#Tradespect

Explore tagged Tumblr posts

Text

Essential Rules for Selecting Stocks Using the Trade Ideas Platform

In the dynamic world of stock trading, having the right tools at your disposal can make all the difference between success and failure. One such tool that has gained immense popularity among traders is the availability of a number of Trade Ideas platforms. With their powerful scanning capabilities and real-time market data, these platforms empower traders to identify profitable opportunities quickly and efficiently. However, like any tool, it's essential to know how to wield it effectively.

Here, we'll explore the essential rules for selecting stocks using any Trade Ideas platform, allowing you to maximize your chances of success.

The Power of the Trade Ideas Scanner

At the heart of the Trade Ideas platform lies its advanced scanning technology, the Trade Ideas scanner. This sophisticated tool enables traders to filter through thousands of stocks, sifting out those that meet specific criteria based on various technical and fundamental factors. From price movements and volume patterns to earnings reports and news events, the Trade Ideas scanner can be customized to capture precisely the opportunities you're seeking.

Rule #1: Define Your Trading Strategy

Before diving into the Trade Ideas scanner, it's crucial to have a well-defined trading strategy in place. This strategy should align with your investment goals, risk tolerance, and personal preferences. Are you a swing trader looking for short-term opportunities, or do you prefer a more long-term approach? Do you prioritize momentum plays or value investing? Clearly defining your strategy will help you set up the appropriate filters and alerts within the Trade Ideas platform.

Rule #2: Customize Your Scan Criteria

Once you've established your trading strategy, it's time to tailor the Trade Ideas scanner to suit your needs. The platform offers a vast array of customizable filters, allowing you to narrow down your search based on specific criteria.

For example, if you're interested in momentum stocks, you might set filters for a certain price range, volume thresholds, and technical indicators like moving averages or relative strength index (RSI).

Rule #3: Incorporate Fundamental Analysis

While technical analysis is a powerful tool for identifying potential trade setups, it's essential to complement it with fundamental analysis. The Trade Ideas platform integrates fundamental data, such as earnings reports, news events, and analyst ratings, enabling you to make more informed decisions. By combining technical and fundamental factors, you can gain a holistic understanding of a stock's potential, reducing the risk of missed opportunities or blind spots.

Rule #4: Leverage Real-Time Alerts

One of the standout features of the Trade Ideas platform is its real-time alerting system. By setting up customized alerts based on your scan criteria, you can stay ahead of the game and react swiftly to emerging opportunities. Whether it's a stock breaking out of a consolidation pattern or a significant news event affecting a particular company, real-time alerts ensure you never miss a potential trade.

Rule #5: Embrace Backtesting and Optimization

The Trade Ideas platform offers powerful backtesting capabilities, allowing you to evaluate the effectiveness of your trading strategies and scan criteria against historical data. By backtesting your approach, you can identify potential weaknesses, refine your filters, and optimize your strategy for maximum profitability. Additionally, the platform's optimization tools enable you to fine-tune your scans, ensuring they capture the most promising opportunities.

Rule #6: Manage Risk Effectively

Successful trading is not only about identifying profitable opportunities but also about managing risk effectively. The platforms offer various risk management tools, such as stop-loss orders and position sizing calculators, to help you mitigate potential losses and protect your capital. Add these tools into your trading plan and consistently adhere to your predetermined risk parameters.

Rule #7: Stay Disciplined and Adaptable

Discipline and adaptability are crucial components of successful trading. Stick to your trading plan and avoid deviating from your established rules and criteria, even in the face of tempting opportunities. At the same time, remain adaptable and open to adjusting your strategy as market conditions evolve. Regularly review your performance, identify areas for improvement, and refine your approach accordingly.

Discover Tradespect: Your Gateway to Trade Ideas Mastery

If you're looking to take your Trade Ideas experience to the next level, look no further than Tradespect. Tradespect has one of the best Trade Ideas Scanner, specializing in helping traders maximize their potential with the Trade Ideas platform.

At Tradespect, you'll find a wealth of valuable resources that help you become a more proficient and successful trader.

But that's not all – Tradespect also offers a suite of powerful trading tools and services. From customized trading alerts and analysis to portfolio management solutions, Tradespect has everything you need to take your trading game to new heights.

So, why wait? Try Tradespect today and unlock the full potential of this Trade Ideas platform. And don't forget to check out our YouTube channel for a huge library of educational videos, trading tips, and market insights.

#Trade Ideas Platform#Tradespect#Trading Ideas Scanner#Trade Ideas AI#Stock Screener#Trade Ideas Cost#Best Screeners for Stocks#Crypto Trade Ideas

0 notes

Text

Ways to Maximize returns with free trade ideas

Maximizing returns in trading is the ultimate goal for every investor. Free trade ideas offer a pathway to achieving this goal without the burden of high costs. These ideas provide valuable insights and strategies that can help traders make informed decisions and capitalize on market opportunities. However, here are some effective ways to leverage Trade Ideas free to enhance returns and optimize trading performance.

Access to Expertise:

Free trade ideas often come from experienced traders, analysts, or AI algorithms, providing access to valuable expertise and insights.

Diverse Perspectives:

It covers a wide range of markets, and trading styles, offering diverse perspectives and strategies to explore.

Risk Management:

Utilizing free trade ideas can help traders identify potential risks and implement risk management strategies to protect their capital.

Real-Time Updates:

Free trade ideas are often accompanied by real-time market updates and alerts, enabling traders to stay informed and adapt to changing market conditions effectively.

Conclusion:

However, find profitable opportunities with trade ideas cost-effectively giving you valuable insights to improve your trading strategy without spending too much money. Get the highest probability of AI trade ideas and become statistically profitable. So, sit back and get in touch with Tradespect to generate high-confidence trade ideas. Sign up for Trade Ideas Free Trial today and experience their features with a free, limited account.

0 notes

Text

Revolutionize your investment strategy with TradeSpect , a leading AI Stock Trading Platform. Harnessing the power of cutting-edge artificial intelligence, TradeSpect analyzes market data in real-time, executing trades with unmatched precision. With advanced algorithms and predictive modeling, this platform ensures proactive risk management and optimal portfolio optimization. Explore the future of trading with TradeSpect, where AI-driven insights provide a competitive edge in navigating the dynamic landscape of the stock market.

0 notes

Text

Unleashing the Power of AI in Stock Trading: A Comprehensive Look at TradeSpect

Introduction: In the ever-evolving world of stock trading, AI has emerged as a transformative force, revolutionizing how investors and traders navigate the financial markets. AI stock trading software, such as the cutting-edge platform TradeSpect, has gained prominence for its ability to analyze complex market data, predict trends, and execute trades with unparalleled efficiency. In this article, we delve into the realm of AI Stock Trading Software, drawing insights from the features and capabilities of TradeSpect.

Understanding AI in Stock Trading: AI stock trading software leverages advanced algorithms and machine learning models to process vast amounts of financial data, historical trends, and real-time market information. The goal is to make data-driven decisions, optimizing trading strategies, and ultimately maximizing returns while minimizing risks.

Key Features of TradeSpect:

Predictive Analytics: TradeSpect utilizes sophisticated predictive analytics to forecast market trends and stock price movements. By analyzing historical data and identifying patterns, the software empowers traders with valuable insights for making informed investment decisions.

Algorithmic Trading: The platform supports algorithmic trading, allowing users to automate their trading strategies. TradeSpect's algorithms execute trades based on predefined parameters, optimizing the timing and efficiency of transactions and reducing the potential for human error.

Risk Management Tools: TradeSpect places a strong emphasis on risk management, incorporating AI-driven tools to assess and mitigate potential risks associated with market volatility. These tools help traders protect their investments and maintain a balanced portfolio.

Real-time Market Monitoring: Keeping pace with the dynamic nature of financial markets, TradeSpect provides real-time market monitoring. Users can stay updated on relevant news, market trends, and events that may impact stock prices, enabling them to make informed decisions in a rapidly changing environment.

Intuitive User Interface: TradeSpect boasts an intuitive user interface that caters to both seasoned traders and newcomers to the world of stock trading. The platform's user-friendly design ensures a seamless experience, allowing users to navigate the software effortlessly and focus on strategic decision-making.

Benefits of AI Stock Trading Software:

Efficiency and Speed: AI stock trading software, exemplified by TradeSpect, operates at lightning speed, processing information and executing trades with unparalleled efficiency. This speed is a critical advantage in capitalizing on fleeting market opportunities.

Data-Driven Decision Making: With its ability to analyze extensive datasets, AI software facilitates data-driven decision-making. Traders can rely on comprehensive analyses rather than intuition, leading to more strategic and informed investment choices.

Adaptability to Market Changes: The dynamic nature of financial markets requires adaptability. AI stock trading software excels in adapting to changing market conditions, allowing traders to adjust their strategies promptly based on real-time information.

Conclusion: AI stock trading software, as exemplified by TradeSpect, is at the forefront of reshaping the financial landscape. The integration of predictive analytics, algorithmic trading, and robust risk management tools empowers traders to navigate the complexities of the stock market with confidence. As the influence of AI continues to grow in the financial sector, platforms like TradeSpect showcase the potential for a more intelligent and efficient future for stock trading.

0 notes

Text

#AI Trade Ideas#Best Screeners for Stocks#Best Stock Screener#Crypto Trade Ideas#Good Stock Screeners

0 notes

Text

Leverage AI with Tradespect for Smarter Investment Decisions

The financial market offers traders various trading products, from stocks and bonds to exchange-traded funds (ETFs) and mutual funds. These products can confuse new investors when identifying suitable investment opportunities. But you don’t have to worry! You can use an AI Trade Ideas Scanner, like Tradespect, to help you navigate the trading market and make a wise decision!

What are Screeners and Where to Find Them?

Market screener tools are filters that allow you to sort through a sea of investment options based on specific criteria. Imagine sifting through a library – an AI Trade Ideas screener lets you define parameters like genre, author, or publication date to find the books that interest you most. Similarly, you can set criteria like price range, dividend yield, or technical indicators to identify investments that fit your investment strategy.

Many online platforms offer trading idea tools to help you make a wise decision while trading. Let's take a look at how Tradespect, one of the most advanced AI-generated Trade Ideas Scanner platforms, can help you trade whether you are a newbie or a seasoned trader:

Sign up for a free trial or a Pro subscription.

Explore the platform and its features.

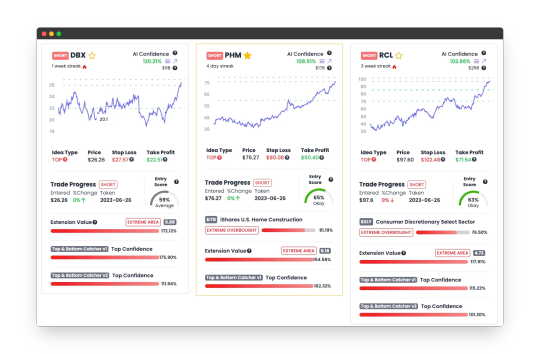

Look at the AI trade ideas. Consider the AI confidence score.

Analyze the reversal detection tools. This includes smart-money buy/sell meters, options zones, crypto meters, and industry monitoring.

View the charts, data, and key levels.

Utilize the paper trading feature to test the ideas in a simulated environment before applying your knowledge to the real markets.

What Tradespsct Has To Offer To The Traders?

Here is what Tradespect offers traders:

AI-powered trading platform: Tradespect uses machine learning algorithms to analyze markets and identify potential opportunities.

Suitable for all experience levels: Features cater to both beginners and experienced traders.

Automated trading strategies: The platform can automate trades based on its analysis. (Beneficial for busy traders or those wanting to remove emotion from decisions).

Data-driven insights: Tradespect provides users with data and analysis to support informed investment decisions.

Predictive analytics: The platform may offer features to predict market movements.

Adaptable strategies: Tradespect can adjust its trading strategies over time to potentially maximize returns and minimize risks.

Freemium model: A basic level of service might be free, with premium options offering more in-depth information for a fee.

How to Use Tradespect For Trading?

As you know, Tradespect is an online platform that provides data and analysis on the U.S. stock market. It uses AI technology to suggest trade ideas based on statistical analysis and contrarian indicators. Tradespect aims to help traders buy low and sell high by identifying potential market reversals. If you're interested in using Tradespect for trading, here are some tips to keep in mind:

Identify potential trades: Tradespect offers AI-generated trade ideas with high success rates. You can use these ideas as a starting point for your research, but it is important to remember that they are not guaranteed profits.

Analyze market conditions: Tradespect provides access to real-time data and market conditions. This can help you to understand the current market sentiment and make informed trading decisions.

Consider options order flow: Options order flow data can be valuable for options traders. Tradespect provides access to this data, which can help you to identify potential trading opportunities.

Identify market reversals: Tradespect offers reversal detection tools to help you identify potential market tops and bottoms. This can be helpful for swing trading and capturing longer-term trends.

Test your trades: Tradespect offers a simulated portfolio to test out trade ideas in a risk-free environment before investing real money. This is a great way to test your thesis and see how your trades would perform in the market. You can check out their Trade Ideas Scanner Short Video to understand how to get help from Tradespect!

Benefits Of Using Tradespect

Free Trial & Paid Options: Tradespect offers both free and paid options. You can try the free plan to understand how Tradespect works before you opt for the paid plan.

AI Trade Ideas & Confidence Scores: Identify potential opportunities with insights into the AI's confidence level.

Reversal Detection Tools: Gain insights with smart-money meters, options zones, and industry monitoring features.

Charts & Data Analysis: Make informed decisions with detailed visualizations and key market levels.

Paper Trading: Test your strategies in a simulated environment before risking real capital.

Remember, Tradespect is a tool, not a magic formula. Use its suggestions as a starting point for your research. By combining AI insights with your own analysis and risk management, you can make informed decisions and navigate the investment landscape with greater confidence. So don’t wait to visit Tardespect today to enjoy the benefits of a trade ideas scanner!

#AI Trade Ideas#Best Screeners for Stocks#Best Stock Screener#Crypto Trade Ideas#Good Stock Screeners#Market Screener#Stock Market Scanners

0 notes

Text

How To Use A Stock Screener Effectively

A Stock Screener is like a tool that helps investors. It can save them time and work by finding stocks that match what they want to invest in. Also, it stops investors from making decisions based on feelings and helps them focus on facts.

To find good stocks using a tool called a stock screener, follow these steps:

1. Think about what you want from your investments. This will help you choose the right stocks.

2. Decide what things are important to you when choosing stocks. For example, you might want stocks with low prices compared to how much money they make, or stocks from growing companies.

3. Look at the stocks that match your criteria. Check things like how well the company is doing financially and what experts think about the industry it's in.

Tradespect is a helpful tool for trading stocks. It uses advanced technology to find stocks that are likely to do well, saving you time. Visit the website today and start mastering the art of stock trading with it’s help!

0 notes

Text

Tips To Build a Long-Term Portfolio with Tradespect

Tradespect can be a valuable Trading Ideas Scanner for building a long-term portfolio, especially for new investors. Here's how to leverage its features and a free trial to make informed decisions:

Understanding the Trade Cards

The free trial offers access to "trade cards" displaying potential trades. Use these tips to decode them:

Look for a low "Extension" value for short-term entry and a "bearish" trend on the 1-hour timeframe for potential short positions.

A green "SL ratio" favors long trades. Aim for an "AI confidence percentage" above 110% for stronger signals.

Avoid stocks with recent price gaps ("GAP UPs"). "OK" or "Good" entry scores are suitable for short-term plays.

Mastering the Platform

Top Trade Monitor: This feature provides short- and long-term trade ideas.

High Market Cap: Focus on stocks with a larger market capitalization for better stability.

Exporting Ideas: Save your trade ideas for future reference.

Free Trial Advantage

Use the $200,000 virtual balance to practice interpreting the trade cards and test your strategies before investing real money.

Beyond the Free Trial

Tradespect offers paid plans with additional features like more trade ideas, real-time monitoring, and advanced filtering tools. These can be beneficial as you gain experience. So what are you waiting for? Sign up with Tradespect to get the benefits of this Trading Ideas Scanner today!

#Trading Ideas Scanner#AI Trade Ideas#Best Stock Screener#Good Stock Screeners#Market Screener#Stock Price Screener

0 notes

Text

This informative infographic explains how AI is transforming stock trading through companies like Tradespect. See how advanced algorithms analyze massive data to detect profitable trades in real-time. Learn about the proprietary AI system powering Tradespect's platform and the key benefits of AI-powered trading, including split-second analysis and improved accuracy. Discover how AI is revolutionizing trading and boosting portfolio performance.

#AI Based Stock Trading#trading software#AI Based Trading Software#AI Driven Stock Trading#AI for Day Trading#AI for Stock Trading#AI Powered Stock Trading

0 notes

Text

How does stock trading AI software work?

AI technology has revolutionized the world of stock trading by utilizing machine learning algorithms and artificial intelligence. Now, we have a wide range of stock trading AI software in the market. Do you know how they work? Let us tell you how they work in simple words.

The Steps Involved

Collects Data: The first thing that an AI software does is collect important data. This step is the most crucial in the whole process. In this step AI application gathers past data and the current data to proceed further.

Analyze Data: Once the data is collected, the next step is to analyze the data. Using the algorithms, the AI bots study the market trends and recognize the patterns and the current market situation. After thorough research and investigation, it reaches a conclusion that will help to generate profits.

Decision Making: Once the data is examined, the software makes you aware of the current market situation, and the necessary parameters like top and bottom catchers, penny stocks, dark pool and order flow, and the leading stocks.in this way, it will help you make the right decision to reduce risks.

Executes Trades: If it is an automated trading AI software, then it will execute trades on its own behalf while looking at the key indicators such as top and bottom catchers, penny stock, and other crucial parameters. However, if it is simply instructional software, it will present favorable metrics in front of you to maximize your success rate and gain profit as discussed in the previous step.

This is a brief idea of how stock trading AI software works. It has changed the way people opt for trading. Not only this, a few AI software like Tradespect also educate people about trading and how to become a professional in this skill besides offering AI-driven trade ideas and intelligent trading strategies. Moreover, its discard bot is always there to assist if you have any doubts. Interested in learning more? Then visit their website and pave the way to safe and smart trading.

#stock trading AI software#AI Based Trading Platform#AI Trading Platform#AI Software for Stock Trading#AI Stock Market Trading#Best AI Trading Software

0 notes

Text

How AI Transforms The Stock Trading Industry in 2024

The use of AI has unlocked new potential in stock marketing. It has maximized trade profits swiftly. Furthermore, it also developed some conventional approaches due to its better decision-making abilities.

Many times, when it comes to developing a stock trading app, AI can assist investors and traders in various dynamic stock markets and reduce the risks on profits.

While an AI trading platform offers attractive potential, it’s important to learn how it works in stock trading. AI stock trading involves the use of advanced algorithms and machine learning techniques.

They analyze the vast amount of financial data and use it to make informed decisions. The AI identifies the patterns, trends, and anomalies going on in the market and optimizes the strategies to achieve better returns.

Brief Overview of AI Stock Trading Working Process

1. Data Pre-processing: The data that the AI gathers, needs to be normalized and cleaned. By cleaning we mean transforming into a suitable format.

It is then analyzed for missing values, removing noise, and scaling data. This process ensures the data's quality. Experts use this data to train AI models.

2. The Selection of Algorithm: Now, we can use various algorithms for stock trading. Therefore, the training agents use the process of reinforced learning methods.

These methods use the information based on the feedback received from the market.

Natural Language Processing (NLP) techniques also can analyze sentiments from news based on social media data and discern their likely influence on stock prices.

3. Machine Learning Models: All the AI models then use the data for training. The AI algorithms try to learn with the help of patterns.

They try to capture the dynamics of the market and make predictions according to their learning process.

The process of backtesting provides valuable insights that we can use to improve future development.

Now, let’s discuss a few benefits of AI in stock trading

Most Popular Benefits of AI in Stock Trading

1. Increases Accuracy and Reduces the Research Time

With the help of AI, modern investors can save time and also control their transactions easily. They can also get expert advice and automate their research procedures.

With AI-powered algorithms, they can also utilize data-driven tactics in their trading process. Also, it’s seen in a recent study that it can boost productivity by 10% with better accuracy.

2. Low Expenses

The traditional investment firms, to manage their business, employ a large number of employees. These employees include analysts, brokers, advisers, and more.

But now, with a better AI-Based Trading Platform, they can easily automate the stock trading process. Although there may be short-term issues for adopting this new system, modern businesses will save more money by using it.

3. Go With Modern Trends

With AI-powered stock trading, it can gather diverse linguistic and textual elements with sentiment analysis. Using new sources and social media data, AI can identify the current market trends and the changes.

Wrapping It Up

As the emergence of AI grows in the stock market, in time, trading at stock markets will become a whole new level of seeing things. With AI automated stock trading techniques, it offers streamlined efficiency with savings.

Not only the market is going to improve, but it will also bring new challenges to the profile of stock trading.

If you’re also interested in AI stock trading, then we suggest visiting the Tradespect website. A specially designed all-in-one stock market toolkit is made for retail traders.

Here, you can also get the highest probability of AI trade ideas used in the current market.

#Ai Trading Platform#Ai Based Trading Platform#Ai Automated Stock Trading#Ai Based Trading Software#Ai for Day Trading

0 notes

Text

AI Trading Software: Revolutionizing the Future of Financial Markets

In the dynamic realm of financial markets, technological advancements have ushered in a new era of trading sophistication. At the forefront of this revolution is AI Trading Software, exemplified by the cutting-edge platform offered by TradeSpect . This innovative software combines artificial intelligence with financial expertise to provide traders with a powerful tool that transforms the way investments are managed.

Key Features:

Advanced Algorithms: TradeSpect's AI trading software is powered by advanced algorithms that continuously analyze vast amounts of market data. These algorithms are designed to identify patterns, trends, and potential opportunities, allowing traders to make informed decisions based on data-driven insights.

Automated Execution: The platform's automation capabilities enable swift and precise trade execution. By removing the emotional element from trading, AI ensures that decisions are based on logic and strategy, leading to optimized outcomes.

Real-time Market Insights: Stay ahead of the market with real-time data and insights. TradeSpect's AI software provides up-to-the-minute information on market conditions, allowing users to adapt their strategies promptly to capitalize on emerging opportunities or mitigate risks.

Risk Management: Mitigating risks is paramount in trading, and TradeSpect's AI software excels in this aspect. The platform incorporates robust risk management tools, helping traders set and adhere to predefined risk parameters to safeguard their investments.

User-friendly Interface: Accessibility is key, and TradeSpect ensures a user-friendly interface that caters to both seasoned traders and newcomers. Intuitive design and seamless navigation make it easy for users to leverage the power of AI without a steep learning curve.

Performance Tracking and Analytics: Evaluate and refine your trading strategies with comprehensive performance tracking and analytics. TradeSpect's software provides detailed reports and analytics, enabling users to assess their trading performance and make data-driven adjustments.

0 notes

Text

Master the Markets: Explore AI Stock Market Trading with TradeSpect

Delve into a new era of precision trading with TradeSpect's innovative AI Stock Market Trading. Our platform leverages the prowess of artificial intelligence to redefine how traders navigate the complexities of financial markets. With intelligent algorithms, real-time market analysis, and adaptive strategies, TradeSpect empowers users to stay ahead of market fluctuations. The user-friendly interface ensures accessibility for all, from seasoned traders to newcomers. Join the future of trading with TradeSpect's AI Stock Market Trading and experience a transformative approach to decision-making and success in the dynamic world of finance.

0 notes

Text

When it comes to choosing the right trading software, look no further than Tradespect. In this section, we present a collection of AI Trading Software Reviews from traders who have used our Ai Trading Software. Discover what they have to say about their experiences and the impact our software has had on their trading journey. Our software provides valuable insights from seasoned traders to beginners, and risk-averse investors to full-time traders. Additionally, it saves time, enhances risk management, and empowers traders to make better-informed decisions.

0 notes

Text

Tradespect is your ultimate choice for trading software, and our AI Trading Software Reviews speak for themselves. Hear from traders who have experienced the transformative impact of our software on their trading journey. Gain valuable insights from seasoned professionals, beginners, and risk-averse investors alike. Our software saves time, improves risk management, and empowers traders to make well-informed decisions. Join the community of satisfied traders and elevate your trading with our AI Trading Software Reviews.

0 notes

Text

Unleash the potential of Tradespect, the game-changing AI Stock Trading Platform reshaping the market landscape. Powered by advanced data analysis and trend detection, Tradespect empowers traders to stay ahead. Optimize your investment strategy with precise entry and exit signals, leveraging the self-learning algorithm that adapts to market conditions. With comprehensive stock reversal analytics, Tradespect equips you with invaluable insights for informed financial decisions. Stay ahead of the competition with the ultimate AI Stock Trading Platform - Tradespect.

0 notes