#StartupFinance

Explore tagged Tumblr posts

Text

Unlock Success: 8 Benefits of Professional Accounting Services

Unlock your Delhi startup's potential by hiring professional accounting services from Taxgoal. Enjoy expert financial guidance, accurate bookkeeping, tax compliance, time savings, enhanced decision-making, access to financial technology, scalability, and peace of mind. Let Taxgoal handle your finances, allowing you to focus on growing your business. Contact us (+91 9138531153) today for Online Bookkeeping and Accounting Services Near Me.

#Taxgoal#ProfessionalAccounting#StartupFinance#DelhiStartups#BusinessSuccess#FinancialServices#AccountingBenefits#TaxCompliance#Bookkeeping#FinancialGuidance

1 note

·

View note

Text

Traditional Financing vs. Invoice Financing : Which is Better for Small Businesses

1 note

·

View note

Text

Costs and Fees Associated with RAK Mainland Company Formation

RAK Mainland Company Formation provides entrepreneurs with a cost-effective alternative to other UAE jurisdictions. To make a well-informed choice, it's essential to fully grasp the financial aspects involved. This guide explores the primary costs associated with RAK Mainland Company Formation, encompassing initial setup fees, ongoing business expenses, and possible unforeseen charges.

#StartupFinance#BusinessInRAK#UAEEntrepreneur#CostEffectiveStartup#MiddleEastBusiness#InvestInUAE#BusinessExpenses#CompanyRegistration#UAEMainland#RasAlKhaimah#BusinessSetup#StartupCosts#EntrepreneurshipUAE#UAEBusiness#RAKCompanyFormation

0 notes

Text

Is Virtual CFO effective for a new business?

Absolutely, a Virtual CFO (Chief Financial Officer) can be incredibly effective for a new business. As a startup, you face unique challenges and opportunities, and having a seasoned financial expert on your team can make a significant difference. Here is why a Virtual CFO could be the right choice for your new business:

Cost-Effective Expertise - Hiring a full-time CFO can be prohibitively expensive for a new business. A Virtual CFO provides access to high-level financial expertise without the hefty salary and benefits package of a full-time executive. This allows you to allocate resources more efficiently while still benefiting from top-tier financial guidance.

Strategic Financial Planning - A Virtual CFO can help you develop and implement strategic financial plans tailored to your business goals. This includes budgeting, forecasting, and financial modelling, which are crucial for making informed decisions and steering your business towards growth and profitability.

Cash Flow Management - Managing cash flow is critical for any new business. A Virtual CFO can help you monitor and manage your cash flow effectively, ensuring that you have the necessary funds to cover expenses, invest in growth opportunities, and navigate any financial challenges that arise.

Access to Advanced Financial Tools - With a Virtual CFO, you gain access to advanced financial tools and software that can provide deeper insights into your business’s financial health. These tools can help you track key performance indicators (KPIs), analyze financial data, and make data-driven decisions.

Scalable Support - As your business grows, your financial needs will evolve. A Virtual CFO offers scalable support that can adapt to your changing requirements. Whether you need more in-depth financial analysis or assistance with investor relations, a Virtual CFO can provide the flexibility you need.

Objective Perspective - A Virtual CFO brings an objective perspective to your business. This can be invaluable for identifying potential financial risks and opportunities that you might not see from within the company. Their external viewpoint can help you make more balanced and strategic decisions.

Focus on Core Competencies - By outsourcing your financial management to a Virtual CFO, you can focus on what you do best—running and growing your business. This can lead to improved efficiency and effectiveness across all areas of your company.

For instance, Virtual CFO Hub specializes in providing customized financial solutions for new businesses. They offer a range of services including financial planning, cash flow management, and strategic advising, all tailored to meet the unique needs of startups. By partnering with experts like Virtual CFO Hub, you can ensure your financial foundation is strong, allowing you to focus on building a successful business. In conclusion, a Virtual CFO can be a game-changer for a new business, offering expertise, strategic planning, and financial stability at a fraction of the cost of a full-time CFO. For startups looking to establish a solid financial footing and drive growth, leveraging the services of a Virtual CFO, such as those offered by Virtual CFO Hub, can be a smart and effective choice.

#FinancialManagement#BusinessGrowth#CFOservices#FinancialPlanning#SMEfinance#StartupFinance#CashFlowManagement#FinancialStrategy#BusinessStrategy#FinancialExpertise#ScalableSolutions#Compliance#FinancialHealth

0 notes

Text

Feeling a spark of discontent? Yearning to break free and shape the future? Look no further than the wisdom of innovation quotes!

These powerful insights, distilled from the minds of history’s most groundbreaking individuals, can ignite your spirit and unlock your inner innovator. They have the power to transform your perspective and empower you to push beyond limitations.

#innovationquotes#innovation#businessinnovation#entrepreneur#innovatingsociety#socialinnovators#socialinnovationlab#socialentrepreneurshipisthefuture#socialinnovation#entrepreneurlifetsyle#entrepreneursclub#decisionmakers#designthinkingmethod#designthinking#startupdaily#startupfinance#startupstory#startupbusinessowners

0 notes

Text

Navigating Business Finances with Confidence: Financial Statements, Forecast & Projection

In the dynamic world of business, having a clear financial roadmap is essential for success. Our Financial Statement, Forecast & Projection service at SAI CPA Services ensures that your business is well-equipped to make informed decisions. We specialize in crafting accurate financial statements, providing a snapshot of your current financial health. Our experts go beyond mere numbers; we delve into forecasting and projections, guiding you towards future opportunities and potential challenges.

Understanding the significance of financial planning, we tailor our services to suit your unique business needs. Whether you're a startup seeking to secure funding or an established business aiming for strategic growth, our team is dedicated to helping you navigate the complexities of business finance with confidence. Trust SAI CPA Services for transparent, reliable financial insights that empower your business journey.

#SAICPAServices#FinancialInsights#BusinessForecasting#SmartBusinessDecisions#FinancialPlanning#BusinessGrowth#FinancialClarity#StrategicFinance#TransparentFinances#BusinessSuccess#ExpertCPAServices#FinancialStatements#FuturePlanning#StartupFinance#SAICPAExperts

1 note

·

View note

Text

कृषि प्रौद्योगिकी स्टार्टअप निवेश में कमी, स्टॉक लिमिट घटाई गई

केंद्र सरकार ने बाज़ार में तुअर और उड़द दाल की कीमतों को नियंत्रित करने के लिए इसकी भंडारण सीमा को 31 दिसम्बर तक बढ़ा दिया है। यही नहीं, अब थोक और बड़े विक्रेताओं के लिए डिपो स्तर पर स्टॉक लिमिट 200 से घटाकर 50 मीट्रिक टन कर दी गई है। वहीं, खुदरा विक्रेताओं और खुदरा … Read more

#AgTechStartup#InvestmentReduction#AgriculturalInnovation#StartupFunding#StockLimitCut#AgricultureInvestment#TechInAg#StartupFinance#InvestmentChange

0 notes

Text

Check Out My Least Article : A Comprehensive Guide to Business Financial Planning in 2023 !

#FinancialPlanning#BusinessFinance#Budgeting#CashFlowManagement#InvestmentStrategies#TaxPlanning#RiskManagement#FinancialForecasting#SmallBusinessFinance#CorporateFinance#FinancialGoals#FinancialStrategy#Entrepreneurship#FinancialLiteracy#BusinessGrowth#Profitability#StartupFinance#EconomicStrategy#MoneyManagement#FinancialEducation

1 note

·

View note

Text

#VirtualCFO#FinancialStrategy#StartupFinance#CFOservices#FinancialAdvisory#FinancialManagement#BusinessGrowth#StartupSupport#FinancialConsulting#EntrepreneurialFinance

1 note

·

View note

Text

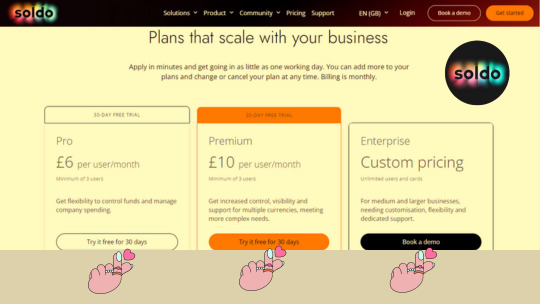

Pricing: Pick The Ideal Soldo Plan For Your Business

Soldo offers a range of pricing plans designed to cater to the diverse needs of businesses, from startups to established enterprises. With their flexible pricing options, you can choose the plan that aligns perfectly with your business's size and requirements. Soldo's pricing is tailored to offer you the right balance of features, prepaid company cards, and automation tools to streamline your expense management processes.

Basic Plan: Ideal for small businesses or startups, Soldo's Basic Plan provides a solid foundation for efficient expense management. This plan includes a set number of prepaid company cards to empower your employees with convenient spending, along with essential expense tracking and reporting features. It's a cost-effective option for businesses looking to get started with organized expense management.

Advanced Plan: For growing businesses with increased expense management needs, Soldo's Advanced Plan offers enhanced features and scalability. You'll benefit from a higher number of prepaid company cards, enabling more of your team to manage expenses seamlessly. Additionally, this plan may include advanced reporting options, integrations with popular accounting software, and greater automation capabilities, saving your finance team valuable time.

Enterprise Plan: Designed for larger corporations with complex expense workflows, the Enterprise Plan provides a comprehensive suite of tools to optimize expense management. With a generous allotment of prepaid company cards, this plan supports businesses with numerous departments and teams. Expect advanced reporting and analytics, custom integrations, and dedicated support to cater to your business's unique requirements.

Custom Plan: Soldo understands that every business has unique needs. If your business demands a tailored solution, Soldo's Custom Plan offers the flexibility to create a package that addresses your specific challenges. This plan could include a combination of features from other plans, as well as specialized support to ensure that your expense management is as efficient as possible.

Free Plan:

Soldo's Free Plan offers an entry-level option for businesses seeking basic expense management without the commitment of a subscription fee. While specific features may vary, this plan typically provides a limited number of prepaid company cards for your team. It's an excellent choice for startups and small businesses aiming to organize their spending without incurring additional costs.

Key Features:

Limited number of prepaid company cards.

Basic expense tracking and categorization.

Basic reporting features.

Essential tools for managing employee spending.

Limitations:

Limited scalability for larger businesses.

Basic automation features.

Reduced access to advanced reporting and integrations.

#SoldoFreePlan#ExpenseManagement#BusinessSpending#SmallBusinessSolutions#BudgetingTools#StartupFinance#CostControl#FreeExpenseTracking#FinancialManagement#BusinessCardSolutions

0 notes

Text

#smallbusinessloans#businesslineofcredit#sbaloan#sbaloans#revenueloan#performanceadvance#quickfinancing#quickbusinessfinancing#cannabusinessfinancing#startupbusinessfunds#startupbusinessfinancing#commercialbusinessfinancing#startupbusinessloans#startuploans#startupfinance#startupfinancing#purchaseorderfinancing#franchisefinancing#Franchiseloans#franchiseloan#merchantcashadvance#mca#assetbasedlending#assetbasedloans#assetbasedfinancing#assetbasedfinance

0 notes

Text

Professional GST Return Services in Delhi for Startups

Professional GST return filing services from Taxgoal offer Delhi startups expert support for accurate, timely returns. They handle documentation, and compliance, and ensure deductions, saving time and minimizing errors. With tailored solutions, Taxgoal helps startups focus on growth while ensuring legal and financial efficiency. Reach out to Taxgoal today for expert assistance Contact us (+91-9138531153) today for GST Return Filing in Delhi.

#Taxgoal#GSTReturnFiling#DelhiStartups#StartupGrowth#GSTServices#DelhiBusinesses#ProfessionalTaxServices#GSTFilingBenefits#StartupFinance#TaxCompliance#DelhiEntrepreneurs#BusinessGrowth#StartupSupport#GSTConsulting#StartupSuccess

0 notes

Text

How to Manage Business Finances: Essential Tips for Success

How to manage business finances is a crucial skill for any entrepreneur. By creating a solid budget, separating personal and business finances, tracking cash flow, and using accounting software, you can ensure that your business remains financially healthy and positioned for growth. Additionally, planning for emergencies, paying yourself a salary, and seeking professional advice will help you avoid financial pitfalls and achieve long-term success. By implementing these tips, you’ll be well on your way to mastering financial management and building a successful business.

#BusinessFinances#EntrepreneurTips#FinancialManagement#SmallBusinessSuccess#BudgetingForBusiness#CashFlowManagement#AccountingTips#FinancialPlanning#BusinessGrowth#MoneyManagement#EntrepreneurMindset#FinancialHealth#BusinessFinanceTips#AccountingSoftware#PayYourselfFirst#BusinessStrategy#FinancialSuccess#EmergencyPlanning#BusinessBudgeting#LongTermSuccess#StartupFinances

0 notes

Text

Costs and Fees Associated with RAK Mainland Company Formation

Setting up a company in RAK mainland company formation offers entrepreneurs a budget-friendly alternative to other UAE emirates. However, it's crucial to grasp the full financial picture. Let's break down the expenses involved, including initial setup, ongoing operations, and potential hidden costs.

#RAKCompanyFormation#UAEBusiness#EntrepreneurshipUAE#StartupCosts#BusinessSetup#RasAlKhaimah#UAEMainland#CompanyRegistration#BusinessExpenses#InvestInUAE#MiddleEastBusiness#CostEffectiveStartup#UAEEntrepreneur#BusinessInRAK#StartupFinance

0 notes

Text

What are the benefits of a Virtual CFO?

The role of a CFO (Chief Financial Officer) is crucial for any business aiming for financial stability and growth. However, many small to medium-sized enterprises (SMEs) and startups might not have the resources to hire a full-time CFO. This is where a Virtual CFO (VCFO) steps in, offering multiple benefits that can significantly enhance a company's financial health.

1. Cost-Effective Expertise: Hiring a full-time CFO can be expensive, with salaries and benefits often running into six figures. A Virtual CFO provides access to top-tier financial expertise at a fraction of the cost. This is particularly beneficial for growing businesses that need strategic financial guidance but cannot justify the expense of a full-time executive.

2. Flexibility and Scalability: Virtual CFO services can be tailored to the specific needs of your business, whether you require full-time, part-time, or project-based support. This flexibility allows you to scale the level of financial oversight as your business grows and your needs evolve.

3. Strategic Financial Planning: A Virtual CFO can help you with long-term financial planning, budgeting, and forecasting. They bring an objective perspective to your business, helping you set realistic financial goals and develop strategies to achieve them. This ensures you’re always prepared for future growth and potential challenges.

4. Improved Cash Flow Management: Effective cash flow management is vital for the survival and growth of any business. A Virtual CFO can implement robust cash flow monitoring systems, identify potential shortfalls, and advise on measures to improve liquidity. This proactive approach helps prevent cash flow crises and ensures smooth operations.

5. Enhanced Financial Reporting and Compliance: Staying compliant with financial regulations is crucial to avoid penalties and legal issues. A Virtual CFO ensures that your financial reporting is accurate, timely, and complies with all relevant laws and standards. They can also help prepare for audits and liaise with external auditors on your behalf.

6. Objective, Unbiased Advice: An in-house CFO might be too close to the business to offer truly impartial advice. A Virtual CFO, on the other hand, provides an external, objective viewpoint. This can be invaluable when making tough financial decisions or assessing the viability of new projects and investments.

For businesses looking to harness these benefits, Virtual CFO Hub offers a comprehensive suite of services designed to meet the unique needs of each client. Their team of experienced professionals can help you navigate the complexities of financial management, providing the strategic insight and operational support needed to drive your business forward.

Whether you are a startup aiming for rapid growth or an established SME looking to optimize your financial operations, Virtual CFO Hub can tailor their services to your specific requirements, ensuring you achieve your financial goals efficiently and effectively. #FinancialManagement#BusinessGrowth#CFOservices#FinancialPlanning#SMEfinance#StartupFinance#CashFlowManagement#FinancialStrategy#BusinessStrategy#FinancialExpertise#ScalableSolutions#Compliance#FinancialHealth

#FinancialManagement#BusinessGrowth#CFOservices#FinancialPlanning#SMEfinance#StartupFinance#CashFlowManagement#FinancialStrategy#BusinessStrategy#FinancialExpertise#ScalableSolutions#Compliance#FinancialHealth

0 notes

Text

Financial Tips for Entrepreneurs Starting a Business

Starting a business can be both an exhilarating and challenging endeavor, especially when it comes to managing finances. Entrepreneurs often find themselves navigating a complex landscape, balancing risk and reward. In this comprehensive article, we will delve into financial tips crucial for entrepreneurs embarking on the journey of establishing their own business. Benefits of Strategic…

View On WordPress

0 notes