#Swiss ISIN

Explore tagged Tumblr posts

Text

Amagvik AG: Ist Joelkis Rosario neuer Strohmann von Michael Oehme?

Michael Oehme übergibt an Stiefsohn Joelkis Rosario die Leitung :-)

Verlässt Drazen Mijatovic das sinkende Schiff ?

Die Amagvik AG (BX Swiss: AMAN) gab heute bekannt, dass sich Drazen Mijatovic im Dezember 2024 aus persönlichen Gründen aus dem Verwaltungsrat der Gesellschaft zurückziehen möchte und daher beruft der Verwaltungsrat eine ausserordentliche Generalversammlung auf Mittwoch, 11. Dezember 2024 ein.

Traktanden ausserordentliche Generalversammlung Der Verwaltungsrat beantragt der ausserordentlichen Generalversammlung die Wahl des bestehenden Mitglieds Michael Oehme als neuen Verwaltungsratspräsidenten sowie die Zuwahl von Joelkis Rosario als neues Mitglied des Verwaltungsrats, jeweils für eine Amtsdauer bis zur nächsten ordentlichen Generalversammlung.

Die Einladung zur ausserordentlichen Generalversammlung wird in den kommenden Tagen im Schweizerischen Handelsamtsblatt entsprechend publiziert und an die im Aktienregister eingetragenen Aktionäre versandt.

Kurzporträt Joelkis Rosario Staatsangehörigkeit: Deutschland, Dominikanische Republik; Jahrgang: 1993 Joelkis Rosario hat seine berufliche Ausbildung als Bankkaufmann (2017-2020; Bank 1 Saar eG, Saarbrücken) und Kaufmann im Einzelhandel (2011-2014; E-Plus Mobilfunk GmbH, Saarbrücken) erlangt und war in diesen Jahren jeweils für die genannten Institute sowie von 2014-2017 als Sales Agent für telefonica GmbH (vormals E-Plus) in den Bereichen Kundenberatung und Verkauf tätig. Im Jahr 2021 war er Praktikant bei der Gallus Immobilien Konzepte GmbH, München. Von Januar bis August 2022 sammelte er Erfahrungen im Bauwesen bei der M3 Bau- und Projektmanagement AG, mit heutigem Sitz in St. Gallen, und ist seit September 2022 Juniorprojektleiter bei der Amagnus AG, Herisau. Parallel dazu absolviert er berufsbegleitend einen Bachelorstudiengang im Bauingenieurwesen der ZHAW Architektur, Gestaltung und Bauingenieurwesen, Winterthur, bzw. seit Oktober 2024 an der HTWG – Hochschule Konstanz.

Erfolgreicher Verkauf des Bauprojekts in Wängi Zur Entlastung der finanziell angespannten Situation hat sich der Verwaltungsrat zum Verkauf des laufenden Bauprojekts in Wängi/TG entschlossen. Das Überbauungsprojekt mit insgesamt 14 Wohnungen kann mit Gewinn verkauft werden. Die mit dem Projekt verbundenen Hypotheken werden entsprechend zurückgeführt. Die Eigentumsübertragung ist bis Ende November 2024 vorgesehen.

Kontakt Michael Oehme, Mitglied des Verwaltungsrats Amagvik AG, Vadianstrasse 24, CH-9000 St. Gallen T +41 71 388 76 01 [email protected]

Amagvik AG www.amagvik.ch Die Amagvik AG ist eine Schweizer Immobiliengesellschaft mit Sitz in St. Gallen. Sie fokussiert ihre Geschäftsaktivitäten auf den Aufbau eines nachhaltigen Immobilienportfolios mit Wohnimmobilien, insbesondere im Raum Ostschweiz. Langfristig wird basierend auf einer „Build and Hold“ Strategie ein Portfolio an selbsterstellten Renditeliegenschaften mit Wohnnutzung aufgebaut. Die Namenaktien der Gesellschaft sind an der BX Swiss kotiert: Ticker AMAN; Valor 130795970; ISIN CH1307959705.

Disclaimer Diese Medienmitteilung dient ausschliesslich zu Informationszwecken. Sie stellt weder ein Angebot noch eine Aufforderung zum Kauf oder Verkauf von Aktien der Amagvik AG noch zum Erwerb oder Verkauf von anderen Finanzinstrumenten oder Dienstleistungen dar. Diese Medienmitteilung kann bestimmte, in die Zukunft gerichtete Aussagen enthalten, z.B. Angaben unter Verwendung von Worten wie „glaubt“, „geht davon aus“, „erwartet“, „plant“, „wird“ oder Formulierungen ähnlicher Art. Solche in die Zukunft gerichteten Aussagen unterliegen bekannten und unbekannten Risiken, Unsicherheiten und sonstigen Faktoren, die dazu führen können, dass die tatsächlichen Ereignisse, finanzielle Situation, Entwicklung oder Leistungen des Unternehmens wesentlich von denjenigen in den zukunftsgerichteten Aussagen direkt oder indirekt genannten abweichen. Vor dem Hintergrund dieser Unsicherheiten sollten die Leser sich nicht auf diese in die Zukunft gerichteten Aussagen verlassen. Amagvik AG übernimmt keine Verpflichtung, diese zukunftsgerichteten Aussagen zu aktualisieren oder diese an zukünftige Ereignisse oder Entwicklungen anzupassen. Diese Medienmitteilung sowie die darin enthaltenen Informationen dürfen nicht in die Vereinigten Staaten von Amerika (USA) gebracht oder übertragen werden oder an US-amerikanische Personen (einschliesslich juristischer Personen) sowie an Publikationen mit einer allgemeinen Verbreitung in den USA verteilt oder übertragen werden.

#Gallus Immobilien eG#business#Michael Oehme Schweiz#Joelkis Rosario#Joelkis Rosario Amagvik AG#Captal PR AG Michael Oehme#Michael Oehme BM AG#Business Media AG#Michael Oehme Trogen#Michael Oehme Business Media AG#Schneeballsysthem#Kapitalbetrug#Anlegerbetrug#Totalverlust#dominikanische Republik#immobilien#Insolvenz#Amagvik AG Michael Oehme#Amagvik AG#Strohmann

1 note

·

View note

Text

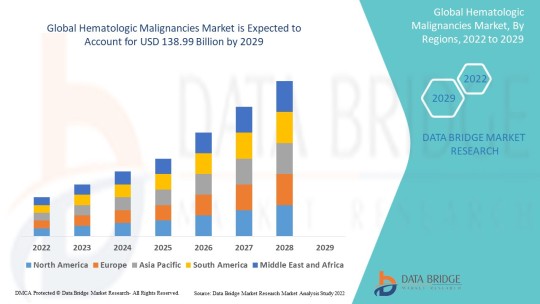

Hematologic Malignancies Market Size, Share, Trends, Growth and Competitive Analysis

"Global Hematologic Malignancies Market – Industry Trends and Forecast to 2029

Global Hematologic Malignancies Market, By Type (Leukaemia, Lymphoma, Myeloma), Therapy Type (Chemotherapy, Immunotherapy, Targeted Therapy), Diagnosis (Blood Tests, Biopsy, Imaging Tests, Others), Route of Administration (Oral, Parenteral, Others), Dosage Form (Tablets, Capsules, Injections, Others), End-Users (Hospitals, Specialty Clinics, Homecare, Others), Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, Others) – Industry Trends and Forecast to 2029

Access Full 350 Pages PDF Report @

**Segments**

- Leukemia: Leukemia, a type of hematologic malignancy, is characterized by the rapid production of abnormal white blood cells in the bone marrow, leading to complications in the immune system's function. The leukemia segment is significant in the hematologic malignancies market, with a high prevalence globally. Factors such as genetic predisposition, exposure to radiation, and certain chemotherapy drugs contribute to the development of leukemia.

- Lymphoma: Lymphoma is another key segment in the hematologic malignancies market, affecting the lymphatic system and lymphoid tissues. There are two main types of lymphoma: Hodgkin lymphoma and non-Hodgkin lymphoma. Hodgkin lymphoma is characterized by the presence of Reed-Sternberg cells, while non-Hodgkin lymphoma comprises a diverse group of lymphomas with varying characteristics and prognosis. The lymphoma segment is witnessing advancements in treatment options, including immunotherapy and targeted therapies.

- Myeloma: Multiple myeloma is a type of hematologic malignancy that affects plasma cells in the bone marrow. This segment of the market is characterized by the abnormal production of monoclonal proteins, leading to bone damage, renal complications, and other symptoms. The myeloma segment has seen significant progress in treatment modalities, including proteasome inhibitors, immunomodulatory drugs, and monoclonal antibodies. The market for myeloma therapies continues to expand, with a focus on improving patient outcomes and quality of life.

**Market Players**

- Roche: Roche is a prominent player in the hematologic malignancies market, offering a range of innovative therapies for leukemia, lymphoma, and myeloma. The company's portfolio includes targeted therapies, immunotherapies, and personalized medicine options for patients with hematologic malignancies. Roche invests heavily in research and development to introduce novel treatments and improve existing standards of care for these conditions.

- Novartis: Novartis isIn the competitive landscape of the hematologic malignancies market, Roche and Novartis stand out as key market players with a significant presence and impact on the industry. Roche, a Swiss multinational healthcare company, has established itself as a leader in providing innovative therapies for leukemia, lymphoma, and myeloma. With a diverse portfolio that includes targeted therapies, immunotherapies, and personalized medicine options, Roche continues to drive advancements in treatment options for patients with hematologic malignancies. The company's strong focus on research and development enables it to introduce novel treatments that address unmet medical needs and improve patient outcomes in this complex and challenging disease area.

Novartis, another major player in the hematologic malignancies market, has made substantial contributions to advancing the field of oncology with its portfolio of innovative therapies. The company's commitment to developing cutting-edge treatments for leukemia, lymphoma, and myeloma has made it a key player in the market. Novartis's emphasis on precision medicine and personalized treatment approaches has led to the development of targeted therapies that aim to improve the efficacy and safety profiles of treatments for hematologic malignancies. By investing in research and collaborations with key stakeholders in the healthcare ecosystem, Novartis continues to drive progress in addressing the evolving needs of patients with these complex diseases.

Both Roche and Novartis play a vital role in shaping the hematologic malignancies market through their focus on innovation, research, and patient-centric approaches to therapy development. These companies leverage their expertise in oncology and biotechnology to bring forward novel treatment options that have the potential to transform the standard of care for patients with leukemia, lymphoma, and myeloma. In addition to developing new therapies, Roche and Novartis also engage in strategic partnerships, regulatory initiatives, and patient advocacy efforts to drive awareness, access, and affordability of hematologic malignancy treatments on a global scale.

As the landscape of hematologic malignancies continues to evolve with advancements in technology**Segments:**

- Leukemia: Leukemia, a type of hematologic malignancy, is a significant segment in the market due to its high prevalence globally and the complexities associated with the rapid production of abnormal white blood cells. Factors such as genetic predisposition and exposure to certain chemicals play a role in the development of leukemia. The market for leukemia treatments is driven by continuous research and development efforts to improve patient outcomes and quality of life.

- Lymphoma: Lymphoma, affecting the lymphatic system, comprises Hodgkin lymphoma and non-Hodgkin lymphoma. Advancements in treatment options, including immunotherapy and targeted therapies, have significantly impacted the lymphoma market. The focus on personalized medicine and precision therapies is shaping the future of lymphoma treatment, with a strong emphasis on improving therapeutic efficacy and reducing adverse effects for patients.

- Myeloma: Multiple myeloma, characterized by the abnormal production of monoclonal proteins, poses challenges such as bone damage and renal complications. The myeloma segment has witnessed remarkable progress in treatment modalities, with the introduction of novel therapies such as proteasome inhibitors and monoclonal antibodies. The market for myeloma therapies is expanding, driven by the need to address unmet medical needs and enhance patient care.

**Global Hematologic Malignancies Market:** - By Type: Leukemia, Lymphoma, Myeloma - Therapy Type: Chemotherapy, Immunotherapy, Targeted Therapy

Key points covered in the report: -

The pivotal aspect considered in the global Hematologic Malignancies Market report consists of the major competitors functioning in the global market.

The report includes profiles of companies with prominent positions in the global market.

The sales, corporate strategies and technical capabilities of key manufacturers are also mentioned in the report.

The driving factors for the growth of the global Hematologic Malignancies Market are thoroughly explained along with in-depth descriptions of the industry end users.

The report also elucidates important application segments of the global market to readers/users.

This report performs a SWOT analysis of the market. In the final section, the report recalls the sentiments and perspectives of industry-prepared and trained experts.

The experts also evaluate the export/import policies that might propel the growth of the Global Hematologic Malignancies Market.

The Global Hematologic Malignancies Market report provides valuable information for policymakers, investors, stakeholders, service providers, producers, suppliers, and organizations operating in the industry and looking to purchase this research document.

TABLE OF CONTENTS

Part 01: Executive Summary

Part 02: Scope of the Report

Part 03: Research Methodology

Part 04: Market Landscape

Part 05: Pipeline Analysis

Part 06: Market Sizing

Part 07: Five Forces Analysis

Part 08: Market Segmentation

Part 09: Customer Landscape

Part 10: Regional Landscape

Part 11: Decision Framework

Part 12: Drivers and Challenges

Part 13: Market Trends

Part 14: Vendor Landscape

Part 15: Vendor Analysis

Part 16: Appendix

Countries Studied:

North America (Argentina, Brazil, Canada, Chile, Colombia, Mexico, Peru, United States, Rest of Americas)

Europe (Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Russia, Spain, Sweden, Switzerland, United Kingdom, Rest of Europe)

Middle-East and Africa (Egypt, Israel, Qatar, Saudi Arabia, South Africa, United Arab Emirates, Rest of MEA)

Asia-Pacific (Australia, Bangladesh, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Sri Lanka, Thailand, Taiwan, Rest of Asia-Pacific)

Browse Trending Reports:

Thermal Imaging Cameras Market Baby Food Market Thin Film Encapsulation Market Paper Coating Materials Market Protein Engineering Market Psoriasis Treatment Market Whole Exome Sequencing Market Std Diagnostics Market Medication Delivery Systems Market Lane Keep Assist System Market Liquid Synthetic Rubber Market Mainframe Market Myxoid Round Cell Liposarcoma Drug Market Hematology Analyzer Market Low Differential Pressure Sensor Market Biofuel Enzyme Market Aroma Ingredients Market Coconut Water Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: [email protected]"

0 notes

Text

Counos U Stable Coin Listed With Swiss ISIN No. and Backed 100%

Counos U Stable Coin Listed With Swiss ISIN No. and Backed 100%

Counos U: A New Means of Payment is Conquering the World

Being able to pay with one currency and get a return has never been seen before and will conquer the world in no time. Counos U is 100% backed with dollars and has a fixed value of $100. To ensure this, a specially developed vehicle is built. This vehicle secures the deposited dollars.

That is 4 trustees, a Swiss bank, and seven other…

View On WordPress

#counos#Counos Decentralized Exchange#counos platform#counos u#cryptocurrencynews#paidpost#revenue#sponsored#Swiss ISIN#TCRNews#thecryptoreport

0 notes

Text

Summer List 2021

Now that I’m done with the semester I have time do things again. This is more for personal use, so feel free to ignore it. However, I do welcome recipe recommendations.

Read:

Pretty Boy Detective Club 1-3 by Nisio Isin

A Wild Sheep Chase by Haruki Murakami

Kitchen by Banana Yoshimoto

If I finish the above, anything else in my backlog

Games:

Nier: Automata

Yakuza Kiwami (half finished)

.hack//G.U. (half finished)

Psycho-Pass: Mandatory Happiness

Baking/Cooking:

pudding desert

swiss role cake

vegetable takoyaki

cookies of some kind

Russian bread

Translation (I’ll probably do none of these):

Ghost Hunt: Old Schoolhouse Ghost Story by Fuyumi Ono

Hypnosis Mic Hypster Magazine

mobile games (Hypmic, Blackstar, Tenirabi)

Hana*Doll booklets

Other:

Finish quilt square, start next one

Sew pincushions

Write and edit stories

2 notes

·

View notes

Text

Swiss crypto ETP issuer passes $1B assets under management

21Shares, a Swiss provider of exchange-traded cryptocurrency products (ETP), has seen its assets under management rise 100% in the past two weeks.

The company announced Monday that 21Shares has crossed the $1 billion mark in assets under management in its 12 diversified FTEs. Hany Rashwan, CEO of 21Shares, said the company has recently experienced strong growth in its encrypted FTE products, with assets under management doubling in less than two weeks. The company previously announced that 21Shares crossed the $500 million mark in assets under management on February 8.

According to the announcement, the huge increase in 21Shares’ ETP crypto business is largely due to the rapid adoption of cryptocurrency by institutional investors, as well as the availability of the products on regulated European exchanges.

Mr. Rashwan said institutional investors can invest in 21Shares’ cryptocurrency FTEs by using the International Securities Identification Number, or ISIN, which is a global standard used to identify certain securities, such as bonds, stocks, derivatives and others:

“With such high institutional demand for cryptocurrency exposure via an ISIN, we have gone from announcing UM500 million to over $1 billion in less than two weeks. For many asset managers, private banks, family offices and individuals, it is quickly becoming reasonable to invest in cryptocurrency assets.”

According to a product breakdown in the announcement, the majority of total 21Shares assets under management come from 21Shares Binance BNB FTE (ABNB) – an FTE that tracks the investment performance of Binance Coin (BNB). BNB’s dominant share of total assets under management comes against the backdrop of Binance Coin’s recent surge, making it the world’s third-largest cryptocurrency on February 19.

Source: 21Shares

On February 18, ABNB was apparently still behind 21Shares Bitcoin FTE, or ABTC, with assets under management of about $214 million, while ABTC’s assets under management were $272 million, according to official data on the 21Shares website.

Formerly known as Amun AG, 21Shares is known for having launched the world’s first multi-crypto FTE, which was listed on the SIX Swiss Exchange in November 2018. In just over two years since launching its first encrypted FTE, 21Shares has actively diversified its encrypted FTE offering and seen its assets under management grow 200-fold. In early February, 21Shares launched the world’s first Polkadot-based FTE (DOT).

Related Tags:

Privacy settings,How Search works,new cryptocurrency,bitcoin news today,cryptocurrency prices,is bitcoin safe

0 notes

Text

Switzerland's FiCAS Pioneers the World's First Actively Managed Cryptocurrency Exchange Traded Product (ETP)

FiCAS AG, a Swiss-based crypto investment management boutique, has successfully registered the Bitcoin Capital Active ETP (BTCA; ISIN CH0548689600) - the world's first actively managed crypto exchange-traded product, listed at SIX. The discretionary ETP, issued by Bitcoin Capital AG, will be managed by FiCAS AG, which trades the top 15 cryptocurrencies and aims to deliver enhanced returns for clients. The Bitcoin Capital Active ETP is issued at CHF 100. Dr. Mattia Rattaggi, Chairman of the FiCAS Board, said: "Amid the current market environment of historically low-interest rates and global equity market volatility, we are seeing a real desire among investors to diversify into alternative asset classes." ''With this in mind, FiCAS' pioneering ETP launch today, an industry-first achievement, is the ideal opportunity to pursue superior returns while expanding asset diversification." "A discretionary managed ETP is a much more appropriate new instrument in the context of the still novice cryptocurrency market and further bridges the worlds of traditional and crypto finance." "FiCAS has received full regulatory approvals in Switzerland for the listing of the Bitcoin Capital Active ETP, which provides the green light for retail and institutional investors to tap the burgeoning asset class in a simple and secure way." Ali by Richard Kastelein #ETP #EXCHANGETRADEDPRODUCT #FICAS Read the full article

0 notes

Text

Germany’s Second Largest Exchange Adds New Bitcoin Trading Product

Boerse Stuttgart, Germany’s second-largest stock exchange, has added a new inverse Bitcoin Exchange Traded Product (ETP). This will be the first crypto ETP, called 21Shares Short Bitcoin ETP, which allows traders to short Bitcoin. World’s first Bitcoin short product, will the halving leave investors rekt? Boerse Stuttgart has just introduced a brand new investment product for institutional and retail traders, which will allow them to short Bitcoin. This is a first for the Bitcoin investment industry and the first short product available in the world. The 21Shares Short Bitcoin ETP will be backed by the underlying asset at 1:1. It is the first Bitcoin financial instrument wrapped as an ETP with an International Securities Identification Number (ISIN) and Wertpapierkennnummer (WKN). The underlying BTC will be custodied by an independent custodian with segregated accounts. 21Shares is approved by the SFSA, the Swiss Financial Supervisory Authority. This means investors in Germany and other European markets can now get short exposure on BTC when the prices start to dump. 21Shares was formerly known as Amun AG, and they offer a full suite of ETPs which will be migrating over to the 21Shares brand. This Bitcoin Short ETP will be fully regulated under Swiss law. As the world’s first Bitcoin Short ETP, with the current bullish hype surrounding the halving, it will be interesting to see what the response towards this product will be from investors. Euro markets are innovating crypto, US markets stall With the release of the new 5AML EU anti-money laundering guidelines, crypto businesses can no longer be discriminated against by banks. They will need to be treated the same as any other business. European investors have been crying out for crypto-friendly regulation, we have seen quite a few EU nations introduce crypto-friendly policies, tax structures, and extend the olive branch to crypto startups. Crypto Valley in Zug, Malta, and Portugal, come to mind. In the US, overzealous regulation and uncertainty about tax policy and regulatory enforcement have put a chill on the crypto industry. Startups have decided it is easier to jurisdiction shop and start in a friendlier and more well-defined climate. Domestically both investors and entrepreneurs have pressured the SEC and IRS to issue clearer guidelines that are easier to comply with. This has led to certain new developments like Hester Pierce’s proposed safe harbor law, which has met mixed feedback from the crypto industry. Some wonder if it is too little, too late. US regulators need to take a page from their European counterparts and relax the strict rules to allow for innovation. New investment products like the 21Short ETP are the type of crypto exposure investors are looking for on both sides of the pond. Do you think Boerse Stuttgart’s new short Bitcoin ETP is bullish for the leading cryptocurrency? Add your thoughts below! Images via Shutterstock from Cryptocracken Tumblr https://ift.tt/3a9nQC1 via IFTTT

0 notes

Text

Swiss-based asset management firm FiCAS launches cryptocurrency ETP

Swiss-based asset management firm FiCAS launches cryptocurrency ETP

FiCAS AG, a Swiss-based crypto investment management boutique, announced today it has successfully registered the Bitcoin Capital Active ETP (BTCA; ISIN CH0548689600) — an actively managed crypto exchange-traded product, listed on SIX. The discretionary ETP, issued by Bitcoin Capital AG, will be managed by FiCAS AG, which trades the top 15 cryptocurrencies and aims to deliver enhanced returns for…

View On WordPress

0 notes

Text

Ripple (XRP) Racing After World Bank Recognition, XRP ETP Launch

Ripple prices solid above 34 cents

NGM launch XRP Tracker One allowing investment in a regulated manner attracting institutions and other HNWI

Boerse Stuttgart’s NGM did launch two ETPs tracking the performance of Ripple (XRP) and Litecoin. The XRP Tracker One allows investment without exposure and risks of owning the underlying asset and is regulated meaning broadcasting exchanges are under the microscope. A day after launch, XRP is up 6.8 percent, outperforming Bitcoin (BTC) and Ethereum (ETH).

Ripple Price Analysis

Fundamentals

After three, or even five months of consolidation, Ripple (XRP) is back to the limelight. By leading the surge, the third most capitalized coin is now up 6.8 percent from yesterday’s close and is benefiting from Bitcoin lift-off. But it has not always been like this. Despite market supporting fundamentals and Bitcoin printing higher highs in the last couple of weeks, Ripple was mostly unchanged. Luckily, there are many reasons to be optimistic.

A standout is a recognition by the World Bank and the mentioning of cost savings and speed of xRapid. As a solution that seeks to change status quo benefiting the end user, the global financier notes that Ripple’s solution has the possibility of impacting people’s lives positively. Being one of Ripple’s core product, xRapid do leverage XRP as a medium of exchange. The digital asset, in a recent Weiss Ratings survey, turned out to be more popular in the US than Bitcoin.

From these developments, Nordic Growth Market (NGM) operating by Swiss’s FSA rules, seeks to take advantage of the coin’s popularity by availing an exchange-traded product (ETP) based on XRP–XRP Tracker One, allowing investment without exposure. The XRP Tracker One has a valid ISIN Number meaning they are legit securities.

Candlestick Arrangements

Back to price action and the trend is clear. Bulls are firing XRP. By adding 6.8 percent today, Ripple (XRP) is leading the way. By the close of today, the coin will likely be above 34 cents meaning our previous XRP/USD trade plan is valid and risk-off, aggressive traders can load up on every dip.

Already, we can note that momentum is high because, despite Apr 3 and 4 bars closing above the upper BB, prices found support in the Asian session arresting liquidation.

As a result of this development—and high participation levels exceeding those of Apr 4, bulls are firm and aggressive traders should load up on pullbacks as long as XRP is above 34 cents.

Technical Indicators

Volumes are high, and even though the initial excitement is subsiding, Ripple (XRP) prices are trending above 34 cents. Because of this, we expect higher highs with targets at 40 cents. After that, any gain driving prices above 40 cents must be with high volumes preferably above those of Apr-2, 79 million.

Chart courtesy of Trading View

The post Ripple (XRP) Racing After World Bank Recognition, XRP ETP Launch appeared first on NewsBTC.

from Cryptocracken WP http://bit.ly/2G3jcZO via IFTTT

0 notes

Text

Ripple (XRP) Racing After World Bank Recognition, XRP ETP Launch

Ripple prices solid above 34 cents

NGM launch XRP Tracker One allowing investment in a regulated manner attracting institutions and other HNWI

Boerse Stuttgart’s NGM did launch two ETPs tracking the performance of Ripple (XRP) and Litecoin. The XRP Tracker One allows investment without exposure and risks of owning the underlying asset and is regulated meaning broadcasting exchanges are under the microscope. A day after launch, XRP is up 6.8 percent, outperforming Bitcoin (BTC) and Ethereum (ETH).

Ripple Price Analysis

Fundamentals

After three, or even five months of consolidation, Ripple (XRP) is back to the limelight. By leading the surge, the third most capitalized coin is now up 6.8 percent from yesterday’s close and is benefiting from Bitcoin lift-off. But it has not always been like this. Despite market supporting fundamentals and Bitcoin printing higher highs in the last couple of weeks, Ripple was mostly unchanged. Luckily, there are many reasons to be optimistic.

A standout is a recognition by the World Bank and the mentioning of cost savings and speed of xRapid. As a solution that seeks to change status quo benefiting the end user, the global financier notes that Ripple’s solution has the possibility of impacting people’s lives positively. Being one of Ripple’s core product, xRapid do leverage XRP as a medium of exchange. The digital asset, in a recent Weiss Ratings survey, turned out to be more popular in the US than Bitcoin.

From these developments, Nordic Growth Market (NGM) operating by Swiss’s FSA rules, seeks to take advantage of the coin’s popularity by availing an exchange-traded product (ETP) based on XRP–XRP Tracker One, allowing investment without exposure. The XRP Tracker One has a valid ISIN Number meaning they are legit securities.

Candlestick Arrangements

Back to price action and the trend is clear. Bulls are firing XRP. By adding 6.8 percent today, Ripple (XRP) is leading the way. By the close of today, the coin will likely be above 34 cents meaning our previous XRP/USD trade plan is valid and risk-off, aggressive traders can load up on every dip.

Already, we can note that momentum is high because, despite Apr 3 and 4 bars closing above the upper BB, prices found support in the Asian session arresting liquidation.

As a result of this development—and high participation levels exceeding those of Apr 4, bulls are firm and aggressive traders should load up on pullbacks as long as XRP is above 34 cents.

Technical Indicators

Volumes are high, and even though the initial excitement is subsiding, Ripple (XRP) prices are trending above 34 cents. Because of this, we expect higher highs with targets at 40 cents. After that, any gain driving prices above 40 cents must be with high volumes preferably above those of Apr-2, 79 million.

Chart courtesy of Trading View

The post Ripple (XRP) Racing After World Bank Recognition, XRP ETP Launch appeared first on NewsBTC.

from CryptoCracken SMFeed http://bit.ly/2G3jcZO via IFTTT

0 notes

Text

FiCAS und SIX Swiss Exchange lancieren das weltweit erste aktiv verwaltete Krypto Exchange Traded Product (ETP)

FiCAS und SIX Swiss Exchange lancieren das weltweit erste aktiv verwaltete Krypto Exchange Traded Product (ETP)

Bitcoin Capital Active ETP (BTCA) kann von privaten und institutionellen Anlegern einfach über eine Bank oder einen Broker gekauft werden – wie beim Kauf von Aktien

FiCAS AG, eine in der Schweiz ansässige Krypto-Investmentmanagement-Boutique, hat das Bitcoin Capital Active ETP (BTCA; ISIN CH0548689600) erfolgreich registriert – es ist damit das weltweit erste aktiv verwaltete…

View On WordPress

0 notes

Text

Achiko Limited: Achiko extends platform to tackle Indonesia's Covid-19 pandemic problem

Achiko Limited: Achiko extends platform to tackle Indonesia’s Covid-19 pandemic problem

ZURICH, SWITZERLAND – EQS Newswire – 4 June 2020 – Achiko Ltd. (ISIN KGY0101M1024), a FinTech company listed on the Swiss Stock Exchange, has launched its product, Teman Sehat (http://temansehat.co) and is currently conducting testing. Based on the Achiko platform, Teman Sehat, meaning “Health Buddy” in Indonesian, is a set of interconnected health-related applications, starting with Covid-19 tes…

View On WordPress

0 notes

Text

High-Profile ETF Issuer Joins Swiss Stock Exchange

Credit Suisse lists its first five ETFs on the Swiss Stock Exchange, offering investors additional choices of ESG products. Today, the Swiss Stock Exchange welcomes another high-profile issuer to its growing ETF segment: Credit Suisse Asset Management lists its first 5 ETFs. This takes the number of ETF providers to 25, and the number of ETFs to a record of 1'564, emphasizing the position of the Swiss Stock Exchange as one of Europes top three ETF venues. Danielle Reischuk, Senior ETFs & ETPs Sales Manager at the Swiss Stock Exchange, welcomes Credit Suisse to the family of ETF providers: "With the new products, investors gain access to more than 100 sustainable ETFs on our platform and have additional opportunities to diversify their portfolios." The strategic importance of ETFs is expected to further increase in the future as digital sales platforms gain greater significance and drive demand for liquid, exchange-tradable products. The Swiss Stock Exchange is ideally positioned to meet the changing needs of the market. Four of the five new ETFs branded Credit Suisse Index Fund (IE) enable investors to gain exposure to broadly diversified ESG portfolios. The four ESG products are benchmarked to MSCI USA ESG Leaders and MSCI World ESG Leaders respectively. The underlying indices select the top 50 percent of companies by environmental, social and corporate governance performance in each sector of the parent index. The liquidity for the five ETFs is provided by Credit Suisse Europe, who newly joins the ETF segment as a market maker, and by Flow Traders. "We have been replicating indices with high accuracy for a wide array of benchmarks since 1994. Thanks to our core index business with more than CHF 132 billion of assets we have the critical mass, technology, and expertise to provide ETFs that will supplement our existing offering of 94 index funds", says Dr. Valerio Schmitz-Esser, Head of Credit Suisse Asset Management Index Solutions. Product Name Trading Currency Benchmark Symbol ISIN Market Maker CSIF (IE) MSCI USA Blue UCITS ETF B USD USD MSCI USA (NR) CMXUS IE00BJBYDR19 CS Europe Flow Traders CSIF (IE) MSCI USA ESG Leaders Blue UCITS ETF B USD USD MSCI USA ESG Leaders (NR) USESG IE00BJBYDP94 CS Europe Flow Traders CSIF (IE) MSCI World ESG Leaders Blue UCITS ETF B USD USD MSCI World ESG Leaders (NR) WDESG IE00BJBYDQ02 CS Europe Flow Traders CSIF (IE) MSCI World ESG Leaders Blue UCITS ETF BH EUR EUR MSCI World ESG Leaders (NR) (EUR hedged) WDESGE IE00BKKFT300 CS Europe Flow Traders CSIF (IE) MSCI World ESG Leaders Blue UCITS ETF BH CHF CHF MSCI World ESG Leaders (NR) (CHF hedged) WDESGC IE00BKKFT292 CS Europe Flow Traders From Pioneer to Leading Marketplace Since the Swiss Stock Exchange launched the ETF segment almost 20 years ago as one of the first in Europe, it has experienced remarkable growth. In 2019, ETF turnover exceeded the previous years figure by 24%, reaching a new all-time high of CHF 124.7 billion; the previous record stood at CHF 116.4 bn (2017). Sustainable ETFs achieved a market turnover of CHF 1.08 billion in 2019 representing a growth of 18% over 2018. At 1'040'186, the number of trades exceeded one million for the third time in a row in 2019. Efficient Trading ETFs offer you the numerous advantages of regulated exchange trading. We operate one of the worlds most stable exchanges and bring together buyers and sellers from around the world on one central platform. The extensive product range, offered by a unique mix of large and smaller providers from both Switzerland and abroad, covers a wide spectrum of investment needs. The latest information on market data, turnover and new listings can be found on our website. The Swiss Stock Exchange publishes the latest figures about the growth of its segment in the ETF Market Report. Contact https://www.six-group.com/exchanges/exchanges/news/overview_en.html?id=credit_suisse_etf_issuer (Source of the original content)

0 notes

Text

Copper Catalyst Plans to Make Digital Assets Mainstream and Easily Bankable - Bringing Crypto into the Zeitgeist

London-based digital asset infrastructure provider Copper Technologies has launched their latest fare called Copper Catalyst — a next-generation framework designed to bridge the gap between traditional financial markets and the emerging crypto investment space. Copper Catalyst will enable crypto funds to create and issue securities on all digital assets rapidly and cost-effectively Securities will be fully bankable and clearable in the form of a Swiss Security (ISIN) Dmitry Tokarev, Chief Executive Officer, Copper Technologies, said: "The crypto fund industry has shown enormously promising growth over the last decade, with impressive strategies and an excellent return for investors. But it is no secret that there has been a clear barrier to their graduation into the investment mainstream: the lack of feasible securitisation options. With sky-high costs and extensive compliance issues associated with most available structures, there is a gulf between traditional financial markets and this next generation of funds: a gulf that Copper Catalyst will bridge." "More and more, we are seeing traditional investors looking for exposure in cryptoassets – not least as a hedge against the economic damage and impending inflation as a result of the COVID-19 pandemic." "There are scores of investors whose only barrier to engaging in crypto is the perceived risk associated with managing your own currency. by Richard Kastelein #AMCs #catalyst #Copper #CopperTechnologies #cryptoassets #digitalassets #ISIN Read the full article

0 notes

Link

Zurich, 15 May 2019 – innovation made in Switzerland: two innovative financial solution providers have joined forces. Blockchain-based digital asset exchange Lykke and “new generation” securitization specialist GENTWO have made Lykke’s utility tokens investable and bankable through a conventional Swiss-compliant tracker certificate complete with Swiss ISIN.

True innovation through purpose-oriented partnerships

Gentwo’s subsidiary GENTWO Digital has securitized Lykke’s utility tokens – known collectively as LyCI Service Tokens (ticker: LyCI). This unique expertise regarding digital assets has thus been prepared for conventional investments in the traditional financial markets. The new securitized product is an open-end index tracker, a participation certificate based on the original utility token LyCI. Tracker certificates represent the simplest and best-known type in the product category of structured products. They reflect the price performance of an underlying asset on an almost one-to-one basis. The new Lykke index open-end tracker comes complete with a Swiss ISIN code, thus making it easily accessible for qualified (and also large-scale) investors, but still harnessing the power of the blockchain-based innovation.

Always be invested in the top 25 digital blockchain assets

The underlying LyCI is a utility token allowing the purchase of the world’s top 25 crypto assets based on index-weighted market capitalization, all in a single transaction. LyCI Service Token (ticker: LyCI) is priced in real-time and rebalanced on a minute-by-minute basis. LyCI is the first token of its kind and makes it easy for users to pick winners, diversify risk and simplify the management of the complex and rapidly-evolving universe of cryptos. The new issuance combines outstanding expertise within the blockchain segment and unique issuance setup that transforms digital assets into a format that has been used in finance for decades. It has the potential to accelerate the blockchain revolution for qualified investors around the world – from family wealth funds through to fully-fledged institutionalised investors.

Joint development of innovative products means shaping market landscape together

Purpose-oriented partnerships among specialized service providers like the one from Lykke and GENTWO Digital are becoming increasingly important. They are forward-looking and show genuine innovative strength (made in Switzerland). The new cooperation between Lykke and GENTWO also shows the old world of traditional finance and the new world of blockchains will increasingly be bridged to create new value and potential of growth to the traditional and newly evolving financial market and its participants.

Patrick Loepfe, founder and chairman of GENTWO said “with a simple, conventional product and one single transaction, it has become possible to invest in the exceptional Lykke token and thus in 25 promising digital assets at the same time. The traditional financial market has nothing more efficient to offer. Investors will quickly experience the added value our combined expertise will create. We are the bridge builders and we will continue to build more such bridges.”

Richard Olsen, founder and CEO of Lykke said “this new product is very exciting for us as it represents the link between what came before and what is coming next. Until today, many traditional investors found it difficult to define a pathway into digital assets and to reconcile this new innovative asset class with their own portfolios. This new product – made possible by the partnership between Lykke and Gentwo – will provide this pathway, finally bridging the two worlds of traditional finance and the blockchain-based future.”

About Lykke

Zug-based Lykke is an internationally operative, Swiss-based company building a global marketplace for the free exchange of financial assets. Lykke’s mission is to democratize finance by leveraging the power of the blockchain. Eliminating market barriers, Lykke will provide and promote equal access from anywhere in the world to the digitization and trade of virtually any asset of value.

Lykke index: https://www.lykke.com/lyci/, Lykke: https://www.lykke.com/

About GENTWO and GENTWO Digital

Zurich-based innovative securitization specialist GENTWO has created a new generation of financial products. The company enables institutional clients to securitize not only bankable, but also non-bankable assets with a Swiss ISIN. The focus on so-called off-balance-sheet investment products solves the problem of declining margins and growth barriers for many financial market players. It opens up new performance potential by creating access to a theoretically unlimited world of asset classes. Financial intermediaries, including banks, can use GENTWO’s setup to realize their own product and business innovations. GENTWO Digital is a joint venture based in the Crypto Valley in Zug, Switzerland. It makes digital assets bankable and turns it into conventional securities (investment certificates).

GENTWO Digital: www.g2d.io, GENTWO: www.g2fp.com

Contact GENTWO:

Sandra Chattopadhyay

Chief Marketing & Communications Officer

E-Mail: [email protected]

Tel.: +41 44 512 75 06

www.g2fp.com/blog

Contact Lykke:

Marina de Mattos

Head of Marketing

E-Mail: [email protected]

Tel.: +41 76 227 41 63

www.lykke.com

The post Lykke’s utility tokens go traditional with GENTWO appeared first on ZyCrypto.

0 notes

Text

Ripple (XRP) Racing After World Bank Recognition, XRP ETP Launch

Ripple prices solid above 34 cents

NGM launch XRP Tracker One allowing investment in a regulated manner attracting institutions and other HNWI

Boerse Stuttgart’s NGM did launch two ETPs tracking the performance of Ripple (XRP) and Litecoin. The XRP Tracker One allows investment without exposure and risks of owning the underlying asset and is regulated meaning broadcasting exchanges are under the microscope. A day after launch, XRP is up 6.8 percent, outperforming Bitcoin (BTC) and Ethereum (ETH).

Ripple Price Analysis

Fundamentals

After three, or even five months of consolidation, Ripple (XRP) is back to the limelight. By leading the surge, the third most capitalized coin is now up 6.8 percent from yesterday’s close and is benefiting from Bitcoin lift-off. But it has not always been like this. Despite market supporting fundamentals and Bitcoin printing higher highs in the last couple of weeks, Ripple was mostly unchanged. Luckily, there are many reasons to be optimistic.

A standout is a recognition by the World Bank and the mentioning of cost savings and speed of xRapid. As a solution that seeks to change status quo benefiting the end user, the global financier notes that Ripple’s solution has the possibility of impacting people’s lives positively. Being one of Ripple’s core product, xRapid do leverage XRP as a medium of exchange. The digital asset, in a recent Weiss Ratings survey, turned out to be more popular in the US than Bitcoin.

From these developments, Nordic Growth Market (NGM) operating by Swiss’s FSA rules, seeks to take advantage of the coin’s popularity by availing an exchange-traded product (ETP) based on XRP–XRP Tracker One, allowing investment without exposure. The XRP Tracker One has a valid ISIN Number meaning they are legit securities.

Candlestick Arrangements

Back to price action and the trend is clear. Bulls are firing XRP. By adding 6.8 percent today, Ripple (XRP) is leading the way. By the close of today, the coin will likely be above 34 cents meaning our previous XRP/USD trade plan is valid and risk-off, aggressive traders can load up on every dip.

Already, we can note that momentum is high because, despite Apr 3 and 4 bars closing above the upper BB, prices found support in the Asian session arresting liquidation.

As a result of this development—and high participation levels exceeding those of Apr 4, bulls are firm and aggressive traders should load up on pullbacks as long as XRP is above 34 cents.

Technical Indicators

Volumes are high, and even though the initial excitement is subsiding, Ripple (XRP) prices are trending above 34 cents. Because of this, we expect higher highs with targets at 40 cents. After that, any gain driving prices above 40 cents must be with high volumes preferably above those of Apr-2, 79 million.

Chart courtesy of Trading View

The post Ripple (XRP) Racing After World Bank Recognition, XRP ETP Launch appeared first on NewsBTC.

from Cryptocracken Tumblr http://bit.ly/2G3jcZO via IFTTT

0 notes