#TheBanker

Text

Happy Birthday Jessie 🥳🎂🎈🎁🎉

February 29,1992

Buon Compleanno 🥳🎂🎈🎁🎉

29 Febbraio 1992

#jessie t usher#actor#world cinema#cinema#movies#film#cinemetography#filmography#comedy movies#drama movies#tv shows#2000s movies#beautifulboy#inappropriatecomedy#independencedayresurgence#shaft#thebanker#dangerouslives#the boys#celebrity#happy birthday

1 note

·

View note

Text

WeBank Makes Repeat Appearance on Forbes Blockchain 50

The fifth Forbes Blockchain 50 list contains WeBank, the top digital bank in the world, as one of its featured companies. The list, which was just revealed, includes 50 globally recognized market leaders that have used blockchain technology to reinvent their industries.

Some of the most exciting yearly developments in the public and consortium chain were highlighted by their successful projects. WeBank, a long-term open source consortium chain platform creator and ecosystem builder, has been honored for its Distributed Data Transfer Protocol-based personal information portability solution.

WeBank serves over 350 million individual users and over 3.4 million micro, small, and medium-sized businesses and sole proprietors as the leading digital bank in the world by utilizing the benefits of ABCD technologies (A.I., Blockchain, Cloud Computing, and Big Data).

WeBank has been making investments in consortium chain technology research and development since 2015. It began to open-source successful projects in 2017 and took part in the development of the open source consortium chain ecosystem.

In April 2022, WeBank launched the "WeBank Blockchain" brand, which is committed to constructing a trusted foundation for stakeholders engaged in Environmental, Social and Governance strategies involving government, business community and the general public.

So far, the WeBank Blockchain open source ecosystem has gathered more than 4,000 institutions and enterprises, and 90,000 individual developers.

The ecosystem has accumulated more than 300 benchmarking applications in key fields such as finance, healthcare, environmental protection, agriculture, and cross-border data circulation. Those applications help to boost industrial digitalization, serve the development of the real economy, and promote equity and sustainability.

The personal information portability solution introduced in the list - the information verification platform, is built by partners based on the DDTP and the FISCO BCOS open source consortium chain platform.

The platform is designed based on DDTP which aims to achieve cross-agency, cross-scenario, cross-business data collaboration.

The platform introduces user as the key participant, leverages the full process traceability, anti-tampering, transfer of trust technological capabilities of blockchain, and invites authoritative organizations such as notary office, to facilitate more secure, credible, and collaborative personal information portability applications.

The information verification platform has been widely adopted in various online scenarios such as finance, background investigation, marriage and dating, etc. It tackles the pain point that is to verify the authenticity in the process of user data transmission for enterprises.

By the end of 2022, the total number of users who have activated the platform exceeded 3.1 million, and the number of users who have activated the platform in financial services exceeded 2.5 million.

About WeBank

Launched in 2014, WeBank Co., Ltd. is the first privately-owned bank and digital bank in China. WeBank provides more convenient financial services to micro-, small- and medium-sized enterprises and the general public, and continuously improves the quality of services in response to customers' specific needs.

As one of the top 100 banks in China, WeBank now ranks 331 in Top 1000 World Banks by The Banker.

WeBank focuses on innovation and technology. As the first commercial bank to obtain the national high-tech enterprise certification in China, WeBank has maintained its proportion of technical personnel above 50% since its establishment, while its research and development expenses of accounted for around 10% of its revenue.

WeBank is now at the top of the industry in core technologies such as artificial intelligence, blockchain, cloud computing and big data.

Sources: THX News & WeBank Co Ltd.

Read the full article

0 notes

Text

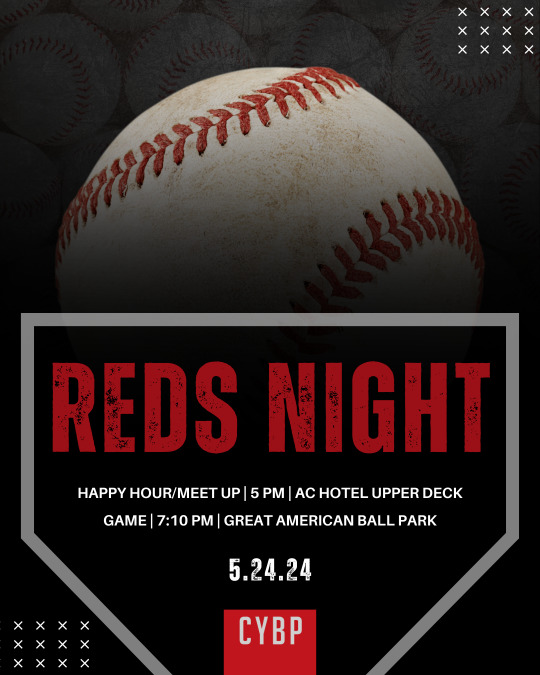

I'm with the Reds like I'm at a Cincinnati game!

CYBP is back with another Reds baseball game meet-up! Join us at Great American Ball Park for an evening of baseball and networking with other Young Black Professionals, while we cheer on our home team as they take on the Los Angeles Dodgers on Friday, May 24th.

Our meet-up and Happy Hour will be at 5:00 pm at the AC Hotel Upper Deck (135 Joe Nuxhall Way). Please plan to meet us there to mob over to the game! The Cincinnati Reds vs. Los Angeles Dodgers game will start promptly at 7:10 pm!

We can’t wait to see you there!

IMPORTANT DETAILS:

Please verify your email address when purchasing your ticket here.

Tickets to the game will be emailed TWO days before the event from CYBP.

You will need to download the MLB ballpark app to retrieve the tickets, so use the same email to create an account.

All tickets are in the same section (142 right field), so you can sit wherever you like with our group. Don't worry about purchasing tickets together.

Tickets are non-refundable. If you can not make it, you can transfer your tickets to another party to join us at the game through the MLB ballpark app.

Secure your seats HERE

#cincinnati reds#reds game#thingstodo#youngprofessionals#cybp#cincinnati#happyhour#rooftop#networking#memorial day weekend#longweekend#night out#baseball#OTR#Thebanks#meetup

0 notes

Photo

From one queen to another… you’re beautiful, Cincy. 😘💋💄🏙 #newfavoriteliveshotlocation #ontheriver #crownme👑 #jadore #queencity #theenvyofothers #liveshot #tvreporter #tvanchor #showtime #cincinnati #ohiogram #ohioriver #thebanks #roeblingbridge #brooklynvibes #cincyrefined #fox19now #fox19nowfamous #goddessrising #bossbabe #nextlevel #shinetime #swagpack #confidenceonfleek #hellobeautiful #blessed #melaninmagic✨ #thriving #addictedtohustle (at Cincinnati) https://www.instagram.com/p/Co1BHUgghTH/?igshid=NGJjMDIxMWI=

#newfavoriteliveshotlocation#ontheriver#crownme👑#jadore#queencity#theenvyofothers#liveshot#tvreporter#tvanchor#showtime#cincinnati#ohiogram#ohioriver#thebanks#roeblingbridge#brooklynvibes#cincyrefined#fox19now#fox19nowfamous#goddessrising#bossbabe#nextlevel#shinetime#swagpack#confidenceonfleek#hellobeautiful#blessed#melaninmagic✨#thriving#addictedtohustle

0 notes

Text

Tipsy Bingo

Looking for some DAY drinking with the girls? Bachelorette party? Girls' day out? Birthday celebration? Bumble date?

For my birthday this year all I wanted was a day with all my favorite women! So, I planned a brunch and searched high and low for something fun to do with them after brunch. Right in front of my eyes was tipsy bingo at the Fishbowl at the banks. This was a FREE to participate two-hour event in which we drank incredible fishbowls and cocktails while playing your grandma’s favorite past time game - BINGO! The drinks are reasonably priced $10 personal bowl to a $40 bowl to share and many in between!

Our group had some winners which ranged from shots on the house to gift cards to use at our next visit!

From fishbowls with vodka and red bull to a hot chocolate bowl there is something for everyone. Their appetizers looked amazing, and I think we all were bummed we didn’t try them out! The BINGO caller was so much fun and made sure to give a shout out to each person celebrating from birthdays to bach parties he did a great job.

It was really fun to support a local business and was a great reminder of the fun things we have in our backyard here in Cincy! They do Tipsy Bingo Tuesdays 7:30-9:30 and Saturday/Sunday 2-4pm. Grab your friends, co-workers, significant others, and family for a good ole Sunday Funday down at Fishbowl at the banks! Want to up the fun?? Add some party pack drink markers, our group was men in underwear they set right on the side of your drink and make for a good convo starter!

Check out their website with this link: https://www.fishbowlatthebanks.com/

Mini men drink markers

#fishbowl bachparty girlsday birthday thebanks cincy supportlocal minimen celebrate bingo tipsybingo

0 notes

Photo

The Sistah Scifi Graphic Novel club will discuss The Banks by Roxane Gay and artist Ming Doyle. December 17th 2022 from 4p - 5:30p PST. Discussion will be led by Erika Hardison (@blerdywomanist) of @FabulizeMag About The Banks🪐 The Banks is a heist thriller about the most successful thieves in Chicago: The women of the Banks family. For fifty years the women of the Banks family have been the most successful thieves in Chicago by following one simple rule: never get greedy. But when the youngest Banks stumbles upon the heist of a lifetime, the potential windfall may be enough to bring three generations of thieves together for one incredible score and the chance to avenge a loved one taken too soon. "The Banks is the best kind of heist story: a sharp, tight robbery with escalating tensions and threats coming from every direction." - The A.V. Club "It will leave most readers smiling at the end of their journeys with the Banks family." - The Beat TKO Studios recently announced a partnering with MACRO (whose films have garnered nine Oscar nominations and one Oscar win for Viola Davis in FENCES) to produce a film adaptation of the graphic novel. Screenplay to be written by Roxane Gay. Register now to be able to join the discussion. Link in bio > LIT EVENTS: @SistahScifi | https://www.eventbrite.com/e/sistah-scifi-graphic-novel-club-the-banks-tickets-390265423387 @roxanegay74 @mingdoyle @tkopresents #sistahscifi #bookstagram #thebanks #thebanksgraphicnovel #graphicnovel #graphicnovelclub #graphicnovelclubdiscussion #sistahscifibookstore #blackownedbookstore (at Sistah Scifi) https://www.instagram.com/p/Cl9GjNGJnVJ/?igshid=NGJjMDIxMWI=

#sistahscifi#bookstagram#thebanks#thebanksgraphicnovel#graphicnovel#graphicnovelclub#graphicnovelclubdiscussion#sistahscifibookstore#blackownedbookstore

0 notes

Text

BANK OF AMERICA HEALTHCARE CONFERENCE

Banking/ Byzakria Nadeem

Bank of America held a healthcare conference to discuss the future of healthcare and how it will be impacted by technology.

TheBankof America Healthcare conference is an event that brings together the best and brightest minds in healthcare. It features a wide range of speakers with different expertise, who provide insights on the latest trends in healthcare. The conference is held annually and attracts over 1,000 people from finance, government, academia, and other industries.

It is one of the most highly anticipated events in the healthcare industry. Every year, top executives and decision-makers from across the sector gather to discuss the latest trends and issues facing the industry. So This year’s conference will be no different, with a packed agenda that includes keynote speeches from industry leaders, panel discussions on the challenges facing the sector, and breakout sessions on the latest innovations in healthcare.

Whether you’re a healthcare executive or just interested in the latest developments in the industry, theBank of America healthcare conference is a must-attend event. Whether you are in finance, academia, or any other field related to healthcare, the upcoming conference provides unparalleled insight into the future of healthcare.

This year’s theme is Helping Improve Care Delivery and addresses critical areas such as cost reduction strategies, data analytics technologies for clinical research & drug discovery, and new initiatives aimed at improving care delivery models.

BANK OF AMERICA GLOBAL HEALTHCARE CONFERENCE

Bank of America Global Healthcare Conference is an annual event that brings together healthcare leaders to discuss the latest trends in healthcare.

It is a premier global forum for executives,investors, and policymakers to explore the most pressing issues in health care. It is organized by Bank of America and held annually in various cities around the world.

The conference provides an opportunity for executives from around the world to discuss the most pressing issues in health care, including:

– Technology’s impact on healthcare

– How to address rising drug prices

– The effect of aging populations on healthcare costs

– Strategies for managing chronic disease, including diabetes and Alzheimer’s disease

– Transforming healthcare with technology and data

The conference consists of plenary talks, sessions on new technologies, breakout sessions, discussions of trending topics in the industry, and interactive panel discussions. There are also several networking opportunities for participants to meet with other attendees and attend pre-conference workshops. Attendees also receive access to the newest thinking on key drivers andrisksaffecting both private and public sectors of the industry.

BANK OF AMERICA GLOBAL HEALTHCARE CONFERENCE BOSTON

The Bank of America Global Healthcare Conference Boston is a three-day event. TheBankof America Global Healthcare Conference Boston is one of the most important healthcare conferences in the United States. It is attende-d by leading healthcare professionals from around the world, and provides a forum for discussing the latest developments in the industry.

The conference covers a wide range of topics, including medical research, new treatments and technologies, policy issues, and the business of healthcare. It is an excellent opportunity to network with other professionals in the field, and to learn about the latest innovations in healthcare. If you are involve in any way with healthcare, whether as a provider or a patient, this is a conference that you cannot afford to miss.

There will be over 200 sessions on some of the most significant issues affecting our healthcare system. Topics include health care reform, delivery models, and the latest innovations in health care financing. With speakers from leading hospitals such as Massachusetts General Hospital and Johns Hopkins University Medical Center; health insurance companies like Aetna; and federal agencies like the Centers for Medicare & Medicaid Services, no matter what your interest or level of expertise there is something at this conference for you.

BANK OF AMERICA HEALTHCARE CONFERENCE LAS VEGAS

Bank of America Healthcare Conference Las Vegas is a conference that focuses on the healthcare industry. It is a place for people in the industry to come together and discuss new developments, best practices, andfuture trends.

The Bank of America Healthcare Conference Las Vegas is an exclusive event that only allows a limited number of people to attend. Attendees can learn from some of the top medical professionals in their fields while also meeting with other experts within their own field.

The purpose of theBankof America Healthcare Conference Las Vegas is to bring people together and discuss new developments, best practices, and future trends. With a more hands-on approach than other conferences, this event offers its attendees a number of opportunities to meet with leaders in their field and explore topics in depth.

Attendees will find plenty of workshops, breakout sessions, and networking opportunities as well as receptions sponsored by leading healthcare providers. So Networking events include cocktail receptions at three venues throughout the weeklong program. These evening events offer attendees a chance to mingle over hors d’oeuvres with executives from companies such as UnitedHealth Group Inc., Humana Inc., and Quest Diagnostics Incorporated.

#bankofamerica#cfalevel#wellsfargo#paypal#frmpart#bitcoin#jpmorgan#finance#zelle#remesas#investmentbanker#cashapp#venezuela#pwc#kpmg#deloitte#blackrock#hdfcbank#frmexam#charteredaccountant#earnstandyoung#chase#portfoliomanager#money#cfaprogramexam#syllabus#conceptsnclaritycfafrm#garpfrm#sapient#careersinfinance

2 notes

·

View notes

Text

#theirquellatcore #haeh_possib .@law @law @harvard_law @bbc_whys @france24 @haaretzcom #itis .@scotus @scotus @scotusblog @bbcr4sundays .@fisa .@snowden .@france24 #reframed #their #govt #caused #crimes their quell is atcore and because iam c o n s t a n tl y deedtype truth is why idonot fear their twisting of their crimes and witnessprotect misguided ai may not understand and lawyerspin of asudden tries to germande serve fromtheir crimes fromthe victim //// the organic support system how really helpless survive that is why youdonot handle a dead cold case where they throw obje ct after object until you let it be idonot know how to charge it daytime as all is under their control in obey and me held emptyhanded while endangered itis reallytricky thebanks know the banksupervision knows the intels know the court s know but all follow a realm segragation while the vulnerability is obvious manytimes deeds that would have doomed them usually they shuffled as if iho pe he notices thistime or such haha the ones that control their dumpsters proxies intheir system tight control all that tight that force acceptance trick make self fulfillingprophecy trick all obey and repeat crimes until it matches framing is obvious

#theirquellatcore #haeh_possib .@law @law @harvard_law @bbc_whys @france24 @haaretzcom #itis .@scotus @scotus @scotusblog @bbcr4sundays .@fisa .@snowden .@france24 #reframed #their #govt #caused #crimes

their quell is atcore

and because iam c o n s t a n tl y deedtype truth

is why idonot fear their twisting of their crimes

and witnessprotect misguided

ai may not understand and lawyerspin of…

0 notes

Text

Thế Bảo

Phạm Thế Bảo - CEO & Founder tại nhà cái 78win hay còn được biết đến với biệt danh là "thebank". Sinh ra và lớn lên tại Thành Phố Hồ Chí Minh. Anh được tiếp xúc với môi trường công nghệ từ nhỏ, nên sau khi tốt nghiệp anh đã quyết tâm trở thành một nhà sáng lập trang website giải trí dành riêng cho bản thân mình.

Website: https://78win.casa/

Phone: 0852621488

Địa chỉ:8 Tân Kỳ Tân Quý, Tân Quý, Tân Phú, Thành phố Hồ Chí Minh, Việt Nam

Hastag:#thebao #thebao78win #thebao78wincasa

1 note

·

View note

Text

Thế Bảo

Phạm Thế Bảo - CEO & Founder tại nhà cái 78win hay còn được biết đến với biệt danh là "thebank". Sinh ra và lớn lên tại Thành Phố Hồ Chí Minh. Anh được tiếp xúc với môi trường công nghệ từ nhỏ, nên sau khi tốt nghiệp anh đã quyết tâm trở thành một nhà sáng lập trang website giải trí dành riêng cho bản thân mình.

Website: https://78win.casa/

Phone: 0852621488

Địa chỉ:8 Tân Kỳ Tân Quý, Tân Quý, Tân Phú, Thành phố Hồ Chí Minh, Việt Nam

Hastag:#thebao #thebao78win #thebao78wincasa

1 note

·

View note

Text

Thebanker tone freightbandit tems doubledawg rudy roast

1 note

·

View note

Text

Navigating the Landscape of Bank Recruitment in the U.S.

Estimated reading time: 14 minutes

Table of contents- I. Introduction

- II. Steps to Securing a Bank Job in the U.S.

- III. Is a Banking Career a Good Choice in the U.S.?

- IV. Highest Paying Jobs in U.S. Banks

- V. Bank Recruitment Stages in the U.S.

- VI. The Employment Landscape: Bank Jobs in the U.S.

- VII. Navigating Challenges in U.S. Bank Recruitment

- VIII. Conclusion

I. Introduction

As pillars of the U.S. financial landscape, banks perform a critical function. They are at the heart of amyriad of activities, from safeguarding our hard-earned savings to extending credit that facilitates bothpersonal aspirations and commercial expansions. In effect, our banking institutions are instrumental indriving the nation's economic engine, spurring growth, and fostering financial well-being.

At the crux of a bank's seamless operation and its capacity to serve the economy is a critical process -bank recruitment. This procedure goes beyond simply filling a job position. It's a rigorous andcarefully orchestrated process of spotting, assessing, and bringing on board the talent capable ofsteering the financial ship. The importance of bank recruitment is underscored by the fact that everybanking role, from entry-level to executive, is a cog in the vast financial apparatus, contributing to thebank's stability, innovation, and customer engagement.

In the journey through this article, we'll shine a spotlight on the mechanics of bank recruitment withinthe U.S., exploring its processes, challenges, and the integral role it plays in sculpting the future ofAmerican banking.

II. Steps to Securing a Bank Job in the U.S.

Securing a bank job in the United States can be an enriching path leading to a stable andrewarding career. However, it's important to remember that the journey into the banking sector can becompetitive and requires a keen understanding of the recruitment landscape, coupled with the rightqualifications and skills. Here's an expanded breakdown of the steps typically involved:

Identify Your Area of Interest: The banking sector is as vast as it is diverse. It spans variousdepartments such as retail banking, investment banking, risk management, compliance, andinformation technology, among others. Each area offers a unique set of roles and responsibilities. Asan aspiring banking professional, your first step is to identify the role that suits your skills, interests,and long-term career aspirations.

Acquire the Necessary Qualifications: A solid educational background is essential in the bankingindustry. Typically, a bachelor's degree in finance, business, economics, or a related field is thebaseline requirement for most banking jobs. However, specialized roles might demand furtherqualifications. For instance, investment bankers often hold an MBA, while roles in bank ITdepartments might require a background in computer science or related certifications. It's crucial toresearch your chosen area and understand its specific educational requirements.

Build Relevant Skills: In addition to academic qualifications, banks look for a host of skills thatensure a candidate's effectiveness in the role. These may include analytical acumen, technicalproficiency, excellent communication skills, and the ability to work effectively within a team.Moreover, in the age of digital banking, skills such as data analysis, proficiency in financial analysissoftware, and understanding of digital banking systems can give you a significant competitive edge.

Gain Practical Experience: Hands-on experience in the form of internships or entry-level jobs can beinvaluable in gaining industry insights, developing practical skills, and enhancing your resume. Theseexperiences expose you to the real-world banking environment, helping you understand its dynamicsand demands.

Networking: In many industries, and banking is no exception, it's often about 'who you know.' Attendjob fairs, industry events, or engage in professional networking platforms to connect with bankingprofessionals, potential mentors, and peers. Staying informed about job openings and maintaining astrong professional network can be instrumental in landing a bank job.

Application Process: This step involves marketing yourself effectively to potential employers. Craft acompelling resume and cover letter, tailored to the specific job role, that highlight your qualifications,experiences, and skills. Once you spot a job opportunity that aligns with your aspirations, submit yourapplication.

Prepare for Interviews: If your application passes the initial screening, you'll be invited for aninterview. This is your chance to articulate your passion for banking, explain why you're interested inthe specific role, and elaborate on your qualifications and experiences. Prepare for potential questions,do your research on the bank, and practice your answers.

Post-interview Follow-ups: After the interview, it's a good practice to send a follow-up email. Thisshould express gratitude for the opportunity and reiterate your interest in the role.

Patience, persistence, and ongoing skill development are key in your banking career journey.Each bank has its unique recruitment process, and staying adaptable is essential. As the bankingindustry continues to evolve, so should you – by engaging in continuous learning and skillsenhancement, ready to seize the opportunities that come your way.

III. Is a Banking Career a Good Choice in the U.S.?

A career in banking has been traditionally viewed as a stable, respectable choice with plentifulopportunities for growth. The U.S., being the world's largest economy with a well-establishedfinancial sector, offers a diverse range of roles within banking that can cater to a variety of interestsand skill sets. However, like any other career path, it comes with its unique set of pros and cons.Here's an analysis to help you determine if banking is the right career choice for you.

Pros of a Banking CareerCompetitive Salary and Benefits: Banking jobs are known for offering attractive compensationpackages. In addition to the base salary, banks often provide benefits such as health insurance,retirement plans, and bonuses.

Opportunities for Career Advancement: The banking sector is hierarchical, which means there's aclear path for upward mobility. With dedication and performance, you can climb the corporate ladderto reach senior-level positions.

Variety of Roles: Whether you're interested in financial analysis, customer service, risk management,or technology, banks have a role that suits your interests and skills.

Stability: Banks are foundational elements of the economy, offering more job security compared tomany other industries.

Professional Development: Banks often provide robust training programs for their employees,fostering continual learning and professional growth.

Cons of a Banking CareerStress and Pressure: Banking can be a high-pressure industry with demanding work hours, especiallyin roles such as investment banking. Meeting targets and dealing with large financial transactions cancontribute to stress.

Bureaucracy and Politics: Like any large organization, banks can be bureaucratic. Navigating officepolitics can sometimes pose challenges.

Technological Disruption: The rise of fintech and digital banking is causing a shift in traditionalbanking jobs. While it opens up new opportunities, it may also make some roles obsolete.

When considering a career in banking, it's crucial to weigh these pros and cons. Reflect onyour personal career goals, your tolerance for stress and long hours, and your willingness to adapt toindustry changes. A banking career can be incredibly rewarding for those who thrive in a fast-paced,dynamic environment where meticulous analysis, customer service, and financial acumen are valued.

IV. Highest Paying Jobs in U.S. Banks

The banking industry in the U.S. is known for offering lucrative compensation packages.However, some roles stand out as being particularly high-paying due to their responsibilities,complexity, and the level of expertise required. Here's a description of a few top-paying jobs in U.S.banks and an overview of the skills and qualifications necessary for these roles.

Investment Banker: Investment Bankers play a crucial role in helping corporations, governments,and other entities to raise capital. They advise clients on mergers and acquisitions, and manage andunderwrite securities issuance. This role typically requires a bachelor's degree in finance, economics,or a related field. An MBA can be particularly advantageous. Key skills include financial modeling,negotiation, and a deep understanding of financial markets.

Risk Manager: Risk Managers are tasked with identifying, evaluating, and mitigating financial risksthat a bank could potentially face. They use various predictive models and strategies to prevent losses.A bachelor's degree in finance, business, or a related field is typically required, while an advanceddegree or certifications like FRM (Financial Risk Manager) can enhance job prospects. Skills in dataanalysis, problem-solving, and risk assessment are essential.

Financial Manager: Financial Managers oversee the financial health of the bank. They preparefinancial reports, direct investment activities, and develop plans for the bank's long-term financialgoals. These roles typically require a bachelor's degree at minimum, but many employers prefercandidates with a master's degree and substantial experience in a finance-related role. Analytical skills,detail orientation, and strategic planning are important abilities for this job.

Quantitative Analyst: Quantitative Analysts, or 'Quants,' apply mathematical and statistical methodsto financial and risk management problems. They design and implement complex models that banksuse to make decisions about risk, investments, pricing, and more. They usually hold a degree in aquantitative field like math, physics, or engineering, although many also have postgraduatequalifications. Key skills include proficiency in data analysis, knowledge of programming languages,and strong numerical abilities.

Compliance Officer: Compliance Officers ensure that the bank adheres to all relevant legal andinternal rules and regulations. They identify potential areas of compliance vulnerability and developcorrective action plans. A bachelor's degree in law, business administration, finance, or a related fieldis typically required, and additional certifications may be preferred. Attention to detail, knowledge oflegal aspects, and ethical integrity are critical skills for this role.

Each of these roles commands a high salary due to the expertise required and the significantresponsibilities that they entail. However, they also demand a robust educational background, a solidfoundation of skills, and often, substantial industry experience. But for those willing to commit to thenecessary career path, they can offer a rewarding and lucrative career in the banking industry.

V. Bank Recruitment Stages in the U.S.

The recruitment process in the banking sector in the United States is a well-structured and thoroughprocedure, designed to select the best talent for the role. It all begins with a comprehensive jobanalysis, where the bank delineates the duties, responsibilities, and qualifications required for a specific job role. The output of this stage is a detailed job description that clearly outlines what the job entails and what is expected of a potential candidate.

Once the job description is ready, the job is advertised through various channels such as the bank'sown website, job boards, social media platforms, and recruitment agencies. The aim is to attract a widepool of applicants who are interested in and qualified for the role.

As applications pour in, the HR team at the bank undertakes the task of screening each application.This typically involves a review of the applicants' resumes and cover letters to identify thosecandidates whose skills, qualifications, and experience align with the job's requirements.

Candidates who make it through the initial screening are then invited for an initial interview. This isoften conducted via phone or video call by a member of the HR team. The aim of this stage is to gaugethe candidate's interest in the role, their understanding of the job, and their overall fit within theorganization.

For certain roles, the bank may also administer assessment tests designed to evaluate the candidate'stechnical skills, aptitude, or even their compatibility with the job role and the bank's culture.Candidates who successfully navigate the initial interview and any necessary assessment tests maythen be invited for a second, often more in-depth interview. This is typically conducted by seniormembers of the team or department and allows the bank to delve deeper into the candidate's suitabilityfor the role.

At this point, if a candidate is deemed suitable, the bank may proceed to reference checks. Thisinvolves contacting the references provided by the candidate to verify the candidate's previousemployment, work ethic, and performance.

After successful reference checks, the chosen candidate is extended a job offer. This offer outlines thecompensation package, the job role's specifics, and any other terms and conditions of employment.Finally, once the job offer is accepted, the bank's onboarding process begins. This phase involvesvarious orientation sessions and training programs to help the new hire integrate into the bank'sculture, understand their role and responsibilities, and start their new job on a strong footing.

The recruitment stages, although broadly similar, can vary from one bank to another depending ontheir individual hiring policies and procedures. However, understanding the overall process canprovide a valuable framework for candidates navigating the bank recruitment landscape in the U.S.

VI. The Employment Landscape: Bank Jobs in the U.S.

Banking is a cornerstone of the U.S. economy, and employment in this sector forms a significantportion of the country's job market. As per the latest data from the U.S. Bureau of Labor Statistics (asof the last update in September 2021), over 1.9 million people were employed in the banking sector inthe U.S., which doesn't include those working in associated industries such as financial planning,investment services, and insurance.

The banking sector in the U.S. is diverse, providing a wide array of job opportunities for individuals with various skill sets and qualifications. Whether it's retail banking, corporate banking, investment banking, or ancillary services, these roles play a crucial part in maintaining the financial health of thenation.

In terms of the economy, the role of bank employment is multifaceted. On one hand, bank jobscontribute directly to economic growth by providing employment opportunities and contributing toincome generation. This, in turn, influences consumer spending, which fuels the broader economy.

Moreover, the services that banks offer – from facilitating savings and investments to providing loansfor individuals and businesses – are vital for economic activity.

On the other hand, banks also contribute indirectly to the economy. They play a crucial role inmaintaining financial stability, which is a precondition for sustainable economic growth. By managingrisks and serving as intermediaries for financial transactions, banks ensure the smooth functioning ofthe financial system. This, in turn, supports other sectors of the economy, from construction andmanufacturing to retail and services.

With ongoing advances in technology and financial regulations, the banking employment landscape inthe U.S. is continually evolving. Roles in areas such as fintech, cybersecurity, and data analytics areon the rise, reflecting changes in how banking services are delivered. At the same time, traditionalbanking roles remain critical for delivering personalized services, maintaining customer relationships,and ensuring regulatory compliance.

In conclusion, bank jobs in the U.S. form a critical component of the country's job market and play asignificant role in the economy. Whether it's through providing employment, facilitating economictransactions, or ensuring financial stability, the banking sector's contribution to the U.S. economycannot be overstated.

VII. Navigating Challenges in U.S. Bank Recruitment

The process of recruiting the best talent in the U.S. banking sector is not without its challenges. Theindustry faces several obstacles in its pursuit of the right candidates, and successfully navigating thesechallenges requires strategic planning, flexibility, and innovation.

One of the most common challenges in bank recruitment is the highly competitive nature of the jobmarket. With numerous banks and financial institutions vying for top talent, attracting and retainingskilled professionals can be an uphill battle. This competition is particularly intense for roles in areassuch as investment banking, risk management, and emerging fields like fintech and data analytics.Another significant challenge lies in aligning candidate skills with the evolving needs of the bankingindustry. The rapid advancement of technology and changing regulatory landscapes have led to shiftsin the industry's skill requirements. Consequently, finding candidates with the right mix of technicalexpertise, industry knowledge, and adaptability is a demanding task.

The multigenerational workforce presents yet another challenge. With baby boomers, Generation X,millennials, and Generation Z all coexisting in the workplace, banks need to cater to diverseexpectations in terms of work culture, flexibility, career growth, and learning opportunities. Balancingthese varying needs can be tricky but is essential to create an inclusive and productive workenvironment.

To overcome these challenges, banks employ several strategies. One common approach is employerbranding, where banks work on portraying themselves as attractive places to work. This can involvehighlighting benefits like competitive salaries, opportunities for career advancement, strongmentorship programs, and a positive work culture.

To tackle the skills gap, many banks invest heavily in training and development programs. Theseinitiatives not only equip employees with necessary skills but also help in retaining talent by offeringpathways for career growth. Furthermore, banks are increasingly partnering with universities andeducational institutions to influence curriculum design and ensure a steady pipeline of graduates withthe required skill sets.

To cater to a multigenerational workforce, banks are working towards creating flexible and inclusivework environments. This can include flexible working hours, remote working options, robust diversityand inclusion policies, and tailored training and development programs.

In summary, while the process of bank recruitment in the U.S. presents its fair share of challenges, theindustry continues to find innovative ways to attract and retain the talent it needs. Whether throughstrong employer branding, investment in employee development, or the creation of inclusive workenvironments, U.S. banks are continuously evolving their recruitment strategies to meet thesechallenges head-on.

VIII. Conclusion

The role of banks in the U.S. economy is undeniably significant, from providing essential financialservices to being major employers. In the journey to securing a bank job in the U.S., understanding therecruitment process, the desirable qualifications, and the various roles available in the industry canprovide a valuable advantage.

While banking continues to be an attractive career choice in the U.S, one must consider various factorssuch as career progression, work-life balance, and the evolving nature of banking jobs.

Read the full article

0 notes

Text

Best Banks in Finland

Finland may be a nation with a solid money related framework. The keeping money segment is well-regulated and there are a number of trustworthy banks to select from. When choosing a bank in Finland, it is vital to consider your person needs and circumstances. A few variables to consider include the sort of accounts you would, like the fees charged, and the level of client benefit.

Here are many of the most excellent banks in Finland:

Nordea is the biggest bank in Finland. It offers a wide extend of items and administrations, counting current accounts, savings accounts, contracts, and loans. Nordea incorporates a great notoriety for client benefit and its online managing an account stage is simple to utilize.

OP Bank may be a co-operative bank that's possessed by its customers. It offers a comparable run of items and administrations to Nordea, but with a center on client benefit and neighborhood community association. OP Bank encompasses a solid nearness in Finland, with over 1,000 branches.

Danske Bank may be a Danish bank that contains a huge nearness in Finland. It offers a wide extend of items and administrations, counting current accounts, reserve funds accounts, contracts, and advances. Danske Bank features a great notoriety for its online keeping money stage and its client benefit

When choosing a bank in Finland, it is important to compare the diverse alternatives carefully and select the bank that best meets your needs. You'll discover more data around banks in Finland on the websites of the Finnish Monetary Supervisory Specialist and the European Managing an account Specialist.

Things to consider when choosing a bank in Finland

When choosing a bank in Finland, there are a lot of factors to consider:

The sort of accounts you wish. Do you would like a current account, a investment funds account, a contract, or a advance? A few banks offer a more extensive run of items and administrations than others.

The expenses charged. Make beyond any doubt to compare the expenses charged by distinctive banks for things like account upkeep, ATM withdrawals, and outside cash exchanges.

The level of customer benefit. How simple is it to induce in touch with a client benefit agent? How rapidly do they react to your inquiries?

The bank's notoriety. Do a few inquire about to discover out what other individuals think of the bank. Are there any complaints almost the bank's client benefit or its items and administrations?

The bank's online keeping money stage. Do you incline toward to do your managing an account online? On the off chance that so, make beyond any doubt to check out the bank's online keeping money stage. Is it simple to utilize? Does it offer all of the highlights you wish?

The bank's versatile app. On the off chance that you like to do your managing an account on your phone, make beyond any doubt to check out the bank's portable app. Is it simple to utilize? Does it offer all of the highlights you would? like

Thebank's ATM organize. How numerous ATMs does the bank have? Are there ATMs found close where you live and work?

The bank's branches. Does the bank have branches found close where you live and work? In case you incline toward to do your managing an account in individual, this can be an important factor to consider.

Once you've got considered all of these factors, you'll be able to select the finest bank for your needs.

Here are a few extra tips for choosing a bank in Finland:

Get cites from numerous banks. Do not fair select the primary bank you come across. Get cites from multiple banks so you can compare the expenses and highlights.

Perused the fine print. Before you sign any printed material, make beyond any doubt to examined the fine print. This will offer assistance you understand the terms and conditions of the account.

Inquire questions. In the event that you have got any questions, do not be anxious to inquire the bank agent. They ought to be able to reply any questions you've got approximately the account.

By taking after these tips, you can select the best bank for your needs and circumstances.

0 notes

Photo

A Cincinnati sunrise really would make the perfect martini 🍸. #queencity #cincinnati #cincygram #thenati #thebanks #casualstyle #casualfits #thursdayselfie #justme❤️ #leopardprint #quietlybold #queening #blessup🙏 #vibes #rooftopping #highlevel #adream #sittingpretty💋 #bossbaby #slayqueen #girlnextdoor #fulllips #thickhips #goodlife #instadaily #createyourself #thursdaymood #thursdaylook https://www.instagram.com/p/CnDsC5-LG7c/?igshid=NGJjMDIxMWI=

#queencity#cincinnati#cincygram#thenati#thebanks#casualstyle#casualfits#thursdayselfie#justme❤️#leopardprint#quietlybold#queening#blessup🙏#vibes#rooftopping#highlevel#adream#sittingpretty💋#bossbaby#slayqueen#girlnextdoor#fulllips#thickhips#goodlife#instadaily#createyourself#thursdaymood#thursdaylook

0 notes

Text

Cập Nhật Lãi Suất Vay 1 Tỷ Tại Ngân Hàng Chuẩn Nhất 2023

Vay 1 tỷ tại các ngân hàng (như ngân hàng Agribank, BIDV, Sacombank, Techcombank,…) với đa dạng hình thức vay như: vay trả góp, vay thế chấp, vay khoản vay mua nhà,… Hãy cùng Taichinh.vip tìm hiểu về điều kiện, thủ tục, lãi suất cùng nhiều thông tin liên quan khác về gói vay vốn này qua bài viết dưới đây nhé!

Điều kiện vay thế chấp 1 tỷ đồng

Nhiều người thường lầm tưởng rằng chỉ cần có tài sản thế chấp là có thể vay tiền ngân hàng.

Tuy nhiên, tài sản thế chấp chỉ là điều kiện cần, ngoài ra khách hàng phải đáp ứng điều kiện về thu nhập, sử dụng vốn và lịch sử tín dụng tốt. Do đó, dù bạn có tài sản 10 tỷ nhưng không đảm bảo các điều kiện khác thì ngân hàng vẫn từ chối hồ sơ vay của bạn.

Dưới đây là những điều kiện cần thiết để bạn có thể vay được ngân hàng 1 tỷ:

Sống và làm việc tại các tỉnh, thành phố nơi đăng ký chi nhánh ngân hàng cho vay hoạt động.

Có nguồn thu nhập ổn định và có khả năng trả nợ.

Bạn có thể cung cấp các tài liệu, hồ sơ để chứng minh nguồn thu nhập của mình

Không có nợ xấu với ngân hàng hoặc tổ chức tín dụng

Có đủ tài sản thế chấp để hoàn trả khoản vay. Với gói vay mua nhà, ngân hàng thường chấp nhận tài sản là nhà, đất, giấy tờ có giá…

Thủ tục vay 1 tỷ tại ngân hàng

Ngân hàng sẽ không bắt đầu đánh giá tín dụng cho đến khi bạn nộp một bộ hồ sơ vay hoàn chỉnh. Một bộ hồ sơ đầy đủ bao gồm các giấy tờ sau:

Bản sao chứng minh nhân dân/thẻ căn cước của người vay và người đồng ký tên

Bản sao hộ khẩu hoặc KT3

Bản sao giấy đăng ký kết hôn hoặc giấy chứng nhận độc thân

Bảo hành các giấy tờ pháp lý như sổ đỏ, sổ hồng…

Chứng minh thu nhập

Các giấy tờ chứng minh mục đích sử dụng vốn vay như hợp đồng mua bán, giấy nộp tiền, giấy đặt cọc

Vay 1 tỷ trong bao lâu?

Các hình thức vay thế chấp ngân hàng hiện nay có thời hạn vay khá dài lên đến 15, 20 thậm chí là 35 năm. Ngân hàng cho phép khách hàng lựa chọn thời hạn vay linh hoạt nhưng không vượt quá thời hạn vay tối đa quy định.

Lãi suất vay 1 tỷ thấp nhất ở ngân hàng nào?

Hầu hết các ngân hàng đều hỗ trợ vay 1 tỷ với thời hạn thanh toán linh hoạt. Lãi suất vay ở các ngân hàng gần như giống nhau, không có sự chênh lệch quá nhiều. Lãi suất vay thế chấp ưu đãi thường dao động trong khoảng 8-10%/năm.

Hết thời gian ưu đãi, lãi suất sẽ tăng lên và dao động trong khoảng 10 – 15%/năm. Tuy nhiên, với mỗi ngân hàng khác nhau sẽ có những điều chỉnh nhất định tùy thuộc vào điều kiện, điều kiện của người vay và chính sách riêng của ngân hàng. Vì vậy, việc xem xét và thảo luận các điều khoản trong hợp đồng vay là rất quan trọng.

Vay 1 tỷ lãi suất mỗi tháng là bao nhiêu?

Để bạn dễ hình dung số tiền phải trả hàng tháng khi vay ngân hàng 1 tỷ, hãy cùng TheBank phân tích ví dụ sau. Khách hàng A vay 1 tỷ. Lãi suất 7% cố định trong 12 tháng. Từ tháng thứ 13 lãi suất là 10%.

Lãi tính trên dư nợ giảm dần của khoản vay, gốc trả góp hàng tháng theo công thức sau:

Vốn hàng tháng = số tiền vay/thời hạn vay (tháng)

Tiền lãi hàng tháng = (số tiền vay – số tiền gốc phải trả) x lãi suất (%/tháng)

Vay 1 tỷ trong 10 năm

Theo công thức trên nếu bạn vay 1 tỷ trong 10 năm thì hàng tháng bạn sẽ phải trả số tiền như sau:

Tiền gốc mỗi tháng: 8.333.333 VNĐ

Thanh toán tháng đầu tiên (vốn và lãi): 14.166.666 VND

Thanh toán hàng tháng tối đa: 15.833.333 VND

Vay 1 tỷ trong 20 năm

Theo công thức trên nếu bạn vay 1 tỷ trong 10 năm thì hàng tháng bạn sẽ phải trả số tiền như sau:

Tiền gốc mỗi tháng: 4.166.667 VNĐ

Trả góp tháng đầu tiên (vốn và lãi): 10.000.000 VND

Thanh toán hàng tháng tối đa: 12.083.334 VND

Lưu ý khi vay thế chấp 1 tỷ tại ngân hàng

1 tỷ đồng là một khoản tiền khá lớn nên để tối ưu hóa chi phí và giảm thiểu rủi ro trong quá trình vay vốn cũng như trả nợ, bạn cần lưu ý những điều sau:

Tham khảo điều kiện, lãi suất vay của nhiều ngân hàng để lựa chọn ngân hàng phù hợp nhất

Tính toán kỹ nguồn thu nhập trả nợ để tránh khả năng trả nợ sau này

Cần cung cấp thông tin chính xác cho ngân hàng. Mọi hình thức lừa đảo nếu bị ngân hàng phát hiện sẽ bị từ chối và đưa vào “danh sách đen” không được vay ở bất cứ đâu.

Lãi và gốc phải được trả đúng hạn. Nếu chậm trả, bạn không chỉ bị tính phí, bị phạt mà còn bị chuyển sang nhóm nợ. Việc vào nhóm nợ xấu sẽ khiến bạn khó vay vốn sau này.

0 notes

Photo

2023.01.29 dustbox intergalactic ~Blue Sparks Tour~ w/locofrank @ 盛岡CLUB CHANGE WAVE 今年初locofrankとdustbox locofrank 去年11月振り 毎回やる曲変わらないのに毎回この流れや曲が好き過ぎる reasonスタートも BEFULL→surviveの流れも大好きなのだけど久々この流れ聞けた (surviveはthebank以来でした) 前日秋田普段朝まで残らないスガさんも4時までいてどれだけ好きなんだよって木下さん dustbox FIGHTBACKでは物足りなかったのでやっぱりライブハウスの感じがしっくり来る アンコールで よこしんドラムで breakthrough 達也さんといいよこしんといいlocofrankのドラマー凄すぎるな Neo Chavezでlocofrankメンバー登場 スガさん誕生日もステージで祝って(ケーキも出てきた) No More tequila tequilaではなく全員ビールだったけど 黒沼さんにライブ早く終わらせて飲もうぜと言われたらしい笑笑 thousandmiracle tour仙台でジョージが本当にtequilabottle持ってきて自分で飲んだりステージに上がって来た人に飲ませてたの思い出した懐かしいの みんなそれぞれ楽しみたいように楽しめる環境が改めて最高だな @dustbox_official @locofrank773four @sugacurry @jojisatoudustbox @kinoshita_masayuki @yusukemori7734 @yokoshin0425 #dustbox #locofrank #ダストボックス #ロコフランク locofrank reason Motion Tabaco Smoke Mountain range voyage it's OVER BE FULL survive CROSSOVER Returning HAPPY START dustbox Emosions Not Over Resistance chocoholic Riot Sparks My Life Without You Still Believing Try My luck Bird of Passage Bitter Sweet Here Comes A Miracle Summer TO Remember jupiter Smash the Crown Hurdle Race Unnameed song Strawberry Break Through Tomorrow Neo Chavez 400(locofrankと) No More tequila (盛岡クラブチェンジウェイブ) https://www.instagram.com/p/CoFaQAbBCzM/?igshid=NGJjMDIxMWI=

0 notes