#Sp500

Explore tagged Tumblr posts

Text

Pete Rock

One is the GREATEST Hip Hop Producers

of all time!

#pete rock#petetrumentals#hip hop beats#hip hop#pete rock and cl smooth#sp500#beats#jazz#music#wutang

11 notes

·

View notes

Text

If Time Is Precious, Then What You Choose To Spend Your Time On Matters…..A Lot

It is vital that you embrace knowing who you are and take action to create a plan and rules to follow when trading and investing….Continue Reading Here.

5 notes

·

View notes

Text

LOWER LOWS AND LOWER HIGHS PATTERN

The "Lower Lows and Lower Highs" pattern is a chart formation where consecutive lower highs and lower lows suggest a short-term reversal. One trading strategy involves entering at the close when a daily bar shows both a lower high and a lower low, with an exit after 1-10 bars. Another strategy enters after two consecutive days of lower highs and lows for stronger confirmation. This pattern is often used to identify potential reversals in trending markets.

2 notes

·

View notes

Text

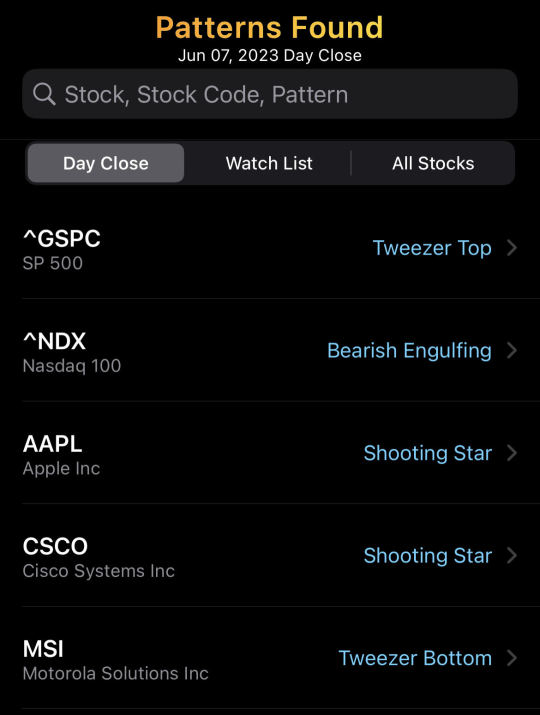

Daily CandleStick Pattern

#TweezerTop #CandleStickPattern on #SP500 end-of-day chart on Jun, 07. Potential reverse to #bearish. #SPX #Daytrading #technicalanalysis #stockmarket

5 notes

·

View notes

Text

Küresel Piyasaların ABD Seçim Gelişmelerine Tepkisi Küresel Piyasaların Seçim Gelişmelerine Tepkisi Küresel piyasalar, bu sabah ABD başkanlık seçiminin gidişatına göre yön bulma çabası içerisinde. Özellikle Don...

#ABDbaşkanlıkseçimi#ABDtahvilleri#Dolar#DonaldTrump#hissesenetleri#küreselpiyasalar#piyasaanalizi#SP500

0 notes

Text

Küresel Piyasaların ABD Seçim Gelişmelerine Tepkisi Küresel Piyasaların Seçim Gelişmelerine Tepkisi Küresel piyasalar, bu sabah ABD başkanlık seçiminin gidişatına göre yön bulma çabası içerisinde. Özellikle Don...

#ABDbaşkanlıkseçimi#ABDtahvilleri#Dolar#DonaldTrump#hissesenetleri#küreselpiyasalar#piyasaanalizi#SP500

0 notes

Text

Küresel Piyasaların ABD Seçim Gelişmelerine Tepkisi Küresel Piyasaların Seçim Gelişmelerine Tepkisi Küresel piyasalar, bu sabah ABD başkanlık seçiminin gidişatına göre yön bulma çabası içerisinde. Özellikle Don...

#ABDbaşkanlıkseçimi#ABDtahvilleri#Dolar#DonaldTrump#hissesenetleri#küreselpiyasalar#piyasaanalizi#SP500

0 notes

Text

Küresel Piyasaların ABD Seçim Gelişmelerine Tepkisi Küresel Piyasaların Seçim Gelişmelerine Tepkisi Küresel piyasalar, bu sabah ABD başkanlık seçiminin gidişatına göre yön bulma çabası içerisinde. Özellikle Don...

#ABDbaşkanlıkseçimi#ABDtahvilleri#Dolar#DonaldTrump#hissesenetleri#küreselpiyasalar#piyasaanalizi#SP500

0 notes

Text

Küresel Piyasaların ABD Seçim Gelişmelerine Tepkisi Küresel Piyasaların Seçim Gelişmelerine Tepkisi Küresel piyasalar, bu sabah ABD başkanlık seçiminin gidişatına göre yön bulma çabası içerisinde. Özellikle Don...

#ABDbaşkanlıkseçimi#ABDtahvilleri#Dolar#DonaldTrump#hissesenetleri#küreselpiyasalar#piyasaanalizi#SP500

0 notes

Text

为什么砍了0.5%,不是0.25%?为什么SP500跌,纳指涨?

今天,美联储决定将利率下调0.5% 这一举措在市场上引发了显著的反应。值得注意的是,在这一利率政策公布后,标普500指数(S&P 500)出现了下跌,而纳斯达克指数(NASDAQ)则上涨。这一现象引发了市场参与者的广泛讨论,为什么会出现这样的分化?本文将分析美联储的降息决策及其对不同市场的影响。 一、美联储的降息决策 美联储…

1 note

·

View note

Text

Market Recap: Dow Rises as Nvidia Drops, Dollar General Slumps, and Affirm Soars 32%

In today's market session, the Dow Jones Industrial Average rose by 143 points, marking a 0.6% increase, while the S&P 500 posted a modest gain of 0.1%. The NASDAQ Composite, however, experienced a slight decline of 0.2%. Among the key movers, Nvidia (NASDAQ: NVDA) saw a sharp drop of over 6%, pulling back after recent highs. Apple Inc. (NASDAQ: AAPL) bucked the trend with a gain of more than 1%, reflecting continued investor confidence.

Dollar General (NYSE: DG) faced significant losses, with its stock plummeting 30%, likely due to disappointing earnings or forward guidance. Meanwhile, Salesforce (NYSE: CRM) also saw its stock dip by 1%, despite recent positive performance in the tech sector.

On the upside, CrowdStrike (NASDAQ: CRWD) surged nearly 3%, benefiting from strong demand for cybersecurity services. Affirm Holdings Inc. (NASDAQ: AFRM) was the standout performer, jumping 32% on positive financial results or market sentiment.

This mixed performance reflects the ongoing volatility in the market, as investors navigate sector-specific challenges and broader economic concerns. Stay tuned as these trends continue to unfold in the coming days.

#MarketRecap#DowJones#NASDAQ#SP500#Nvidia#Apple#DollarGeneral#Salesforce#CrowdStrike#AffirmHoldings#StockMarket#Investing#TechStocks

0 notes

Text

Why You Should Prepare For The Coming Collapse Now

James Connor of Bloor Street Capital and Chris have a great discussion about the precipice the stock market and economy seem to be clinging to. “It’s all good until the music stops. And then it isn’t.���

What James and I talked about included:

The continual highs of the S&P 500 and Nasdaq.

Trading on opinions vs technical analysis price action.

The surge in Apple after their AI announcement.

The surge in Tesla since their Q2 deliveries report.

NVDA, is there any weakness forming, or will it keep going?

The technical indicators I use to gauge how much upside momentum is left in the markets.

If the S&P goes to 5800 and then has a pullback, where would it go on the downside?

Big Cap banks vs smaller regional banks.

Thoughts on gold chart patterns.

Silver and gold miners and holding physical metals.

Bitcoin: what I see when I look at the chart.

Looking at the TSX (Toronto Stock Exchange), what are my views on its upward momentum?

Are there indications on the RBC chart (RY-TC) that show where the Canadian banking system may be headed?

The incoming future for Canadian real estate.

Comparing the chart of Scotia Bank (BNS-TC) to RBC.

The chart pattern for Telecom (BCE-TC) and Telus (T-TC).

As a Canadian investor, how should we prepare for the imminent future?

Watch The Interview Here

#nvidia#technology#stocks#investing#gold#silver#precious metals#daytrading#commodities#sp500#nasdaq#bitcoin

2 notes

·

View notes

Text

UNVEILING OPENING PRICE RETURNS

Many traders overlook that much of the market's gains occur when it’s closed. Analyzing the S&P 500’s returns from close to open reveals an average gain of 0.04% per trade, resulting in an annual return of 9.5%, nearly matching buy-and-hold. While implementing this approach has challenges, such as slippage and commissions, gains above 0.1% can help offset these costs.

1 note

·

View note

Text

サラリーマン投資家の資産状況(2024/08/17)

今週も8月5日の円高株安から戻した格好となりました。 急な円高につられて、外貨建て資産(円現金からドル預金へ)が増える格好になっています。 このブログ記事でわかること 元金1580万円の株式投資でどれくらいの損益や値動きがあるのか? 簡単な日米の金融政策の状況 週間の40代のサラリーマンの投資状況 投資の考え方 新NISAへの投資方針 元金1580万円を投資するとどのような値動きになるか(ボラティリティ)を体感してもらって、「この程度なら大丈夫」であったり「こんな値動き耐えられない」といったリスク許容度を感じてもらえたら幸いです。 今週の状況 私はSBI V S&P500 インデックスファンドを中心に投資しています。 SBI V S&P500インデックスファンド は…

0 notes

Text

Asya-Pasifik Hisselerinde Yükseliş ve Çin'in Bankalara Sermaye Enjeksiyonu Planı Asya-Pasifik Hisselerinde Yükseliş Hafta boyunca Çin teşviklerinin olumlu etkisiyle Asya-Pasifik borsa endeksleri, özellikle teknoloji sektöründeki güçlü perfor...

#ABDtahvilgetirileri#AsyaPasifik#BankofChina#borsa#çin#CSI300#HangSeng#ICBC#Kospi#MSCI#Nikkei225#SP500#sermayeenjeksiyonu#Teknoloji

0 notes