#Tax advisor LA;

Explore tagged Tumblr posts

Text

It's Tax Time Again - CPA Howard Dagley SCV - SFV

It’s Tax Time Again! If you live in the Santa Clarita or San Fernando Valley, you may be wondering if you’re in need of a tax pro in your area. The clock is taking on the tax deadline. With CPA Howard Dagley, you’ll be in good hands this tax season. Howard Dagley, CPA is a certified tax accountant serving tax payers in the SCV, SFV & Los Angeles areas. Get help filing your taxes this March.…

#Accountant Santa Clarita#best cpa in Santa Clarita#business consultations SCV SFV#CPA San Fernando Valley#CPA SCV#CPA SFV#Howard Dagley CPA SCV#It&039;s Tax Time Again SCV SFV#tax advisor#Tax Returns#tax services Santa Clarita#tax time SCV SFV LA

0 notes

Text

Idk why Nintendo hasn’t ever tried a Robin Hood-esque zelda game, it’d be perfect.

Huge monster problem in the kingdom, evil king (Nintendo would probably do Ganondorf somehow but I would just make it be Hyrule’s regular king I think anyway) ignoring the issue and also taxing the citizens dry. Maybe he promises to use all these rupees to fix the monster problem but nothing ever happens. Link is the only one who’s doing anything about the monsters, and he eventually gains a ragtag group of people who are helping him out.

Zelda is doing her best, but she can’t do much in the political position she’s in (age or something like that is the issue, despite her being the princess. Unless she’s a lower rank and the only female heir? hm), but she’s aware of Link and his merry men doing what they can to help.

To make it more zelda-y it probably turns out the king has a nasty advisor who’s the cause of the monsters, and had his own agenda in mind (waking up Ganon of course. Or maybe he is Ganon a la oot?), and Link goes a little deeper into the woods one day to a place he’s never been and finds this cool sword.

Anyway Link also has a fairy or companion of some sort who’s name is little John. Hire me Nintendo.

#rambles from the floor#legend of zelda#legend of Zelda au#kinda#don’t ever let me think about green hats and archery too long or else this kind of thing happens

164 notes

·

View notes

Text

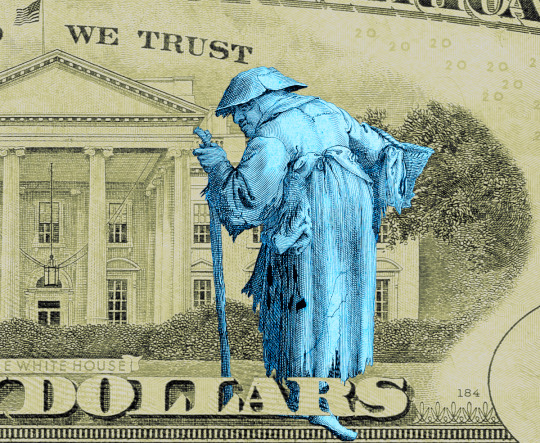

Biden wants to ban ripoff “financial advisors”

I'll be at the Studio City branch of the LA Public Library on Monday, November 13 at 1830hPT to launch my new novel, The Lost Cause. There'll be a reading, a talk, a surprise guest (!!) and a signing, with books on sale. Tell your friends! Come on down!

Once, American workers had "defined benefits pensions," where their employers promised to pay them a certain amount every year from their retirement to their death. Jimmy Carter swapped that out for 401(k)s, "market" pensions where you have to guess which stocks will be valuable or starve in your old age:

https://pluralistic.net/2020/07/25/derechos-humanos/#are-there-no-poorhouses

The initial 401(k) rollout had all kinds of pot-sweeteners that made them seem like a good deal, like heavy employer matching that doubled or even tripled the value of every dollar you put into the market for your retirement. But over the years, as Reaganomics took hold and workers' power ebbed away, all these goodies were clawed back. In the end, the market-based pension makes you the sucker at the poker table, flushing your savings into a rigged casino that is firmly tilted in favor of finance barons and other eminently guillotineable plutocrats.

Neoliberalism is many things, but most of all it is a cult of individualism. The fact that three generations of workers are nows facing down retirement without pensions that will provide them with secure housing and food – let alone money to see the odd movie, buy birthday gifts for their grandkids, or enjoy a meal out now and then – is framed as millions of individual failures, not a systemic one.

In other words, if you are facing food insecurity and homelessness after a lifetime of hard work, it's because you saved wrong. Perhaps you didn't save enough (through a 40-year run of wage stagnation and skyrocketing housing, health and education costs). Or perhaps you saved wrong, making the wrong bets on the stock market. If you can't afford to run your air conditioner during a heat dome, that's on you: you should have been better at stocks.

Apologists for this system will say that you don't have to be good at stocks – you just have to pay an Independent Financial Advisor to pick the stocks for you and you'll be fine. But IFAs don't work for free! What if you can't afford one?

Enter "predatory inclusion" – the practice of offering scammy, overpriced and substandard products to poor people and declaring it to be a good deed, because otherwise, those poor people would have to do without. The crypto bubble relied heavily on this: think of Spike Lee and others shilling for pump-and-dump scams as a way of "building Black wealth":

https://www.nytimes.com/2021/07/07/business/media/cryptocurrency-seeks-the-spotlight-with-spike-lees-help.html

More recently, Intuit and other scammy tax-prep services have argued against the IRS's plan to offer free tax preparation as bad for Black and brown people, because it will deny them the chance to be deceived and ripped off with TurboTax:

https://pluralistic.net/2023/09/27/predatory-inclusion/#equal-opportunity-scammers

Back in 2018, Trump won the predatory inclusion Olympics, when his Department of Labor let the Fifth Circuit abolish the "Fiduciary Rule" for Independent Financial Advisors:

https://www.investopedia.com/updates/dol-fiduciary-rule/

What was the Fiduciary Rule? It said that your IFN had to put your interests ahead of their own. Like, if there were two different funds you could bet on, and one would pay your IFN a big commission, while the other would be a better bet for you, the IFN couldn't put your retirement savings into the fund that offered them a bribe.

When Trump killed the Fiduciary Rule, he proclaimed it a victory for poor people, especially Black and brown people. After all, if IFNs weren't allowed to accept bribes for giving you bad financial advice, then they would have to make up the difference by charging you for good advice. If you couldn't afford that advice, well, you'd have to make bad retirement investments on your own, without the benefit of their sleazy self-dealing.

The Biden Administration wants to change that. Biden's Acting Labor Secretary is Julie Su, and she's very good at her job. Last spring, she forced west coast dockworkers' bosses to cough up the contract they'd stalled on for a year, with 8-10% raises for every worker, owed retroactively:

https://pluralistic.net/2023/06/16/that-boy-aint-right/#dinos-rinos-and-dunnos

Su has proposed a way to reinstate the Fiduciary Rule, as part of the Biden Administration's war on junk fees, estimating that this will increase retirees' net savings by 20%:

https://prospect.org/labor/2023-11-07-julie-su-labor-retirement-savers/

The new rule will force advisors who cheat their clients to pay restitution, and will require them to deliver all their advice in writing so that this cheating can be detected and punished.

The industry is furious, of course. They claim that "The Market (TM)" will solve this: if you get bad retirement savings advice and end up homeless and starving, then you will choose a different advisor in your next life, after you are reincarnated (I guess?).

And of course, they're also claiming that forcing IFNs to stop cheating their clients will deny poor people access to expert (bad) advice. As the Financial Services Institute's Dale Brown says, this will have a "negative impact on Main Street Americans’ access to financial advice":

https://www.fa-mag.com/news/legal-challenge-predicted-for-new-dol-fiduciary-proposal-75257.html

Here's that rule – read it for yourself, then submit a comment expressing your views on it. The government wants to hear from you, and administrative law requires them to act on the comments they receive:

https://www.federalregister.gov/documents/2023/11/03/2023-23782/proposed-amendment-to-prohibited-transaction-exemptions-75-1-77-4-80-83-83-1-and-86-128

Su is part of a wave of progressive, technically skilled regulators in the Biden administration that resulted from a horse-trading exercise called the Unity Task Force, which divvied up access to top appointments among the progressive wing and the finance wing of the Democratic Party. The progressive appointments are nothing short of incredible – the most competent and principled agency leaders America has seen in half a century:

https://pluralistic.net/2023/10/23/getting-stuff-done/#praxis

But then there's the finance wing's appointments, like Judge Jacqueline Scott Corley, who ruled against Lina Khan's attempt to block the rotten Microsoft/Activision merger (don't worry, Khan's appealing):

https://pluralistic.net/2023/07/14/making-good-trouble/#the-peoples-champion

Perhaps the worst, though, is Biden's Secretary of Commerce Gina Raimondo, a private equity ghoul who did a stint for the notorious wreckers Bain Capital before founding her own firm. Raimondo has stuffed her department full of Goldman Sachs alums, and has sidelined labor and civil society groups as she sets out to administer everything from the CHIPS Act to regulating ChatGPT.

As Henry Burke writes for the Revolving Door Project and The American Prospect, Raimondo's history as a corporate raider, her deference to the finance sector, and she and her husband's conflicts of interest from their massive stakes in companies she's regulating all serve to undermine Biden's agenda:

https://prospect.org/economy/2023-11-08-commerce-secretary-gina-raimondo-undercutting-bidenomics/

When the administration inevitably complains that its popular economic programs aren’t breaking through the media coverage, they’ll have no one to blame but themselves.

The Unity Task Force gave us generationally important policymakers, but ultimately, it's a classic "pizzaburger." If half your family wants pizza, and the other half wants burgers, and you serve them something halfway in between that makes none of them happy, you haven't made a wise compromise – you've just made an inedible mess:

https://pluralistic.net/2023/06/17/pizzaburgers/

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/11/08/fiduciaries/#but-muh-freedumbs

#pluralistic#julie su#fiduciary rule#intergenerational warfare#aging#retirement#401ks#old age#pensions#finance#pizzaburgers#Gina Raimondo

273 notes

·

View notes

Text

Selcouthian World Building: The Agrona Councils and Kingdoms

In the kingdom of Agrona Morgana there are 9 kingdoms within the main kingdom.

Each kingdom has a council, these councils range from 5-11 people per council.

Overall, the hierarchy of councils goes as follows:

Grandmasters Council:

The council responsible for overseeing all action done by the government. However, they rarely ever meet as this is not necessary all the time.

Usually used for: plans of war, crisis that have inflicted the citizens, among other large scale issues.

(Pandora is on this Council later on)

Grand Judicial Council:

Self explanatory, responsible for ruling over federal laws and the highest profile cases.

(Noah is on this Council later on)

Grand Executive Council:

Used for enforcing laws and dealing in foreign affairs.

(Pandora is also on this one later on)

Grand Legislative Council:

Makes all other laws, regulates commerce, and controls taxing and spending policies.

Ruling Council(s):

The councils that rule over the individual kingdoms (have their own Executive, Judicial, and Legislative councils)

Local Council(s):

Similar to the Ruling Councils, just local to cities and small territories inside the kingdoms.

The Grandmasters are:

Morgana - Diana De La Dáinn (Female) (Later Pandora De La Dáinn (Female))

Edelweiss - Arya Adair (Female)

Bronwen - Bastian Warblaze (Male)

Noel - Aerith Windward (Non Binary)

Bylur - Samuel Verlice (Male)

Albina - Lucien Huxley (Male)

Fintan - Marius Bozzelli (Female)

Wynn - Serian Wix (Non Binary)

Dwight - Lysandra Odessa (Female)

Fun fact: Noah does NOT get put on the grandmasters council when he becomes grand judge

He IS however considered an advisor to Pandora and does occasionally sit in on meetings and give his two cents as the grand judge

So while he’s up high, he’s not on top

Noah is fine doing his thing and letting his wife do the big stuff, he’s just here to oversee cases and make sure the wrong people aren’t put in prison.

Each Kingdom is responsible for a different aspect of trade, communications, and/or resources. Some of these do overlap.

Morgana - Foreign Affairs, Weaponry, Arts

Edelweiss - Farming (Fields)

Bronwen - Fishing, Sea Trade

Noel - Music, Arts, Processing Food and other materials

Bylur - Land Trade, Farming (Mountains)

Albina - Foraging, Farming (Underground)

Fintan - Mining, Rare Resources

Wynn - Mining, Construction Materials

Dwight - Exploration, Weaponry

#Selcouthian world building#the tales of selcouth#the crux#bowl mixes#writeblr#writing#writers on tumblr#original character#oc#original oc#original story#original writing#writeblr community

16 notes

·

View notes

Text

Ralph D. de Magne de Chabert (January 12, 1890 - February 6, 1955) the son of Louis de Chabert and Laura de Chabert, was born in Saint Croix, Danish West Indies.

He was interested in agriculture and spent much of his time working on sugar farms during his youth. He supported the efforts of David Hamilton Jackson, a Saint Croix labor rights advocate and founder of The Herald. He advocated for improved social and economic conditions for the agricultural workers of Saint Croix and joined the farm workers on the island when they went on strike.

Polylingual in English, Danish, and French, he studied Journalism and Legal Studies through the La Salle Extension University, accredited by the National Home Study Council and the State of Illinois.

He was excited about the islands now being under the US flag. Nonetheless, he continued to stress the need for political power for the local population.

He founded The Saint Croix Tribune. He edited the paper’s articles and wrote editorials. A daily newspaper (except on Sundays), the Tribune adopted the mottos, “A Journal for the Progress of the People” and “Let Justice Be Done Though the Heavens Should Fall.” He was one of the founders of the Saint Croix Chamber of Commerce and served as its first president. He was a founder of the Saint Croix Democratic Party.

He served as a legal advisor to the Virgin Islands government’s executive, legislative, and judicial branches. He introduced the Homestead Act which granted adult heads of families, public land for a minimal filing fee. This act allowed thousands of Virgin Islanders to become homeowners.

He worked as a dairy farmer. He purchased and developed land for farming in Estate Blessings, Hope, and Jerusalem. He continued working with the Virgin Islands government in various capacities as an elected official responsible for the tax assessment of all property throughout the islands and as the administrator, collecting property taxes and maintaining public records and documents regarding real estate deeds and mortgages.

He married Ansetta Muckle, an entrepreneur from Frederiksted. They had six children. #africanhistory365 #africanexcellence

9 notes

·

View notes

Note

“we’re quite progressive! we take pride in our equal society. we don’t care about what you identify as; so long as you pay your taxes!”

is this the prime minister speaking or the advisor? also, is there like any crime in Las viles cause they could just lower the number of crimes committed by legalizing things like drugs. Plus, people wouldn't need to launder money and just file their taxes normally cutting out a lot of work.

the prime minister is speaking! the advisor will never use exclamation marks.

there are crimes, yes! a small portion are actually made aware of, though. the underground portion of the city is quite sneaky.

5 notes

·

View notes

Text

Richelieu- Background and social outlook

Armand-Jean du Plessis de Richelieu's family background and personal career made him familiar with all three estates of the realm plus the royal court and government. His father, François, had risen from the lesser nobility of Poitou to become grand provost at the Valois court. The elder Richelieu was in charge of maintaining order and provisions within the king's personal retinue and was ranked just below the great officers of the king's household (which included the masters of the stable, hunt, wardrobe, and king's chamber). François died serving as a captain of the guards for Henry IV when Armand, born in 1585, was not yet five.

Armand's eldest brother, Henri, was well positioned as a courtiersoldier during Louis XIII's minority; a second brother, Alphonse, decided on the monastic life. Armand was groomed by Louis XIII's riding master, Pluvinel, to be a courtier-soldier, but he was also inclined to theological studies. In 1607, Richelieu embarked on an ecclesiastical career when he assumed the family's recently acquired ecclesiastical post at Luçon. Bishop of a poor diocese, almoner to Queen Anne, and finally a cardinal and holder of several benefices, he was as committed a cleric as he was instinctively a gentilhomme.

Through his mother, Suzanne de La Porte, Richelieu had another rich inheritance. Her Poitevin grandfather had been a tax agent for a local prince, her father a celebrated parlementary lawyer who helped frame the great sixteenth-century ordinances of royal laws. The La Portes were as successful members of the robe nobility as the Richelieus were typical nobles of the sword. The Richelieu who served Louis XIII was a unique exemplar of the values of the three estates. As a cleric, he blended Catholic reformationist zeal and reverence for the Papacy with an appreciation of the autonomy of the French monarchy. He had come to court as a friend of such religious devots as Pierre Bérulle, who founded the second of his famous Oratory seminaries at Luçon; however, bon Français leanings lay just beneath the surface. Unlike the devots, but like Louis XIII, Richelieu respected the Huguenots, while wanting to see them convert peacefully. As bishop of Luçon, he had written a polemic against Calvinism, fought off an attempt by local Huguenots to build a temple adjacent to his cathedral, and fretted about the Protestant state within the state, whose greatest seaboard town of La Rochelle lay just down the road.

Richelieu came to the court with some of the style of a Second Estate noble. He married his relatives into great families like the Condés. He pursued personal wealth. He even used public funds for private interests. Yet he saw the nobility's greatness not in independent lawless acts, but in service to the monarch. He earned the title of duke and peer in that service. And he joined his king in condemning noble violence, horrified by an uncle's dueling death, his father's killing of the offender in a second duel, and his brother Henri's demise in a duel over the spoils of the first War of the Mother and Son.

When it came to the ways of the Third Estate, this descendant of jurists was a curious blend of royal reformer and pragmatist. Like his royal master, he was opposed on principle to venal officeholding and judicial obstruction of state laws; yet he knew how crucial parlementary loyalty was to establishing a climate of submissiveness, by subjects both high and low. Louis had a habit of lecturing judges for interfering with affairs of what he called "my state"; Richelieu saw the need to bring the judgmental ruler around to a compromise that advanced the cause of that state.

Differences in their social outlook were less significant than shared attitudes. Had it been otherwise, Richelieu would have quickly suffered the fate of Louis's previous advisors. The self-effacing monarch who was comfortable in the dress of a simple soldier could tolerate ostentatious tastes only in a cardinal who liked to lead his armies. The frugal king who talked benevolently of "my poor people" could understand the duke and peer who thought of the poor as beasts of burden, at their best when working hard.

A. Lloyd Moote - Louis XIII the Just

#xvi#xvii#a.lloyd moote#louis xiii the just#cardinal de richelieu#louis xiii#françois iv du plessis de richelieu#antoine de pluvinel#suzanne de la porte#anne d'autriche

16 notes

·

View notes

Note

The guy who won that $2 Billion Powerball only got between $700M and $900M, which I will gladly take any hundred million number, but it's definitely ridiculous how much tax is taken out. Also, kind of scary how the media now follows him around and reports his big spendings. I will say though that it's a bit ridiculous how much he is spending so quickly. Property tax is not cheap in CA, especially the LA area. Hope he has a financial advisor lol

Winning the lottery is so dangerous for people who don’t have a good financial plan

2 notes

·

View notes

Text

☕ Coffee Break Story....

.

🌹 On this day - 10th April 1599 🌹

.

🌹 Death of Gabrielle d'Estrées 🌹

Mistress of King Henry IV of France

.

🌹 Gabrielle d’Estrées was born in 1573, to Antoine d’Estrées, Marquis of Cœuvres and his wife Françoise Babou de La Bourdaisière.

Gabrielle, her mother and sisters, were known for their great beauty - they were also known to be notorious courtesans, having taken quite a few lovers!

Due to their many s€xual liaisons, they were shockingly called the 'seven capital sins'!!

🌹 In early 1590, seventeen year old Gabrielle was in a relationship with the grand equerry of France, Roger de Saint-Lary, Duke of Bellegarde.

Roger de Saint-Lary was close to the new king, Henry IV.

He told the king raunchy tales about his young and incredibly beautiful mistress, Gabrielle.

The king's interest was definitely piqued.

🌹 When Henry met Gabrielle, he fell head over heels in love.

Gabrielle definitely stood out from the crowd, with her exquisite colouring, pale blonde hair and large blue eyes, the king soon developed an intense passion for her.

The King had taken dozens of lovers in the past, yet none were quite like Gabrielle.

However, initially Gabrielle was not keen on pursuing a relationship with the older King.

She held out giving herself to him, until January of 1591.

🌹 In the early years of their relationship, Henry IV was busy travelling around France.

He was trying to subdue Catholic revolts, who opposed their Protestant king.

Rather than parading around the palace showing off her pretty dresses and extravagant jewels - as a mistress usually would - Gabrielle was by the King’s side, on the battlefield.

🌹 Gabrielle's tent was cold and damp, but she would regularly cook for the King, and wash his clothes by hand.

These conditions led the couple to become very close, very quickly.

Henry had few trusted advisors, and Gabrielle soon became the one Henry trusted above all others.

Henry confided his secrets to her, and followed her advice.

🌹 During this period, King Henry IV was married to Queen Margaret of Valois.

The couple were living apart, and their marriage was a never-ending series of disasters from the get-go.

At her father's insistence, Gabrielle found herself married off to Nicholas d’Amerval, Seigneur de Liancourt.

Although both were now unhappily married, Henry and Gabrielle were openly affectionate with each other in public.

Everyone knew they were an item.

🌹 It was not long before Gabrielle became pregnant, and around this time, her marriage was conveniently annulled.

During her pregnancy, Gabrielle stayed by her king's side

She even provided her own funds for the king’s army, shouted orders on the battlefield, and sheltered from cannon fire.

The king was so in awe of Gabrielle, that he promised to marry her and make her Queen of France.

🌹 Gabrielle herself, was born a Catholic.

She figured that the best way to end the religious wars, was for Henry himself to convert to Catholicism.

Henry eventually agreed, and famously proclaimed:

"Paris vaut bien une messe"

Paris is well worth a mass.

Following his conversion, Henry was finally accepted as King of France, and peace was reached with the Catholic League.

Gabrielle wedding and coronation would never happen, due to her untimely and sudden death.

🌹 For her services to the king, Gabrielle was elevated to the position of Marquise de Monceaux.

Rather than flaunting her new title and wasting the nation’s taxes on jewels and clothing, Gabrielle dressed modestly and conducted herself in such a way that it was hard to dislike her.

She used her skills and charms to write personally to the pope.

She explained that it was through her hard work that the King had converted to Catholicism, and if she had not, France could have broken with Rome as England had under King Henry VIII!

🌹 At long last, King Henry IV of France was crowned on 27th February 1594, in Chartres.

Until this point, Henry had been excommunicated by the Catholic Church, which was revoked by Pope Clement VIII.

The Coronation was followed by great celebrations throughout the kingdom.

🌹 Once Henry had been crowned, he made his triumphal entrance into Paris.

It was Gabrielle, not the Queen, who was proudly at his side.

Gabrielle dazzled in the most beautiful black satin dress, covered in pearls.

She was carried in an open litter for all to see.

Henry was showing off the importance of Gabrielle as his Maîtresse-en-titre.

🌹 On 7th June 1594, their first child, a son, was born.

The baby was boldly given the name César.

Giving birth to the King’s son gave Gabrielle even more power at court.

Though born illegitimate, in time, César was legitimised by the King and later created the Duke of Vendôme.

As King Henry had no children with his wife Margaret of Valois, he hoped that he could eventually marry Gabrielle and name César as his heir.

🌹 In March 1596, Henry IV made the extraordinary decision to make Gabrielle part of his council.

Gabrielle was more than Henry’s romantic partner she had played a very important role in the governance of France, she was involved in many key decisions, policymaking, and negotiations.

Foreign monarchs and French nobility began sending her lavish diplomatic gifts.

One of the gifts was a large diamond and sapphire brooch mounted in gold - from Queen Elizabeth I of England!

🌹 As time went on, Gabrielle continued to work tirelessly for the king.

With the Catholics now under control, it was time to look towards the protestants.

The Protestants were still in uproar due to their king converting to Catholicism, and their lack of rights within the kingdom.

Over the following years, Henry and Gabrielle entered negotiations, culminating in 'The Edict of Nantes'.

The Edict of Nantes was signed in 1598, and assured civil equality and extended rights to France’s Huguenot population, bringing an end to the religious wars.

🌹 Along with advising her kingly-lover, Gabrielle gave birth to a daughter, Catherine-Henriette de Bourbon, in 1596.

Another son, Alexandre de Bourbon followed in 1598.

Henry still had no children with his queen, and began to put pressure on members of his council to have his marriage annulled.

Queen Margaret herself opposed the annulment.

She said:

"It is repugnant to me to put in my place a woman

of such low extraction and of so impure a life as

the one about whom rumour speaks."

The queen may have been separated from the king, but she definitely didn't want him marrying Gabrielle.

🌹 In the later years of their relationship, Gabrielle acted as if she were Queen of France - and was treated as such by many.

She presided over a large household with over two hundred serving staff.

In 1598, she even moved into the Queen’s apartments.

With Gabrielle pregnant with their fourth child, Henry took matters into his own hands and wrote to the pope to push for the annulment of his marriage.

🌹 Pope Clement VIII agreed that the marriage between Henry and Margaret of Valois had been over for a long time, but was still apprehensive about passing the annulment.

Despite the lack of annulment, Henry gave Gabrielle his coronation ring and promised they would soon be married.

🌹 Plans were made for the wedding to take place.

Gabrielle was ecstatic, she had waited for this moment for ten years!

Five months pregnant, and glowing with excitement, Gabrielle was so sure that the wedding would finally take place, she stated,

"Only God or the king's death could put an end

to my good luck!"

It seemed she had spoken too soon, as Gabrielle suddenly became unwell....

🌹 Gabrielle's previous pregnancies had been textbook perfect.

Now, suddenly she didn't feel quite right.

With just days to go before her wedding, Gabrielle was in Paris making last minute preparations.

Suddenly, Gabrielle went into early labour.

There were many rumours that she was poisoned, however the general consensus was that she was suffering from either eclampsia or placenta previa.

🌹 Even today, these conditions are dangerous, but in the 16th century, they were almost always a death sentence.

As Gabrielle writhed in agony, she lost her sight and hearing.

Tragically, the baby had died in her womb, the doctors worked frantically to remove him.

Gabrielle’s once beautiful face was so distorted by convulsions, that it became blackened and twisted - causing onlookers to faint at the sight of her.

Gabrielle passed away on 10th April 1599, giving birth to a stillborn son.

🌹 The sudden death of twenty-nine year old Gabrielle, left Henry grief-stricken.

Rather than marrying his beloved, Henry now had to bury her.

King Henry IV provided Gabrielle with a funeral fit for a queen.

Gabrielle was interred in the Notre Dame La-Royale, at Maubuisson Abbey.

🌹 In an unprecedented move, the king wore black to signify his grief, something a King of France had never done before.

Henry even kept the wax effigy of Gabrielle, and visited it for years following her death.

Gabrielle's effigy stood in a small chamber in Henry’s room in the Louvre.

Each day he had it dressed in a new gown.

🌹 Later, in 1599, Henry received the annulment he had been seeking for so long, releasing him from his marriage.

Henry went on to marry Marie de’ Medici.

Marie went on to produce six children for the king, including an heir.

However, these children were often overlooked by Henry IV as he always preferred his children with Gabrielle.

🌹 Gabrielle’s three children were raised in the royal nursery alongside the royal children, much to Marie de’ Medici's displeasure.

Gabrielle’s son, César de Vendôme, had a successful career at the court, becoming an important player in the reigns of Louis XIII and Louis XIV.

Her daughter Catherine Henriette de Bourbon married Charles II, Duke of Elbeuf of the House of Guise.

Their youngest child, Alexandre de Vendôme, was governor of Caen, as well as ambassador to Rome.

Our Group

The Tudor Intruders (and more)

.

🌹 Source - History of Royal Women/Gabrielle d'Estrées

Amy Eloise Kelly 2024

.

🌹 Gabrielle d'Estrées

In the Style of Lavinia Fontana.

The Hepworth, Wakefield.

0 notes

Text

ECO4 vs GBIS: What’s the Difference and Which Grant Do You Qualify For?

If you’re looking to make your home more energy-efficient or reduce your heating bills, you may have heard of two popular UK government schemes: ECO4 and GBIS. While both offer funding for energy-saving upgrades, they are designed for different situations and have different eligibility requirements.

In this article, we’ll explain the difference between ECO4 and GBIS in simple terms, break down what each scheme offers, and help you figure out which one you might qualify for.

What is ECO4?

ECO4 (Energy Company Obligation Phase 4) is the latest phase of the government’s ECO scheme. It runs from 2022 to 2026 and is designed to help low-income households improve their home’s energy efficiency. Funded by energy suppliers, the scheme focuses on whole-house upgrades to reduce carbon emissions and energy costs.

Key Features of ECO4:

Focuses on low-income and fuel-poor households

Offers whole-house retrofit measures

Includes insulation, boiler upgrades, solar panels, and first-time central heating

Applies to both on-gas and off-gas properties

What is GBIS?

GBIS (Great British Insulation Scheme), previously known as ECO+ before its launch in 2023, is a newer and simpler scheme aimed at helping more households with basic insulation measures. While ECO4 is targeted and comprehensive, GBIS is broader and provides single insulation measures.

Key Features of GBIS:

Open to a wider range of households (not just low-income)

Focused mainly on insulation (like loft and cavity wall insulation)

Helps improve EPC ratings from D or below

Faster installation process compared to ECO4

Who is Eligible for ECO4?

You may qualify for ECO4 if:

You receive certain government benefits (like Universal Credit, Income Support, etc.)

Your household has a low income or is considered fuel-poor

Your home has a low EPC rating (E, F, or G)

You live in a hard-to-heat home

ECO4 also supports vulnerable individuals, including the elderly, disabled, or families with young children.

There is also a Local Authority Flexibility (LA Flex) option that allows councils to refer households that don’t meet the core benefit criteria but are still in need of support.

Who is Eligible for GBIS?

You might qualify for GBIS if:

You live in a property with an EPC rating of D or below

You fall into a low Council Tax band (A-D in England, A-E in Scotland and Wales)

You have a low household income (usually under £31,000)

Unlike ECO4, you don’t necessarily need to be receiving benefits to qualify for GBIS. This makes it a more accessible option for homeowners and tenants who might not meet ECO4’s stricter requirements.

Which Grant is Right for You?

Here’s a quick guide to help you decide:

Choose ECO4 if:

You’re on benefits or have a very low income

Your home has no central heating or needs multiple upgrades

You want a more complete, long-term energy solution

You live in a rural or off-gas area

Choose GBIS if:

You want just loft or cavity wall insulation

You’re in a lower Council Tax band or on a modest income

You don’t qualify for ECO4 but still want help improving energy efficiency

Can You Apply for Both?

In most cases, you won’t be able to claim both ECO4 and GBIS at the same time. However, if you received help through GBIS and later meet the criteria for ECO4, you may be able to get further upgrades under ECO4. Each home is assessed individually, so it’s best to speak to an accredited installer or advisor.

Final Thoughts

Both ECO4 and GBIS are valuable schemes that aim to improve the energy efficiency of UK homes and reduce heating costs. While ECO4 is more suited for in-depth improvements in vulnerable households, GBIS provides a quicker, simpler option for basic insulation needs.

Understanding which scheme you qualify for is the first step toward making your home warmer, greener, and more affordable to run.

If you think you might be eligible, don’t wait—look into the application process today and start your journey to a more energy-efficient home.

#unitedkingdom#boiler replacement#eco4#gbis#free insulation#boiler grant#free boiler#government schemes#solar energy#grants

0 notes

Text

Today in Politics, Bulletin 85. 3/6/25

Today in Politics, Bulletin 85. 3/6/25 Ron Filipkowski

The theme of the day was Trump backpedaling on several of his major announcements, executive orders, campaign promises, and policies after intense backlash. He walked back a plan to deport Ukrainian asylum seekers, tariffs on Canada and Mexico, DOGE cuts and firings, and his plan to dismantle the Dept of Education.

… For today. Tomorrow he could reinstate some or all of them. Trump loves creating chaos, but it isn’t just that. Most of these things he campaigned on, they were on his website, they were in Project 2025, they are ideas from his closest advisors, and supported by his MAGA base. He is only walking them back after learning that many of these ideas are wildly unpopular.

… If only independent voters and moderate Republicans paid closer attention during the campaign to what he said he was going to do, because it turns out he wasn’t bluffing on any of it.

… Trump posted on Truth Social that members of his Cabinet met with Elon Musk today and he heard their concerns about him firing their employees and canceling contracts and agreements: “We just had a meeting with most of the Secretaries, Elon, and others, and it was a very positive one. It’s very important that we cut levels down to where they should be, but it’s also important to keep the best and most productive people. We said use the scalpel rather than the hatchet.”

… But then he later said this in the Oval Office: "We're gonna be watching the Cabinet members. And Elon and the group are gonna be watching them. And if they can cut, it's better. And if they don't cut, then Elon will do the cutting."

… AP reported that the CDC announced they are reversing the DOGE firings of 180 employees and want them to come back to work. They sent this email: “Read this e-mail immediately. After further review and consideration … You should return to duty under your previous work schedule. We apologize for any disruption that this may have caused.”

… Then Trump reversed his tariffs on Mexico: “After speaking with President Claudia Sheinbaum of Mexico, I have agreed that Mexico will not be required to pay Tariffs on anything that falls under the USMCA Agreement. This Agreement is until April 2nd. I did this as an accommodation, and out of respect for, President Sheinbaum. Our relationship has been a very good one. Thank you to President Sheinbaum for your hard work and cooperation!”

… He also reversed the tariffs on Canada, and blamed the victim again by claiming that Trudeau secretly wanted him to impose tariffs: “Believe it or not, despite the terrible job he’s done for Canada, I think that Justin Trudeau is using the Tariff problem, which he has largely caused, in order to run again for Prime Minister. So much fun to watch!”

… In other words, dipshit Trump just found out that what he has done with Canada has rejuvenated Trudeau’s approval ratings, which were pretty bad until Trump picked a fight with Canada for no reason.

… Right before Trump announced he was reversing his tariffs, his Commerce Secretary Howard Lutnick was on Fox saying that the tariffs were great because eventually we won’t have to pay income taxes because of them: “Tariffs are going to drive America better. Wouldn't it be amazing to stop paying taxes to the IRS and have the External Revenue Service of make America great again replace our taxes? That is the goal of Trump.”

… If that is the case, why does he keep “pausing” them?

… Sen. John Kennedy (R-LA): "I'm worried about the tariffs. If this starts causing inflation, we're gonna have to recalibrate. The single most important thing, and the thing people expect the president to fix, is high prices."

… Reuters reported from multiple inside sources that Trump was planning to revoke the temporary legal status of 240,000 Ukrainians who were allowed to come to the US after Russia invaded their country, and fast-track their deportations in April. Backlash ensued, then Press Secretary Karoline Leavitt claimed the story was “fake news” and said that “nothing has been decided yet” on their asylum status.

… WSJ obtained a draft executive order that Trump was expected to issue today which would essentially abolish the Dept of Education. It includes language that directed Secretary Linda McMahon to “take all necessary steps to facilitate the closure of the Education Department to the maximum extent appropriate and permitted by law. The experiment of controlling American education through Fed programs and dollars, and the unaccountable bureaucrats those programs and dollars support, has failed our children, our teachers, and our families.”

… That is classic Stephen Miller language.

… Rep. Dan Goldman (D-NY) was asked on CNN about Trump trying to dismantle DOE by executive order: "Just the fact that this is what he's doing shows his disdain for the American people, shows his disdain for public education, shows his disdain for special programs that are essential for so many Americans to use and learn."

… After that story broke and backlash ensued, Trump has reportedly also changed his mind on that. This was a campaign promise and something his supporters have been calling for vociferously. But that is also not happening. For now.

… Sen. Todd Young (R-IN), who co-authored the bipartisan CHIPS Act advanced by the Biden Admin, was stunned when Trump said he wanted Congress to repeal it: “Trump’s comments seemed in tension with the reassurances which I had received privately and publicly from his now-Cabinet nominees, reassurances which I sought in order to be supportive of certain nominees.”

… Another one who took Trump at his word, despite thousands of reasons not to.

… Honda issued a statement that Trump lied in his speech to Congress about their company building a new plant in Indiana. Trump: "In fact, already, numerous car companies have announced that they will be building massive automobile plants in America, with Honda just announcing a new plant in IN, one of the largest anywhere in the world."

… Honda said that plant has been in IN since 2008 and they have no immediately plans to build another one: “Honda has made no such announcement and will not comment on this report. While Honda did not announce plans for a new plant in the US at this time, we have invested over $3 billion in advanced vehicle manufacturing in America in just the past 3 years.”

… I think Biden was president then.

… The jobs report will be coming out tomorrow, and it’s not going to look pretty. CNBC reports that employers announced 172,017 layoffs for February, which is up a staggering 245% from January and the highest monthly count since July 2020. This is the worst February since 2009. Analyst Andrew Challenger: “With the impact of the DOGE actions, as well as canceled government contracts, fear of trade wars, and bankruptcies, job cuts soared in February.”

… Fox host and former Trump appointee Larry Kudlow: "Some very smart people are telling me that the February jobs number coming out Friday could be flat, even negative. The GDP tracker from the Atlanta Fed is showing for the first quarter a -2.5 or -2.8%. And we've had lousy numbers on things like housing and business investment. We're gonna have to suffer through some bad news."

… Car owners are now missing their monthly payments at the highest rate since 1994. Bloomberg reports that the number of auto borrowers at least 60 days past due on their loans rose to 6.56% last month. The Fed Reserve Bank of NY reported that the share of auto loans among all borrowers that transitioned into serious delinquency - defined as 90 days or more past due - rose to the highest level since 2010.

… Disabled Air Force vet Nathan Hooven voted for Trump but was just fired by DOGE. He told AP: “I think a lot of other veterans voted the same way, and we have been betrayed. I feel like my life and the lives of so many like me, so many that have sacrificed so much for this country, are being destroyed. I’ve been blindsided. My life has been completely upended with zero chance to prepare. I was fired without notice, unjustly, based on a lie that I’m a subpar, poor performer at my job.”

… 30% of the federal workforce are military veterans.

… An internal memo from the new Secretary of the VA obtained by Military.com shows that the agency intends to fire more than 83,000 employees.

… There is now a change in strategy for Trump, Musk, DOGE and Johnson, and that is to include all the DOGE cuts that have been halted by the courts in the House CR. This will force Republicans in swing districts to vote for all of them or vote against them to force a government shutdown, and most of these cuts are not popular with their constituents.

… CNN’s Manu Raju: “In closed-door meeting with Musk for more than 90 minutes, GOP senators push for a vote to codify DOGE cuts through a package of rescissions. Musk is open to it, senators said. Musk meets with House Rs tonight.”

… They are running out of time on all of this, because the government shuts down next week if they don’t get it done.

… Sen. Lindsey Graham: “So what I want to do is take all of those things that DOGE has found, all the silly spending, put it in a bill, call rescission and vote on it and I dare them to vote to keep this kind of crazy stuff going.”

… CNN’s Kaitlyn Collins asked Rep. Carlos Gimenez (R-FL) why Congress didn’t make these cuts to begin with instead of trying to have Musk do it: “I like Elon Musk doing it. He's also finding and writing code and and figuring out the code of the federal government.”

… The Congressional Budget Office has scored the House Republican budget framework, and made it clear that it is impossible for them to cut $880 billion without taking hundreds of billions from Medicaid. Trump has promised repeatedly that Medicaid would not be touched.

… AOC: “Everyone who voted for this - almost every House GOP - voted to cut Medicaid. When they try to pretend later that they didn’t, know that they are lying to you. This was the vote. They knew it, we knew it, CBO confirms it. Good news is we can still defeat it. Time to organize.”

… The Prospect reports that the Social Security Administration is making major cuts in staff: “Field offices will be affected. The same thing happened in the 80s, when 21% of field office jobs were cut. And a new research paper finds that it resulted in 80,000 eligible Americans not getting earned benefits. It'll be worse today, as nearly 2x as many people are on Social Security/SSI. Low-income disabled, blind, and elderly people won't be able to access assistance. One field office worker said people will die while waiting for benefits.”

… ABC reports that Mike Johnson’s Chief of Staff Hayden Haynes was arrested after Trump’s speech for DUI after crashing into a parked Capitol Police car.

If you missed yesterday’s episode of Uncovered, I talked quite a bit about Democrats reaction to the speech along with a deep dive into several other hot news items this week. You can watch it here.

LIVE: MAGA gets UNCOVERED as Trump Faces BACKLASH Everywhere

… Gavin Newsom had his first podcast episode and the guest was right-wing talk show host and blatant racist Charlie Kirk, who said he gets nervous whenever he gets on a flight and there is a black pilot. I have to admit I was pretty disappointed in this move. I get that the mission statement of the podcast is to “call out” people who disagree with him, but I watched it and didn’t see much calling out happening.

… Newsom told Kirk that he that the ads Trump ran against Kamala Harris about transgender athletes in women’s sports really hurt: “She didn’t even react to it, which was even more devastating. Almost 90% of Americans disagreed with her on that. Then you had the video of her as a validator. Brutal. It was a great ad.”

… I have no problem with Newsom debating the worst of the worst on the Right - I thought he was great in his debate with Desantis. But I just think the optics of making Kirk the very first guest on his very first podcast was a really bad choice. I am going to try and keep an open mind on what he’s trying to do here, but right now it is pretty hard after what I just saw.

… Rep. Al Green (D-TX) went into Trump’s speech before Congress on a mission to get kicked out, and the mission was accomplished: “I think that on some questions of conscience, you have to be willing to suffer the consequences. And I have said I will. I will suffer whatever the consequences are because I don't believe in the richest country in the world people should be without good health care. I stood up for my constituents then. I'm standing up for them now. I would do it again.”

… Green was censured by the House today, which was expected. Green trolled the censure by announcing on social media when it would take place so everyone could watch.

… A consistent trend for House Dems who voted with Republicans to censure Al Green is that almost all are in tough swing districts, some won by Trump: Bera, Case, Costa, Gillen, Himes, Houlahan, Kaptur, Moskowitz, Perez, Souzzi. A lot of people were upset by these votes, and I totally get that, but the reality is that Green didn’t care. He wanted to be censured to wear it like a badge of honor. The last Dem to get censured was Adam Schiff - and he used it to get elected to the Senate.

… That will not be happening for Green, but I think he was perfectly happy with how everything played out.

… Rep. Jasmine Crockett (D-TX) was asked after Trump’s speech if she could say anything to Trump right now, what would it be: “I would say to grow a spine and stop being Putin’s ho.”

… She never holds back!

… Rep. Andy Biggs (R-AZ) in a committee hearing was ridiculing Dems for bringing small signs to the speech: “That’s what we saw on display last night, juvenile attempts to disrupt the joint speech.” Rep. Jamie Raskin (D-MD) responded: “I’m delighted we were able to show you what a nonviolent protest looks like, and I appreciate the fact that you praise people for bringing signs rather than steel pipes and confederate flags and Trump flags to beat people up.”

… Trump had an interesting interaction with a few Supreme Court justices after his speech on Tuesday night, which happened right before Justices Roberts and Coney-Barrett ruled against him the following morning on DOGE cuts.

… Trump said “thank you” to Roberts, which most interpreted as Trump thanking him for his vote on presidential immunity. Kavanaugh had a slightly shocked look on his face - as if to say that Trump isn’t supposed to say those quiet parts out loud. But the most interesting reaction was ACB, who had a look of utter contempt and disgust on her face as she turned away from Trump. I posted the clip on X, Bluesky and Threads. It has 3.7 million views so far just on X.

… Trump then posted about it: “The Fake ‘Play the Ref’ News, in order to create a divide between me and our great SCOTUS, heard me say last night ‘thank you,’ to Chief Justice Roberts. Like most people, I don’t watch Fake News CNN or MSDNC, but I understand they are going ‘crazy’ asking what is it that I was thanking Justice Roberts for? They never called my office to ask, of course, but if they had I would have told these sleazebag “journalists” that I thanked him for SWEARING ME IN ON INAUGURATION DAY, AND DOING A REALLY GOOD JOB IN SO DOING!”

… Right. I’m sure we all believe that.

… The Prospect reports that the Trump admin will likely change the broadband buildout that was part of Biden’s infrastructure bill so Musk's Starlink can get more of the $42.5 billion: “But there's another way to hand Starlink critical infrastructure for its business: through govt spectrum sales. Currently the FCC isn't authorized to conduct spectrum auctions. Some Repubs want to reauthorize but also accelerate auctions and dictate what spectrum should be sold. It's not a stretch to think Musk will influence the auctions, put constraints on competitors that Starlink won't have, and acquire this crucial public infrastructure that would carry a major return on investment.” (TOTAL CORRUPTION!!!)

… Trump threatened Hamas again: “‘Shalom Hamas’ means Hello and Goodbye - You can choose. Release all of the Hostages now, not later, and immediately return all of the dead bodies of the people you murdered, or it is OVER for you. I am sending Israel everything it needs to finish the job, not a single Hamas member will be safe if you don’t do as I say. This is your last warning! To the People of Gaza: A beautiful Future awaits, but not if you hold Hostages. If you do, you are DEAD! Make a SMART decision. RELEASE THE HOSTAGES NOW, OR THERE WILL BE HELL TO PAY LATER!”

… Trump also said pretty much the exact same thing on January 7.

… Then he gave them another last warning or else on February 10.

… But this time he really means it.

… When Trump promised during the campaign to reinstate military service members who were discharged for refusing the Covid vaccine with back pay, they were all excited. Then Pete Hegseth announced he would follow through on the promise. But then the details came out on Trump’s executive order, which requires them to return and go back onto active duty with no guarantee about back pay. As it turns out, they aren’t interested in that and are pretty upset.

… Military Times reports that only 650 service members expressed interest in returning under those conditions, which is only 8% of the 8,200 who were discharged.

… The bottom line is this - these are people who just wanted to get out of the military before their contracts were up and used the vaccine as an excuse. Maybe a handful felt that passionately about it, but most just wanted out. Then they wanted Trump to give them 4 years of pay for doing nothing while others who followed orders had to sacrifice for their country to earn that money. Once they found out they would have to go back to work, they decided it wasn’t for them.

… The Broadway musical “Hamilton” announced they are canceling plans to perform at the Kennedy Center, citing Trump’s hostile takeover of the iconic venue. Lead producer Jeffrey Seller issued a statement saying that the Center is a “sacred” place for artists that should be “protected from politics.” Also from the statement: “Given the recent actions, our show simply cannot, in good conscience, participate and be a part of this new culture that is being imposed on the Kennedy Center. We are not acting against his admin, but against the partisan policies of the Kennedy Center as a result of his recent takeover.”

… Show creator Lin-Manuel Miranda: “We’re not going to be part of it while it is the Trump Kennedy Center.”

… Trump’s interim Executive Director, the utterly repulsive Ric Grenell, responded: “Seller and Lin-Manuel first went to the NYT before they came to the Kennedy Center with their announcement that they can’t be in the same room with Republicans. This is a publicity stunt that will backfire. The Arts are for everyone – not just for the people who Lin likes and agrees with. The American people need to know that Lin-Manuel is intolerant of people who don’t agree with him politically. It’s clear he and Sellers don’t want Republicans going to their shows.”

… Grenell has done the exact same thing to me repeatedly. Whenever I go after him he typically responds to me that I am being intolerant of gay people or something close to that (because he is gay), even though my posts have nothing to do with that. Grenell is a baby, he’s crying because all the top shows and artists are bailing and he’s going to be left with Kid Rock, Ted Nugent, Lara Trump, Lee Greenwood as performers. And an empty arena. Good for Hamilton.

… Missouri’s insane Republican AG Andrew Bailey: “BREAKING: I am demanding the DOJ investigated whether President Biden’s cognitive decline allowed unelected staff to push through radical policy without his knowing approval. If true, these executive orders, pardons, and all other actions are unconstitutional and legally void.”

(Biden didn't have cognitive decline, Trump does. See Dr John Gartner on Youtube about this)

… Zelensky left an emergency summit with EU leaders in Brussels, and seemed relieved and reassured after he was abused by Trump and Vance in the US. The EU announced that 20 countries agreed to increase military aid or send troops. Zelensky thanked everyone in attendance profusely: "During all this period, and last week, you stayed with us. We are not alone, and these are not just words, we feel it. You made a strong signal to the Ukrainian people."

… Marco Rubio repeated the Putin talking point that the US has been fighting a proxy war against Russia using Ukraine: "Frankly, it's a proxy war between nuclear powers – the US, helping Ukraine, and Russia – and it needs to come to an end."

… Kremlin spokesman Dmitry Peskov said they agree with Rubio: "We can and want to agree with it, and we do agree with it. That's the way it is. We have said this repeatedly. So it is absolutely in line with the position that our president and foreign minister have repeatedly expressed. We have said this repeatedly, and yes, we agree that it is time to stop this conflict and this war."

… CNN reports that CIA Director John Ratcliffe has paused intelligence support to Ukraine. The US military has cut back on Intelligence, Surveillance, Target Acquisition, and Reconnaissance (ISTAR) flights near Ukraine, while telling allies to not share US shared-intelligence with Ukraine, which is likely to effect the air-defense of Kyiv and other cities. A Ukrainian official has confirmed to them that all intelligence support from the US ceased earlier today.

… The Economist: “America cut a key intel link for alerts at 2 pm Kyiv time. Before that, they cut targeting data for HIMARS. Ukraine also isn’t receiving realtime information for long-range strikes. ‘Trump wanted a thank you,’ says a source. ‘We will be writing it on graves of dead Ukrainians.’”

(THIS IS TREASONOUS!! AS IF PUTIN GAVE THE ORDER!!!)

… Zelensky spokesman Andriy Yermak posted a photo of a hotel that was just struck by a Russian missile: “The Russians struck a hotel in Kryvyi Rih with a ballistic missile, casualties reported.”

… House Armed Services Ranking Member Adam Smith (D-WA): "Trump can no longer credibly claim that what he's trying to achieve in the war in Ukraine is peace. He is abandoning Ukraine in favor of Putin. He's cutting off all aid, he's cutting off all military support, and he's cut off intelligence sharing. Ukraine will now be vastly more vulnerable to Russian attacks because they won't have the early warning they need to defend themselves against those attacks. I sincerely hope that Republicans who claim to support Ukraine will speak up more loudly. Thus far, their silence has been appalling."

… The first measles case in a long time has been reported in FL. Still waiting for word from RFK Jr. on what he intends to do about this.

… New special at a restaurant in Canada:

0 notes

Text

Tax Services In SCV SFV And LA - CPA Howard Dagley

For Reliable Tax Services In SCV SFV And LA, Call Howard Dagley CPA Today! Give Howard a call today at 1-661-255-8627 for help getting organized for the upcoming tax year! Just because tax season is over, doesn’t mean you should consider them a thing of the past. The months are flying by fast this year. Don’t put your taxes on the back burner until the last minute. Get help filing quarterly…

View On WordPress

#Accountant Santa Clarita#best cpa in Santa Clarita#book keeping#business valuations#certified#college of the canyons#CPA San Fernando Valley#CPA Santa Clarita#CPA SCV#CPA SFV#Howard Dagley CPA SCV#tax advisor#Tax Services In SCV SFV And LA#tax services Santa Clarita

0 notes

Text

Today in Politics, Bulletin 85. 3/6/25

Today in Politics, Bulletin 85. 3/6/25 Ron Filipkowski Mar 7 ∙

… The theme of the day was Trump backpedaling on several of his major announcements, executive orders, campaign promises, and policies after intense backlash. He walked back a plan to deport Ukrainian asylum seekers, tariffs on Canada and Mexico, DOGE cuts and firings, and his plan to dismantle the Dept of Education.

… For today. Tomorrow he could reinstate some or all of them. Trump loves creating chaos, but it isn’t just that. Most of these things he campaign on, they were on his website, they were in Project 2025, they are ideas from his closest advisors, and supported by his MAGA base. He is only walking them back after learning that many of these ideas are wildly unpopular.

… If only independent voters and moderate Republicans paid closer attention during the campaign to what he said he was going to do, because it turns out he wasn’t bluffing on any of it.

… Trump posted on Truth Social that members of his Cabinet met with Elon Musk today and he heard their concerns about him firing their employees and canceling contracts and agreements: “We just had a meeting with most of the Secretaries, Elon, and others, and it was a very positive one. It’s very important that we cut levels down to where they should be, but it’s also important to keep the best and most productive people. We said use the scalpel rather than the hatchet.”

… But then he later said this in the Oval Office: "We're gonna be watching the Cabinet members. And Elon and the group are gonna be watching them. And if they can cut, it's better. And if they don't cut, then Elon will do the cutting."

… AP reported that the CDC announced they are reversing the DOGE firings of 180 employees and want them to come back to work. They sent this email: “Read this e-mail immediately. After further review and consideration … You should return to duty under your previous work schedule. We apologize for any disruption that this may have caused.”

… Then Trump reversed his tariffs on Mexico: “After speaking with President Claudia Sheinbaum of Mexico, I have agreed that Mexico will not be required to pay Tariffs on anything that falls under the USMCA Agreement. This Agreement is until April 2nd. I did this as an accommodation, and out of respect for, President Sheinbaum. Our relationship has been a very good one. Thank you to President Sheinbaum for your hard work and cooperation!”

… He also reversed the tariffs on Canada, and blamed the victim again by claiming that Trudeau secretly wanted him to impose tariffs: “Believe it or not, despite the terrible job he’s done for Canada, I think that Justin Trudeau is using the Tariff problem, which he has largely caused, in order to run again for Prime Minister. So much fun to watch!”

… In other words, dipshit Trump just found out that what he has done with Canada has rejuvenated Trudeau’s approval ratings, which were pretty bad until Trump picked a fight with Canada for no reason.

… Right before Trump announced he was reversing his tariffs, his Commerce Secretary Howard Lutnick was on Fox saying that the tariffs were great because eventually we won’t have to pay income taxes because of them: “Tariffs are going to drive America better. Wouldn't it be amazing to stop paying taxes to the IRS and have the External Revenue Service of make America great again replace our taxes? That is the goal of Trump.”

… If that is the case, why does he keep “pausing” them?

… Sen. John Kennedy (R-LA): "I'm worried about the tariffs. If this starts causing inflation, we're gonna have to recalibrate. The single most important thing, and the thing people expect the president to fix, is high prices."

… Reuters reported from multiple inside sources that Trump was planning to revoke the temporary legal status of 240,000 Ukrainians who were allowed to come to the US after Russia invaded their country, and fast-track their deportations in April. Backlash ensued, then Press Secretary Karoline Leavitt claimed the story was “fake news” and said that “nothing has been decided yet” on their asylum status.

… WSJ obtained a draft executive order that Trump was expected to issue today which would essentially abolish the Dept of Education. It includes language that directed Secretary Linda McMahon to “take all necessary steps to facilitate the closure of the Education Department to the maximum extent appropriate and permitted by law. The experiment of controlling American education through Fed programs and dollars, and the unaccountable bureaucrats those programs and dollars support, has failed our children, our teachers, and our families.”

… That is classic Stephen Miller language.

… Rep. Dan Goldman (D-NY) was asked on CNN about Trump trying to dismantle DOE by executive order: "Just the fact that this is what he's doing shows his disdain for the American people, shows his disdain for public education, shows his disdain for special programs that are essential for so many Americans to use and learn."

… After that story broke and backlash ensued, Trump has reportedly also changed his mind on that. This was a campaign promise and something his supporters have been calling for vociferously. But that is also not happening. For now.

… Sen. Todd Young (R-IN), who co-authored the bipartisan CHIPS Act advanced by the Biden Admin, was stunned when Trump said he wanted Congress to repeal it: “Trump’s comments seemed in tension with the reassurances which I had received privately and publicly from his now-Cabinet nominees, reassurances which I sought in order to be supportive of certain nominees.”

… Another one who took Trump at his word, despite thousands of reasons not to.

… Honda issued a statement that Trump lied in his speech to Congress about their company building a new plant in Indiana. Trump: "In fact, already, numerous car companies have announced that they will be building massive automobile plants in America, with Honda just announcing a new plant in IN, one of the largest anywhere in the world."

… Honda said that plant has been in IN since 2008 and they have no immediately plans to build another one: “Honda has made no such announcement and will not comment on this report. While Honda did not announce plans for a new plant in the US at this time, we have invested over $3 billion in advanced vehicle manufacturing in America in just the past 3 years.”

… I think Biden was president then.

… The jobs report will be coming out tomorrow, and it’s not going to look pretty. CNBC reports that employers announced 172,017 layoffs for February, which is up a staggering 245% from January and the highest monthly count since July 2020. This is the worst February since 2009. Analyst Andrew Challenger: “With the impact of the DOGE actions, as well as canceled government contracts, fear of trade wars, and bankruptcies, job cuts soared in February.”

… Fox host and former Trump appointee Larry Kudlow: "Some very smart people are telling me that the February jobs number coming out Friday could be flat, even negative. The GDP tracker from the Atlanta Fed is showing for the first quarter a -2.5 or -2.8%. And we've had lousy numbers on things like housing and business investment. We're gonna have to suffer through some bad news."

… Car owners are now missing their monthly payments at the highest rate since 1994. Bloomberg reports that the number of auto borrowers at least 60 days past due on their loans rose to 6.56% last month. The Fed Reserve Bank of NY reported that the share of auto loans among all borrowers that transitioned into serious delinquency - defined as 90 days or more past due - rose to the highest level since 2010.

… Disabled Air Force vet Nathan Hooven voted for Trump but was just fired by DOGE. He told AP: “I think a lot of other veterans voted the same way, and we have been betrayed. I feel like my life and the lives of so many like me, so many that have sacrificed so much for this country, are being destroyed. I’ve been blindsided. My life has been completely upended with zero chance to prepare. I was fired without notice, unjustly, based on a lie that I’m a subpar, poor performer at my job.”

… 30% of the federal workforce are military veterans.

… An internal memo from the new Secretary of the VA obtained by Military.com shows that the agency intends to fire more than 83,000 employees.

… There is now a change in strategy for Trump, Musk, DOGE and Johnson, and that is to include all the DOGE cuts that have been halted by the courts in the House CR. This will force Republicans in swing districts to vote for all of them or vote against them to force a government shutdown, and most of these cuts are not popular with their constituents.

… CNN’s Manu Raju: “In closed-door meeting with Musk for more than 90 minutes, GOP senators push for a vote to codify DOGE cuts through a package of rescissions. Musk is open to it, senators said. Musk meets with House Rs tonight.”

… They are running out of time on all of this, because the government shuts down next week if they don’t get it done.

… Sen. Lindsey Graham: “So what I want to do is take all of those things that DOGE has found, all the silly spending, put it in a bill, call rescission and vote on it and I dare them to vote to keep this kind of crazy stuff going.”

… CNN’s Kaitlyn Collins asked Rep. Carlos Gimenez (R-FL) why Congress didn’t make these cuts to begin with instead of trying to have Musk do it: “I like Elon Musk doing it. He's also finding and writing code and and figuring out the code of the federal government.”

… The Congressional Budget Office has scored the House Republican budget framework, and make it clear that it is impossible for them to cut $880 billion without taking hundreds of billions from Medicaid. Trump has promised repeatedly that Medicaid would not be touched.

… AOC: “Everyone who voted for this - almost every House GOP - voted to cut Medicaid. When they try to pretend later that they didn’t, know that they are lying to you. This was the vote. They knew it, we knew it, CBO confirms it. Good news is we can still defeat it. Time to organize.”

… The Prospect reports that the Social Security Administration is making major cuts in staff: “Field offices will be affected. The same thing happened in the 80s, when 21% of field office jobs were cut. And a new research paper finds that it resulted in 80,000 eligible Americans not getting earned benefits. It'll be worse today, as nearly 2x as many people are on Social Security/SSI. Low-income disabled, blind, and elderly people won't be able to access assistance. One field office worker said people will die while waiting for benefits.”

… ABC reports that Mike Johnson’s Chief of Staff Hayden Haynes was arrested after Trump’s speech for DUI after crashing into a parked Capitol Police car.

… Gavin Newsom had his first podcast episode and the guest was right-wing talk show host and blatant racist Charlie Kirk, who said he gets nervous whenever he gets on a flight and there is a black pilot. I have to admit I was pretty disappointed in this move. I get that the mission statement of the podcast is to “call out” people who disagree with him, but I watched it and didn’t see much calling out happening.

0 notes

Text

Top Tips for Buying Orihuela Costa Property in 2025

Top Tips for Buying Orihuela Costa Property in 2025

Thinking About Buying an Orihuela Costa Property? Read This First!

Have you ever dreamed of owning a home in the stunning Orihuela Costa? Picture waking up to the Mediterranean breeze, enjoying sun-soaked beaches, and living in a vibrant expat community. But before you dive in, do you know the challenges that come with buying a property here?

Buying an Orihuela Costa Property in 2025 can be a rewarding investment, but it’s not as simple as picking a house and signing a contract. What are the hidden costs? How do you avoid legal pitfalls? Which locations are best for long-term value? Let’s break down everything you need to know so you can make an informed decision with confidence.

1. Understand the Market Trends

The Orihuela Costa Property market has been booming, with increasing demand from both international buyers and investors. Prices have been steadily rising, but will this trend continue in 2025?

Current Market Insights: Property prices in Orihuela Costa have grown by approximately 5% annually in recent years. With new developments and growing tourism, the trend is expected to continue.

Buyer’s vs. Seller’s Market: 2025 may see a shift due to economic factors. Research whether it’s a good time to buy or if waiting could get you a better deal.

2. Choose the Right Location

Not all areas in Orihuela Costa offer the same benefits. Some are perfect for holiday homes, while others are better for long-term investment.

Cabo Roig & La Zenia: Ideal for beachfront properties and luxury living.

Playa Flamenca & Punta Prima: Great for families and access to amenities.

Villamartín & Los Dolses: Known for golf courses and expat communities.

Consider your lifestyle needs and potential rental income before finalizing a location.

3. Budget for Hidden Costs

Many buyers focus only on the purchase price and overlook additional costs. Here’s what you should be prepared for:

Taxes: Property transfer tax (ITP) in Spain is around 10%.

Legal Fees: Hiring a lawyer is crucial and may cost 1,000–3,000€.

Notary & Registry Fees: Expect around 1.5% of the property value.

Community Fees: If buying in a gated community, maintenance fees apply.

Utility Setup: Electricity, water, and internet activation may have one-time charges.

Always calculate your full financial commitment before making a decision.

4. Secure Financing Beforehand

If you need a mortgage for your Orihuela Costa Property, plan ahead:

Spanish Mortgages: Banks typically lend 60-70% to foreign buyers.

Deposit Requirements: Be prepared for a 30-40% down payment.

Exchange Rate Fluctuations: If buying from abroad, currency shifts can impact costs.

A mortgage broker can help you secure the best rates and terms.

5. Work With a Trusted Real Estate Agent

A knowledgeable agent can save you time, money, and stress. Look for:

Local Expertise: They should know the best areas and investment opportunities.

Bilingual Service: If you don’t speak Spanish, ensure they can assist in your language.

Transparency: Avoid agents who push properties with hidden fees.

Use platforms like Property The Leader to find reliable listings.

6. Get a Legal Advisor

Spanish property laws can be complex, and scams are not uncommon. A lawyer will:

Check Legal Documentation: Ensure the property has no outstanding debts.

Handle Contracts: Avoid unfavorable clauses in your purchase agreement.

Assist With NIE & Taxes: Non-residents need an NIE (Spanish tax ID) for buying property.

7. Inspect Before You Invest

Never buy a property in Orihuela Costa without a thorough inspection. Watch out for:

Structural Issues: Cracks, dampness, or poor-quality construction.

Community Rules: Some urbanizations have strict regulations.

Noise & Accessibility: Visit at different times to assess surroundings.

If possible, visit in person or hire a local surveyor.

8. Plan for Residency & Taxes

If you’re moving to Spain, consider:

Golden Visa Program: Buying property over 500,000€ may qualify you for residency.

Tax Implications: Understand how Spanish property taxes affect your finances.

Health Insurance & Utilities: If staying long-term, get set up properly.

9. Think Long-Term: Rental & Resale Value

An Orihuela Costa Property isn’t just a home—it’s an investment.

Tourist Demand: Properties in prime areas can generate great rental income.

Future Development: Look for areas with upcoming infrastructure improvements.

Resale Market: Pick properties that will appreciate in value over time.

Your Dream Home in Orihuela Costa Awaits!

Buying an Orihuela Costa Property in 2025 can be one of the best decisions of your life—if done correctly. From understanding market trends to avoiding legal pitfalls, these tips ensure you’re making a safe and smart investment.

Ready to take the next step? Explore verified property listings on Property The Leader and connect with experts to make your dream home a reality.

Start your journey today!

#Orihuela Costa Property#Buying Property in Spain#Spanish Real Estate#Costa Blanca Homes#Moving to Spain

0 notes

Note

maybe Louis bought it but Oli is the owner so the press won’t find out - I actually think Louis really did this with some of his investments. There’s no way he only has one house, my family is middle class and we bought a spare flat which is up for rent (investment + money is safer like that). Louis is multimillionaire who lives between London and LA and there’s no way he doesn’t have a place in LA (he literally stayed there for months in 2023) so yeah it’s obviously a speculation but I wouldn’t be surprised if Louis did this.

Real estate can be a tax shelter for UK residents, and it’s also a fairly stable investment even though not super exciting (very few locations can expect % returns like some other investments— Openstage e.g.). If I were Louis, I’d probably park most money in an index fund and take out a bit for higher risk investments, but then he doesn’t have the time to investigate much and most advisors are 🫳. So real estate makes sense.

0 notes

Text