#Tax Return London

Explore tagged Tumblr posts

Text

Get a Brief Idea about Individual Tax Return

An individual tax return is considered to be an official form that a person submits to report all the taxable income received during a definite period. This record is mainly used to assess the amount of tax that is due or overpaid for the individual for that period. The taxation authority will assess the information on whether the amount of tax paid in the fixed period will be enough to cover the individual’s taxation position. Here we will get all the information regarding the individual tax return.

Need to lodge an individual tax return

Most of the people are required to lodge an individual tax return each year. The income you earn can be gained from different types of sources like salary, profit in business, sale of house and interest received among others. You must see a tax consultant in London to file your tax return according to the tax slabs of each year.

Filing an Income tax return

As per the latest income tax rules, if you earn more than the limit you should be exempted from being taxed by the government. The filing of your ITR post also may attract some penalties and make you eligible to get a role in the future. The value-added tax (VAT) is applied to every kind of activity that is involved in the production of goods and services. To save your money and time you must complete the filing of the VAT return in London.

Self lodgement process

The conventional way of lodging and preparing for many people. Hire a tax consultant in London for the completed tax return must be printed out and posted to the income tax authority using the paper method. Due to the amount of information needed to complete the return which includes the yearly payment information from your employers as well as filling out your personal information each year before you start the return, this may take longer.

Summary

The tax consultants will provide all the details of your income to the accountant. They will inform you of any further information that they will need and be able to assist you in further deductions.

#Tax Advisor London#Tax Consultant London#Financial Advisor London#Tax Return#Tax Return London#Vat Return London

0 notes

Text

2 notes

·

View notes

Text

How to Choose the Right Pension Plan for Your Future

Planning for retirement can feel overwhelming, but the right pension plan simplifies it and protects your future.

30-Second Summary

Choosing the right pension plan ensures a financially secure retirement. Start by understanding your goals, risk tolerance, and available options like workplace, personal, or state pensions.

Consult experts like accounting firms in Cambridge, and use tools such as the best accounting software in the UK to simplify planning. Review providers carefully, watch for red flags, and rely on auditors to ensure compliance. Regularly revisit your plan to keep it aligned with your future needs.

Why Choosing the Right Pension Plan Matters

Many people assume they’ll figure out their retirement savings later. But the truth is, the earlier you start planning, the better off you’ll be. A pension plan isn���t just about saving money—it’s about making sure you have enough to maintain your lifestyle once you stop working. Without a good plan, you might have to delay retirement, cut back on expenses, or rely on government aid, which is often not enough to cover basic living costs.

One of the biggest mistakes people make is underestimating how long they’ll live. The average life expectancy in the UK is now around 81 years. If you retire at 65, that’s at least 16 years of living expenses you need to cover—possibly more. I know someone who thought their savings would last, only to find themselves struggling just ten years into retirement. Don’t let that be you.

Another mistake is not contributing enough. Some people only put in the bare minimum required by their employer’s pension scheme. While something is better than nothing, it’s often not enough to build a comfortable retirement fund. The good news is that with the right strategy, you can set yourself up for financial security.

The Role of Accounting Firms

A lot of people don’t realize how much an accountant can help with pension planning. Accounting firms in London specialize in financial planning, including pensions. If you're unsure where to start, an accountant can break down your options and help you decide how much to contribute based on your current income and future goals.

Cambridge has some of the best financial professionals who work with individuals and businesses to manage pensions. They can guide you on tax-efficient ways to save, ensuring you’re not paying more than necessary. London-based accountants, on the other hand, have access to some of the best financial tools and pension schemes. They can analyze market trends, investment options, and tax advantages, giving you an edge when planning for retirement.

When I finally sat down with an accountant, I realized I had been missing out on tax benefits I could have taken advantage of. A good accountant will show you how to maximize employer contributions, avoid unnecessary taxes, and keep more of your hard-earned money for retirement.

Common Pension Plan Options Explained

There are three main types of pensions in the UK: workplace pensions, personal pensions, and the state pension. Each one has its pros and cons, and the right choice depends on your financial situation.

A workplace pension is one of the easiest ways to save for retirement because your employer contributes to it. If you’re employed, you’re likely already enrolled in a workplace pension. The best part? Your employer usually matches your contributions, which means free money going into your retirement fund. However, not all workplace pensions are the same. Some have higher fees, while others invest more aggressively. That’s why it’s important to review your plan regularly and make sure it aligns with your long-term goals.

If you’re self-employed or want more control over your savings, a personal pension might be a better fit. With a personal pension, you decide how much to contribute and where to invest your money. There are different types of personal pensions, including stakeholder pensions and self-invested personal pensions (SIPPs). SIPPs give you the most flexibility, allowing you to invest in a range of assets, but they also require more knowledge and management.

The state pension provides a basic income in retirement, but it’s not enough to live on by itself. As of 2024, the full state pension is around £203.85 per week, which adds up to about £10,600 per year. That’s significantly lower than what most people need to maintain their standard of living. That’s why relying on the state pension alone is risky. It should be treated as a supplement to other retirement savings, not your primary source of income.

When choosing a pension plan, think about your retirement goals, how much risk you’re comfortable with, and how much you can afford to contribute each month. The earlier you start, the easier it will be to build a solid retirement fund.

Factors to Consider When Choosing a Pension Plan

One of the first things to consider is how much income you’ll need in retirement. Experts recommend aiming for about 70% of your pre-retirement income to maintain your standard of living. This means if you earn £40,000 per year now, you’ll need around £28,000 per year after retirement.

Risk tolerance is another major factor. Some pension funds invest in stocks, which have higher potential returns but also more risk. Others focus on bonds or fixed-income assets, which are safer but grow more slowly. If you’re in your 20s or 30s, you can afford to take more risks because you have time to recover from market downturns. If you’re closer to retirement, a more conservative approach might be better.

Tax benefits are also important. Pension contributions are tax-free up to certain limits, which means you can reduce your taxable income by saving for retirement. For higher earners, this can lead to significant savings. However, there are limits to how much you can contribute each year without facing penalties. A financial advisor can help you make sure you’re making the most of these tax advantages.

Another thing to watch out for is fees. Some pension plans have high management fees that eat into your savings over time. A seemingly small 1% fee might not sound like much, but over 30 years, it can cost you thousands of pounds in lost growth. Always compare fees when choosing a provider.

I made the mistake of ignoring fees when I first started investing in my pension. It wasn’t until years later that I realized I could have saved thousands by choosing a lower-cost plan. Don’t make the same mistake—always check the fees before committing to a pension provider.

How Auditors Can Help with Compliance

Pension planning isn’t just about choosing the right plan—it’s also about making sure your plan follows all the rules. This is where auditors come in. Auditors in Cambridge play a crucial role in ensuring pension schemes comply with regulations. Without proper oversight, pension funds can be mismanaged, or worse, misused.

If you’re part of a workplace pension, an auditor reviews the company’s pension contributions to ensure everything is handled correctly. They check whether employer contributions are being made on time and if employees are getting what they’re entitled to. Some businesses try to cut corners, and without regular audits, employees may lose out on money they’ve rightfully earned.

For personal pensions, auditors can review statements and reports to ensure the pension provider is following best practices. If there are hidden fees or poor investment strategies, an auditor can help identify those issues early on. I’ve heard stories of people who realized too late that their pension funds were being drained by unnecessary costs. An independent audit could have saved them from losing thousands.

Another major reason audits are important is fraud prevention. Unfortunately, pension scams exist, and fraudsters target people who aren’t familiar with the complexities of retirement savings. Auditors in Cambridge work to detect fraud, ensuring that your pension is safe and secure.

It’s always a good idea to ask for an audit if you’re unsure about the health of your pension. If your employer’s pension plan hasn’t been audited in a while, you might want to ask about it. It’s your money on the line, and you deserve to know it’s being handled properly.

The Role of Cost and Management Accounting in Pension Planning

Understanding where your money is going is key to making smart financial decisions. Cost and management accounting helps with that by tracking how much you're contributing, where it's being invested, and how much you'll likely have when you retire.

Management accountants work with businesses and individuals to analyze costs and predict future financial needs. If you own a business, having a management accountant ensures that your company’s pension scheme is running efficiently. They’ll assess whether you're overpaying on fees, whether your company contributions are sustainable, and how pension costs impact your bottom line.

For individuals, cost accounting helps in planning monthly contributions without straining your budget. Many people assume they can’t afford to contribute more to their pension, but with proper budgeting, small adjustments can lead to significant long-term gains.

For example, I once believed I could only afford to put away 5% of my income. After working with an accountant, I restructured my budget and found ways to increase my contributions to 12% without affecting my daily expenses. Small changes, like cutting unnecessary subscriptions and adjusting spending habits, allowed me to secure a better retirement without feeling the pinch.

The bottom line is that cost and management accounting helps you plan smarter. Whether you're an employee, business owner, or self-employed, understanding where every pound is going will help you make better financial decisions.

Best Practices for Evaluating Pension Providers

Choosing the right pension provider is as important as choosing the right pension plan. A bad provider can cost you thousands in fees and poor investment returns, while a good one can help you grow your money efficiently.

The first thing to check is fees. Every pension provider charges a fee for managing your money, but some charge more than others. Even a small percentage difference can add up over time. For example, if you invest £100,000 and your provider charges a 1% fee, you’ll pay £1,000 per year. If another provider charges 0.5%, you’ll only pay £500 per year. That difference adds up to thousands of pounds over the course of your retirement savings.

Performance history is another key factor. Look at how well the provider’s funds have performed over the past 10–20 years. While past performance isn’t a guarantee of future success, consistent positive growth is a good sign. Be wary of providers that have frequent dips or long periods of poor performance.

Customer service also matters. If you ever need to adjust your pension, withdraw funds, or ask questions, you want a provider that is responsive and easy to deal with. Reading reviews from other customers can give you a good idea of what to expect.

One mistake I made when choosing my first pension provider was focusing only on investment returns. I picked a provider with high returns but didn’t realize they had poor customer service and high fees. When I needed help making changes to my plan, I struggled to get clear answers. Now, I always look at the full picture before choosing a provider.

The Importance of Accounting Firms for Pension Planning

London is home to some of the UK’s top financial experts. Accountant London specialize in pension planning, tax strategies, and investment management. If you're serious about securing a strong financial future, working with an expert can save you from costly mistakes.

One of the biggest advantages of working with a London-based accountant is their access to the best pension schemes. Many top-tier pension funds are managed by firms based in the city, and accountants here have direct connections to providers with the best track records.

Another benefit is tax efficiency. London-based accountants understand complex pension tax laws and can help you maximize your contributions while reducing your tax bill. If you're a high earner, this is especially important since tax relief on pensions can save you thousands each year.

Even if you're not in London, working with a firm from the city can give you access to top-tier financial advice. Many firms offer virtual consultations, meaning you can benefit from their expertise no matter where you live.

How Technology Can Simplify Pension Planning

Managing a pension used to be complicated, but technology has made it easier than ever. The best accounting software in the UK now offers tools for tracking contributions, predicting retirement income, and adjusting investments.

One of the biggest benefits of using accounting software is automation. Many programs allow you to set up automatic contributions and investment rebalancing, ensuring your pension stays on track without constant monitoring.

Cloud-based software also makes it easier to access your pension data anytime, anywhere. You can check your balance, see how your investments are performing, and make adjustments all from your phone or laptop.

Some of the best accounting software in the UK also integrates with financial advisors. This means you can get real-time advice and insights without needing to schedule meetings or wait for reports.

If you're not using technology to manage your pension, you’re missing out on an easy way to optimize your savings. I started using pension management software a few years ago, and it completely changed how I plan for retirement. I can now track my progress effortlessly and make informed decisions without stress.

Actionable Steps to Get Started

If you're ready to take control of your pension, here’s what you should do right now:

Calculate how much you need for retirement. Think about your future expenses and decide on a target retirement income.

Check your current pension status. If you have a workplace pension, review your contributions and employer matching benefits.

Increase your contributions if possible. Even a small increase now can lead to huge benefits later.

Consult an accountant. Whether you're in Cambridge, London, or elsewhere, a financial expert can help you make the best choices.

Choose the best pension provider. Look at fees, performance history, and customer service before making a decision.

Use accounting software to track your pension. This will make managing your savings easier and more efficient.

Review your plan regularly. Life changes, and so should your pension strategy. Check your plan at least once a year.

Conclusion

Choosing the right pension plan isn’t just about saving money—it’s about securing your future. By making smart decisions now, you can ensure a comfortable and stress-free retirement.

Whether you work with accounting firms in Cambridge or London, use the best accounting software in the UK, or seek advice from auditors, the key is to stay informed and proactive.

Don’t wait until it’s too late. Start planning today, and give yourself the financial freedom you deserve in retirement.

#tax assist london#tax consultant london#tax return services london#tax consultant east london#cambridge accountant#accountant in cambridge#cambridgeshire

0 notes

Text

Top Tips for Completing Your Self Assessment Tax Return on Time

It doesn't have to be an unpleasant or time-consuming process to file your self assessment tax return with a little preparation and attention to detail.

Visit Us: https://www.upload.ee/files/17226614/Top_Tips_for_Completing_Your_Self_Assessment_Tax_Return_on_Time.pdf.html

0 notes

Text

Maximize Your Financial Resources with London's EFJ Consulting

Excellent services for company tax returns, London management accounting, and the Construction Industry Scheme are the areas of expertise for EFJ Consulting. Our knowledgeable staff guarantees timely and precise corporate tax filings, assisting your company in maintaining compliance and optimizing savings. Get insightful information with our management accounting services to improve financial performance and spur strategic growth. We provide thorough support for individuals working in the construction industry with the Construction Industry Scheme, taking care of registrations and monthly returns to maintain compliance. Put your trust in EFJ Consulting to increase your corporation tax returns company's profitability and streamline your financial procedures.

0 notes

Text

Let Property Campaign (LPC)

#let property campaign#property taxes#property investing#lpc#hmrc#landlords#tax services#tax accountant#tax returns#london#uk

0 notes

Text

The Best Tax Return Accountants in London are Experts in Tariff Relief Techniques

Do you want someone to keep an eye on your HMRC tax and VAT reliefs going forward? Get the best advice possible from top-rated Tax Return Accountants in London. They offer their clients the greatest possible support with regard to tax reliefs and business reports. Primatus has certified chartered accountants who have solutions for any of your accounting-related problems. They provide support comparable to year-end accounts, bookkeeping, payroll services, administration, tax, and VAT returns, among other things.

Tax Return Accountants in London offer expert assistance at affordable rates. This service includes account administration services directed at specialised chartered accountants. Additionally, they oversee activities including filling out and organising VAT return forms, providing bookkeeping guidance, and extending corporate profits. They also make general bookkeeping software easier while showing appreciation for their customers.

The easement comprises services like the endowment of self-assessment Tax Statements, development of reports at HM revenue and customs duties, followed by reasonably priced Business Announcing Language tags, and they also provide counselling to their clients. With such affordable support, they are able to uphold their reputation as best Tax Return Accountants in London.

For more information about it you can visit their website:

https://primatus.co.uk/

0 notes

Text

Get Wonderful Assistance For Personal Tax Returns London Services At Primtus

Primatus is a personal tax returns London company with specialists and experience. With experience in accounting and tax services, they have the knowledge and expertise to assist other firms swiftly and efficiently while also ensuring that the performance of the business account is current. Their primary goals are to maximise profit and meet the needs of the customer. In order to concentrate on their company, they also make sure that their clients are happy and comfortable.

It is a top company for resolving accounting issues and providing consumers with follow-up via preparation and personal tax returns London. They give this amazing support to all compliance and business advisory service organisations with a very competent and competitive crew.

By doing this, you may decide if you wish to contact them. Afterwards, visit their website to learn more. Get in touch with the business to take advantage of the chance to have your task completed by their most trustworthy and knowledgeable personal tax returns London. You can also contact them by simply texting your information to the provided number on their website, after which you can call them or email them. Click the given link below, for further details-

https://primatus.co.uk/

0 notes

Text

Benefits To A Business In Using An Online Bookkeeping Service UK

On-site Bookkeeping Services: On-site bookkeeping services London are typically provided by a team of trained professionals who work directly with a business's accounting department. They support tasks such as preparing financial statements, managing payroll, and reconciling bank accounts.

#bookkeeping services uk#bookkeeping services london#bookkeeping london#vat return services#vat return online#small business accounting services#small business tax accountant#Self-assessment tax return

0 notes

Text

Keeping a suspense file gives you superpowers

I'll be in TUCSON, AZ from November 8-10: I'm the GUEST OF HONOR at the TUSCON SCIENCE FICTION CONVENTION.

Two decades ago, I was part of a group of nerds who got really interested in how each other managed to do what we did. The effort was kicked off by Danny O'Brien, who called it "Lifehacking" and I played a small role in getting that term popularized:

https://craphound.com/lifehacksetcon04.txt

While we were all devoted to sharing tips and tricks from our own lives, many of us converged on an outside expert, David Allen, and his bestselling book "Getting Things Done" (GTD, to those in the know):

https://gettingthingsdone.com/

GTD is a collection of relatively simple tactics for coping with, prioritizing, and organizing the things you want to do. Many of the methods relate to organizing your own projects, using a handful of context-based to-do lists (e.g. a list of things to do at the office, at home, while waiting in line, etc). These lists consist of simple tasks. Those tasks are, in turn, derived from another list, of "projects" – things that require more than one task, which can be anything from planning dinner to writing a novel to helping your kid apply to university.

The point of all this list-making isn't to do everything on the lists. While these lists do help you remember what to do next, what they're really good for is deciding what not to do – at all. The promise of GTD is that it will help you consciously choose not to do some of the things you set out to accomplish. This is in contrast to how most of us operate: we have a bunch of things we want to do, and we end up doing the things that are easiest, or at top of mind, even if they're not the most important things.

GTD recognizes that you can be very "productive" (in the sense of getting many things done) and still not do the things that you really wanted to do. You know what this is like: you finish a Sunday with an organized sock-drawer, all your pennies neatly rolled, the trash-can in your car emptied…and no work at all on that novel you're hoping to write.

You can't do everything, but you can control what you don't do, rather than just defaulting into completing a string of trivial, meaningless tasks and leaving the big stuff on the sidelines. Organizing your own tasks and projects is a hugely powerful habit, and one that's made a world of difference to my personal and professional life.

But while good to-do lists can take you very far in life, they have a hard limit: other people. Almost every ambitious thing you want to do involves someone else's contribution. Even the most solitary of projects can be derailed if your tax accountant misses a key email and you end up getting audited or paying a huge penalty.

That's where the other kind of GTD list comes in: the list of things you're waiting for from other people. I used to be assiduous in maintaining this list, but then the pandemic struck and no one was meeting any of their commitments, and I just gave up on it, and never went back…until about a month ago. Returning to these lists (they're sometimes called "suspense files") made me realize how many of the problems – some hugely consequential – in my life could have been avoided if I'd just gone back to this habit earlier.

My suspense file is literally just some lines partway down a text file that lives on my desktop called todo.txt that has all my to-dos as well. Here's some sample entries from my suspense file:

WAITING EMAIL Sean about ENSHITTIIFCATION manuscript deadline 10/24/24 WAITING EMAIL Russ about missing royalty statement 10/12/24 WAITING EMAIL Alice about Christmas vacation hotel 10/8/24 10/20/24 WAITING EMAIL Ted about Sacramento event 8/12/24 9/5/24 10/5/24 10/20/24

WAITING CALL LA County about mosquito abatement 10/25/24 WAITING CALL School attendance officer about London trip 10/18/24

WAITING MONEY EFF reimbusement for taxi to staff retreat $34.98 10/7/24

WAITING SHIPMENT New Neal Stephenson novel from Bookshop.org 10/23/24

This is as simple as things could possibly be! I literally just type "WAITING," then a space, then the category of thing I'm waiting for, then a few specifics, then the date. When I follow up on an item, I add the date of the followup to the end of the line. If I get some details that I might need to reference later (say, a tracking code for a shipment, or a date for an event I'm trying to organize), I'll add that, too, as it comes up. Creating a new entry on this list takes 10-25 seconds. When someone gets back to me, I just delete that line.

That is literally it.

Every day, or sometimes a couple of times a day, I will just run my eyes up and down this list and see if there's anything that's unreasonably overdue, and then I'll send a reminder or make a followup call. In the example above, you can see that I've been chasing Ted about Sacramento for months now (this is a fake entry – no plans to go to Sacto at the moment, sorry):

WAITING EMAIL Ted about Sacramento event 8/12/24 9/5/24 10/5/24 10/20/24

So now I've emailed Ted four times. Maybe my email's going to his spam, and so I could try emailing a friend of Ted and ask them to check whether he's getting my messages. But maybe Ted's trying to send me a message here – he's just not interested in doing the event after all. Or maybe Ted is available, but he's so snowed under that he's in danger of fumbling it, and I need to bring in some help if I want it to happen.

All of these are possibilities, and the fact that I'm tracking this means that I now get to make an active decision: cancel the gig or double down on making sure it happens. Without this list, the gig would just die by default, forgotten by both of us. Maybe that's OK, but I can't tell you how many times I've run into someone who said, "Dammit, I just remembered I was supposed to email you about getting that thing done and I dropped the ball. Shit! I really was looking forward to that. Is it too late now?" Often it is too late. Even if it's not, the work of picking up the pieces and starting over is much more than just following through on the original plan.

Restarting my suspense file made me realize how many of the (often expensive or painful) fumbles I've had since the pandemic were the result of me not noticing that someone else hadn't gotten back to me. In essence, a suspense file is a way for me to manage other people's to-do lists.

Let me unpack that. By "managing other people's to-do lists," I don't mean that I'm deciding for other people what they will and won't do (that would be both weird and gross). I mean that I'm making sure that if someone else fails to do something we were planning together, it's because they decided not to do it, not because they forgot. As GTD teaches us, the real point of a to-do list isn't just helping us remember what to do – it's helping us choose what we're not going to do.

This is not an imposition, it's a kindness. The point of a suspense file isn't to nag others into living up to their commitments, it's to form a network of support among collaborators where we all help one another make those conscious choices about what we're not going to do, rather than having the stuff we really value slip away because we forgot about it.

I have frequent collaborators whom I know to be incapable of juggling too many things at once, and my suspense file has helped me hone my sense of when it would be appropriate to ask them if they want to do something together and when to leave them be. The suspense file helps me dial in how much I rely on each person in my life (relying on someone isn't the same as valuing them – and indeed, one way to value someone is to only rely on them for things they're able to do, rather than putting them in a position of feeling bad for failing you).

Lifehacking gets a bad rap, and justifiably so. Many of the tips that traffick as "lifehacks" are trivial or stupid or both. What's more, too much lifehacking can paint you into a corner where you've hacked any flexibility out of your life:

https://locusmag.com/2017/11/cory-doctorow-how-to-do-everything-lifehacking-considered-harmful/

But ever since Danny coined the term "lifehack," back in 2004, I've been cultivating daily habits that have let me live the life I wanted to live, accomplishing the things I wanted to accomplish. I figured out how to turn daily writing into a habit and now I've written more than 30 books:

https://www.locusmag.com/Features/2009/01/cory-doctorow-writing-in-age-of.html

A daily habit of opening a huge, ever-tweaked collection of tabs has made me smarter about the news, helped me keep tabs on my friends, helped me find fraudsters who were trying to steal my identity, and ensured that all those Kickstarter rewards and other long-delayed, erratic shipments didn't slip through the cracks:

https://pluralistic.net/2024/01/25/today-in-tabs/#unfucked-rota

Daily habits are superpowers. Once something is a habit, you get it for free. GTD turns on decomposing big, daunting projects into bite-sized, trackable tasks. I have a bunch of spaces around the house – my office, my closet, the junk sheds down the side of the house, our tiki bar – that I used to clean out once or twice a year. Each one was all-day, sweaty, dirty job, and for most of the year, all of those spaces were a dusty, disorganized mess.

A month ago, I added a new daily task: spend five minutes cleaning one space. I did the bar first, and after two weeks, I'd taken down every tchotchke and bottle and polished it, reorganizing the undercounter spaces where things pile up:

https://www.flickr.com/search/?user_id=37996580417%40N01&sort=date-taken-desc&text=tiki+bar&view_all=1

Now I'm working through my office. Ever day, I'm dusting a bookshelf and combing through it for discards to stick in our Little Free Library. Takes less than five minutes most day, and I'll be done in about three weeks, when I'll move on to my closet, then the side of the house, and then back to the bar. A daily short break where I get away from my computer and make my living and working environments nicer is a wonderful habit to cultivate.

I'm 53 years old now. I was 33 when I started following Getting Things Done. In that time, I've gotten a lot done, but what's even more relevant is that I didn't get a ton of things done – things that I consciously chose not to abandon. Figuring out what you want to do, and then keeping it on track – in manageable, healthy, daily rhythms that bring along the other people you rely on – may not be the whole secret to a fulfilled life, but it's certainly a part of it.

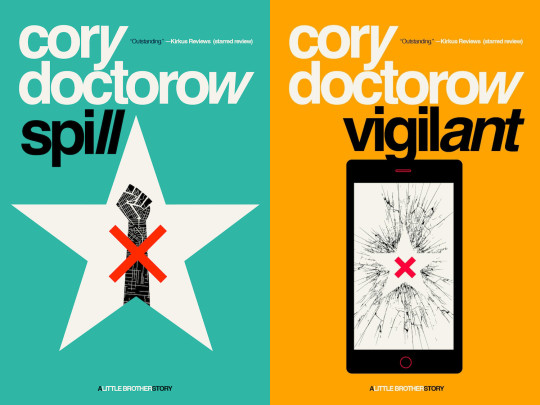

Tor Books as just published two new, free LITTLE BROTHER stories: VIGILANT, about creepy surveillance in distance education; and SPILL, about oil pipelines and indigenous landback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/10/26/one-weird-trick/#todo.txt

#pluralistic#gtd#lifehacks#getting things done#being busy#correspondence#deliberately choosing what you abandon

314 notes

·

View notes

Text

Tax Tips Which You Should Know as a Business Owner

It won't be wrong to say that filling out income tax returns becomes a very stressful and hectic task for business owners. This is because they are so busy managing their work and clients that many times they miss the deadline. Due to this, they have to pay a heavy fine and sometimes also have to face legal issues. So if you don't want to face any kind of legal problem then you should file for an income tax return in London on time.

There are a few tips which you can know so that at the time of filling out for tax return you do not have to waste your time and miss the deadline.

Important Things You Need To Do

It is highly important for every business owner to keep their accounts up to date. To make things easy you can use cloud-based accounting software. This will help you to keep all the records accurately. You will get to see all the real-time information on your income, revenue, cash flow as well as shortfalls.

You should not forget to take advantage of the instant asset write-off.

Having the best knowledge of GST obligations can turn out to be helpful at the time of registering for goods and services tax (GST). For better ideas and information regarding this, you can consult with a professional tax advisor in London.

You can also claim work from home expenses as a tax deduction. This can be phone call costs for business purposes, the cost of buying a laptop and using electricity and internet for business work, etc.

These are a few important things which you need to do. However, you can make things easy and simple by hiring the service of professional London tax advisors. As they are highly qualified and have years of experience you can trust them to help you efficiently.

#Tax Return#Tax Return London#Vat Return London#Tax Advisor London#financial advisors london#tax consultant

1 note

·

View note

Text

East London Charted Accountants

"Looking for Trusted Chartered accountants in East London?our Expert Team Delivers Top-notch Financial Services,Tax Advice,and business Solutions.Contact Us Today"

0 notes

Text

How to Plan for Inheritance Tax and Protect Your Assets

Inheritance tax can feel like a financial burden, but with the right strategies, you can protect your assets and secure your family’s future.

30-Second Summary

Planning for inheritance tax ensures that your hard-earned assets go to your loved ones instead of being lost to taxes. In this guide, I’ll explain what inheritance tax is, why it’s essential to plan ahead, and how professional accountant in London can help you.

You’ll learn practical steps, such as gifting assets, using trusts, and taking advantage of exemptions, to minimize tax liability and protect your wealth.

What Is Inheritance Tax?

Inheritance tax, often abbreviated as IHT, is a tax applied to the estate of someone who has passed away. This includes property, possessions, and money. In the UK, the standard rate of inheritance tax is 40%, which can significantly reduce the value of your estate if proper planning isn’t in place.

For many people, this tax can feel like an added layer of stress during what is already a difficult time for their loved ones.

To put it simply, if your estate is valued above the tax-free threshold, which is currently £325,000, you’ll need to pay 40% on anything above that amount. For example, if your estate is worth £500,000, the taxable portion is £175,000.

That means your family could face an inheritance tax bill of £70,000. Without proper planning, this amount could eat into the wealth you intended to leave behind for your loved ones.

Fortunately, there are allowances that can help. Married couples and civil partners can combine their tax-free thresholds, effectively doubling the amount to £650,000.

Additionally, there is the Residence Nil Rate Band (RNRB), an extra allowance of up to £175,000 if you’re leaving your home to direct descendants. While these allowances can be helpful, navigating the specifics can be tricky without expert guidance.

Working with a London accountant who understands inheritance tax laws can make a world of difference. With their help, you can ensure your estate is structured in a way that minimizes tax liability and maximizes what your family receives.

Why You Need to Plan Ahead

Failing to plan for inheritance tax can have serious consequences. One of the biggest risks is that your family might face a hefty tax bill they weren’t prepared for. This could mean they’re forced to sell valuable assets, like a family home, just to cover the tax owed.

Beyond the financial impact, this can also create emotional stress during an already challenging time.

On the other hand, taking the time to plan ahead brings several benefits. First and foremost, it allows you to reduce the tax liability on your estate. By taking advantage of exemptions and reliefs, you can ensure more of your wealth is passed on to your loved ones.

Planning also provides financial security for your family, giving you peace of mind knowing they won’t be burdened by unexpected costs. Additionally, a well-thought-out plan can help avoid legal complications and disputes among beneficiaries.

From my experience, many families I’ve worked with in London have found that starting early is the key to successful inheritance tax planning. It’s not just about saving money—it’s about protecting your legacy and ensuring your wishes are respected.

How to Minimize Inheritance Tax Liability

One of the most effective ways to reduce inheritance tax liability is through gifting. By giving away assets during your lifetime, you can reduce the size of your estate and, in turn, the amount of tax owed. For example, you’re allowed to gift up to £3,000 each year without it being counted towards your estate. This may not seem like much, but over time, these annual gifts can add up and make a significant difference.

Another strategy is the use of trusts. Trusts are legal arrangements that allow you to transfer assets to beneficiaries while retaining some level of control. For instance, a discretionary trust lets you decide how and when the assets are distributed, which can be particularly useful if you’re concerned about how the money will be used.

Trusts also offer the added benefit of reducing inheritance tax, as the assets placed in the trust are typically excluded from your estate.

Exemptions and reliefs are another crucial part of minimizing inheritance tax. Business Relief, for example, allows you to reduce the value of qualifying business assets by up to 100%.

Similarly, Agricultural Relief applies to farmland and certain agricultural property, providing significant tax savings. Donations to charities are also entirely exempt from inheritance tax, making philanthropy a worthwhile consideration for those looking to leave a positive impact.

While these strategies are effective, they require careful planning and execution. A qualified accountant London can guide you through the process, ensuring you’re making the most of the available options.

Protecting Your Assets

Protecting your assets is just as important as minimizing tax liability. One way to do this is by taking out a life insurance policy specifically designed to cover inheritance tax. This ensures that your family won’t have to dip into the estate to pay the tax bill, preserving more of your wealth for them.

Another effective method is holding assets jointly. When assets are owned jointly, they automatically pass to the surviving co-owner, bypassing the probate process and potentially reducing the tax owed. For example, if you own a property jointly with your spouse, it will pass to them directly upon your death, avoiding inheritance tax in many cases.

It’s also essential to keep your will up to date. An outdated will can lead to confusion, disputes, and unnecessary tax bills. Regularly reviewing and updating your will ensures that it reflects your current wishes and takes advantage of any new tax-saving opportunities.

Common mistakes, such as procrastination and overlooking exemptions, can be costly. That’s why starting early and seeking professional advice is so important. With the right strategies in place, you can safeguard your wealth and provide for your loved ones long after you’re gone.

How Accounting Firms in London Can Help

Accounting firms in London specialize in helping individuals and families navigate the complexities of inheritance tax planning. Their expertise can make a significant difference in the amount of tax you pay and the ease with which your estate is managed.

One of the main advantages of working with a London accountant is their familiarity with local property values and tax regulations. London’s real estate market is unique, and having an accountant who understands its nuances can be invaluable.

They can help you identify tax-saving opportunities specific to your situation, such as using the Residence Nil Rate Band effectively.

From my own experience, partnering with a skilled London accountant gave me access to strategies I wouldn’t have considered on my own. Their guidance not only reduced my tax liability but also gave me peace of mind knowing that my assets were protected.

Choosing the right accountant is crucial. Look for a firm with a strong track record in inheritance tax planning, positive client reviews, and a clear fee structure. Asking questions about their experience and approach can help you find someone who’s the right fit for your needs.

Next Steps: Start Planning Today

Planning for inheritance tax might seem daunting, but it doesn’t have to be. By taking proactive steps and seeking professional advice, you can protect your assets and ensure your loved ones are provided for.

Don’t wait—start planning today by consulting a trusted London accountant who can guide you through the process and help you achieve peace of mind.

#accountants in london#accountantsinlondon#londonaccountants#tax assist london#tax consultant london#tax return services london#tax consultant east london

0 notes

Text

Top Tips for Completing Your Self Assessment Tax Return on Time

It doesn't have to be an unpleasant or time-consuming process to file your self assessment tax return with a little preparation and attention to detail.

Visit Us: https://www.quora.com/profile/Mysimplytax/Top-Tips-for-Completing-Your-Self-Assessment-Tax-Return-on-Time

0 notes

Text

Friends

——————

Pairing: Hermione Granger x Fem!Reader

AU: Friends AU

WARNING: None

——————

Third Person P.O.V:

New York City

Hermione hummed softly as she washed the dishes in the sink, she could hear Pansy talking on the phone to her father. Yelling was actually the better term since it would be a blessing if one of their neighbors didn't come to complain.

"For the last time Father, I don't want nor need, your money! Goodnight!" Pansy huffed angrily as she hung up the phone and put it back on the receiver. Hermione looked over her shoulder and watched as the raven-haired girl sat on the couch and folded her arms across her chest.

"That was either the lottery calling to tell you that you lost, or your fathers called again," Hermione says as Pansy groans and lies onto the fabric, burying her face into the cushion. Hermione just chuckled to herself as she shut off the sink and wiped her hands clean with the towel.

"I don't know why you keep answering, there's no harm in letting it go to the answering machine," she says as Pansy just groans again and turns her face towards the TV. She could see Hermione walk over to the couch and lean against the backrest from the reflection on the screen.

"I know, but what if it's an emergency? Like...his bank is on fire" Pansy grumbled as Hermione smiled and patted her head before walking towards the refrigerator.

One thing was for certain, Pansy missed having money.

"Trust me, if his bank was on fire, you'd sense it. It would be like how a mother knows her child is in danger" Hermione replied as she grabbed a can of Pepsi and shut the fridge.

She heard their front door open, and popped in was Y/n, one of their across-the-hall neighbors and good friend. She smiled and shut the door behind her as she stepped inside.

"Either Pansy is really against her tax return, or she was fighting off her accountant," Y/n says as Pansy pushes herself back up to a sitting position and looks over at Y/n with a glare.

"Or both" she continues as she takes a step back in fear of her. Hermione just smiled as she stepped into the conversation.

"Her father called again" she explains as Y/n nodded and walked over to the couch, taking a seat next to Pansy.

"What did he want this time?" She asked as Pansy leaned her elbows against her knees and huffed again in disbelief.

"He wants me to come home and take over the family firm. He even tried to bribe me with a luxury apartment in London!" Pansy sighed as she rubbed her temples, seemingly utterly annoyed. Y/n and Hermione's eyes catch.

"That guy just grinds my gears," Y/n says sarcastically, earning a soft smack to the back of her head from Hermione once she was close enough. Pansy stood up and took a deep breath, placing her hands at her sides as she walked into the kitchen and grabbed a bottle of wine from the rack above the fridge.

"I don't want to talk about it anymore. Anyways, where's the other three?" She asks as she digs around in one of the drawers for the corkscrew. Hermione looked down at Y/n and raised an eyebrow.

"Harry is downtown for an astronomy conference and Luna is protesting the fishing boats by the docks. As for Draco...where is Cheech, Chong?" She asks as Y/n rolls her eyes and shrugs her shoulders, looking at at her with offense.

"Just because we live together, doesn't mean I know where he is 24/7" Y/n replied as Hermione sat on the top of the backrest, and cracked open her pop.

"Didn't you two hold hands during that haunted house last Halloween, and proceeded to do 'marco pollo' when you got separated?" Pansy asked with a small smirk as she turned the screw into the cork and watched as Y/n gave a glare back toward her.

"You saw those paper spiders! Terrifying," she replied as Pansy popped open the wine bottle and poured some out for herself. Hermione sipped on her Pepsi as Y/n looked up at her with an unimpressed expression.

"Very scary, I'm surprised you survived the encounter" Hermione chuckled as she handed her the soda and ran a hand through Y/n's hair as she stood up from the couch.

Pansy hid a smirk behind her wine glass as she watched Y/n hide her face from any prying eyes, but it was obvious that the simple gesture made her flush. It was cute that she still got nervous around Hermione after all this time of knowing one another, but then again, Hermione didn't help with her unknowing flirtation.

Or maybe she did know?

Pansy still hadn't gotten a clear-cut answer from her when they would stay up and talk about their relationship problems or lack thereof a relationship. Yet, she seemed to hold back when talking about her interests in one person.

She always said a 'certain someone'.

It had to be Y/n, it was way too obvious with the stolen glances and touches they gave each other on a daily basis. So, Pansy has been very ingrained in their relationship.

But she would be lying if she, Draco, Luna, and Harry, weren't all rooting for them to get together. Like the friends they are, they try their best to put them in romantic situations.

Hermione had even begun to notice their involvement in her love life. Maybe her secret wasn't as hush-hush as she thought.

"So...what are you two up to tonight? Any plans? Maybe dates?" Pansy asks with a raised eyebrow as she watches Hermione pour her own glass of wine. Y/n looked back at them with intrigue as she sipped on the last of the Pepsi, not noticing that a bit of Hermione's lipstick was smudging onto her lips.

"I was supposed to go out with this guy tonight, but he canceled. It had to do with something with a fish and his mother...I sort of clocked out of the phone call" Hermione explained with a shrug as Pansy chuckled, and then both women looked at Y/n with their own intrigued expression.

"What about you? Any lady friends that are swooning at the sound of your call?" Hermione hums with a smirk as Y/n rolls her eyes and waves her off. She crunched the empty can and stood up, walking over to the garbage bin.

"Oh, sure. Sharon Stone has been leaving me messages about our next date, and I don't think she's getting the hint" Y/n replied with a slight mumble as she tossed it into the bin. Pansy gently nudged Hermione, their eyes met, and a silent conversation began. Y/n was too busy trying to pick off lint from her shirt to notice.

Finally Pansy just shoved Hermione toward the other girl, earning herself a glare from the brunette. Hermione straightened her back and took a quiet breath before placing her hand on the middle of Y/n's back, capturing her attention.

"Do you want to do something with me tonight? I think we could find something to do on such short notice" Hermione asked with a small smile and Y/n nodded in agreement as she tried to keep her face from bursting into flames.

"Uh, sure! What do you have in mind?" Y/n asks as she absentmindedly pushes the wrinkles off her shirt and straightens her posture. Hermione sort of shrugged as she looked at the time on her watch, it read '7:37 P.M'.

"How about we grab a late dinner first? Somewhere around here, and we'll figure out the rest later" Hermione asks, and Y/n quickly to nodded. She stepped towards the door, before running into it. The girls chuckled as they watched their friend quickly open and shut the door behind her, before running over to the apartment across the way.

"So...what are you going to wear?" Pansy asked, which caused them both to look at each other. There was a beat of silence before Hermione darted towards the bathroom and Pansy placed down her wine and ran into the brunette's room to find something for her.

"Why did I say dinner?! I don't have time to get ready!" Hermione yelled as she stripped and jumped into the shower, as soon as the cold water hit her skin, she fought back the urge to run out.

"Why do you dress like a school teacher?!" Pansy yelled back as she desperately looked for something that didn't say 'what's 12 multiplied by 9?'. Hermione rolled her eyes as the water began to heat up, letting her quickly relax as she rang her shampoo through her locks.

Pansy finally found a shirt that was good enough and the pair of jeans that she knew fit her friend like a glove. As she emerged from the room, Hermione also left the bathroom with a towel around her head and body.

"God, what if she thinks this is just a friendly outing? I mean it's Y/n, I love her, but...it's her." Hermione sighed as she took the clothes and ran into her room, shutting the door behind her as Pansy walked over and leaned against the wall. Y/n was quick-witted, but her obliviousness to anything romantic, it made it hard for anyone who liked to play cat and mouse.

Y/n was a blind cat that walked past the mice.

"Well, you better be direct then. Maybe state that you want to be more than just friends?" Pansy asks as she listens to the clattering of makeup and the whirling of a hair dryer. Hermione sighed as she felt the hot air from the machine heat her scalp as she tried to quickly dry it before Y/n returned.

"What if she doesn't feel that same? This could ruin our friendship and the group" Hermione yelled over the loud humming, to which Pansy just snickered.

"Seriously? You two have been pining over each other for years, why wouldn't she feel that same?" Pansy yelled back as she heard the sound of the hair dryer turning off. Hermione shrugged, even though Pansy couldn't see it.

"I don't know, maybe I'm just anxious? What if all this fascination was all for nothing? What if she secretly collects dolls that look like her mother?" Hermione says as she shudders at the thought, Pansy walks into the room and rolls her eyes.

"I tell you about one of my nightmares exes, and now that's your biggest fear" she sighs as she crosses her arms, watching as Hermione changed into her clothes.

"I'm sorry Pans, but you know what I mean" Hermione explained as she sat back down in front of her vanity mirror. She didn't want to be disappointed, but a part of her didn't believe Y/n would.

"Everyone has their quirks...some worse than others, much, much worse." Pansy hummed as she walked over and sat on her friend's bed, crossing one leg over the other as she stared up at the ceiling.

The girls hoped this would go well.

——————

Y/n ran into her apartment and slammed the door behind her as she tried to figure out what she was going to wear. She goes to run to her room but then stops. Then she goes to run to the bathroom then stops again.

"Oh god, what do I do first?! This is a harder decision than when Draco tries to pick one ice cream flavor" she sighs as she runs her fingers through her hair. Thankfully, her roommate, Draco, walked through the door with a whistle.

"Draco! Thank god, I need your help" Y/n quickly says as she runs up to him, he raises an eyebrow and places a bag of Chinese food on the kitchen counter.

"Can it wait till after we eat? Because I'm starved" he says, but she quickly shakes her head and starts to explain. Her frazzled state actually spooked Draco, but he didn't want to say that out loud.

"I can't, I'm going out to dinner with Hermione...maybe it's even a date" she says with a bit of excitement as Draco walks past her to sit on the couch. He didn't really register what was said, instead just humming as he sat down.

"Cool, cool. Where are you guys going?" He asks nonchalantly as he places both servings of food on the coffee table. Draco was a secret food lover. He could eat until his stomach popped but always refrained due to his diet.

Yet, when Y/n couldn't eat her portion of dinner? Draco always gave the 'well I can't let it go to waste' excuse, as he stuffed his face in the process.

Y/n stared at him with furrowed brows, she understood that her roommate was a bit of a 'selective hearing' kind of person, but seriously? She turned and looked at herself in the reflection on the stove door.

It took a moment of silence before Draco finally registered what was said. His head snaps up as his eyes widen in surprise, he fumbles with the container in his hands, making sure not to drop it.

"Wait. You're going on a date? With Hermione? The girl you've been in love with since you met her? And she does know about this date, correct? It's not a delusional idea that will get you on the eleven o'clock news?" He asked with a raised eyebrow, which got him an eye roll in return as he watched Y/n walk over to the couch. She thought for a moment.

"No...no. She asked me out" Y/n states as she makes sure that her memory actually was correct. Draco wrapped an arm around Y/n's neck and grinned happily while patting her shoulder.

"Alright! That's what I'm talking about! So, when do you have to get ready?" He asks and that caused a pause in their conversation. They stared at one another before Y/n quickly ran to her room, tripping over the coffee table in the process. She immediately got up and began looking for clothes as Draco just shrugged and went back to eating his two meals.

——————

8:03 P.M.

Simultaneously, both of the women stepped into the hallway and were taken by surprise to see the other. Their eyes roamed each other's bodies for a moment before Y/n finally said something.

"You look...wow," she says as their gazes lock and Hermione turns bashful. Her head lowers to look at herself. Did she look nice? Was the 'wow' a good 'wow' or a bad 'wow'? Now she was anxious.

"In a good way?" she asks and Y/n nods in confusion. Acting as if Hermione had uttered something blasphemous. It was almost comical.

"Good, very good! You just...wow. You take my breath away" Y/n mutters, which had Hermione taking a small breath to steady her heart rate. These moments were few and far between. Where they were the only ones, where Y/n didn't joke every five seconds, and Hermione gave a jab in return.

"You're going to make the sprinkles go off if you keep making my cheeks burn like this" Hermione chuckled as she looked back at Y/n, giving her a view of her flushed face. It wasn't hard to make Hermione blush, but Y/n had never seen it when she was the reason it surfaced.

"Good idea, I never did learn how to use a fire extinguisher" she replied with a small laugh as they both began to walk towards the stairs, their shoes echoing in different pitches.

"So, where are we going?" Y/n asks as they slowly walk down the steps. Hermione blinked, realizing she had forgotten to think of a place to actually eat.

"Uh, I honestly had forgotten about dinner," she says with an embarrassed chuckle, but Y/n just waved it off and slid slowly down the railing. Hermione couldn't help but chuckle softly as she felt her gaze soften.

"That's alright. How about we grab a few beers and hotdogs, and sit at Central Park?" Y/n asks as she lands on the first floor. Hermione loved that idea. It was a perfect place where it wouldn't make it an obvious date, but it wasn't just a place spent with a friend either. It was also kinda cheesy, but it fit Y/n's personality.

"That sounds perfect," she says breathlessly as Y/n opens the door out into the humid summer air. It felt like stepping into a different world, one that Hermione didn't feel familiar with. She felt a gentle hand land on the space of her back. Her eyes zipped to her left to find Y/n smiling softly at her.

The neons of the Central Perk's sign shined down on them like a heavenly glow. For once Y/n heard the city go silent, just for them. This was new for both of them. They were crossing a line, and both knew it.

"Have I ever told you how beautiful your eyes are?" Hermione whispers as they stare at one another, and Y/n sort of just tilts her head as she feels the brunette take her arm in hers and navigate her slowly down the street.

"Mine? Well, uh...I'm not sure" Y/n stammered as she felt Hermione's hand glide down her forearm and intertwine with hers. As they walked further Y/n became more aware of the city again, hearing the honking from cars and the rumble of the subway beneath their feet.

"Well, they are. They hold a lot of...gutsy" Hermione hummed softly as she followed the barrier between Y/n's iris and and pupil. There was always something that caught her eye when she looked at them.

"Gutsy? Did you learn that from your Word Of The Day Calendar?" Y/n asked with a chuckle as they waited for the walk signal so they could cross. Hermione rolled her eyes but the smile never faltered from her lips.

"Maybe, but that's not the point. You know what I mean, don't you?” Hermione asks as they quickly make their way to the other side of the street. Y/n thought about it but decided to be honest.

“No, but hopefully you'll tell me?” she replied as they walked past a closed antique shop. Hermione took a second to go through exactly how she wanted to word her description. Her eyes took in the window display of computers from the 80’s and dolls that looked too haunted for her taste.

“Your eyes are…brave. Determined. Honest.” Hermione replied before looking back at her, Y/n couldn't help but laugh quietly.

“Brave? I called you over to kill a spider in my shower last week,” she states as she watches Hermione roll her eyes and gently squeeze her hand.

“That may be so, but bravery doesn't just mean facing your fears” the brunette argued as they crossed another street. The streetlights illuminated the road like an airstrip runway, it was quite beautiful.

“It doesn't? That's news to me” Y/n teases as they walk into a 24-hour bodega. They heard a soft meow from a calico cat that was lounging behind a shelf of barbeque chips. Hermione leaned down and smiled at the kitty, reaching out and running her fingers across the underside of its chin.

“It also means being brave enough to embrace who you are, and I do not know anyone more themselves, than you” she added back as she watched Y/n grab a six-pack of beer from the cooler nearby. Hermione stood back up straight, giving a soft ‘bye’ to the cat as she followed her date to the checkout area.

“I think you're confusing my comedian-like…je ne sais quoi, for bravery, when in reality it's just a defense mechanism,” Y/n says as she pulls out her wallet, Hermiome rolls her eyes as she pays with her card before the other woman got the chance.

“You little…anyways, as long as you laugh, I'll take your compliment,” Y/n sighs with a small smile as Hermione playfully rolls her eyes, and loops their arms again, leaving Y/n to carry the beer. The cat meows one last time before stepping back out into the night air.

——————

Their conversation was light and a bit intimate as they walked towards Central Park. The subject of the conversations wasn't all that important, it was as simple as Hermione’s pitiful excuse for a boss, or Y/n’s annoying coworker. Their heads were lowered towards each other, hushed whispers and small chuckles escaping them.

“Hey, there is a cart still out” Y/n points out to a hotdog stand sitting at one of the corners just before the park, Hermione felt her stomach rumble. God, she didn't realize how hungry she actually was.

“Four please,” Y/n says once they were close enough, this time quickly enough to pull out some cash before Hermione could, and she heard a soft ‘huff’ from the brunette because of it.

“It's hotdogs, it's not like I'm paying your car insurance” Y/n chuckled as they split the meal between them, adding their desired condiments to the hotdogs as a nearby bar blasted ‘Jessies Girl’.

“That is not the point” Hermione chuckled as they walked across the street to the park, it was almost 9:30 now, but there were still a lot of people in the area.

“Then what is the point?” Y/n asked with a small smirk as they sat down on a bench in a well-lit area. Hermione opened her mouth, then closed it again before sighing.

“Shut up” she mumbled as she took a bite of her very late dinner. Y/n snickered softly and popped off the tops of their beer, handing her one in the process. Hermione took hold of the drink and gulped down a bit before she bravely brought up her next topic.

She was definitely nervous about it. She couldn't stop thinking about how this could destroy their friend group if it didn't go as she planned. A part of her wanted to grab Y/n’s shoulders and yell that she didn't understand how oblivious she could be.

“So… I need to talk to you about something,” Hermione says after she is sure she has no food or beer left in her mouth. Y/n nodded as she turned to her with her full attention. Even as the dim glow of the path lights along the park, she thought that Hermione had never looked more beautiful.

“Alright, but it better not be over that time I changed the channel while you were in the bathroom. I told you that I didn't know you were watching Grey's Anatomy!” Y/n says with a nervous laugh, but Hermione waves her off as she takes another breath to calm her nerves.

“No, no. Nothing like that,” she replied as her eyes darted around the area surrounding them. Why was this so hard for her to admit? She never had trouble before when she would flirt with other people. Maybe it was because those people weren’t Y/n.

“Listen, do you see this putting as more than…friends?” Hermione asks sheepishly, her gaze flickering from the asphalt under her feet and up to Y/n’s face.

“Well, I…yeah, yeah I do,” Y/n says with a shaky breath. She felt like a kid, stuttering like a skipping record as the girl you like gives you a small smile in the hallway. Hermione body relaxes as she smiles and takes another bite of her hotdog.

“Good, because you’re taking me somewhere nice next weekend” Hermione states with a sly smirk as Y/n stuttered even more. Even though she was only teasing, it was a way to get a proper date out of her longest love interest.

“N-Next weekend? Sure, how’s Saturday night or Friday? I could do Friday, but I can also do Saturday or Sunday!…I just realized how sad my weekends are” Y/n coughed out as she shut her rambling down, and felt her face get hot. It probably wasn’t red, but it just felt like someone belted her face with a hairdryer.

Hermione couldn’t help but laugh as she grasped Y/n’s forearm with a comforting hand, but it soon interlocked back with the other woman’s. There was a beat of silence before Hermione just chuckled again.

“How about we just focus on now? We can talk more tomorrow” she stated as Y/n took another deep breath and smiled.

They spent most of the night like that. Awkward, but gentle. They didn’t know how to move forward, but they now had each other. This was saying a lot considering how long they’d been alone in this aspect of this relationship.

It was nice, to be wanted.

101 notes

·

View notes