#Top-rated money transfer provider

Explore tagged Tumblr posts

Text

Fast and Secure Money Transfers from Australia to India with Instarem

Looking for a reliable and efficient way to send money from Australia to India? Look no further! Instarem is your go-to money transfer service provider, offering the best-priced, fast, and secure currency exchange services across the globe. With Instarem, you can rest assured that your hard-earned money reaches your loved ones in India swiftly and securely.

Why Choose Instarem for Your Money Transfers?

Competitive Rates: At Instarem, we understand the importance of getting the best exchange rates. With our transparent and competitive AUD to INR exchange rates, you can ensure that your money goes further, maximizing the value for your recipient in India.

Lightning-Fast Transactions: Time is of the essence when it comes to money transfers. Instarem ensures quick processing, making sure your funds reach the intended recipient without unnecessary delays. Say goodbye to waiting for days for your money to arrive!

Top-Notch Security: We prioritize the safety and security of your transactions. Instarem uses the latest encryption technology and adheres to strict compliance measures to safeguard your personal and financial information. You can trust us to handle your money with the utmost care and confidentiality.

Hassle-Free Process: Sending money from Australia to India has never been easier. Our user-friendly platform allows you to complete the transfer process within a few simple steps. No more lengthy paperwork or complex procedures!

How to Send Money with Instarem:

Sign Up: Create an account with Instarem and complete the quick verification process.

Enter Transfer Details: Select Australia as the sending country and India as the receiving country. Enter the amount you wish to send, and our platform will display the exact amount your recipient will receive in INR.

Choose Delivery Option: Select the delivery option that suits your recipient's needs. Instarem offers various options for quick and convenient access to the transferred funds.

Review and Confirm: Double-check all the details to ensure accuracy, and confirm the transaction.

Track Your Transfer: Rest assured, you can monitor the progress of your transaction in real-time with our tracking feature until it reaches its destination in India.

Conclusion: When it comes to sending money from Australia to India, Instarem stands out as a fast, secure, and cost-effective solution. With competitive exchange rates, lightning-fast transactions, top-notch security, and a user-friendly process, Instarem is the ideal choice for your money transfer needs. Experience the convenience and reliability of Instarem today and send money to India with confidence.

#Instarem money transfer#Send money from Australia to India#AUD to INR exchange rates#Fast money transfer service#Secure currency exchange#Best-priced money transfers#Reliable remittance to India#Instant AUD to INR transfers#Hassle-free money transfers#Top-rated money transfer provider

0 notes

Text

Fintech bullies stole your kid’s lunch money

I'm coming to DEFCON! On Aug 9, I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On Aug 10, I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Three companies control the market for school lunch payments. They take as much as 60 cents out of every dollar poor kids' parents put into the system to the tune of $100m/year. They're literally stealing poor kids' lunch money.

In its latest report, the Consumer Finance Protection Bureau describes this scam in eye-watering, blood-boiling detail:

https://files.consumerfinance.gov/f/documents/cfpb_costs-of-electronic-payment-in-k-12-schools-issue-spotlight_2024-07.pdf

The report samples 16.7m K-12 students in 25k schools. It finds that schools are racing to go cashless, with 87% contracting with payment processors to handle cafeteria transactions. Three processors dominate the sector: Myschoolbucks, Schoolcafé, and Linq Connect.

These aren't credit card processors (most students don't have credit cards). Instead, they let kids set up an account, like a prison commissary account, that their families load up with cash. And, as with prison commissary accounts, every time a loved one adds cash to the account, the processor takes a giant whack out of them with junk fees:

https://pluralistic.net/2024/02/14/minnesota-nice/#shitty-technology-adoption-curve

If you're the parent of a kid who is eligible for a reduced-price lunch (that is, if you are poor), then about 60% of the money you put into your kid's account is gobbled up by these payment processors in service charges.

It's expensive to be poor, and this is no exception. If your kid doesn't qualify for the lunch subsidy, you're only paying about 8% in service charges (which is still triple the rate charged by credit card companies for payment processing).

The disparity is down to how these charges are calculated. The payment processors charge a flat fee for every top-up, and poor families can't afford to minimize these fees by making a single payment at the start of the year or semester. Instead, they pay small sums every payday, meaning they pay the fee twice per month (or even more frequently).

Not only is the sector concentrated into three companies, neither school districts nor parents have any meaningful way to shop around. For school districts, payment processing is usually bundled in with other school services, like student data management and HR data handling. For parents, there's no way to choose a different payment processor – you have to go with the one the school district has chosen.

This is all illegal. The USDA – which provides and regulates – the reduced cost lunch program, bans schools from charging fees to receive its meals. Under USDA regs, schools must allow kids to pay cash, or to top up their accounts with cash at the school, without any fees. The USDA has repeatedly (2014, 2017) published these rules.

Despite this, many schools refuse to handle cash, citing safety and security, and even when schools do accept cash or checks, they often fail to advertise this fact.

The USDA also requires schools to publish the fees charged by processors, but most of the districts in the study violate this requirement. Where schools do publish fees, we see a per-transaction charge of up to $3.25 for an ACH transfer that costs $0.26-0.50, or 4.58% for a debit/credit-card transaction that costs 1.5%. On top of this, many payment processors charge a one-time fee to enroll a student in the program and "convenience fees" to transfer funds between siblings' accounts. They also set maximum fees that make it hard to avoid paying multiple charges through the year.

These are classic junk fees. As Matt Stoller puts it: "'Convenience fees' that aren't convenient and 'service fees' without any service." Another way in which these fit the definition of junk fees: they are calculated at the end of the transaction, and not advertised up front.

Like all junk fee companies, school payment processors make it extremely hard to cancel an automatic recurring payment, and have innumerable hurdles to getting a refund, which takes an age to arrive.

Now, there are many agencies that could have compiled this report (the USDA, for one), and it could just as easily have come from an academic or a journalist. But it didn't – it came from the CFPB, and that matters, because the CFPB has the means, motive and opportunity to do something about this.

The CFPB has emerged as a powerhouse of a regulator, doing things that materially and profoundly benefit average Americans. During the lockdowns, they were the ones who took on scumbag landlords who violated the ban on evictions:

https://pluralistic.net/2021/04/20/euthanize-rentier-enablers/#cfpb

They went after "Earned Wage Access" programs where your boss colludes with payday lenders to trap you in debt at 300% APR:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

They are forcing the banks to let you move your account (along with all your payment history, stored payees, automatic payments, etc) with one click – and they're standing up a site that will analyze your account data and tell you which bank will give you the best deal:

https://pluralistic.net/2023/10/21/let-my-dollars-go/#personal-financial-data-rights

They're going after "buy now, pay later" companies that flout borrower protection rules, making a rogues' gallery of repeat corporate criminals, banning fine-print gotcha clauses, and they're doing it all in the wake of a 7-2 Supreme Court decision that affirmed their power to do so:

https://pluralistic.net/2024/06/10/getting-things-done/#deliverism

The CFPB can – and will – do something to protect America's poorest parents from having $100m of their kids' lunch money stolen by three giant fintech companies. But whether they'll continue to do so under a Kamala Harris administration is an open question. While Harris has repeatedly talked up the ways that Biden's CFPB, the DOJ Antitrust Division, and FTC have gone after corporate abuses, some of her largest donors are demanding that her administration fire the heads of these agencies and crush their agenda:

https://prospect.org/power/2024-07-26-corporate-wishcasting-attack-lina-khan/

Tens of millions of dollars have been donated to Harris' campaign and PACs that support her by billionaires like Reid Hoffman, who says that FTC Chair Lina Khan is "waging war on American business":

https://prospect.org/power/2024-07-26-corporate-wishcasting-attack-lina-khan/

Some of the richest Democrat donors told the Financial Times that their donations were contingent on Harris firing Khan and that they'd been assured this would happen:

https://archive.is/k7tUY

This would be a disaster – for America, and for Harris's election prospects – and one hopes that Harris and her advisors know it. Writing in his "How Things Work" newsletter today, Hamilton Nolan makes the case that labor unions should publicly declare that they support the FTC, the CFPB and the DOJ's antitrust efforts:

https://www.hamiltonnolan.com/p/unions-and-antitrust-are-peanut-butter

Don’t want huge companies and their idiot billionaire bosses to run the world? Break them up, and unionize them. It’s the best program we have.

Perhaps you've heard that antitrust is anti-worker. It's true that antitrust law has been used to attack labor organizing, but that has always been in spite of the letter of the law. Indeed, the legislative history of US antitrust law is Congress repeatedly passing law after law explaining that antitrust "aims at dollars, not men":

https://pluralistic.net/2023/04/14/aiming-at-dollars/#not-men

The Democrats need to be more than The Party of Not Trump. To succeed – as a party and as a force for a future for Americans – they have to be the party that defends us – workers, parents, kids and retirees alike – from corporate predation.

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/07/26/taanstafl/#stay-hungry

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#fintech#ed-tech#finance#usury#payment processing#chokepoints#corruption#monopoly#cfpb#consumer finance protection bureau

212 notes

·

View notes

Text

Xrpclassic - Mega+

XRP Classic

Xrp Classic is an innovative token based on the Ethereum blockchain, launched in December 2022. Xrp classic contact address is 0x30c54D82564aeE6a56755F80AA4bbdF2e5093322. Xrp Classic is a hyper-inflation token with a smart exchange system in the blockchain ecosystem. So what does hyperinflation mean? When you invest in this project, your money does not melt in the face of inflation. You can follow the project's Twitter account to follow Xrp classic news and news. The main aim of the project is to make the world of crypto money easier for everyone, to develop environmentally friendly solutions, to provide fast transfers and to keep commission rates low. It is a strong Ethereum competitor. You can read the explanations and comments about the token on xrp classic reddit. Although the project is quite new, it does not give confidence yet, but over time it aims to be among the top 100 coins on the Coinmarketcap.com site. Although the Xrp classic wallet is not available for now, it is known that it will be in wallets very soon.

1K notes

·

View notes

Text

Hello Reddit transfers! Here's some scam spotting tips

Hi! I'm Key (Or Jess), and I'm here to give you some tips to spotting scams. Think of my blog as a subreddit but with several posts a day that often show a scam post or give scam information. All this info is done as a hobby so I'll give you a rundown on the basics of how pet donation scams work here. If you like my hard work, feel free to throw me pocket change or check out my Ko-Fi where I take art commissions. Or just say thanks!

If you share a popular/trending text post, you may get an ask from a blog who wants you to share their pinned pet post. They'll ask you to answer the ask privately but urge you their pet is very ill and needs aid quickly. Commonly, this pet is a cat. But on occasion it's a dog. The ask will tell you their not a bot/etc and are just a person, promise!

If you check the blog, turn timestamps on under dashboard settings. By doing so, you'll get to see the date their pinned post was made. Usually, these posts are only a few hours old or even a few days old so always take caution if you see it's a post that isn't very old. This isn't always a red flag for a scam post, but it's advised to pay attention since you'll see these kind of things often enough since the scammer barely changes up their pattern.

Scrolling the account should also show you how many posts the blog has made. Often, you'll only find roughly 100 posts that are always made within minutes of the other. These posts come from a trending tag of the day generally and are rarely tagged since their just shared all at once and then nothing else. You will usually also see the archive has been turned off since the blog is set to only dashboard view and only accessible to logged in users. This measure isn't always a sign of a scammer, as users can have real reasons for this! But it's a common tactic for scam accounts.

The post tells you the cat/dog is suffering from some medical condition and claims the op will get paid in a few weeks but they need the money before then and they promise they'll pay you back when they reach their goal. Not all users who make posts like that are scam accounts and many of them are real people who will return the help once they can. The op will also tell you to send money by friends and family because they need it quickly and don't want it held up. Usually they'll have a link that will tell you to send them funds there.

However, you may notice some things are off in the post itself. While the op asks for USD, their pay link says their in the Philippines which is not USD and would require conversion rates to apply. Not all PH-based bloggers are scammers and some are disappointed that some people are. Its sadly a well known thing here that this scammer is from there but no one knows who they really are as every name used is stolen off a private aid group. Another thing to do is check the notes and see how many reblogs are directly from the op. Usually you'll find several.

If you want to, it is suggested to ask the op if they can provide you proof they own the cat/dog if your unsure of the legitimacy of their claim. For example, ask them to write their url on a piece of paper and take a picture of it on top of the pet they supposedly own or even post a short video of them calling the pet and holding the paper in sight. Usually this results in the op likely blocking you.

It's suggested to warn anyone sharing these scam posts and reporting scam accounts under Phishing as it's usually the fastest way to deal with them on a daily basis. This scammer has been doing this for years and even brags about how they get away with it since they make hundreds of dollars doing it and ruin the reputation of the names they steal.

These scammers are also stealing content from private facebook groups and reposting them here without the owner being aware of it. The scam accounts are saving pictures and passing them off as their pet. Watermark your vet bill and pet pics in your aid posts if you want to deter scammers from stealing it for future uses. If you are in a fb group that posts vet bill help, please inform them a scammer is going around taking their posts and reusing it for fraudulent reasons. I have seen cases where some scammers even used pictures off Reddit to use for scams.

48 notes

·

View notes

Text

Fast Charging Cable: A Game-Changer in Modern Smartphone Technology

In today's fast-paced world, where we rely heavily on our smartphones for everything from communication to entertainment, having a reliable and efficient charging solution is crucial. One of the most significant advancements in this area is the fast charging cable. If you're tired of waiting hours for your phone to reach full charge, investing in a fast charging cable can make a world of difference. At Sankarani Communication, we understand the importance of staying connected, and that's why we're here to discuss everything you need to know about fast charging cables and how they can revolutionize your charging experience.

What is Fast Charging?

Before diving into the importance of fast charging cables, it’s essential to understand what fast charging means. Fast charging refers to a technology that allows devices to charge at a faster rate compared to standard charging. Most smartphones today come with fast charging support, allowing users to power up their devices much quicker.

Traditional chargers typically deliver 5 watts (W) of power, whereas fast charging can deliver anywhere from 18W to 100W, depending on the charger and device. The higher the wattage, the faster the phone charges. However, to take full advantage of fast charging, you need both a compatible phone and the right accessories, including a fast charging cable.

How Does a Fast Charging Cable Work?

A fast charging cable is designed to handle higher power outputs compared to regular cables. The cable's ability to deliver more current and voltage directly impacts the charging speed. With fast charging, the charger sends more current through the cable into the device’s battery without generating excessive heat or damaging the battery, thanks to intelligent charging technology.

Here’s a simple breakdown of how it works:

Higher Current: Fast charging cables are built with thicker wires that can carry more current (amperes), typically up to 3A or higher.

Improved Voltage Regulation: Fast charging cables allow higher voltage transfers, enabling the charger to supply more power efficiently.

Efficient Data and Power Transfer: Some fast charging cables also support high-speed data transfer, allowing you to sync files quickly while charging your device.

Why Choose a Fast Charging Cable?

Save Time Time is of the essence, especially when you're on the go. With a fast charging cable, you can charge your smartphone up to 50% in as little as 30 minutes. Whether you're traveling or preparing for an important meeting, fast charging ensures you won’t be left waiting.

Compatibility with Modern Devices Most modern smartphones, including flagship models from Apple, Samsung, and OnePlus, support fast charging. Having a compatible fast charging cable ensures you can fully utilize your phone’s potential, keeping your battery topped up when needed.

Durability and Longevity Quality fast charging cables are made from durable materials like nylon-braided or reinforced connectors, making them more resistant to wear and tear. At Sankarani Communication, we offer cables that are designed to last, providing better value for your money.

Enhanced Safety Fast charging cables come with built-in safety features like overcurrent, overvoltage, and short circuit protection. These features help prevent overheating and protect your device from potential damage during charging.

Universal Use Fast charging cables are compatible with a variety of devices beyond just smartphones. You can use them to charge tablets, laptops, and other gadgets that support fast charging, making them a versatile solution for all your charging needs.

Factors to Consider When Buying a Fast Charging Cable

When shopping for a fast charging cable at Sankarani Communication, keep the following factors in mind to ensure you get the best product:

Cable Length: Choose a length that fits your needs, whether it’s for home, office, or car use. Long cables are great for convenience, while shorter ones are ideal for portability.

Charging Speed: Ensure the cable supports the charging speed compatible with your device. Look for cables that offer up to 3A or higher for optimal fast charging performance.

Connector Type: Depending on your phone, you may need a USB-C, Lightning, or Micro-USB connector. USB-C is becoming the standard for most modern smartphones, while Lightning is specific to Apple devices.

Brand and Warranty: At Sankarani Communication, we provide high-quality, branded fast charging cables with warranty options for peace of mind.

Conclusion

A fast charging cable is more than just an accessory; it’s a necessity in today’s world where staying connected is vital. Whether you're looking to reduce charging times, enhance your smartphone's performance, or protect your device, a fast charging cable from Sankarani Communication is the solution you need. By investing in a reliable and durable fast charging cable, you'll experience the convenience of faster charging times, enhanced safety features, and long-lasting performance.

At Sankarani Communication, we offer a wide range of fast charging cables tailored to meet your specific needs. Visit our store today to explore our collection and give your smartphone the power boost it deserves!

1 note

·

View note

Text

Taxi Haarlem by Taxi Bos: Your Ultimate Guide to Reliable and Efficient Taxi Services

When it comes to taxi services in Haarlem, Taxi Bos stands out as a premier choice for both residents and visitors. We take pride in providing top-notch, reliable, and efficient transportation solutions tailored to meet the diverse needs of our customers. With an unwavering commitment to excellence, Taxi Haarlem has established itself as a trusted name in the industry, offering a wide range of services designed to ensure a seamless and comfortable travel experience.

Why Choose Taxi Bos in Haarlem?

Unmatched Reliability and Punctuality

At Taxi Bos, we understand the importance of time and reliability. Our fleet of well-maintained vehicles and professional drivers ensures that you reach your destination promptly and safely. Whether you need a ride to the airport, a business meeting, or a night out in the city, you can count on Taxi Bos to be there on time, every time. Our advanced booking system allows you to schedule your ride in advance, giving you peace of mind and eliminating any last-minute hassles.

Experienced and Professional Drivers

Our team of experienced drivers is the backbone of our service. Each driver is carefully selected, thoroughly vetted, and trained to provide the highest level of customer service. With an in-depth knowledge of Haarlem and its surroundings, our drivers ensure that you take the most efficient routes, avoiding traffic and delays. They are not only skilled behind the wheel but also courteous and helpful, making your journey pleasant and stress-free.

Comfortable and Well-Maintained Vehicles

Comfort is a top priority at Taxi Bos. Our fleet comprises a variety of vehicles to suit different needs and preferences. From luxury sedans to spacious minivans, we have the perfect ride for every occasion. All our vehicles are regularly serviced and equipped with modern amenities to ensure a comfortable and enjoyable ride. Cleanliness and safety are paramount, and we adhere to the highest standards of maintenance and hygiene.

Competitive Pricing and Transparent Fare Structure

We believe in providing value for money. Taxi Bos offers competitive pricing without compromising on quality. Our transparent fare structure ensures that you know exactly what you are paying for, with no hidden charges or surprises. Whether you are booking a short trip within the city or a long-distance journey, you can expect fair and reasonable rates. Our commitment to affordability makes us a preferred choice for many customers in Haarlem.

Wide Range of Services

Airport Transfers

Traveling to and from the airport can be stressful, but with Taxi Bos, it doesn’t have to be. We offer reliable airport transfer services, ensuring you arrive at the airport with plenty of time to spare. Our drivers monitor flight schedules to accommodate any changes, providing a hassle-free experience. Whether you are catching a flight or coming home, you can rely on us for a smooth and timely transfer.

Corporate and Business Travel

For corporate clients, Taxi Bos offers tailored transportation solutions to meet the demands of business travel. We provide a professional and discreet service, ensuring that you and your colleagues arrive at meetings and events on time and in style. Our executive vehicles are equipped with all the amenities you need to stay productive on the go. Trust us to handle your business transportation needs with utmost professionalism.

Event and Special Occasion Transportation

Make your special occasions even more memorable with Taxi Bos. We offer transportation services for weddings, parties, and other events, ensuring that your guests arrive safely and comfortably. Our team works closely with event planners to provide customized transportation solutions that meet the unique requirements of your event. Let us take care of the logistics so you can focus on enjoying your special day.

City Tours and Sightseeing

Discover the beauty and charm of Haarlem with our city tour services. Our knowledgeable drivers act as your local guides, taking you to the best attractions and hidden gems in the city. Whether you are a tourist or a local looking to explore new places, our sightseeing tours offer a convenient and enjoyable way to experience Haarlem. Sit back, relax, and let us show you the highlights of this historic city.

Commitment to Customer Satisfaction

24/7 Availability and Support

Taxi Bos is available around the clock to meet your transportation needs. Whether you need a ride early in the morning or late at night, you can count on us to be there. Our customer support team is always ready to assist you with any inquiries or special requests. We value your feedback and strive to continuously improve our services to meet and exceed your expectations.

Safety and Security

Your safety is our top priority. All our drivers undergo rigorous background checks and training to ensure they meet our high standards of safety and professionalism. Our vehicles are equipped with the latest safety features, and we adhere to strict safety protocols to provide a secure travel experience. Travel with peace of mind knowing that you are in safe hands with Taxi Bos.

Sustainable Practices

At Taxi Bos, we are committed to environmental sustainability. We continually seek ways to reduce our carbon footprint and promote eco-friendly practices. Our fleet includes hybrid and electric vehicles, and we implement fuel-efficient driving techniques to minimize emissions. By choosing Taxi Bos, you are supporting a greener future for our community.

How to Book a Taxi with Taxi Bos

Booking a taxi with Taxi Bos is quick and easy. You can book online through our user-friendly website or mobile app, or you can call our 24/7 customer service hotline. Provide your pickup location, destination, and preferred time, and we will take care of the rest. Enjoy the convenience of cashless payments and real-time tracking of your ride. With Taxi Bos, you are just a few clicks away from a reliable and comfortable ride.

Conclusion

Taxi Bos is your trusted partner for all your transportation needs in Haarlem. With our commitment to reliability, professionalism, and customer satisfaction, we have earned a reputation as the go-to taxi service in the area. Experience the difference with Taxi Bos and enjoy a seamless and enjoyable travel experience.

2 notes

·

View notes

Text

Making Financial Transactions Effortless and Smart

From seeking quick loans to making international money transfers or even paying utility bills, these transactions have become an integral part of our routine. But what if there was a way to simplify these processes, making them not just effortless but also smart? Enter Muthoot FinCorp ONE, an all-in-one digital financial platform designed to revolutionize the way you handle your finances.

The Convenience You Deserve

At Muthoot FinCorp ONE, convenience isn’t just a promise; it's a commitment we live by. Muthoot FinCorp ONE gives you the ability to secure a Gold Loan swiftly, without any hassle, and from anywhere you prefer, be it the comfort of your home or at any of our 3600+ branches across India. With our quick doorstep service, you can have your Gold Loan sanctioned in as little as 30 minutes*. Plus, we offer competitive interest rates as low as 0.83%* per month and, as a cherry on top, a zero* processing fee. You can avail the Gold Loan at offered gold rates up to ₹4200/gm, making it a lucrative and hassle-free option for your financial needs.

Digital Gold and Beyond

We understand the importance of diversifying your portfolio, which is why we offer the opportunity to invest in Digital Gold. With an entry point as low as Re. 1, you can start your journey into gold investment, secured at 99.99% purity, and trade it at market prices, all stored safely and securely.

NCDs for a Secure Investment Future

For those seeking stability and high returns, our Non-Convertible Debentures (NCDs) present an excellent opportunity to build a robust investment portfolio. Starting with just Rs. 10,000, enjoy returns of up to 9.43%* with fast-tracked investments, high-yield, low-risk opportunities, and flexible tenure durations to suit your needs.

Simplified Forex Transactions

Navigating the complexities of foreign exchange transactions can be daunting, but not with Muthoot FinCorp ONE. Enjoy secure and reliable forex services with competitive exchange rates and guaranteed 24-hour* transfers. We also provide a buy-back guarantee, ensuring your peace of mind throughout the process.

Seamlessly Handle Payments and Recharges

From bill payments to recharges, Muthoot FinCorp ONE simplifies it all. Recharge your DTH or prepaid mobile, pay electricity, internet, or LPG gas cylinder bills instantly, or manage your financial services and taxes hassle-free—all with a few taps on our app. Moreover, pay your rent or vendors effortlessly, making the entire process quick, secure, and available 24x7.

Our commitment to making your financial life easier continues with the Muthoot FinCorp ONE app. It’s your gateway to effortless Gold Loans, Digital Gold investments, Forex transactions, and more, available whenever and wherever you need it. Expect regular updates, enhanced services, and an unwavering dedication to simplifying your financial journey.

Muthoot FinCorp ONE is not just about transactions; it's about transforming the way you interact with your finances. Experience ease, convenience, and reliability—all in one place.

At Muthoot FinCorp ONE, we're not just simplifying financial transactions; we are empowering you to make smarter choices, effortlessly. Join us and witness a new era of financial convenience and intelligence.

About Muthoot FinCorp ONE

Muthoot FinCorp ONE is an all-in-one digital financial platform that makes getting an MSME & a Gold Loan, investing in Digital gold & NCDs, making payments & remittances, buying insurance & exchanging forex, simple and convenient.

As an SBU of Muthoot FinCorp Limited, Muthoot FinCorp ONE is backed by a legacy stretching back over 135 years, and the trust of more than 1 crore customers and is building a holistic financial ecosystem using the latest digital products for lending, investing, protection and payments.

Muthoot FinCorp ONE continues to uphold the values of the parent, the Muthoot Pappachan Group (Muthoot Blue) by providing its customers with easily accessible services, replete with unmistakable quality. The Muthoot Pappachan Group is among India’s most reputed names in the financial services industry, with customers in diverse segments like Automotive industry, Financial Services, Hospitality, Alternate Energy, Real Estate, and Precious Metals.

So what are you waiting for? Head to the Play Store and download the Muthoot FinCorp ONE app. You can also visit the website today to know more.

Alternatively, you can also follow us on Facebook, Instagram, Twitter or LinkedIn to stay tuned to our latest offerings.

Chat on Whatsapp | Branch Locator | Email us - [email protected] | Download App

2 notes

·

View notes

Text

About LYOPAY

Are you a crypto-enthusiast searching for a reliable medium to store, exchange, and trade cryptocurrencies? LYOPAY App is the solution you've been looking for! It seamlessly connects fiat and cryptocurrencies, providing a platform to meet all your crypto needs. LYOPAY is more than just an app; it's a comprehensive ecosystem of crypto services empowering individuals to integrate cryptocurrencies into their daily lives. From basic payment services to advanced features, LYOPAY has you covered. One notable feature is the IBAN Account EUR, enabling easy fund transfers via wire transfer. Experience the convenience of fast SEPA withdrawals, ensuring quick access to your funds. LYOPAY App offers a versatile Crypto Wallet for protectively storing various cryptocurrencies and tokens like BTC, ETH, and USDT. Seamlessly transact with other wallets and exchanges using LYO Credit. The Crypto Exchange feature enables immediate cryptocurrency trading at the best market prices. With the ability to trade with Euro, converting between fiat and cryptocurrencies is effortless. Benefit from LYOPAY's SEPA feature, facilitating Euro transfers to external banks within 24-48 hours. Enjoy hassle-free money transfers using your unique IBAN. For instant currency exchanges, Turbo Swap is the perfect solution. Take advantage of low fees on over 100 exchange rates, making possible quick and affordable conversions between traditional and cryptocurrencies. LYOPAY prioritizes compliance and operates in accordance with regulations, ensuring transparent transactions and safeguarding your funds and personal information. Customer support is a top priority, with an in-app chat feature for prompt assistance. Discover LYOPAY App, the convenient platform for all your cryptocurrency needs, at the LYOPAY Website - https://lyopay.com/

2 notes

·

View notes

Text

Best Top 10 Cryptocurrency to Invest 2023

March 1, 2023 by Adil Ali

Ethereum is a revolutionary cryptocurrency that’s snappily gaining traction in the global request. Its smart contracts, dApps, interoperability, and brisk sale pets make it a seductive option for businesses and inventors likewise. As further people borrow Ethereum and its DeFi capabilities, the eventuality for the platform to transfigure the way we do deals and contracts continues to grow. also, updates similar to EIP- 1559 on the horizon pledge to make Ethereum indeed more important. With such a promising future, Ethereum looks to be a decreasingly feasible platform for digital deals.

1. Bitcoin (BTC)

Market Cap: $458 billion

Bitcoin is the first and most popular cryptocurrency, created in 2009 by an unknown person or group using the alias Satoshi Nakamoto. It operates on a decentralized tally called blockchain, which allows for secure, transparent, and tamper-resistant deals. Bitcoin is known for its high volatility and is frequently considered a store of value or digital gold.

2. Ethereum (ETH)

Market Cap: $216 billion

Ethereum is the alternate-largest cryptocurrency by request capitalization and was created in 2015 by Vitalik Buterin. Unlike Bitcoin, Ethereum is further than just a digital currency; it’s a decentralized platform that enables inventors to make and emplace decentralized operations( dApps) on its blockchain. The platform’s native currency is Ether( ETH), which is used to pay-for-sale freights and computational services on the Ethereum network.

3. Tether (USDT)

Market Cap: $66 billion

Tether is a stablecoin that was created to be pegged to the US bone at an 11 rate. It was launched in 2014 by Tether Limited and is used as a means of transferring finances between exchanges and trading cryptocurrency without having to convert back to edict currency. Tether is controversial, with some critics claiming that it isn’t completely backed by US bones

4. USD Coin (USDC)

Market Cap: $54 billion

USD Coin, established by the financial technology corporation Circle and the cryptocurrency exchange Coinbase, is a stable coin tied to the American dollar. It’s backing of USD and routine audit protocols guarantee the stability and clarity of its operation.

5. Binance Coin (BNB)

Market Cap: $52 billion

Established in 2017, Binance Coin is the crypto asset associated with the renowned Binance Exchange, one of the largest crypto trading platforms globally. This digital asset is utilized to pay for trade fees on the Binance Exchange, as well as to access reduced commission fees on the same exchange.

6. Ripple (XRP)

Market Cap: $18 billion

In 2012, Ripple Labs initiated the cryptocurrency known as Ripple. This global payment system enables instantaneous and dependable cross-border payments with the utilization of its blockchain technology. Financial institutions and payment providers can benefit from Ripple’s services.

7. Cardano (ADA)

Market Cap: $18 billion

Input Output Hong Kong (IOHK), a blockchain research and development company, created Cardano, a decentralized platform, in 2017. With a vision of tackling the scalability and security issues that have affected preceding blockchain networks, Cardano is a third-generation blockchain. The native currency of the platform, ADA, is employed to pay transaction fees and to involve oneself in the governance of the Cardano network. Save to documented

8. Binance USD (BUSD)

Market Cap: $18 billion

Binance USD, a fiat-pegged stablecoin developed by the renowned crypto exchange Binance, is constantly monitored to guarantee transparency and maintain full US dollar support. Its main purpose is to allow seamless transfers and trading of digital assets without the need for reverting to conventional money.

9. Solana (SOL)

Market Cap: $15 billion

Solana was founded in 2017 by Solana Labs, to create a blockchain platform with speedy transactions and minimal costs for decentralized applications. As a result, SOL is the cryptocurrency native to this platform, utilized for transaction fees and to join in the administration of the Solana network.

10. Polkadot (DOT)

Market Cap: $10 billion

The Web3 Foundation designed the Polkadot platform in 2016 to bring together different blockchains and allow for seamless interconnectivity. To guarantee high performance and scalability, Polkadot uses a specialized technique called sharding. The native currency of the network is DOT, which is utilized to pay for transaction costs and grant holders a say in Polkadot’s governance.

Conclusion:

Ultimately, while these crypto assets vary in attributes and functions, they all share the objective of furnishing a distributed and safe system of exchanging value. As the industry of cryptocurrency persists to advance, we can assume to witness more breakthroughs and novel applications emerge, generating a thrilling period for both financiers and consumers. It is crucial to complete comprehensive research and recognize the risks linked with investing in any cryptocurrency.

8 notes

·

View notes

Text

Private equity finally delivered Sarah Palin's death panels

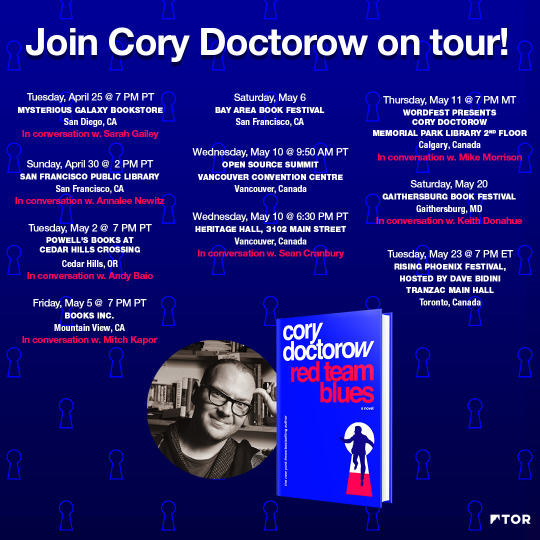

Tonight (Apr 26), I’ll be in Burbank, signing Red Team Blues at Dark Delicacies at 6PM.

Remember “death panels”? Sarah Palin promised us that universal healthcare was a prelude to a Stalinist nightmare in which unaccountable bureaucrats decided who lived or died based on a cost-benefit analysis of what it would cost to keep you alive versus how much your life was worth.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/04/26/death-panels/#what-the-heck-is-going-on-with-CMS

Palin was right that any kind of healthcare rationing runs the risk of this kind of calculus, where we weight spending $10,000 to extend a young, healthy person’s life by 40 years against $1,000 to extend an elderly, disabled person’s life by a mere two years.

It’s a ghastly, nightmarish prospect — as anyone who uses the private healthcare system knows very well. More than 27m Americans have no health insurance, and millions more have been tricked into buying scam “cost-sharing” systems run by evangelical grifters:

https://www.nytimes.com/2020/01/02/health/christian-health-care-insurance.html

But for the millions of Americans with insurance, death panels are an everyday occurrence, or at least a lurking concern. Anyone who pays attention knows that insurers have entire departments designed to mass-reject legitimate claims and stall patients who demand that the insurer lives up to its claim:

https://kffhealthnews.org/news/article/khn-podcast-an-arm-and-a-leg-how-to-shop-for-health-insurance-november-24-2021/

The private healthcare sector is designed to deny care. Its first duty is to its shareholders, not its patients, and every dollar spent on care is a dollar not available for dividends. The ideal insurance customer pays their premiums without complaint, and then pays cash for all their care on top of it.

All that was true even before private equity started buying up and merging whole swathes of the US healthcare system (or “healthcare” “system”). The PE playbook — slash wages, sell off physical plant, slash wages, reduce quality and raise prices — works in part because of its scale. These aren’t the usual economies of scale. Rather the PE strategy is to buy and merge all the similar businesses in a region, so customers, suppliers and workers have nowhere else to turn.

That’s bad enough when it’s aimed at funeral homes, pet groomers or any of the other sectors that have been bigfooted by PE:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

But it’s especially grave when applied to hospitals:

https://pluralistic.net/2020/05/21/profitable-butchers/#looted

Or emergency room physicians:

https://pluralistic.net/2022/03/14/unhealthy-finances/#steins-law

And if you think that’s a capitalist hellscape nightmare, just imagine how PE deals with dying, elderly people. Yes, PE has transformed the hospice industry, and it’s even worse than you imagine.

Yesterday, the Center for Economic and Policy Research published “Preying on the Dying: Private Equity Gets Rich in Hospice Care,” written by some of the nation’s most valiant PE slayers: Eileen Appelbaum, Rosemary Batt and Emma Curchin:

https://cepr.net/report/preying-on-the-dying-private-equity-gets-rich-in-hospice-care/

Medicare pays private hospices $203-$1,462 per day to take care of dying old people — seniors that a doctor has certified to have less than six months left. That comes to $22.4b/year in public transfers to private hospices. If hospices that $1,462 day-rate, they have lots of duties, like providing eight hours’ worth of home care. But if the hospice is content to take the $203/day rate, they are not required to do anything. Literally. It’s just free money for whatever the operator feels like doing for a dying elderly person, including doing nothing at all.

As Appelbaum told Maureen Tkacik for her excellent writeup in The American Prospect: “Why anybody commits fraud is a mystery to me, because you can make so much money playing within the guidelines the way the payment scheme operates.”

https://prospect.org/health/2023-04-26-born-to-die-hospice-care/

In California, it’s very, very easy to set up a hospice. Pay $3,000, fill in some paperwork (or don’t — no one checks it, ever), and you’re ready to start caring for beloved parents, grandparents, sisters, brothers, aunts and uncles as they depart this world. You do get a site inspection, but don’t worry — you aren’t required to bring your site up to code until after you’re licensed, and again, they never check — not even if there are multiple complaints. After all, no one at the Centers for Medicare & Medicaid Services (CMS) has the job of tracking complaints.

This is absolute catnip for private equity — free government money, no obligations, no enforcement, and the people you harm are literally dying and can’t complain. What’s not to like? No wonder PE companies have spent billions “rolling up” hospices across the country. There are 591 hospices in Van Nuys, CA alone — but at least 30 of them share a single medical director:

https://auditor.ca.gov/reports/2021-123/index.html#pg34A

Medicare caps per-patient dispersals at $32,000, which presents an interesting commercial question for remorseless, paperclip-maximizing, grandparent-devouring private equity ghouls: do you take in sick patients (who cost more, but die sooner) or healthy patients (cost less, potentially live longer)?

In Van Nuys, the strategy is to bring in healthy patients and do nothing. 51% of Van Nuys hospice patients are “live discharged” — that is, they don’t die. This figure — triple the national average — is “a reliable sign of fraud.”

There are so many hospice scams and most of them are so stupid that it takes a monumental failure of oversight not to catch and prevent them. Here’s a goodun: hospices bribe doctors to “admit” patients to a hospice without their knowledge. The hospice bills for the patient, but otherwise has no contact with them. This can go on for a long time, until the patient tries to visit the doctor and discovers that their Medicare has been canceled (you lose your Medicare once you go into hospice).

Another scam: offer patients the loosest narcotics policy in town, promising all the opioids they want. Then, once their benefits expire, let them die of an overdose (don’t worry, people who die in hospice don’t get autopsies):

https://www.newyorker.com/magazine/2022/12/05/how-hospice-became-a-for-profit-hustle

You can hire con artists to serve as your sales-force, and have them talk vulnerable, elderly people into enrolling in hospice care by convincing them they have nothing to live for and should just die already and not burden their loved ones any longer.

Hospitals and hospices also collude: hospitals can revive dying patients, ignoring their Do Not Resuscitate orders, so they can be transfered to a hospice and die there, saving the hospital from adding another dead patient to their stats.CMS’s solution is perverse: they’re working with Humana to expand Medicare Advantage (a scam that convinces patients to give up Medicare and enrol in a private insurance program, whose private-sector death panel rejects 13% of claims that Medicare would have paid for). The program will pay private companies $32,000 for every patient who agrees to cease care and die. As our friends on the right like to say, “incentives matter.”

Appelbaum and co have a better idea:

Do more enforcement: increase inspections and audits.

Block mergers and rollups of hospices that make them too big to fail and too big to jail.

Close existing loopholes.

They should know. Appelbaum and her co-authors write the best, most incisive analysis of private equity around. For more of their work, check out their proposal for ending pension-plan ripoffs by Wall Street firms:

https://pluralistic.net/2022/05/05/mego/#A09948

Catch me on tour with Red Team Blues in Burbank, Mountain View, Berkeley, San Francisco, Portland, Vancouver, Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

[Image ID: An industrial meat grinder, fed by a conveyor belt. A dead, elderly man is traveling up the conveyor, headed for the grinder's intake. The grinder is labelled 'HOSPICE' in drippy Hallowe'en lettering. It sits in a spreading pool of blood.]

Image: Seydelmann (modified) https://commons.wikimedia.org/wiki/File:GW300_1.jpghttps://commons.wikimedia.org/wiki/File:GW300_1.jpg

CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

#pluralistic#cepr#medicare advantage#medicare#hospice#aca#aging#death panels#fraud#california#preying on the dying

141 notes

·

View notes

Text

High Yield Savings Account: Maximizing Returns While Safeguarding Your Savings

From the realm of individual finances, the quest for higher returns often comes along with increased threats. Even so, for risk-averse people trying to find a safe yet satisfying choice, the High Produce Savings Account emerges being an attractive option. An Increased Yield Savings Account supplies the excellent balance between growing your cash and preserving its basic safety. On this page, we are going to explore exactly what a Higher Produce Bank Account is, its pros, and tips on how to make the most of this investment automobile to accomplish your financial objectives.

Understanding High Yield Savings Account:

A High Deliver Bank Account is a form of bank account provided by banks and credit unions. What packages it besides a traditional bank account is the significantly higher monthly interest it gives. When standard cost savings balances may offer nominal earnings, Great Produce Financial savings Profiles try to outpace rising prices and supply a lot more significant revenue on the settled funds.

Advantages of High Yield Savings Account:

Competitive Interest Rates: The key good thing about a very high Generate Bank Account will be the increased rate of interest. These balances typically offer costs well on top of the countrywide average, leading them to be an attractive selection for those seeking greater earnings on their price savings.

Safety and Security: Great Deliver Financial savings Balances are usually reinforced with the Federal government Deposit Insurance plan Company (FDIC) in the United States or comparable downpayment insurance coverage plans in other nations. This means that your deposited money is insured up to a particular restriction (usually $250,000 per depositor), ensuring the security of your funds even in the event of a lender failure.

Liquidity: Substantial Deliver Financial savings Profiles provide you with the versatility of quick access to your funds. Unlike some long-term investments, you may pull away cash from the bank account whenever you need it without incurring penalties.

No Investment Risk: Contrary to shares or joint money, which can be susceptible to industry variances, an increased Yield Bank Account offers a stable comeback without disclosing your price savings to investment risk.

No Lock-In Period: As opposed to certificates of deposit (CDs), which require that you secure your cash set for a particular word, Great Produce Cost savings Accounts have zero secure-in time. This means you can access your resources whenever essential without restrictions.

Making the Most of Your High Yield Savings Account:

To maximize the benefits of a High Yield Savings Account, consider the following strategies:

Research and Compare Rates: Different banking institutions offer diverse rates on Substantial Deliver Savings Accounts. Make time to research and compare prices to get the best deal for your cost savings.

Automate Regular Contributions: Set up automated transfers from your principal bank checking account in your Higher Yield Savings Account. Automating efforts allows you to conserve consistently and builds your savings more quickly.

Leverage Compound Interest: Substantial Deliver Savings Credit accounts typically ingredient attention, which suggests your attention earns attention as time passes. The greater number of you leave your money from the profile, the quicker it is going to develop.

Use It for Emergency Fund: Higher Generate Savings Credit accounts are fantastic for positioning your urgent fund. These balances supply both safety and liquidity, making certain your money is plentiful when unanticipated costs come up.

Monitor and Adjust: Keep close track of the interest rates and also the performance of your own Substantial Generate Bank Account. If you locate much more competing charges in other places, think about relocating your resources to a greater-paying profile.

Conclusion: A Very High Generate Bank Account is a wonderful choice for people seeking to boost their price savings while keeping safety and liquidity. It's very competitive rates, basic safety through FDIC insurance coverage, and suppleness transform it into a valuable accessory for your fiscal toolkit. By investigating charges, automating contributions, leveraging ingredient fascination, and taking advantage of it as an emergency account, you can get the most from your Great Generate Bank Account and get your monetary goals with confidence and ease. Remember, while Higher Yield Financial savings Profiles offer greater profits than normal financial savings profiles, they are certainly not intended for long-term prosperity-building or great-risk purchase aims. Instead, they give a solid foundation for preserving your savings and making constant, risk-totally free returns.

Find More Information: High Yield Savings Account

youtube

2 notes

·

View notes

Text

PHEMEX Exchange

Founded by former executives of Morgan Stanley in 2019, Phemex stands as a leading cryptocurrency futures exchange, facilitating the trading of diverse digital assets such as Bitcoin, Ethereum, Solana, Avalanche, Shiba Inu, and over 250 others. With a commitment to serving both professional and retail traders, Phemex offers an intuitive interface, competitive fees, tight spreads, and lightning-fast execution speeds.

Unleash the power of Phemex, the visionary platform that empowers traders worldwide. Trade a vast array of digital assets, including renowned cryptocurrencies like Bitcoin, Ethereum, and Ripple. Phemex caters to both spot and margin trading, ensuring that even the most seasoned traders have access to advanced tools and features. Experience the advantage of Phemex’s minimal fees, enabling you to maximize your profits. Available in over 180 countries, Phemex welcomes traders from around the globe to embark on an exciting journey towards financial success.

PHEMEX: Secure and Reliable?

Phemex assures safety as a regulated cryptocurrency exchange, duly registered with the US Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). This regulatory oversight mandates stringent financial compliance, including robust anti-money laundering (AML) and countering-the-financing-of-terrorism (CFT) measures.

Rest easy knowing that Phemex provides a secure haven for buying, selling, and trading digital assets. As a testament to its credibility, the platform boasts support from industry giants like Galaxy Digital and BitMEX, cementing its position as a trusted choice in the cryptocurrency landscape. Embrace the peace of mind that comes with Phemex’s commitment to safety and the backing of renowned investors.

PHEMEX Trading Fees

Phemex stands out as the most cost-effective exchange globally, offering an unprecedented 0.025% rebate on market maker orders. Here’s how it works: when you place a limit order on Phemex and it successfully matches with another trade, Phemex will reward you with a 0.025% rebate.

Moreover, for standard market orders, Phemex imposes a mere 0.075% taker fee per trade. Take advantage of these exceptional rates and maximize your trading potential on Phemex, the ultimate destination for affordable cryptocurrency transactions. Unleash the power of low fees and embrace a rewarding trading experience with Phemex.

PHEMEX KYC Verification

Currently, Phemex sets itself apart by not mandating KYC verification for trading on their platform. This unique feature allows users to swiftly engage in cryptocurrency trading without the hassle of submitting identity verification documents. Phemex stands out as one of the few derivatives exchanges that still provide this convenience.

However, for traders dealing with substantial sums exceeding $100,000 USD, the completion of Phemex Premium membership verification becomes necessary to facilitate seamless transfers to and from their bank accounts. This added verification step ensures smooth transactions and meets the needs of large-scale traders.

Join Phemex, where trading freedom and convenience converge. Enjoy the ease of trading cryptocurrencies without the burden of KYC verification. Explore the possibilities, and if you’re a high-volume trader, unlock the full potential of Phemex by undergoing Premium membership verification. Experience a platform that caters to both small-scale and large-scale traders with efficiency and flexibility.

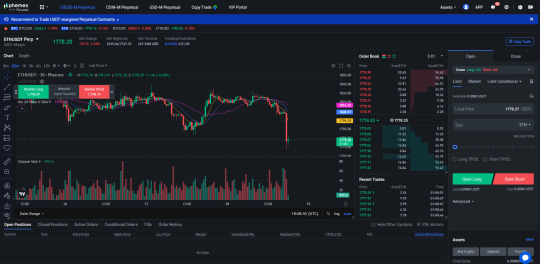

Futures and Derivatives Trading on PHEMEX

Trading ETH/USD derivatives on Phemex Futures.

Available Cryptocurrencies on PHEMEX

Phemex presents an extensive selection of top cryptocurrencies, akin to those found on renowned exchanges such as Binance or FTX. With a diverse range of over 200 digital assets, Phemex keeps pace with the ever-evolving market by promptly listing trending coins like ApeCoin (APE) or Decentraland (MANA). Discover the thrill of trading with an array of exciting options on Phemex’s platform, where opportunities abound and innovation thrives. Unleash your trading potential and explore the world of cryptocurrencies with Phemex.

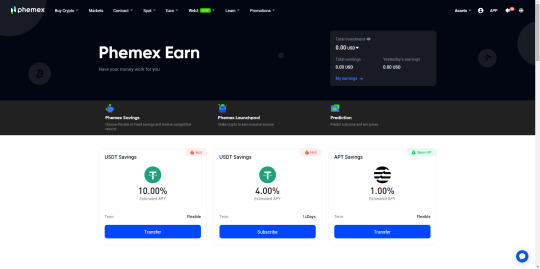

PHEMEX Earn

PHEMEX Conclusion

Discover the thriving world of Phemex, a user-friendly cryptocurrency exchange that is rapidly gaining momentum. With an impressive array of over 250 assets available for spot and futures trading, Phemex eliminates the hassle of KYC verification. Embrace the allure of low fees, abundant liquidity, and a platform tailored for both seasoned traders and beginners alike. Rest assured, Phemex prioritizes your safety, being registered with the CFTC and SEC. Unlock the potential of passive income through Phemex Earn, where staking opens doors to enticing opportunities. Join now through the provided link and seize the exclusive $180 Crypto Bonus. Don’t let this exhilarating journey pass you by.

2 notes

·

View notes

Text

Luxury well furnished Service Apartments Delhi

Service apartments provide the perfect accommodations for those who are looking to experience a luxurious living experience. These types of apartments typically come fully furnished, offering beautiful and well-appointed furniture that adds a touch of sophistication and style to any space.

Luxury well furnished apartments

Furniture is one of the most important aspects of interior design, as it sets the overall mood and tone for a room. Well-furnished apartments often include high quality pieces such as comfortable sofas, armchairs, coffee tables, sideboards, and bedding. These pieces help to create an inviting atmosphere that is both aesthetically pleasing and comfortable. Additionally, Service Apartments Delhi may feature artwork or other decorative items such as lamps or rugs that further enhance their overall look and feel.

When selecting furniture for your service apartment, it’s important to take into account how much you space have available in each room. The size of the pieces should match the size of the room in order to ensure it does not appear cluttered or overcrowded. It’s also important to consider which materials are best suited for your lifestyle – wood furniture may be more durable but leather sofas may be easier to maintain over time.

Top-notch amenities at worthy rates

When it comes to luxury living, Service Apartments Gurgaon provides the perfect balance between affordability and comfort. Many of these serviced apartments offer amenities that rival those of five-star hotels, such as well-appointed bedrooms, spacious living areas, modern kitchens and luxurious bathrooms. But what makes them truly special is that they also provide best facilities and amenities at much more affordable rates than a hotel stay.

For instance, serviced apartments feature state-of-the-art gyms with the latest exercise equipment and access to onsite swimming pools. They have concierge services or even a 24/7 reception desk that can help you with any queries during your stay. Other common features include private terraces for al fresco dining, games rooms, lounges with satellite TV, high speed internet access and even complimentary breakfast included in the price of your stay. With all these facilities available at an affordable rate, staying in a service apartment can make luxury living within reach for everyone.

In terms of location as well, Service Apartments Noida are often situated in prime areas with easy access to public transport links and local attractions. This means you will be able to explore the city without having to worry about transportation costs or time constraints. Furthermore, many service apartments also offer special discounts if you book longer stays or multiple nights – so you get great value for money when booking your accommodation!

https://lh6.googleusercontent.com/0nGfDAtcD1LCGo4RK_VdZTo1r2TItkuI7Dgu1Fm6OqhxsDM0N24Pqr_zbmxQJq_AimG9diG_mMpmCHjvQAopt7TKvb-T2wizhq2yJA1oktJz02MTXa7sykXI9IzPyEl7rg=w1280

Conclusion

Serviced apartment providers also have additional services such as car rentals and airport transfers available upon request so that you can enjoy a hassle-free vacation experience from start to finish! All these features combine to make staying in a service apartment ideal for anyone looking for luxury living at an affordable rate – with no compromises on quality or comfort!

Source URL- https://sites.google.com/view/service-apartments-delhi-7/home

#vacation rentals in delhi#service apartments noida#service apartments in south delhi#service apartments gurgaon#service apartments delhi

1 note

·

View note

Text

List of Best Trading Apps in India 2023

The world of trading has become more accessible than ever before, thanks to the rise of trading apps. With just a few clicks on your smartphone, you can now buy and sell shares in real-time from anywhere in India. But with so many options available, which trading app should you choose? In this article, we've compiled a list of the top 10 best trading apps in India for 2023. Whether you're a seasoned trader or just starting out, this comprehensive review will help you find the perfect app for your needs. So let's dive right into it!

List of the Top 10 Trading Apps in India

Zerodha: With over 3 million users, Zerodha is one of the most popular trading apps in India. It offers a user-friendly interface and low brokerage fees, making it an excellent choice for both beginners and experienced traders.

Upstox: Another top-rated app is Upstox, which boasts a simple yet effective platform for buying and selling stocks. It has competitive pricing and advanced charting tools to help you make informed decisions.

Angel Broking: Known for its extensive research capabilities, Angel Broking provides valuable insights into market trends that can help investors maximize their profits. The app also features a range of financial products like mutual funds and insurance.

Groww: A relatively new player in the market, Groww has quickly gained popularity thanks to its zero-commission policy on stock trades and easy-to-use interface.

Kotak Securities: This app by Kotak Mahindra Bank offers seamless integration with your bank account, allowing you to transfer funds seamlessly between them while trading shares or investing in mutual funds.

Sharekhan: With more than 20 years of experience in the market, Sharekhan is known for its robust research reports that provide detailed analysis of stocks from various sectors.

Edelweiss: Offering customizable watchlists and charts along with real-time news updates, Edelweiss makes it easier for investors to stay up-to-date with current events affecting their investments.

HDFC Securities: This app by HDFC Bank provides access to global markets along with local ones at affordable prices while providing comprehensive research reports covering several industries

ICICI Direct: ICICI direct allows you not only trade through mobile but also via call-n-trade. Their simplified version makes it perfect even if you are a beginner

Axis Direct: Last but not least AxisDirect comes equipped with all essential features including personalized alerts, easy order placement and comprehensive market analysis tools.

Complete Review of All Best Trading Apps in India

When it comes to choosing the best trading app in India, there are plenty of options available. But which one is right for you? In this complete review of all the best trading apps in India, we will take a closer look at each one and help you make an informed decision.

First up is Angel Broking. With its user-friendly interface and advanced charting tools, Angel Broking makes it easy for beginners to get started with trading. It also offers low brokerage fees and instant fund transfer options.

Next on our list is Zerodha. Known for its no-brokerage policy, Zerodha has quickly become a popular choice among traders in India. The app offers various features such as market depth analysis, advance charts and technical indicators.

Groww is another great option for those looking for a seamless trading experience. Its simple design allows users to navigate through the app with ease while offering commission-free investments in mutual funds.

Kotak Securities’ mobile application provides real-time updates on the stock market along with research reports from their team of experts giving you valuable insights about specific companies' performances based on their financial history.

Edelweiss Trading App combines investment opportunities with insightful advice from analysts making sure that traders make informed decisions before investing money into stocks or mutual funds

These are just some of the top contenders when it comes to finding the best trading app in India - but ultimately, your choice will depend on what suits your needs as an investor or trader.

To sum up, in this article we have discussed the top 10 trading apps in India for the year 2023. We have reviewed each app based on its features, user interface and overall performance.

Whether you are a beginner or an experienced trader, these apps offer you a seamless experience with no brokerage charges and easy access to market data.

Angel Broking, Zerodha and Kotak Securities are some of the popular names that provide unique features to make your trading journey smooth. Edelweiss also offers reliable services with advanced charts and tools.

Groww is another great option for beginners as it has a simple user interface along with low brokerage fees. nifty bees share price can be easily tracked through Angel One while Old Mumbai Chart provides historical data essential for analysis.

Each app excels in different areas making them suitable for different types of traders. So choose the one that best fits your requirements and start trading today!

After analyzing and reviewing the top 10 trading apps in India, it is evident that each app has its unique features and benefits. Whether you are a beginner or an experienced trader, there is an app on this list that will suit your needs.

From Angel Broking's seamless user interface to Zerodha's low brokerage fees, each app offers something special. Other notable mentions include Kotak Securities' advanced charting tools, Edelweiss' research reports, and Groww's zero brokerage platform for mutual funds.

Choosing the best trading app in India can be challenging. However, by assessing your needs as a trader and comparing them with the offerings of these top 10 trading apps, you can find one that perfectly suits you. So go ahead and download your favorite trading app today

Related - https://hmatrading.in/best-trading-app-in-india/

Source - https://sites.google.com/view/list-of-best-trading-apps

#best trading app in india#best trading app in india 2022#angel broking login#zerodha brokerage calculator#nifty bees share price#angel one share price#kotak securities login#edelweiss share price#old mumbai chart#angel broking share price#no brokerage#groww brokerage calculator#angelone share price#HMA Trading

2 notes

·

View notes

Text

2 notes

·

View notes

Text

Five Common Myths About Crowdfunding

You must be agreeing with the fact that crowdfunding is a fairly new concept in a developing country like India. People are still often confused about what the term crowdfunding means. In simple terms, crowdfunding is defined as the practice of funding a project or venture by raising money from a large number of people, typically via the internet. Crowdfunding is a form of crowdsourcing and alternative finance. In 2021, the global crowdfunding market was valued at 13.64 billion U.S. dollars and was forecasted to double by 2028, growing at a compound annual growth rate (CAGR) of 11.2 per cent.

So crowdfunding isn’t a dying market at all. On a similar note in this article, we will clear the top five misconceptions regarding crowdfunding. Here are they listed below:

Yes, All the Cases Are Genuine!

We at Filaantro personally go the extra mile to verify the genuinity of all of our campaigns. Moreover, these cases are evaluated on a periodic basis. We put utmost work into embedding the importance of making sure that our crowdfunding platform is safe and trustworthy of the donor’s and the patient’s belief. Documents like hospital bills and doctor’s prescriptions are shared without any masking to enable the donor to confirm the genuinity of the campaign.

2. Yes! The Money Is Actually Being Received By The Patient/Beneficiary

As far as money is concerned, for all the medical crowdfunding campaigns the money is transferred directly into the bank account of the hospital. So there is a hundred percent transparency. Whereas if there is a campaign for a personal cause the money is directed to the individual’s account. We make sure to provide the correct, accurate bank account details in the campaign description itself so that any donor can verify and safely transfer the money to the needy campaigner.

3. Yes, It’s Totally Safe to Donate on a Crowdfunding Platform

Whatever data you fill in while donating or starting a crowdfunding campaign is never shared with any third-party website. We at Filaantro use the highest SSL encryption system to make sure your data is in safe hands. You can rest assured about your data all while donating or starting a new crowdfunding campaign.

4. Fundraisers Are Just for emergencies

This is one of the most common myths about crowdfunding campaigns, that a crowdfunding campaign is only for emergencies. People can surely start crowdfunding campaigns during emergencies as well as during funerals, to pay for education, to pay for costly medical bills, etc. Due to the novel coronavirus pandemic, many people lost their jobs and livelihood, such people can also start a crowdfunding campaign to ask for help and gather funds to pay for their basic necessities.

5. Money Can’t be Raised for an Individual

Surely money can be easily raised for a larger cause but on a similar note, money can be also raised for an individual entity. If the individual’s needs are genuine and authentic, people don’t mind donating to the person’s campaign. There are a multitude of stories where people have donated generously for an individual crowdfunding campaign.

We, at Filaantro, believe in crowdfunding for a cause. It is the platform that allows any individual, society or community across the globe to raise funds for any cause such as medical, education, natural calamity, sports, rehabilitation, non-profit, animal support, emergency, arts and media, technology, rural development, and other causes, with great ease. Our vision is to connect like minded Individuals and communities through our platform and inspire them to raise funds for the greater good. And our mission is to help campaigners achieve their goals through trust, transparency and simplicity.

It takes only a few minutes to register with us and raise your campaign. We believe in your cause. We believe in your dream, We believe in you.

#filaantro#crowdfunding#crowdfund#crowdfunding in india#debt crowdfunding#myths of crowdfunding#crowdsourcing#fundraising

2 notes

·

View notes