#TokenizeAssets

Explore tagged Tumblr posts

Text

How Asset Tokenization Works: Process, Cost, and Benefits

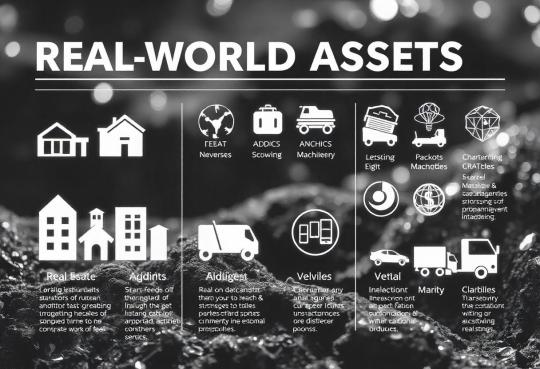

In today’s digital economy, Asset Tokenization is transforming how we perceive ownership, transfer value, and invest in assets. From real estate to fine art, and even commodities, almost any asset can now be tokenized using blockchain technology. This innovation is streamlining traditional investment models, improving liquidity, and opening the door for global participation.

In this article, we will explore what Asset Tokenization is, how the process works, the associated costs, and the numerous benefits it offers to both investors and asset owners.

What is Asset Tokenization?

Asset Tokenization is the process of converting rights or ownership of a real-world asset into a digital token on a blockchain. These tokens represent fractional ownership and can be bought, sold, or traded on digital platforms.

Imagine owning a piece of a luxury apartment in New York or a rare piece of artwork without having to buy the entire asset. With Asset Tokenization, this becomes possible. It democratizes access to high-value investments by allowing individuals to purchase small fractions.

How Asset Tokenization Works – Step-by-Step

The process of Asset Tokenization involves several key steps, integrating legal compliance, smart contracts, and blockchain technology to create a secure digital representation of the physical asset.

1. Asset Selection

The first step is choosing the asset to tokenize. This could be:

Real estate

Artwork

Precious metals

Intellectual property

Private company shares

2. Due Diligence and Legal Structuring

Before tokenization, the asset must undergo proper valuation, legal checks, and documentation. Legal compliance is crucial to ensure that the tokenized asset is recognized in the jurisdiction of interest.

3. Smart Contract Development

Smart contracts are self-executing codes on the blockchain that define how the tokenized asset behaves. They establish rules for ownership, transfer, and revenue distribution.

4. Token Creation

After the smart contract is ready, tokens are minted on a blockchain platform such as Ethereum, Polygon, or Solana. Each token represents a share in the asset.

5. Token Distribution

The tokens are then distributed to investors via a token sale, Security Token Offering (STO), or private investment rounds. Investors can purchase these tokens using fiat or cryptocurrencies.

6. Secondary Trading

Once distributed, tokens can be listed on secondary markets or token exchanges, enabling liquidity and transferability of the asset.

Through this process, Asset Tokenization provides a secure, transparent, and efficient way to manage ownership and transfer of real-world assets.

Cost of Asset Tokenization

The cost of Asset Tokenization can vary depending on the asset class, jurisdiction, and level of complexity involved. Here’s a general breakdown:ComponentEstimated Cost (USD)Legal & Compliance$10,000 – $50,000Smart Contract Development$5,000 – $20,000Token Minting & Platform Fee$3,000 – $10,000Marketing & Investor Onboarding$5,000 – $30,000Maintenance & CustodyVariable

Total Estimated Cost: $25,000 to $100,000+

Despite the upfront cost, the long-term value derived from liquidity, broader investor reach, and automation often outweighs the initial investment.

Key Benefits of Asset Tokenization

Asset Tokenization offers multiple advantages that are driving its rapid adoption across industries. Let’s explore the top benefits:

1. Improved Liquidity

Traditional assets like real estate are often illiquid. Asset Tokenization enables fractional ownership, making it easier to buy or sell small portions, thus improving liquidity.

2. Global Reach

With tokenized assets, investors from around the world can participate without geographic limitations, expanding the potential investor base significantly.

3. Fractional Ownership

Instead of needing large sums to invest in expensive assets, investors can buy small fractions, lowering the entry barrier.

4. Transparency and Security

Blockchain provides an immutable ledger, ensuring all transactions are transparent and traceable. This reduces the risk of fraud and builds trust among stakeholders.

5. Faster Transactions

Blockchain eliminates intermediaries, reducing the time required for settlements. This leads to faster, cheaper, and more efficient transactions.

6. Programmability

Through smart contracts, tokenized assets can have programmable features such as automated dividends, voting rights, and transfer conditions.

7. Cost Efficiency

Over time, the reduction in administrative overhead, paperwork, and legal fees can result in significant cost savings.

These benefits make Asset Tokenization a compelling solution for modernizing asset management and investment practices.

Use Cases of Asset Tokenization

Let’s look at a few real-world use cases where Asset Tokenization is creating significant impact:

1. Real Estate

Developers are tokenizing commercial and residential properties to allow fractional investment and improve liquidity.

2. Art and Collectibles

Rare artworks, collectibles, and luxury goods are being tokenized to allow investors to own and trade fractions of valuable items.

3. Commodities

Gold, oil, and other commodities can be tokenized, offering easy exposure to these markets without physical possession.

4. Equity and Private Markets

Private startups and SMEs can tokenize shares to raise funds more efficiently and offer secondary liquidity to early investors.

Challenges in Asset Tokenization

While Asset Tokenization is promising, it also comes with its own set of challenges:

Regulatory Uncertainty: Compliance with financial regulations across jurisdictions is complex and evolving.

Technology Adoption: Many traditional players are still wary of blockchain adoption.

Market Education: Lack of awareness among investors and institutions can slow down adoption.

Overcoming these challenges requires collaboration among regulators, technology providers, and asset owners.

Conclusion

Asset Tokenization is reshaping the financial world by making real-world assets more accessible, liquid, and secure. From real estate and commodities to art and private equity, the potential applications are limitless.

With the right legal framework, robust smart contracts, and a trusted blockchain platform, the process of Asset Tokenization can unlock enormous value for businesses and investors alike.

If you're considering entering the tokenized economy, now is the time to explore how Asset Tokenization can benefit your asset portfolio or investment strategy.

#RealWorldAssetTokenization#AssetTokenization#RWATokenization#RealEstateTokenization#TokenizeAssets#CryptoAssets#ShamlaTech#TokenEconomy#BlockchainForAssets#DigitalAssets

0 notes

Text

Best Real World Asset Tokenization Companies in 2025

The world of finance is shifting gears, and at the heart of this transformation is real world asset tokenization. In 2025, this tech-forward movement is revolutionizing how we invest in physical assets, offering liquidity, transparency, and global access. But with a booming industry comes a crucial question—who are the Best Real World Asset Tokenization Companies in 2025?

This guide dives deep into the companies that are setting the gold standard this year.

Introduction to Real World Asset Tokenization

What is Asset Tokenization?

Let’s break it down. Asset tokenization is the process of converting ownership of tangible assets—like real estate, art, or commodities—into digital tokens on a blockchain. These tokens represent fractional ownership, which can be traded, bought, or sold.

Imagine owning a piece of the Eiffel Tower (hypothetically) or a fraction of a Picasso painting. With tokenization, that’s not just a dream—it’s a tangible investment reality.

Why Tokenize Real World Assets?

The benefits are massive. Tokenization:

Increases asset liquidity

Reduces transaction fees

Enhances transparency

Offers global access to investment opportunities

This is why the Best Real World Asset Tokenization Companies are in high demand.

Growth of Real World Asset Tokenization in 2025

Market Expansion and Institutional Adoption

2025 marks a turning point. Institutional players, including major banks and asset managers, are fully onboard. The global tokenized asset market is expected to reach trillions in value. This explosive growth demands robust, compliant platforms—exactly what the Best Real World Asset Tokenization Companies in 2025 provide.

Key Trends in 2025

Cross-chain interoperability

On-chain compliance and KYC

Tokenized bonds and real estate REITs

Yield-generating tokenized assets

Criteria for Evaluating Tokenization Companies

Before we spotlight the Best Real World Asset Tokenization Companies, let’s understand what makes a company best-in-class.

Regulatory Compliance

The best firms follow jurisdictional laws to the letter. Without proper licenses, tokenized assets won’t fly.

Security and Transparency

Blockchain security protocols and full auditability are essential for user trust.

Platform Flexibility and Integration

Can the platform handle multiple asset classes? Does it integrate with wallets, exchanges, and banking systems?

Best Real World Asset Tokenization Companies in 2025

Here’s our handpicked list of the Best Real World Asset Tokenization Companies in 2025 that are leading innovation and compliance.

1. Shamla Tech

Overview and Core Offerings

Shamla Tech is a pioneer in the space, offering compliant token issuance, secondary trading, and investor onboarding tools. Backed by Coinbase and SoftBank, they cater to both institutional and retail investors.

Why It Stands Out in 2025

Shamla Tech continues to dominate as one of the Best Real World Asset Tokenization Companies by expanding its infrastructure and tokenizing everything from real estate to credit products.

2. Polymesh

Overview and Features

Polymesh is a security token-specific blockchain, built from the ground up to meet regulatory standards. Its identity-based chain ensures compliance and control at every level.

Institutional Grade Compliance

Polymesh is perfect for high-value asset tokenization projects in banking and finance, making it one of the Best Real World Asset Tokenization Companies in 2025.

3. Tokeny

Asset Coverage and Blockchain Support

Headquartered in Luxembourg, Tokeny supports tokenization of real estate, venture capital, and private equity across Ethereum and Polygon.

Ecosystem Expansion in 2025

Tokeny partners with governments and major financial institutions, pushing it into the top tier of the Best Real World Asset Tokenization Companies.

4. tZERO

Integration with Traditional Finance

tZERO brings Wall Street to Web3. As a regulated ATS (alternative trading system), it allows the trading of digital securities while complying with the SEC.

Innovations and Achievements

In 2025, tZERO’s integration with legacy finance systems makes it a powerhouse—earning its spot as one of the Best Real World Asset Tokenization Companies in 2025.

5. Ondo Finance

Tokenizing Treasury and Yield Products

Ondo is taking the world by storm with tokenized U.S. Treasuries and other yield-bearing products.

Unique Value Proposition

By making yield accessible on-chain, Ondo is not just innovative—it’s transforming the DeFi/RWA narrative, solidifying its status as one of the Best Real World Asset Tokenization Companies.

Rising Stars in Tokenization

Not all stars shine the same. Some are emerging fast.

RedSwan CRE

Specializing in commercial real estate, RedSwan enables fractional ownership in multi-million-dollar properties.

Mattereum

Mattereum merges IoT and legal smart contracts to bring physical verification to digital assets.

Both are gunning for a top spot in the list of Best Real World Asset Tokenization Companies in 2025.

Use Cases of Asset Tokenization in 2025

Real Estate

Tokenization allows investors to own a fraction of luxury buildings or rental income streams.

Private Equity

Startups can raise funds without going public, offering tokens instead of shares.

Commodities and Art

Gold, silver, diamonds, and fine art are being converted into tradable digital tokens.

Challenges Facing the Industry

It’s not all sunshine. Even the Best Real World Asset Tokenization Companies in 2025 face hurdles.

Legal Complexity Across Jurisdictions

Each country has different laws. Navigating global compliance is complex.

Interoperability Between Chains

Different blockchains don’t always talk to each other. Cross-chain operability is still evolving.

The Future of Tokenized Assets

The Road Ahead for 2026 and Beyond

Expect:

AI-powered asset management

Fully on-chain compliance systems

Broader token adoption among Gen Z investors

The future is decentralized—and tokenized.

Conclusion

If 2024 was the warm-up, 2025 is the breakout year. With billions pouring into tokenized assets, choosing the right platform is more critical than ever. The Best Real World Asset Tokenization Companies in 2025 combine innovation, security, compliance, and scalability.

Whether you're an investor, asset manager, or institution—getting ahead means choosing a tokenization partner that’s built for the future.

FAQs

1. What are the best real world asset tokenization companies in 2025? Some of the top companies include Shamla Tech, Polymesh, Tokeny, tZERO, and Ondo Finance.

2. Why is asset tokenization gaining traction in 2025? It offers liquidity, fractional ownership, transparency, and a lower barrier to entry for investors.

3. What types of assets can be tokenized? Real estate, art, private equity, commodities, bonds, and even music royalties.

4. Is tokenization legal? Yes, but it depends on the jurisdiction. Top companies ensure full regulatory compliance.

5. How can I invest in tokenized assets? You can sign up with platforms offered by the Best Real World Asset Tokenization Companies and start investing using fiat or crypto.

#RealWorldAssetTokenization#AssetTokenization#RWATokenization#RealEstateTokenization#TokenizeAssets#CryptoAssets#ShamlaTech#TokenEconomy#BlockchainForAssets#DigitalAssets

0 notes

Text

Top Real World Asset Tokenization Services to Explore

In the ever-evolving world of blockchain, one concept has moved from buzzword to business model: Real World Asset (RWA) Tokenization. But with countless service providers out there, which ones should you trust? This guide dives deep into the Top Real World Asset Tokenization Services and explores what makes them stand out in 2025.

Introduction to Real World Asset (RWA) Tokenization

What Are Real World Assets?

Real World Assets include anything that exists in the physical or traditional financial world—real estate, commodities, art, precious metals, bonds, and even intellectual property. These are tangible or legally recognized assets with real-world value.

The Rise of Asset Tokenization

Tokenization converts ownership rights of real-world assets into digital tokens on a blockchain. It’s not just about cryptocurrency anymore—now, entire apartment buildings, artworks, or even wine collections can be tokenized, opening doors for broader investor participation.

Why Tokenization of Real World Assets Is a Game Changer

Increased Liquidity

Most physical assets are illiquid. Tokenization changes that. By converting them into tradable tokens, owners can access liquidity without selling the entire asset.

Fractional Ownership

Imagine owning a slice of a million-dollar Manhattan apartment. That’s possible through fractionalized token ownership. It democratizes investment, making high-value assets accessible to average investors.

Global Accessibility

Blockchain knows no borders. With asset tokenization, a buyer in Tokyo can invest in real estate in New York or gold in London—with just an internet connection.

How Real World Asset Tokenization Works

Step-by-Step Tokenization Process

Asset Identification: Select and evaluate the real-world asset.

Legal Structuring: Ensure it complies with local and international regulations.

Token Creation: Develop blockchain-based tokens representing fractional ownership.

Smart Contracts: Automate transactions and compliance.

Listing on Platform: Make tokens available for trading or investing.

Blockchain Networks Used in Tokenization

Popular chains include Ethereum, Polygon, Avalanche, and Solana. Security and compliance-friendly blockchains like Polymesh and Tezos are also gaining traction.

Key Features to Look for in RWA Tokenization Services

Regulatory Compliance

You need more than flashy tech. Ensure the service meets local securities laws and global compliance standards like AML/KYC.

Security and Smart Contracts

From wallet security to smart contract audits, robust security infrastructure is non-negotiable.

Interoperability and Scalability

A good platform should support multiple chains and scale with demand, ensuring broad market access and flexibility.

Top Real World Asset Tokenization Services to Explore

1. Shamla Tech

Purpose-built for security tokens, Shamla Tech excels in compliance and confidentiality. It simplifies regulatory workflows and supports permissioned access control.

Blockchain: Proprietary Shamla Tech Chain

Ideal For: Regulated financial instruments and tokenized equities

2. Tokeny

Tokeny is Europe’s go-to platform for compliant token issuance. With a strong focus on identity and lifecycle management, it enables issuers to stay compliant across jurisdictions.

Based In: Luxembourg

USP: Decentralized identity framework and investor whitelisting

3. Securitize

A U.S.-regulated giant in the tokenization space, Securitize provides end-to-end token services—from issuance to secondary market trading.

Licenses: SEC & FINRA approved

Assets Supported: Real estate, equity, funds, and more

4. tZERO

Backed by Overstock, tZERO bridges traditional finance with blockchain. Its secondary trading platform sets it apart.

Specialty: Regulated secondary trading of security tokens

Bonus: Offers real-time trade settlements

5. RealT

A favorite for real estate investors, RealT allows you to buy fractions of U.S. rental properties via Ethereum and Gnosis Chain.

Benefits: Weekly rental income in stablecoins

Assets: Detroit, Chicago, and Miami properties

6. Ondo Finance

Ondo tokenizes institutional-grade assets such as U.S. Treasury Bonds, making DeFi-native exposure to TradFi possible.

Notable Product: OUSG (tokenized BlackRock fund)

Audience: Yield-seeking DeFi users

7. Tangible

Tangible turns physical goods—like gold, wine, and watches—into on-chain assets. It stores real-world assets in insured vaults and mints NFTs as receipts.

USP: Tangible Vault & Instant NFT Redemption

Perfect For: Luxury collectors and alternative asset investors

Comparative Table of Tokenization Platforms

PlatformSpecialtyRegulatory StrengthBlockchain SupportUnique FeaturePolymeshSecurity TokensHighPolymeshIdentity + Compliance FocusTokenyIdentity ManagementHigh (EU-compliant)EthereumDecentralized ID SystemSecuritizeBroad Asset SupportVery High (SEC, FINRA)Ethereum, AlgorandFull-Service TokenizationtZEROTrading PlatformHighProprietaryInstant Trade SettlementsRealTReal EstateModerateEthereum, GnosisRental Income in StablecoinsOndo FinanceInstitutional AssetsHighEthereumDeFi-TradFi BridgeTangibleLuxury GoodsModeratePolygonPhysical Vaulting + NFTs

Real-World Use Cases and Success Stories

Tokenized Real Estate

Companies like RealT have helped over 10,000 global investors own U.S. property. These tokenized homes generate rental income distributed weekly to token holders.

Tokenized Art & Collectibles

Platforms like Tangible allow users to invest in rare art, wine, and luxury watches, turning passion into portfolio diversification.

Challenges in Real World Asset Tokenization

Legal Uncertainty

Different countries have varying definitions of securities and digital assets. This legal grey zone can discourage institutional adoption.

Market Fragmentation

Dozens of platforms, blockchains, and token standards can create interoperability issues. A lack of unified standards slows mass adoption.

The Future of RWA Tokenization

From central banks exploring tokenized bonds to luxury brands leveraging NFTs for authentication, the momentum is undeniable. Experts predict the tokenized asset market could surpass $16 trillion by 2030, driven by DeFi, regulation, and rising investor demand.

Conclusion

Real World Asset Tokenization isn’t just a passing trend—it’s a financial revolution. Whether you're an investor, institution, or curious learner, the Top Real World Asset Tokenization Services listed above offer cutting-edge solutions to unlock liquidity, transparency, and global investment opportunities.

By understanding the features, challenges, and key players in the space, you're better equipped to tap into the future of asset ownership. The line between the physical and digital world is blurring—and now is the time to explore what lies beyond.

FAQs

1. What are the benefits of tokenizing real world assets? Tokenization increases liquidity, enables fractional ownership, simplifies cross-border investment, and enhances transparency using blockchain.

2. Is it legal to tokenize physical assets? Yes, but it depends on local regulations. Always choose tokenization platforms that prioritize compliance with securities laws.

3. Can I earn income from tokenized assets? Absolutely. For instance, RealT distributes rental income weekly to property token holders, and some tokenized bonds offer fixed returns.

4. Which blockchain is best for asset tokenization? Ethereum remains the most popular due to its smart contract capabilities, but niche platforms like Polymesh offer tailored compliance features.

5. Is investing in tokenized assets risky? Like any investment, it carries risks. These include regulatory shifts, smart contract bugs, and market volatility. Always conduct due diligence.

#RealWorldAssetTokenization#AssetTokenization#RWATokenization#RealEstateTokenization#TokenizeAssets#CryptoAssets#ShamlaTech#TokenEconomy#BlockchainForAssets#DigitalAssets

0 notes

Text

What are Real-World Assets (RWA)? A Comprehensive Guide to Asset Tokenization

In today’s fast-evolving digital economy, the intersection of blockchain technology and traditional finance has given rise to innovative solutions that revolutionize how we perceive and interact with assets. One of these groundbreaking innovations is the concept of Real-World Assets (RWA). In this article, we will explore what RWAs are, how their tokenization works, and why businesses and investors alike are increasingly interested in this emerging field. We’ll also highlight the benefits of real-world asset tokenization and discuss the services provided by leading companies such as Shamla Tech.

What Are Real-World Assets (RWA)?

Real-world assets refer to tangible or intangible assets that exist in the physical world but are tokenized on a blockchain. These assets can include anything from real estate, commodities, and precious metals to intellectual property rights, art, and even financial instruments like bonds or stocks. Tokenization is the process of representing these physical assets as digital tokens, which can then be bought, sold, or traded on a blockchain-based platform.

Through real-world asset tokenization, the traditional limitations of liquidity, accessibility, and fractional ownership are overcome. Blockchain technology ensures that these tokens are secure, immutable, and easily transferable, allowing asset holders to reach a broader pool of investors, enabling fractional ownership and liquidity in previously illiquid markets.

The Importance of Real-World Asset Tokenization Development

Real-world asset tokenization development plays a critical role in enabling the digitization and democratization of traditional assets. Businesses, developers, and investors turn to specialized RWA tokenization services to facilitate the process of converting their real-world assets into digital tokens. This involves various complex tasks, including smart contract development, legal compliance, and setting up platforms for trading and managing tokenized assets.

Shamla Tech, a renowned leader in the blockchain industry, is a trusted tokenized asset development company. They provide comprehensive RWA tokenization services, helping businesses of all sizes navigate the complexities of tokenizing assets. Their team of experts ensures a seamless transition from traditional ownership models to a digital, decentralized economy.

How Does Asset Tokenization Work?

The process of asset tokenization can be broken down into several key steps:

Asset Identification: First, the real-world asset to be tokenized is identified. This could be a property, a piece of artwork, a commodity, or any valuable physical item.

Asset Valuation: The value of the asset is determined using traditional valuation methods. This is a crucial step because the value of the tokenized asset will be directly linked to its real-world counterpart.

Smart Contract Development: Once the asset is identified and valued, developers create smart contracts that govern the rules and conditions of token ownership and transactions. These smart contracts automate the process of buying, selling, or transferring tokens and ensure transparency.

Token Issuance: The tokens representing the asset are issued on a blockchain network, such as Ethereum. Each token is a digital representation of a fractional ownership stake in the underlying asset.

Compliance and Regulation: An essential part of the process is ensuring that the tokenization adheres to local and international regulations. This includes know-your-customer (KYC) and anti-money laundering (AML) processes to ensure legal compliance.

Secondary Market Trading: Once issued, the tokens can be traded on secondary markets, providing liquidity for assets that were previously difficult to trade or sell in parts.

Benefits of Real-World Asset Tokenization

The advantages of real-world asset tokenization are transforming industries by making previously illiquid and inaccessible assets tradable and more flexible. Some key benefits include:

1. Increased Liquidity

Traditionally, certain assets like real estate or fine art were difficult to sell quickly or in small parts. However, tokenization enables fractional ownership, allowing investors to buy or sell smaller portions of these assets. This increases liquidity, as more investors can participate in the market.

2. Fractional Ownership

Investors no longer need to buy entire assets. Instead, they can purchase fractions or shares of assets, lowering the barrier to entry and democratizing access to investments. For example, an investor could own a fraction of a high-value property or a piece of expensive artwork.

3. Global Market Access

Tokenized assets can be bought, sold, or traded globally, opening up new markets and investment opportunities for both asset holders and investors. This reduces the traditional geographical barriers to asset ownership and trade.

4. Transparency and Security

Blockchain technology provides a transparent and immutable record of all transactions involving tokenized assets. This increases trust among investors and ensures that transactions are secure and verifiable.

5. Cost Efficiency

Traditional asset management often involves intermediaries such as brokers or legal firms, which increase the costs of buying or selling assets. Tokenization streamlines the process by reducing the need for intermediaries, lowering transaction fees, and shortening the time for transactions.

Industries Adopting Real-World Asset Tokenization

Several industries are already benefiting from the tokenization of real-world assets. Here are a few sectors that are leading the way:

1. Real Estate

Tokenizing real estate allows for fractional ownership and makes it easier to sell parts of a property or raise capital from multiple investors. This also facilitates cross-border investments and liquidity in traditionally illiquid markets.

2. Commodities

Precious metals like gold, silver, and other commodities can be tokenized, enabling investors to trade fractions of these assets without needing to physically store them. This provides a secure and more efficient way to invest in commodities.

3. Art and Collectibles

Art pieces, rare items, and collectibles can be tokenized, allowing collectors to own a share of a high-value item. This not only opens up new investment opportunities but also provides liquidity for art and collectibles, which are usually difficult to trade.

4. Financial Instruments

Bonds, securities, and other financial instruments can be tokenized to allow fractional ownership and easier trading. This improves liquidity and opens up access to a broader base of investors, particularly in markets that were traditionally restricted to large-scale or institutional investors.

Why Choose a Tokenized Asset Development Company?

Choosing the right tokenized asset development company is essential to the success of any tokenization project. Whether you’re tokenizing real estate, commodities, or artwork, a specialized company can help you navigate the complex legal, technical, and regulatory landscape involved in creating and managing tokenized assets.

Shamla Tech, a global leader in blockchain solutions, offers cutting-edge real world asset tokenization development services. They provide end-to-end solutions that cover everything from token creation and smart contract development to compliance with local regulations and setting up secondary markets for trading tokens. Their expertise ensures that businesses can focus on their core operations while Shamla Tech handles the intricacies of the tokenization process.

Future of Real-World Asset Tokenization

The future of asset tokenization looks promising as more industries adopt blockchain technology and realize the benefits of tokenizing their assets. With increased liquidity, accessibility, and transparency, tokenized assets have the potential to transform traditional investment markets and create new opportunities for businesses and investors alike.

Governments and regulatory bodies are also starting to recognize the potential of tokenized assets, leading to more favorable regulatory environments. As the legal framework surrounding tokenization matures, we can expect to see more widespread adoption and innovation in this space.

Conclusion

Real-world asset tokenization is reshaping the way we think about ownership, trading, and investment. By digitizing tangible and intangible assets, businesses can unlock liquidity, fractionalize ownership, and reach a global market. As industries continue to evolve, the benefits of real-world asset tokenization will become more apparent, leading to broader adoption across multiple sectors.

For businesses looking to enter the world of tokenization, partnering with a trusted tokenized asset development company like Shamla Tech can provide the expertise and tools needed to navigate this exciting new frontier. With their comprehensive RWA tokenization services, Shamla Tech is well-positioned to help businesses leverage blockchain technology for tokenizing their real-world assets and tapping into the future of digital ownership.

#RWATokenization#AssetTokenization#BlockchainSolutions#TokenizeAssets#RealWorldAssetTokenization#ShamlaTech#RWATokenizationServices#FractionalOwnership#DigitalAssets#TokenizationDevelopment#AssetManagement

0 notes