#Sunil Singhania

Explore tagged Tumblr posts

Text

A Guide to the Best Knee Arthroscopy Surgeons in Jaipur"

Introduction:

When it comes to orthopedic procedures, especially knee-related issues, finding the right surgeon is crucial for a successful outcome. Jaipur, known for its rich cultural heritage, is also home to several highly skilled Knee Arthroscopy Surgeon in Jaipur. In this guide, we'll explore some of the best knee arthroscopy surgeons in Jaipur who have earned a reputation for their expertise, experience, and patient satisfaction.

Dr Ashish Rana

Dr Ashish Rana is a renowned orthopedic surgeon specializing in knee arthroscopy. With over 15 years of experience, he has successfully treated a myriad of knee conditions. Dr. Rana is known for his patient-centric approach, ensuring thorough consultations and personalized treatment plans.

Location: SP-4 & 6, Central Road, Malviya Nagar Industrial Area, Malviya Nagar, Jaipur, Rajasthan 302017

Dr. Anjali Gupta

Dr. Anjali Gupta is a leading knee arthroscopy surgeon in Jaipur, with a focus on minimally invasive techniques. Her commitment to staying updated with the latest advancements in orthopedic surgery sets her apart. Patients appreciate her compassionate care and dedication to ensuring optimal recovery.

Dr. Sunil Verma

Dr. Sunil Verma is a skilled orthopedic surgeon with a specialization in knee arthroscopy. His comprehensive approach to diagnosis and treatment, coupled with state-of-the-art facilities at his clinic, has made him a trusted name in the field. Dr. Verma is known for his successful track record in handling complex knee surgeries.

Dr. Priya Mathur

Dr. Priya Mathur is a board-certified orthopedic surgeon with a keen interest in knee arthroscopy. Her dedication to patient education and involvement in the decision-making process has earned her praise from the local community. Dr. Mathur believes in a holistic approach to knee health, emphasizing both surgical and non-surgical solutions.

Dr. Arvind Singhania

Dr. Arvind Singhania is a veteran in the field of orthopedic surgery, particularly knee arthroscopy. With a career spanning over two decades, he brings a wealth of experience to his practice. Patients appreciate his clear communication, transparency, and commitment to providing the best possible outcomes.

Choosing the right knee arthroscopy surgeon involves considering factors such as experience, patient reviews, and the surgeon's approach to treatment. It's advisable to schedule consultations with a few surgeons to discuss your specific case and make an informed decision.

Conclusion:

When it comes to knee health, seeking the expertise of a qualified Orthopedic Surgeon in Jaipuris paramount. The surgeons mentioned in this guide are among the best in Jaipur, known for their skill, experience, and commitment to patient well-being. Prioritize your health by consulting with one of these esteemed professionals for personalized and effective knee care.

Facebook - https://www.facebook.com/orthopaedicsurgeonjpr/

Instagram - https://www.instagram.com/drashishrana/

#orthopedic doctor in jaipur#acl repair doctor in jaipur#best hip replacement surgeon in jaipur#orthopedic surgeon in jaipur

0 notes

Text

Markets On Diwali: Glittering Samwat In Store For D-Street? Nikunj Dalmia | Sunil Singhania | ET Now

ET NOW: http://dlvr.it/SykzVR

0 notes

Text

What is the future of Alternative Investment Funds?

Introduction

Before we delve into what lies in the future for Alternative Investment Funds, we can understand what it really means. Alternative Investment Funds (AIFs) are basically a pool of funds where the funds are collected from investors to invest it according to a defined investment policy so that the investors can benefit from it. It can be invested in real estate, startups, SMEs, hedge funds, social venture funds and venture capital funds. These are asset classes which are not accessible to all. Although, these are high risk mediums but if invested in smartly they can yield highly impressive returns.

AIFs in eagle eye view

AIFs have three categories. Category I AIFs are majorly for investing in start-ups, SMEs, venture capital funds, social venture funds and infrastructure. This category has a pass-through status exempting it from any tax on running the fund. Category II funds comprise of private equity funds or debt funds. This category too has the pass-through status. Moving on to Category III, this comprises of hedge funds or funds with short term returns. It uses complex strategies to trade. This category does not have the pass-through status and is taxed in various stages; hence it is hardly advised to the investors.

History

AIFs came into existence in the second half of 20th century in the U.S. and since then they have grown into a $7 trillion-plus industry across the world. Venture capitals have been in existence for twenty years in India, AIFs started existing only after SEBI passed its 2012 regulations. Edelweiss Alpha Fund was the first AIF in the country and was launched in June 2013, which was followed by DSP BlackRock Enhanced Equity Fund in May 2014.

Edelweiss’s distressed assets fund is currently raising nearly $1 billion globally. This tells us that AIFs have gained a reliance and popularity among the investors of the world and also that people are more open to investing in such high-risk mediums.

Some Leading AIFs

Monarch AIF – MNCL Capital Compounder Fund was the top gainer among all AIFs in July having a record return of 13%. Other leading AIF performers in 2022 were Nippon India’s Financial Services Scheme at 12.7% and Ampersand Capital Trust’s Growth Opportunities Fund at 11.87%. Sunil Singhania led Abakkus Asset’s funds gained up to 8.5%. Alchemy Capital’s Leaders of Tomorrow also managed a similar return of 8.36%. These are all Category III AIFs, which use strategies in investments that yield high returns.

Reason for growth

Investors who have diversified portfolios including alternate investments apart from the FDs, mutual funds, stocks, gold and silver, and real estate etc., are most likely to get better returns and safety for their investments. In India, some of the alternate investment methods have been in use for decades but they have been accessible only to the extremely rich. These are mostly marketed by wealth management firms to their top-tier clients and demand a very high entry price. Fixed income alternate investments are like a shield against inflation. This is because they have no direct correlation with the market. Some other benefits are generation of passive income, and interest payments which can be an excellent post-retirement benefit. Alternate investment methods are a good way to expand one’s portfolio as they help in avoiding risks, and provide stability to income while generating healthy returns. Mutual funds and PMS (portfolio management services) were not allowed but Category-III AIFs are allowed to use complex trading strategies for investors of sophisticated portfolio and who are willing to invest at least Rs 1 crore in high-reward and high-risk bets.

Present scenario of AIFs

There has been a change in lifestyle and with that a rise in income which can be disposed, and this can be smartly put into investments. Individual small-scale investors now have been presented with new mediums that can help them expand their portfolios. Return on Investment is a major focus area but there are other factors as well, such as safety, liquidity, and a strong mechanism which monitors the investment throughout its lifecycle and the individual investors are now aware of these factors. The market for alternate investments is growing at a great speed in recent years, and according to the latest data from the Securities and Exchange Board of India (SEBI), the investments made in Alternate Investment Funds (AIFs) grew over Rs. 3.11 lakh crore by the end of June 2022. While most of these are linked to Category I and II AIFs, it also signifies that investors are getting more interested in such asset classes and they need to be made more accessible. For the reasons such as high-ticket size that was only affordable for high-net-worth individuals (HNIs), the risks involved, lack of regulation in alternate investments the common public was earlier denied an opportunity to invest in these asset classes. But, with the introduction of technology-driven platforms convenience and transparency has also entered the process and the barriers are falling. While the convenience is technology-driven, the world of investments still needs a high degree of due diligence for each opportunity, along with accurate processes and careful post-investment monitoring. Start-ups have a great opportunity to help deepen the financial instruments and portfolios for investors in India. Together they can be the building blocks for financial strength of the country.

The future of AIFs in India

Currently, opportunities in this space include giving a form of debt to corporates such as a corporate loan, leasing, etc. However, there is a lot of potential for the Indian market, and it can slowly mature to more fields like investing in farmlands, agricultural products, artworks, Non-fungible Tokens (NFTs), collectibles, etc. Growth in technology has also led to innovative products with the use of blockchain/smart contract which helps in the identifying the ownership. This can play a huge role in achieving greater transparency and safety in this space in the future. In the coming times, people will get an opportunity to consume products/services and invest and earn from what they use in their everyday lives. The need for fixed income alternative investments in investors’ portfolio is important. Regulators are also playing a helping hand by bringing clarity to deeply strengthen the financial markets while safeguarding investors. If we look into the minds of investing giants, they believe that AIFs will be the next big boom just like the Mutual Funds. As per the SEBI records, 1070 AIFs are already functioning in India and as more people are getting attracted towards this method, this is bound to see a change in Indian investing practices. After the early 90s, access to public stock markets was driving the wealth for many people in the country. Today, India is facing a similar opportunity, where participating in alternate investments will be the next leap in leading financial stability.

Conclusion

While we have talked about the scenarios of AIFs, we should also look at some challenges, keeping in mind the restrictions which are imposed on fund managers who accept capital from Indian institutions, many fund managers first raise the capital from the offshores and then domestic capital from private institutions, family offices and HNIs. If any capital is to be raised from India, the financial institutions with significant capital should be allowed more flexibility to invest in alternative assets. This will give the much-needed leap to the AIF industry.

Our product SimplyTransact is just meant for you. Please reach out to our Product Head– Ms. Shilpa Agarwal at the mail ID [email protected] or [email protected] to know more.

Resource: https://simplybiz45.blogspot.com/2023/04/what-is-future-of-alternative.html

0 notes

Text

Sunil Singhania founder of Abbakus Asset Management

Sunil Singhania, CFA, is the founder of Abbakus Asset Management. He was the first person from India to be nominated to the CFA Institute Board of Governors, and is currently chair of its investment committee. Prior to establishing his current firm in 2018, he was global head, equities, at Reliance Capital where he oversaw equity assets and provided strategic inputs across the Reliance Capital Group of companies, including asset management, insurance, AIF, and offshore assets. Singhania was also the founding president of CFA Society India, formerly the Indian Association of Investment Professionals. He was the first fund manager to take his NAV to 1000rs in India . His latest and current venture is Abakkus Asset Manager. He manages to funds with Abakkus with a total AUM of around Rs 3000 cr. He is know for his value style of investing and choosing businesses that are quality businesses and are yet available at a significant discount to peers. Abakkus portfolio aims to perform similarly under his guidance.PMS AIF WORLD is a modern day analytics and content based Wealth Management firm helping today’s and tomorrow’s investors to create wealth over sustained and long periods of time.

1 note

·

View note

Text

Sunil Singhania, Chief Investment Officer (Equity), Reliance Capital Asset Management

Sunil Singhania, Chief Investment Officer (Equity), Reliance Capital Asset Management

Numbers fascinate Sunil Singhania. So do balance sheets. In 1991, when India opened its economy to the world, Singhania channelled his love for numbers and balance sheets to take up a new hobby—stock spotting. He worked as an institutional broker in the mid-1990s and moved to Reliance Mutual Fund in 2003. He was one of the key strategists behind the success of Reliance Growth Fund, which, in May…

View On WordPress

0 notes

Text

NSE-BSE bulk deals: Sunil Singhania’s PMS buys stake in TV Today

NSE-BSE bulk deals: Sunil Singhania’s PMS buys stake in TV Today

MUMBAI: Sunil Singhania’s PMS Abakkus Asset Manager today bought 800,000 shares of at Rs. 345 apiece through a bulk deal on the BSE. In another transaction, Steinberg India Opportunities Fund sold 800,000 shares of TV Today at Rs. 345 apiece through a bulk deal on the BSE. Shares of TV Today ended 17 per cent higher at Rs. 402.5 on the BSE. Following are the other major bulk and block deals…

View On WordPress

0 notes

Text

Sebi move to bring interest back to midcaps from very high PE stocks: Sunil Singhania

Sebi move to bring interest back to midcaps from very high PE stocks: Sunil Singhania

The latest Sebi move will broadbase the investment horizon leading to even the smaller and midcap companies getting access to capital, says the Founder, Abakkus Asset Manager LLP.

The path breaking move by Sebi could lead to a big churn in the markets. While it could lead to a re-rating in small and midcaps, it could fix the underperformance challenge in the mutual fund industryso far. What is…

View On WordPress

#abakkus asset#et now#latest sebi move#markets#midcap companies#mutual fund#mutual fund industry#Sunil Singhania

0 notes

Text

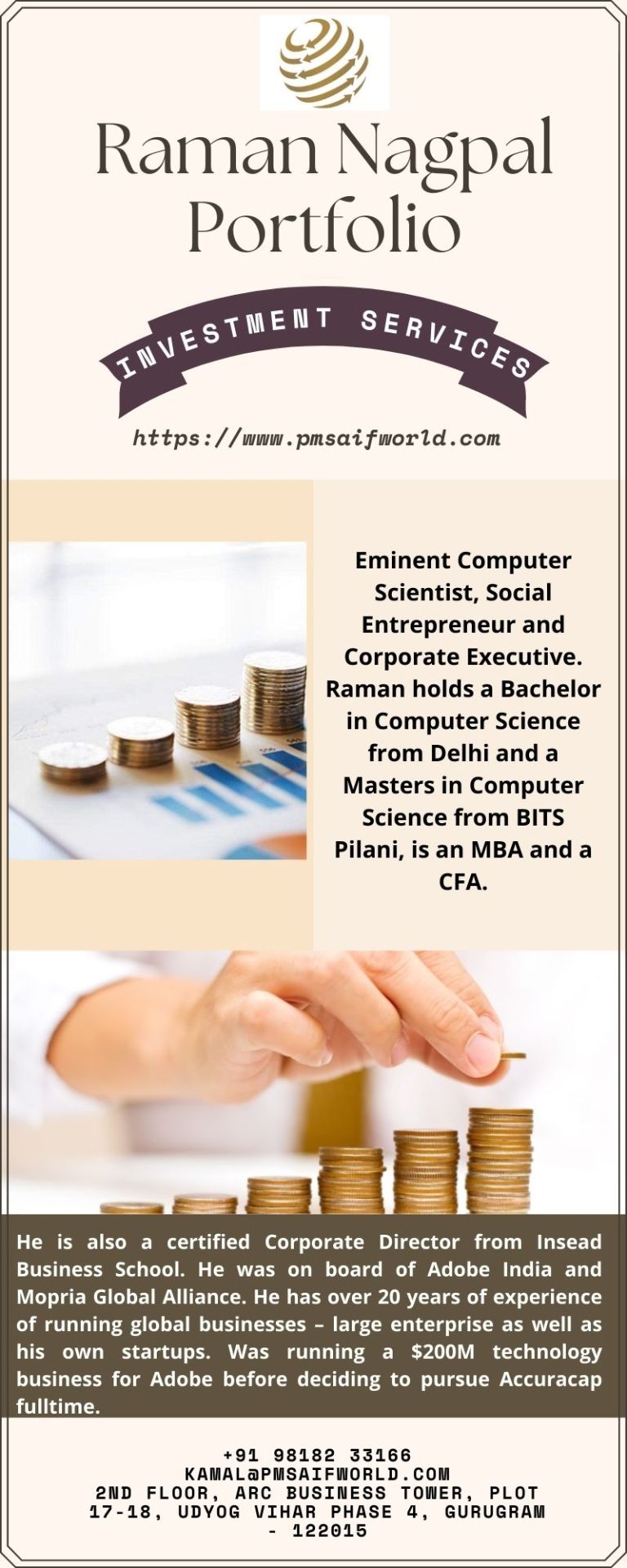

India's No.1 Portfolio management professionals / experts driven by analysis helping you make informed investments and choose outperforming PMS in the Indian Capital Market. https://www.pmsaifworld.com/team_mf/raman-nagpal/

#Raman Nagpal Portfolio#anup maheshwari portfolio#iifl investment managers#Portfolio Manager#negen capital portfolio#rajesh kothari#bharat shah portfolio#equity fund managers#sunil singhania fund manager

2 notes

·

View notes

Text

Check Abakkus Fund - Sunil Singhania portfolio, recently added stocks, corporate shareholdings and investments with detailed company analysis on Ticker.

#abakkus fund - sunil singhania portfolio#sunil singhania investor#sunil singhania shareholdings#sunil singhania investments

0 notes

Text

Today, the Goregaon Sports Club (GSC) is the pride of Malad in Mumbai. Blessed with the best sporting facilities, sports events & culture building activities. The club positively impacts the lives of more than 30,000 people.

Things were not always so awesome. This fascinating and unbelievable story of change will reinstil your faith in the power of positivity.

Goregaon Sports Club – an international level club – the pride of Malad, Mumbai.

Steering the time clock back to 2001, Mumbai. The year I got married and moved to Goregaon.

Being born & brought up in South Mumbai, the move was a culture shock for me for a while. Over time, it was nice to see Goregaon & Malad growing into ‘happening’ suburbs. The marshy lands were being replaced by buildings, malls, restaurants, hotels & commercial complexes. The suburb had all the ingredients of an impending real estate boom.

However, time stood still for the Goregaon Sports Club till 2013.

“The club was perceived as a space full of bitterness, animosity and a breeding ground for politics. The ‘sports’ was out of the club and replaced by power games where annual meetings would end into death threats. Corruption would perform a naked dance on the roof while everyone buried their heads in the sand like ostriches. If there can be one MAJOR change that the club witnesses today, its the fact that we are NO LONGER A BITTER PLACE.” says Sunil Dewali, current Vice President, GSC. Interestingly, Mr. Dewali was the first non-Gujrati/non-Marwadi who contested club elections & won.

The club has changed for the better. No more bickering, bitterness and politicking. Thanks to the GenNext movement.

My husband, Amarkant Jain & I silently watched from the wings while we saw my father-in-law & his fellow co-founders’ dream being burned to ashes.

Fast-forward to 2013, a group of young men was disallowed from playing cricket due to reasons totally unrelated to cricket.

They decided to stand up against an established system with a simple demand: “We deserve to play SPORTS in a sports club. We need the facilities to be rightfully allocated through a fair and transparent process for the purpose of playing SPORTS.”

A simple demand that led to the birth of GenNext, a movement that changed Goregaon Sports Club forever.

Sunil Singhania, Mukul Agarwal & Sunil Dewali – the 3 Aces who initiated the Change Management Process at Goregaon Sports Club

The landmark elections where GenNext won almost unanimously. Spurring a change process at Goregaon Sports Club

What has changed at GSC?

Improved sporting facilities comparable to international standards

Better coaches to ensure members ace at their sport of choice

International walking track benefits over 1000 members & non-members daily

Promotion of health & wellness through camps

Urging people to ‘Run for health’ through Marathons

More intra-club sporting events that promote the game & spirit of sports (Squash league, Badminton League, Women’s Throwball, Cricket League, Tennis League etc.)

Culture-building events like Bhagwad Gita recitation, enactment of Ramayana the epic etc.

Fellow-ship events like Mango Festival, Women’s Day, Garba Night, Musical Night, Play enactment, Sunday Housie, Movie screening etc.

5-star living facilities for guests & members

3 affordable multi-cuisine restaurants

New suite at the club

State of the art basket ball ground

Increased focus on sports

Renovated Swimming pool

Resort like swimming pool

Walking track that is used by over 1000 people a day

What numbers are we looking at?

Over 1000 people using the walking track daily

Culture-building & fellowship events attracting crowds of over 2500 people per event

Over 3000 people participating in the Marathon

Over 155 events organized in 2018 alone!

Every event has a chairman who assumes the responsibility of the event. Thus the club has created 155 leaders within their fold.

Mukul Agarwal, architect of the GenNext Movement spoke about his dream for Goregaon Sports Club

How does the financial structure work?

“Most events are self-funded where the money is raised through sponsors. The club stands to gain as the club stands to gain as brand GSC highlighted. Each activity has a chairperson who presents a proposal that is budgeted, approved and a check is kept by the respective office bearer. The club stands to gain when activities are giving a higher return on investment.” explains Sunil Singhania, President, GSC.

Sunil Singhania, President, Goregaon Sports Club

Mr. Singhania has invested in sponsoring cricket teams for the Goregaon Sports Club Premiere League (GSCPL). He is the founder of Abakkus Asset Manager and avidly uses the walking track for his own health.

How does a handful of committee members organize so many events and catalyze so many changes? Answer: They don’t!

The robust model followed by the GenNext is one that believes in the inherent goodness of the human being. “Out of 100 people you meet, 95 will always be good. One needs to empower good people & watch the world change for the best,” says Mukul Agarwal, Mentor & Architect of GenNext.

Mukul Agarwal, Mentor and Architect of GenNext.

“As a result, any member who comes up with a positive idea in the interest of the club members is given the tools & budgets to implement it. As a result, over 160 leaders have been created within GSC today. Each of them selflessly works towards the betterment of the club while contributing to their own self-worth & happiness.” Mr. Agarwal continues.

Param Cricket Academy at GSC

Mr. Agarwal leads an extremely busy life as the MD of Param Capital Pvt. Ltd. He chose not to occupy any seat of power and instead helps the club by staying among the members. He sponsors a team at GSCPL and has also funded the Cricket Academy at the club.

Can anyone come forward and make a difference? Answer: YES!

The GenNext is constantly on the lookout for more and more members to take lead in the club’s matters. “The current management has a progressive attitude and the team believes in advocating positivity in thought, speech, and action. Empowering our fellow members is what GenNext is all about. We serve in our best capacity and we pass on the baton to the next responsible person. We leave behind something so solid, that solid becomes the new benchmark” says Nigam Patel, Hon. Secretary, GSC.

Nigam Patel, Hon. Secretary, Goregaon Sports Club.

A cricketer and cyclist, Mr. Patel is an entrepreneur who sets aside time from his busy schedule to attend to the club matters. Every single day, Mr. Patel ensures that he spends at least 2-3 hours at the club, solving matters and interacting with the members.

GenNext’s new system ensures that complaints are attended to & solved within 24 hours.

More than 30,000 people with over 500 key members who remain active in all events. What keeps them together? How do they stay away from politics and narcissism?

“Passion for sports is the number one reason that binds us all together. The entire GenNext consists of sports people who wish to promote sports and a healthy lifestyle. We got together with the common goal of promoting sports and stood up for what is right rather than supporting popular, politically correct opinions. We want to give back to society & share our experiences while doing so. At the same time, we want to network and learn from co-members in the club and ensure that everyone feels in-charge and empowered to create a difference. We want the child within us to stay alive forever so that we don’t feel old.” shared Mr. Agarwal.

“We want the child within us to stay alive forever so that we don’t feel old,” says Mukul Agarwal. Seen here with Rishi Kedia, current outdoor chairman & ace cricketer, Sushil Patil.

You will see Mr. Agarwal merging into the crowds while standing out like a leader among equals, with his feet firmly on the ground. He attributes the initial trigger to his friend, Rishi Kedia, GSC’s current outdoor sports chairman who made him realize that if one had to change the system, one had to be part of the system.

How does the GenNext ensure that every member feels involved and empowered?

“When we decided to contest elections in 2014, we were just 3 candidates the rest of them were sourced by making announcements at every event in the club. We were facing people who wanted to stay miles away from the club’s daily affairs. We worked hard to create a mind shift and get people to join us. We have introduced a simple system to ensure that the working stays as democratic and inclusive as possible; none of us holds an office for more than two terms and no chair for more than one year.” says Mr. Dewali.

Sunil Dewali, current Vice President and former secretary of Goregaon Sports Club.

Mr. Dewali is not only an avid user of the club facilities and a cricketer par excellence, but you will also see him networking with the members every single day. Dewali is the COO of Andromeda Marketing Ltd.

How does GenNext prevent misuse, embezzlement, politicking, and nepotism – a signature in most public institutions?

“There are two kinds of people who take up positions in public institutions like ours, one type is fanatic about name, fame, money, and power. The other category is those people who actually wish to work and participate in the club activities. Passionate sportspersons who are equally involved in the development of the club are those who win hearts through the positive changes at the institution. The idea is to ignite passion and inspire others to join the movement and take over the office for the betterment of the club.” reiterates Mr. Patel.

Mutual respect & belief in each other’s good intention binds GenNext together

The whole climate is that of mutual respect for each other’s intellect and a deep-rooted trust that each person is working towards the betterment of the club. This is reflected when Mr. Singhania shares, “I received tremendous support from the outgoing President and am inspired to fully support the next one who takes the baton from me. It’s like a chain reaction or relay race where we keep passing the torch to the next responsible and passionate person. So far, the model is working and we are sure it will continue to work as long as there are good sportspersons & human beings in this world.”

What does founder member K K Jain think about the GenNext?

Founder member, Krishankant Jain (fondly known as KK Jain Sahab) has always been perceived as the most neutral. History of the club reveals stories of how he single-handedly stood up for what is right and garnered loads of negativity and enemies in the bargain. However, he stood his ground – always. His main aim is the betterment of the club and nothing else.

Krishankant Jain, Founder Member, Goregaon Sports Club

“When one sees a selfless initiative making quantum changes at the club, one feels it right to hand over the baton to the right people. It’s nice to come to the meetings and discuss with an intelligent lot who keep the club before anything else. Arguments and disagreements still occur but everyone has only one goal in mind and that is the betterment of the club. After many years, I am now able to peacefully enjoy the club facilities without having to bother about mindless actions of vested interests.” shared KK Jain Sahab.

Who is GenNext and who are the people involved?

“GenNext is a movement of like-minded individuals. If you are progressive and keep the club before self, then you are GenNext.” emphasizes Mr. Agarwal.

Note from DiaryOfAnInsaneWriter:

I have breathed air that is free of politics and bitterness. And that is why this I decided to write this blog post.

It is indeed IMPOSSIBLE to believe that there exists a space where ZERO POLITICS and MUTUAL RESPECT form part of the atmosphere. A wonderful space where people come together to have fun and promote sports and culture. If you still don’t believe it, then NOW is a good time to step into Goregaon Sports Club and feel the change.

On my part, over the past one year, I have participated in Throwball, Marathon, Walking, Women’s Day celebration, Mango Festival, Musical Night, Garba, Aerobics, Swimming, Yoga among others. Recently, I got the opportunity to perform in front of 3500 people in RAMAYANA – a magnum opus production conceptualized by GSC’s Cultural Chairman, JD Majethia.

You can follow GSC on:

Facebook | Twitter | Instagram | Website

Do leave your comments, I would love to read your thoughts and suggestions. Don’t forget to like and share this post with your friends and family.

Curated & Written by:

Mayura Amarkant

An unbelievable story of change, impacting 30,000 lives: #InFocus: Goregaon Sports Club #ChangeManagement #CaseStudy Today, the Goregaon Sports Club (GSC) is the pride of Malad in Mumbai. Blessed with the best sporting facilities, sports events & culture building activities.

#Andromeda#Best change management case study#Change Management#change management case study#facilities at Goregaon Sports Club#family time#Goregaon Sports Club#Goregaon Sports club changes#Goregaon Sports Club membership#inspiration#Krishankant Jain#life#Mukul Agarwal#Param Capital#Rishi Kedia#Shyam Agarwal#sports#Sunil Dewali#Sunil Singhania#who moved my cheese

0 notes

Text

India well placed to reach $5 trillion economy mark by 2024 and $10 trillion by 2030, say industry who’s-who

- Experts from Banking, Industry, Economy, Finance and Capital Market discussed the roadmap for achieving the GDP targets at the Financial Conclave organised by Jito Professional Forum

- The financial conclave was attended by 250 finance professionals, bankers, fund managers, capital market participants, all JITO Members

Mumbai, September 25, 2019: Following the recent positive steps taken by the government to support the economy’s growth and boost various industry sectors through capital market reforms, banking sector consolidation, corporate tax rate cut, Rs 10000 crore special window funding to real estate along with many other measures, the who’s-who of the industry have evinced their confidence about the Indian economy not only reaching the target of $5 trillion by 2024 but also looking beyond to achieve the $10 trillion mark by 2030.

At the “Jito Professional Forum -Finance Conclave” organized by The JITO Professional Forum (JPF), an arm of Jain International Trade Organization ( JITO ), on Sunday, September 22, 2019, over 250 participants which included the who’s-who of the industry comprising of CXOs managing 40 % AUM of Indian Mutual Fund Industry & equity market experts, as well as experts from Banking, Industry serving over 40 % of the Indian Banking market ,Industry handling over 50 % of India’s Data consumption ,Economy and Finance, discussed the roadmap for the industry to achieve the mission of $ 5 trillion dollar economy by 2024. The experts were part of panel discussions on various avenues that could lead India to achieve the abovementioned goals.

The panel on the “Way Forward” to achieve the $5trillion target was moderated by Dr. Ashok Ajmera, CMD of Ajcon Global Services Ltd and a Sr Equity Analyst.

Mr. Prashant Jain, ED & CIO of HDFC AMC, Mr. Navneet Munot, CIO of SBI Mutual Fund, Mr. Sankaran Naren, ED & CIO, ICICI Prudential AMC, Mr. S. P. Tulsian, senior Equity market analyst, Mr. Sunil Singhania of Abakkus Asset Manager LLP (Fr. Global Head – Equities at Reliance Capital) and Mr. Vijay Anand – Product & Research Head of Aum Capital, were part of this panel discussion.

Mr. Prashant Jain, ED & CIO of HDFC AMC, made a presentation to show that Indian investor would continue to see exponential advantage in investing in equity market as compared to other asset classes: “The power of equity investment can be judged from the simple fact that the BSE Sensex has moved to 40000 in 2019 from 100 in 1979. This is, 400 times appreciation in 40 years, which is around 16% CAGR. No other asset class has given returns even remotely near to this. Patience is the key to successful investing in equities,” he said.

Mr. Sankaran Naren, ED & CIO, ICICI Prudential AMC, however, advised that “Small cap is cheap and quality is costly.”

Speaking about the benefits of some of the recent reforms measures announced by the government, Mr. S. P. Tulsian, senior Equity market analyst, said, “Indian economy is poised to grow touching a rapid double digit growth over next 5 years. The recent Tax rate cut will revive investment climate with FDI & FII investment seen rising over next 2-3 years. Contract manufacturing allowed with 100% FDI, coupled with new units attracting 17% Income tax will accelerate setting up of new units in electronic, defence and technological sectors.”

Mr. Navneet Munot - CIO of SBI Mutual Fund, agreed with Mr. Prashant Jain and said: “Investors will benefit from remaining invested in equity market in the medium to long term and should avoid selling it low and buying at high. He added, “A reform friendly government with significant political capital, a stable macro-economic environment and structural drivers like favorable demographics, demand and digitalisation will take India to a $5 trillion economy. A world dealing with excessive liquidity and anemic growth will find India as an 'Oasis of Hope'.”

The second panel discussion on “The Outlook” for Indian economy was moderated by Mr. Arijit Basu, Managing Director of State Bank of India, and the panelists included Mr. Saumya Kanti Ghosh, Gr. Chief Economic Advisor for SBI, Kewal Handa, Charman of Union Bank of India, Mr. Rajneesh Jain, CFO, Reliance Jio Infocomm Ltd., and Shri. Pankaj Jain, Director at Duff & Phelps.

Mr. Saumya Kanti Ghosh provided statistical numbers to prove that India could easily reach the target of USD 5 trillion by 2024. He said: “The decision to rationalise corporate taxes will result in significant corporate savings and could act as an enabler in an investment led recovery in medium term. We must remember that $5 trillion is just a number and policies must be tailored towards that objective.”

From JITO Mumbai Zone, Chairman, Shri. Hitesh Doshi and from JPF –Director In Charge, Shri. Ravi Jain welcomed the guests and Vice Chairman – JPF Shri. Ajay Bohara gave the details of activities being carried out by JPF. Shri. Vicky Oswal, Chief Secretary-Mumbai ZONE, delivered the vote of thanks.

Mr. Ajmera congratulated the JPF team for ensuring that their first-ever Finance Conclave was such a huge hit. “Kudos to the team JPF tam for making this event a super-duper hit. This event has become the most sought-after professional event series by the professionals in the Jain community," he said.

1 note

·

View note

Text

Best PMS Products for Wealth Creation

Equities are the one of the best ways to create wealth over longer periods of time. And, Portfolio Management Services are one of the most effective ways to invest in equities.

In the last decade (2010-2020 ) equity market delivered very average returns less than 5 % CAGRas SENSEX went up from 20000 to 40000, and the decade prior to that ( 2000-2010 ), was one of the best decades for equities as SENSEX went up from 3000 level to around 21000 level. If the pattern is to be extrapolated the decade next 2020-2030 could be to be another stellar decade for wealth creation. There are many fundamental reasons for that. Let’s understand them.

With historic fall in interest rates, cost of capital has gone down significantly. This presents a good business case which many entrepreneurs have always chased in India over years. Also, fall in interest rates, from highs of 9% to almost 5% currently, makes the case for valuations to be seen differently, and hence some high valued companies could command even higher valuations as they would be seen for the potential to generate higher return on capital employed over next decade.

Indian Economy as measured from Gross Domestic Product ( GDP ) has grown from US $ 1.6 tn in 2010 to US $ 2.8 tn in 2020. An absolute performance of 75%. Significantly higher than performance of equity market as Sensex growth was only 50% during last 10 years. This has led to a multi-year GAP between equity market cap and GDP. Currently market cap - to - GDP stands at ~ 60 %. This ratio has fallen swiftly from ~80% as in FY 19 to ~60% in FY 20. It is today, much below long - term average of 75% and closer to levels last seen during FY 09. The ratio has been quite stable over FY15-19 in the 70-80% band. The lowest in the last two decades has been ~45% seen in FY04. The ratio hit a peak of 149% in December 2007 during the 2003-08 bull run. This GAP in Market Cap to GDP ought to be filled and Market Cap to GDP could surpass 100% mark over next decade.

India is an agrarian economy with nearly 50% of Indians livelihood dependent on agriculture and allied sectors. This year has seen a good Rabi crop and the India meteorological department (IMD) announced that it expects monsoon rainfall to be normal this year. Rollout of long pending Agri reforms like scraping of essential commodities act, allowing farms to sell their produce anywhere in the country etc shall pave a way for corporatization of agriculture sector and should lead to growth of this sector in medium to long term.

FII holdings today stands at the lowest level since 2013, at ~20%, govt holding is also at a record low of at ~ 6.6%, DII holding is at 14%, and retail holding is also at 14%. But, at the same time, Indian promotors have increased their holding and are on the buying Spree where they see their franchises under-valued.

China which is largest manufacturing hub to many multinational companies is facing distress wave. And, most of these companies are looking for another alternative, today. CII & Indian Govt. has made representation to around 1500 global companies for moving production to India. Besides, last 10 years have paved way too many policy moves as well as reforms at fiscal, monetary and tax levels. Current scenario is becoming highly conducive for India to attract potential FDI over next decade.

Fall in global crude oil prices is a huge positive for India. Remember 85% of oil is what we import, and every 1 dollar fall in its price, leads to 1 bn dollars of saving on our import bill. This has cascading effect on lower inflation, lower current account deficit, and accommodative monetary stance.

So , investing in Equity is going to see some interesting times ahead and PMS managed by experienced fund managers are going to be one of the best ways to WEALTH CREATION in the coming decade.

Best 5 PMSesbased on the recent past performance (Year 2018 & 2019 ) are

1) Marcellus Consistent Compounders,

2) Stallion Asset Core Fund,

3) IIFL Multi Cap PMS,

4) Ambit Coffee CAN,

5) ASK India Entrepreneurial Portfolio.

0 notes

Text

Abakkus funds beat market comprehensively in 2020

Alternative investment funds (AIFs) of Abakkus Asset Management, led by Sunil Singhania, have delivered satisfying performance to investors in 2020. Abakkus Emerging Opportunities Fund – 1, also called AEOF, logged in 51% returns for CY20. On the other hand, Abakkus Growth Fund – 1 (AGF) clocked a 28% jump for the year.

0 notes

Text

Bulk deals | Sunil Singhania#39;s Abakkus picks 2.6% stake in J Kumar Infra, Jwalamukhi Investment almost exits IFB Industries

Bulk deals | Sunil Singhania#39;s Abakkus picks 2.6% stake in J Kumar Infra, Jwalamukhi Investment almost exits IFB Industries

Copthall Mauritius Investment, which had held 1.11 percent stake (or 60 lakh shares) as of March 2022, was the seller in Indiabulls Real Estate. The stock fell 5 percent to Rs 81.85. May 04, 2022 / 11:03 PM IST Ace investor Sunil Singhania’s Abakkus Growth Fund has picked 2.6 percent equity stake in J Kumar Infraprojects, while Jwalamukhi Investment almost exited IFB Industries via open market…

View On WordPress

0 notes

Text

Sunil Kataria joins Raymond as the chief executive officer of lifestyle business

Kataria will be responsible for steering the next phase of growth by driving the Raymond's digital agenda and strengthening the brand’s presence in domestic and international markets Kataria will be responsible for steering the next phase of growth by driving the Raymond's digital agenda and strengthening the brand’s presence in domestic and international markets.

The lifestyle business is the agship vertical of Raymond Group which includes branded textiles, garmenting, shirting, retail and apparel business. The business includes brands such as Raymond, Raymond Ready-to-Wear, Raymond Made to Measure, Park Avenue, ColorPlus, Parx and Ethnix by Raymond.

Gautam Hari Singhania, chairman and managing director, Raymond Ltd said that over the last few years the company has made strong strides and created brands and retail experiences for new-age consumers. Kataria could be instrumental in accelerating growth for the business in India and international markets, he added.

In 2019, Raymonds had announced the demerger of its core lifestyle business and its listing as a separate entity in a bid to create two separate companies. However, the demerger scheme of the lifestyle business was subsequently withdrawn. Instead, the company moved to consolidate its apparel business.

“With a focus to fast track the recovery post pandemic, Raymond will consolidate its B2C business by transfer of apparel business into Raymond Ltd.

This move will strengthen efciencies, streamline and simplify processes and bring in synergy benets in terms of design and innovation, sourcing and retail network, " it said in a 2021 September ling to the exchanges.

The company has witnessed an overhaul of processes and technology over last few years. “In an endeavour to emerge as a new age lifestyle conglomerate, technology has been increasingly playing a signicant role. Its latest slew of launches be it—DIY range of denims, home concierge services, stylist advisory, virtual tradeshows and bookings, increasing presence on e-commerce and various other initiatives are ably aided by technology across consumer lifecycle, " the company said.

Kataria is the second executive to lead the lifestyle business since 2020 after Sanjay Behl quit in 2020; mid last year Joe Kuruvilla stepped down from the role.

Last month, GCPL announced that Sunil Kataria, chief executive ofcer, India and SAARC, had decided to step down from his role to pursue an opportunity outside the company. Raymond is a popular worsted suiting manufacturer in India that offers end-to-end solutions for fabrics and garmenting. Raymond’s retail networks consist of 1,400 stores in more than 600 towns.

It also has a packaged consumer goods business—in the men’s personal grooming category and personal hygiene.

0 notes

Text

Raymond appoints Sunil Kataria as CEO of Lifestyle Business

Leading textile and apparels firm Raymond on Wednesday said it has appointed Sunil Kataria as the CEO of its lifestyle business.

The Mumbai-based company said it has strengthened its leadership team by on-boarding the seasoned professional reckoned for leading large-scale business transformations and creating strong consumer brands in India and Southeast Asia.

In his new role, Kataria will be responsible for steering the next phase of growth by driving the digital agenda and strengthening the brand's presence in domestic and international markets.

"At Raymond, we believe in having industry's finest talent that resonates with our vision to create a future ready organisation. During the last few years, we have been making stronger strides and creating brands and retail experiences for our loyal and new-age consumers," Raymond Chairman & Managing Director Gautam Hari Singhania said in a regulatory filing.

The Lifestyle Business is the flagship vertical of Raymond Group which includes branded textiles, garmenting, shirting, retail and apparel verticals.

Kataria's role will be pivotal in driving the ongoing transformation to create a future ready entity that intersperses digital and physical experiences while infusing freshness to product portfolio to drive growth, the company stated.

During his earlier stint as the CEO of Godrej Consumer Products Ltd, Kataria managed the business operations of India and Southeast Asia.

Read more

0 notes