#Top 5 Cryptocurrencies to Watch

Explore tagged Tumblr posts

Text

Top 5 Must Buy Crypto in 2025; Do Not Miss Out on This

Specific tokens stand out as the cryptocurrency market evolves for their unique capabilities and growth potential. With rapid advancements in blockchain technology and rising adoption, investors are keenly monitoring key projects poised for success in 2025. This article highlights the top crypto to buy that have shown resilience, innovation, and strategic developments, These projects are not just…

#cardano#chainlink#crypto to buy#Cryptocurrency#hedera#ripple#Solana#Top 5 Cryptocurrencies to Watch

0 notes

Note

What is a random headcanons you have of Kai? Like the type of headcanons that would make him seem really human and not like he's constantly a murderer or psychopathic.

KAI ANDERSON // headcanons

a/n: here goes.. but i fear he’s just as fucked up bc i was trying to be realistic ya know

judges people by their handshakes. a weak grip disgusts him, and he’ll never respect someone with gross clammy hands.

watches old footage of leaders like hitler, stalin, or jfk to study their body language, hand movements. kai practices in front of a mirror until it feels natural. every gesture he makes while speaking is rehearsed. the way he waves his hands, points, or clenches his fists is meant to manipulate emotions.

practices subtle gestures (touching someone’s shoulder, making intense eye contact) to make people subconsciously trust him.

enjoys watching true crime documentaries and infodumps about jonestown or heaven’s gate.

remembers oddly specific details about people but weaponises them later in arguments.

thrives on debates, especially when he can dominate someone intellectually. he’ll derail conversations just to win, even if it’s about the dumbest shit like the best way to eat a subway sandwich.

has entire passages of nietzsche and shakespeare memorized, knows random latin phrases and sprinkles them into conversations to seem cultured.

hates losing at anything—he’ll rage quit a game of monopoly if it’s not going his way.

when fixated on something—a person, an idea, or a goal—he becomes consumed by it. spends hours researching or strategising, often at the expense of his health.

has casually invested in bitcoin and other cryptocurrencies. checks his coinbase and binance accounts obsessively. has strong opinions about dogecoin being a joke.

occasionally reads self-help books.

his library consists mostly of power-centric books. his favourites include the prince by machiavelli, the 48 laws of power by robert greene, the art of war by sun tzu, and nietzsche’s thus spoke zarathustra. also delves into russian literature like dostoevsky’s notes from underground and tolstoy’s war and peace.

collects super offensive internet memes in a private folder. posts pepe memes on 4chan ironically but secretly thinks they’re funny.

leaves people on read for hours, just because.

desensitised himself to gore.

loves gta, rdr2 and civilization VI. played cod religiously in his incel days.

follows elon musk on x (formerly known as twitter) and admires him as a disruptor of society. or maybe it’s a tech bro thing idk. retweets his memes but also calls him a sellout for pandering to the masses.

loathes andrew tate for his shallow and illogical takes but agrees with 10% of his misogynistic rhetoric.

posts inflammatory tweets that toe the line between radicalism and satire, carefully wording them to avoid getting banned.

an avid user of letterboxd. some of his reviews are super scathing—but for some reason, they always blow up. he’d open the app to find that his hate review on la la land got 7.2k likes. screenshot compilations circulate on reddit and instagram.

his letterboxd favourites are: american psycho, fight club, the social network and the matrix (all 5 star ratings)—but claims he likes them for their philosophical depth.

his favourite show is mr. robot, saying elliot alderson is “the closest thing to a genius on tv.” he also likes the twilight zone and breaking bad.

obsessed with eminem—he’s been a fan ever since d-12. the marshall mathers lp are his go-to rage anthems. thinks lose yourself is the pinnacle of motivational music.

thinks kanye west is a misunderstood genius and frequently defends him online.

uses dark mode on every device.

apple loyalist. owns a macbook, iphone, and airpods because he appreciates their sleek and minimalistic design. calls android users “peasants.”

never charges his phone until it has like 2% left.

brilliant with tech—can hack into nearly anything. knows how to code in several languages, always staying on top of the latest tech trends and occasionally contributes to dark web forums.

builds custom pcs for fun. dabbles in coding and hacking. knows how to create computer viruses.

used to spend wayyy too much time on forums like 4chan, r/RedPill, r/foreveralone and r/incels, though he’s mostly active on subreddits like r/iamverybadass, and r/unpopularopinion. also lurks r/atheism just to mock people with religion.

frequently visits r/AmITheAsshole to judge people, always siding with the “bad guy.” bro has the potential to be a criminal defense lawyer that the DA despises.

lowkey obsessed with angelina jolie, specifically from her tomb raider days. probably has a pinup poster stashed somewhere in his room.

uses arctic fox’s poseidon blue hair dye.

firmly believes in the efficiency of 3-in-1 body wash, shampoo, and conditioner.

wears dior sauvage because it’s “masculine but sophisticated.” probably bought it after seeing johnny depp in an ad.

when he’s in a mood, kai loves sneaking up on people to startle them. he’s perfected the art of standing silently in doorways until someone notices.

prefers dogs because they’re trainable, loyal, and trusting on their owner. in other words they are easy to manipulate and control.

constantly rolls his shoulders and cracks his neck. it’s both a habit and a way to intimidate people.

his lust for power stems from feeling powerless in his youth, particularly after witnessing his father’s abuse to his mother and the lack of control he had over the situation.

struggles to process complex emotions like guilt, shame, or empathy. often suppresses them or redirects them into rage.

swings between grandiosity (believing he’s destined for greatness) and crippling self-doubt (thinking he’s fundamentally unlovable)

finds it almost impossible to open up emotionally unless it’s to manipulate someone.

criticism, even minor, eats away at him. he’ll stew over it for days, replaying it in his head while devising ways to “prove them wrong.”

gets uneasy if someone expresses affection without clear reason—suspects ulterior motives.

goes online to stalk whoever winter’s dating at the time. sends cryptic, vaguely threatening texts from a burner number or straight up dox them. half of it is for shits and giggles, the other half is rooted in jealousy.

he’s attracted to girls who are intelligent and opinionated. independent but emotionally vulnerable, so he can swoop in and “save” them (he has a saviour complex). loyalty is non-negotiable, and she has to make him feel like her top priority.

anyone resembling winter is immediately his type, but he’d never admit it.

freakishly good at darts and chess.

knows how to pick locks and also, how to build a perfect pipe bomb.

his clown mask is inspired by satan in dante’s divine comedy (based on this convo with @porcelainlipgloss)

alternates between ice-cold showers and scalding hot ones depending on his mood.

drums his fingers or shakes his leg while sitting. can spin a pen around his fingers like a pro. learned it during boring college lectures and now does it absentmindedly.

can’t stand slow walkers, or when someone scrapes a fork on their teeth. his reactions to these are disproportionate and borderline hostile.

prone to road rage.

has read elliot rodger’s manifesto once, mostly out of curiosity and boredom, but ended up getting weirdly immersed in it. he disagreed with the bravado and entitlement, though—he finds it pathetic and would mock it, but still, he couldn’t put it down. deep down, he understands the mindset too well, which makes him uncomfortable.

selectively polite. says “please” and “thank you” when it benefits him but will completely ignore social etiquette in other situations, like cutting lines or taking the last slice of pizza.

his workout playlist consists of nine inch nails, rammstein. aggressive rap like eminem (“till i collapse” is a staple) and dmx. sometimes mixes in orchestral movie scores (the dark knight rises soundtrack pumps him up)

brushes his teeth aggressively, so his toothbrushes always wear out quickly.

loves gas station beef jerky and bags of plain popcorn with way too much salt.

doesn’t drink often, claiming alcohol dulls the mind. but when he does, it’s always something hardcore like everclear or absinthe. has a surprisingly high alcohol tolerance.

can literally live off black coffee or monster zero ultra (white can). claims he doesn’t need caffeine, but drinks it constantly because he “likes the bitterness.”

his handwriting is pretty neat, but only when he’s focused—otherwise, it’s chicken scratch.

loves the smell of gasoline and sharpies.

can’t sit his ass down during phone conversations—kai paces back and forth like a caged animal.

rarely gets more than four hours of sleep.

and when he does sleep, he sleeps on his stomach with one arm dangling off the bed.

sleep talks under extreme stress.

secretly likes it when someone takes care of him. whether it’s bandaging a cut or insisting he eats when he’s been working too hard, he fucking melts. he’ll complain about being babied, but it’s a front.

#american horror story#the more normal ones ofc#ahs#kai anderson#ahs cult#evan peters#kai anderson x reader#kai anderson x y/n#ahs season 7#some of them are based on me#evan peters x reader

112 notes

·

View notes

Text

Get Rich Quick with Ali's Top 5 Financial Tips (And a Bonus Tip That'll Blow Your Mind!)

Hey there, my fellow financial wizards! Are you ready to turn those measly pennies into a fat stack of cash? Of course you are, that's why you're here, reading my brilliant blog.

So, you want to get rich quick, huh? Well, lucky for you, I've got the inside scoop on the top 5 financial tips that'll have you swimming in money faster than you can say "capital gains."

Tip #1: Invest in Cryptocurrency - Forget about boring old stocks and bonds, cryptocurrency is where it's at. Just throw your life savings into some random crypto with a cool name and watch as your portfolio explodes! Easy as pie.

Tip #2: Start a Ponzi Scheme - Who needs a legitimate business when you can just scam your friends and family out of their hard-earned cash? Build a pyramid of lies and deception and you'll be rolling in dough in no time.

Tip #3: Rob a Bank - This one's a classic. Just grab a ski mask, a bag with a dollar sign on it, and you're good to go. Just make sure you don't get caught. Jail time isn't exactly conducive to wealth-building.

Tip #4: Get a Sugar Daddy/Mommy - Hey, there's no shame in using your looks to your advantage. Just find yourself a wealthy older partner and voila, instant financial security. Who needs a career when you can just lounge around and spend your sugar daddy's money all day?

Tip #5: Gamble, Gamble, Gamble - Forget about saving up for a rainy day, just throw all your money at the blackjack table and pray for a stroke of luck. It's like investing, but with more adrenaline and less guaranteed returns.

And now, for the bonus tip that'll blow your mind: don't listen to any of my previous advice. Seriously, don't. These are terrible ideas that will probably land you in jail, broke, or both. Instead, focus on building a legitimate career and investing in your future. It may not be as flashy as robbing a bank or finding a sugar daddy, but it's a lot more sustainable (and legal).

296 notes

·

View notes

Note

top 5 video essays!!!

just 5?? okay, um. i'm gonna have to run my favorite video essays playlist through a few filters: minimum one hour, one video per creator, and no hbomberguy or defunctland. everyone here knows roblox_oof.mp3 and the disney theme, i want to show some love for other videos)

1- The man who tried to fake an element (Bobbybroccoli) He's a master of explaining just enough of the historical and scientific context to put things into perspective while keeping it interesting. The way he visually depicts what he's talking about is also always fantastic. This video is the pinnacle of both of those, I think.

Also it's a really interesting and funny story. How he thought he'd get away with it still baffles me.

2- FNaF & Undertale: How to/NOT to Tell A Story (Spaceman Scott) The thesis is perfectly unbiased. There's no objectively right or wrong way to tell a story, let's look at these two culture-changingly popular stories and how differently they were created and are told.

The other 75 minutes of the video are absolutely shitting on Scott Cawthon and talking about how much the attention, love, and care Toby Fox put into Undertale shows.

3- The False Evolution of Execution Methods (Jacob Geller) Incredibly well researched, thought out, and presented. It would have been easy for it to just be talking about the statistics, but he does a really phenomenal job of putting them in the context of societal and technological changes and not pulling punches or being too graphic when discussing what happens when things go wrong with the different methods.

I don't want to spoil the ending, but it hit me like a ton of bricks.

Honestly the only reason it isn't higher is because it is such a heavy watch. (yes it's technically 53 minutes but I had to pause and process shit for at least seven minutes while watching it. It counts.)

4- Who Is Nazeem REALLY? Skyrim's Most HATED Character (Camelworks) I've done some deep dives into incredibly niche things, but this takes the goddamn cake. I want to study the creator like a bug. No one asked, but my god they delivered a fucking masterpiece.

5- The Most Painful Death Ever (VIEWER DISCRETION) (Wendigoon) Nuclear physics and weird medical things are both interests of mine, so I found it fascinating. That said, oh my god take the warning seriously. It was all presented very respectfully and tactfully, but the facts of the situation are intense to say the least. I'm not squicked by medical stuff in general, but some of it had me feeling truly shaken.

honorable mention for This is Financial Advice (Folding Ideas) for making cryptocurrency, both the thing itself and the culture around it, make sense to me.

40 notes

·

View notes

Text

Navigating the Crypto Landscape: News, Trends, and Investment Strategies for 2025

Since its inception in 2009, Bitcoin has revolutionized how we perceive money and financial transactions. The cryptocurrency market is constantly evolving, with Bitcoin news emerging every second, influencing Bitcoin prices and mining activities. Staying informed is crucial, whether you're a seasoned investor or just starting. This article provides a comprehensive guide to navigating the crypto landscape, covering the latest news, emerging trends, and investment strategies for success in 2025.

Latest Crypto News and Market Trends

Bitcoin (BTC): As of February 2, 2025, Bitcoin is trading at approximately $99,383.00. Bitcoin price hit an all-time high of over $69,000 in November 2021. Analysts believe that Bitcoin’s bull market could extend past 2025 with institutional involvement and shifting market dynamics. Be aware of potential bear traps, which are coordinated selling efforts that cause temporary price dips in a long-term uptrend.

Ethereum (ETH): Ethereum is trading at approximately $3,096.90. Ethereum's dominance in fee earnings remained unchallenged in 2024, with a total of almost $2.5 billion, more than double that of TRON. Analysts are closely watching if Solana can compete with Ethereum to be the top Layer 1 blockchain. Ethereum faces significant resistance at $3,400, with over $1 billion worth of cumulative leveraged shorts set to be liquidated.

Altcoins: Litecoin (LTC) and Mantra (OM) are showing potential for gains. Solana (SOL) is trading at approximately $213.44. Solana is gaining traction with significantly higher daily transactions compared to Ethereum. XRP (XRP) is trading at approximately $2.84. Dogecoin (DOGE) is in focus with Grayscale launching a DOGE trust.

Stablecoins: Tether (USDT) reported net profits of $13 billion in 2024. Kraken is delisting Tether (USDT) and other stablecoins in Europe to comply with MiCA regulations.

Other News: Trump's tariffs may impact the crypto market. North Dakota introduces a bill to uphold Bitcoin mining rights. El Salvador ends mandatory Bitcoin acceptance for merchants. Malaysia is leveraging Blockchain and AI to fight fraud.

Investment Strategies and Tips

Diversification: Consider diversifying your crypto portfolio to mitigate risk. Investing in a mix of Bitcoin, Ethereum, and promising altcoins can provide a balanced approach.

Stay Informed: Keeping a close eye on BTC prices and Bitcoin news is essential due to the cryptocurrency market's volatility.

Utilize Crypto Exchanges: Use cryptocurrency exchanges, Bitcoin ATMs, or P2P marketplaces to buy Bitcoin.

Monitor Market Sentiment: Pay attention to where investment capital is flowing to gauge market sentiment and identify potential high-growth areas.

Be Aware of Regulatory Changes: Stay informed about regulatory developments, such as India's tax penalties on undisclosed crypto gains and Europe's MiCA regulations affecting stablecoins.

Long-Term Holding (HODL): Consider a long-term holding strategy, as demonstrated by Illinois' proposed state-run Bitcoin reserve with a five-year holding period.

Assess Risk Tolerance: Understand the risks associated with cryptocurrency investments and carefully consider your risk tolerance before investing.

Follow Expert Analysis: Look to crypto analysts for insights on market trends, potential breakouts, and future price targets.

Guides

How to Buy Bitcoin: Cryptocurrency Exchange: Use reputable exchanges like Coinbase to purchase Bitcoin. Bitcoin ATMs: Utilize Bitcoin ATMs for quick purchases. P2P Marketplace: Engage in peer-to-peer transactions for potentially better rates.

How to Stay Safe from Crypto Scams: Be wary of "pump-and-dump" schemes: Chainalysis reports that nearly 5% of all tokens launched in 2024 had patterns similar to pump-and-dump schemes. Beware of Telegram scams: Crypto scammers are increasingly using Telegram to target victims. Adjust slippage tolerance: When trading, adjust slippage tolerance to protect your crypto trades from being exploited by sandwich attacks.

How to Earn Free Bitcoin: Bitcoin Faucets: Explore opportunities to earn free Bitcoin through various Bitcoin faucets.

Examples of Successful Crypto Investments

Ethereum Trader: Some cryptocurrency traders are profiting millions from Ether’s downtrend through leveraged trading.

Thumzup Media Corporation: Doubled its Bitcoin holdings to 19.106 BTC, increasing its investment in digital assets to $2 million.

MicroStrategy: MicroStrategy’s stock offering was oversubscribed 3x due to the "Bitcoin Effect".

Tether: Reported net profits of $13 billion during 2024.

The cryptocurrency market offers exciting opportunities, but it also demands vigilance and informed decision-making. By staying updated on the latest news, understanding market trends, and employing sound investment strategies, you can navigate the crypto landscape successfully in 2025.

0 notes

Text

Custom Software Development Trends to Watch in 2025

Custom software development is set to reach new heights in 2025 as businesses demand solutions that are tailor-made to address their specific needs. In an era of rapid technological advancements, custom software development trends 2025 reflect a shift beyond generic solutions, as companies seek applications that drive efficiency, enhance security, and elevate user experiences.

Why Custom Software Matters in 2025

The traditional, one-size-fits-all approach to software is fast becoming obsolete. Companies today need solutions that are specifically built to suit their objectives. Custom software development provides a strategic advantage by offering applications that align perfectly with business goals while ensuring scalability and flexibility. By choosing the right custom software development company, businesses can innovate and stay ahead of their competition.

Key Custom Software Trends for 2025

1. Artificial Intelligence and Machine LearningAI and machine learning are already game-changers in software development, but by 2025, their influence will expand even further. These technologies allow businesses to create smarter applications that can adapt to user needs and automate tasks. For example, AI-powered chatbots and virtual assistants will provide real-time customer support, while machine learning will continuously optimise software to improve user experience.

2. No-Code and Low-Code Development PlatformsIn 2025, no-code and low-code platforms will be essential tools for businesses looking to develop software quickly and efficiently. These platforms enable non-technical users to build applications with minimal coding knowledge, speeding up the development process. While these tools are simple to use, they still offer flexibility, allowing custom features to be integrated where needed.

3. Cloud-Native Software SolutionsCloud computing is now a necessity for businesses that want to remain competitive. By 2025, custom software solutions will increasingly be designed specifically for the cloud, providing better scalability, cost-effectiveness, and performance. Cloud-native applications allow businesses to store and manage data more effectively while ensuring accessibility from any location.

4. Cybersecurity FocusAs cyber threats grow more sophisticated, cybersecurity will become an integral part of custom software development. In 2025, businesses can expect to see more advanced security features built into their applications. AI-powered threat detection, automated security updates, and multi-factor authentication will become the norm, offering better protection against evolving cyber risks.

5. Personalisation and User-Centric DesignUser experience will continue to be a top priority. In 2025, custom software will offer more personalised experiences, adapting to individual user preferences and behaviours. AI will help developers create applications that feel intuitive and highly relevant to each user, enhancing engagement and satisfaction.

6. Edge Computing for Speed and EfficiencyEdge computing will become increasingly important in 2025. By processing data closer to the source, this technology reduces latency and improves application performance, particularly in industries where real-time data processing is crucial, such as healthcare and finance.

7. Blockchain for TransparencyBlockchain will no longer be confined to cryptocurrencies. By 2025, its integration into custom software will offer greater transparency and security. Applications in areas like supply chain management, financial transactions, and identity verification will benefit from blockchain’s decentralised and immutable nature, ensuring trust and integrity.

8. Internet of Things (IoT) IntegrationAs IoT devices continue to proliferate, custom software will need to handle and analyse the massive amounts of data generated. In sectors like healthcare, manufacturing, and logistics, software that integrates seamlessly with IoT systems will be crucial for improving operational efficiency and delivering real-time insights.

9. DevOps and Continuous DeliveryThe need for faster, more reliable software updates will drive the adoption of DevOps practices and continuous delivery. By 2025, these approaches will streamline the development process and ensure that businesses can roll out new features and security patches with ease, helping them stay competitive in a fast-paced market.

10. Sustainability in Software DevelopmentEnvironmental concerns will influence software development in 2025. Custom software companies will focus on creating energy-efficient applications that reduce the carbon footprint of digital operations. Whether optimising applications for lower energy consumption or supporting green initiatives, sustainability will become a key consideration for businesses and consumers alike.

Choosing the Right Software Development Partner

With so many trends to navigate, selecting the right custom software development company will be crucial. Look for a partner that stays ahead of industry trends and has a proven track record in delivering innovative, secure, and scalable solutions. By working with the right team, your business can stay at the forefront of software innovation in 2025 and beyond.

In conclusion, custom software development in 2025 will be characterised by AI integration, personalisation, and a strong focus on security. By embracing these trends, businesses can enhance their operations, improve user experience, and remain competitive in an ever-evolving digital landscape.

0 notes

Text

Top 10 Cryptocurrency Development Trends to Watch in 2025

The cryptocurrency landscape is evolving rapidly, driven by advancements in blockchain technology, increased adoption, and the rise of decentralized finance (DeFi). As we step into 2025, the crypto industry continues to grow, with new trends and innovations shaping the future. In this blog, we'll explore the top 10 cryptocurrency development trends to watch for in 2025, offering insights into the developments that are expected to have a major impact on the ecosystem.

1. Layer 2 Solutions and Scalability Improvements

One of the key challenges for blockchain networks has been scalability the ability to handle a large number of transactions quickly and efficiently. In 2025, Layer 2 solutions, such as Optimistic Rollups and zk-Rollups, will play a significant role in improving scalability. These solutions work by processing transactions off-chain and then consolidating them onto the main blockchain, reducing congestion and lowering transaction fees.

Ethereum, for example, is actively working on integrating these Layer 2 solutions to enhance its scalability and reduce gas fees. As these technologies mature, blockchain networks will be able to support millions of transactions per second, making them more accessible and practical for businesses and everyday users.

2. Decentralized Finance (DeFi) Innovation

DeFi continues to disrupt traditional finance by offering decentralized alternatives to banking, lending, trading, and insurance. In 2025, the DeFi sector will continue to grow, with more innovative projects emerging to solve real-world financial problems. Cross-chain interoperability and decentralized exchanges (DEXs) will become increasingly popular as users seek greater flexibility and better liquidity.

New DeFi platforms are also expected to focus on providing traditional financial services like mortgages and loans, but in a decentralized and permissionless manner. Moreover, the rise of decentralized identity verification systems and self-sovereign identity protocols will further enhance the DeFi ecosystem's security and trustworthiness.

3. NFTs Beyond Art: Utility and Interoperability

Non-Fungible Tokens (NFTs) gained massive popularity for their role in the art world, but in 2025, NFTs will go beyond digital art and collectibles. Expect to see NFTs with utility, such as tokenized real estate, gaming assets, intellectual property rights, and even physical goods. This will make NFTs more practical and valuable as they represent ownership, rights, and access to various services.

Interoperability between different blockchain networks will also become a significant focus. As more NFT platforms are built on multiple blockchains, the ability to transfer NFTs seamlessly across networks will become crucial. This will allow for greater market access and the expansion of the NFT ecosystem beyond its current limits.

4. Tokenization of Real-World Assets (RWA)

In 2025, the tokenization of real-world assets (RWA) will gain significant traction. Tokenizing assets such as real estate, commodities, and stocks will provide investors with increased liquidity, fractional ownership, and access to markets that were previously difficult to tap into. Blockchain's transparency and security features make it an ideal platform for tokenizing tangible assets.

By creating digital representations of physical assets, investors can own fractions of high-value assets like real estate without needing to buy the entire property. This trend will democratize investment opportunities, making them accessible to a wider range of people and encouraging greater global participation.

5. Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies (CBDCs) have been a topic of discussion among governments and central banks worldwide. In 2025, we can expect further development and potential rollouts of CBDCs in several countries. These digital currencies will allow central banks to issue their own digital currencies, backed by the national government, and will be more stable than private cryptocurrencies.

CBDCs could help bridge the gap between traditional finance and the crypto world, offering consumers a digital currency that maintains the stability and trust of a central authority. The launch of CBDCs will also spark conversations about the role of cryptocurrencies in the global monetary system and how they can be integrated with the broader financial ecosystem.

6. Privacy and Security Enhancements

As the cryptocurrency ecosystem expands, so does the need for enhanced privacy and security features. In 2025, privacy coins like Monero and Zcash, which offer anonymity features, will continue to gain popularity, especially for individuals who prioritize confidentiality in their transactions. However, privacy features will not only be limited to privacy coins but also integrated into broader blockchain systems.

Advancements in zero-knowledge proofs (ZKPs) will enable users to transact privately on public blockchains, ensuring that sensitive information, such as transaction details and wallet balances, remains secure. Alongside this, improvements in cryptographic algorithms and multi-signature wallets will strengthen the security of crypto assets, preventing hacks and thefts.

7. Interoperability Between Blockchains

One of the most significant challenges facing the blockchain industry is the lack of interoperability between different networks. In 2025, the trend of cross-chain interoperability will become increasingly important as users and developers demand a more connected ecosystem.

Platforms like Polkadot, Cosmos, and Avalanche are already leading the way by offering solutions that allow different blockchains to communicate and share data seamlessly. This will enable assets and data to flow freely between various blockchain networks, creating a more cohesive and functional ecosystem. The rise of interoperability will also empower decentralized applications (dApps) to access data from multiple blockchains, making them more versatile and powerful.

8. Blockchain for Supply Chain and Traceability

Blockchain's ability to provide transparency and traceability will become even more valuable in industries such as supply chain management in 2025. Blockchain technology will help companies track the origin and journey of goods, ensuring that products are ethically sourced and are not counterfeit.

In supply chains, blockchain will be used to record every step in the production and delivery process, providing a transparent record that can be audited by all stakeholders. This will increase trust in global supply chains and reduce inefficiencies caused by fraud and lack of transparency.

9. AI and Machine Learning in Crypto Development

Artificial Intelligence (AI) and machine learning (ML) are playing a growing role in cryptocurrency development. In 2025, AI will be used to improve trading algorithms, enhance the efficiency of mining operations, and optimize blockchain networks. Machine learning can help predict market trends, analyze crypto data, and automate decision-making processes.

In addition, AI-powered chatbots and customer service solutions will become more common on cryptocurrency platforms, improving user experience and support. AI will also help identify vulnerabilities and potential security threats, making cryptocurrency platforms safer and more reliable.

10. Sustainability and Eco-Friendly Mining Solutions

Environmental concerns about the energy consumption of cryptocurrency mining have gained traction in recent years. In 2025, we expect to see a growing focus on sustainability in crypto development. Eco-friendly mining solutions, such as proof-of-stake (PoS) consensus mechanisms, will continue to gain adoption as they are far less energy-intensive than proof-of-work (PoW) mining.

Cryptocurrency projects will also look into using renewable energy sources for mining operations, reducing the carbon footprint of blockchain networks. As the world moves toward greener practices, cryptocurrencies will need to align with sustainability goals, making eco-friendly mining a key trend in 2025.

Conclusion

As we head into 2025, the cryptocurrency industry is poised for significant growth and transformation. Layer 2 solutions, DeFi innovations, NFTs with utility, tokenization of real-world assets, and the rise of CBDCs are just a few of the exciting developments shaping the future. With privacy, security, interoperability, and sustainability becoming increasingly important, the crypto space is evolving into a more accessible, efficient, and secure ecosystem. By keeping an eye on these trends, businesses and investors can stay ahead of the curve and capitalize on the opportunities that lie ahead in the world of cryptocurrency development.

0 notes

Text

Top 5 Crypto Exchange Clone Solutions Poised to Revolutionize 2025

As the cryptocurrency industry continues to expand at an unprecedented pace, businesses are looking for innovative ways to enter the market. One of the most efficient and cost-effective methods is through crypto exchange clones. These pre-built platforms replicate the functionality of popular exchanges, allowing entrepreneurs to launch their trading platforms with minimal time and effort.

In this blog, we explore the top 5 crypto exchange clone solutions that have the potential to redefine the cryptocurrency landscape in 2025, providing businesses with advanced features and scalable solutions.

What is a Crypto Exchange Clone?

A crypto exchange clone is a ready-made, customizable software solution designed to replicate the core features of a well-known cryptocurrency exchange. These clones enable businesses to:

Launch their platforms quickly.

Customize the interface to match their branding.

Include advanced trading tools and security features.

Why Choose a Crypto Exchange Clone?

Reduces development costs and time.

Offers a proven framework trusted by users.

Ensures scalability and high performance.

Top 5 Crypto Exchange Clones to Watch in 2025

1. Binance Clone

Overview: Binance, the world’s largest cryptocurrency exchange by trading volume, is a leading inspiration for crypto exchange clones. A Binance clone provides businesses with robust trading features and high liquidity.

Key Features:

Multi-currency trading support for hundreds of tokens.

Advanced trading options, including futures, margin, and staking.

Secure wallets with multi-signature authentication.

High-speed matching engine for seamless trade execution.

Why It’s a Game-Changer: With its user-friendly interface and diverse features, a Binance clone enables businesses to attract both novice and professional traders.

2. Coinbase Clone

Overview: Coinbase is renowned for its simplicity and regulatory compliance. A Coinbase clone is ideal for businesses targeting a wide audience, including beginners entering the crypto space.

Key Features:

Intuitive and easy-to-navigate user interface.

Fiat-to-crypto trading support.

Built-in wallets with high-security protocols.

Compliance with KYC/AML regulations for secure onboarding.

Why It’s a Game-Changer: By replicating Coinbase’s success, businesses can create platforms that prioritize security and accessibility, appealing to a broad demographic.

3. Kraken Clone

Overview: Kraken is a top choice for professional traders, offering advanced tools and deep liquidity. A Kraken clone caters to businesses looking to provide high-level trading capabilities.

Key Features:

Margin trading and futures contracts.

High-liquidity trading pairs for seamless execution.

Staking options for earning passive income.

24/7 customer support and robust security measures.

Why It’s a Game-Changer: A Kraken clone allows businesses to target institutional investors and seasoned traders, offering them a feature-rich trading experience.

4. Uniswap Clone

Overview: Uniswap, a decentralized exchange (DEX), has revolutionized the crypto space with its automated market maker (AMM) model. A Uniswap clone is perfect for businesses looking to build decentralized trading platforms.

Key Features:

Decentralized peer-to-peer trading.

Liquidity pools for automated token swaps.

Non-custodial wallet integration.

Support for ERC-20 tokens and other blockchain networks.

Why It’s a Game-Changer: With growing interest in decentralized finance (DeFi), a Uniswap clone provides a secure and innovative way for users to trade without intermediaries.

5. LocalBitcoins Clone

Overview: LocalBitcoins is a peer-to-peer (P2P) exchange that facilitates direct trading between buyers and sellers. A LocalBitcoins clone is ideal for businesses targeting localized markets or those prioritizing privacy.

Key Features:

Escrow services for secure transactions.

Multi-payment options, including bank transfers and digital wallets.

Multi-language and multi-currency support for global reach.

Decentralized architecture for user privacy.

Why It’s a Game-Changer: A LocalBitcoins clone empowers businesses to tap into underserved regions, offering a secure and flexible trading platform tailored to local markets.

Benefits of Using Crypto Exchange Clones

Speedy Launch: Start your platform in weeks rather than months.

Cost-Efficiency: Save on development costs with pre-built frameworks.

Scalability: Easily handle growing user bases with advanced infrastructure.

Customization: Tailor the platform to suit your brand and target audience.

Proven Framework: Leverage the success of established exchanges to build trust.

How to Choose the Right Crypto Exchange Clone for Your Business

When selecting a clone, consider the following factors:

Target Audience: Identify whether your platform will serve beginners, advanced traders, or specific niches like DeFi.

Features: Ensure the clone supports the tools and functionalities your audience needs.

Security: Prioritize clones with advanced security protocols, including encryption, 2FA, and cold wallet integration.

Regulatory Compliance: Choose a solution that includes KYC/AML features to comply with global regulations.

Scalability: Ensure the platform can handle increased trading volumes as your user base grows.

Why Partner with a Professional Crypto Exchange Development Company?

To ensure a smooth and successful launch, it’s crucial to work with a reliable crypto exchange platform development provider.

Benefits of Partnering:

Expertise in building scalable and secure platforms.

Customizable solutions tailored to your business needs.

Post-launch support and maintenance.

Integration of advanced features like DeFi, staking, and NFTs.

Conclusion

The demand for crypto exchange platforms is set to skyrocket in 2025, and leveraging crypto exchange clones is a smart way to capitalize on this trend. From Binance and Coinbase clones to decentralized solutions like Uniswap, these ready-made platforms provide a cost-effective and efficient way to launch a feature-rich exchange.

By partnering with experienced crypto exchange development services, businesses can customize their platforms to meet market demands and ensure long-term success. The future of cryptocurrency trading is bright—make your move today and be part of the next big wave in the crypto revolution!

#cryptoexchange#cryptocurrencyexchange#justtrytechnologies#crypto exchange platform development company#crypto exchange development company#crypto exchange platform development#cryptocurrency exchange development service#top crypto exchange development company

1 note

·

View note

Text

Top 5 Altcoins to Watch This Year

Discover the top 5 altcoins to watch this year! From Solana to Polkadot, these cryptocurrencies are set to transform your portfolio. Get actionable insights and stay ahead in the dynamic crypto market. Dive in now! #Altcoins #CryptoInvestment #Blockchain

“Altcoins aren’t just alternatives; they’re the future of digital finance!” With over 10,000 cryptocurrencies in the market, finding the next big thing can feel like searching for a needle in a haystack. But fear not, we’ve done the heavy lifting for you. In 2021, the altcoin market saw explosive growth, with some coins delivering returns of over 10,000%. The potential for high returns is…

#Altcoins#Blockchain Technology#Cardano#Crypto Investment#Cryptocurrency#Digital Assets#Polkadot#Ripple#Solana#Stellar

0 notes

Text

Top five predictions today,

Top five predictions today,

Every day comes with thrilling opportunities and outcomes that people anticipate, whether in sports, finance, or entertainment. Here are today’s top five predictions across various categories, offering insight into what could unfold.

1. Premier League Clash: Arsenal vs. Manchester United

A major showdown in the Premier League promises excitement as Arsenal hosts Manchester United. Recent form suggests Arsenal has the upper hand with their solid defense and home-ground advantage. Prediction: Arsenal to win 2-1.

2. Stock Market Movement: Tech Sector to Rally

The tech industry is expected to see a positive trend today, driven by optimism surrounding a new product launch from a leading company. Key stocks in the sector could gain up to 3%. Keep an eye on giants like Apple and Nvidia.

3. NBA Spotlight: Golden State Warriors vs. LA Lakers

Basketball fans are in for a treat with the Warriors facing the Lakers. With Steph Curry in fine form and the Lakers struggling with injuries, the Warriors are predicted to take the game with a margin of at least 10 points. Prediction: Golden State Warriors win 115-105.

4. Cryptocurrency Update: Bitcoin to Surge

Bitcoin has shown signs of recovery after recent dips. Analysts predict a 5% rise in its value by the end of the day, fueled by increased institutional investments and positive regulatory news.

5. Entertainment: Box Office Hit

The highly anticipated movie release this weekend is expected to dominate the box office. Early reviews suggest it could gross $50 million globally on its opening day. This blockbuster is a must-watch for cinema enthusiasts.

Final Thoughts

Predictions are educated guesses based on trends and data. While they can guide decisions, outcomes remain uncertain. Always approach predictions with caution and enjoy the excitement they bring to your day.

0 notes

Text

100K Bitcoin System Review – Automated Bitcoin Generating System

Welcome to my 100K Bitcoin System Review. As cryptocurrency revolutionizes the world of finance, a new army of seasoned investors and curious beginners continue to push their investments into the digital currency. When it comes to the many passive income systems, one that has been getting a lot of attention is the 100K Bitcoin System.

This is marketed as a ‘set & forget’ done for you AI driven platform that exploits a ‘free crypto hack’ that makes $25-$50 in Bitcoin per day. How credible are these claims, however? In this detailed review we will analyze 100K Bitcoin System features, benefits, how it works, user feedback, pricing, pros, cons, and whether it is something worthy to your precious time and money.

What Is 100K Bitcoin System?

100K Bitcoin System is an automated cryptocurrency trading platform that uses artificial intelligence (AI) to execute trades on behalf of its users. This system is different from common trading systems that rely on human intervention and constant monitoring, the system can be operated independently by someone who is just starting or is really busy.

According to its creators, the system leverages a “free crypto hack,” purportedly exploiting specific market inefficiencies to secure consistent profits. It aims to make Bitcoin accessible to everyone by simplifying the trading process and providing a low-risk, high-reward opportunity.

100K Bitcoin System Review: Overview of Product

Product Creator: Glynn Kosky

Product Name: 100K Bitcoin System

Launch Date: 2025-Jan-16

Launch Time: 10:00 EST

Front-End Price: $17 (One-time payment)

Official Site: Click Here To Visit Official Salespage

Product Type: Tools and Software

Support: Effective Response

Discount: Get The Best Discount Right Here!

Recommended: Highly Recommended

Bonuses: YES, Huge Bonuses

Skill Level Required: All Levels

Discount Coupon: Use Code “BTCFIVE” To Get $5 Off

Refund: YES, 180 Days Money-Back Guarantee

Key Features of 100K Bitcoin System

✍ 100K Bitcoin System App

The Only AI System on the Market That Allows Me to Exploit the Entire Crypto Market for Massive Profit.

✍ 100K Bitcoin System ZERO Work HACK

The Only AI System That Exploits the Markets for Unlimited Potential!

✍ 100K Bitcoin System Mobile EDITION

This Will Allow You To Also Operate The System, Even From Your Mobile Phone. Whether it’s An Android, IPhone, Or Tablet, and It Will Work.

✍ Step-By-Step Training Videos

Have A Question? Just Reach Out To Us And Our Team Will Do Their Best To Fix Your Problem In No Time.

✍ World-Class Support

Have A Question? Just Reach Out To Us And Our Team Will Do Their Best To Fix Your Problem In No Time.

✍ DFY 1-1 Mentoring

You’ll Also Get 7-Days of Unlimited 1-1 Mentoring. Simply Let Us Know And Our Expert Will Reach Out To You To Give 1-1 Mentoring.

100K Bitcoin System Review: How Does It Work?

Just Three Simple Steps Gets Us FREE Automated Bitcoin!

Step #1: Access

The 100K Bitcoin System.

Step #2: Follow

The simple setup instructions, which takes less than 10 minutes.

Step #3: Profit

This is where we sit back and watch as Bitcoin flows into our wallets!

Benefits of 100K Bitcoin System

Done-For-You Crypto Profit System

Top-Converting Crypto System

Earn FREE CRYPTO + FREE BITCOIN

Built-In Crypto Targeted FREE Traffic

Setup Takes Less Than 60 Seconds

First Of Its Kind On WarriorPlus or ClickBank

In-Demand System In The Current Climate

Easiest System To Earn FREE Crypto

Get IN FRONT Of The Hottest New Niche In YEARS!

Automated System Works From Anywhere

Custom-Built Especially For Beginners

NO MONTHLY COSTS (when you get in now)

NO CRYPTO INVESTMENT REQUIRED

Built Huge Email Lists of Crypto Buyers

Grow Your OWN Crypto Portfolio For Huge Gains!

No Website, No Tech Skills, No Experience Needed

Brand New 1st-To-Market System

Unlock The Laptop Lifestyle

Proven Method Developed By Elite Affiliate Marketer

100K Bitcoin System Review: Old Way VS New Way

Verify Users Say About 100K Bitcoin System

100K Bitcoin System Review: Who Should Use It?

Affiliate Marketers

Teenagers

College Students

Entrepreneurs

People In Their 20s

Housewives

Freelancers

Stay At Home Dads

Busy People

Marketing Agencies

The Family Man

Old Age Pensioners

Digital Marketers

And Many Others

100K Bitcoin System Review: OTO’s And Pricing

Front End Price: 100K Bitcoin System ($17)

OTO1: 100K BTC UNLIMITED ($67 – $47)

OTO2: 100K BTC 100% DONE FOR YOU ($97 – $67)

OTO3: 100K BTC UNLIMITED TRAFFIC ($97 – $67)

OTO4: 100K BTC AUTOMATION $67 – $47

OTO5: 100K BTC ATM EDITION ($67 – $37)

OTO6: 100K BTC License Rights ($197 – $97)

100K Bitcoin System Review: Money Back Guarantee

Still On The Fence? Your Results Are Backed By OUR Money! 100% Money Back Guarantee

We’re so confident that you’ll succeed with this that we’ll take away any risk from your purchase. Use the 100K Bitcoin System and all accompanying materials for the next 180 days risk-free. Enjoy the full potential of this earning strategy that is completely done for you.

Our support center in the United States is manned by specialists who are always pleased to assist you. However, in the unusual event that you do not believe our technique achieves what we have said. You may get a hassle-free refund up to 6 months after purchase! So invest with confidence knowing that we take all of the risk; let us deliver you the results you deserve.

100K Bitcoin System Review: Pros and Cons

Pros:

Fully Automated System and Beginner-Friendly

One Time “Five Minute” Setup – We’ll Even Do It For You!

Zero Learning Curve – Plug & Play System

24/7 Income Potential – Works Day In, Day Out

Done-For-You System – You’ll Love IT!

Perfect For Beginners, Investors AND Passive Income Seekers!

Cons:

Requires a one-time investment

Requires stable internet connection

Nothing wrong with it, it works perfectly!

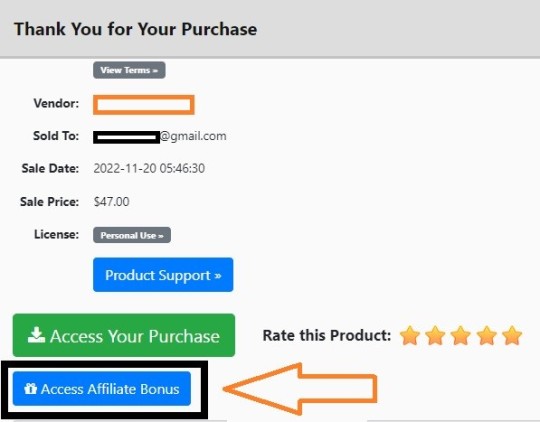

My Own Customized Exclusive VIP Bonus Bundle

***How To Claim These Bonuses***

Step #1:

Complete your purchase of the 100K Bitcoin System: My Special Unique Bonus Bundle will be visible on your access page as an Affiliate Bonus Button on WarriorPlus immediately after purchase. And before ending my honest 100K Bitcoin System Review, I told you that I would give you my very own unique PFTSES formula for Free.

Step #2:

Send the proof of purchase to my e-mail “[email protected]” (Then I’ll manually Deliver it for you in 24 HOURS).

100K Bitcoin System Free Premium Bonuses

Frequently Asked Questions (FAQ’s)

Q. My computer isn’t the best, will 100K Bitcoin System work on mine?

As long as it connects to the internet. YES. This is the same for any other device. The only thing is, it needs to have access to a web browser. If that’s the case, you’re all good to go.

Q. How long will it take to receive profits?

This varies, but the vast majority of our users report receiving it within 12-24 hours after activating it. In short, the quicker you activate, the sooner you’ll likely profit.

Q. Do I need any tech skills?

None whatsoever. I hate technical crap as much as you do, so we designed a 100K Bitcoin System in mind for the average Joe and Jane. After all, not everyone has a computer science degree.

Q. Do I need to buy any traffic?

Nope… You don’t have to mess around

Q. What if I get confused along the way?

Don’t worry, we have video training that shows you every step of the way, from A-Z… We’ll show you everything you need to know so you can begin getting results.

Q. I’m sold. How do I get started?

Click the button below to get a 100K Bitcoin System for the lowest price.

My Recommendation

100K Bitcoin System is an intriguing entrance point for those wishing to familiarise themselves with cryptocurrency trading. An appeal due to its automated, beginner friendly approach and promise of passive income. Transparency however, and the inherent risk associated with trading, are to be disregarded.

Approach the 100K Bitcoin System if you want to try it. Get started with a small investment, and research, research, research! It’s not unusual that no trading system can assure you of profits every time, so stay updated and make decisions on the basis of facts.

>>> Click Here To Get Instant Access 100K Bitcoin System Now <<<

Check Out My Previous Reviews: KidzKDP Review, AzonKDP Review, Revio Review, Voice Magik Review, and Kadjo App Review.

Thank for reading my “100K Bitcoin System Review” till the end. Hope it will help you to make purchase decision perfectly

#100kbitcoinsystem#100kbitcoinsystemreview#100kbitcoinsystemcoupon#100kbitcoinsystemhonestreview#100kbitcoinsystemfeatures#100kbitcoinsystemworks#whatis100kbitcoinsystem#100kbitcoinsystemreviews#buy100kbitcoinsystem#100kbitcoinsystemprice#100kbitcoinsystemdiscount#100kbitcoinsystemfe#100kbitcoinsystemoto#get100kbitcoinsystem#100kbitcoinsystembenefits#100kbitcoinsystembonus#howto100kbitcoinsystemworks#100kbitcoinsystemsoftware#100kbitcoinsystemsoftwarereview#100kbitcoinsystemFunnels#marketingprofitmedia#100kbitcoinsystemUpsell#100kbitcoinsysteminfo#purchase100kbitcoinsystem#100kbitcoinsystemwebsite#software#traffic#100kbitcoinsystemexample#100kbitcoinsystemworthgorbuying#ai

1 note

·

View note

Text

Top 10 DeFi Exchange Development Trends to Watch in 2025

Decentralized Finance (DeFi) has revolutionized the world of finance in recent years, providing an alternative to traditional financial systems through decentralized applications (dApps) built on blockchain technology. As we move toward 2025, the DeFi space continues to evolve, bringing with it new trends and developments that are transforming how users trade, borrow, lend, and invest. In this blog post, we will explore the top 10 DeFi exchange development trends that are likely to dominate in 2025.

1. Layer 2 Solutions for Scalability

One of the most significant challenges facing DeFi exchanges is scalability. Many decentralized exchanges (DEXs) are built on top of blockchains like Ethereum, which, although highly secure, can suffer from congestion and slow transaction speeds, especially during times of high demand.

To address these limitations, Layer 2 solutions, such as Optimistic Rollups and zk-Rollups, have gained traction. These solutions work by processing transactions off-chain and then settling them on the main blockchain, improving speed and reducing transaction costs. As the demand for DeFi services increases in 2025, Layer 2 solutions are expected to play a crucial role in scaling DEXs to handle higher volumes of trades and users.

2. Cross-Chain Interoperability

Cross-chain interoperability is another trend that will define DeFi exchange development in 2025. In the current DeFi ecosystem, many exchanges and platforms are confined to a single blockchain, limiting the range of assets that can be traded and used across different networks. Cross-chain solutions enable assets from multiple blockchains to be transferred and used seamlessly within the same platform.

As DeFi exchanges continue to grow, interoperability between blockchains will become increasingly important. Platforms like Polkadot and Cosmos are already laying the groundwork for a multi-chain world, and in 2025, we can expect to see more DeFi exchanges offering cross-chain trading, allowing users to access a broader range of assets and improving liquidity across the ecosystem.

3. Automated Market Makers (AMMs) 2.0

Automated Market Makers (AMMs) have been a key component of decentralized exchanges, allowing users to trade assets without relying on order books or centralized intermediaries. However, the current AMM models, like those used by Uniswap, have limitations, such as impermanent loss and inefficient pricing in certain market conditions.

To address these issues, we can expect the development of AMM 2.0 in 2025. These upgraded models will improve capital efficiency, reduce slippage, and offer better risk management tools. Some AMM 2.0 protocols are already being developed, focusing on optimizing liquidity provision, dynamic fees, and innovative approaches to mitigating impermanent loss. The next generation of AMMs will play a critical role in enhancing the efficiency and usability of decentralized exchanges.

4. DeFi Derivatives and Synthetics

Derivatives and synthetic assets have long been essential components of traditional finance, and they are increasingly making their way into the DeFi space. In 2025, DeFi derivatives and synthetic assets will continue to grow in importance, offering users a broader range of financial instruments to trade and hedge their positions.

DeFi derivatives platforms enable users to trade contracts that derive their value from underlying assets, such as stocks, commodities, and cryptocurrencies. Synthetic assets, on the other hand, allow users to gain exposure to traditional assets without actually owning them. In the coming years, expect more DeFi exchanges to offer products like decentralized options, futures contracts, and synthetic commodities, helping to bring more complex financial products to the decentralized world.

5. Improved User Experience (UX) and Interface Design

The DeFi space has often been criticized for its complex user interfaces and steep learning curves, which can deter mainstream users from participating. However, as the DeFi ecosystem matures, we can expect a significant shift toward improving the user experience (UX) and interface design of decentralized exchanges.

In 2025, DeFi platforms will likely adopt more intuitive designs, making it easier for users to interact with the protocols and services. This includes simplifying the process of connecting wallets, making transactions more transparent, and improving navigation. A user-friendly DeFi experience will help attract a broader audience, including those who are new to blockchain technology and decentralized finance.

6. Decentralized Identity and KYC Solutions

Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations are standard practices in traditional finance, but the decentralized nature of DeFi exchanges makes it challenging to enforce these rules. However, as regulatory scrutiny on DeFi grows, there will be an increasing push toward integrating decentralized identity and KYC solutions into DeFi exchanges.

In 2025, expect to see more DeFi platforms implementing self-sovereign identity (SSI) systems, allowing users to verify their identity without compromising privacy. These solutions will enable DeFi exchanges to comply with regulations while maintaining the core principles of decentralization and privacy. Decentralized KYC solutions can create a balance between user anonymity and regulatory compliance, allowing the DeFi space to grow without facing significant legal hurdles.

7. AI and Machine Learning for Trading

Artificial Intelligence (AI) and Machine Learning (ML) are rapidly transforming many industries, and the DeFi space is no exception. In 2025, we can expect to see the widespread adoption of AI-driven trading strategies and analytics on DeFi exchanges.

AI and ML can be used to analyze market trends, predict price movements, and execute trades more efficiently than human traders. Some DeFi exchanges may even offer AI-powered trading bots that allow users to automate their strategies. Additionally, AI can be employed to detect fraudulent activities, optimize liquidity, and enhance risk management. The integration of AI into DeFi exchanges will improve overall market efficiency and provide users with advanced tools to make more informed trading decisions.

8. Privacy-Enhancing Features

Privacy has always been a significant concern in the cryptocurrency and DeFi space. While blockchain technology provides transparency, it also makes all transactions traceable, which can be problematic for users who prioritize privacy.

In 2025, we can expect to see more DeFi exchanges incorporating privacy-enhancing technologies like zero-knowledge proofs (ZKPs) and privacy coins. These technologies allow users to transact privately while still ensuring the integrity of the blockchain. ZKPs, for instance, enable the validation of transactions without revealing sensitive information. Privacy-focused DeFi exchanges will provide users with greater control over their data and ensure that sensitive financial transactions remain confidential.

9. Tokenization of Real-World Assets (RWAs)

Tokenization is the process of converting real-world assets, such as real estate, commodities, and stocks, into digital tokens that can be traded on blockchain networks. This trend is expected to gain significant momentum in 2025, as more DeFi exchanges begin to offer tokenized versions of real-world assets.

Tokenizing RWAs provides many benefits, including increased liquidity, fractional ownership, and easier access to global markets. DeFi exchanges will serve as the platform for trading these tokenized assets, allowing users to diversify their portfolios beyond cryptocurrencies. This trend is likely to attract institutional investors to the DeFi space, further boosting the adoption of decentralized exchanges.

10. Governance and Decentralized Autonomous Organizations (DAOs)

Governance and decentralized decision-making are essential components of the DeFi ecosystem. In 2025, we can expect to see even greater emphasis on decentralized governance and the rise of Decentralized Autonomous Organizations (DAOs) within DeFi exchanges.

DAOs are organizations that are governed by smart contracts and community members, rather than centralized authorities. DeFi exchanges will increasingly adopt DAO structures to allow token holders to vote on important protocol decisions, such as changes to the exchange’s fees, liquidity pools, and governance rules. DAOs will enable users to have a direct say in the future of the platforms they use, promoting fairness and decentralization within the DeFi space.

Conclusion

As we look ahead to 2025, the DeFi exchange landscape is poised for significant growth and innovation. From scalability improvements through Layer 2 solutions to the integration of AI and privacy features, the trends we’ve outlined above will shape the future of decentralized finance.

While challenges remain, such as regulatory concerns and the need for user education, the continued development of DeFi exchanges is a testament to the potential of blockchain technology to transform the financial world. Whether you're a seasoned DeFi user or new to the space, keeping an eye on these trends will help you stay informed and prepared for the exciting changes ahead.

The next few years will undoubtedly bring new opportunities and challenges, but one thing is certain: DeFi is here to stay, and its evolution in 2025 will set the stage for the future of finance.

#crypto#blockchain#cryptocurrency#defi#defi development#ai chatbot#chatbotservices#ai generated#ai#artificial intelligence#machine learning

1 note

·

View note

Text

Top 10 Cryptocurrencies to Watch in 2025 | TheNewsCrypto

The cryptocurrency market continues to evolve, shaping the future of global finance with its innovative technology and decentralized approach. As we look forward to 2025, several digital assets are poised to dominate the market. Here, The News Crypto highlights the Top 10 Cryptocurrencies in 2025, offering insights into their potential impact and growth.

1. Bitcoin (BTC)

Bitcoin remains the leader in the crypto space. As the first cryptocurrency, it continues to attract investors due to its widespread adoption and status as digital gold. With institutional interest surging, BTC is expected to maintain its dominance in 2025.

2. Ethereum (ETH)

Ethereum’s transition to Ethereum 2.0 and its focus on scalability and sustainability make it a top contender. Its smart contract capabilities power decentralized applications (dApps), ensuring its position among the Top 10 Cryptocurrencies in 2025.

3. Binance Coin (BNB)

The native token of Binance, the world’s largest cryptocurrency exchange, BNB has shown consistent growth. Its utility in trading fee discounts and as a medium for DeFi applications secures its future relevance.

4. Cardano (ADA)

Cardano’s research-driven approach and focus on sustainability and interoperability have garnered significant attention. With continual updates, it is set to remain a strong player in the market.

5. Ripple (XRP)

Despite regulatory challenges, XRP’s focus on cross-border payments and partnerships with financial institutions make it a valuable asset for the future.

6. Solana (SOL)

Solana’s high-speed transactions and low fees have made it a preferred choice for developers and users. It’s expected to be a major player in the blockchain ecosystem.

7. Polkadot (DOT)

Polkadot’s unique multi-chain approach facilitates seamless communication between different blockchains, driving its growth and ensuring a spot in the Top 10 Cryptocurrencies in 2025.

8. Avalanche (AVAX)

Known for its scalability and low transaction costs, Avalanche has gained traction in DeFi and enterprise solutions, positioning itself as a future leader.

9. Chainlink (LINK)

As the leading oracle solution, Chainlink connects smart contracts with real-world data. Its continued innovation cements its role in the blockchain ecosystem.

10. Polygon (MATIC)

Polygon’s Layer 2 scaling solution for Ethereum has made it a go-to platform for developers, ensuring its place among the Top 10 Cryptocurrencies in 2025. The cryptocurrency landscape is dynamic, and staying informed is crucial for success. Rely on The News Crypto for accurate insights and updates on the latest trends in digital assets

0 notes

Text

How to Earn Free Crypto Without Investment?

Cryptocurrencies are becoming a mainstream financial tool specially after bitcoin hitting 100k. By earning free crypto without investment, you can:

Gain exposure to the crypto market without financial risk.

Learn about cryptocurrency and blockchain technology through hands-on experience.

Accumulate digital assets that could appreciate in value over time.

Best Ways to Earn Free Crypto Without Investment

There are multiple ways to earn free crypto. Here, we break down some of the most effective methods.

1. Using Autofaucets

One of the simplest and most popular methods to earn free crypto without investment is through autofaucets. These platforms dispense small amounts of cryptocurrency for free, often requiring minimal effort.

Using autofaucets can earn you decent amounts of free crypto if you put in the time. It usually revolves around:

Watching PTC ads (Paid-to-Click advertisements).

Completing shortlinks that redirect you to specific websites. and you get paid for each visits some satoshis.

Engaging in offerwalls, such as watching videos, taking surveys, or downloading apps.

Referring friends or others who may also be interested in earning free crypto without investment.

For more detailed insights into earning crypto, visit this guide on how to earn free crypto and make money.

2. Airdrops and Giveaways

Crypto projects often distribute free tokens to promote their platforms. Here’s how you can take advantage:

Sign up for new projects offering airdrops.

Participate in social media campaigns, such as liking, sharing, or commenting on their posts.

Hold specific cryptocurrencies to be eligible for bonus tokens.

3. Play-to-Earn (P2E) Games

Blockchain-based games reward players with cryptocurrencies or NFTs (Non-Fungible Tokens). These games often involve:

Completing missions or tasks to earn tokens.

Trading in-game assets for cryptocurrency.

Some popular P2E games include Axie Infinity and Decentraland. For a deeper understanding, check out this guide on unlocking the secrets to earning crypto with P2E games.

4. Crypto Faucets

Crypto faucets are similar to autofaucets but require manual action. Here’s how they work:

Sign up for a faucet website.

Claim small amounts of crypto periodically by solving captchas or Clicking an ad or doing a shortlink.

For more information, visit earn crypto hassle-free with top 15 instant faucets.

5. Referral Programs

Many platforms reward users for referring others. By sharing your unique referral link, you can:

Earn a percentage of your referral’s earnings.

Increase your passive income without extra effort.

You can also check one of the biggest PTC websites here how to earn free crypto and make money.

Tips to Maximize Earnings

Stay Consistent

Earning free crypto without investment often requires patience and consistent effort. Set aside time daily to engage with the platforms.

Avoid Scams

Be cautious of:

Websites asking for private keys.

Platforms requiring upfront payments for withdrawals.

Projects making unrealistic promises.

Use Multiple Platforms

Diversify your efforts by using multiple autofaucets, playing P2E games, and participating in several airdrops.

Focus on High-Paying Tasks

Not all tasks yield the same rewards. Prioritize tasks with higher payouts to optimize your time.

Refer More People

Referrals can significantly boost your earnings. Promote your referral links through:

Social media.

Blogs or websites.

Online forums related to crypto.

Frequently Asked Questions (FAQ)

How to earn free Bitcoin without investment?

You can earn free Bitcoin by using crypto faucets, completing tasks on autofaucets, or participating in airdrops and referral programs. These methods require no financial investment.

What are free crypto games to earn money without investment?

Play-to-Earn (P2E) games such as Axie Infinity and Decentraland allow you to earn cryptocurrency or NFTs by completing in-game missions or trading digital assets.

What are the best places to earn free crypto?

Some of the best platforms to earn free crypto include autofaucets, crypto faucets, and websites offering airdrops, giveaways, and referral programs.

How to earn crypto free in 2025?

In 2025, you can earn crypto for free by leveraging new autofaucets, participating in crypto games, and joining innovative blockchain projects offering token airdrops.

How to make money with crypto for free?

You can make money with crypto for free by engaging in tasks like watching PTC ads, completing shortlinks, joining referral programs, or participating in blockchain gaming and airdrop campaigns.

Conclusion

Earning free crypto without investment is a realistic way to accumulate digital assets without financial risk. By leveraging methods like using autofaucets, participating in airdrops, and playing P2E games, you can build a small but potentially valuable crypto portfolio. Just remember to stay consistent, avoid scams, and explore multiple platforms to maximize your earnings.

0 notes

Text

Top 10 Crypto-Friendly Countries to Watch in 2024

The world of cryptocurrency continues to evolve, and with it, various countries have embraced the technology, adapting their regulations to foster growth and innovation in the sector. As we step into 2024, it's clear that some nations have become particularly crypto-friendly, offering a favorable environment for crypto enthusiasts, businesses, and investors. Here are the top 10 crypto-friendly countries to watch in 2024, where the latest crypto coin news today and crypto currency news today are thriving.

1. Switzerland

Switzerland has long been a hub for blockchain innovation, particularly in the city of Zug, known as "Crypto Valley." In 2024, Switzerland remains one of the most crypto-friendly countries, offering clear regulations and a robust financial infrastructure. The Swiss government has shown a commitment to supporting blockchain technology and cryptocurrency, making it a top destination for crypto investors and startups. Additionally, the country offers tax benefits and legal clarity for crypto transactions, which helps create a stable environment for growth. As a leader in crypto currency news, Switzerland continues to be an ideal location for crypto businesses to thrive.

2. Singapore

Singapore has established itself as a leader in the cryptocurrency space. The Monetary Authority of Singapore (MAS) has implemented a progressive regulatory framework that supports crypto businesses while maintaining investor protection. In 2024, Singapore remains a global crypto hub, offering low taxes, clear regulations, and a strong financial sector that attracts crypto investors and blockchain companies. Singapore's stable economy and tech-friendly policies continue to make it a go-to location for cryptocoin news and the latest updates on the coin in market.

3. Malta

Malta, often referred to as "Blockchain Island," has embraced cryptocurrency and blockchain technology with open arms. The country passed comprehensive laws to regulate cryptocurrencies and blockchain applications, offering legal certainty to businesses in the space. Malta has become a prime location for crypto exchanges and blockchain companies, and in 2024, its crypto-friendly stance remains a key factor in its attractiveness to crypto entrepreneurs. Keep an eye on Shiba Inu coin news and other coins news crypto coming from this growing crypto hotspot.

4. Portugal

Portugal has gained popularity among crypto enthusiasts due to its favorable tax regime for crypto-related income. In 2024, Portugal continues to be one of the most crypto-friendly countries in Europe. The country offers tax exemptions on capital gains from the sale of cryptocurrencies for individuals, which makes it an attractive place for crypto investors. Portugal's welcoming attitude toward blockchain technology and its growing crypto ecosystem make it a prime destination for both businesses and individuals. Bitcoin price today remains a topic of interest in the Portuguese crypto community.

5. Estonia

Estonia has long been a pioneer in digital innovation, and its approach to cryptocurrency is no different. The Estonian government has implemented policies that foster the growth of blockchain technology and digital currencies. In 2024, Estonia's clear regulatory framework, including the e-residency program, continues to attract crypto businesses from around the world. With low corporate taxes and a tech-savvy population, Estonia remains one of Europe's top crypto-friendly countries, making headlines in crypto currency news for its blockchain advancements.

6. Germany

Germany's approach to cryptocurrency is unique compared to many other European countries. As of 2024, Germany has established itself as one of the most crypto-friendly countries in Europe, thanks to its regulatory clarity. The country has legalized the use of cryptocurrencies as a form of payment and offers tax advantages for crypto investors. Additionally, Germany has a strong financial sector that is increasingly integrating blockchain technology, which makes it an attractive destination for crypto businesses. Bitcoin news from Germany reflects the country's positive stance on blockchain innovation.

7. Japan

Japan has been one of the first major economies to embrace cryptocurrencies, and in 2024, it continues to be a crypto-friendly country. The country has a clear regulatory framework that ensures consumer protection while allowing crypto businesses to operate legally. Japan's proactive stance on blockchain technology and crypto exchanges has made it a leader in the crypto space in Asia. With a large, tech-savvy population and robust infrastructure, Japan remains an important market for coins news crypto and crypto coin news today.

8. United Arab Emirates (UAE)

The UAE, particularly Dubai, has emerged as a major crypto hub in the Middle East. The government has introduced a favorable regulatory environment, which includes tax-free crypto trading and the establishment of the Dubai Blockchain Strategy. In 2024, the UAE continues to invest heavily in blockchain technology and cryptocurrency-related businesses. Its forward-thinking policies and the presence of numerous crypto firms and exchanges make it an attractive destination for crypto entrepreneurs. Stay updated on the latest NFT news coming from this rapidly growing crypto ecosystem.

9. Cayman Islands

The Cayman Islands, a popular offshore financial center, has developed a crypto-friendly regulatory framework that allows businesses to operate with minimal interference. In 2024, the country remains a top choice for crypto companies looking for a jurisdiction with favorable tax policies and low operating costs. The Cayman Islands is home to many crypto hedge funds and exchanges, and its commitment to blockchain innovation continues to attract international investors and businesses. With a growing presence in the crypto currency news, this offshore haven offers opportunities for crypto investors.

10. El Salvador

El Salvador made history in 2021 by becoming the first country to adopt Bitcoin as legal tender, and in 2024, it remains a crypto pioneer. The country has shown its commitment to Bitcoin and cryptocurrency by offering a range of incentives for crypto businesses, including tax exemptions and infrastructure investments. El Salvador’s push to become the first "Bitcoin City" reflects its dedication to becoming a leading crypto hub, and its proactive approach to blockchain technology has garnered attention from around the world. Keep an eye on Bitcoin price today as El Salvador's Bitcoin initiatives continue to influence global trends.