#TaxablePaymentsAnnualReport

Explore tagged Tumblr posts

Text

Do you know what is TPAR?

Presented on 1 July 2012 the Taxable Payments Reporting framework is utilized by the ATO to recognize temporary workers who haven't met their expense commitments. Notwithstanding, numerous organizations have been delayed to execute this cycle, as it has been hard to follow the lodgement of these reports. This might open numerous organizations to ATO punishments and reviews.

In the event that your business determines at any rate 10% of your GST turnover from one of the accompanying zones, you have to stop a TPAR for the 2020 money related year by 28 August:

Building and development administrations;

Cleaning administrations who make installments to contractual workers;

Dispatch administrations who make installments to contractual workers;

Street cargo administrations who make installments to temporary workers;

Data innovation (IT) administrations who make installments to temporary workers;

Security, examination, or observation administrations who make installments to contractual workers;

Blended administrations (a business that gives at least one of the administrations recorded previously).

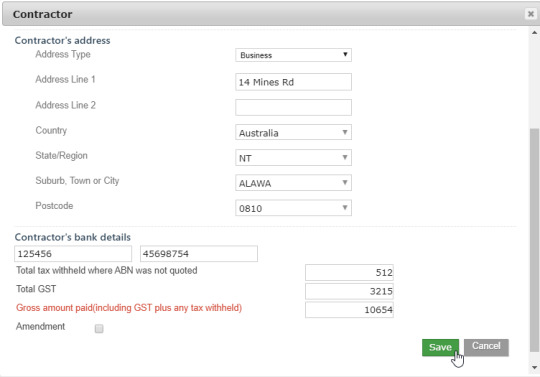

The receipt you would have gotten from the contractual worker ought to have the subtleties you have to report.

This incorporates:

Their Australian Business Number (ABN);

Their name and address;

The gross sum you paid to them for the money related year (counting any GST).

This data is then utilized by the ATO GovReports to discover contractual workers who have detailed their pay mistakenly. The ATO framework is upheld by best in class information coordinating innovation that connects to banks and other outsider suppliers. The TPAR framework has seen the ATO as of now get more than $2.7 billion from the structure and development industry in the 2016 money related year.

Most present-day bookkeeping frameworks can follow TPAR data given, the framework is set up effectively. If you don't mind, contact our office on 1300 65 25 90 or email us at [email protected] for more data about your detailing necessities.

Disclaimer: This data is of an overall sort and ought not to be seen as speaking to monetary guidance. Clients of this data are urged to look for additional guidance in the event that they are indistinct concerning the importance of anything contained in this article. GovReports acknowledges no duty regarding any misfortune endured because of any gathering utilizing or depending on this article.

0 notes

Photo

Have you lodged your TPAR yet? Let us help you guide quickly to meet your reporting obligations.

For more details, please call us on 📞 +61 2 7202 6914 or visit our website 🌐 www.venusaccountants.com.au

#VenusAccountants#TPAR#TaxablePaymentsAnnualReport#Taxation#OutsourceAccountingService#TaxationServices#OffshoreAccounting

0 notes