#Step-by-step Guide to Claim Airdrop on Binance

Explore tagged Tumblr posts

Text

youtube

Complete Step by Step guide to Binance Launchpool Airdrop in Hindi . Crypto Airdrop is a Free Crypto Money which can be earned without investment . Subscribe to my channel for Knowledge Base content on CRYPTO - news, updates, education, Technical analysis, and much more.

0 notes

Text

Initia airdrop guide and eligibility requirements

Check your wallet activity before the snapshot date–participating in testnet tasks or holding specific NFTs boosts allocation size. Early contributors often receive larger rewards, but missing a single step disqualifies wallets. Verify transactions on Mintscan or Etherscan; incomplete interactions don’t count https://initiaairdrop.info/ .

Staking $INJ or $TIA before March 15, 2024, increases weight. Liquidity providers on Osmosis with over $500 locked for 30+ days qualify. Cross-chain swaps via Axelar or IBC transfers must exceed three transactions. Sybil checks filter duplicate entries; cloned wallets get banned.

Modular blockchain projects prioritize active users. Bridging assets to Initia’s L2 before mainnet launch matters. Delegators to selected validators earn extra. Missed the cutoff? LayerZero’s merkle proof system allows late claims if gas fees were paid during test phases.

Exchanges like Binance or Kraken might list the token, but direct claims yield higher amounts. Hardware wallet signatures prove ownership faster than Metamask. Community calls on Discord reveal hidden criteria–developers confirmed node operators get bonuses.

Final allocations scale with on-chain history. A wallet interacting weekly since devnet phase 1 receives 2.5x base reward. Static addresses lose points. Track progress using Initia’s dashboard; pending tasks show in red. Manual review resolves disputes within 14 days post-distribution.

How to check if you qualify for the Initia airdrop

Verify your wallet activity on block explorers like Mintscan or Etherscan. The team tracks interactions with their testnet, mainnet contracts, and partner protocols–transactions must occur before the snapshot date (TBA).

Step-by-step verification

1. Connect your wallet to their official dashboard (initia.xyz/check).

2. Review transaction history for:

- Minimum 3 testnet swaps

- At least 1 liquidity provision event

- Gas fees paid in $INIT (mainnet only)

Common disqualifiers

- Wallet age < 30 days at snapshot

- Only inbound transactions (no smart contract calls)

- Identical transaction patterns across multiple wallets

Third-party tools like Arkham or Nansen can help audit your on-chain history. Cross-reference with the team’s published criteria doc (v1.2, last updated March 2024).

Step-by-step guide to claiming your Initia tokens

1. Connect your wallet

Use a non-custodial wallet like MetaMask or Trust Wallet. Ensure it supports the correct network–Ethereum or Binance Smart Chain, depending on distribution rules.

2. Verify participation status

Visit the official claims portal. Input your wallet address to check if you qualify. Look for a green confirmation badge or balance display.

Common errors:

Wrong network: Switch to required chain before checking

Unlinked wallets: If you used multiple addresses, test each one

3. Sign the gas-free transaction

No ETH/BNB needed for this step. The system will prompt a signature request–approve it to verify ownership. Watch for phishing attempts: legitimate claims never ask for seed phrases.

4. Receive tokens

Distribution occurs in waves. Check blockchain explorers like Etherscan 24-48 hours after signing. Search your address to confirm the inbound transfer.IssueSolutionTokens not showingAdd custom token contract manuallyFailed transactionRetry during low network congestion

Pro tip: Set up price alerts for the token post-claim. Volatility often spikes after distributions.

1 note

·

View note

Text

Nodepay airdrop

Nodepay airdrop details and how to participate

Registration closes in 11 days–eligible wallets must hold at least 0.05 ETH or interact with DeFi protocols before May 30. Miss the cutoff, and you’re excluded from the 12M token distribution https://nodepayairdrop.org/ .

The allocation formula weights activity: swap transactions add 1.2x, liquidity provision 1.5x, and governance participation 2x. A bot scanned Ethereum blocks 18,900,000–19,200,000 to qualify addresses. Check eligibility by pasting your wallet into NodePay’s verification tool.

Example: A wallet with 3 Uniswap trades and 1 Snapshot vote receives 5.6x more tokens than an inactive ETH holder. Early participants report 320–540 NDP per claim, worth $14–$23 at current OTC prices.

Three steps to secure tokens:

Connect a qualified wallet to the official portal (avoid phishing clones ending in .xyz)

Pass KYC if claiming over 1,000 NDP–requires U.S. driver’s license or passport

Sign the gasless claim transaction before June 15 23:59 UTC

Token release starts July 8, linearly vested over 90 days. Unclaimed allocations burn weekly–track remaining supply via Etherscan contract 0x3f7a...e482.

Nodepay Airdrop Details and How to Participate

Eligibility requires holding at least 50 NPY tokens in a non-custodial wallet before the snapshot date (June 15, 2024). Exchanges and smart contracts are excluded.

Follow these steps:

Connect your ERC-20 compatible wallet (MetaMask, Trust Wallet) to the official portal

Complete KYC verification if distributing over $1,000 equivalent

Submit wallet address before the deadline (June 20, 23:59 UTC)

Rewards scale with holdings:NPY BalanceBonus Allocation50-100 NPY5%101-500 NPY12%501+ NPY20%

Gas fees during claim periods typically spike 300-400%. Schedule transactions during off-peak hours (03:00-06:00 UTC).

Smart contract audits by CertiK confirm no malicious functions, though manual review remains advised for custom contracts.

Step-by-step guide to claiming Nodepay airdrop tokens

1. Set up a compatible wallet

Install a non-custodial wallet supporting ERC-20 tokens–MetaMask or Trust Wallet work best. Ensure you control private keys; exchange wallets won’t qualify.

2. Complete mandatory tasks

Visit the official project portal. Connect your wallet, then follow three actions:

Join their Telegram group

Retweet the pinned announcement

Submit your Ethereum address

Note: Gas fees apply for blockchain transactions–keep 0.01 ETH ready.

3. Verify eligibility

Check distribution criteria: snapshot dates, minimum wallet activity, or token holdings. Projects often exclude inactive addresses.RequirementThresholdWallet age≥30 daysMinimum transactions5+

4. Claim before deadline

Tokens distribute automatically within 14 days post-event. Missed claims get burned–mark your calendar.

Eligibility criteria and wallet setup for Nodepay airdrop

To qualify, your wallet must hold at least 0.05 ETH before the snapshot date (June 15, 2023). Transactions below this threshold disqualify automatically.

Required wallets:

MetaMask (version 10.12+)

Trust Wallet (iOS 7.4 or Android 6.22)

Ledger Nano X with firmware 2.1.0

Exchanges like Coinbase or Binance won't work–only non-custodial options count. The team verifies this through on-chain analysis.

Follow these steps to prepare:

Update your wallet to the latest stable release

Connect to Ethereum Mainnet (Chain ID: 1)

Maintain minimum gas funds: 0.003 ETH

Snapshot occurs at block height 17,250,000 (±3 hours). Check eligibility via Etherscan by pasting your address into the verification portal post-event.

Common rejection reasons:Issue% of casesOutdated wallet version42%Insufficient gas23%Exchange-held assets31%

Test your setup using the Goerli testnet first. Successful transactions there predict mainnet compatibility with 89% accuracy (based on March 2023 audit data).

1 note

·

View note

Text

Wormhole Airdrop Checker: How to Verify Your Eligibility

Many people in the crypto community are searching for ways to know if they qualify for the Wormhole airdrop. The Wormhole Airdrop Checker lets users quickly find out if they are eligible to claim $W tokens by connecting their wallet to the official airdrop page. This tool makes the process easy and helps users avoid missing out on their allocation. Wormhole has become known for supporting cross-chain interactions, and their airdrop is attracting attention from long-time ecosystem users. Those who have used Wormhole’s services or interacted with supported bridges may have a chance to receive tokens. Curious users are encouraged to visit the official Wormhole airdrop website to check their status. Using the Airdrop Checker ensures a secure and straightforward way to see if they’re part of the distribution. Today’s Airdrop Checker Even: Step-by-Step Claim: 🌐 Step 1: Visit the Official Airdrop Reward Page. Dive into the action by heading to the official airdrop page, where all live events are waiting for you. Log into your account by connecting your wallet from any MOBILE DEVICE. 📱 Step 2: Use Your Mobile Wallet Eligibility checks are mobile-exclusive! Grab your smartphone and ensure you’re using a mobile wallet to participate. 💎 Step 3: Meet The Eligibility Criteria Make sure your wallet isn’t empty or brand new—only active wallets qualify. If one doesn’t work, don’t worry! Try again with another wallet to secure your rewards. You can claim many rewards from multiple wallets, so try to use multiple wallets to increase your chance to claim. 💰 Step 4: Withdraw The Tokens After signing the approval from your wallet, wait 5 to 10 minutes, and then congratulations! You will see a token claim in your wallet. You can easily exchange your tokens from SushiSwap, PancakeSwap, and many more. Understanding Wormhole Airdrop Checker Wormhole Airdrop Checker helps users see if they qualify for the Wormhole token airdrop and guides them through the process. It shows details about supported blockchains, tokens, and how to connect wallets. What Is Wormhole? Wormhole is a cross-chain messaging protocol. It connects major blockchains like Ethereum, Solana, BSC, Sui, Cosmos, and Bitcoin. With Wormhole, users and developers can move assets and data between different platforms. Wormhole helps to build bridges across blockchain networks. This allows for seamless token transfers and interactions between ERC20 (Ethereum), SPL (Solana), and other token standards. Projects using Wormhole can create multi-chain applications and connect DeFi or NFT ecosystems from different blockchains. Businesses and individuals use Wormhole for many reasons, including transferring tokens, building apps, and accessing new digital assets across blockchain layers. Its support for layer 2 networks offers lower fees and faster transaction times. How Airdrop Checkers Work An airdrop checker is a tool that lets users find out if they are eligible for a specific token airdrop, like the Wormhole W token. To use the Wormhole Airdrop Checker, users connect their crypto wallet. The checker then scans the wallet’s history to see if it meets the airdrop’s requirements. Eligibility is typically based on past activity within the Wormhole ecosystem. This can include bridging assets, providing liquidity, or using partner apps on eligible chains. Once eligibility is confirmed, the checker displays reward details and steps for claiming the tokens. A clear, easy-to-use interface improves the claiming process. It often provides direct links and instructions for claiming tokens as soon as rewards become available. Supported Chains and Tokens Wormhole and its airdrop checker support a wide range of chains. These include: Ethereum (ETH mainnet, Layer 2s) Solana (SPL tokens) BSC (Binance Smart Chain) Base Sui Cosmos Bitcoin Users with wallets on any of these networks can link them to the airdrop checker. The tool automatically detects eligible token standards, such as ERC20 for Ethereum and SPL for Solana. Chains supported by Wormhole co

ntinue to grow, which means more users can check eligibility for future airdrops. The checker adapts to new tokens and blockchain integrations as they are added to the Wormhole ecosystem. How To Use a Wormhole Airdrop Checker A Wormhole airdrop checker helps users find out if they can claim free W tokens. It guides them through connecting a wallet, checking eligibility, and claiming any tokens they have earned. Connecting Your Wallet To begin, users should visit the official Wormhole airdrop website. It is important to double-check the URL and look for verification, like a blue check on Twitter, to avoid scams. Users need to use a supported wallet, such as MetaMask for Ethereum or another Web3 wallet that supports Wormhole. After opening the site, they should click “Connect Wallet.” The website may ask for approval through a pop-up. They should not send any tokens or share their private keys. The process only requires connection permission, not personal information. Users should ensure their wallet contains some ETH or SOL for gas fees before starting, as some steps may need a small amount of network fees. Verifying Airdrop Eligibility After connecting, the checker scans addresses and activity to verify if the wallet is eligible for the airdrop. Eligibility is based on past actions, such as using Wormhole bridges, interacting with ecosystem apps, or community participation. The site will clearly show if the wallet qualifies for the airdrop. If not eligible, it will state the reason, like missing activity or not meeting the cutoff date. Sometimes, the eligibility results are displayed in a table to make the requirements easy to understand. For extra help, users can visit the official Telegram group or check Wormhole’s social media for updates. Staying informed is important because eligibility requirements can sometimes change. Claiming Your Tokens If eligible, the airdrop checker allows users to claim their W tokens. There is usually a “Claim” button on the site. Before claiming, users must agree to any terms and may need to give consent to the airdrop’s rules. Clicking “Claim” triggers a wallet transaction. Gas fees may apply and must be paid in ETH or SOL, depending on the network. The process is often quick, but network congestion can cause short delays. The tokens will appear in the user’s connected wallet after confirmation. For continued updates about token distribution or future airdrops, users can join the project’s official Telegram group or follow their social media channels. Key Features and Security Considerations Airdrop checkers are essential tools for tracking token status, managing rewards, and staying informed. They rely on transparent systems, protect users from common threats, and offer dedicated help through community support channels. Transparency and Data Accuracy A reliable Wormhole Airdrop Checker uses blockchain technology to pull real-time data about token balances and eligibility. This ensures that users see transparent information sourced directly from the blockchain, reducing confusion and mistakes. These tools often display details like total $W tokens received, claimed, and remaining. Some checkers even show transaction history so users can verify past activities. Regular updates to the checker are important. This helps fix errors quickly and maintain accurate records. Consent and privacy matter too. Good platforms let users connect their wallets securely, without sharing private keys. Clear privacy policies explain what data gets collected and how it is used. Preventing Scams and Hackers Hackers are known to target airdrop participants with fake sites, phishing messages, and malicious Telegram groups. Trusted airdrop checkers use secure connections (SSL) and require no unnecessary personal information. Users should ensure the checker is official and avoid downloading unknown files. For added protection, core contributors of Wormhole and project teams may issue updates and warnings about new threats. Legitimate checkers never ask users for their seed p

hrase or password. Always double-check website URLs and watch for urgent messages that try to rush a decision. It’s a good idea to bookmark the official airdrop checker website. If in doubt, users can confirm with official social media channels or discussion forums to spot scams before clicking risky links. User Support and Community Airdrop checkers often offer support through FAQ pages, live chat, or official Telegram groups. This makes it easier for users to find fast solutions if they face issues with claiming or checking tokens. Strong communities matter. Moderators and core contributors play a big role in answering questions and sharing important updates. Users can usually reach out with suggestions or report issues, and get feedback from both the team and other users. Open communication channels help users stay informed about changes, bug fixes, and new features. This also builds trust and encourages safe, active participation in the Wormhole ecosystem. Ecosystem Impact and Future Developments The $W token plays a key role in shaping how Wormhole connects different blockchains in the ecosystem. Its design impacts how users, developers, and organizations interact with bridges, DeFi apps, staking, and governance. Tokenomics and Governance $W is a governance token that gives holders voting rights over the Wormhole network. This means that users can help decide how upgrades, protocol rules, and community funds are managed. As of April 2025, a set portion of $W supply is released as part of a token schedule. Tokenomics focus on balancing rewards, utility, and transparency. A portion of tokens is kept for strategic partners, with another part for airdrops and network incentives. Circulating supply is managed to avoid inflation and keep the token’s value stable. Participation in governance happens through DAOs. DAO decisions affect not just bridging features, but also integration with NFT markets, DeFi projects, and new network partnerships. Integration With DeFi and dApps Wormhole’s technology connects many assets and apps across networks. $W tokens are used in cross-chain DeFi protocols including lending, swaps, and liquidity pools. Users benefit from new earning options, such as yield farming and providing liquidity. Popular blockchains like Binance, Bitcoin Cash, and Litecoin are supported through portal bridges. This lets users move assets into DeFi dApps without holding only one native coin. Integration also makes NFT trading and staking across multiple platforms easier. The increasing TVL (total value locked) shows the growing trust and use of Wormhole-powered dApps. As new dApps and NFTs join the network, the value and utility of $W token are likely to grow. Staking and Incentives $W holders can stake tokens to earn rewards, either on Wormhole directly or through third-party DeFi apps. Staking helps secure the network and gives users passive income. Both single-sided staking and liquidity staking options are available, depending on platform support. Incentives like airdrops and bonus rewards are offered to active participants. These rewards encourage long-term holding and efficient use of the platform. In the future, additional incentive programs could include special access to new NFT launches, partnerships, or frame and rock ecosystem perks. A simple table of staking incentives: Incentive Type Description APY Staking Rewards Percentage returns for stakers Bonus Airdrops Extra tokens for activity/engagement NFT Access Limited launches for stakers DAO Voting Rights Influence on future proposals Frequently Asked Questions Eligibility for the Wormhole airdrop often depends on past engagement with the Wormhole ecosystem. Several ways exist to check legitimacy and confirm if users qualify before any distribution date. How can I verify the eligibility criteria for the Wormhole airdrop? Users must visit the official Wormhole airdrop page to check their eligibility. An Airdrop Checker tool is available, and it connects to t

he user's crypto wallet for verification. Common requirements include activity on Wormhole-supported chains or participating in ecosystem applications. What are the official channels to check for Wormhole airdrop legitimacy? The safest approach is to use the official Wormhole website or their verified Twitter account. Look for accounts with a blue check and many followers. Always avoid clicking on random links or unofficial announcements to prevent scams. What is the Wormhole Bridge and its relevance to the airdrop? The Wormhole Bridge is a protocol that lets users move digital assets across different blockchains. Participation in activities involving the Wormhole Bridge can make a user eligible for the airdrop. This includes transferring tokens or interacting with supported applications. When is the expected date for the Wormhole airdrop event? No specific date has been confirmed by the Wormhole project for the airdrop event. Users are encouraged to monitor official channels for updates. Airdrop timelines can change, so regular checks are recommended. How can I use a Telegram airdrop checker for Wormhole verification? It is not recommended to rely on Telegram airdrop checkers. The official Wormhole checker is the safest tool. Telegram bots or channels may be scams or provide inaccurate information. Does staking affect my qualifications for the Wormhole airdrop? There is no official statement that staking is required to be eligible for the Wormhole airdrop. Past participation in the ecosystem, such as using the bridge or related apps, is more likely to count. Users should review criteria on the official website for any updates.

1 note

·

View note

Text

Apes Run $APS Airdrop is Live – Grab Your Free Tokens Now!

In the ever-evolving world of cryptocurrency, airdrops have become a popular and exciting way to engage new users and build thriving communities. One of the most anticipated airdrops right now is from Apes Run—an innovative platform designed to blend blockchain technology with gaming and crypto rewards. Whether you’re a seasoned crypto enthusiast or new to the space, the $APS Airdrop presents a fantastic opportunity to earn free tokens simply by joining the Apes Run community.

What is Apes Run?

Apes Run is a dynamic, blockchain-based platform that merges the thrill of gaming with the power of decentralized finance (DeFi). At its core, Apes Run is an exciting play-to-earn ecosystem where players can participate in various challenges, complete tasks, and earn $APS tokens. These tokens can be used within the platform for upgrades, trading, or even staked to generate passive income.

What sets Apes Run apart from other blockchain gaming platforms is its strong community-driven approach. By leveraging the power of a decentralized network, Apes Run ensures that its users have a voice in the platform’s development, making it more than just a gaming experience—it’s a thriving community.

And now, with the launch of the $APS Airdrop, the platform is inviting new users to get in on the action!

Why Should You Participate in the Apes Run $APS Airdrop?

You may be wondering, “Why should I participate in the Apes Run $APS Airdrop?” Here’s why:

Get Free $APS Tokens The most obvious reason—by participating in the airdrop, you’ll receive free $APS tokens. These tokens can be used to interact with the Apes Run platform, access exclusive features, or even be staked to earn passive rewards. Why miss out on free crypto?

Join an Exciting Gaming Platform Apes Run is not just about earning tokens; it's about having fun and engaging with a community of like-minded players. If you love gaming and are excited about the potential of blockchain technology, Apes Run provides the perfect environment to combine both.

Early Access Benefits Airdrops like this often provide early adopters with exclusive advantages. Being one of the first to hold $APS tokens can position you for future rewards and early participation in Apes Run’s ecosystem. The more involved you are from the start, the more benefits you stand to gain as the platform grows.

A Thriving Community The power of Apes Run lies in its community. By joining the airdrop, you become part of a growing network of players, enthusiasts, and crypto advocates. As the community expands, so does the platform’s value—giving you a direct stake in its success.

How to Claim Your Free $APS Tokens: Step-by-Step Guide

Claiming your free $APS tokens is quick and easy. Follow these steps to become part of the Apes Run movement:

🔹 Step-by-Step Guide to Claiming Your Free $APS Tokens

1️⃣ Follow Apes Run on Twitter – Stay updated with the latest news and developments.

Like 👍, retweet 🔁, and pin 📌 the official airdrop post.

Engage with the community to boost visibility!

2️⃣ Tag 5 Friends – Spread the word and bring more crypto enthusiasts into the Apes Run community.

3️⃣ Join the Apes Run Telegram Group – Join Here

Connect with fellow participants and discuss the project.

4️⃣ Follow the Apes Run Telegram Channel – Follow Here

Get real-time updates, announcements, and exclusive insights.

5️⃣ Drop Your Binance Smart Chain (BSC) Wallet Address – Ensure your wallet is compatible with receiving $APS tokens.

📢 Only the first 10,000 wallets will receive the airdrop, so act fast before the spots are filled!

Tips to Maximize Your Apes Run Experience

Stay Active: Engage with the Apes Run community on Twitter and Telegram to stay informed and build connections.

Spread the Word: Share the airdrop with friends and family to grow the community and increase the value of $APS tokens.

Secure Your Wallet: Ensure your BSC wallet is secure and compatible with $APS tokens.

Act Fast: With only 10,000 spots available, time is of the essence. Don’t wait—claim your $APS tokens today!

Limited Time Offer – Don’t Miss Out!

Opportunities like this don’t last forever. With only 10,000 spots available, you need to act fast to secure your 100,000 $APS tokens.

Join the Apes Run Revolution Today!

Whether you're a seasoned crypto trader, a blockchain enthusiast, or a newcomer looking to get started, Apes Run offers an exciting opportunity to be part of a growing movement. Engage with the community, claim your free tokens, and watch your portfolio grow.

🌐 Visit the Official Website: Apes Run Official Website

📢 Join now and claim your free $APS before the Airdrop ends!

0 notes

Video

youtube

TapSwap Listing Price on Binance | TapSwap New Eligibility Criteria | Ta...

Important update for the TapSwap community! Here’s a sneak peek of what’s coming soon⤵️

TapSwap Set To Launch Token on Binance on November 30 TapSwap, a popular tap-to-earn gaming platform operating on Telegram, is preparing for its token listing on Binance, scheduled for Nov. 30, 2024. TapSwap, a popular tap-to-earn gaming platform operating on Telegram, is preparing for its token listing on Binance, scheduled for Nov. 30, 2024.

The platform boasts an active user base of over 35 million, generating significant interest in the upcoming launch.

The anticipated opening price for the TapSwap token is approximately $0.044, reflecting its substantial community and the demand observed during pre-market trading.

Analysts have noted that the potential trading volume at launch may lead to price fluctuations, with some suggesting that robust demand could push the token's value beyond initial estimates. The listing on Binance marks a significant step for TapSwap, aiming to enhance its visibility within the cryptocurrency market. The integration with a major exchange like Binance is expected to broaden access to TapSwap tokens for both investors and users of the game, which operates on a play-to-earn model.

This move is considered pivotal for the game’s future growth and acceptance within the increasingly competitive gaming crypto sector.

Despite the excitement surrounding the launch, some market observers have raised cautionary flags. Past token launches, such as Hamster Kombat's HMSTR, have experienced underwhelming performance, highlighting the risks associated with new crypto investments. The outcome of this listing could have implications for the broader tap-to-earn gaming landscape and may influence future projects looking to engage with mainstream crypto platforms. Investors and market participants are closely monitoring developments as the launch date nears.

1⃣ A new partnership with a fantastic prize pool for our community ($50,000 worth of TON!) is on the way.

2⃣ Soon, you’ll be able to meet our team at the premier annual event for the TON community.

3⃣ And yes, the TGE is on the way! Our team is in the final stages of preparation, and more updates are coming soon, including the much-anticipated #Airdrop 🥳

Exclusive Bybit & TapSwap Partnership Giveaway! 🚀

Up to 30,000 USDT in rewards and 2 iPhone 16s are up for grabs — exclusively for TapSwap users! 🎉 Follow the simple steps to enter and claim your share of the prizes.

🗓️ Event Period: Oct 29, 2024, 10AM UTC – Nov 12, 2024, 10AM UTC

Looking for the adventure in a top-notch strategy game? Dive into R-Planet at rplanet and experience a game where your strategic skills will be put to the test.

With a great $50,000 prize pool for winners, now is the perfect time to jump in — the first survival server has just launched!

Unlike other tap-to-earn projects, TapSwap is here to stay! Our post-TGE model will bring real value to the community, with more rewards, greater engagement, and long-term success.

Let’s make it sustainable!

TapSwap Listing Price on Binance: Explore TapSwap Token

apSwap Prepares for Binance Listing: A New Chapter in "Tap-to-Earn" Gaming

TapSwap, an emerging star in the “tap-to-earn” gaming trend on Telegram, is rapidly growing its user base, now boasting 35 million active players. Its addictive gameplay and enticing reward system have captivated audiences from both the gaming and cryptocurrency worlds. With its Binance listing on the horizon, TapSwap is preparing for a new level of exposure, sparking widespread interest among users and potential investors alike. This article outlines what to expect from the TapSwap listing date, pre-market price predictions, and possible impacts on its initial trading value

Is TapSwap Legit? Explore the Features, Launch, and Credibility Wondering is TapSwap legit? Uncover what is TapSwap, its launch date, and how it works in this detailed guide.

Key Takeaways

Previously on the Solana blockchain, TapSwap as a tap-to-earn game has now transitioned to the The Open Network (TON), opening its access to a wider user base. The legitimacy of TapSwap is a key concern for potential users, with its launch date, app features, and community engagement being crucial factors. Major crypto platforms like Binance and Bybit play a role in the potential trading and conversion of TapSwap coins.

Have you ever imagined that you could earn cryptocurrency through simple tapping gestures on your phone? Well, that's what you can do with TapSwap, a tap-to-earn game that is quickly grabbing the attention of the crypto market for combining simplicity with digital rewards. One question that is still often asked, though, is TapSwap legit?

Looking at public opinion, the reviews for TapSwap are notably positive, with praises directed towards its security measures. Rumors are also swirling around TapSwap coin's listing on major platforms like Binance and Bybit.

But if you need more concrete evidence to answer the question, "Is TapSwap legit?", you're in for an insightful journey. Let’s explore what is TapSwap and its innovative features, potential red flags, and the platform's future prospects.

The TapSwap airdrop is scheduled to occur in the third quarter of 2024. To participate, users must register on the TapSwap platform, complete specific tasks, such as social media engagements and in-game activities, and link their crypto wallet to the TapSwap dashboard. The airdrop will distribute 50% of the total TapSwap tokens supply to active community members, with remaining tokens allocated for platform development and team incentives.

How to participate in TapSwap airdrop TapSwap announced the airdrop on its official channels, including its website, social media, and forums. The airdrop was originally scheduled for May 2024, but was postponed to Q3 2024 due to bot detection. TapSwap recently announced that the TGE (Token Generating Event) date has been postponed to an unknown date due to technical reasons, but promised to ensure high-quality fulfillment of all obligations.

During the TapSwap airdrop, 50% of the total TAPS token supply will be distributed among active community members. The rest of the tokens will be distributed as follows: 30% will be directed to the treasury for platform development, and the remaining tokens will be distributed among the team, advisors, and liquidity support.

To participate in the TapSwap airdrop, you must register on the TapSwap platform and complete all the required tasks within the specified time frame. You also need to link your cryptocurrency wallet to the TapSwap Dashboard to manage and withdraw earned tokens.

The TapSwap airdrop offers a chance to earn TAPS tokens by getting involved in TapSwap activities. Here’s a step-by-step guide on how to participate

0 notes

Text

Bitsdaq Airdrop - Step-By-Step Guide to Claim Your 5200 Free BXBC tokens

Bitsdaq is a new exchange based in Hong Kong and the official partner of Bittrex in Macau, Singapore, and Canada.

Bitsdaq is airdropping 5200 Free BXBC Tokens to their new users. Create an account at Bitsdaq and complete your KYC to receive the tokens.

Here are the steps, You should follow to receive your 5200 Free BXBC Tokens:

1. Visit the following link and create your account:

https://bitsdaq.com/signup?referralCode=DRYAKLWJ

2. Submit your details and signup.

3. Enter the email passcode and log in. You will receive 1000 BXBC (For Successful SignUp using above link) + 200 BXBC (For the First Login).

4. Now complete your KYC as per the instructions and You will receive an additional 4000 BXBC on successful KYC Approval.

These 4 simple steps will reward you with 5200 Free BXBC Tokens. Hurray! :)

It is not the end:

- You will also get an additional 200 BXBC as daily login reward.

So You will get a total of 5200 BXBC Tokens + 200 BXBC Tokens daily just by logging into your BitsDaq account by the End of March.

Do not stop yourself here as there is more to earn :)

How?

- Bitsdaq is also doing a candy programme where you can get 1000's of their BXBC tokens for free by referrals.

You will get 500 BXBC for every referral and an extra 1000 BXBC if the referee completes KYC.

This is all totally free money. It is possible to accumulate over 1000's of free BXBC tokens by the End of March.

In July 2017, Binance created its own Token Binance Coin (BNB). Before they launched their exchange, they did a sign up and referral programme where they gave out 1000's of free tokens to new users. Today those tokens are trading at over $10 each.

Imagine if BitsDaq's BXBC will trade as low as $0.50 by the end of the year, that amounts to 1000's of Dollars.

So Don't delay, Register TODAY using below link. Each day you wait will cost you a minimum of 200 tokens.

Registration Link:

https://bitsdaq.com/signup?referralCode=DRYAKLWJ

4 notes

·

View notes

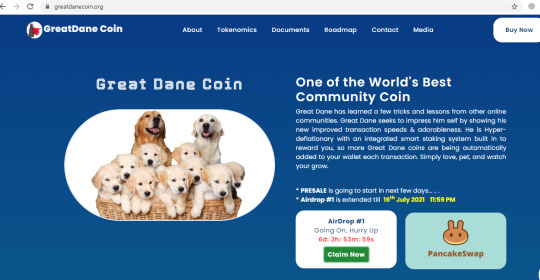

Photo

With cryptocurrencies attracting attention from all corners of the globe, investors are eager to maximize the potential of their investment portfolio. GreatDaneCoin is definitely going to be one of the leading cryptocurrencies by the end of July 2021. A newly launched token that is on the way to the moon. Go and grab the opportunity in the Airdrop to get 5Cr GreatDaneCoin for free. You can make it happen in 2 simple steps. Visit the website: https://greatdanecoin.org, click on Airdrop and Claim to get the coins! GreatDane is going to be a top competitor for tokens like Dogecoin, Matic, ETH, Babydoge, and many other coins.

Here is more info! Airdrop: GREATDANE COIN 💲 Reward: 50000000 tokens 👨👨👧 Referral: N/A 📰 End Date: 16 July, 23:59 🌐 Website: Greatdanecoin.org 🔥 Telegram: https://t.me/GreatDane_coin 🔥 Twitter: https://twitter.com/GreatDane_coin?s=09 🔥 Pancakeswap: 0x8fEef77A25219137E5fC63f95087faCEC1A2e297 👨✈️Airdrop-Caption-Guide : ✅ Join the Telegram group ✅ Join the Telegram channel ✅ Follow the Twitter account ✅ Retweet the recent posts ✅🎁Fill the Airdrop Form Link https://claim.greatdanecoin.org/ 📄Additional Information: Greatdane is the best Decentralized Meme Exchange and Launchpad on Binance Smart Chain. airdrop is 100% free. Don't send any fee or penny for receiving airdrop tokens. Just join airdrop for free.

0 notes

Text

Cryptocurrency and Taxes Guide

https://ift.tt/2IhQubM

Cryptocurrency and Taxes Guide

The world of cryptocurrency is one sector that is fascinating and drawing a wide swath of individuals to it. Why are they interested in this emerging sector? Well, it provides a wide variety of opportunities for wealth creation to those who know how to act and operate today. We all know that wealth is a key driver for progress, growth, and learning.

It is no different for the digital asset sector. The industry started with the leading crypto asset, bitcoin, and continues to make progress each year.

Bitcoin proves that the blockchain does have viability and can create value in multiple ways from commerce to ownership and transparency. It is common knowledge the leading digital asset is one that abhor centralized entities and is decentralized by nature. Banks and money processors are an anathema to bitcoin, and decentralization is core to the entire system.

The authority is present in the mathematically reliable codebase that executes transactions. Individuals with the right tools and resources can contribute computing power to the network and play a role in the process of verification. These operators contribute to participate and earn rewards which will be appreciated over time.

That means that it is likely to stick around and be meaningful to society for a while. It has the ability to change fundamentals in different industries and generate massive value. It is surely very exciting to be involved in the industry in some form or fashion.

From general ledger innovations to accounting and value transfer it can provide revenue for several entities. It can even be a boon to fintech and other segments related to finance and currency. The idea here is to bring about change on a massive scale.

But when people create transactions, middlemen, like the government, want a piece of the growing pie. Of course, this last point is a point of contention for many crypto enthusiasts but it is something that many must come to terms with over the long run.

Why? Speculators, businesses, and other entities in this market must pay taxes on transactions as they do in the traditional financial markets. This is especially true for those who continue to buy and sell assets and have a large set of transactions per year. Everyone must pay taxes and the government takes increasing steps to make sure they get what they believe they are rightfully owed.

Again, the relationship between bitcoin and the current superpower have an intriguing interconnection. Bitcoin seeks to provide freedom and usurp different power components of centralized money and value transfer that gives power to sovereign nations.

Detractors of the asset point to the fact that it could be used in negative and seedy situations from gambling to the facilitation of consciousness altering chemicals. The cryptocurrency has quite a few implications that can usurp traditional fiat oriented governance. Surely, you can understand why taxation of such a mechanism is important.

It appears that the present relationship will continue and evolve as the emerging industry evolves, creates jobs, and adds further value to society. Yet, it is essential to learn more about taxes and how it can relate to you as a crypto trader to preserve your freedom and wealth. Still, it is opaque and confusing and so people expect more clarity. Let us take a look at cryptocurrency and the notion of taxation within the industry.

The Leading Digital Asset Bitcoin and Government Taxation

It is a new game today and bitcoin is a more known factor. Transactions that take place within the bitcoin network are transparent making it to where motivated entities could potentially track down general non privacy oriented transactions. It is not as obscure as it once was and more companies seek to bring about sophisticated tools to help governments track those who make bitcoin and digital asset transactions.

Therefore, traders and others would notice a surge in facilitation hubs such as Binance and Coinbase mandating know-your-customer rules to be in compliance with the government and letting them continue their operations without any hassles.

These entities do so because they are known entities, they deal in large volumes and growing transactions of various digital assets. They don’t just facilitate bitcoin and other top tier assets but hundreds of them ranging from stablecoins to network oriented ones.

The larger their revenues, the more strict these facilitators must become with regard to their compliance. If they follow rules and they are house, then so must you as the player who frequents their space. Remember that the larger the space becomes, the more value that passes through the sector.

As more value continues to move here, the more taxes that different countries can collect according to their tax laws. If a portion of your gains is always part of government revenue, you better believe that they will look for it and make sure to collect.

As such, for instance, digital token traders in the United States and other nations must pay close attention to the edicts of the Internal Revenue Service and other government based institutions that oversee taxation aggregation. Other countries will have their authorities that are as strict as the IRS and may impose penalties and jail time for those who try to evade taxes.

Governmental institutions of all sorts note that it is a factor that must face taxation and so all parties in the digital asset world comply with these strict regulations to continue to exist and grow.

The critical question here is how should traders view this increasing taxation presence in the crypto asset industry?

The Cryptocurrency Tax Details

The answer, as many components of cryptocurrency, is not simple at all. Everyone knows that they must comply with edicts presented by their respective taxation authorities. Traders must realize that it is essential to pay attention to edicts that are etched into the law books.

Remember that regulatory authorities can put forth different proposals that are not relevant until it is a part of official legislation. Many rumors float around in the cryptocurrency sector that talk about what may happen due to statements presented by one regulator or another.

For instance, the tax codes in the United States are fairly the same since the IRS presented information in early 2014. What must you pay attention to in the United States and likely in other countries in regard to cryptocurrency tax law?

The first point is that digital tokens are treated as property. If one seeks to utilize crypto tokens to purchase another item it may be seen as a capital gain and the rate of taxes will depend on how long one clutched the digital token.

What does that mean? Let us say that you took it upon yourself to purchase a rare book with bitcoin that was valued at $10,000, you should also understand what your bitcoin is worth when you make the book purchase.

If bitcoin goes upto $12,000 when you purchase the rare item, you would buy a fiat noted good with a virtual currency that is valued at a higher price than in the past. The bitcoin outlay and price appreciation is now taxed in accordance with capital gains.

Why did we talk about goods and bitcoin transactions? Any bitcoin expenditure from good purchases to digital asset bartering is subject to capital gains tax.

It shows that movement of bitcoin can be expensive from a fee standpoint and from a legal taxation standpoint. Here’s how you can prepare.

Traders Must Disclose Information To Tax Authorities

Your local broker may not offer a 1099 form that details your transactions but you must still report your crypto transaction information to your local tax authorities.

What kind of digital transactions are of the taxable nature? We shall see that in general it will include these aspects:

Conversion of digital assets to dollars, euros, or government oriented currencies

Sending digital tokens to merchants and others for materials and service transactions

Converting one token to another digital asset

When obtaining forked tokens or airdropped assets due to holding a different tokens

It seems as if everything is tax oriented but here are those that are not:

Acquiring a digital token with government money

Digital token charitable contributions to exempt organizations

Gifts to others

Token movement from one storage account to another.

Calculating Your Tax Expenses From Cryptocurrency Related Transactions

Thinking about and doing the work in regard to your digital asset transactions is not as simple as it seems. Let’s look at a few scenarios and analyze it to provide more clarity.

Divesting Your Crypto Assets

Remember that when you want to turn your crypto gains into government money you must remember to note that gain or loss down for your tax records. Let us illustrate, you buy $100,000 (at the going rate of $35,000 per bitcoin) in June month.

You are patient and you wait three months, it is now $40,000. You sell a portion of your holdings. Now, you have a little gain in dollars but now owe on your capital gains. You will owe taxes for your short term gain. If you waited more than a year to sell, then you would see a lower tax rate on your long term transaction.

The tax rates will vary by country and by the length of the holding duration.

Now, what if you were a miner? When miners sell, governments can see it as revenue and can tax it as such. Therefore, if one has expenses related to this action as a miner, they can claim that as well.

The general idea here is that you should record your transactions and have a good understanding of what you are doing to profit or stay above water when factoring in government taxes. Again, you want to take good notes because you want to know which ones are trades and which ones are purchases of goods and services with bitcoin as those differ slightly.

Cryptocurrency Conversion

If you are like others, you don’t stick with one digital asset, you are bartering them to make profits. One day it might be bitcoin to ethereum, the next day might be ethereum to litecoin, and the next might be ethereum to numerai. No matter how you slice it, you are converting on crypto to the other one and seeking profits.

But of course, this will incur taxes. What is happening in crypto conversions is that you are divesting, say, a bitcoin to acquire ethereum. That means you will need to note the price of the initial asset and the price of the second asset as well as the date. You might not need to make detailed notes everyday as the exchange could automatically record transactions but it is better to play it safe. Keep an excel or google sheet to record digital asset movements.

More entities look to offer more services to make this aspect as simple as possible each year.

Precautions and Professionals

The simple lesson is to take great precautions in your crypto trading to minimize your chance of audit from your local tax authorities. Then, you want to make sure to keep a transparent and simple record of all transactions from trades to purchases of goods with crypto differentiate them and have the right cost basis.

Finally, a significant portion of people might turn to professionals such accountants to pore over their crypto transactions and conduct the right operations to stay in line with the tax authority. If you feel comfortable crunching your numbers for taxes you might opt to do it yourself but safety is found with professionals.

Professionals are learning about the industry, becoming better, and even using tools to improve the process. Speaking of, crypto tax tools are also out there to help you out but you still must double check your numbers to stay safe from tax authorities.

No one wants to pay attention to taxes. The fact is that it doesn’t go away. It is always there. Keep trading, cover your tax bases, and continue to earn safely by knowing the cryptocurrency tax rules and sticking to them.

Wanna Win Some Free Crypto?

This is our favorite crypto casino... Check it out and get a free sign up bonus and daily crypto rewards!

The post Cryptocurrency and Taxes Guide appeared first on ESA Token.

from WordPress https://ift.tt/3kbf0Z3 via IFTTT https://ift.tt/3oqtis8 https://ift.tt/3dTdjOi

0 notes

Text

Don't Miss Out: A Step-by-Step Guide to Claiming Airdrops on Binance with Trading DX

The world of cryptocurrency is rife with exciting opportunities, and airdrops are one way projects can generate buzz and attract new users. Binance, a leading cryptocurrency exchange, is a popular platform for launching airdrops. But how do you claim these free tokens and ensure you're not falling victim to a scam? Fear not, crypto enthusiasts! Trading DX is here to guide you through the airdrop claiming process on Binance with this comprehensive step-by-step guide.

Before You Begin: Understanding Airdrops

What is an Airdrop?

An airdrop is a distribution of free cryptocurrency tokens by a project or platform. The aim is to generate awareness, attract new users, and incentivize participation in their ecosystem. Projects may airdrop tokens directly to wallets or require specific actions, like holding a certain amount of another token on the platform.

Why Should You Care About Airdrops?

Airdrops offer a chance to acquire new cryptocurrencies for free, potentially leading to significant gains if the project behind the airdrop takes off. However, it's crucial to approach airdrops with caution and only participate in legitimate ones.

Identifying Legitimate Airdrops on Binance

Trust the Source: Always check if the airdrop announcement originates from Binance's official channels, like their website, social media (beware of fake accounts!), or announcements directly on the platform.

Research the Project: Before claiming an airdrop, research the project behind it. Is it a legitimate project with a clear purpose and development roadmap? Beware of airdrops promising unrealistic returns or requiring suspicious actions.

Beware of Scams: Never share your private keys or sensitive information to claim an airdrops. Legitimate airdrops will not require you to send cryptocurrency or pay any fees. If something feels off, it probably is!

Claiming Your Airdrop on Binance: A Step-by-Step Guide

1. Locate the Airdrop Announcement:

The first step is to identify the airdrop you're interested in claiming. Legitimate airdrops will be announced through official Binance channels, as mentioned previously. Look for details about the airdrop, including eligibility criteria, the distribution date, and how to claim your tokens.

2. Ensure Eligibility:

Each airdrop has specific criteria to determine who can claim the tokens. These criteria may involve factors like holding a certain amount of another cryptocurrency on Binance, completing specific tasks, or registering for the airdrop during a designated timeframe. Carefully review the eligibility requirements to ensure you qualify.

3. Access Your Binance Account:

Once you've confirmed your eligibility, log in to your Binance account. Ensure you're using the official Binance website or mobile app to avoid phishing scams.

4. Navigate to the Airdrop Section (if applicable):

Depending on the specific airdrop, you might need to navigate to a dedicated section on the Binance platform. This section could be labeled "Airdrop" or "Distribution" and may be found under the "Wallet" or "Rewards" tab. Refer to the airdrop announcement for specific instructions.

5. Locate the Specific Airdrop:

If there's a dedicated airdrop section, browse through the listed airdrops and find the one you're interested in claiming.

6. Claim Your Tokens:

Once you've located the airdrop, you'll likely find a button labeled "Claim" or "Receive." Click this button to initiate the claiming process. Follow any additional on-screen instructions specific to that airdrop.

7. Review Your Claimed Tokens (Optional):

After successfully claiming your airdrop, you may want to verify that the tokens have been deposited into your Binance account. Navigate to your "Wallet" section and check the balance for the airdropped tokens.

Important Takeaways:

Stay Vigilant: Always prioritize safety when claiming airdrops. Stick to official channels and thoroughly research the project behind the airdrop. Never share your private keys or sensitive information.

Double-check Eligibility: Ensure you meet all the criteria before attempting to claim an airdrop.

Beware of FOMO (Fear of Missing Out): Don't rush into claiming airdrops based on hype alone. Do your due diligence before participating.

Trading DX: Your Trusted Partner in the Crypto Space

The exciting world of cryptocurrency can be overwhelming, especially for newcomers. Trading DX is here to empower you with the knowledge and resources you need to navigate the crypto landscape with confidence. From educational content on YouTube (@tradingdx) to market analysis and a supportive online community, we're committed to your success.

Also See;

How to Earn Money from Crypto Market? How to Invest in Crypto 2024? Crypto Trading for Beginners

Buy/Sell USDT in INR, How to Buy USDT in India ✅, Easy way to Buy Crypto

How to Store Crypto Safely ✅, Best Crypto Wallet in 2024

How to Earn by Cryptocurrency Trading

cryptocurrency exchange

2 notes

·

View notes

Video

youtube

Memes Lab Airdrop Listing Date & withdrawal | Memes Lab Airdrop Update |...

Memes Lab Airdrop Listing Date: What Will Be Listing Price

Memes Lab Airdrop Listing Date: What Could Be The Expected Price Memes Lab Bot, a groundbreaking memecoin platform on the TON Blockchain, is rapidly gaining traction in the cryptocurrency world. With over 10 million Telegram users already onboard, this platform combines the best of Web2 fun and Web3 earning potential, making it a one-stop solution for memecoin creation, trading, and management. Memes Lab Bot allows users to purchase and upgrade meme characters, merge them for better stats, and engage in thrilling PvP battles. Backed by the Notcoin team, this platform is set to play a pivotal role in shaping the meme narrative on TON Blockchain.

Memes Lab Listing Date One of the most anticipated developments for Memes Lab Bot is its upcoming listing on major cryptocurrency exchanges. According to the latest updates, Memes Lab is expected to debut on top platforms like Binance, Bybit, and Bitget before November 30th. This milestone is crucial for the project, as it will provide greater accessibility for users looking to invest and trade memecoins. A listing on such renowned exchanges will undoubtedly enhance Memes Lab’s visibility and liquidity, contributing to its broader adoption within the crypto community.

Memes Lab Airdrop Date In addition to its exchange listing, Memes Lab Bot’s airdrop is highly anticipated by its growing user base. The platform has confirmed that the airdrop is set to take place before November 30th, providing early adopters with an exciting opportunity to receive memecoins as rewards. With every point earned through farming, completing tasks, and claiming daily rewards, users can increase their future airdrop allocations. This feature, coupled with Memes Lab’s three-level referral system, encourages community participation and growth.

Memes Lab Listing Price Market analysts are speculating that Memes Lab’s listing price will fall between $0.0064 to $0.0079 per token. This range is based on the platform’s current traction, strong backing from the Notcoin team, and its unique position within the memecoin ecosystem. With millions of users already engaged and the platform offering exciting features like PvP battles and character upgrades, Memes Lab Bot is well-positioned to make a significant impact upon its listing.

In summary, Memes Lab Bot is gearing up for a monumental launch, with its listing and airdrop dates set before November 30th. Stay tuned for this exciting opportunity to dive into the world of memecoins on the TON Blockchain.

Step into the Memes Lab: Your Guide to Earning Free Tokens via Telegram Dive into the world of cryptocurrency and earn free tokens with the Memes Lab Airdrop Bot on Telegram! In the ever-evolving world of cryptocurrency, innovative projects are constantly emerging, each vying for attention and participation. Among them, Memes Lab stands out, offering a unique and engaging way for users to earn tokens through its Telegram Airdrop Game. If you’re looking for an exciting opportunity to expand your crypto portfolio without financial investment, this is for you!

What is the Memes Lab Airdrop Bot? 🤔 At its core, the Memes Lab Airdrop Bot is a user-friendly chatbot that facilitates the distribution of Memes Lab tokens (MEME) via the popular messaging platform, Telegram. Airdrops have become a favored method for blockchain projects to distribute tokens and engage their communities. The Memes Lab Airdrop Bot simplifies this process, making it accessible to anyone with a Telegram account.

The Mechanics of Earning Tokens 🪙 What is Meme Lab? Meme Lab (MEMELAB) is an NFT collection. Meme Lab (MEMELAB) price floor today is $10.73, with a 24 hour sales volume of 0 ETH. As of today, there is a total of 65 NFTs minted, held by 7,981 unique owners, and has a total market cap of $697.24.

Meme Lab is a collection for The Memes by 6529 artists to run whatever experiments they like

Where to buy Meme Lab NFT? You can buy and sell Meme Lab (MEMELAB) on OpenSea and LooksRare.

How many Meme Lab NFTs are there? There is a total of 65 unique NFTs in the Meme Lab collection.

How many holders are collecting the Meme Lab NFT? There is a total 7,981 unique addresses that are holding the MEMELAB NFT.

Memes Lab is a meme-themed Telegram game that uses the tried and tested recipe popularized by Hamster Kombat and other tap-to-earn apps. One of the unique features of Memes Lab is that it features PVP battles, where players can put their characters to the test agains their friends or random players.

By collecting coins in the Meme Labs app, players become eligible for a token airdrop, which means that the in-game rewards will be transferable to real-world value. Of course, it’s important to keep expectations realistic, as it’s very unlikely that you will strike it rich through an airdrop.

Memes Lab daily memecoin cipher for October 5, 2024 One of the best ways to earn extra rewards in Memes Lab is to successfully solve the daily cipher.

The Memes Lab daily memecoin cipher for October 5, 2024 is: LFG

To solve the daily cipher, go to the “Battle” section of the Memes Lab mini app and click the button in the top right corner of the interface.

How to maximize Memes Lab rewards Although the daily cipher is a great way to earn some extra coins in Memes Lab, there are also other things you can do to boost your rewards.

Purchase upgrades: Go the the “Lab” tab and use your coins to purchase upgrades that will boost your passive earning power. Complete tasks: You can get extra rewards by going to the “Earn” tab and completing various tasks. This includes joining Memes Lab social media channels, as well as completing quests related to other Telegram projects. Refer friends: Like with most other tap-to-earn games, you can get extra benefits in Memes Lab if you refer friends to the app. Memes Lab airdrop The Memes Lab team is preparing a token airdrop that will be distributed to players based on different factors, including the amount of coins they manage to collect in the game. According to the team, the snapshot date for the Memes Lab airdrop will be announced soon.

0 notes