#Tax On Crypto:

Explore tagged Tumblr posts

Text

JUST IN: 🇺🇸 Donald Trump plans to lower corporate income tax to 15% if elected President.

5 notes

·

View notes

Text

youtube

Oh we're FUCKEDDDDDD fucked

#.txt#literally yknow vance just told trump about how much easier it is to do tax evasion and money laundering on crypto#thats all he had to hear before dollar signs started blinding him#Youtube

2 notes

·

View notes

Text

"We're doing a deep dive into the sham world for voluntourism, where people pay for the experience of charity without actually helping locals—and often even making their lives worse. Join us live on Twitch now:"

https://bird.makeup/users/vicenews/statuses/1688978145272111107

#vice news#vice#jerkmillionaires#jerktrillionaires#jerkbillionaires#voting is a scam#religion is a scam#scammers#scam#tourism#tourist#crypto fraud#billions of facebook users warned of ‘job fraud’ that could cost you – eight key signs to look out for#voter fraud#election fraud#tax fraud#fraud#voluntourism#poverty#working class#class warfare#class war#classism#classwar#ausgov#politas#auspol#tasgov#taspol#neoliberal capitalism

2 notes

·

View notes

Text

i think it would be sooooo funny if gracie was into the st*ckmarket honestly :/

#oc: gracie#someone needs to ban me from making posts abt ocs after i watch succession its so bad for me#shes not into crypto or nfts but still a cringefail for sure#its a shame shes a pollard zero bc she too would probably keep a painting locked in a safe for 'tax purposes'. cough#anyways

6 notes

·

View notes

Text

modern au aloy cracks me up because she’s so ingrained in technology but was still raised out in the woods and i know if i met her personally she’d get on my last nerves

#°⋄ ➸ ––– ◜ headcanon . ◞#°⋄ ➸ ––– ◜ v: 06. keep my head above the alpine . ◞#°⋄ ➸ ––– ◜ v: 07. time-rich and cash-poor . ◞#gsfdhsjk#is she still radicalized and committing tax fraud and constantly complaining about crypto?#yes and i love her for it#but she's still annoying tho lmao#she's buff and smart and well informed and i am intimidated by her#aloy who grew up properly socialized is too powerful frankly

5 notes

·

View notes

Text

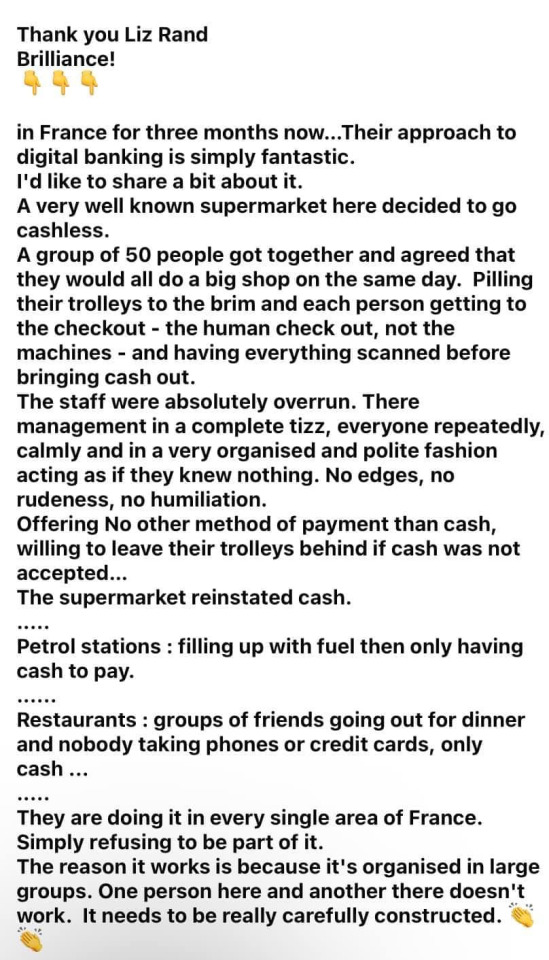

I would point out the post was abt French people (and possibly fabricated? though i know the french love to do coordinated resistance to changes they hate, and that collective action works) but sure, let's focus on USAmericans for a bit:

- we still pay taxes on cash transactions (sales tax babey!) and cash income is also still recorded and taxed in most cases

- bank accounts cost money to open AND maintain; I've been so poor i couldn't keep one open before, and that's more common than you might expect

- card users and transactions are subject to more surveillance, plus a bigger paper trail also opens them up to more hacking opportunities

- if my bank account gets hacked or otherwise compromised? i'm fucked without cash until it's sorted out -- a process which can take weeks to months if I'm missing certain documents (which cost money to reorder if theyre stolen, destroyed in flood/fire/etc, or simply lost, so with no access to funds I'm MEGA fucked)

- can't pay with card during a power outage so everyone in disaster areas are fucked

- undocumented immigrants and some types of disabled people may not be able to open bank accounts so they're also fucked

- domestic abuse victims have a harder time squirreling away hidden funds to escape their situations if their account is controlled by their abuser

- card payment processors charge per transaction, giving small businesses a harder time staying afloat (i.e; either destroying their own margins or charging more because they need to absorb more of the processor cost, making them less competitive and losing customers outright)

tl;dr maybe it is USAmerican to go for cash, but it's not an exceptionalism thing this time. instead of criticizing the practice itself, the structures that make cashlessness an issue (here and elsewhere) should be criticized instead

#tax evaders more use cryptocurrency like bitcoin lol. tax evasion is the entire point of crypto.#just a side note there#economics

18K notes

·

View notes

Text

USDT Flashing Software

In the rapidly changing landscape of digital assets, innovative solutions are emerging to enhance the way we transact. One such solution is Flash USDT, a unique digital currency that offers a safe and effective method for trading in the digital asset market. This blog will explore what Flash USDT is, its features, and how you can purchase it securely. Reach out to them through the following contacts; Telegram: Digital Vault (https://t.me/Digitalva0lt) WhatsApp: https://wa.me/+12568235121 Understanding Flash USDT Flash USDT is a temporary digital asset that allows users to transact with ease and security. For an investment of just $200, you can purchase $2000 worth of Flash USDT, with a minimum order of $2000. This makes it an attractive option for traders looking to maximize their investment potential. For those interested in larger transactions, the platform accommodates orders up to $10,000,000 for $1,000,000 worth of Flash USDT. Key Features of Flash USDT Temporary Existence: One of the most notable features of Flash USDT is that it disappears from any wallet after 60–240 days from the date it was received. This means that any crypto it has been converted to will also vanish after this period, ensuring a unique transactional experience. Limited Transfers: Flash USDT can only be transferred a maximum of 35 times. This limitation adds an extra layer of security and control over the currency, making it a practical choice for cautious traders. Conversion Flexibility: Flash USDT can be converted into any other type of cryptocurrency on an exchange. However, if it is restored, that coin will also disappear after 10 days, maintaining the temporary nature of the transaction. Why Choose Flash USDT? The flash usdt currency offers a practical and economical option for traders wishing to transact in large quantities. With a commitment to flawless transactions and the highest caliber of security, our platform ensures that your valuables are safeguarded throughout the process. If you’re looking to engage in flash usdt purchase with Binance or explore other trading options, you can do so with confidence. The usdt flashing software and usdt flasher tools available make the process seamless and efficient. Telegram: Digital Vault (https://t.me/Digitalva0lt) WhatsApp: https://wa.me/+12568235121 How to Purchase Flash USDT Ready to dive into the world of Flash USDT? You can easily purchase Flash USDT from Digital Vault. They provide a secure platform for your transactions and are dedicated to ensuring a smooth experience. Reach out to them through the following contact details: Telegram: Digital Vault (https://t.me/Digitalva0lt) WhatsApp: https://wa.me/+12568235121 By choosing Digital Vault, you can ensure that you are engaging with a reputable source for your flash usdt currency needs. Conclusion In conclusion, Flash USDT represents a groundbreaking approach to digital asset transactions, offering unique features that cater to the needs of modern traders. With its temporary nature and secure transaction process, it stands out as a viable option in the digital currency market. If you’re ready to explore the potential of Flash USDT, consider reaching out to Digital Vault for your purchase. Telegram: Digital Vault (https://t.me/Digitalva0lt) WhatsApp: https://w.me/+12568235121

#flash usdt wallet#flash usdt#flash usdt binance#flash bitcoin#flash usdt transaction#usdt flasher#flash usdt sender#usdt flashing software#what is flash usdt#crypto#blockchain#fintech#defi#digitalcurrency#ethereum#crypto tax#cryptotrends#cryptotrading#crypto token#cryptotech

0 notes

Text

Simplify Finances with Professional Bookkeeping Services

Stay on top of your business finances with Fullstack Advisory's Bookkeeping Services. Our experts handle accounts, reconcile transactions, and streamline your financial records, ensuring accuracy and compliance. Focus on growth while we manage your books—partner with Fullstack today!

#bookkeeping services#business bookkeeping#crypto tax accountant#startup accountant#r&d tax incentive australia#cfo advisory#crypto tax#r&d tax consultants#ecommerce accountant#crypto tax australia

0 notes

Text

South Korean National Assembly Delays Session Over Crypto Tax Dispute

The South Korean National Assembly has postponed its plenary session, initially scheduled for November 26, 2024, due to a heated political debate over the taxation of virtual assets. The session was intended to address several critical issues, with cryptocurrency taxation at the forefront. However, conflicts between the ruling People Power Party (PPP) and the opposition Democratic Party of Korea…

0 notes

Text

Look into Our Services that are provided by FinAcee

At FinAcce, we offer expert financial services designed to drive your business forward. From precise bookkeeping and accounting to strategic CFO guidance and comprehensive crypto accounting, streamlining processes and enhancing efficiency. Utilizing AI and cutting-edge technologies, our skilled CPAs and CAs deliver secure, cost-effective solutions tailored to your needs. Partner with FinAcce for strategic financial management that empowers your success.

Read more: https://finacce.com/services/

#digital assets#crypto trading websites#crypto trading#cryptocurrency accounting firms#crypto accounting services#accounting cryptocurrency#fiat and crypto#cryptocurrency accounting software#crypto tax accountants#accounting finance book#accounting efficiency#technical accounting advisory#advanced accounting terms

0 notes

Text

Italy Lowers Proposed Crypto Tax Rate to 28% After Industry Feedback

Italy’s government has decided to reduce the proposed capital gains tax on cryptocurrency transactions from 42% to 28%, following significant feedback from industry stakeholders and political figures. The initial proposal, introduced in October 2024, aimed to increase the tax rate from the existing 26% to 42%, sparking widespread concern among investors and businesses within the cryptocurrency…

#Bitcoin#crypto#cryptocurrency#finance#italy#italy crypto tax#Italy Lowers Proposed Crypto Tax Rate to 28% After Industry Feedback#Italy to Raise Bitcoin Capital Gains Tax to 42%#Maurizio Leo#technology

0 notes

Text

What You Should Know About Overdue Tax Returns in Sydney?

If your tax returns are overdue and you live in Sydney, you may be feeling overburdened, worried about fines, or not knowing where to begin. For many people, tax season may be a stressful time, particularly if life interferes and tax returns are delayed. There are easy ways to get back on track, so don't worry—you're not alone.

A crypto tax filing company will create your tax returns after keeping track of all your transactions and figuring out your income or losses. Because of their experience, you may be sure that your return is submitted accurately and under Australian tax legislation. A qualified accountant can easily include complicated cryptocurrency transactions, various income streams, or self-employment into your entire tax return.

Monitoring a Cryptocurrency Portfolio With Frequently Modified Regulations

Keeping track of every transaction might be a headache if you trade on several peer-to-peer networks, wallets, or exchanges. Transaction records may be provided in a different format by each exchange, and manually combining everything might easily result in errors.

Australia's cryptocurrency tax rules are continually developing, and the ATO often revises its regulations to reflect new market trends. Previously grey-area activity may suddenly be categorised as capital gain or taxable income, and investors who are not tax experts may find it difficult to keep up with these developments.

Precise Capital Gains Estimates Using Easier Tax Submission

It can be challenging to determine capital gains or losses on cryptocurrency, particularly if you've made several trades within the fiscal year. These businesses guarantee that you submit the right amounts to the ATO and reduce your tax obligations by precisely estimating your capital gains.

You may feel secure knowing that your cryptocurrency taxes are in capable hands when you collaborate with an expert who is knowledgeable about both the specific difficulties associated with digital assets and the nuances of Australian tax legislation.

Source

0 notes

Text

Tax Accountant For Doctors | Australian Tax Specialists

Australian Tax Specialists Based in Sydney, Glenfield and Brisbane, has long been servicing doctors and dental practices for over 10 years. We realize that as a doctor or a dentist your main priority is your patients, and you need an Accountant who can keep your tax and accounting affairs up to date and provide you with appropriate guidance. We specialise in this sector, and we provide maximum value to Doctors, Dentists and their business.We are Sydney-based Accounting firm that Helps Doctors, Dentists & Medical Industry personnel with Tax & Accounting. Because of the excellent service we have continued to provide to our clients in the medical industry, over the years, we have received steady referrals and are known as Tax Accountant for Doctors among our medical clients !

Resource URL: https://australiantaxspecialists.com.au/accountant-for-doctors-dentists

#Australian Tax Specialists#Accountant For Transport Business#Tax Accountant For Doctors#Australian Tax Accountant#Tax Accountant For Retail#Accountants For Retail Business#Business Tax Returns Accountant#Crypto Tax Accountant Sydney

0 notes

Text

Discover the Most Tax-Friendly States for Retirees

Retirement is a time to enjoy the fruits of your labor, but where you choose to retire can significantly impact your financial well-being. Some states offer better tax benefits for retirees than others. In this guide, we explore the most tax-friendly states for retirees, helping you make an informed decision on where to spend your golden years.

Understanding Retirement Taxes

Retirement taxes can eat into your savings if you don't plan wisely. Key areas to consider include income tax, property tax, sales tax, and estate/inheritance tax. Understanding how each state taxes these areas will help you choose the best location for your retirement.

Top Tax-Friendly States for Retirees

1. Florida

No State Income Tax: Florida does not impose a state income tax, which means retirees can keep more of their Social Security benefits, pensions, and other retirement income.

Low Property Taxes: The state offers homestead exemptions that can significantly reduce the taxable value of your primary residence.

No Estate or Inheritance Tax: Florida also does not have estate or inheritance taxes, making it an attractive destination for retirees with substantial assets.

2. Nevada

No State Income Tax: Like Florida, Nevada does not tax personal income, which is beneficial for retirees relying on various income sources.

Low Property Taxes: While not the lowest in the nation, Nevada’s property taxes are relatively moderate and manageable.

No Estate or Inheritance Tax: Nevada does not impose estate or inheritance taxes, ensuring that your assets can be passed on to your heirs without state interference.

3. South Dakota

No State Income Tax: South Dakota is another state that does not tax personal income, allowing retirees to maximize their retirement income.

Low Property Taxes: The state offers various property tax relief programs for seniors, reducing the burden on fixed incomes.

No Estate or Inheritance Tax: With no estate or inheritance taxes, South Dakota is a favorable state for preserving your wealth for future generations.

4. Wyoming

No State Income Tax: Wyoming’s lack of a state income tax makes it a popular choice among retirees.

Low Property Taxes: The state’s property taxes are among the lowest in the nation, with additional relief programs for seniors.

No Estate or Inheritance Tax: Wyoming does not have estate or inheritance taxes, offering further financial peace of mind for retirees.

5. Delaware

No Sales Tax: Delaware’s absence of a sales tax can lead to significant savings on purchases.

Low Property Taxes: The state offers some of the lowest property taxes in the country, with additional senior-specific exemptions.

Partial Taxation of Retirement Income: While Delaware does tax some forms of retirement income, it offers generous exclusions for Social Security benefits and other retirement plans.

Factors to Consider When Choosing a Tax-Friendly State

When evaluating the tax friendliness of a state, consider the following factors:

Income Taxation

States like Florida, Nevada, South Dakota, and Wyoming do not impose a state income tax, allowing retirees to keep more of their income. Others, like Delaware, offer significant exclusions for retirement income.

Property Taxes

Property taxes can vary widely by state and even by county. Look for states with low property tax rates and senior-specific exemptions to reduce your overall tax burden.

Sales Taxes

States with no sales tax, such as Delaware, can offer significant savings, especially on large purchases. Be mindful of local sales taxes, which can add to the overall cost of living.

Estate and Inheritance Taxes

Estate and inheritance taxes can erode the value of your estate. States like Florida, Nevada, South Dakota, and Wyoming do not impose these taxes, ensuring that more of your assets can be passed on to your heirs.

Additional Considerations

Consider the overall cost of living, healthcare costs, and climate when choosing a retirement destination. These factors, combined with tax policies, will help you find the most suitable state for your retirement.

Conclusion

Choosing a tax-friendly state for retirement is crucial for maintaining your financial health. States like Florida, Nevada, South Dakota, Wyoming, and Delaware offer significant tax benefits that can help you preserve your savings and enjoy a comfortable retirement. By considering factors such as income tax, property tax, sales tax, and estate/inheritance tax, you can make an informed decision about where to spend your retirement years.

0 notes