#Steam Trap Market Share

Explore tagged Tumblr posts

Text

|| ᴄᴀᴜɢʜᴛ ʀᴇᴅ ʜᴀɴᴅᴇᴅ ||

Hello everyone! Welcome to part one of my seven-part series featuring the one and only Neon Leon. I’m so excited to be sharing this with you all, and I hope you enjoy! Part two will be coming next week :)

| next | masterlist |

You stifle a yawn, rubbing your eyes as you sit back up from where you had fallen asleep in the kitchen. You stretch, feeling your spine pop. Your lips part for a solid yawn to escape, sleepily blinking a couple times.

You glance at the clock on the top of the archway that connects your kitchen to the storefront, realizing that your cookies are about to be burnt. You grab the oven mitts, avoiding the cloud of hot steam that escapes once you swing open the door to your oven.

You take out the tray, hissing when your finger barely touches the burning hot metal. You place it on the wooden counter, allowing the freshly baked cookies to cool. You hurry over to where you had set down another tray from the same batch of chocolate chip cookies you had made, still unbaked. You slide it into the oven, shutting the door with a relieved sigh.

You look down at your crumpled dress, trying to brush out the creases but failing miserably. You shrug, deciding to take a quick shower. You change into a fresh set of clothes, slipping a recently-ironed cerulean dress onto your shoulders. You brush your tangled hair, brushing your teeth after.

By the time you were done, the new batch had finished baking. You repeat your actions from earlier, but this time putting all the cookies straight into a basket lined with a red checked cloth. You lock the door behind you, heading out into the market.

Today was the day before the week-long festival celebrating the return of the long-lost princess. In the years she had been missing, the king and queen of the kingdom had hosted a small celebration of lights, calling it the Sun Festival in honour of their missing child in hopes that she would one day return. However, that had been last week, and now, they had extended it to celebrate her return.

You participated every year ever since moving to the kingdom five years ago. And every year, you repeated the same routine of giving away free samples of your pastries, and you gained recognition for having some of the best baked goods in town.

However, the reputation came with its downfalls. Every year without fail, a thief would steal at least five of each baked good you set out on display. You knew it was the same thief because they'd leave a tell-tale sign - an almost cocky way of letting you know they would never be caught. It came in the form of an italic capitalized '𝓛,' which was their initial, or so you suspected.

You knew almost everyone in the village, and every person whose name started with L had reassured you that they had never stolen a single item before. You believed them, especially since they were all decent people with alright reputations.

As such, the search continued for five years, and the thief managed to escape the countless traps you set each time. It was absolutely infuriating.

You hand a cookie to Margaret, a girl only one year younger than you who helped to run her family's clothing store. They were your go-to for new clothes, and without fail, they'd always produce the most gorgeous dresses with subtle details that made them stand out.

"Thanks, Y/n!" Margaret greets you with a smile, taking the cookie you hand to her. You chuckle at the messy bun she sports, helping to brush a few strands of her hair away from her eyes. She brings the cookie close to her face, inhaling deeply with a blissful sigh.

"No worries, here's some for your parents, too, as thanks for the dress you made me." You hand her another two, and she takes them gratefully.

"Aw, yes! They love your cookies! I had to convince them not to buy thirty like they did last year." Margaret groans at the memory of the entire bucketload of cookies her parents had brought back home. You giggle, remembering how excited her parents' faces were when buying a few loaves, croissants, and cookies.

"The dress looks great on you, though!" She looks you up and down, her eyes calculative as she views how the cerulean compliments your hair.

"It's a little loose on the waist, but I think that's just the stress for this year's festival."

"Oh, that can be fixed in a second! Hang on." She pulls out a few safety pins from her skirt pocket, approaching you and taking some of the material, fiddling with it. She takes a step back after a few moments, a satisfied smile on her face as you beam, the dress resting perfectly and allowing your corset to settle nicely on your skin.

"So, how's preparation to catch the thief going?" Margaret asks, putting the rest of the safety pins back in her pocket. You smirk.

"Safe to say, that thief won't get away so easily this year." You hum, placing your hand on your hip with a smug smile. Hours of brainstorming for ways to catch them had proved fruitful, and you now had various plans in mind.

"That's good. Update me when you can! I gotta go off and finish another order."

You wave goodbye to Margaret, who hurries off, watching her weave through the crowd and back into her shop. You continue to walk, handing out cookies to anyone in sight.

The crowd of tourists almost made it impossible to squeeze through the public, and you had to hold your breath every now and then for some wiggle room. Your basket is practically empty, save for one last cookie. You were almost home, so that cookie would be saved as your late-night snack.

"Ugh!"

You stumble, almost falling to the ground if not for a gloved hand holding your arm. You steady yourself, breathing a sigh of relief and glancing at the cookie in your basket. Thankfully, it was still in one piece. You look back up with a glare, the cloaked stranger in front of you taking a step back.

A hood covers their face, casting it in shadow. You wait for an apology, but none comes. So you stand and wait silently. They're adorned in a simple brown cloak and about a head taller than you.

"Well? Aren't you going to apologize to me?"

Your brows furrow, taken aback by the stranger's question. His voice is deep, yet there is an underlying playfulness within it.

"Excuse me, you bumped into me." You point out incredulously, raising a brow.

The stranger chuckles, shaking his head. "You were the one not looking where you were going. Oh well, I'll accept this as an apology."

Before you can even blink, a gloved hand snatches the cookie from your basket, holding it up to his eyes. (Or where you believe their eyes were. It was hard to tell.)

"Hey!" You protest, "That's mine!"

"What about all the other cookies you were handing out? Aren't they yours too?"

You fall silent, fingers curling into fists as you rein in your temper. You can hear the conceit in his voice as he tucks the cookie into his pocket. So much for your supper that night.

"Fine." You snap, feeling irritated by the man's presence.

"So, you're a baker?" You can almost hear the smirk on his lips.

"Yeah, I am. So you'd better enjoy that cookie because there sure won't be any left tomorrow." You nod towards his pocket where your precious cookie rests, and he chuckles. You cross your arms, ready to end the conversation with the rude man in front of you.

"Is that so? Well, I'll be sure to stop by then." His words have an almost impish edge, and your frown only spurs him to take a single bite of the freshly baked good he had snatched from you earlier.

He hums, and your curiosity overrides your disdain for the man. You wait for his reaction, expecting nothing less than a sigh of bliss.

"Kinda salty."

"Salty?" You repeat, flabbergasted by his response. He shrugs nonchalantly, watching your shoulders slump. You run your fingers through your hair, a few strands falling across your eyes as you laugh in disbelief.

No. You shouldn't believe in the words of a stranger who bumps into you without so much of an apology, much less blaming it on you.

You had better things to do, like catch a thief.

Besides, the thousands of people that flock to your store every year are more than enough to validate how good your baking is.

"Well," You address the stranger, and he shifts his weight to rest on one leg, "Thank you for your feedback, but I will not be changing the recipe to suit the taste buds of one man when many others enjoy my baking." You plaster a fake smile onto your lips, your words are emotionless, and your eyes regard him coldly.

"Goodbye." You walk past him, brushing against his cloak and approaching your door. You can sense his gaze on you, and you almost fumble with the keys. You unlock the door, cooly making your exit and shutting it behind you before heaving a frustrated groan in the comforts of your own home.

You leave your basket on the counter, eyeing the empty shelves of the store. You quickly eat, preparing for the all-nighter ahead of you if you want to get those pastries out by the morning. You push all thoughts of the earlier encounter out of your mind, washing your hands and turning out batches of dough that had been resting.

You work into the rest of the night, restocking empty shelves until the rooster that usually wanders into the empty streets of the early morning crows loudly. You look up from the piles of washed and dried metal trays, wiping off the sweat on your brow.

You glance around the store, a satisfied smile on your lips as you survey the shelves filled with loaves of bread of different varieties and, of course, your famous chocolate chips on a table in the centre of the store.

You head upstairs to your bedroom, quickly washing up in the bathroom before collapsing onto your bed in a tired heap. You nap for an hour, your clock soon ringing to wake you up. You drag yourself out of bed, putting on a new peach-coloured dress after a cold shower that wakes you up.

Sliding on a pair of comfortable flats, you head back downstairs where a crowd of regulars that visit your store every festival await you. You wave hello through the glass windows, setting up the drawer where you store your coins for change after the customers make their payment.

You take off the cloth covering all the shelves of baked goods, everyone outside becoming visibly excited. You fold them and put them away into a separate drawer, taking a deep breath before unlocking the door.

Customers pour in, making a beeline for the products they want. The bell hooked up to the top of the door jingles every time it's open, and it was a constant sound with the stream of people flooding in.

You take your place behind the counter, calculating the right amount of change and bagging the baked goods in paper bags.

"Hey, Mr. Smith, how's the missus?" You greet the tailor, who holds three loaves of rosemary and olive bread and two medium-sized bags of cookies. He hands you three crowns, and you open the drawer to give him the change.

"She's back home with Margaret, but she says hello, and to pass you this." He takes out a small handkerchief with your initials embroidered, and you gasp in delight. Cerulean lace surrounds the edges, the soft material like a cloud against your hand.

"Thank you!" You gush, folding it gently and placing it in your pocket. "I love it." You hand him back the change, bagging up the loaves in the paper bags. You wave him off with a toothy smile, paying attention to the next customer in the queue.

You take a break in the afternoon to have lunch, shutting the door much to the chagrins of others. You wave the tourists off, directing them to other stalls while you have lunch and prepare the first trap of many.

During the past few years, you had noticed that the thief always came around nightfall when everyone was distracted by the sunset.

Not this time.

This time you had a plan and were confident it'd succeed.

You restock the shelves, making sure to leave the last bag of cookies sitting on the table. You grab some pepper, sprinkling some inside the bag. You grab a small jar on the counter, coating the bag's underside and making sure it isn't apparent to the thief.

It was a jar of finely ground rose petals, the pigmented powder a gift from Margaret as a lip stain for your lips. However, you were using it to set the trap instead. Hopefully, she'd understand.

You hum a cheerful tune under your breath, heading into the back and waiting for the familiar chime of the bell. You grab a tray of croissants, heading back into the storefront. You fill the empty shelf, ensuring the wax paper is lined properly so the pastries wouldn't touch the bare wood.

You turn, glancing over your shoulder at the cookie trap you set.

Or at least where the cookies were a minute ago.

The tray clatters to the floor as you stand still, stunned by how the thief had managed to slip in and out without so much as a sound. This was the first time this had happened. You had even locked all the windows as a precaution, so how had he managed to get in??

The door was firmly shut, and the bell hadn't made a single chime or jingle.

The edge of the table has a faint dusting of red, and an italic '𝓛' is once again written in it. You grit your teeth, seething at the fact that the thief had not only managed to elude your sight yet again, but the cocky inscription of their initials was the tipping point.

"UGH!" You throw your hands up in frustration, your blood boiling as you storm back into the kitchen. You see yourself in the mirror, cheeks red and nostrils flared. Your eyes are filled with frustration.

You were so sure that it'd work!

You quickly march out the door to your store, eyes darting around as you try to spot the thief in the crowd. They had to be around somewhere.

You spot a flash of red, and you run, gently pushing past people and muttering, "excuse me!" in a rushed tone. You couldn't let them out of your side. They pause at a booth, and you finally catch up. "Got you now!"

Your words die in your throat when you finally look up from where your hands are on your hips, panting heavily to catch your breath. A tall, muscular man looks at you with wide eyes, confused by your sudden accusation.

You look down at his hands. You had seen red, hadn't you?

He holds a bouquet of roses, glancing down at it and back to you in a mildly unsettled manner. "Can I help you…?" He questions. He looks nervously at the owner of the booth you both are at, the owner shrugging helplessly.

"I must have mistaken you for someone else," You stammer out, cheeks flushed from embarrassment, "Have a free cookie at my store as an apology."

The man's face lights up, smiling broadly. "Gee, thanks!"

You hear a faint chuckle, instantly looking up at the crowd and scanning it intently. You were sure that had to have been the thief. It had to be.

You try to catch every face in the crowd, attempting to narrow down who it could have been. Unfortunately, it seemed that they had made yet another clean getaway. You practically deflate, almost tearing up out of frustration.

"You all good?" The man you accused earlier asks, and you respond with a simple nod, wiping your eyes roughly with the back of your hand.

"Yeah." You trudge back to your store with a forlorn look on your face. You clean the dust off the table along with the initial and restock the bags of cookies before opening for the evening crowd.

You focus on handling the customers, finally closing when the clock strikes midnight. You slide the lock shut on the front door, the now empty shelves a stark contrast to the early morning. You count the profit you made from the first day, sorting it into a small coin pouch and leaving the rest to use as change for the next day.

You wash up and head to bed, your body on autopilot. Your mind races with thoughts as you lay in your bed and stare blankly at the ceiling.

Today, the trap had failed.

That was what Plan B was for. It was only the first day, and there were still 6 more.

A spark of indignation is all it takes to get you fired up for the next day, and you drift off to sleep with a newly steeled resolve to catch that thief, even if it takes you countless plans from A through Z.

The following day, you wake up bright and early, changing into a rosemary-coloured dress, planning to upsell your herbed loaves of bread. You descend the stairs in your flats, brushing your hair back into a low ponytail.

You restock the shelves again, welcoming yet another crowd into the store. The day passes, and you're so caught up in promoting and selling your products that you almost forget to take a break for dinner.

Your hair is slightly dishevelled, locks framing your face as you wipe away the sweat with a damp cloth in the kitchen. You sit down, grab some baked potatoes and load them up with cream, sliced spring onions, and pickles. You set the plate down on the table, preparing the next trap.

You set down five loaves of bread where the cookies used to be(they had all sold out in the morning), securing a small bell to the last one and leaving a small hidden loop on the floor. It was a standard rabbit trap.

When the thief inevitably steals the loaves of bread, they'd pull on the last loaf, which would trigger the bell and the rope attached to it, causing their foot which would land in the small loop, to be trapped in the tightened rope, leaving them dangling and helpless.

Was it too much for Plan B?

Yes.

Would it stop you from using it?

Absolutely not.

So you stay in the back, choosing to sit so that you are close enough to the storefront and can rush out immediately. You eat your baked potato slowly, catching your breath from the hectic morning and taking the time to recharge for the evening crowd.

Minutes pass, and you begin to think the thief will never come.

The bell jingles.

You can hear muffled grunting, grabbing a solid frying pan on your stove, and slowly approaching the front. You peek out from behind the arch wall dividing the store's front and back, seeing a cloaked figure dangling by their green foot from the ceiling.

Wait.

Green?

Your brows furrow in confusion, walking towards them.

You recognize the cloak. It was the stranger you had bumped into the other day. The one who had said your cookie was too salty.

"Juuust great." His sarcastic comment makes you frown. He hadn't noticed you yet. You suck in a sharp and audible inhale through your teeth, and his body visibly stiffens, turning around.

His hood still shrouds his face in shadow, though you were pretty sure the rest of him was green too. His hands are holding down his cloak from exposing more than just his legs, and he gasps.

"Uh, rude?? You can't just stare at people like that, pervert."

Your face heats up at the lazy accusation he throws your way, eyes narrowing into a glare. You hold the frying pan defensively and turn it, so the handle is facing him instead. You poke his chest a few times.

"Ow." His deadpan voice makes you flinch, and you raise your brows.

"Look, this is all just a misunderstanding. I came here to check out the cookies again, and your stupid trap thing," He gestures to the rope around his ankle, keeping him dangling from the ceiling, "is making me late to meet my brothers." When gesturing, he lets go of the cloak, and it falls towards the ground. He yelps, clumsily grabbing it and holding it back to hide his body.

You catch a glimpse of two swords he has tucked away on his waist, along with more green skin. Your eyes study him until something catches your eye. You grab his hand, leaning in and looking at the bright red coating his fingertips.

"Ha!" You gasp as elation begins to rush through your body.

You did it! You caught the thief!

The thief sighs, his hands going limp. "Okay, fine. You got me." He caves easily, and you rejoice with a victorious giggle.

"I did it! I caught you! Ohhhhh, you've been such a pain in the side for five years. Five years! I've waited for this day. Now, pay up for all the stuff you took." You demand, lips pursed as you point the frying pan at him threateningly. You lean back smugly, your head tilted. There was nowhere for him to run, much less escape.

"So, about that…." You frown at his response, firmly pressing the frying pan's tip against his chest. "Wait! I don't have money. Can't you just put it on my tab, and we can settle this later. You can contact me through my lawyer!" He cries out.

You were getting tired of talking to a shadowed face. You wanted to see the face of the man who had been an irritating source of loss for you over the years. You use the handle to flip back the hood.

Your eyes widen, looking down at the thief in front of you.

Was he even human?

His entire body was lime green, a blue bandanna around his face with holes carefully cut out for his eyes. The tails of his bandanna fall out of the hood, dangling upside down above his head. Red crescent-like stripes over his eyes add a pop of colour, and you're stunned by the creature in front of you.

Your grip loosens, the frying pan sliding out of your hand to meet the floor with a loud clang. You take a step back, almost stumbling back.

"So... this is awkward." You flinch when he speaks, blinking rapidly as you process the sight. You don't know where to look, eyes darting from his face to his legs. He watches you with an almost amused smile, and you don't know whether to take that as offensive.

You’re a hundred percent sure you voice is shaky, scrambling to pick up your frying pan - your only weapon. Your legs give out, and you fall to the ground, pointing it at him with trembling hands. Your lips part.

"What are you?"

#rottmnt#rottmnt x reader#rottmnt leo x reader#tmnt x reader#leo x reader#leonardo x reader#enemies to lovers#rottmnt leo x female reader#100 followers celebratory fic#CaughtRH#x reader#series

251 notes

·

View notes

Text

Navigating Liquid Markets Like a Pro: The 1-Hour Timeframe Secrets That Traders Overlook “A watched kettle never boils,” they say—but traders know that a watched Forex chart can do a lot worse. Blink once, and you've missed a prime entry. Blink twice, and your trade's evaporated like the steam from that kettle. That's the beauty of the 1-Hour timeframe in a liquid market: it’s fast enough for excitement but slow enough for a little breathing room. But let’s move past clichés, shall we? Today, I’m taking you behind the velvet ropes of the 1-Hour timeframe—sharing some off-the-books tips that pros use but rarely talk about.” The Secret Sweet Spot: Why the 1-Hour Timeframe is the Goldilocks of Forex Ever notice how traders are always in two camps—those glued to the 1-minute chart, looking like caffeine-fueled gamers, and those staring at the daily chart like they’re awaiting a solar eclipse? The 1-hour timeframe offers the best of both worlds: short enough to get multiple opportunities per day, long enough to eliminate most noise. You see, in a liquid market—where orders are flying faster than a sale on those hideous shoes you bought—the 1-hour chart helps us focus on genuine price action without the distracting blips. Advanced Tactic: Watch the 30-Minute, Enter on the Hour Here’s a little insider trick: instead of being glued solely to the 1-hour timeframe, start by monitoring the 30-minute chart for early signs of momentum and volume shifts. Liquid markets are notoriously difficult to predict, but by reading the 30-minute candles, you get an extra hint. It’s like reading the preview before watching the movie. When the 1-hour closes, if it lines up with what you saw—boom—that’s your trade. It’s about being one step ahead of those who just follow textbook setups. Market Truth Bomb: The top 1% of traders aren’t just reacting to the 1-hour candles—they’re cross-referencing different timeframes, like a detective piecing together a complex case. The Liquidity Myth: Deep Liquidity Isn't Always Your Friend A lot of new traders equate liquidity with safety. But here's the harsh reality—high liquidity in the Forex market can often act like quicksand for undisciplined traders. In a highly liquid market, stop-hunting is the name of the game. Big players have orders so large that they can't execute them all at once. They need the liquidity. This is why sometimes it feels like the market 'knows' where your stops are. Spoiler: it kinda does. Contrarian Insight: Fade the Freak-Outs You know those times when price just spikes like your blood pressure during tax season? Chances are, it's not a natural move—it's an artificial liquidity grab. The trick here is to wait for those exaggerated moves and then—when the retail herd has all been lured into one direction—do the opposite. It’s almost like saying, “I’ll have what they’re not having.” Keep your entries tight and your stops just above those "manipulative" spikes. Remember, market makers feed off impulsive decisions, so feed them some fake bait. Smart Money and Dumb Money: Identifying the Footprints If you think that Forex is a level playing field, you’re in for a rude awakening. But don’t worry—we’re here to play smarter, not harder. A liquid market—especially on the 1-hour chart—offers a unique glimpse into what’s called the Smart Money/Dumb Money interplay. Smart Money leaves footprints that are visible to those who know where to look. The Ninja Tactic: Tracking Liquidity Pools If you ever wondered why the price tends to "magically" reverse right around significant price levels, you’re not alone. Those are liquidity pools—areas where the market expects a lot of orders to be sitting. Think of them as hidden traps set by big banks. The trick here is not to be bait, but to set up shop on the other side. When you spot a cluster of wicks forming around a major price level, wait for the inevitable fake-out—the Smart Money liquidity grab—and then pounce when the coast is clear. It's a counter-intuitive approach, but it makes the difference between running into trouble and running away with the profits. Bonus Tip: Use the Smart Trading Tool (https://www.starseedfx.com/smart-trading-tool) to automatically calculate optimal lot sizes for these kinds of precision plays. It’s like having a personal assistant who knows exactly what you need without you even asking. Market Timing Isn’t Just for Swingers: The Best Times to Watch the 1-Hour Chart The Forex market’s 24-hour nature can make trading a bit like a game of musical chairs—you don’t want to be left holding the bag during low liquidity. The 1-hour timeframe is particularly useful during peak trading sessions, when volume—and consequently opportunities—are at their highest. Here’s a little-known fact: the 1-hour candle that opens during London/New York overlap has the highest probability of a breakout. It’s like sitting in on a meeting between Elon Musk and Jeff Bezos—a lot of power concentrated in one place, with volatile results. Next-Level Technique: The Pinpoint Trap Setup During these high-volume sessions, watch out for consolidation on the 1-hour chart, typically forming in a 20-30 pip range. Once this range "breaks," the next candle often tells the real story—whether it was a false move or genuine momentum. Rather than entering at the breakout itself, wait for that first failed re-test. If it falls back within the previous range—congratulations, you’ve just spotted the "pinpoint trap." Enter on the opposite side, set your stops tight just beyond the fakeout zone, and enjoy the roller-coaster as you catch the genuine directional move. The Hidden Gem Indicators: Volume and The 1-Hour Secret Combo Standard indicators like RSI and Moving Averages are as well-known as Coca-Cola—nothing wrong with them, but they’re hardly underground. For the liquid market, the 1-hour timeframe sings with an unconventional combo: the Volume Weighted Average Price (VWAP) and the Average True Range (ATR). Why, you ask? Because VWAP shows you where the institutions are probably averaging in—a smart indication of value—and ATR gives you the "safety margin" to stay out of volatility’s way. Here’s the kicker: enter when the price reclaims VWAP after a pullback and set your stops using ATR—usually around 1.5x ATR from the current candle’s high or low. You’re essentially insulating yourself from market traps and tagging along for the institutional ride. Mental Game: Managing the ‘Fear of Missing Out’ (FOMO) We all know that feeling—watching a beautiful, textbook trade take off without us. It’s enough to make you want to jump in late, only to find yourself underwater faster than you can say “Oops.” Here’s the truth: the liquid market moves fast, but there’s always another train. Mastering the 1-hour timeframe is about being disciplined, not chasing every move. A simple exercise is to set an "alert-only day"—one day where you just watch and alert potential trades without entering. Sounds boring, but trust me—it’s transformative for eliminating the FOMO gremlin. Real Talk Moment: The best trades aren’t the ones that make you rich overnight—they’re the ones that don’t leave you crying into your cereal the next morning. Keep your FOMO in check, and watch how your P&L thanks you. Putting It All Together: The Power of The Trading Journal I know, keeping a trading journal sounds as exciting as doing your taxes. But if there’s one hack that separates pros from amateurs, it's keeping a detailed journal—not just of your trades, but of your thought process. This is your personal roadmap—an archive of what worked and what didn’t in the liquid madness of the 1-hour timeframe. Want to supercharge your journaling game? Use the Free Trading Journal at https://www.starseedfx.com/free-trading-journal to analyze metrics, spot patterns, and refine your strategy. If your P&L is the movie, then the journal is your behind-the-scenes director's cut—the key to improving your "acting" in the Forex markets. Be the Trader Who Dances Through the Chaos In the liquid market, with all its frenzy and unpredictability, the 1-hour timeframe is like that cool party DJ—it gives you rhythm, energy, and enough predictability to stay in sync. The secrets are in the timing, in avoiding being tricked by liquidity grabs, and in knowing where the big boys are playing—so you can dance around them, grab your piece, and move to the next beat. Remember, it’s not about mastering the market—it’s about mastering yourself in the market. Use these tricks, apply the tactics, and make the liquid dance work for you. And if you’re ready to take it up a notch, check out the resources at StarseedFX—because the right tools can make all the difference between a stumble and a moonwalk. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

0 notes

Text

0 notes

Text

Food Leavening Agent Market: Global Industry Analysis and Forecast 2023 – 2030

Global Food Leavening Agent Market size is expected to grow from USD 7825.5 Million in 2022 to USD 12193.04 Million by 2030, at a CAGR of 5.7% during the forecast period (2023-2030).

A chemical that creates carbon dioxide gas in food to cause it to rise and become fluffy and light is known as a leavening agent. They are necessary ingredients for bread, cakes, cookies, and pastries, among other baked foods. The carbon dioxide gas that leavening chemicals produce becomes trapped in the batter or dough, causing it to rise. A chemical interaction, either between an acid and a base or through yeast fermentation, produces the gas.

In the culinary arts, food leavening agents such as baking soda, baking powder, and yeast are vital for turning uncooked components into delectable recipes. They aid in the leavening process, which gives different food products the proper texture, volume, and flavor. They help dough rise for soft, fluffy bread, cakes, and pastries, which is their main function in baking. They contribute to the light and airy texture of batter-based foods, pizza dough, and pancakes. Their impact may be seen in both home and commercial food preparation, demonstrating their adaptability and importance in the culinary industry.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

https://introspectivemarketresearch.com/request/1970

Updated Version 2024 is available our Sample Report May Includes the:

Scope For 2024

Brief Introduction to the research report.

Table of Contents (Scope covered as a part of the study)

Top players in the market

Research framework (structure of the report)

Research methodology adopted by Worldwide Market Reports

Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years.

Leading players involved in the Food Leavening Agent Market include:

Angel (China), Forise Yeast (China), Sunkeen (China), Vitality King (China), Hongxing (China), Xiaguang (China), Rongda (China) Kraft Foods Group Inc. (U.S.), Church & Dwight (U.S.), Natural Soda (U.S.), Lallemand (Canada), DSM (Netherlands), AB Mauri (UK), Lesaffre (France), Solvay (Belgium), and Other Major Players

If You Have Any Query Food Leavening Agent Market Report, Visit:

https://introspectivemarketresearch.com/inquiry/1970

Segmentation of Food Leavening Agent Market:

By Type

Yeast

Baking powder

Baking soda

By Form

Dry

Wet

By Application

Bread

Cake

Biscuit

Steamed bread

By Distribution Channel

Supermarkets/hypermarket

Convenience stores

Specialty food stores

E-commerce

Market Segment by Regions: -

North America (US, Canada, Mexico)

Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

South America (Brazil, Argentina, Rest of SA)

What to Expect in Our Report?

(1) A complete section of the Food Leavening Agent market report is dedicated for market dynamics, which include influence factors, market drivers, challenges, opportunities, and trends.

(2) Another broad section of the research study is reserved for regional analysis of the Food Leavening Agent market where important regions and countries are assessed for their growth potential, consumption, market share, and other vital factors indicating their market growth.

(3) Players can use the competitive analysis provided in the report to build new strategies or fine-tune their existing ones to rise above market challenges and increase their share of the Food Leavening Agent market.

(4) The report also discusses competitive situation and trends and sheds light on company expansions and merger and acquisition taking place in the Food Leavening Agent market. Moreover, it brings to light the market concentration rate and market shares of top three and five players.

(5) Readers are provided with findings and conclusion of the research study provided in the Food Leavening Agent Market report.

Our study encompasses major growth determinants and drivers, along with extensive segmentation areas. Through in-depth analysis of supply and sales channels, including upstream and downstream fundamentals, we present a complete market ecosystem.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Acquire This Reports: -

https://introspectivemarketresearch.com/checkout/?user=1&_sid=1970

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assisting our clients to grow and have a successful impact on the market. Our team at IMR is ready to assist our clients to flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, that specializes in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyse extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1-773-382-1047

Email: [email protected]

#Food Leavening Agent#Food Leavening Agent Market#Food Leavening Agent Market Size#Food Leavening Agent Market Share#Food Leavening Agent Market Growth#Food Leavening Agent Market Trend#Food Leavening Agent Market segment#Food Leavening Agent Market Opportunity#Food Leavening Agent Market Analysis 2023

0 notes

Text

Timestamp #296: Nikola Tesla's Night of Terror

New Post has been published on http://esonetwork.com/timestamp-296-nikola-teslas-night-of-terror/

Timestamp #296: Nikola Tesla's Night of Terror

Doctor Who: Nikola Tesla’s Night of Terror (1 episode, s12e04, 2020)

Two great minds collide at the turn of the century!

The place is Niagara Falls. The time is 1903. The man is Nikola Tesla and he is marketing his new method of harnessing electricity through a wireless system. The assembled group is impressed until he names the price tag of $50,000. That ask is one too far, and an investor named Brady publicly flounces after recalling Tesla’s claims about a signal from Mars. The whole affair is interrupted by the discovery of a corpse nearby.

Tesla and his assistant Dorothy Skerrit wonder if the man may have been killed by electric shock. That night, Tesla realizes that some parts have been stolen and discovers a green orb floating nearby. Tesla and Dorothy find the Doctor, then Brady holding a gun. When Brady is killed by a laser blast, the Doctor helps Tesla and Dorothy escape.

They end up on a passing steam train heading to New York City. After introducing the fam in their period costumes, the Doctor helps everyone escape from a cloaked attacker wielding a Silurian blaster. The attacker is one of the investors from the meeting.

The Doctor explains that her team was visiting the area when they found a strange energy reading that led them to Tesla. When Tesla doesn’t cooperate, the Doctor decides to stick to his side. When they arrive in New York City, they run into a protest staged against Tesla and his science of alternating current. Once past the protest line, the Doctor talks to her companions about Tesla’s future achievements. Tesla eventually shows her the orb, a device she identifies as an Orb of Thassor. It belongs to an ancient race who created it to share knowledge, though this model has been modified.

The Doctor and Tesla bond before Dorothy arrives with a letter from Mr. Morgan, an investor who just withdrew his support. When a spy for Thomas Edison snaps a photo from a window, the Doctor decides to visit the rival inventor. Edison decides to give the Doctor and companions a private audience when confronted with the Silurian weapon, but he denies wanting to steal from Tesla and explains their history together, claiming that Tesla is bitter.

Meanwhile, Yaz asks Tesla about his Wardenclyffe project. He muses about his plans to transmit all of humanity’s knowledge wirelessly – the dreams of databases and mobile phones – but he has no investors to realize his dreams. The orb activates just as the red-eyed assassin arrives at Edison’s facility and electrocutes all of the engineers. Edison theorizes that the Doctor’s team is trying to sabotage his work. They are interrupted by the assassin and flee, realizing along the way that it can mimic people. Specifically, dead people. She uses zinc to trap the creature behind a wall of fire, but it disappears after being confronted.

The Doctor tries to warn Yaz, but Dorothy arrives, the hostage of two assassins wearing dead men’s bodies. The creatures teleport Tesla and Yaz to a room filled with scorpion-like aliens. The Doctor arrives moments later with Edison in the TARDIS and takes Dorothy along as they pursue the aliens. The Doctor realizes that the orb has been hacked to receive information about the period. It has been searching for Tesla, and after Dorothy recalls the claims about signals from Mars, the Doctor sets a course for Wardenclyffe.

The leader of the scorpions introduces herself as the Queen of the Skithra. She has been scavenging Tesla’s equipment and wants the inventor to prepare them for battle. When Tesla refuses, the queen decides to kill Yaz. Luckily, the Doctor arrives with a Braxium Bouncer (Mark III) to teleport the humans home. The Doctor realizes that the Skithra ship is made from stolen tech and the queen needs someone to fix it. Once the bouncer recharges, the Doctor teleports herself, Yaz, and Tesla away.

Of course, Tesla is surprised to find Edison in his private lab. He’s even more surprised by the TARDIS. Once inside, the Doctor issues an ultimatum to the Skithra to leave Earth. The queen sends her disguised minions to find Tesla while he ponders her decision to either take him or destroy the Earth. The Doctor asks him to explain his Wardenclyffe project, realizing that could generate an electric bolt and hit the Skithra ship. Edison disagrees, but the Doctor presses her plan into action.

Tesla and the Doctor work on the tower after extending the TARDIS shields around the area. Edison and Yaz clear the streets while Dorothy, Graham, and Ryan fortify the laboratory. The Skithra attack as the tower charges – there’s not enough energy to keep the shields up at the same time – and the queen lands at Wardenclyffe before the tower can fire.

The queen threatens the group as the Doctor confronts her. The Doctor tries to take the bouncer, but the queen takes it instead. The Doctor activates the device with her sonic screwdriver, teleporting the queen back to her ship. Tesla activates the tower and blasts the ship, forcing the Skithra to teleport back before leaving the planet for good.

As everyone recovers, Edison offers Tesla a job, but Tesla turns him down. Yaz wonders if the events they witnessed will change history, but the Doctor laments that Tesla still dies forgotten and penniless. His inventions still change the world, though, and as the team says farewell, Tesla promises to work for the future.

In what seems to be a better version of the previous episode, we get a good monster mystery with a good historical basis to go with it. The setting of 1903, which is never directly stated in the episode, is an approximation based on events: The real Wardenclyffe Tower was completed around 1902 and was primarily funded by investor J.P. Morgan; the real letter from Mr. Morgan was dated July 14, 1903, and was a refusal to fund Tesla’s project after the inventor changed the project’s scope; and that night, the tower apparently came to life with bright flashes of light.

Indeed, we don’t speak enough about Nikola Tesla. I spent a lot of time learning about him in my physics studies, but the rest of the world thinks more about Thomas Edison when considering electricity. The resurgence of popular interest in Tesla over the last few decades has been amazing to watch.

The villains of this piece, the Skithra, could have easily been the Racnoss. True, the Empress and her people that we met in The Runaway Bride were supposed to be the last of their kind, but this is Doctor Who, where everything is made up and the continuity has been fluid since 1963. The queen was a mindbender since I’m used to seeing actress Anjli Mohindra as Rani Chandra on The Sarah Jane Adventures. She and Bradley Walsh crossed paths in the Whoniverse during The Day of the Clown.

Robert Glenister, the actor who played Edison, is also a familiar face. We last saw him as Salateen in The Caves of Androzani.

I loved the mystery behind the Skithra, and even though they come across as more violent versions of Star Trek‘s Pakleds, the menace and creepiness were a lot of fun. The Braxium Bouncer (Mark III) bit was a nice double-cross in an era where the Doctor seems more reactive than proactive.

All told, I really enjoyed this episode and consider it a great step forward for the season.

Rating: 4/5 – “Would you care for a jelly baby?”

UP NEXT – Doctor Who: Fugitive of the Judoon

The Timestamps Project is an adventure through the televised universe of Doctor Who, story by story, from the beginning of the franchise. For more reviews like this one, please visit the project’s page at Creative Criticality.

0 notes

Text

Consolidated Edison Inc.(NYSE: ED) ED stock price has shown a double bottom pattern and has retested the support zone of $85 in the last trading sessions. Moreover, the price action showed the range-bound moves of ED stock and hovers between the trajectory swings of $80 – $100 and showed incisiveness between the bulls and bears. Furthermore, the chart shows that ED stock has delivered volatile swings for the past sessions. ED share price has split the channel lows of $80, which trapped the long positions. After that, ED stock reversed sharply and re-entered the channel, which trapped the short positions. ED stock is close to retesting the 20-day EMA and is showing buying interest, and bulls are accumulating the stock to retain the swing of $90, followed by $100. Furthermore, the trajectory swing of $95 must be sustained for a reversal amid the reversal. For a significant reversal to catch the upside, ED stock must surpass the 200-day EMA above the upper trendline of $92, beyond the blue sky zone of $100, which can be retested if the momentum continues. As per the options chain, at the strike price of $90, indecisiveness was shown on the call side with an open interest of 399 hundred shares, whereas, on the put side, an open interest of 390 hundred shares shows a solid battle to watch out for the following sessions. Bulls and bears are trying their best to dominate the battle, but ED stock is hanging below $90. At press time, ED stock price was $86.35 with an intraday gain of 1.88%, showing buying interest in yesterday’s market session. Moreover, the trading volume increased by 1.22% to 2.890 Million, and the market cap is $29.784 Billion. However, analysts maintained a neutral and underperform rating with a yearly target price of $87.93, which leads to a negative sentiment. Consolidated Edison, Inc. is a holding company that engages in regulated electric, gas, and steam delivery. It operates through the following segments: Consolidated Edison Company of New York (CECONY), Orange and Rockland Utilities(O&R), Con Edison Clean Energy Businesses and Con Edison Transmission. The CECONY segment is involved in the regulated electric, gas, and steam utility businesses. Will ED Stock Retain Gains Above $90 or Drag to $80? Source: ED Stock Price Chart At TradingView On the daily charts, ED stock price is trading close to the make-or-break zone of $80, which, if it breaks, would produce a fresh downtrend towards $70, followed by $60. Conversely, if the ED share price holds gains above $80, a reversal toward $95 can be anticipated. Besides $95, if momentum continues, it will reach $100 and $110. However, ED share price has split the 38.2% Fib zone and is trying to sustain it. Moreover, ED stock slipped below the mid-bollinger band, showing a negative sign on the charts. The RSI curve stayed below neutrality and showed a bearish divergence, indicating a negative crossover on the charts. The MACD indicator showed a bearish crossover and formed red bars on the histogram, suggesting a bearish outlook for the upcoming sessions. Summary ED share price trades below the significant moving averages and shows a bearish outlook for the past sessions. Moreover, ED stock persists in forming the lower lows and staying below neutrality, indicating a drop in investor interest. ED stock is stuck in the congestion zone between $80 – $100. Technical Levels Support Levels: $80 and $75 Resistance Levels: $90 and $100

0 notes

Text

China's Deflationary Woes and the Ripple Effect on Bitcoin

China's Deflationary Woes and the Ripple Effect on Bitcoin

Image Source: Pexels

China‘s economy slipping into deflation for the first time in more than two years might have negative near-term impacts on Bitcoin (BTC).

In the latest episode of Macro Markets, analyst Marcel Pechman argued that deflation in China, which economists believe is an issue, would leave short to mid-term adverse impacts on Bitcoin, commodities, as well as stocks that rely on global economic growth.

“It will certainly not be fun to hold stocks that happen to depend on global economic growth or simply use too much financial leverage,” Pechman said.

“And probably not a good time to hold commodities. So expect a short to mid-term negative impact on Bitcoin if China’s growth dissipates.”

Last month, China experienced deflationary conditions for the first time in two years, indicating a potentially concerning new phase in its struggling economy.

According to the official consumer price index, Chinese consumer prices dropped by 0.3% in July compared to the previous year.

By excluding volatile food and energy prices, core inflation actually rose to 0.8% in July, the highest level since January, up from 0.4% in June.

The data release paints a gloomy picture for China, as the economic recovery loses steam due to various issues, including declining exports, record-high youth unemployment, and a stagnant housing market.

China is also facing falling prices across different sectors, including commodities like steel and coal, as well as essential consumer goods like vegetables and appliances.

This is in contrast with the global trend, where many countries are grappling with rising inflation after easing Covid-19 restrictions.

The concern lies in the potential entrenchment of the expectation of falling prices, which could dampen demand, exacerbate debt burdens, and trap the economy in a cycle that is difficult to escape using traditional stimulus measures employed by Chinese policymakers.

Deflation poses a particular risk for countries with high levels of debt, such as China, as it increases the cost of servicing that debt and may discourage borrowing, spending, and investment.

“The reality looks increasingly grim,” Eswar Prasad, a Cornell University economist who once headed the International Monetary Fund’s China division, told The Wall Street Journal.

“The government’s approach of downplaying the risks of deflation and stalling growth could backfire and make it even harder to pull the economy out of its downward spiral.”

Impacts of the Fed’s Balance Sheet

Pechman also discussed the effects of the United States Federal Reserve‘s balance sheet and how it increased its assets by $5 trillion between December 2019 and April 2022.

He pointed out that this expansion period coincided with a 38% decline in the S&P 500 index.

Additionally, the Federal Reserve’s balance sheet surpassed $8.9 trillion just as the stock market index reached its highest point of 4,800.

According to Pechman, the issue lies in the significant deficit of the US Treasury Department, as the government spends more than it receives from revenues and taxes.

Consequently, the government needs to roll over some of the debt instead of letting it expire.

This means that the Federal Reserve may no longer be able to continue reducing its balance sheet, which has played a significant role in lowering inflation.

Ultimately, Pechman argued that once the Federal Reserve is compelled to expand its balance sheet again, inflation will be significantly impacted.

He advised individuals who possess valuable assets such as Apple shares, land, gold, and Bitcoin to hold on tight and not be swayed by the temporary period of reduced inflation.

The Information contained in or provided from or through this website is not intended to be and does not constitute financial advice, investment advice, trading advice, or any other advice.

New Post has been published on https://crynotifier.com/chinas-deflationary-woes-ripple-effect-bitcoin-htm/

0 notes

Text

Quantum: Recharged classic arcade gaming is making a comeback

Quantum: Recharged 2D action shooter game now has a release date for Linux, Atari VCS, Mac, and Windows PC. SneakyBox poured their heart and soul to bring this masterpiece back to life. Due to make its way onto Steam next week. Let's dive into some classic arcade gaming with a taste of 21st-century classics. This is not just any other past-time; this is Quantum: Recharged, straight from the legendary house of Atari. They've been at the top of the market since before most of us were born. So now, they're bringing some of that golden-age classics right to Linux PC's. Remember those vintage arcade machines? Now, Atari's taken the 2D action shooter game and put a modern spin on it. Imagine having the rush of the '80s arcades, but with the slickness and polish of today’s graphics and controls. In Quantum: Recharged, you're in control of a ship. But here's the twist: there are no lasers or guns on this ride. As a result, your mission, is to use that ship's leverage to trap and circle your enemies, creating ares of pure doom. It's about flexing and outthinking your enemies, and strategically taking control of the battlefield.

Quantum: Recharged - Release Date Announcement

youtube

Now, while the essence is retro, the features are nothing short of futuristic. Since you can dodge endlessly, or freeze your enemies. These power-ups let you change the outcome of a battle, due to make you practically unstoppable. If you ever feel like sharing the action, there's a co-op mode in Quantum: Recharged. Bring a friend along and strategize in tandem, covering more ground and keeping enemies at bay. And if you're in the mood for some friendly competition, there's a global leaderboard for you to stamp your mark. Doing so in both the Arcade and Challenge modes. In case you're curious about the minds behind this modern classic 2D action shooter, give a salute to Sneakybox for developing it and Atari for bringing it to PC. Whether you're on Linux, Mac, Windows PC, or Atari VCS, gear up for the August 17, 2023, release date. It's time to experience the past, present, and future of arcade gaming. So be sure to Wishlist the game on Steam. Now, to connect into all things retro with Atari. Since they've been creating magic for years, there’s always something new around the corner. Maybe you want to keep an ear out for the tunes from the brilliant Megan McDuffie. Follow on Facebook, Twitter, Instagram, and YouTube, and join the community on Discord.

0 notes

Text

Steam Energy Management Market Overview Analysis, Trends, Share, Size, Type & Future Forecast to 2032

Overview:

Steam energy management refers to the practice of optimizing and controlling the generation, distribution, and utilization of steam in industrial processes.It aims to improve energy efficiency, reduce operational costs, and minimize environmental impact by effectively managing steam resources.Steam energy management involves various techniques and technologies, including steam trap management, condensate recovery, heat exchanger optimization, and steam system audits.

The market for steam energy management is driven by increasing energy prices, stringent environmental regulations, and the need for sustainable and energy-efficient solutions in industries.The adoption of steam energy management solutions can lead to significant energy savings, reduced carbon emissions, and improved overall operational performance for industrial facilities.

Key Points:

Steam system audits: Conducting comprehensive audits to identify inefficiencies, leaks, and areas of improvement in steam systems.

Steam trap management: Regular monitoring and maintenance of steam traps to ensure optimal operation and prevent steam losses.

Condensate recovery: Recovering and reusing condensate from steam systems to reduce the need for fresh water and decrease energy consumption.

Boiler optimization: Implementing advanced control systems and technologies to improve boiler efficiency and reduce fuel consumption.

Heat exchanger optimization: Optimizing heat transfer processes in heat exchangers to enhance overall system efficiency.

Steam pressure and temperature control: Implementing precise control mechanisms to maintain optimal steam pressure and temperature levels.

Integration with IoT and data analytics: Utilizing IoT devices and data analytics tools to monitor and optimize steam energy management processes.

Training and education programs: Providing training programs to educate employees on best practices for steam energy management and system optimization.

Maintenance and service contracts: Offering maintenance and service contracts to ensure ongoing efficiency and performance of steam systems.

Steam leakage detection: Implementing advanced technologies such as acoustic sensors and thermal imaging to detect and fix steam leaks promptly.

Demand:

Increasing energy costs: Rising energy prices create a strong demand for steam energy management solutions that can help reduce operational costs and improve energy efficiency.

Environmental regulations: Stringent environmental regulations and sustainability initiatives drive the demand for steam energy management solutions to minimize carbon emissions and promote sustainable practices.

Characteristics:

Energy efficiency: Steam energy management solutions focus on optimizing energy usage and reducing waste, leading to improved overall energy efficiency.

Cost savings: Effective steam energy management can result in significant cost savings by minimizing energy consumption and reducing maintenance and repair costs.

Environmental sustainability: By optimizing steam systems and reducing energy waste, steam energy management contributes to environmental sustainability by lowering carbon emissions and conserving resources.

Customization: Steam energy management solutions can be tailored to specific industrial processes and requirements, allowing for customized optimization strategies.

Integration with existing systems: Steam energy management solutions can be integrated with existing infrastructure and control systems, minimizing the need for major system overhauls.

Opportunity:

Industrial sector adoption: There is a significant opportunity for increased adoption of steam energy management solutions in various industries such as manufacturing, power generation, chemical, and food processing.

Emerging markets: The growing industrialization and increasing energy consumption in emerging markets present a significant opportunity for steam energy management solution providers to expand their operations and offer their expertise in these regions.

We recommend referring our Stringent datalytics firm, industry publications, and websites that specialize in providing market reports. These sources often offer comprehensive analysis, market trends, growth forecasts, competitive landscape, and other valuable insights into this market.

By visiting our website or contacting us directly, you can explore the availability of specific reports related to this market. These reports often require a purchase or subscription, but we provide comprehensive and in-depth information that can be valuable for businesses, investors, and individuals interested in this market.

“Remember to look for recent reports to ensure you have the most current and relevant information.”

Click Here, To Get Free Sample Report: https://stringentdatalytics.com/sample-request/steam-energy-management-market/5919/

Market Segmentations:

Global Steam Energy Management Market: By Company • Ackam • Zhejiang Energy • Steam Management, Inc. • Rawson-ICD • TLV Global Steam Energy Management Market: By Type • Control System • Heat Exchange System • Hydrophobic System • Condensing Recovery System • Waste Heat And Pressure Recovery System • Other Global Steam Energy Management Market: By Application • Petroleum Chemical Industry • Pharmaceutical • Industrial Manufacturing Global Steam Energy Management Market: Regional Analysis All the regional segmentation has been studied based on recent and future trends, and the market is forecasted throughout the prediction period. The countries covered in the regional analysis of the Global Steam Energy Management market report are U.S., Canada, and Mexico in North America, Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe in Europe, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), and Argentina, Brazil, and Rest of South America as part of South America.

Visit Report Page for More Details: https://stringentdatalytics.com/reports/steam-energy-management-market/5919/

Reasons to Purchase Steam Energy Management Market Report:

• To obtain insights into industry trends and dynamics, including market size, growth rates, and important factors and difficulties. This study offers insightful information on these topics.

• To identify important participants and rivals: This research studies can assist companies in identifying key participants and rivals in their sector, along with their market share, business plans, and strengths and weaknesses.

• To comprehend consumer behaviour: these research studies can offer insightful information about customer behaviour, including preferences, spending patterns, and demographics.

• To assess market opportunities: These research studies can aid companies in assessing market chances, such as prospective new goods or services, fresh markets, and new trends.

• To make well-informed business decisions: These research reports give companies data-driven insights that they may use to plan their strategy, develop new products, and devise marketing and advertising plans.

In general, market research studies offer companies and organisations useful data that can aid in making decisions and maintaining competitiveness in their industry. They can offer a strong basis for decision-making, strategy formulation, and company planning.

About US:

Stringent Datalytics offers both custom and syndicated market research reports. Custom market research reports are tailored to a specific client's needs and requirements. These reports provide unique insights into a particular industry or market segment and can help businesses make informed decisions about their strategies and operations.

Syndicated market research reports, on the other hand, are pre-existing reports that are available for purchase by multiple clients. These reports are often produced on a regular basis, such as annually or quarterly, and cover a broad range of industries and market segments. Syndicated reports provide clients with insights into industry trends, market sizes, and competitive landscapes. By offering both custom and syndicated reports, Stringent Datalytics can provide clients with a range of market research solutions that can be customized to their specific needs

Contact US:

Stringent Datalytics

Contact No - +1 346 666 6655

Email Id - [email protected]

Web - https://stringentdatalytics.com/

0 notes

Text

The Commodity Channel Index (CCI) & NZDCAD: A Ninja's Guide to Mastering Trend Shifts Who knew a seemingly boring term like Commodity Channel Index could actually be your secret ninja weapon in trading? Well, it's not just a mouthful, but also a potent force when it comes to spotting reversals in the Forex market. In today’s escapade, we’re uncovering how to use the CCI to trade the NZDCAD pair like a boss. But remember, every trading strategy comes with its fair share of booby traps – like accidentally hitting that dreaded ‘sell’ button instead of ‘buy’— so brace yourself for a mix of expert insights and cringe-worthy analogies to keep it light but enlightening. Why Most Traders Get CCI Wrong (And How to Avoid It) Let’s be real: Commodity Channel Index is the kind of indicator that many traders think they understand, but don’t really get to the depths of. It's like buying a fancy juicer and only using it to make orange juice—when it can actually make smoothies, sorbets, and even nut milk. The truth is, the CCI can do much more than just indicate overbought or oversold levels. If used correctly, it can give you a strong edge in the market, especially with something as moody as the NZDCAD. Now, unlike those “just go with the flow” indicators, CCI dives into the depths of price fluctuations and pulls out those secret opportunities that the masses miss. It’s designed to measure the difference between the current price and its average price over a specific period. When applied to the NZDCAD, the results can be like suddenly getting backstage access to the market's upcoming moves—a real VIP pass. The Hidden Formula Only Experts Use Here’s a lesser-known secret about CCI: it’s fantastic at highlighting divergence between price action and momentum. Let me put it this way: imagine the price is heading upwards, but CCI is like, "Nah bro, I’m going the other way." This discrepancy, or divergence, is actually an early warning that a reversal might be around the corner. Think of it like when your partner says they’re fine, but you know from their tone it’s not fine at all—get ready for a change of direction. Quick CCI Ninja Move: - If NZDCAD is trending up but CCI starts dipping below 100, take that as a clue. Just like seeing a shopping cart full of kale in someone’s groceries; there's a health kick coming, i.e., prepare for a shift! How the NZDCAD Pair Is Uniquely Tricky (But Here’s How to Outsmart It) NZDCAD, oh boy. This is not your everyday currency pair, and that’s exactly why we love it. If major pairs are the polished executives of the Forex world, NZDCAD is the scrappy underdog startup CEO. It’s quirky, it’s feisty, and that’s what makes trading it so rewarding. This pair is heavily influenced by commodities—after all, New Zealand is a major exporter of dairy, while Canada has oil as its secret sauce. When trading NZDCAD, look at the Commodity Channel Index to gauge the market sentiment relative to these commodity-dependent economies. Is Canada pumping more oil, and the prices are rising? Expect CAD to strengthen. Meanwhile, if dairy prices are dropping faster than your patience on a Monday morning, the Kiwi dollar might be in trouble. But using CCI can help pinpoint the moments where you shouldn’t believe the hype, and instead anticipate a reversal. How to Predict Market Moves with Precision The 100/-100 CCI levels are essential for our ninja tactic arsenal. Most rookie traders see these levels as rigid rules—i.e., sell at +100, buy at -100. But here’s the secret sauce that can truly elevate your trading game: breakouts past these levels are where hidden opportunities lie. Imagine CCI is breaking past the +100 level, and the price is at a key resistance level. Rather than mindlessly selling, understand this move as momentum gaining steam. The CCI gives you permission to break from the ordinary: hold, assess, and potentially prepare for a breakout continuation. CCI says, “Hey, there’s power here. Let’s ride it.” And if you pair this with a contrarian mindset—like questioning why every trader is shorting at resistance—you might just be onto an epic move. Advanced Ninja Hack: - Look for divergence between CCI and price near major support/resistance levels. When NZDCAD is heading up to resistance, and CCI diverges, that’s your early warning to change the play. CCI Secrets from the Shadows: Lesser-Known Tricks So here’s something most won’t tell you—the CCI can work wonders on multiple timeframes simultaneously. Like a multitasking ninja, watching how the CCI is moving on the daily and the 4-hour chart can give you a double confirmation. If both timeframes are signaling an overbought level, you’re looking at a heightened probability for a reversal. It's like seeing a raincloud on your weather app and feeling those first droplets—you know you’re going to need that umbrella. To effectively use this method, apply the CCI on both a higher timeframe (daily) to gauge the general trend, and a lower timeframe (4-hour or 1-hour) to time your entry points. When the higher timeframe CCI signals an overbought market while the lower timeframe starts showing divergence, you've got a potential sniper-level entry—like catching that rare limited-edition sneaker drop before anyone else. Case Study: How a CCI Divergence Saved the Day Here’s a real-world case to make this concrete. Imagine you’re eyeing an NZDCAD short position after noticing that oil prices are getting a boost. NZDCAD price action starts to rally, pushing through a resistance level that’s been tested several times. Your intuition says, "This is going to reverse," but rather than jumping in headfirst, you wisely check the CCI on both the daily and 4-hour charts. Sure enough, the daily CCI shows levels above +100—an overbought signal—and the 4-hour CCI starts diverging. Price action is still climbing, but CCI tells a different story—momentum is weakening. You take a short position, set a tight stop-loss, and, lo and behold, the reversal hits. You exit with profits, and maybe even treat yourself to that fancy juicer we talked about earlier… but this time, you make the sorbet too. Turning Insight into Action Using CCI with the NZDCAD isn’t just about reading lines on a chart. It’s about understanding the market’s heartbeat—those swings driven by dairy prices, oil dynamics, and unpredictable news cycles. If you treat CCI as a tool to understand divergence and market sentiment rather than just another overbought/oversold indicator, you’ll be a step ahead of those who aren’t willing to dig deeper. Elite Tactics at a Glance: - Divergence is King: When CCI diverges from price, pay attention. It’s often a precursor to a market pivot. - Watch Multiple Timeframes: Confirm your entries with CCI signals across different timeframes. One signal is good, two signals are great, and three signals? Now that’s ninja-level trading. - Breakouts Beyond the Norm: Don’t always sell at +100 or buy at -100. Sometimes, power is in the push. Look for signs of continuation instead of reversal. Trading isn’t just a game of numbers—it’s about reading between the lines, anticipating moves others don’t see, and occasionally taking that contrarian stance that turns losses into gains. The Commodity Channel Index is your undercover ally, and used with NZDCAD, it’s your passport to catching moves that other traders won’t see coming until it’s too late. So, grab that CCI and get ready to turn the charts into your playground. The next NZDCAD move could be just a CCI divergence away. Conclusion: Join the Winning Side Loved what you read? That was just the tip of the iceberg. For more exclusive insights, live trading ideas, and even some advanced tricks up our sleeve, head on over to StarseedFX Community for the full behind-the-scenes experience. Whether it’s real-time market analysis or insider tactics, we’ve got the elite strategies you need to outsmart the competition and level up your trading. And while you’re at it, don’t forget to download our free trading plan and trading journal – because every ninja needs their tools sharp and ready. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

0 notes

Text

Evil Wizard - A Twist On Revenge Plots

Releasing in a little under a month from the date of the post, Evil Wizard puts you in control of a final boss that has been defeated but gets a chance for revenge. If I’ve said it once I’ve said it a thousand times, I love playing as mage characters. There’s something about a mage that really speaks to me and I love picking and enjoying new experiences with them. https://www.youtube.com/watch?v=sOuyUwmednk In their words “The Evil Wizard team has put together a unique, action-packed, sometimes crude and downright hilarious game that we’re excited to share with players,” said Kavka Wang, Marketing Director, at E-Home Entertainment. “Fans of action-RPGs will find a lot to love with the world of Evil Wizard and the various locales, bosses and ability progression.” Key Features of Evil Wizard: The Wizard With a Mouth: Delve into a new, eviller, point of view, explore carefully crafted locations, navigate intricate levels, and use your skills and elements to unlock new paths in the Metroidvania-inspired world. If You’re Evil and You Know It: Utilize that evil-ness you harbor to slash, hack, and stab your enemies, and if that isn’t enough, you know you’re a wizard, right? Harness the elements and vaporize them. Metroidvania-inspired Design: Explore carefully-crafted locations and navigate intricate levels. Use your skills and elements to interact with the in-game world and unlock new paths. A Quest Called Revenge!: Face off against hordes of heroes, avoid devastating deadly traps, and solve increasingly problematic puzzles as you reclaim the halls of your castle from the filth that now lives within it! Just watching the trailer you get a sense of the type of humor that you’ll encounter in this game and I can’t wait to play through it and read all the jokey dialogue. Evil Wizard releases on Xbox and Windows PC via Steam, Epic and GOG on May 25, 2023 Read the full article

0 notes

Link

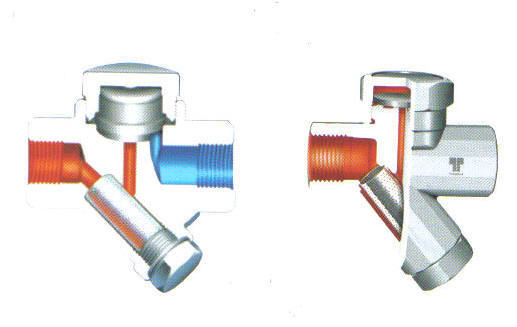

The steam trap market is projected to grow at a CAGR of 4.86% to reach US$2.593 billion by 2024, from US$1.951 billion in 2018.A stream trap is used to release condensate and non-condensable gasses with unimportant loss of live steam. In other words, it is a drain valve, which distinguishes between steam and condensate. The steam trap holds back steam and discharges condensates under varying pressure or loads.

#Steam Trap Market#Steam Trap Market share#Steam Trap Market size#Steam Trap Market analysis#Steam Trap Market trend#market research

0 notes

Text

Global Steam Trap Market Will Reach at a Highest CAGR of 5.25% by 2026

Global steam trap market is registering a substantial CAGR of 5.25% in the forecast period of 2019-2026. The report contains data of the base year 2018 and historic year 2017. This rise in market value can be attributed to the constant use for reducing fuel consumption; strict rules enforced by regulatory authorities to enhance manufacturing effectiveness and reduced expenses.

Key Market Competitors:

Few of the major competitors currently working in the global steam trap market are Spirax-Sarco Engineering plc, The Weir Group PLC, Flowserve Corporation, CIRCOR International, Inc., Emerson Electric Co., Schlumberger Limited., Thermax Global, Velan Inc., Watts., Richards Industrials, Watson McDaniel, Pentair plc., Volfram., Colton Industries, VYC Industrial, Armstrong International Inc., Axion Flexible Insulation Jackets, CIRCOR International, Inc., Kirloskar Brothers Limited (India)., Spirax Sarco Limited, among others.

Download PDF Sample report @ https://www.databridgemarketresearch.com/reports/global-steam-trap-market

Steam traps are a sort of automated valve that drains out gaseous oxygen (i.e. compressed steam) and non-incondensable gases like water without enabling steam to flee. Steam has been used frequently in the sector for cooling or as a mechanical power pulling force. Steam cages are used to extract condensate gasses from the water network. Propulsion/drive, atomization, heating/sterilization, cleaning, humidification, humidification, motive and moisturization are some typical applications for steam in the sector.

Competitive Analysis:

Global steam trap market is highly fragmented and the major players have used various strategies such as new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, and others to increase their footprints in this market. The report includes market shares of steam trap market for global, Europe, North America, Asia-Pacific, South America and Middle East & Africa.

Segmentation: Global Steam Trap Market

By Product (Mechanical, Thermodynamic, Thermostatic)

By Application (Tracing Application, Drip Application, Process Application)

By Body Material (Steel, Iron, Others)

By End-User Industry (Chemicals, Energy and Power, Food & Beverages, Oil & Gas, Pharmaceuticals, Others)

By Geography (North America, Europe, Asia-Pacific, Europe, South America, Middle East and Africa)

Want Full Report? Enquire Here@ https://www.databridgemarketresearch.com/inquire-before-buying/?dbmr=global-steam-trap-market

Market Drivers:

End-user industries constantly are using steam traps to reduce fuel consumption

Strict rules enforced by regulatory authorities for the reduction of the carbon footprints

Strengthening the use of safe and renewable sources of energy

High demands for gasoline across distinct end-user sectors

Market Restraints:

Regular servicing and operating costs associated with the steam trap activities

Strict laws and rules governing the manufacturing of steam traps

When managing heavy stresses and capacity, the traps become big, costly and hard for staff to manage

Key Insights in the report:

Complete and distinct analysis of the market drivers and restraints

Key Market players involved in this industry

Detailed analysis of the Market Segmentation

Competitive analysis of the key players involved

Acess Full Report@ https://www.databridgemarketresearch.com/reports/global-steam-trap-market

About Us: