#TDS on maturity of LIC policy

Explore tagged Tumblr posts

Text

youtube

#Section 194DA#TDS on maturity of LIC policy#nilesh ujjainkar#taxguidenilesh#TDS#income tax#194DA#of life insurance policy#Youtube

0 notes

Text

Term Life Insurance plans in Hyderabad

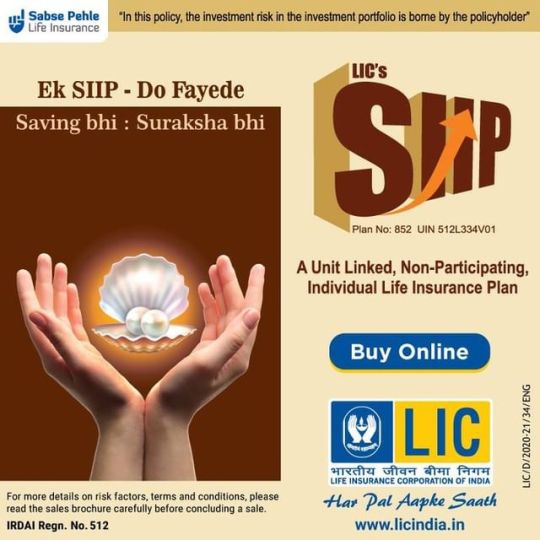

SIIP Plan Features and Benefits

Introduction

Life is unpredictable. To help you take control of your life, you need insurance. Which brings us to the most common dilemma you face what to choose. That’s why there is Life Insurance Corporation. The biggest life insurance company in India, with a network of over 13 lakh agents and 2048 branches all over India. With the highest claim settlement record in the world and a customer base of over 30 crore policy holders, LIC brings with it a world of experience. LIC Offers you customized insurance products that suit your specific needs, and helps you plan for a secure future.

Unique Identification No. 512L301V01

Your financial priority in life, be it savings, protection or investment, depends on the stage of life you are in. With changing life stages, your priorities will change as well. To meet these constantly evolving needs, you may need to buy different policies at every stage.

Now, LIC of India presents an unit-linked non-participating individual life insurance plan, LIC's SIIP which comes out as an opportunity to monetize the investment options offered by the market.

Regular Premium, Non-Participating, Unit Linked Insurance

If the insured survives until the maturity date, the plan will offer an amount to the insured which will be equal to the fund value. In Addition to that, provided all due premiums under the policy have been paid, an amount equal to the total amount of Mortality Charges deducted in respect of life insurance cover shall be payable along with the Maturity benefit.

On the death of the insured, the nominee will be liable to receive the death benefits.

On the death (before the commencement date of risk) during the policy tenure, the plan will pay an amount which will be equal to the unit fund value to the nominee or the beneficiary.

On death after the date of commencement risk, an amount higher of basic sum assured or unit fund value or 105% of the total premium is payable.

The death benefits shall be payable either in lumpsum or in installments, if settlement options is opted for.

Min. age at entry

90 days (completed) *

Max. age at entry

65 yrs (near birthday)

Max. Maturity age

85 yrs (near birthday)

Policy Term

10 to 25 yrs

PPT

Same as Policy Term

Min. Basic S.A.

10 * Annualized premium for age below 55 years 7 * Annualized premium for age 55 years & above

Min. Premium

Yly

Hly

Qly

Mly (ECS)

40,000

22,000

12,000

4,000

Max. Premium

No limit. Annualized premium shall be payable in multiple of Rs. 1000 for all modes other than Mly. For Monthly (NACH), the premium shall be in multiples of Rs. 250

Modes allowed

Yly, Hly, Qly, Mly(NACH)

*Age at entry for the L.A. Is to be taken as nbd except for the min. Age at entry i.e. 90 days

Guaranteed Addition as a percentage of Annualized Premium as mentioned in the table below shall be added to the Unit fund on completion of specific duration of policy years provided all due premiums are paid and policy is inforce.

End of Policy Year Guaranteed Addition of one Annualized Premium

6

5%

10

10%

15

15%

20

20%

25

25%

This is the cost of life insurance cover. Mortality charges will be taken every month by canceling appropriate number of units out of your fund value.

This Plan does not have provision to invest additional money as Top-Up.

No Policy Administration charges shall be applicable under this plan.

If at a later stage your financial priorities change, you can switch between different funds at any time. There is a provision of 4 free switches every policy year. Any switch beyond this limit will be charged at Rs.100/- per switch. Partial switching is not allowed.

The Fund Management Charge (FMC) for the various funds will be as follows:

1.35% p.a. of Unit Fund for all the four fund types available under an inforce policy.

I.e. Bond fund, Secured fund, Balanced fund and Growth fund.

0.50% p.a. of Unit Fund for "Discontinued policy fund".

FMC will be deducted on the date of computation of NAV. NAV, thus declared, will be net of FMC.

In the unfortunate event of accidental death, apart from the emotional trauma, there are financial liabilities a family must face. This rider offers cover against Accident and Disability.

In the event of the death due to accident, the nominee gets an Accident Sum Assured under the rider.

Accident Benefit can be availed of as an optional Rider benefit by paying an additional premium of Rs. 0.40 for every Rs. 1,000/- of the Accident Benefit Sum assured per policy per year by cancellation of appropriate number of units.

The Plan has a provision to receive the death benefit amount in 5 yearly or 10 half yearly installments.

The installment amount shall be total no of units as on the date of death divided by total number of installments. The no. of units arrived at in respect of each installment will be multiplied by the NAV as on the date of installment payment.

You can either surrender the policy or you can partially withdraw the amount. If policy is surrendered before completion of 5 years the unit value on the date of surrender is paid but only after completion of 5 years. But once premium has been paid for 5 years and policy is surrendered, full unit value is paid on date of surrender. The partial withdrawal is allowed only after completion of 5 years subject to following conditions:

Policy Year Maximum Withdrawal Allowed

6th to 10th Year

20% of Unit Fund

11th to 15th Year

25% of Unit Fund

16th to 20th Year

30% of Unit Fund

21st to 25th Year

35% of Unit Fund

If partial withdrawal is opted, the sum assured will be reduced for the withdrawn amount for 2 years period from the date of withdrawal

if premiums under the policy have not been paid before the expiry of the grace period (30 days), then the policy shall be in a state of discontinuance. During the grace period, the policy shall be treated as in-force and the mortality as well as accident benefit cover charges will be applicable as usual.

Benefits payable under the policy upto to expiry of grace period shall remain same except partial withdrawal, which shall not be allowed if all due premiums have not been paid.

Upon expiry of the grace period, the Unit fund Value after deducting the Discontinuance Charges shall be converted into monetary terms. This monetary amount shall be transferred to the Discontinued Policy Fund and the risk cover and rider cover, if any, shall cease.

On such discontinuance, a communication will be sent to you within three months of the date of first unpaid premium, communicating the status of the policy and the option of revival available during the revival period of three years from the date of First Unpaid Premium.

Policy can be surrendered anytime during the policy term.If policyholder surrenders the policy during 5 year lock in period, then the Unit Fund value after deducting the discontinuance charge shall be converted into montery amount which shall be transferred to the Discontinued Policy fund. If policyholder surrenders the policy after completion of 5 year lock in period, then the Unit Fund value on the date of surrender shall be payable. There will be no discontinuance charge under the policy.

The proceeds of Discontinued Policy Fund in respect of the policy shall be higher of Discontinued

Policy Fund Value or the Guaranteed Monetary Amount. The Guaranteed Monetary Amount is the accumulation of monetary amount transferred into the Discontinued Policy Fund at the guaranteed interest rate.

Currently, this guaranteed interest is 4% p.a. from the date of withdrawal to the end of 5 years from commencement. The amount along with this guaranteed interest will be due to you only at the end of five years.

0 notes

Text

Tax savings investments in a nutshell

This article is written by Kamala Pulugundla.

Introduction

Given a choice, the majority of us would not like to pay tax on the income we earn. However, it is essential that we pay tax. As citizens of India, we are also consumers of the public infrastructure and facilities. Thus, it is our responsibility and duty to contribute towards its development and maintenance. This contribution can be made by duly paying the taxes on income to the government, after availing the benefits under the Income Tax Act, 1961 in the form of exemptions and deductions, as income tax is the major source of government revenue.

The best time to plan investments, is the beginning of the financial year, which commences from April. This is because it will help you take planned and informed decisions rather than in a hurry. Early investments help you to earn compounded returns and help achieve long term goals.

Following is a summary of tax saving investments for ready reference. It shall then be followed by a detailed analysis.

Summary:

Section / serial no

Particulars

Benefits

limitations

80C

1.1

Life Insurance Premium

Maturity proceeds tax tax-free u/s 10(10D) subject to conditions

Maximum deduction Rs. 150000

1.2

Public Provident Fund

Low risk and guaranteed returns

Interest accrued exempt u/s 10(11)

Maturity proceeds exempt u/s 10(11)

Maximum deduction Rs. 150000

Mandatory lock in period – 15 years

1.3

National Saving Certificate (NSC)

Interest received – deduction allowed u/s 80C

Can avail secured loans against NSC

Maximum deduction Rs. 150000

1.4

Statutory Provident fund (SPF)/ Recognized Provident fund (RPF)

Interest on RPF exempt up to 9.5%

SPF Interest fully exempt

1.5

Fixed deposits (FD) for a period of 5 years or more

Guaranteed returns

Handsome interest depending on investment period

Avail loans against FD

1.6

Notified bonds of NABARD

Tax free bonds. Thus no tax and TDS

Secured, since backed by Government of India

1.7

Senior citizens saving scheme (SCSS)

Low risk, fixed income

Maximum investment Rs. 15,00,000

Eligibility – individuals above the age of 60 years or retired at the age of 55 or later or under VRS

Tenure – 5 years + 3 years

Max deduction u/s 80C 1,50000

1.8

Unit Linked Insurance Plan (ULIP)

Maturity proceeds exempt u/s 10D. no long term capital gain

Maximum deduction Rs. 150000

1.9

Housing loan

Deduction in respect of principal amount repaid

1.10

Notified units of Mutual fund and ELSS

Consistent and regular returns subject to market risk.

Maximum deduction Rs. 150000

Lock in period of 3 years

80CCC

Contribution to Pension fund of LIC or other insurance company

Premium paid qualifies deduction

Death benefit paid exempt u/s 10(20D)

Commuted pension received is exempt

Maximum deduction Rs. 150000

3.80CCD

Contribution to Pension Scheme of Central Government/ New Pension Scheme (NPS)

Contribution qualifies for deduction maximum of Rs 1,50,000

Additional deduction of Rs. 50,000 granted u/s 80CCD(1)

Employers Contribution can be claimed as deduction U/s 80CCD(2)

80CCE

Deduction u/s 80C + 80CCC + 80CCD(1) restricted to Rs. 1,50,000

80D

Medical Insurance Premium

Forced savings for securing health and saving tax

Detailed analysis

Specific Investments: Section 80C

Eligible Assessee: Individual and HUF

Aggregate maximum deduction that can be claimed for Investments u/s 80C: Rs. 1,50,000/-

Investments u/s 80C:

Life Insurance Premium (LIP):

Individual: can claim deduction for LIP paid for self, spouse and children. No deduction can be claimed in respect of LIP paid for parents.

Maximum premium that can be claimed as deduction:

If Policy issued before 01/04/2012:

If Policy issued after 01/04/2012:

If Policy issued after 01/04/2013 for a person with disability specified u/s 80U:

Lower of:

Lower of:

Lower of:

Premium paid

Premium paid

Premium paid

20% of sum assured

10% of sum assured

15% of sum assured

Example:

Premium paid: Rs. 20,000

Sum Assured: Rs. 1,35,000

Deduction Allowed will be as under:

If Policy issued before 01/04/2012:

If Policy issued after 01/04/2012:

If Policy issued after 01/04/2013 for a person with disability specified u/s 80U:

Lower of:

Lower of:

Lower of:

Premium paid: 20,000

Premium paid: 20,000

Premium paid: 20,000

20% of sum assured: 1,35,000*20% = 27,000

10% of sum assured: 13,500

15% of sum assured: 20,250

Deduction allowed: 20,000

Deduction allowed: 13,500

Deduction allowed: 20,000

(If the Policy was taken on after 01/04/2012 but before 01/04/2013, then maximum deduction allowed shall be 10% of sum assured i.e. 13,500.

Benefits

Deduction u/s 80C as specified above from the gross total income

U/s 10(10D) the proceeds on maturity are Tax-free subject to certain conditions:

Conditions u/s 10(10D):

If the premium paid is within the above limits, then the proceeds on maturity are completely tax free.

If the premium paid exceeds the above limits, then taxability would be as under:

Receipts before 01/09/2019

Receipts after 01/09/2019

Entire sum assured taxable

TDS applicable u/s 194DA: 1% on sum assured i.e. proceeds on maturity

Amount taxable:

Maturity proceeds less premium paid

TDS applicable u/s 194DA: 5% on Maturity proceeds less premium paid

Note: No TDS of proceeds on maturity is less than Rs. 1,00,000.

Amount deposited in Public Provident Fund (PPF)

(Contribution made in respect of resident assessee, spouse and children. Thus NRIs are not eligible to open a PPF account. However, existing accounts on their name can continue.)

Benefits:

Deposits in PPF account qualify for deduction u/s 80C

Low Risk and guaranteed returns as this plan is mandated by the government.

The annual contribution starts as low as Rs. 5,00 with a maximum cap on annual contribution of Rs.1,50,000.

Benefit of availing loans against the investment amount.

Note:

Loan can be availed any time between 3rd and 6th year from the date of activation of the PPF account.

The maximum amount that can be availed as loan is 25% of the amount available in the PPF account.

The maximum period of loan availed as above is 3 years or 36 months.

Total interest accrued on investment in PPF is also exempt u/s 10(11).

Entire proceeds received on maturity also exempt u/s 10(11)

A further extension of 5 years is available after maturity.

Investment in PPF can be made in installments as well. A maximum of 12 installments is allowed in a year.

Limitations:

Mandatory lock in period of 15 years is imposed on the principal amount i.e. amount deposited. However, partial withdrawal is allowed in case of emergencies. Such a withdrawal can however be made only after 5 years of the activation of the PPF account. 50% of the total balance can be withdrawn in a single transaction permitted in a financial year.

Funds cannot be liquidated before the maturity.

Investment in National Saving Certificate (NSC)

NSC is an Indian Government Savings bond, primarily for small savings and low risk appetite investors. It is a popular Income Tax saving instrument in India.

Term: 5 – 10 years

Benefits:

Qualify for deduction u/s 80C

Interest received thereon on such Investment also allowed as deduction u/s 80C as the same gets accrued and reinvested, except in the year of maturity

Can be used to avail secured loans.

Maximum Limit: Rs. 1,50,000

Taxability:

Interest income accrued needs to be disclosed in the Income Tax Return and claimed as deduction every year except in the year of maturity. In the year of maturity, the interest income is taxable under the head Income from Other Sources.

Contribution towards Statutory provident fund (SPF), Recognized provident fund (RPF)

Benefits:

Deduction u/s 80C

You can transfer your old pension fund account to your new employer

Interest on RPF is exempt upto 9.5%. Interest exceeding 9.5% will be added to the employee’s salary.

Interest from SPF: fully exempt

Taxability:

Proceeds on termination of service or withdrawal is tax free provided, one has been in continuous service for not less than 5 years u/s 1(11) and 10(12). Service rendered to the previous employer is also considered. Benefit of exemption is also available if the continuous service is less than 5 years due to reasons beyond the control of the employee (illness, discontinuance of employer’s business, etc.)

If the above condition is not satisfied, then the amount of proceeds are taxable.

Applicability of TDS u/s 192A if proceeds are not exempt: 10% (TDS not applicable if proceeds are less than Rs. 50,000.

Fixed Deposits (FDs) in a Scheduled bank or Post office for 5 years or more

Benefits:

Deduction u/s 80C of the investment amount

Non-volatile investment with guaranteed return

Considerable interest rates

Limitation

Premature withdrawal not allowed

Loan cannot be availed against these tax saver FD’s

Taxability:

Interest earned on these FDs is taxable under the head income from other sources.

Applicability of TDS: 10% –

In case aggregate interest on FDs from a single bank exceeds Rs. 40,000 (w.e.f 011/0402019. Earlier the limit was Rs. 10,000)

In case of senior citizens, the above limit is Rs. 50,000

Deposits in notified bonds of NABARD

Benefits:

Deduction of investment amount u/s 80C.

NABARD issues tax free bonds thus there is no Tax and consequently no TDS under the Income Tax Act, 1961.

These bonds are backed by Government of India.

These bonds are mostly AAA or AA rated by CRISIL and are thus highly secure.

Considerable annual coupon rate/ interest and such interest is tax free.

NABARD tax-free bonds are proposed to be listed on stock exchange. Thus, the investor has the option to sell in the secondary market, if he wishes to exit.

Taxability:

NABARD also issues zero- Coupon Bonds. That is no interest/ coupon will be payable during the life of the bond. Such bonds are issued at deep discount and generally redeemed at par or face value. On maturity, the difference between the maturity value and issue price is treated as capital appreciation. If the holding period is more than one year, it shall be a long term capital gain at the rate of 10% without indexation benefit and 20% with indexation benefit as per section 112 of the Income Tax Act, 1961. This generates considerable tax efficiency as against other non-interest paying bonds or zero coupon bonds, where the differential amount is treated as interest instead of capital appreciation, and hence taxed under Income from other sources and taxed at regular slab rates along with other income.

Deposit in Senior Citizen Saving Scheme (SCSS)

Eligibility:

Individuals above the age of 60 years.

Individuals who retired at the age of 55 years or later but before 60 years under superannuation or Voluntary retirement Scheme.

Retired defense personnel on satisfaction of certain terms and conditions.

Not eligible – NRIs, Person of Indian Origin, any member of a HUF

Benefits:

Low risk, fixed income investment, interest being paid quarterly

Moderate return. Current interest rate is 7.4%

It is similar to FDs but unlike FDs it is a government backed security and hence more secure.

Investment in this account can be made of an amount as low as Rs. 1,000, maximum investment cap being Rs. 15,00,000.

SCSS accounts can be held either individually or jointly with a spouse.

Premature termination is possible. However, it attracts a penalty of 1% – 1.5% of the deposit amount. No penalty will be charged if the investor is deceased before maturity.

Tenure of Deposit: 5 years with a further extension of 3 years

Taxability:

Interest Income which is credited to savings account of the same bank linked to it, shall be subject to tax at regular slab rates. TDS at the rate of 10% u/s 194A applicable if the total interest in a fiscal year exceeds Rs. 50,000.

Maximum deduction u/s 80C: Rs. 1,50,000.

Contribution to Unit Linked Insurance Plan (ULIP)

ULIP is a plan in which the policyholders pay either an annual or monthly premium. A small amount of this premium goes towards securing the life of the investor, and the balance amount is put into investments in stock, bonds, and mutual funds. Thus, it acts as both life insurance cover, as well as an investment plan. However, investments made are subject to capital market risks.

Benefits:

Deduction u/s 80C of the premium amount paid.

Dual benefit of protection and Investment.

ULIPs offer a range of high, medium and low risk investment options for varied risk appetite investors.

Maturity proceeds are exempt u/s 10D. Thus, there is no Long term capital gain tax.

Allows you to switch between fund options with no additional charges up to 12 switches in a year.

Partial withdrawal allowed in case of unforeseen future events.

Benefit of market linked growth without actually participating in the stock market.

Availability of top-up facility. Thus, an investor can voluntarily invest an amount over and above the premium amount, when the ULIP is performing well.

Maximum deduction u/s 80C: Rs. 1,50,000.

1.9. Housing Loan

Benefits:

Deduction in respect of interest paid on housing loan is available u/s 24 with a cap of Rs. 2,00,000 if the property is self-occupied. There is no limit on deduction under this section if the property is let-out.

Deduction in respect of Principal amount is available u/s 80C.

1.10. Notified units of Mutual fund

Benefits:

Deduction /us 80C of the amount invested, maximum cap being Rs.1,50,000.

Consistent and regular returns.

Offers varied types of investment plans to suit investor needs and long term goals.

Taxability:

Taxation of Dividend:

Up to financial year 2020-2021

From financial year 2020-2021

Concerned mutual fund was subject to Dividend Distribution Tax (DDT) u/s 115R

Mutual funds no longer liable to deduct DDT u/s 115R

Income received was exempt in the hands of investor u/s 10(35)

Dividend Income taxable at regular tax rates. TDS provisions are also applicable.

1J. Notified Pension Scheme of UTI or Mutual Fund

NOTE: aggregate amount of deduction /s 80C in respect of all the above schemes shall not exceed Rs. 1,50,000.

Contribution to Pension fund of LIC or other insurance company u/s 80CCC

Eligible assessee: Individual

Maximum amount of Deduction u/s 80CCC: Rs. 1,50,000

Benefits

Premium paid qualifies for deduction u/s 80CCC subject to maximum of Rs. 1,50,000

Death benefit paid under LIC Pension Plan is exempt u/s 10(10D)

Commuted pension received from such funds is exempt. Whereas, uncommuted pension received is taxable

Contribution to Pension Scheme of Central Government / new Pension Scheme (NPS): section 80CCD

Eligible Assessee: Individual

Amount of deduction:

80CCD(1)

Salaried employees

Other Individuals

Lower of:

Lower of:

Employees contribution

Assessee’s contribution

10% of salary (Basic + DA)

20% of Gross Total Income

80CCD(1B): Additional deduction of Rs. 50,000 shall be allowed other than contributions covered u/s 80CCD(1)

80CCD(2): Employers contribution to NPS for the benefit of the employee:

Employers contribution is first taxed as salaries and thereafter allowed as deduction u/s 80CCD(2)

Deduction:

Lower of –

Employer’s contribution

10% salary (Basic + DA)

80CCE: Aggregate deduction /s 80C + 80CCC + 80CCD(1) is restricted to a maximum of Rs. 1,50,000

Tax planning advice: Since 80CCD(1B) is not covered under 80CCE limit, it is advisable to first exhaust Rs. 50,000 deduction available u/s 80CCD(1B) and the balance u/s 80CCD(1).

Section 80D: Deduction in respect of medical Insurance Premium, central government health scheme, preventive health check-up and medical treatment

Eligible assessee: Individual & HUF

Deduction in respect of premium paid for:

In case of individual: self, spouse, dependent children and parents

In case of HUF: Any member of HUF

Amount of Deduction:

Particulars

Individual

HUF

Self, spouse, dependent children

parents

Members

A

Medical insurance premium

Yes

Yes

Yes

Central Government health scheme

Yes

No

No

Preventive health check-up

yes

yes

no

General deduction i +ii + iii

Max Rs. 25000

Max rs. 25000

Max rs. 25000

Additional deduction when policy taken on life of senior citizen

Max 25000

Max 25000

Max 25000

B. Medical Expenditure of senior citizen and mediclaim premium not paid for such person

Max deduction: 50,000

Max deduction: 50,000

Max deduction: 50,000

Maximum deduction (A+B)

Max deduction: 50,000

Max deduction: 50,000

Max deduction: 50,000

Benefits

Acts as both forced savings for securing health and savings in tax.

Important pointers to be kept in mind while planning investments:

Check for existing tax-saving expenses like LIC Premiums, children’s tuition fees, Home loan repayment, etc.

Deduct the above amount from Rs. 1,50,000 to arrive at balance investment to be made, if the aggregate of the expenses in pt.1 is below Rs. 1,50,000

Choose appropriate tax-saving investments based on your risk-taking capability and short-term and long term fund requirements and goals.

LawSikho has created a telegram group for exchanging legal knowledge, referrals and various opportunities. You can click on this link and join:

https://t.me/joinchat/J_0YrBa4IBSHdpuTfQO_sA

Follow us on Instagram and subscribe to our YouTube channel for more amazing legal content.

The post Tax savings investments in a nutshell appeared first on iPleaders.

Tax savings investments in a nutshell published first on https://namechangers.tumblr.com/

0 notes

Text

RBI Floating Rate Savings Bond Vs PMVVY Vs SCSS

RBI Floating Rate Savings Bond Vs PMVVY Vs SCSS which is the best option for senior citizens? Replacing the 7.75% Government of India Savings Bonds, Government announced the Floating Rate Savings Bonds, 2020 (Taxable).

What are Floating Rate Savings Bonds?

Usually, when you invest in Bonds, the coupon (interest) what you get is fixed throughout the period. However, in the case of floating rate bonds, the interest is not fixed and it changes as per the specified bond feature.

Hence, such bonds are sensitive to interest rate fluctuation. It is not like your typical Bank FD, where you know well in advance the interest rate payable by banks for the full FD tenure.

The term of the bond is fixed. However, if you are not interested to retain the bonds, then you can sell it in the secondary market at the prevailing price of the bond if such bonds are eligible to trade.

RBI Floating Rate Savings Bond, 2020 (Taxable) Features and Eligibility

In addition to above features, let me share certain important features of this bond.

# If holder of the bond turned NRI, then he can hold the bond up to maturity.

# The Bonds will be issued only in the electronic form and held at the credit of the holder in an account called Bond Ledger Account (BLA), opened with the Receiving Office.

# The interest on the bonds will be payable half-yearly from the date of the issue of the bond. Once on 30th June and another on 31st December yearly. As I mentioned above, there is no option of cumulate in this bond.

# The interest will change on a half-yearly basis starting from 1st January 2021. This interest rate is linked to the prevailing interest rate of NSC (Post Office National Savings Certificate)+35 BPS (100 BPS=Rs.1). Hence, the coupon rate of Floating Rate Savings Bonds, 2020 (Taxable) for the period of 1st July 2020 to 31st December 2020 is fixed at 7.15%. Because the current NSC interest rate is 6.8%+0.35%=7.15%.

# Interest will be payable directly to the bond holder’s account.

# The bonds will repayable after the completion of 7 years. Premature withdrawal is allowed only for those whose age is 60 years and above subject to the submission of document relating to the date of birth proof. The minimum lock-in period for the age group 60 Yrs to 70 Yrs is 6 years. For 70 Yrs to 80 Yrs is 5 Yrs and for those whose age is beyond 80 years is 4 years.

# Even though you request for redemption as per your age slab, the redemption amount will be transferred with immediate next interest rate period. Hence, irrespective of your submission for premature withdrawal, Govt will process it either on 1st July or 1st January every year. Also, in such premature closure, Govt will deduct 50% of the last coupon payment.

I have written a detailed post about RBI Floating Rate Savings Bonds, You can refer the same for more details.

Features of Pradhan Mantri Vaya Vandana Yojana (PMVVY)

Let us now discuss about the features and eligibility of Pradhan Mantri Vaya Vandana Yojana (PMVVY) 2020- 2023.

Some other features of this product are as below:-

# You can surrender this policy during the policy period under certain exceptional circumstances like pensioner requires money for treatment of any critical/terminal illness of self or spouse. Surrender value payable will be 98% of the purchase price.

# You can avail the loan facility after completion of 3 policy years. The maximum loan payable will be 75% of the purchase price. Interest on the loan will be recovered from the pension amount.

# Pension is payable at the end of each period, during the policy term of 10 years, as per the frequency of monthly/ quarterly/ half-yearly/ yearly as chosen by the pensioner at the time of purchase.

# Pradhan Mantri Vaya Vandana Yojana (PMVVY) scheme does not provide tax deduction benefit under section 80C of the Income Tax Act. Returns from this scheme will be taxed as per existing tax laws.

# There is no TDS on this product.

# During the policy period, the pensioner will receive the monthly, quarterly, half-yearly, or yearly pension as he has opted during the time of buying. On the death of the pensioner during the policy term, the Purchase Price will be refunded to the nominee (or legal heirs in the absence of nominee). If the pensioner survives up to the end of the policy term, Purchase Price and final installment of the pension will be paid to the pensioner.

# You can buy this through LIC (either online or offline).

Read a complete detailed post “Pradhan Mantri Vaya Vandana Yojana (PMVVY) 2020 – 2023 – 5 Changes you must know“.

Features of Senior Citizen Savings Scheme (SCSS)

# Anyone who attained the age of 60 years or above can invest in this product.

# NRIs and HUF are not allowed to invest.

# You can open Senior Citizen Savings Scheme either in the post office or with recognized 24 PSU banks and one private bank.

# Minimum investment is Rs.1,000 and maximum is Rs.15,00,000.

# The current interest rate is 7.4% and will change on quarterly basis.

# Interest will be payable on quarterly basis.

# Premature withdrawal is allowed but with certain conditions. In case the account is closed after the expiry of 1 year but before the expiry of 2 years from the date of opening of the account, an amount 1.5% of the deposit shall be deducted and the balance paid to the depositor. In case the account is closed on or after the expiry of 2 years from the date of opening of the account, an amount equal to 1% of the deposit shall be deducted and balance paid to the depositor.

# Account will not be extended automatically.

# You can extend for a period of 3 years after 5 years maturity period. However, you have to submit Form B within one year from the date of maturity.

# Also, such extended accounts can be closed after one year of extension without any penalty. Means after completion of 6th year, one can withdraw the amount without any penalty.

# Interest rate during such extension period will be as per prevailing rate of interest after 5 years maturity.

# Only one extension is allowed to the old account. Means after 5 years completion of SCSS, you can extend only for once. After that, the account will be matured.

# However, you are free to open one more account during the old account tenure or after maturity of old account subject to the maximum ceiling of Rs.15 lakh.

# Loan is not available.

# One can avail up to Rs.1,50,000 as a maximum benefit under Sec.80C by investing in SCSS scheme.

# Interest Income-Interest income is treated as taxable income. Hence, there is no tax benefits. It will be taxed as per your tax slab. TDS can be deducted on interest earned if it exceeds the minimum limit prescribed by the Government.

Read the complete post about SCSS at “Post Office Senior Citizen Scheme (SCSS)-Benefits and Interest Rate“.

RBI Floating Rate Savings Bond Vs PMVVY Vs SCSS – Which is the best?

Let us understand which is the best among RBI Floating Rate Savings Bonds Vs PMVVY Vs SCSS. I will try to compare all these products with respect to the features for your benefit.

# Tenure

RBI Floating Rate Savings Bond offers you 7 years. PMVVY is for 10 years and SCSS is for 5 years.

# Minimum and maximum investment

In case of RBI Floating Rate Savings Bonds, the minimum investment is Rs.1,000 and there is no maximum limit. However, in the case of PMVVY, the minimum investment is Rs.1,56,658 for a yearly pension of Rs.12,000 and maximum investment is Rs.15,00,000. In case of SCSS, the minimum amount is Rs.1,00,000 and the maximum is Rs.15,00,000.

# Interest rates

In the case of RBI Floating Rate Savings Bonds, the current coupon up to 31st December 2020 is 7.15%. However, as I pointed above, it will change twice in a year. Once in 1st July and another time on 1st January. Hence, you can’t expect a fixed interest on this bond. However, in the case of PMVVY and SCSS the current interest rates are 7.4%.

# Frequency of interest rate payment

In case of RBI Floating Rate Savings Bonds, the interest payment is a half-yearly basis. However, in case of PMVVY it is monthly, quarterly, half-yearly, or yearly. In case of SCSS, it is on a quarterly basis.

In case of RBI Floating Rate Savings Bonds, the interest rate will change once in 6 months. Once on 1st January and second time on 1st July every year.

In case of PMVVY, the interest will be revised on yearly basis. For SCSS, it is on quarterly basis.

However, if you invested in PMVVY and SCSS now, then the same interest rate will be applicable for you throughout the end. Even though the interest rate on PMVVY and SCSS change on a yearly and quarterly basis respectively, it is for NEW INVESTORS but not for the existing investors.

# Minimum Age

There is no such mention of a minimum age limit in RBI Floating Rate Bonds. However, in case of PMVVY and SCSS, the minimum age limit is 60 years.

# Liquidity

In case of RBI Floating Rate Bond, premature withdrawal is allowed only for those whose age is 60 years and above subject to the submission of document relating to the date of birth proof. The minimum lock-in period for the age group 60 Yrs to 70 Yrs is 6 years. For 70 Yrs to 80 Yrs is 5 Yrs and for those whose age is beyond 80 years is 4 years.

The Bonds are not allowed to transfer, trade or eligible for collateral.

In case of PMVVY, you can surrender this policy during the policy period under certain exceptional circumstances like pensioner requires money for treatment of any critical/terminal illness of self or spouse. Surrender value payable will be 98% of the purchase price.

In case of SCSS, in case the account is closed after the expiry of 1 year but before the expiry of 2 years from the date of opening of the account, an amount 1.5% of the deposit shall be deducted and the balance paid to the depositor. In case the account is closed on or after the expiry of 2 years from the date of opening of the account, an amount equal to 1% of the deposit shall be deducted and balance paid to the depositor.

# Loan facility

In case of RBI Floating Rate Bond, it is not eligible as collateral for availing loans from banks, financial Institutions and Non-Banking Financial Companies.

In case of PMVVY, you can avail the loan facility after completion of 3 policy years. The maximum loan payable will be 75% of the purchase price. Interest on the loan will be recovered from the pension amount.

In case of SCSS, you are not allowed to avail the loan by pledging it. Because this scheme is meant for regular income from your investment.

# Tax Benefits while investing and the returns

Let us discuss the tax benefits of RBI Floating Rate Bond Vs PMVVY Vs SCSS during an investment and the tax treatment of interest income.

Tax Benefits during investment

In the case of RBI Floating Rate Bond and PMVVY, there are no tax benefits. However, in the case of SCSS, you can avail the tax benefits of up to Rs.1,50,000 under Sec.80C by investing in this product.

Tax Benefits on interest income

In RBI Floating Rate Bond, Interest on the Bonds will be taxable under the Income Tax Act, 1961 as applicable according to the relevant tax status of the Bondholders. The interest payment is subject to TDS laws.

In case of PMVVY and SCSS, returns from these scheme will be taxed as per existing tax laws.

# TDS Facility

In case of RBI Floating Rate Bonds, tax will be deducted at source while making payment of interest. However, by submitting the Form 15G/H, you can avoid the TDS.

In case of PMVVY, there is no TDS. But in case of SCSS, TDS can be deducted on interest earned if it exceeds the minimum limit prescribed by the Government.

How to buy?

You can buy RBI Floating Rate Bonds from designated Banks.

You can buy PMVVY through LIC (either online or offline). However, in the case of SCSS, you can open the Senior Citizen Savings Scheme either in the post office or with recognized 24 PSU banks and one private bank.

Conclusion:-There is nothing called the best. However, with comparison to RBI Floating Rate Savings Bond Vs PMVVY Vs SCSS, you can easily decide which is the best for your requirement. All three products are SAFE. Hence, choose the products based on your actual requirements.

Refer our latest posts:-

Top 5 Super Top-up Health Insurance Plans in India 2020

RBI Floating Rate Savings Bond Vs PMVVY Vs SCSS

Latest Post Office Interest Rates July-Sept 2020

Covid Standard Health Policy or Corona Kavach Policy – Features and Benefits

Government of India Floating Rate Savings Bonds, 2020 (Taxable) – Should you invest?

How to create ONE CRORE Rupees from EPF?

The post RBI Floating Rate Savings Bond Vs PMVVY Vs SCSS appeared first on BasuNivesh.

RBI Floating Rate Savings Bond Vs PMVVY Vs SCSS published first on https://mbploans.tumblr.com/

0 notes

Text

TAXABILITY OF LIFE INSURANCE MATURITY AMOUNT- BUDGET 2019

TAXABILITY OF LIFE INSURANCE MATURITY AMOUNT- BUDGET 2019

Most of us think that the Taxability of Life Insurance Maturity Amount is tax-free. But many of us are unaware that the Government has newly introduced the TDS on Life Insurance Maturity Amount. Further, it is increased in the Budget 2019.

Hence, let us understand the applicable TDS on Life Insurance Maturity Amount.

Before understanding the TDS concept, let us first understand the taxation on Life Insurance Policies.

Must Read –

TERM LIFE INSURANCE COMPANIES CHOOSE BEST PLAN ONLINE

Here are the sections to know the Taxability of Life Insurance Maturity Amount

1) Section 80C of Income Tax Act

We all very well know that whatever premium you pay towards life insurance can be shown under Sec 80C. But there are some conditions to qualify under this section.

If the premium paid towards a life insurance policy on self, spouse or kids and if the policy was issued on or before 31st March 2012, then eligible deduction under Sec 80C is only 20% of the sum assured. (Example I)

If the premium paid towards a life insurance policy on self, spouse or kids and if the policy was issued on or after 1st April 2012, then eligible deduction under Sec 80C is only 10% of the sum assured. (Example II)

2) Sec 80CCC of Income Tax Act

Any premiums paid by taxpayer towards pension schemes like LIC’s New Jeevan Suraksha will be eligible for deduction under this section. Please note below two points here.

This section only deals with the individual taxpayer. Hence the contribution made in the name of spouse or kids is not eligible for taxation.

The aggregate amount of deduction under Sec80C, Sec80CCC and Sec 80CCD (1) shall not exceed Rs.1,50,000.

3) Section 10 (10D) of Income Tax Act

Now it is important to understand Section 10 (10D) of the Income Tax Act.

If you purchased the policy on or before March 31, 2003, then such maturity from these policies will be TAX-FREE.

If you purchased the policy after 1st April 2003 to 31st March 2012, and premium paid towards such policy on self, spouse and kids are less than 20% of sum assured, then such maturity amount is TAX-FREE.

Next, if you purchased the policy on or after 1st April 2012, and premium paid towards such policy on self, spouse and kids are less than 10% of sum assured, then such maturity amount is TAX-FREE.

Death Claim amount one receives from Life Insurance is completely TAX-FREE.

Any Sum received under Keyman Insurance is TAX-FREE.

If the policy is issued on or after 1st April 2013 for those who are disabled or suffering from ailments as specified by the Income Tax Act, where the premium payable in any given year exceeds 15% of the actual sum assured (as per section 80DDB) is TAX-FREE.

If you purchased the policy which is issued on or before March 31, 2003, then such maturity from these policies will be TAX-FREE.

Some Practical Examples on TDS on Life Insurance Maturity Amount

Example I

Let us say Mr.A took a life insurance plan before 31st March 2012 with Sum Assured as Rs.3,00,000.The Policy term being 10 years and yearly premium is Rs.65,000.

But according to the above rule, only 20% of Sum Assured (in this case 20% of Rs.3,00,000 I.e Rs.60,000) is eligible for tax deduction under Sec 80C.

So Mr.A can avail benefit only to Rs.60, 000 not Rs.65, 000.

Example II

Let us say Mr.A took a life insurance plan after 1st April 2012 with Sum Assured as Rs.3,00,000 term being 10 years. The yearly premium was Rs.65,000. But according to the new above rule, only 10% of Sum Assured (in this case 10% of Rs.3,00,000 I.e Rs.30,000) is eligible for tax deduction under Sec 80C. So Mr.A can avail benefit only up to Rs.30, 000 but not whole Rs.65, 000.

Must Read –

INSURANCE TYPES – DIFFERENCES YOU MUST KNOW

Taxability of Life Insurance Maturity Amount- Budget 2019

A few years back Government of India introduced the TDS concept on the Life Insurance Maturity Amount. This TDS rate is now revised in Budget 2019.

In finance bill of Budget 2019, the government said, “It is proposed to amend the said section so as to provide that the levy of tax deduction at source shall be on the income comprised in the sum payable by way of redemption of a life insurance policy, including the sum allocated by way of bonus on such life insurance policy, excluding the amount exempted under the said clause (10D) of section 10 at the increased rate of five per cent.”

Hence, as per this change, there is a change in Income Tax Section 194DA. As per this, the TDS will be applicable to below conditions.

If your maturity amount exceeds more than Rs.1 lakh in a year.

Also, If the policies are not exempt as per the above said Sec.10(10D) of IT Act.

If you do not provide the PAN details with the Life Insurance Companies.

In such a situation, Life Insurance Companies will deduct the TDS. The revised TDS rate after Budget 2019 is as below.

if your maturity amount exceeds more than Rs.1 lakh a year and policies are not exempt as per the above said Sec.10(10D), then there will be a TDS of 5%.

If you do not provide the PAN details with the Life Insurance Companies, then there will be a TDS of 20%.

Must Read –

TOP SECRET TECHNIQUES TO CHOOSE THE INSURANCE POLICY

Note:-

The above said all rules are the same for

Term Life Insurance, Endowment Plans or ULIP Plans.

Maturity, Death Claim or Surrender of the Policies.

0 notes

Text

Collingwood Drivers Insurance?

"Collingwood Drivers Insurance?

I'm currently looking to get provisional driving insurance with this company and was wondering do I also need a full insurance policy alongside the provisional one with this company, Can not find any information about it thanks

BEST ANSWER: Try this site where you can compare quotes: : http://saleinsurancequotes.xyz/index.html?src=tumblr

RELATED QUESTIONS:

Car insurance broker or direct to insurance company?

I'm about to get a car, and i'm thinking about car insurance. The thing is, I don't know whether should i go to an insurance broker, or just shop around doing all these web quotes and find the cheapest out there and call them directly. Should i just do this or should i contact an insurance broker? What are the pros and cons of dealing w/ insurance broker? thanks""

I am learning to drive and want to buy a car. What should I buy and what will the insurance be like?

I am learning to drive and want to buy a car. What should I buy and what will the insurance be like?

How can i cut my insurance premiums? UK?

I have 1.9 diesel 306, and have also a TT99 on my driving license which although my ban ended a while ago i have to declare and keep on license till 11/11.I have been driving legally for 18months now but its costing me a fortune every month for the insurance. How can i reduce my insurance from average of around 3000. Or does anyone know what cars are likely to be cheap to insure and run, (baring in mind i have partner and two kids to fit in the car as well. Thanks in advanced""

Is there a website for seeing what class of car you have for insurance to see how much it wil be.?

I know insurance have classes of cars based on a number. Like my old school might be a 7. but my Escalade might be a 20 or something. Please help.

50cc Scooter Insurance Help?

I'm 16 in 9 days, and I'm going to celebrate with a Peugeot V Clic Silver Sport. However, I'm going to need insurance. I live in a quiet area, and my scooter will be kept in a locked, secure garage with four other scooters. I'm also very responsible and won't be thrashing it and doing wheelies. Does anyone think this will reduce the cost of insurance?""

""Car insurance help, i need advise?""

Im 15, hoping to buy a decent car (when i turn 17) that is reasonably cheap to buy and insure, i have around 10,000 budget for the car and 20,000 budget for the insurance, i work on cars so any mechanical problems wont be an issue and i am a very capable driver and certainly not a 'boy racer' i have experience in driving and i just want a nice car that i can keep for a long time that i can pass in and out if london in to my future job (architecture) any car and insurance company suggestions? And remember decent car, 2nd hand.""

Cheapest Car Insurance - Canada?

Need a cheap car insurance... Don't spout off answers if you have no idea... I've researched: TD, RBC, CAA, AllState and Statefarm Living in Ontario!""

Why do we need basic health insurance?

Health insurance should be for serious issues that require surgery or hospitalization. Why do I pay insurance to get a checkup or for routine visits? The problem with health insurance is it is too broad; therefore, it is too big. The idiots who say that car insurance is mandatory as an argument for mandatory health insurance leave out that it is only LIABILITY insurance that is mandatory. You are not required to insure fixing your own car if you choose not to. Think about how much more expensive it would be to take care of routine things like car maintenance, appliance replacement, etc., if they were handled through an insurance company. The answer seems to be to eliminate most of the unnecessary insurance and shrink it to only what is required. That along with serious tort reform would eliminate much of the red tape and cost. The person who abuses their things pays more to replace and fix them. Same thing with the fat people, who suck up most of the insurance money the rest of us pay.. If you choose to be fat, then you will pay more to repair your health. It seems pretty simple, but then again the current proposal is not really about health care is it???""

Low car insurance adjustment from liable company's adjuster?

Someone else hit my car while it was parked. It was very cut-and-dry. I got a police report, the officer talked to the driver. It states that my car was legally parked and the other driver is at fault. The damage is minor rear bumper damage, nothing too terrible. I filed with his insurance company, and after a lot of frustrating phone tag, an insurance adjuster came out and wrote me an estimate for $450. I had an adjustment for $734 from the local body shop for my make of car, and I showed it to him. I expressed my dissatisfaction with this estimate, and he said the body shop would settle with the insurance company directly for costs in excess of the estimate. $300 is a little much. Since it's minor damage, I think the body shop will probably take the money and do a shoddy job on the car. It's my understanding they are supposed to repair my car to pre-accident conditions. I got another estimate for $745 this weekend. I can't get it fixed for $450. What are my options? (cont'd)""

Affordable term life insurance quote?

What good is affordable term life insurance in florida?

How much insurance for a Mustang in Florida?

I'm 18 years old, and I want to get a Mustang and my insurance plan is going to be under my uncle's name (52 yrs old, but he has many records for crashing and tickets, his insurance for the Civic now is $800/ 6 months). If I get a brand new one using Progressive, AT LEAST how much it's gonna cost me for 6 months??""

Will the car insurance pay for my car to be fixed?

i was rear ended. its the other persons fault. the kid that hit me was driving their parents car. the parents had insurance on the car but the kid wasnt listed as a driver. just the mom and dad were. i was told since the car is insured then the insurace will pay for it no matter who was driving. is this true?

Do you find women only car insurance sexist?

Personally I do. For a start their buisiness is based around the idea that women are safer drivers even though what gender you are does not affect your driving, also all of the TV adverts for this insurance have sexist comments in them. If it had been the other way round and these car insurances were exclusive to men there would have been protests and accusations of sexism but because typically women are the victims of sexism it has gone unnoticed.""

Will geico insurance rate go up from storm damage?

My car got hit from a piece of tree/brances and scratched and dent it a little, will insurace go up?""

Health insurance question about coverage under age 26 while married? HELP?

Im currently age 22 and on my mothers health care plan and scheduled to get married in October. My question is, will I still be covered on my mothers insurance plan if my future spous has a form of employer insurance that i could be on. This would however kill her monthly take home pay. Shed make 300$ a month for full time job Im self employed and have NO Employer-based insurance opportunities and will still be 22 when married. So when i get married will i be kicked off my mothers insurance because i have the potential to be on my spouses insurance plan? This Affordable Care act law is somewhat vague on this topic""

How much does it cost to buy insurance for a small business?

How much does it cost to buy insurance for a small business?

Which will cost more to insure? 00-04 mustang base or 00-04 mustang gt?

I'm 17 and live in New York. Been driving with a clean record for one year and I currently pay $100/month on my mom's '10 camry. I want to get my own car and I have narrowed everything down to a mustang, but I can't decide between a base model or a gt. I have discounts on my current policy such as good student and drivers ed. I will also take a defensive driving course for an added discount and the new car will also bring about a multi-car policy discount which will be helpful. My mom will be contributing the same $100 towards the car as she is now and the rest I have to pay for by myself. I have heard that the base and gt will cost about the same to insure, but that doesn't seem right considering that the gt has 100+hp more than the base, but people have supported that by saying the base models are involved in more crashes among young drivers. So can anybody set the record straight for me? Please don't give me responses saying that only my insurance agent can tell me that or too high for you to afford. Also would it be a wise decision to drop collision coverage for a huge insurance discount? I don't plan on racing this car.""

Looking for best insurance product (LIC) which returns guaranteed & handsome amount on maturity along with acc?

Age : 35 yrs., married Premium Amount : 90 99 K per year Premium term : 25 to 30 yrs best lic plan combo plan""

Have any 19 year old male's managed to get their car insurance under 2 grand in the past year or so?

If so, what company were you with? On my mum's suzuki wagon the insurance quote from aviva have been ridiculously high, but I managed to get one for 2 grand with a 50% drop in price next year due to no claims, the cheapest i've managed so far. Anyone with experience know where to go or if it's possible to get it cheaper on a vauxhall corsa?""

How much will my car insurance rates go up if i turn my car accident into the insurance company?

I have full coverage and I'm 17. I currently pay 120 dollar a month for car insurance and I have good grades. I back into someone's car and dented it. Is it worth it to turn into the car insurance place?

""I'm 21 with the Gerber Life Insurance policy plan, should I continue?""

I got a mail indicating that I am not the owner of this policy (my parents started this for me when I was young). So I have a few questions, now that I am 21, do I have 10,000$ worth of life insurance for the rest of my life (without having to continue paying?) Why would I want to continue paying if this is just here as insurance in case for my burial costs.. isn't 10k enough for that? If I stop paying will I still have this 10,000 dollars in life insurance, or am I being forced to pay in order to keep it?""

USA Insurance for New Immigrants?

Hello!! I would like to inquire about medical insurance for new immigrants in the state of Florida. We have been here for 1 year now and who or what organization should we turn to? I have heard that a lot of them are expensive. I was told that we could get family insurance through employment -- but at the moment, my mom is the only one working with us, 3 dependents. So suggestion?""

Has car insurance gone up in the past couple of months?

My partner has just been on 'compare the market' and found that to insure his fiat punto its going to cost him nearly 800 - 2 months ago when he looked he was getting quoted 400. Its nearly doubled in costs!!! What is all that about?

When buying motorbike insurance is CBT= Provisional ?

I was looking about for insurance quotes for a 125 and when you select what type of licence you have it dose not say CBT at all, but it says UK provisional and UK moped, but i dont think moped is a CBT because moped is 50cc only, can anyone tell me what a CBT licence is called when buying insurance""

Whats a good/affordable motorcyle insurance company?

I want to buy a Yamaha R6 but the premiums for a bike are ridiculous.. cheapest ive found was through progressive for 900$/month... thats more than my leased car payment and car insurance a month... anyone? thanks.

Collingwood Drivers Insurance?

I'm currently looking to get provisional driving insurance with this company and was wondering do I also need a full insurance policy alongside the provisional one with this company, Can not find any information about it thanks

Is a 2004 or 2005 Subaru impreza rs hatch a good first car?

is a 2004 or 2005 Subaru impreza rs hatch a good first car? are they reliable, good on insurance and costs to run and fix. cant get a wrx because of p plate restrictions but from experience is the rs any good. what is the average price they sell for and how many k's on them? thanks""

Whats the best insurance company for a young driver?

just passed my driving test and was wondering what the cheapest insurance company for young drivers is?

How do I help families not see life insurance?

How do I help families not see life insurance as a bill but rather protection for their family? I am on a crusade to help families become properly protected (create an immediate estate) in case of a loved ones untimely death. Of lately, prospects see life insurance as another bill. Although it is; can any life insurance agent please share with me how they get around to making sales in the life insurance industry? Thank you.""

Which insurance company offer the lowest price to insure my car? I have a Ford contour 2000 y.?

i need for emergency to insure my car in the cheapest way-very important.That's why i need the best offers from insurance Companyes

What is the average of insurance cost for a 19 year old?

I've been looking around online to research costs and from what I've seen it averages around $150. $200 at the worst. But my mom tells me I have to pay $440 dollars? Like wtf. Even four of my friends, who are still 18, pay around $170 or so. Is she just bullshitting me? I have never incited any tickets and drove safely when I was 18 and still now at 19. I'm not sure what to say to my mom. I told her about how others are paying wayyyyyyy less. I'm thinking the insurance is just cheating my mom or something. Anyone have any idea what I should do? I remember my mom asking me to give her my transcript to show I have a GPA above 3.0 to lower costs. And now she tells oh it's $440 .. I don't know what's going on. I'm not very well spoken in my native language so there's some issues talking about this.""

What is the cheapest/best car insurance and car for a newly licensed driver in MA?

What would be the best and cheapest type of car and car insurance to get for someone who just received their license?

Reason for sudden increase in price on car insurance?

When I bought my car I started paying 1,400 a year on insurance, and the other day I got a letter through the post from my insurance company saying that I need to renew my car insurance since it was close expiring. They said that if I want to continue with the same company I need to now pay 2,000 a year for the same car. I can't seem to understand why there's such a vast increase from my last quote. I haven't had to make a claim and I can't think of anything that may have happened that could result in the price increase. Do insurance companies do this or could there have been something I may have done which has put the price up? Thanks in advance.""

""Im 21years old,male with a mazda miata 2001. My auto insurance to too high. where can I get cheaper insurance?""

Im 21years old,male with a mazda miata 2001. My auto insurance to too high. where can I get cheaper insurance?""

Is my auto insurance too high?

i am 18 yrs old. my car is 2008 c class benz. my insurance for the car is 315 a month!!! aaghh!! is that too high or it is a good price for the car i drive? does the car model matter? please help!! i hate paying this price!

How can a college student find an affordable therapist?

I'm 18 and still under my parent's insurance coverage. I have loads of issues including social anxiety, and I think that I'm starting down the path to clinical ...show more""

Why do I have to pay extra for changing address with my insurance company?

I recently moved and changed the details on my drivers licence and log book. When I called the insurance company to do the same they said i would need to pay 60 to cover the cost of the change between now and the renewal period (which at the time was approx 6 weeks away). All of this was AFTER they took my previous and new address to confirm my ID. When I asked them why this was as I had paid my entire premium in full last year (so as not to incur direct debit charges) they just repeated themselves. I did not have the 60 and said well I will just stay at the previous address (my ex-boyfriends) until my renewal comes through and I will change address then. However...my renewal has just come through in my NEW address but with postcode where vehicle kept overnight as my OLD address!! What does this actually mean?? surely if I have to make a claim it doesn't matter where the vehicle is kept esp as they have my address and the majority of claims do not happen at your residence!!! I have read the policy back to front and they even added amendments this year to include admin charges and NOWHERE does it mention being charged for change of address. I have literally moved around the corner surely its not just about postcodes or am I being naive??

Average cost of insurance and registration in Utah?

My husband and I are looking into getting two different vehicles and I am just trying to get an estimate on how much its going to cost to register them and how much I may need up front for insurance. I am 24 years old, my husband is 23 and a former truck driver. The two cars are a 1996 grand caravan (red if needed) and a 1980 Chevette (black if needed). I do not know mileage yet for either one.""

Which is the type of insurance to avoid?

Which is the type of insurance to avoid? A- mortgage insurance B- identity theft insurance C- disability insurance Why?

Crashed car 3rd party no-one else injured what to do with insurance?

I'm in my first year of driving as a 17 yr old male and i crashed damaging my car beyond repair. My insurance is only 3rd party and that cost 3200 no-one else was involved however the police,ambulance and fire were present. What shall i do, do i inform the insurance company however without making a claim? Do i scrap the car and change my insurance? What are my options to prevent the premium going even higher than it already is.""

Backed into something. Will insurance rates go up?

Today I backed into something in my car. It did slight damage to the rear bumper but nothing else. Could I choose to file this through my Insurance, and would this make my rates go up? I'm 18. Thanks""

I am trying to get a 2006 Dodge Charger R/T. I am worried that insurance will be to high?

I am worried that insurance will be too high. I am 16 years old and my Dad is paying for it. What is the average insurance that someone pays. Do you tihnk insurance on this charger will be a lot?

Is it possible to be added to my parents insurance for a month?

I want to drive to friends house in another city, but I'm not currently insured on any car. Is it possible to become included in my parents car on a one month deal? I'm over 21 in case age is an issue. Also if it is possible can I do it with another insurer or does it have to be one my parents currently use. Finally how much will it probably cost? Thanks""

Insurance for 2 cars with 2 different companys?

I have got a citroen xsara. which has got an insurance with Express till 17/02. I am now buying a mazda 3 which am planning to have it insured today itself with Halifax. Is this legal?

Cheapest car insurance?!?

Im getting a car next week and i need some suggestions on the cheapest car insurance with full coverage im looking for around $200 a month or less im a new driver im 19 so i know its gonna be pricy. I live in Pennsylvania

SHould i trust AIS insurance broker co.?

I just got an auto insurance quote from AIS and they gave me $250 for 6 months for my 1999 ford. that's like $44/month for a 15000/30000 liability insurance and it is through MERCURY insurance co.... should i trust this and go with it?? i currently have GEICO paying $545 for 6 months

How much is Car Insurance in South Florida?

My husband and I are buying a second home in Florida. I am 42 and he is 52. Clean driving records no points only need liability on one 98 Ford Explorer and full coverage on a 2006 Ford Focus. Just an estimate would be great. Thanks

What are some cars with easily tunable engines and low insurance?

i need a car that i can make faster but i don't wanna pay alot f insurance. specific models please

Who has the best health insurance in California for college students?

I am a full time college student, and I am looking for health care insurance, but I'm not for sure which to go for. I was looking up Blue Shield of California, Health net, and Kaiser, but I'm new to this.""

""Car Insurance, should I go as a named driver?""

I am 25, just passed, I got a quote from the post office for a 2001 MITSUBISHI Colt 1.3 Equippe at 2500 for the year... I live in a posh area (my nan n grandads) and the car will be parked on the drive. If I go as a named driver on my Grandad's insurance, who has plus 10yrs no claims how much cheaper do you think it will be? Does my Grandad have to buy the car in his name? What's the best way I can do this? Or should I just drive his punto 1.2l as a named driver, as a guess how much do you think i will have to pay extra so my grandad is still paying the same he usually does?""

Looking for Affordable Health Insurance Rates?

I'm looking for a website that offers affordable health insurance rates.Please suggest me the best site

Collingwood Drivers Insurance?

I'm currently looking to get provisional driving insurance with this company and was wondering do I also need a full insurance policy alongside the provisional one with this company, Can not find any information about it thanks

Penalty points and insurance?

if i take out insurance with no points on my license then a couple of months later get 3 points for a ts50 do i have to contact my insurance company to tell them or not?

Can you report someone for driving without car insurance?

i know this person and i was just wondering if you could turn them in for not having car insurance without them knowing who turned them in. I want to prevent someone from getting hurt and not getting there part of the insurance claim or whatever.....anything will help..THANKS!!!!

Owner of car but not main driver on insurance ?

Hi I'm 18 in a month, and I'm buying a car on finance and I am paying because it will be my car. My dad will use it the same amount as I will be using it until I have it paid off then it will be completely mine. I was wondering can I be the registered owner of the vehicle but be a named driver on the insurance? I know about fronting but of we drive it equally why wouldn't my dad be the main driver as it is cheaper? But does it mean he has to be the registered owner? Thanks""

Car insurance?

I got my license 2 weeks ago and I am getting a car this week. What insurance company would you recommend that I go with? Progressive, Gieco or AIG. If you have any others, feel free to throw it out there.""

""If I get a pull-behind trailer for my car, will I need to insure it?""

Probably a stupid question, but I'm clueless.:) If insurance is required, what happens when I want to loan it out to friends and neighbors? Thanks!!""

Is this the big health insurance lie?

The legislation would impose several new fees on firms in the health sector. New fees would be imposed on providers of health insurance and on manufacturers and importers of medical devices. Both of those fees would be largely passed through to consumers in the form of HIGHER PREMIUMS for PRIVATE COVERAGE. Congressional Budget Office An Analysis of Health Insurance Premiums Under the Patient Protection and Affordable Care Act November 30, 2009 BUT..... The average premium for an unsubsidized, nongroup policy will cost 27-30% MORE. (same report) So won't private coverage decrease sharply ... And so too the fees collected from them ... which are suppose to pay for the subsidies . Or will really caring people flock to buy this extra expensive insurance?""

Ok how much would car insurance cost?

I'm asking this question for my 16 year old friend Gabby her parents just bought her a BMW 328i xDrive Sedan for 37,000 so she is wondering how much insurance is going to cost because she is in the proccess of trying to convince her parents to let her pay insurance or payments shes comparing which will cost less so insurance?? how much $$""

Ninja 250 insurance for a 17 year old?

I have no wrecks tickets or anything on my record for driving a car. I want a motorcycle because they are cool and get like 2-3 times better gas mileage then my car. The problem id my parents complain they are dangerous and thy also say the insurance is like 3 times as much. I live in the U.S will the insurance be a lot, if so can you give me a estimate per month? Also since a 250 is cheap and not very fast will that make a difference in safety and insurance price?""

Can anyone suggest a really affordable health insurance program for a family. That covers alot plus maternity?

Can anyone suggest a really affordable health insurance program for a family. That covers alot plus maternity?

Insurance (probability)?

An auto insurance company has 10,000 policy holders. Each policy holder is classified as.. - young or old - male or female - married or single Of these policyholders, 30000 are young, 4600 are male, and 7000 are married. the policyholders can also be classified as 1320 young males, 3010 married males, and 1400 young married persons. Finally, 600 of the policyholders are young married males. How many of the company's policyholders are young, female, and single?""

Can i put my parents on my medical insurance at work .?

what would i have to do to qualify them to be added to my insurance.

I need car insurance in broomfield co?

I have one speeding ticket and i'm 19 years old where can i go to get car insurance cheap i get min wage. and i need full coverage and if you know what full coverage consists of please let me know i have a 2003 dogde neon se

Estimated car insurance cost for an 18 year old beginner driver?

I waited until I turned 18 until I went to get my drivers permit. I've had my permit since November 18 2009. I plan to stay on the permit until its expiration date. I'm not sure what car I plan to purchase after that, something affordable (nothing over the top) and that will last quite awhile. Now assuming all that, can any of you share with me what your car insurance payment is monthly, just an estimate of course. And throw in what type of car you have in so I can get a better idea. I'll be 19 at the time I finally get my license. My parents will not be adding me to their insurance, I have to pay for this on my own and I'd like to start putting some money away towards it so that I can make the payments with no problem later on. Are their any other things I can do to lower the cost of my car insurance as well?""

Estimated Insurance Costs for Pest Control Business?

Hello, I have been considering starting a Pest Control business. I'd mainly like to focus on the removal of animals, however from a business stand point it would be much wiser to handle pest insects as well. Our state breaks down the minimum insurance you need which I will list below. I was hoping someone could give me just some reasonable estimes of what these types of insurances would cost based on the information I provide? If needed, I live in Rhode Island and based on looking at similar local businessed and their NAICS codes, the industry would be #325320. RULE 21. FINANCIAL RESPONSIBILITY (A) Each applicant for commercial applicator licensing shall show proof of financial responsibility to consist of either: (1) A performance bond drawn payable to the State of Rhode Island in the amount of $20,000 per job, or (2) The following minimum insurance coverage: Comprehensive General Liability (ground application): Bodily Injury Liability - $20,000 each occurrence - $40,000 Aggregate Property Damage Liability (Including completed operations and chemical or pollution liability) - $25,000 (B) Each applicant for commercial applicator certification shall show proof of financial responsibility to consist of either: (1) A performance bond drawn payable to the State of Rhode Island in the amount of $50,000 per job, or (2) The following minimum insurance coverage: Comprehensive General Liability (ground application): Bodily Injury Liability - $50,000 each occurrence - $100,000 Aggregate Property Damage Liability (Including completed operations and chemical or pollution liability) - $50,000 (C) Each applicant for commercial applicator certification in Category 7(c) Fumigation shall show proof of financial responsibility to consist of either: (1) A performance bond drawn payable to the State of Rhode Island in the amount of $100,000 or (2) The following minimum insurance coverage: Comprehensive General Liability: Bodily Injury Liability - $100,000 each occurrence - $300,000 Aggregate Property Damage Liability (Including completed operations and chemical or pollution liability) - $100,000 (D) Each applicant for commercial applicator licensing or certification, who applies pesticides aerially, shall show proof of financial responsibility to consist of either: (1) A performance bond drawn payable to the State of Rhode Island in the amount of $100,000, or (2) The following minimum insurance coverage: General Liability: Bodily Injury Liability - $100,000 each occurrence - $200,000 Aggregate Property Damage Liability (Including completed operations and chemical or pollution liability) - $100,000 (E) Financial responsibility required by paragraphs (A) (D), where appropriate, shall not be required of persons whose pesticide application activities are part of their duties as governmental employees.""

Will my car insurance go down when i turn 18?

I got my license when i turned 16. I was driving a 2001 mustang. Within 6 months i got into a car accident. Long story, but wasn't my fault so don't judge me because i'm not some stupid teen who was handed a mustang and went around speeding and wrecked. I'm not like that. I was raised way better than that. Anyway... Now i'm about to turn 18 and i'm still under my parents insurance. I was wondering if my insurance will go down when i turn 18.""

Teenage Car Insurance?!??!?

I'm 15 and for my 16th Bday I'm getting an mid-sized SUV. & I'm just wondering about how much the monthly payments are gonna be......? thanks for any help:)

Contents Insurance. Average Price Roughly??

Not fantastic area, sharing a house. I have usual 20 something stuff (TV, Games Console, Laptop, DVD Player) Rough Price, THANKYOU""

Which company provides the cheapest car insurance in the UK?

I recently passed my driving test, so for a first time driver its going to be high but what if i am an additional driver""

Do I automatically have to get car insurance right after I get my license?

I'm 18, I live with my parents...In order for me to get my license my mom wants me to pay for car insurance (since I'll be under her name) which is understandable, but I don't have a car yet, and I just want my license in case of an emergency...like I won't even be driving around her car rarely. She told me that even if I wanted to get my license and not get car insurance yet, I can't because I live in her house?? Does that sound right? Can't I just get my license without car insurance until I actually have my own car?""

How long after a DMV hearing will your insurance be notified ?

I recently had my DMV hearing am in the process of getting a sr-22 with another insurance company . I am not the primary holder of my current insurance I want to avoid their rate to go up or for them to find out . How many days do I have to cancel my current insurance before they cancel me .?? Please help ?

Does anyone have a Pontiac G6 GTP?? i need to know how much car insurance are on the them?? please let me know

Does anyone have a Pontiac G6 GTP?? i need to know how much car insurance are on the them?? please let me know

""Florida Auto Insurance Quotes Online, are they really safe?

Florida residents do you really think entering all your valuable personal information online for an auto insurance quote is really the safe way to obtain auto insurance? A local personalized auto insurance agent who you can pick up the phone and call or stop by their office sounds so much safer and personal.

""Car insurance for new driver, help please?""