#Title Loans ontario

Explore tagged Tumblr posts

Text

Car Title Loans Ontario - Ontario Vehicle Title & Equity Loans

Car Title Loans Ontario, offered by Car Title Loans Canada, provides a swift financial solution for individuals facing cash crunches. These loans leverage the equity in a borrower's vehicle, enabling them to secure quick funds without undergoing a credit check. Vehicle title loans in Ontario offer a lifeline to those with less-than-perfect credit scores, as eligibility primarily depends on the value of the vehicle rather than credit history. With Car Title Loans Ontario, applicants can access funds efficiently, often on the same day of application approval. This hassle-free process makes it a popular choice for individuals in need of immediate financial assistance. By utilizing their vehicle's title, borrowers can navigate financial emergencies without the stress of traditional lending constraints. Car Title Loans Ontario stands as a reliable option for obtaining no credit score check loans swiftly.

0 notes

Text

Get Immediate Cash Using Car Title Loans Toronto For a Gender Reveal Party

A gender reveal party is a celebration where the parents of the soon-to-be-born baby find out what their future child's sex will be. These parties are usually set up with pink decorations for girls and blue decorations for boys. To pull off this amazing feeling of having a boy or a girl can be a bit costly. That is where Apex Loans Canada offers your same-day cash Car Title Loans Toronto against your vehicle as collateral. You can get up to $25,000 for four years without credit checks with us.

Set Up an unforgettable gender reveal party using car title loans Toronto

1. Spend on the party venue:

The type of venue that you choose for the party is going to depend greatly on your budget. Some will rent a hall and others may organize it at home. That is where our quick cash Car Title Loans Toronto will provide you with the needed funds for making that party a blast. We can give you up to $25,000 for four years without any hassle of credit checks and with no hidden charges.

2. Print gender reveal invitations:

Once you have chosen your venue and the approximate number of people attending the party, you can start preparing for the big event by printing out gender reveal invitations. You can take these invitations and pass them to your family and friends, so they know what day they need to be there. Fast funds from Car Title Loan Toronto can get you enough cash to print out the correct number of invitations.

3. Arrange your merchandise:

If you plan to decorate your party venue, you can organize your merchandise by shopping around. That is because you need enough decorations to make the party a success! Do not forget to include posters, balloons, party favors and paper goods for your guests. It would help if you used a few shades of blue for the boys and pink for the girls. Taking our quick cash Car Title Loans can help you do that without any cash flow stress. Our interest rates are low and so are our monthly repayments. We do not run any credit checks, so apply even with a bad credit score today.

4. Hire a photographer:

To make the party even more special, you can hire a photographer to photograph the moment. You can ask them for good-looking pictures of the party venue and the guests. A nice album will be essential for sharing these memories with your family and friends once you return home. Taking our quick cash Car Title Loans Ontario will help pay for their services because it comes with no stress of credit checks or employment verification. Apply online today and get approved within an hour.

5. Decide on the gender reveal cake:

The gender reveal cake is the one thing that people always look forward to. It is the centerpiece for the gender reveal party. You can work with your baker to choose the perfect cake for your party. Enough cash from Car Title Loan Toronto is the best way to set up the desired cake without money issues. Our interest rates are as low as 10%, and our monthly repayments are just $100. We do not bother with credit checks or employment verification, so applying for fast cash loans is the best way to get started on your gender reveal party today!

6. Find a balloon guy:

Having enough cash from Car Title Loans Toronto is important if you want to hire a party planner. You can take out cash loans against your vehicle as collateral to get your hands on $25,000 for four years. The amount you will get depends on the current market value of your vehicle and not your credit score.

Conclusion:

Apex Loans Canada is the best way to put your hands on immediate cash of up to $25,000. Our Car Title Loans Toronto term is up to 4 years and we have no prepayment penalties if you wish to pay off the loan early. We do not run any credit checks, so feel free to apply with a bad credit score today. To know more about our terms and conditions, contact us at tel:1-855-908-0908.

#car title loans#Car Title Loan toronto#car title loans Ontario#car collateral loans toronto#car equity loans toronto#bad credit car loans toronto#car collateral loans ontario#car equity loans ontario#bad credit car loans ontario#car title loan

2 notes

·

View notes

Text

Easy Application No Credit Check Car Title Loans Toronto

Looking for no credit check car title loans in Toronto, Ontario? Snap Car Cash offers a hassle-free solution. Get immediate approval and cash in hand without worrying about your credit score. Whether you need funds for emergencies or personal expenses, Snap Car Cash provides flexible terms and competitive rates. Apply online effortlessly and receive your loan. Don't let bad credit stop you from getting the financial help you need. Contact Snap Car Cash today and experience a straightforward process for securing your car title loan in Toronto.

#Car Title Loans Toronto#No Credit Check Car Title Loans Toronto#No Credit Check Car Title Loan Toronto#No Credit Check Car Title Loans Toronto Ontario#Title Loans Toronto

0 notes

Text

In What Ways Car Title Loans Can Solve Your Financial Needs?

We all hope our financial planning will care for us in our old age. But, unfortunately, it doesn't always happen. Whether you need cash to pay for a divorce or something unexpected , car title loans can provide an alternate solution. With auto registration as collateral, you can secure the required funds. Equity Loans Canada lets you borrow up to $60,000 with a loan term of up to 6 years. Our lending process is quick. You will receive the cash in an hour.

Things you can use quick cash Car Title Loans for

1. Personal Use

Personal use can be defined as a loan to meet your financial obligations. It may range from paying medical bills to a large expense like home repair. With car title loans Ontario, you can borrow up to $60,000 and pay it back over the longest loan term of 6 years. The monthly payments are as low as $100, with no credit checks.

2. Home Improvement

Home improvement can increase the value or quality of your home, which will ultimately raise its worth. Using Car Title Loans to borrow money will help you with improvements as you can pay for home repairs and renovation. Also, you can use the cash for interior and exterior care of your house. All you need to qualify is a lien/loan-free vehicle, valid driver's license, auto insurance and a spare key.

3. Major Life Events

Using car title loans Toronto to pay a legal fee and divorce settlement is the right decision, especially if you need the cash ASAP. It is very convenient to borrow money online using our application form, as we offer flexible loan terms and a simple application procedure. If you consider resolving your financial problems, title loans can help immediately.

4. Business

For small business owners, car title loans are an opportunity to fund a new project or buy company equipment. You can borrow money for a new office or other property development. Also, you can use the funds to buy inventory or supplies for your business operations. Apply online today and get the needed cash in an hour.

5. Education

With car title loans, you can make higher education possible for your children who want to attend school. That can help them achieve their goals and find their place in the world. We lend you cash the same day using your vehicle as collateral. Our low-interest rates and low monthly repayment make it easy for you to pay off the loan. If you are dealing with a bad credit score, no worries. We can qualify you without waiting, as we don't run any credit checks.

Conclusion:

Equity Loans Canada offers car title loans in Ontario, which can help you to get the money you need immediately. We approve all types of credit to resolve any financial problems. Our no-credit-check policy allows every person, including people with bad credit, to take advantage of our title loans. To speak with our loan officer, call today at tel:1-844-567-7002.

0 notes

Text

God I feel like the luckiest person in the world sometimes.

My embroidery research led me to this article I mean to write a kind of field notes report on, since it took me months to get my hands on a copy, and it's a really careful and thoughtful examination of how embroiderers thought about and shared new and foreign ideas. It's titled “‘From Scorching Spain and Freezing Muscovy’: English Embroidery and Early Modern Mediterranean Trade,” by Sylvia Houghteling in The Mobility of People and Things in the Early Modern Mediterranean, ed. Elisabeth A. Fraser (London: Routledge, 2020).

It whetted my appetite for more such articles, and Dr Houghteling lists some really cool ones, including:

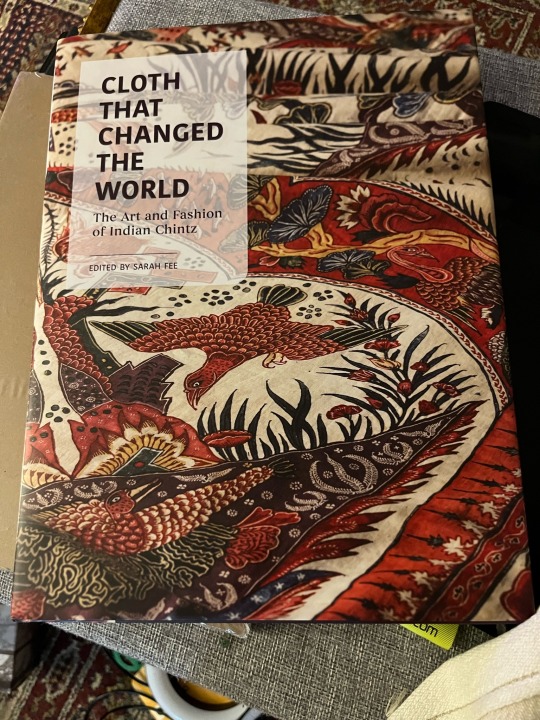

“Origins in Entanglement: Connections Between English Crewel Embroidery and Indian Chintz” in Cloth that Changed the World: The Coloured Cottons of India, ed. Sarah Fee (New Haven: Yale University Press, 2020).

Cloth that Changed the World was actually an exhibit that ran several years at the Royal Ontario Museum, and it sounds like it was really cool. And this book combines photos of the exhibit with modern scholarship, but it is not available in a digital form and I cannot get so much as a printed off copy of a copy through Interlibrary Loan. It costs $50 and that's the end of it until I have an actual research budget. Still, a girl can lust and gripe about the unattainable.

Then this came in the mail today , invoiced to a friend.

🥹🥹🥹

It's a totally amazing book. I love it so much. God, this stuff.

231 notes

·

View notes

Text

Get Fast Auto Title Loans in North York – Borrow Against Your Car

Snap Car Cash offers fast and easy Auto Title Loans North York, Ontario, allowing you to borrow money against your car’s value. If you need quick cash and have bad credit, our no credit check loans are a perfect solution. The process is simple, and you can get approved without the hassle of traditional credit checks. With your car title as collateral, you can access the funds you need in no time. Get in touch with Snap Car Cash today for quick cash loans in North York, Ontario, and get back on track financially!

0 notes

Text

Buying a Foreclosure Homes in Canada a Smart Investment?

Buying a foreclosure home in Canada offers a unique opportunity for investors and buyers to acquire properties at below-market prices. Foreclosed homes are properties that lenders sell after the previous owners fail to pay their mortgages. Though less common, these sales provide buyers with a chance to purchase properties at a discounted rate. With recent increases in mortgage interest rates, some Canadian homeowners have struggled with payments, potentially leading to more foreclosures and opportunities for savvy buyers.

Understanding Foreclosures in Canada

When a Canadian homeowner can’t make their loan payments, the lender has the right to take back and sell the property to recover their losses. This process, known as foreclosure, can begin as soon as a payment is missed. However, it’s not an immediate sale. The lender first issues a notice of default, giving the homeowner time to resolve the issue or sell the property themselves. If the homeowner fails to take action, the lender may proceed to sell the home, often through an auction.

It’s important to note that foreclosures are less frequent in Canada compared to the United States, making them a niche opportunity in the Canadian housing market.

Types of Foreclosures in Canada

There are two primary foreclosure methods used in Canada:

Judicial Sale: In provinces like British Columbia, Quebec, Alberta, Saskatchewan, and Nova Scotia, lenders must go through the courts to gain permission to sell the property. This method can be time-consuming and expensive, often taking several months or even up to a year. The court involvement ensures a fair process, but it also means the lender incurs legal costs, which they recover from the sale proceeds.

Power of Sale: In provinces such as Ontario, Prince Edward Island, New Brunswick, and Newfoundland and Labrador, lenders can sell the property without going through the courts. After the sale, they pay off the mortgage debt and any related fees. If the sale amount exceeds the debt, the remaining funds go to the borrower. However, if the sale falls short, the borrower remains responsible for the outstanding balance. This method is typically quicker and less costly than the judicial sale process.

Things to Know About Foreclosure Sales

Pre-Foreclosure Sales: Sometimes, homeowners attempt to sell their property before the lender takes control. This can present opportunities for buyers to purchase at a discounted price before the foreclosure process is finalized.

Auctions: Banks may sell foreclosed homes through auctions, either in person or online. It’s essential to understand the rules and costs associated with these auctions, as inspections are often only allowed after purchase.

Is Buying a Foreclosure Right for You?

Investing in a foreclosure property can be a great opportunity, but it also comes with risks. It’s essential to assess your financial situation, experience level, and comfort with potential challenges.

Benefits of Buying a Foreclosed Home:

Lower Price: Lenders often aim to sell quickly, which can result in discounted prices.

Investment Potential: Foreclosures can be an affordable entry point for those looking to buy, renovate, and rent or resell properties.

Clean Title: Lenders usually clear old debts or unpaid taxes before selling, simplifying the purchase process.

Renovation Opportunities: Purchasing below market value allows buyers to invest in improvements that could increase the property’s value and equity.

Buying a foreclosed home is often faster than a standard property purchase. Banks and homeowners eager to sell may offer better deals and expedited transactions, appealing to both investors and first-time buyers.

Challenges of Buying a Foreclosed Home

Despite the advantages, buying a foreclosed home has its downsides:

Competitive Market: Not all foreclosures are discounted significantly. In a competitive market, desirable properties may sell quickly, pushing prices higher.

“As-Is” Sales: Foreclosed homes are sold “as-is,” meaning buyers take on any necessary repairs and may need to remove belongings left behind.

Complex Legal and Financial Processes: Purchasing a foreclosed home often involves more stringent procedures, which can be complicated and time-consuming.

Liabilities and Taxes: Mortgage contracts may release lenders from any responsibility for property issues. Buyers may also face land transfer taxes, especially in Ontario, where rates range from 1% to 3% based on the property value.

Steps to Buying a Foreclosed Home in Canada

If you decide to pursue a foreclosure purchase, follow these steps:

Hire a Realtor: A professional REALTOR® with foreclosure experience is crucial. They can guide you through the complexities of buying a distressed property and answer any specific questions you may have.

Inspection and Appraisal: Conduct a thorough property inspection and appraisal to ensure you’re getting a fair deal and to understand the home’s true condition.

Budget for Costs: Foreclosures come with additional expenses, such as:

Reconnecting utilities

Renovations

Changing locks

Land transfer taxes

Administrative fees and permits for modifications

New appliances and repairs

Improve Your Finances: Boost your credit score, save for a substantial down payment, and pay off any existing debts to increase your chances of mortgage approval.

Make an Offer: Once you’ve done your research and decided to move forward, work with your realtor to make a competitive offer.

How to Find Foreclosure Homes in Canada

If you’re interested in exploring foreclosure options, here’s where to look:

Online Listings: Many real estate websites have foreclosure sections or filters to help you locate these properties.

Bank Websites: Some Canadian banks list foreclosed properties under “real estate owned” or “foreclosure” sections.

Real Estate Agents: Agents specializing in foreclosures can help you find and secure properties.

Government Websites: Occasionally, government listings include foreclosures, particularly those related to tax defaults.

Urban Team: Your Trusted Partner in Foreclosure Home Buying

With over 15 years of experience in the Canadian real estate market, Urban Team Homes is your trusted partner in buying foreclosure homes. Whether you’re searching for a primary residence or an investment opportunity, our expert team offers personalized support throughout the entire process, from property search to market analysis and negotiation. We ensure a smooth and successful transaction, making your investment in a foreclosure home a smart and rewarding decision.

Frequently Asked Questions (FAQs)

1. Can you buy foreclosure homes in Canada?

Yes, foreclosure homes are available in Canada, typically listed on the Multiple Listing Service (MLS) or through specialized real estate agents.

2. Why buy a foreclosure home?

They are often sold below market value, offering investment opportunities and quicker closing times.

3. What are the risks?

Risks include unexpected repairs, unpaid taxes, and legal complications. Proper research, inspections, and professional guidance are essential.

4. Where can I find foreclosure listings?

You can search on MLS, bank websites, or government platforms and work with real estate agents specializing in foreclosures.

5. Is buying a foreclosure home right for me?

It depends on your finances, investment goals, and willingness to navigate the complexities of foreclosure purchases. Professional advice is recommended to make an informed decision.

Considering buying a foreclosure? Contact Urban Team Homes for expert guidance and support in finding the best opportunities in the Canadian real estate market.

1 note

·

View note

Text

Get Quick Cash Today with Car Title Loans Barrie, Ontario

Are you facing unexpected expenses and need quick cash today? Snap Car Cash is your solution! With our Car Title Loans Barrie ON, you can unlock the cash tied up in your vehicle. It’s simple: use your car title as collateral, and you could get approved quickly! Our process is straightforward and designed to be stress-free. Plus, we offer competitive interest rates and flexible repayment plans tailored to fit your needs. Don’t let financial worries hold you back—reach out to Snap Car Cash today and transform your car title into the cash you need!

0 notes

Text

Car Title Loans Ontario | Get Cash Now

Get the cash you need quickly with Car Title Loans Ontario from Canada Loan Shop. Use your vehicle's title as security to secure a loan with competitive rates and flexible repayment terms. Ideal for managing unexpected expenses or urgent financial needs, Canada Loan Shop offers a streamlined application process and fast approval, all while allowing you to keep driving your car. Discover a stress-free way to access funds and take control of your financial situation today. Visit our website.

0 notes

Text

Cheap Pre-Owned Cars for Sale Near Me in Tilbury, ON

Are you in the market for an affordable pre-owned car in Tilbury, Ontario? Whether you're a first-time buyer, a student on a budget, or just looking to save some money, buying a used car can be a smart choice. With a little research and guidance, you can find a reliable vehicle that fits your needs without breaking the bank. In this article, we'll explore some tips and tricks for finding cheap pre-owned cars for sale near you in Tilbury.

Vehicles For Sale Near Me

Set Your Budget: Before you start browsing listings, it's essential to determine how much you can afford to spend. Consider not only the upfront cost of the car but also ongoing expenses like insurance, maintenance, and fuel. Setting a budget will help narrow down your options and prevent you from overspending.

Research Models: Once you have a budget in mind, research different car models to find ones that are known for their reliability and affordability. Look for vehicles with good fuel efficiency and low maintenance costs. Websites like Consumer Reports and Edmunds offer comprehensive reviews and ratings for various makes and models, helping you make an informed decision.

Explore Local Listings: Start your search for cheap pre-owned cars by checking out local listings in Tilbury. Websites like AutoTrader, Kijiji, and Craigslist are great places to find a wide selection of used vehicles in your area. You can filter your search by price, make, model, and other criteria to narrow down your options.

Consider Certified Pre-Owned: While certified pre-owned (CPO) cars may be slightly more expensive than regular used cars, they often come with additional benefits like extended warranties and thorough inspections. In some cases, buying a CPO car can provide added peace of mind knowing that the vehicle has been thoroughly vetted by the manufacturer.

Inspect and Test Drive: Once you've found a few promising options, it's essential to inspect and test drive the vehicles before making a purchase. Look for signs of wear and tear, such as rust, dents, and mechanical issues. Take the car for a test drive to get a feel for how it handles on the road and to ensure everything is in working order.

Negotiate the Price: Don't be afraid to negotiate the price when buying a used car. Sellers are often willing to negotiate, especially if the car has been on the market for a while or if there are any issues that need addressing. Be prepared to walk away if you can't agree on a price that fits within your budget.

Consider Financing Options: If you're unable to pay for the car upfront, consider financing options through a bank, credit union, or dealership. Shop around for the best interest rates and loan terms to ensure you're getting a good deal. Keep in mind that a higher down payment can help lower your monthly payments and overall interest costs.

Get a Vehicle History Report: Before finalizing the purchase, be sure to obtain a vehicle history report for the car you're interested in. This report will provide valuable information about the vehicle's past, including any accidents, title issues, or maintenance records. It's a crucial step in ensuring you're not buying a lemon.

0 notes

Text

Car Title Loans Toronto Ontario

Need a fast and reliable way to get cash? Snap Car Cash delivers with their efficient Toronto car title loans, services. By using your vehicle's title as collateral, Snap Car Cash enables you to access instant funds, helping you bridge the gap between paychecks or cover unforeseen expenses. With competitive interest rates and flexible repayment plans, Snap Car Cash ensures that borrowers can manage their loans comfortably while maintaining possession of their vehicles. Experience the convenience of Snap Car Cash and get the financial support you need without the headaches of traditional lending.

0 notes

Text

Title Loans in Ontario

🚗 Need cash quickly? Consider title loans in Ontario! 💰💪 With title loans, you can use your vehicle's title as collateral to borrow money. Find out more about this convenient option today! 📞Call us today (844) 243 5052!🌟

https://www.cashin24.ca/ontario/title-loans-ontario/

1 note

·

View note

Text

Borrow Against Your Car with Auto Title Loans in Toronto

If you're in Toronto and need quick cash, Snap Car Cash has got you covered! With our auto title loans Toronto, Ontario you can borrow money against your car and get the funds you need in no time. Whether you're facing an emergency or need to cover unexpected expenses, our process is simple and hassle-free. Plus, with no income verification required, getting a loan has never been easier! Keep your car while you borrow, and drive away with peace of mind. Apply today with Snap Car Cash and secure your financial future!

#auto title loans Toronto#title loans Toronto#auto title loan Toronto#Auto Title Loans Toronto#car title loans online#car title loans#instant car title loans online#car title loans for older vehicles#loan on your car title#instant car title loans#borrow cash against your car

0 notes

Text

Green Canada Energy Advisors Inc.

Green Canada Energy Advisors – Your Premier Service Organization in Canada

At Green Canada Energy Advisors, we take immense pride in our position as a trusted authority in the energy consulting field. Our clientele spans from residential homeowners to commercial businesses and industrial users. We hold the prestigious title of being a top-rated licensed Service Organization by Natural Resources Canada (NRCan) and a Net Zero Service Organization recognized by the Canadian Home Builders’ Association (CHBA). We specialize in delivering comprehensive commercial energy-saving audits, including Toronto Energy Audit and Ontario Energy Audit, as well as offering guidance on Ontario Energy rebate programs, such as Home Efficiency Rebate Plus (HERX) the Canada Greener Homes Loan, better homes Ottawa, and the home energy loan program (Help). Additionally, we assist in securing insulation rebate Ontario and heat pump rebate Ontario, helping you make energy-efficient upgrades. We also provide valuable information on Doors & windows rebate Ontario. Our unwavering commitment is to provide top-notch energy solutions that empower you to optimize energy consumption, reduce costs, and contribute to a sustainable future.

Website: https://greencanadaenergy.com/

Address : 204-15260 Yonge Street, Aurora, L4G 1N4

Phone Number: (+1) 416-900-4186

Business Hours: Monday - Friday: 9:00 a.m – 6:00 p.m Saturday - Sunday: Closed

1 note

·

View note

Text

Quick Cash Loans: Car Title Loans in Ajax, Ontario

Looking for quick cash loans in Ajax, Ontario? Snap Car Cash offers reliable Car Title Loans Ajax, Ontario, allowing you to borrow against your vehicle's equity effortlessly. Whether you need funds for unexpected expenses or urgent bills, our streamlined process ensures you receive cash quickly. With no credit checks and flexible repayment options, you can enjoy peace of mind while driving your car. Simply bring your vehicle, and we’ll assess its value to determine your loan amount. Experience fast, easy financing with Snap Car Cash—your trusted partner for Car Title Loans in Ajax, Ontario. Get started today!

0 notes

Text

Car Title Loan Ontario-Quick Cash Solutions

Need quick cash ? Canada Loan Shop offers car title loans Ontario Providing a quick way to get the money you need. Use your vehicle's title as security and access funds within hours. Enjoy competitive rates, flexible terms, and a stress-free application process. Get started today and drive away with peace of mind! Visit our website to learn more.

0 notes