaysia.

• Number of veterinarians based on the primary area of specialization, occupation, or core specialty, including but not limited to companion animal exclusive, mixed animal, food animal exclusive and companion animal predominant.

• Growth opportunities and trend assessment.

• Qualitative and quantitative analysis.

Get your copy or request for a free sample of the report “Estimated Number of Veterinarians by Key Countries, and Year, 2017 – 2021.”

Estimated Number of Veterinarians by Key Countries - Report Scope

Actual estimates/Historical data

2017 - 2021

Quantitative units

Number of Veterinarians from 2017 to 2021

Regional Scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country Scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Singapore; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

By Practice Type

Practice type includes private clinic practice and public & corporate employment. These segments are further subdivided into sub-segments, and data available are only for the key market: U.S.

By Area of Work for Veterinarians

Quantitative data on the number of veterinarians who work with companion animals, food-producing animals, equines, and aquaculture and data availability for EU countries

Companion Animals/Food producing animals/Equine/Aquaculture

Numbers are based on the survey of veterinarians and vets are not exclusive of companion animals

Related Reports:

• U.S. Veterinarians Market Size, Share & Trends Analysis Report By Sector (Public, Private (Food Animal Exclusive, Companion Animal Exclusive, Mixed Animal, Equine, Others), Academics), And Segment Forecasts, 2022 - 2030

• Veterinary Services Market Size, Share & Trends Analysis Report By Animal Type (Production, Companion), By Region (North America, Latin America, APAC), And Segment Forecasts, 2021 - 2028

About Us

Grand View Research, Inc. is a market research and consulting company that provides off-the-shelf, customized research reports and consulting services. To help clients make informed business decisions, we offer market intelligence studies ensuring relevant and fact-based research across a range of industries, from technology to chemicals, materials and energy. With a deep-seated understanding of varied business environments, Grand View Research provides strategic objective insights.

Find More information @ https://www.grandviewresearch.com/info/trend-reports

#Veterinarians market#Veterinarians Industry#Veterinary industry statistics#Veterinary services market

0 notes

Text

Veterinary Care Market expected to experience higher medicalization rates during the forecast years 2025

The veterinary care market is expected to foresee positive trends throughout the forecast period. Substantial market growth can be attributed to the rising initiatives undertaken by the regulatory authorities. Government authorities collaborate with veterinarians and develop schemes that assure the availability of optimum inventory at fields for treating the farm animals. Furthermore, veterinary care market growth can be tracked based on animal health product consumption. An increase in demand for animal health products showcases growth trends for the veterinary care market.

Latin America animal health market size is projected to reach around USD 9 billion by 2025 from around USD 5.2 billion in 2018, at a CAGR of 7.3% during the forecast period.

This study involved the extensive use of both primary and secondary sources. The research process included a study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Recent Developments

In February 2020, Zoetis acquired Ethos Diagnostic Science. This acquisition will not only expand company’s product portfolio but will also help the company to grow exponentially in the veterinary space.

In November 2019, Zoetis acquired ZNLabs a reference laboratory company that is operational across the U.S. This has helped the company to enhance its offerings and improve its business performance

In June 2020, Merck completed the acquisition of a Quantified Ag leading data analytics company that monitors cattle temperature and helps in the early detection of any disease. This acquisition will diversify Merck’s veterinary product offerings and will positively impact the company’s profitability.

The animal type segment of the veterinary care market is bifurcated further into dogs, cats, pigs, poultry, cattle, and horses. Livestock animals such as cattle and poultry are expected to experience higher medicalization rates during the forecast years. In emerging economies such as the Philippines and Vietnam, earlier, poultry health was neglected, and owners used to discard the chickens in bulk during a virus outbreak. Similar was the condition of a few cattle farms. Unorganized farms were often neglected, and that hampered the overall meat production in such countries.

Download PDF Brochure@ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=78396315

Based on the type of treatment, the veterinary care market is segmented into no medicalization, basic medicalization, and under veterinary care. The percentage of non-medicalized animals is going to experience a decline over the next few years. The major reason behind this sharp decrease in no medicalization in animals is rising awareness amongst the farm as well as the pet owners. Moreover, government initiatives to promote animal welfare has also raised the medicalization rate in animals; thus, proving beneficial for the overall market.

The geographical regions mapped in the report are: 1. North America 2. Europe 3. Asia-Pacific 4. Africa 5. Latin America

Latin America is one of the regions that has experienced significant growth in animal health space for the past few years. Countries such as Brazil and Argentina have shown potential demand for veterinary products and services. Several major players in the veterinary space have considered expansion Latin America due to the enormous growth opportunities it offers in the animal health industry.

Some key players mentioned in the research report are:

The leading players in the animal treatment market include Zoetis (US), Merck (US), Boehringer Ingelheim (Germany), Elanco (US), Ceva (France), Phibro Animal Health Corporation (US), Virbac SA (France), IDEXX Laboratories, Inc., Neogen Corporation (US), Heska Corporation (US) and others. These players undertake several strategic initiatives such as mergers, acquisitions, new product launches, and geographical expansions that helps them in sustaining market competition.

Request for sample pages @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=78396315

1 note

·

View note

Text

How to Master business growth strategies in 6 Simple Steps

Preparations For How To Get Consulting Clients - Find High-paying Clients For ...

Organization specialists assist business get rid of difficulties, increase income or grow. It's crucial to guarantee service consultants have experience and previous success with business like yours. Organization specialists may charge by the job or the hour, or require day-to-day or month-to-month retainers. Organization experts supply management consulting to help organizations enhance their efficiency and efficiency.

Company owner ought to consider working with business consultants when they need help or point of view on their chosen path or a catalyst for change in their companies. There are numerous factors company owners ought to think about working with experts. Professionals provide a large range of services, including the following: Providing know-how in a specific market Determining problems Supplementing existing personnel Starting modification Offering objectivity Mentor and training staff members Doing the "grunt work," like removing personnel Restoring an organization Developing a brand-new organization Influencing other people, such as lobbyists The initial step for any company expert is the discovery stage, where the goal is to find out the client's organization.

This can include touring the facility, meeting with the board of directors and staff members, evaluating the finances and checking out all business materials. During this process, the service expert will discover the details of a company's mission and what operations remain in place. When business expert has actually developed a thorough understanding of the business, they go into the evaluation stage, where the objective is to recognize where change is needed.

Beginners Overview to Top Consulting Firms - 2020 Reviews - Clutch.co

These concerns can consist of issues that ownership and management have currently determined, as well as brand-new issues business consultant finds as a result of their neutrality. A service expert need to also determine opportunities to grow business, increase earnings and improve effectiveness. In addition to recognizing these issues and chances, a service consultant ought to develop solutions to problems and plans for taking advantage of opportunities.

This is an opportunity for the business to increase marketing resources and profit from the sales staff. Throughout this phase, it is necessary for the expert and the business's staff members to maintain open, clear communications. It is necessary for a business owner to take the service expert's suggestions at this phase as constructive criticism.

Coaching, The Next Big Point!

The owner might be personally near to business, which can be an obstacle to favorable change and growth. The owner ought to have feedback and offer opinions to business specialist, which business owner ought to consider and revise plans as necessary. When the owner and the expert settle on a plan, the specialist must get in the third stage of consulting.

Key Facts About 11 Best Business Consultants For Hire In Nov 2020 - Toptal®

In this phase, the expert constructs on possessions and removes liabilities. They likewise monitor the plan's development and adjust it as needed. Finding the best organization specialist may be the most difficult part for the owner or management. The specialist should have a passion for their work, a drive for quality and an eye for organization and information.

Also, ensure they have solid referrals. In addition, make sure business specialist has any necessary certifications that are appropriate to your industry. You ought to veterinarian the expert through their site and materials. Try to find expert images and well-documented info about their services. It's an excellent concept to request examples of past successes and to speak with those organizations.

The U.S. Bureau of Labor Data keeps in mind that experts can be management (business), scientific or technical. If you desire somebody to help your company establish new proprietary software or computer-based workflow, you may wish to engage a technical specialist. But beyond particular requirements, business normally deal with management experts when they wish to enhance their bottom line, customer fulfillment or employee spirits.

The 6 Things To Consider When Choosing The Right Business ... Forecast

youtube

It assists you comprehend how likely they are to enhance your business. Here's what to consider when examining possible consultants: This can be specifically important in the company world. If somebody came directly out of college labeling themselves as a consultant, do they really know anything more than you do? Think about searching for consultants who have effectively owned or run small companies, enterprise companies or specific departments.

youtube

Search for consultants who have actually operated in your industry and with companies that match yours in design, size, requires and goals. You do not just want a specialist who has the right experience; you want a consultant who has actually shown success with business like yours. Ask for a portfolio or list of brand names the consultant has actually worked for, and demand referrals.

According to the Bureau of Labor Stats, management consultants make an average of $150,000 annually (or $62. 93 per hour). However that's what the person "takes home" as earnings, and consulting charges are usually higher to cover overhead. Experts business growth strategies don't always charge by the hour. According to a expert fee research study from Consulting Success, here are some popular charge approaches and the percentages of experts who prefer them: Per project 34.

1 note

·

View note

Text

Veterinary Hospitals Market Dynamics: Evaluating Market Size, Share, and Growth Forecast

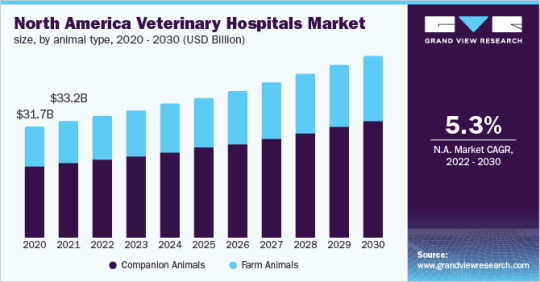

The global veterinary hospitals market size is expected to reach USD 123.8 billion by 2030, expanding at a CAGR of 5.80% from 2023 to 2030, according to a new report by Grand View Research, Inc. The growing pet population is boosting the demand for veterinary clinics and hospitals around the world. Additionally, the COVID-19 pandemic lockdown restrictions led to a rise in the demand for companion animals. For instance, the number of pets in the UK has significantly increased. According to a recent survey conducted by the Pet Food Manufacturers Association, there are currently over 24 million cats and dogs living in the United Kingdom. The market is being driven by the increase in pet ownership, not just in the short term when kittens and puppies need shots, initial checkups, or neutering, but also considerably in the long term as they age into animals needing more veterinarian treatment and care.

Veterinary Hospitals Market Report Highlights

By animal type, the companion animal segment accounted for the largest revenue share in 2022. This is owing to the relatively stable ownership rate of dogs & cats in developed countries like the U.S. and increased expenditure on veterinary care

Based on type, the medicine segment dominated the market in 2022, owing to its significant distribution in veterinary pharmacies

Based on the sector, the private segment dominated the market in 2022. These hospitals offer well-maintained and advanced services at a relatively low price than private hospitals

North America accounted for a 43.4% share of the market in 2022 and is expected to grow over the forecast period. This growth is majorly due to high companion animal ownership rates, favorable government regulations, and increasing adoption of pet insurance for veterinary care

For More Details or Sample Copy please visit link @: Veterinary Hospitals Market Report

The rapidly aging pet population and the availability of advanced pet care options are among the key factors likely to drive expenditure on pets by owners, which is the primary source of revenue growth for veterinary hospitals. Establishment requirements for veterinary hospitals are expected to improve mainly due to the high demand for animal care services for pets & animals food. With the increasing number of pets and pet owners, the focus on animal safety has grown in recent years. Rising concerns and increasing awareness about chronic diseases in companion animals have resulted in high expenditure on pet health. Large spending on animal care is expected to further boost veterinary visits and medication sales in hospitals. Owners are concerned about their pets and consult veterinarians for treatment of several health issues at an early stage. This is further boosting the demand for efficient treatment options, driving the market.

#VeterinaryHospitalsMarket#VeterinaryCare#AnimalHealth#PetCare#VetServices#AnimalHospitals#VeterinaryClinics#PetHealth#VetIndustry#HealthcareForPets#AnimalWelfare

0 notes

Text

Veterinary Hospitals Market Size, Share, Trends And Forecast 2030

The global veterinary hospitals market size is expected to reach USD 125.07 billion by 2030, registering a CAGR of 5.7% over the forecast period, according to a new report by Grand View Research, Inc. Boom in pet population is driving the market growth. As per the American Veterinary Medical Association, over the next 10 years, the number of dogs and cats in the U.S. is anticipated to increase substantially. The dog populace is likely to rise from 85 million in 2020 to over 100 million by 2030. While cat populace is likely to surge even more intensely, from 65 million to more than 82 million. This upsurge in the pet population will drive the market. Despite the difficulties and new ways of working formed by the COVID-19 pandemic, for numerous hospitals, client numbers are growing.

Free Sample Report: https://www.grandviewresearch.com/industry-analysis/veterinary-hospitals-market-report

In addition, veterinary practice activity in the U.S. has fluctuated, but in general, the demand remains high. According to the Veterinary Industry Tracker, revenue per practice was up 13.3% year-over-year (November 2020 to November 2021). Client visits were up 5.1% during the same period. In numerous households across the globe, pets are seen as a core member of the family. There is a growing trend of pet humanization, resulting in an increased average spend on pet healthcare. Thus, pet humanization is set to drive the sales of veterinary services. This trend will be led by the growing population of small animals along with economic growth in developing markets. Improvements in technology have advanced veterinary care.

Technology is becoming more affordable and more practices around the world can adopt MRI and CT scanners. Digital dental X-rays and innovative oral surgery instruments are allowing veterinarians to advance in oral care in companion animals. Constant developments further address health issues in pets not just within hospitals, but on an all-around basis for better care and prevention. Access to veterinary healthcare is relatively underprivileged in most developing countries and some developed nations. For instance, according to a survey conducted in 2020 by the Federation of Veterinarians of Europe, rural and remote areas of Ireland have a shortage of veterinarians. Similarly, England is also experiencing a shortage of veterinarians in rural areas. This may restrict the market growth to some extent.

Veterinary Hospitals Market Report Highlights

In terms of revenue, the medicine segment dominated the market in 2021. The high demand for animal products, such as chicken and milk, is encouraging farmers to adopt vaccinations for their animals to gain higher profitability

The surgery type segment is estimated to register lucrative CAGR over the forecast period due to the growing pet insurance & healthcare expenditure and rising cases of chronic diseases in pets

Companion animals dominated the animal type segment in 2021 due to the growing trend of pet humanization

The private sector segment led the market in 2021 due to the growing disposable income and willingness to pay premium prices for veterinary services among owners

Asia Pacific is expected to witness a lucrative CAGR over the forecast period owing to the increased vigilance about animal health and rapid urbanization

In February 2020, DCC (Dogs Cats & Companions) Animal Hospital announced the launch of a series of multi-specialty animal hospitals across India. These hospitals will be advanced and equipped with innovative infrastructure and medical expertise

Industry players are involved in strategic initiatives, such as business expansion, M&As, and geographic expansion to gain higher market shares

For instance, in June 2021, CVS Group announced the establishment of a new state-of-the-art specialist veterinary hospital in Bristol, which will open in 2022, with modern technology and treatments in all disciplines

Key Companies & Market Share Insights

The hospitals are constantly involved in strategic initiatives, such as regional expansion, mergers, acquisitions, and new service launches, to gain a higher market share. For instance, in February 2021, the CVS group announced the purchase of the Market Hall Vets, a first opinion practice functioning three locations across Carmarthenshire in southwest Wales. In May 2020, Greencross Vets introduced WebVet a 24/7 online consultation service. Thus, enhanced its service offering to Australia’s network of 1000 veterinary professionals. Some of the prominent players in the global veterinary hospitals market include: CVS Group PLC, Greencross Vets, Ethos Veterinary Health, Pets At Home Group PLC, Mars, Animal Hospital Inc., All Pets Animal Hospital, Cahaba Valley Animal Clinic, Blaine Central Veterinary Clinic, Belltowne Veterinary Center

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/veterinary-hospitals-market-report

#Veterinary Hospitals Market Size#Veterinary Hospitals Market Share#Veterinary Hospitals Market Growth#Veterinary Hospitals Market Trends

0 notes

Text

Veterinary Electrosurgery Market : Global Analysis, Size, Share, Growth, Trends & Forecast By 2032

The global veterinary electrosurgery market garnered a market value of USD 471.96 Million in 2021 and is expected to secure USD 505 Million by 2022. The market is expected to accumulate USD 993.41 Million by 2032 while expanding at a CAGR of 7% during the forecast period from 2022 to 2032. Growth of the market can be attributed to rise in demand for pet health insurance along with increasing adoption of pet animals.

The COVID-19 pandemic created several obstacles for the animal industry. This includes pet owners, animal health companies, veterinarians, and veterinary hospitals. Owing to stringent lockdown norms, limited operation of veterinary hospitals and clinics resulted in a decline of veterinary visits, thus impacting the market. But the industry responded well to the pandemic by deploying supportive measures to ensure access to veterinary care and other services.

Furthermore, development in veterinary surgery has always followed in the footsteps of human surgery. Innovative techniques of surgeries to make them less painful is driving the growth of the market. In addition, the proliferation of government administrations associated with animal healthcare and even distinct animal healthcare organizations will surge the demand for treatments across developing nations. These organizations focus on animals in sanctuaries and zoos. This, in turn, will boost the market growth.

On the contrary, the time taken for approvals for medication and instruments required for surgeries is derailing the progress of the market. In addition, the constant emergence of newer ailments amongst animals is a continuous challenge faced by the veterinary electrosurgery market.

Request Sample Report @ https://www.futuremarketinsights.com/reports/sample/rep-gb-15014

Key Takeaways from the Market Study

The veterinary electrosurgery is expected to garner a market value of USD 993.41 Million by registering a CAGR of 7% in the forecast period 2022-2032.

By product, consumables and accessories segment is expected to register a CAGR of more than 15% for veterinary electrosurgery market during the forecast period.

By animal, small animals are expected to possess 65% market share for veterinary electrosurgery market during the forecast period.

By end use, veterinary hospitals and clinics segment is expected to hold a market share of more than 80% in the forecast period 2022-2032.

By application, general surgery is expected to possess a market share of nearly 30% market share in 2022-2032.

U.S is projected to register a CAGR of 8% during the forecast period.

U.K. is anticipated to grow at 9% CAGR for veterinary electrosurgery.

“Increasing investments in adopting pets along with government initiatives to maintain animal health is driving the growth of veterinary electrosurgery market,” comments an FMI analyst.

Competitive Landscape

Key players in the global veterinary electrosurgery companies include Symmetry Surgical Inc, CVS Group, KARL STORZ, Avante Animal Health, B. Braun Melsungen AG, Medtronic, Summit Hill Laboratories, Kwanza Veterinary, Burtons Medical Equipment Ltd, EICKEMEYER and Macan Manufacturing. Some of the recent developments in the global veterinary electrosurgery market are:

In June 2021, CVS Group announced the planning of a new state-of-the-art specialist veterinary hospital in Bristol. The hospital will open in 2022 with modern technology and treatments in all disciplines, including orthopedics, general surgery, internal medicine, neurology, and neurosurgery, among others.

Medtronic, a key player in the veterinary electrosurgery market is focusing on developing instruments that will be technologically advanced to fasten the process of general surgeries for animals.

More Valuable Insights Available

FMI, in its new offering, presents an unbiased analysis of the global veterinary electrosurgery market, presenting historical market data (2017-2021) and forecast statistics for the period of 2022-2032.

The study reveals essential insights by product (Bipolar Electrosurgery Instruments, Monopolar Electrosurgery Instruments, Consumables & Accessories), Animal Type (Small Animal, Large Animal), application (General Surgery, Dental Surgery, Gynecological & Urological Surgery, Orthopedic Surgery, Others), End Use (Veterinary Hospitals and Clinics, Others) & Region Forecast till 2032

Key Segments Covered in the Veterinary Electrosurgery Market

Veterinary Electrosurgery Market by Product:

Bipolar Veterinary Electrosurgery Instruments

Monopolar Veterinary Electrosurgery Instruments

Veterinary Electrosurgery Consumables & Accessories

Veterinary Electrosurgery Market by Animal Type:

Veterinary Electrosurgery for Small Animals

Veterinary Electrosurgery for Large Animals

Veterinary Electrosurgery Market by Application:

General Veterinary Electrosurgery

Dental Veterinary Electrosurgery

Gynecological & Urological Veterinary Electrosurgery

Orthopedic Veterinary Electrosurgery

Other Veterinary Electrosurgery Applications

Veterinary Electrosurgery Market by End Use:

Veterinary Electrosurgery across Veterinary Hospitals And Clinics

Veterinary Electrosurgery across Other End Users

0 notes

Text

U.S. Veterinarians Market Size Worth $23.3 Billion By 2030

U.S. Veterinarians Market Size Worth $23.3 Billion By 2030

U.S. Veterinarians Market Growth & Trends The U.S. veterinarians market size is poised to reach USD 23.3 billion by 2030, expanding at a CAGR of 8.7% during the forecast period, as per a new report by Grand View Research, Inc. The rising cases of zoonotic and chronic diseases, increasing animal health expenditure, and growing pet health concerns are the key factors driving the market. An…

View On WordPress

0 notes

Text

Pet Tech Market Latest Trends, Future Development Outlook and Demand Analysis to 2028

Pets have long been an integral part of human life. From dogs and cats to other pets like birds and fish, companion animals have started to become an increasingly common feature in households worldwide. This trend has gained even more traction during the novel coronavirus pandemic, with over 9 million dogs having been acquired by households in the U.S. since the onset of the crisis.

In recent years, several efforts are being made by prominent technology companies to address these issues using the power of technology, creating a favorable outlook for the pet tech market, which is set to exceed USD 20 billion by 2028, as per a study from Global Market Insights Inc.

Pet technology encompasses everything from solutions to enhance animal health, to smarter surveillance, to automation of regular pet-related tasks such as walks, powered by the rise of advanced technologies like AI (artificial intelligence), big data, and robotics.

Request for a sample copy of this research report @ https://www.gminsights.com/request-sample/detail/4187

USD 75 million investment in Embark Veterinary for personalized DNA-based testing platform

For pet owners, ensuring optimum health and wellness of their pets is a critically important consideration. Market leaders like Embark have identified this need and developed a response in the form of new standards for personalized veterinary care via DNA-based digital insights.

In July 2021, Softbank revealed its interest in this digital-based dog DNA testing solution, by leading a Series B funding worth over USD 75 million, with other participants including Slow Ventures, F-Prime Capital, Third Kind Venture Capital, Freestyle Capital, and SV Angel, among other.

Touted as the largest Series B round for a pet-tech start-up to date, the funding was intended to provide support for Embark’s broader target of expanding the lifespan of dogs by nearly 3 years over the course of the decade.

USD 40 million seed funding in The Vets for tech-enabled at-home veterinary care

In recent years, there has been an increase in demand from pet parents for solutions that would facilitate preventative care and health checkups for pets within their own home environments. Furthermore, the ever-increasing burden of veterinarian burnout has also prompted business entities to develop novel at-home veterinary care platforms that not only help practitioners form stronger relationships with pets but also provide healthcare to pets in stress-free environments.

To that end, tech-enabled pet care platform The Vets received seed funding worth almost USD 40 million led by PICO Ventures, Target Global, and Bolt Ventures, to revolutionize pet care by bringing together at-home care and technological advancement. This investment was meant to be a way for The Vets to enhance its pet healthcare platform, facilitate more precise healthcare forecasts and diagnoses, and analyze pet health trends based on parameters like breed.

Browse report summary @ https://www.gminsights.com/industry-analysis/pet-tech-market

USD 15 million investment in Fitpet for better companion animal healthcare services in South Korea

The South Korean pet industry is growing at a rapid pace as pet ownership continues to gain popularity among the Korean population, which has enhanced the demand for healthcare-focused pet-tech solutions. In response to this, pet care firm Fitpet received significant attention for its companion animal healthcare solution, from pet owners and investors alike.

In May 2022, the firm received an investment of almost USD 15 million from BRV Capital Management. The funding was earmarked by the company as a means to set up a pet insurance service, with an aim to create a more reliable and efficient ecosystem of veterinary care and establish a strong companion animal health database to transform the lives of pets as well as their owners.

Global Pet Tech Market growth will be positively affected by the notable presence of reputed organizations, such as Actijoy Solution, CleverPet, Inc., Dogtra Co., FitBark Inc., Garmin International, Inc., Halo Collar, IceRobotics, Ltd

About Global Market Insights:

Global Market Insights, Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider; offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy and biotechnology.

Contact Us:

Arun Hegde Corporate Sales, USA Global Market Insights, Inc. Phone:1-302-846-7766 Toll Free: 1-888-689-0688 Email: [email protected] Web: https://www.gminsights.com/

0 notes

Text

COMPANION ANIMAL DIAGNOSTICS MARKET WORTH $7.39 BILLION BY 2029

Meticulous Research®– leading global market research company published a research report titled “Companion Animal Diagnostics Market by Product [Consumables (Leukemia, Heartworm, Influenza), System, Software], Technology [ELISA, PCR, Hematology, Urinalysis], Animal Type [Canine, Feline], End User (Point of Care, Hospital) - Global Forecast to 2029”.

According to this latest publication from Meticulous Research®, the global companion animal diagnostics market is expected to grow at a CAGR of 9.8% from 2022 to reach $7.39 billion by 2029. The high growth of the companion animal diagnostics market is mainly attributed to the rising prevalence of diseases in companion animals, increasing animal health expenditure and pet insurance in developed countries, and technological advancements in veterinary diagnostics. Moreover, emerging countries provide growth opportunities for players operating in the companion animal diagnostics market. However, the increasing pet care costs in developed countries is restraining this market's growth.

The global companion animal diagnostics market study presents historical market data in terms of values (2020 and 2021), estimated current data (2022), and forecasts for 2029- by Product [Consumables (Heartworm, Leukemia, Influenza), System, Software], Technology [Immunodiagnostics, Molecular Diagnostics, Hematology, Urinalysis, Clinical Biochemistry, Other Technologies], Animal Type [Canine, Feline, Other Companion Animals), End User (Reference Lab, Veterinary Hospital, PoC Testing], and Geography. The study also evaluates industry competitors and analyzes the regional and country markets.

Based on product, in 2022, the consumables segment is estimated to account for the largest share of the companion animal diagnostics market. The large share of this segment is mainly attributed to the frequent use and availability of a diverse range of reagents and consumables for various diseases. Apart from this, the growing awareness regarding regular animal health check-ups and the emergence of various POC tests and assays are further expected to expand the portfolio of these consumables for early diagnosis.

Based on technology, the immunodiagnostics segment is estimated to account for the largest share of this market in 2022. Factors contributing to the large share of this segment include the growing adoption of diagnostic products based on immunodiagnostic technology and the development of advanced diagnostic immunoassay tests.

Based on animal type, the canines segment is estimated to account for the largest share of the market in 2022. The increasing canine population as pets and the prevalence of diseases such as diabetes are expected to propel the growth of this segment.

Based on end user, the companion animal diagnostics market is segmented into veterinary hospitals, reference laboratories, and point-of-care testing. in 2022, the reference laboratories segment is estimated to account for the largest share of the companion animal diagnostics market.

This research report analyzes major geographies and provides a comprehensive analysis of North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, and the Rest of Europe), Asia-Pacific (Japan, China, India, and RoAPAC), Latin America, and Middle East & Africa. North America is estimated to dominate the global companion animal diagnostics market in 2022, followed by Europe and Asia-Pacific. The increasing awareness of animal disease diagnosis, rising number of veterinarians, and increased spending on the healthcare of pet animals in the region supported the largest share of North America in the companion animal diagnostics market.

Download Sample Report Here: https://www.meticulousresearch.com/download-sample-report/cp_id=5273

The key players operating in the global companion animal diagnostics market are IDEXX Laboratories, Inc. (U.S.), Zoetis Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Heska Corporation (U.S.), Bio-Rad Laboratories, Inc. (U.S.), bioMérieux S.A. (France), INDICAL BIOSCIENCE GmbH (Germany), Agrolabo SpA (Italy), Neogen Corporation (U.S.), and IDvet (France), among others.

Contact Us:

Meticulous Research® Email- [email protected] Contact Sales- +1-646-781-8004 Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

0 notes

Text

Over-The-Counter (OTC) Veterinary Drugs Market : Technological Growth Map over Time

Over-The-Counter (OTC) Veterinary Drugs Market Overview

Over-The-Counter (OTC) Veterinary Drugs, also termed as non-prescription drugs are drugs that are available without any prescription. These drugs are effective and safe when all the directions on the label or directed by the healthcare professional are followed. The FDA in the U.S. considers when a specific drug is effective and safe enough to be sold over-the-counter. Over-the-counter (OTC) veterinary drugs usage is attributable to the savings on cost incurred on clinical visit and on the drug cost. There are limited veterinary drugs that are approved and available to veterinarians. The veterinarians often depend on the use of different sources and types of drugs to treat their patients. Over-The-Counter (OTC) veterinary drugs are checked on the assurance of the product effectiveness, safety, and manufacturing to stringent standards for purity, quality, and potency. The FDA Centre for Veterinary Medicine (CVM) is responsible for the manufacturing and distribution of veterinary food additives and drugs. Over-The-Counter (OTC) veterinary drugs are regulated under The Federal Food, Cosmetic, and Drug ACT, which regulated statutory provisions that govern all the key regulations of Over-The-Counter (OTC) veterinary drugs. The Act formulate drugs as, “articles for use in the cure, diagnosis, treatment, mitigation, or prevention of diseases in animals or man”.

Over-The-Counter (OTC) Veterinary Drugs Market: Drivers and Restraints-

Over-The-Counter (OTC) Veterinary Drugs are poised to witness a significant growth owing it to the paradigm shift from Rx to OTC by major pharmaceutical manufacturers. Increasing tendency of people towards the health of their companion animals in developed regions, majorly, and immense cost savings with Over-The-Counter (OTC) veterinary drugs pose various advantages, further boosting demand for Over-The-Counter (OTC) veterinary drugs. However, several serious issues with OTC drugs pertaining to inappropriate substance abuse vehemently and diagnosis of the animal might obstruct market growth for Over-The-Counter (OTC) veterinary drugs during the forecast timeframe. This has also resulted in withdrawal of various Over-The-Counter (OTC) veterinary drugs used for therapy from the market over the years. Stringent regulations regarding Over-The-Counter (OTC) veterinary drugs and substance abuse related issues might also hinder market growth for Over-The-Counter (OTC) veterinary drugs during the forecast period.

Over-The-Counter (OTC) Veterinary Drugs Market: Overview

Global Over-The-Counter (OTC) Veterinary Drugs market is expected to grow at a decent rate owing it to the increase in number of manufacturers for Over-The-Counter (OTC) veterinary drugs, worldwide. There are variety of drugs available in the market as Over-The-Counter (OTC) veterinary drugs for the safe use in animals. These drugs are available in various forms, topical drugs are available as gels, oils, creams, and sprays for various applications. Antibiotics and non-steroidal anti-inflammatory drugs are very common Over-The-Counter (OTC) veterinary drugs in the market. The drugs are available for various medical conditions related with the skin, eyes, and allergic reactions to the animals. The Over-The-Counter (OTC) veterinary drugs market is well equipped with the retail pharmacies by the end user segment. Injectable drug involve vaccines, which are majorly used by the companion animals for their safety and improving their well-being. The Over-The-Counter (OTC) veterinary drugs market is expected to propel during the forecast period with the growing awareness on the safety and prevention of diseases among companion animals.

Over-The-Counter (OTC) Veterinary Drugs Market: Region-wise Outlook

Over-The-Counter (OTC) veterinary drugs market is immensely concentrated in major developed economies like the U.S., Japan, and China. The United States is expected to witness a moderate growth due to market saturation in a few product categories. Technological advancements is however, expected to boost market growth for Over-The-Counter (OTC) veterinary drugs worldwide. Increase in consumer appetite for Over-The-Counter (OTC) veterinary drugs for their companion animals, and growing need of curbing the veterinary-related healthcare costs is expected to fuel the market growth for Over-The-Counter (OTC) veterinary drugs in the Europe region. Increase in efforts for Over-The-Counter (OTC) veterinary drugs licensing for treatment of various diseases in animals is also expected to boost the market growth for Over-The-Counter (OTC) veterinary drugs during the forecast period. However, traditional medications for veterinary disease treatment might slow down the market growth for Over-The-Counter (OTC) veterinary drugs in the Asia-Pacific and MEA region.

For more insights into the market, request a sample of this report@ https://www.futuremarketinsights.com/reports/sample/rep-gb-9190

Over-The-Counter (OTC) Veterinary Drugs Market: Key Market Participants

Some of the market participants in the Global Over-The-Counter (OTC) Veterinary Drugs market identified across the value chain include: Merck & Co., Inc., Zoetis, Inc., Eli Lilly and Company, Virbac, Bayer AG, Sanofi, Vetoquinol S.A., Boehringer Ingelheim International GmbH, and Dechra Pharmaceuticals PLC.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application, and industry.

The report covers exhaust analysis on:

Market Segments

Market Dynamics

Market Size

Supply & Demand

Current Trends/Issues/Challenges

Competition & Companies involved

Technology

Value Chain

Regional analysis includes:

North America (U.S., Canada)

Latin America (Mexico. Brazil)

Western Europe (Germany, Italy, France, U.K, Spain)

Eastern Europe (Poland, Russia)

Asia Pacific (India, ASEAN, Australia & New Zealand)

China

Japan

Middle East and Africa (GCC Countries, S. Africa, Northern Africa)

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Request a Complete TOC of this Report with figures: https://www.futuremarketinsights.com/toc/rep-gb-9190

About FMI: Future Market Insights (FMI) is a leading provider of market intelligence and consulting services, serving clients in over 150 countries. FMI is headquartered in Dubai, the global financial capital, and has delivery centers in the U.S. and India. FMI’s latest market research reports and industry analysis help businesses navigate challenges and make critical decisions with confidence and clarity amidst breakneck competition. Our customized and syndicated market research reports deliver actionable insights that drive sustainable growth. A team of expert-led analysts at FMI continuously tracks emerging trends and events in a broad range of industries to ensure that our clients prepare for the evolving needs of their consumers.

Contact Us: Mr. Debashish Roy Unit No: AU-01-H Gold Tower (AU), Plot No: JLT-PH1-I3A, Jumeirah Lakes Towers, Dubai, United Arab Emirates MARKET ACCESS DMCC Initiative For Sales Enquiries: [email protected] For Media Enquiries: [email protected] Website: https://www.futuremarketinsights.com

0 notes