#Stock Cash Market Tips

Explore tagged Tumblr posts

Text

Sensex Today Live Updates : Sensex up 230pts, Nifty at 22,640; Auto, FMCG, Pharma, O&G gain, Bank index under pressure

0 notes

Text

Are you a person who wishes to invest in stock market for long term but don't know on what to invest and when to invest? You definitely need to read this book my friend! This book is a very good beginners book. This book explains basics of fundamental analysis of stocks in 5 rules. These 5 rules helps you to identify undervalued stocks, filter out overvalued stocks and accumulate a fundamentally sound stock. Do give it a try! I have attached reviews and descriptions about the book. Please have a look on it to know more about the book 😁

Visit vkrproducts.etsy.com for more details about the book or directly click the below eBook link 👇🏻👇🏻👇🏻

#investing stocks#investment#share market#investors#stock market#stocks#beginnersguide#fundamental#economy#finance#fundamental analysis#long term investment#market share#share market tips#good ebooks#ebook#equity#cash market#stockstowatch#stockstobuy#watchlist#portfolio#investing#learntoearn#wealth#wealth building

1 note

·

View note

Text

We provide stock future tips, nifty future tips, option trading tips, nifty option tips with good accuracy upto 80 to 90.Unlock the potential of stock future with expert tips and tricks. We'll guide you through the intricacies of stock future trading, helping you make informed decisions that align with your investment goals and risk tolerance.

#stock cash tips#Index Option tips#btst trading#btst in share market#stock future tips#intraday trading tips#trading tips#intraday trading tips in hindi#option trading tips#smart trading tips#commodity trading tips#options trading tips#intraday trading tips today#sgx nifty live smart trading tips#intraday trading tips for today#investment advisory services#btst in stock market

0 notes

Text

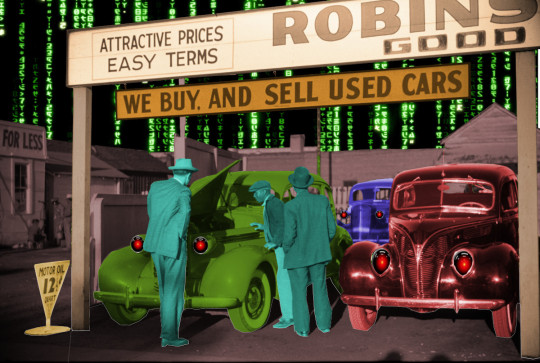

The reason you can’t buy a car is the same reason that your health insurer let hackers dox you

On July 14, I'm giving the closing keynote for the fifteenth HACKERS ON PLANET EARTH, in QUEENS, NY. Happy Bastille Day! On July 20, I'm appearing in CHICAGO at Exile in Bookville.

In 2017, Equifax suffered the worst data-breach in world history, leaking the deep, nonconsensual dossiers it had compiled on 148m Americans and 15m Britons, (and 19k Canadians) into the world, to form an immortal, undeletable reservoir of kompromat and premade identity-theft kits:

https://en.wikipedia.org/wiki/2017_Equifax_data_breach

Equifax knew the breach was coming. It wasn't just that their top execs liquidated their stock in Equifax before the announcement of the breach – it was also that they ignored years of increasingly urgent warnings from IT staff about the problems with their server security.

Things didn't improve after the breach. Indeed, the 2017 Equifax breach was the starting gun for a string of more breaches, because Equifax's servers didn't just have one fubared system – it was composed of pure, refined fubar. After one group of hackers breached the main Equifax system, other groups breached other Equifax systems, over and over, and over:

https://finance.yahoo.com/news/equifax-password-username-admin-lawsuit-201118316.html

Doesn't this remind you of Boeing? It reminds me of Boeing. The spectacular 737 Max failures in 2018 weren't the end of the scandal. They weren't even the scandal's start – they were the tipping point, the moment in which a long history of lethally defective planes "breached" from the world of aviation wonks and into the wider public consciousness:

https://en.wikipedia.org/wiki/List_of_accidents_and_incidents_involving_the_Boeing_737

Just like with Equifax, the 737 Max disasters tipped Boeing into a string of increasingly grim catastrophes. Each fresh disaster landed with the grim inevitability of your general contractor texting you that he's just opened up your ceiling and discovered that all your joists had rotted out �� and that he won't be able to deal with that until he deals with the termites he found last week, and that they'll have to wait until he gets to the cracks in the foundation slab from the week before, and that those will have to wait until he gets to the asbestos he just discovered in the walls.

Drip, drip, drip, as you realize that the most expensive thing you own – which is also the thing you had hoped to shelter for the rest of your life – isn't even a teardown, it's just a pure liability. Even if you razed the structure, you couldn't start over, because the soil is full of PCBs. It's not a toxic asset, because it's not an asset. It's just toxic.

Equifax isn't just a company: it's infrastructure. It started out as an engine for racial, political and sexual discrimination, paying snoops to collect gossip from nosy neighbors, which was assembled into vast warehouses full of binders that told bank officers which loan applicants should be denied for being queer, or leftists, or, you know, Black:

https://jacobin.com/2017/09/equifax-retail-credit-company-discrimination-loans

This witch-hunts-as-a-service morphed into an official part of the economy, the backbone of the credit industry, with a license to secretly destroy your life with haphazardly assembled "facts" about your life that you had the most minimal, grudging right to appeal (or even see). Turns out there are a lot of customers for this kind of service, and the capital markets showered Equifax with the cash needed to buy almost all of its rivals, in mergers that were waved through by a generation of Reaganomics-sedated antitrust regulators.

There's a direct line from that acquisition spree to the Equifax breach(es). First of all, companies like Equifax were early adopters of technology. They're a database company, so they were the crash-test dummies for ever generation of database. These bug-riddled, heavily patched systems were overlaid with subsequent layers of new tech, with new defects to be patched and then overlaid with the next generation.

These systems are intrinsically fragile, because things fall apart at the seams, and these systems are all seams. They are tech-debt personified. Now, every kind of enterprise will eventually reach this state if it keeps going long enough, but the early digitizers are the bow-wave of that coming infopocalypse, both because they got there first and because the bottom tiers of their systems are composed of layers of punchcards and COBOL, crumbling under the geological stresses of seventy years of subsequent technology.

The single best account of this phenomenon is the British Library's postmortem of their ransomware attack, which is also in the running for "best hard-eyed assessment of how fucked things are":

https://www.bl.uk/home/british-library-cyber-incident-review-8-march-2024.pdf

There's a reason libraries, cities, insurance companies, and other giant institutions keep getting breached: they started accumulating tech debt before anyone else, so they've got more asbestos in the walls, more sagging joists, more foundation cracks and more termites.

That was the starting point for Equifax – a company with a massive tech debt that it would struggle to pay down under the most ideal circumstances.

Then, Equifax deliberately made this situation infinitely worse through a series of mergers in which it bought dozens of other companies that all had their own version of this problem, and duct-taped their failing, fucked up IT systems to its own. The more seams an IT system has, the more brittle and insecure it is. Equifax deliberately added so many seams that you need to be able to visualized additional spatial dimensions to grasp them – they had fractal seams.

But wait, there's more! The reason to merge with your competitors is to create a monopoly position, and the value of a monopoly position is that it makes a company too big to fail, which makes it too big to jail, which makes it too big to care. Each Equifax acquisition took a piece off the game board, making it that much harder to replace Equifax if it fucked up. That, in turn, made it harder to punish Equifax if it fucked up. And that meant that Equifax didn't have to care if it fucked up.

Which is why the increasingly desperate pleas for more resources to shore up Equifax's crumbling IT and security infrastructure went unheeded. Top management could see that they were steaming directly into an iceberg, but they also knew that they had a guaranteed spot on the lifeboats, and that someone else would be responsible for fishing the dead passengers out of the sea. Why turn the wheel?

That's what happened to Boeing, too: the company acquired new layers of technical complexity by merging with rivals (principally McDonnell-Douglas), and then starved the departments that would have to deal with that complexity because it was being managed by execs whose driving passion was to run a company that was too big to care. Those execs then added more complexity by chasing lower costs by firing unionized, competent, senior staff and replacing them with untrained scabs in jurisdictions chosen for their lax labor and environmental enforcement regimes.

(The biggest difference was that Boeing once had a useful, high-quality product, whereas Equifax started off as an irredeemably terrible, if efficient, discrimination machine, and grew to become an equally terrible, but also ferociously incompetent, enterprise.)

This is the American story of the past four decades: accumulate tech debt, merge to monopoly, exponentially compound your tech debt by combining barely functional IT systems. Every corporate behemoth is locked in a race between the eventual discovery of its irreparable structural defects and its ability to become so enmeshed in our lives that we have to assume the costs of fixing those defects. It's a contest between "too rotten to stand" and "too big to care."

Remember last February, when we all discovered that there was a company called Change Healthcare, and that they were key to processing virtually every prescription filled in America? Remember how we discovered this? Change was hacked, went down, ransomed, and no one could fill a scrip in America for more than a week, until they paid the hackers $22m in Bitcoin?

https://en.wikipedia.org/wiki/2024_Change_Healthcare_ransomware_attack

How did we end up with Change Healthcare as the linchpin of the entire American prescription system? Well, first Unitedhealthcare became the largest health insurer in America by buying all its competitors in a series of mergers that comatose antitrust regulators failed to block. Then it combined all those other companies' IT systems into a cosmic-scale dog's breakfast that barely ran. Then it bought Change and used its monopoly power to ensure that every Rx ran through Change's servers, which were part of that asbestos-filled, termite-infested, crack-foundationed, sag-joisted teardown. Then, it got hacked.

United's execs are the kind of execs on a relentless quest to be too big to care, and so they don't care. Which is why their they had to subsequently announce that they had suffered a breach that turned the complete medical histories of one third of Americans into immortal Darknet kompromat that is – even now – being combined with breach data from Equifax and force-fed to the slaves in Cambodia and Laos's pig-butchering factories:

https://www.cnn.com/2024/05/01/politics/data-stolen-healthcare-hack/index.html

Those slaves are beaten, tortured, and punitively raped in compounds to force them to drain the life's savings of everyone in Canada, Australia, Singapore, the UK and Europe. Remember that they are downstream of the forseeable, inevitable IT failures of companies that set out to be too big to care that this was going to happen.

Failures like Ticketmaster's, which flushed 500 million users' personal information into the identity-theft mills just last month. Ticketmaster, you'll recall, grew to its current scale through (you guessed it), a series of mergers en route to "too big to care" status, that resulted in its IT systems being combined with those of Ticketron, Live Nation, and dozens of others:

https://www.nytimes.com/2024/05/31/business/ticketmaster-hack-data-breach.html

But enough about that. Let's go car-shopping!

Good luck with that. There's a company you've never heard. It's called CDK Global. They provide "dealer management software." They are a monopolist. They got that way after being bought by a private equity fund called Brookfield. You can't complete a car purchase without their systems, and their systems have been hacked. No one can buy a car:

https://www.cnn.com/2024/06/27/business/cdk-global-cyber-attack-update/index.html

Writing for his BIG newsletter, Matt Stoller tells the all-too-familiar story of how CDK Global filled the walls of the nation's auto-dealers with the IT equivalent of termites and asbestos, and lays the blame where it belongs: with a legal and economics establishment that wanted it this way:

https://www.thebignewsletter.com/p/a-supreme-court-justice-is-why-you

The CDK story follows the Equifax/Boeing/Change Healthcare/Ticketmaster pattern, but with an important difference. As CDK was amassing its monopoly power, one of its execs, Dan McCray, told a competitor, Authenticom founder Steve Cottrell that if he didn't sell to CDK that he would "fucking destroy" Authenticom by illegally colluding with the number two dealer management company Reynolds.

Rather than selling out, Cottrell blew the whistle, using Cottrell's own words to convince a district court that CDK had violated antitrust law. The court agreed, and ordered CDK and Reynolds – who controlled 90% of the market – to continue to allow Authenticom to participate in the DMS market.

Dealers cheered this on: CDK/Reynolds had been steadily hiking prices, while ingesting dealer data and using it to gouge the dealers on additional services, while denying dealers access to their own data. The services that Authenticom provided for $35/month cost $735/month from CDK/Reynolds (they justified this price hike by saying they needed the additional funds to cover the costs of increased information security!).

CDK/Reynolds appealed the judgment to the 7th Circuit, where a panel of economists weighed in. As Stoller writes, this panel included monopoly's most notorious (and well-compensated) cheerleader, Frank Easterbrook, and the "legendary" Democrat Diane Wood. They argued for CDK/Reynolds, demanding that the court release them from their obligations to share the market with Authenticom:

https://caselaw.findlaw.com/court/us-7th-circuit/1879150.html

The 7th Circuit bought the argument, overturning the lower court and paving the way for the CDK/Reynolds monopoly, which is how we ended up with one company's objectively shitty IT systems interwoven into the sale of every car, which meant that when Russian hackers looked at that crosseyed, it split wide open, allowing them to halt auto sales nationwide. What happens next is a near-certainty: CDK will pay a multimillion dollar ransom, and the hackers will reward them by breaching the personal details of everyone who's ever bought a car, and the slaves in Cambodian pig-butchering compounds will get a fresh supply of kompromat.

But on the plus side, the need to pay these huge ransoms is key to ensuring liquidity in the cryptocurrency markets, because ransoms are now the only nondiscretionary liability that can only be settled in crypto:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

When the 7th Circuit set up every American car owner to be pig-butchered, they cited one of the most important cases in antitrust history: the 2004 unanimous Supreme Court decision in Verizon v Trinko:

https://www.oyez.org/cases/2003/02-682

Trinko was a case about whether antitrust law could force Verizon, a telcoms monopolist, to share its lines with competitors, something it had been ordered to do and then cheated on. The decision was written by Antonin Scalia, and without it, Big Tech would never have been able to form. Scalia and Trinko gave us the modern, too-big-to-care versions of Google, Meta, Apple, Microsoft and the other tech baronies.

In his Trinko opinion, Scalia said that "possessing monopoly power" and "charging monopoly prices" was "not unlawful" – rather, it was "an important element of the free-market system." Scalia – writing on behalf of a unanimous court! – said that fighting monopolists "may lessen the incentive for the monopolist…to invest in those economically beneficial facilities."

In other words, in order to prevent monopolists from being too big to care, we have to let them have monopolies. No wonder Trinko is the Zelig of shitty antitrust rulings, from the decision to dismiss the antitrust case against Facebook and Apple's defense in its own ongoing case:

https://www.ftc.gov/system/files/documents/cases/073_2021.06.28_mtd_order_memo.pdf

Trinko is the origin node of too big to care. It's the reason that our whole economy is now composed of "infrastructure" that is made of splitting seams, asbestos, termites and dry rot. It's the reason that the entire automotive sector became dependent on companies like Reynolds, whose billionaire owner intentionally and illegally destroyed evidence of his company's crimes, before going on to commit the largest tax fraud in American history:

https://www.wsj.com/articles/billionaire-robert-brockman-accused-of-biggest-tax-fraud-in-u-s-history-dies-at-81-11660226505

Trinko begs companies to become too big to care. It ensures that they will exponentially increase their IT debt while becoming structurally important to whole swathes of the US economy. It guarantees that they will underinvest in IT security. It is the soil in which pig butchering grew.

It's why you can't buy a car.

Now, I am fond of quoting Stein's Law at moments like this: "anything that can't go on forever will eventually stop." As Stoller writes, after two decades of unchallenged rule, Trinko is looking awfully shaky. It was substantially narrowed in 2023 by the 10th Circuit, which had been briefed by Biden's antitrust division:

https://law.justia.com/cases/federal/appellate-courts/ca10/22-1164/22-1164-2023-08-21.html

And the cases of 2024 have something going for them that Trinko lacked in 2004: evidence of what a fucking disaster Trinko is. The wrongness of Trinko is so increasingly undeniable that there's a chance it will be overturned.

But it won't go down easy. As Stoller writes, Trinko didn't emerge from a vacuum: the economic theories that underpinned it come from some of the heroes of orthodox economics, like Joseph Schumpeter, who is positively worshipped. Schumpeter was antitrust's OG hater, who wrote extensively that antitrust law didn't need to exist because any harmful monopoly would be overturned by an inevitable market process dictated by iron laws of economics.

Schumpeter wrote that monopolies could only be sustained by "alertness and energy" – that there would never be a monopoly so secure that its owner became too big to care. But he went further, insisting that the promise of attaining a monopoly was key to investment in great new things, because monopolists had the economic power that let them plan and execute great feats of innovation.

The idea that monopolies are benevolent dictators has pervaded our economic tale for decades. Even today, critics who deplore Facebook and Google do so on the basis that they do not wield their power wisely (say, to stamp out harassment or disinformation). When confronted with the possibility of breaking up these companies or replacing them with smaller platforms, those critics recoil, insisting that without Big Tech's scale, no one will ever have the power to accomplish their goals:

https://pluralistic.net/2023/07/18/urban-wildlife-interface/#combustible-walled-gardens

But they misunderstand the relationship between corporate power and corporate conduct. The reason corporations accumulate power is so that they can be insulated from the consequences of the harms they wreak upon the rest of us. They don't inflict those harms out of sadism: rather, they do so in order to externalize the costs of running a good system, reaping the profits of scale while we pay its costs.

The only reason to accumulate corporate power is to grow too big to care. Any corporation that amasses enough power that it need not care about us will not care about it. You can't fix Facebook by replacing Zuck with a good unelected social media czar with total power over billions of peoples' lives. We need to abolish Zuck, not fix Zuck.

Zuck is not exceptional: there were a million sociopaths whom investors would have funded to monopolistic dominance if he had balked. A monopoly like Facebook has a Zuck-shaped hole at the top of its org chart, and only someone Zuck-shaped will ever fit through that hole.

Our whole economy is now composed of companies with sociopath-shaped holes at the tops of their org chart. The reason these companies can only be run by sociopaths is the same reason that they have become infrastructure that is crumbling due to sociopathic neglect. The reckless disregard for the risk of combining companies is the source of the market power these companies accumulated, and the market power let them neglect their systems to the point of collapse.

This is the system that Schumpeter, and Easterbrook, and Wood, and Scalia – and the entire Supreme Court of 2004 – set out to make. The fact that you can't buy a car is a feature, not a bug. The pig-butcherers, wallowing in an ocean of breach data, are a feature, not a bug. The point of the system was what it did: create unimaginable wealth for a tiny cohort of the worst people on Earth without regard to the collapse this would provoke, or the plight of those of us trapped and suffocating in the rubble.

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/06/28/dealer-management-software/#antonin-scalia-stole-your-car

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#matt stoller#monopoly#automotive#trinko#antitrust#trustbusting#cdk global#brookfield#private equity#dms#dealer management software#blacksuit#infosec#Authenticom#Dan McCray#Steve Cottrell#Reynolds#frank easterbrook#schumpeter

995 notes

·

View notes

Text

as per the poll results, i wrote around 2k of timkon autumnal indulgence today 🌾🍂🥧

The midmorning wind is brisk, and Tim is glad for the scarf he stole from Kon’s wardrobe earlier. It’s cozy and warm, and it smells like him, and every now and then, when Kon’s busy charming a customer, Tim buries his nose in it just to indulge. Gertrude catches him pressing the end to his cheek once and titters again, and he looks away quickly under the guise of restocking the pickles on the end of the table.

Pretending to be Kon’s boyfriend for the morning shift at a farmer’s market isn’t the worst thing—it’s not like it’s a date, where Kon’s attention would be on him the whole time, and he’d be overthinking every brush of their fingers. It’s easy to fall into step working by Kon’s side, just like on the battlefield; he handles the cash and the logbook, helps Kon keep the tables fully stocked and neatly arranged, and refills the stand of business cards when they run low.

Kon handles most of the talking—he’s the one who can answer questions about the fruits, veggies, eggs, and the farm in general, and the regulars who swing by all already know him. Tim mostly gets to just smile and wave, nibbling on some carrot sticks between refills from the enormous Thermos of apple cider Kon made for them this morning.

It’s surprisingly peaceful, overall. Sure, it’s fast-paced work, especially when bigger groups come through, and it’s not boring, but Tim finds himself taken aback by how serene it is to stand here in the parking lot of the Smallville Community Center, listening to Kon ramble about chickens (“Hennifer and Leon S. Hennedy got into a fight over some squash pieces the other day, and when I went in to break it up, they both unionized to bite me! Can you believe, the audacity of it all!”).

Penny catches his eye from her camp chair, tipping her styrofoam cup of coffee at him with a knowing glint in her eye. “Honeymoon phase, eh?” she chuckles. “When you can’t stop looking at him and swooning. Everything he does makes you melt, am I right?”

“What?!” Tim is not—he’s not swooning. Or melting, or—or anything of that sort! He’s just standing here. Normally. Suavely, even. “That’s not—I’m not doing that!”

Penny laughs at him, actually slapping her knee as if that’s the funniest thing she’s heard all week. “Sure you’re not, sonny. Oh, you have it bad for Conner. I can’t believe he didn’t bring you ‘round sooner!”

Yeah, well, he only asked Tim to be his fake boyfriend last night, so big surprise there. Tim gulps down the last of his cider as the memory replays in his head for the millionth time.

Right before bed, as they were settling down for the night, Kon plopped down next to him, looking oddly uncertain. He was fidgeting with the hem of his shirt, Tim remembers; it stood out at the time, too, because that’s something Kon always does when he gets antsy.

“Hey, Rob,” he said, cheeks pink. “So y’know how there’s the farmer’s market tomorrow? Well, the stall next to ours is run by these two ladies—Gertrude and Penny, they’re super nice, but—well, they keep trying to set me up with Penny’s grandson, and I—man, it’s getting awkward! And, I mean… you’re, you know… you’re my—you’re you, like…”

He trailed off, then, ducking his head, and then reached over and grabbed Tim’s hand. Tim blinked at him, scooting closer, and sleepily lay his head on Kon’s shoulder, and Kon relaxed again at his side.

“So, whaddya say we call tomorrow a date?” Kon’s laughter was nervous, but sweet. “I know, a farmer’s market stall isn’t, like, the most exciting date spot, but we’re in Smallville, so I dunno how high you can set your expectations for that kinda thing, anyway, and hey, it’d get Gertrude and Penny off my back by Bingo next Sunday, so…?”

And Tim’s heart did some weird, flip-floppy, delighted-but-dismayed maneuvers in his chest, because Kon was asking him on a date just to get some old ladies to stop pestering him about his love life. If only it was for real, because he wanted to date Tim, but… Tim will take what he can get, he supposes.

So he said yes, because of course he said yes—how can he ever say no to Kon, when Kon looks at him with those big, soft eyes all full of hope and warmth? Ugh. It’s no fair how cute Kon can be without even trying.

And now here Tim is.

Pining. At a farmer’s market.

161 notes

·

View notes

Text

The Infinite Money Method in GTA 5: A Guide to Making Millions

In "Grand Theft Auto V" (GTA 5), players often seek ways to amass wealth quickly. One popular method is the "Infinite Money Method," which exploits in-game mechanics to generate substantial cash. While this method isn’t technically infinite, it can help players rake in millions with the right approach.

The Basics of the Infinite Money Method

The key to this method lies in the game's stock market and specific missions. Players can manipulate stock prices by completing certain heists, notably the The Big Score heist. Here’s a step-by-step guide:

Prepare for the Heist: Start by progressing through the main storyline until you unlock The Big Score. Choose the "Obvious" approach for this mission to maximize your potential earnings.

Invest in the Right Stocks: Before initiating the heist, ensure you invest in Lifeinvader stocks. Complete the mission and watch the stock prices soar post-heist.

Sell High: Once the stock price peaks, sell your shares to cash in on the profits. This is where players can make millions, depending on the amount invested.

Reload and Repeat: After selling your stocks, reload your save from before the heist. This allows you to repeat the process, earning even more money each time.

Additional Tips

To maximize profits, keep an eye on in-game news and trends that can affect stock prices. Participating in other heists and investing wisely can further enhance your earnings.

Conclusion

While the Infinite Money Method in GTA 5 isn’t truly limitless, it offers a lucrative way to amass wealth efficiently. With strategic planning and smart investing, players can dominate the criminal underworld of Los Santos, driving flashy cars and living lavishly. Just remember, with great wealth comes even greater heists!

Click here to know Learn More!

138 notes

·

View notes

Text

Heart on the Market (ONGOING SERIES) Chapter 1

WARNING: This series will include; NSFW, dead dove, reader is a serial killer, black market possible inaccurate historical slang and fashion, gore, alcohol, toxic relationships that should NOT be replicated in real life, murder, yanderes, cursing, implications of misandry (male misogyny), perversive thoughts, possibly more to add.

Inaccurate canon-timeline and setting (Ashley doesn't exist).

Incest is not Wincest.

Andrew Graves x Old school! Serial killer! Fem! Reader

Wordcount: 3,000+ words

Chapters: Current chapter, chapter 2 (in the works)

It’s 12 in the morning at the 24 hour diner. Despite it being midnight, the diner was bustling with people eating pancakes and drinking spiked milkshakes; a classic 50’s diner.

The floor had black and white checkered tiles had fallen pieces of bacon. One of the tables had spilled milk after a baby knocked their bottle of milk over (why the family is here at this time, she doesn’t know nor does she care). The chairs had chewed gum under them matching the table bottoms too. The red and white counter had drunk men watching an episode of I Love Lucy.

“Do you need anymore coffee?” (Y/N) smiled, holding a piping hot coffee pitcher, steam escaping from the top of the lid.

“Thank you, dear.” A little old lady smiled, probably thinking it was 5 AM in winter when the sun wasn’t up instead of it being 12 o’ clock in the summer.

“Need anymore hash browns?” (Y/N) smiled, grabbing her notepad and pen from her white apron tied around her waist, the tight strings accentuating her figure.

“No, but I’ll take a cookie for the road.” The lady smiled.

“Coming right up, ma’am.” (Y/N) smiled, her black flats walking against the sticky tiled floor as her light blue skirt twirled around her knees.

She walked behind the counter to the display of cookies resting there since yesterday, grabbing a cookie and throwing it in a small, white paper bag. She stapled the bag closed and walked back to her customer, handing her the cookie.

“There you go, ma’am. Is that all for you tonight?” (Y/N) smiled.

“Yes, that’ll be it.” The lady smiled, her sunken cheeks turning up to show her dentures.

“I’ll get the check.” (Y/N) hummed, walking back to the counter and printing out the check for table 26.

She walked back to the old lady, grabbing the printed receipt and handing it to the lady.

“Careful, the ink’s fresh.” (Y/N) smiled.

“Thank you.” The lady smiled, placing 30 bucks on the counter.

“Oh, ma’am. You dropped a few bucks.” (Y/N) spoke, counting the cash. “Your meal was 13 bucks.”

“Keep the change as a tip.” The lady smiled, before leaving the diner.

“Fool…” (Y/N) snickered to herself, placing the tip in her tip pouch on her hip as she took the meal’s money to the cash register.

Old people are so easy to butter up. She thought, smiling. All it takes is a few nice words to make them smile a million bucks. Not to mention their retirement money.

If she keeps it up earning these tips, maybe she can buy a new dress. She’s been meaning to get another poodle skirt anyways.

(Y/N) sorted out the money in the cash register before closing it, walking into the back. There were tablets there on the walls for her to clock out of.

Unnecessary screens in unnecessary places… (Y/N) thought, annoyed. These new generations and their technology!

(Y/N) clocked herself out on time, heading to her work locker and inserting her. She grabbed her work bag and took it with her into the bathroom, changing into her regular clothes.

She put on a black and red fit-and-flare dress with her nude stockings and black gloves. She grabbed her black hand-purse, throwing her work clothes into her work bag. She undid her hair’s bun and brushed her hair out, letting it hang off her shoulders as she put on a black headband with a bow on top in her hair.

She exited the bathroom, putting her work bag back into her locker and shutting it, then exiting the diner out back, walking down the streets.

The streets had an occasional stranger walking down, giving her a weird look at her old 1950’s outfits, but others have seen her enough to know it was her style by now.

She held her purse and walked down the streets, before taking a turn down a dark alley.

It stunk of trash and the air was humid, but that was normal in every overpopulated city. Thank god this city wasn’t a night-life one at least, how troublesome it would be for her work.

A stumbling man appeared in view, leaning on the brick walls of a building, taking a few wary steps before stopping again. He looked absolutely shit-faced, with a fire red face and dilated pupils; drunk and lethargic.

“Do you need any help, sir?” (Y/N) questioned, her transatlantic accent she gained from growing up watching too many movies of the 1930’s shined through.

“I-I need… "urgh…” the male groaned, tipsy before collapsing to his feet, trying to hold his stomach in.

“Oh, pardon me.” (Y/N) smiled, walking closer without fear as her black Mary Jane’s hit the ground.

He probably thought he traveled back in time as he looked at her, confused at the blurry figure approaching.

“Now, sir. Public intoxication is very bad, you know? You can be charged!” (Y/N) scolded, a playful tone in her voice as she crept closer, before coming up behind him.

She fished a black lipstick container out of her purse, popping open the lid to show a black tube with a small green and red button.

“Allow me to help you.” She smiled, pressing the tube to the back of his neck, before holding down the red button, allowing blue sparks to buzz through the air, shocking him.

He convulsed, drool flooding out of his mouth as he yelped, before a flood of vomit followed.

“There you go!” (Y/N) cheered supportingly as he kept the stun gun to his neck.

She removed the tube, watching him fall to the ground, disoriented and confused.

“See, sir. The problem there is your stomach was empty. You don’t ever drink on a empty stomach, no wonder you’re ill!” (Y/N) smiled. “A proper man could hold their liquor at the very least.”

Then again, this modern day and age doesn't know a thing about chivalry unless it's to get under a woman's dress... (Y/N) thought, frowning.

"Now, let's see." (Y/N) hummed, crouching down beside the drunken male lying in his own vomit.

She picked his head up by his hair, yanking it back roughly. "A 4 o' clock shadow that's stubbly. Dilated pupils. Nauseating scent. You must not take good care of your liver considering your performance of drinking tonight..." She frowned, sighing. "It must not hold much value, but something is better than nothing..."

She threw his head back into his bile, reaching into her gloved hand into purse and putting away her lipstick stun gun, replacing it with a 1930's Remington Rh36 hunting knife. She picked the disoriented man's head up, placing the knife under his throat, before making a jagged line around his neck.

"It's a good thing I wore my black pair today!" (Y/N) chirped, referring to her gloves as she dropped the man's head, sitting down on his back so he couldn't get up and fight.

She watched him squirm under her, warm crimson puddling under her as she counted, "99 bottles of beer on the wall, 99 bottles of beer! Take one down, pass it around, 98 bottles of beer on the wall." She smiled, looking down at him. "Oh, good sir. Where is your spirit? Sing with me!"

She grabbed his chin, pressing her thumb on his bottom lip and pressing down as blood spurted out of his mouth. "98 bottles of beer on the wall, 98 bottles of beer. Take one down, pass it around——how many do we have?" (Y/N) smiled, pressing down on the now dead man's lips. "97!" she chirped, putting on a high-pitched voice. "Good job! 97!" she smiled, letting go of his chin.

She stood up, smoothing down her dress and stepping off the man's back. She grabbed her dirty knife, wiping the blade on the man's clothes.

She placed the knife down into her purse, pulling out a neatly folded black trash bag. She unfolded the bag and opened it, shoving the man's head in first (careful to avoid the pile of vomit), before bending his body awkwardly, a crack playing out somewhere in his legs as she forced him into the bag, tying it up.

"Citizen's trash duty: completed." She smiled, picking up the trash bag handles and pulling it down the alley with her.

(Y/N) dragged it with her, taking a shortcut down the alleyway and walking a few blocks until she got to the back of her apartment complex.

(Y/N) dragged the body bag up the fire escape stairs, careful not to tip backwards as the dead man’s head ‘thunked’ against the metal stairs over and over.

Upon reaching the top of the stairwell, she grabbed a spare key she copied stealing the owner’s once, grabbing the copy from her purse and unlocked the door.

She dragged the body inside the halls, taking the body up the stairs since every lazy piece of modern trash around here used the elevators.

She took the body with her down her hallway, fishing for her front door’s key inside of her purse, before pausing as the neighbor’s door next to her opened.

A man stepped out, pale skin akin to snow and eyes fresh like the Iceland hills. There were bags under his eyes, tired as he yawned, wearing a red shirt as his uniform for his job as a gas station attendant.

Andrew Graves; a recluse of a man, if even a person. Andrew doesn’t talk with (Y/N), not unless she corners him by the mailboxes and blabbers with him.

For some reason, the boy couldn’t fall for her charisma or even her appearance. She didn’t understand it; everyone likes her, why doesn’t he?

Perhaps he was just one of those people with a good sixth sense, but whatever it was, it infuriated (Y/N). How was she supposed to maintain a good social image if her next door neighbor didn’t have any good words to say about her?

How could he have any good words to say now that his eyes were widened with surprise and fear, looking down at her feet, where she looked and saw a leg hanging out of the bag, a trail of blood down the hallways.

The bag must’ve ripped upon climbing the stairs somewhere.

(Y/N) stared at the leg, both of them frozen in place as the complex’s AC kicked in.

(Y/N) quickly lunged at Andrew, shoving him back into his apartment. She drug the bag with her, entering his apartment and closing the door behind her.

Andrew’s apartment was completely dark, an unfamiliar terrain as she felt the walls for a light switch before switching it on, illuminating the room.

Andrew was on the ground, silently crawling backwards, making sure to look in her direction before he froze as the light came on.

“Ah!” (Y/N) sighed, happy as she quickly dropped onto her knees, crawling after him like a child.

She caught up to him quickly, especially since he hit the back of his couch, her hands pressing down on his chest as she leaned in, pushing her nose against his.

“I found you~” she smirked.

“What the fuck was that?” Andrew questioned, his eyes shooting behind her at the body bag.

“A Halloween prop.” (Y/N) responded quickly.

“It’s December.” Andrew retorted.

“A prop for Krampus, dummy! He’s a Halloween-Christmas guy!” she smiled.

“It’s an apartment complex! We don’t do decorations!” Andrew spoke, still scared but a bit annoyed that she took him as dumb enough to believe that.

“Well we do now.” (Y/N) smiled.

“I’m not dumb!” Andrew snapped. “So you’re the Manson Murderer, huh?”

Ah, the Manson Murderer, what a name she’s built for herself! "Manson Murderer Multilates Again!" and "Who is the Man of Manson?"

How funny they even think it’s a man. The only reason why so many men are trialed for murder, is because nobody believes a dainty flower of a woman could stabbed a man 41 times in his chest.

“Oh, my! What an accusation!” (Y/N) giggled, staring into his eyes as their faces were mere centimeters apart.

“Don’t you even try lying to me…” Andrew growled, his eyes hardened as he toughened himself up in front of her.

“Oh, have no fear, darling! I would never lie to you, you’re much too smart!” (Y/N) giggles, although she knew it was true.

Could it be possible he never liked her because he knew something was up with her? Is this his proof to having a reason to dislike her, not just because he was an introverted loser?

“Andrew, Andrew, Andrew…” (Y/N) muttered, clicking her tongue as her hand came up to his cheek, caressing it as he flinched at the sudden affection. “My love, why are you so scared? Don’t you know I would never hurt you? Not a man as handsome as yourself at least.” She purred.

“See, Andrew. There are certain duties people like I must fulfill. Someone has to clean the streets up after all.” She hummed.

“Why’d you do it?” Andrew questioned.

“Why didn’t I?” she smiled.

“That isn’t an answer—“ Andrew muttered, but was cut off by her.

“Now, Andrew. You’ll keep your mouth shut, yes?” she smiled. “I would certainly hate… for you to become scum at the bottom of a dumpster after all…

Andrew knew was she was implying. Trash for her to take out like it was a normal Monday.

“Yes…” Andrew seethed through his teeth, not too happy about it.

“Good!” (Y/N) smiled, taking her purse and flipping out her pocket knife.

“W-woah, hey! Hey! I said I won’t tell!” Andrew panicked, squirming but had nowhere to run as he was still pressed against the couch.

“Don’t worry, darling. I’m only sealing our promise.” (Y/N) smiled, pulling up his shirt.

Andrew froze as she placed the knife onto his right side, before a hiss escaped his lips as she impaled the skin, carving into it like leather.

“Pardon my handwriting; mother always said I was messy.” (Y/N) smirked, smiling as the pretty blood ran down his side, matching his red shirt.

“F-fuck!” Andrew gasped, biting down onto his lips.

“When this mark heals, you can tell people it’s me who is the Manson Murderer.” (Y/N) smiled. “But for now, you’re mine to keep, so be a good boy and be quiet.”

(Y/N) smiled, admiring her craftsmanship before wiping the excess blood from the knife off on Andrew’s shirt.

She placed her pocketknife back into her purse, before looking at her words. She stuck out a gloved finger, scooping up some of the red liquid and wiping it on her bottom lip, closing her lips and smearing it like lipstick.

“Mwah! Red looks good on me, don’t you think?” (Y/N) smiled, looking at Andrew as his head was thrown back against the couch’s back, panting as he endured the pain.

“F-fuck… fucking bitch.” He hissed, his eyes sharp as he looked down at her. “Gonna fucking kill you…”

“Mm… keep talking like that…” (Y/N) purred, sitting down on her knees in between his legs, resting both her hands on his cheeks. “I like it.”

She leaned in, kissing his lips with her bloodied ones.

Andrew froze, shocked and helpless on what to do as he bled from his side. His neighbor, his neighbor who was a murderer, was kissing him right now.

One of her hands traveled down to his jaw, before guiding down to his chest sensually, reaching his stomach. Her lips moved against his closed ones, enjoying the power she had over him.

Her hand went to his side, her thumb pressing down onto his wound, causing him to yelp and open his mouth. She quickly dove her tongue into Andrew’s mouth, his cheeks puffing out as her tongue hit them, exploring the taste of his mouth and blood.

“Ah, you taste good…” (Y/N) muttered against his lips. “It’s too bad your heart isn’t on the market, I’d love to own it…” (Y/N) smiled.

Andrew couldn’t look further into her words as she kissed him again. He couldn’t taste anything except rust, and was that a hint of strawberry? Strawberry lipgloss perhaps? She did wear red lipgloss just like every other 1950’s girl did, just like her preferred timeline. Lipgloss so it wasn’t too showy, but still shined and was appropriate for every outfit.

Her tongue parted from his mouth, leaving him breathless (from her lips or from his wound, he wasn’t sure) as a string of saliva connected the two.

“I’ll teach you how to reciprocate later on. It makes it far more enjoyable, you know?” (Y/N) giggles, watching as Andrew’s face went pink.

It felt hot in here even though the AC was on, signaling to (Y/N) that she had to go and take care of this body before it started decomposing faster due to this heat.

“I’ll see you real soon, Andrew… You’ll keep our promise, right?” (Y/N) spoke, tilting her head and purposely puffing out her lips in a show of innocence and seduction.

“Mm… y-yeah. Yeah, I will…” Andrew muttered, laser-focused on her lips.

“Be good for me now.” (Y/N) smiled, getting up off the floor.

Andrew watched from the floor as she walked to his front door, dragging the body bag with her as she shut the door behind her, going back to her apartment.

He couldn’t believe this. His cute neighbor was a murderer, and he kissed her. And he liked it.

His face was burning up, along with his body, but he didn’t know if that was his pain receptors responding to the pain or not. He was hot and sweaty, it suddenly felt too hot for his shirt and everything else, especially under his belt.

Why the fuck did her lips have an impact on him like that? Why was it just her lips? Why did she kiss him in the first place?

Andrew groaned, looking down at the marking she made on him, carving him like a piece of property.

“Mine.” The carving read.

Fuck. He can’t go to work like this. He needs to go to the bathroom, clean up this wound and jerk one (or maybe a few) off.

Oh, he’ll get her back for doing this to him.

I'm sorry for the short chapter, the first chapters are always short to get the reader's attention. I don't want to add too much information that'll draw you guys away! This story is gonna be a spicy one featuring NSFW, so beware.

Want more Andrew Graves content? Check out the Andrew Graves masterlist!

Inbox is OPEN for questions about the story and new plotlines/ideas, not for requests!

#stellar constellations#andrew tcoaal#tcoaal andrew#andrew graves x reader#andrew graves#andy and leyley#andy graves#andy graves fluff#the coffin of andy and leyley#andy graves x reader#tcoaal

101 notes

·

View notes

Note

Good day to you, fair Fellow. And to you as well, adorable Gidel. *Reaches out to give Gidel a pat on the head, a puzzle box toy, and a bag of candy before turning back to address Fellow* I am the owner of a small, but successful candy shop. I was contacted by an associate of mine about a charming person that could possibly use a job? I assume that to be you. If the offer is not appealing, I have several friends that could use a server. You would likely be able to nab some good tips. Some would even offer a small apartment to go with the job. Whatever you decide, I am available anytime.

@ Cater Diamond, are you proud of me for conducting market research for this interaction/j

Waiter!Fellow though... 👀 (my bias comes out ahjdabsidabisyfiyoafi)

So tell me, do you wanna go?

"Excuse me, mister. I'd like to take 16 ounces of this milk chocolate with pistachio cream and kunafa filling."

"I want to buy some of those viral peelable fruit gummies. Can you tell me where to find them?"

"Ooh, these candies are shaped like gems. They come in so many different flavors--I can't decide what to buy! You work here, so which ones would you recommend?"

"One at a time, please!!" Fellow, in a pastel pink apron, pleaded of the encroaching customers. "I'll weigh the amount you want and ring you up at the cash register up front. The fruit gummies you're lookin' for are in aisle 3, between the sour belts and the licorice sticks. Our pumpkin jam-filled crystal candies are popular this season."

His new gig at the candy shop kept him busy. Social media, the owner had told him, had caused certain treats to blow up in popularity. Handling the sweets was a task left to the store owner, who produced all manner of confections. Fellow managed the front end: stocking, answering customer inquiries, doing the arithmetic (which he had always prided himself on).

Gidel hid in the back, sucking on a scraps of sugar and fiddling with a cube-shaped puzzle as Fellow went about his day. Sometimes he would poke his head out and watch as his guardian got swarmed, or swipe a sucker or two.

In the evenings--5 'o clock on the dot--Fellow would close up shop, then swap out his uniform for a white button-down shirt and black slacks, heading for his shift at a local restaurant. They were short-staffed in the evenings and on holidays, so he was quick to swoop in and fill out the vacancy.

A smile, a wink, a few friendly exchanges, and he'd walk away pocketing generous tips. The leftovers, swiped by a clever hand, and ferried away for a free makeshift meal for him and Gidel.

They had settled into the new routine with ease.

When the restaurant locked up for the day, Fellow would haul a drowsy Gidel over his shoulder and to the small apartment upstairs. It was cramped and often smelled like tomato sauce, but it was home and it was theirs.

"You like livin' like this, Giddie?" Fellow asked as he laid the young boy down on a small cot. "It beats havin' to scam folks just to get on by, but some days I miss the open road and the freedom that came with it."

Gidel yawned--and Fellow suspected that his question had fallen upon deaf ears. He shook his head, pulling a thin patchwork comforter over him.

"... Never mind, I'll ask ya again in the morning. Sleep tight, little buddy."

#twst#twisted wonderland#Fellow Honest#Gidel#twst interactions#twisted wonderland interactions#Reader#self insert#Gino#Ernesto Foulworth#disney twisted wonderland#disney twst#a fellow in need is a friend indeed#twst imagines#twst scenarios#twisted wonderland scenarios

66 notes

·

View notes

Note

so, I know you've been vending at a lot of different craft fairs and witch markets for awhile now (sadly, too far away for me to attend!). would you happen to have any tips for someone looking to do the same at their local fairs? thanks!!!!!! ❤️

Sure! To start, brush up on three things - networking, recordkeeping, and people skills. Get an idea of what's going in on your area, talk to the organizers, see what the particulars are for the events. Here are some questions to ask:

What's the venue like? (indoors, outdoors, parking, accessibility)

Do I need to bring my own table and chairs?

Is there electricity / wifi available?

What is the table fee?

When is the event and how long does it run?

Is there a theme or target audience?

Is there advertising being done for the event? (Signal boost!)

Based on the answers you get, you can start putting your stock and setup together.

Do as much as you can WAY ahead of time. If you need to make things, start now. If you need to buy things, give yourself at least a month before an event to make sure everything arrives in time. Get yourself a 6-foot folding table and a comfortable folding chair or camp chair for events where they're not provided by the venue. Sign for Paypal, Venmo, and Cashapp as well as a card payment processing service like Square to give your customers the most payment options possible. And of course, plan to carry some small bills for cash patrons. (You don't need a register or cashbox, a simple bag of appropriate size will do. I literally use a pencil case that says Resting Witch Face. Works great.)

You'll want to get some displays for your merchandise. The type will vary depending on what you have, but it should be simply and sturdy and preferably easy to pack in and out. Vertical visibility is important at these events, so if you can find some kind of stand or tiered display, that will help you get noticed. I'd also suggest some simple clear plastic standups that you can put a printout price list and a basic sign in. A table banner helps people notice your table from afar and you should definitely have business cards to hand out with your shop info and socials. (I use Vistaprint for both.) Decorations are nice, but don't overload the table with them. They should augment your setup, not overwhelm it.

You may also want to get an 8x8 or 10x10 popup canopy and canopy weights if you plan to do outdoor events. Also, GET A COLLAPSIBLE WAGON. Best investment I ever made was a $45 collapsible wagon. It fits in my backseat and makes hauling things in and out of venues SO much easier.

Keep track of everything you spend related to your endeavors, including event fees, supplies, stock, setup items, displays, signage, business cards, and gas and food on the day. Keep those receipts - you can deduct them on your taxes later to offset your earnings. (Because registering as a business can be a pain and comes with fees, but if you don't do it, you may owe money for not collecting sales tax. Put aside some money for that tax bill, just in case.)

Prep your setup and stock the night before an event. Check your merch, charge your card reader (and bring a fully-charged auxiliary power pack and cord, just in case), make any updates to your inventory or pricing that you need to. It really cuts down on stress when you're loading up if you know you've already get everything set. I suggest reusable shopping bags or clear plastic bins to make things easy to haul, plus they can double as storage.

Plan to leave as early as you need to in order to account for traffic and pit stops. Pick an outfit ahead of time so you don't have to dither over clothes. It should be something appropriate for the event and the weather that looks neat and clean and is easy to move around in, including comfortable shoes. (Look to other vendors for examples.)

Make sure you bring water, snacks, and anything you'll need to get through the day, i.e. medicine (headache pills and stomach medicine at minimum), energy drinks, a fan for hot days, an extra layer for cold ones, etc. Get to the venue as early as the organizers allow. The more time you have to park, load in, and set up, the less stressed you'll be. Make sure things are arranged in a way that's accessible and makes sense. Place signage where necessary to explain items and pricing.

GO TO THE BATHROOM BEFORE THE EVENT BEGINS. TRUST ME.

During the event, you're gonna have to do a LOT of socializing, so prepare for that as best you can. Try to stand if possible when there's a lot of foot traffic so you're more noticeable. Be personable - you don't have to grin constantly, just try to keep a pleasant expression and greet people as they pass, especially if they look in your direction. Don't be afraid to invite passersby over if they pause to check out your setup. Welcome them in, invite them to check out your stuff, and let them know you're happy to answer questions. (And ALL questions are good questions. There are no dumb questions. Even if the question is the dumbest thing you've ever heard or it's the fifteenth time you've been asked that day.) Chat and banter a bit where possible. If you can get people smiling or laughing, they're more likely to stick around and possibly purchase your wares. Make sure as many people as possible take your card when they leave.

Yes, you will be exhausted when the event is over, even if you're a naturally outgoing person, and you'll still have to break everything down, haul it out, load your vehicle, and drive home. If you happen to have somebody who can help you out, that really comes in handy.

In any case, know your own capabilities and personal limits and plan for that when you're deciding where to vend. If a venue is too far away for your comfort or doesn't have what you need or the table fee is too high (be wary of any thing over $75 for a single day event), don't sign up. If an event is too long or too far outside your target audience, don't sign up. If you don't have an appropriate setup or don't have the stock / can't get it in time, don't sign up. If something about the event or the venue or the organizers rubs you the wrong way, DON'T SIGN UP. Talk to other local vendors to get an idea of where to go and what to expect. Most will tell you right away what works, what's good, and what to steer clear of.

This is all just the basics. You'll learn a lot more when you start to vend, as far as what your individual needs are, where to go to find reliable business, and how best to connect with local venues and customers. Keep records of everything you do (spreadsheets are your friend!), network with organizers and other vendors, and practice that sociable game face.

And trust me - if a disorganized introvert with social anxiety and ADHD and absolutely NO sales experience can figure out to do this, I think pretty much anyone has a chance.

Good luck!!!! 😁

#A. Nonymousse#witch market#vendors#practical advice#witch tips#life hacks#Bree answers your inquiries

37 notes

·

View notes

Text

How Trump's billionaires are hijacking affordable housing

Thom Hartmann

October 24, 2024 8:52AM ET

Republican presidential nominee and former U.S. President Donald Trump attends the 79th annual Alfred E. Smith Memorial Foundation Dinner in New York City, U.S., October 17, 2024. REUTERS/Brendan McDermid

America’s morbidly rich billionaires are at it again, this time screwing the average family’s ability to have decent, affordable housing in their never-ending quest for more, more, more. Canada, New Zealand, Singapore, and Denmark have had enough and done something about it: we should, too.

There are a few things that are essential to “life, liberty, and the pursuit of happiness” that should never be purely left to the marketplace; these are the most important sectors where government intervention, regulation, and even subsidy are not just appropriate but essential. Housing is at the top of that list.

A few days ago I noted how, since the Reagan Revolution, the cost of housing has exploded in America, relative to working class income.

When my dad bought his home in the 1950s, for example, the median price of a single-family house was around 2.2 times the median American family income. Today the St. Louis Fed says the median house sells for $417,700 while the median American income is $40,480—a ratio of more than 10 to 1 between housing costs and annual income.

ALSO READ: He’s mentally ill:' NY laughs ahead of Trump's Madison Square Garden rally

In other words, housing is about five times more expensive (relative to income) than it was in the 1950s.

And now we’ve surged past a new tipping point, causing the homelessness that’s plagued America’s cities since George W. Bush’s deregulation-driven housing- and stock-market crash in 2008, exacerbated by Trump’s bungling America’s pandemic response.

And the principal cause of both that crash and today’s crisis of homelessness and housing affordability has one, single, primary cause: billionaires treating housing as an investment commodity.

A new report from Popular Democracy and the Institute for Policy Studies reveals how billionaire investors have become a major driver of the nationwide housing crisis. They summarize in their own words:

— Billionaire-backed private equity firms worm their way into different segments of the housing market to extract ever-increasing rents and value from multi-family rental, single-family homes, and mobile home park communities. — Global billionaires purchase billions in U.S. real estate to diversify their asset holdings, driving the creation of luxury housing that functions as “safety deposit boxes in the sky.” Estimates of hidden wealth are as high as $36 trillion globally, with billions parked in U.S. land and housing markets. — Wealthy investors are acquiring property and holding units vacant, so that in many communities the number of vacant units greatly exceeds the number of unhoused people. Nationwide there are 16 million vacant homes: that is, 28 vacant homes for every unhoused person. — Billionaire investors are buying up a large segment of the short-term rental market, preventing local residents from living in these homes, in order to cash in on tourism. These are not small owners with one unit, but corporate owners with multiple properties. — Billionaire investors and corporate landlords are targeting communities of color and low-income residents, in particular, with rent increases, high rates of eviction, and unhealthy living conditions. What’s more, billionaire-owned private equity firms are investing in subsidized housing, enjoying tax breaks and public benefits, while raising rents and evicting low-income tenants from housing they are only required to keep affordable, temporarily. (Emphasis theirs.)

It seems that everywhere you look in America you see the tragedy of the homelessness these billionaires are causing. Rarely, though, do you hear about the role of Wall Street and its billionaires in causing it.

The math, however, is irrefutable.

Thirty-two percent is the magic threshold, according to research funded by the real estate listing company Zillow. When neighborhoods hit rent rates in excess of 32 percent of neighborhood income, homelessness explodes. And we’re seeing it play out right in front of us in cities across America because a handful of Wall Street billionaires are making a killing.

As the Zillow study notes:

“Across the country, the rent burden already exceeds the 32 percent [of median income] threshold in 100 of the 386 markets included in this analysis….”

And wherever housing prices become more than three times annual income, homelessness stalks like the grim reaper. That Zillow-funded study laid it out:

“This research demonstrates that the homeless population climbs faster when rent affordability — the share of income people spend on rent — crosses certain thresholds. In many areas beyond those thresholds, even modest rent increases can push thousands more Americans into homelessness.”

This trend is massive.

As noted in a Wall Street Journal article titled “Meet Your New Landlord: Wall Street,” in just one suburb (Spring Hill) of Nashville:

“In all of Spring Hill, four firms … own nearly 700 houses … [which] amounts to about 5% of all the houses in town.”

This is the tiniest tip of the iceberg.

“On the first Tuesday of each month,” notes the Journal article about a similar phenomenon in Atlanta, investors “toted duffels stuffed with millions of dollars in cashier’s checks made out in various denominations so they wouldn’t have to interrupt their buying spree with trips to the bank…”

The same thing is happening in cities and suburbs all across America; agents for the billionaire investor goliaths use fine-tuned computer algorithms to sniff out houses they can turn into rental properties, making over-market and unbeatable cash bids often within minutes of a house hitting the market.

After stripping neighborhoods of homes young families can afford to buy, billionaires then begin raising rents to extract as much cash as they can from local working class communities.

In the Nashville suburb of Spring Hill, the vice-mayor, Bruce Hull, told the Journal you used to be able to rent “a three bedroom, two bath house for $1,000 a month.” Today, the Journal notes:

“The average rent for 148 single-family homes in Spring Hill owned by the big four [Wall Street billionaire investor] landlords was about $1,773 a month…”

As the Bank of International Settlements summarized in a 2014 retrospective study of the years since the Reagan/Gingrich changes in banking and finance:

“We describe a Pareto frontier along which different levels of risk-taking map into different levels of welfare for the two parties, pitting Main Street against Wall Street. … We also show that financial innovation, asymmetric compensation schemes, concentration in the banking system, and bailout expectations enable or encourage greater risk-taking and allocate greater surplus to Wall Street at the expense of Main Street.”

It’s a fancy way of saying that billionaire-owned big banks and hedge funds have made trillions on housing while you and your community are becoming destitute.

Ryan Dezember, in his book Underwater: How Our American Dream of Homeownership Became a Nightmare, describes the story of a family trying to buy a home in Phoenix. Every time they entered a bid, they were outbid instantly, the price rising over and over, until finally the family’s father threw in the towel.

“Jacobs was bewildered,” writes Dezember. “Who was this aggressive bidder?”

Turns out it was Blackstone Group, now the world’s largest real estate investor run by a major Trump supporter. At the time they were buying $150 million worth of American houses every week, trying to spend over $10 billion. And that’s just a drop in the overall bucket.

As that new study from Popular Democracy and the Institute for Policy Studies found:

“[Billionaire Stephen Schwarzman’s] Blackstone is the largest corporate landlord in the world, with a vast and diversified real estate portfolio. It owns more than 300,000 residential units across the U.S., has $1 trillion in global assets, and nearly doubled its profits in 2021. “Blackstone owns 149,000 multi-family apartment units; 63,000 single-family homes; 70 mobile home parks with 13,000 lots through their subsidiary Treehouse Communities; and student housing, through American Campus Communities (144,300 beds in 205 properties as of 2022). Blackstone recently acquired 95,000 units of subsidized housing.”

In 2018, corporations and the billionaires that own or run them bought 1 out of every 10 homes sold in America, according to Dezember, noting that:

“Between 2006 and 2016, when the homeownership rate fell to its lowest level in fifty years, the number of renters grew by about a quarter.”

And it’s gotten worse every year since then.

This all really took off around a decade ago following the Bush Crash, when Morgan Stanley published a 2011 report titled “The Rentership Society,” arguing that snapping up houses and renting them back to people who otherwise would have wanted to buy them could be the newest and hottest investment opportunity for Wall Street’s billionaires and their funds.

Turns out, Morgan Stanley was right. Warren Buffett, KKR, and The Carlyle Group have all jumped into residential real estate, along with hundreds of smaller investment groups, and the National Home Rental Council has emerged as the industry’s premiere lobbying group, working to block rent control legislation and other efforts to control the industry.

As John Husing, the owner of Economics and Politics Inc., told The Tennessean newspaper:

“What you have are neighborhoods that are essentially unregulated apartment houses. It could be disastrous for the city.”

As Zillow found:

“The areas that are most vulnerable to rising rents, unaffordability, and poverty hold 15 percent of the U.S. population — and 47 percent of people experiencing homelessness.”

The loss of affordable homes also locks otherwise middle class families out of the traditional way wealth is accumulated — through home ownership: over 61% of all American middle-income family wealth is their home’s equity.

And as families are priced out of ownership and forced to rent, they become more vulnerable to homelessness.

Housing is one of the primary essentials of life. Nobody in America should be without it, and for society to work, housing costs must track incomes in a way that makes housing both available and affordable.

Singapore, Denmark, New Zealand, and parts of Canada have all put limits on billionaire, corporate, and foreign investment in housing, recognizing families’ residences as essential to life rather than purely a commodity. Multiple other countries are having that debate or moving to take similar actions as you read these words.

America should, too.

ALSO READ: Not even ‘Fox and Friends’ can hide Trump’s dementia

16 notes

·

View notes

Text

Dividend Stocks: Century Textiles, Ingersoll-Rand, five other stocks to trade ex-dividend today

0 notes

Text

Disability-Friendly Prosperity Magic

So let's face it, those who are disabled have a hard time with money in general, either from being unable to work or not having a steady, strong source of income. Sometimes we can monetize our hobbies, admittedly at a limited capacity (some less or more than others).

From our relationship with money, money mindsets, and income streams, it's hard. That's not to shame anyone, either. Some overspend to cope, while others are incredibly frugal.

In this post, I will review some resources, tips, and tricks for the struggling disabled witch.

The Mundane Before Magical

Step one is to make a budget and track your expenses. I'm serious. Sit down, look at where your money is going, and decide on a budget that you can realistically stick to. I use the 50/30/20 rule as a budget, which is 50% Needs, 30% Wants, and 20% Savings. However, I recently switched wants and savings around so I can save for a trip.

Now I do not want you to worry about a big fancy budget method. I don't want you to overthink it. Here is a resource (Canada, but it can be used in the USA) to start one. Focus on your needs like housing, utilities, basic clothing, food, etc. Then go into wants and entertainment, and finally, savings. I suggest you put any debt payoff into the needs category if you have any debt. You do not want a blow to your credit report.

Now do you have any financial goals? Going back to school? Debt payoff? A trip? Even a big medical trip coming up? Here is a resource (Canada, but it can be used in the USA) that can help you create a goal and a plan to pay this off.

Savings, please, your SAVINGS. It is vital to have an emergency fund. Job loss? Death? Vet bills? Children? Dentist? You better believe that piles up. It is recommended if you are single to have at least 3 months of income saved up, with a child and single at least 6 months. Married on two incomes, the same amount. Married with one income, it is recommended without children at least 6 months saved up and with children 9 months. It is vital you have the means to take care of yourself if an emergency strikes. It is never recommended that money be stopped from being put into these accounts.

If you are in debt, look at your debt relief options. Sometimes there are services out there that can advocate for you regarding debt. They will help you develop a plan, understand the relief options, sign documents with you, and develop a credit rebuilding program. These services are out there; even if they are paid, they can help you pay off some of your debt, especially credit card debt.

Educate yourself on investing, basic investing, and financial literacy, in stock markets and everything beyond. Know what kind of accounts you can hold and what could help you in your situation.

Need help applying for disability? Here's a resource for the USA (a lot can also be used for Canada).

The Magical

Upkeep a prosperity altar. Work with the spirit of money like you would any other spirit. Honour it, talk to it, venerate it. Money loves to be valued, moved, not wasted, and used in charity. Most importantly, money takes time. Money takes time to grow and build a relationship with.

This is the most important thing I've learned about money. It wants to be worked with. It's sitting there. It wants to help and aid you in ways that you need.

Work with this altar on Thursdays, incorporating the spirit of Jupiter. Jupiter rules over finances. Long steady finances, not quick finances. Jupiter rules over business, legal and all things finances. Jupiter is a slower-moving planet.

You can also incorporate the spirit of Mercury on Wednesdays along with your Jupiter workings. Mercury is a fast-moving planet, a planet for fast-moving money. However, you must build a long, steady form of finances over quick, easy cash (but sometimes you do need it right now).

You can create a money bowl and work with it on this altar, a Jupiter cashbox (I will make a future post on this), or a manifestation mirror box filled with petitions, sigils and your investment/banking information.

Fill your altar with greens and gold, imagery for wealth and abundance, pocket change, and anything else that symbolizes wealth.

Do not forget to leave offerings for your money altar. A simple glass of water can do but try to do more if you can.

Road opener workings or petition with an offering for the cross-road spirits who can unblock blockages in your way.

Final Take Away

I know this might not help everyone, but I sincerely hope this helps somebody. Financial literacy was not taught to everyone, nor were proper budgeting tips. I wanted to share what I've learned over the years as I believe it is vital information for some of the information I have collected.

Blessings

#witchcraft#witch#spoonie magic#spoonie witch#prosperity magic#prosperity spell#prosperity#witchblr#spoonie withcraft#money manifestation#money management#money magic#money spell#prosperity altar

43 notes

·

View notes

Text

Maximizing Returns in the Stock Market: A Guide to Trading Tips

Introduction

Investing in the stock market can be a lucrative endeavor, but it also comes with its fair share of risks and uncertainties. To navigate this complex financial landscape successfully, traders often rely on various strategies and tips. In this article, we will explore some essential trading tips, including stock cash tips, index option tips, BTST (Buy Today, Sell Tomorrow) trading, stock future tips, and intraday trading tips, to help you make informed decisions and maximize your returns.

Stock Cash Tips

Stock cash tips, also known as equity cash tips, are recommendations provided by financial experts or advisory firms to help traders make informed decisions when trading in the equity or cash segment of the stock market. These tips typically include information about which stocks to buy or sell in the short or long term.

To make the most of stock cash tips:

Research the recommended stocks thoroughly.

Diversify your portfolio to manage risk.

Stay updated with market news and events.

Index Option Tips

Index option tips are specifically designed for traders interested in options trading within stock market indices like the S&P 500 or Nifty 50. Options provide traders the right, but not the obligation, to buy or sell an index at a predetermined price.

To benefit from index option tips:

Understand the basics of options trading.

Analyze market volatility.

Set clear entry and exit strategies.

BTST Trading (Buy Today, Sell Tomorrow)

BTST trading is a popular strategy where traders buy stocks today and sell them the following trading day. This approach is well-suited for those who anticipate short-term price movements and want to capitalize on them.

To succeed in BTST trading:

Identify stocks with potential for short-term gains.

Monitor market trends and news closely.

Set stop-loss orders to limit losses.

Stock Future Tips

Stock future tips are recommendations that focus on trading in futures contracts. Futures contracts are agreements to buy or sell a specified quantity of a particular stock at a predetermined price and date in the future.

To make the most of stock future tips:

Understand the mechanics of futures trading.

Analyze technical and fundamental factors.

Use risk management tools to protect your capital.

Intraday Trading Tips

Intraday trading involves buying and selling stocks within the same trading day. It requires a keen understanding of market trends, technical analysis, and quick decision-making.

To excel in intraday trading:

Develop a robust trading strategy.

Use technical indicators for entry and exit points.

Keep emotions in check and stick to your plan.

Conclusion

Successful trading in the stock market requires a combination of knowledge, discipline, and the right strategy. Stock cash tips, index option tips, BTST trading, stock future tips, and intraday trading tips are valuable tools that can help you make informed decisions and maximize your returns. However, it's crucial to remember that no tip or strategy guarantees success, and the stock market always carries inherent risks. Therefore, always do your research, manage your risk, and stay updated with market developments to make the most of your trading journey.

click here for more details:

#stock cash tips#Index Option tips#btst trading#btst in share market#stock future tips#intraday trading tips#trading tips#intraday trading tips in hindi#option trading tips#smart trading tips#commodity trading tips#options trading tips#intraday trading tips today#sgx nifty live smart trading tips#intraday trading tips for today#investment advisory services#btst in stock market

0 notes

Text

Unlock Infinite Money in GTA 5

Easy & Safe Ways to Get Rich Fast!