#Trendline channel strategy

Explore tagged Tumblr posts

Text

MACD + Falling Wedge: The Hidden Forex Strategy You Need The Secret Sauce: Using MACD and Falling Wedges to Outfox the Forex Market The Game-Changing Combo Most Traders Ignore Imagine trying to bake a cake with only half the recipe. Sure, you might end up with something edible, but will it be the masterpiece that gets all the likes on Instagram? Probably not. That’s how most traders approach the Forex market—they have some tools, like the MACD (Moving Average Convergence Divergence), but fail to pair them with the right context. Enter the falling wedge pattern, a technical analysis gem that could turn your trading strategy from "meh" to magnificent. But first, let’s decode this combo—because MACD and falling wedges aren’t just buzzwords; they’re the secret handshake of elite traders. And no, you don’t need a secret decoder ring to crack this code. Let’s break it down. MACD: The Trend Whisperer For the uninitiated, the MACD indicator is like the wise old mentor in your favorite underdog movie. It quietly tells you when momentum is shifting and when the market might be ready to make a big move. It’s made up of two lines: the MACD line and the signal line. When these lines cross, it’s like fireworks for traders—indicating a potential buy or sell signal. But here’s the kicker: relying on MACD alone is like depending on a GPS that only updates once every 10 miles. You need to combine it with other tools to pinpoint precision entries. That’s where the falling wedge steps in like a suave sidekick. Falling Wedge: The Plot Twist You Need A falling wedge pattern is a bullish reversal or continuation pattern that’s often hiding in plain sight. Picture this: prices are trapped in a narrowing channel, making lower highs and lower lows, but the overall momentum is gearing up for a breakout. It’s like watching a pressure cooker build up steam before it finally explodes (in a good way). The beauty of the falling wedge is its reliability when paired with a trusty companion—the MACD. Let’s dive into why this dynamic duo deserves your attention. Why Most Traders Miss the Big Moves Most traders treat the Forex market like a one-size-fits-all T-shirt. They see a MACD crossover and hit "buy" or "sell" without considering the bigger picture. That’s like buying a pair of shoes because they’re on sale, only to realize they don’t match anything in your closet. Here’s the thing: MACD signals are powerful, but they need context. The falling wedge pattern provides that context. When you spot a bullish MACD crossover within a falling wedge, it’s like finding avocado toast at half price—a rare but golden opportunity. The Hidden Formula for Using MACD and Falling Wedges - Spot the Falling Wedge: Look for a pattern where price action is making lower highs and lower lows, but the range is narrowing. This is your falling wedge. - Check MACD for Confirmation: Pay attention to the MACD histogram. If it’s showing bullish divergence (i.e., higher lows on the MACD while the price makes lower lows), you’re onto something big. - Wait for the Breakout: Don’t jump the gun. Wait for the price to break above the upper trendline of the falling wedge. Combine this with a bullish MACD crossover for a higher probability trade. - Set Your Entry and Exit: Once the breakout occurs, set your entry slightly above the breakout level and target the height of the wedge for your take-profit. Use a stop-loss below the recent low to manage risk. A Real-World Example Let’s say you’re trading EUR/USD. You spot a falling wedge forming on the 4-hour chart. Meanwhile, the MACD is signaling bullish divergence—the histogram is making higher lows even as the price dips. You patiently wait for a breakout above the wedge’s resistance. Once the price clears that level and the MACD lines confirm the momentum shift, you enter the trade. Result? The EUR/USD surges, hitting your target profit and earning you bragging rights in your trading circle. That’s the power of combining MACD with the falling wedge. Common Pitfalls (And How to Avoid Them) - Ignoring Volume: A breakout without volume is like a birthday party without cake. Check for increased trading volume during the breakout to validate the move. - Overtrading: Not every wedge is worth trading. Be selective and ensure the MACD signals align with the pattern. - Skipping Risk Management: Always use a stop-loss. Trading without one is like riding a bike downhill without brakes—thrilling but dangerous. Elite Tactics to Refine Your Strategy - Combine Time Frames: Use higher time frames (like the daily chart) to confirm the overall trend and lower time frames (like the 1-hour chart) for precise entries. - Leverage Other Indicators: Pair MACD and the falling wedge with tools like RSI or Fibonacci retracements for additional confirmation. - Journal Your Trades: Track your performance to identify patterns in your successes and failures. (Pro tip: Use our free trading journal at StarseedFX!) Where the Magic Happens MACD and the falling wedge are a match made in Forex heaven. Together, they can help you spot high-probability setups and avoid the pitfalls that trip up most traders. But remember, no strategy is foolproof. Success in trading requires discipline, patience, and a dash of humor—because let’s face it, sometimes the market’s moves are funnier than a sitcom plot twist. Ready to elevate your trading game? Check out StarseedFX for cutting-edge tools, free resources, and a community of like-minded traders who share your passion for success. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Best Technical Analysis Course In Noida

Have you ever questioned why certain traders seem to have an easier time making money in the markets while others do not? Their success can be attributed in large part to their use of technical analysis. It's an effective instrument that aids in trend identification, price movement prediction, and timely trading.

Technical analysis is entirely data-driven, in contrast to fundamental analysis, which examines the financial health of a company. It involves reading charts and predict the future movement of any stock or index. A technical analysis course can help you in evaluating historical market data, mainly price and volume, in order to predict future price changes. The objective of Technical Analysis is to find trends and patterns in price charts that will aid traders in making wise choices.

How a Technical Analysis Course Will Help You Win the Game:

Many people are initially intimidated by the volume of information accessible when it comes to trading and investing in the financial markets. It might be difficult to know where to start when it comes to stock markets, currency, and even cryptocurrencies. A technical analysis course can help with this by providing the information and abilities necessary to make wise decisions based on market data and price movements by studying technical analysis. Through the best technical analysis course in Noida, you can learn the following:

Creating a Strategy: You need a clear approach if you want to generate income on a regular basis. This entails integrating several technical analysis tools to develop a system that suits your needs. Finding Market Trends: Finding the market's trend is the initial stage. Is it sideways, bullish, or bearish? You can verify the trend with the aid of trend indicators such as moving averages. Levels of Support and Resistance: An asset typically reaches support when it stops declining, and resistance when it finds it difficult to rise. You can use these levels to forecast when prices are most likely to stall or reverse. Making Use of Channels and Trendlines: You can better see the market's direction by adding trendlines to your chart. Two trendlines combine to produce channels, which aid in defining the limits of price movement.

Conclusion Technical analysis course will offer you all the necessary practical knowledge and effective strategy for profiting in the financial markets. Gaining a grasp of chart patterns, indicators, and risk management techniques can help you trade stocks, FX, or cryptocurrencies more effectively. Keep in mind that consistency is essential. Having a well-planned approach, discipline, and patience will help you succeed in the long term.

#stock market#stock market courses#best stock market institute#technical analysis#technical analysis course in noida#stock market institute#stock market trading

0 notes

Text

without taking any risks and using a consistently successful strategy? What are some strategies or tools that can achieve this?

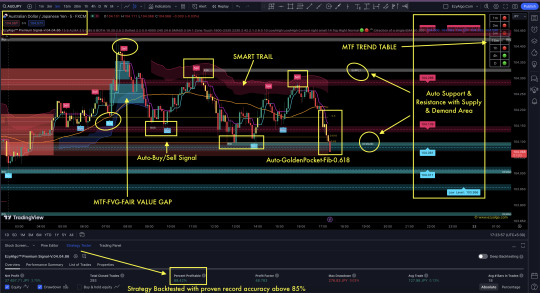

Leverage Key Levels and Signals with (EzyAlgo) Premium Indicator for AUD/JPY Trading Success!-Full Strategy Explained in Details

Key Insights:

Support and Resistance Levels: Support: Key levels where AUD/JPY might find buying interest and halt its decline. Resistance: Levels where selling pressure might emerge, potentially stopping upward movement.

Trend Analysis: Indicates if AUD/JPY is in an upward (bullish), downward (bearish), or sideways (consolidating) trend.

Trading Signals: Buy Signal: Indicates a potential upward movement, suggesting entering long positions.Sell Signal: Indicates a potential downward movement, suggesting entering short positions.

Volatility Insights: Provides information on expected price volatility to help manage risk and position sizes.

Timeframe Consideration: Signals are relevant to specific timeframes (e.g., intraday, daily, weekly) and should align with your trading strategy.

EzyAlgo Premium Indicator Singly Proven & Backtested with above 80–85% accuracy always, regardless of whether the market is sideways or trending. It offers perfect entry after detecting major key levels at confluence points. Here are the rules:

Key Levels:

Buy/Sell Signal must be generated.

Signal must be above Demand Area with POI (Point of Interest) Level.

Identified Swing High/Low to determine the trend.

Wait for Trend Tracker Confirmation with Color change or signal candle closing above Tracker.

Green Dot must be generated nearby within 1–3 candles in our EzyAlgo Trend Oscillator.

Extra Key Levels:

Trendline support.

Auto Golden Pocket Area (-0.618) met in the same place.

If all these conditions are met, it constitutes a 90% accurate signal. Otherwise, no trades are initiated. The indicator also highlights key levels for additional confirmation.

This strategy aims to provide a robust framework for identifying trading opportunities and optimizing trades

Get Access to EzyAlgo indicators: https://ezyalgo.com/Join our Free Telegram Channel: https://t.me/EzyAlgoSolutionsJoin our WhatsApp Channel: https://wa.me/message/HTHBVTMYZRJEO1

#forexsignals#forex trading#forex market#forex education#forex indicators#tradingview#tradingviewindicator#indicator#technical analysis#volume profile#candlestick#stock market

1 note

·

View note

Text

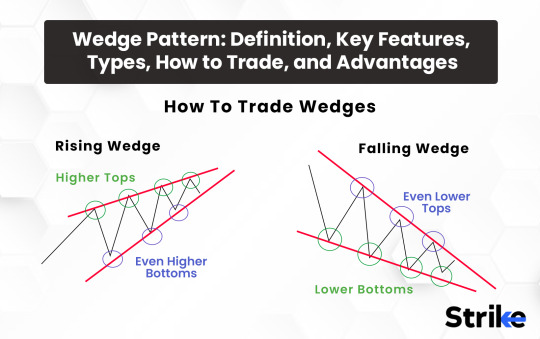

Wedge Pattern in Trading: Definition, Features, Types, Trading Strategies, and Advantages

Introduction

The wedge pattern is a significant chart formation used in technical analysis, helping traders to predict the potential continuation or reversal of trends. This pattern can be observed in all financial markets including stocks, forex, commodities, and indices. Understanding the wedge pattern, its features, types, trading methodologies, and advantages can provide traders with a strategic edge. This comprehensive guide covers these aspects in detail.

Definition of the Wedge Pattern

A wedge pattern is formed when the price of an asset moves between two converging trendlines. These trendlines are drawn above and below the price, indicating the levels of resistance and support, respectively. The convergence of these lines suggests a decrease in volatility and a forthcoming breakout. Typically, the pattern is recognized for its ability to signal shifts in market behavior before they occur on a larger scale.

Key Features of the Wedge Pattern

Several key features define the wedge pattern:

Converging Trendlines: Unlike parallel channels, wedge patterns are characterized by lines that move toward each other.

Declining Volume: As the wedge develops, trading volume typically diminishes, which signifies waning momentum and consolidates the pattern’s reliability.

Duration: Wedge patterns can develop over short-term periods (a few weeks) or long-term periods (several months), making them versatile for various trading strategies.

Types of Wedge Patterns

Wedge patterns are primarily categorized into two types based on their potential signal about the price movement direction:

Rising Wedge: This pattern forms during an uptrend, with the lines sloping up as the price makes higher highs and higher lows. It typically indicates a bearish reversal when the price breaks below the support line.

Falling Wedge: Contrary to the rising wedge, this forms during a downtrend with lines sloping downward as the price makes lower highs and lower lows. A falling wedge is generally considered a bullish reversal pattern when the price breaks above the resistance line.

How to Trade the Wedge Pattern

Trading the wedge pattern effectively requires a good understanding of where to enter and exit trades, and how to manage risk:

Entry Points: For a rising wedge in an uptrend, traders should prepare to go short when the price breaks below the lower trendline. Conversely, for a falling wedge in a downtrend, traders should get ready to go long when the price breaks above the upper trendline.

Stop-Loss Orders: It’s prudent to place stop-loss orders just outside the trendline from which the breakout occurs. This minimizes potential losses if the breakout turns out to be a false signal.

Profit Targets: Traders often calculate profit targets by measuring the height at the widest part of the wedge and then projecting this distance from the breakout point in the direction of the breakout.

Advantages of Trading the Wedge Pattern

Trading the wedge pattern comes with several advantages:

Predictive Quality: Wedge patterns are highly regarded for their ability to forecast reversals and continuations well before they occur, allowing traders to position themselves advantageously.

Applicability Across Markets: This pattern can be identified in various asset classes, including stocks, forex, commodities, and more, making it a versatile tool for multi-market traders.

Risk Management: The clear structure of the wedge allows for effective risk management. Traders can set stop-losses relative to the trendlines and manage positions with a clear understanding of where the market could invalidate their analysis.

Conclusion

The wedge pattern is a powerful tool in the arsenal of technical analysis. By recognizing and understanding its types, traders can harness its predictive capabilities to enhance their trading strategies. Whether it indicates a continuation or reversal, the wedge pattern provides clear entry and exit points, helping traders to manage risks and maximize returns. As with any trading strategy, it is recommended to use wedge patterns in conjunction with other technical indicators and fundamental analysis to validate and strengthen trading signals, ensuring a well-rounded approach to market analysis.

0 notes

Text

Analysts Warn as Ethereum Encounters Critical $2,400 Test Amidst Bullish Obstacles

Ethereum (ETH) is currently at a pivotal juncture as it faces a critical test at the $2,400 support zone, according to insights provided by Crypto Tony, a highly regarded crypto analyst. Despite Ethereum's recent bullish trend and remarkable recovery, market sentiments have shifted, with sellers preparing to take the lead in anticipation of upcoming Bitcoin Halving events.

In a recent post on the X platform, Crypto Tony highlighted the crucial importance of Ethereum holding the $2,400 level, emphasizing that this level will play a decisive role in determining the cryptocurrency's future trajectory. Ethereum enthusiasts and investors are closely watching whether the digital asset can maintain its position above this level, as it has the potential to either strengthen the bullish momentum or allow bears to take control.

According to data from Into the Block, the majority of Ethereum holders, precisely 77.39% of addresses, are currently in a profitable position. However, caution is advised, as 20.51% of addresses face losses, having purchased Ethereum at a higher price than its current value.

Analyzing the daily chart, buyers seem to be in control as they establish dominance within a rising channel. However, a potential concern arises with the observation of a double top at the overhead trendline, indicating a possible retest of the $2,400 breakout. Despite a 2.45% decline in the last day and $28 million worth of long liquidations, Ethereum is resilient at $2,472.

The weekly RSI trend remains positive as it approaches the overbought boundary. Yet, a bearish divergence in the last two peaks suggests a brief pullback for trend correction. In this scenario, buyers may see the $2,400 level as an entry opportunity, employing a buy-low, sell-high strategy. Conversely, a breach below the $2,400 support zone could initiate a price decline, targeting the psychological mark of $2,000.

Crypto Tony's analysis adds a layer of caution to Ethereum's prevailing optimism, urging stakeholders to closely monitor the $2,400 level. As the cryptocurrency market continues to evolve, the coming weeks are poised to provide a clearer picture of Ethereum's resilience in the face of potential challenges.

0 notes

Text

Bitcoin (BTC) stayed glued to $27,500 at the Oct. 4 Wall Street open as attention continued to focus on rampant United States yields.BTC/USD 1-hour chart. Source: TradingViewAnalysis: $27,000 now "key" for BTC priceData from Cointelegraph Markets Pro and TradingView showed a calm day for BTC price action while U.S. dollar volatility ruled.After its own spate of hectic trading to start the week, Bitcoin was once more seeking direction, with market observers marking out key price points.Popular trader Skew flagged market takers selling toward $27,600, lending “importance to this price level reclaim.”“Get that reclaim & decent pop will come,” he predicted in part of the day’s X analysis.$BTC takers selling into $27.6K adds importance to this price level reclaim Get that reclaim & decent pop will come note coinbase CVD (actual buyer led price into $27.6K) pic.twitter.com/Jr6MDb7ru1— Skew Δ (@52kskew) October 4, 2023 Fellow trader Crypto Tony additionally highlighted $27,000 as the line in the sand to the downside.$BTC / $USD - Update Holding that $27,000 low, so i remain long for the time being and would be shorting if we lose this low here, or pump up and reject hard as suggested on chart below pic.twitter.com/bSDjWWaJEU— Crypto Tony (@CryptoTony__) October 4, 2023 Updating his own trading strategy, meanwhile, trader Mark Cullen likewise placed emphasis on $27,000 holding as support.“Bitcoin getting a reaction from its first attempt into my zone & a tap of the break out trendline,” accompanying commentary stated. “Market conditions in Tradfi aren't great so pressure's down. Lets see if BTC can hold this area for a while longer, until other markets stabilize. Holding 27k is key for $BTC!”BTC/USD annotated chart. Source: Mark Cullen/XBitcoin bides its time as dollar sees sharp retraceAs Cullen and others explained, the mood on legacy markets was decidedly less stable than Bitcoin on the day.This came thanks to U.S. 30-year bond yields surging to 16-year highs — something which got commentators wary of a potential meltdown to come.Skew suggested that this angst over how macro forces would play out was responsible for the lack of significant BTC trading volume.“Not much besides dipping toes in the water kind of bid other than that it's perps mostly buying,” another X post stated earlier.“Market is likely trying to digest everything that is going on terms of risk parameters and exposure. Many are capitulating to cash imo under market distress.”U.S. dollar strength delivered upheaval of its own prior to the Wall Street open, with the U.S. dollar index (DXY) swiftly dropping from levels not seen since Q4 last year.As customary in recent times, BTC/USD continued to shake off snap DXY moves.U.S. dollar index (DXY) 1-hour chart. Source: TradingViewCommenting on the situation, Sven Henrich, founder of NorthmanTrader, showed that long term, DXY chart performance was behaving as expected.“Amid all the chaos & volatility one amazingly consistent clean chart: The US dollar respecting the channel trend lines,” he told X subscribers. “Negative divergence on recent highs at top of the channel. What happens with this will likely be one of the key market drivers for the rest of the year.”U.S. dollar index (DXY) chart. Source: Sven Henrich/XThis article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

0 notes

Text

This comprehensive blog from Funded Traders Global covers the Price Action Strategy and mastering market trends for successful trading. It begins by defining the Price Action Strategy, emphasizing its importance in predicting future price movements. The blog explores the components of Price Action, including candlestick patterns, support and resistance levels, and chart patterns. It highlights the benefits of this strategy, such as simplicity, enhanced decision-making, and its applicability to various markets.

The blog outlines key principles of Price Action, including candlestick patterns, support and resistance levels, and trendlines and channels. It then focuses on reading market trends, with an emphasis on identifying trends, assessing their strength, and recognizing trend reversals. The importance of setting clear trading goals and effective risk management is stressed, along with crafting precise entry and exit strategies.

Common mistakes to avoid in trading are discussed, including overtrading, ignoring fundamental analysis, and emotional trading. The blog also provides information on essential tools and resources, including recommended charting software, books, courses, and online trading communities to support traders in their journey.

In conclusion, the blog encourages traders to apply the knowledge gained, practice consistently, and continue their education to become proficient and successful traders. Trading is described as both an art and a science, emphasizing the importance of discipline and adaptability in the ever-evolving world of finance.

#Applicability to Multiple Markets#Assessing Trend Strength#Benefits of Price Action Strategy#Books and Courses#Building a Price Action Trading Plan#Candlestick patterns#charting software#Common Mistakes to Avoid#Components of Price Action#decision-making skills in traders#Definition of Price Action Strategy#Emotional Trading#Entry and Exit Strategies#financial markets#Funded Traders Global#Identifying Trends#Ignoring Fundamental Analysis#Importance of Mastering Market Trends#Key Principles of Price Action#market trends#Mastering the Art of Reading Market Trends#Online Communities#overtrading#price action strategy#Reading Market Trends#Recognizing Trend Reversals#Risk Management#secrets to trading success#setting clear and achievable trading goals#Simplicity and Clarity

0 notes

Text

A Comprehensive Guide for Traders to Mastering in Technical Analysis

Technical analysis is sometimes compared to fundamental research, which looks at the underlying economic variables and firm fundamentals, but it is not without its drawbacks and limitations. To obtain a more thorough grasp of the markets and make wise trading decisions, many traders mix the two methods.

Technical Analysis Overview:

Recognizing the advantages and goals of technical analysis.

Identifying the differences between technical and fundamental analyses.

Investigating the psychology of price changes and patterns on charts.

Crucial Concepts and Tools for Charting:

Describing the many chart kinds, such as line, bar, and candlestick.

Recognizing upward, downward, and sideways trends.

Identifying important patterns on charts, such as triangles, head and shoulders, and double tops and bottoms.

Important Technical Indicators:

Overview of well-known indicators, including the stochastic oscillator, moving averages, MACD, and relative strength index (RSI).

How to use and understand indicators to generate trading signals.

Combining indicators to confirm trade arrangements

Analysis of Support and Resistance:

Recognizing the degrees of resistance and support.

Establishing channels and trendlines.

Weghing resistance and support when making trade selections.

Analysis of Trends:

Technical tool analysis for trend strength determination.

Identifying trends' continuations and reversals.

Strategies for trading derived from trend analysis.

Price Action and Candlestick Patterns:

Comprehensive examination of popular candlestick patterns, including engulfing, hammer, and doji.

Candlestick patterns are useful for determining market sentiment.

Candlestick patterns are incorporated into trading plans.

Fibonacci Explanation:

Investigating the Fibonacci extension and retracement levels.

Utilizing Fibonacci analysis to determine levels of support and resistance and possible price goals.

Risk Management and Trading Techniques:

Creating technical analysis-based trading techniques. Setting up technical signals to establish entry and exit locations.

Putting stop-loss, take-profit, and position-sizing orders into practice as risk management strategies.

Useful Cases and Illustrative Examples:

Real-world examples of technical analysis trades that were made.

Examining deals that were successful and unsuccessful in order to draw conclusions.

Discipline and Psychology of Trading:

Use technical analysis to control your emotions when trading.

Acquiring self-control in following technological indications and approaches.

Conquering typical psychological traps.

Methods of Advanced Technical Analysis:

Examining more complex ideas such as market profile, Gann analysis, and Elliott wave theory.

When to include sophisticated approaches in your analysis and how to do so.

Iterative Testing and Ongoing Enhancement:

The significance of backtesting trading plans.

Examining past facts to improve your strategy.

Modifying your technical analysis techniques in response to changing market conditions.

Materials and Implements:

Suggested reading lists, websites, and online classes for additional education.

Tools for back testing, technical analysis, and charting in software.

Recall that the manual ought to offer equilibrium between conceptual understanding and real-world implementation. The intention is to give traders the knowledge and abilities they need to employ technical analysis to improve their trading decisions.

#best trading platforms#best trading online platform#trading online#best trading website#trading techniques#online trade marketing#best online trading#online trading company

1 note

·

View note

Link

0 notes

Text

OBV & Falling Wedge: The Secret Forex Formula How to Unlock Forex Success with On-Balance Volume & the Falling Wedge: Ninja Tactics You Need If you've ever stared at your trading charts, wondering if they're plotting your success or just a zigzag art project, you're not alone. Enter two unsung heroes of technical analysis: On-Balance Volume (OBV) and the Falling Wedge pattern. Used strategically, these tools can give you the precision of a ninja, the foresight of a fortune teller, and the humor of... well, this article. Let’s dive into these hidden gems that could change the way you trade forever. Why Most Traders Miss the Mark on Volume Volume: It’s like the heartbeat of the market, yet many traders treat it like elevator music—background noise they barely notice. Big mistake. Here’s the deal: - What Is On-Balance Volume? OBV is a momentum indicator that marries price and volume. It’s as simple as “If today’s price closes higher, add the volume; if lower, subtract it.” Repeat until you feel like a Forex wizard. - The Genius of OBV: It acts as a leading indicator, signaling potential price moves before they happen. Think of it as your market gossip friend who’s always a step ahead: "Hey, volume’s doing something funky—price might follow." - Common Pitfall: Many traders ignore divergences between OBV and price. When price says "I’m chill” but OBV screams, “Something’s cooking!” you’d better listen. The Falling Wedge: A Trader’s Best Wingman Imagine the falling wedge as that friend who always knows how to get out of sticky situations. This pattern often forms during a downtrend and signals a potential reversal. But beware: it’s not just any triangle on your chart—it’s the one that counts. - How to Spot It: - Look for a downward-sloping channel where both the upper and lower trendlines converge. - Confirm with volume: Volume should decrease as the wedge narrows. - Watch for a breakout above the upper trendline, often accompanied by increasing volume. - Why It Works: Falling wedges signal that bearish momentum is losing steam. When bulls take over, price often breaks out, sometimes explosively. Like finally escaping a bad sitcom plotline, the market starts to trend upward. - Hidden Opportunity: Combine the falling wedge with OBV divergences. If OBV rises while price is stuck in a wedge, you’ve got yourself a golden trade setup. Ninja Strategy: Merging OBV and the Falling Wedge Here’s the magic sauce: - Spot the Setup: Identify a falling wedge on your preferred currency pair (EUR/USD or GBP/USD often work like a charm). - Check OBV: Is it diverging? If OBV shows accumulation while the price consolidates, the market’s priming for a breakout. - Entry Timing: Enter the trade when price breaks above the wedge’s upper trendline. Bonus points if volume spikes. - Set Targets: Measure the height of the wedge and project it upward from the breakout point. That’s your first profit target. - Risk Management: Always set a stop-loss below the recent swing low to avoid unpleasant surprises (and fewer reasons to question your life choices). Case Study: The Euro’s Sneaky Breakout Let’s look at a real-world example. In early 2023, EUR/USD formed a textbook falling wedge. OBV started climbing even as the price languished. Traders who noticed this ninja combo got in at the breakout and rode the wave for a 200-pip gain. Missed it? Don’t worry; the market’s like a bus stop—another opportunity is always coming. Myth-Busting: “Indicators Don’t Work in Forex” Sure, the Forex market has quirks, and no indicator—not even OBV or the falling wedge—is foolproof. But dismissing them outright is like refusing to use a map because “you prefer the scenic route.” Instead, think of these tools as compasses. When combined with price action, they’re hard to beat. Your Secret Weapon: StarseedFX Tools Take your trading to the next level with these free resources: - Latest Economic Indicators and Forex News: Stay informed at StarseedFX. - Free Forex Courses: Dive deeper into advanced methodologies at StarseedFX. - Smart Trading Tool: Automate lot sizes and manage orders seamlessly at StarseedFX. - Free Trading Journal: Sharpen your strategies with detailed metrics at StarseedFX. Elite Tactics Recap: - Use OBV to anticipate price movements. - Spot falling wedges for high-probability reversals. - Combine the two for precision trading. - Apply strict risk management. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Review BSCTRUST PLATFORM

Decentralized Launchpad Plus Liquidity and Team token lock platform on Binance Smart Chain.

About BSCTrust?

So, I can say that BSCTrust is a Decentralized IDO platform built using the BSC Blockchain or Binance Smart Chain. Apart from that, this platform has some unique features that are rarely shared by other platforms, especially with BSCTrust, you can get initial priority access to quality low-cap Gems + Free NFT to top Stakers.

The BSCTrust Platform is run by a third party, so that anyone including you can access or use this Platform at your own risk. like an example: if you bet money on the BSCTrust platform then you can also get a real return on investment. The BSCTrust platform provides a variety of services that are environmentally friendly and easy to access by anyone involved in it. this platform is very multifunctional bro, so hurry up and join this great project

AMALOVERSCLUB will hold an AMA with

https://twitter.com/bsctrust_fin on Thursday, 15th April 2021 at 16:00 UTC

Rewards of 100 USDT for the best questions

Join: https://t.me/amaloversclub

Introduction to BSCTrust Launchpad

Despite the challenges and hurdles the project has faced, BSCTrust has come a long way since the launch of its token on pancake swap a few weeks ago and the community keeps growing bigger and stronger. With the launch of BSCLOCK well afoot and the kick-off of BSCTrust launchpad around the corner, there is a lot for supporters of the project to be excited about!

The BSCTrust Launchpad is an ample service launchpad for new projects in decentralized finance who want to provide solution to existing drawbacks by optimizing the security smart contracts offer in the Binance Smart Chain. In order to initiate a token on the BSCTrust Launchpad, projects will be required to allocate 2% of their total supply to be airdropped to the Top 200 BSCTrust holders.

One of the perks of projects initiating from the BSCTrust launchpad is the prompt support and engagement from the already existing and growing community. The liquidity and team tokens of these projects will be locked on BSCLOCK before/immediately after launch to ensure safety of investors’ funds.

There’s been a lot of questions in the community about the number of tokens needed to get into these launchpads. In order to make this inclusive to all our supporters, the launchpad allocation will be distributed in tiers. This means that the more BSCTrust tokens you have in your wallet, the more allocation you will receive. In the future, this will be evaluated based on the number of tokens staked over time.

The table below shows the allocation tiers and their requirements. For example, to receive a 1x allocation you have to hold a minimum of 800 BSCTrust. These allocations are guaranteed as long as you meet the requirement.

Also, there will be no need for investors to KYC as we want this opportunity to be accessible to everyone, irrespective of whether or not their country of residence restricts them from participating in IDOs.

As the Binance Smart Chain continue to gain wider acceptance and adoption, getting involved with BSCTrust can be your ticket for early access to the best premiere projects in the blockchain.

BSCTrust Launchpad: Introduces bCharts

BSCTrust is proud to announce its partnership with its first lauchpad, bCharts. bCharts is unequivocally set to launch its token offering in May. Exact date, time and details about its tokenomics to be announced in the coming days.

bCharts is an analytical, computer-based visualization toolkit that provides currency traders with decentralized exchange trading analysis. This software tool produces interactive price charts for various currency pairs along with various technical indicators and overlays, that helps traders track live market movements and detect trendlines to evaluate the patterns in the trading data.

In the modern world of decentralized finance and exchanges, a vital part of a trader’s success, especially those who trade frequently, is the ability to evaluate the patterns in trading data. bCharts aims to provide solutions to two major drawbacks in existing charting tools that support the Binance Smart Chain network.

•REAL-TIME DATA: The market moves so fast that the information provided by some of these tools lag a few minutes behind. When you make a decision, it is most certainly too late.

•ACCESS FEE: The few tools providing real-time data demand that users either purchase their token, or pay some kind of subscription fee before granting them access to their data.

bCharts gives a standard and principal core of trading information on a daily basis and has some capabilities that gives it an edge over its competitors:

DEX AGGREGATION: bCharts.io source liquidity from different DEXs and thus offer users better token swap rates than they could get on any single DEX.

BOTS: With bChart’s external API traders can create unique trading strategies for maximum profitability.

REAL TIME DATA AND CHARTS: Follow the best pairs through this tool with real-time graphics and transactions, add your pairs to favorites and much more.

Join their telegram community if you have any questions. http://bcharts.io/

Introducing Bricks Estate

BSCTRust Launchpad has partnered with Bricks Estate to aid in the execution of its token offering. Exact date and time of the offering will be announced in the near future.

BricksEstate is a community blockchain project that will allow investors access to a variety of real estates and properties owning full or parts of these assets through fractional ownership and be part of the ever-growing real estate industry.

BricksEstate aims to offer clients a verifiable record of property data that would allow the parties to complete a deal who generally don’t know each other and to trust that the seller actually has true ownership of that property through both the blockchain immutable ledger and utilisation of NFT ownership certificates.

These powerful tools will allow all parties involved in a domestic or international transfer of property to see without any question or doubt that there are not any claims against the title of that property outside of the current purchase.

Having an undisputed history of record is incredibly important, and while this may be possible without this technology, using blockchain can help make the process more efficient and secure than processes currently in place today.

SOLUTIONS OFFERED BY BRICKS ESTATE

BricksEstate platform adopts blockchain technology to curb safety problems by allowing listing on an immutable decentralized network, unlike Third-party property listing sites. Data stored in the blocks are highly encrypted giving high levels of safety assurance to property buyers and sellers.

Safety is fostered by storing documents in BricksEstate document vault which is a core product, and also issuing advanced secure property certificates in form of non-fungible tokens or collectibles. BricksEstate will be a key player in Real Estate tokenization.

Cross border restriction solution: BricksEstate makes it easy for average and accredited investors in various locations worldwide to easily invest in Real Estate with no boundary barriers. Cryptocurrency as a payment option in BricksEstate platform can be used for faster transactions. BricksEstate NFT Marketplace will also enhance accessibility for property ownership transfer with no location barriers. NFT property certificates can easily be transferred from seller to buyer via this medium with the help of smart contracts.

Solution to Fraud/scam: BricksEstate will ensure scam-free transactions between buyers and sellers. All necessary information will be stored on the blockchain. The information stored on the blockchain cannot be altered and is protected against damage.

Fair commission fees: BricksEstate ensures high commission is not the cause of failed negotiations by implementing fair commission fees, partly paid in BRICK which is the native token of the platform.

THE BRICKS TOKEN

BRICK Token BRICK is the native token of Bricksestate built on the BSC BEP-20 network. BRICK is designed to empower the connection of real estates and properties through a fully transparent, community-owned platform on Binance Smart Chain.

The total BRICK token supply is 1,000,000.

Token distribution is as follows:

25% — IFO: 25% will be sold on Public sales.

5% — 5% of BRICK token will be sold on private sales.

Unsold Tokens — Unsold tokens will be returned to Reserve.

30% — Ecosystem Fund: 30% will be used for partners to build BricksEstate project and its ecosystem as a vault.

10% — Team: Team token will be vested and small portions would be released monthly for a period of 2 years.

10% — Reserve: 10% of BRICK will be reserved for future BricksEstate projects.

20% — Liquidity: 20% of BRICK will be used to provide liquidity including exchange pools.

Non-mutable- No new tokens will be created. BRICK total supply will remain the same forever.

For more information about roadmap, whitepaper and the bricks estate team, check out their website https://bricksestate.co/ . Join their telegram community if you have any questions. https://t.me/bricksestate

We are happy to announce that Bricks Estate will be having her AMA on our Telegram group, on the 11th of this month, 4pm UTC. Endeavour not to miss it.

SUBSCRIBE TO OUR CHANNELS

Twitter: https://twitter.com/bsctrust_fin

Telegram: https://t.me/BSCTrust

Announcement channel: https://t.me/bsctrustannouncement

Website: https://bsctrust.finance/

Author:

Forum Username: Manuel Akanji

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=2954998

Telegram Username: @Manuelakanji777

BEP20 Wallet address: 0x00F321558065b1c9dca5e6EcbeECE9B01F73D6E1

1 note

·

View note

Text

Review BSCTRUST

Decentralized Launchpad on Binance Smart Chain

BSCTrust is an IDO platform on Binance Smart Chain. With BSCTrust, you gain early priority-access to quality low-cap Gems + Free NFT to the top Stakers. By staking BSCTrust, you get guaranteed access.

Introduction to BSCTrust Launchpad

Despite the challenges and hurdles the project has faced, BSCTrust has come a long way since the launch of its token on pancake swap a few weeks ago and the community keeps growing bigger and stronger. With the launch of BSCLOCK well afoot and the kick-off of BSCTrust launchpad around the corner, there is a lot for supporters of the project to be excited about!

The BSCTrust Launchpad is an ample service launchpad for new projects in decentralized finance who want to provide solution to existing drawbacks by optimizing the security smart contracts offer in the Binance Smart Chain. In order to initiate a token on the BSCTrust Launchpad, projects will be required to allocate 2% of their total supply to be airdropped to the Top 200 BSCTrust holders.

One of the perks of projects initiating from the BSCTrust launchpad is the prompt support and engagement from the already existing and growing community. The liquidity and team tokens of these projects will be locked on BSCLOCK before/immediately after launch to ensure safety of investors’ funds.

There’s been a lot of questions in the community about the number of tokens needed to get into these launchpads. In order to make this inclusive to all our supporters, the launchpad allocation will be distributed in tiers. This means that the more BSCTrust tokens you have in your wallet, the more allocation you will receive. In the future, this will be evaluated based on the number of tokens staked over time.

The table below shows the allocation tiers and their requirements. For example, to receive a 1x allocation you have to hold a minimum of 800 BSCTrust. These allocations are guaranteed as long as you meet the requirement.

Also, there will be no need for investors to KYC as we want this opportunity to be accessible to everyone, irrespective of whether or not their country of residence restricts them from participating in IDOs.

As the Binance Smart Chain continue to gain wider acceptance and adoption, getting involved with BSCTrust can be your ticket for early access to the best premiere projects in the blockchain.

BSCTrust Launchpad: Introduces bCharts

BSCTrust is proud to announce its partnership with its first lauchpad, bCharts. bCharts is unequivocally set to launch its token offering in May. Exact date, time and details about its tokenomics to be announced in the coming days.

bCharts is an analytical, computer-based visualization toolkit that provides currency traders with decentralized exchange trading analysis. This software tool produces interactive price charts for various currency pairs along with various technical indicators and overlays, that helps traders track live market movements and detect trendlines to evaluate the patterns in the trading data.

In the modern world of decentralized finance and exchanges, a vital part of a trader’s success, especially those who trade frequently, is the ability to evaluate the patterns in trading data. bCharts aims to provide solutions to two major drawbacks in existing charting tools that support the Binance Smart Chain network.

•REAL-TIME DATA: The market moves so fast that the information provided by some of these tools lag a few minutes behind. When you make a decision, it is most certainly too late.

•ACCESS FEE: The few tools providing real-time data demand that users either purchase their token, or pay some kind of subscription fee before granting them access to their data.

bCharts gives a standard and principal core of trading information on a daily basis and has some capabilities that gives it an edge over its competitors:

DEX AGGREGATION: bCharts.io source liquidity from different DEXs and thus offer users better token swap rates than they could get on any single DEX.

BOTS: With bChart’s external API traders can create unique trading strategies for maximum profitability.

REAL TIME DATA AND CHARTS: Follow the best pairs through this tool with real-time graphics and transactions, add your pairs to favorites and much more.

Join their telegram community if you have any questions. http://bcharts.io/

Introducing Bricks Estate

BSCTRust Launchpad has partnered with Bricks Estate to aid in the execution of its token offering. Exact date and time of the offering will be announced in the near future.

BricksEstate is a community blockchain project that will allow investors access to a variety of real estates and properties owning full or parts of these assets through fractional ownership and be part of the ever-growing real estate industry.

BricksEstate aims to offer clients a verifiable record of property data that would allow the parties to complete a deal who generally don’t know each other and to trust that the seller actually has true ownership of that property through both the blockchain immutable ledger and utilisation of NFT ownership certificates.

These powerful tools will allow all parties involved in a domestic or international transfer of property to see without any question or doubt that there are not any claims against the title of that property outside of the current purchase.

Having an undisputed history of record is incredibly important, and while this may be possible without this technology, using blockchain can help make the process more efficient and secure than processes currently in place today.

SOLUTIONS OFFERED BY BRICKS ESTATE

BricksEstate platform adopts blockchain technology to curb safety problems by allowing listing on an immutable decentralized network, unlike Third-party property listing sites. Data stored in the blocks are highly encrypted giving high levels of safety assurance to property buyers and sellers.

Safety is fostered by storing documents in BricksEstate document vault which is a core product, and also issuing advanced secure property certificates in form of non-fungible tokens or collectibles. BricksEstate will be a key player in Real Estate tokenization.

Cross border restriction solution: BricksEstate makes it easy for average and accredited investors in various locations worldwide to easily invest in Real Estate with no boundary barriers. Cryptocurrency as a payment option in BricksEstate platform can be used for faster transactions. BricksEstate NFT Marketplace will also enhance accessibility for property ownership transfer with no location barriers. NFT property certificates can easily be transferred from seller to buyer via this medium with the help of smart contracts.

Solution to Fraud/scam: BricksEstate will ensure scam-free transactions between buyers and sellers. All necessary information will be stored on the blockchain. The information stored on the blockchain cannot be altered and is protected against damage.

Fair commission fees: BricksEstate ensures high commission is not the cause of failed negotiations by implementing fair commission fees, partly paid in BRICK which is the native token of the platform.

THE BRICKS TOKEN

BRICK Token BRICK is the native token of Bricksestate built on the BSC BEP-20 network. BRICK is designed to empower the connection of real estates and properties through a fully transparent, community-owned platform on Binance Smart Chain.

The total BRICK token supply is 1,000,000.

Token distribution is as follows:

25% — IFO: 25% will be sold on Public sales.

5% — 5% of BRICK token will be sold on private sales.

Unsold Tokens — Unsold tokens will be returned to Reserve.

30% — Ecosystem Fund: 30% will be used for partners to build BricksEstate project and its ecosystem as a vault.

10% — Team: Team token will be vested and small portions would be released monthly for a period of 2 years.

10% — Reserve: 10% of BRICK will be reserved for future BricksEstate projects.

20% — Liquidity: 20% of BRICK will be used to provide liquidity including exchange pools.

Non-mutable- No new tokens will be created. BRICK total supply will remain the same forever.

For more information about roadmap, whitepaper and the bricks estate team, check out their website https://bricksestate.co/ . Join their telegram community if you have any questions. https://t.me/bricksestate

SUBSCRIBE TO OUR CHANNELS

Twitter: https://twitter.com/bsctrust_fin

Telegram: https://t.me/BSCTrust

Announcement channel: https://t.me/bsctrustannouncement

Website: https://bsctrust.finance/

Author:

Forum Username: Jadon Sancho

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=2954208

Telegram Username: @Jadonsancho09

BSC Wallet address: 0xb05fc25bCfa612Eaef1Fa17cEBF05A675a40D5e1

1 note

·

View note

Text

In a significant development for XRP investors, the cryptocurrency has successfully broken through a crucial resistance level. The local resistance, reflected in the descending trendline at around $0.5010, has been a focal point for traders and analysts alike. As of the latest data, XRP is trading at $0.5082, surpassing the resistance and indicating a potential bullish trend.The current price of XRP stands at $0.52, confirming that the asset has moved past its previous resistance level of $0.5010. The successful breach of the resistance level could pave the way for further upward movement.Source: TradingViewBreaking a resistance level is often seen as a bullish indicator, suggesting that the asset may continue to rise in value. However, it is essential to consider other market factors and perform a comprehensive analysis before making any investment decisions.The first and most optimistic scenario is that XRP will continue its upward trajectory, possibly aiming for the next resistance level.Breakthrough of the 200 EMA: If XRP can also break through the 200 Exponential Moving Average (EMA), it would be another bullish sign, adding more credibility to the notion that the asset could continue to appreciate.Reversal and Downward Trend: On the flip side, failed attempts to sustain the breakthrough could see XRP move back toward the support level of the descending channel. However, a drop below this is unlikely due to the lack of volume and liquidity on the market, as well as another support level at $0.48.PEPE making comebackIn a market where volatility is the norm, PEPE token has been making waves with its unexpectedly strong performance. Currently trading at $0.0000008, PEPE is drawing closer to the 50 Exponential Moving Average (EMA) resistance level. While this could be a point where the token may reverse its course, liquidity and volume metrics suggest that PEPE is robust enough to potentially break through.As PEPE approaches the 50 EMA resistance level, traders and investors are keenly watching to see if it will break through or reverse. The token's liquidity and trading volume indicate that it has the strength to potentially surpass this resistance, but as always, great selling pressure may occur at any given moment, nullifying the asset's growth.One of the most plausible explanations for PEPE's recent surge is whale manipulation. There has been a noticeable uptick in social interest toward PEPE, and it is likely that whales are capitalizing on this. By pushing the token's price upwards, these large holders aim to create a retail momentum that could propel the token even further. This is a common strategy used to influence less-established tokens, and PEPE seems to be the latest beneficiary — or victim, depending on your perspective — of this tactic.Triangle no more for ADACardano has finalized its symmetrical triangle pattern formation, a technical indicator often used to predict the future direction of an asset's price. Currently trading at $0.2525, Cardano is showing signs of bullish momentum, further evidenced by an uptick in its Relative Strength Index (RSI) breaking through the 21 Exponential Moving Average (EMA).The symmetrical triangle is a chart pattern used in technical analysis that is typically neutral, meaning it can break out in either an upward or downward direction. For Cardano, the pattern has been completed, and the price seems to be leaning toward a bullish breakout. This could be a pivotal moment for ADA holders and potential investors as the asset may be gearing up for a significant move.Adding to the bullish sentiment is Cardano's RSI, which has recently broken through the 21 EMA. This is often considered a bullish signal, indicating that the asset might be entering an uptrend. The next target for Cardano is the 50 EMA, a level that could act as resistance but, if broken, could pave the way for further gains.

0 notes

Text

Trend Reversal: 3 Powerful Strategies to Detect Trend Changes (BEFORE They Happen)

New Post has been published on https://hititem.kr/trend-reversal-3-powerful-strategies-to-detect-trend-changes-before-they-happen-2/

Trend Reversal: 3 Powerful Strategies to Detect Trend Changes (BEFORE They Happen)

Howdy hi there what’s up my buddy so in ultra-modern video i’m going to share with you right sensible techniques and approaches right that you should use to identify pattern reversal within the markets i know proper most of the time most of you might be pondering of purchasing media stock or trying to go along and the market has transfer up so much already and when the pullback comes right you’re wondering is this for actual is this a pullback or is that this the reversal of the pattern ok so i’ll share with you three matters proper that you can pay concentration to to appear for right to support you establish pattern reversal available in the market the very first thing that I wish to share with you is what I name the brick off constitution so suppose about this proper in a trending market shall we say an uptrend you understand the price makes a sequence of larger highs and higher lows right now you’ll find over right here right better lows and greater highs so what do I imply with the aid of a destroy off constitution so the destroy of constitution manner correct there the primary clue that the market is telling you that it is about to get its Rick right or it can be about to reverse is if you have a ruin off constitution where the rate makes a new cut back low and low or high so on this case all proper this over right here you could have a lessen high and a cut down low so this sorry this uh this let me simply redo this right this is not a very good example so we doing it right so uptrend okay market breaks down pulls again after which persisted slash so now you’ve a reduce low and a reduce high this cut back high is under this diminish high over here so this right is the first clue to you that marking correct it can be about to reverse slash it’s no assurance right nevertheless it’s a clue given to you via the market that hi there you already know there is a ruin off constitution the cost could possibly reverse cut down so let me share with you just a few examples o.K. So this is the Bitcoin proper which you can if you are you are mindful right in 2017 Bitcoin at DISA meteoric upward push right to twenty,000 right individuals are shopping all proper going long and one can find this robust parabolic move higher so now at what point right would you or instead would you be alert correct at howdy this trains about to reverse once more the suggestion I simply shared with you proper an uptrend higher highs and bigger lows so we’re watching for a spoil of structure what you’re looking for is a lessen excessive and a lower low so at this point correct what I see correct say that is the subject of help at this factor you could have definitely gotten a shrink excessive correct this element which is a low excessive and when rate breaks below this subject of aid you may have this minimize low a decrease excessive low a low so this tells you that hi there you already know this trend might be weakening right the trend could reverse proper you fairly wish to be careful down here and in fact proper this more often than not form of sealed the deal right as Bitcoin went to the lack of our 6000 over right here so this is able to be style of a confirmation right the place it is telling that the trend on Bitcoin is ready to end while you get a lower low and a diminish excessive towards the present up-teach ok an additional example right so let’s if you happen to recall correct crude oil right in 2015 2014 an extraordinarily strong decline right I feel declined to a lack of about if you see over here 2030 greenbacks so once more can we apply this inspiration correct a wreck of structure so you will find that earlier the decline proper sequence of minimize highs and lessen lows right easy easy market structure however at this point this is where matters obtained fascinating ok this proper now at this factor you will have a better low and when the price breaks above right here you completely satisfied larger high on the grounds that the price broke this this prior resistance right now you’ve gotten a greater excessive let me simply spotlight to you right a bigger excessive and a bigger low bigger high this area over right here a larger excessive and larger seem k so this again must provide you with a robust clue that good day you know this downtrend could in all probability have come to an finish correct so you do not hear me making use of phrases like guarantees verify proper backside out or prime out proper there’s no such thing as guarantee in trading or in technical evaluation or whatever if anybody promise II promise you you know assurance run a ways away k so because of this i admire to use phrases like most often likely in all likelihood correct there’s at all times this detail of non-guaranteed at the back of it so anyway this is a different example of the break of constitution and you can find that a fee did eventually particularly up greater from right here okay so the an additional technically I wanna share with you is what I name larger time period constitution proper it’s essential to pay concentration correct the place you are in terms of the huge snapshot so because of this you ought to hear merchants say hello you realize you will have to pay concentration to what the greater time period is doing correct that’s so referred to as the supplying you with the however ice view proper of the place you might be in a tremendous image so this is the reason you recognize I want to share with you concerning the higher period of time constitution so let’s seem at the first example over here proper you might marvel and look at this chatty howdy Rana why did the price you already know come up here and then decline proper what what’s so magical about this this discipline ok rate it sounds as if breaks above this a swing excessive over right here and it crumple scale down as I reply a variety of traders who are unaware they buy the breakout only to get caught on the flawed facet hmm why is that correct once more I recounted some thing known as bigger period of time structure so let me point out to you should you look at this chat over right here you can find that bigger time frame this is the day-to-day time frame what you might have seen previous is the 4 hour period of time you see that over right here on this better time frame this is where you’ve you recognize prior aid that might act as resistance so the breakout that you’ve got obvious prior is certainly at this element over here you’re shopping to interrupt up into this previous help that could act as resistance which is which is once more proper it is a low probability breakup considering you are buying right into a enormous selling stress right and it’s a ordinarilly no wonder why this market reversed from right here so that is what I mean by using larger time period constitution proper you need to pay concentration to where the fee is coming into particularly if it’s coming to any higher time period structure like you know support resistance trendline channel and so forth one more illustration right over here new zealand yen on this four hour time frame k fee come down curb soar time factor increase fairly hi there what occurred man what’s going on a clue proper bigger time period constitution and despite the fact that I do agree that you’ve got a series of better lows and larger highs because the fee get away of this resistance as good proper I do agree correct however a different factor that I want to share with you to seem out for is higher period of time constitution so looking at the daily period of time you’ll find that over here i know there may be a really just a little of traces over right here however what i need you to pay concentration to is that this portion it got here into a strong support on this everyday time period in fact I suppose it’s even a father or mother on a weekly time period and if you happen to draw a pattern channel this is this calm of this trend channel as well so once more no surprise proper at hello you realize that you may anticipate a jump or perhaps a reversal of this field to your chat all right so this is what I mean by using better time period structure k and the final tip that I wish to share with you is pay concentration to the 200 interval moving natural so for those of you who have been following me a whilst now you already know that I I have a tendency to say that you recognize if the rate is above the 200 and me correct attempt to stay long right and if the fee is below the 200 ma right try to keep brief and the intent is rather simple surely in case you think about this correct want 200 interval moving normal it summarizes the prices of the final 200 candles correct so if the fee right now could be a beginning the 200 ma is telling you that the rate proper has been trending higher so that is why it’s above the 200 ma and if the fee is beneath the 200 ma it is telling you that the fee proper has been trending diminish very well so this can be a simple strategy to style of tell you what’s the long-time period pattern correct of the designated shot that you are buying and selling discover that i exploit the word long-term trend off the specific shot of your buying and selling given that it could be the 200 ma on the five minutes timeframe and it isn’t rather a protracted-term pattern when you consider that it can be a five minutes time for you likewise it may be a 200 ma on the day-to-day time we’re in debt hello that is a horny long time frame so i might say it can be the long-term development of the chart that you are buying and selling relying on what time period you’re watching at however anyway correct let’s have a look at the illustration proper that is the 200 ma on the day-to-day period of time so once more how can we practice this uh this system once more you at this port at this factor over right here the fee is above the 200 ma so I noticeable right have a long bias I did not say bye I mentioned have a protracted bias which means you want to look for long opportunities you seem for opportunities to buy in this market so from the appears of it correct i’ll say that is an field of support ok and at any time when you realize if rate comes with into an subject of help it varieties a cost rejection there is a valid buying and selling setup and on top of it correct you recognize that you’re buying and selling along in conjunction with the long term trend which is on the up-instruct right so this might had been skills setups proper this one as well ok this one cost just slice by means of it there wasn’t any price rejection or anything so you realize there is for me there isn’t any rationale to be lengthy k so now that the rate has now you know traded beneath the 200 ma right now the cost is under the 200 m e price is below it now hey I see it correct to have a shot by way of it so now which you can look for possibilities to move shot so just once more easy market structure that you would be able to seem for a prior help and resistance or i admire over right here proper previous aid that could against resistance over here okay in a similar fashion right here earlier help appearing as resistance so now that is how one can truly use the 200ma to give you a biased recognize whether or not it must be lengthy or quick after which simply reference correct to a market structure like help resistance or might be moving each attempt to kind of establish the field of price that you want to exchange from ok so that is out 200 Amir I might offer you alright alert to you that the development probably about to reverse an extra instance we could write Aussie greenback towards the japanese yen so get this one again a cost over here at this factor proper cost is above T 200 ma right so once more you should have a long bias correct so now the query is do you may have an extended buying and selling setup k so on this case I to me there is not right when you consider that there’s any cost rejection proper price just more often than not go by way of it at this factor now the fee is below 200 ma my bias is famous from lengthy to brief so once more ask myself at what degree on the chat do I wanna trade so it’s the rate you know hit curb for example no setup this over here might be a feasible setup ok you can observe that there’s this a swing low price spoil below it comes up offers you a rate rejection before continues to the sector came again up into this resistance now hit cut back got here back up once more for that point hit reduce came again up hit scale down on high of it this one over here you will have the ok this one is a relatively colossal right given that quantity one we proven at 200 ma number two into this field of resistance okay and number three you’ve gotten this falls break of this highs over your price I feel did set off above this heist k after which cave in reverse slash o.K. So alternatively rate retest a 200 ma come down lower did a pullback toward this previous swing load that might extra resistance and then continue lessen so you will discover that if you happen to reference the 2 200 ma in your patrons proper one can find that possibilities are you are mostly trading you recognize on the right facet of the trend of path there are occasions the place you recognize this fully destroy down chiefly if the market goes into a long run an extended-time period retry shall we embrace a long term range like this 200 ma is most of the time like in the center proper so yeah at this point in time proper you would get a chop up just a little bit however in case you simply use just a little bit of customary experience and see that the market is in an extended-time period ranger you still can you recognize adapt to it thus so anyway right this 200 ma it is priceless once more to support you identify the trend reversal and to support you tree on the right aspect of the educate okay so good so relocating on correct let’s do a fast recap proper now on this I love to do this to be certain the concepts proper and tactics goes into your hip first thing we spoke about damage off constitution right I say that you already know in an uptrend you could have a sequence of higher highs and bigger lows so in case you get a series of we or in the event you get a lessen high and scale down low it’s a sign to you that hi there you already know the uptrend could probably in all probability lower would be reversing quantity two I spoke about referencing it to the greater period of time constitution where are you within the significant photograph are you coming into a long term robust aid resistance trendline channel and so on that is anything that you need to be aware of as well and a third thing we spoke about is how you should utilize the 200 ma right – quantity one identify trend reversal and you aid you trade alongside the proper side of the trend I imply that’s a mouthful right to determine development reversal and to exchange with the trend okay so with that said right I’ve come to the end of this video if you want to gain knowledge of extra about what I do right can go right down to my internet site buying and selling with Rainer calm in view that my title is Rainer buying and selling wet or calm all correct you scroll down just a little bit proper so today we spoke about absolutely largely about rate motion so each an extra competencies on it go down right here and download this describe the price section the perfect guide to cost motion buying and selling click this blue button i’m going to ship it to your e mail at no cost and when you study more about trending markets writing huge traits going download this excellent development following consultant proper again that you would be able to click on this blue button and i will send it to your e mail at no cost okay so that’s it I’ve come closer to the end of this video in the event you enjoyed it you like it smash right there like button subscribe to my youtube channel any questions leave it beneath and i’m going to get again to you so with that is it I wish you just right success and excellent trading and i will talk to you soon you

2 notes

·

View notes

Text

Bank Nifty Chart For 12th June 2023

Bank Nifty Analysis: Minor Support Found, Resistance at 44188, Bullish Channel Broken In the recent analysis of the Bank Nifty, a prominent index in the Indian stock market, it is observed that minor support was found on the expiry day, BANK NIFTY (https://www.tradingview.com/x/3gy2yXMu) NIFTY (https://www.tradingview.com/x/CztaHfDr) indicating a potential shift in market sentiment. However, traders should take note of the resistance level that formed around 44188, which could hinder further upward movement. Bullish Channel Breaks, Trendline Retested and Closed Below The Bank Nifty has experienced a significant development as it broke its bullish channel. This suggests a possible change in the overall market trend and investor sentiment. Moreover, the index retested the broken trendline and closed below it, highlighting the significance of this technical breakdown. Specific Price Levels to Monitor At the price level of 43735, a minor pullback with a bullish run has been observed. This indicates a temporary surge in buying interest or a corrective rally. However, it is important to approach this bullish movement with caution, as its longevity may be limited. A more substantial bullish movement has been witnessed at 43240, which represents a significant area of support. Sustaining above this level could signal a potential resurgence of bullish momentum. Traders and investors should closely monitor price action around this level for potential trading opportunities. Caution and Independent Analysis Advised It is crucial to exercise caution when interpreting these technical levels. The current market dynamics may lead to a range-bound environment, characterized by sideways movement between support and resistance levels. Clear directional cues for the Bank Nifty will only emerge through a decisive break above or below the marked levels on the chart. As market dynamics can swiftly change and technical indicators are not infallible, traders and investors are strongly advised to conduct their own analysis. Considering various factors such as fundamental news, market sentiment, and broader economic trends will aid in making well-informed trading decisions. Conclusion The Bank Nifty analysis reveals the discovery of minor support on the expiry day, coupled with the emergence of resistance at 44188. With the breakage of the bullish channel and the subsequent retest of the trendline below, there are indications of a potential shift in market dynamics. However, it is important to approach specific price levels with caution, as the index currently remains within a range-bound environment. Traders are urged to conduct thorough analysis and adapt their trading strategies accordingly. Read the full article

0 notes