#Tax exemption in Dubai

Text

Dubai is one of the top cities where you can grow your business and enjoy tax-free zones in the Middle East.

We'll give you a brief idea of how a business owner can benefit from the free zones and how they work.

#dubai tax free zone#Dubai Tax-Free Zone#Dubai Tax-Free Zone business#Governing Authority in Dubai#Tax exemption in UAE#Tax exemption in Dubai#Business Ownership in Dubai#Business Ownership in UAE#Business Activity In UAE#Business Activity In Dubai#Ownership and Leasing Choices in Dubai#Ownership and Leasing Choices in UAE#Business Entities In Dubai#Business Entities in UAE#Currency Regulations In UAE#Currency Regulations In Dubai#Import/Export Exemption in Dubai#Import/Export Exemptionin UAE#Company Incorporation in Dubai#Company Incorporation in UAE

0 notes

Text

Dubai news | Company | business news | income tax | income tax exemption | UAE government

Indians will get tax exemption of Rs 84 lakh in this country, how different is the tax law here from India

Every Indian cherishes the dream of earning abroad, even those who go abroad, this question always remains in their mind as to where the tax will have to be paid on this income. In some countries, a lot of tax is charged, then in many places, big discounts are also given. The UAE government…

View On WordPress

1 note

·

View note

Text

Mainland Company Setup in Dubai: Your Ultimate Guide to Success

Dreaming of starting a mainland business setup in UAE? You're on the right path! Dubai, with its dynamic economy and strategic location, offers a world of opportunities for entrepreneurs. However, navigating the process of mainland company setup in Dubai can be complex. Fear not! This ultimate guide will walk you through the essentials, from understanding the benefits and legal requirements to choosing the right location and obtaining your business license. Get ready to unlock the potential of your business in Dubai’s thriving market with confidence and ease!

Why Choose Mainland Company Setup in Dubai?

Dubai’s mainland offers a strategic advantage. Businesses have direct access to the local market, with the freedom to trade within and outside the UAE without restrictions.

Here are some compelling reasons to consider mainland company setup in Dubai:

Unlimited Market Access: Unlike free zones, mainland companies can trade anywhere in the UAE.

Flexible Business Activities: Engage in a wide range of commercial, professional, and industrial activities.

Ease of Business Expansion: Mainland companies can open multiple branches across the UAE.

Government Contracts: Only mainland companies can bid for lucrative government projects.

Benefits of Mainland Company Setup in Dubai

Setting up a mainland company in Dubai comes with several perks:

Unlimited Workforce: Unlike free zones, mainland companies can hire unlimited staff.

No Currency Restrictions: There are no restrictions on currency used for transactions.

Tax Benefits: Enjoy corporate tax exemptions and other financial incentives.

Office Flexibility: Rent office space anywhere in Dubai, enhancing operational flexibility.

Tips for a Smooth Mainland Company Setup

Here are some tips to ensure your setup process is smooth and hassle-free:

Conduct Market Research: Understand the market demand and competition.

Seek Professional Help: Consider hiring business setup consultants to navigate complex procedures.

Budget Wisely: Plan your finances to cover setup costs and initial operations.

Stay Compliant: Regularly update your knowledge of Dubai’s business laws to stay compliant.

Setting up a mainland company in Dubai is a rewarding venture. With its strategic location, robust infrastructure, and business-friendly environment, Dubai offers a fertile ground for businesses to thrive. By following the outlined steps and leveraging the benefits of mainland company setup, you can pave the way for your business’s success. Embrace the opportunities, stay informed, and watch your business flourish in the vibrant market of Dubai.

#MainlandBusinessSetupUAE#MainlandCompanySetupDubai#CompanyFormationUAE#MainlandBusinessLicenseDubai#BusinessSetupChecklist#BusinessSetupConsultants#CommercialLicenseUAE#dubaibusinesssetup#businesssetupdubai#365proservices

2 notes

·

View notes

Text

Ultimate Guide to Starting a Business in Dubai: Everything You Need to Know

Understanding Dubai’s Business Landscape

Dubai has a diverse and dynamic business landscape, catering to various industries such as trade, tourism, finance, real estate, and technology. It is essential to research and understand the market demand, competition, and potential opportunities for your proposed business idea.

Choosing the Right Business Structure

Dubai offers several business structures, including sole proprietorship, limited liability company (LLC), branch office, and free zone company. Each structure has its own advantages, requirements, and regulations. Selecting the appropriate structure is crucial for your business’s growth, liability protection, and tax implications.

Obtaining the Necessary Licenses and Approvals

Starting business in Dubai, UAE requires obtaining the necessary licenses and approvals from the relevant authorities. These may include trade licenses, commercial licenses, and other industry-specific permits. The process can be complex, so it’s advisable to seek guidance from legal experts or business consultants.

Free Zones: A Viable Option for Foreign Investors

Dubai’s free zones offer attractive incentives for foreign investors, such as 100% foreign ownership, tax exemptions, and streamlined business setup processes. Popular free zones include Dubai Multi Commodities Centre (DMCC), Dubai Internet City (DIC), and Dubai Design District (D3).

Finding the Right Location and Office Space

Choosing the right location and office space is essential for your business’s success. Dubai offers a range of options, from modern office towers to shared workspaces and free zone facilities. Consider factors such as accessibility, infrastructure, and proximity to your target market.

Hiring and Managing a Team

Building a strong and talented team is crucial for your business’s growth. Dubai’s diverse workforce offers a pool of skilled professionals from various backgrounds. However, it’s important to understand the local labor laws, visa requirements, and cultural nuances when hiring and managing employees.

Banking and Financial Considerations

Establishing a business banking account, securing funding, and managing finances are critical aspects of start business in Dubai. Research the local banking system, explore financing options (such as bank loans, investors, or government initiatives), and develop a solid financial plan.

Marketing and Promoting Your Business

With a competitive business environment, effective marketing and promotion strategies are essential for your business’s success. Leverage digital marketing, networking events, tradeshows, and other channels to reach your target audience and build brand awareness.

Complying with Legal and Regulatory Requirements

Dubai has a comprehensive legal and regulatory framework governing business operations. Familiarize yourself with the relevant laws, regulations, and compliance requirements to ensure your business operates legally and avoids penalties or fines.

Seeking Professional Assistance

Starting business in UAE can be a complex process, especially for those new to the region. Consider seeking professional assistance from business consultants, lawyers, or accountants to navigate the process smoothly and avoid costly mistakes.

Start business in Dubai can be a rewarding and lucrative endeavor, but it requires careful planning, understanding of the local business landscape, and adherence to the relevant laws and regulations. By following this ultimate guide and seeking professional advice when needed, you can increase your chances of success in this dynamic and thriving business hub.

2 notes

·

View notes

Text

Unveiling the Secrets of Corporate Tax Efficiency with Transcend Accounting

At our firm, we specialize in aiding investors to expand their businesses across diverse nations, with a particular focus on the UAE. Our comprehensive services encompass everything from facilitating business establishment in the region—including Company Formation, Visa Procedures, and Bank Account Opening—to Managing HR, Payroll, VAT, Corporate Tax and accounting needs. We provide stress-free and worry-free business services that cater to all the requirements of our investors, ensuring seamless operations and optimal growth.

Strategic Planning: The Backbone of Tax Efficiency

At the core of enhancing corporate tax efficiency lies strategic planning. Our accounting team specializes in crafting bespoke tax strategies that precisely align with the unique needs and objectives of businesses. Through meticulous analysis of financial data and forecasting future trends, we assist businesses in optimizing their corporate tax structure to minimize liabilities and maximize savings.

Leveraging Local Tax Incentives

One of the key advantages of utilizing our accounting's corporate tax services in Dubai is tapping into the array of local tax incentives and exemptions. From free zone benefits to specific industry incentives, we have a deep understanding of the local tax landscape and can guide businesses in leveraging these opportunities to their advantage. By strategically positioning businesses within the appropriate tax jurisdictions, we can unlock significant cost savings.

Technology-Assisted Simplified Tax Procedures

In the age of digitization, increasing tax efficiency requires the use of technology. we use state-of-the-art instruments and software to automate tedious work, reduce errors, and expedite corporate tax procedures. By using technology, businesses can save time and money on tax compliance, allowing them to focus on their core operations and key strategic initiatives.

Global Expansion:

Expanding your business globally opens up a world of opportunities, but it also introduces complexities in terms of taxation and compliance. corporation tax services are vital in helping companies who are expanding into foreign markets by offering them the necessary support. These services ensure compliance with tax rules and regulations in numerous jurisdictions and have the experience to navigate the complexities of cross-border taxation.

Peace of Mind:

Businesses can have priceless peace of mind knowing that their tax matters are being managed by appropriately qualified professionals when they use corporate tax services.

Taxation is a complex and ever-changing field, and attempting to manage it internally can be daunting and time-consuming for businesses.

We offer a pathway to financial optimization for businesses operating in the dynamic landscape of Dubai. By employing strategic planning, leveraging local tax incentives, and embracing technology, we empower businesses to maximize tax efficiency and save money. Achieving long-term financial success can be significantly increased by partnering with Transcend Accounting.

So, why not take the leap and explore the advantages of Transcend Accounting's corporate tax services in Dubai today?

#TaxEfficiency#DubaiBusiness#CorporateTax#FinancialOptimization#TranscendAccounting#TaxSavings#StrategicPlanning#TechnologyInTax#TaxIncentives#BusinessGrowth#taxation#uaebusiness#business strategy

3 notes

·

View notes

Text

Unlocking Boundless Opportunities with Golden Visa Services in Dubai

In the bustling metropolis of Dubai, opportunities abound for savvy entrepreneurs looking to take their business to new heights. And one sure-fire way to unlock a treasure trove of benefits is by obtaining a Golden Visa through Pro Deskk. But what exactly does this prestigious visa offer, and how can it turbocharge your business endeavors? Let's dive in and explore the myriad ways a Golden Visa can supercharge your entrepreneurial journey in the vibrant city of Dubai.

With a Golden Visa in hand, entrepreneurs partnering with Pro Deskk gain access to a diverse pool of global talent, ready to contribute their skills and expertise to your business ventures. Whether you're in need of top-tier professionals or innovative thinkers, Dubai's Golden Visa program ensures that you have the talent pipeline necessary to drive success. Additionally, the visa opens doors to expansive markets, both regionally and internationally, providing unparalleled opportunities for growth and expansion.

Navigating the business landscape can be daunting, especially in a bustling hub like Dubai. However, with a Golden Visa facilitated by Pro Deskk, entrepreneurs enjoy streamlined processes and access to a wealth of resources designed to facilitate business operations. From simplified visa procedures to business-friendly regulations, Dubai's Golden Visa program, with Pro Deskk's expertise, removes barriers and paves the way for seamless business transactions, allowing entrepreneurs to focus on what they do best – driving innovation and growth.

One of the most enticing aspects of Dubai's Golden Visa program, facilitated by Pro Deskk, is the array of tax benefits and financial incentives it offers to entrepreneurs. From corporate tax exemptions to favourable business regulations, the city provides a fertile environment for businesses to thrive and flourish. Additionally, the Golden Visa opens doors to strategic partnerships and investment opportunities, further bolstering your financial prospects and paving the way for long-term success.

Perhaps the most exciting aspect of obtaining a Golden Visa in Dubai through Pro Deskk is the boundless opportunities it presents for expansion and growth. With access to a dynamic marketplace, a talented workforce, and favourable business conditions, entrepreneurs are empowered to scale their ventures to new heights. Whether you're looking to establish new branches, explore strategic partnerships, or tap into emerging markets, Dubai's Golden Visa program, with Pro Deskk's support, provides the perfect platform for realizing your business ambitions.

The benefits of acquiring a Golden Visa in Dubai through Pro Deskk are truly golden. From access to talent and markets to tax benefits and opportunities for expansion, the advantages are undeniable. So why wait? Take the leap, unlock boundless opportunities, and watch your business soar to new heights with Pro Deskk's Golden Visa services in Dubai.

#ProDeskk#GoldenVisaDubai#BusinessOpportunities#Entrepreneurship#BusinessGrowth#TaxBenefits#GlobalTalent#MarketExpansion#VisaServicesUAE#StartupSuccess#EntrepreneurialJourney#BusinessInDubai#OpportunityKnocks#IncorporationServices#CorporateGrowth#DubaiBusiness#InternationalExpansion#dubaifreezone#uaebusiness#dubaibusinesssetup#freezonedubai

5 notes

·

View notes

Text

Business setup in Dubai

Business setup in Dubai refers to the process of establishing a business entity within the city of Dubai, which is one of the seven emirates of the United Arab Emirates (UAE). Dubai is a thriving business hub known for its strategic location, robust infrastructure, and business-friendly environment. Here is a detailed explanation of business setup in Dubai:

Mainland Business Setup: Mainland business setup allows businesses to operate within the local market of Dubai and the UAE. It requires partnering with a local Emirati sponsor or a local service agent, depending on the nature of the business activity. The sponsor holds a minority share (typically 51%) in the company, while the majority share can be owned by foreign investors.

Free Zone Business Setup: Free zones in Dubai are designated areas that offer attractive incentives and benefits to businesses. These include 100% foreign ownership, tax exemptions, full repatriation of profits, and simplified procedures. Each free zone in Dubai caters to specific industries or sectors, such as Dubai Multi Commodities Centre (DMCC) for commodities trading, Dubai Internet City (DIC) for technology companies, and Dubai Media City (DMC) for media and advertising companies.

Offshore Business Setup: Dubai also offers offshore company formation through jurisdictions such as JAFZA Offshore and RAK Offshore. Offshore companies are not allowed to operate within the UAE market but are ideal for international business activities, asset holding, or as a vehicle for investment and wealth management. They provide privacy, tax advantages, and ease of administration.

Legal Structures: Dubai offers various legal structures for business setup, including Limited Liability Company (LLC), Sole Proprietorship, Partnership, Branch of a Foreign Company, and more. The choice of legal structure depends on factors such as ownership requirements, liability considerations, and business objectives.

Licensing and Permits: Business setup in Dubai requires obtaining the necessary licenses and permits from the relevant authorities. This includes trade licenses, professional licenses, industrial licenses, and specialized permits based on the nature of the business activity. The requirements vary depending on the type of business and the jurisdiction in which it is established.

Office Space and Infrastructure: Businesses in Dubai need to secure suitable office space or facilities to operate. This can be done through leasing commercial spaces, utilizing shared office spaces, or renting virtual offices. Dubai offers state-of-the-art infrastructure, modern office buildings, and world-class amenities to support business operations.

Visa and Immigration Services: Business setup in Dubai includes visa and immigration services for company owners, employees, and their dependents. This involves obtaining residence permits, work permits, investor visas, and other necessary documents from the Dubai Department of Economic Development (DED) and the General Directorate of Residency and Foreigners Affairs (GDRFA).

Compliance and Regulations: Businesses in Dubai must comply with local regulations, including financial reporting, tax obligations, labor laws, and industry-specific regulations. Compliance requirements vary based on the legal structure and the nature of the business activity. It is important to stay updated with the regulations and engage professional advisors to ensure ongoing compliance.

Dubai offers numerous advantages for businesses, including a strategic location that serves as a gateway to the Middle East, Africa, and Asia, a robust infrastructure, a diverse and multicultural workforce, political stability, and a supportive business ecosystem. However, navigating the business setup process in Dubai can be complex, and it is advisable to seek the assistance of experienced business setup consultants who can guide you through the legal requirements, procedures, and best practices to ensure a successful and compliant business establishment.

#business#business services#business setup#business setup company in dubai#business setup consultants in dubai#business setup in uae#business setup services in dubai#businessinuae#businesssetup#businesssetupdubai

8 notes

·

View notes

Text

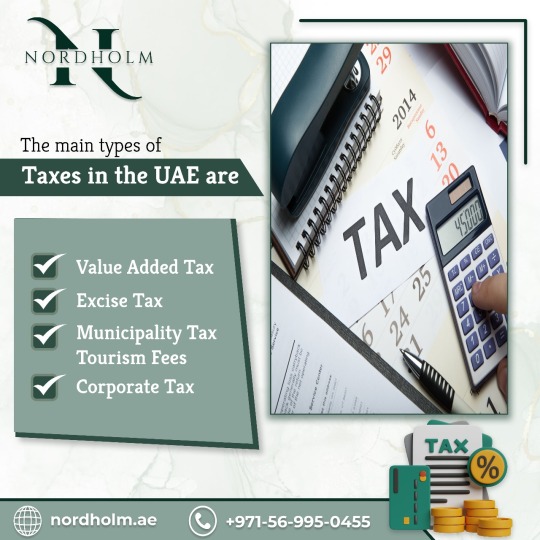

Best Expert Tax Services in Dubai for Investor Success - Nordholm

Welcome to Nordholm Accounting and Bookkeeping Services, a subsidiary managed by Swiss entity Nordholm Investments, dedicated to guiding investors through the intricate landscape of business growth in the UAE, particularly concerning Tax Services in Dubai. Our suite of services encompasses the entire gamut of business establishment, visa processing, bank account setup, HR solutions, payroll management, VAT compliance, and comprehensive accounting services.

Navigating Dubai's intricate business environment necessitates meticulous attention to tax compliance and accurate financial records. Entrusting these critical tasks to seasoned professionals is essential for seamless operations while ensuring strict adherence to diverse tax regulations.

Our range of Tax Services in Dubai includes comprehensive assistance in various areas:

Corporate Tax Advisory: Although Dubai imposes no corporate or income taxes on individuals and corporations, specific considerations apply to branches of foreign entities. Our experts offer strategic guidance, ensuring compliance with applicable regulations and optimizing financial strategies within this unique tax framework.

VAT Compliance Expertise: Operating under a Value Added Tax (VAT) system, Dubai mandates compliance with VAT regulations. Our specialized services assist businesses in Navigating VAT intricacies, timely filing of returns, and implementing strategies to effectively manage VAT liabilities.

Navigating Customs Duties: For businesses involved in importing or exporting goods, understanding and adhering to customs duties are critical. Our services encompass navigating customs regulations, duty exemptions, and ensuring meticulous documentation to mitigate duty-related risks.

Expertise in Excise Taxes: Dubai imposes excise taxes on specific goods like tobacco, sugary drinks, and energy drinks. Our services aid businesses in understanding, reporting, and complying with these taxes, ensuring adherence to statutory requirements.

Tailored Industry-Specific Tax Guidance: Certain industries in Dubai might face specific taxes or levies. We provide tailored guidance to ensure compliance with industry-specific tax obligations, such as tourism-related taxes or real estate-related fees.

At Nordholm Accounting and Bookkeeping Services, we're committed to providing comprehensive support for investors navigating Dubai's multifaceted business landscape, especially regarding Tax Services. Partner with us for expert guidance, ensuring compliance and strategic positioning for sustainable growth in this dynamic market.

#DubaiTaxExperts#TaxComplianceDubai#NordholmTaxServices#TaxAdvisoryDubai#VATConsultants#TaxPlanningUAE#DubaiBusinessTaxes#CorporateTaxDubai#TaxSolutions

5 notes

·

View notes

Text

UAE Corporate Tax and Property Investments: Are Owners Accountable to File Taxes?

As the UAE ushers in its first form of taxation - the Corporate Tax 2023 - there’s been a surge in queries online. Among the many questions, the one that was asked most frequently was: Who must adhere to mandatory tax filing, and who is exempt from this financial threshold?

To put an end to these uncertainties, a beacon of clarity came from the Ministry of Finance through a decisive cabinet decision. This landmark decision delineates the regulations governing foreign corporations and non-resident property owners, be it in Dubai or anywhere else in the country.

The UAE Ministry of Finance has taken a carefully thought-out step by introducing Cabinet Decision No. 56 of 2023. This decision sets new rules for foreign companies and non-residents, making them answerable to the new Corporate Tax in the UAE. What it means is that these entities now have to pay taxes on the money they make from real estate and other property investments in the UAE.

To navigate this situation, these companies need to start working with the UAE's regulatory authorities. Given that this rule applies to properties used for business and investment within the UAE. Recent information from the Ministry of Finance says that foreign companies (or property developers in UAE) owning property in the country must pay Corporate Tax based on their income after deducting expenses.

However, there's a positive side to these tax rules. Businesses affected by this tax can subtract relevant expenses that match the rules outlined in the Corporate Tax law. This smart calculation of deductions lowers the amount of income that gets taxed, which helps ease the financial load.

For people in situations where they are foreigners living in another country or who live in the UAE. If they own a real estate property, like a building, regardless if they’ve bought it themselves or through special arrangements, they usually wouldn’t have to pay a special tax on the money they make from it. But this special tax exemption doesn't apply anymore if they do certain kinds of business activities specified in the Cabinet Decision.

In a similar way, there's another situation where real estate investment trusts and certain investment funds can make their mark. They can avoid paying Corporate Tax on income from UAE's properties if they follow specific rules and conditions.

Younis Haji Al Khoori, the undersecretary of the Ministry of Finance, whose declarations echo global wisdom, elucidates, "The Corporate Tax treatment of income derived from UAE real estate and other immovable property by foreign juridical persons is in line with international best practice," further reinforcing the tenet that income tied up with immovable property should be up for taxation within the sovereign grounds which hosts the said property.

His strong message echoes deeply. The UAE's Corporate Tax Law cleverly combines elements that follow international tax rules, carefully designed to create fairness, ensuring a balanced situation for local and foreign companies dealing with property income in the UAE.

Summary

In summary, the symphony of this paradigm shift composes a melody of equity woven through the tapestry of Corporate Tax. As the sands of Dubai bear witness, this arrangement aligns itself with global conventions, creating an environment where enterprises, irrespective of their origin, will stand on equal footing.

#residential projects in dubai#top developers in dubai#residential property for sale in dubai#shapoorji properties

2 notes

·

View notes

Text

Economic impact of the logistics sector on Dubai's economy.

Dubai, often referred to as the gateway between East and West, has long been a pivotal logistics hub due to its strategic location, world-class infrastructure, and progressive policies. The logistics sector, a cornerstone of Dubai's economy, plays a crucial role in driving growth and development. In this blog, we'll explore the economic impact of the logistics sector on Dubai's economy and why the phrase Logistics in Dubai resonates globally.

A Strategic Gateway

Dubai’s geographical positioning makes it a natural logistics nexus, connecting major markets in Asia, Europe, and Africa. The city's state-of-the-art ports, such as Jebel Ali Port, one of the busiest in the world, and its leading airports, including Dubai International Airport and Al Maktoum International Airport, enhance its connectivity. These facilities handle millions of tons of cargo annually, solidifying Dubai’s status as a global logistics hub.

Economic Contributions

GDP and Employment

The logistics sector is a significant contributor to Dubai’s GDP. It supports a wide array of businesses, from freight and shipping companies to warehousing and distribution centers. According to the Dubai Economic Report, logistics and transportation contribute around 14% to Dubai's GDP. This robust sector provides employment to thousands, fostering economic stability and growth.

Trade Facilitation

Dubai’s logistics capabilities are integral to its role as a global trading hub. The Emirate’s free zones, such as Jebel Ali Free Zone (JAFZA), offer businesses incentives like tax exemptions and full foreign ownership, attracting multinational companies. These free zones facilitate trade by providing seamless logistics solutions, thus boosting Dubai’s trade volume. In 2020, Dubai’s non-oil foreign trade reached AED 1.182 trillion, underscoring the logistics sector's vital role.

Infrastructure Development

The logistics sector drives significant infrastructure investments. Projects like the expansion of Al Maktoum International Airport and enhancements at Jebel Ali Port ensure that Dubai can accommodate future growth and maintain its competitive edge. These developments not only bolster logistics capabilities but also spur related sectors such as construction and real estate.

Technological Advancements

Dubai is at the forefront of integrating advanced technologies into logistics. The adoption of AI, IoT, and blockchain enhances efficiency, reduces costs, and improves transparency in supply chain operations. Initiatives like the Dubai Blockchain Strategy aim to make Dubai a paperless government by 2021, streamlining logistics processes and reinforcing its position as a smart city.

Challenges and Adaptations

While the logistics sector in Dubai is robust, it faces challenges such as fluctuating oil prices, regional geopolitical tensions, and the need for sustainable practices. However, Dubai's proactive approach in addressing these issues through diversification and innovation ensures resilience. For instance, the city’s focus on renewable energy and sustainable logistics solutions demonstrates its commitment to long-term growth.

The Future of Logistics in Dubai

Looking ahead, the logistics sector in Dubai is poised for continued growth. The upcoming Expo 2020 is expected to further boost logistics activities, attracting global attention and investment. Additionally, initiatives like the Dubai Silk Road Strategy aim to enhance Dubai’s position as a central logistics hub on the New Silk Road, connecting it with other major trade routes.

Logistics in Dubai is more than just a sector; it’s a critical economic driver that shapes the city’s global standing. From contributing significantly to GDP and employment to fostering trade and driving infrastructure development, the impact of logistics on Dubai’s economy is profound and far-reaching. As Dubai continues to innovate and adapt, its logistics sector will undoubtedly remain a cornerstone of its economic success, solidifying its reputation as a global logistics powerhouse.

By understanding the economic impact of logistics in Dubai, stakeholders can better appreciate the strategic importance of this sector and the continuous efforts needed to maintain and enhance its global leadership.

0 notes

Text

VAT HEALTH CHECK IN DUBAI, UAE

The United Arab Emirates (UAE) continues to implement Value-Added Tax (VAT) regulations. Businesses in Dubai need to stay compliant and up-to-date on the latest rules. This is why a VAT Health Check in Dubai is essential. A VAT Health Check in the UAE can help to ensure that your business is adhering to the correct regulations. And allows you to identify areas that may need improvement. We will discuss the importance of a VAT Health Check in Dubai. How it can benefit your business.

WHAT IS VAT HEALTH CHECK?

A VAT health check is an assessment of a business’s VAT (Value-Added Tax) compliance and processes. To identify potential areas of risk, Non-compliance, and inefficiencies. It is a comprehensive review of a business’s VAT records, procedures. And systems to ensure that they are in line with the VAT regulations and requirements.

The purpose of a VAT health check is to identify any potential issues that could lead to errors or penalties in VAT reporting. As well as to ensure that the business is taking full advantage of any VAT exemptions. Reliefs, or opportunities that may be available to them.

A VAT health check typically involves a detailed review of a business’s VAT records and processes. Such as their VAT registration, invoicing, VAT returns, and record-keeping. It may also involve interviews with key personnel and an assessment of the business’s VAT risk profile.

For more details: https://masaraudit.ae/vat-health-check-in-uae/

0 notes

Text

Dubai Free Zone Business Setup: A Clear and Concise Step-by-Step Guide

Starting a freezone business setup in Dubai's vibrant economy can be both thrilling and challenging. Establishing a presence in this bustling hub is best achieved through a freezone business setup. Dubai's free zones, including the Dubai Airport Free Zone, offer numerous advantages such as 100% foreign ownership, tax exemptions, and streamlined processes.

Tips for a Smooth Freezone Business Setup

Research and Plan

Thorough research and planning are essential. Understand the free zone regulations, costs, and benefits. It saves time and prevents unexpected issues.

Seek Professional Help

Consider hiring a business setup consultant. They can guide you through the process, ensuring all steps are completed correctly and efficiently.

Stay Updated with Regulations

Regulations in free zones can change. Stay updated with the latest rules to ensure compliance. It helps avoid penalties and keeps your business running smoothly.

Network and Collaborate

Take advantage of the networking opportunities in free zones. Attend events, join business groups, and collaborate with other companies. It helps in business growth and expansion.

Setting up a freezone company in Dubai is a rewarding venture. The process involves selecting the right free zone, deciding on your company structure, reserving a company name, and obtaining necessary approvals and licenses. Leasing office space, applying for visas, and opening a corporate bank account are also key steps.

With the right planning and resources, your business can thrive in Dubai’s dynamic free zone environment. Whether you choose the Dubai Airport Free Zone or another, the opportunities are immense. Stay informed, seek professional guidance if needed, and embrace the journey of entrepreneurship in one of the world’s most vibrant business hubs. Happy business setup!

#ProServicesInDubai#BusinessProServices#CorporateProServicesInDubai#ProServices#BestProServices#CorporateProServices#ProServicesDubai#DMCFreeZone#BestProServicesInDubai#DubaiAirportFreeZone#DubaiFreeZone#FreezoneBusinessSetup#FreezoneCompany#365proservices#uaeconsultancy#businesssetupuae#dubaibusinesssetup

2 notes

·

View notes

Text

Offshore Company Setup in Dubai: A Comprehensive Guide

Benefits of Setting Up an Offshore Company in Dubai

Tax Advantages: One of the most significant benefits is the tax efficiency. Offshore companies in Dubai are exempt from corporate tax, income tax, and value-added tax (VAT). This allows businesses to maximize their profits without the burden of heavy taxation.

Confidentiality: Dubai offers a high degree of privacy and confidentiality for offshore companies. Shareholder and director information is not disclosed to the public, Offshore Company Setup Dubai which helps in maintaining business discretion and protecting sensitive information.

Asset Protection: Offshore companies can be used to hold assets and intellectual property, providing a robust layer of protection against legal disputes and potential creditors.

No Currency Restrictions: Dubai's offshore jurisdictions do not impose currency restrictions, allowing businesses to operate freely in multiple currencies, which is particularly beneficial for international trade and investment.

Ease of Setup and Maintenance: The process of setting up an offshore company in Dubai is straightforward and can be completed within a few days. Furthermore, the ongoing administrative requirements and costs are minimal compared to other jurisdictions.

Requirements for Setting Up an Offshore Company

Shareholders and Directors: A minimum of one shareholder and one director is required, and they can be the same individual. There are no restrictions on the nationality or residency of shareholders and directors.

Registered Office: An offshore company must have a registered office address within the offshore jurisdiction in Dubai.

Capital Requirements: There is no minimum capital requirement for offshore companies in Dubai, making it accessible for businesses of all sizes.

Company Name: The company name must be unique and comply with the naming conventions set by the offshore jurisdiction. It should not be similar to any existing company names or include restricted words.

Business Activities: Offshore companies are generally not permitted to conduct business within the UAE. Their operations should be focused on international markets, holding assets, or facilitating trade outside the UAE.

Process of Setting Up an Offshore Company in Dubai

Choose an Offshore Jurisdiction: Dubai offers several offshore jurisdictions, such as Jebel Ali Free Zone (JAFZA) and Ras Al Khaimah International Corporate Centre (RAK ICC). Each has its own regulations and benefits, so choose one that best suits your business needs.

Engage a Registered Agent: To initiate the setup process, you must engage a registered agent who is authorized to handle offshore company registrations. The agent will assist with the documentation and submission process.

Prepare and Submit Documents: The required documents typically include a completed application form, passport copies of shareholders and directors, Dubai Freezone Company Setup proof of address, and a business plan. The registered agent will submit these documents to the relevant authorities.

Company Registration and Approval: Once the documents are reviewed and approved, the company will be officially registered. You will receive a certificate of incorporation, along with other relevant documents, such as the memorandum and articles of association.

Open a Bank Account: After the company is registered, you can open a corporate bank account in Dubai or any other preferred banking jurisdiction. This step is crucial for conducting financial transactions and managing the company’s funds.

0 notes

Text

Having Commercial Space Certified by LEED

As a LEED Consultancy in Agile Advisors, The U.S. Green Building Council has certified LEED buildings, or Leadership in Energy and Environmental Design, as having the most up-to-date green technologies. There are several advantages to selecting a LEED building for your company, even if rental prices are frequently higher than those of traditional facilities. It has been demonstrated that spaces in LEED buildings offer superior indoor air quality conditions compared to other offices because of their cutting-edge green HVAC systems, outfitted with antimicrobial, allergy-friendly filters. As a result, your staff may take fewer sick days annually, boosting output. There can be a 50% reduction in air quality-related illnesses even in spaces modified to meet LEED requirements.

We as a LEED Consultancy in Dubai, Research has indicated that LEED-certified buildings can assist employers in luring top talent. Additionally, there is typically less staff turnover in LEED-certified offices due to high worker satisfaction. This is particularly true for Millennials, who strongly prefer working for environmentally conscious companies. Leasing eco-friendly office space not only demonstrates your company's commitment to sustainability but also sets you apart from the competition. In a world where environmental consciousness is increasingly valued, this can be a significant competitive advantage, particularly in large cities where such buildings are well-known. LEED-certified office space can help your business achieve its green operations goals.

Agile Advisors provides LEED Consultant, the areas are more energy-efficient and will fit well with your entire sustainability strategy plan. Less water and electricity are used in LEED-certified buildings. Your bottom line will benefit from decreased utility use. Some businesses even discover that the lower utility expenses make up more rent increases related to renting space in a green building. If your firm leases space in a LEED-certified building, you can be eligible for tax incentives based on your industry and location. Certain LEED buildings may even be exempt from paying state or local taxes since they are in specific economic growth zones. Waste is usually put to good use through recycling and composting systems, as seen in LEED buildings. Refunds for recycled materials sold to you are possible in certain circumstances.

In our role as a LEED Consultancy in UAE, Office spaces in LEED-certified buildings offer attractive, well-lit workspaces with bright natural lighting, which can improve employee performance. According to one study, employees who worked in LEED-certified spaces proved to be 25% more efficient mentally when doing memory tasks. LEED office spaces are better for the environment; besides all the other advantages they provide your business. The area of your carbon footprint will decrease if you live in one. The world's most popular green building rating system is called LEED, or Leadership in Energy and Environmental Design. LEED offers a foundation for creating green buildings that are healthful, highly efficient, and economical, and it is available for almost all sorts of building, community, and residential project types.

0 notes

Text

Achieving Excellence: Meydan Free Zone Powered by PRO Deskk Services

Nestled in the heart of Dubai, Meydan Free Zone presents an optimal locale for launching your business with the adept assistance of PRO Deskk One Stop Solution. Positioned strategically near Dubai's downtown area, Meydan Free Zone is designed to offer economical solutions for setting up businesses, attracting global investors seeking a smooth entry into Dubai's thriving market.

As specialists in facilitating business setups, PRO Deskk Solution ensures a seamless and efficient process within Meydan Free Zone, enabling entrepreneurs to capitalize on a plethora of advantages. These encompass 100% ownership, tax exemptions, the ability to recruit foreign talent, high-speed internet access, and streamlined import-export procedures. The flexible desk option is particularly well-suited for businesses not necessitating a permanent physical office space.

At the core of Meydan lies the iconic Meydan Stadium, a testament to Dubai's visionary efforts in global connectivity through international horse racing events. Yet, Meydan's allure extends beyond the stadium, embracing a diverse array of commercial, sports, hospitality, entertainment, and residential developments. Additionally, it houses cutting-edge business parks, healthcare, educational facilities, and luxurious waterfront destinations.

Our Services provide unparalleled advantages:

Facilitation of seamless business setup processes

Flexibility in business operations through the personalized Flexi desk option

Prime location benefits enhancing visibility and accessibility for your business setup

Assurance of 100% capital and profit repatriation, safeguarded by our experts

Unrestricted ownership rights for individuals and corporate entities, ensuring complete control

A secure and conducive business environment bolstered by our support

Meydan Free Zone as the preferred destination for emerging businesses in Dubai, endorsed by our credibility

Competent management of licensing and registration procedures by our Services

#PRODeskkServices#MeydanFreeZone#PRODeskkSolutions#DubaiBusiness#BusinessSetup#Entrepreneurship#CorporateSolutions

5 notes

·

View notes

Text

Benefits of Starting a Home-Based Business in Dubai

The Benefits of Starting a Home-Based Business in Dubai

Starting a home-based business in Dubai offers several advantages that can be beneficial for entrepreneurs. Here are some key benefits of starting a home-based business in Dubai:

Cost Savings: Operating a business from home eliminates the need for leasing or purchasing commercial space, which can significantly reduce overhead costs. You can save on expenses such as rent, utility bills, and commuting costs, allowing you to allocate more resources towards business growth and development.

Flexibility: Running a home-based business provides flexibility in terms of working hours and work-life balance. You have the freedom to set your own schedule and work at your own pace. This flexibility is especially valuable for individuals with personal commitments or those who prefer a more flexible working environment.

Convenience: Operating from home eliminates the need for a daily commute, saving you time and reducing stress. You have the convenience of working in a comfortable and familiar environment, with all the necessary tools and resources at your fingertips. This can enhance productivity and overall job satisfaction.

Reduced Risks: Starting a home-based business allows you to test your business idea with minimal risk. Since you don't have the financial burden of leasing a commercial space, you can experiment, refine your offerings, and assess market demand before scaling up. This mitigates the risk of investing significant capital upfront.

Lower Regulatory Requirements: Home-based businesses in Dubai generally have fewer regulatory requirements compared to businesses with physical locations. This simplifies the setup process and reduces administrative tasks, allowing you to focus more on your core business activities.

Tax Benefits: Depending on the nature of your home-based business, you may be eligible for certain tax benefits or exemptions. Consult with a tax advisor to understand the specific tax advantages available to home-based businesses in Dubai.

Enhanced Work-Life Balance: Working from home allows you to strike a better balance between your personal and professional life. You can save time on commuting, have more flexibility in managing family commitments, and enjoy a better quality of life. This can lead to higher job satisfaction and overall well-being.

Global Reach: With advancements in technology and the internet, home-based businesses in Dubai can easily reach a global customer base. You can leverage digital platforms, social media, and e-commerce tools to market and sell your products or services to customers worldwide, expanding your business opportunities.

Scalability: Starting as a home-based business provides a solid foundation for future growth. As your business expands and generates revenue, you can consider scaling up by transitioning to a dedicated commercial space or exploring additional business avenues while maintaining the advantages of a home-based setup.

It's important to note that starting a home-based business still requires careful planning, determination, and adherence to legal and regulatory requirements. Conduct thorough market research, develop a solid business plan, and seek professional advice to ensure your home-based business in Dubai is set up for success.

#business setup services in dubai#business services#business#business setup#business setup company in dubai#business setup consultants in dubai#business setup in uae#proservicesdubai2022#businesssetupdubai#businessinuae#businesssetup#uaevisitvisaonline#VISACONSULTATION#VisitDubai#visitvisauae#freezone#mainland#uaevisitvisa#uaebusiness#dubaibusiness#dubaibusinesssetup#dubaibusinessman#immigration#tradelicense#tradelicenserenewal#tradelicensedubai#tradelicenseajman#AbuDhabi#ajman#sharjah

2 notes

·

View notes