#Stock Brokerage Charges

Explore tagged Tumblr posts

Text

Zerodha Discount Broker Review 2020: Compare Broker Online

Zerodha with a one of a kind name and significance, Zero + rodha (Barrier in English) is developing as the single largest discount broker in India you will see in this zerodha discount broker review 2020. The reason Zerodha turning into the best trading platform in India is expected to giving “the best internet exchanging stage India”, “low brokerage and high presentation”, “free direct shared reserve venture stage” and “effective client assistance.”

In only a limited capacity to focus time (9+ years) Zerodha top the list to become the best stock broker in India as far as dynamic customers. Zerodha contributions & backing is developing step by step.

The principle contributing exercises offered by Zerodha are exchanging value, value F&O, ware, cash on NSE, BSE, MCX and MCX-SX and interest in Direct Mutual Funds through SIP and single amount, ETFs, Government protections, and securities.

Zerodha offers free exchanging value delivery and charges a low brokerage of Rs 20 or .03% whichever is lower for exchanging value Intraday, F&O, cash, and ware.

The Demat administrations provided are of being a DP of CDSL. Furthermore, there is NRI trading facility at Rs 200 or .1% per request whichever is lower for value conveyance and Rs 100 for each request for value F&O.

Zerodha Mutual Fund Investment

This is the first broker in quite a while to offer a Direct Mutual Fund investment facility to its clients for nothing.

In this, you can put resources into direct shared store plots that give you better returns contrasted with customary common reserve plans.

Fundamentally, there is no commission setting off to the brokerage house from your common store speculation.

Zerodha Account Opening Process and 3-in-1 Account

You would instant be able to open records with them. The advantages of 3-in-1 record are offered in tie-up with IDFC First bank in the structure of Zerodha-IDFC FIRST Bank 3-in-1 record.

The business as usual of the record – a solitary record comprehensive of exchanging, DEMAT and financial balance for consistent and bother free web based banking and contributing experience. It has now become the exchanging and self-clearing part to give customers the advantage of no clearing charges. In addition, Zerodha provides cover request and section request (CO/BO) with trailing stop misfortune include for value and F&O best among the top 10 discount brokers in India.

Zerodha Charge/Fee Structure:

Protections Transaction Tax (STT): This is charged distinctly on the sell side for intraday and F&O exchanges. It’s charged on two sides for Delivery exchanges Equity.

Stamp Duty: Charged according to the condition of the customer’s correspondence address.

Merchandise and Enterprises Tax (GST): This is charged at 18% of the complete expense of brokerage in addition to exchange charges.

Different Charges (Zerodha Hidden Fees):

Call and Trade highlight is accessible at an additional expense of ₹50 per call.

Source - https://medium.com/@deepakcomparebroker/zerodha-discount-broker-review-2020-compare-broker-online-2e0b057bef50

Related - https://comparebrokeronline.com/

#best trading platform in india#top stock broker#best stock broker in india#lowest brokerage charges#top share broker#zerodha review

2 notes

·

View notes

Text

Investing in the stock market has become a key financial strategy for individuals and organizations looking to build wealth. Among the various trading platforms available in India, MStock stands out as an innovative and reliable choice. In this detailed review, we delve into MStock’s features, pricing, benefits, and drawbacks to help you make an informed decision.

#mstock#mstock login#mstock brokerage calculator#mstock charges#mstocks.com#m stock charges#m stock review

0 notes

Text

#gold rate in delhi#gold price today#gold rate forecast for next week#best stock broker in india#lowest brokerage charges#best stock broker app in india#best trading platform in india#lowest brokerage charges in india#best stock broker

0 notes

Text

Unlocking The Secrets to The Lowest Brokerage Charges in India For Online Trading

Before we dive into finding the lowest brokerage charges in India, it's essential to understand what brokerage charges are. This is the fees that stockbrokers charge for facilitating your buy and sell orders in the stock market. These charges vary from one broker to another and can significantly impact your trading profitability. Visit us : https://shorturl.at/hoS08

0 notes

Text

Lowest Brokerage Charges in India 2023

Embark on a cost-efficient trading journey with our Lowest Brokerage Charges in India 2023 service. Maximize your profits with minimal fees, ensuring your financial success. Experience unparalleled value as you trade seamlessly in the dynamic Indian market, making every investment count. Your path to prosperity starts here!

#Lowest Brokerage Charges in India 2023#lowest brokerage charges in india#low commission brokerage#lowest stock trading fees#less brokerage charges in india#lowest brokerage fees in india

0 notes

Text

ICICI Direct Brokerage Calculator - Calculate Your Trading Costs Instantly

Make informed investment decisions with the ICICI Direct Brokerage Calculator. Easily calculate the brokerage charges, taxes, and other trading costs for your stock trades. Plan your trades effectively and optimize your investment returns.

0 notes

Text

Angel Broking Login – Process to Login Angel Trading App & Back Office

To log in to Angel Broking’s trading app and back office, you can follow these steps:

Angel Broking Trading App Login:

a. Download the Angel Broking Trading App from the Google Play Store or Apple App Store.

b. Install the app and open it.

c. Enter your Angel Broking client code, registered mobile number, and password.

d. Click on the “Login” button to log in to your account.

Angel Broking Back Office Login:

a. Go to the Angel Broking website (https://www.angelbroking.com/).

b. Click on the “Login” button on the top-right corner of the homepage.

c. Select “Back Office” from the drop-down menu.

d. Enter your Angel Broking client code, registered mobile number, and password.

e. Click on the “Login” button to log in to your account.

Note: If you have forgotten your password, you can reset it by clicking on the “Forgot Password” link on the login page and following the instructions provided.

Angel Broking Login Method — Back Office Login Process

To login to Angel Broking’s Back Office, you can follow these steps:

Go to the Angel Broking website (https://www.angelbroking.com/).

Click on the “Login” button on the top-right corner of the homepage.

Select “Back Office” from the drop-down menu.

Enter your Angel Broking client code, registered mobile number, and password.

Click on the “Login” button to log in to your account.

Note: If you have forgotten your password, you can reset it by clicking on the “Forgot Password” link on the login page and following the instructions provided.

Angel One Login Process — Angel One App Login Method

To login to Angel One’s trading app, you can follow these steps:

Download the Angel One trading app from the Google Play Store or Apple App Store.

Install the app and open it.

Enter your Angel One client code, registered mobile number, and password.

Click on the “Login” button to log in to your account.

Note: If you have forgotten your password, you can reset it by clicking on the “Forgot Password” link on the login page and following the instructions provided.

Angel One Trade Login Process — Web Trading Platform

To log in to Angel One’s web trading platform, you can follow these steps:

Go to the Angel One website (https://trade.angelone.in/).

Click on the “Login” button on the top-right corner of the homepage.

Enter your Angel One client code, registered mobile number, and password.

Click on the “Login” button to log in to your account.

Note: If you have forgotten your password, you can reset it by clicking on the “Forgot Password” link on the login page and following the instructions provided.

FAQs about Angel One Login

Here are some frequently asked questions about Angel One login:

How can I reset my Angel One login password?

To reset your Angel One login password, click on the “Forgot Password” link on the login page, enter your registered mobile number and email address, and follow the instructions provided.

What should I do if I am unable to log in to my Angel One account?

If you are unable to log in to your Angel One account, first ensure that you are entering the correct client code, registered mobile number, and password. If the issue persists, you can contact Angel One customer support for assistance.

Can I log in to my Angel One account from multiple devices?

Yes, you can log in to your Angel One account from multiple devices, including the trading app and web trading platform.

Is it safe to log in to my Angel One account on public Wi-Fi networks?

It is generally not recommended to log in to your Angel One account on public Wi-Fi networks, as these networks may not be secure and could potentially be compromised by hackers. It is better to use a private network or mobile data to log in to your account.

How can I ensure the security of my Angel One account?

To ensure the security of your Angel One account, you should use a strong and unique password, enable two-factor authentication, and avoid sharing your login credentials with anyone. You should also keep your device and antivirus software up to date and be vigilant against phishing attempts and other types of online scams.

Source — https://comparebrokeronline.com/angel-broking-login/

Related — https://sites.google.com/view/angel-broking-login/home

0 notes

Text

The lower brokerage fee refers to the least amount an investor or trader has to pay their stockbroker. Because each stockbroker has a different minimum brokerage amount, the lowest brokerage fees usually apply when the computed brokerage amount is less than the minimum brokerage amount. Here are the top stockbroker with lowest brokerage charges in India. Compare their offerings, features, and others in this post.

#lowest brokerage charges in India#options backtesting software#best trading app in india#best stock advisor in india

1 note

·

View note

Text

A Drop in the Ocean

summary: you buy barça for alexia

warnings: none

a/n: requested on the back of a similar one i wrote

word count: 1.5k

-

You don’t even think about it anymore, the money. The commas and zeros stopped meaning anything the moment they started adding up faster than you could count. You don’t remember exactly when it happened, just that it did. One day you were checking the balances on your brokerage account religiously, watching the stock tickers on your phone at breakfast, and then at some point—probably after that second meeting in Geneva or maybe the fourth trip to Dubai—you stopped caring altogether. The accounts became endless, infinite, numbers that only existed on a screen and held no weight in the real world. You could buy anything, do anything. You do.

You’ve bought Barcelona FC. For Alexia.

It wasn’t a particularly difficult purchase, and that’s what bothers you, how easy it was. You’d made a few calls, orchestrated a few backroom meetings with men in navy-blue suits who wear Patek Philippe watches but don’t know how to spell "integrity," and within weeks, it was done. The club—one of the most storied institutions in world football—was now, for all intents and purposes, yours. They were failing in every department that mattered, so it wasn’t hard to make them see reason. The board was crumbling under its own corruption and incompetence anyway, the men in charge having long ago stopped caring about anything other than their own salaries. They saw the numbers you offered and couldn’t sign the dotted lines fast enough.

You’re sitting in the back of your Bentley Bentayga—the V8 model because the W12 felt too much, like gilding the lily—watching the city of Barcelona pass by in blurred streaks of sunlight and shadows. You don’t drive yourself anymore; it’s not that you’ve forgotten how, but why would you bother when you can pay someone to do it for you? You’re sipping on an iced Americano from a local coffee roaster that isn’t La Colombe but isn’t Starbucks either—because Starbucks is for tourists and people who don’t care what real coffee tastes like—and tapping your thumb against the cool glass, counting down the minutes until you get home. Home isn’t the place you grew up, or even the first penthouse you bought in Barcelona—God, you’ve already sold that one off—but the sprawling villa in the hills that overlooks the city like a predator watching its prey.

You’d bought the house because Alexia liked it. You had taken her to see it on a whim, even though you knew you’d buy it regardless of her opinion. But she’d loved it, her eyes lighting up in that way they do when she’s genuinely moved by something, not when she’s just being polite or trying to please you. It’s rare, that reaction, and you’ve noticed it only happens when she’s either on the pitch or somewhere quiet, somewhere she can breathe. It makes you feel something, a tightness in your chest, almost a panic, like the world’s collapsing in on itself, but in a good way. If there even is a good way for that to happen.

Your phone buzzes, vibrating against the buttery-soft leather of your seat. You glance at it and see it’s a text from her.

Training's over. Home soon?

You smile, the kind of smile that makes the people around you uneasy, because they never know if it’s genuine or not. It is, but it’s small, fleeting, like everything in your life that isn't Alexia.

On my way. You send the reply quickly, almost too quickly, like you’re not supposed to care that much. But you do. You always do.

You met Alexia when you were young—stupid young—back when you still believed that success was something you had to fight for. She was everything you weren’t: grounded, focused, humble. Even now, with all the accolades and the Ballon d'Ors and the fanfare, she still feels *real* in a way you don’t anymore. She still eats cereal for breakfast sometimes, not some overpriced organic granola shipped in from the Swiss Alps. She’ll sit on the sofa in her sweatpants and watch trashy reality TV with you, her feet in your lap, like the world outside doesn’t exist. Like she’s not the face of women’s football, the woman everyone wants to be. You want to be her too, sometimes.

But then you remember: she’s yours. And you’re the one with the power, the one pulling the strings now. You’re the one who’s going to fix everything for her.

You think about the RFEF, the Royal Spanish Football Federation, and how utterly revolting they are, how they’ve mishandled everything about the women’s game. It makes you angry, but not in the way normal people get angry, not in that quick, fleeting way. Your anger is cold, calculated, the kind of anger that doesn’t make itself known until it’s too late. You’d called in favours—favours you didn’t even know you had—and now you’re restructuring the whole thing from the inside out. The old guard, the men who’ve spent years belittling and undermining women’s football, will be gone soon, and they don’t even see it coming. You’ll replace them with people who actually care, people who understand what’s at stake.

Alexia doesn’t know yet. She doesn’t need to. She already carries enough weight on her shoulders; you see it in the way she moves, the subtle slump in her posture after a long day. She’s been fighting this fight for years, but you can take it from here. You’ll make sure she never has to fight again.

When you finally pull up to the villa, the sky is turning that particular shade of burnt orange that only seems to exist in Spain. The driver opens your door, and you step out, the sound of your Louboutins clicking against the cobblestone driveway. You’re wearing something understated but expensive—a cream-coloured silk blouse from The Row, tailored trousers that cost more than most people’s monthly rent, and a watch that could fund a small country’s healthcare system for a year. You’ve always preferred quiet luxury, the kind of wealth that doesn’t scream but whispers, softly, in the background. Alexia likes that about you. At least, you think she does.

You walk through the front door—minimalist, custom-made, imported from Italy—and the scent of jasmine fills your lungs. Alexia’s perfume. She’s here.

You find her in the living room, sprawled out on the sofa, her legs up on the coffee table, still in her training kit. Her hair is pulled back in a messy ponytail, strands falling loose around her face. She’s scrolling through her phone, probably reading up on whatever the media is saying about the latest match, and she looks up when you walk in. There’s that smile again, the one that makes everything else disappear for a moment, just a moment, but long enough to matter.

“Hey,” she says, her voice soft, like it’s only meant for you.

You cross the room and sit next to her, pulling her legs into your lap, your fingers automatically tracing circles on her shins. You don’t say anything for a while, because neither of you needs to. The silence between you is comfortable, familiar, the kind of silence that only comes when two people have been through everything together and still come out on the other side.

“I bought the club,” you say, casually, like you’re talking about picking up milk from the store.

Alexia looks at you, her eyes widening for a second before she catches herself. She’s good at that, at pretending nothing surprises her, but you know her well enough to see through it.

“You did what?” she asks, her tone somewhere between disbelief and amusement.

“I bought Barcelona,” you repeat, leaning back against the cushions. “They were fucking it all up, especially with the women’s team. I’m fixing it. For you”

She doesn’t respond immediately, and you can see the gears turning in her head, trying to process what you’ve just said. It’s not that she doesn’t believe you; she does. It’s just…a lot.

“You didn’t have to do that,” she says finally, but there’s no conviction in her voice. She knows as well as you do that you don’t *have* to do anything. You want to.

“I did,” you reply, your voice firm. “Because they don’t care about you. Not like I do”

She looks at you for a long moment, and you can see the conflict in her eyes, the push and pull of wanting to argue but knowing there’s no point. You’ve already made up your mind. You always have.

“Thank you,” she says eventually, and the sincerity in her voice catches you off guard. You’re used to people thanking you, sure, but it’s always perfunctory, transactional. This is different. This is real.

You lean in and kiss her, slow and soft, and for a moment, everything is perfect. You don’t think about the money or the power or the corruption you’ve spent years navigating. You don’t think about the board meetings or the backroom deals or the restructuring of the RFEF. You just think about her, and how she’s the only thing that makes any of it worth it.

When you pull back, she’s smiling, and it’s that smile again—the one that makes your chest tighten and your heart race in a way that nothing else does. Not even the money.

“Let’s go fix everything,” you say, and for the first time in a long time, you feel like maybe, just maybe, you already have.

#alexia putellas#alexia putellas x reader#fcb femeni#fcb femeni x reader#espwnt#espwnt x reader#woso#woso x reader#woso imagine#woso community

657 notes

·

View notes

Text

Investing 101

Part 2 of ?

In my last post I explained what stocks are, why companies might want to issue shares and some of the types of stocks. I also explained dividends and why some stocks are called Growth and others called Value stocks. The next logical question is, "How do I buy stocks?"

For most beginning investors, their 401K or IRA is their first opportunity to purchase stock. My recommendation to my kids (which I followed myself) is to set your 401K withholding at least high enough to earn the maximum employer match. Most employers will match a fixed percentage of an employee's 401K withholdings up to a maximum amount. Not withholding at least enough to get the maximum employer match is like taking a salary cut. This is 'free money' from your employer but only you save enough to take advantage of it. 401K plans are almost always administered by a large brokerage firm and through that firm participants are offered a variety of investment options, some more limited than others. I will talk a bit more about the various investments options later.

If you're already investing in your 401K and you still have after-tax funds you'd like to invest (in stocks or other investments), there are a few options.

The simplest, lowest cost option is a direct stock purchase plan (DSPP) which enables individual investors to purchase stock directly from the issuing company without a broker. I've never done this, but it's possible and if you're a big fan of a company and want to be a long term investor, you may want to consider it.

The more common approach is to open an account with a Broker. From Investopedia, "Brokerage firms are licensed to act as a middleman who connects buyers and sellers to complete a transaction for stock shares, bonds, options, and other financial instruments. Brokers are compensated in commissions or fees that are charged once the transaction has been completed." When you open an account with a broker, they take care of all trading paperwork and send you investment reports and tax forms.

ETrade and RobinHood are examples of Discount Brokers (low cost, self-service). They execute your trades (buying and selling) for very low fees and include online resources for the investor to research investments. It is easy to set an up account online and start trading using their mobile apps.

Full Service Brokers like Morgan Stanley, Ameriprise, Edward Jones, etc. operate on the other end of the spectrum. These firms execute trades like the self-service brokers but their account relationships include the services of a Financial Advisor. Ostensibly, the Financial Advisor is periodically meeting with you to review your portfolio, rebalancing your investments to ensure continued alignment with your goals and risk tolerance and recommending investments to buy and sell. Financial advisors generally charge an annual fee of 1% or more of the value of your portfolio. These brokerage firms also have online investment research materials, but the idea is that the Financial Advisor is actively helping you steer the ship.

Alternatively, you can consult a Certified Financial Planner (CFP). These individuals can help manage your broader financial life (including investments, budgeting, insurance needs assessment, estate planning), though CFPs generally aren't brokers (i.e. they don't execute stock trades). Rather than charging a percentage of your portfolio as a fee, CFPs generally have a fixed hourly rate. That hourly rate might seem steep, but it is almost always less than the fee of a full service broker/Financial Advisor.

Assuming you're already investing enough in your 401K to get your employer match, which investing/broker relationship should you pursue? Because full service Financial Advisor fees are a % of your portfolio, these advisors tend to pursue relationships with wealthier clients. If you don't have a large portfolio, it can be difficult get the time/attention of a full service broker. (True story, 30 years ago a friend who was also our financial advisor fired Beth and I as clients when his firm raised its minimum portfolio threshold to exclusively service wealthy clients. I'd like to think he regrets that decision now.) A caveat to this is if your parents have an established relationship with a broker/advisor - then that advisor may be more enthusiastic about managing the adult child's portfolio. (Yes, this is an example of white privilege.)

If you're just starting out (ex <$100K portfolio), I think engaging a fee-based CFP 2-3x a year and opening a Discount Brokerage account is the way to go.

I know several investors with large portfolios who also prefer the Discount Broker strategy, however, because they loathe the idea of paying 1% of their portfolio every year to a financial advisor. There is plenty of research supporting this strategy for large portfolios... after all 1% every year really adds up. Over 20-30 years the 1% annual fee can be very expensive. Despite this, Beth and I have always used a Full Service Advisor.

Beth and I are both CPAs and financially literate, why would we pay the higher fees for a Full Service Advisor? We pay an advisor so we can sleep at night. When I was still working I checked my portfolio balance no more than once or twice a month. I check it more often now, but that's mostly because I simply have more free time. I've never spent any mental energy trying to research good investments. Most importantly, I've never had any emotional attachment to an investment. Every quarter or so we will meet with our advisor and he recommends investments we should sell, either because they haven't performed well or sometimes because they have performed well and have 'topped out'. I never feel any guilt or blame for investments that haven't done well because I didn't originate the investment idea when we bought it. I don't feel tempted to hang on to the investment in hopes that it will rebound and I will be proven right. I can be completely objective and devoid of emotion. And that's one of the reasons I've never lost any sleep over our investments.

Next installment - what to buy.

23 notes

·

View notes

Text

Are you on the lookout for some promising penny stocks under $1 to invest in 2021? You’ve come to the right place! Penny stocks can be a great way to invest your money without breaking the bank. Read more https://besttradingappindia2023.blogspot.com/2023/05/best-penny-stocks-to-buy-in-india-2023.html

#angel broking#free demat account#best trading app in india#lowest brokerage charges#mutual funds#lowest brokerage charges in india#penny stocks

0 notes

Text

In the fast-evolving world of online stock trading, finding a reliable and cost-effective platform is crucial for both novice and experienced traders. One such platform that has gained significant attention in India is mStock—a trading app designed to simplify stock market investments and make trading accessible to everyone. This zero brokerage trading app has quickly become popular for its no-brokerage charges on equity delivery and its user-friendly interface. But is mStock the right choice for you? Let’s dive into an in-depth mStock review to understand its features, pros, cons, brokerage plans, and more.

#mstock#mstock login#sensibull#sensibull option chain#share market#mstock review#mstock charges#mstock brokerage calculator#m stock#zero brokerage trading app#m stock charges#m stock review#0 brokerage trading app#sensibull login#tradetron#no brokerage

0 notes

Text

#Top 10 Lowest Brokerage Charges#Lowest Brokerage Charges in India#online stock broker#stockbroker#Discount Broker#Top 5 Lowest brokerage charges#Demat Account#Lowest Brokerage Charges Stockbrokers in India

0 notes

Text

Achieving Success with The Lowest Stock Trading Fees

Maximize your investment returns with Lowest Stock Trading Fees. Our cost-effective solutions ensure minimal expenses, allowing you to retain more of your earnings. Whether you're a seasoned trader or a novice investor, our low fees enhance the overall value of your stock trading experience. For any queries contact us at: 8920927713

#lowest stock trading fees#low commission brokerage#low fee brokerage firms#lowest trading charges#less brokerage charges in india#lowest brokerage charges#lowest brokerage fees#cheapest brokerage firm in india#lowest brokerage fees in india

0 notes

Text

Mutual Funds Made Easy: A Guide to Beginners.

What is a Mutual Fund?

Hey buddy, Mutual funds are a type of investment vehicle that pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. The mutual fund is managed by a professional fund manager who makes investment decisions on behalf of the investors, to maximize returns while minimizing risk.

Types of Mutual Funds

There are several types of mutual funds, including equity funds, fixed-income funds, balanced funds, index funds, and specialty funds. Equity funds invest in stocks, fixed-income funds invest in bonds, and balanced funds invest in a mix of stocks and bonds. Index funds are designed to track a specific market index, such as the S&P 500, while specialty funds focus on a particular sector or industry.

Benefits of investing in mutual funds

Mutual funds offer several benefits, including diversification, professional management, convenience, and flexibility. Diversification is important because it helps reduce the risk of losses by spreading investments across many different assets. Professional management ensures that your money is invested by a trained and experienced professional. Mutual funds are also convenient because they can be purchased and sold through a brokerage account or financial advisor. Additionally, they offer a high level of flexibility, allowing you to buy or sell shares at any time.

Risks of investing in mutual funds

All investments come with some level of risk, and mutual funds are no exception. The value of mutual funds can fluctuate based on changes in the financial markets, and past performance is not always an indicator of future performance. Additionally, mutual funds charge fees and expenses, which can eat into your returns over time.

Choosing a mutual fund

When choosing a mutual fund, it’s important to consider your investment goals, risk tolerance, and investment time horizon. You should also research the fund’s fees and expenses, as well as its historical performance. Finally, consider working with a financial advisor who can help you choose the right mutual funds for your portfolio.

I will give two tips on checking to choose a mutual fund before investing first one is

Performance History: Look at the fund’s past performance over a period of time, preferably five to ten years. While past performance is not an indicator of future returns, it can give you an idea of how the fund has performed during different market conditions. You can check easily on grow app or whatever app you like it.

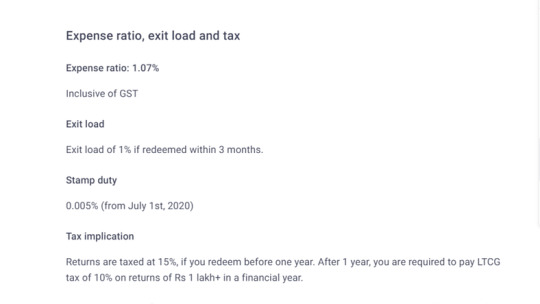

Expense Ratio: The expense ratio represents the cost of managing the fund and is deducted from your returns. Look for funds with a lower expense ratio, as high fees can eat into your returns over time.

I will show pictures of higher expense ratios and lower expense ratios.

Monitoring your mutual fund

After you invest in a mutual fund, it’s important to monitor your investment regularly to ensure that it continues to meet your investment goals. This may involve reviewing the fund’s performance, fees, and expenses, as well as rebalancing your portfolio periodically to maintain a diversified mix of investments.

Remember, mutual funds can be a great way to invest in the stock market and other assets without having to choose individual stocks or assets yourself. However, it’s important to do your research and carefully consider the risks and potential rewards before investing.

Hope you enjoy and like this blog post. Later on, I will post a full detailed blog on Mutual funds. Make sure to share with your friends and comment with your opinions and subscribe.

Disclaimer:

The information provided on this blog is for educational and informational purposes only and should not be considered financial advice. I am not a certified financial advisor and do not hold any professional licenses in the finance industry. Any financial decisions you make based on the information provided on this blog are at your own risk. Please consult with a certified financial advisor before making any significant financial decisions.

2 notes

·

View notes

Text

The Securities and Exchange Commission sued crypto exchange Coinbase

in New York federal court on Tuesday morning, alleging that the company was acting as an unregistered broker and exchange and demanding that the company be “permanently restrained and enjoined” from continuing to do so.

Shares closed down 12% Tuesday. Coinbase stock had already fallen 9% on Monday, after the SEC unveiled charges against rival crypto exchange Binance and its founder Changpeng Zhao.

“These trading platforms, they call themselves exchanges, are commingling a number of functions,” SEC chair Gary Gensler said on CNBC Tuesday. “We don’t see the New York Stock Exchange operating a hedge fund,” Gensler continued.

Coinbase’s flagship prime brokerage, exchange and staking programs violate securities laws, the regulator alleged in its complaint. The company “has for years defied the regulatory structures and evaded the disclosure requirements” of U.S. securities law.

8 notes

·

View notes