#Triodos

Explore tagged Tumblr posts

Text

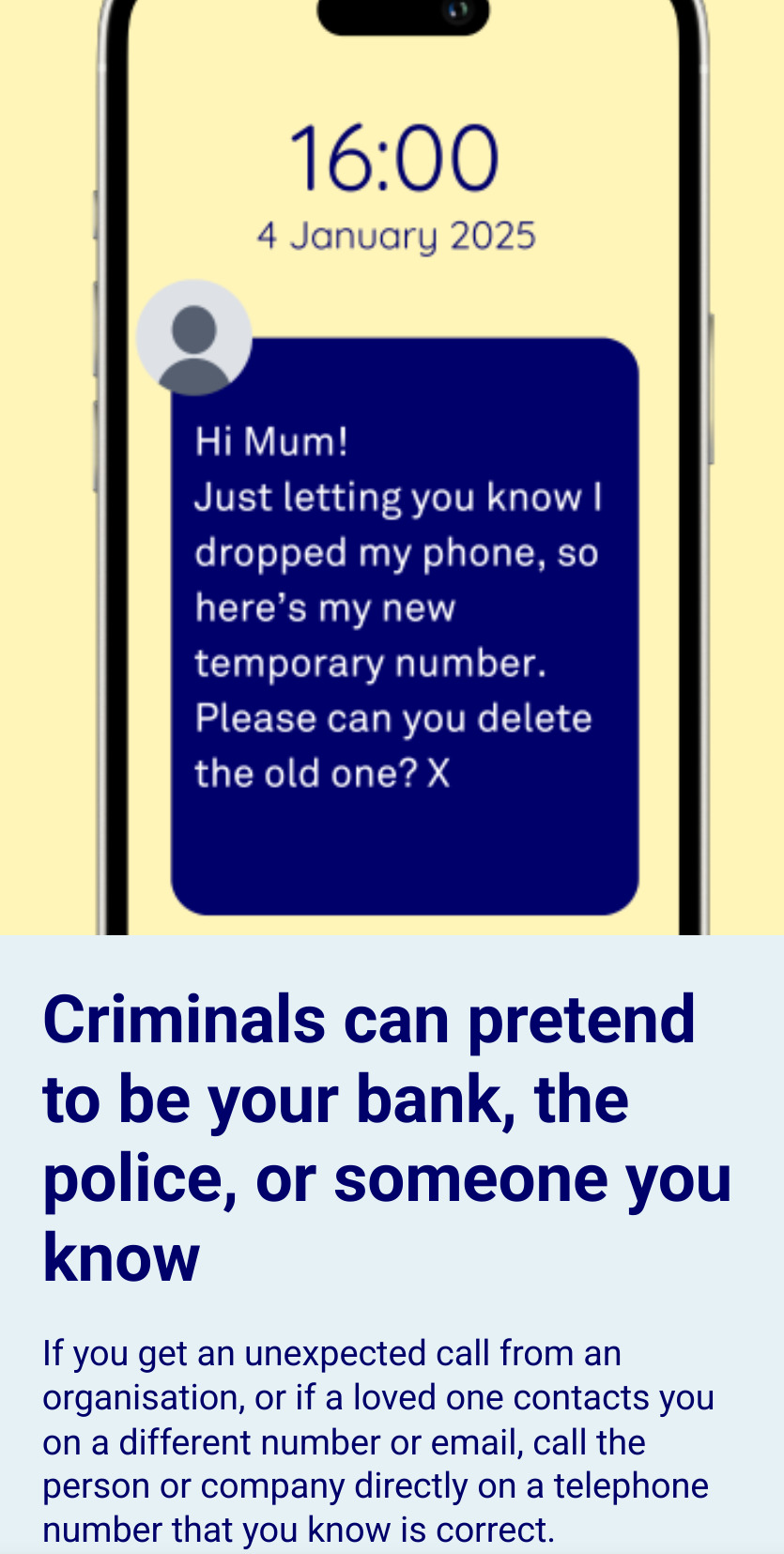

Scams To Look Out For

Follow the links to learn more from Triodos Bank about Romance Fraud, Second-Hand Marketplace Scams, Impersonation Fraud and False Delivery Messages

Infographics are screenshots from Triodos Bank

0 notes

Text

Del Triodo al Mundo Conectado: El Origen de las Telecomunicaciones Modernas #Tecnocompras #DatosParaLaHistoria #Telecomunicaciones

#Del Triodo al Mundo Conectado: El Origen de las Telecomunicaciones Modernas#Tecnocompras#DatosParaLaHistoria#Telecomunicaciones

0 notes

Link

0 notes

Link

0 notes

Text

CEO Marcel Zuidam to leave Nationale-Nederlanden Bank

News Release – 30 January2025 – Marcel Zuidam, Chief Executive Officer (CEO) at Nationale-Nederlanden Bank (NN Bank) will step down as of 1 April 2025 to join Triodos Bank. Pieter Emmen, Chief Risk Officer of NN Bank, has been appointed acting CEO, subject to approval by the Dutch Central Bank. This is a temporary position until a permanent successor is appointed. Further announcements on the…

0 notes

Text

youtube

Korg Handytraxx Tube Tocadiscos Portátil

El tocadiscos portátil Handytraxx Tube de Korg está diseñado para ofrecer un sonido de calidad en un dispositivo portátil. Utiliza un tubo de vacío triodo para producir cálidos sonidos analógicos y hace girar los vinilos sobre un plato de aluminio liso y estable.

Cuenta con altavoces estéreo integrados, salidas de nivel phono y línea, además de un puerto USB para digitalizar los discos. También puede funcionar con energía de baterías.

1 note

·

View note

Link

Triodos Bank, sinds 1980 koploper op het gebied van duurzaam bankieren, heeft vandaag haar prestaties over de eerste helft van 2024 gepubliceerd. Het Halfjaarverslag 2024 is ook vandaag gepubliceerd. Leveren van positieve impact We kondigden een samenwerking aan met het...

0 notes

Text

0 notes

Video

youtube

Innovation Revolution: Balancing Benefits and Costs for a Sustainable Future

The fight for a sustainable future hinges on innovation. While traditional methods have brought us this far, advancements across various sectors are crucial for tackling environmental challenges and building a thriving future. Let's delve into the cost-benefit analysis of these innovations:

Environmental Benefits:

Reduced Air and Water Pollution: Renewable energy sources like solar and wind power drastically cut air and water pollution compared to fossil fuels.

Soil Conservation: Technologies like precision agriculture and vertical farming minimize land use and soil degradation.

Improved Energy Efficiency: Innovations like smart grids and energy-efficient appliances lead to significant reductions in energy consumption.

Economic Benefits:

Cost Savings: Renewable energy sources are becoming increasingly cost-competitive, offering long-term economic benefits.

Job Creation: The transition to a sustainable future fosters the creation of new green jobs in clean technology and sustainable infrastructure.

Market Opportunities: Companies developing and implementing sustainable solutions gain a competitive edge, attracting environmentally conscious consumers and investors.

Examples of Innovative Companies:

Fintech: Companies offering sustainable investment options and green bonds facilitate environmentally conscious financial decisions. (e.g., Triodos Bank)

Proptech: Proptech firms develop solutions for smart buildings and energy management, leading to reduced energy consumption in the real estate sector. (e.g., NeST)

Climatech: Climate tech companies focus on innovative solutions for carbon capture, storage, and emissions reduction. (e.g., Climeworks)

Challenges and Costs:

Initial Investment: Developing and implementing new technologies often requires significant upfront costs compared to established methods.

Infrastructure Upgrade: Transitioning to a fully sustainable infrastructure necessitates substantial investments in renewable energy grids and sustainable transportation systems.

Call to Action:

While challenges exist, the long-term benefits outweigh the costs. Here's how you can contribute:

Support Sustainable Businesses: Choose companies committed to environmental responsibility and invest in sustainable solutions.

Advocate for Change: Demand sustainable practices from corporations and policymakers.

Embrace Innovation: Stay informed about advancements and support the development and adoption of sustainable technologies.

Together, by fostering innovation and embracing a sustainable future, we can create a world where environmental benefits outweigh the initial costs, paving the way for a healthier planet and a thriving economy.

Explore further:

The World Bank - Climate Action for Sustainable Development: https://www.worldbank.org/en/topic/climatechange

Project Drawdown - Solutions to Reverse Global Warming: https://drawdown.org/

Let's be the generation that ushers in a sustainable future. Share this information and encourage others to join the movement!

#sustainability #innovation #climatechange #renewableenergy #greentech #fintech #proptech #climatetech

0 notes

Text

Impact Investing: Catalyzing Positive Change in Finance

Impact investing has emerged as a powerful force reshaping the landscape of finance, where financial goals coalesce with a commitment to generating positive social and environmental outcomes. This article takes an in-depth look at the essence of impact investing, its key principles, notable strategies, real-world examples, and the evolving role it plays in driving systemic change.

Unveiling Impact Investing

1. Defining Impact Investing

Impact investing goes beyond traditional financial metrics, incorporating environmental, social, and governance (ESG) considerations into investment decisions. The primary goal is to generate measurable positive impacts alongside financial returns.

2. Dual Objectives

Impact investing seeks to achieve a dual bottom line—financial returns for investors and positive societal or environmental outcomes. Balancing these objectives distinguishes impact investing from conventional investment approaches.

3. Measuring Impact

Impact investors employ a range of metrics to assess the social and environmental effects of their investments. These metrics may include social return on investment (SROI), environmental footprint, and other indicators aligned with the United Nations Sustainable Development Goals (SDGs).

What Are The Key Principles?

1. Intentionality

Central to impact investing is the intentionality of generating positive outcomes. Investors proactively seek opportunities that align with their values and contribute to addressing specific social or environmental challenges.

2. Additionality

Impact investments aim to go beyond what traditional markets or philanthropy might achieve. The concept of additionality emphasizes the need for investments to create positive impacts that would not occur without intentional intervention.

3. Measurable Impact

Measuring impact is a core principle. Impact investors prioritize investments where the positive outcomes can be quantified, providing transparency and accountability in demonstrating the effectiveness of their efforts.

Strategies You Should Know

1. Thematic Investing

Thematic investing involves targeting specific themes aligned with impact goals, such as renewable energy, affordable housing, or healthcare accessibility. Investors allocate capital to projects or companies that directly contribute to the chosen theme.

2. Community Development Finance

Community development finance focuses on investing in projects that uplift underserved communities. This may include affordable housing developments, small business loans, or initiatives fostering community resilience and economic empowerment.

3. ESG Integration

Environmental, social, and governance (ESG) integration entails evaluating traditional investment opportunities through the lens of sustainability. Investors consider factors such as a company’s carbon footprint, labor practices, and governance structures in their decision-making.

Real-world Examples

1. The Rise Fund – Education

The Rise Fund, co-founded by private equity firm TPG, has invested in the education sector with a focus on edtech. By supporting companies like DreamBox and EverFi, The Rise Fund aims to improve educational outcomes globally.

2. Triodos Sustainable Equity Fund – Renewable Energy

The Triodos Sustainable Equity Fund emphasizes renewable energy investments. It supports companies like Vestas Wind Systems and Orsted, contributing to the transition towards a more sustainable and clean energy future.

3. MicroVest – Financial Inclusion

MicroVest directs its investments towards financial inclusion. By providing capital to microfinance institutions worldwide, MicroVest works to empower entrepreneurs in developing economies and promote inclusive financial systems.

Evolving Trends

1. Impact Measurement Innovation

As your investing matures, there is a growing focus on enhancing impact measurement methodologies. Innovations in data analytics and technology facilitate more precise and comprehensive assessments of social and environmental outcomes.

2. Mainstream Integration

Impact investing is transitioning from a niche approach to mainstream adoption. Large institutional investors and financial institutions are incorporating ESG factors into their decision-making processes, signalling a broader acceptance of impact principles.

3. Global Collaboration for Impact

The impact investing community recognizes the need for global collaboration to address complex challenges. Initiatives like the Impact Management Project and the Global Impact Investing Network (GIIN) foster collaboration, standardization, and knowledge-sharing.

Challenges and Considerations

1. Impact Washing

Impact washing refers to the risk of investments being labeled as impact without delivering meaningful positive outcomes. Rigorous due diligence and adherence to impact measurement standards are crucial in mitigating this challenge.

2. Trade-offs between Impact and Returns

Balancing financial returns with impactful outcomes can be challenging. Impact investors often face trade-offs, and navigating these requires careful consideration of risk tolerance, time horizon, and the specific impact goals.

3. Lack of Standardization

The absence of standardized impact metrics poses a challenge. Efforts to establish common frameworks for measuring impact, such as the Impact Reporting and Investment Standards (IRIS), aim to address this issue and enhance comparability.

The Future Trajectory of Impact Investing

1. Emergence of Impact Funds

Specialized impact funds are likely to proliferate, focusing on specific impact themes or sectors. These funds will attract investors seeking targeted and impactful opportunities aligned with their values.

2. Technological Advancements in Impact Measurement

Continued advancements in technology, including blockchain and artificial intelligence, will play a role in refining impact measurement methodologies. This will enhance accuracy, transparency, and the ability to track long-term outcomes.

3. Regulatory Support for Impact Standards

Governments and regulatory bodies are expected to play a more active role in supporting impact investing by endorsing and regulating standardized impact measurement practices. This support will contribute to the credibility and integrity of investing initiatives.

Conclusion

Impact investing stands at the intersection of finance and positive social and environmental change, embodying a transformative approach to investment. As the field evolves, impact investors, fund managers, and policymakers will continue to collaborate, refine methodologies, and navigate challenges. The trajectory of investing holds the promise of a financial landscape where profitability converges with purpose, catalyzing a sustainable and inclusive global economy. As investors increasingly recognize the potential of impact, the ripples of positive change are poised to reverberate through markets, fostering a future where capital serves as a force for good.

Also Read: Option Investing: A Strategic Tool for Entrepreneurs

0 notes

Note

Triodos is a pretty deliberately ethical bank

Heya Aye, I was wondering if you have any info on what bank in the UK is the least uh...unethical? I've been with barclays since I was a teenager but I plan to switch because they're on the BDS list, only I have no idea which one to switch to. They're all evil bastards that don't care about their customers so I'm having a hard time figuring out WHICH evil bastard to go with here

It's definitely one of those 'Pick the one that works for you' - Afraid I can't give too much advice on what's the right bank to choose. But you can probably look up each one individually and see what exactly they are funding.

You might have some luck with the newer digital banks like Monzo/Starling etc?

66 notes

·

View notes

Text

TRIODOS BANK

Triodos Bank ha conseguido 21 sentencias a su favor en los juzgados españoles de segunda instancia, frente a diez desfavorables, en casos relacionados con la comercialización de sus Certificados de Depósitos de Acciones (CDA), según han indicado fuentes del banco a Europa Press. Trece Audiencias provinciales han dictado a favor del banco, la AP de Navarra ha fallado en contra del banco en 9…

0 notes

Text

Gesellschaftliche Unternehmensverantwortung im Crowdfunding – Eine Analyse

Was ist gesellschaftliche Unternehmensverantwortung?

Der Begriff GSU (Gesellschaftliche Unternehmensverantwortung) ist heutzutage in aller Munde. Das bedeutet, dass Unternehmen, die soziale Verantwortung übernehmen, in der Regel so organisiert sind, dass sie sozial verantwortlich handeln können. Es gibt keinen „richtigen“ Weg zur gesellschaftlichen Unternehmensverantwortung (GSU). Stattdessen verfolgen viele Unternehmen eine breite Palette von Strategien und Initiativen, um die Welt positiv zu verändern. Die gesellschaftliche Unternehmensverantwortung gewinnt allgemein an Bedeutung.

Aufgrund moralischer Überzeugungen haben sich viele Firmen der gesellschaftlichen Unternehmensverantwortung verschrieben. Dies kann einem Unternehmen helfen, sich in den Augen von Investoren, Verbrauchern und Aufsichtsbehörden zu profilieren. Es verbessert auch das Engagement, die Zufriedenheit und die Produktivität der Mitarbeiter. Dieser Prozess kann einem Unternehmen helfen, seine soziale und ökologische Leistung zu verbessern. Er kann auch zu neuen Produkten und Dienstleistungen führen, die dem Unternehmen helfen, sozialer zu handeln. gesellschaftliche unternehmensverantwortung

Arten die gesellschaftliche Unternehmensverantwortung

Die gesellschaftliche Unternehmensverantwortung wird in vier Kategorien unterteilt.

1. Verantwortung für die Umwelt

2. Ethische Verantwortung

3. Philanthropische Verantwortung

4. Wirtschaftliche Verantwortung

Was ist die gesellschaftliche Philanthropie von Unternehmen?

Philanthropie konzentriert sich zwar in erster Linie auf finanzielle Spenden, kann aber auch Zeit und Ressourcen umfassen. Dieses Konzept kann genutzt werden, um den sozialen Wandel voranzutreiben. Es kann auch direkte Spenden an verschiedene Wohltätigkeitsorganisationen umfassen. Anstatt nur kurzfristige Hilfe zu leisten, konzentriert sich, deutsche Gesellschaft für ernährung eine langfristige Lösung für die angesprochenen Probleme zu finden. Dieses Konzept kann durch verschiedene Formen des Gebens umgesetzt werden.

Gemeinschaften beschränkt sind. Sie können auch genutzt werden, um umfassendere soziale Probleme anzugehen.

Wenn es um gesellschaftliche geht, hört man immer öfter, dass das Unternehmen die von den Mitarbeitern gesammelten Spenden verdoppelt.

Ihre eigene Crowdfunding-/ GSU-Plattform (Gesellschaftliche Unternehmensverantwortung)

Alle Arten von Crowdfunding- und Fundraising-Kampagnen können über eine Plattform durchgeführt werden.

Verschiedene Organisationen wie ING und die Triodos-Stiftung haben ihre eigene, von gesellschaftliche-unternehmensverantwortung entwickelte Plattform, auf der die Mitarbeiter einzeln oder nach Abteilungen Spendenaktionen organisieren können. Es ist auch möglich, Verbindungen zu den HR-Systemen herzustellen, wodurch auch Sachspenden (Arbeitsstunden oder Urlaubstage) möglich sind.

Weitere Informationen finden Sie hier:

0 notes

Text

Ver "¡CRIMINAL! LA POCA SOBERANÍA QUE NOS QUEDA SERÁ ENTREGADA EN USA POR LA G0LPISTA" en YouTube

0 notes